Filed Pursuant to Rule 253(g)(2)

File No. 024-12141

RISE COMPANIES CORP.

SUPPLEMENT NO. 3 DATED MAY 3, 2023

TO THE OFFERING CIRCULAR DATED FEBRUARY 13, 2023

This document supplements, and should be read in conjunction with, the offering circular of Rise Companies Corp. (the "Company", “we”, “our” or “us”), dated February 13, 2023 and filed by us with the Securities and Exchange Commission (the “Commission”) on February 14, 2023 (the “Offering Circular”). Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the Offering Circular.

The purpose of this supplement is to:

| | · | Update the offering price for our common shares throughout the Offering Circular; and |

| | · | Provide, as Exhibit A, a copy of the Company’s webpage that was launched on or about the date hereof related to the Company’s offering. |

Offering Price for Our Common Shares

The following information supersedes and replaces the first paragraph on the cover page of the Offering Circular:

We are continuing to offer up to 1,004,692 shares of our Class B Common Stock to the public. As of May 1, 2023, we had sold 243,570 shares at $15.15 per share for approximately $3.7 million in offering proceeds. We previously settled approximately 18,686,856 shares of our Class B Common Stock in connection with our previous offerings. This does not include 635,555 shares that have been sold in a private placement offering. Effective May 3, 2023, the offering price per share of our Class B Common Stock is $15.90. Investors will pay the most recent publicly announced offering price as of the date of their subscription.

The following information supersedes and replaces the table on the cover page of the Offering Circular:

| | | Per Share | | | Total

Maximum (1) | |

| Public Offering Price (2) | | $ | 15.90 | | | $ | 19,664,688 | (5) |

| Underwriting Discounts and Commissions (3) | | $ | — | | | $ | — | |

| Proceeds to Us from this Offering to the Public (Before Expenses (4)) | | $ | 15.90 | | | $ | 19,664,688 | (5) |

| Proceeds to Other Persons | | $ | — | | | $ | — | |

| (1) | This is a “best efforts” offering, which means we are only required to use our best efforts to sell the Class B Common Stock offered in this offering. |

| (2) | The price per share shown was arbitrarily determined by our board of directors and may be changed from time to time by our board of directors in its sole discretion. |

| (3) | Investors will not pay upfront selling commissions in connection with the purchase of our Class B Common Stock. |

| (4) | All expenses incurred as a result of this offering, which we estimate to be approximately $300,000, will be borne by us. Estimated expenses include all expenses incurred from the commencement of this offering on February 13, 2023 through the expected termination of this offering in 2026, when we expect to file a new offering statement on Form 1-A. Purchasers of our Class B Common Stock are not directly responsible for costs incurred as a result of this offering. |

| (5) | We are currently continuing to offer an additional $16.0 million in our Class B common shares, which, when taken together with the approximately $39.1 million in Class B common shares sold in our current and previous offering in the last 12-months, is less than the rolling 12-month maximum offering amount of $75 million allowable under Regulation A. As of May 1, 2023, we have raised approximately $173.2 million from shares that were previously qualified as follows: |

| Date of Qualification | | Number of Class B

Shares

Qualified | |

| January 31, 2017 | | | 2,000,000 | |

| February 15, 2017 | | | 1,000,000 | |

| July 28, 2017 | | | 2,000,000 | |

| August 22, 2018 | | | 5,000,000 | |

| February 27, 2020 | | | 2,598,884 | |

| November 27, 2020 | | | 2,163,000 | |

| July 28, 2021 | | | 3,576,000 | |

| March 7, 2022 | | | 2,887,000 | |

| May 31, 2022 | | | 1,977,000 | |

| August 15, 2022 | | | 1,333,000 | |

| February 13, 2023 | | | 1,298,000 | |

| Total Prior Qualified Shares | | | 25,832,884 | |

The following information supersedes and replaces the first paragraph under “Use of Proceeds” on page 35 of the Offering Circular:

We estimate that the net proceeds to us from the sale of Class B Common Stock in this offering will be approximately $19.4 million, based upon (i) previous capital raised in this offering of approximately $3.7 million, (ii) the sale of an additional 1,004,692 shares of Class B Common Stock being offered under this offering circular at an offering price of $15.90 per share and (iii) an estimate of $300,000 offering expenses payable by us being deducted from the gross proceeds. Estimated expenses include all expenses incurred from the commencement of this offering through the expected termination of this offering in 2026, when we expect to file a new offering statement on Form 1-A. We previously raised approximately $169.5 million in our prior offerings.

The following information supersedes and replaces “Dilution” on pages 35 through 37 of the Offering Circular:

If you invest in our Class B Common Stock, your interest will be diluted to the extent of the difference between the offering price per share of our Class B Common Stock and the pro forma net tangible book value per share of our Class B Common Stock immediately after this offering. Dilution results from the fact that the per share offering price of our Class B Common Stock is substantially in excess of the pro forma net tangible book value per share attributable to the existing equity holders. Net tangible book value represents net book equity attributable to equity holders of the Company excluding intangible assets. Note, the net tangible book value does not include any assets or liabilities attributable to consolidated but non-controlling interests.

