UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

|

|

Filed by the Registrant ý |

Filed by a party other than the Registrant o |

|

| |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

________________________________________________________________________________________________________

JOUNCE THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

________________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| | |

| Payment of Filing Fee (Check the appropriate box) |

| ý | No Fee required |

| o | Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filling Party: |

| | (4) | Date Filed: |

JOUNCE THERAPEUTICS, INC.

780 Memorial Drive

Cambridge, Massachusetts 02139

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

To be held June 19, 2018

You are cordially invited to attend the 2018 Annual Meeting of Stockholders, or the Annual Meeting, of Jounce Therapeutics, Inc., which is scheduled to be held on Tuesday, June 19, 2018 at 1:00 p.m. Eastern time, at the offices of Wilmer Cutler Pickering Hale and Dorr LLP, 60 State Street, Boston, Massachusetts 02109.

Only stockholders who owned common stock at the close of business on April 23, 2018 can vote at the Annual Meeting or any adjournment that may take place. At the Annual Meeting, the stockholders will consider and vote on the following matters:

| |

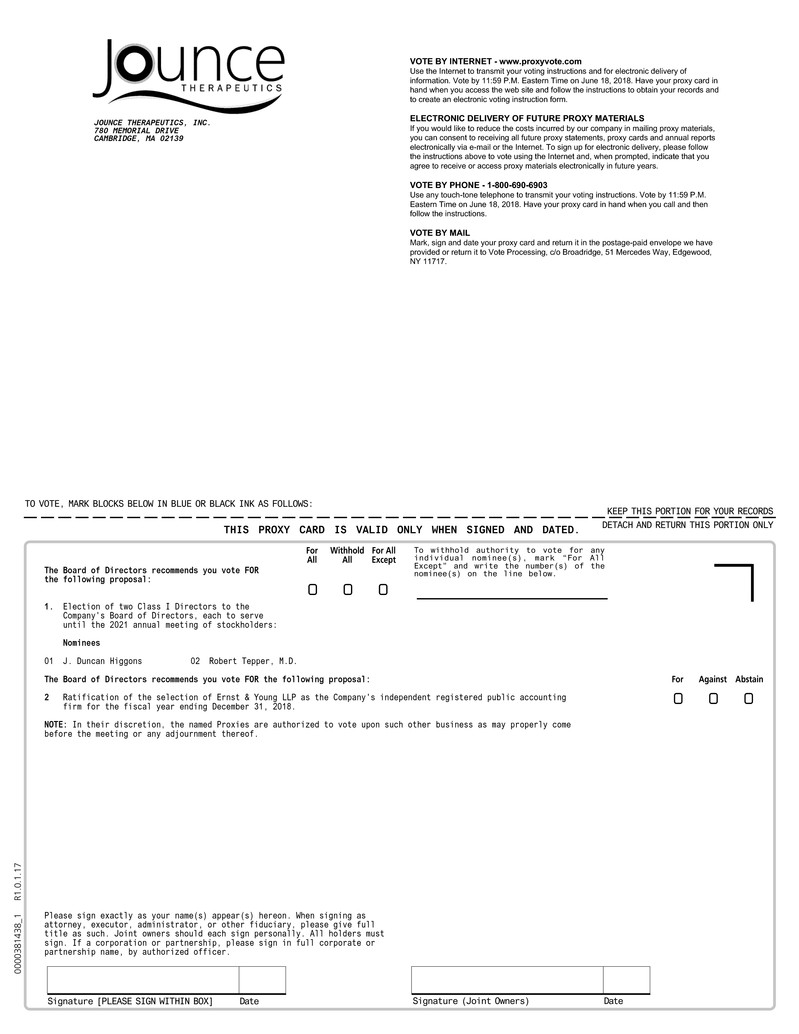

| 1. | Election of two Class I directors to our board of directors, each to serve until the 2021 annual meeting of stockholders; |

| |

| 2. | Ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; and |

| |

| 3. | Transaction of any other business properly brought before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

You can find more information, including information regarding the nominees for election as directors, in the attached Proxy Statement. The board of directors recommends that you vote in favor of each of proposals one and two as outlined in the attached Proxy Statement.

Instead of mailing a printed copy of our proxy materials to all of our stockholders, we provide access to these materials via the Internet. Accordingly, on or about April 27, 2018, we will begin mailing a Notice of Internet Availability of Proxy Materials, or Notice, to all stockholders of record on our books at the close of business on April 23, 2018, the record date for the Annual Meeting, and will post our proxy materials on the website referenced in the Notice. As more fully described in the Notice, stockholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail, or electronically by email, on an ongoing basis.

If you are a stockholder of record, you may vote in one of the following ways:

| |

| • | Vote over the Internet, by going to www.proxyvote.com (have your Notice or proxy card in hand when you access the website); |

| |

| • | Vote by Telephone, by calling the toll-free number 1-800-690-6903 (have your Notice or proxy card in hand when you call); |

| |

| • | Vote by Mail, if you received (or requested and received) a printed copy of the proxy materials, by completing, signing and dating the proxy card provided to you and returning it in the prepaid envelope provided to you; or |

| |

| • | Vote in person at the Annual Meeting. |

If your shares are held in "street name," that is, held for your account by a bank, broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted.

Whether or not you plan to attend the Annual Meeting in person, we urge you to take the time to vote your shares.

|

| | |

| | | By order of the Board of Directors, |

| | | Richard Murray, Ph.D. President and Chief Executive Officer |

Cambridge, Massachusetts

April 27, 2018

TABLE OF CONTENTS

780 Memorial Drive

Cambridge, Massachusetts 02139

PROXY STATEMENT

FOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS

to be held June 19, 2018

This proxy statement and the enclosed proxy card contain information about the Annual Meeting of Stockholders of Jounce Therapeutics, Inc., or the Annual Meeting, to be held on Tuesday, June 19, 2018 at 1:00 p.m. Eastern time, at offices of Wilmer Cutler Pickering Hale and Dorr LLP, 60 State Street, Boston, Massachusetts 02109. The board of directors of Jounce is using this proxy statement to solicit proxies for use at the Annual Meeting. In this proxy statement, unless expressly stated otherwise or the context otherwise requires, the use of "Jounce," "our," "we" or "us" refers to Jounce Therapeutics, Inc. and its wholly-owned subsidiary.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Stockholders to be Held on June 19, 2018:

This proxy statement and our 2017 Annual Report to Stockholders are

available for viewing, printing and downloading at http://www.proxyvote.com.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017, or 2017 Annual Report, as filed with the Securities and Exchange Commission, or SEC, will be furnished without charge to any stockholder upon written request to Jounce Therapeutics, Inc., 780 Memorial Drive, Cambridge, Massachusetts 02139. This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 are also available on the SEC's website at http://www.sec.gov.

