Filed Pursuant to Rule 253(g)(2)

File No. 024-11149

RISE COMPANIES CORP.

SUPPLEMENT NO. 6 DATED APRIL 6, 2021

TO THE OFFERING CIRCULAR DATED NOVEMBER 27, 2020

This document supplements, and should be read in conjunction with, the offering circular of Rise Companies Corp. (the “Company”, “we”, “our” or “us”), dated November 27, 2020 and filed by us with the Securities and Exchange Commission (the “Commission”) on December 1, 2020 (the “Offering Circular”). Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the Offering Circular.

The purpose of this supplement is to disclose the letter sent to investors on or about April 6, 2021

.

Investor Letter sent on or about April 6, 2021

Update

Portfolio update: 2021 flagship acquisitions off to a strong start

In the first quarter of operations, we’ve invested more than $110 million into real estate, totaling 846 rental units across both multifamily and single-family rental asset classes.

As we stated in our annual letter to investors published in January, we rang in the new year by introducing an upgraded version of our proprietary fund infrastructure, enabling the creation of a unified flagship product, which we intend to power the core of our investors’ portfolios going forward. We believe this innovation should not only reduce the overall impact of cash drag on investor returns but also provide the potential for greater portfolio diversification over the long run.

One quarter into ramp-up, we’re pleased to report significant progress toward this aim, having acquired more than $110 million of real estate, totaling 846 rental units (768 existing and 78 under development) across both multifamily apartment and single-family asset classes.

Whether you just joined the platform or have been investing with us for years, a significant portion of any funds you’ve added to the platform recently has likely been allocated to the new fund infrastructure. While we believe the potential returns are strong, it’s important to remember that private real estate business plans take time to begin to bear fruit (if you haven’t already, we suggest taking a look at our guide to how returns work on Fundrise). With that in mind, let’s review what we’ve built together so far this year, and where we’re headed in the coming months.

Multifamily apartments

While the pandemic has created uncertainty around future demand for urban apartments in expensive gateway cities like New York, Boston, or San Francisco, more affordably priced suburban apartment communities across the Sunbelt have generally experienced stable or growing demand during this period.

Prices for these assets have risen over the past 12 months; however, we believe that opportunities to invest at (or below) current market prices continue to represent an attractive proposition from a risk-adjusted return perspective.

To put this into context, we find it helpful to look at current stock prices. As of March 31, 2021, the Shiller S&P 500 price-to-earnings (PE) ratio stands at 35.7. That is to say, if you were to buy into the stock market today, you would be investing at a 2.5% annual return in terms of the actual current earnings produced by the companies whose stock you are purchasing. The only time in US history when stocks have been more expensive as a multiple of earnings was leading up to the “Dotcom Bubble crash” of 2000.

In comparison, we expect the annual current earnings of our recent apartment acquisitions to be at least 4.5% of the price we paid for the investment (this is known as the cap rate in real estate investing terms). In other words, one could argue that apartments represent a better value investment than stocks. By paying a lower price for an investment relative to its earnings, one would expect a higher income yield in the near term, as well as the potential for greater appreciation over the long term to the extent that demand increases in the future (of course, all investments involve risk and there can be no guarantees of any returns).

Each of our first two apartment investments follows a Core Plus strategy of acquiring and operating stabilized, cash flowing real estate. We expect these properties to begin generating distributions for investors in the coming months, once they’ve paid off typical acquisition and onboarding costs.

