Exhibit 99.1

22NW 22NW F UND , LP Investor presentation concerning DIRTT Environmental Solutions Ltd. March 2022

2 22NW • Table of Contents – Executive Summary – Background to the Solicitation – The Case for Change at DIRTT – 22NW’s Outstanding Nominees – Transition Plan

3 22NW • 22 NW is a Seattle - based investment manager founded in 2015 . We focus on long duration capital and make multi - year investments in undervalued securities, often in turnaround situations . We currently own approximately 18 . 9 % of DIRTT Environmental Solutions Ltd . ’s (“ DIRTT ” or the “ Company ”) stock and first became shareholders of the Company in March, 2020 . • We have previously sought to engage constructively with the board of directors of the Company (the “ Board ”) for shareholder representation of one board seat and have thus far been denied . Since then we believe the Board has undertaken a series of strategic missteps, including terrible operating performance, value destroying capital raises and firing the CEO with no replacement immediately available . • Our highly qualified nominees are committed to creating and unlocking shareholder value . In our view, DIRTT’s current Board lacks shareholder alignment, as they collectively own less than 1 % of DIRTT’s stock . Our nominees will work to improve the Company’s operations and unlock value for the benefit of all shareholders . • As further discussed herein, the Board has been publicly admonished by the Alberta Securities Commission (the “ ASC ”) for bringing a meritless application against 22 NW and another shareholder, thereby wasting Company resources . We believe the Board has become entrenched and improperly tried to stifle criticism from its shareholders, and that this misconduct raises serious questions about the Board’s integrity . Executive Summary

4 22NW Background to the Solicitation

5 22NW Background to the Solicitation: DIRTT’s Shareholder Unfriendly Board • 22 NW is the Company’s largest shareholder, owning approximately 18 . 9 % of DIRTT’s stock . In August 2021 , we first approached the Board to discuss obtaining shareholder representation of one board seat . We believed this was a reasonable request given the magnitude of our financial commitment to DIRTT . • 22 NW’s concerns about the Board’s ineffectiveness grew over time as DIRTT completed dilutive offerings, missed guidance and burned cash . It became clear to us that the Board was failing to prioritize operational results and shareholder value . • During our discussions with the Board between August and November 2021 , it became apparent that the Board was applying a different process to 22 NW than it did to other recent Board additions . The Board chose to deny DIRTT’s largest shareholder modest representation during a period of especially weak operating results . • We believe that its recent actions show that the Board is motivated by entrenchment, not a pursuit of shareholder value, and that the submissions of ASC staff in connection with DIRTT’s recent failed complaint against 22 NW provide a similar perspective on the performance of the Board (see below) .

6 22NW Background to the Solicitation: 22NW is Forced to Requisition a Meeting • Throughout the fall of 2021 , 22 NW was patient and attempted to work collaboratively with the Board to respect its process, until DIRTT pulled long - term guidance, oversaw additional destruction of value with a second convertible debt offering in less than a year, and posted alarmingly weak financial results at the end of 2021 . • In our view, DIRTT’s Chairman, Todd Lillibridge, and DIRTT’s Nomination and Governance Committee Chair, Denise Karkkainen, failed to provide a compelling answer as to why there should not be increased shareholder representation on the Board, especially as DIRTT’s performance struggled . • 22 NW advised the Board that we would requisition a special meeting to remove and replace Board members if our request for shareholder representation, unencumbered by a standstill agreement, was refused by the Board . The Board refused and in November 2021 , 22 NW was forced to submit a requisition (the “ Requisition ”) for a special meeting of DIRTT shareholders to remove six of the members of the current Board and replace them with six outstanding nominees (see below) . • Critically, the Board owns less than 1 % of DIRTT’s stock . We believe that the Board is not aligned with shareholders, and that the Board desperately needs shareholder representation and insight . Staff of the ASC commented on the Board’s minimal exposure when compared to the other shareholders of DIRTT : • “ Given the determination of the Applicant’s board to defeat the dissident slate and the board’s currently limited economic alignment with Applicant shareholders, Staff is concerned that the Applicant might adopt further defensive tactics, such as a transaction involving the dilutive issuance of Shares representing a significant percentage of the outstanding Shares . ”

7 22NW Background to the Solicitation: Board Ignores Shareholder Votes • Surprisingly, the Board did not contact 22 NW after we delivered the Requisition and instead continued to pursue a defensive entrenchment campaign that apparently first began in August 2021 , before we even requested Board representation . • Recognizing that the Board appeared ready to engage in what we view as a wasteful defense strategy at the cost of shareholder value, 22 NW submitted a settlement offer on December 9 , 2021 , which proposed the removal of fewer directors than called for in the Requisition . The Board rejected the proposal and did not provide a counter proposal . • In mid - January 2022 , 22 NW delivered executed documents from the beneficial owners of approximately 50 . 4 % of DIRTT’s shares supporting our nominees for election to the Board and again provided a second settlement offer to the Board . The Board dismissed the shareholder support for 22 NW’s nominees and again outright rejected our settlement offer with no counter proposal . • On the following business day, the Board fired DIRTT’s CEO, Kevin O’Meara . Three days later, the Board applied for a hearing before the ASC in which it alleged violations of Canadian securities law against 22 NW and another shareholder, which we believe was nothing more than an intimidation tactic to attempt to defeat our lawful Requisition and silence 22 NW and other concerned shareholders .

8 22NW Background to the Solicitation: The Board’s Apparently Frivolous and Futile Complaint to the Alberta Securities Commission • As DIRTT’s Chairman, we contend that Mr . Lillibridge must take ultimate responsibility for submitting the wasteful complaint to the ASC against 22 NW and DIRTT’s second largest shareholder . Indeed, in DIRTT’s press release dated March 7 , 2022 , Mr . Lillibridge stated that “DIRTT believes strongly in the facts and stands firm in our position . ” • Ultimately, the truth prevailed and the ASC dismissed all claims against 22 NW in a stinging rebuke against the Board . The complaint against 22 NW and DIRTT’s second largest shareholder was a disaster : in the words of the ASC, it was “ dismayed” that the complaint was even made, characterizing it as “ill - conceived” and an “imprudent” use of DIRTT’s resources (see below) . • The other members of the Special Committee, beside Mr . Lillibridge, who have overseen this waste of DIRTT’s resources are Denise Karkkainen, Diana Rhoten, and Shauna King . 22 NW believes these directors must be held accountable . • In its proxy statement and management circular for the 2022 annual and special meeting (the “ Meeting ”), the Board discloses that it anticipates spending approximately $ 825 , 000 dollars in connection with its solicitation . We believe these costs could have been limited or avoided if the Board had been willing to constructively engage with 22 NW with respect to its settlement offers .

