Jounce Therapeutics Corporate Presentation A NEXT GEN IMMUNOTHERAPY COMPANY AUGUST 2022 Exhib i t 99.1

Legal Disclaimer 2 Various statements concerning our future expectations, plans and prospects, including without limitation, our expectations regarding financial guidance, operating expenses and capital expenditures, the timing, initiation, progress, results of and release of data for clinical trials of our product candidates, including JTX-8064, vopratelimab and pimivalimab, identification, selection and enrollment of patients for our clinical trials, the timing, progress and results of discovery programs, preclinical studies and clinical trials for our product candidates and any future product candidates, the potential benefits of any of these product candidates and the timing or likelihood of regulatory filings, and our cash position may constitute forward- looking statements for the purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995 and other federal securities laws and are subject to substantial risks, uncertainties and assumptions. . You should not place reliance on these forward-looking statements, which often include words such as “anticipate,” “expect,” “goal,” ”trend,” “may,” “plan,” “predictive” or similar terms, variations of such terms or the negative of those terms. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee such outcomes. Actual results may differ materially from those indicated by these forward-looking statements as a result of various important factors, including, without limitation, risks that the COVID-19 pandemic and/or the conflict in Ukraine may disrupt our business and/or the global healthcare system more severely than we have anticipated, which may have the effect of further delaying our ability to enroll and complete our ongoing clinical trials, delaying our timelines for conducting analyses of our clinical trial data, preparing regulatory submissions or disclosing data, or delaying or interrupting the work of our third-party partners, our ability to successfully demonstrate the efficacy and safety of our product candidates and future product candidates, the preclinical and clinical results for our product candidates, which may not support further development and marketing approval, the potential advantages of our product candidates, the development plans of our product candidates, the management of our supply chain for the delivery of drug product and materials for use in our clinical trials and research and development activities, the use of our product candidates in combination with other therapies and our ability to obtain such therapies, actions of regulatory agencies, which may affect the initiation, timing and progress of preclinical studies and clinical trials of our product candidates and our anticipated milestones, our ability to obtain, maintain and protect our intellectual property, our ability to enforce our patents against infringers and defend our patent portfolio against challenges from third parties, the market opportunity for our product candidates, competition from others developing products for similar uses, our ability to manage operating expenses, our ability to establish or maintain collaborations, our dependence on third parties for development, manufacture and commercialization of product candidates and unexpected expenditures, as well as those risks more fully discussed in the section entitled “Risk Factors” in Jounce’s most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission as well as discussions of potential risks, uncertainties, and other important factors in our subsequent filings with the Securities and Exchange Commission. All such statements speak only as of the date made, and we undertake no obligation to update or revise publicly any forward- looking statements, whether as a result of new information, future events or otherwise.

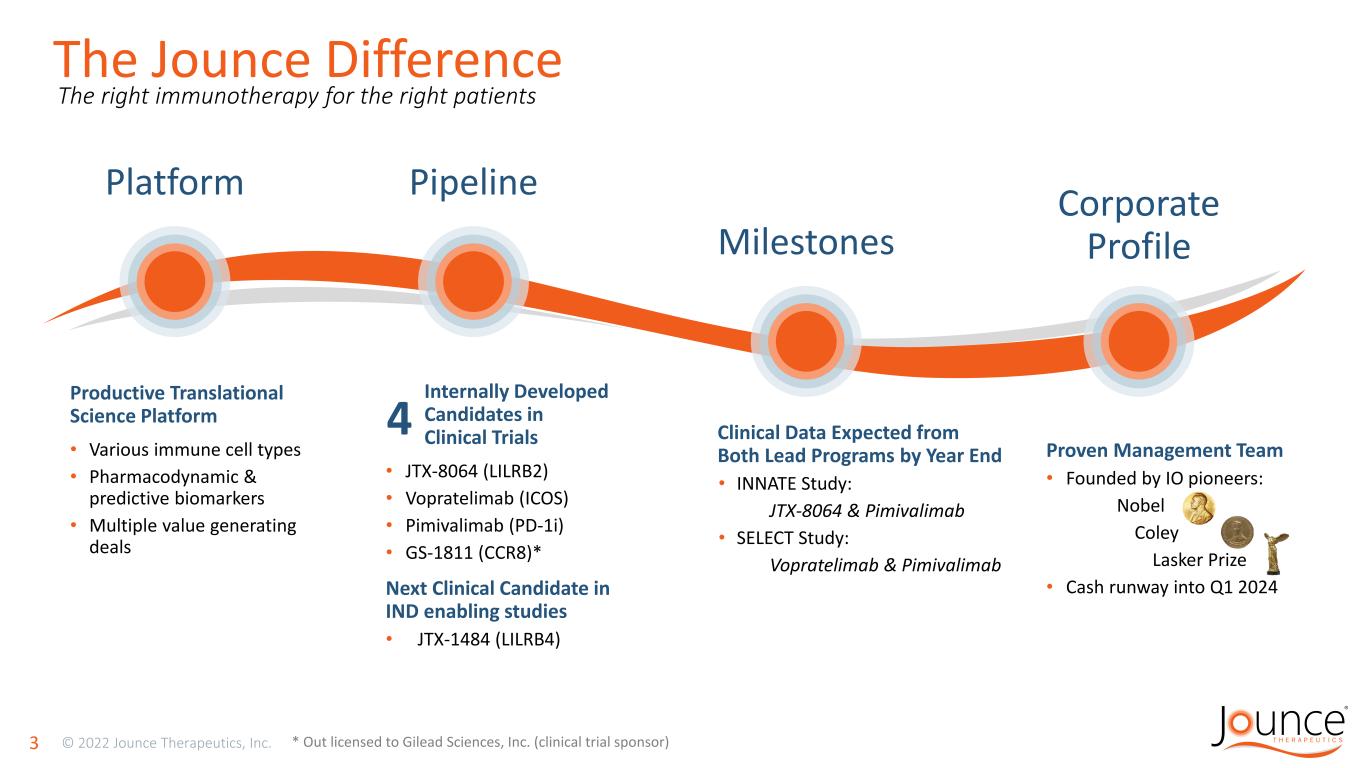

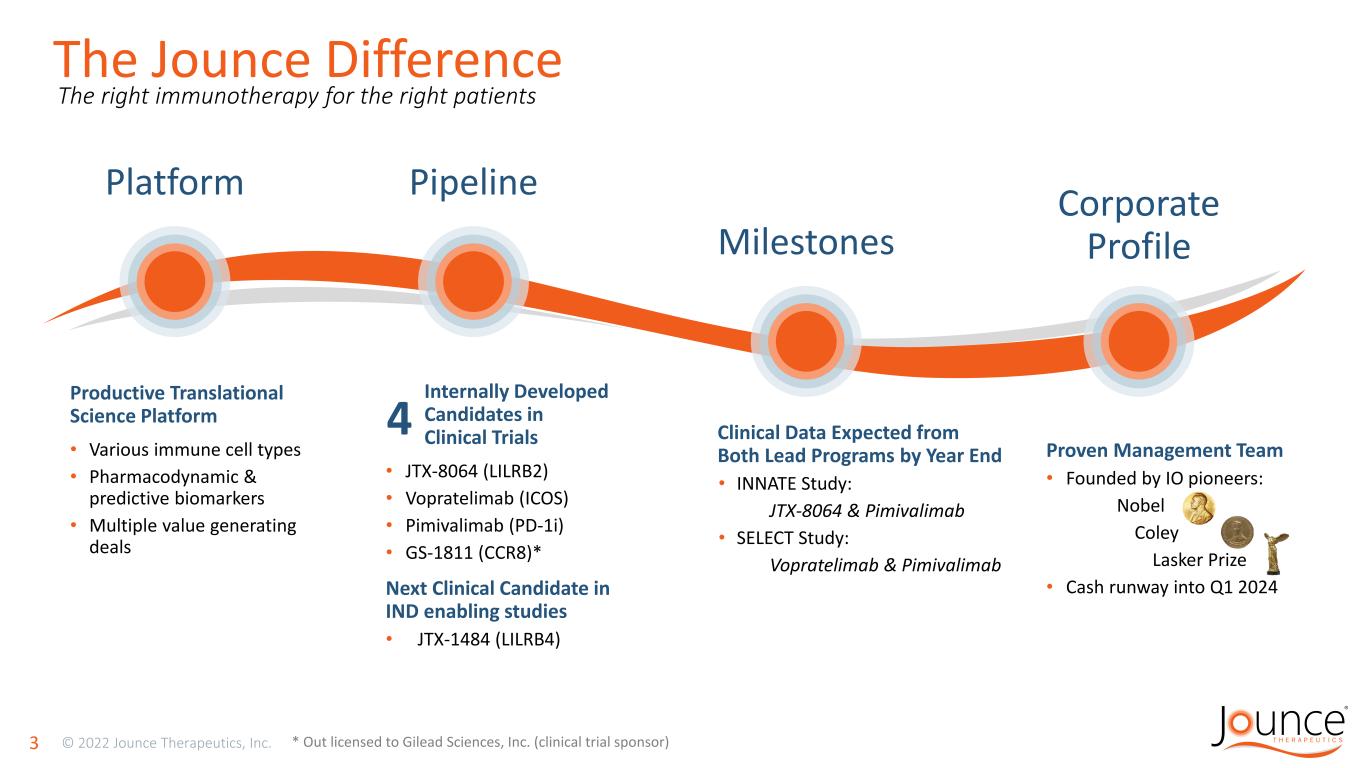

Proven Management Team • Founded by IO pioneers: Nobel Coley Lasker Prize • Cash runway into Q1 2024 The Jounce Difference 3 * Out licensed to Gilead Sciences, Inc. (clinical trial sponsor) The right immunotherapy for the right patients Productive Translational Science Platform • Various immune cell types • Pharmacodynamic & predictive biomarkers • Multiple value generating deals Internally Developed Candidates in Clinical Trials • JTX-8064 (LILRB2) • Vopratelimab (ICOS) • Pimivalimab (PD-1i) • GS-1811 (CCR8)* Next Clinical Candidate in IND enabling studies • JTX-1484 (LILRB4) 4 Platform Pipeline Milestones Corporate Profile Clinical Data Expected from Both Lead Programs by Year End • INNATE Study: JTX-8064 & Pimivalimab • SELECT Study: Vopratelimab & Pimivalimab