Recent acquisitions

As of March 31, 2021

| Community | | Investment size¹ | | Unit count | | | Market rent growth² | |

Williamson at the Overlook

Georgetown, TX (Austin MSA) | | $25 million | | | 270 | | | | 2.2 | % |

Lotus Starkey Ranch

Odessa, FL (Tampa MSA) | | $42.6 million | | | 384 | | | | 8.3 | % |

| Overall | | $67.6 million | | | 654 | | | | | |

| 1. | Fundrise sponsored programs collective equity investment in the property. |

| 2. | Trailing 12 month rent growth in the property’s metropolitan statistical area (MSA). |

Potential new acquisitions under contract

We’re already looking ahead to another two potential acquisitions of apartment communities in the upcoming months — as always, investors can expect to receive timely updates about any future acquisitions.

| Community¹ | | Est. investment¹ | | Unit count | | | Market rent growth² | |

New acquisition

Orlando, FL | | $42 million | | | 300 | | | | 0.7 | % |

New acquisition

Charleston, SC | | $27 million | | | 276 | | | | 2.6 | % |

| Overall | | $69 million | | | 576 | | | | | |

| 1. | These properties are under contract by a wholly owned subsidiary of Rise Companies. While we expect to close on these properties in the coming months, there can be no guarantee. All values are estimates. |

| 2. | Trailing 12 month asking rent growth in the property’s metropolitan statistical area (MSA). |

Single-family rental

Like our apartment investments, our investments in single-family rental communities stem from a belief that affordably-priced rental housing in growing areas will generate consistently strong returns.

In addition to the general trend of population growth in the Sunbelt, there are two other trends that we believe could contribute to outsized demand for rental homes:

| 1. | Millennials are starting families and looking for more space. While many will follow in their parents’ footsteps and become homeowners, we believe that a significant share will prefer to rent for some period of time for reasons related to convenience and affordability. |

| 2. | Changing social norms around work, shopping, and dining, in some cases brought about or accelerated by COVID-19, have increased the share of renters who prefer the increased privacy and square footage offered by a detached single-family dwelling. |

To date, we’ve acquired batches of newly-built, vacant homes in seven communities. By purchasing these homes in volume directly from homebuilders and leasing them up ourselves to assemble stabilized communities, we believe we can get better prices — and therefore the potential for better returns — than if we had purchased “finished products.”

Single-family rental portfolio

As of March 31, 2021

| Community | | Amount

invested | | Number

of homes | | | Our price

per home | | | Avg. retail

price¹ | | | Discount

to market | |

The Estates at Fort King

Dade City, FL (Tampa MSA) | | $8.6 million | | | 33 | | | $ | 251,070 | | | | N/A² | | | | N/A² | |

Crestridge Meadows

Lavon, TX (Dallas MSA) | | $4.7 million | | | 20 | | | $ | 224,698 | | | $ | 259,429 | | | | 13.4 | % |

Windmill Farms

Forney, TX (Dallas MSA) | | $5.5 million | | | 26 | | | $ | 202,814 | | | $ | 242,823 | | | | 16.5 | % |

Trinity Crossing

Forney, TX (Dallas MSA) | | $0.9 million | | | 4 | | | $ | 207,240 | | | $ | 212,740 | | | | 2.6 | % |

Hidden Creek3 Zephyrhills, FL (Tampa MSA) | | $1.3 million | | | 5 | | | $ | 255,220 | | | $ | 265,483 | | | | 3.9 | % |

Riverstone3 Lakeland, FL (Tampa MSA) | | $2.0 million | | | 9 | | | $ | 215,783 | | | $ | 248,145 | | | | 13.0 | % |

Homestead Estates3 Elgin, TX (Austin MSA) | | $2.1 million | | | 9 | | | $ | 220,776 | | | $ | 260,300 | | | | 15.2 | % |

Oak Ridge3 Fort Worth, TX (Dallas MSA) | | $2.1 million | | | 8 | | | $ | 256,525 | | | $ | 290,186 | | | | 11.6 | % |

| Overall | | $27.1 million | | | 114 | | | | | | | | | | | | | |

| 1. | Average price of comparable homes by the same builder in the same community as the subject. |

| 2. | We are the sole buyer in this community, so this data is not available. |

| 3. | This is a recent acquisition. A detailed update about the acquisition is coming soon. |

To date, we’ve seen strong early results from our leasing efforts, with more than a quarter of the homes we’ve acquired having already secured tenants.

