UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-SA

SEMIANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the Semiannual Period ended June 30, 2023

Rise Companies Corp.

(Exact name of issuer as specified in its charter)

| Delaware | | 45-4862460 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

11 Dupont Circle NW, 9th Floor

Washington, DC

(Full mailing address of principal executive offices) | | 20036

(Zip Code) |

(202) 584-0550

Issuer’s telephone number, including area code

TABLE OF CONTENTS

Item 1: Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and the related notes thereto contained in this Semiannual Report on Form 1-SA. The following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in the Statements Regarding Forward Looking Information contained in our latest offering circular (the “Offering Circular”) qualified by the Securities and Exchange Commission (“SEC”) on February 13, 2023 as part of the latest post-qualification amendment to our latest offering statement, which may be accessed here. Except as otherwise required by the U.S. federal securities laws, we disclaim any obligations or undertaking to publicly release any updates or revisions to any forward-looking statement to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Unless otherwise indicated, the latest results discussed below are as of June 30, 2023. The consolidated financial statements included in this filing as of June 30, 2023 and for the six months ended June 30, 2023 and 2022 are unaudited and have not been reviewed, and may not include year-end adjustments necessary to make those financial statements comparable to audited results, although in the opinion of management all necessary adjustments have been included to make interim statements of operations not misleading.

Business

Rise Companies Corp. (“Rise”, “Rise Companies”, “we”, “our”, the “Company” and “us”), together with its affiliate organizations (“Fundrise”), combines modern financial technology and what we believe is best-in-breed investment management to build the next generation of alternative asset management infrastructure. We generate revenue from fees related to a portfolio of approximately $6.5 billion of real estate and technology assets. Our technology platform has allowed us to build a differentiated business with a significant competitive advantage, including approximately 409,000 investors, 2 million users, and what we believe is cutting-edge software infrastructure.

In the pursuit of our mission to democratize investing in private markets, we believe we are now the largest direct-to-investor alternative asset manager in America. With nearly 300 employees, our aim is to build and own the future of private markets.

Technology inevitably disrupts every industry. We’ve seen it over and over again — in commerce, media, advertising, computing, communication, and even work itself. Today, there remain only a few great bastions still resisting this revolution — airlines, automobiles, energy, real estate, and capital formation to name a few. These industries, we believe, have been more resistant to current technology because, as companies like Tesla have shown, they are more capital intensive and therefore require enormous outlays of risk capital to achieve the scale necessary to deliver a truly disruptive product.

From the beginning, the mission of Fundrise has been to build a better financial system — one that we are designing to work on behalf of individuals rather than at their expense. However, the financial system itself is enormous and far too large for us to try to improve all at once. It is complex, full of arcane regulation, and has hardly changed over the past century.

We believe the public markets are where the vast majority of individuals invest and, not coincidentally, where there has been a significant amount of technology penetration and disruption. The raucous trading pit has been replaced by silent machines. The internet and apps drove the cost to trade stocks down to zero. Public company data has never been so transparent and readily available. The promise of an efficient market is truer than ever.

On the other hand, we believe our private markets still resemble the public markets of more than a half century ago. Transactions are performed manually by salespeople. Data is opaque and fragmented. Access is fundamentally barred to individuals. Sophisticated investors capture excess alpha from highly inefficient markets.

In short, we believe the private financial markets have managed to escape true disruption to-date and are ripe for reinvention. So, we first focused on giving our investors access to the real economy by redefining the process of investing in real estate. As of December 31, 2022, based on data from recent PERE rankings, Fundrise (through our Fundrise Investment Products, (as defined below within Other Details, Corporate Structure)) is one of the 50 largest real estate private equity investors in the world by total annual fundraising and total annual deployment, both raising and deploying more than $2 billion of capital over the last two years, 2021 and 2022. This year, we expanded our scope into growth equity, giving investors the chance to build a portfolio of companies that may become tomorrow’s technology giants by investing in high growth, mid-to-late stage private technology companies in sectors like modern data infrastructure, fintech, and artificial intelligence and machine learning. We have spent over ten years building a technology platform (the “Fundrise Platform”) that disrupts those asset classes, democratizing and reimagining private markets altogether.

Rise Timeline of Innovation and Growth

Where we started

We believe the financial system, at its most basic level, is made up of three component parts to the value chain: 1) distribution, 2) investment (or selection), and 3) production (or operation). And while the glory may lie in investment or selection, we believe the power is actually in the distribution and production.