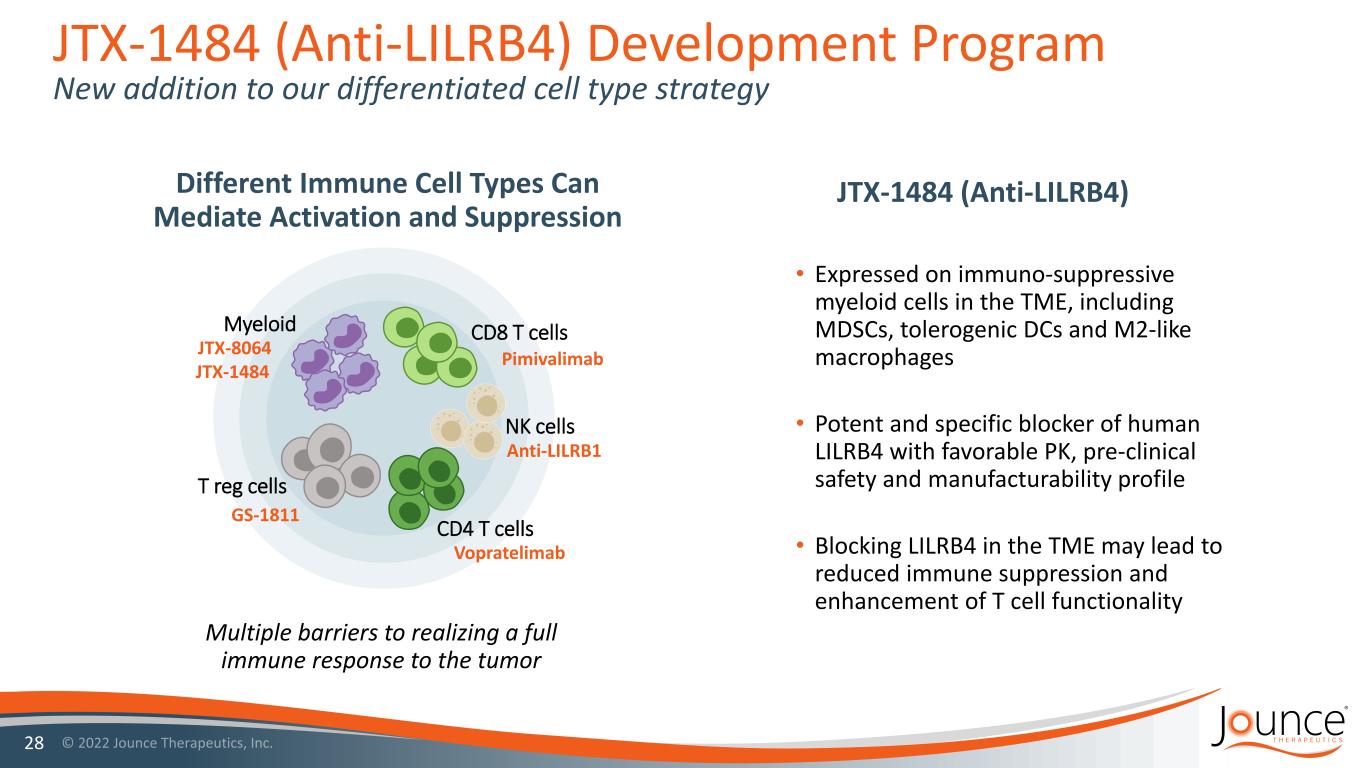

The Challenge and Promise of IO Therapy Lessons Learned Define New Opportunities 4 *PD-(L)1i = PD-1 inhibitor or PD-L1 inhibitor • Tumor with PD-(L)1i* approval • Minority of pts benefit • Tumor with PD-(L)1i approval • Majority pts do not respond • Tumor with no PD-(L)1i approval • Little to no benefit in that tumor Human Solid Tumors & Immunotherapy Response Different Immune Cell Types Can Mediate Activation and Suppression Multiple barriers to realizing a full immune response to the tumor Primary or Acquired PD-(L)1i resistance inhibits even broader use of IO CD8 T cells CD4 T cells T reg cells Myeloid NK cells Pimivalimab Vopratelimab JTX-8064 GS-1811 JTX-1484 Anti-LILRB1

