Investor Presentation May 2022 Exhibit 99.2

Disclaimer This presentation contains forward-looking statements. All statements other than statements of historical facts contained in this presentation, including statements regarding possible or assumed future results of operations, business strategies, development plans, regulatory activities, competitive position, potential growth opportunities, & the effects of competition are forward-looking statements. These statements involve known & unknown risks, uncertainties & other important factors that may cause actual results, performance or achievements of EverQuote, Inc. (“the Company”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “should,” “expect,” “plan,” “project,” “estimate,” “guidance,” or “potential” or the negative of these terms or other similar expressions. The forward-looking statements in this presentation are only predictions. The Company has based these forward-looking statements largely on its current expectations & projections about future events & financial trends that it believes may affect the Company’s business, financial condition & results of operations. These forward-looking statements speak only as of the date of this presentation & are subject to a number of risks, uncertainties & assumptions, some of which cannot be predicted or quantified & some of which are beyond the Company’s control. The events & circumstances reflected in the Company’s forward-looking statements may not be achieved or occur, & actual results could differ materially from those projected in the forward-looking statements, including as a result of: (1) the Company’s ability to attract and retain consumers and insurance providers using the Company’s marketplace; (2) the Company’s ability to maintain or increase the amount providers spend per quote request; (3) the impact on the Company and the insurance industry of the COVID-19 pandemic; (4) the effectiveness of the Company’s growth strategies and its ability to effectively manage growth; (5) the Company’s ability to maintain and build its brand; (6) the Company’s reliance on its third-party service providers; (7) the Company’s ability to develop new and enhanced products and services to attract and retain consumers and insurance providers, and the Company’s ability to successfully monetize them; (8) the impact of competition in the Company’s industry and innovation by the Company’s competitors; (9) the expected recovery of the auto insurance industry; (10) developments regarding the insurance industry and the transition to online marketing; (11) the Company’s ability to successfully integrate PolicyFuel; (12) the Company’s ability to successfully remediate the material weaknesses identified in the Company’s internal controls over financial reporting; and (13) as a result of the risks described in the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q & the other filings that the Company makes with the Securities & Exchange Commission from time to time. Moreover, new risk factors & uncertainties may emerge from time to time, & it is not possible for management to predict all risk factors & uncertainties that the Company may face. Except as required by applicable law, the Company does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. The Company’s presentation also contains estimates, projections, & other information concerning the Company’s industry, the Company’s business & the markets for certain of the Company’s products & services, including data regarding the estimated size of those markets. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties & actual events or circumstances may differ materially from events & circumstances reflected in this information. Unless otherwise expressly stated, the Company obtained this industry, business, market & other data from reports, research surveys, studies & similar data prepared by market research firms & other third parties, from industry, general publications, & from government data & similar sources. The Company presents Adjusted EBITDA as a non-GAAP measure, which is not a substitute for or superior to, other measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure is included in the Appendix to these slides.

Our vision Become the largest online source of insurance policies by using data and technology to make insurance simpler, more affordable and personalized, ultimately reducing cost and risk.

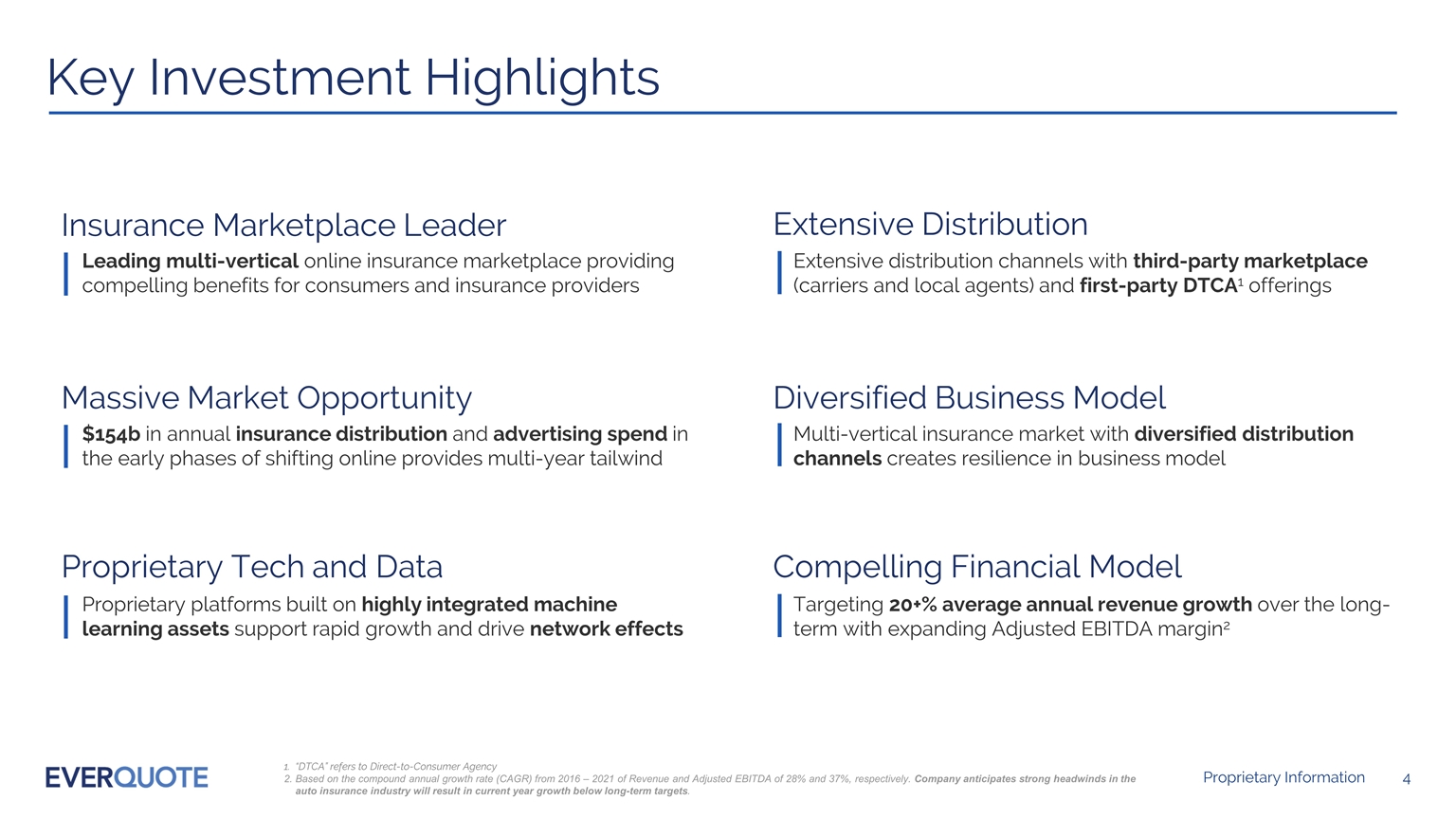

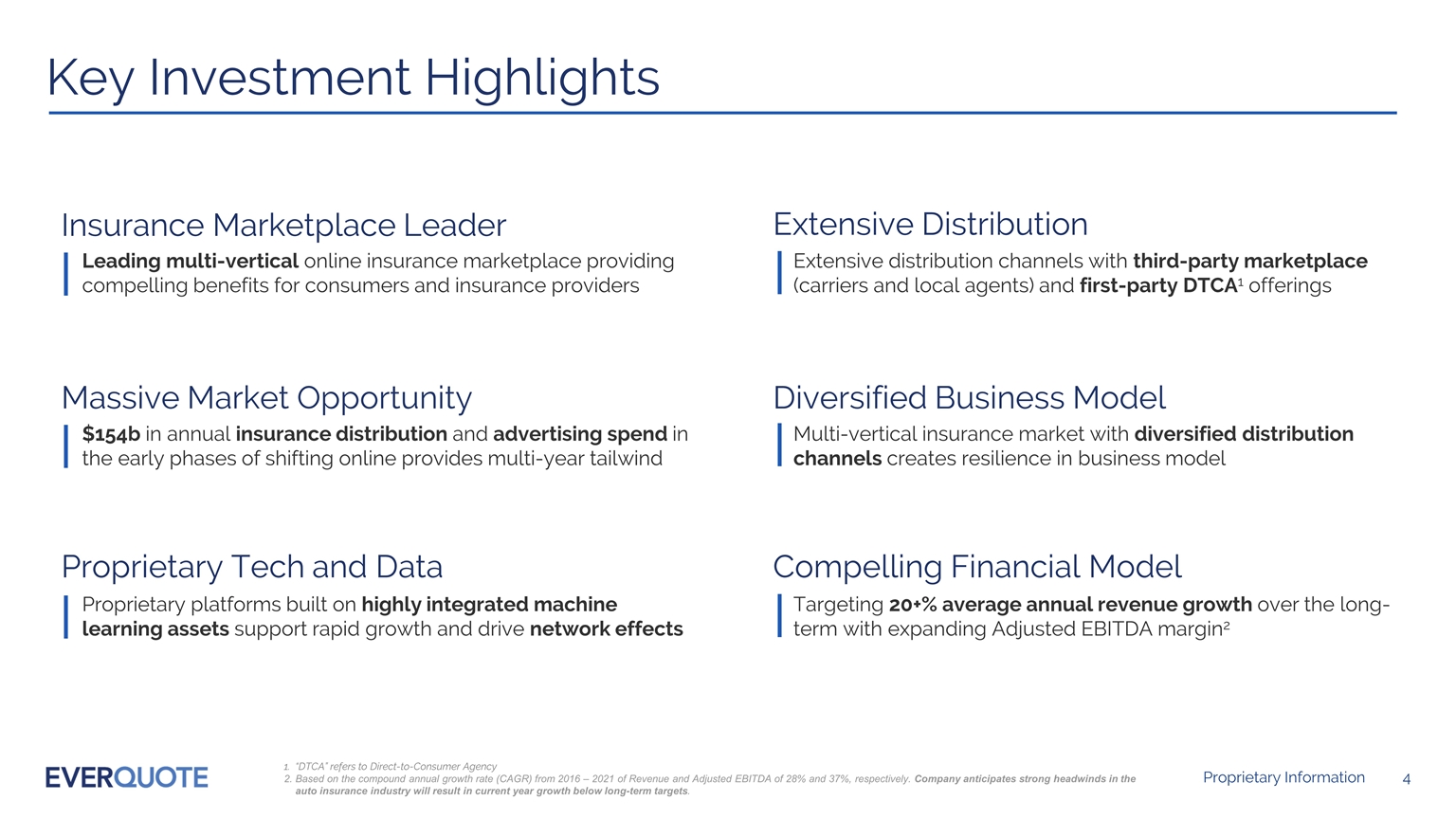

“DTCA” refers to Direct-to-Consumer Agency Based on the compound annual growth rate (CAGR) from 2016 – 2021 of Revenue and Adjusted EBITDA of 28% and 37%, respectively. Company anticipates strong headwinds in the auto insurance industry will result in current year growth below long-term targets. Insurance Marketplace Leader Leading multi-vertical online insurance marketplace providing compelling benefits for consumers and insurance providers Massive Market Opportunity $154b in annual insurance distribution and advertising spend in the early phases of shifting online provides multi-year tailwind Proprietary Tech and Data Proprietary platforms built on highly integrated machine learning assets support rapid growth and drive network effects Extensive Distribution Extensive distribution channels with third-party marketplace (carriers and local agents) and first-party DTCA1 offerings Diversified Business Model Multi-vertical insurance market with diversified distribution channels creates resilience in business model Compelling Financial Model Targeting 20+% average annual revenue growth over the long-term with expanding Adjusted EBITDA margin2 Key Investment Highlights