We started by rebuilding the distribution phase because, at the time, we believed it was the most ripe for disruption. The internet had created a new channel by which to communicate and interact with customers, and through our app and web platform, we unlocked direct private non-traded real estate investment as an asset class that had previously been unavailable for most individual investors. We then paired this customer interface with our own backend infrastructure, leveraging software to drive down the marginal cost of investment to nearly zero. As a result, we were able to bring the minimum investment down from the traditional hundreds of thousands to only $10, and for the first time (in our opinion) truly democratize access to the private real estate market.

This process of opening up private markets to individuals is, on its own, a big business.

We believe distribution (aka fundraising) is power, because ultimately he or she who writes the checks makes the decisions. And unlike most investment managers who distribute their investments through an army of salespeople, we at Fundrise have formed direct relationships with hundreds of thousands of individuals.

And “hundreds of thousands” is just a start. We believe there are tens of millions of investors who will need access to private markets over the next several years and decades. By freeing control of the capital from traditional institutions, we have been able to build a new system without institutional encumbrance from the resistance to change by those who fear career risk.

However, as we’ve said, the mission of Fundrise — and its true, deeper potential — lies in disrupting not only one step of the chain but the entire financial system itself.

Where we are going

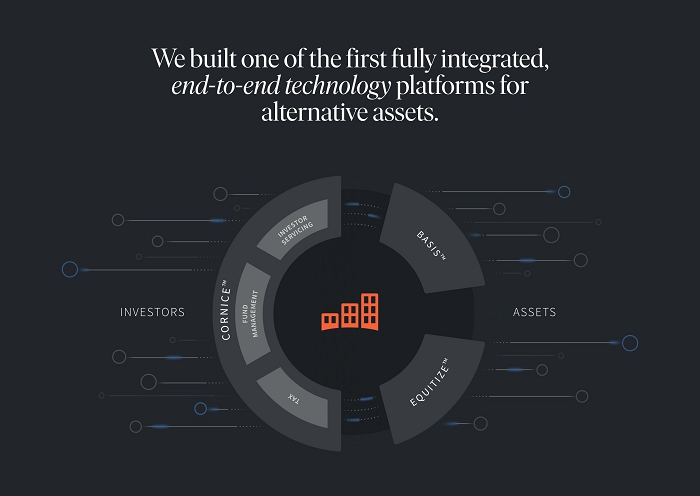

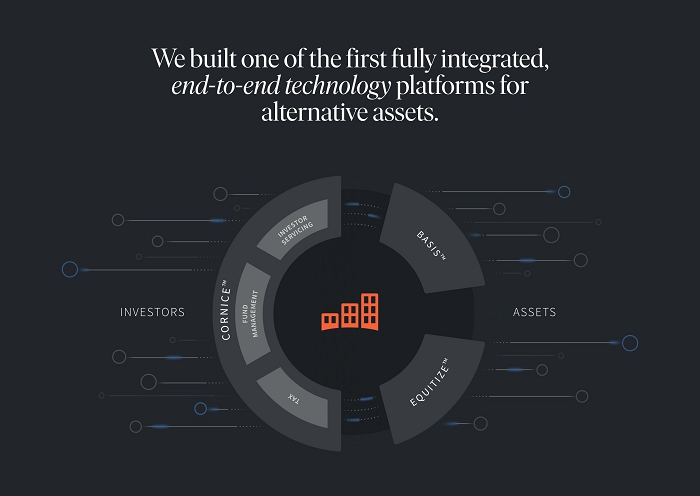

We are systematically replacing each step with software. Over time, we have built a new set of rails for the private investment industry.

To paraphrase the saying, how does software eat finance? One byte at a time.

Over the past several years, our energy and attention has increasingly expanded to redesigning and rebuilding both the investment/selection and production/operation components of the value chain. And while we still have a lot left to do, we have at this point created (to our knowledge) the first truly end-to-end software platform connecting the dollars entrusted to us by our investors directly to the assets we are investing in and operating on their behalf.

And while we believe the benefits, both existing and future, are numerous, two simple measures of the value of our system come in the form of (i) greater overall efficiency (or reduced costs) as a result of vertical integration and lower overall fees; and (ii) alignment of the decisions made at each step of the chain, back up to what we perceive is in the best interest of investors in our Fundrise Investment Products.

