Exhibit 15

Investor Letter dated April 3, 2020

We built your Fundrise portfolio to be a fortress in times of uncertainty

To follow up on last month’s letter, we’re sharing a detailed analysis of how we believe the pandemic will continue to evolve, and the latest measures we’ve put in place to protect our entire investor community.

Key takeaways

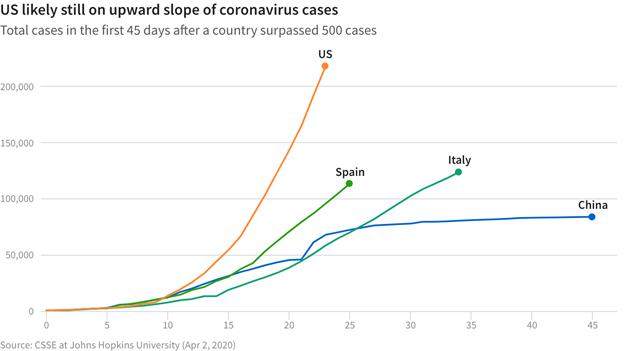

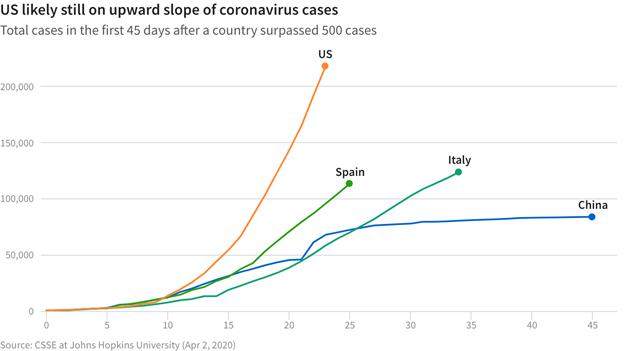

| ● | We believe that we are still on the upward slope of the curve when it comes to the spread of the coronavirus across the country. |

| ● | As a result, the extent of the negative impacts on the broader economy remain uncertain and the risk of a prolonged downturn is real. |

| ● | Our duty, as investment managers, is to take the hard but necessary steps to protect the interests of our investor base as a whole during this time. |

| ● | Therefore, we’ve suspended redemptions for our mature eREITs and eFunds in order to maximize cash reserves and ensure the portfolio is in a position of strength. |

| ● | Lastly, we completed an extensive stress test of every asset we hold and are sharing the results in order to provide transparency into why we feel confident our portfolio will outperform most other investment assets through an extended recession. |

Less than thirty days ago, we sent a letter to all our investors describing our concerns about the emerging coronavirus (COVID-19) global outbreak. Since then, it has been a sobering experience to witness how quickly the world has changed.

At that time, the US had approximately 1,000 known cases of COVID-19. As of this writing, there have been more than 245,000 confirmed cases reported.

It’s difficult now to remember that, even then, many people were still skeptical about the potential scale of the outbreak and most could not imagine the prospect of America’s major cities going into lockdown. But here we are.

Today, we suspect that there is not a single one of our investors who has not been directly impacted by this pandemic in a significant way.

It’s important to reiterate a point that we often make when sharing these types of letters, which is that our goal here is transparency. We do not attempt to predict the future, nor do we believe that we are always right in our assumptions. We do, however, believe that being transparent in our thinking and the resultant course of our actions is imperative.

To that end, we want to walk you through the details of how we believe this situation will continue to unfold, and the critical steps we are taking as a result.

The virus and the economy

We are not scientists. Nor do we believe that anyone can truly feel confident today forecasting the near future. But as investment managers, we have a responsibility to prepare for a wide range of outcomes and rely on the data to help us make the best decisions possible for our investors.

Though painful to acknowledge, we believe the evidence suggests that we are still on the upward slope of the curve when it comes to the spread of the coronavirus across the country.

As the case count continues to rise, and stories of overwhelmed hospitals become more and more frequent, it’s difficult to imagine that many people will not shift towards more genuine panic. We believe that this period of panic will reach its peak somewhere between 2-6 weeks from now (the exact timing being somewhat dependent on locale).

Yet, as more cities and states fully embrace the need for “shelter-in-place” mitigation, we also believe that cases will eventually begin to taper. What remains unknown is just how long it will take for these steps to actually bring the virus under control, and what the new normal looks like then. It is not unreasonable to assume that we won't be able to return to a world more like what we knew pre-COVID-19 until a vaccine is developed, which even in optimistic scenarios is likely a year off.