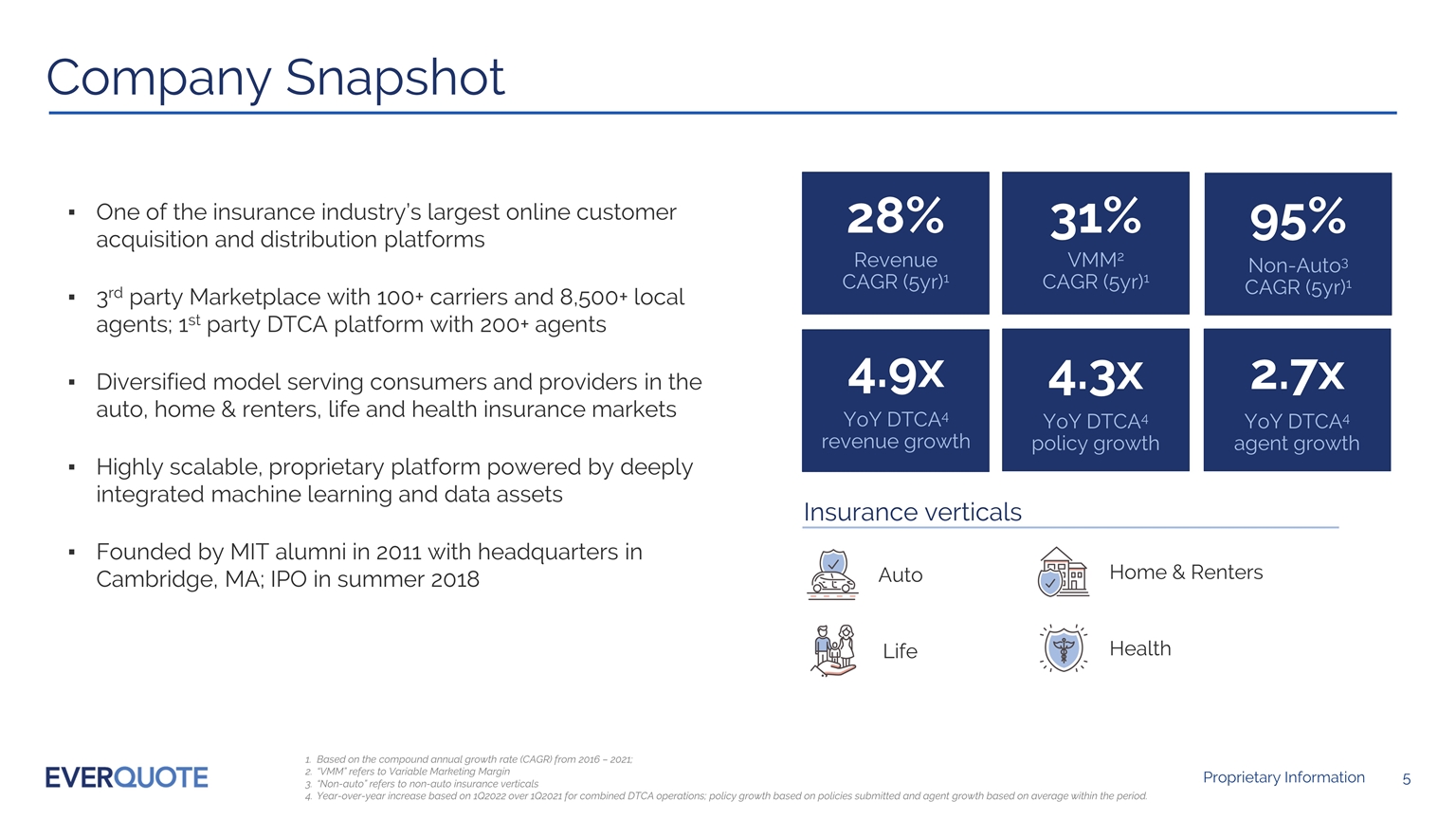

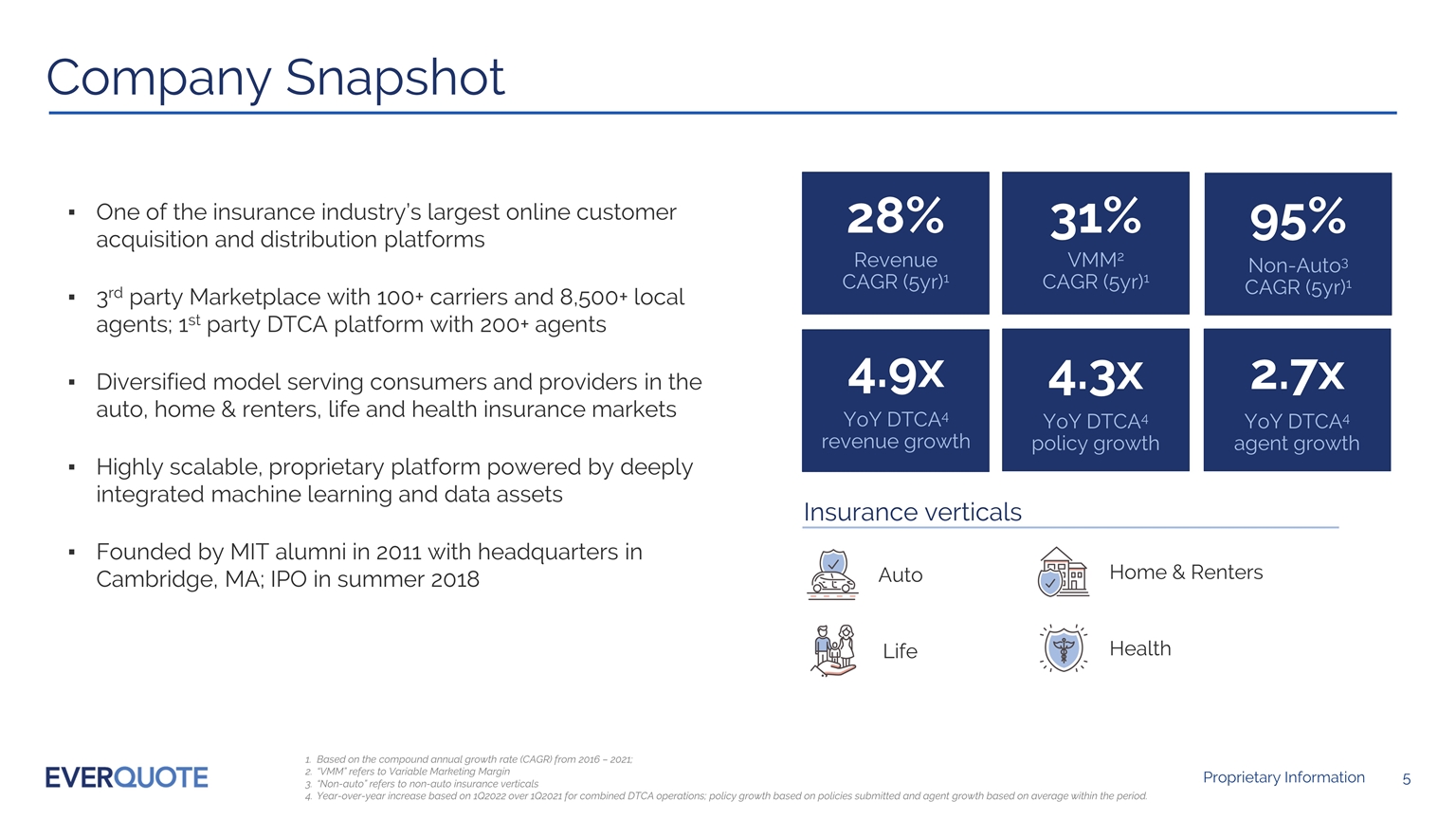

Company Snapshot Insurance verticals Based on the compound annual growth rate (CAGR) from 2016 – 2021; “VMM” refers to Variable Marketing Margin “Non-auto” refers to non-auto insurance verticals Year-over-year increase based on 1Q2022 over 1Q2021 for combined DTCA operations; policy growth based on policies submitted and agent growth based on average within the period. One of the insurance industry’s largest online customer acquisition and distribution platforms 3rd party Marketplace with 100+ carriers and 8,500+ local agents; 1st party DTCA platform with 200+ agents Diversified model serving consumers and providers in the auto, home & renters, life and health insurance markets Highly scalable, proprietary platform powered by deeply integrated machine learning and data assets Founded by MIT alumni in 2011 with headquarters in Cambridge, MA; IPO in summer 2018 Life Home & Renters Health Auto 28% Revenue CAGR (5yr)1 31% VMM2 CAGR (5yr)1 4.3x YoY DTCA4 policy growth 26% 2.7x YoY DTCA4 agent growth 95% Non-Auto3 CAGR (5yr)1 4.9x YoY DTCA4 revenue growth

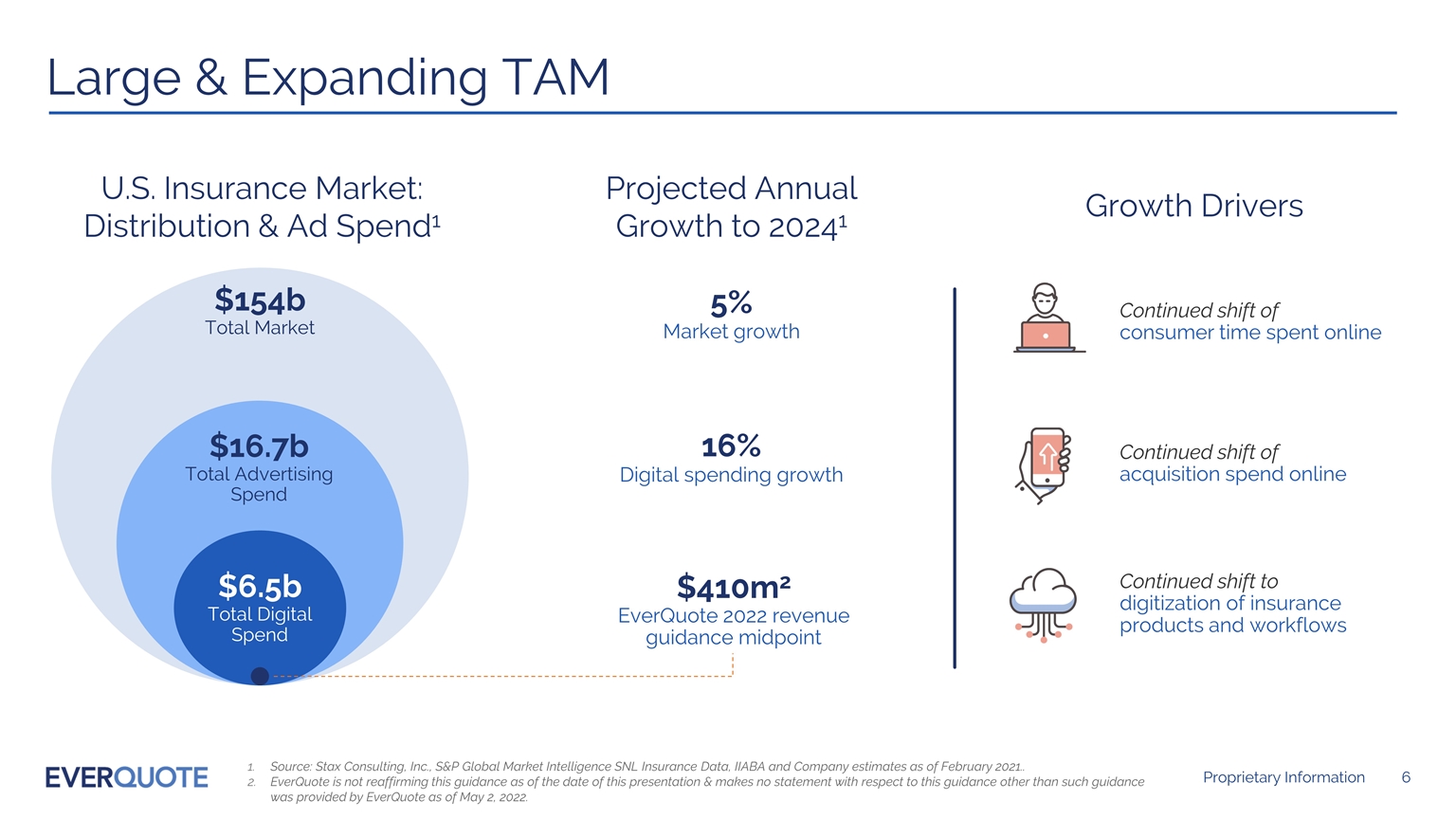

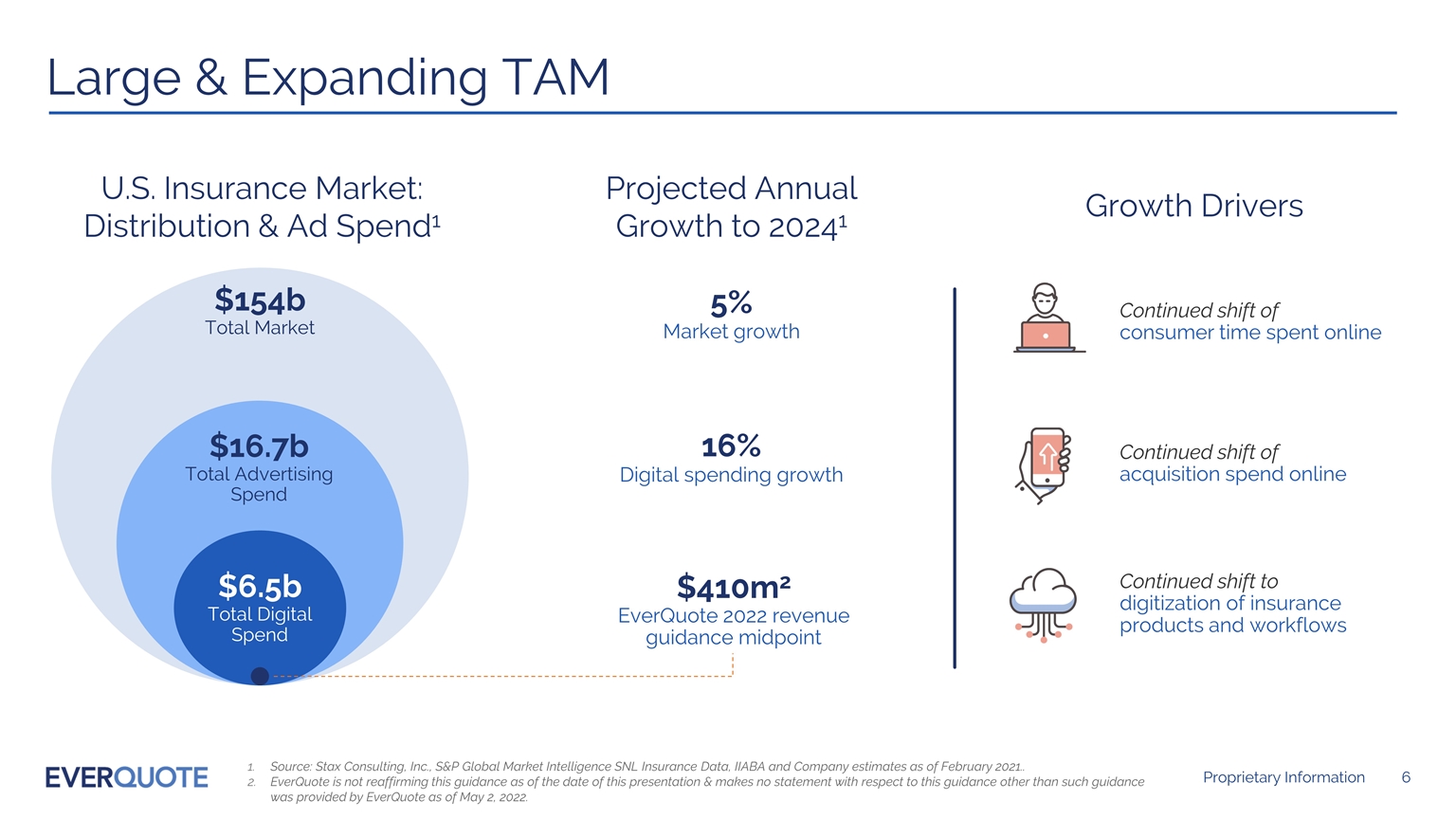

Large & Expanding TAM Projected Annual Growth to 20241 Growth Drivers U.S. Insurance Market: Distribution & Ad Spend1 Source: Stax Consulting, Inc., S&P Global Market Intelligence SNL Insurance Data, IIABA and Company estimates as of February 2021.. EverQuote is not reaffirming this guidance as of the date of this presentation & makes no statement with respect to this guidance other than such guidance was provided by EverQuote as of May 2, 2022. $410m2 EverQuote 2022 revenue guidance midpoint $154b Total Market $16.7b Total Advertising Spend $6.5b Total Digital Spend Continued shift of consumer time spent online Continued shift of acquisition spend online Continued shift to digitization of insurance products and workflows Digital spending growth 16% Market growth 5%

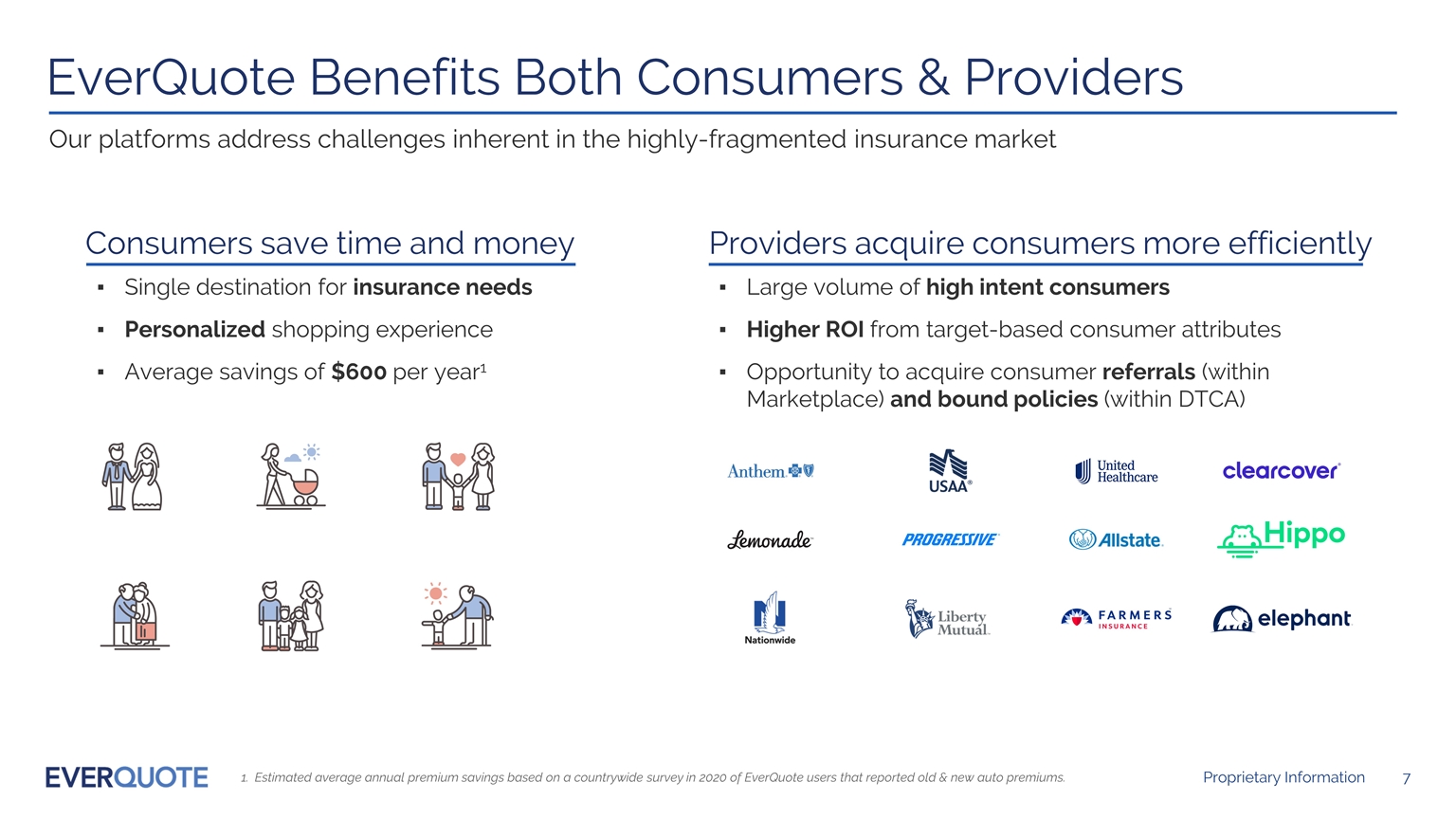

EverQuote Benefits Both Consumers & Providers Estimated average annual premium savings based on a countrywide survey in 2020 of EverQuote users that reported old & new auto premiums. Consumers save time and money Single destination for insurance needs Personalized shopping experience Average savings of $600 per year1 Providers acquire consumers more efficiently Large volume of high intent consumers Higher ROI from target-based consumer attributes Opportunity to acquire consumer referrals (within Marketplace) and bound policies (within DTCA) Our platforms address challenges inherent in the highly-fragmented insurance market

