Filed Pursuant to Rule 253(g)(2)

File No. 024-11149

As filed with the Securities and Exchange Commission on March 7, 2022

OFFERING CIRCULAR

Rise Companies Corp.

Up to 2,887,000 shares of our Class B Common Stock

We are continuing to offer up to 2,887,000 shares of our Class B Common Stock to the public, which represents the value of the shares available to be offered as of January 31, 2022 out of the rolling 12-month maximum offering amount of $75 million in our Class B Common Stock taking into account $ 31.7 million in shares of Class B Common Stock sold over the prior 12-month period. Since this offering commenced on February 28, 2020, we have sold 62,508 shares at $8.87 per share, 1,738,062 shares at $9.09 per share, 1,557,297 shares at $9.54 per share, 492,080 shares at $10.90 per share, and 1,002,310 shares at $11.44 per share for approximately $48.0 million in offering proceeds. We have also sold 611,887 shares of our Class B Common Stock in a private placement offering at $11.44 per share.

There is no minimum number of shares you must acquire in order to make an investment in our Class B Common Stock. We expect to offer Class B Common Stock in this offering until we raise the maximum amount being offered, unless terminated by our board of directors at an earlier time. We intend to limit the offer and sale of our Class B Common Stock in this offering solely to investors who have purchased one or more investments sponsored by us. See “Securities Being Offered” and “Plan of Distribution” for a fuller description of our Class B Common Stock to be sold pursuant to this offering circular.

There is no established public trading market for our Class B Common Stock.

Investing in our Class B Common Stock is speculative and involves substantial risks. You should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 12 to read about the more significant risks you should consider before buying our Class B Common Stock. Potential investors are urged to consult their tax advisors regarding the tax consequences to them, in light of their particular circumstances, of acquiring, holding and disposing of our Class B Common Stock.

The United States Securities and Exchange Commission (the “SEC”) does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the SEC; however, the SEC has not made an independent determination that the securities offered are exempt from registration.

| | | Per Share | | | Total

Maximum (1) | |

| Public Offering Price (2) | | $ | 15.00 | | | $ | 91,345,141 | (5) |

| Underwriting Discounts and Commissions (3) | | $ | — | | | $ | — | |

| Proceeds to Us from this Offering to the Public (Before Expenses (4)) | | $ | 15.00 | | | $ | 91,345,141 | (5) |

| Proceeds to Other Persons | | $ | — | | | $ | — | |

| | (1) | This is a “best efforts” offering, which means we are only required to use our best efforts to sell the Class B Common Stock offered in this offering. |

| | (2) | The price per share shown was arbitrarily determined by our board of directors and will apply for the duration of this offering. |

| | (3) | Investors will not pay upfront selling commissions in connection with the purchase of our Class B Common Stock. |

| | (4) | All expenses incurred as a result of this offering, which we estimate to be approximately $375,000, will be borne by us. Estimated expenses include all expenses incurred from the commencement of this offering on February 28, 2020 through the expected termination of this offering in February 2023, when we expect to file a new offering statement on Form 1-A. Purchasers of our Class B Common Stock are not directly responsible for costs incurred as a result of this offering. |

| | (5) | Since this offering commenced in February 2020, total maximum calculations take into account 62,508 of Class B common shares previously sold under this offering at the offering price of $8.87 per share, 1,738,062 of Class B common shares previously sold under this offering at the offering price of $9.09 per share, 1,557,297 of Class B common shares previously sold under this offering at the offering price of $9.54 per share, 492,080 of Class B common shares previously sold under this offering at the offering price of $10.90, and 1,002,310 of Class B common shares previously sold under this offering at the offering price of $11.44. We are currently continuing to offer an additional $43.3 million in our Class B common shares, which, when taken together with the approximately $31.7 million in Class B common shares sold in this offering in the last 12-months, is less than the rolling 12-month maximum offering amount of $75 million allowable under Regulation A. As of December 31, 2021, we have raised approximately $114.4 million from shares that were previously qualified as follows: |

| Date of Qualification | | Number of Class B

Shares

Qualified | |

| January 31, 2017 | | | 2,000,000 | |

| February 15, 2017 | | | 1,000,000 | |

| July 28, 2017 | | | 2,000,000 | |

| August 22, 2018 | | | 5,000,000 | |

| February 27, 2020 | | | 2,598,884 | |

| November 27, 2020 | | | 2,163,000 | |

| July 28, 2021 | | | 3,576,000 | |

| Total Prior Qualified Shares | | | 18,337,884 | |

Our office is located at 11 Dupont Circle NW, 9th Floor, Washington, DC 20036. Our telephone number is (202) 584-0550. Information regarding the Company is also available on our web site at www.fundrise.com, the contents of which (other than the offering statement, this offering circular and the appendices and exhibits thereto) are not incorporated by reference in, or otherwise a part of, this offering circular.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to non-natural persons and we are entitled to apply different rules to accredited investors. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A under the Securities Act of 1933, as amended. For general information on investing, we encourage you to refer to www.investor.gov.

We are providing the disclosure in the format prescribed by Part II of Form 1-A.

The date of this offering circular is March 4, 2022

TABLE OF CONTENTS

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

Please carefully read the information in this offering circular and any accompanying offering circular supplements, which we refer to collectively as the offering circular. You should rely only on the information contained in this offering circular. We have not authorized anyone to provide you with different information. This offering circular may only be used where it is legal to sell these securities. You should not assume that the information contained in this offering circular is accurate as of any date later than the date hereof or such other dates as are stated herein or as of the respective dates of any documents or other information incorporated herein by reference.

This offering circular is part of an offering statement that we filed with the SEC, using a continuous offering process. Periodically, as we have material developments, we will provide an offering circular supplement that may add, update or change information contained in this offering circular. Any statement that we make in this offering circular will be modified or superseded by any inconsistent statement made by us in a subsequent offering circular supplement. The offering statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this offering circular. You should read this offering circular and the related exhibits filed with the SEC and any offering circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. See the section entitled “Additional Information” below for more details.

The offering statement and all supplements and reports that we have filed or will file in the future can be read at the SEC website, www.sec.gov, or on the Fundrise Platform website, www.fundrise.com. The contents of the Fundrise Platform website (other than the offering statement, this offering circular and the appendices and exhibits thereto) are not incorporated by reference in, or otherwise a part of, this offering circular.

We, and if applicable, those selling Class B Common Stock on our behalf in this offering, will be permitted to make a determination that the purchasers of Class B Common Stock in this offering are “qualified purchasers” in reliance on the information and representations provided by the purchaser regarding the purchaser’s financial situation. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A (“Regulation A”) under the Securities Act of 1933, as amended (the “Securities Act”). For general information on investing, we encourage you to refer to www.investor.gov.

Unless otherwise indicated, all references in this offering circular to “Rise Companies”, “Fundrise”, the “Company”, “we”, “our”, “us” or other similar terms refer to Rise Companies Corp. and its subsidiaries.

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Our Class B Common Stock is being offered and sold only to “qualified purchasers” (as defined in Regulation A). As a Tier 2 offering pursuant to Regulation A, this offering will be exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our Class B Common Stock offered hereby is offered and sold only to “qualified purchasers” or at a time when our Class B Common Stock is listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D under the Securities Act (“Regulation D”) and (ii) all other investors so long as their investment in our Class B Common Stock does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). However, our Class B Common Stock is being offered and sold only to those investors that are within the latter category (i.e., investors whose investment in our Class B Common Stock does not represent more than 10% of the applicable amount), regardless of an investor’s status as an “accredited investor.” Accordingly, we reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

To determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser” definition, the investor must be a natural person:

| | 1. | who has an individual net worth, or joint net worth with the person’s spouse, that exceeds $1,000,000 at the time of the purchase, excluding the value of the primary residence of such person; |

| | 2. | who has earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year; |

| | 3. | who has certain professional certifications, designations or credentials or other credentials issued by an accredited educational institution, as designated by the Securities and Exchange Commission (“SEC”); or |

| | 4. | who, with respect to investments in a private fund, are “knowledgeable employees” of the fund, as defined in the Investment Company Act of 1940. |

The list above is non-exhaustive; prospective investors should review Rule 501 of Regulation D for more details on whether they are an “accredited investor.” If the investor is not a natural person, different standards apply. See Rule 501 of Regulation D for more details.