9 22NW The Case for Change at DIRTT

10 22NW • We believe DIRTT’s legacy Board members oversaw and were responsible for the value - destructive situation involving Mogens Smed . • Through their contributions to the CEO Search Committee in 2018 , as well as their roles on the Nomination & Governance and Compensation Committees, the legacy Board was instrumental in overseeing the hiring of Kevin O’Meara . • However, we believe the legacy Board has failed to learn from its previous mistakes and fired Kevin O’Meara as part of its entrenchment strategy before finding a permanent replacement . • Notably, numerous directors, including those appointed from a previous activist effort (in 2018 ), have resigned after short tenures citing the Board’s negative culture . The Case for Change at DIRTT: Four CEOs in Four Years Mogens Smed Michael Goldstein Kevin O’Meara Todd Lillibridge

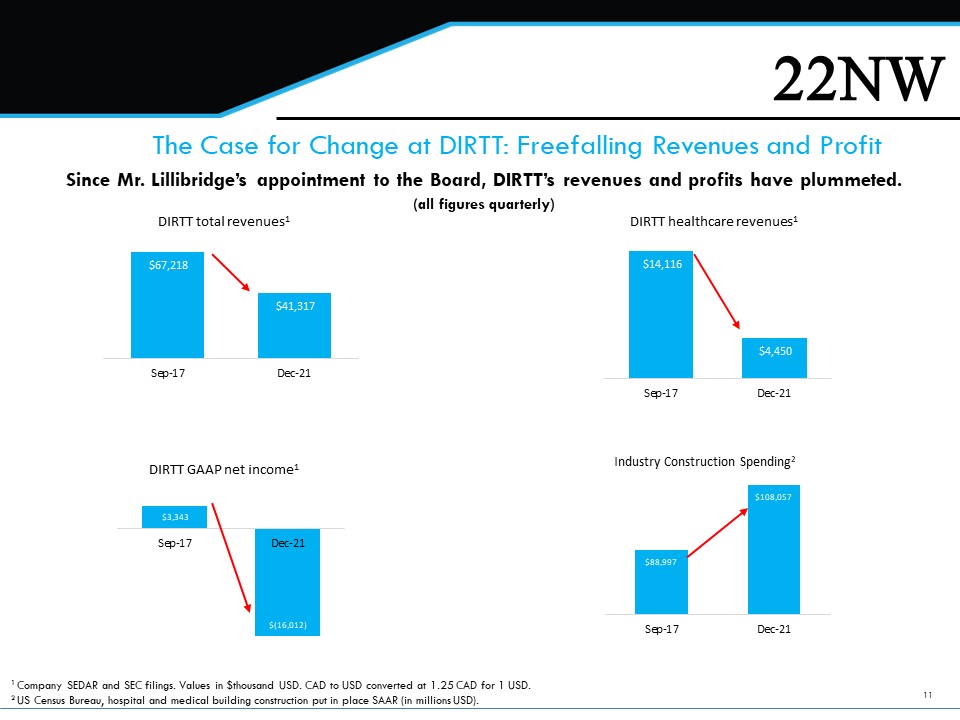

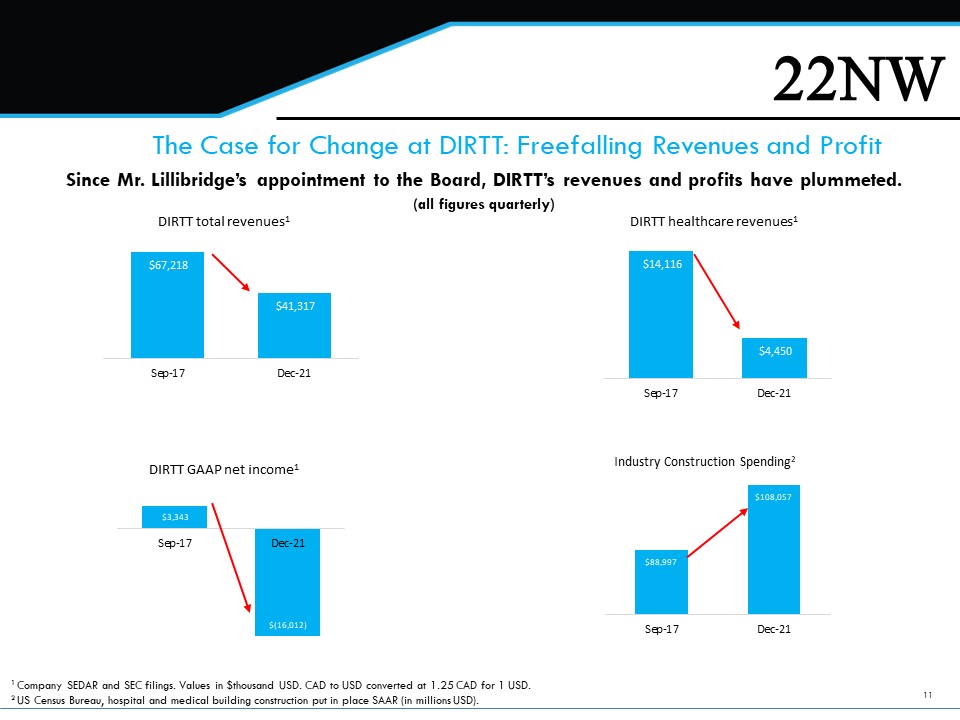

11 22NW (all figures quarterly) The Case for Change at DIRTT: Freefalling Revenues and Profit $14,116 $4,450 Sep-17 Dec-21 $67,218 $41,317 Sep-17 Dec-21 DIRTT total revenues 1 DIRTT healthcare revenues 1 1 Company SEDAR and SEC filings. Values in $thousand USD. CAD to USD converted at 1.25 CAD for 1 USD. 2 US Census Bureau, hospital and medical building construction put in place SAAR (in millions USD). DIRTT GAAP net income 1 $3,343 $(16,012) Sep-17 Dec-21 $ 88,997 $ 108,057 Sep-17 Dec-21 Industry Construction Spending 2 Since Mr. Lillibridge’s appointment to the Board, DIRTT’s revenues and profits have plummeted.

12 22NW The Case for Change at DIRTT: TSR Severely Underperforming DRT.TO stock has severely underperformed its self - selected peer group and the broader market indices over all relevant time periods. 1 As of 3/18/22… 6 month 1 year 2 year 3 year Since Todd's addition Since Denise's addition DIRTT -53% -51% 77% -73% -65% -65% S&P 600 Building Products Index 3% -10% 126% 72% 111% 176% Russell 2000 Growth Index -14% -15% 95% 32% 56% 87% Russell 2000 Value Index 2% 0% 130% 39% 49% 90% Russell 2000 Index -6% -7% 115% 38% 57% 96% 1 Total shareholder return data sourced by Capital IQ as of March 18, 2022. Starting dates for Todd and Denise assumed to be Au gus t 31, 2017 and August 31, 2015, respectively.