Our pro forma net tangible book value per share as of December 31, 2022, plus subsequent offering proceeds through May 1, 2023, was approximately $26.9 million, or approximately $0.62 per share of our Common Stock on a fully diluted basis. Pro forma net tangible book value represents the amount of total tangible assets less total liabilities. Pro forma net tangible book value per share represents pro forma net tangible book value divided by the number of shares of Common Stock outstanding on a fully diluted basis.

The following table illustrates the substantial and immediate dilution per share of Class B Common Stock to a purchaser in this offering, assuming issuance of an additional 1,004,692 shares of Class B Common Stock in this offering:

| On Basis of Full Conversion of Issued Instruments | | $19.7 Million

Raise | |

| Price per Share | | $ | 15.90 | |

| Shares previously issued in this offering | | | 243,570 | (1) |

| Additional estimated shares to be issued in this offering | | | 1,004,692 | |

| Total expected shares in this offering | | | 1,248,262 | |

| Previous proceeds from this offering | | $ | 3,690,086 | |

| Additional estimated proceeds from this offering | | $ | 15,974,603 | |

| Anticipated Net Offering Proceeds from this offering | | $ | 19,364,688 | (2) |

| Capital raised in previous offering(s) | | $ | 176,745,604 | (3) |

| Net Tangible Book Value Pre-Financing from this offering | | $ | 26,900,779 | (4) |

| Net Tangible Book Value Post-Financing | | $ | 42,875,382 | (4) |

| | | | | |

| Shares issued and outstanding Pre-Offering assuming full conversion | | | 43,275,355 | (5) |

| Post-Financing Shares Issued, net of Redemptions | | | 44,280,047 | (5) |

| | | | | |

| Net tangible book value per share prior to offering | | $ | 0.62 | |

| Increase/(Decrease) per share attributable to new investors | | $ | 0.35 | |

| Net tangible book value per share after offering | | $ | 0.97 | |

| Dilution per share to new investors ($) | | $ | 14.93 | |

| Dilution per share to new investors (%) | | | 93.91 | % |

| (1) | 243,570 shares have been previously sold in this offering at $15.15 per share for proceeds of approximately $3,690,086. |

| (2) | Net Offering Proceeds from this offering is net of estimated offering expenses of $300,000. Estimated expenses include all expenses incurred from the commencement of this offering on February 13, 2023 through the expected termination of this offering in 2026, when we expect to file a new offering statement on Form 1-A. |

| | |

| (3) | Includes proceeds raised from the offering of 9,966,425 shares pursuant to Regulation A and 23,668 shares pursuant to Rule 506(c) of Regulation D at an average share price of $6.64 in the Company’s initial offering, and proceeds raised from the offering of 8,720,431 shares pursuant to Regulation A and 611,887 shares pursuant to Rule 506(c) of Regulation D at an average share price of $11.83 in the Company’s previous offering. |

| (4) | Net tangible book value is based on the net tangible equity attributable to equity holders of the Company as of December 31, 2022 in additional to offering proceeds of $3,690,086 received after December 31, 2022. In the instance upon dissolution/sale of the Company, the value of assets and liabilities attributable to non-controlling interests would be excluded from the value of the Company. Thus, assets and liabilities attributable to non-controlling interests are excluded from the Company's net tangible book value. |

| (5) | Assumes conversion of all issued shares of Series A Preferred Stock to Class A Common Stock, and vesting of all issued restricted Class A Common Stock grants. |

The following table sets forth, as of May 1, 2023, on the same pro forma basis as above, the number of shares of Class B Common Stock purchased from us (net of redemptions), the total consideration paid, or to be paid, and the average price per share paid, or to be paid, by existing stockholders and by the new investors, using the prior offering results, and assuming the remaining 1,004,692 shares being offered pursuant to this Offering Circular are issued at $15.90 per share, before deducting estimated offering expenses payable by us:

| | | Dates Issued | | | Issued Shares | | | Effective Cash

Price

per Share at

Issuance

or Potential

Conversion | |

| Class A Common Stock | | | 2014-2019, 2021 | | | | 2,455,894 | | | $ | 0.17 | (2) |

| Class F Common Stock | | | 2014 | | | | 10,000,000 | | | | N/A | (3) |

| Series A Preferred Shares | | | 2014 | | | | 10,647,531 | (1) | | $ | 2.19 | |

| Series A Preferred Shares (Conversion of convertible notes payable) | | | 2014 | | | | 1,217,515 | (1) | | $ | 1.20 | |

| | | | | | | | | | | | | |

| Total Common Stock Equivalents | | | | | | | 24,320,940 | | | $ | 1.04 | |

| Class B Common Stock, assuming an additional $16.0 million raised | | | 2017-2023 | | | | 20,570,673 | | | $ | 9.61 | (4) |

| | | | | | | | | | | | | |

| Total After Inclusion of this Offering | | | | | | | 44,891,613 | | | $ | 4.97 | (5) |