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles.

OFFERING CIRCULAR SUMMARY

This offering summary highlights material information regarding our business and this offering. Because it is a summary, it may not contain all of the information that is important to you. To understand this offering fully, you should read the entire offering circular carefully, including the “Risk Factors” section before making a decision to invest in our Class B Common Stock.

Rise Companies Corp.

Rise Companies Corp. (“Rise,” “Rise Companies,” “we,” “our,” the “Company,” and “us”) is a financial technology company that owns and operates a direct-to-investor web and mobile real estate investment platform, located at www.fundrise.com (the “Fundrise Platform”). We believe technology-powered investment management is the future of the real estate industry and other alternative asset classes. Enabled by our proprietary technology, we leverage data and technology to lower the operating cost and improve the performance of our investments. Through a vertically integrated infrastructure that automates the traditional processes of the real estate investment business, the Company aggregates thousands of individuals from across the country to create the scale of an institutional investor on a single digital backbone – thereby lowering the marginal cost of each investor to nearly zero. Individuals can invest through the Fundrise Platform at ultra-low costs for what we believe is a superior web-based and mobile experience. Investors use the Fundrise Platform to have the ability to earn returns from real estate and other alternative asset classes that have generally been closed to many investors.

We believe that, as our business scales, while our growth may increase in absolute terms, our individual performance metrics on a standalone basis may not reflect our total performance. Accordingly, it may be insufficient to rely solely on any single performance metric as a measurement of our success.

We operate through the following consolidated subsidiaries, with the following activities:

| | • | Fundrise, LLC (“Fundrise”), a wholly-owned subsidiary of Rise Companies, owns and operates the Fundrise Platform that allows investors to become equity or debt holders in alternative investment opportunities. |

| | • | Fundrise Lending, LLC (“Fundrise Lending”), a wholly-owned subsidiary of Rise Companies, is a licensed finance lender in the State of California that facilitates real estate loans (“Real Estate Loans”). |

| | • | National Commercial Real Estate Trust (the “Trust”), a wholly-owned statutory trust of Rise Companies, historically acquired loans from Fundrise Lending and held them for the sole benefit of certain investors that had purchased Project-Dependent Notes (the “Notes”) issued by the Trust and were related to specific underlying loans for the benefit of the investor (collectively, the “Notes Program”). |

| | • | National Commercial Real Estate Trustee LLC, a wholly-owned subsidiary of Rise Companies, acts as the manager trustee of the Trust. |

| | • | Fundrise Advisors, LLC (“Fundrise Advisors”), a wholly-owned subsidiary of Rise Companies, is a registered investment advisor with the Securities and Exchange Commission (“SEC”) that acts as the non-member manager for the real estate investment trust programs and the real estate investment fund programs sponsored by the Company and offered for investment via the Fundrise Platform. |

| | • | Fundrise, L.P. (“Fundrise LP”), is an affiliate of Rise Companies and was created with the intent to directly benefit the Company by driving its growth and profitability. Rise Companies owns approximately 2% of Fundrise LP and has the ability to direct its assets. |

| | • | Fundrise Management, LLC is the sole member and manager of Fundrise GP I, LLC, which is the general partner of Fundrise LP. |

| | • | Fundrise Servicing, LLC, a wholly-owned subsidiary of Rise Companies, acts as a servicer for our Sponsored Programs (as defined below). |

| | • | RSE Capital Partners, LLC, a wholly-owned subsidiary of Rise Companies, acts as an originator for real estate assets for our Sponsored Programs. |

| | | |

| | • | RSE Development, LLC, a wholly-owned subsidiary of Rise Companies, acts as a developer of real estate assets for the Sponsored Programs. |

| | | |

| | • | Fundrise Real Estate, LLC, a wholly-owned subsidiary of Rise Companies, is a real estate operating platform through which many of the real estate assets of our Sponsored Programs are managed. |

| | | |

| | • | Certain unlaunched investment programs that are not yet being offered to investors. |

The Company has sponsored the following investment programs, as of January 31, 2022:

| | • | Fundrise Real Estate Investment Trust, LLC, Fundrise Equity REIT, LLC, Fundrise West Coast Opportunistic REIT, LLC, Fundrise East Coast Opportunistic REIT, LLC, Fundrise Midland Opportunistic REIT, LLC, Fundrise Income eREIT II, LLC, Fundrise Growth eREIT II, LLC, Fundrise Income eREIT III, LLC, Fundrise Growth eREIT III, LLC, Fundrise Income eREIT 2019, LLC, Fundrise Development eREIT, LLC (the result of a merger between Fundrise Growth eREIT 2019, LLC and Fundrise Growth eREIT V, LLC), Fundrise Income eREIT V, LLC, , Fundrise eREIT XIV, LLC (f/k/a Fundrise Income eREIT VI, LLC), Fundrise Growth eREIT VI, LLC, Fundrise Growth VII, LLC, Fundrise Balanced eREIT, LLC and Fundrise Balanced eREIT II, LLC are the real estate investment trust programs (the “eREITs”) sponsored by the Company. |

| | • | Fundrise eFund, LLC, (f/k/a Fundrise For-Sale Housing eFund – Los Angeles CA, LLC) is the real estate investment fund program (the “eFund”) sponsored by the Company. The Company previously sponsored two other eFunds, Fundrise For-Sale Housing eFund – Washington DC, LLC and Fundrise National For-Sale Housing eFund, LLC, both of which merged into the Fundrise eFund, LLC on November 30, 2020. We define the eFund, together with the eREITs, as the “eDirect Programs.” |

| | • | Fundrise Opportunity Fund, LP and Fundrise Opportunity Zone OP, LLC (collectively referred to as the “Opportunity Fund” and the “oFund”), make up a tax-advantaged real estate investment fund program offered under Regulation D that is offered through the Fundrise Platform. |

| | • | Fundrise Real Estate Interval Fund, LLC (“ Flagship Fund”) is a newly organized Delaware limited liability company that is registered under the Investment Company Act of 1940, as amended, as a non-diversified, closed-end management investment company that is operated as an interval fund. |

The eREITs, eFund, oFund and Flagship Fund are referred to, individually or collectively as the context requires, as the “Sponsored Programs” or the “Programs”.

Given the unprecedented level of disruption and ongoing uncertainty caused by the global coronavirus (COVID-19) pandemic, in an effort to protect the interests of existing shareholders of the Sponsored Programs, processing and payment of redemptions under each Sponsored Program’s redemption plan was suspended until further notice, effective as of March 31, 2020, (including redemptions made during the Introductory Period). Processing and payment of redemptions resumed under each Sponsored Program’s redemption plan as of June 30, 2020.

Through the Fundrise Platform, we reduce upfront fees and costs to investors in the Sponsored Programs by eliminating high-fee broker-dealers and other intermediaries, while removing the double promote (where real estate and alternative fund sponsors receive a share of the profits in the distribution waterfall) common with alternative asset investments. Our direct online investment model allows us to more efficiently raise and invest capital than through conventional institutional avenues.

Other than our initial seed investments in each of the Sponsored Programs, we do not assume the long-term credit risk of the investments facilitated through and managed by the Fundrise Platform.