On or about April 27, 2018, we will mail a Notice of Internet Availability of Proxy Materials, or Notice, to our stockholders (other than those who previously requested electronic or paper delivery of proxy materials), directing stockholders to a website where they can access our proxy materials, including this proxy statement and our 2017 Annual Report, and view instructions on how to vote online or by telephone. If you would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice. If you have previously elected to receive our proxy materials electronically, you will continue to receive access to those materials via e-mail unless you elect otherwise.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Purpose of the Annual Meeting

At the Annual Meeting, our stockholders will consider and vote on the following matters:

| |

| 1. | Election of two Class I directors to our board of directors, each to serve until the 2021 annual meeting of stockholders; |

| |

| 2. | Ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; and |

| |

| 3. | Transaction of any other business properly brought before the Annual Meeting or any adjournment or postponement thereof. |

As of the date of this proxy statement, we are not aware of any business to come before the Annual Meeting other than the first two items noted above.

Board of Directors Recommendation

Our board of directors unanimously recommends that you vote:

FOR the election of the two nominees to serve as Class I directors on our board of directors for a three-year term; and

FOR the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.

Availability of Proxy Materials

The Notice regarding our proxy materials, including this proxy statement and our 2017 Annual Report, is being mailed to stockholders on or about April 27, 2018. Our proxy materials are also available for viewing, printing and downloading on the Internet at http://www.proxyvote.com.

Who Can Vote at the Annual Meeting

Only stockholders of record at the close of business on the record date of April 23, 2018 are entitled to receive notice of the Annual Meeting and to vote the shares of our common stock that they held on that date. As of April 23, 2018, there were 32,482,458 shares of common stock issued and outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the Annual Meeting.

Difference between a "stockholder of record" and a beneficial owner of shares held in "street name"

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare, then you are considered a "stockholder of record" of those shares. In this case, your Notice has been sent to you directly by us. You may vote your shares by proxy prior to the Annual Meeting by following the instructions contained on such Notice.

Beneficial Owners of Shares Held in Street Name. If your shares are held in a brokerage account or by a bank, trust or other nominee or custodian, then you are considered the beneficial owner of those shares, which are held in "street name." In this case, your Notice has been forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct that organization as to how to vote the shares held in your account by following the instructions contained on the voting instruction card provided to you by that organization.

How to Vote

If you are a stockholder of record, you can vote your shares in one of two ways: either by proxy or in person at the Annual Meeting. If you choose to vote by proxy, you may do so by telephone, via the Internet or by mail. Each of these methods is explained below. If you hold your shares of our common stock in multiple accounts, you should vote your shares as described in each set of proxy materials you receive.

| |

| • | By Telephone. You may transmit your proxy voting instructions by calling 1-800-690-6903. You will need to have your Notice or proxy card in hand when you call. |

| |

| • | Via the Internet. You may transmit your proxy voting instructions via the Internet by accessing the website specified on the enclosed proxy card. You will need to have your Notice or proxy card in hand when you access the website. |

| |

| • | By Mail. If you received (or requested and received) a printed copy of the proxy materials, you may vote by proxy by completing, signing and dating the proxy card provided to you and returning it in the prepaid envelope provided to you. |

| |

| • | In Person at the Annual Meeting. You may vote in person at the Annual Meeting. We will give you a ballot when you arrive. If you are the beneficial owner of shares held in "street name" and you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from the organization that holds your shares and present it with your ballot to the inspector of election at the Annual Meeting. Even if you plan to attend the Annual Meeting, we urge you to vote your shares by proxy in advance of the Annual Meeting so that if you should become unable to attend the Annual Meeting your shares will be voted as directed by you. You may obtain directions to the location of the Annual Meeting by calling our offices at 857-259‑3840. |

Telephone and Internet voting for stockholders of record will be available up until 11:59 p.m. Eastern time on June 18, 2018, and mailed proxy cards must be received by June 18, 2018 in order to be counted at the Annual Meeting. If the Annual Meeting is adjourned or postponed, these deadlines may be extended. The voting deadlines and availability of telephone and Internet voting for beneficial owners of shares held in "street name" will depend on the voting processes of the organization that holds your shares. Therefore, we urge you to carefully review and follow the voting instruction card and any other materials that you receive from that organization.

Ballot Measures Considered "Discretionary" and "Non-Discretionary"

If your shares are held in "street name," your bank, broker or other nominee may under certain circumstances vote your shares if you do not return voting instructions. Banks, brokers or other nominees are permitted to vote customers' shares for which they have received no voting instructions on specified routine, or "discretionary," matters, but they are not permitted to vote these shares on other non-routine, or "non-discretionary," matters.

The election of directors (Proposal No. 1) is considered a non-discretionary matter under applicable rules. Therefore, if your shares are held in "street name," your bank, broker or other nominee cannot vote on this matter without voting instructions from you. The ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for 2018 (Proposal No. 2) is considered a discretionary matter under applicable rules. Therefore, if your shares are held in "street name," your bank, broker or other nominee may exercise discretionary authority to vote on this matter in the absence of voting instructions from you.

If you do not instruct your bank, broker or other nominee how to vote with respect to the election of directors (Proposal No. 1), your bank, broker or other nominee may not vote with respect to this proposal and your shares will be counted as "broker non-votes." Broker non-votes are shares that are held in "street name" by a bank, broker or other nominee that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

Quorum

A quorum of stockholders is necessary to hold a valid meeting. Our amended and restated by-laws provide that a quorum will exist if stockholders holding a majority of the shares of stock issued and outstanding and entitled to vote are present at the meeting in person or by proxy. If a quorum is not present, the meeting may be adjourned until a quorum is obtained.

For purposes of determining whether a quorum exists, we will count as present any shares that are voted over the Internet, by telephone, by completing and submitting a proxy by mail or that are represented in person at the Annual Meeting. Further, for purposes of establishing a quorum, we will count as present shares that a stockholder holds even if the stockholder votes to abstain or only votes on one of the proposals. In addition, we will count as present shares that are "broker non-votes."

Votes Required to Elect a Director and to Ratify Selection of Ernst & Young LLP

To be elected, a director must receive a plurality of the votes properly cast by stockholders entitled to vote at the meeting (Proposal No. 1). A stockholder may vote either "for" the nominees or "withhold" its vote from any or all of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors.

The ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the shares of common stock present or represented by proxy and properly voted "for" or "against" such matter (Proposal No. 2). We are not required to obtain the approval of our stockholders to select

our independent registered public accounting firm. However, if our stockholders do not ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for 2018, our audit committee may reconsider its selection.

Abstentions and broker non-votes will not be counted as votes cast or votes on either of the proposals. Abstentions and broker non-votes will have no effect on the results of this vote.

Method of Counting Votes

Each holder of common stock is entitled to one vote at the Annual Meeting on each matter to come before the Annual Meeting, including the election of directors, for each share held by such stockholder as of the record date. Votes cast in person at the Annual Meeting or by proxy by mail, via the Internet or by telephone will be tabulated by the inspector of election appointed for the Annual Meeting, who will also determine whether a quorum is present.

Revoking a Proxy; Changing Your Vote

If you are a stockholder of record, you may revoke your proxy before the vote is taken at the meeting:

| |

| • | by submitting a new proxy with a later date before the applicable deadline either signed and returned by mail or transmitted using the telephone or Internet voting procedures described in the "How to Vote" section above; |

| |

| • | by voting in person at the meeting; or |

| |

| • | by filing a written revocation with our corporate Secretary. |

If your shares are held in "street name," you may submit new voting instructions by contacting your bank, broker or other organization holding your account. You may also vote in person at the Annual Meeting, which will have the effect of revoking any previously submitted voting instructions, if you obtain a legal proxy from the organization that holds your shares as described in the "How to Vote" section above. Your attendance at the Annual Meeting will not automatically revoke your proxy.