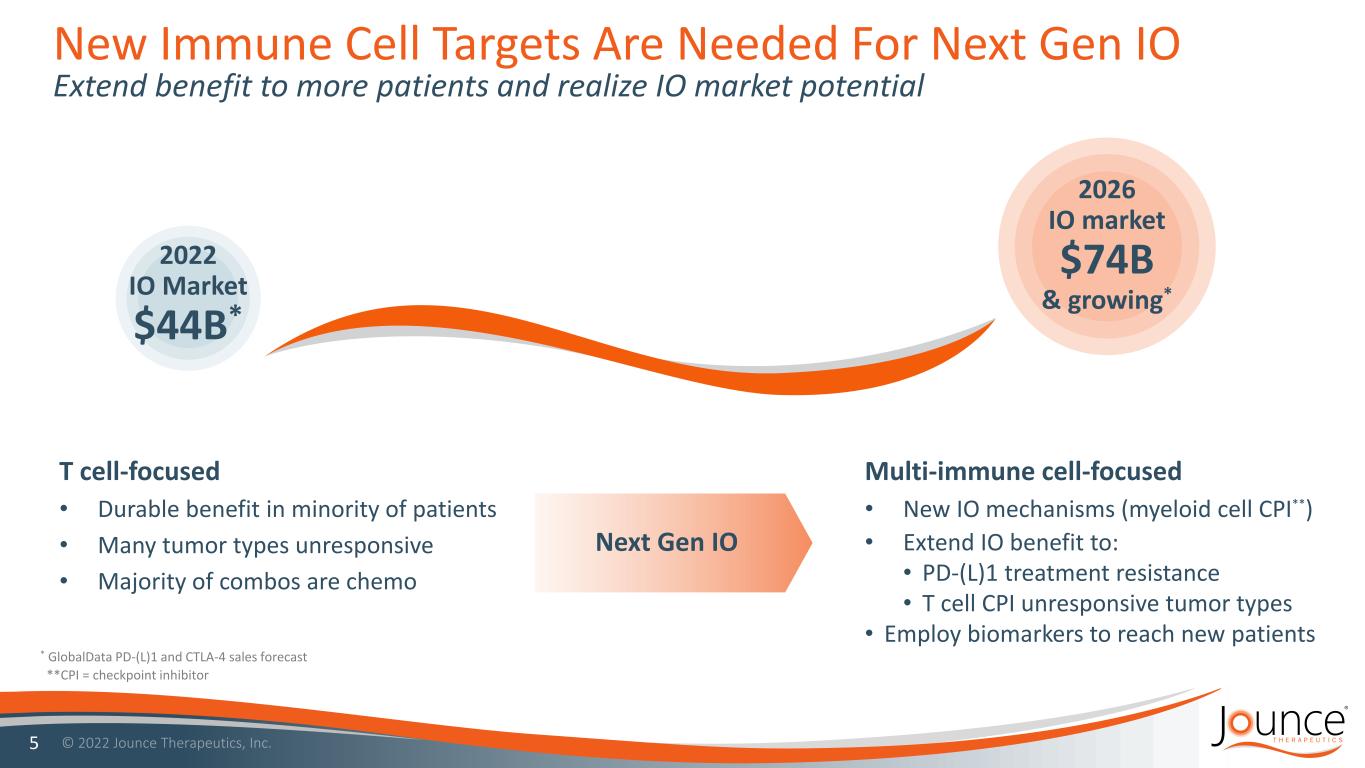

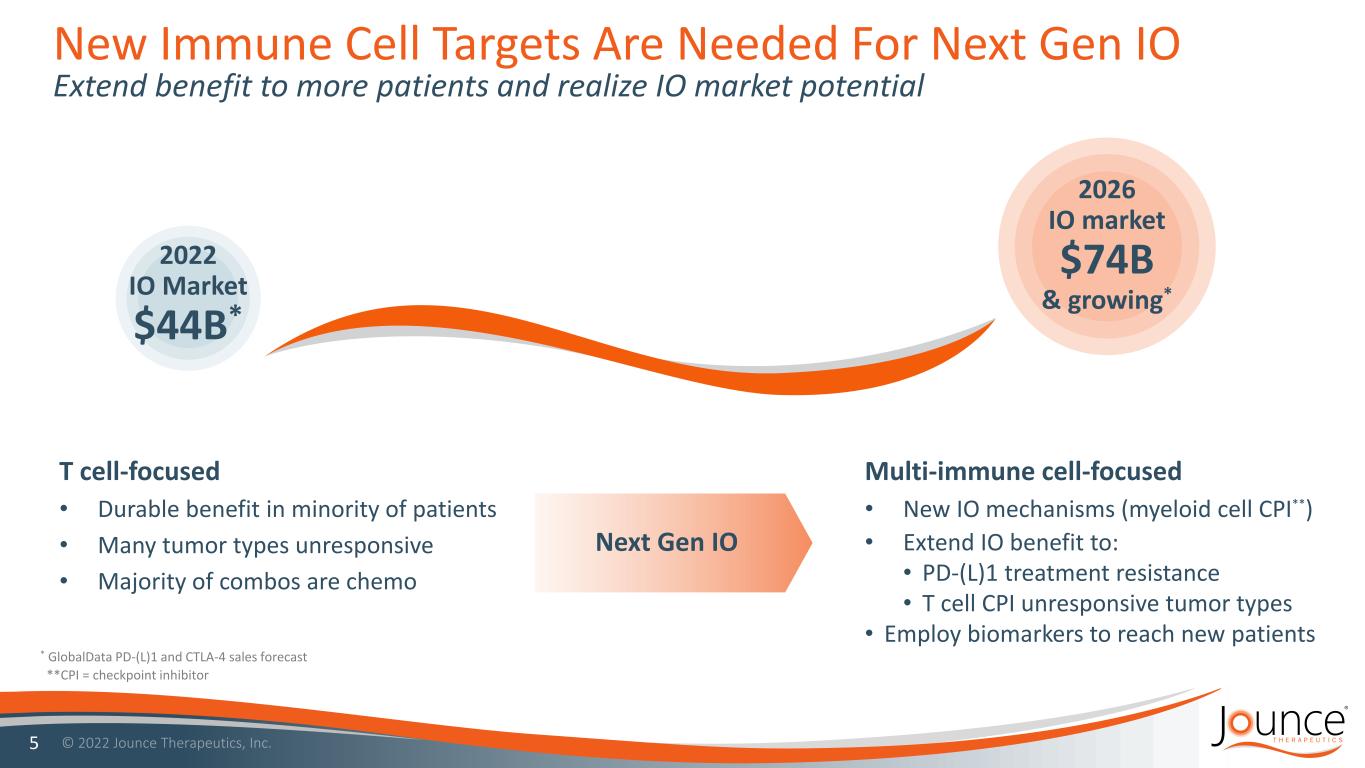

New Immune Cell Targets Are Needed For Next Gen IO Extend benefit to more patients and realize IO market potential 5 2022 IO Market $44B* 2026 IO market $74B & growing* Next Gen IO T cell-focused • Durable benefit in minority of patients • Many tumor types unresponsive • Majority of combos are chemo Multi-immune cell-focused • New IO mechanisms (myeloid cell CPI**) • Extend IO benefit to: • PD-(L)1 treatment resistance • T cell CPI unresponsive tumor types • Employ biomarkers to reach new patients * GlobalData PD-(L)1 and CTLA-4 sales forecast **CPI = checkpoint inhibitor

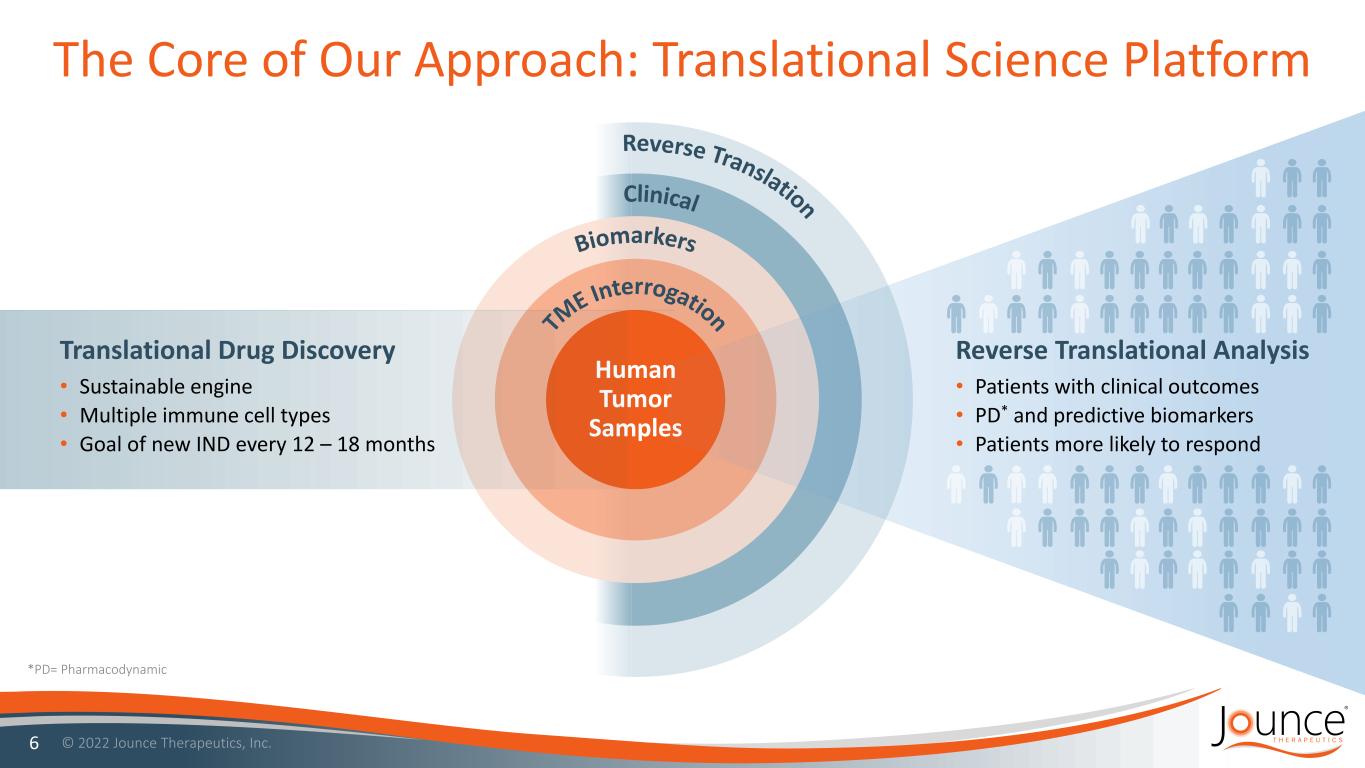

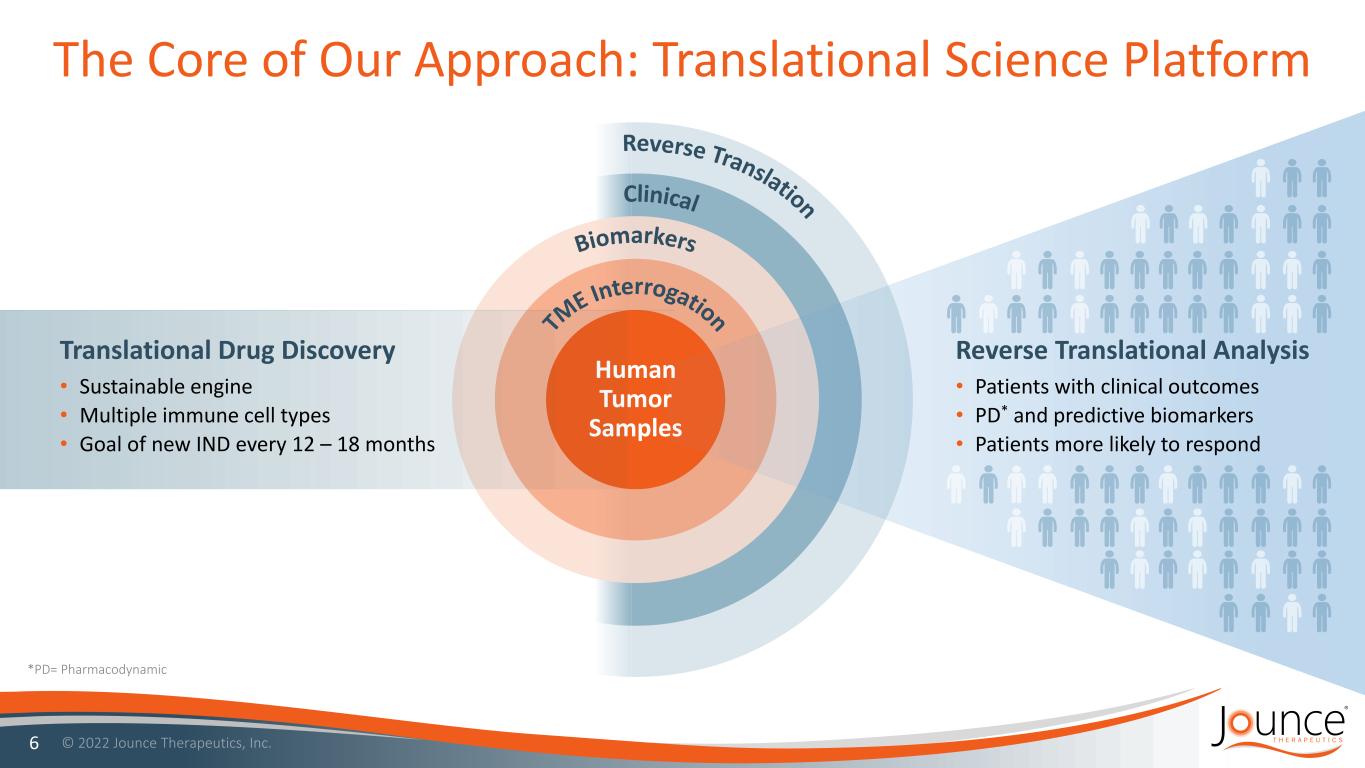

Human Tumor Samples The Core of Our Approach: Translational Science Platform 6 *PD= Pharmacodynamic Translational Drug Discovery • Sustainable engine • Multiple immune cell types • Goal of new IND every 12 – 18 months Reverse Translational Analysis • Patients with clinical outcomes • PD* and predictive biomarkers • Patients more likely to respond

DISCOVERY PROGRAMS LILRB1 (ILT2) Myeloid & Lymphoid Bi-Specifics (Not Disclosed) Diverse Immune Cell Types Other Targets (Not Disclosed) PD-(L)1i Resistance Mechanisms Jounce Immunotherapy Pipeline 7 * Formerly JTX-1811 now out-licensed to Gilead Sciences, Inc. Program Target Biology Discovery Preclinical IND Enabling Clinical Phase 1 Phase 2 Phase 3 DEVELOPMENT PROGRAMS Vopratelimab ICOS CD4 Focused Pimivalimab PD-1 CD8 Focused JTX-8064 LILRB2 (ILT4) Macrophage Focused GS-1811* CCR8 T-Reg Focused JTX-1484 LILRB4 (ILT3) Myeloid Focused SELECT (PD-(L)1i naïve patients) SELECT & INNATE INNATE (PD-(L)1i experienced & naïve patients)