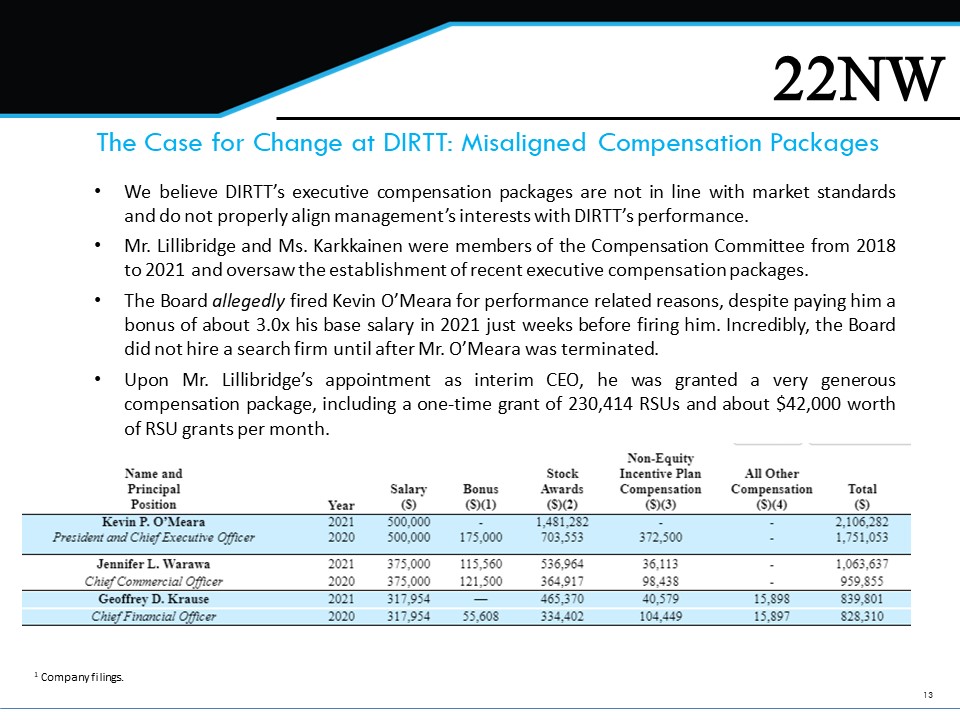

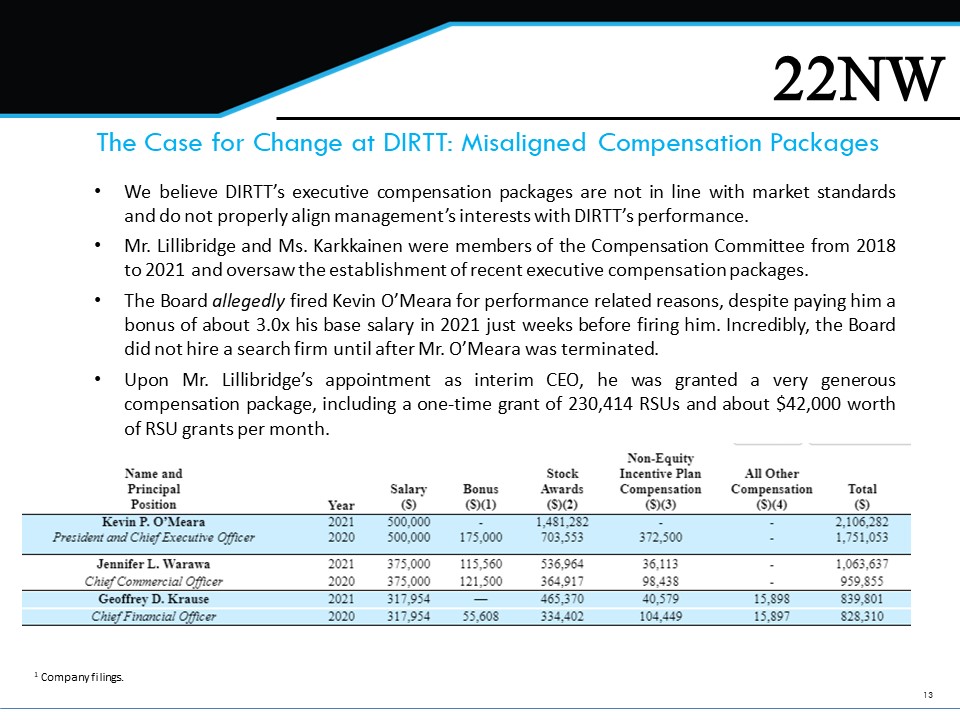

13 22NW • We believe DIRTT’s executive compensation packages are not in line with market standards and do not properly align management’s interests with DIRTT’s performance . • Mr . Lillibridge and Ms . Karkkainen were members of the Compensation Committee from 2018 to 2021 and oversaw the establishment of recent executive compensation packages . • The Board allegedly fired Kevin O’Meara for performance related reasons, despite paying him a bonus of about 3 . 0 x his base salary in 2021 just weeks before firing him . Incredibly, the Board did not hire a search firm until after Mr . O’Meara was terminated . • Upon Mr . Lillibridge’s appointment as interim CEO, he was granted a very generous compensation package, including a one - time grant of 230 , 414 RSUs and about $ 42 , 000 worth of RSU grants per month . The Case for Change at DIRTT: Misaligned Compensation Packages 1 Company filings.

14 22NW The Case for Change at DIRTT: Apparent Lack of Responsibility • The Board responded to 22 NW’s good faith proposal for three director seats in December 2021 by publicly and falsely accusing 22 NW and another large shareholder of illegally operating as an undisclosed group and filing an application with the ASC . 1 , 2 As of March 28 , 2022 , the Board has never offered 22 NW a counter proposal . • Despite losing on all counts at the ASC hearing, the Board’s apparent smear campaign resumed shortly thereafter . 3 , 4 We contend that the Board’s press releases and preliminary proxy filings contain numerous misrepresentations about 22 NW and other shareholders that directly contradict the ASC ruling and DIRTT’s own affidavits – notably the Board attempts to champion a late filing from 22 NW as a major victory . However, the ASC found that 22 NW’s late filing was an ordinary course compliance issue that was subsequently remedied and dismissed all requested relief . In short, the Board’s complaint to the ASC was a complete and wasteful failure . 1 22NW press release on December 9, 2021. 2 DIRTT press release on December 10, 2021. 3 22NW press release on March 4, 2022. 4 DIRTT press release on March 7, 2022.

15 22NW The Case for Change at DIRTT: Difficulties with Regulators • In connection with the Board’s complaint against 22 NW, staff of the ASC commented as follows in its submission to the ASC panel : • “ While Staff unequivocally defers to the Panel’s assessment of the merits of the Applicant’s [DIRTT] complaint and the strength of the evidence it has adduced, we do have concerns with the manner in which the Applicant and its board have sought to take advantage of the commencement of Staff’s investigation of its original complaint in its public disclosures and its attempt to utilize the Commission's enforcement powers in furtherance of what appears to be a very ugly but ultimately private dispute with its two largest shareholders . We also have concerns with respect to the defensive tactics adopted by the Applicant in response to the activism of 22 NW, which include a tactical shareholder rights plan, its refusal to promptly convene a shareholder meeting in response to a valid shareholder requisition, its offhand rejection of the proxies obtained by 22 NW to date and this Application, in which it seeks orders which would at least partly disenfranchise its two largest shareholders, and disqualify English and Mitchell from election to the board . These tactics suggest a resolute intention on the part of the Applicant’s board to defeat 22 NW’s dissident campaign . ”

16 22NW The Case for Change at DIRTT: Difficulties with Regulators • In rejecting the Board’s complaint against 22 NW, the ASC concluded as follows : • “ Lastly, we express our dismay that this Application was brought at all . There was a paucity of circumstantial evidence that fell well short of establishing on a balance of probabilities that the respondents were acting jointly or in concert . In our view, this was an ill - conceived application and an imprudent use of DIRTT’s resources . ” • Unbelievably, on March 7 , 2022 , the Board issued a press release which included the headings “ ASC Agrees 22 NW Broke the Law” and “The Board Has a Fiduciary Duty to Protect Shareholders Including Making of Application to the ASC . ” In this press release, among other things, DIRTT arrogantly claimed that its apparent entrenchment tactic against 22 NW, despite the views of the ASC, was “neither ill - conceived nor imprudent . ” • On March 15 , 2022 , the Board issued another press release, in which it attempted to more accurately report the findings of the ASC . Coincidentally during this time, DIRTT was finalizing its U . S . proxy statement with the U . S . Securities and Exchange Commission (the “ SEC ”) . From its initial preliminary filing on February 25 , 2022 , it took DIRTT almost a month – until March 24 , 2022 – to file its definitive proxy statement . 22 NW believes that this delay was likely caused by the multiple apparent inaccuracies in DIRTT’s preliminary proxy statement concerning the ASC proceedings, and potential requests by the SEC to correct these inaccuracies .