Our historical growth rates in facilitating investments through the Fundrise Platform reflect a deliberate strategy which has allowed us to build and develop the various enterprise functions needed to support our scale, including operations, risk controls, customer support, compliance and technology. Demand from real estate operators and investors will continue to inform our business and investment product decisions, but we have so far failed to see value for our investors in compromising the long-term quality of our underwriting to pursue short-term measures that we believe would result in investment performance below our standards.

We have achieved the following significant milestones since our founding:

| | • | In February 2011, we filed a provisional patent application for Systems and Methods for Online Securitization of Illiquid Assets. This patent is currently pending. |

| | • | In June 2012, to our knowledge, we invented online real estate investing when our co-founders sponsored the first ever online real estate offering under Regulation A (available to all residents of the District of Columbia and the Commonwealth of Virginia) for a property at 1351 H Street NE, in Washington, DC. |

| | • | In April 2014, Renren Inc. led our Series A convertible preferred stock (“Series A”) financing round where we raised approximately $24.7 million. |

| | • | In June 2014, we introduced the Notes Program that allowed investors to deploy capital targeting returns tied to select specific real estate assets through a standardized and simplified online investment process. |

| | • | In November 2015, we sponsored the first ever online real estate investment trust available to anyone in the U.S. (an “eREITTM”), called Fundrise Real Estate Investment Trust, LLC. |

| | • | In June 2016, we surpassed 100,000 users on the Fundrise Platform. |

| | • | In October 2016, we surpassed $100 million in assets under management in the Sponsored Programs. |

| | • | In September 2017, we surpassed $200 million in assets under management in the Sponsored Programs. |

| | • | In July 2018, we surpassed 50,000 active investor accounts and 250,000 users on the Fundrise Platform. |

| | | |

| | • | In November 2018, we surpassed $500 million in AUM in the Sponsored Programs. |

| | | |

| | • | In April 2019, we launched the Fundrise iOS mobile application. |

| | | |

| | • | In August 2019, we surpassed 100,000 active investor accounts and 500,000 users on the Fundrise Platform. |

| | | |

| | • | In January 2020, we surpassed $1 billion in AUM in the Sponsored Programs. |

| | | |

| | • | In February 2020, we launched the Fundrise Android mobile application. |

| | | |

| | • | In September 2020, we surpassed 150,000 active investor accounts on the Fundrise Platform. |

| | | |

| | • | In March 2021, we surpassed $1.5 billion in AUM in the Sponsored Programs. |

| | | |

| | • | In May 2021, we secured a $300 million credit facility from Goldman Sachs Bank to grow our single-family rental portfolio. |

| | | |

| | • | In July 2021, we lowered the investment minimum to $10 in our Flagship Fund, our lowest minimum investment ever. |

| | | |

| | • | In August 2021, we surpassed 1 million users on the Fundrise Platform. |

| | | |

| | • | In October 2021, we surpassed $2.0 billion in AUM in the Sponsored Programs |

| | | |

| | • | In October 2021, we raised over a $100 million dollars in single month through our Sponsored Programs. |

| | | |

| | • | In November 2021, we surpassed 200,000 active investor accounts on the Fundrise Platform. |

Our office is located at 11 Dupont Circle NW, 9th Floor, Washington, D.C. 20036. Our telephone number is (202) 584-0550. Information regarding the Company is also available on our web site at www.fundrise.com.

As of January 31, 2022 we had 257 employees.

Recent Developments

Capital Raised

The Company is currently offering up to approximately $43.3 million of its Class B Common Stock, which represents the value of the shares available to be offered as of January 31, 2022 out of the rolling 12-month maximum offering amount of $75 million in our Class B Common Stock taking into account $31.7 million in shares of Class B Common Stock sold over the prior 12-month period. The Offering is being conducted as a continuous offering pursuant to Rule 251(d)(3) of Regulation A, meaning that while the offering of securities is continuous, active sales of securities may occur sporadically over the term of the Offering. As of January 31, 2022 we have sold 14,842,350 shares of our Class B Common Stock at varying prices as set forth below, for approximately $114.4 million in gross offering proceeds. This does not include 611,887 shares that have been sold in a private placement pursuant to Rule 506(c) of Regulation D at $11.44 for proceeds of $6,999,987 in 2021.

Offering Results

| Effective Date of Price per Share | | | Price Per Share | | | Number of Class B

Common Shares Sold | | | Offering Proceeds | |

| January 31, 2017 | | | $ | 5.00 | | | | 2,884,129 | | | $ | 14,420,645 | |

| July 28, 2017 | | | | 5.50 | | | | 699,880 | | | | 3,849,340 | |

| January 27, 2018 | | | | 6.00 | | | | 649,781 | | | | 3,898,686 | |

| May 22, 2018 | | | | 6.30 | | | | 240,589 | | | | 1,515,711 | |

| July 23, 2018 | | | | 6.60 | | | | 522,878 | | | | 3,450,995 | |

| October 19, 2018 | | | | 6.90 | | | | 814,870 | | | | 5,622,603 | |

| January 31, 2019 | | | | 7.30 | | | | 1,073,630 | | | | 7,837,499 | |

| May 3, 2019 | | | | 7.67 | | | | 457,748 | | | | 3,510,927 | |

| July 26, 2019 | | | | 8.05 | | | | 1,029,649 | | | | 8,288,674 | |

| October 18, 2019 | | | | 8.45 | | | | 864,499 | | | | 7,305,017 | |

| January 21, 2020 | | | | 8.87 | | | | 814,948 | | | | 7,228,589 | |

| July 17, 2020 | | | | 9.09 | | | | 1,738,062 | | | | 15,798,984 | |

| February 17, 2021 | | | | 9.54 | | | | 1,557,297 | | | | 14,856,613 | |

| April 28, 2021 | | | | 10.90 | | | | 492,080 | | | | 5,363,672 | |

| August 16, 2021 | | | | 11.44 | | | | 1,002,310 | | | | 11,466,426 | |

| Totals | | | | — | | | | 14,842,350 | | | $ | 114,414,381 | |

Shares are currently offered pursuant to this offering circular and are sold on a continuous basis only to existing investors in the Sponsored Programs. The funds received from the issuance of our Class B common stock are a primary source of capital for our operating expenditures.

Impact of COVID-19 on our Business

Given that the majority of our income is derived from the fees we receive from the Sponsored Programs we have in the past sponsored, and expect in the future to sponsor, the impact of COVID-19 on the Sponsored Programs’ business and operations will have a material impact on our business.

For information regarding the potential impact of the COVID-19 pandemic on the various assets held by the Sponsored Programs we sponsor, please see the following links for information that was the subject of previous supplements to our Offering Circular:

| | • | Blog post titled What You Should Expect from Fundrise During the Next Financial Crisis – originally published in October 2017, this blog post has been republished annually and is re-sent to every new investor within 60 days of their first investment |

| | • | Blog post titled Year-end letter to investors – 2019, published January 16, 2020 |

| | • | Blog post titled How We’re Navigating the Global Coronavirus Outbreak, originally published March 11, 2020 |

| | • | Investor Letter and Fundrise Stress Test, originally published April 3, 2020 |

| | • | Investor Letter regarding portfolio performance over the first half of 2020, originally published July 1, 2020 |

| | • | Investor Letter providing update on Fundrise during the first half of 2020, originally published July 16, 2020 |

| | • | Investor Letter providing year-end update on Fundrise, originally published January 21, 2021 |

| | • | Investor Letter providing year-end highlights and a look forward to 2021, originally published February 17, 2021 |

| | • | Question and Answer session with Chief Executive Officer, Ben Miller, originally published March 4, 2021 |

| | • | Investor Letter providing update on first quarter of 2021, originally published April 6, 2021 |

| | • | Investor Letter providing update on first half of 2021, originally published July 7, 2021 |

| | • | Investor Letter providing update on Fundrise during Q3 of 2021, originally published October 1, 2021 |

| | • | Investor Letter providing update on Fundrise during Q3 of 2021, originally published October 22, 2021 |

| | • | Investor Letter providing year-end highlights on Fundrise and a look forward to 2022, originally published January 13, 2022 |

| | • | Investor Letter providing year-end highlights and a look forward to 2022, originally published January 27, 2022 |

The Company is encouraged by both the performance of the managed real estate assets held by its Sponsored Programs and by its own ability to navigate and continue to grow throughout the economic upheaval and public health crisis brought on by the COVID-19 pandemic that has caused many businesses to radically shift their operations during a majority of 2020 and 2021. The Company has continued to see strong performance especially in the Flagship Fund, which invested more than $264 million into real estate across a diversified portfolio of multifamily apartment, single-family rental, and industrial asset classes in the first half of 2021.