What’s so different about this crisis (that many others have also identified) is the fact that the keys to combating the outbreak itself simultaneously act as massive brakes on the broader economy. Like trying to bring a high speed train to a full stop in only a matter of seconds, this kind of universal emergency shut-down is creating an extraordinary (and unpredictable) cascade of negative side effects.

The big question which no one knows the answer to is if this domino effect of having to close such a large number of businesses will lead to a prolonged recession...or worse. At more than $21 trillion in annual gross domestic product (GDP), shutting down the entire US economy for only a few months could mean such a huge loss in output that even the unprecedented combination of the $2 trillion congressional stimulus package and the Federal Reserve's promise of unlimited quantitative easing may not be sufficient to restart the metaphorical engines.

There’s simply no “on-off” switch for the economy.

Your Fundrise portfolio

Given our ongoing concern that what started as a health crisis, will spread into a liquidity crisis, followed by a credit crisis, and ultimately end in a recession, the next logical question is “What does this mean for my Fundrise portfolio?”

In short, we’ve spent the last several years building the broader Fundrise portfolio, and by extension the many unique permutations owned by our community of 130,000+ individual investors, to be a fortress specifically designed to withstand this type of severe downturn.

We view each property that we collectively own or have invested in as another brick that’s been carefully laid by hand to form a secure barrier. And the dollars that we hold in reserve are the stores of grain, meant to ensure that our entire investor community can endure a long, harsh winter.

Up until now, our singular focus has been on acquiring assets that we believed would outperform during a period such as this. At times we’ve looked smart, when the stock market crashed and fears of a potential recession started to surface. And at times we’ve looked foolish, when the stock market rallied and prospects of endless prosperity swept over the country.

But regardless we kept at it, unwilling to compromise in our convictions.

We’ve also been intentional in telling our investors what we were doing, sending the same letter to every single person who’s ever invested with us.

“We [consistently seek] to make sound investments with strong fundamentals, even if it means being slightly more conservative in our approach than others around us. We focus on the intrinsic value of the real estate, choosing to invest in areas with high barriers to entry and at prices that are at or below replacement cost (i.e., below the cost to construct a new building of similar quality). We believe strongly that if we invest in markets with stable or rising demand and own properties at a lower cost basis than our competition, then over time our investments should experience stronger than average performance — even if the market goes through a downturn.”

