| O L S H A N | 1325 AVENUE OF THE AMERICAS ● NEW YORK, NEW YORK 10019

TELEPHONE: 212.451.2300 ● FACSIMILE: 212.451.2222 |

EMAIL: RNEBEL@OLSHANLAW.COM

DIRECT DIAL: 212.451.2279

January 5, 2022

VIA EDGAR AND ELECTRONIC MAIL

Mr. Perry Hindin

United States Securities and Exchange Commission

Division of Corporation Finance

Office of Mergers & Acquisitions

Mail Stop 3628

100 F Street, N.E.

Washington, D.C. 20549

| Re: | DIRTT Environmental Solutions Ltd. (“DIRTT” or the “Company)

Preliminary Proxy Statement on Schedule 14A filed by 22NW Fund, LP,

22NW, LP, 22NW Fund GP, LLC, 22NW GP, Inc., Aron R. English, et. al

Filed December 23, 2021 (the “Proxy Statement”)

File No. 001-39061 |

Dear Mr. Hindin:

We acknowledge receipt of the comment letter of the Staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) dated December 30, 2021 (the “Staff Letter”) with regard to the above-referenced matter. We have reviewed the Staff Letter with 22NW Fund, LP and the other participants in its solicitation (collectively, “22NW”) and provide the following responses on 22NW’s behalf. For ease of reference, the comments in the Staff Letter are reproduced in italicized form below. Terms that are not otherwise defined have the meanings ascribed to them in the Proxy Statement.

Preliminary Proxy Statement on Schedule 14A

Letter to Shareholders, page i

| 1. | Disclosure indicates that “the enclosed WHITE proxy card may only be voted for our nominees and does not confer voting power with respect to any of the Company’s director nominees. Shareholders who return the WHITE proxy card will only be able to vote for our six nominees and will not have the opportunity to vote for the two other seats up for election at the Meeting.” Please expand the disclosure to advise shareholders that the WHITE proxy card will not permit shareholders to vote on any other proposals that may be included on the Company’s proxy card. |

22NW acknowledges the Staff’s comment and has revised the Proxy Statement to provide the following:

| | |

| | |

| O L S H A N F R O M E W O L O S K Y L L P | WWW.OLSHANLAW.COM |

“Shareholders who return the WHITE proxy card will only be able to vote for our six nominees and will not have the opportunity to vote for the two other seats up for election at the Meeting or any other proposals that may be included on the Company’s proxy card.”

Please see the cover letter and page 2 of the Proxy Statement, as well as the proxy card.

Background to the Solicitation, page 6

| 2. | Refer to the following two statements found in this section: |

| · | “On September 10, 2021, Mr. English had an in-person meeting with Messrs. O’Meara and Lillibridge, in Jackson Hole, Wyoming, to discuss 22NW’s governance concerns with respect to the Company.” |

| · | “On October 11, 2021, Mr. English participated in a telephone call with Mr. Lillibridge to reiterate his concerns about the Company’s governance.” |

It is our understanding that Mr. English’s sole concern both at the in-person meeting and on the telephone call was his potential appointment to the Board as opposed to his broader concerns about the Company’s “governance.” Please advise or revise.

22NW acknowledges the Staff’s comment and respectfully disagrees with the characterization that Mr. English’s sole concern at the September 10, 2021 meeting (the “September Meeting”) was his potential appointment to the Board. 22NW provides the following clarifications concerning the September Meeting on a supplemental basis. The September Meeting was an in-person meeting that lasted approximately 3 hours and occurred in Jackson Hole, Wyoming between Messrs. English, O’Meara and Lillibridge. Many topics were discussed during the September Meeting, including, but not limited to, the following: (i) the Board’s lack of material ownership in the Company, (ii) the lack of shareholder representation on the Board, (iii) 22NW’s concerns about the Company’s capital allocation, (iv) 22NW’s concerns about the emerging Delta variant of COVID-19 and its potential impact on the Company’s business, (v) 22NW’s concerns about the Company’s lack of pipeline transparency, (vi) 22NW’s views on how to improve the Company’s investor relations efforts, (vii) 22NW’s opposition to the Company’s proposed shareholder rights agreement and (viii) the composition of the Board. Notwithstanding the foregoing, 22NW has revised its disclosure to provide the following:

“On September 10, 2021, Mr. English had an approximately 3-hour in-person meeting with Messrs. O’Meara and Lillibridge in Jackson Hole, Wyoming to discuss 22NW’s views and concerns with respect to the Company, including, among others, (i) the Board’s lack of material ownership in the Company, (ii) the lack of shareholder representation on the Board, (iii) the Company’s capital allocation, (iv) the emerging Delta variant of COVID-19 and its potential impact on the Company’s business, (v) the Company’s lack of pipeline transparency, (vi) how to improve the Company’s investor relations efforts, (vii) the Company’s proposed shareholder rights agreement and 22NW’s opposition thereto and (viii) the composition of the Board.”

Please see page 7 of the Proxy Statement.

With respect to the October 11, 2021 telephone call (the “October Call”), 22NW acknowledges the Staff’s comment and provides on a supplemental basis that the October Call was a follow-up discussion to the September Meeting. While this call had been intended to follow-up on the variety of topics discussed at the September Meeting, the brief call focused primarily on the composition of the Board and Mr. English’s potential appointment thereto. 22NW has revised its disclosure to provide the following:

“On October 11, 2021, Mr. English participated in a telephone call with Mr. Lillibridge as a follow-up to their September 10, 2021 meeting and to further discuss the composition of the Board, including Mr. English’s potential appointment to the Board.”

Please see page 8 of the Proxy Statement.

| 3. | Refer to the following statement found in this section: |

| · | “On November 12, 2021, Mr. English participated in a telephone call with Mr. Lillibridge and Ms. Karkkainen to further discuss Mr. English being appointed to the Board. Mr. Lillibridge and Ms. Karkkainen indicated that the Board declined to appoint Mr. English.” |

It is our understanding that Mr. Lillibridge and Ms. Karkkainen reiterated to Mr. English on the telephone call that the Board would consider his candidacy in February 2022 consistent with its customary review and selection process for director nominees for election at an annual general meeting, and Mr. Lillibridge and Ms. Karkkainen offered to send to Mr. English a form of standstill agreement that they believed would be required by the Company in connection with any appointment of Mr. English. Please advise or revise.

22NW acknowledges the Staff’s comment and respectfully disagrees with the above description of the November 12, 2021 telephone call (the “November 12 Call”). To the best of Mr. English’s recollection, neither Mr. Lillibridge nor Ms. Karkkainen advised him that the Company would consider his candidacy for the Board in February 2022 or offered to provide a form of standstill agreement during the November 12 Call. Mr. English has no record of the Company sending a form of standstill agreement or any written communication that would constitute an offer for him to join the Board.

| 4. | Refer to the following statement found in this section: |

| · | “On December 7, 2021, the Company issued a press release announcing that, in response to the Requisition, the Board had decided to call a joint special and annual meeting to be held on April 26, 2022, more than four months after the latest date for the meeting requested by 22NW in the Requestion, being January 21, 2022, and alleged that 22NW did not propose any new business or strategy at the Meeting warranting an earlier special meeting.” |

It is our understanding that the latest date for the meeting requested by 22NW was January 21, 2022. The date April 26, 2022 is approximately three months and five days after January 21, 2022, not “more than four months” after such date. Please advise or revise.

22NW acknowledges the Staff’s comment and has revised its disclosure to provide the following:

“On December 7, 2021, the Company issued a press release announcing that, in response to the Requisition, the Board had decided to call a joint special and annual meeting to be held on April 26, 2022, more than three months after the latest date for the meeting requested by 22NW in the Requisition, being January 21, 2022, and alleged that 22NW did not propose any new business or strategy at the Meeting warranting an earlier special meeting.”