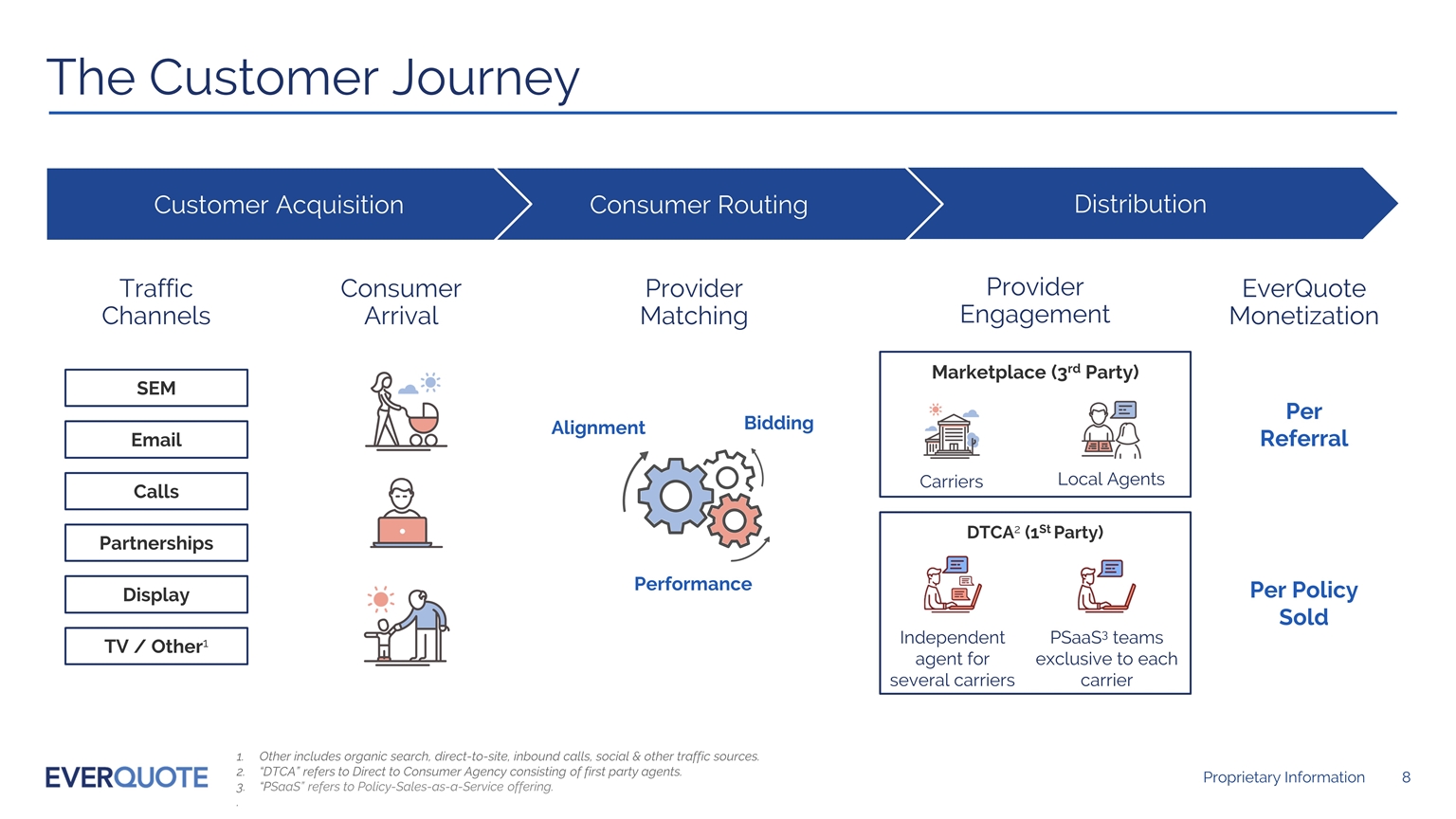

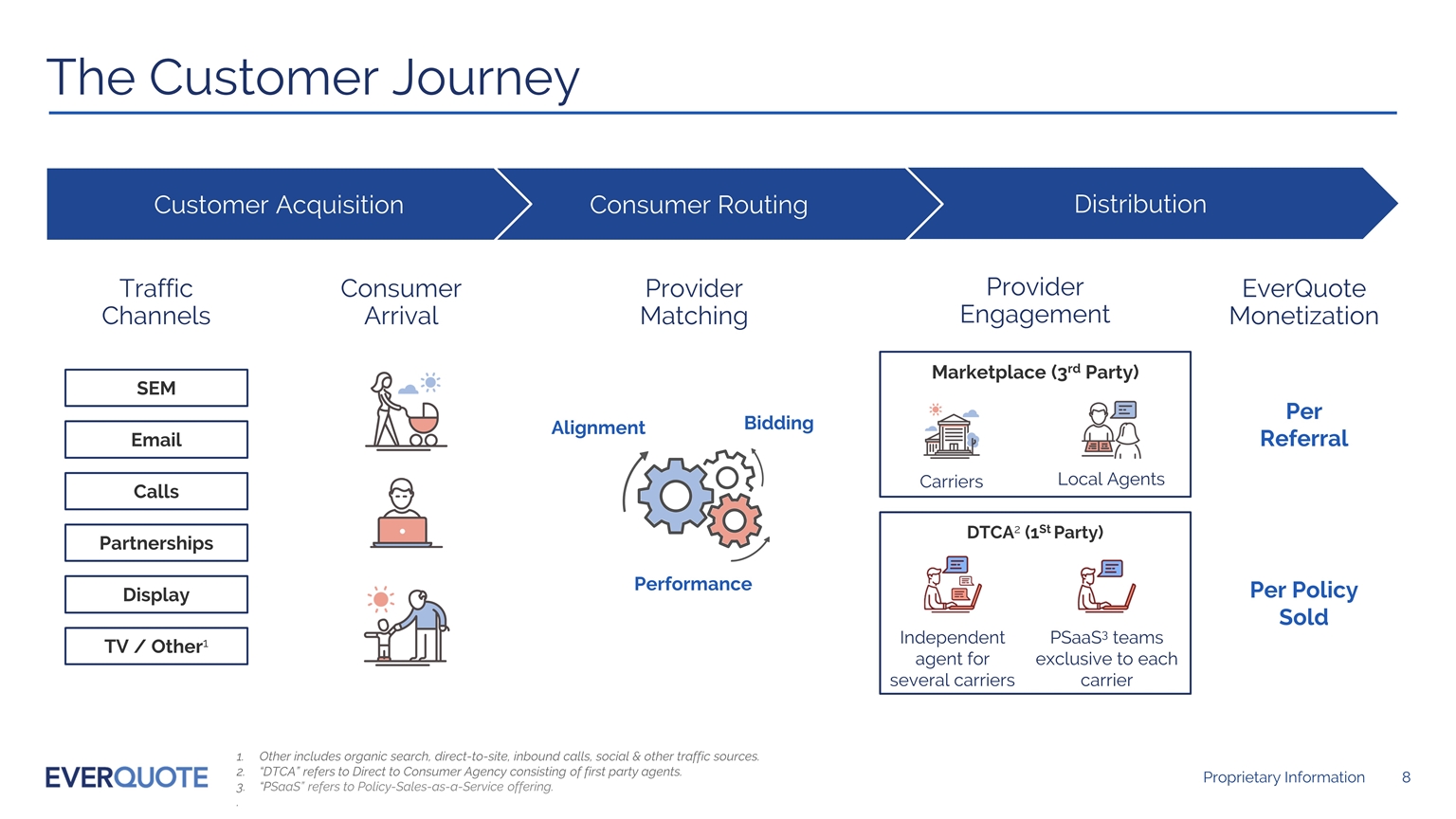

Distribution The Customer Journey Traffic Channels Provider Engagement Consumer Arrival Provider Matching Other includes organic search, direct-to-site, inbound calls, social & other traffic sources. “DTCA” refers to Direct to Consumer Agency consisting of first party agents. “PSaaS” refers to Policy-Sales-as-a-Service offering. . Display Email TV / Other1 SEM Partnerships Carriers Local Agents Marketplace (3rd Party) Marketplace Per Referral EverQuote Monetization Per Policy Sold DTCA2 (1St Party) Independent agent for several carriers PSaaS3 teams exclusive to each carrier Calls Consumer Routing Customer Acquisition Performance Alignment Bidding

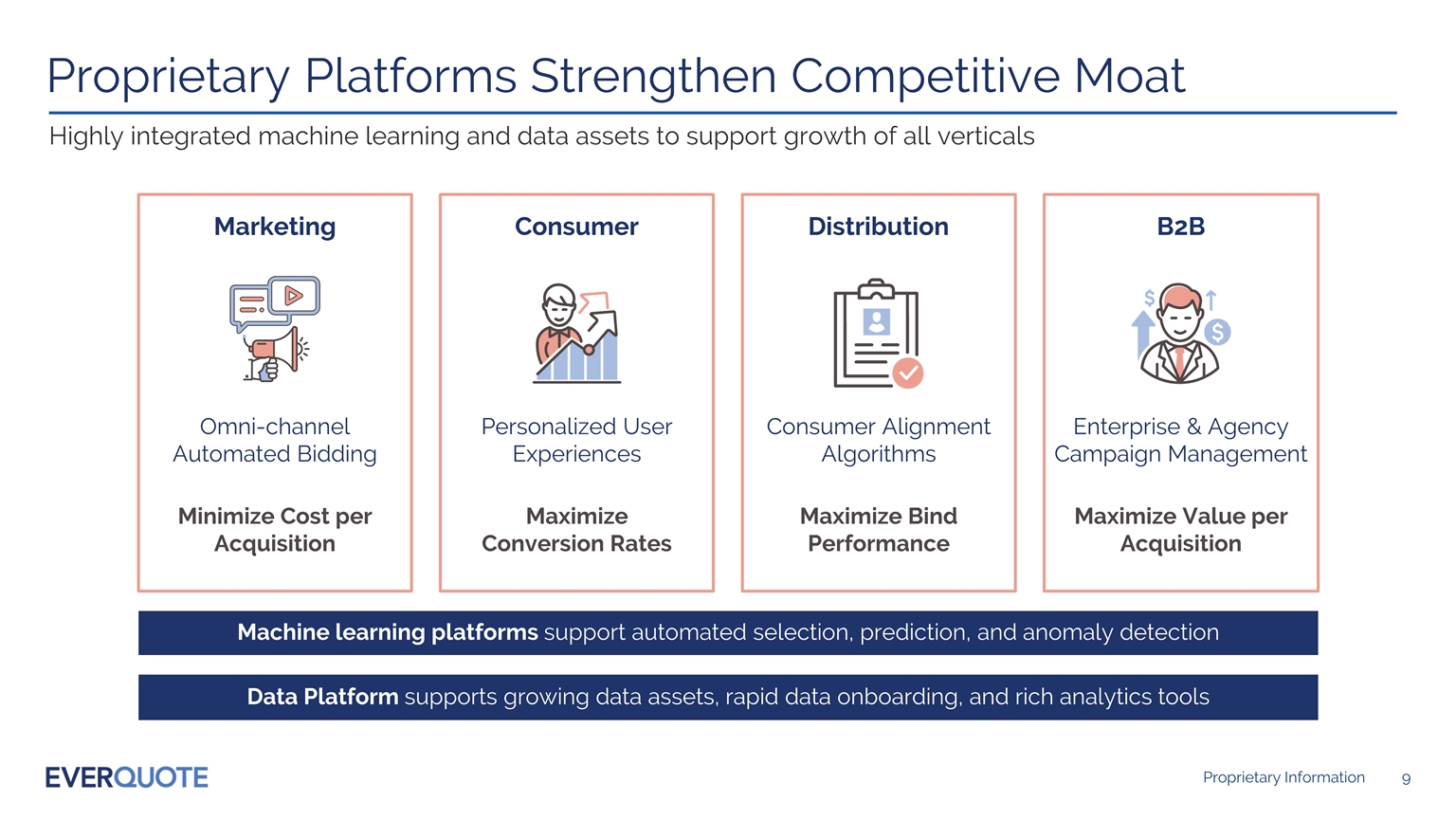

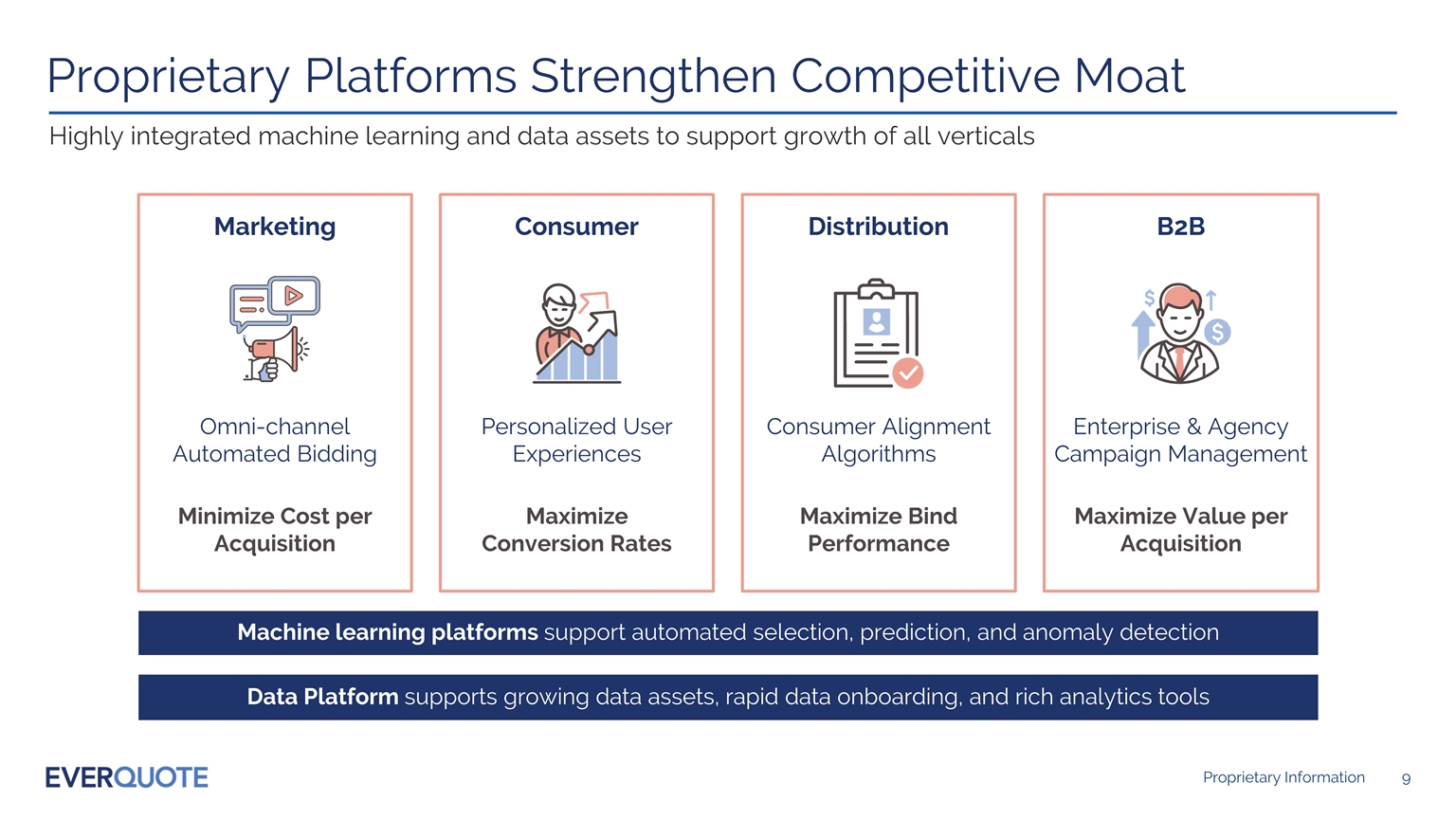

Proprietary Platforms Strengthen Competitive Moat Data Platform supports growing data assets, rapid data onboarding, and rich analytics tools Machine learning platforms support automated selection, prediction, and anomaly detection Minimize Cost per Acquisition Omni-channel Automated Bidding Marketing Maximize Conversion Rates Consumer Personalized User Experiences Maximize Bind Performance Consumer Alignment Algorithms Distribution Maximize Value per Acquisition Enterprise & Agency Campaign Management B2B Highly integrated machine learning and data assets to support growth of all verticals