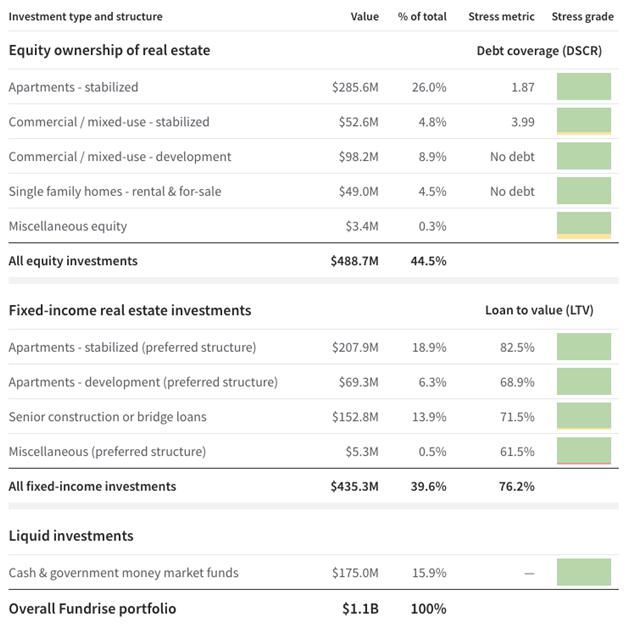

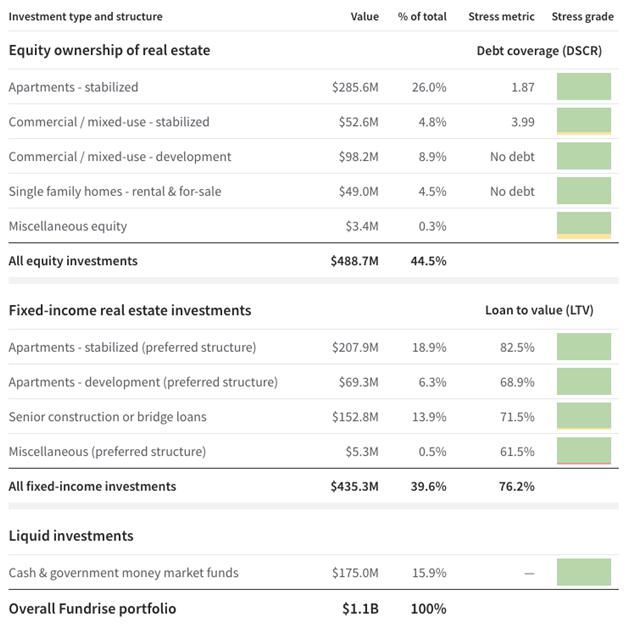

Today, the result of that work is a portfolio which is more than 80% made up of rental apartments and residential senior loans (an asset type that we’ve stated before we feel is likely to be one of the best-performing investments during this crisis). In addition, virtually all of the remaining 20% of the portfolio consists of mixed-use property investments located in major urban markets, owned 100% equity with no leverage — an approach, we also believe, is one of the lowest-risk options available today. Lastly, the portfolio also has roughly $175 million of cash reserves (our grain stockpile) currently held in government money market funds.

In total, from a risk-adjusted-return standpoint, we believe the portfolio is as well positioned to be able to sustain a severe economic downturn as any other investment asset with which we are familiar.

Portfolio stress test

To substantiate this belief, we’ve spent the last few weeks conducting an in-depth analysis of every single asset in the eREIT and eFund portfolio (213 in total) and stress tested them against an extreme downside scenario — a forecast period where stabilized multifamily apartments experience more than 30% economic vacancy for approximately twelve months (for reference, this is approximately 3 times the amount experienced during the financial crisis of 2008, which according to the Federal Reserve peaked at around 11.1% nationwide).

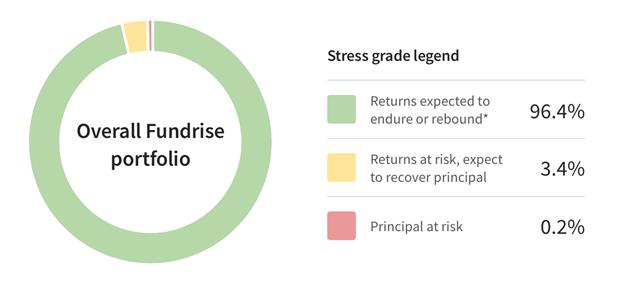

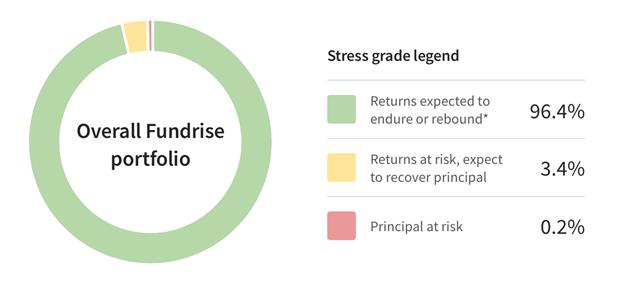

Summary of stress test results

As evidenced below, we believe that even under this scenario where we experience greater distress than in the Great Recession of 2008-2009, nearly the entirety of the portfolio would still be able to perform with little to no principal risk, assuming that a minimum $50 million of our $175 million cash reserve was available to either cover potential operating shortfalls, continue with development that is already in process, make debt paydowns, or in the very rare instance step in and take over as manager of the property. Of course, while we believe the assumptions made in this stress test analysis are extremely severe and ultimately unlikely to occur, we cannot guarantee how the future will play out.

*In the stress test scenario, some assets may experience temporary dips in value or periods of lost income,which we believe would rebound over the full lifecycle of the investment. However, there can be no guarantee that the conditions created by the ongoing COVID-19 global pandemic, or any other future unforeseen event, will not result in greater stress on the assets than is demonstrated here.

Detailed stress test results

Click on each investment category for the full set of assumptions and property-level analysis.

Why we are suspending redemptions

Fundamentally, Fundrise investors own real property, which is simply not liquid. Fulfilling redemption requests in today’s environment would mean either substantially depleting vital cash reserves, or even worse, potentially selling assets into a down market, and likely at a price far below actual value.

As highlighted above, the availability of cash reserves is a critical piece in our stress test scenario of an extreme downturn. Having lived (and invested) through both the 2001 and 2008 recessions, we have learned that no matter how strong the quality of your assets, the ability to make additional capital infusions when necessary is an indispensable element in successfully navigating unexpected economic shocks.

Therefore, we’ve determined that it is necessary to suspend redemptions across all of our mature eREITs and eFunds.

