Exhibit 15

Shareholder Letter dated January 23, 2020

iPO update: 2019 year-end report

Our CEO shares highlights from the previous year’s operations and a look at our plans for continued growth in 2020.

Dear fellow shareholders,

I’m pleased to report that 2019 proved to be another very successful year for Fundrise, as we were able to achieve substantial growth across all our key performance indicators (KPIs), reaching several notable milestones along the way. And as you likely read in our annual letter to investors last week, we finished the year with an overall platform return of approximately 9.47%¹.

As many of our now long-time iPO investors are aware, each April we file a full annual report (1-K) with the SEC which includes audited financials for the previous calendar year. While the annual report is comprehensive, we also like to provide iPO investors with an additional update in advance of our full 1-K.

Sustained growth through 2019

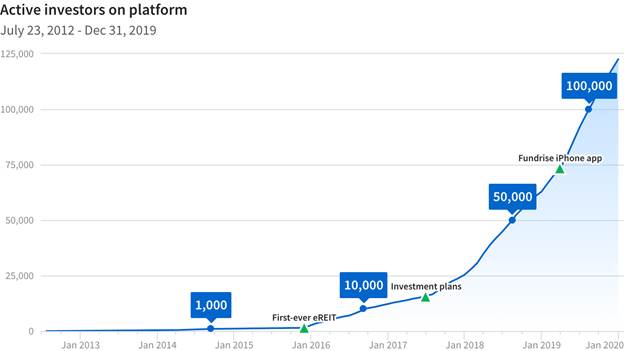

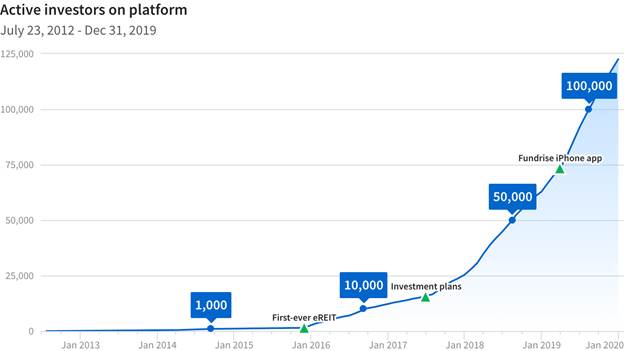

In our mid-year iPO update, we noted that the first half of 2019 started strong with growth across all KPIs, due to a combination of factors including expansion in our marketing and advertising channels, new marketing relationships, an updated brand narrative and the launch of our iPhone app.

This growth continued through the late summer and fall with a major milestone occurring in August when we surpassed 100,000 active investors on the platform.

We ended the year with approximately 125,000 active investors and nearly $1 billion in assets under management (officially surpassing $1 billion in AUM during the second week of 2020). Below is a summary of our KPIs for the year:

| | Dec 31, 2018 | Dec 31, 2019 | YoY Growth |

| Assets under management | $486 million | $988 million | +104% |

| Active investors | 63,271 | 122,544 | +94% |

| Employees | 76 | 110 | +45% |

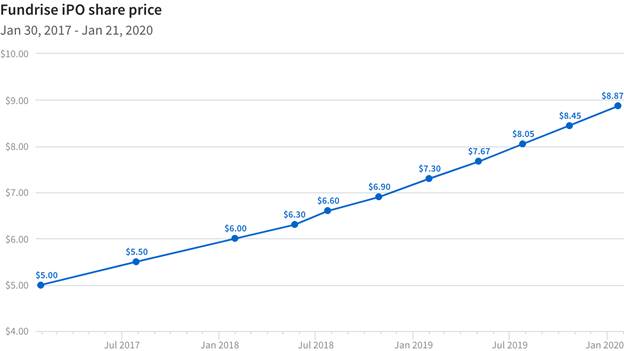

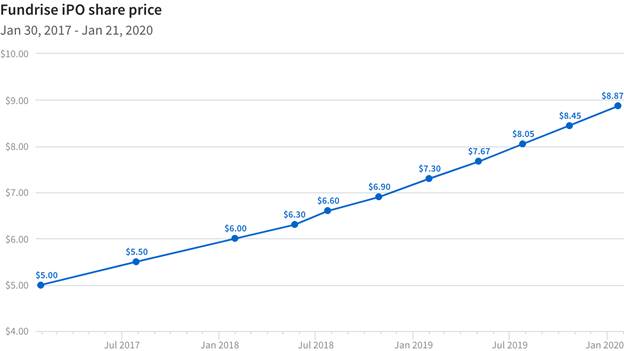

This continued top-line growth balanced with controlled increases in expenses, such as total headcount and net burn (i.e., how much money we spent to achieve this growth), has enabled us to not only increase the iPO share price from $6.90 to $8.45 in 2019 (+22.5%), but also fully fund the operations of the company, adding over 8,000 new iPO investors as fellow owners of the company along the way.

