Exhibit 15.1

Q3 2022 - Letter to Investors

With a Fed-induced recession looming, the Fundrise portfolio continues to outperform.

The third quarter ended up unfolding much the way that we envisioned in our mid-year letter, with inflation continuing to remain stubbornly high and the Federal Reserve forced to become even more aggressive with its interest rate hikes. Rising rates had the impact that most would suspect, generally slowing growth. And, despite an attempted recovery in August, the stock market fell to new lows by the end of September, down nearly 24% for the year.

Meanwhile public REITs fared even worse, down more than 28% through the end of Q3.

In contrast, the broader Fundrise portfolio has continued to withstand much of these external pressures with remarkable resiliency. While overall growth has slowed relative to the beginning of the year, the average return across all clients’ accounts for Q3 was positive at 0.09%, resulting in a YTD average return of 5.40%, an outperformance relative to the stock market of approximately 30%.

2022 YTD returns through September 30, 2022

| | | Fundrise1

(all clients) | | | Public REITs2

(all US REITs) | | | Public stocks3

(S&P 500) | |

| Dividends (income return) | | | 1.67 | % | | | 1.85 | % | | | 0.90 | % |

| Appreciation (price return) | | | 3.73 | % | | | -30.19 | % | | | -24.77 | % |

| Total return | | | 5.40 | % | | | -28.34 | % | | | -23.87 | % |

Despite the recent positive-but-short-lived swings in the public markets, we feel the trend going forward remains clear: as markets continue to process the sustained impact of rising rates, growth will slow further, borrowing costs will rise, jobs losses will mount, and asset values (in most cases) will decline. The recession — which hindsight will likely show started mid-year — will continue into 2023, with the risk of a more severe decline dependent on the total magnitude of future interest rate increases.

A Fed-induced recession years in the making

Our conviction around this forecast stems from a broader belief that it is virtually impossible to fight the Fed. And while the future is inherently uncertain, we view it as our responsibility to put our investors in the best possible position based on the likelihood of a range of scenarios coming to fruition (especially as it relates to protecting the downside).

Today, we see ourselves in the midst of a scenario that has concerned us for years: the great deleveraging that would inevitably come from the 10+ years of accomodative monetary policy that followed the Great Recession of 2008 (i.e., low-interest rates and quantitative easing). In fact, we’ve been so paranoid about this risk that in 2017 we wrote a letter to all our investors telling them what they should expect from us during a financial crisis and have sent it to every new investor who has joined the platform since.

The current inflationary environment presents investors with a uniquely difficult challenge because, to combat this inflation, the Federal Reserve must adopt the explicit mandate to drive down asset values. The Fed’s goal is to reduce demand and, to do that, people and companies need to feel poorer. This is known as the “wealth effect,” and moving interest rates up and down is the primary method by which the Fed aims to achieve it. But adjusting interest rates is an indirect tool, often with lagging impacts, so the Fed often has to overshoot in order to ensure they’ve achieved their goal. For investors, living through this process can feel like trying to paddle upstream, in the middle of a hurricane, in nothing but a small rowboat.

Given this reality, the question most investors face today is not, “How much money am I going to make?” but instead, “How can I best avoid losing money amidst the avalanche of losses occurring across nearly every asset class?”

Fundrise and the real economy

In our mid-year letter, we stated that we believe the broader Fundrise portfolio, and its underlying investment strategies, represent as attractive an asset to hold in this environment as any we’re aware of… and three months later this still holds true.

Again, this is not because we believe the portfolio is immune to macroeconomic shockwaves or the impacts of rising rates. Such a belief would be born of hubris and a recipe for disaster.

Instead, (as stated before) our confidence stems from the fact that the Fundrise portfolio is made up of real assets (i.e., actual physical properties) which, in contrast to financial assets, derive their value from the utility they provide in people’s everyday lives.

Rental housing, which makes up the foundation of the portfolio, is a basic necessity. Meaning that even as everything gets more expensive and people start cutting back spending on nonessential comforts like new cars, entertainment, eating out, vacations, or NFTs of random cartoon animals, they will continue to spend a reliable percentage of their income on food and shelter. In fact, as we’ve cited many times before, rent is one of the costs that has historically kept pace with inflation, making rental housing one of the few investment assets potentially able to hold its value during periods like this one.