Some may question why, with such confidence in the portfolio, could we not use a portion of the cash reserves to fulfill existing redemption requests?

And the answer is that we strongly believe choosing to reduce cash reserves or sell assets at this time would cause a material increase in the risk of unnecessary loss or otherwise avoidable problems for the vast majority of our investors who intend to stay invested for the long term.

Time may prove that our concerns about the severity of the downturn never come to pass, however, there is a legitimate possibility that this pandemic unleashes the greatest threat to our economic prosperity since the Great Depression. In such a world, the liquidity reserves held at the funds would become the safeguard that protects our investors against the threat of meaningful losses.

Although we’ve made significant efforts over the years to communicate that this type of suspension was an eventuality that comes with territory of investing in real estate -- such as including the following statement in the aforementioned letter about what to expect from us during a financial crisis:

“...while under normal market conditions we seek to provide our investors with liquidity through the redemption program, during a financial crisis, investors should expect us to pause the program to allow enough time for whatever events may unfold.”

-- we’re also mindful of the fact that this will ultimately be a difficult and unpopular decision for the relatively small portion of investors who have an outstanding redemption request at this time.

We know that there will be those investors who’ve been disproportionately impacted by this pandemic; some may have been recently laid off and are seeking to redeem their funds to help pay for critical expenses. Telling that individual we cannot process their redemption at this time will be, without question, one of the more difficult conversations we’ve had since starting the company.

However, as manager of the funds, it is our obligation to put the interests of the entire investor community first. We could not, in good conscience, make a decision that was directly in conflict with the framework we’ve provided every investor as to how we would act in such a scenario. Nor could we give preference to the small percentage of the investors seeking to redeem today and risk not having access to those critical cash reserves in the future, again to protect the vast majority of our investors who intend to stay invested for the long term.

We truly hope that over the ensuing weeks and months it proves out that we were in fact more conservative than necessary. That would mean the virus was subdued quickly and economic conditions could return to a more stable state. In such an event, we would most certainly return to normal operations and once again resume fulfilling redemption requests. But while we hope for the best, we must plan for the worst, which means not delaying the hard decisions, just to spare ourselves tough conversations.

What it means going forward

Since starting the company, our mission has always been to treat every individual investor with the level of respect and transparency that a professional investment manager would demand. Rather than assume individual investors were not sophisticated enough to understand the world of alternative investments (and therefore should not have access to them), we set out to provide our investors with the same type of investment product that had traditionally been reserved for only the largest institutions and then gave them the power to make their own decisions through a user-friendly digital experience.

The result is that today Fundrise investors are arguably able to own real property in a more direct and low-cost way than was previously ever possible. But it also means that collectively, in times of financial crisis, the Fundrise investor community is agreeing to forgo individual liquidity in order to maintain shared stability within the portfolio and preserve value for the whole.

Unlike in the stock market, where you are alone in a zero-sum competition against thousands of financial services firms and their software algorithms whose purpose is to make money for themselves at your expense, Fundrise exists to direct the collective force of 130k+ individuals into one cohesive actor, providing our investors with the power and opportunities that otherwise only exist for the billion dollar institutions.

As we’ve shared many times before, our loudest skeptics have always told us our fatal flaw would be that in a time of financial crisis the individual investor would panic, attempt to liquidate their shares, force us to sell assets, and in the process drag their fellow investors down with them.

We’ve waited for almost ten years to prove them wrong.

Going forward, our more mature eREITs and eFunds, in which redemptions have been suspended, will also pause accepting new investments. These funds were raised and deployed in the pre-COVID-19 world, and because we believe that the panic from the coronavirus outbreak will still get worse before it gets better, our immediate near term focus for these funds will be on shoring up existing assets and moving forward with those projects that may specifically benefit from continuing to make progress in today’s environment.

At the same time, for those investors who continue to invest for the long-term, new investment dollars will go into new funds that will raise and deploy into strategies tailored specifically for the COVID-19 world in which we live in today. While much of the real estate market has frozen, as the country moves from a state of panic to broader acceptance of the hard but necessary steps to quell the outbreak, we expect that the current extreme levels of uncertainty will give way to a relatively more predictable period of contraction.

Eventually, as the fallout from the extended nationwide shutdown works its way through the economy, we believe that new and attractive opportunities to proactively deploy funds will begin to present themselves. And further, that our diligence in maintaining sufficient cash reserves will be rewarded as many of the large incumbent financial institutions will still be wounded and vulnerable.