Lead Macrophage Program: JTX-8064 8

JTX-8064: Potential Macrophage Checkpoint Inhibitor LILRB2 / ILT4 Target • LILRB2 is expressed on immunosuppressive macrophages • Immunosuppressive macrophages are a negative prognostic factor for many cancer types • Inhibition of LILRB2 reprograms macrophages to an immune active state and activates T cells • Supportive clinical data on the target* 9 *Siu et al. ESMO Sep. 2020; Siu et al. Clinical Cancer Research, Jan. 2022 (Merck’s LILRB2 / ILT4 Program) JTX-8064 Program Highlights • Novel, highly selective & potent IgG4 antibody to LILRB2 • Potential to reverse PD-(L)1i resistance • INNATE Trial: • Monotherapy and combo dose escalation complete • Phase 2 POC expansion cohorts initiated • Ovarian and Renal Cell Carcinoma combo cohorts advanced to Simon’s 2nd stage • Ovarian combo cohort completed stage 2 enrollment • NSCLC (2/3L) cohort did not meet stage 2 expansion criteria • Well tolerated to date Preliminary Clinical Data by Year End

LILRB2 (ILT4) May Inhibit Response to PD-(L)1i Therapy 10 • CD163 is a general marker for immunosuppressive macrophages • Similar associations between OS and CD163 have been reported for most tumor types in INNATE High LILRB2 / IFNγ Signature Ratio Correlates With Poor Response to PD- (L)1i Treatment2 1 Analysis of TCGA data; Each dot represents one tumor sample. Spearman correlation coefficient: 0.77 2 Data adapted from Mariathasan et al. Nature 2018; Responder = complete or partial response. Expression data from pre-treatment biopsies; Additional details presented by McGrath et al at AACR 2021; *** p<0.0001 P = 0.0006 n=66 High Levels of Immunosuppressive Macrophages (CD163+) are a Negative Prognostic Marker in Many Cancer Types Correlation between LILRB2 and CD1631 Clear Cell Renal Cell Carcinoma ***

JTX-8064 Inhibits A Unique Macrophage Checkpoint LILRB2 (ILT4) Proposed mechanism of action 11 Potential to Reverse PD-(L)1i Resistance JTX-8064 Immunosuppressive Macrophage (M2-like) Immune Activated Macrophage (M1-like) • Cytokine Production • Antigen Presentation • T-cell Activation

JTX-8064 Reprograms Macrophages to Enhance T Cell Responses 12 1. Cohen et al., Abstract 5007, AACR 2019; 2. McGrath et al., Abstract 1727, AACR 2021. JTX-8064 reprogrammed macrophages are more effective at stimulating T cells in co-culture2 Reprogramming of macrophages from M2 to an M1 state through inhibition of LILRB21 JTX-8064 precursors polarize macrophages to an M1 state1 Control IgG JTX-8064 T cells only T cells + macrophagesT cells only T cells + macrophages Control IgG JTX-8064 IF N γ (p g/ m l) N um be r o f C D8 + T Ce lls 4-fold decrease 4-fold increaseSame P < 0.05 (with FDR correction) normalized to isotype control T-Cell Activation T-Cell Proliferation Downregulated Upregulated

Translational Informatics Defined Initial Tumor Types Higher Lower • Relative evaluation and ranking across all TCGA indications • Focus on 3 key RNA measures (LILRB2, Jounce TAM signature, IFNγ signature) • Figure sorted by LILRB2 13 TUMOR TYPE Testicular Cancer Mesothelioma Renal Cancer (clear cell) Soft Tissue Sarcoma NSCLC (nonsquamous) Gastric Cancer NSCLC (squamous) Pancreatic Cancer HNSCC Renal Cancer (papillary) Ovarian Cancer Liver Cancer Melanoma / Skin Cancer Colon Cancer Breast Cancer Top ranked tumor typesPrimary tumors ranked by median biomarker levels (TCGA) • Strong biologic rationale • High unmet medical need • Negative prognostic factors may be positive predictive markers

Mono (n=22) & Combo (n=9) Dose Escalation Completed JTX-8064: INNATE Study Designed to Rapidly Demonstrate POC Preliminary Clinical Data by Year End 2022 • Full receptor occupancy at 300mg • 700mg RP2D* • No DLTs** (up to 1200mg) 14 Combo expansions • Ovarian (3/4L) • HNSCC (1L) • Sarcoma (2-4L) • HNSCC (2/3L) • ccRCC (2/3L) • NSCLC (2/3L)†† • cSCC (2/3L) PD-(L)1 Resistant Patients Mono expansion • Ovarian (3/4L) IO Naïve Patients • Ovarian (3/4L IO naïve) • ccRCC (2/3L PD-(L)1 resistant) Simon’s 2-Stage Expansion Cohorts Stage 1 (n = 14 mono; 10 combo) Stage 2 (Total n = up to 47 mono; 29 combo) † * RP2D = recommended Phase 2 Dose; ** DLT = Dose Limiting Toxicities; † Combined total of Stage 1 and 2 †† Did not meet criteria for stage 2 expansion

JTX-8064: INNATE Three Categories of Patients Mechanistic potential to improve effectiveness of T cell-directed therapies 15 3/4L Ovarian Cancer (Mono & Combo) No Approved PD-(L)1i (IO Naïve Patients) 1L Head and Neck Squamous Cell Carcinoma Approved PD-1i (IO Naïve Patients) 2/3L clear cell Renal Cell Carcinoma 2-4L Triple Negative Breast Cancer* 2/3L Head and Neck Squamous Cell Carcinoma 2/3L Cutaneous Squamous Cell Carcinoma 2/3L Non-Small Cell Lung Cancer* PD-(L)1i Resistant (progressed on or after PD-(L)1i Tx) 2-4L Sarcoma (UPS and LPS) Clinical Response to T Cell Checkpoint Inhibitors Unmet Medical Needs & Potential for New Mechanisms *Closed to enrollment

High Unmet Need in INNATE Indications * Clinical trial patients who received PD-(L)1i treatment beyond RECIST progression (PD-(L)1i as last prior therapy) References: 1 Gandara et al. Journal of Thoracic Oncology 2018; Kazandjian et al. Seminars in Oncology 2017; 2 Haddad et al. Cancer 2019; 3 Escudier et al. European Urology 2017, McDermott et al. Journal of Clinical Oncology 2016 reported an ORR of 21% from a Phase 1a trial; 4 Burgess et al. J Clin Oncol 37, 2019 (supplemental abstract 11015), Chen et al. J Clin Oncol 38: 2020 (supplemental abstract 11511); 5 Keytruda® prescribing information; 6 Matulonis et al. J Clin Oncol 38: 2020 (supplemental abstract 6005) 16 PD-(L)1i resistant patients* Tumor Type ORR for PD-(L)1i (Ph 2 & Ph 3 trials) NSCLC 7% 1 HNSCC 5% 2 RCC 13% 3 cSCC No data PD-(L)1i naïve patients Tumor Type ORR for PD-(L)1i (Ph 2 & Ph 3 trials) UPS 8-23% 4 LPS 7-10% 4 HNSCC (PD-L1+) 19% 5 Ovarian 9% 6 • Low response rates for PD-(L)1i as monotherapies • Opportunity for novel combos with the potential to overcome PD-(L)1i resistance