The Company has regained its pre-pandemic growth momentum, achieving a 64% CAGR for the semi-annual period beginning January 2021. With just our progress in 2021, the Company has already set new records with multiple largest ever fundraising months for the Sponsored Programs. It has been our belief that as the broader demographic tailwinds create a new generation full of millions and millions of new investors, the platform that was able to provide consistently strong performance with the best overall experience would be well-positioned to succeed. According to the Deloitte Center for Financial Services, the vast majority of new wealth creation in the United States will come from Generation X and Millennials, who will increase from approximately 28% in 2020 to 47% in 2030 of all wealth in the United States. Fundrise is well positioned to become the go-to platform for the rising generations to invest in the real estate industry and other alternative asset classes, and to leverage data and technology in its efforts to empower and center the individual as the key stakeholder in the financial services markets.

Since the start of 2021, the Company has continued to build on our products and improve the overall platform, most notably:

| | • | In January, the introduction of the Flagship Fund, a registered 40 Act interval fund, has enhanced our proprietary fund infrastructure, enabling the creation of a unified flagship strategy. We believe the Flagship Fund will power the core of our investors’ portfolios going forward by reducing the overall impact of short-term cash drag on investor returns and also provide the potential for greater portfolio diversification over the long run. |

| | • | The Flagship Fund’s co-investment vehicle has secured a credit facility from Goldman Sachs Bank (NYSE:GS), which enables such vehicle to borrow up to $300 million against the value of our single-family rental portfolio. |

| | • | We have built up the single-family rental home portfolio held by the Sponsored Programs to a total of 452 homes across nineteen communities and expect to close in excess of 1,000 homes in total by the end of this fiscal year. Our goal is to create a portfolio of homes that can achieve operating economies of scale, generating consistent income, while at the same time positioning the Sponsored Programs to capture what we believe will be outsized price appreciation thanks to the confluence of demographic factors driving demand for affordably-priced rental homes. |

| | • | We upgraded key software infrastructure, operations, and services to allow for greater scale, leading to us lowering the minimum investment on the platform to $10 in July. |

Looking back since the start of the COVID-19 pandemic, in a period with so many unexpected challenges, we believe we have not only established ourselves as the clear leader in the space, but continue to innovate rapidly and distance ourselves from the rest of the pack.

While success is never guaranteed, together with our renewed focus on expanding overall awareness of our brand, we believe these key initiatives have allowed us to recover our momentum and put us on track to build a world class data and technology enabled alternative asset investment platform.

Our Board of Directors

We operate under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. Our board of directors has ultimate responsibility for our operations, corporate governance, compliance and disclosure. We have five members on our board of directors, three of whom have been determined by our board of directors to be “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing standards of the NASDAQ Stock Market LLC, even though we are not currently subject to such rules.

About the Fundrise Platform

Fundrise, LLC, a wholly-owned subsidiary of ours, owns and operates the Fundrise Platform, which may be found on the website: www.fundrise.com. The Fundrise Platform allows investors to become equity or debt holders in alternative real estate investment activities. Through the use of the Fundrise Platform, investors can browse and screen real estate investments, view details of an investment and sign legal documents online.

Benjamin S. Miller, our co-founder and Chief Executive Officer, is responsible for overseeing our and our affiliates’ day-to-day operations.

Our Structure

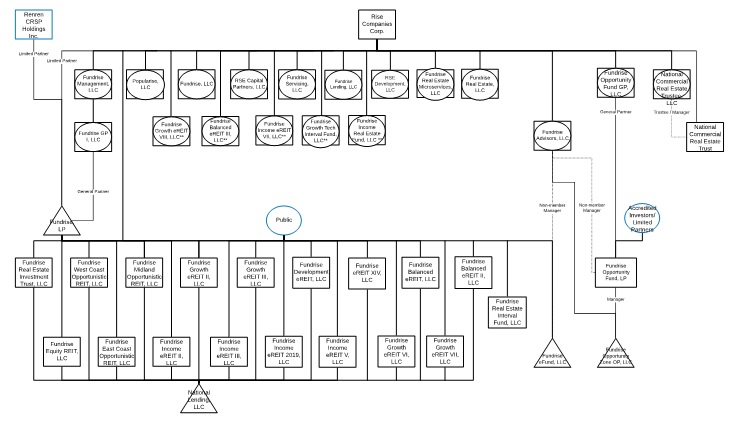

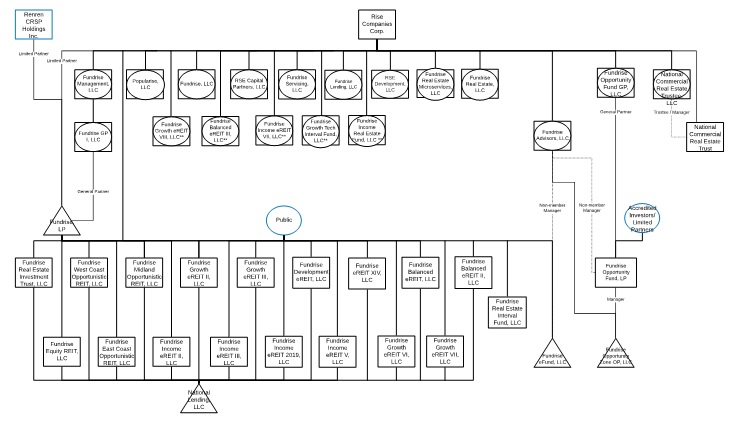

The chart below shows the relationship among us and our affiliates as of the date of this offering circular.

Fundrise, LLC (“Fundrise”), a wholly-owned subsidiary, owns and operates the Fundrise Platform that allows investors to become equity or debt holders in alternative investment opportunities.

Fundrise Lending, LLC (“Fundrise Lending”), a wholly-owned subsidiary, is a licensed finance lender in the State of California that facilitates real estate loans (“Real Estate Loans”).

National Commercial Real Estate Trust (the “Trust”), a wholly-owned statutory trust, which historically acquired loans from Fundrise Lending, LLC and held them for the sole benefit of certain investors that had purchased Project-Dependent Notes (“Notes,” “Note,” and “the Notes”) issued by the Trust and that related to specific underlying loans for the benefit of the investor.

National Commercial Real Estate Trustee, a wholly-owned subsidiary of Rise, acts as the manager trustee of the Trust.

Fundrise Advisors, LLC (“Fundrise Advisors”), a wholly-owned subsidiary, is a registered investment advisor with the Securities and Exchange Commission (“SEC”) that acts as the non-member manager for the real estate investment trust programs and the real estate investment fund programs sponsored by the Company and offered for investment via the Fundrise Platform.