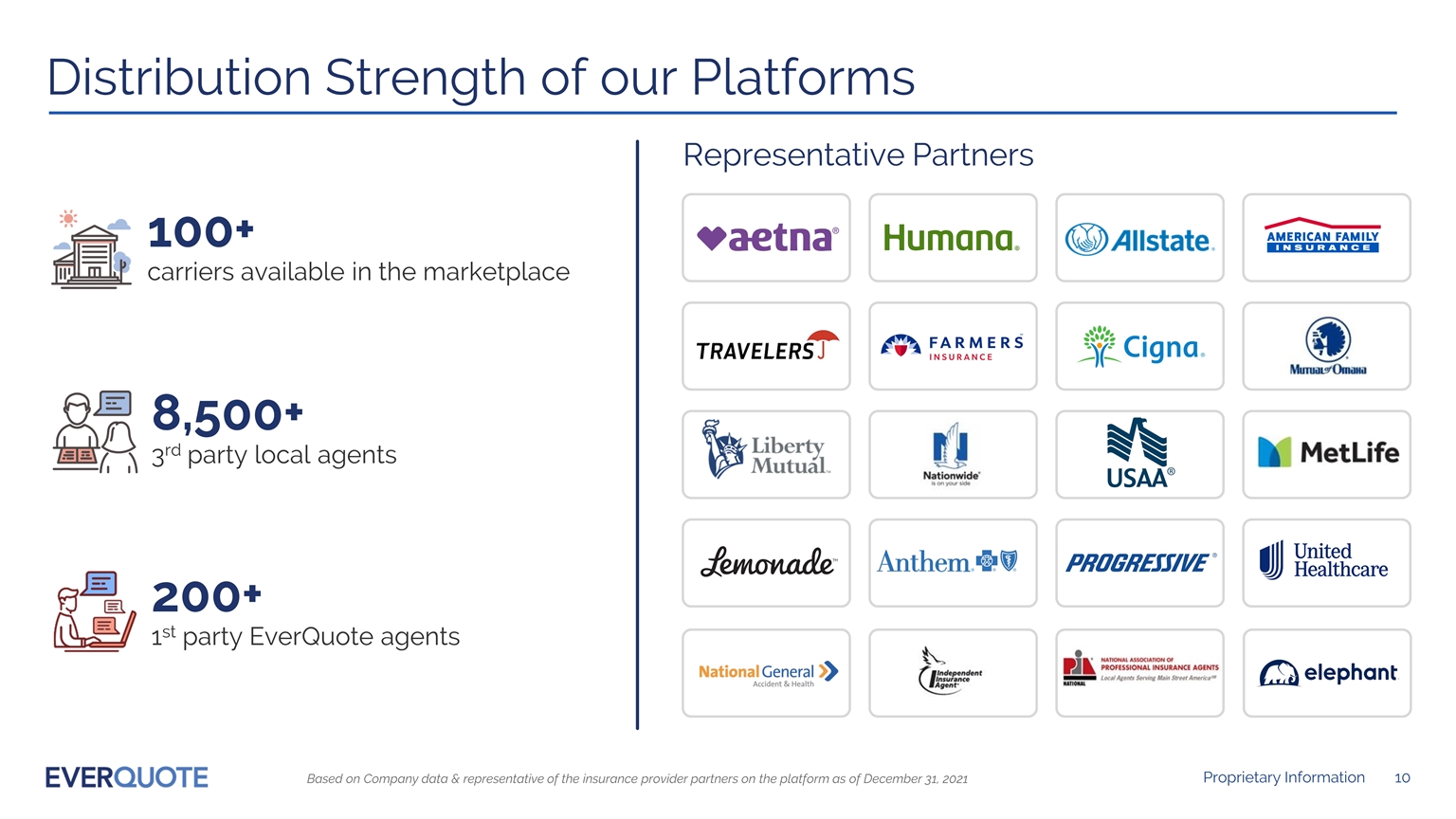

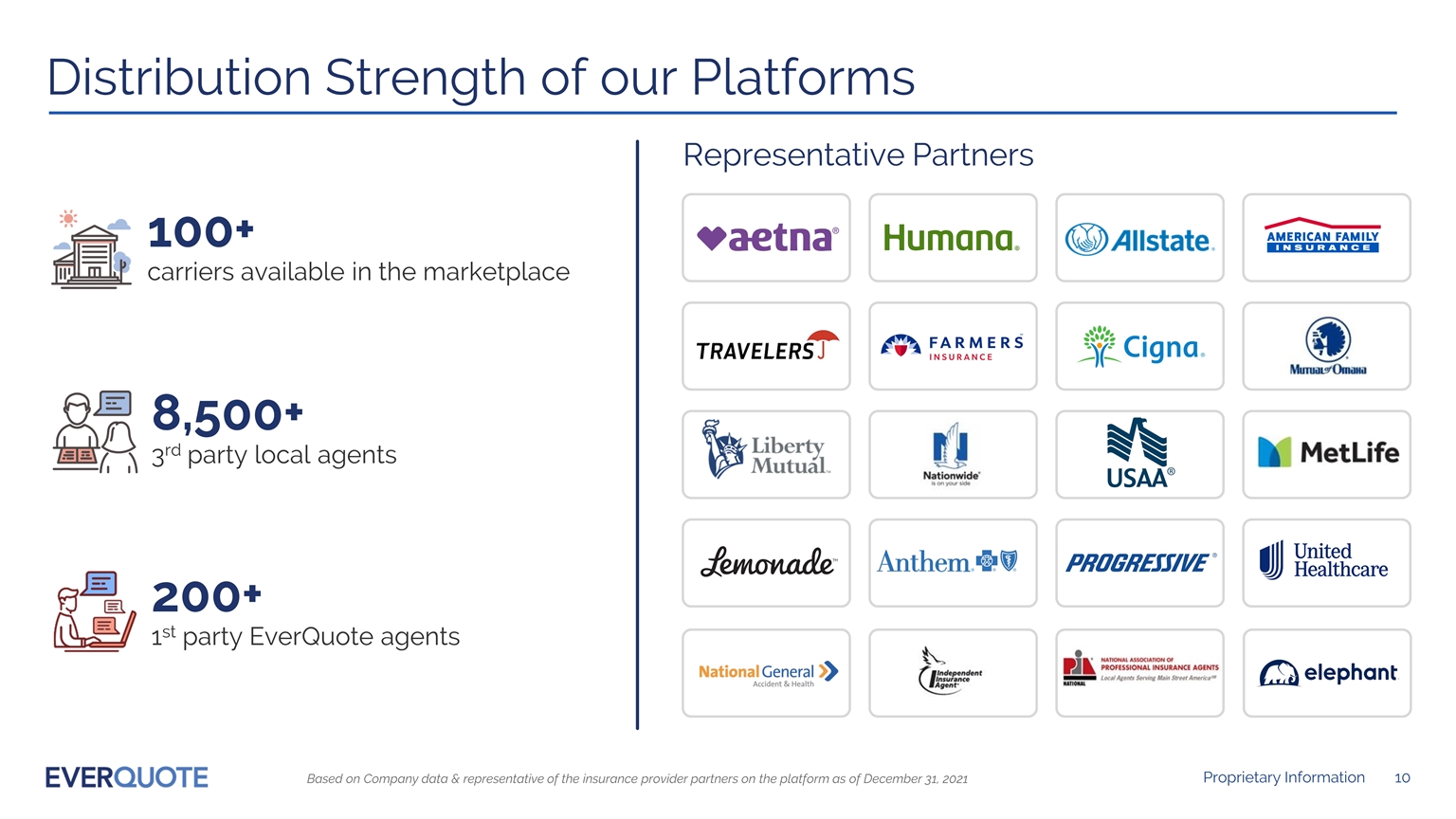

Distribution Strength of our Platforms Based on Company data & representative of the insurance provider partners on the platform as of December 31, 2021 8,500+ 3rd party local agents Representative Partners 200+ 1st party EverQuote agents 100+ carriers available in the marketplace

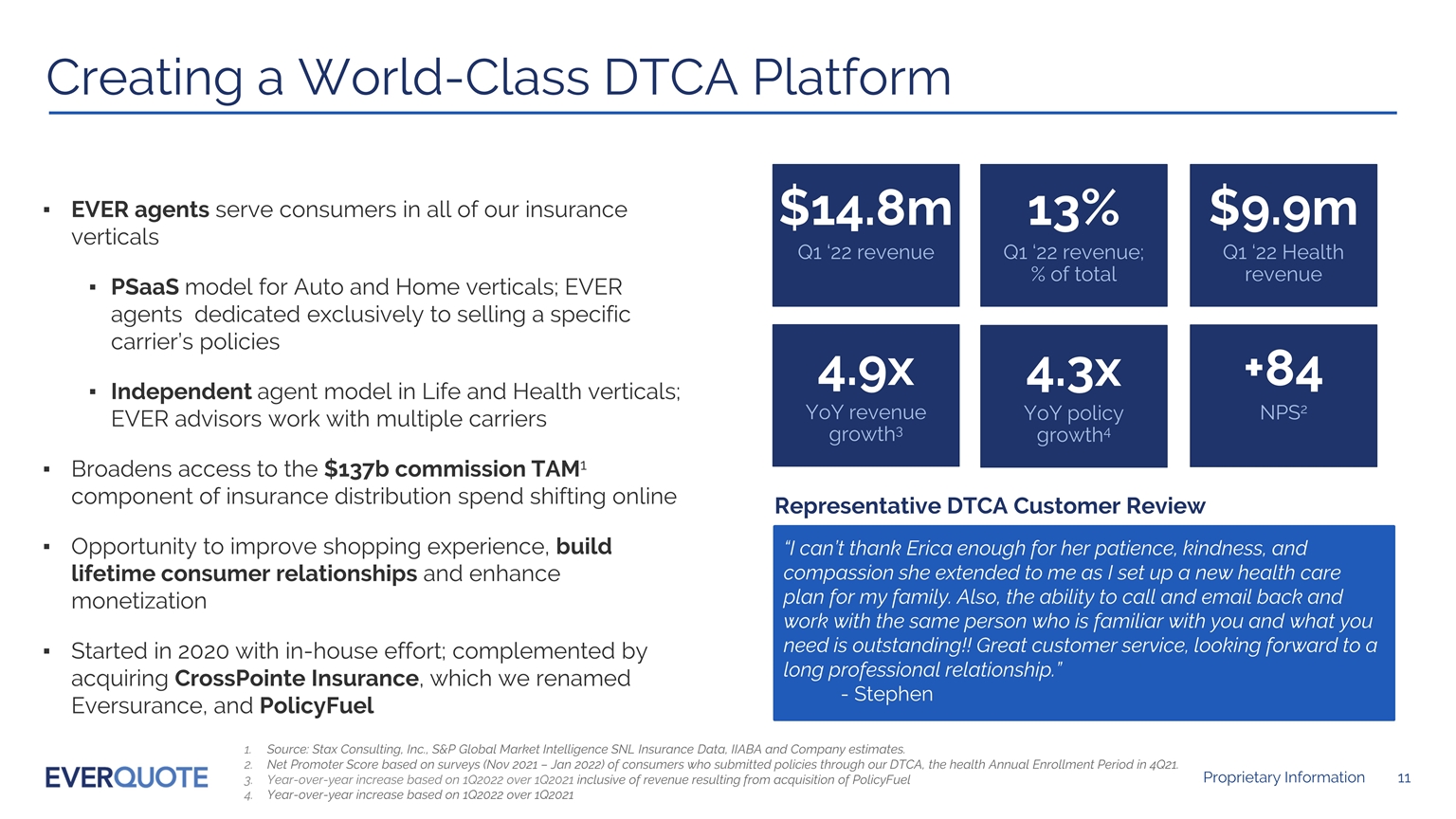

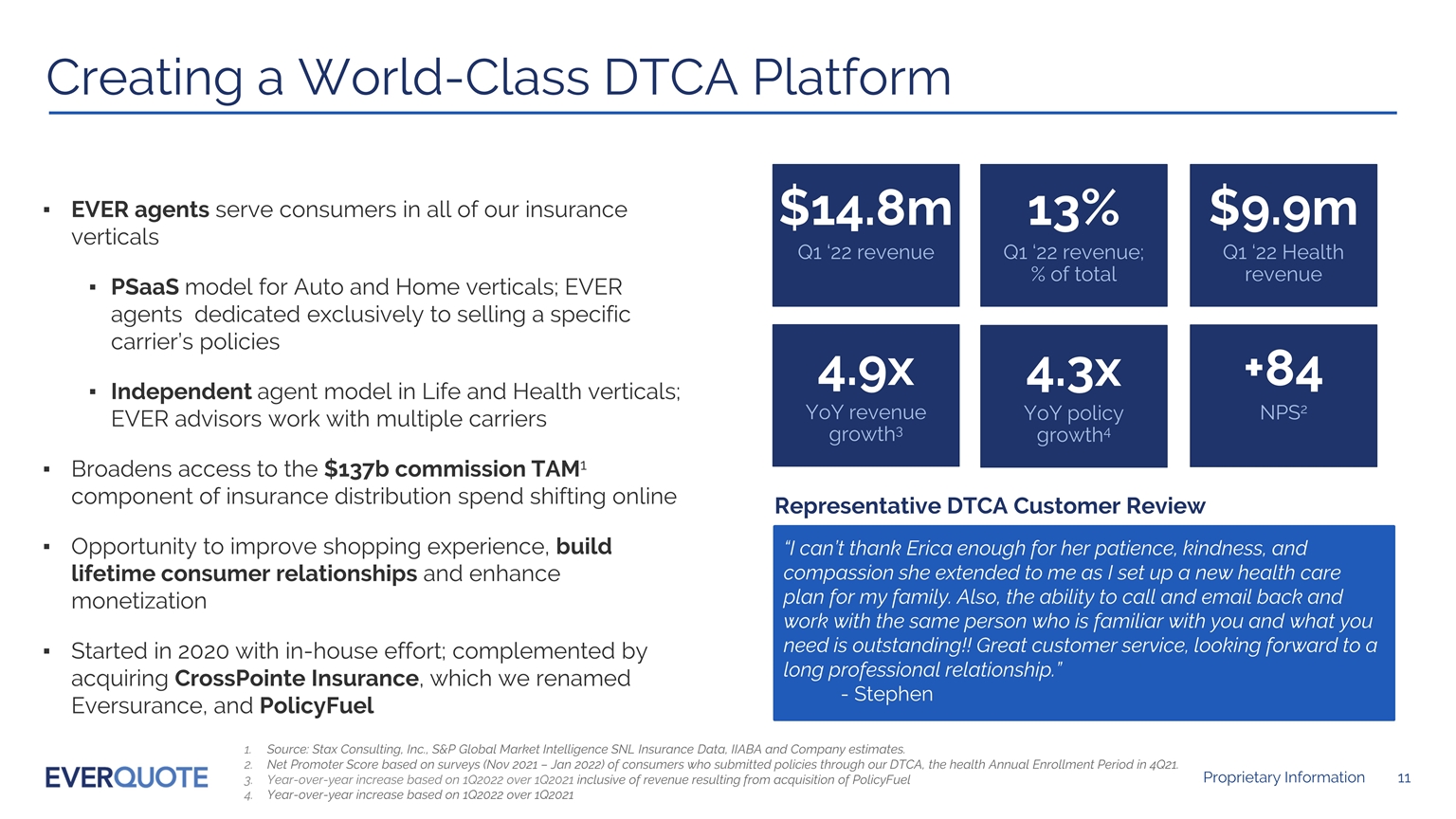

Creating a World-Class DTCA Platform Source: Stax Consulting, Inc., S&P Global Market Intelligence SNL Insurance Data, IIABA and Company estimates. Net Promoter Score based on surveys (Nov 2021 – Jan 2022) of consumers who submitted policies through our DTCA, the health Annual Enrollment Period in 4Q21. Year-over-year increase based on 1Q2022 over 1Q2021 inclusive of revenue resulting from acquisition of PolicyFuel Year-over-year increase based on 1Q2022 over 1Q2021 Representative DTCA Customer Review “I can’t thank Erica enough for her patience, kindness, and compassion she extended to me as I set up a new health care plan for my family. Also, the ability to call and email back and work with the same person who is familiar with you and what you need is outstanding!! Great customer service, looking forward to a long professional relationship.” - Stephen EVER agents serve consumers in all of our insurance verticals PSaaS model for Auto and Home verticals; EVER agents dedicated exclusively to selling a specific carrier’s policies Independent agent model in Life and Health verticals; EVER advisors work with multiple carriers Broadens access to the $137b commission TAM1 component of insurance distribution spend shifting online Opportunity to improve shopping experience, build lifetime consumer relationships and enhance monetization Started in 2020 with in-house effort; complemented by acquiring CrossPointe Insurance, which we renamed Eversurance, and PolicyFuel 13% Q1 ‘22 revenue; % of total $9.9m Q1 ‘22 Health revenue $14.8m Q1 ‘22 revenue +84 NPS2 4.3x YoY policy growth4 4.9x YoY revenue growth3