| Class B Redemptions | | | | | | | (611,566 | ) | | | | |

| Total After Inclusion of this Offering, net of Class B redemptions | | | | | | | 44,280,047 | | | | | |

| (1) | Assumes conversion of all issued shares of Series A Preferred Stock to Class A Common Stock. |

| (2) | As of May 1, 2023, 2,453,935 shares have been authorized and issued, and are fully vested, and 1,959 options have been exercised. Class A Common Stock Issued previously included 432,965 forfeited shares, these are no longer included in the total Class A Common Stock Issued, as it is unlikely that we will reissue those shares under our Stock Plan in the foreseeable future. 1,912,900 shares were issued for an effective cash price of $0.1105 per share. 174,000 shares were issued for an effective cash price of $0.19 per share. 797,500 were issued for an effective cash price of $0.29 per share. 2,500 shares were issued for an effective cash price of $5.50 per share. 459 options were exercised for $5.50 per share and 1,500 options were exercised for $5.25 per share. |

| (3) | Common shares issued without cash payment includes 10,000,000 Class F shares to the co-founders for the contribution of Fundrise LLC, Popularise LLC, Fundrise Servicing LLC, and other assets of the Company. |

| (4) | Based on shares issued previously, and assuming the 1,004,692 remaining shares being offered pursuant to this offering circular are issued at $15.90 per share, the Class B weighted average per share will be $9.61. |

| (5) | Based on total Common and Preferred shares issued previously, and assuming the 1,004,692 additional Class B shares being offered pursuant to this offering circular are issued at $15.90 per share, the weighted average per share will be $4.97. |

The table above does not give effect to shares of our Class A Common Stock that may be issued upon the exercise of options that we expect to grant under our stock-based compensation plans after the time of this offering.

To the extent shares of our Class A Common Stock are issued pursuant to the Company’s 2014 Stock Option and Grant Plan, there will be further dilution to new investors.

Exhibit A

Webpage Information

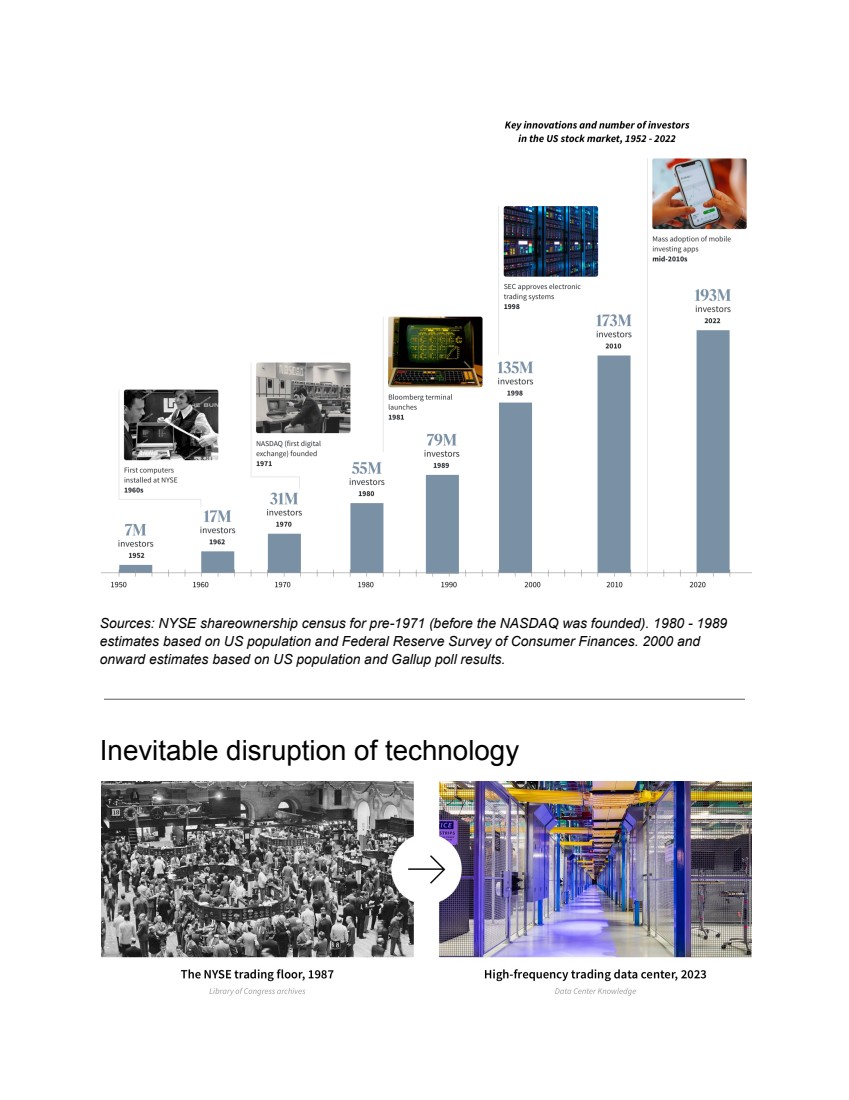

| The Fundrise iPO Internet public offering Our mission is to build a better financial system by empowering the individual. You’re invited to join us. The arc of financial history bends toward democracy. When we started Fundrise, institutions asked us, “Why bother with the little guy?” Private markets had always been exclusive to institutional and high net worth investors. Closed to +95% of individuals. What they didn’t understand is that democracy is inseparable from technology. Expanding access drives technological progress, which drives even greater access. Open markets win over closed markets. The past 100 years of public markets have been a virtuous cycle of technology and democracy. And, the history of public markets is the future of private markets. |