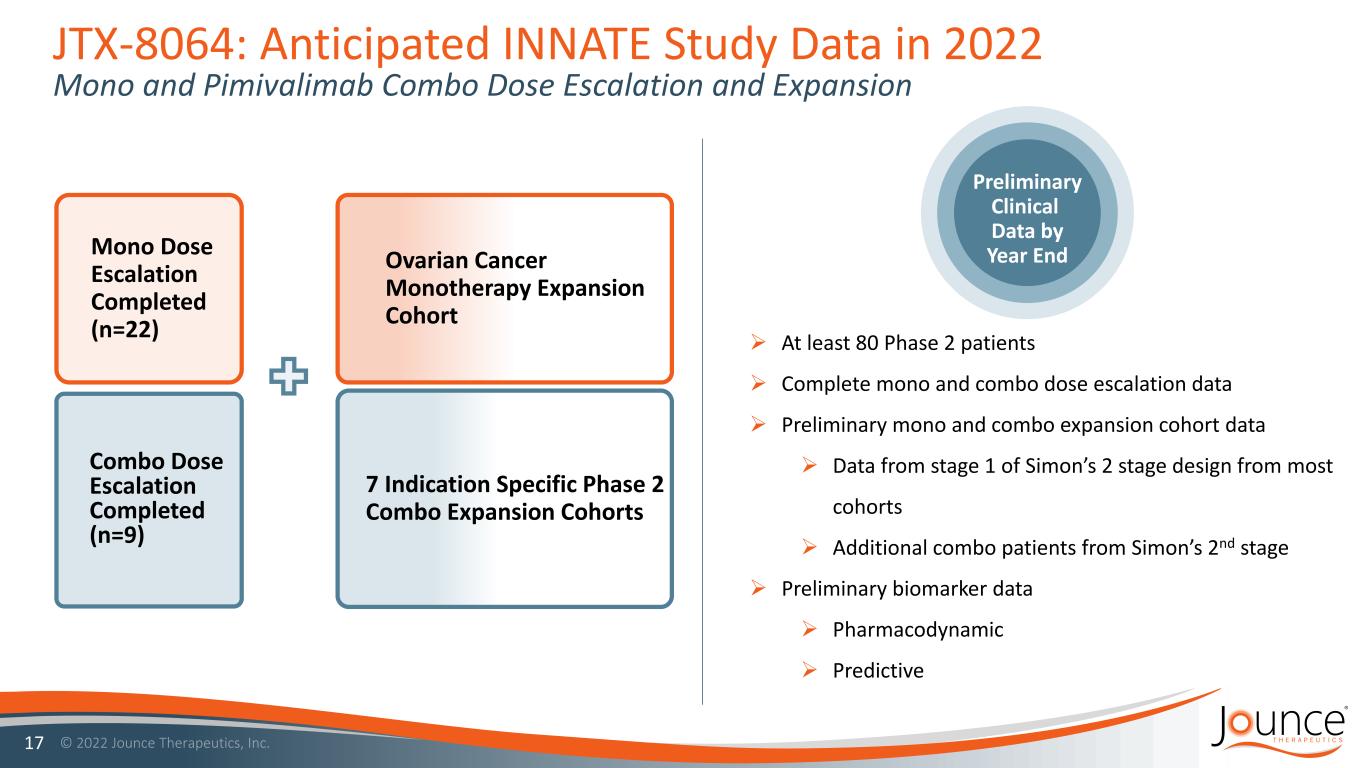

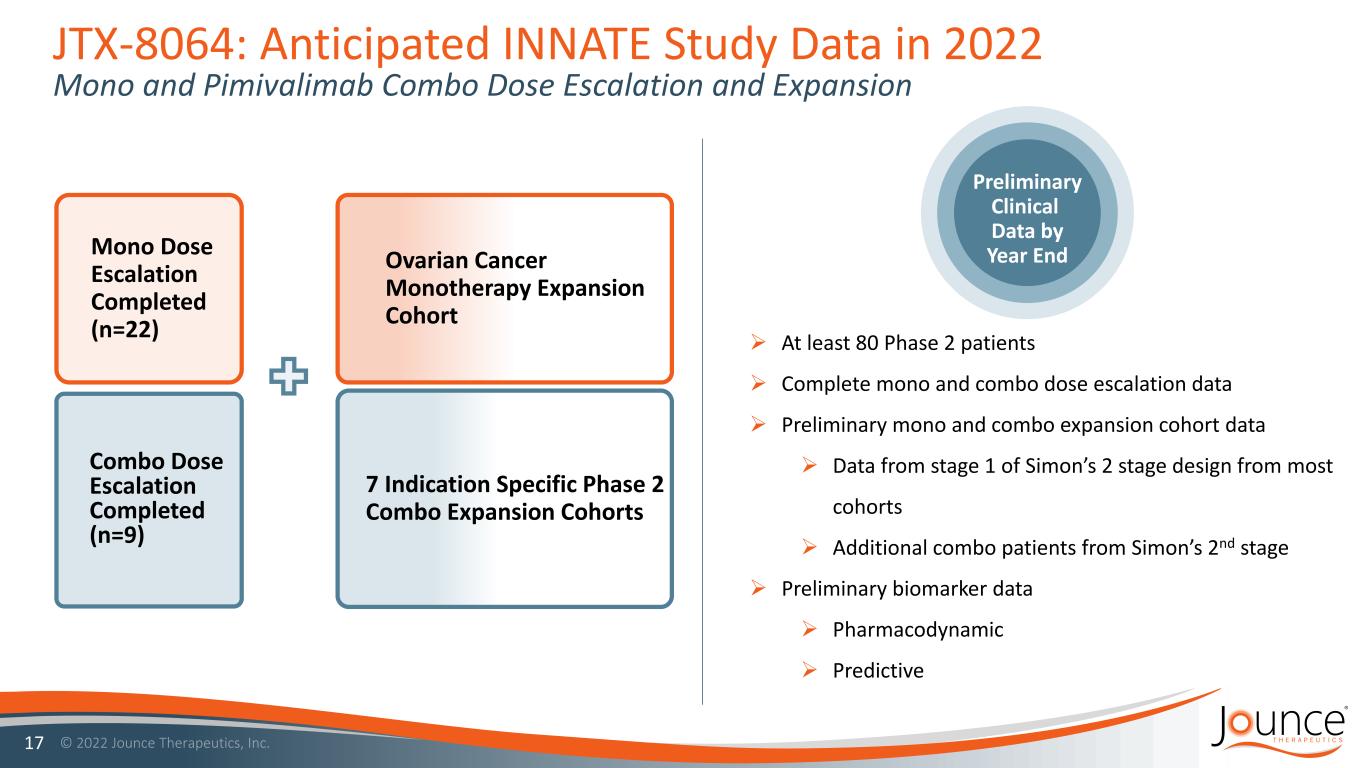

JTX-8064: Anticipated INNATE Study Data in 2022 Mono and Pimivalimab Combo Dose Escalation and Expansion 17 Preliminary Clinical Data by Year End At least 80 Phase 2 patients Complete mono and combo dose escalation data Preliminary mono and combo expansion cohort data Data from stage 1 of Simon’s 2 stage design from most cohorts Additional combo patients from Simon’s 2nd stage Preliminary biomarker data Pharmacodynamic Predictive 7 Indication Specific Phase 2 Combo Expansion Cohorts Ovarian Cancer Monotherapy Expansion Cohort Mono Dose Escalation Completed (n=22) Combo Dose Escalation Completed (n=9)

Vopratelimab 18

Vopratelimab Biological Activity Distinct from CD8 Focused PD-(L)1i • Vopra is an IgG1 agonist antibody selective for ICOS (inducible co-stimulatory of T cells) • Activates CD4 T cells that have been primed by antigen presentation Clinical Learnings to Date • Well tolerated at all doses tested alone and in combination with PD-1i across multiple trials • Highly durable clinical benefit and acceptable safety profile observed alone and in combination with PD-1i* or CTLA-4i • Pulsatile lower dose of 0.03 mg/kg + pimi shows encouraging trends by multiple measures • TISvopra may select for patient benefit independent of PD-L1 for PD-1i containing regimens 19 *Yap, T, ASCO 2018, 3000; Harvey, C., AACR 2019, 4053; Hanson, A., SITC 2018, P52