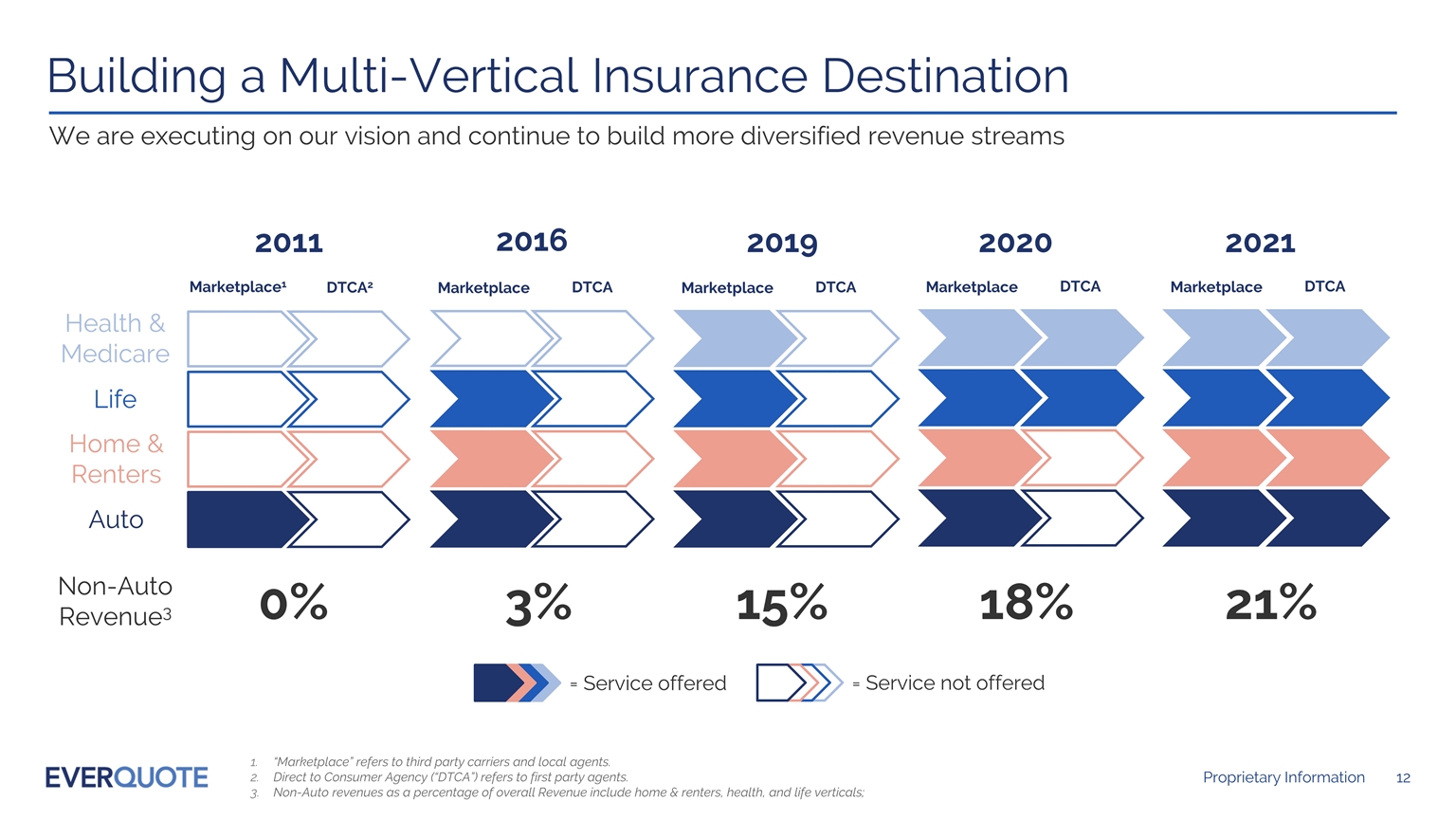

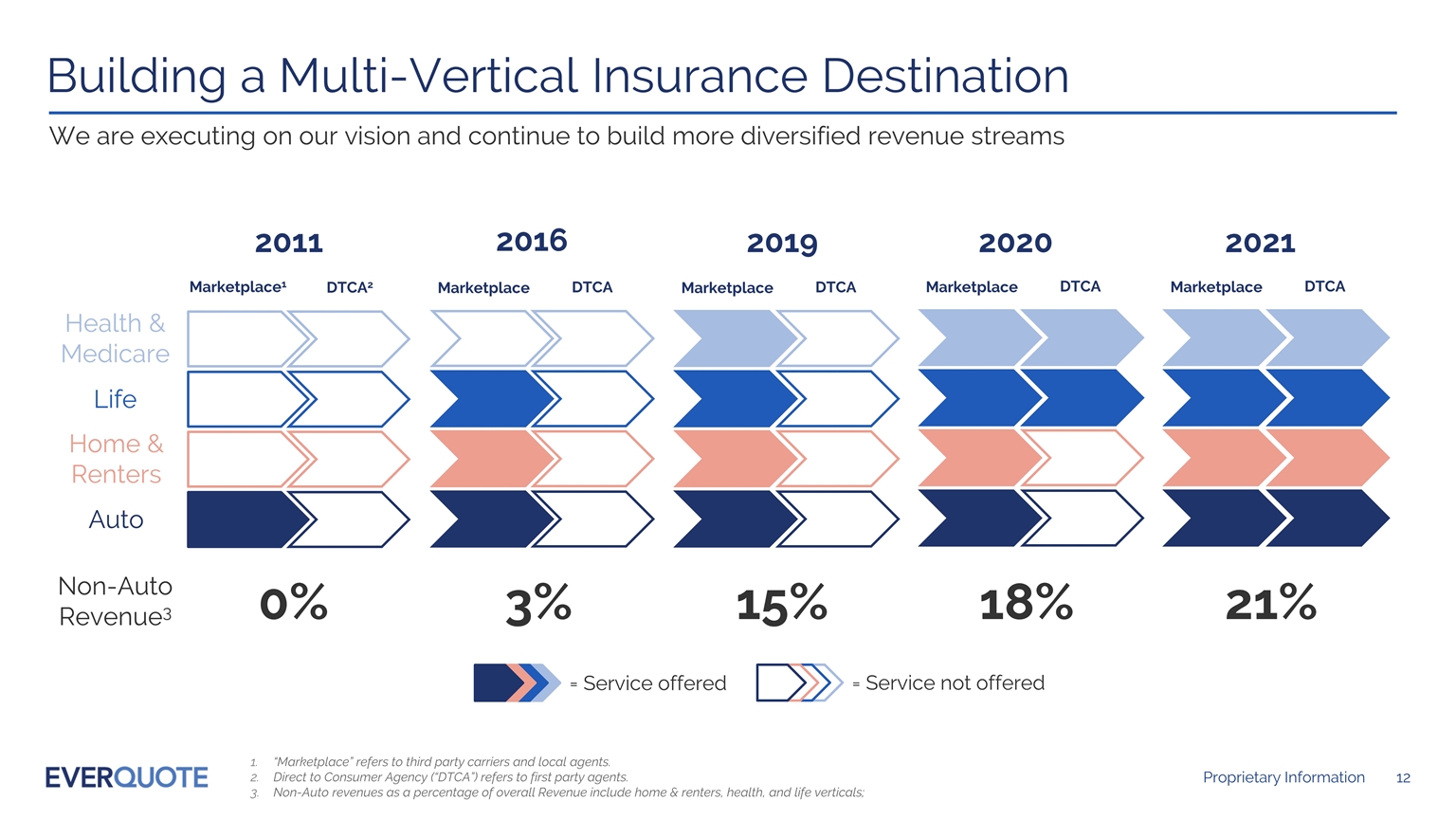

Building a Multi-Vertical Insurance Destination 21% “Marketplace” refers to third party carriers and local agents. Direct to Consumer Agency (“DTCA”) refers to first party agents. Non-Auto revenues as a percentage of overall Revenue include home & renters, health, and life verticals; = Service not offered = Service offered 3% 2016 Marketplace DTCA 15% 2019 Marketplace DTCA 2021 Marketplace DTCA Auto Home & Renters Life Health & Medicare Non-Auto Revenue3 2011 Marketplace1 DTCA2 0% 2020 Marketplace DTCA 18% We are executing on our vision and continue to build more diversified revenue streams

Track-Record of Successful Acquisitions Digitally-enabled insurance agency offering auto and home policies via a PSaaS model; advisor teams focused exclusively on selling a carrier’s own insurance offerings to its target consumers Founders with decades of collective P&C insurance experience; a team of 90 full-time employees (many of whom are agents)2 PolicyFuel (closed August 2021) A sales and decision support agency that connects consumers to high quality health insurance in a customer-centric environment. Founders with deep health insurance experience; approximately 30 full-time employees (many of whom are agents)1 Crosspointe Insurance, which we renamed Eversurance (closed September 2020) Support growth of carrier partners Accelerate DTCA strategy Broaden market opportunity Build diversified revenue streams Financially accretive Enhance consumer experiences Acquisition Criteria Pursued opportunities that accelerate our strategy to be the leading online destination for insurance shopping Recent Transactions Represents data as of time of acquisition closing. Represents data as of time of acquisition closing.

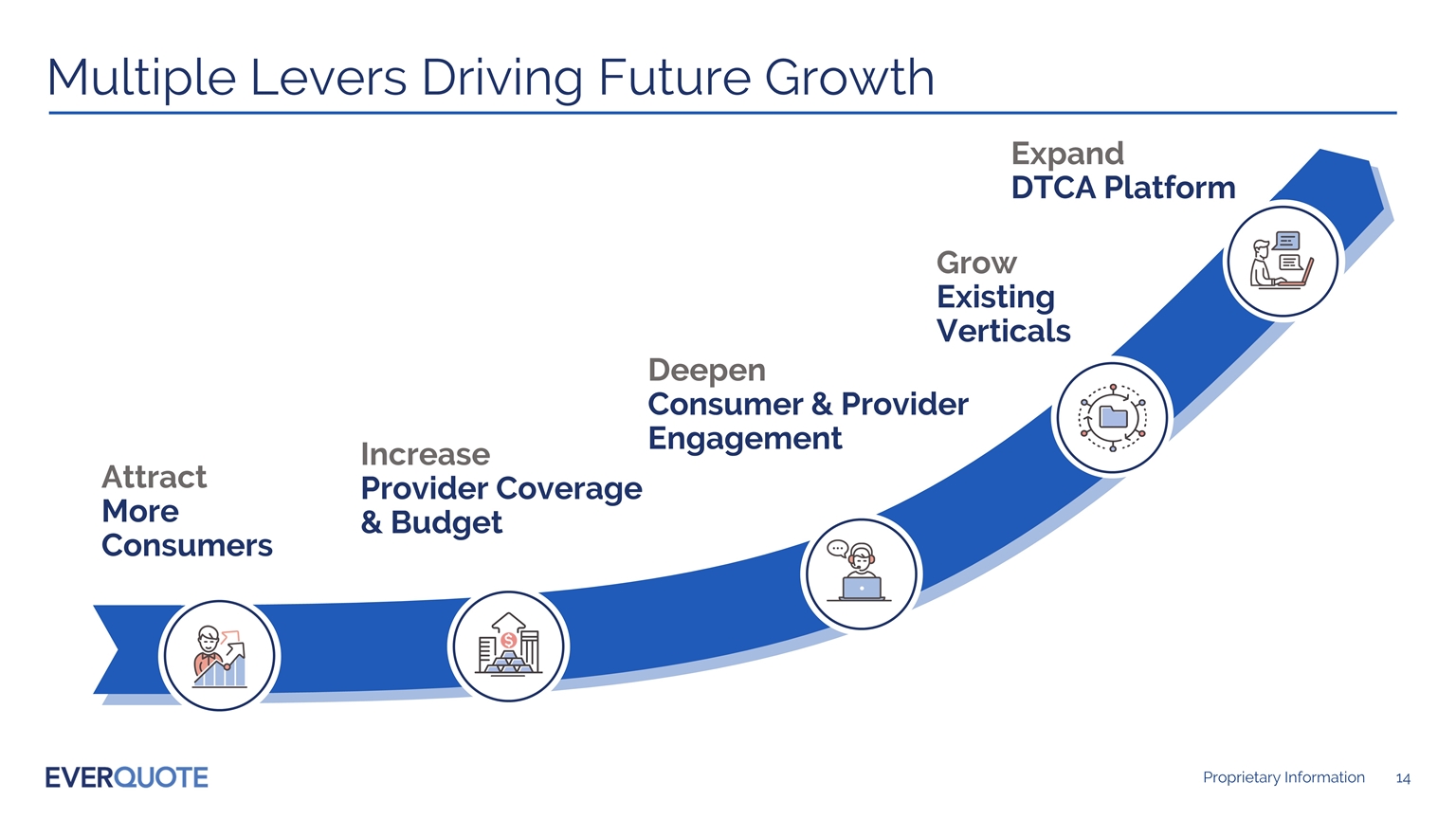

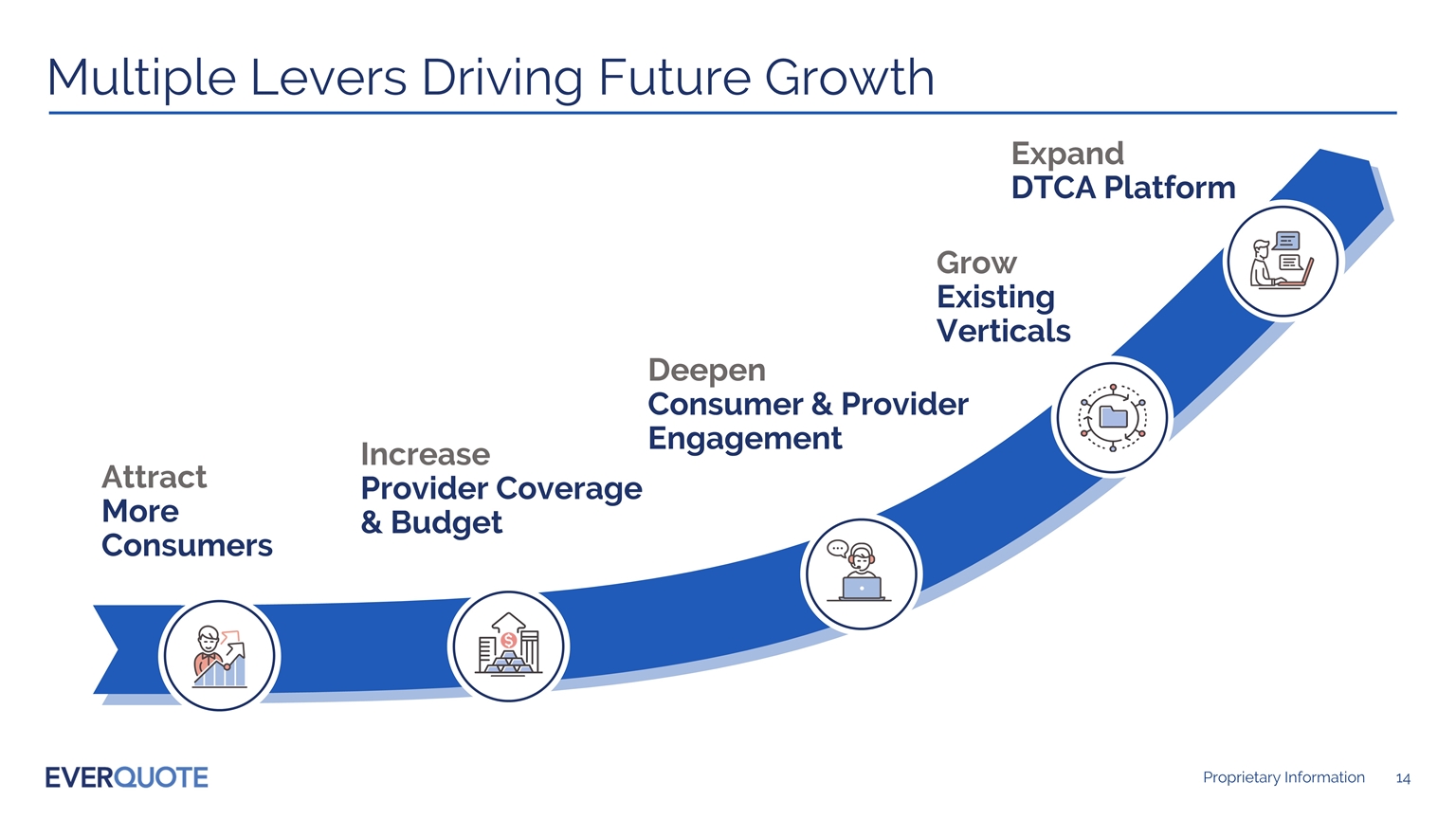

Multiple Levers Driving Future Growth Attract More Consumers Expand DTCA Platform Increase Provider Coverage & Budget Deepen Consumer & Provider Engagement Grow Existing Verticals