Over the years, we have come to believe that we are building a much different company than most in the financial industry appreciate (something we think is a good thing). We believe this is probably because most fintech companies to date have been more hype than substance, essentially acting as shiny digital wrappers of the same underlying systems and products.

Where we stand today

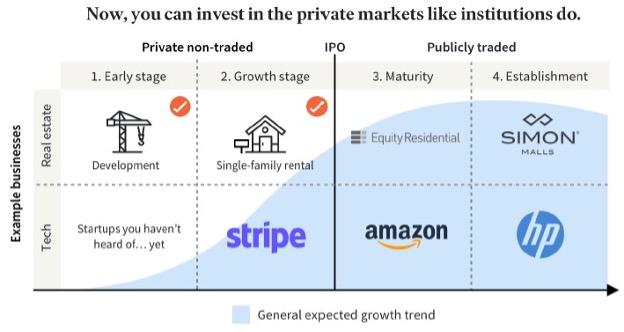

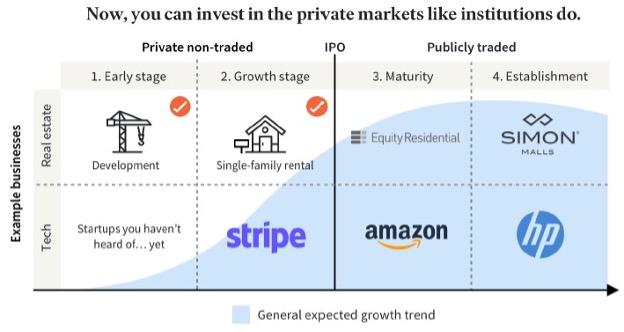

When an individual invests through the Fundrise Platform, they are investing into private market assets previously outside the reach of the everyday individuals. This is, of course, as opposed to the public markets (such as publicly traded stocks, ETFs, etc.). Increasingly, companies are not entering the public markets until later and later, if at all. The lifecycle of growth companies and assets is increasingly occurring in private markets. See this example(1).

(1) The above general expected growth trend is only to illustrate the general expectations of institutional investors when making their investment analyses and does not reflect actual or expected growth of investments made with our Fundrise Investment Products. All company names, logos and brands are property of their respective owners. All company, product and service names and logos used in this document are general examples used for informational purposes only. Use of these names, logos and brands does not imply endorsement.

And much like trying to invest in Snowflake, Google, or Uber before they went public, access to private market (i.e. “early stage”) investments is restricted -- only available to those who go through a series of institutional channels controlled by intermediaries and gatekeepers, all of whom charge hefty tolls in the form of performance fees, sales commissions, and other transaction costs.

In fact, unless they happen to be old enough to have a pension, we believe most investors simply do not have any feasible way to access private markets and as a result are limited to investing exclusively in publicly traded stocks.

This matters because we believe that a more diversified portfolio generally results in a better risk-adjusted return. Moreover, when they invest in a company (or real estate asset) once it is in the public markets, investors are far more often than not paying a higher price, i.e., a premium, vs. those who have the ability to buy into the asset while it is still private.

This idea of both disrupting and reinventing the “private equity value chain” lies at the very heart of the Fundrise Platform. Our platform today covers the following aspects of the value chain:

| | · | Distribution: Fundrise owns and operates the Fundrise Platform, a leading alternative asset investment platform, that: |

| | o | allows individuals to invest in what we believe is both a superior and simpler investing experience, including: |

| | § | frictionless investment transaction and management that is constantly evolving with the goal of becoming the most simple, transparent, and user-friendly experience in finance; |

| | § | ultra-low costs and zero upfront fees, eliminating high-fee broker-dealers and other expenses of the investment process usually involving many intermediaries; |

| | § | payment processing, including deep validation layers for anti-fraud, non-sufficient funds, and identity; we processed 3.7 million ACH transactions in 2022 and 2.1 million during the period ended June 30, 2023; |

| | § | real-time reporting of return calculations performed daily for each client account via ETL software layer, currently storing over 36.6 billion data points; and |

| | o | enables investors in our Fundrise Investment Products to earn returns from alternative asset classes that have generally been unavailable to many individual investors. |

| | · | Selection: Fundrise has created an investment and fund management platform that leverages automated processes and reporting to reap the benefits of a lower cost structure of a back-of-house built with APIs and data stores rather than PDFs and Excel that allows for us to: |

| | o | remove the double promote (where alternative fund sponsors receive a share of the profits in the distribution waterfall) common with alternative asset investments; |

| | o | systematize the back-of-house of accounting, tax, operations and fund operations, including software generating over a million 1099s and K-1s at minimal cost to the investor; and |

| | o | maintain 57 million unique shareholding records, including daily automated transfer agent integration. |

| | · | Production: Fundrise has developed operating platforms that leverage software to lower the operating cost and improve the selection, management, and performance of investments by: |

| | o | building “software-first” solutions to manage deal origination and investment data capture; and |

| | o | developing a systems-based approach to asset management and operations that systematically updates and replaces the data input and analysis with our proprietary software. |