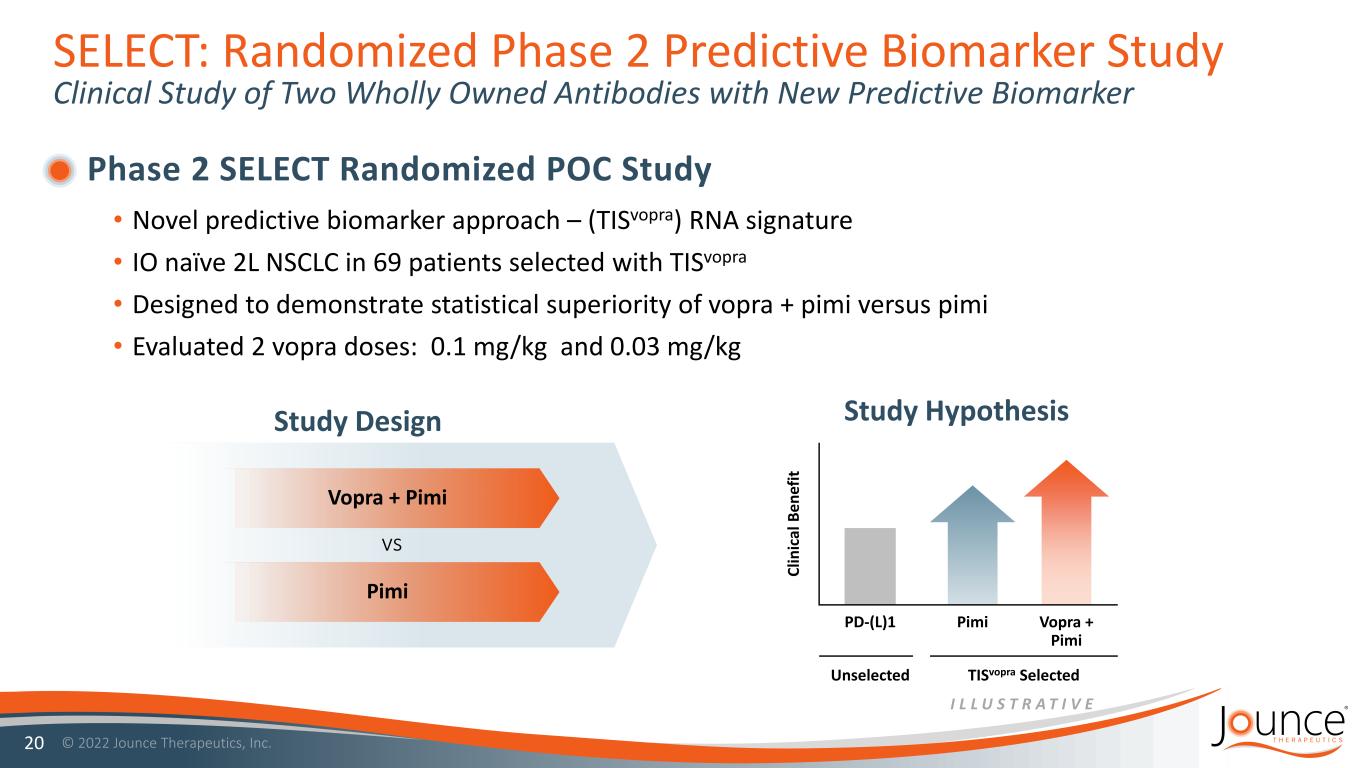

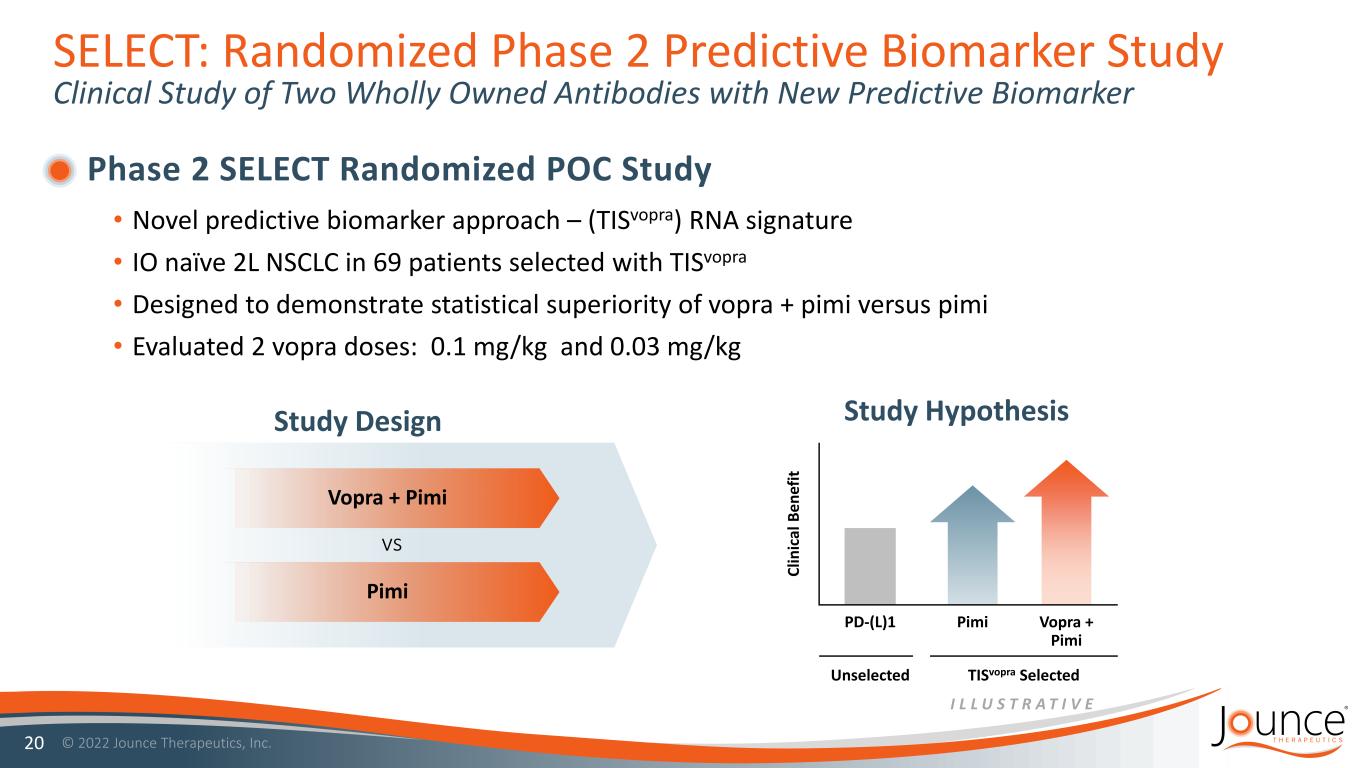

SELECT: Randomized Phase 2 Predictive Biomarker Study Clinical Study of Two Wholly Owned Antibodies with New Predictive Biomarker Phase 2 SELECT Randomized POC Study • Novel predictive biomarker approach – (TISvopra) RNA signature • IO naïve 2L NSCLC in 69 patients selected with TISvopra • Designed to demonstrate statistical superiority of vopra + pimi versus pimi • Evaluated 2 vopra doses: 0.1 mg/kg and 0.03 mg/kg 20 Study Design Study Hypothesis Vopra + Pimi Pimi vs PD-(L)1 Pimi Vopra + Pimi Unselected TISvopra Selected Cl in ic al B en ef it I L L U S T R A T I V E

SELECT Trial Top Line Results (ICR*; FAS) • Vopra continues to remain well tolerated and had no new safety signals • Expected differentiated pulsatile dosing was achieved 21 • Mean percent change from baseline in tumor size in all measurable lesions, averaged over 9 and 18 weeks • Continuous variable measure chosen to minimize study size and potential predictor of overall survival • Not a binary measure, susceptible to outliers General Primary Endpoint JTX-4014 (pimi) monotherapy (N=36) Pooled pimi + vopra combination doses** (N=33) pimi + vopra 0.1 mg/kg (N=18) pimi + vopra 0.03 mg/kg (N=15) Average over Week 9 & 18 *** Mean % change (95% CI) 7.33 (-12.46, 27.12) 0.23 (-20.10, 20.56) 8.35 (-19.94, 36.65) -7.89 (-37.15, 21.37) Difference vs. pimi monotherapy for Average of Week 9 & 18, Absolute % (95% CI) -7.10 (-35.42, 21.22) 1.02 (-33.46, 35.51) -15.22 (-50.51, 20.06) P-value 0.6174 0.9528 0.3908 Data-cut date: 07 July 2022 ; *ICR = Independent Central Review; ** vopra 0.1 mg/kg + pimi and vopra 0.03 mg/kg + pimi; *** Means, 95% CIs, difference between means, 95% CIs of difference, and p-values are based on a mixed-model repeated measures (MMRM) analysis

22 *ICR = Independent Central Review; **Disease Control Rate or DCR = CR + PR + SD of at least 9 weeks; Data cut date: 07 July 2022 JTX-4014 (pimi) (N=36) pimi + vopra 0.1 mg/kg (N=18) pimi + vopra 0.03 mg/kg (N=15) Overall response rate n (%) (95% CI) 9 (25.0) (12.12, 42.20) 3 (16.7) (3.58, 41.42) 6 (40.0) (16.34, 67.71) p-value compared to pimi mono therapy 0.4892 0.2879 DCR n (%)** (95% CI) 22 (61.1) (43.46, 76.86) 11 (61.1) (35.75, 82.70) 13 (86.7) (59.54, 98.34) Landmark 6 month Progression Free Survival (PFS), % (95% CI) 33 (16,50) 29 (10,52) 80 (50,93) Secondary Endpoints • Secondary endpoints included ORR, PFS (OS not mature) • More traditional and familiar endpoints SELECT Trial Summary RECIST v1.1 Response & PFS (ICR*; FAS) Data cut date: 07 July 2022; subject to change; landmark PFS data is only mature for the 0.03 mg/kg cohort.