Fundrise Real Estate Investment Trust, LLC, Fundrise Income eREIT II, LLC, Fundrise Income eREIT III, LLC, Fundrise Income eREIT 2019, LLC, Fundrise Income eREIT V, LLC, Fundrise eREIT XIV, LLC (f/k/a Fundrise Income eREIT VI, LLC), Fundrise Equity REIT, LLC, Fundrise Growth eREIT II, LLC, Fundrise Growth eREIT III, LLC, Fundrise Growth eREIT 2019, LLC, Fundrise Development eREIT, LLC (the result of a merger between Fundrise Growth eREIT 2019, LLC and Fundrise Growth eREIT V, LLC), Fundrise Growth eREIT VI, LLC, Fundrise Growth eREIT VII, LLC, Fundrise Balanced eREIT, LLC, Fundrise Balanced eREIT II, LLC, Fundrise West Coast Opportunistic REIT, LLC, Fundrise East Coast Opportunistic REIT, LLC, and Fundrise Midland Opportunistic REIT, LLC are the real estate investment trust programs (the “eREITs®”) sponsored by the Company.

Fundrise eFund, LLC is the real estate investment fund program (the “eFund”) sponsored by the Company. The Company previously sponsored two other eFunds, Fundrise For-Sale Housing eFund – Washington DC, LLC and Fundrise National For-Sale Housing eFund, LLC, both of which merged into the Fundrise eFund, LLC on November 30, 2020.

The Flagship Fund is a newly organized Delaware limited liability company that is registered under the Investment Company Act of 1940, as amended, as a non-diversified, closed-end management investment company that is operated as an interval fund.

Fundrise LP, a limited partnership (“Fundrise LP”), is an affiliate of Rise and was created with the intent to directly benefit the Company by driving its growth and profitability. Rise owns 1.96% of Fundrise LP and has the ability to direct its assets.

Fundrise Management, LLC is the sole member and manager of Fundrise GP I, LLC, which is the general partner of Fundrise, L.P.

RSE Capital Partners, LLC, a wholly-owned subsidiary of Rise, acts as an originator for real estate assets for our Sponsored Programs.

RSE Development, LLC, a wholly-owned subsidiary of Rise Companies, acts as a developer of real estate assets for our Sponsored Programs.

Popularise, LLC, a wholly-owned subsidiary of Rise, owns and operates the Popularise website, which allows developers to seek input from the public on potential future tenants.

Fundrise Servicing, LLC, a wholly-owned subsidiary of Rise, acts as a servicer for our Sponsored Programs.

Fundrise Opportunity Fund, LP and Fundrise Opportunity Zone OP, LLC (collectively referred to as the “Opportunity Fund” and the “oFund”), make up a tax-advantaged real estate investment fund program offered under Regulation D that is offered through the Fundrise Platform.

Fundrise Real Estate, LLC, a wholly-owned subsidiary of Rise Companies, is a real estate operating platform through which many of the real estate assets of our Sponsored Programs are managed.

Certain unlaunched investment programs that are not yet being offered to investors.

THE OFFERING

| Class B Common Stock we are offering | | 2,887,000 shares of Class B Common Stock. |

| | | |

| Class B Common Stock outstanding as of December 31, 2021 | | 15,008,588 shares of Class B Common Stock. |

| | | |

| Class B Common Stock to be outstanding immediately after this offering if all shares being offered are sold | | 17,895,588 shares of Class B Common Stock. |

| | | |

| Class A Common Stock to be outstanding immediately after this offering | | 2,455,894 shares of Class A Common Stock. |

| | | |

| Class F Common Stock to be outstanding immediately after this offering | | 10,000,000 shares of Class F Common Stock. |

| | | |

| Class M Common Stock to be outstanding immediately after this offering | | 0 shares of Class M Common Stock. |

| | | |

| Preferred stock to be outstanding immediately after this offering | | 11,865,046 shares of Series A Preferred Stock. |

| | | |

| Voting power held by holders of Class B Common Stock after giving effect to this offering | | 0% |

| | | |

| Voting power held by holders of Class A Common Stock after giving effect to this offering | | 2.15% |

| | | |

| Voting power held by holders of Class F Common Stock after giving effect to this offering | | 87.47% |

| | | |

| Voting power held by holders of Class M Common Stock after giving effect to this offering | | 0% |

| | | |

| Voting power held by holders of Series A Preferred Stock after giving effect to this offering | | 10.38% |

| | | |

| Voting Rights | | Class B Common Stock carries no voting rights. One vote per share for Class A Common Stock, nine votes per share for Class M Common Stock, ten votes per share for Class F Common Stock, and one vote per share for Series A Preferred Stock. For additional information, see “Securities Being Offered.” |

| | | |

| Use of Proceeds | | The principal purposes of this offering are to increase our capitalization and financial flexibility. As of the date of this offering circular, we cannot specify with certainty all of the particular uses for the net proceeds to us from this offering. Currently, we intend to use the net proceeds to us from this offering for general corporate purposes, including working capital, operating expenses and capital expenditures. For additional information, see “Use of Proceeds” below. |

| Investment Requirements | | There is no number of shares you must acquire in order to make an investment in our Class B Common Stock. |

| | | |

| | | We intend to initially limit the offer and sale of our Class B Common Stock in this offering solely to investors who have purchased one or more investments sponsored by us. For additional investment requirements, see “State Law Exemption and Purchase Restrictions.” |

| | | |

| Liquidity Event | | Subject to then existing market conditions, we may consider alternatives for providing liquidity to our stockholders within three to five years from the completion of this offering. However, there can be no assurance that a suitable transaction will be available or that market conditions for a transaction will be favorable during that time frame. Our board of directors has the discretion to consider a liquidity transaction at any time if it determines such event to be in our best interests, such as, but not limited to, a listing of our common stock on a national securities exchange or a similar transaction. We do not have a stated term, as we believe setting a finite date for a possible, but uncertain future liquidity transaction may result in actions that are not necessarily in the best interest, or within the expectations of, our stockholders. Accordingly, stockholders should be prepared to hold the shares of Class B Common Stock indefinitely. |

| | | |

| Risk Factors | | Investing in our Class B Common Stock involves a high degree of risk. You should carefully review the “Risk Factors” section of this offering circular, beginning on page 12, which contains a detailed discussion of the material risks that you should consider before you invest in our Class B Common Stock. |

RISK FACTORS

An investment in our Class B Common Stock involves substantial risks. You should carefully consider the following risk factors in addition to the other information contained in this offering circular before purchasing shares. The occurrence of any of the following risks might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this offering circular, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Statements Regarding Forward-Looking Information.”

Risks Related to Our Business

The growth of our business depends in large part on our ability to raise capital from investors. If we are unable to raise capital from new or existing investors or existing investors decide to withdraw their investments from our Programs, our Programs will be unable to deploy such capital into investments and we will be unable to collect additional fees, which would have a negative effect on our growth prospects.

Our ability to raise capital from investors depends on a number of factors, including many that are outside our control. Investors may choose not to make investments with alternative asset managers, including sponsors of real estate investment programs and private real estate investment funds, and may choose to invest in asset classes and fund strategies that we do not offer. Poor performance of our Programs could also make it more difficult for us to raise new capital. Investors and potential investors in our Programs continually assess the performance of our Programs independently and relative to market benchmarks and our competitors, and our ability to raise capital for existing and future Programs depends on our performance. If economic and market conditions deteriorate, we may be unable to raise sufficient amounts of capital to support the investment activities of our new and future Programs. In addition, one of our key growth strategies is the expansion of our product offerings through the development of new Programs. If we are unable to successfully raise capital for our existing and future Programs, we will be unable to collect additional fees in connection with our management of our Programs. Our fees consist primarily of (i) origination fees from debt and equity investments paid by the real estate operators with which we partner, (ii) asset management fees from our Programs, (iii) advisory fees from investors in our Programs, and (iv) interest income which would have a negative effect on our growth prospects.