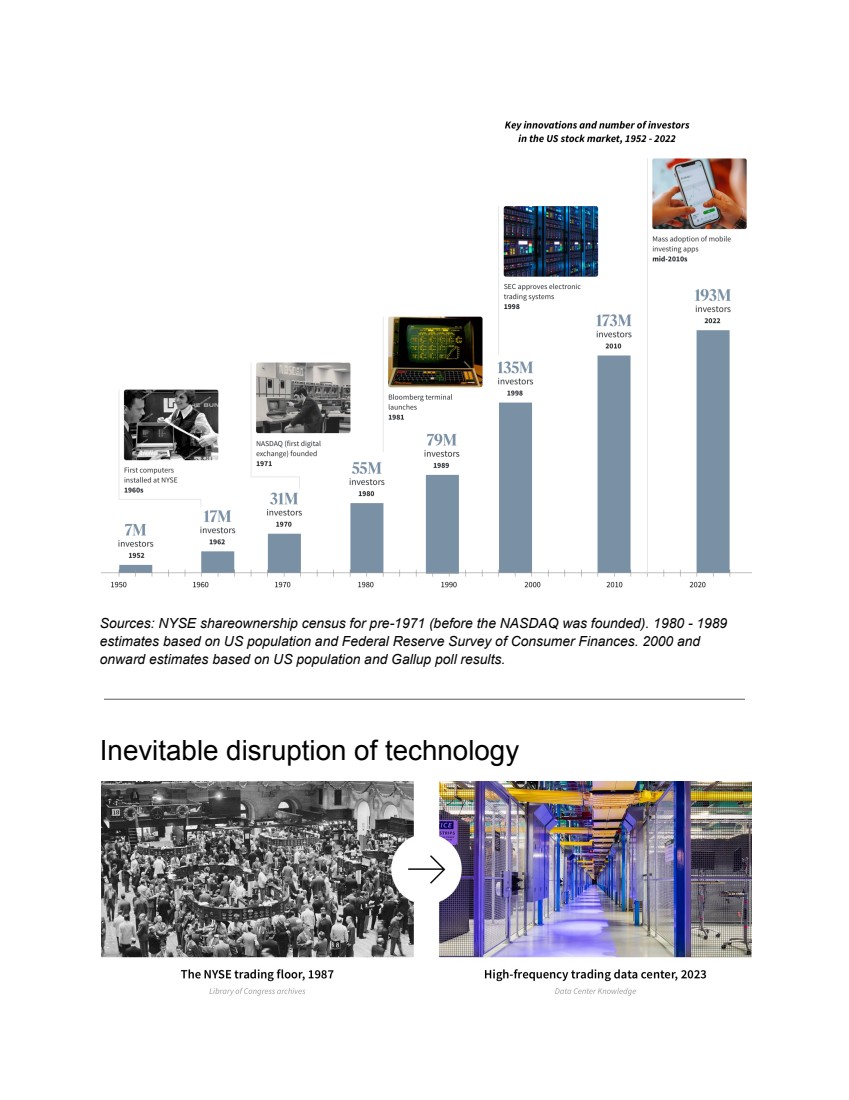

| Sources: NYSE shareownership census for pre-1971 (before the NASDAQ was founded). 1980 - 1989 estimates based on US population and Federal Reserve Survey of Consumer Finances. 2000 and onward estimates based on US population and Gallup poll results. Inevitable disruption of technology |