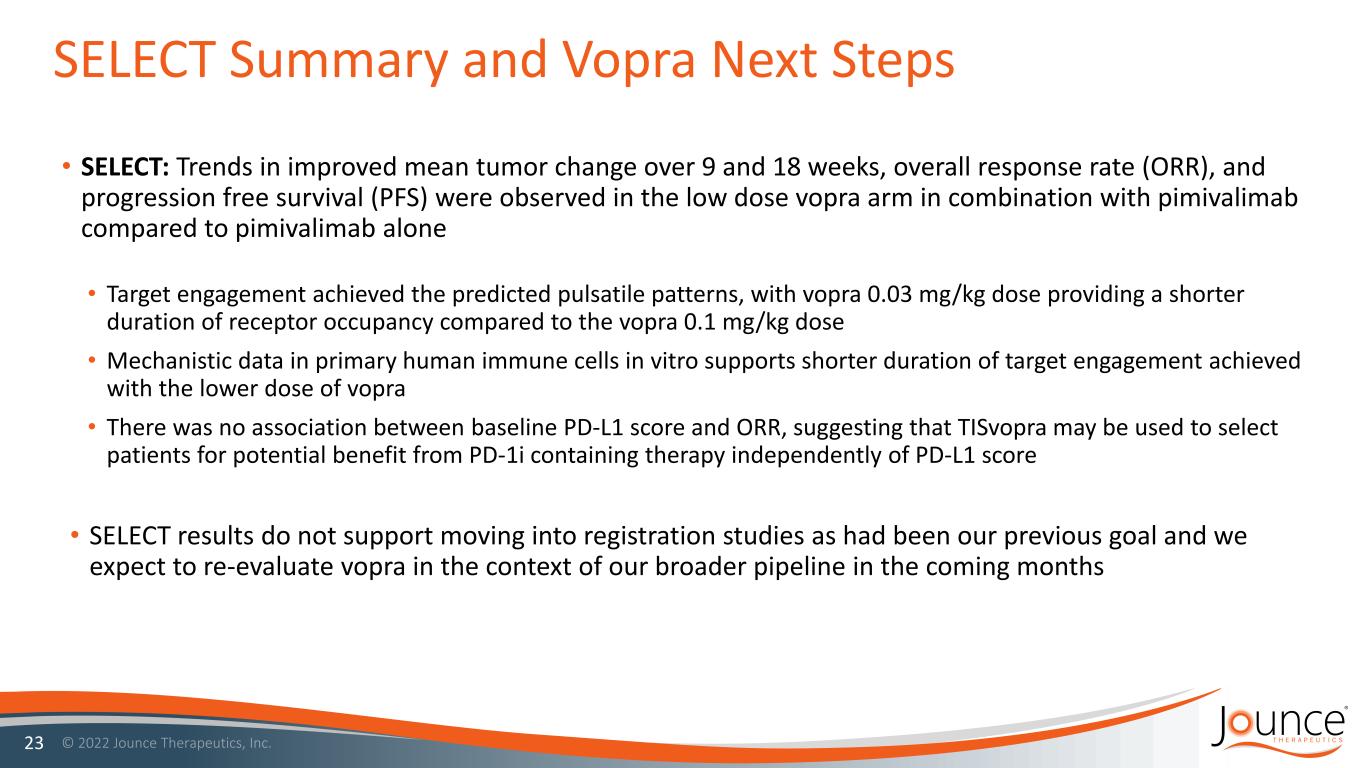

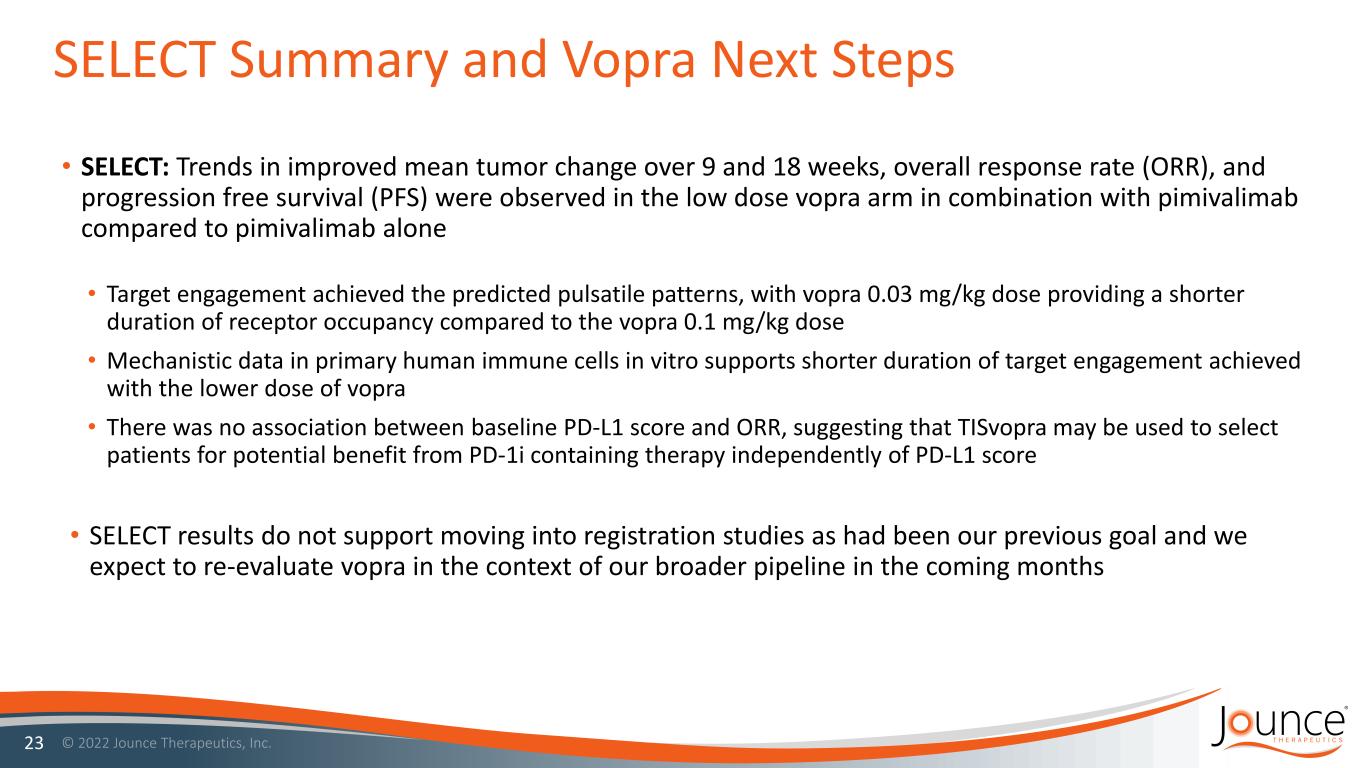

SELECT Summary and Vopra Next Steps 23 • SELECT results do not support moving into registration studies as had been our previous goal and we expect to re-evaluate vopra in the context of our broader pipeline in the coming months • SELECT: Trends in improved mean tumor change over 9 and 18 weeks, overall response rate (ORR), and progression free survival (PFS) were observed in the low dose vopra arm in combination with pimivalimab compared to pimivalimab alone • Target engagement achieved the predicted pulsatile patterns, with vopra 0.03 mg/kg dose providing a shorter duration of receptor occupancy compared to the vopra 0.1 mg/kg dose • Mechanistic data in primary human immune cells in vitro supports shorter duration of target engagement achieved with the lower dose of vopra • There was no association between baseline PD-L1 score and ORR, suggesting that TISvopra may be used to select patients for potential benefit from PD-1i containing therapy independently of PD-L1 score

Pimivalimab PD-1 inhibitor 24

Pimivalimab (Pimi): PD-1 Inhibitor in 2 POC Combo Studies Well-Characterized PD-1 Antibody, Fully Human IgG4 Phase 2 SELECT Monotherapy Results • 9/36 (25.0%) overall response rate • Well tolerated Phase 1 Study Results* • 3/18 (16.7%) confirmed responses • No deaths or dose limiting toxicities Opportunities for Pimi • Biomarker selected IO naïve patients (SELECT) • PD-(L)1i naïve & experienced patients (INNATE) 25 *Papadopoulos, K., Cancer Immunology, Immunotherapy 2020

Discovery 26

Jounce’s Translational Science Platform Deconstructing the Tumor Microenvironment to Identify Novel Therapeutics 27 T cell Identify targets uniquely tied to cell types of interest Profile human tumors for target expression on cell types of interest More IO Responsive Less IO Responsive Targets for less IO responsive tumors: Any tumor resident cell type TAM T reg NK cell Stroma Design therapeutics in bispecific or mono specific format Create Cell Type Signatures Correlate Signature(s) to Expression from 1000s of Human Tumors