Potential new acquisitions under contract

While we are excited about the progress made to date within this strategy, we believe that the true value creation will come from building out a portfolio of homes that can achieve operating economies of scale. To do so, our team has been focused on developing a systematic approach for buying and leasing the homes, with the goal of reducing costs and efficiently deploying capital.

The majority of our current portfolio and pipeline includes homes that we have bought or intend to buy directly from the homebuilder when they deliver. To diversify our approach and help ensure a healthy pipeline of new homes to add to the portfolio, we’re also starting to invest directly in the construction of these homes. The first example of this new approach is a 5-acre property in Houston that we recently acquired for roughly $16.2 million, with plans to spend an additional $12.5 million to build 78 townhomes on the site. We expect these homes will deliver over the next 14 months, creating another stream of homes in our pipeline.

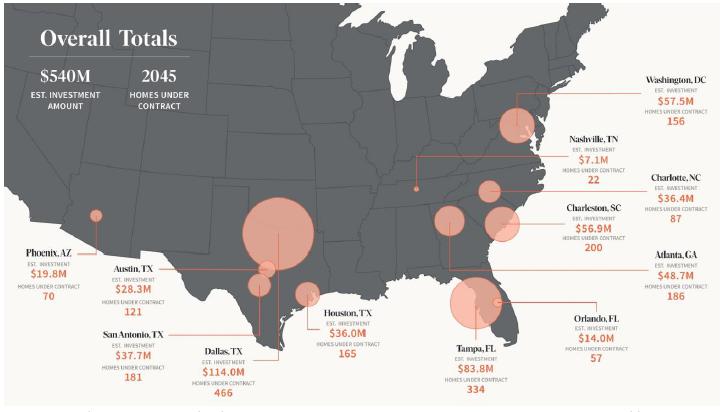

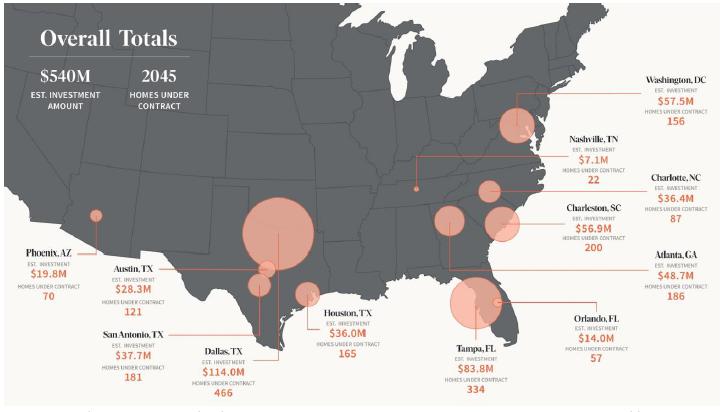

With systems in place to buy or build, we aim to scale up the portfolio to more than 2,000 homes for lease in 12 markets over the next 12 months.

These properties are under contract by a wholly owned subsidiary of Rise Companies. While we expect to close on these properties in the coming months, there can be no guarantee. All values are estimates.

What this means for your portfolio

If you’ve been investing with us for some time, you’ve likely heard us say that real estate, as a long-term illiquid investment, differs from the stock market, in that its returns are expected to start out lower and increase over time.

Investors who joined the platform since the start of the new year may experience an even more pronounced pattern of lower returns early on, since a significant portion of their portfolios are being allocated to the new flagship product.

Much like planting seeds in the spring in anticipation of a harvest later in the year, the progress of a real estate portfolio during its ramp up phase should be measured by the potential for future value creation that is being sown by the acquisition of new properties and the commencement of their business plans. To begin to see results, you must have the patience to let those plans — and time itself — work on your behalf.

We look forward to continuing to provide you with frequent updates on new acquisitions and progress of the projects in your portfolio.

Questions?

Check out some frequently asked questions here, or reach out to our team.