17 22NW 22NW’s Outstanding Nominees

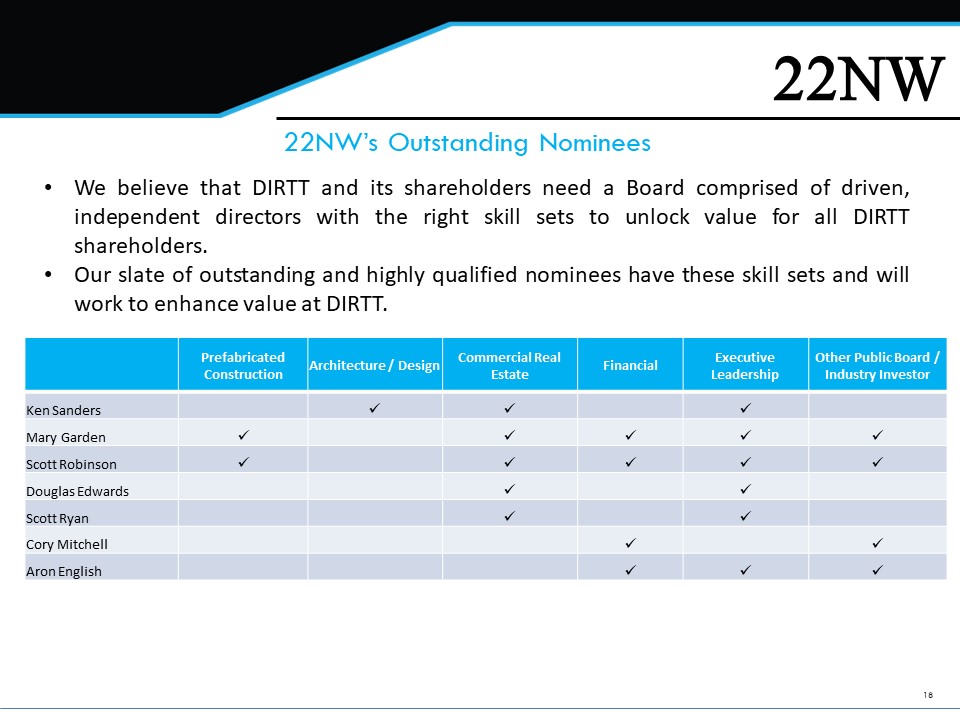

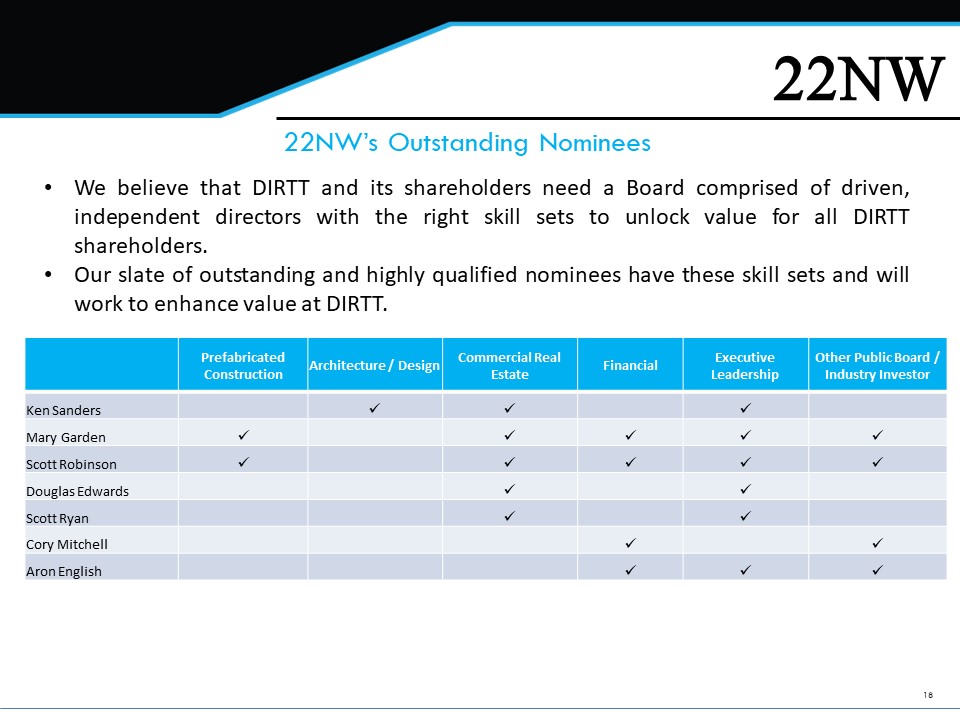

18 22NW Prefabricated Construction Architecture / Design Commercial Real Estate Financial Executive Leadership Other Public Board / Industry Investor Ken Sanders x x x Mary Garden x x x x x Scott Robinson x x x x x Douglas Edwards x x Scott Ryan x x Cory Mitchell x x Aron English x x x 22NW’s Outstanding Nominees • We believe that DIRTT and its shareholders need a Board comprised of driven, independent directors with the right skill sets to unlock value for all DIRTT shareholders . • Our slate of outstanding and highly qualified nominees have these skill sets and will work to enhance value at DIRTT .

19 22NW Prefabricated Construction Architecture / Design Commercial Real Estate Financial Executive Leadership Other Public Board / Industry Investor Ken Sanders x x x 22NW’s Outstanding Nominees: Ken Sanders • Ken Sanders, FAIA, brings valuable architecture and engineering experience that the Company’s leadership is currently lacking . His background in technology and leadership development are also needed on the Board , in addition to both C - suite and board experience . • Mr . Sanders is a member of the board of directors of NELSON, an award - winning architecture, interior design, graphic design and brand strategy firm . The firm's network includes more than 1 , 100 professionals in 25 offices, combining industry experience, service expertise and geographic reach to deliver projects across the country and around the world . Mr . Sanders also serves on the board of directors of Clarus, the leading designer and manufacturer of writable glassboards . The company's broad range of innovative products are at the center of high - performance collaborative workplaces . • As Managing Principal at DesignIntelligence, Mr . Sanders provides consulting services to a variety of architecture and engineering firms on strategic operations, technology and leadership development . He is a Fellow of the American Institute of Architects and a Senior Fellow and Executive Board Member of the Design Futures Council . During his 17 - year career at Gensler, as Managing Principal and Board Member, Mr . Sanders co - led the team responsible for Gensler’s global operations, including finance, legal, talent, technology, research and business development .