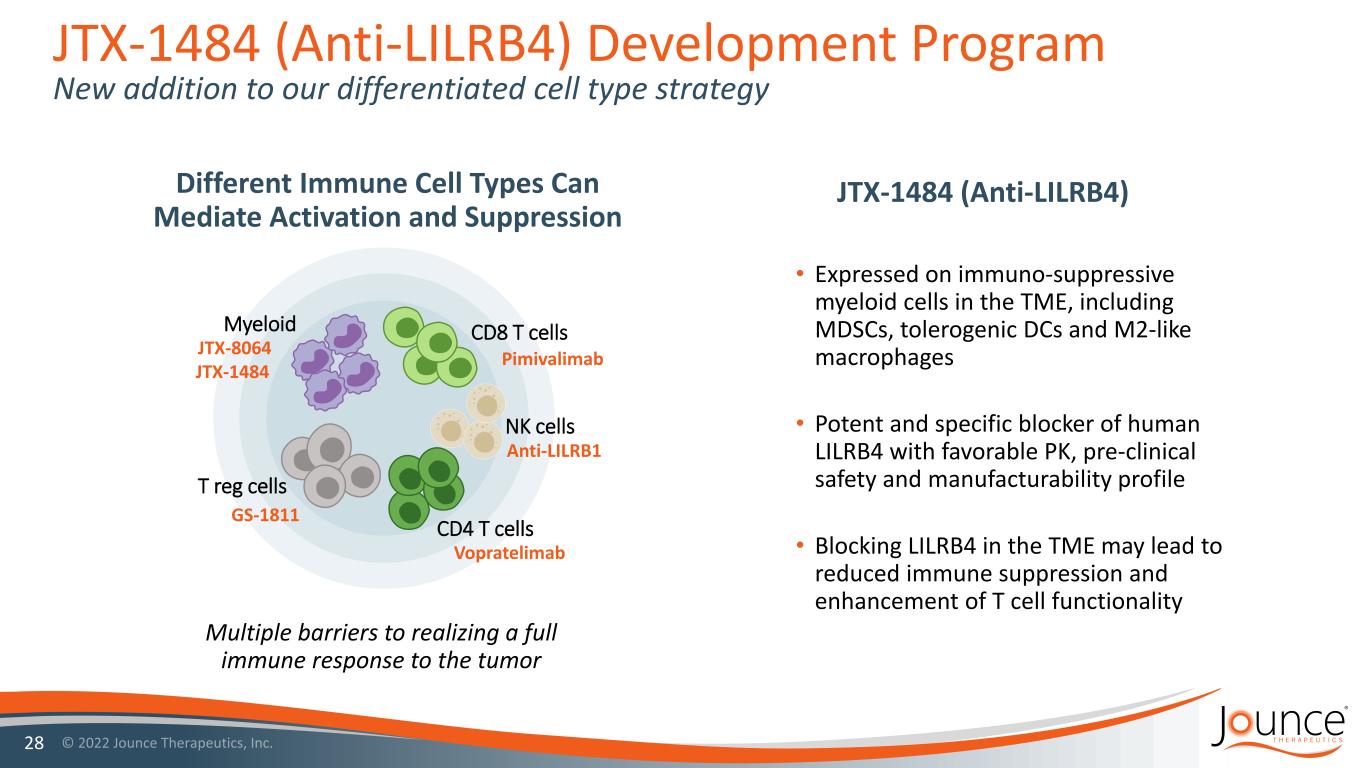

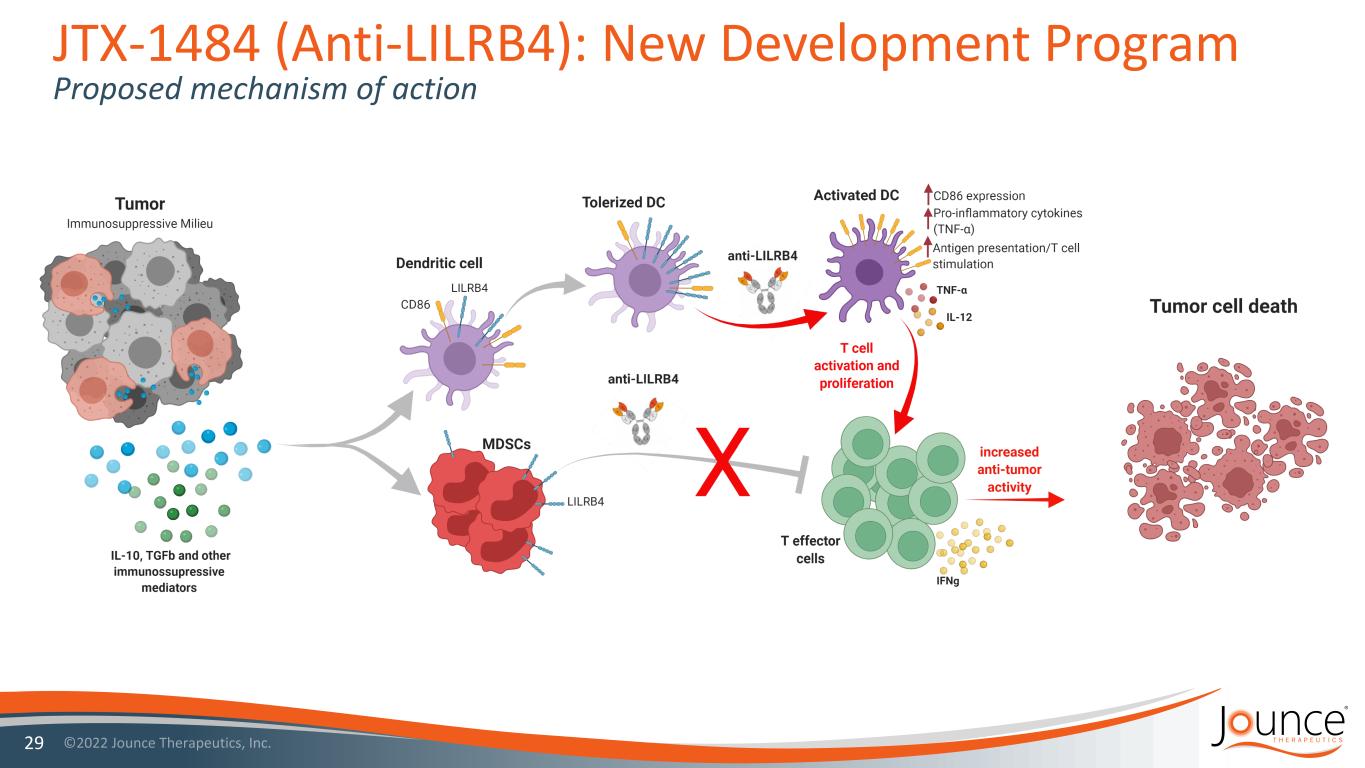

JTX-1484 (Anti-LILRB4) Development Program New addition to our differentiated cell type strategy 28 • Expressed on immuno-suppressive myeloid cells in the TME, including MDSCs, tolerogenic DCs and M2-like macrophages • Potent and specific blocker of human LILRB4 with favorable PK, pre-clinical safety and manufacturability profile • Blocking LILRB4 in the TME may lead to reduced immune suppression and enhancement of T cell functionality Different Immune Cell Types Can Mediate Activation and Suppression Multiple barriers to realizing a full immune response to the tumor JTX-1484 (Anti-LILRB4) CD8 T cells CD4 T cells T reg cells Myeloid NK cells Pimivalimab Vopratelimab JTX-8064 GS-1811 JTX-1484 Anti-LILRB1

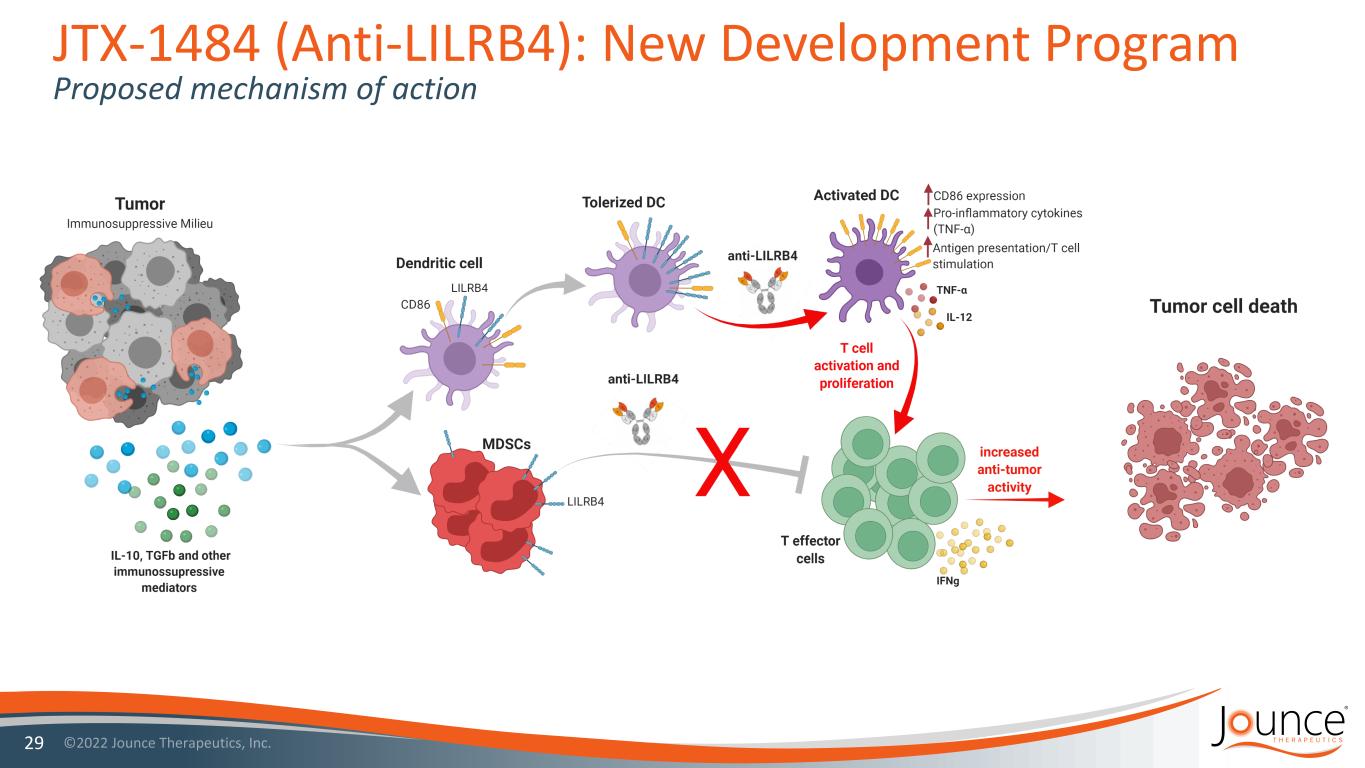

JTX-1484 (Anti-LILRB4): New Development Program Proposed mechanism of action 29

Milestones & Financials 30

Vopratelimab (SELECT): Top-line results reported • Plan to submit full data clinical abstract to ESMO-IO in December 2022 • Safety and preliminary efficacy data • Performance of biomarker JTX-1484 (LILRB4): • Continue to advance towards a 2023 IND Discovery: • Continue to advance multiple new targets through discovery pipeline with a goal of an IND every 12-18 months Upcoming Milestones JTX-8064 (INNATE): • Clinical data by year end: • All mono and combo dose escalation • > 80 Phase 2 patients • Multiple expansion cohorts • Preliminary biomarker data • Pharmacodynamic • Predictive 31

Financial Strength and Flexibility NASDAQ: JNCE Strong Balance Sheet • Cash runway into Q1 2024 • Excludes any potential milestone payments • $162.3M in cash, cash equivalents and investments, as of June 30, 2022 Cash Guidance • 2022 gross cash burn $115M - $130M Common Stock Outstanding • 51.7M shares as of June 30, 2022 32

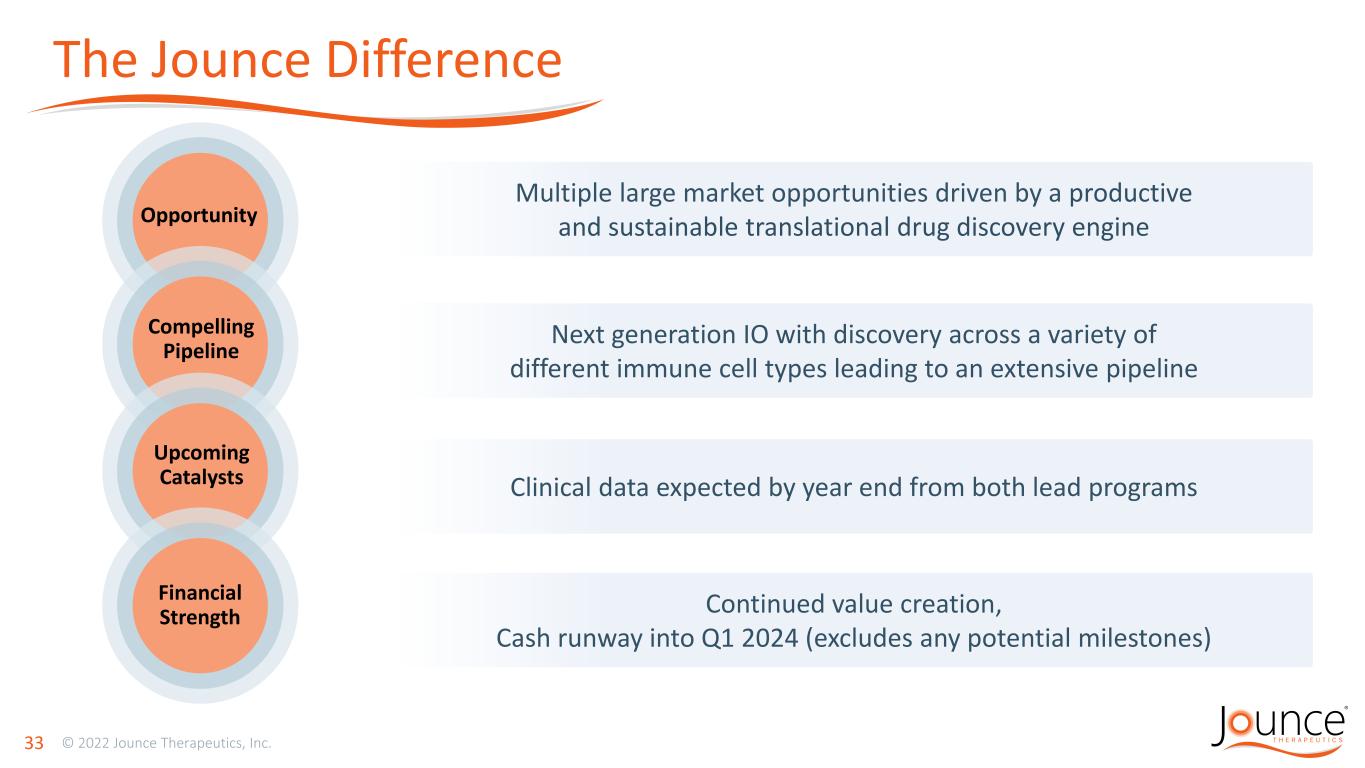

The Jounce Difference 33 Opportunity Compelling Pipeline Upcoming Catalysts Financial Strength Clinical data expected by year end from both lead programs Next generation IO with discovery across a variety of different immune cell types leading to an extensive pipeline Multiple large market opportunities driven by a productive and sustainable translational drug discovery engine Continued value creation, Cash runway into Q1 2024 (excludes any potential milestones)

Jounce Therapeutics JOUNCETX.COM 34