In addition, investors are typically permitted to withdraw their investments from our Programs through various redemption plans. In difficult market conditions, the pace of investor redemptions or withdrawals from our Programs could accelerate if investors move their funds to investments they perceive as offering greater opportunity or lower risk. Although investments in our Programs may generally be redeemed only at a discount to the original investment amount and redemptions are subject to other restrictions, redemptions could have the effect of decreasing the capital available for investments in our Programs and reduce our revenues and cash flows.

We are currently incurring net losses and expect to continue incurring net losses in the future.

We are currently incurring net losses and expect to continue incurring net losses in the future. Our failure to become profitable could impair the operations of the Fundrise Platform by limiting our access to working capital to operate the Fundrise Platform. In addition, we expect our operating expenses to increase in the future as we expand our operations. If our operating expenses exceed our expectations, our financial performance could be adversely affected. If our revenue does not grow to offset these increased expenses, we may never become profitable. In future periods, we may not have any revenue growth, or our revenue could decline.

The loss of our executive officers or key personnel could have an adverse effect on our business. Our ability to attract and retain qualified investment professionals is critical to our success.

We depend on the investment expertise, skill and network of business contacts of our executive officers and key personnel. Our executive officers and key personnel evaluate, negotiate, structure, execute, monitor and service our investments. Our future success will depend to a significant extent on the continued service and coordination of our executive officers and key personnel. In particular, Benjamin S. Miller, our co-founder and Chief Executive Officer, is critical to the management of our business and operations and the development of our strategic direction. The departure of Mr. Miller or of any other executive officers or key personnel could have an adverse effect on our ability to achieve our investment objective.

The ability of the Programs to achieve their investment objectives depends on our ability to identify, analyze, invest in, finance and monitor real estate investments that meet their investment criteria. Our capabilities in structuring the investment process and providing competent, attentive and efficient services to our Programs depend on the employment of investment professionals in adequate number and of adequate sophistication to match the corresponding flow of transactions. To achieve the investment and growth objectives of the Programs, we may need to hire, train, supervise and manage new investment professionals to participate in our investment selection and monitoring process. We may not be able to find investment professionals in a timely manner or at all. We also face competition from other industry participants for the services of qualified investment professionals, both with respect to hiring new and retaining current investment professionals. Failure to support our investment process could have an adverse effect on our business, financial condition and results of operations. We do not carry any “key man” insurance that would provide us with proceeds in the event of the death or disability of our executive officers or key personnel.

Our business model depends to a significant extent upon strong relationships with key persons and companies in the real estate market for sources of investment opportunities. The inability of our executive officers or key personnel to maintain or develop these relationships, or the failure of these relationships to generate investment opportunities, could adversely affect our business.

We expect that certain of our executive officers and key personnel will maintain and develop our relationships with key persons and companies in the real estate market, and our Programs will rely to a significant extent upon these relationships to provide them with potential investment opportunities. Certain key persons and companies in the real estate market regularly provide us with access to their transactions. If our executive officers and key personnel fail to maintain their existing relationships or develop new relationships with key persons and companies in the real estate market for sources of investment opportunities, we will not be able to grow the investment portfolios of our Programs. In addition, individuals with whom our executive officers and key personnel have relationships are not obligated to provide us with investment opportunities, and, therefore, there is no assurance that such relationships will generate investment opportunities for our Programs.

The investment management business is intensely competitive.

The investment management business is intensely competitive, with competition based on a variety of factors, including investment performance, continuity of investment professionals and relationships with key persons in the real estate market, the quality of services provided to partner real estate operators, corporate positioning, business reputation and continuity of differentiated products. A number of factors, including the following, serve to increase our competitive risks:

| | • | a number of our competitors have greater financial, technical, marketing and other resources, including a lower cost of capital and better access to funding sources, more established name recognition and more personnel than we do; |

| | • | there are relatively low barriers impeding entry to new investment funds, including a relatively low cost of entering these businesses; |

| | • | the recent trend toward consolidation in the investment management industry, and the securities business in general, has served to increase the size and strength of our competitors; |

| | • | some competitors may invest according to different investment styles or in alternative asset classes that the markets may perceive as more attractive than our investment approach; |

| | • | some competitors may have higher risk tolerances or different risk assessments than we or our Programs have; |

| | • | other industry participants, private real estate funds and alternative asset managers may seek to recruit our qualified investment professionals; and |

| | • | we have a limited operating history and investors may choose conventional platforms with more operating experience and name recognition. |

If we are unable to compete effectively, our revenue would be reduced and our business could be adversely affected.

Poor performance of our Programs would cause a decline in our revenues and results of operations and could adversely affect our ability to raise capital for future Programs.

We generate the majority of our revenues from (i) origination fees from debt and equity investments paid by the real estate operators or joint-ventures with which we partner, (ii) asset management fees from our Programs, (iii) advisory fees from investors in our Programs, and (iv) interest income.

If any of our Programs perform poorly, either by incurring losses or underperforming benchmarks, as compared to our competitors or otherwise, our investment record would suffer. As a result, our revenues may be adversely affected and the value of our assets under management could decrease, which may, in turn, reduce our fees. Poor performance of our Programs could also make it more difficult for us to raise new capital. Investors in our Programs may decline to invest in future Programs we form as a result of poor performance. Investors and potential investors in our Programs continually assess the performance of our Programs independently and relative to market benchmarks and our competitors, and our ability to raise capital for existing and future Programs and avoid excessive redemption levels depends on our Programs’ performance. Accordingly, poor performance may deter future investment in our Programs and thereby decrease the capital invested in our Programs and, ultimately, our revenues. Alternatively, in the face of poor performance of our Programs, investors could demand lower fees or fee concessions for existing or future Programs which would likewise decrease our revenues.

The performance of our Programs depends primarily on the performance and net value of the underlying properties that our Programs own or in which our Programs make debt or equity investments. Lack of performance or a reduction of the net value of some of these properties may adversely affect the performance of our Programs, and our financial condition and results of operations would be harmed.

Our success depends significantly upon the performance and net value of the properties that our Programs own or in which our Programs make debt or equity investments. The performance and net value of these properties is subject to risks typically associated with real estate, which include the following many of which are partially or completely outside of our control:

| | • | climate change and natural disasters such as hurricanes, earthquakes and floods, or acts of war or terrorism, including the consequences of terrorist attacks, such as those that occurred on September 11, 2001, may result in a substantial damage to the properties; |

| | • | adverse changes in national and local economic and real estate conditions, including potential increases in interest rates and declines in real estate values, may adversely affect the investments of our Programs; |

| | • | an oversupply of (or a reduction in demand for) space in the areas where particular properties are located and the attractiveness of competing properties to prospective tenants may limit our Programs’ ability to attract or retain tenants; |

| | • | changes in governmental laws and regulations, fiscal policies and zoning ordinances may adversely affect the use of or rental income generated by the properties, and the related costs of compliance therewith and the potential for liability under applicable laws may result in losses to our Programs; |

| | • | remediation and liabilities associated with environmental conditions affecting properties may result in significant costs to our Programs; |

| | • | uninsured or underinsured property losses may result in corresponding losses to our Programs; |

| | • | an inability to realize estimated market rents may adversely affect the financial conditions of our Programs; |

| | • | a concentration of investments in properties in one sector (such as residential or retail properties) may leave our Programs’ profitability vulnerable to a downturn or slowdown in such sector and expose our Programs to risks unique to such sector; |

| | • | the geographic concentration of investments in a limited number of regions may expose our Programs to adverse conditions in such regions; |

| | • | properties that have significant vacancies could be difficult to sell, which could diminish the return on these properties; |

| | • | lease defaults or terminations by tenants could reduce our Programs’ net income; |

| | • | the profitability of investments in retail properties will be significantly impacted by the success and economic viability of the retail anchor tenants; |

| | • | potential development and construction delays and resultant increased costs and risks may hinder our Programs’ results of operations and decrease net income; |

| | • | actions of any joint venture partners that our Programs may have could reduce the returns on joint venture investments; |

| | • | the commercial real estate loans our Programs originate or invest in could be subject to delinquency, foreclosure and loss, which could result in losses to our Programs; |

| | • | investments in non-conforming or non-investment grade rated loans involve greater risk of loss; |

| | • | changes in interest rates and/or credit spreads could negatively affect the value of any debt investments our Programs may make, which could result in reduced earnings or losses; |

| | • | prepayments can adversely affect the yields on any debt investments our Programs may make; |

| | • | many of our Programs’ investments are illiquid and our Programs may not be able to vary their portfolios in response to changes in economic and other conditions; and |

| | • | if our Programs overestimate the value or income-producing ability or incorrectly price the risks of investments, they may experience losses. |

Fees received in connection with the management of our Programs comprise a significant portion of our revenues and a reduction in or elimination of such fees, including from the termination of certain relationships with our Programs, could have an adverse effect on our revenues and results of operations.