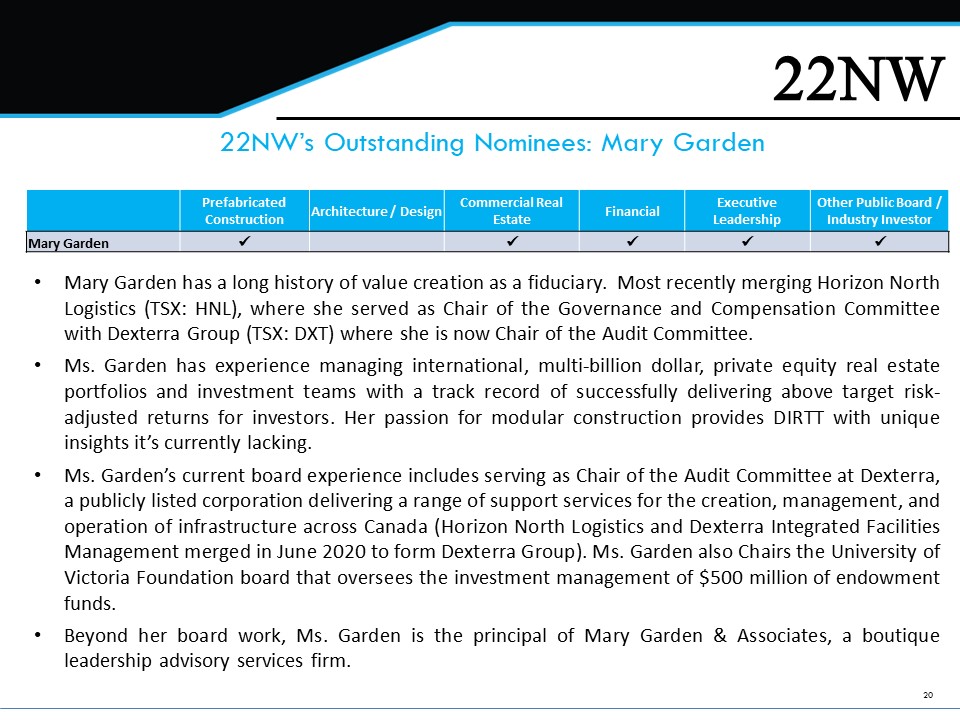

20 22NW Prefabricated Construction Architecture / Design Commercial Real Estate Financial Executive Leadership Other Public Board / Industry Investor Mary Garden x x x x x 22NW’s Outstanding Nominees: Mary Garden • Mary Garden has a long history of value creation as a fiduciary . Most recently merging Horizon North Logistics (TSX : HNL), where she served as Chair of the Governance and Compensation Committee with Dexterra Group (TSX : DXT) where she is now Chair of the Audit Committee . • Ms . Garden has experience managing international, multi - billion dollar, private equity real estate portfolios and investment teams with a track record of successfully delivering above target risk - adjusted returns for investors . Her passion for modular construction provides DIRTT with unique insights it’s currently lacking . • Ms . Garden’s current board experience includes serving as Chair of the Audit Committee at Dexterra, a publicly listed corporation delivering a range of support services for the creation, management, and operation of infrastructure across Canada (Horizon North Logistics and Dexterra Integrated Facilities Management merged in June 2020 to form Dexterra Group) . Ms . Garden also Chairs the University of Victoria Foundation board that oversees the investment management of $ 500 million of endowment funds . • Beyond her board work, Ms . Garden is the principal of Mary Garden & Associates, a boutique leadership advisory services firm .

21 22NW 22NW’s Outstanding Nominees: Scott Robinson • Scott Robinson is a successful real estate investor with extensive experience in the areas of real estate finance and construction . Mr . Robinson has C - suite experience in the modular construction industry as well as public board experience in the real estate industry . • Mr . Robinson serves on the board of Monmouth Real Estate (NYSE : MNR), a fully integrated and self - managed real estate company with 115 properties in its portfolio . • He also served on the board of FullStack Modular, one of America’s only sell - framed modular builder capable of constructing modular buildings from seven to 45 stories . He was Interim CEO of FullStack Modular from December 2019 to March 2020 . • Mr . Robinson also currently serves as a Managing Director of Oberon Securities and Co - Head Real Estate Investment Banking since 2013 . Prefabricated Construction Architecture / Design Commercial Real Estate Financial Executive Leadership Other Public Board / Industry Investor Scott Robinson x x x x x

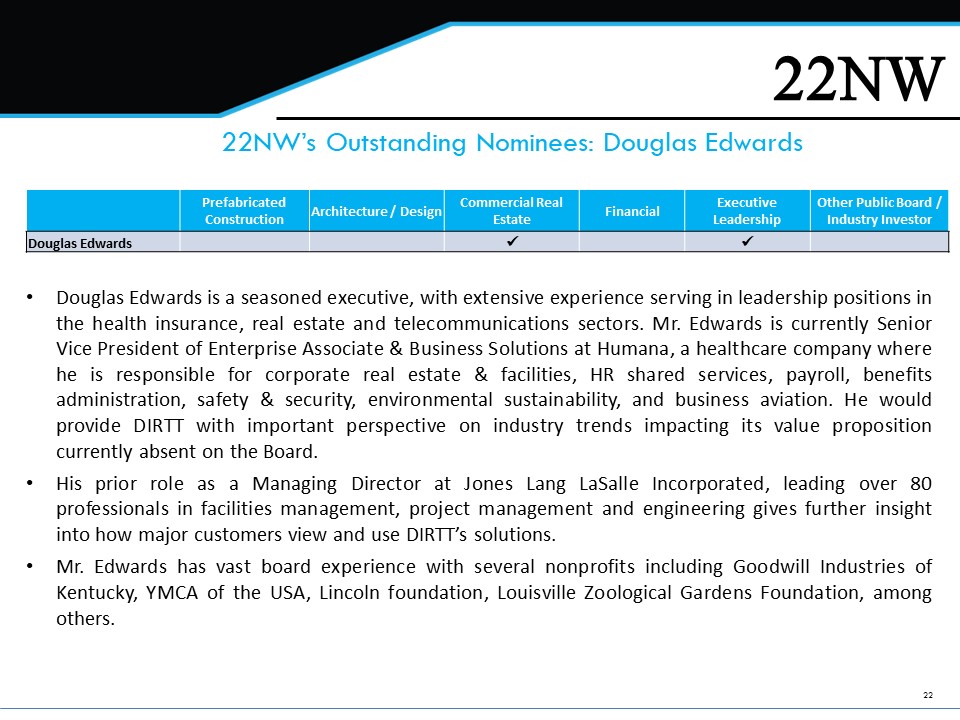

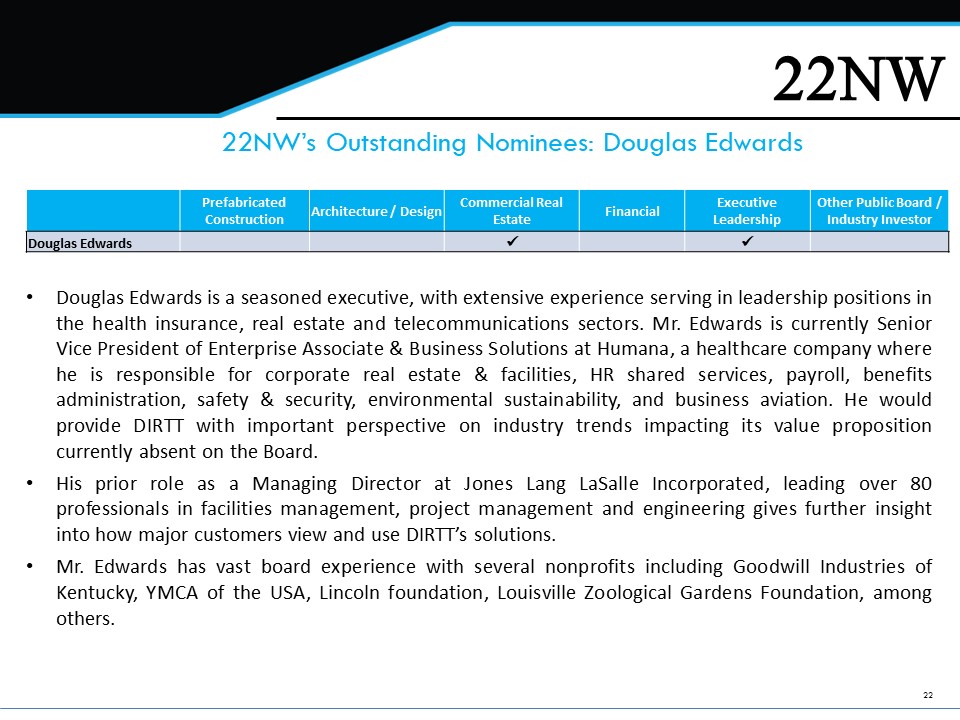

22 22NW 22NW’s Outstanding Nominees: Douglas Edwards • Douglas Edwards is a seasoned executive, with extensive experience serving in leadership positions in the health insurance, real estate and telecommunications sectors . Mr . Edwards is currently Senior Vice President of Enterprise Associate & Business Solutions at Humana, a healthcare company where he is responsible for corporate real estate & facilities, HR shared services, payroll, benefits administration, safety & security, environmental sustainability, and business aviation . He would provide DIRTT with important perspective on industry trends impacting its value proposition currently absent on the Board . • His prior role as a Managing Director at Jones Lang LaSalle Incorporated, leading over 80 professionals in facilities management, project management and engineering gives further insight into how major customers view and use DIRTT’s solutions . • Mr . Edwards has vast board experience with several nonprofits including Goodwill Industries of Kentucky, YMCA of the USA, Lincoln foundation, Louisville Zoological Gardens Foundation, among others . Prefabricated Construction Architecture / Design Commercial Real Estate Financial Executive Leadership Other Public Board / Industry Investor Douglas Edwards x x