Costs of Proxy Solicitation

We will bear the costs of soliciting proxies. In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, facsimile, email, personal interviews and other means.

Voting Results

We plan to announce preliminary voting results at the Annual Meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Annual Meeting.

PROPOSAL NO. 1—ELECTION OF TWO CLASS I DIRECTORS

Our board of directors currently consists of eight members. In accordance with the terms of our restated certificate of incorporation and our amended and restated by-laws, our board of directors is divided into three classes (Class I, Class II and Class III), with members of each class serving staggered three-year terms. The members of the classes are divided as follows:

| |

| • | the Class I directors are J. Duncan Higgons and Robert Tepper, M.D., and their term will expire at the Annual Meeting; |

| |

| • | the Class II directors are Luis Diaz, Jr., M.D., Barbara Duncan and Robert Kamen, Ph.D., and their term expires at the annual meeting of stockholders to be held in 2019; and |

| |

| • | the class III directors are Cary Pfeffer, M.D., Perry Karsen and Richard Murray, Ph.D., and their term expires at the annual meeting of stockholders to be held in 2020. |

Upon the expiration of the term of a class of directors, directors in that class will be eligible to be elected for a new three-year term at the annual meeting of stockholders in the year in which their term expires.

Our restated certificate of incorporation and our amended and restated by-laws provide that the authorized number of directors may be changed only by resolution of our board of directors. Our restated certificate of incorporation and amended and restated by-laws also provide that our directors may be removed only for cause by the affirmative vote of the holders of at least 75% of the votes that all our stockholders would be entitled to cast in an election of directors, and that any vacancy on our board of directors, including a vacancy resulting from an enlargement of our board of directors, may be filled only by vote of a majority of our directors then in office.

Our board of directors has nominated Mr. Higgons and Dr. Tepper for election as Class I directors at the Annual Meeting. Each of the nominees is presently a director, and each has indicated a willingness to continue to serve as director, if elected. If a nominee becomes unable or unwilling to serve, however, the proxies may be voted for substitute nominees selected by our board of directors.

We have no formal policy regarding board diversity, but our corporate governance guidelines provide that the Nominating and Corporate Governance Committee will set the criteria for selecting director candidates. The criteria considered by the Nominating and Corporate Governance Committee include the background and qualifications of the members of our board of directors considered as a group should provide a significant breadth of experience, knowledge, and ability to assist our board of directors in fulfilling its responsibilities. Our priority in selection of board members is identification of members who will further the interests of our stockholders through their established records of professional accomplishment, the ability to contribute positively to the collaborative culture among our board members, knowledge of our business, understanding of the competitive landscape in which we operate and adherence to high ethical standards. Certain individual qualifications and skills of our directors that contribute to our board of directors' effectiveness as a whole are described in the following paragraphs.

Nominees for Election as Class I Directors

Biographical information, including principal occupation and business experience during the last five years, for our nominees for election as Class I directors at our Annual Meeting is set forth below.

|

| | | | |

| Class I Director Nominees | | Age | | Director Since |

J. Duncan Higgons—Mr. Higgons served as chief operating officer of Agios Therapeutics, Inc., or Agios, a public biopharmaceutical company, from 2009 to January 2016. Prior to joining Agios, Mr. Higgons served as executive vice-president, and interim president and chief executive officer at Archemix Corporation, or Archemix, from 2006 to 2009. Prior to Archemix, Mr. Higgons served as the chief commercial officer at TransForm Pharmaceuticals, Inc., which was acquired by Johnson & Johnson Company. Mr. Higgons serves on the board of PsiOxus Therapeutics Ltd., a private cancer therapeutics company. He holds a B.Sc. in Mathematics from King's College University of London and a M.Sc. in Economics from London Business School. We believe that Mr. Higgons is qualified to serve on our board of directors due to his leadership and management experience. | | 63 | | November 2015 |

| | | | | |

Robert Tepper, M.D.— Since 2007, Dr. Tepper has served as a partner at Third Rock Ventures, LLC, a venture capital fund, which he co-founded in 2007. From February 2013 to January 2015, Dr. Tepper served as our interim chief scientific officer and, from October 2015 to November 2016, he served as the interim chief scientific officer of Neon Therapeutics, Inc., an immuno-oncology company. Prior to joining Third Rock Ventures, LLC, Dr. Tepper held multiple positions at Millennium Pharmaceuticals, Inc., including as president of research and development from 2002 to 2007, executive vice president of discovery from 2001 to 2002 and chief scientific officer from 1999 to 2002. Dr. Tepper serves on the boards of directors for numerous companies, including publicly-traded companies Allena Pharmaceuticals, Inc. and Kala Pharmaceuticals, Inc., and private companies Constellation Pharmaceuticals, Inc. and Neon Therapeutics, Inc. Previously, Dr. Tepper served on the board of directors of Bluebird Bio, Inc. from September 2010 through March 2015 and various other private life science companies. Dr. Tepper received an M.D. from Harvard Medical School and an A.B. in biochemistry from Princeton University. We believe that Dr. Tepper is qualified to serve on our board of directors due to his experience in the venture capital industry, particularly with biotech and pharmaceutical companies, combined with his experience building and leading research and development operations, serving on the boards of public and private life sciences companies and as faculty and advisory board members of several healthcare institutions. | | 62 | | February 2013 |

The board of directors recommends voting "FOR" the election of J. Duncan Higgons and Robert Tepper, M.D. as Class I directors, for a three-year term ending at the annual meeting of stockholders to be held in 2021.

Any properly submitted proxy will be voted in favor of the nominees unless a contrary specification is made in the proxy. The nominees have consented to serve as directors if elected. However, if any nominee is unable to serve or for good cause will not serve as a director, the persons named in the proxy intend to vote in their discretion for one or more substitutes who will be designated by our board of directors.

Directors Continuing in Office

Biographical information, including principal occupation and business experience during the last five years, for our directors continuing in office after the Annual Meeting is set forth below. |

| | | | |

| Current Directors Not Standing for Election at the 2018 Annual Meeting | | Age | | Director Since |