Please see page 9 of the Proxy Statement.

| 5. | Disclosure indicates that “Members of 22NW have continuously been shareholders of DIRTT since early 2020.” Please revise to identify such “members.” |

22NW acknowledges the Staff’s comment and revised its disclosure to provide the following:

“The 22NW Parties (as defined below) have continuously been shareholders of DIRTT since March 2020.”

Please see page 6 of the Proxy Statement.

Reasons for the Solicitation, page 11

| 6. | Please expand the disclosure to explain what is meant by the phrase “analyzing DIRTT from various perspectives.” |

22NW acknowledges the Staff’s comment and clarifies on a supplemental basis that 22NW has been actively performing diligence on the Company since prior to its initial investment nearly two years ago. A non-exhaustive list of 22NW’s diligence efforts includes performing expert network calls with the Company’s former employees, current and former customers, and competitors, reviewing all of the Company’s public filings since inception, tracking the Company’s list of distribution partners, engaging in detailed financial modelling and engaging in site visits and discussions with the Company’s management. Notwithstanding the foregoing, 22NW has revised its disclosure to provide the following:

“After performing extensive diligence with respect to DIRTT (including by, among other methods, building detailed financial models, conducting network calls with competitors, former employees and customers and reviewing the Company’s public filings since inception), as well as attempting to substantively engage with the Board without success, we have concluded that the Board appears more interested in entrenching themselves than substantively engaging with its shareholders.”

Please see page 11 of the Proxy Statement.

| 7. | Disclosure refers to the term “cash burn” without definition or reference to a metric in order for a shareholder to properly ascertain the merits of 22NW’s claims. Please revise to define what is meant by term and why 22NW considers it “high.” |

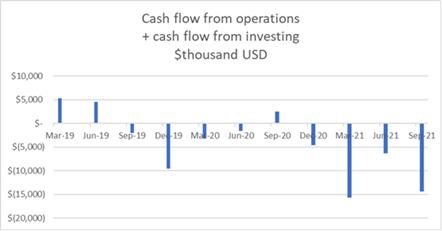

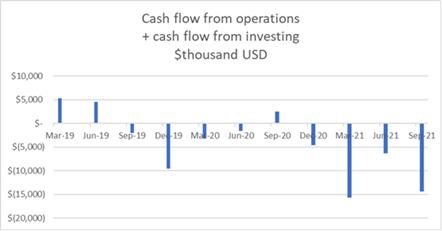

22NW acknowledges the Staff’s comment and clarifies on a supplemental basis that when it refers to “cash burn” it is referencing DIRTT’s negative cash flow from operations and negative cash flow from investing activities, as reported in the Company’s public filings and related earnings reports. As shown in the graph below, except for one quarter in 2020, the Company has not reported a positive combined cash flow from operations and cash flow from investing activities since June of 2019.

1

1

22NW has revised its disclosure to include a definition for “cash burn” and the above graph. Please see page 12 of the Proxy Statement.

| 8. | Refer to the following two statements found on pages 11 and 12: |

| · | “In addition, DIRTT’s revenue declined by 26% year over year, while its competitors and the industry at large have experienced a positive inflection.” |

| · | “Out of a group of nearly 40 public companies that we believe are peers to DIRTT, DIRTT is only one of two companies that does not disclose quantitative metrics around its pipeline. Shareholders have repeatedly requested improved disclosure surrounding these metrics from the Company’s management and these requests have thus far been ignored.” |

1 Company’s public filings; S&P Capital IQ.

Please revise the disclosure to provide support for the first statement, identify the referenced “competitors” and explain the meaning of “positive inflection.” We note that the comparison of stock prices to the Russell 2000 and TSX SmallCap Index in page 12 does not appear specific to the construction industry. Please also revise the disclosure to identify the 40 companies and provide support for your belief that these are appropriate peers for comparison to DIRTT.