Such a world may set up perhaps the most poetic response to our skeptics, who may have to sit back and watch as we, and our investors, are proven to have in fact been the more disciplined group and, as a reward for our patience, collectively go big game hunting.

Till then, onward.

Ben

DISCLAIMER - PLEASE READ

The information contained in this email and in the accompanying Fundrise portfolio stress test is for informational purposes only, and has not been reviewed, compiled or audited by any independent third-party or public accountant. Further, this analysis is specific to the underlying assets held by each fund sponsored by Fundrise, and is not intended to project how any particular fund will perform in the future.

Obviously we cannot predict the future, and, while we believe that the assumptions contained herein to be extremely severe, there can be no guarantee that the conditions created by the ongoing COVID-19 global pandemic, or any other future unforeseen event, will not result in greater stress on the assets than is demonstrated here. In such a scenario, there may be greater risk to the various assets than is presented in this analysis.

All of the information contained herein is based on the most recently available data as of March 31, 2020. We undertake no obligation to update or review any of the information contained herein, whether as a result of new information, future developments or otherwise.

This analysis contains numerous forward-looking statements You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in this analysis.

Accompanying Communication

Fundrise portfolio stress test

Published April 3 to accompany a letter to investors on the coronavirus (COVID-19) pandemic

Under normal market conditions, we review the position of each asset in the Fundrise portfolio on a periodic basis. Given the extreme uncertainty caused by the ongoing COVID-19 pandemic, we decided to conduct an additional severe “stress test” analysis of the entire portfolio in which we assumed extreme adversity in the real estate market with the intention of providing investors further transparency into what we believe is the relative overall strength of the Fundrise portfolio to withstand such a scenario.

In this overview, we will cover the assumptions that were generally applied to create a “stressed” scenario. For reference, where appropriate measurements are applicable and the historical data exists, we used assumptions that were more severe than what occurred to similar types of assets during the 2008 Great Recession. The result, we believe, is an extreme downside scenario which we remain hopeful will not ultimately come to pass.

Below is a summary of key results from the analysis:

| 1. | More than 82% of the portfolio is invested in residential assets, including rental apartments and senior loans on properties intended for residential use. We believe residential real estate is one of the most defensive asset types to own in this crisis; since shelter, like food, is a basic need. |

| 2. | Our equity ownership positions in rental apartments are relatively low-leveraged with fixed-rate loans. The average loan-to-value (LTV) on these assets is approximately 60%. |

| 3. | The portfolio of senior loans, both acquisition and construction loans, are held on balance sheet with no additional leverage and are secured by the underlying property. In virtually every case, these assets are located in urban infill locations. |

| 4. | Properties that are either currently under development or expected to begin development soon represent 12% of the total portfolio and are owned without any senior debt. |

| 5. | Commercial and mixed-use real estate makes up only 6% of the total portfolio and is moderately leveraged with an average of loan-to-value (LTV) of 50 - 55%. |

*In the stress test scenario, some assets may experience temporary dips in value or periods of lost income,which we believe would rebound over the full lifecycle of the investment. However, there can be no guarantee that the conditions created by the ongoing COVID-19 global pandemic, or any other future unforeseen event, will not result in greater stress on the assets than is demonstrated here.

Equity ownership of real estate

Primary stress metric: debt service coverage ratio (DSCR)

Debt service coverage ratio (DSCR) is a metric that expresses how much income the property generates relative to the required debt payments. A DSCR of 1.0 means that the property generates enough income to pay debt service, and the higher the DSCR number, the greater the margin of safety. For example, a property with $125,000 of income and $100,000 of debt service each year would have a DSCR of 1.25. The DSCR also allows you to determine the relative drop in income that would have to occur before the property would risk not being able to meet its debt service requirements. In the prior example, the income from the property would have to fall by more than 20% before the DSCR dropped below 1.0.

In addition, many of the equity investments are owned outright, i.e., with no debt. In such cases, the risk of losing the property due to foreclosure (one of the primary ways that real estate investors risk losing principal during a financial crisis) is essentially non-existent since there is no lender.

Apartments - stabilized

$285.5 million (25.8% of overall portfolio value)

Typical business plan: The Fundrise stabilized apartment strategy is focused on providing well-located and reasonably priced housing for workforce renters. These types of assets have generally better withstood past downturns, as people tend to downsize to more affordable housing during times of economic hardship.

How we stress tested it: We stress tested the operating cash flow by assuming the current coronavirus crisis causes average economic vacancy/loss factor to increase to approximately 32% for a period of 12 months, which would include actual vacancy as well as potential lost income from tenants who miss rent payments.