Financial Overview

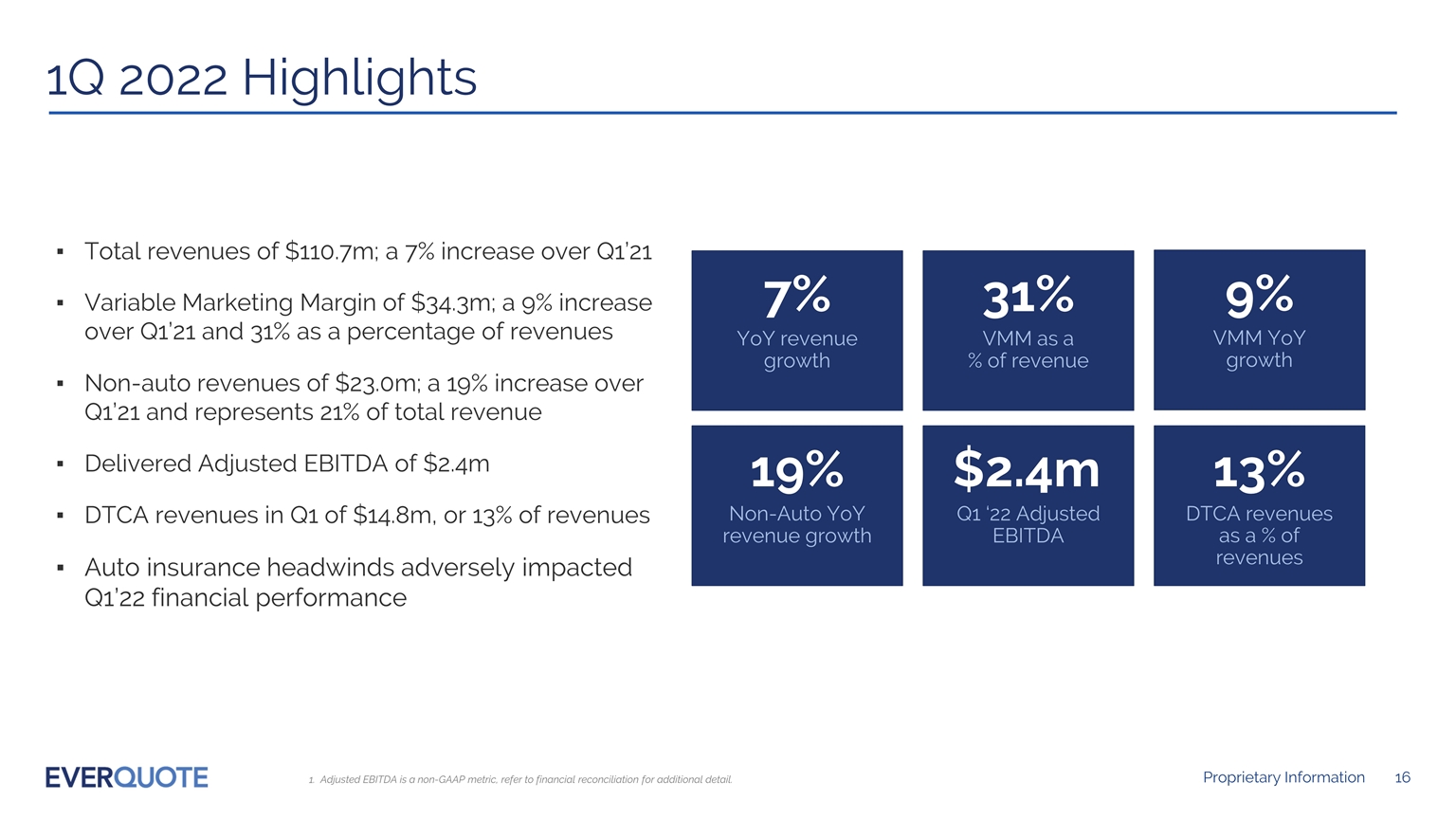

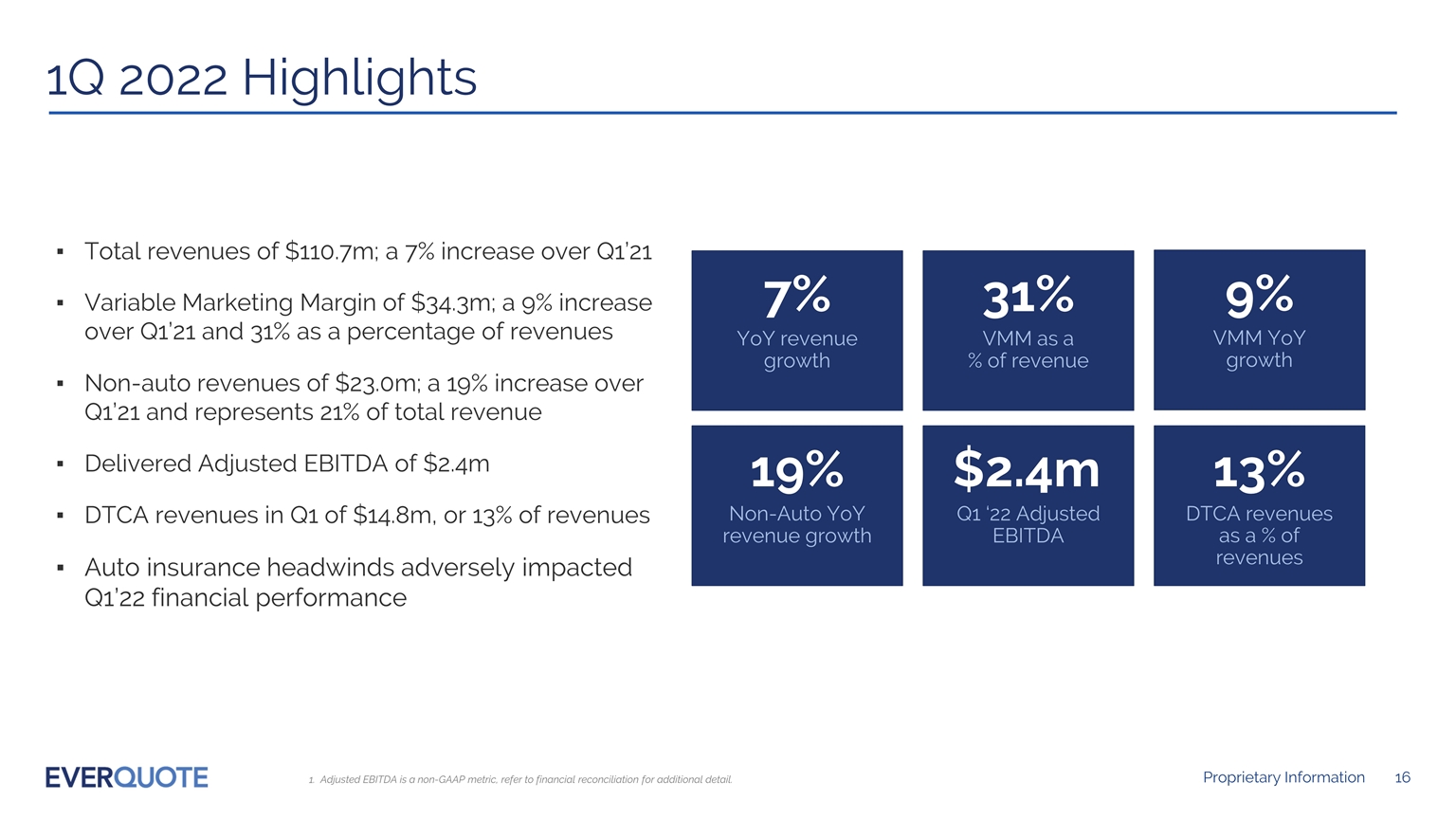

1Q 2022 Highlights Adjusted EBITDA is a non-GAAP metric, refer to financial reconciliation for additional detail. Total revenues of $110.7m; a 7% increase over Q1’21 Variable Marketing Margin of $34.3m; a 9% increase over Q1’21 and 31% as a percentage of revenues Non-auto revenues of $23.0m; a 19% increase over Q1’21 and represents 21% of total revenue Delivered Adjusted EBITDA of $2.4m DTCA revenues in Q1 of $14.8m, or 13% of revenues Auto insurance headwinds adversely impacted Q1’22 financial performance 31% VMM as a % of revenue 19% Non-Auto YoY revenue growth 9% VMM YoY growth 13% DTCA revenues as a % of revenues 7% YoY revenue growth $2.4m Q1 ‘22 Adjusted EBITDA

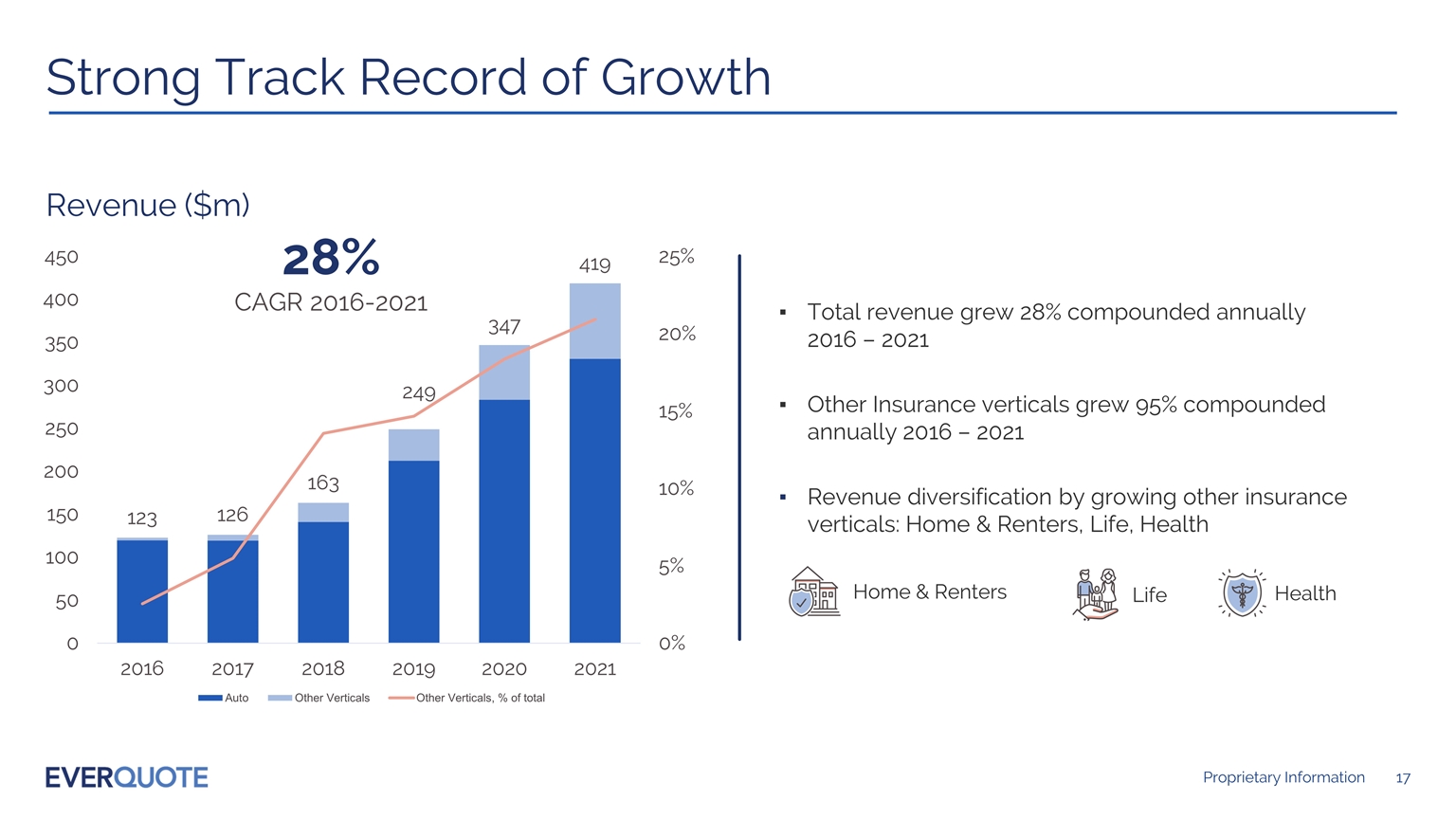

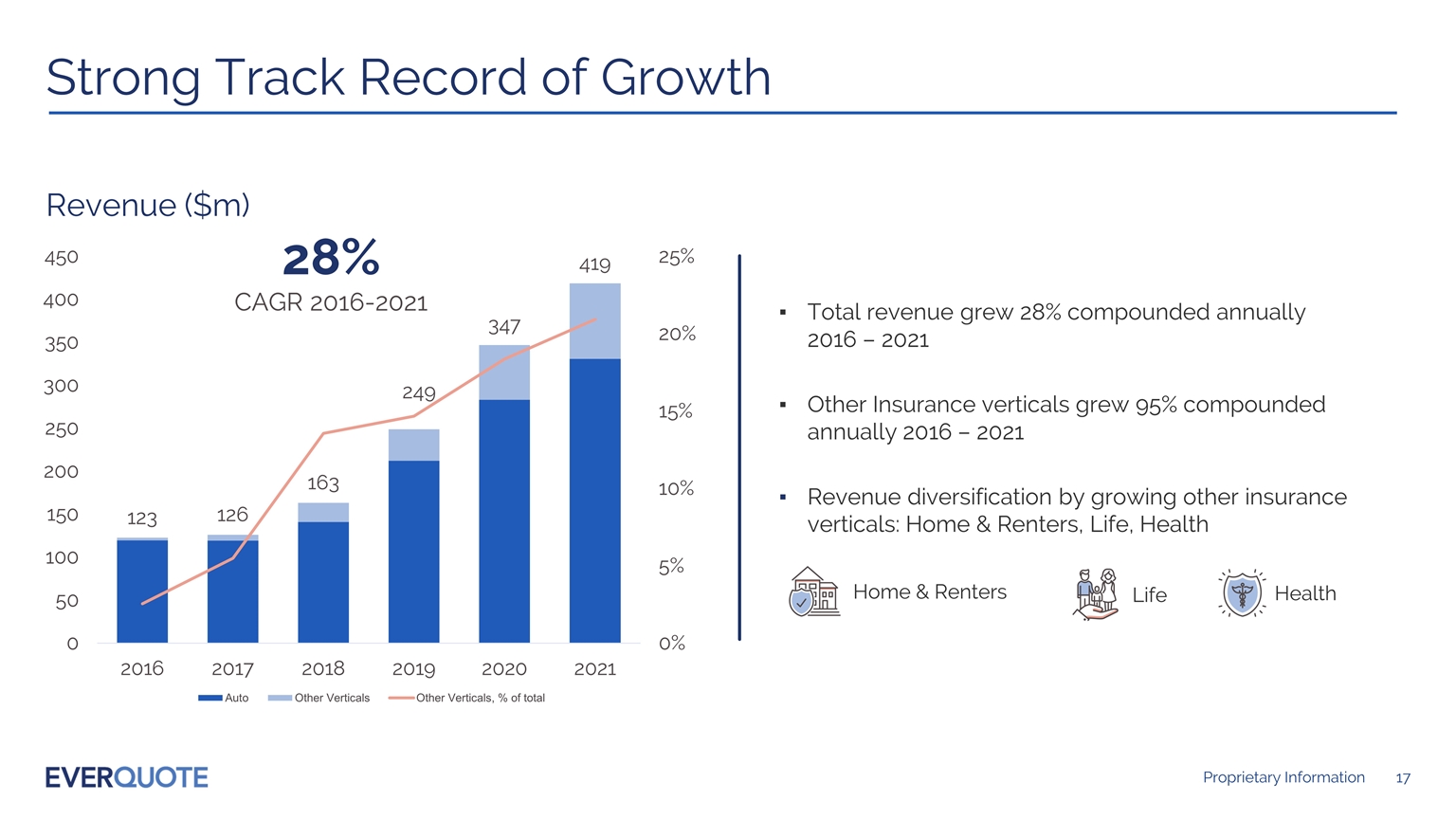

Revenue ($m) 28% CAGR 2016-2021 Track Record of Strong Growth Strong Track Record of Growth Total revenue grew 28% compounded annually 2016 – 2021 Other Insurance verticals grew 95% compounded annually 2016 – 2021 Revenue diversification by growing other insurance verticals: Home & Renters, Life, Health Life Home & Renters Health