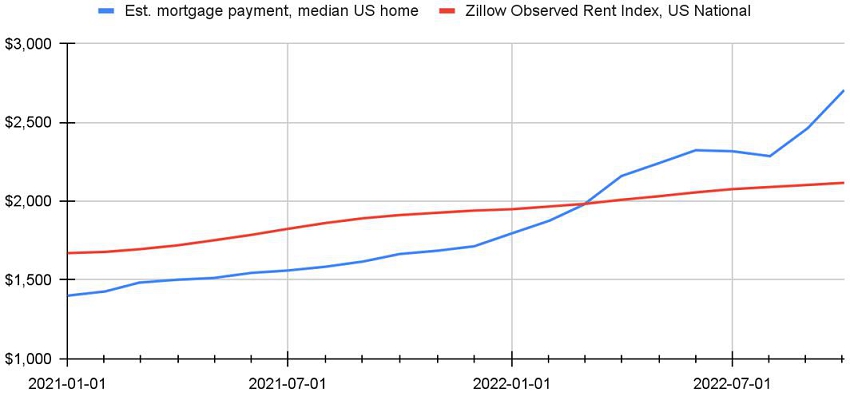

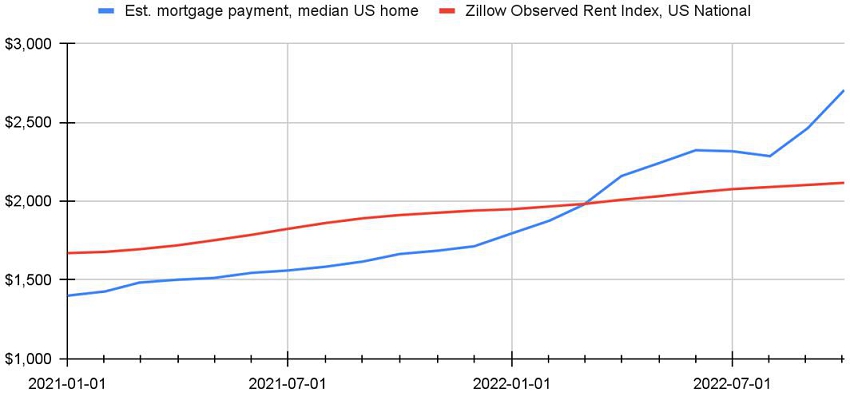

Additionally, as long as rates stay elevated, the rent-vs-buy decision will continue to skew in favor of “rent.” In the span of scarcely two years, the expected monthly mortgage payment for the buyer of a median-priced US home has nearly doubled, far outstripping both wage and rent growth, leading more and more would-be homebuyers to hold off on purchasing.

Estimated mortgage payment vs. national rent index

Source: Zillow Home Value Index (ZHVI), Federal Reserve Economic Data, & Zillow Observed Rent Index (ZORI), as of October 2022

It’s also worth noting that despite some of the headlines around falling home values, the environment today is very different from the dynamics that caused the housing crisis in 2008. The issues then were a result of overleverage and oversupply, whereas the housing market now is both underlevered and undersupplied. Mortgage underwriting standards over the past decade have been significantly tighter, requiring much higher credit scores and much more equity from borrowers. As a result, going into this year the average amount of equity held by homeowners was the highest on record.

The housing market today further benefits from strong demographic and technological macroeconomic drivers. The largest generation, Millennials, have entered the age when many will start families and want to move into single-family homes. Meanwhile, the remote work revolution has already transferred $500 billion of value from office buildings to residential property. In fact, by some measures, work from home has been responsible for approximately 60% of recent housing appreciation. Simply put, people use and value their homes more than ever, driving increasing demand and, over the long-term, increased values.

In summary, we are not suggesting that housing prices will not fall in the short run; in fact, they almost certainly will (though not likely to the same extent as during 2008). What all of these factors do suggest is that the underlying demand for housing as a utility should remain robust, and we expect that demand will shift increasingly away from for-sale housing and towards rental housing. As a result, we anticipate the fundamental drivers of performance for the Fundrise portfolio — rents, occupancy, delinquencies, etc. — will remain strong in the face of the broader recessionary headwinds.