With respect to the first bullet point, 22NW acknowledges the Staff’s comment and respectfully refers the Staff to DIRTT’s Quarterly Report on Form 10-Q for the third quarter of 2021, which states that “[r]evenues for the quarter ended September 30, 2021 were $34.1 million, a decline of $12.1 million or 26% from $46.2 million for the quarter ended September 30, 2020.”2 Based on prior discussions with DIRTT’s management, 22NW believes that MillerKnoll, Inc. (NASDAQ: MLKN), a producer of office furniture, equipment and home furnishings, and Steelcase Inc. (NYSE: SCS), a US-based furniture company, are the most relevant peers for DIRTT. While DIRTT’s revenues were down 26% year over year for Q3 2021, MLKN and SCS have reported positive inflections and are seeing revenue growth and positive earnings.3 22NW has revised its disclosure to reflect the foregoing, please see page 11 of the Proxy Statement.

With respect to the second bullet point, 22NW acknowledges the Staff’s comment and clarifies on a supplemental basis that it has identified almost 40 companies, as listed on Annex A attached hereto, as appropriate peers for comparison to DIRTT. 22NW believes these companies are appropriate peers as they are all public companies within the building products and infrastructure/construction industries, which it considers relevant for DIRTT. In addition, 22NW has revised its disclosure to identify these companies and to provide the following:

“Out of a group of nearly 40 public companies in the building products and infrastructure/construction industries that we believe are appropriate peers to the Company, DIRTT is only one of two companies that do not disclose quantitative metrics around its pipeline.”

Please see page 12 of the Proxy Statement.

2 DIRTT’s Quarterly Report on Form 10-Q filed with the Commission on November 3, 2021.

3See MLKN’s Second Quarter Fiscal 2022 Results, as filed as Ex. 99.1 to MLKN’s Current Report on Form 8-K filed with the Commission on January 4, 2022 (reporting a 26.4% increase in quarterly orders year over year organically); SCS’s Quarterly Report on Form 10-Q filed with the Commission on December 20, 2021 (reporting a 19.5% increase in revenue year over year).

| 9. | Disclosure states that “[s]hareholders have repeatedly requested improved disclosure surrounding these metrics from the Company’s management and these requests have thus far been ignored.” Please revise to clarify if such shareholders include any shareholders other than 22NW and the Participants. |

22NW acknowledges the Staff’s comment and respectfully directs the Staff’s attention to DIRTT’s transcript for its November 4, 2021 earnings call. Specifically, an analyst from National Bank Financial Inc. asked Mr. O’Meara for additional details surrounding the Company’s pipeline and additional disclosure from management about the Company’s projected level of activity in the New Year and how it might compare to the previous quarter. Mr. O’Meara responded in general terms without disclosing specific plans concerning the Company’s pipeline. Notwithstanding the foregoing, 22NW has revised its disclosure to provide the following:

“We believe additional disclosure surrounding a company’s pipeline is industry standard for construction and building products companies. Multiple stakeholders have requested improved disclosure surrounding these metrics from the Company’s management and these requests have thus far been ignored.”

Please see page 12 of the Proxy Statement.

Certain Additional Information, page 30

| 10. | Please advise us if the Participants anticipate distributing their proxy statement before the registrant distributes its proxy statement. Given that reliance on Exchange Act Rule 14a-5(c) is impermissible at any time before the registrant distributes its proxy statement, the Participants will accept all legal risk in connection with distributing the initial definitive proxy statement without all required disclosures. Please confirm the Participants understand their obligation to subsequently provide any omitted information in a supplement in order to mitigate that risk to the extent it arises in the context of this solicitation. |

22NW acknowledges the Staff’s comment and advises the Staff that it anticipates distributing its proxy statement before the registrant distributes its proxy statement. 22NW understands that it will accept all legal risk in connection with distributing the initial definitive proxy statement without all required disclosures and will subsequently provide any omitted information in a supplement to its definitive proxy statement after the information has been made public by the Company in order to mitigate such risk.