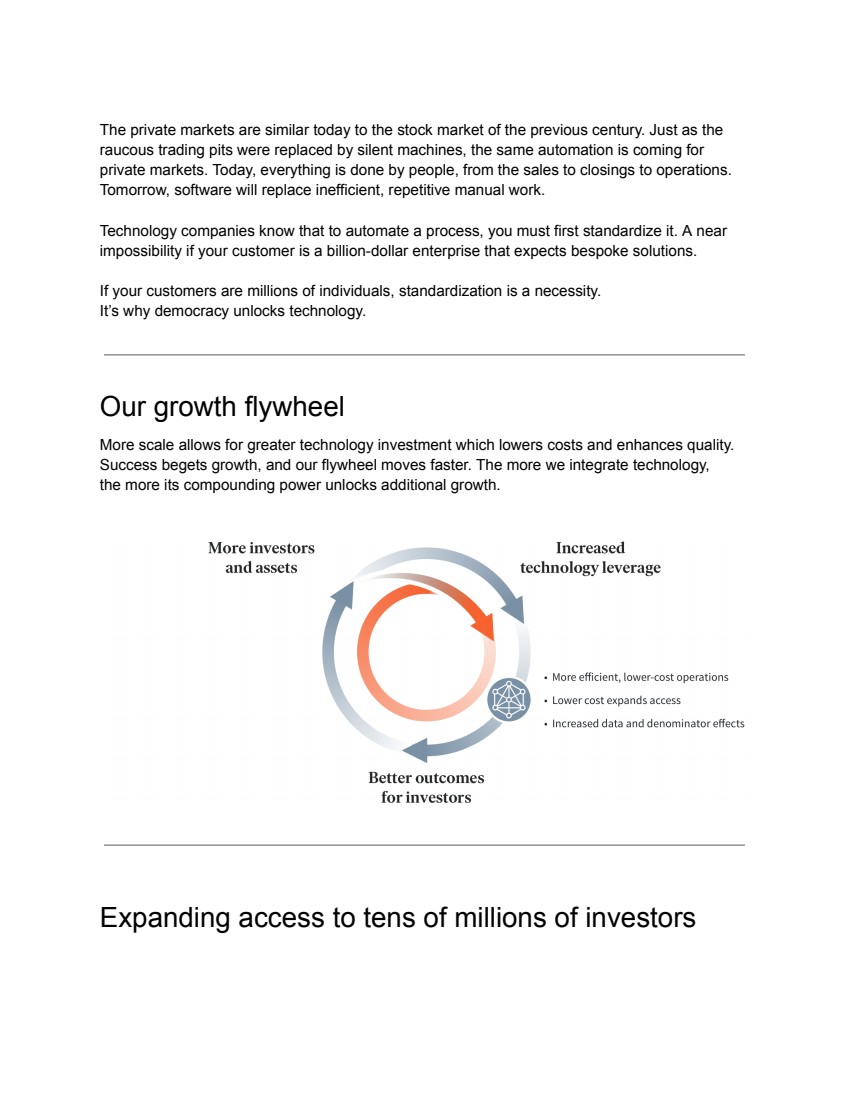

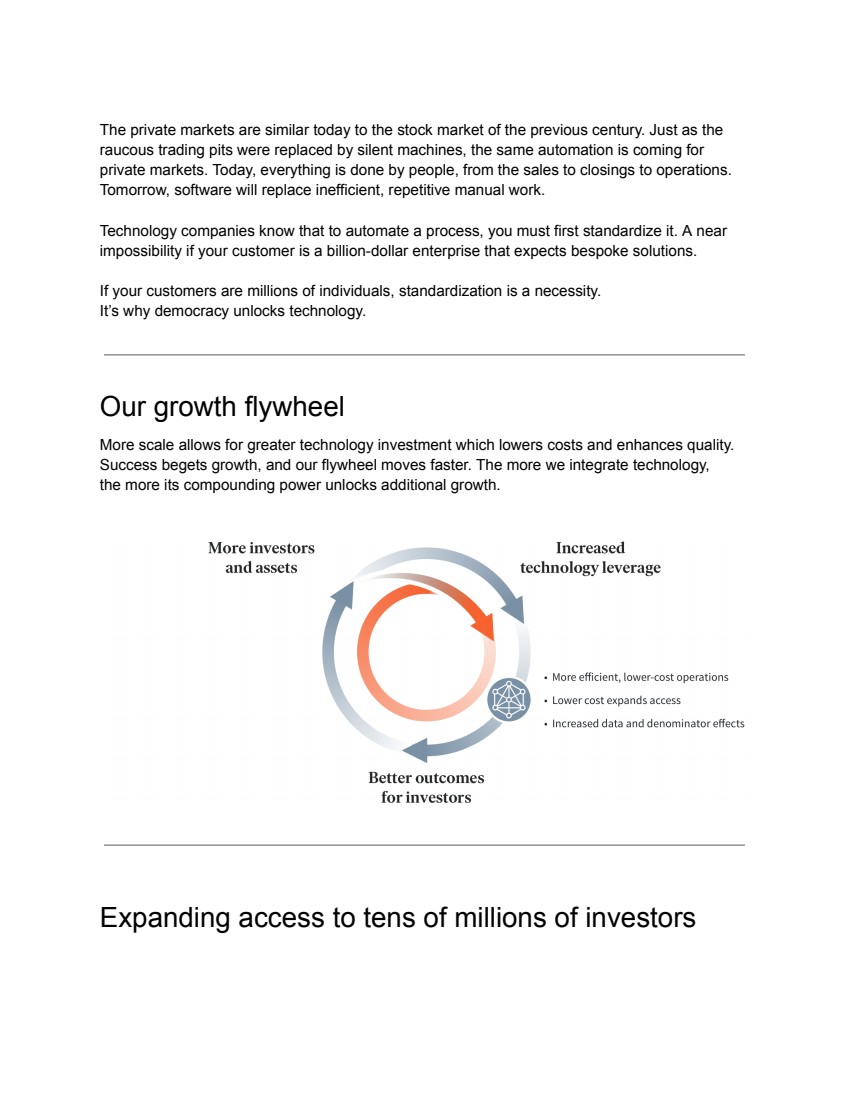

| The private markets are similar today to the stock market of the previous century. Just as the raucous trading pits were replaced by silent machines, the same automation is coming for private markets. Today, everything is done by people, from the sales to closings to operations. Tomorrow, software will replace inefficient, repetitive manual work. Technology companies know that to automate a process, you must first standardize it. A near impossibility if your customer is a billion-dollar enterprise that expects bespoke solutions. If your customers are millions of individuals, standardization is a necessity. It’s why democracy unlocks technology. Our growth flywheel More scale allows for greater technology investment which lowers costs and enhances quality. Success begets growth, and our flywheel moves faster. The more we integrate technology, the more its compounding power unlocks additional growth. Expanding access to tens of millions of investors |