What lies ahead

First, as always, it is worth reiterating that despite all of the strength outlined above we are not suggesting that the Fundrise portfolio is immune to any pain. If the Fed does continue to raise rates further, there will be inevitable declines in nearly all asset classes. And it is always possible that some assets within the portfolio may experience temporary write-downs in value, at least on paper. But we expect that, as has been true for the past nine months, our relative performance will far exceed nearly every other comparable.

Additionally, within what some may say is a gloomy near-term outlook on the economy, we actually see a great deal of silver lining. As the Fed continues to contend with the policies they wrought, it is refreshing to have economic fundamentals begin to matter again. Of course, recessions are not fun, and we don’t want to give the impression that the next several months won’t be difficult. But, slowly, the rules of the game are starting to make sense, and we for one welcome the end of “helicopter money” and investment performance having more to do with illusions and false promises than substance and execution. And yes, we are talking about things like dog coins and flying cars.

Once again, risk management matters. Execution rather than hype will deliver results. So although we expect the next 6-9 months to be volatile and that markets will get worse before they get better, we are already beginning to look ahead to an eventual bottom and finally tipping towards cautious optimism.

As always, we appreciate your continued support and hope you take comfort in knowing that we are confident in the long-term outcome because of the thousands of decisions we have made over the years to do right things rather than the expedient.

We recognize that the tortoise only beats the hare at the very end of the race and will continue to work as hard as we ever have to deliver exceptional results for you.

Onward.

Ben and the entire Fundrise team

–

A note on the impact of Hurricane Ian: Several investors have reached out inquiring about the impact on the portfolio from the recent deadly hurricane that made landfall in the Ft. Myers area of Florida. Most importantly, we want to share our support and sympathy with all those affected. We are very fortunate to be able to report that the portfolio did not experience any material damage (outside of some minor maintenance issues), nor do we expect there to be any impact to asset values at this time.

Appendices

Appendix A: Q3 2022 returns of client accounts by individual Fundrise sponsored fund4

| Fund name / objective | | Average AUM | | | Launch date | | Net total return | |

| Registered funds | | | | | | | | | | |

| Flagship Real Estate Fund | | $ | 1,271,866,717 | | | Jan 2021 | | | -0.88 | % |

| Income Real Estate Fund | | $ | 460,441,987 | | | Apr 2022 | | | 1.62 | % |

| Growth | | | | | | | | | | |

| Growth eREIT | | $ | 266,231,703 | | | Feb 2016 | | | 2.12 | % |

| Growth eREIT II | | $ | 133,054,747 | | | Sep 2018 | | | 0.66 | % |

| Development eREIT | | $ | 124,002,534 | | | Jun 2019 | | | -0.01 | % |

| eFund | | $ | 105,499,892 | | | Jun 2017 | | | -0.02 | % |

| Growth eREIT III | | $ | 67,132,633 | | | Feb 2019 | | | 2.64 | % |

| Growth eREIT VII | | $ | 96,562,505 | | | Jan 2021 | | | -7.21 | % |

| Growth eREIT VI | | $ | 34,305,244 | | | Dec 2019 | | | 0.96 | % |

| Balanced | | | | | | | | | | |

| East Coast eREIT | | $ | 184,635,981 | | | Oct 2016 | | | -1.02 | % |

| Heartland eREIT | | $ | 119,906,533 | | | Oct 2016 | | | 3.70 | % |

| West Coast eREIT | | $ | 95,882,476 | | | Oct 2016 | | | 1.06 | % |

| Balanced eREIT | | $ | 34,604,022 | | | Dec 2019 | | | 3.03 | % |

| Balanced eREIT II | | $ | 64,096,505 | | | Jan 2021 | | | 0.43 | % |

*Growth eREIT VII experienced a decrease in NAV of $0.91 per share for the quarter driven mainly by two factors. First, the general recessionary headwinds from rising interest rates outlined above. And second due to an administrative error that was discovered during the September 30th calculation. This miscalculation resulted in the June 30th NAV per share being overstated by approximately $0.67 per share.