23 22NW 22NW’s Outstanding Nominees: Scott Ryan • Scott Ryan is a lawyer and seasoned arbiter specializing in construction disputes . He is currently the founding partner of FR Law Group , a litigation and commercial transaction firm specializing in development, construction, corporate compliance, risk management, and human resources . We believe Mr . Ryan’s experience and knowledge base will be vital in opining on the correct path for DIRTT’s numerous, ongoing lawsuits . • Mr . Ryan’s career started as a project engineer with an Engineering New Record Top 10 contractor managing + $ 200 M construction projects . After law school and practicing law at a large national law firm, Mr . Ryan returned to the construction industry where he served as General Counsel of Tutor Perini Corporation, Building Group (NYSE : TPC), a large publicly traded company, ultimately progressing to Senior Vice President and General Counsel of the corporation's entire Building Group . Mr . Ryan, and his law partner, formed their own firm four years ago, and Mr . Ryan’s practice predominately is in the construction space representing large multi - national contractors and developers . • Mr . Ryan’s prior board experience includes serving on the board of Patryot, a veteran owned business that focuses on government contracting opportunities . Prefabricated Construction Architecture / Design Commercial Real Estate Financial Executive Leadership Other Public Board / Industry Investor Scott Ryan x x

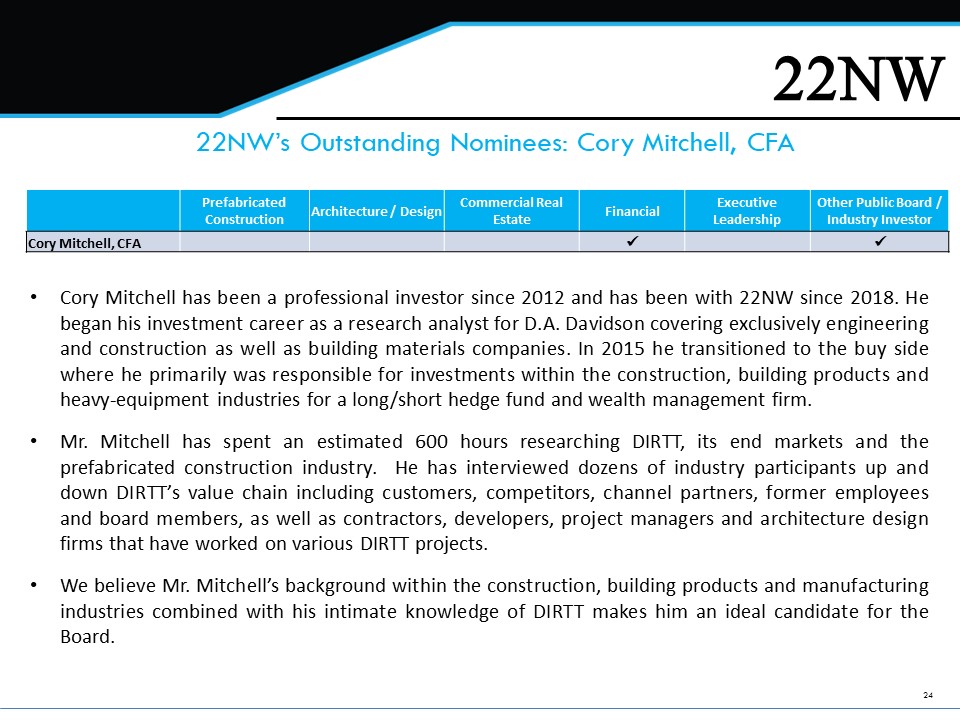

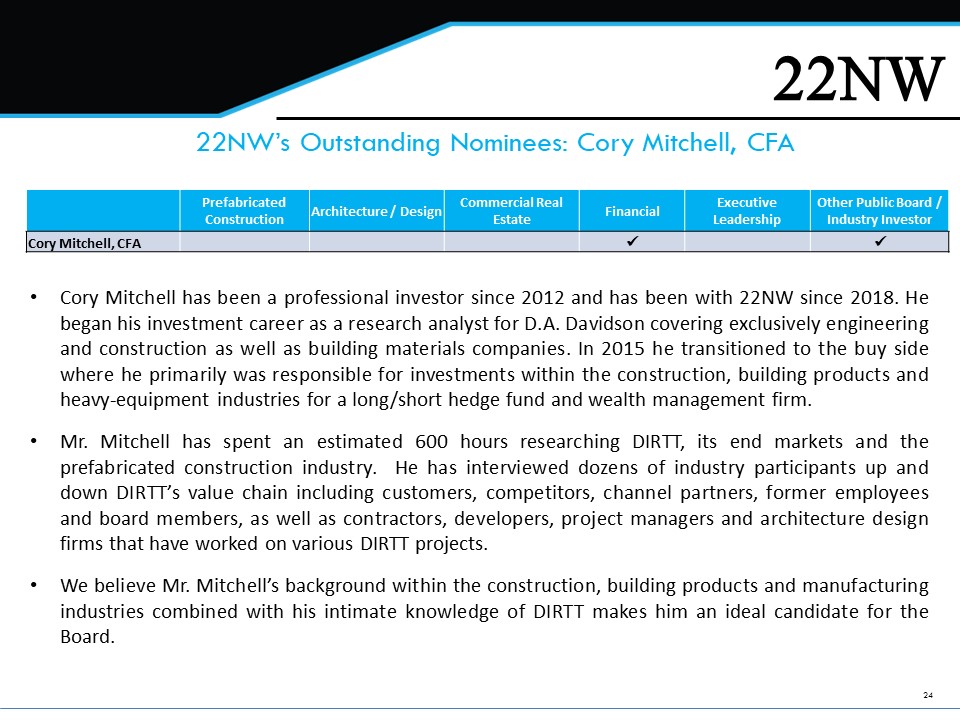

24 22NW 22NW’s Outstanding Nominees: Cory Mitchell, CFA • Cory Mitchell has been a professional investor since 2012 and has been with 22 NW since 2018 . He began his investment career as a research analyst for D . A . Davidson covering exclusively engineering and construction as well as building materials companies . In 2015 he transitioned to the buy side where he primarily was responsible for investments within the construction, building products and heavy - equipment industries for a long/short hedge fund and wealth management firm . • Mr . Mitchell has spent an estimated 600 hours researching DIRTT, its end markets and the prefabricated construction industry . He has interviewed dozens of industry participants up and down DIRTT’s value chain including customers, competitors, channel partners, former employees and board members, as well as contractors, developers, project managers and architecture design firms that have worked on various DIRTT projects . • We believe Mr . Mitchell’s background within the construction, building products and manufacturing industries combined with his intimate knowledge of DIRTT makes him an ideal candidate for the Board . Prefabricated Construction Architecture / Design Commercial Real Estate Financial Executive Leadership Other Public Board / Industry Investor Cory Mitchell, CFA x x