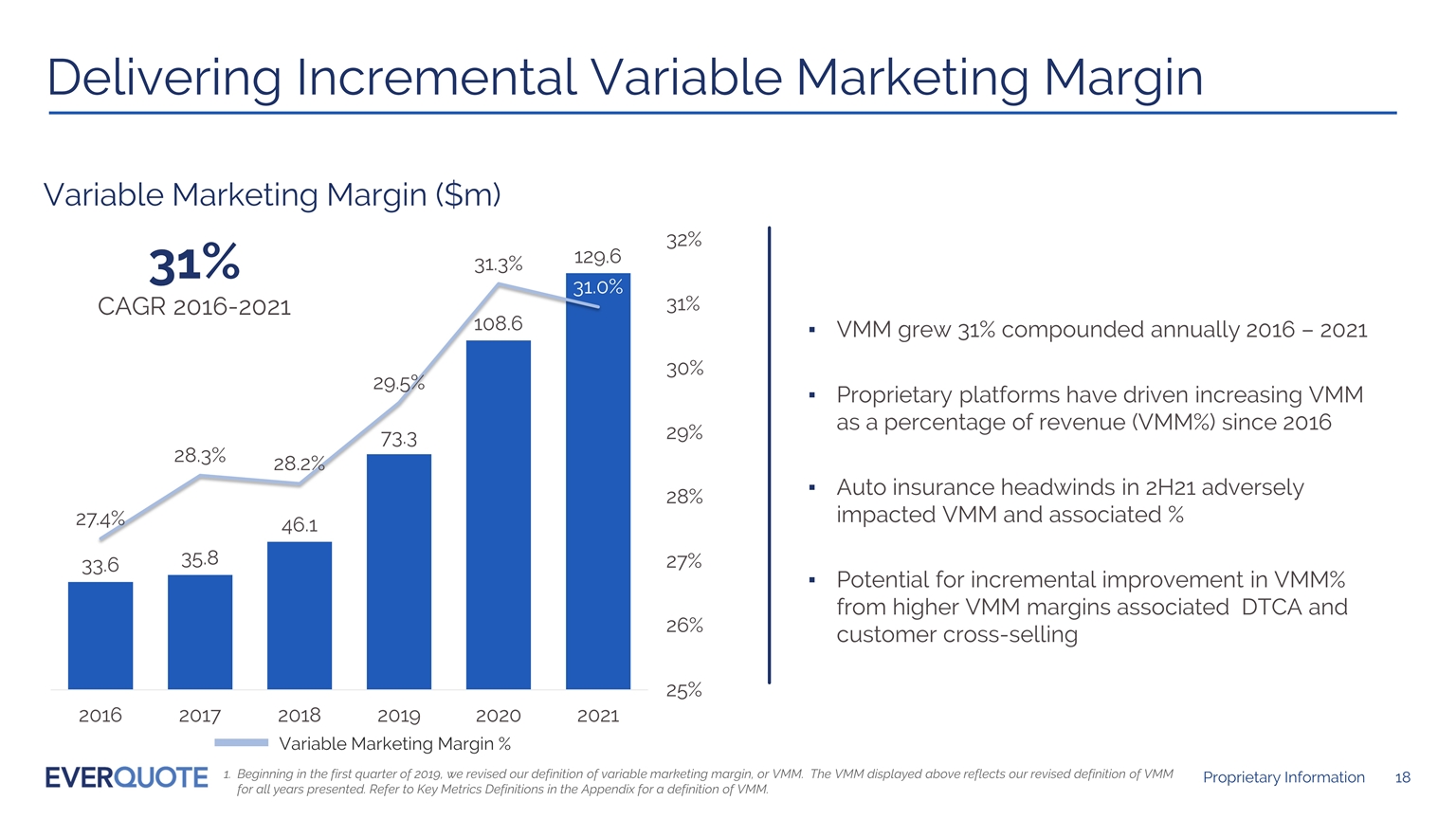

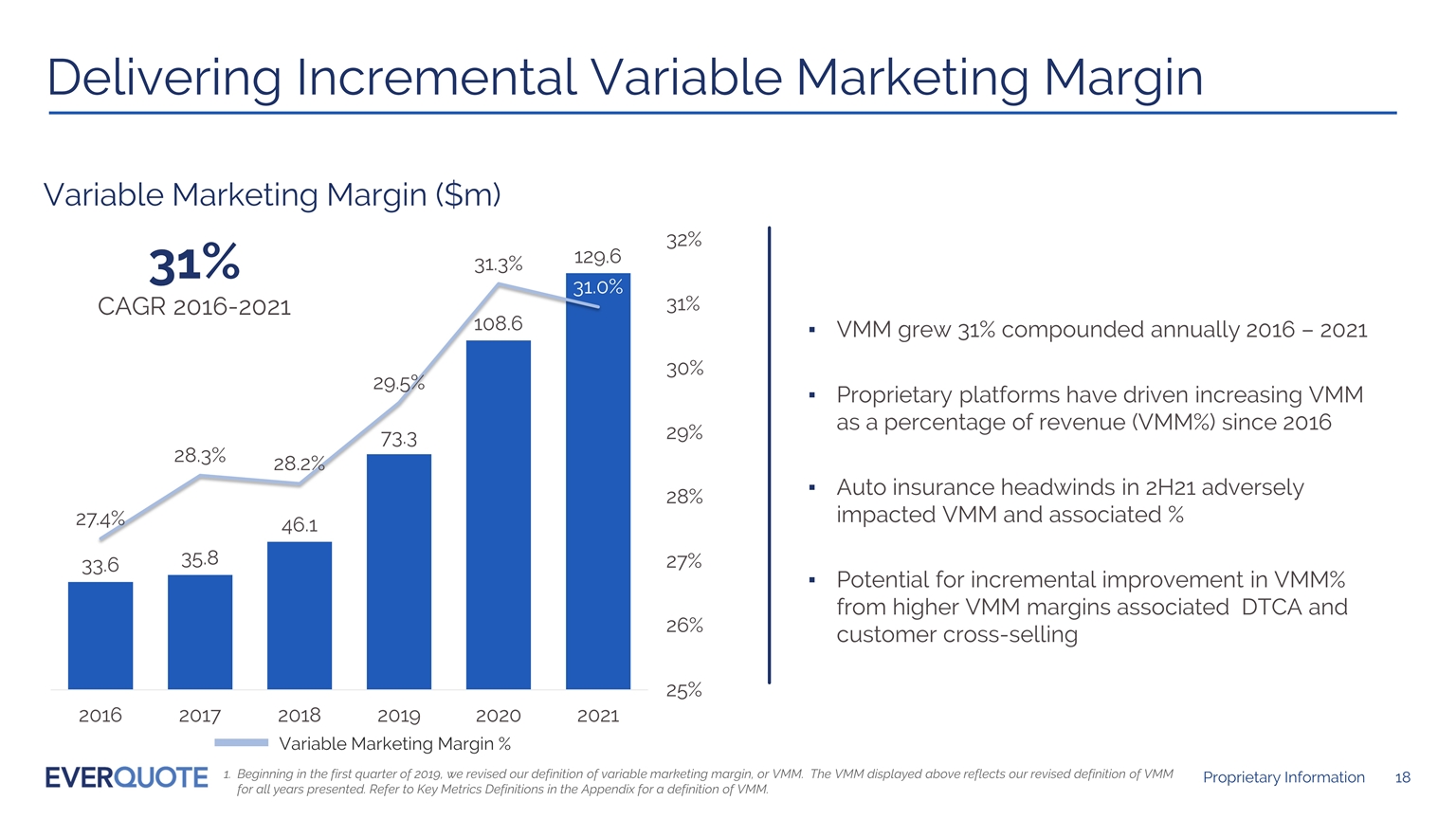

31% CAGR 2016-2021 Variable Marketing Margin ($m) Beginning in the first quarter of 2019, we revised our definition of variable marketing margin, or VMM. The VMM displayed above reflects our revised definition of VMM for all years presented. Refer to Key Metrics Definitions in the Appendix for a definition of VMM. Variable Marketing Margin % VMM grew 31% compounded annually 2016 – 2021 Proprietary platforms have driven increasing VMM as a percentage of revenue (VMM%) since 2016 Auto insurance headwinds in 2H21 adversely impacted VMM and associated % Potential for incremental improvement in VMM% from higher VMM margins associated DTCA and customer cross-selling Delivering Incremental Variable Marketing Margin

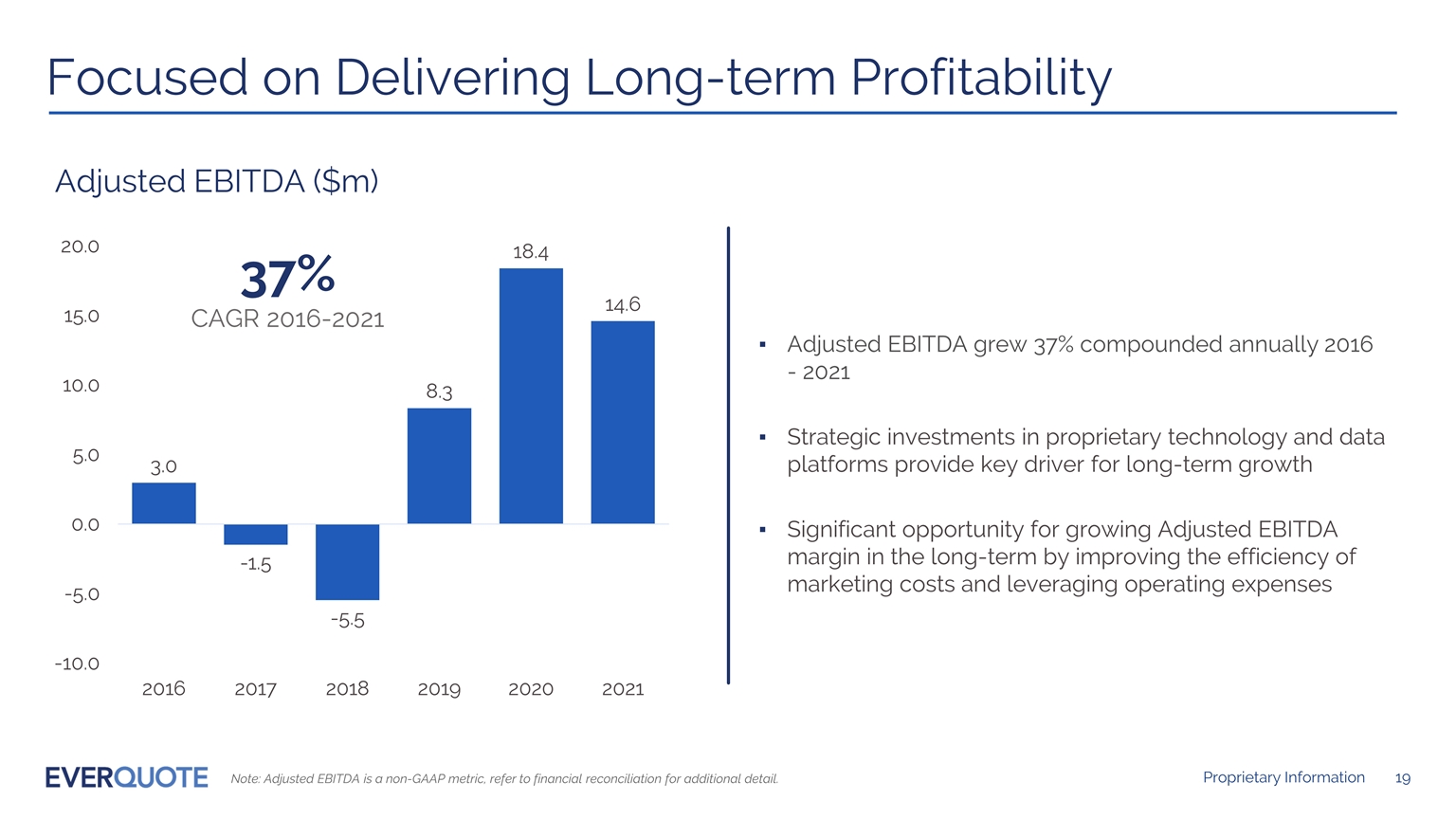

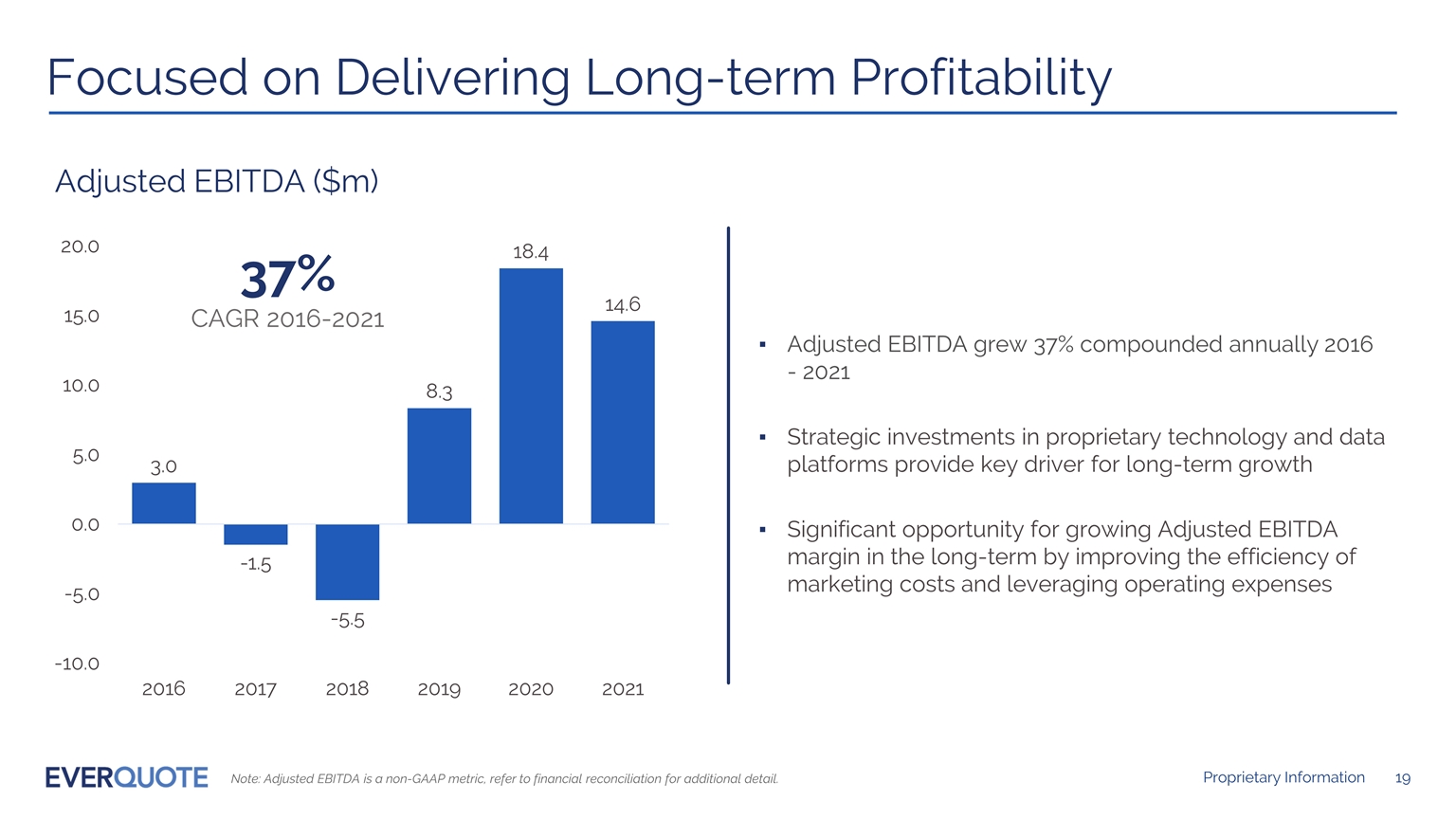

Focused on Delivering Long-term Profitability Adjusted EBITDA ($m) Note: Adjusted EBITDA is a non-GAAP metric, refer to financial reconciliation for additional detail. 2018 37% CAGR 2016-2021 Adjusted EBITDA grew 37% compounded annually 2016 - 2021 Strategic investments in proprietary technology and data platforms provide key driver for long-term growth Significant opportunity for growing Adjusted EBITDA margin in the long-term by improving the efficiency of marketing costs and leveraging operating expenses

NASDAQ: EVER

Appendix

Key Metrics Definitions Variable Marketing Margin We define variable marketing margin, or VMM, as revenue, as reported in our consolidated statements of operations and comprehensive income (loss), less advertising costs (a component of sales and marketing expense, as reported in our statements of operations and comprehensive income (loss)). We use VMM to measure the efficiency of individual advertising and consumer acquisition sources and to make trade-off decisions to manage our return on advertising. We do not use VMM as a measure of profitability. Adjusted EBITDA We define Adjusted EBITDA as net income (loss), adjusted to exclude: stock-based compensation expense, depreciation and amortization expense, acquisition-related costs, legal settlement expense, one-time severance charges, interest income and the provision for (benefit from) income taxes. We monitor & present Adjusted EBITDA because it is a key measure used by our management & board of directors to understand & evaluate our operating performance, to establish budgets & to develop operational goals for managing our business.