Appendix B: YTD 2022 returns of client accounts by individual Fundrise sponsored fund4

| Fund name / objective | | Average AUM5 | | | Launch date | | Net total return | |

| Registered funds | | | | | | | | | | |

| Flagship Real Estate Fund | | $ | 1,045,312,683 | | | Jan 2021 | | | 4.34 | % |

| Income Real Estate Fund | | $ | 300,862,821 | | | Apr 2022 | | | 4.72 | % |

| Growth | | | | | | | | | | |

| Growth eREIT | | $ | 241,872,006 | | | Feb 2016 | | | 9.61 | % |

| Growth eREIT II | | $ | 115,835,210 | | | Sep 2018 | | | 9.27 | % |

| Development eREIT | | $ | 120,060,716 | | | Jun 2019 | | | -0.77 | % |

| eFund | | $ | 101,158,471 | | | Jun 2017 | | | 1.04 | % |

| Growth eREIT III | | $ | 61,169,580 | | | Feb 2019 | | | 15.60 | % |

| Growth eREIT VII | | $ | 74,273,634 | | | Jan 2021 | | | 2.82 | % |

| Growth eREIT VI | | $ | 44,382,741 | | | Dec 2019 | | | 3.82 | % |

| Balanced | | | | | | | | | | |

| East Coast eREIT | | $ | 170,541,482 | | | Oct 2016 | | | 8.30 | % |

| Heartland eREIT | | $ | 116,224,552 | | | Oct 2016 | | | 9.03 | % |

| West Coast eREIT | | $ | 97,107,887 | | | Oct 2016 | | | 4.05 | % |

| Balanced eREIT | | $ | 46,146,551 | | | Dec 2019 | | | 4.66 | % |

| eREIT XIV6 | | $ | 15,764,033 | | | Dec 2019 | | | 6.02 | % |

| Balanced eREIT II | | $ | 54,489,284 | | | Jan 2021 | | | 5.21 | % |

| Income | | | | | | | | | | |

| Income eREIT6 | | $ | 47,429,381 | | | Dec 2015 | | | 4.14 | % |

| Income eREIT II6 | | $ | 26,572,702 | | | Sep 2018 | | | 5.43 | % |

| Income eREIT V6 | | $ | 21,712,720 | | | Oct 2019 | | | 3.92 | % |

| Income eREIT 20196 | | $ | 14,252,090 | | | Jun 2019 | | | 5.34 | % |

| Income eREIT III6 | | $ | 12,065,884 | | | Feb 2019 | | | 5.57 | % |

Disclaimers

1. Figures represent the weighted average aggregate performance of all client accounts during the period indicated, including any shares acquired as a result of the reinvestment of dividends, and net of a 0.15% advisory fee, if applicable. Commissions are not considered since clients of Fundrise Advisors are not charged trading commissions or any other transaction-based fees. Returns were calculated using the Modified Dietz method. This information is presented for informational purposes only. Past performance is not indicative of future results, and any investment carries with it the risk of loss.

2. Specifically, the National Association of Real Estate Investment Trusts (NAREIT) All US REITs index total return, which includes both dividends and capital gains / losses, for the period indicated. This index covers all publicly listed US REITs and is designed to present investors with a comprehensive family of REIT performance indexes that spans the commercial real estate space across the US economy, with exposure to all investment and property sectors. As an index, the FTSE NAREIT All REITs index is inherently not investable, and is presented for informational purposes only.

3. Specifically, the S&P 500 index total return, which includes both dividends and capital gains / losses, for the period indicated. The index includes 500 leading companies and covers approximately 80% of available market capitalization of US publicly listed stocks. As an index, the S&P 500 is inherently not investable, and is presented for informational purposes only.

4. “Returns of client accounts by individual Fundrise sponsored fund” specifically refers to the time weighted return for the time period indicated, calculated using the Modified Dietz method. Returns are inclusive of dividends and capital gains / losses, are net of fees, and include shares which were acquired via dividend reinvestment. Past performance is not indicative of future results, and all investments may result in total or partial loss. All prospective investors should consult their personal tax and investment advisors before making any investment on the Fundrise platform. All estimated performance figures presented include both dividends and capital gains / losses, are net of fees, and include shares which were acquired via dividend reinvestment. For more information, please see our full performance disclosure, as well as the offering circulars available at fundrise.com/oc.

5. “Average AUM” is the daily average invested capital in the indicated program during the first half of 2022, calculated using the Modified Dietz method. The average capital calculation weights individual cash flows (for example investments or redemptions) by the length of time between those cash flows until the end of the period. Flows which occur towards the beginning of the period have a higher weight than flows occurring towards the end.

6. As of April 1, 2022, these funds were merged into the Fundrise Income Real Estate Fund, an SEC registered interval fund. For more information, see the full investor update.