Employees

As of the date of this filing, we had 294 employees (all of which were full-time employees), the majority of whom work remotely.

Legal Proceedings

As of the date of the consolidated financial statements, we are not currently named as a defendant in any active or pending material litigation. However, it is possible that the Company could become involved in various litigation matters arising in the ordinary course of our business. Although we are unable to predict with certainty the eventual outcome of any litigation, management is not aware of any litigation likely to occur that we currently assess as being significant to us.

Results of the Business

We are encouraged by both the performance of the managed real estate assets held by our Fundrise Investment Products (as defined within the Other Details, Corporate Structure section) and by our own ability to navigate and continue to grow throughout the economic upheaval and public health crisis brought on by the COVID-19 pandemic, coupled with a period of heightened economic uncertainty due to inflation that is not transitory in nature, supply chain problems initially brought on by pandemic disruptions and exacerbated by the Russian invasion of Ukraine, and other factors.

We achieved a 30% growth in Fundrise Platform’s AUM for the eighteen months ended June 30, 2023. It has been our belief that as the broader demographic tailwinds create a new generation full of millions of new investors, the platform that was able to provide consistently strong performance with the best overall experience would be well-positioned to succeed. According to the Deloitte Center for Financial Services, the vast majority of new wealth creation in the United States will come from Generation X and Millennials, who will increase from approximately 28% in 2020 to 47% in 2030 of all wealth in the United States. We believe that Fundrise is well positioned to become the go-to platform for the rising generations to invest in the real estate industry and other alternative asset classes, and to leverage data and technology in its efforts to empower and center the individual as the key stakeholder in the financial services markets.

Since the start of 2022, we continued to build on our products and improve the overall platform, most notably:

| | · | The Fundrise Investment Products generated consistently strong returns for investors relative to the broader stock market and publicly listed REITs. Based on our long-term focus and strategy, Fundrise delivered its strongest ever total performance in 2021, generating an average net return for investors in our Fundrise Investment Products of 22.99%. As the public markets faltered in 2022, the average net return for our Fundrise Investment Products’ investors for 2022 was approximately 1.50% and the Fundrise Investment Products achieved their best relative performance ever, beating the S&P 500 on an absolute basis by nearly 20%. As of June 30, 2023, despite headwinds brought on by further interest rate hikes, our income-focused funds continued to achieve an average net total return of 0.65%. |

| | | |

| | · | We streamlined the Fundrise Investment Products’ investor experience by merging six of the Income eREITs into the new Income Interval Fund (defined below), which is our second real estate fund registered under the Investment Company Act (a “40 Act Fund”). As of June 30, 2023, $2.0 billion of our total $3.19 billion AUM in the Fundrise Investment Products, or approximately 62%, is in a 40 Act Fund. We believe this shift to the 40 Act Fund structure will benefit investors in our Fundrise Investment Products with increased efficiency and diversification due to their larger overall scale, which will allow raising and deploying into strong income return focused assets, with the aim of further driving down fund-level operating costs, ultimately resulting in stronger potential returns for such investors. |

| | · | The Fundrise Investment Products secured additional credit facilities on their portfolio of real estate assets for a total committed value of $815 million with major financial institutions as of June 30, 2023 including Goldman Sachs Bank (NYSE: GS), The Hartford (HIG), Metlife (NYSE: MET), KeyBank (NYSE: KEY), Regions Financial Corp (NYSE: RF), Citizens Financial Group (NYSE: CFG), and US Bank (NYSE: USB). |

| | · | We have built up the single-family rental home operating platform and portfolio held by certain of the Fundrise Investment Products to a total of more than $1.4 billion of real estate under management, consisting of approximately 4,500 homes across over 80 communities as of June 30, 2023. Our goal is to create a portfolio of homes that can achieve operating economies of scale, generating consistent income, while at the same time positioning the Fundrise Investment Products to capture what we believe will be outsized price appreciation thanks to the confluence of demographic factors driving demand for affordably-priced rental homes. |