Performance drives increase in iPO share price

As you are aware, the Fundrise iPO is one of the most innovative aspects of the company. Our ability to align the interests of our investors on the platform (our customers) with the owners of the company itself (you, our iPO investors) means that we can make decisions that are in the best long-term interest of both. We believe this provides us with a competitive advantage that will ultimately be critical to the company’s success.

In order to continue to raise capital through the iPO, the board of directors and a majority of voting shareholders authorized an increase in the number of Class B shares available to be sold via the Fundrise iPO. This authorization does not require us to sell more shares, but provides the flexibility to continue to raise funds if management and the board determines that it’s in the best interests of the company.

As an iPO investor and therefore fellow shareholder in the company, pursuant to Delaware General Corporation Law Section 228(e), we wanted to make you aware that this authorization has taken place, as well as an authorization to increase the number of Class A shares available to be issued pursuant to our employee stock plan. Further information regarding both notices is publicly available on the SEC’s EDGAR website.

A deeper look at the work behind our numbers

Although our key performance metrics are an effective way to measure total company performance at a high level, they can also oversimplify and underemphasize the sheer volume of work required by the team to generate these kinds of results.

So we thought it might be useful and interesting to look at what was accomplished in 2019 through another lens (all numbers are estimates)...

| Public filings on SEC EDGAR website | 700+ |

| Lines of new code written and deployed | 930,000+ |

| Real estate deals reviewed | 1,200+ |

| Miles traveled by real estate team | 342,000+ |

| Responses to investor inquiries | 86,000+ |

| Unique transactions processed | 5,000,000+ |

| Google searches for “Fundrise” | 900,000+ |

| Unique visitors to fundrise.com | 5,300,000+ |

Like a duck that glides smoothly across a pond while furiously paddling just below the surface, our goal (and our job) is to create a beautiful and effortless experience for our customers. But as an owner of the company, we feel it is valuable for you to understand the amount of effort that goes on behind the scenes across a wide variety of skill sets to make this possible. The fact that it’s not easy to reproduce something that may seem straightforward is one of the moats around our business.

Planning for 2020 and beyond

Although we are incredibly proud of what we have accomplished in the last year, we still view it as only one small step in our much larger mission:

Building a better financial system by empowering the individual.

That is the mandate, and it is not accomplished overnight.

Ultimately, we will measure our success by the mass adoption of our model and the structural change we drive within the broader investment industry. Accomplishing both of these goals means reaching an enormous scale with the technology infrastructure and investor trust to support it. In other words, we need more people knowing of and using the product (your assistance in spreading the word about Fundrise is incredibly valuable in this effort), while simultaneously improving the quality of the experience and driving great investment performance.

To that end, we will continue working to build on last year’s successes, driving greater brand awareness, launching new partnerships, delivering new and better product features, and expanding our real estate investment strategies.

As with our real estate investment strategies, we must achieve this performance while maintaining a conservative approach, managing costs and overhead, and preparing the company to withstand potential shocks or economic downturns.

100,000 investors and $1 billion in assets under management is a level of validation that, eight years ago, seemed difficult to imagine. But in fact, it’s only the beginning.

We thank you for your support and continued partnership in this journey. And as always, we’d love to hear from you. Don’t hesitate to reach out to us at investments@fundrise.com with your thoughts, feedback, or questions.

Onward,

Ben and the Fundrise team

| 1. | Fundrise platform performance for each calendar year consists of the time-weighted, weighted-average returns of the real estate investing programs sponsored by Rise Companies Corp., and is not representative of the performance of any individual Fundrise investor. 6-year average performance is the compounded annual growth rate (CAGR) across each calendar year of performance from 2014 to 2019. Individual investment results may vary depending on the mix of investments owned by any investor on the Fundrise platform. Fundrise platform performance does not include investments in Rise Companies Corp itself (The Fundrise iPO) or the Fundrise Opportunity Fund, the inclusion of either of which could potentially have a negative effect on the total performance of the Fundrise platform. Past performance is not indicative of future results, and all investments may result in total or partial loss. All prospective investors should consult their personal tax and investment advisors before making any investment on the Fundrise platform. All estimated performance figures presented are net of fees and inclusive of dividend reinvestment. For more information, please see our full performance disclosure, as well as the offering circulars available at fundrise.com/oc. |