Perry Karsen—Mr. Karsen has served as the chairman of our board of directors since April 2016. Previously, Mr. Karsen was the chief executive officer of the Celgene Cellular Therapeutics division of Celgene Corporation, or Celgene, a global biopharmaceutical company, from May 2013 until his retirement in December 2015. Mr. Karsen served as executive vice president and chief operations officer of Celgene from 2010 to May 2013, and as senior vice president and head of worldwide business development of Celgene from 2004 to 2009. Mr. Karsen was chief executive officer of Pearl Therapeutics Inc., from 2009 to 2010. Earlier in his career, Mr. Karsen held executive positions at Human Genome Sciences, Inc., Bristol-Myers Squibb Co., Genentech, Inc. and Abbott Laboratories. He has served as the chairman of the board of directors of Intellia Therapeutics, Inc. since April 2016, as a member of the board of directors and executive chairman of OncoMed Pharmaceuticals, Inc. since January 2016 and January 2018, respectively, and a member of the board of directors of Voyager Therapeutics, Inc. since July 2015, all of which are public life sciences companies. Mr. Karsen received a Masters of Management from Northwestern University's Kellogg Graduate School of Management, a Masters of Arts in Teaching of Biology from Duke University and a B.S. in Biological Sciences from the University of Illinois, Urbana-Champaign. We believe Mr. Karsen is qualified to serve on our board of directors because of his executive leadership experience and membership on boards of directors of other public companies. | | 62 | | January 2016 |

| | | | | |

Luis Diaz, Jr., M.D.—Dr. Diaz has served as the head of the solid tumor oncology division and a faculty member at the Memorial Sloan Kettering Cancer Center since December 2016. From 2004 to December 2016, Dr. Diaz was a faculty member and physician at Johns Hopkins University School of Medicine. Dr. Diaz is also a founder and board member, and from 2010 to April 2016 served as president, chief executive officer and chief medical officer, of Personal Genome Diagnostics Inc., a private cancer genome analysis company. He received his M.D. from the University of Michigan, where he also received his B.A. in Microbiology. We believe Dr. Diaz is qualified to serve on our board of directors due to his background as a physician focused on oncology and his experience as a faculty member at a major hospital and medical center. | | 47 | | October 2017 |

| | | | | |

Barbara Duncan—Ms. Duncan served as the chief financial officer of Intercept Pharmaceuticals Inc., a biopharmaceutical company, from 2009 to June 2016 and as treasurer from 2010 to September 2016. From 2001 to 2009, Ms. Duncan served as chief financial officer and then chief executive officer at DOV Pharmaceutical, Inc. Previously, Ms. Duncan served as a vice president of Lehman Brothers Inc. in its corporate finance division from 1998 to 2001. She has served on the board of directors of Adaptimmune Therapeutics plc since June 2016, Aevi Genomic Medicine, Inc. (formerly Medgenics, Inc.) since June 2015, ObsEva SA since December 2016, Ovid Therapeutics, Inc. since June 2017 and Innoviva, Inc. from September 2016 to April 2018, all of which are public companies. Ms. Duncan holds an M.B.A. from the Wharton School of Business and a B.S. from Louisiana State University. We believe Ms. Duncan is qualified to serve on our board of directors because of her experience in the biopharmaceutical industry, her experience in the financial sector and membership on boards of directors of other public and private companies. | | 53 | | May 2016 |

|

| | | | |

| Current Directors Not Standing for Election at the 2018 Annual Meeting | | Age | | Director Since |

Robert Kamen, Ph.D.—Dr. Kamen is a venture partner at Third Rock Ventures, LLC, which he joined in 2010. Dr. Kamen served as our interim chief technology officer from February 2013 to December 2015. From 2005 to 2010, Dr. Kamen served as the chairman of BioAssets Development Corporation. From 2002 to 2008, Dr. Kamen served as executive-in-residence at Oxford Bioscience Partners. From 2001 to 2002 he served as president of Abbott Laboratories' Abbot Bioresearch Center and as a member of the Abbott Pharma Executive Management Committee, and from 1991 to 2001, he served as the president of BASF Bioresearch Corporation. Dr. Kamen serves on the boards of directors for numerous private companies, including EpimAb Biotherapeutics, Inc., Harbour Antibodies BV, Lycera Corporation and Neon Therapeutics, Inc. Dr. Kamen holds a Ph.D. in biochemistry and molecular biology from Harvard University and a B.S. in biophysics from Amherst College. We believe that Dr. Kamen is qualified to serve on our board of directors because of his experience in the venture capital and life sciences industries, membership on various other boards of directors, and his leadership and management experience. | | 73 | | February 2013 |

| | | | | |

Richard Murray, Ph.D.—Dr. Murray has served as our president, chief executive officer and a member of our board of directors since July 2014. Prior to joining Jounce, Dr. Murray served as senior vice president of biologics and vaccines research and development at Merck & Co., a global healthcare company, from 2009 to June 2014, where he was responsible for the advancement of biologics and vaccines, including Merck's cancer immunotherapy pipeline. From 2008 to 2009, Dr. Murray served as an advisor to venture capital and life science investors. From 2003 to 2008, he served in a variety of roles at PDL Biopharma Inc., or PDL, initially as vice president of research to executive vice president and chief scientific officer. He also served as a director of PDL from 2007 to 2008. Earlier in his career, Dr. Murray was a co-founder and served as vice president of research at Eos Biotechnology, Inc. Dr. Murray holds a Ph.D. in microbiology and immunology from the University of North Carolina at Chapel Hill and a B.S. in microbiology from the University of Massachusetts, Amherst. We believe that Dr. Murray is qualified to serve on our board of directors due to his operating and historical experience gained from serving as our president, chief executive officer and as a board member, combined with his experience in drug research and development. | | 59 | | July 2014 |

| | | | | |

Cary Pfeffer, M.D.—Dr. Pfeffer is the interim chief business officer of Rheos Medicines, Inc., a biopharmaceutical company, which he joined in March 2018, and is a partner at Third Rock Ventures, LLC, which he joined in 2007. Dr. Pfeffer served as the chairman of our board from July 2014 to April 2016 and as our interim chief executive officer from February 2013 to July 2014. Dr. Pfeffer was the interim chief executive officer of Neon Therapeutics, Inc. from October 2015 to September 2016. Dr. Pfeffer served at Biogen Inc. from 1992 to 2002 in a variety of domestic and international executive management roles. Dr. Pfeffer serves on the boards of directors for several private companies, including Ablexis, LLC, Edimer Pharmaceuticals, Inc., Tango Therapeutics, Inc. and Neon Therapeutics, Inc., where he serves as chairman of the board. From August 2009 to September 2016, Dr. Pfeffer was a member of the board of directors of Eleven Biotherapeutics, Inc., a public biologics oncology company, and served as its chief business officer from February 2010 to September 2011. Dr. Pfeffer received an M.B.A. from the Wharton School of Business, an M.D. from the University of Pennsylvania School of Medicine and a B.A. in biochemistry from Columbia University. We believe that Dr. Pfeffer is qualified to serve on our board of directors because of his experience in the venture capital industry, life sciences industry, membership on various other boards of directors, his prior service as our president and chief executive officer, and his leadership and management experience. | | 55 | | February 2013 |

There are no family relationships between or among any of our directors or executive officers. The principal occupation and employment during the past five years of each of our directors was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary or other affiliate of us. There is no arrangement or understanding between any of our directors and any other person or persons pursuant to which he or she is to be selected as a director.

There are no material legal proceedings to which any of our directors is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

Executive Officers

The following table sets forth our executive officers as of April 23, 2018.

|

| | | | |

| Name | | Age | | Position |

Richard Murray, Ph.D.(1) | | 59 | | President, Chief Executive Officer and Director |

| Kimberlee C. Drapkin | | 50 | | Chief Financial Officer and Treasurer |

| Hugh M. Cole | | 53 | | Chief Business Officer and Head of Corporate Development |

| Elizabeth G. Trehu, M.D. | | 57 | | Chief Medical Officer |

(1) Richard Murray, Ph.D. is also a director of the Company and his biographical information appears on page 8.