For context, an economic vacancy/loss factor of 32% is nearly 5x higher than the existing economic vacancy/loss factor for the portfolio, which has been about 7%, on average, as of Q1 2020. It is also nearly 3x higher than the peak vacancy nationwide in Q1 2009 of 11.1% during the Great Recession, per data from the Federal Reserve. Since 1956 when Federal Reserve data begins tracking, the average apartment vacancy nationwide has ranged from about 5% to 11%. In other words, we believe that a 32% economic vacancy is an extremely severe stress test.

We used the following definitions in our calculations:

Operating Cash Flow = Gross Income minus Total Expenses minus Debt Service. (i.e, we included a replacement reserve assumption ranging between $250 - 300 / unit / year depending on vintage and used the most recently available trailing 12-month (T-12) figures (annualizing for some assets w/ less than 12 months of operations)).

Gross Income = Gross Rent plus Other Income minus Economic Vacancy (which was applied to Other Income as well as Rental Income).

Footnotes:

1a. Under the stress test scenario, it is projected that several stabilized apartment properties would have their DSCR fall below 1.0. In such circumstances, we project that these properties would require a total additional investment of roughly $1,500,000 in cash reserves to cover their collective debt service over the entire 12 month period.

1b. As Manager, we chose not to place any debt on these small-balance apartments.

Mixed-use - stabilized

$52.6 million (4.8% of overall portfolio value)

Due to the relatively unique aspects of each of these properties, we stress tested them on an individual basis as detailed in the footnotes.

Footnotes:

2a. The stress test assumes that extreme social distancing and/or the lockdown is required for 12 months and no retail tenants pay their rent for the entire 12 months. The result is a projected shortfall on the annual debt service which is paid by the fund.

2b. The property is leased to the US Postal Service, which the stress test assumes continues to pay rent in full.

2c. The stress test assumes that extreme social distancing and/or the lockdown is required for 12 months and no retail tenants pay their rent for the entire 12 months except for those tenants that are considered essential services and the tenants with corporate credit. Stress test also assumes that 20% of the office tenants do not pay rent, and there is no parking revenue for that period.

2d. Property has no debt and is leased to Beacon Roofing Supply, Inc. (NASDAQ: BECN), which the stress test assumes continues to pay rent in full.

Mixed-use - development

$98.2 million (8.9% of overall portfolio value)

Typical business plan: The Fundrise mixed-use development strategy is focused on acquiring well-located but underutilized properties in core urban infill locations, particularly in clusters or portfolios that allow us to achieve a critical mass. These properties are intended to be developed over a long-term horizon and aim to meet the growing demand for both residential and commercial uses in large cities. These types of assets typically generate little to no cash-flow in the near term but benefit from long-term appreciation potential due to the highly supply-constrained nature of most urban markets.

How we stress tested it: We chose to not place any debt on the assets the funds own directly that are either in development or that we intend to begin development on in the near future. As a result, there is little to no risk of loss from a property lender. Most projects are recently acquired and in pre-development. Any cash reserves required are for the permitting, architectural work, and other soft costs to be spent as the projects progress through the entitlement/zoning process. Also, historically, during a recession, local governments have typically been more supportive of development, and construction costs tend to be much lower, both of which would potentially be beneficial to the business plan for these types of investments.

Single-family homes - rental & for-sale

$49.0 million (4.5% of overall portfolio value)

Typical business plan: The Fundrise single-family home rental and for-sale strategies are both focused on capitalizing on the undersupply of relatively affordable single family homes in major urban markets such as Washington, DC and Los Angeles. As millennials continue to age out of apartments and begin to start families, we believe, once the current COVID-19 crisis has passed, the demand for these types of “starter homes” will continue to increase overtime. The Fundrise rental strategy aims to provide these homes for rent with the long-term upside of either renovating or selling, while the Fundrise for-sale strategy is focused on renovating and providing the homes for sale in the near term. While to date rising construction costs have been detrimental to the home renovation business, once the country is through the current crisis, potentially lower mortgage rates and the desire to move out of an apartment into a home may create unexpectedly higher demand for new homes.

How we stress tested it: None of the homes carries any property debt. As a result, there is little to no risk of loss from a property lender. Any cash reserves required are for limited ongoing development or home renovations. The majority of current rental vacancy is as a result of homes under renovation that have not been put on the market for lease up. We assumed all homes would continue to be held through the 12 month period and that any relative near term decrease in value would ultimately revert back once the market stabilized.