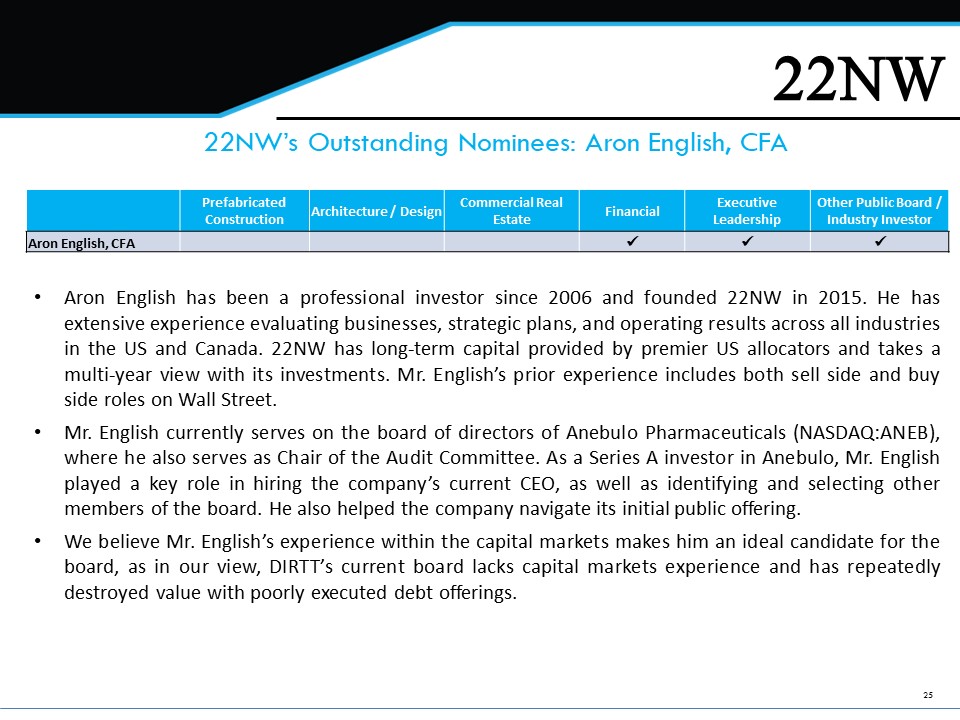

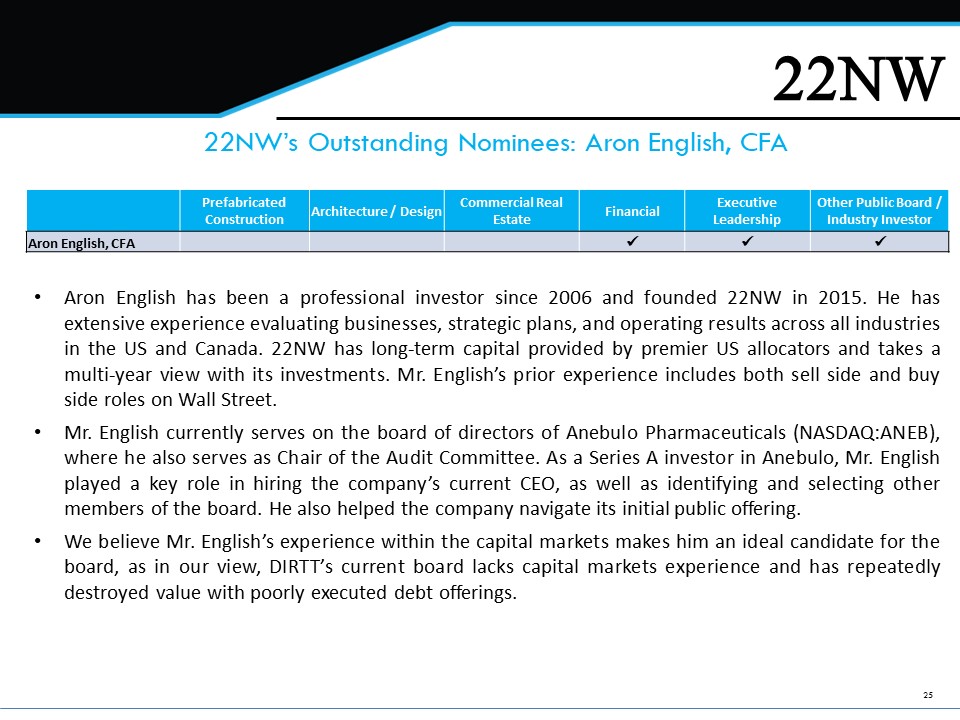

25 22NW 22NW’s Outstanding Nominees: Aron English, CFA • Aron English has been a professional investor since 2006 and founded 22 NW in 2015 . He has extensive experience evaluating businesses, strategic plans, and operating results across all industries in the US and Canada . 22 NW has long - term capital provided by premier US allocators and takes a multi - year view with its investments . Mr . English’s prior experience includes both sell side and buy side roles on Wall Street . • Mr . English currently serves on the board of directors of Anebulo Pharmaceuticals (NASDAQ : ANEB ), where he also serves as Chair of the Audit Committee . As a Series A investor in Anebulo, Mr . English played a key role in hiring the company’s current CEO, as well as identifying and selecting other members of the board . He also helped the company navigate its initial public offering . • We believe Mr . English’s experience within the capital markets makes him an ideal candidate for the board, as in our view, DIRTT’s current board lacks capital markets experience and has repeatedly destroyed value with poorly executed debt offerings . Prefabricated Construction Architecture / Design Commercial Real Estate Financial Executive Leadership Other Public Board / Industry Investor Aron English, CFA x x x

26 22NW Transition Plan

27 22NW Transition Plan: First 90 Days • 22 NW’s nominees for election as directors have regularly met to formulate their action plan if elected at the Meeting . • The first element of the plan is to embark immediately on a comprehensive due diligence review, envisioned to be performed from DIRTT’s Calgary offices . • The plan includes retaining key talent in DIRTT’s C - Suite, which will be critical to righting DIRTT’s path . Before hiring a new CEO, it is envisioned that an ‘Office of CEO’ would be created with DIRTT’s existing executive suite to help preserve business continuity and leverage existing knowledge . 22 NW also has identified replacement candidates for these roles, if needed . • A pipeline of qualified permanent CEOs has been created and interviews of these candidates are underway . If elected, our nominees intend to conclude the new CEO search within the first 90 days following the Meeting . • 22 NW has also been engaged in discussions with prior Board members about special advisory roles to provide continuity to the new Board .

28 22NW 22NW’s Transition Plan: Grow DIRTT’s Revenue • 22 NW pushed management to disclose greater visibility and key performance i ndicators on its sales pipeline . We believe recent disclosures clearly show how ineffective the Board has been at generating revenue growth . • We have identified multiple potential revenue - generating partners who appear eager to do business with DIRTT but have thus far been unable to constructively engage with the Board . • Our group of Board nominees have deep industry connections that we feel will be critical to helping DIRTT expand within and beyond its existing industry verticals . This includes working with trade groups within the architecture and design, and general contractor industries to educate and correct current misperceptions surrounding DIRTT and its approach to prefabricated construction . • We believe DIRTT’s value proposition is largest among healthcare customers, and thus, should be one of the Company’s best drivers of growth . We have discussed this opportunity with several Fortune 500 healthcare companies . Growing the healthcare business will be a key focus for 22 NW’s group of Board n ominees .

29 22NW Transition Plan: Listening to Key Stakeholders • In our view, the Board has failed to appropriately motivate DIRTT’s employee base and retain key talent . 22 NW has identified several cultural problems at DIRTT . E xtensive interviews with DIRTT’s employees will be conducted to correct additional shortfalls . • 22 NW strongly believes it is vital for DIRTT to empower and interact with its valuable distribution partner network . Based on the strong data reported by the U . S . Census Bureau, 22 NW believes its end markets are healthy and DIRTT’s problems are at root an idiosyncratic failure of leadership . 22 NW applauds the Partner Advisory Counsel initiative recently announced by the C ompany . We believe that DIRTT was more successful when channel partners had a larger voice within the Company that was unfortunately taken away years ago . We have pushed management to give channel partners a more formal advisory role and plan to support, and ultimately grow, this initiative . • We believe DIRTT is now known as a shareholder - unfriendly company, which has damaged DIRTT’s brand and increased its cost of capital . We plan to improve disclosures and restore confidence to DIRTT’s shareholders and the market at large .