Kimberlee C. Drapkin—Ms. Drapkin has served as our chief financial officer since August 2015, and our treasurer since February 2013. From 2009 to August 2015, Ms. Drapkin was the owner of KCD Financial LLC, through which she served as our interim chief financial officer from 2012 to August 2015, and consulted for numerous biotechnology companies. Previously, Ms. Drapkin served as the chief financial officer of Predix Pharmaceuticals Holdings, Inc. from 2005 to 2006, and, after Predix was acquired by EPIX Pharmaceuticals, Inc., as chief financial officer of EPIX from 2006 to 2009. From 1995 to 2005, Ms. Drapkin served in a variety of roles at Millennium Pharmaceuticals, Inc., including director of finance. Ms. Drapkin began her career at PricewaterhouseCoopers LLP, is a certified public accountant and holds a B.S. in accounting from Babson College.

Hugh M. Cole—Prior to joining Jounce in August 2017, Mr. Cole served as chief business officer for ARIAD Pharmaceuticals, Inc., an oncology company, from March 2014 to June 2017, where he led numerous business development transactions. Previously, Mr. Cole served as senior vice president, strategic planning and program management at Shire plc, a global biopharmaceutical company, from 2007 to March 2014. At Shire, Mr. Cole's responsibilities included the global development strategy and commercialization of the rare disease drug Firazyr. Earlier in his career, Mr. Cole was vice president, corporate development for Oscient Pharmaceuticals, Inc. and served as senior director, business development and strategy at Millennium Pharmaceuticals, Inc. Mr. Cole earned his M.B.A. in health care management and finance at the Wharton School of Business and his A.B. in chemistry from Harvard University.

Elizabeth G. Trehu, M.D.—Dr. Trehu joined Jounce as our chief medical officer in November 2015. Prior to joining Jounce, Dr. Trehu served as the chief medical officer of Promedior, Inc., a biotechnology company, from 2012 to November 2015. Previously, Dr. Trehu served as vice president, product development and medical affairs for Infinity Pharmaceuticals, Inc. from 2010 to 2012. Earlier in her career, Dr. Trehu served in a variety of roles for Genzyme Corporation, including as the vice president and general manager, hematology from 2009 to 2010, vice president and general manager of Clolar from 2008 to 2009 and vice president, global medical affairs of Genzyme Oncology from 2006 to 2008. Earlier in her career, Dr. Trehu served from 2002 to 2006 in a variety of positions at Millennium Pharmaceuticals, Inc., including as vice president of oncology global medical affairs in 2006. Dr. Trehu holds an M.D. from the New York University School of Medicine and an A.B. in English from Princeton University.

PROPOSAL NO. 2—RATIFICATION OF THE SELECTION OF

ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR THE FISCAL YEAR ENDING DECEMBER 31, 2018

Our stockholders are being asked to ratify the selection by the audit committee of the board of directors of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.

The audit committee is solely responsible for selecting our independent registered public accounting firm for the fiscal year ending December 31, 2018. Stockholder approval is not required to appoint Ernst & Young LLP as our independent registered public accounting firm. However, our board of directors believes that submitting the selection of Ernst & Young LLP to the stockholders for ratification is good corporate governance. If the stockholders do not ratify this selection, the audit committee will reconsider whether to retain Ernst & Young LLP. If the selection of Ernst & Young LLP is ratified, the audit committee, in its discretion, may direct the selection of a different independent registered public accounting firm at any time it decides that such a change would be in the best interest of our company and our stockholders.

A representative of Ernst & Young LLP is expected to be present at the Annual Meeting and will have an opportunity to make a statement if he or she desires to do so and to respond to appropriate questions from our stockholders.

The following is a summary and description of fees incurred by Ernst & Young LLP for the fiscal years ended December 31, 2017 and 2016.

|

| | | | | | | | | | | | |

| | | Fiscal Year 2017 | | Percentage of 2017 Services Approved by Audit Committee | | Fiscal Year 2016 | | Percentage of 2016 Services Approved by Audit Committee |

Audit fees(1) | | $ | 768,626 |

| | 100% | | $ | 975,896 |

| | 100% |

Audit-related fees(2) | | — |

| | 100% | | 65,500 |

| | 100% |

Tax fees(3) | | 95,000 |

| | 100% | | 131,500 |

| | 100% |

All other fees(4) | | 1,995 |

| | 100% | | — |

| | 100% |

| Total fees | | $ | 865,621 |

| | 100% | | $ | 1,172,896 |

| | 100% |

| |

| (1) | Audit fees consist of fees billed for professional services by Ernst & Young LLP for the audit of our consolidated financial statements, reviews of our interim financial statements, reviews of registration statements on Forms S-1 and S-8 and related services that are normally provided in connection with statutory and regulatory filings or engagements. |

| |

| (2) | Audit-related fees consist of fees billed for accounting consultations reasonably related to the performance of the audit or review of our consolidated financial statements. |

| |

| (3) | Tax fees consist of fees for professional services performed by Ernst & Young LLP with respect to tax advisory services. |

| |

| (4) | All other fees consist of licensing fees paid to Ernst & Young LLP for access to its proprietary accounting research database. |

Audit Committee Pre-Approval Policy and Procedures

The audit committee of our board of directors has adopted policies and procedures for the pre-approval of audit and non-audit services for the purpose of maintaining the independence of our independent auditor. We may not engage our independent auditor to render any audit or non-audit service unless either the service is approved in advance by the audit committee, or the engagement to render the service is entered into pursuant to the audit committee's pre-approval policies and procedures.

From time to time, our audit committee may pre-approve services that are expected to be provided to us by the independent auditor during the following 12 months. At the time such pre-approval is granted, the audit committee must identify the particular pre-approved services in detail by category of service and, at each regularly scheduled meeting of the audit committee following such approval, management or the independent auditor shall report to the audit committee regarding each service actually provided to us pursuant to such pre-approval. The audit committee has delegated to its chairman the authority to grant pre-approvals of audit or non-audit services to be provided by the independent auditor if time constraints require that such pre-approval occur prior to the audit committee's next scheduled meeting. Any approval of services by the chairman of the audit committee is reported to the committee at its next regularly scheduled meeting.

The board of directors recommends voting "FOR" Proposal No. 2 to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.

Any properly submitted proxy will be voted in favor of the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018 unless a contrary specification is made in the proxy.

CORPORATE GOVERNANCE

Director Nomination Process

Our nominating and corporate governance committee is responsible for identifying individuals qualified to serve as directors, consistent with criteria approved by our board, and recommending the persons to be nominated for election as directors, except where we are legally required by contract, law or otherwise to provide third parties with the right to nominate.

The process followed by our nominating and corporate governance committee to identify and evaluate director candidates includes requests to board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the committee and our board. The qualifications, qualities and skills that our nominating and corporate governance committee believes must be met by a committee-recommended nominee for a position on our board of directors are as follows:

| |

| • | Nominees should have a reputation for integrity, honesty and adherence to high ethical standards. |

| |

| • | Nominees should have demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to our current and long-term objectives and should be willing and able to contribute positively to our decision-making process. |

| |

| • | Nominees should have a commitment to understand our company and our industry and to regularly attend and participate in meetings of our board of directors and its committees. |

| |

| • | Nominees should have the interest and ability to understand the sometimes conflicting interests of our various constituencies, which include stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all stockholders. |

| |

| • | Nominees should not have, nor appear to have, a conflict of interest that would impair the nominee's ability to represent the interests of all of our stockholders and to fulfill the responsibilities of a director. |

| |

| • | Nominees shall not be discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law. The value of diversity on our board of directors is a consideration. |

The nominating and corporate governance committee may use a third-party search firm in those situations where particular qualifications are required or where existing contacts are not sufficient to identify an appropriate candidate.