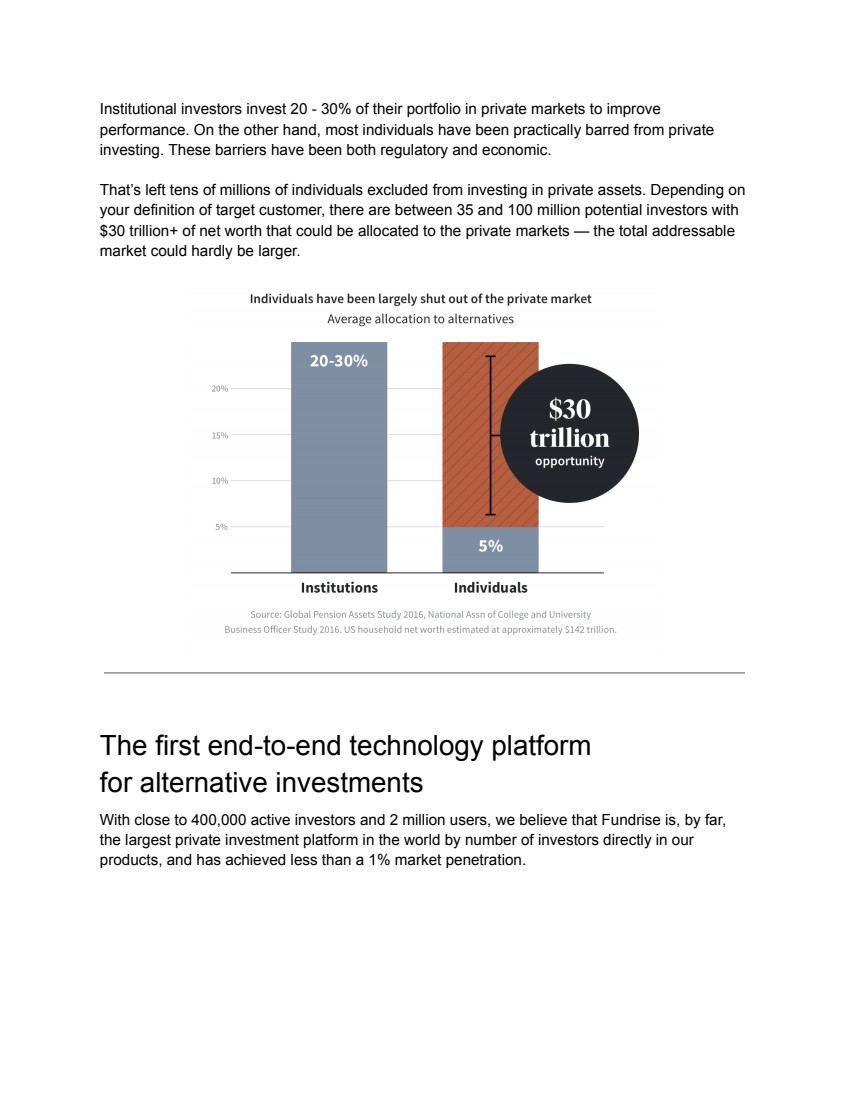

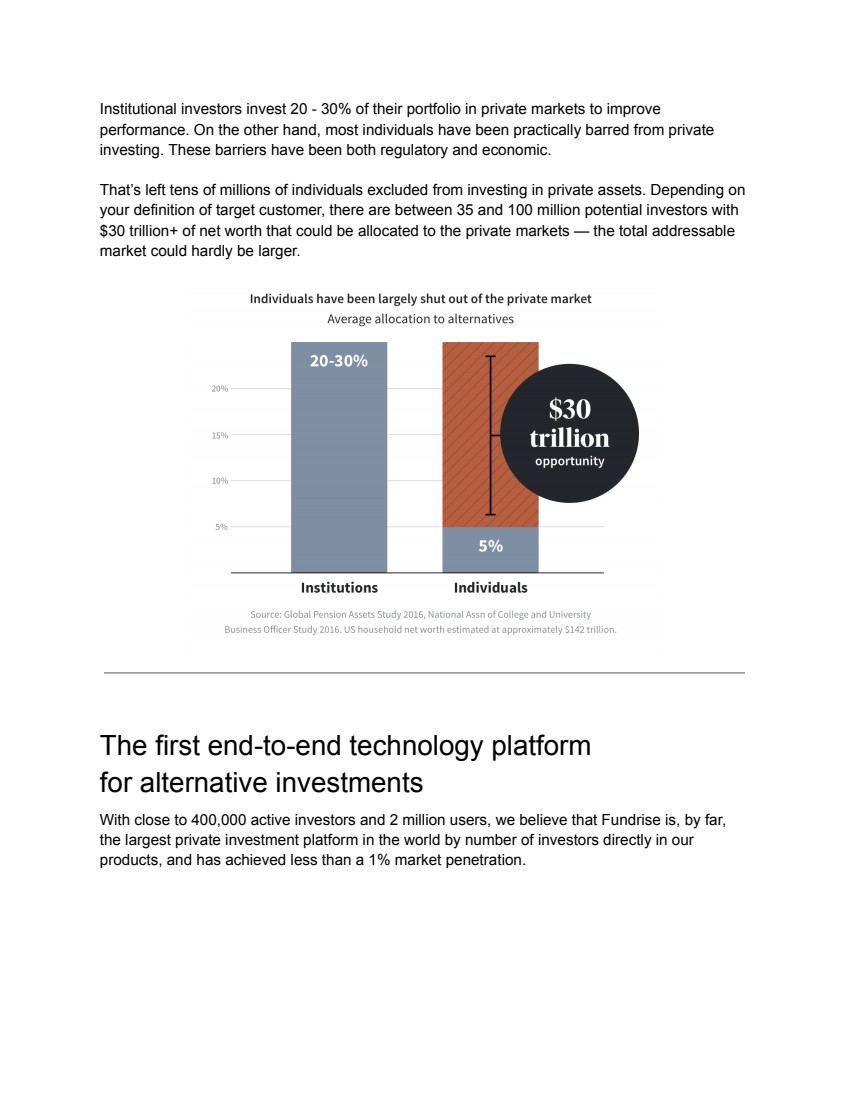

| Institutional investors invest 20 - 30% of their portfolio in private markets to improve performance. On the other hand, most individuals have been practically barred from private investing. These barriers have been both regulatory and economic. That’s left tens of millions of individuals excluded from investing in private assets. Depending on your definition of target customer, there are between 35 and 100 million potential investors with $30 trillion+ of net worth that could be allocated to the private markets — the total addressable market could hardly be larger. The first end-to-end technology platform for alternative investments With close to 400,000 active investors and 2 million users, we believe that Fundrise is, by far, the largest private investment platform in the world by number of investors directly in our products, and has achieved less than a 1% market penetration. |

| Distribution Through our web and mobile platforms, individuals can access institutional quality alternative investments, without the high-fees and mark-ups associated with traditional channels. Our proprietary payments software processed 2.5 million ACH transactions in 2021 and 3.7 million during 2022, while real-time reporting of return calculations is performed daily for each client account, currently storing over 29.3 billion data points. Selection Our internal software systems allow us to remove the double promote and systematize the back-of-house of accounting, tax, operations and fund operations, including software generating over a million 1099s and K-1s, maintaining 54 million shareholding records, and daily automated transfer agent integration, all at a minimal cost to the investor. Production We’ve revolutionized the asset management process by leveraging modern data infrastructure tools to unlock real time information, automate reporting, and improve decision making across our approximately $6 billion real estate portfolio, which consists of 16,000+ residential units and more than 3 million square feet of commercial space across multifamily, build for rent, urban infill and last-mile industrial asset classes. |