Footnotes:

3a. The stress test assumes that extreme social distancing and/or the lockdown is effectively in place for 12 months and new home sales see weakened demand. As a result, some homes are sold at or near cost (i.e., no profit).

Miscellaneous equity

$2.9 million (0.3% of overall portfolio value)

Due to the relatively unique aspects of each of these properties, we stress tested them on an individual basis as detailed in the footnotes.

Footnotes:

4a. The property is currently 100% pre-leased. The stress test assumes that extreme social distancing and/or the lockdown is required for 12 months and no retail tenants pay their rent for the entire 12 months except for those tenants that are considered essential services and the tenants with corporate credit. The result is a projected shortfall on the annual debt service of $225,000 which is paid by Growth eREIT II.

4b. The property consists of 12 newly-built homes that were recently completed and currently on the market for sale, with 5 of those homes under contract as of March 31, 2020. The stress test assumes that extreme social distancing and/or the lockdown is effectively in place for 12 months and new home sales see weakened demand. As a result, all the homes are sold at cost (i.e no profit) and the lender requires 12 months of debt service covered by Los Angeles eFund.

Fixed-income real estate investments

| Category | Latest net asset value | Q1 2020 loan to value (LTV) | Stressed LTV |

| Apartments - stabilized (preferred structure) | $207.9M | 82.46% | 84.97% |

| Apartments - development (preferred structure) | $69.3M | 68.88% | 74.11% |

| Senior construction or bridge loans | $152.8M | 71.51% | 78.14% |

| Miscellaneous (preferred structure) | $5.3M | 61.50% | 88.62% |

| Total or weighted average | $435.3M | 76.20% | 80.89% |

Stress metric: loan to value ratio (LTV)

For real estate debt and similar fixed-income investments, we believe that fundamentally the relative relationship of our investment basis to the value of the property, as represented by the loan-to-value ratio (LTV), is the most important measure of the probability of preserving principal and return. In the stressed scenario, to determine our projected basis, we assume that income for all the loans falls to nearly zero for a 12 month period, any project under development is delayed for a 12 month period, and all senior lenders require the funding of a new 12 month interest reserve. Conversely, for the projected value of the properties we chose not to revise them under the stressed LTVs as we did not feel confident in forecasting when values will recover and in what manner. Instead, we concluded a continued reasonable assumption over the life of the investment was to use actual cost or ‘as completed’ appraisals as the measure for value.

While these stress test assumptions are broad, and in many cases feel unlikely to occur, we take additional comfort knowing that 65% of the fixed income portfolio is invested in apartments and over 95% in residential assets more broadly. Though prices (and values) may vary in the short term, we believe that well located, supply constrained real estate owned at a basis below replacement costs is fundamentally a sound value investment strategy.

Apartments - stabilized (preferred structure)

$207.9 million (18.8% of overall portfolio value)

Typical business plan: The Fundrise preferred equity stabilized apartment strategy, like the Fundrise equity strategy, is focused on providing well-located and reasonably priced housing for workforce renters. The primary difference being that rather than holding an equity with potential upside, we hold a preferred equity position that is senior in payment priority to the equity (this is generally considered a relatively lower risk position with a lower potential return than equity). As before, we believe these types of assets generally have better withstood past economic downturns as people downsize to more affordable housing during a downturn.

How we stress tested it: We stress tested each investment’s loan to value (LTV) and operating cash flow by assuming the current coronavirus crisis causes average approximate 34% economic vacancy/loss factor for 12 months, which would include actual vacancy as well as potential non-collections from tenants' missed rent payments and bad debt.

An economic vacancy/loss factor of 34% is 2.5x higher than the existing economic vacancy/loss factor of about 9% portfolio average as of Q1 2020 and nearly 4x higher than the peak vacancy nationwide in Q1 2009 of 11.1% during the Great Recession, per data from the Federal Reserve. Since 1956 when Federal Reserve data begins tracking, the average apartment vacancy nationwide has ranged from about 5% to 11%. In other words, we believe that 34% economic vacancy is an extremely severe stress test.

We assumed the eREITs fund any potential shortfall as a result of the average 34% economic vacancy/loss factor, which adds to the principal balance. Any unpaid interest and new funding accrue at least at the standard gross interest rate.

We used the following definitions in our calculations:

Operating Cash Flow = Gross Income minus Total Expenses minus Debt Service. (for those with a detailed understanding of residential apartment underwriting we included a replacement reserve assumption ranging between $200-$300/unit/year depending on vintage and used the most recently available trailing 12-month (T-12) figures (annualizing for some assets w/ less than 12 months of operations).