Stockholders may recommend individuals to the nominating and corporate governance committee for consideration as potential director candidates. Any such proposals should be submitted to our corporate secretary at our principal executive offices and should include appropriate biographical and background material to allow the nominating and corporate governance committee to properly evaluate the potential director candidate and the number of shares of our stock beneficially owned by the stockholder proposing the candidate. The specific requirements for the information that is required to be provided for such recommendations to be considered are specified in our amended and restated by-laws and must be received by us no later than the date referenced below under the heading "Stockholder Proposals." Assuming that biographical and background material has been provided on a timely basis, any recommendations received from stockholders will be evaluated in the same manner as potential nominees proposed by the nominating and corporate governance committee. If our board of directors determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included on our proxy card for the next annual meeting.

Director Independence

Rule 5605 of the Nasdaq Listing Rules requires a majority of a listed company's board of directors to be comprised of independent directors within one year of listing. In addition, the Nasdaq Listing Rules require that, subject to specified exceptions, each member of a listed company's audit, compensation and nominating and corporate governance committees be independent under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Audit committee members must also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act, and compensation committee members must also satisfy the independence criteria set forth in Rule 10C-1 under the Exchange Act. Under Rule 5605(a)(2), a director will only qualify as an "independent director" if, in the opinion of our board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an

affiliated person of the listed company or any of its subsidiaries. In order to be considered independent for purposes of Rule 10C-1, the board must consider, for each member of a compensation committee of a listed company, all factors specifically relevant to determining whether a director has a relationship to such company which is material to that director's ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to: the source of compensation of the director, including any consulting, advisory or other compensatory fee paid by such company to the director; and whether the director is affiliated with the company or any of its subsidiaries or affiliates. In March 2018, our board of directors undertook a review of the composition of our board of directors and its committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our board of directors has determined that each of our directors, with the exception of Dr. Murray, is an "independent director" as defined under Nasdaq Listing Rules. Dr. Murray is not an independent director under these rules because he is currently serving as our president and chief executive officer. Our board of directors has also determined that Ms. Duncan and Messrs. Karsen and Higgons, who comprise our audit committee, and Dr. Pfeffer and Messrs. Higgons and Karsen, who comprise our compensation committee, satisfy the independence standards for such committees established by the SEC and the Nasdaq Listing Rules, as applicable. In making such determination, our board of directors considered the relationships that each such non-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director.

Board Committees

Our board of directors has established an audit committee, a compensation committee, and a nominating and corporate governance committee. Each of the audit committee, compensation committee, and nominating and corporate governance committee operates under a charter, and each such committee reviews its respective charter at least annually. A current copy of the charter for each of the audit committee, compensation committee, and the nominating and corporate governance committee is posted on the "Corporate Governance" section of the "Investors & Media" section on our website, which is located at http://ir.jouncetx.com.

Audit Committee

The members of our audit committee are Barbara Duncan, J. Duncan Higgons and Perry Karsen. Ms. Duncan is the chair of our audit committee. Our board of directors has determined that Ms. Duncan is an "audit committee financial expert" as defined by applicable SEC rules. Our audit committee assists our board of directors in its oversight of our accounting and financial reporting process and the audits of our consolidated financial statements. The audit committee met four times during the year ended December 31, 2017, including telephonic meetings. Our audit committee's responsibilities include:

| |

| • | appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm; |

| |

| • | pre-approving auditing and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm; |

| |

| • | reviewing the overall audit plan with our independent registered public accounting firm and members of management responsible for preparing our financial statements; |

| |

| • | reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures as well as critical accounting policies and practices used by us; |

| |

| • | coordinating the oversight and reviewing the adequacy of our internal control over financial reporting; |

| |

| • | establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns; |

| |

| • | recommending based upon the audit committee's review and discussions with management and our independent registered public accounting firm whether our audited financial statements shall be included in our Annual Report on Form 10-K; |

| |

| • | monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters; |

| |

| • | preparing the audit committee report required by SEC rules to be included in our annual proxy statement; |

| |

| • | reviewing all related person transactions for potential conflict of interest situations and approving all such transactions; and |

| |

| • | reviewing quarterly earnings releases. |

All audit services to be provided to us and all non-audit services, other than de minimis non-audit services as defined under the Exchange Act of 1934, as amended, to be provided to us by our registered public accounting firm must be approved in advance by our audit committee.

Compensation Committee

The members of our compensation committee are J. Duncan Higgons, Perry Karsen and Cary Pfeffer, M.D. Mr. Higgons is the chair of our compensation committee. Our board of directors has determined that each of Messrs. Higgons and Karsen and Dr. Pfeffer is independent within the meaning of Rule 10C-1 under the Exchange Act. Our compensation committee assists our board of directors in the discharge of its responsibilities relating to the compensation of our executive officers. The compensation committee met nine times during the year ended December 31, 2017, including telephonic meetings. Our compensation committee's responsibilities include:

| |

| • | reviewing and making recommendations to our board of directors with respect to the compensation of our chief executive officer and our other executive officers; |

| |

| • | reviewing and evaluating our overall director and executive compensation process and procedures; |

| |

| • | overseeing the evaluation of our senior executives; |

| |

| • | overseeing our overall compensation structure, policies and programs; |

| |

| • | reviewing and making recommendations to our board of directors with respect to our incentive-compensation and equity-based compensation plans; |

| |

| • | overseeing and administering our equity based plans; |

| |

| • | evaluating and making recommendations to our board of directors with respect to director compensation; |

| |

| • | reviewing and discussing with management our "Compensation Discussion and Analysis" disclosure to the extent such disclosure is required by SEC rules; |

| |

| • | preparing the compensation committee report to the extent required by SEC rules; and |

| |

| • | reviewing and approving the retention or termination of any consulting firm or outside adviser to assist in the evaluation of compensation matters. |

The compensation committee meets regularly in executive session. However, from time to time, various members of management and other employees, as well as outside advisors or consultants, may be invited by the compensation committee to make presentations, to provide financial or other background information or advice, or to otherwise participate in compensation committee meetings. No officer may participate in, or be present during, any deliberations or determinations of the compensation committee regarding the compensation for such officer or any immediate family member of such officer. The charter of the compensation committee grants the compensation committee authority to obtain, at our expense, advice and assistance from compensation consultants, legal counsel and/or other advisers. In particular, the compensation committee may, in its sole discretion, retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant's reasonable fees and other retention terms.

The compensation committee engaged Radford, an Aon Hewitt company, as its compensation consultant during 2017. Our compensation committee considered the relationship that Radford has with us, the members of our board of directors and our executive officers. Based on the committee's evaluation, the compensation committee has determined that no conflicts of interest exist between the company and Radford.