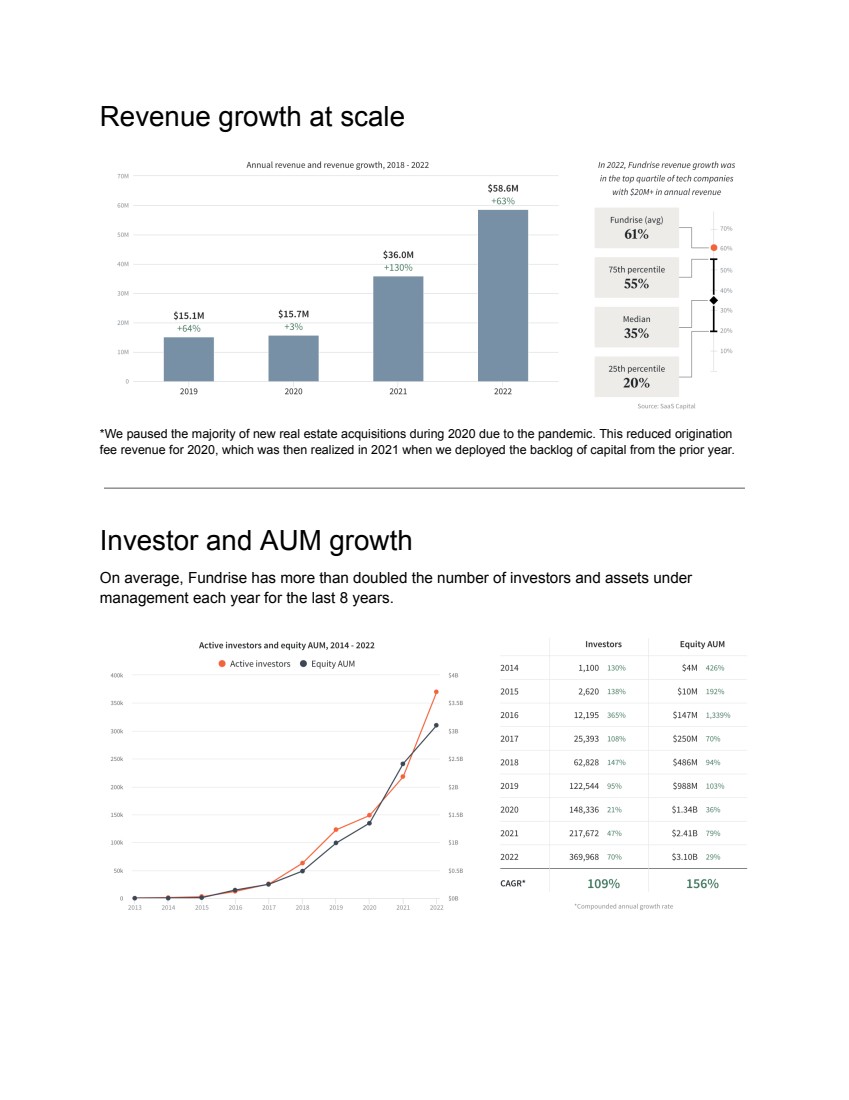

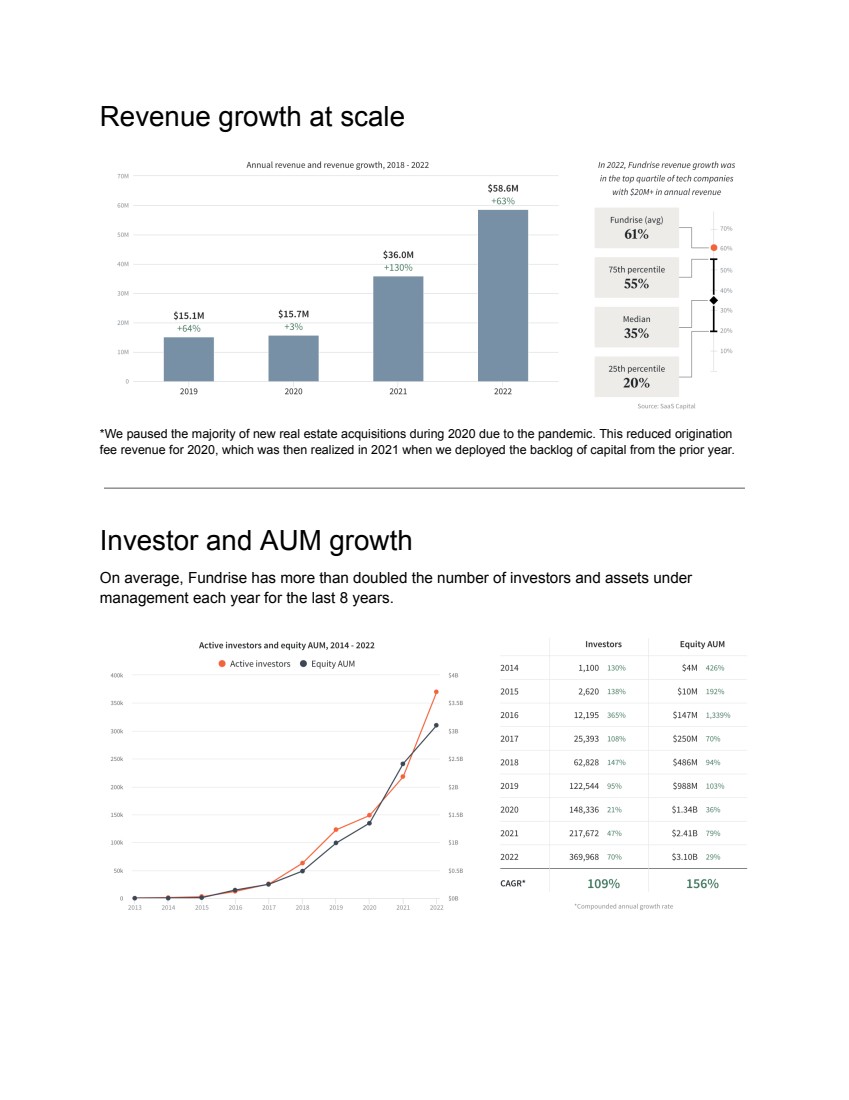

| Revenue growth at scale *We paused the majority of new real estate acquisitions during 2020 due to the pandemic. This reduced origination fee revenue for 2020, which was then realized in 2021 when we deployed the backlog of capital from the prior year. Investor and AUM growth On average, Fundrise has more than doubled the number of investors and assets under management each year for the last 8 years. |