30 22NW Transition Plan: Improve DIRTT’s ESG Score • While improving DIRTT’s operations will be the highest priority of our Board nominees, there are additional important steps that can be taken to improve DIRTT’s valuation and trading dynamics . We believe the Board’s lack of capital markets experience and apparent unwillingness to listen to its shareholders have been a few of the primary impediments to unlocking DIRTT’s full value . • We would support a goal of ensuring that at least 30 % of the Board is composed of female members within 12 months of the Meeting . • In fact, 22 NW made several ESG - related suggestions to the Board before engaging in this solicitation, all of which were ignored . • We believe DIRTT is an ideal candidate to become an ESG growth stock darling, but the Board lacks the ability to appropriately engage with the investment community to position the stock as such . We believe indexation of DIRTT’s stock c ould lead to significant benefits from passive fund flows .

31 22NW Transition Plan: The Risk is the Status Quo • At the core, we believe the Board has severely mismanaged DIRTT and impaired its balance sheet . • Mr . Lillibridge fired almost a fifth of DIRTT’s work force just days into the job despite having no experience running a company comparable to DIRTT . We believe he and the Board are desperate to point towards any actions as “ progress,” regardless of the future implications of those actions . • The Board could face further admonishment from the ASC when the ASC releases its written reasons for its decision dismissing the complaint . • We believe it is likely that revenue will fail to recover under the current leadership – making excuses related to COVID only goes so far . • We believe the biggest risk shareholders face is not replacing the current Board and retaining the untenable status quo . We believe now is the time for the Board to accept accountability.

32 22NW DIRTT on 11/17/21: https://www.dirtt.com/news/2021 - dirtt - announces - receipt - of - shareholder - meeting - requisition/ DIRTT 12/7/21: https://www.dirtt.com/news/2021 - dirtt - announces - adoption - of - shareholder - rights - plan/ DIRTT 12/7/21: https://www.dirtt.com/news/2021 - dirtt - responds - to - activist - requisition - and - sets - meeting - date/ 22NW on 12/9/21: https://www.newsfilecorp.com/release/107216/22NW - Makes - Proposal - to - DIRTT DIRTT on 12/10/21: https://www.dirtt.com/news/2021 - dirtt - reiterates - commitment - to - engaging - with - shareholders - in - an - appropriate - forum/ 22NW on 12/21/21: https://www.newsfilecorp.com/release/108244/22NW - Provides - Update - on - DIRTT - Shareholder - Meeting - Requisition DIRTT on 1/4/22: https://www.dirtt.com/news/2022 - dirtt - comments - on - unnecessary - activist - action - and - failure - to - comply - with - applicable - regulations/ 22NW on 1/6/22: https://www.globenewswire.com/news - release/2022/01/06/2362867/0/en/22NW - Provides - Update - on - Requisition - of - DIRTT - Shareholder - Meeting.html 22NW on 1/14/22: https://www.globenewswire.com/news - release/2022/01/14/2367344/0/en/22NW - Provides - Update - on - Requisition - of - DIRTT - Shareholder - Meeting.html Appendix: 22NW and DIRTT communications

33 22NW DIRTT on 1/18/22: https://www.dirtt.com/news/2022 - dirtt - announces - ceo - transition/ DIRTT on 1/20/22: https://www.dirtt.com/news/2022 - dirtt - provides - updates - regarding - conduct - of - activist/ DIRTT on 2/22/22: https://www.dirtt.com/news/2022 - dirtt - announces - multiple - initiatives - as - it - regains - momentum/ DIRTT on 2/25/22: Preliminary proxy filing https://www.sec.gov/Archives/edgar/data/1340476/000119312522054682/d289979dprec14a.htm 22NW on 3/4/22: https://www.globenewswire.com/news - release/2022/03/05/2397369/0/en/22NW - Prevails - Against - Complaints - by - DIRTT - s - Board.html DIRTT on 3/7/22: https://www.dirtt.com/news/2022 - dirtt - board - of - directors - to - continue - momentum - of - change - and - enhanced - shareholder - value/ DIRTT on 3/16/22: https://www.dirtt.com/news/2022 - dirtt - provides - an - update - on - its - annual - and - special - meeting - of - shareholders - and - 22nw/ 22NW on 3/22/22: Definitive proxy filing https://www.sec.gov/Archives/edgar/data/1340476/000092189522000936/dfrn14a10680012_03162022.htm Appendix: 22NW and DIRTT communications (cont.)

34 22NW Disclaimer – Important Information The materials contained herein (the “Materials”) represent the opinions of 22 NW Fund, LP and the other participants named in its proxy solicitation (collectively, “ 22 NW”) and are based on publicly available information with respect to DIRTT Environmental Solutions, Ltd . (the “Company”) . 22 NW recognizes that there may be confidential information in the possession of the Company that could lead it or others to disagree with the 22 NW’s conclusions . 22 NW reserves the right to change any of its opinions expressed herein at any time as it deems appropriate and disclaims any obligation to notify the market or any other party of any such changes . 22 NW disclaims any obligation to update the information or opinions contained herein . Certain financial projections and statements made herein have been derived or obtained from filings made with the Securities and Exchange Commission (“SEC”), SEDAR or other regulatory authorities and from other third party reports . There is no assurance or guarantee with respect to the prices at which any securities of the Company will trade, and such securities may not trade at prices that may be implied herein . The estimates, projections and potential impact of the opportunities identified by 22 NW herein are based on assumptions that 22 NW believes to be reasonable as of the date of the Materials, but there can be no assurance or guarantee that actual results or performance of the Company will not differ, and such differences may be material . The Materials are provided merely as information and are not intended to be, nor should they be construed as, an offer to sell or a solicitation of an offer to buy any security . Certain members of 22 NW currently beneficially own, and/or have an economic interest in, securities of the Company . It is possible that there will be developments in the future (including changes in price of the Company’s securities) that cause one or more members of 22 NW from time to time to sell all or a portion of their holdings of the Company in open market transactions or otherwise (including via short sales), buy additional securities (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls or other derivative instruments relating to some or all of such securities . To the extent that 22 NW discloses information about its position or economic interest in the securities of the Company in the Materials, it is subject to change and 22 NW expressly disclaims any obligation to update such information .

35 22NW Disclaimer – Continued The Materials contain forward - looking statements . All statements contained herein that are not clearly historical in nature or that necessarily depend on future events are forward - looking, and the words “anticipate,” “believe,” “expect,” “potential,” “opportunity,” “estimate,” “plan,” “may,” “will,” “projects,” “targets,” “forecasts,” “seeks,” “could,” and similar expressions are generally intended to identify forward - looking statements . The projected results and statements contained herein that are not historical facts are based on current expectations, speak only as of the date of the Materials and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such projected results and statements . Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of 22 NW . Although 22 NW believes that the assumptions underlying the projected results or forward - looking statements are reasonable as of the date of the Materials, any of the assumptions could be inaccurate and therefore, there can be no assurance that the projected results or forward - looking statements included herein will prove to be accurate . In light of the significant uncertainties inherent in the projected results and forward - looking statements included herein, the inclusion of such information should not be regarded as a representation as to future results or that the objectives and strategic initiatives expressed or implied by such projected results and forward - looking statements will be achieved . 22 NW will not undertake and specifically declines any obligation to disclose the results of any revisions that may be made to any projected results or forward - looking statements herein to reflect events or circumstances after the date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated events . Unless otherwise indicated herein, 22 NW has not sought or obtained consent from any third party to use any statements, photos or information indicated herein as having been obtained or derived from statements made or published by third parties . Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein . No warranty is made as to the accuracy of data or information obtained or derived from filings made with the SEC or SEDAR by the Company or from any third - party source . All trade names, trademarks, service marks, and logos herein are the property of their respective owners who retain all proprietary rights over their use .

36 22NW www.englishcap.com info@englishcap.com