Our primary sources of revenue currently consist of (i) origination fees from debt and equity investments paid by the real estate operators or joint-ventures with which we partner, (ii) asset management fees from our Programs, and (iii) advisory fees from investors in our Programs. If the total assets or net investment income of our Programs were to decline significantly for any reason, including without limitation, due to short-term changes in market value, mark-to-market accounting requirements, the poor performance of our Programs’ investments or the failure to successfully access or invest capital, the amount of the fees we receive would also decline significantly, which could have an adverse effect on our revenues and results of operations.

In addition, fees paid to us could vary from due to a number of factors, including a Program’s ability to invest in properties or other real estate assets that meet its investment criteria, the interest rate payable on the debt securities it acquires, the level of its expenses, variations in and the timing of the recognition of realized and unrealized gains or losses, the degree to which it encounters competition in the market, its ability to fund investments and general economic conditions. Variability in fees we received would have an adverse effect on our revenues, results of operations and could cause volatility or a decline in the value of our Class B Common Stock.

In addition, the advisory, management or other arrangements between us or our affiliates on one hand, and any of our Programs on the other hand, may be terminated. For example, the manager of a Sponsored Program may be removed for “cause” upon the affirmative vote or consent of the holders of two-thirds of the then issued and outstanding common shares of such Sponsored Program. Additionally, the arrangement between Fundrise Servicing, LLC and our Programs, pursuant to which Fundrise Servicing, LLC receives certain servicing and other fees, may be terminated upon the occurrence of certain events, such as the insolvency of Fundrise Servicing, LLC or its failure to comply with the terms of the applicable servicing agreement. If any such arrangements between us or our affiliates on one hand, and any of our Programs on the other hand, are terminated, we would experience a reduction in or elimination of such fees, resulting in a significant decline in revenues.

Future pressures to lower, waive or credit back our fees could reduce our revenue.

We have on occasion lowered, waived or credited the fees otherwise payable to us in connection with our management of our Programs to improve projected investment returns and attract investors. There has also been a trend toward lower fees in some segments of the third-party asset management business, and fees payable to us in connection with our management of our Programs could follow these trends. In order for us to maintain our fee structure in a competitive environment, we must be able to provide investors with investment returns and service that will incentivize them to pay such fees. We cannot assure you that we will succeed in providing investment returns and service that will allow us to maintain our current fee structure. Fee reductions on existing or future Programs could have an adverse impact on our revenue.

The historical returns attributable to our Programs may vary significantly from the future results of our Programs, our new investment strategies, our operations or any returns expected on an investment in our Class B Common Stock.

We have presented in this offering circular the returns relating to the historical performance of our Programs. The returns are relevant to us primarily insofar as they are indicative of revenues we have earned in the past and may earn in the future, our reputation and our ability to form new Programs. The returns of our Programs are not, however, directly linked to returns on our Class B Common Stock, since an investment in our Class B Common Stock is not an investment in any of our Programs (although we typically invest a limited amount of capital in our Programs to create an alignment of interest with investors in our Programs). Therefore, you should not conclude that continued positive performance of our Programs will necessarily result in positive returns on an investment in our Class B Common Stock. However, poor performance of our Programs will cause a decline in our revenue from such Programs, and would therefore have a negative effect on our performance and the value of our Class B Common Stock. Moreover, the historical returns of our Programs should not be considered indicative of, and may vary significantly from, the future returns of these or any future Programs we may form, in part because our Programs’ returns have benefited from investment opportunities and general market conditions that may not repeat themselves, including the availability of debt capital on attractive terms, and there can be no assurance that our current or future Programs will be able to avail themselves of profitable investment opportunities.

In addition, the internal rate of return, or IRR, for any current or future Program may vary considerably from the historical IRR generated by any particular Programs, or for our Programs as a whole. Future returns will also be affected by the risks described elsewhere in this offering circular, including risks of the industries and businesses in which a particular Program invests.

The Programs face competition for investment opportunities, which could reduce returns and result in losses to the Programs and reduce our revenues.

Even though our Programs are focusing on investments consisting primarily of small balance commercial real estate assets, which we believe are not targeted by institutional funds, the Programs compete for the acquisition of properties and other investments and the origination of loans with certain other companies, including REITs, insurance companies, commercial banks, certain private investment funds, hedge funds, specialty finance companies, online investment platforms and other investors. Several of our competitors are substantially larger and have considerably greater financial, technical and marketing resources than we or our Programs do. For example, some competitors may have a lower cost of capital and access to funding sources that are not available to us or the Programs. In addition, some of our competitors may have higher risk tolerances or different risk assessments than we or our Programs have. These characteristics could allow our competitors to consider a wider variety of investments, establish more relationships and offer better pricing and more flexible structuring than we are able to do for our Programs. We may lose investment opportunities for our Programs if we do not match our competitors’ pricing, terms and structure. If we are forced to match our competitors’ pricing, terms and/or structure, we may not be able to achieve acceptable returns on investments for the Programs or such investments may bear substantial risk of capital loss, particularly relative to the returns to be achieved. Furthermore, a significant increase in the number and/or the size of our competitors in our target market could force us to accept less attractive investment terms for the Programs. Moreover, some of our competitors have greater experience operating under, or are not subject to, the regulatory restrictions that the Investment Advisers Act of 1940 imposes on the manager of our eDirectTM Programs.

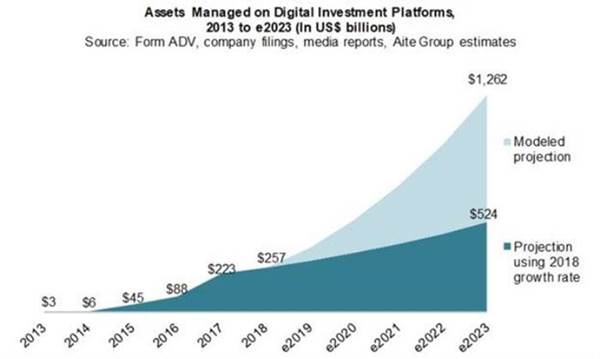

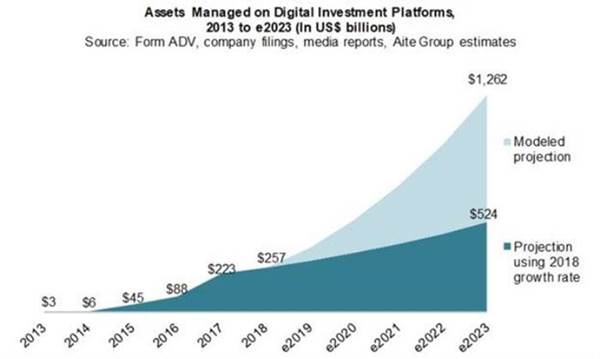

The significant growth we have experienced, particularly with respect to assets under management and revenues, will be difficult to sustain.