Radford assisted the committee in conducting a competitive compensation assessment for our executive officers for the fiscal year ended December 31, 2017, as well as in connection with determination of compensation for the executive officer we hired in 2017. In evaluating the total compensation of our executive officers, the compensation committee, with the assistance of Radford, established a peer group of 19 publicly traded companies in the biopharmaceutical industry that was comprised of companies whose market capitalization, number of employees, maturity of product development pipeline and area of therapeutic focus are similar to ours.

Radford also supplemented the peer group information with published survey data, which provided a broader market representation of companies and deeper position reporting.

Historically, our compensation committee reviews all compensation components including base salary, bonus, benefits, equity incentives and other perquisites, as well as severance arrangements, change-in-control benefits and other forms of executive officer compensation and either approves or provides a recommendation to our board of directors on the compensation of our chief executive officer and our other executive officers. In addition, the compensation committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of our compensation strategy, potential modifications to that strategy, and new trends, plans, or approaches to compensation, at various meetings throughout the year. The compensation

committee also makes recommendations to our board of directors regarding the compensation of non-employee directors and has the authority to administer our equity-based plans.

Under its charter, the compensation committee may form, and delegate authority to, subcommittees, consisting of one or more of its members, as it deems appropriate. Pursuant to our 2017 Stock Option and Incentive Plan, the compensation committee may delegate to our chief executive officer the authority to approve grants of stock options to employees who are not Section 16 reporting persons or covered employees as defined in Section 162(m) of the Internal Revenue Code, subject to certain limitations as to the amount of stock underlying awards that may be granted during the period of the delegation and guidelines as to the determination of the exercise price and the vesting criteria.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves, or in the past has served, as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our board of directors or our compensation committee. Dr. Pfeffer, a member of our compensation committee, served as our interim chief executive officer from 2013 to 2014.

Nominating and Corporate Governance Committee

The members of our nominating and corporate governance committee are Ms. Duncan, Mr. Karsen and Dr. Pfeffer. Mr. Karsen is the chair of our nominating and corporate governance committee. The nominating and corporate governance committee met four times during the year ended December 31, 2017, including telephonic meetings. Our nominating and corporate governance committee's responsibilities include:

| |

| • | developing and recommending to the board of directors criteria for board and committee membership; |

| |

| • | establishing procedures for identifying and evaluating board of director candidates, including nominees recommended by stockholders; |

| |

| • | reviewing the size and composition of the board of directors to ensure that it is composed of members containing the appropriate skills and expertise to advise us; |

| |

| • | identifying individuals qualified to become members of the board of directors; |

| |

| • | recommending to the board of directors the persons to be nominated for election as directors and to each of the board's committees; |

| |

| • | developing and recommending to the board of directors a code of business conduct and ethics and a set of corporate governance guidelines; and |

| |

| • | overseeing the evaluation of our board of directors and management. |

Board and Committee Meetings Attendance

The full board of directors met nine times during 2017. During 2017, each member of the board of directors attended in person or participated in 75% or more of the aggregate of (i) the total number of meetings of the board of directors (held during the period for which such person served as a director) and (ii) the total number of meetings held by all committees of the board of directors on which such person served (during the periods that such person served).

Director Attendance at Annual Meeting of Stockholders

Although we do not have a formal policy regarding attendance by members of our board of directors at our annual meeting of stockholders, we encourage all of our directors to attend. We did not hold an annual meeting of stockholders during the time we were a public company in 2017.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers, and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the code is posted under the heading "Corporate Governance" on the "Investors & Media" section of our website, which is located at http://ir.jouncetx.com. If we make any substantive amendments to, or grant any waivers from, the code of business conduct and ethics for any officer or director, we will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K.

Corporate Governance Guidelines

Our board of directors has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of our company and our stockholders. A copy of the corporate governance

guidelines is posted under the heading "Corporate Governance" on the "Investors & Media" section of our website, which is located at http://ir.jouncetx.com.

Board Leadership Structure and Board's Role in Risk Oversight

Our amended and restated by-laws and corporate governance guidelines provide our board of directors with flexibility to combine or separate the positions of chairman of our board and chief executive officer in accordance with its determination that utilizing one or the other structure would be in the best interests of our company. As a general policy, our board of directors believes that separation of the positions of chairman and chief executive officer reinforces the independence of the board of directors from management, creates an environment that encourages objective oversight of management’s performance and enhances the effectiveness of the board of directors as a whole. Accordingly, we currently separate the roles of chief executive officer and chairman of the board of directors, with Dr. Murray serving as our president and chief executive officer and Mr. Karsen serving as chairman of the board of directors. As president and chief executive officer, Dr. Murray is responsible for setting the strategic direction for our company and the day-to-day leadership and performance of our company, while Mr. Karsen, as chairman of the board of directors, presides over meetings of the board of directors, including executive sessions of the board of directors, and has oversight responsibilities. The board of directors has not appointed a lead independent director. Our board of directors has three standing committees that currently consist of, and are chaired by, independent directors. Our board of directors delegates substantial responsibilities to the committees, which then report their activities and actions back to the full board of directors. We believe this structure represents an appropriate allocation of responsibilities for our company.

Risk is inherent with every business and how well a business manages risk can ultimately determine its success. We face a number of risks, including those described under "Risk Factors" in our 2017 Annual Report. Our board of directors is actively involved in oversight of risks that could affect us. This oversight is conducted primarily by our full board of directors, which has responsibility for general oversight of risks. Our board of directors oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis and our board and its committees oversee the risk management activities of management. Our board of directors satisfies this responsibility through full reports by each committee chair regarding the committee's considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within our company. Our audit committee oversees risk management activities related to financial controls and legal and compliance risks, including ongoing risk management and mitigation activities related to data protection and cybersecurity. Our compensation committee oversees risk management activities relating to our compensation policies and practices. Our nominating and corporate governance committee oversees risk management activities relating to board composition. In addition, members of our senior management team attend our quarterly board meetings and are available to address any questions or concerns raised by the board on risk management and any other matters. Our board of directors believes that full and open communication between management and the board of directors is essential for effective risk management and oversight.

Communication with Our Directors

Any interested party with concerns about our company may report such concerns to the board of directors or otherwise the chairman of the nominating and corporate governance committee, by submitting a written communication to the attention of such director at the following address:

c/o Jounce Therapeutics, Inc.

780 Memorial Drive

Cambridge, Massachusetts 02139

You may submit your concern anonymously or confidentially by postal mail. You may also indicate whether you are a stockholder, customer, supplier, or other interested party.

A copy of any such written communication may also be forwarded to our legal counsel and a copy of such communication may be retained for a reasonable period of time. The director may discuss the matter with our legal counsel, with independent advisors, with non-management directors, or with our management, or may take other action or no action as the director determines in good faith, using reasonable judgment, and discretion. Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the chairman of the board or otherwise the chairman of the nominating and corporate governance committee, subject to the advice and assistance of counsel, consider to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we receive repetitive or duplicative communications.

EXECUTIVE AND DIRECTOR COMPENSATION

This section discusses the material elements of our executive compensation policies for our "named executive officers" and the most important factors relevant to an analysis of these policies. It provides qualitative information regarding the manner and context in which compensation is awarded to and earned by our executive officers named in the "Summary Compensation Table" below, or our "named executive officers," and is intended to place in perspective the data presented in the following tables and the corresponding narrative.