Gross Income = Gross Rent plus Other Income minus Economic Vacancy (which was applied to Other Income as well as Rental Income).

Footnotes:

5a. Fundrise preferred equity investment is senior to all common equity on a pooled basis for the combined portfolio of 11 apartment buildings.

Apartments - development (preferred structure)

$69.3 million (6.3% of overall portfolio value)

Typical business plan: Financing the development of new apartment communities in fast-growing markets, primarily in the Southeast. The Fundrise preferred structure is similar to debt, where the respective eREITs are entitled to a fixed rate of return which is senior to the sponsor’s equity in terms of priority of payment but still junior to the senior loan.

How we stress tested it: We stressed potential capital needs by assuming every project is delayed by 12 months by the current coronavirus crisis, regardless of status (whether the project is just starting construction, near completion, or in lease-up). We assumed each senior lender would require the funding of an additional 12 months of interest reserve at a 5% interest rate, plus any outstanding balance of the senior loan and the applicable fund's preferred equity investment accrue for the additional 12 month. We forecast, on a stressed basis, one project requiring a potential payment of $1 million for construction cost overrun, covered by a fund rather than the borrower, which increases the investment’s LTV basis.

Senior construction or bridge loans

$152.8 million (13.8% of overall portfolio value)

Typical business plan: Nearly the entirety of the Fundrise senior debt portfolio consists of financing the entitlement or construction of mid-sized residential properties in supply-constrained California, particularly infill locations in Los Angeles. The market for this mid-sized entitlement and construction financing has proven to be inefficient and underserved by traditional banks creating opportunities for higher relative risk-adjusted returns.

How we stress tested it: We stress tested each loan's basis by assuming all loan timelines are delayed by 12 months by the current coronavirus crisis , resulting in an increased accrued basis for each loan net of interest reserves.

Footnotes:

7a. West Coast eREIT has placed the borrower in default.

7b. Los Angeles eFund has placed the borrower in default.

7c. Los Angeles eFund has placed the borrower in default.

Miscellaneous (preferred structure)

$5.3 million (0.5% of overall portfolio value)

Due to the relatively unique aspects of each of these properties, we stress tested them on an individual basis as detailed in the footnotes.

Footnotes:

8a: The stress test assumes the hotel remains closed or maintains record low occupancy for 12 months. As a result, the senior lender could foreclose on Income eREIT’s preferred equity investment, which would wipe out the investment.

8b:The stress test assumes that extreme social distancing and/or the lockdown is required for 12 months. The stress tested loan to values (LTV) assume all tenants cease paying rent during the period and both the senior loans and the applicable fund's preferred equity investments accrue interest for an additional 12 months without any current payments or pay downs.

Disclaimers

The information contained in this Fundrise portfolio stress test is for informational purposes only, and has not been reviewed, compiled or audited by any independent third-party or public accountant. Further, this analysis is specific to the underlying assets held by each fund sponsored by Fundrise, and is not intended to project how any particular fund will perform in the future.

Obviously we cannot predict the future, and, while we believe that the assumptions contained herein to be extremely severe, there can be no guarantee that the conditions created by the ongoing COVID-19 global pandemic, or any other future unforeseen event, will not result in greater stress on the assets than is demonstrated here. In such a scenario, there may be greater risk to the various assets than is presented in this analysis.

All of the information contained herein is based on the most recently available data as of March 31, 2020. We undertake no obligation to update or review any of the information contained herein, whether as a result of new information, future developments or otherwise.

This analysis contains numerous forward-looking statements You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in this analysis.

Fundrise, LLC (“Fundrise”) operates a website at fundrise.com and certain mobile apps (the “Platform”). By using the Platform, you accept our Terms of Service and Privacy Policy. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All securities involve risk and may result in partial or total loss. While the data we use from third parties is believed to be reliable, we cannot ensure the accuracy or completeness of data provided by investors or other third parties. Neither Fundrise nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances. Neither Fundrise nor any of its affiliates assume responsibility for the tax consequences for any investor of any investment. Full Disclosure

The publicly filed offering circulars of the issuers sponsored by Rise Companies Corp., not all of which may be currently qualified by the Securities and Exchange Commission, may be found at fundrise.com/oc.

© 2020 Fundrise, LLC. All Rights Reserved. eREIT, eFund and eDirect are trademarks of Rise Companies Corp.