Our assets under management increased from approximately $250 million as of December 31, 2017 to approximately $2.41 billion as of December 31, 2021. The continued growth of our business will depend on, among other things, our ability to devote sufficient resources to maintaining existing investment strategies and developing new investment strategies and Programs, our ability to raise adequate capital for our Programs, our ability to identify and source appropriate real estate assets and investments, our ability to maintain and further develop relationships with real estate operators and other sources of investment opportunities, our success in producing attractive returns from our investment strategies, our ability to extend our distribution capabilities and direct investor traffic to the Fundrise Platform, our ability to deal with changing market conditions, our ability to maintain adequate financial and business controls and our ability to comply with legal and regulatory requirements arising in response to the increased sophistication of the real estate investment management market. Any failure to sustain the level of growth we have achieved historically could adversely affect our ability to generate revenues and control our expenses.

Our failure to manage future growth effectively may have an adverse effect on our financial condition and results of operations.

We may experience continued rapid growth in our operations, which may place a significant strain on our management, administrative, operational and financial infrastructure. Our success will depend in part upon the ability of our executive officers to manage growth effectively. Our ability to grow also depends upon our ability to successfully hire, train, supervise and manage new employees, obtain financing for our capital needs, expand our systems effectively, allocate our human resources optimally, maintain clear lines of communication between our transactional and management functions and our finance and accounting functions and manage the pressures on our management, administrative, operational and financial infrastructure. We also cannot assure you that we will be able to accurately anticipate and respond to the changing demands we will face as we continue to expand our operations, and we may not be able to manage growth effectively or to achieve growth at all. Any failure to manage our future growth effectively could have an adverse effect on our business, financial condition and results of operations.

We intend to expand into new investment strategies and geographic markets and may enter into new lines of business, each of which may result in additional risks and uncertainties in our businesses.

If market conditions warrant, we intend to grow by increasing assets under management in existing businesses and expanding into new investment strategies and geographic markets and may enter into new lines of business. We may develop new strategies and Programs organically through the Fundrise Platform. We may also pursue growth through acquisitions of critical business partners or other strategic initiatives.

Attempts to expand our businesses involve a number of special risks, including some or all of the following:

| | • | the required investment of capital and other resources; |

| | • | the diversion of management’s attention from our core businesses; |

| | • | the levels of experience of our executive officers, investment professionals and senior management in operating new investment strategies and Programs; |

| | • | the assumption of liabilities in any acquired business; |

| | • | unexpected difficulties or the incurrence of unexpected costs associated with integrating and overseeing the operations of new businesses and activities; |

| | • | entry into geographic markets or lines of business in which we may have limited or no experience; |

| | • | increasing demands on our operational and management systems and controls; |

| | • | new investment strategies and Programs may provide for less profitable fee structures and arrangements than our existing investment strategies and Programs; |

| | • | compliance with additional regulatory requirements; and |

| | • | the broadening of our geographic footprint, increasing the risks associated with conducting operations in certain jurisdictions where we currently have no presence. |

Entry into certain lines of business may subject us to new laws and regulations with which we are not familiar, or from which we are currently exempt, and may lead to increased litigation and regulatory risk. If a new business does not generate sufficient revenues or if we are unable to efficiently manage our expanded operations, our results of operations will be adversely affected. Our strategic initiatives may include joint ventures, in which case we will be subject to additional risks and uncertainties in that we may be dependent upon, and subject to liability, losses or reputational damage relating to systems, controls and personnel that are not under our control. Further, as we expand existing and develop new Programs that are not permanent capital vehicles, we may be subject to a greater risk of, among other things, investor redemptions and reallocation. Because we have not yet identified these potential new investment strategies, geographic markets or lines of business, we cannot identify all the risks we may face and the potential adverse consequences on us and your investment that may result from any attempted expansion. The risks described above, including those we cannot identify, may prevent us from growing our business through expanded product offerings or result in unexpected costs that may lead to a decline in our financial position and the value of our Class B Common Stock.

Operational risks may disrupt our business, result in losses or limit our growth.

We are heavily dependent on the capacity and reliability of the technology systems supporting our operations, whether owned and operated by us or by third parties. Operational risks such as interruption of our financial, accounting, compliance and other data processing systems, whether caused by fire, other natural disaster, power or telecommunications failure, cyber-attacks or other cyber incidents, act of terrorism or war or otherwise, could result in a disruption of our business, liability to investors, regulatory intervention or reputational damage. If any of these systems do not operate properly or are disabled for any reason or if there is any unauthorized disclosure of data, whether as a result of tampering, a breach of our network security systems, a cyber-incident or attack or otherwise, we could suffer financial loss, a disruption of our businesses, liability to our Programs, regulatory intervention or reputational damage. Insurance and other safeguards might be unavailable or might only partially reimburse us for our losses. Although we have back-up systems in place, our back-up procedures and capabilities in the event of a failure or interruption may not be adequate.

The inability of our systems to accommodate an increasing volume of transactions also could constrain our ability to expand our businesses. Additionally, any upgrades or expansions to our operations or technology may require significant expenditures and may increase the probability that we will suffer system degradations and failures.

Employee misconduct and unsubstantiated allegations against us could expose us to significant reputational harm.

We are vulnerable to reputational harm, as we operate in an industry where integrity and the confidence of investors in our Programs are of critical importance. If an employee were to engage in illegal or suspicious activities, or if unsubstantiated allegations are made against us by employees, stockholders or others, we may suffer serious harm to our reputation (as a consequence of the negative perception resulting from such activities or allegations), financial position, relationships with key persons and companies in the real estate market, and our ability to attract new investors. Our business often requires that we deal with confidential information. If our employees were to improperly use or disclose this information, we could suffer serious harm to our reputation, financial position and current and future business relationships.

It is not always possible to deter employee misconduct, and the precautions we take to detect and prevent this activity may not be effective in all cases. Misconduct by our employees, or even unsubstantiated allegations of misconduct, could subject us to regulatory sanctions and result in an adverse effect on our reputation and our business.

If our techniques for managing risk are ineffective, we may be exposed to unanticipated losses.

In order to manage the significant risks inherent in our business, we must maintain effective policies, procedures and systems that enable us to identify, monitor and control our exposure to market, operational, legal and reputational risks. Our risk management methods may prove to be ineffective due to their design or implementation or as a result of the lack of adequate, accurate or timely information. If our risk management efforts are ineffective, we could suffer losses or face litigation, particularly from our clients, and sanctions or fines from regulators.

Our techniques for managing risks in our Programs may not fully mitigate the risk exposure in all economic or market environments, or against all types of risk, including risks that we might fail to identify or anticipate. Any failures in our risk management techniques and strategies to accurately quantify such risk exposure could limit our ability to manage risks in those Programs or to seek positive, risk-adjusted returns. In addition, any risk management failures could cause fund losses to be significantly greater than historical measures predict. Our more qualitative approach to managing those risks could prove insufficient, exposing us to unanticipated losses in the net asset value of the Programs and therefore a reduction in our revenues.

We may be required to repay loans that we guarantee in order for our Programs to finance the acquisition of properties.

From time to time we may provide certain guarantees of loans in order for our Programs to finance the acquisition of properties. If, in the future, we are called upon to satisfy a substantial portion of these guarantees, our results of operations and financial condition could be harmed.

A significant amount of our Programs are structured through vehicles intended to qualify as REITs for U.S. federal income tax purposes. REITs are generally not subject to U.S. federal corporate income tax on their net income that is distributed to their shareholders. If any such Program fails to satisfy the requirements necessary to permit it to qualify for this favorable tax status, we could be subject to claims by investors and our reputation for structuring these Programs would be negatively affected, which would have an adverse effect on our financial condition and results of operations.