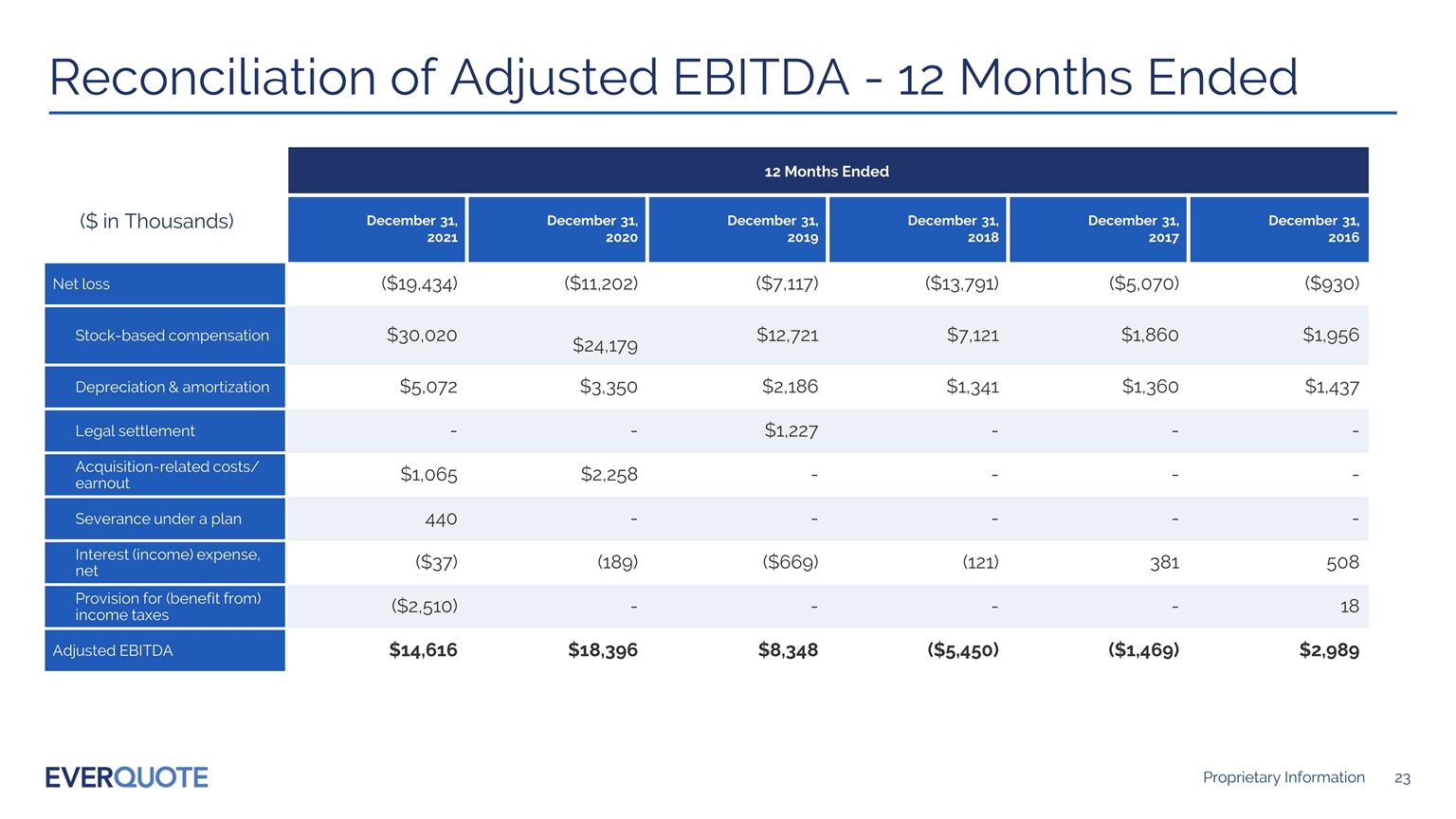

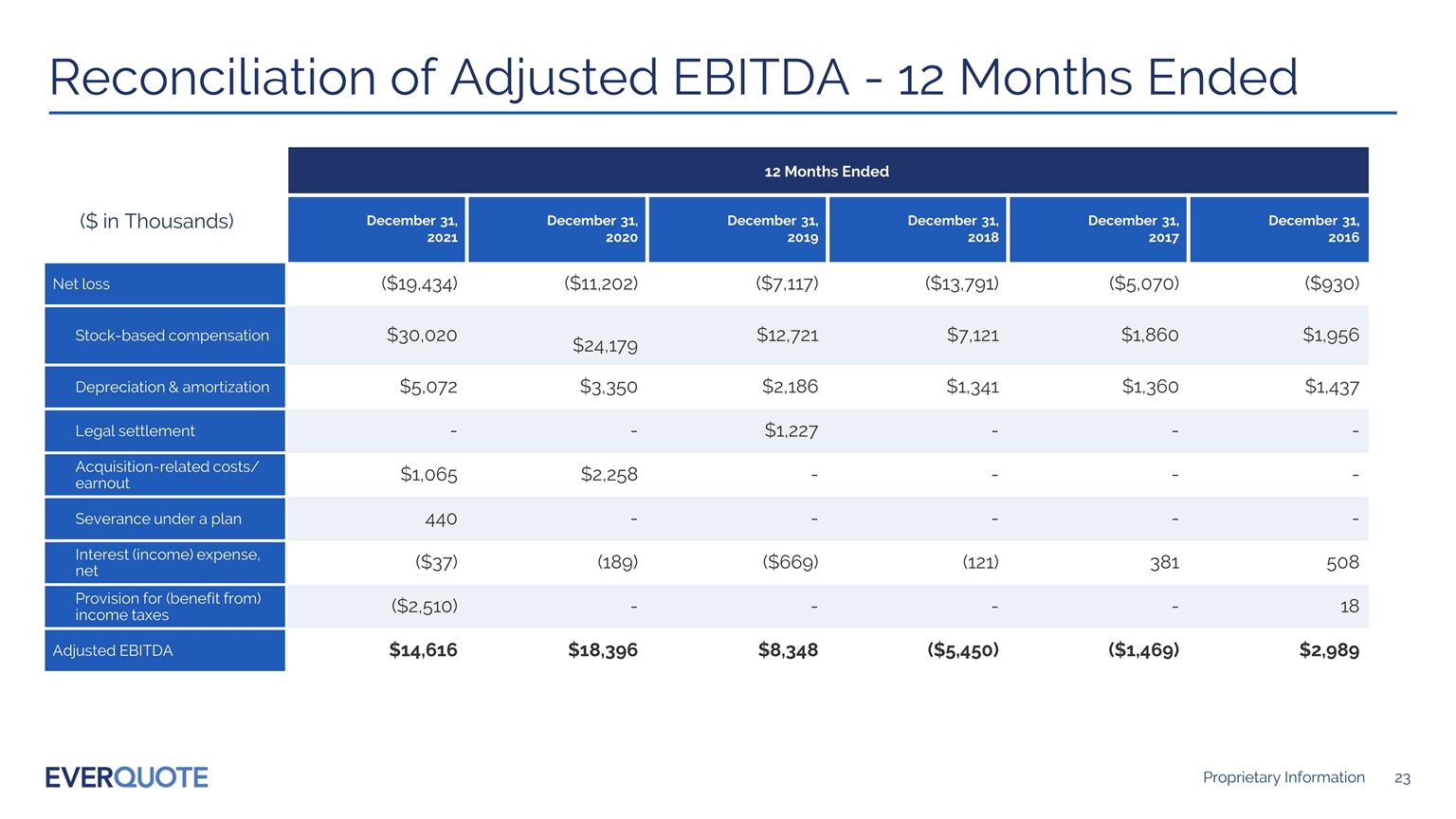

Reconciliation of Adjusted EBITDA - 12 Months Ended 12 Months Ended December 31, 2021 December 31, 2020 December 31, 2019 December 31, 2018 December 31, 2017 December 31, 2016 Net loss ($19,434) ($11,202) ($7,117) ($13,791) ($5,070) ($930) Stock-based compensation $30,020 $24,179 $12,721 $7,121 $1,860 $1,956 Depreciation & amortization $5,072 $3,350 $2,186 $1,341 $1,360 $1,437 Legal settlement - - $1,227 - - - Acquisition-related costs/ earnout $1,065 $2,258 - - - - Severance under a plan 440 - - - - - Interest (income) expense, net ($37) (189) ($669) (121) 381 508 Provision for (benefit from) income taxes ($2,510) - - - - 18 Adjusted EBITDA $14,616 $18,396 $8,348 ($5,450) ($1,469) $2,989 ($ in Thousands)

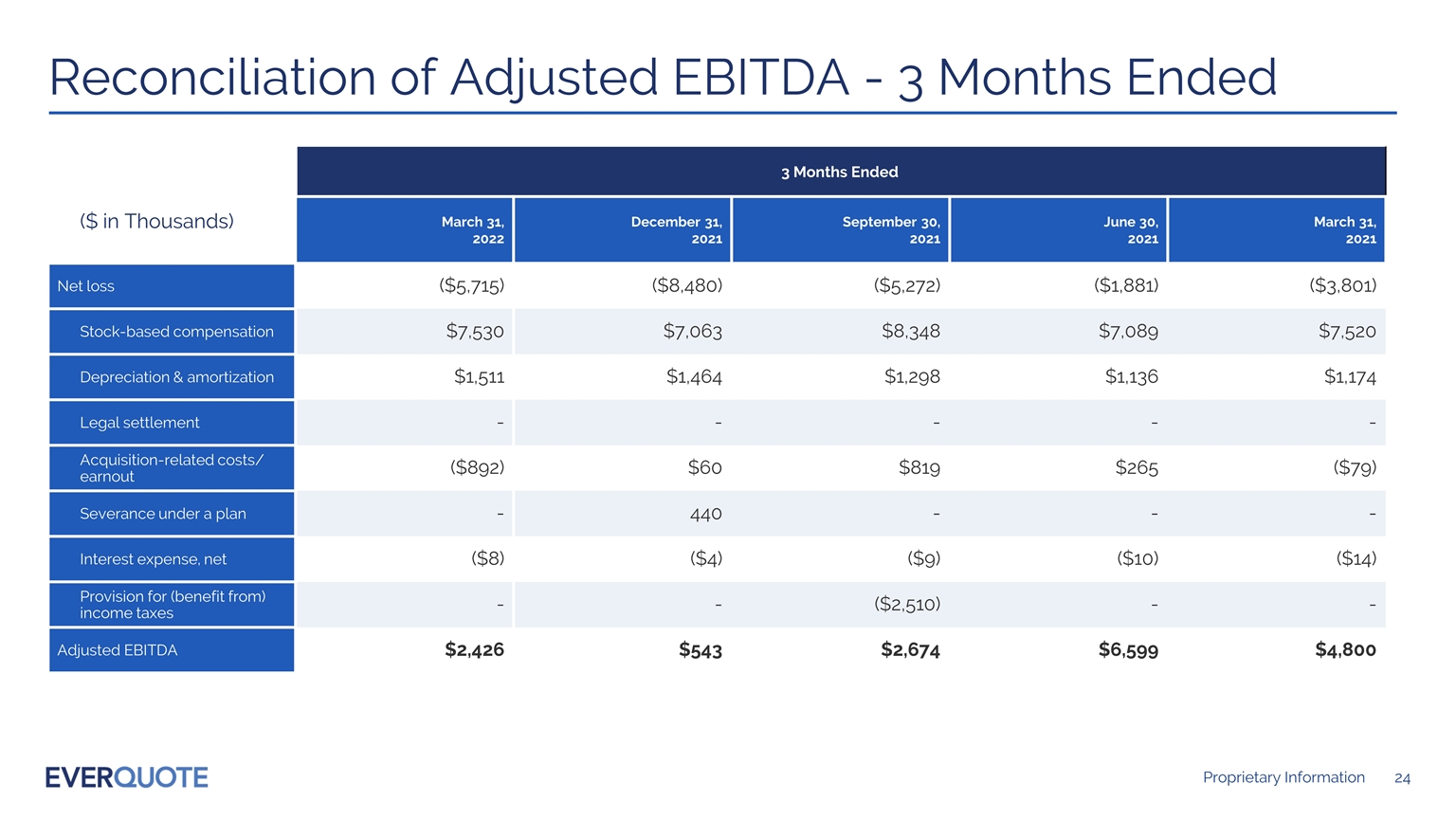

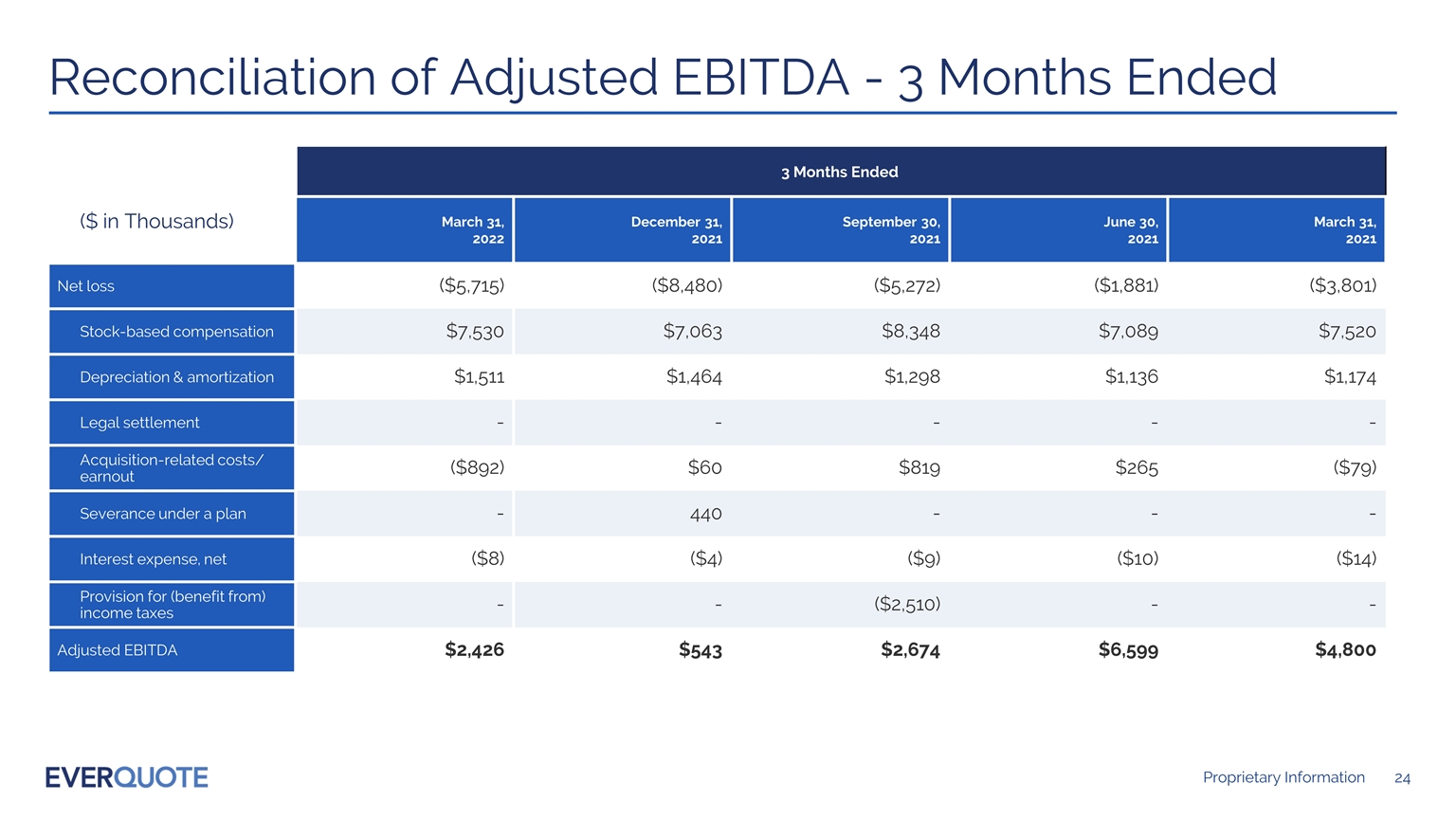

Reconciliation of Adjusted EBITDA - 3 Months Ended 3 Months Ended 3 Months Ended March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 Net loss ($5,715) ($8,480) ($5,272) ($1,881) ($3,801) Stock-based compensation $7,530 $7,063 $8,348 $7,089 $7,520 Depreciation & amortization $1,511 $1,464 $1,298 $1,136 $1,174 Legal settlement - - - - - Acquisition-related costs/ earnout ($892) $60 $819 $265 ($79) Severance under a plan - 440 - - - Interest expense, net ($8) ($4) ($9) ($10) ($14) Provision for (benefit from) income taxes - - ($2,510) - - Adjusted EBITDA $2,426 $543 $2,674 $6,599 $4,800 ($ in Thousands)