General

| 11. | We note disclosure on pages 1 and 2 that “[t]he Company has not yet publicly disclosed the Record Date or the number of Common Shares outstanding as of the Record Date. Once the Company publicly discloses such information, we intend to supplement this Proxy Statement with such information and file revised definitive materials with the SEC.” With a view towards revised disclosure, please (1) confirm whether 22NW will disseminate proxy cards prior to the public disclosure of the Record Date and (2) if 22NW will so disseminate, advise us of 22NW’s plans with respect to any proxy cards received from shareholders who ultimately were not entitled to notice of and to vote at the Meeting. |

22NW acknowledges the Staff’s comment and advises the Staff that it currently intends to disseminate proxy cards prior to the public disclosure of the Record Date. Any proxy cards received from shareholders who ultimately are not entitled to notice of and to vote at the Meeting as of the Record Date will be disregarded. 22NW has revised the Proxy Statement to provide the following:

“The attached Proxy Statement and the enclosed WHITE proxy card are first being mailed or given to shareholders on or about [________], 2022. In the event such date is prior to the record date for the Meeting, any proxy cards received from shareholders who ultimately are not entitled to notice of and to vote at the Meeting as of the record date for the Meeting will be disregarded and not counted at the Meeting.”

Please see the cover letter and page 1 of the Proxy Statement.

Sincerely,

/s/ Ryan Nebel

Ryan Nebel

| cc: | Aron English, 22NW, LP |

Annex A

| Company Name | Ticker |

| 1. Aecon Group Inc. | TSX:ARE |

| 2. Apogee Enterprises, Inc. | APOG |

| 3. Bird Construction Inc. | TSX:BDT |

| 4. Comfort Systems USA, Inc. | FIX |

| 5. Construction Partners, Inc. | ROAD |

| 6. Cornerstone Building Brands, Inc. | CNR |

| 7. Dycom Industries, Inc. | DY |

| 8. Enerflex Ltd. | TSX:EFX |

| 9. Exterran Corporation | EXTN |

| 10. Fluor Corporation | FLR |

| 11. Gibraltar Industries, Inc. | ROCK |

| 12. Granite Construction Incorporated | GVA |

| 13. Great Lakes Dredge & Dock Corporation | GLDD |

| 14. Hill International, Inc. | HIL |

| 15. HNI Corporation | HNI |

| 16. IES Holdings, Inc. | IESC |

| 17. KBR, Inc. | KBR |

| 18. Kimball International, Inc. | KBAL |

| 19. Knoll, Inc. | KNL |

| 20. L.B. Foster Company | FSTR |

| 21. MasTec, Inc. | MTZ |

| 22. Matrix Service Company | MTRX |

| 23. MillerKnoll, Inc. | MLHR |

| 24. MYR Group Inc. | MYRG |

| 25. North American Construction Group Ltd. | TSX:NOA |

| 26. NV5 Global, Inc. | NVEE |

| 27. Orion Group Holdings, Inc. | ORN |

| 28. Primoris Services Corporation | PRIM |

| 29. Quanta Services, Inc. | PWR |

| 30. Shawcor Ltd. | TSX:SCL |

| 31. Simpson Manufacturing Co., Inc. | SSD |

| 32. SNC-Lavalin Group Inc. | TSX:SNC |

| 33. Stantec Inc. | TSX:STN |

| 34. Steelcase Inc. | SCS |

| 35. Sterling Construction Company, Inc. | STRL |

| 36. Tecnoglass Inc. | TGLS |

| 37. Tutor Perini Corporation | TPC |

| 38. WSP Global Inc. | TSX:WSP |

1

1