2017 Summary Compensation Table

The following table presents information regarding the total compensation awarded to, earned by and paid to our named executive officers for services rendered to us in all capacities for the years indicated.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary ($) | | | Bonus ($) | | | Option Awards ($)(1) | | All Other Compensation ($) | | | Total ($) |

Richard Murray, Ph.D.,(2) | | 2017 | | $ | 500,000 |

| | | $ | 250,000 |

| (3) | | $ | — |

| | $ | 258 |

| (4) | | $ | 750,258 |

|

| President and Chief Executive Officer | | 2016 | | $ | 445,500 |

| | | $ | 196,100 |

| (5) | | $ | 1,105,289 |

| | $ | 258 |

| (4) | | $ | 1,747,147 |

|

| Hugh M. Cole, | | 2017 | | $ | 147,337 |

| (6) | | $ | 103,400 |

| (7) | | $ | 1,923,902 |

| | $ | 52 |

| (4) | | $ | 2,174,691 |

|

| Chief Business Officer and Head of Corporate Development | | | | | | | | | | | | | | |

|

|

| Elizabeth G. Trehu, M.D., | | 2017 | | $ | 385,200 |

| | | $ | 128,100 |

| (3) | | $ | — |

| | $ | 258 |

| (4) | | $ | 513,558 |

|

| Chief Medical Officer | | 2016 | | $ | 370,000 |

| | | $ | 164,000 |

| (5) | | $ | 302,652 |

| | $ | 258 |

| (4) | | $ | 836,910 |

|

| |

| (1) | Amounts reflect the aggregate grant date fair value of option awards in accordance with Financial Accounting Standards Board, Accounting Standards Codification 718, or ASC 718. Such grant-date fair value does not take into account any estimated forfeitures related to service-vesting conditions. For information regarding assumptions underlying the valuation of option awards, see Note 12 to our audited consolidated financial statements appearing in our 2017 Annual Report. These amounts do not correspond to the actual value that may be recognized by the named executive officers upon vesting of the applicable awards. |

| |

| (2) | Dr. Murray also serves as a member of our board of directors but does not receive any additional compensation for his service as a director. |

| |

| (3) | The amount reported represents a bonus based upon the achievement of the Company and individual performance objectives for the year ended December 31, 2017, which was paid in February 2018. |

| |

| (4) | The amounts reported represent life insurance premiums paid by the Company. |

| |

| (5) | The amount reported represents a bonus based upon the achievement of the Company and individual performance objectives for the year ended December 31, 2016, which was paid in February 2017. |

| |

| (6) | Mr. Cole's employment commenced with us in August 2017. The amount reported reflects the pro-rated portion of Mr. Cole's annual salary of $385,000 from commencement of his employment through December 31, 2017. |

| |

| (7) | The amount reported represents a sign-on bonus of $50,000, paid in 2017 pursuant to the terms of Mr. Cole's employment agreement, and a pro-rated bonus based upon the achievement of the Company and individual performance objectives for the year ended December 31, 2017. |

Narrative Disclosure to Summary Compensation Table

Base Salary. Base salaries are used to recognize the experience, skills, knowledge and responsibilities required of our named executive officers. Base salaries for our named executive officers typically are established through arm’s length negotiation at the time such executive officer is hired, taking into account the position for which the executive officer is being considered and the executive officer’s qualifications, prior experience and prior salary. None of our named executive officers is currently party to an employment agreement that provides for automatic or scheduled increases in base salary. However, on an annual basis, our compensation committee reviews and evaluates, with input from our chief executive officer (except with respect to his own compensation and performance), the need for adjustment of the base salaries of our executive officers based on changes and expected changes in the scope of an executive officer’s responsibilities, including promotions, the individual contributions made by and performance of the executive officer during the prior year and over a period of years, overall labor market conditions, our overall growth and development as a company and general salary trends in our industry and among our peer group and where the

executive officer’s salary falls in the salary range presented by that data. No formulaic base salary increases are provided to our executive officers.

In 2017, we paid an annual base salary of $500,000 to Dr. Murray, $385,200 to Dr. Trehu and $147,337 to Mr. Cole, which represents the pro-rated portion of an annual base salary of $385,000. In 2016, we paid an annual base salary of $445,500 to Dr. Murray and $370,000 to Dr. Trehu.

Annual Bonus. Our compensation committee or our board of directors, with input from management, may, in its discretion, award bonuses to our named executive officers from time to time. Our board of directors typically establishes annual bonus targets based around a set of specified corporate goals for our named executive officers and conducts an annual performance review to determine the attainment of such goals. Under the terms of their respective employment agreements, each of our named executive officers is eligible to receive an annual cash bonus, as determined by our compensation committee or board of directors, with a target of a specified percentage of such officer's annual base salary earned in a calendar year, which percentage shall be subject to adjustment from time to time by our compensation committee or board of directors.

The target annual bonus percentage for 2018 for each of our named executive officers is 50%, 35% and 35% for Dr. Murray, Mr. Cole and Dr. Trehu, respectively. With respect to 2017, we awarded bonuses of $250,000, $53,400 and $128,100 to Dr. Murray, Mr. Cole and Dr. Trehu, respectively, based on our achievement of certain company goals and individual performance objectives. Mr. Cole's 2017 bonus was pro-rated due to his employment commencing in the third quarter of 2017. In August 2017, Mr. Cole also received a sign-on bonus of $50,000, which much be repaid in full if Mr. Cole is terminated for cause (as defined in his employment agreement) or resigns voluntarily within the first twelve months of his employment. With respect to 2016, we awarded bonuses of $196,100 and $164,000 to Dr. Murray and Dr. Trehu, respectively, based on achievement of certain company goals and certain individual performance objectives.

Equity Incentives. Although we do not have a formal policy with respect to the grant of equity incentive awards to our executive officers, or any formal equity ownership guidelines applicable to them, we believe that equity grants provide our executives with a strong link to our long-term performance, create an ownership culture and help to align the interests of our executives and our stockholders. In addition, we believe that equity grants with a time-based vesting feature promote executive retention because this feature incentivizes our executive officers to remain in our employment during the vesting period. Accordingly, our board of directors periodically reviews the equity incentive compensation of our named executive officers and from time to time may grant equity incentive awards to them in the form of stock options or other forms of awards available under our 2017 Stock Option and Incentive Plan.

We typically grant stock options to our executive officers annually, as well as upon commencement of employment. We base the exercise price and grant date fair value of stock options on our per-share estimated valuation on the date of grant. Grants made in connection with the commencement of employment typically vest as to 25% of the underlying shares on the first anniversary of the employment start date and in equal quarterly installments thereafter through the fourth anniversary of the employment start date. Annual stock option grants typically vest as to 25% of the underlying shares on the first anniversary of the grant date and in equal quarterly installments thereafter through the fourth anniversary of the grant date.

In 2017, we granted Mr. Cole an option to purchase an aggregate of 190,000 shares in connection with the start of his employment. We did not grant any equity awards to Dr. Murray or Dr. Trehu in 2017. In 2016, we granted stock options to purchase an aggregate of 182,926 and 50,135 shares of common stock to Dr. Murray and Dr. Trehu, respectively.