| | · | We completed the full deployment of our real estate operating platform where we took on the work from former third party vendors which allows us to use “software-first” solutions to manage deal origination and investment data capture and a systems-based approach to asset management and operations (the “Real Estate Operating Platform”). We believe this will better serve investors in our Fundrise Investment Products with lower, less complex, more transparent fees earned by fewer, incentive-aligned, scalable, and sustainable parties without the potential bias or associated marginal costs. Most importantly we are not charging carried interest or a promote (generally 20% of the profits in the distribution waterfall to be paid to other sponsors) in our Fundrise Investment Products that are open to everyday investors. We believe this aligns our incentives to create better outcomes for individuals as we don’t have a disproportionately large share in the upside (a consideration that often leads to short-term thinking and profit motivations). |

| | · | In July 2022, we launched the Fundrise Innovation Fund (defined below), seeking to raise $1 billion for a first-of-its kind, perpetual growth equity fund aimed at democratizing access to investments in top private technology companies. |

June 30, 2023 year-to-date net returns of all client accounts by investment plan objective:

| Plan objective | | Income | | | Balanced | | | Growth | | | Overall | |

| Dividends | | | 1.96 | % | | | 0.96 | % | | | 0.60 | % | | | 0.99 | % |

| Appreciation | | | -1.30 | % | | | -1.86 | % | | | -2.12 | % | | | -1.87 | % |

| Net Total Return(1) | | | 0.65 | % | | | -0.90 | % | | | -1.53 | % | | | -0.88 | % |

| | (1) | “Net Total Return” consists of the time-weighted, weighted-average aggregate returns of Fundrise Advisors client accounts that have participated in the indicated investment plan objective during the period indicated, calculated using the Modified Dietz method. Net total returns are inclusive of dividends and capital gains / losses, are net of fees, and include shares that were acquired via dividend reinvestment. “NAV distributions” (if any) are considered as part of the appreciation / price return component. Net total returns do not include investments in the Fundrise Opportunity Fund, Innovation Fund, and Credit Fund. |

As of June 30, 2023, we have yet to generate any profits from our operations and are incurring net losses, and do not expect to generate any profits while we continue to build the business and invest in big ideas and new innovation.

Outlook and Recent Trends

Our optimism about the Company, our continued evolution, and our future success in executing on our mission is rooted in over a decade-long history of innovative ideas, exceptional engineering talent, patience for and focus on long-term growth rather than short-term results, and a commitment to the mission and our customer, the individual. Our annual growth throughout the past three years since the beginning of the COVID-19 pandemic is an achievement we are incredibly proud of and exemplifies an underlying concept we’ve been passionate about at Rise since the beginning: non-linear growth. It is a common misconception that the growth of companies, when observed over long periods of time, is – or even should be – clear and steady. In actuality, we believe nearly all massively successful businesses in today’s environment have experienced punctuated periods of non-linear growth unlocked through true product or market innovations. This phenomenon has certainly held true in Rise’s over ten-year history, as we have always seen a small number of critical initiatives lead to outsized growth that has allowed us to reach milestones that seemed previously unattainable.

It’s important to remember that while Rise is a technology company focused on finance, our performance reflects aspects of investment management, real estate and alternative asset management, and software as a service businesses. As a result, our performance and potential are not fully captured by metrics used by the companies operating in those industries today, given the generally outdated approach taken by businesses in those industries. We believe that, as our business scales, while our growth may increase in absolute terms, our individual performance metrics on a standalone basis may not reflect our total performance or may require looking at new metrics that reflect the evolution of our business model. In short, we believe the metrics that matter the most to us in operating our business and creating new value for our customers, and therefore in creating an effective measurement of our success, will continue to evolve. Accordingly, it may be insufficient to rely solely on any single performance metric as a measurement of our success.

The Metrics That Matter

In our business today, the metrics that drive our success and direct our attention are those that most effectively describe our geometric growth. Of course, revenue and expense on a gross basis as well as by category are key; the mass adoption of our technology platform and the performance of our advised investment vehicles is also clearly relevant. You can see those metrics within our “Results of the Business” and “Results of Operations” sections herein. And while we are proud of the current year growth reflected by those metrics, we have always been and will continue to be focused on the long-term. We believe we are at the beginning of a multi-decade paradigm shift across many macroeconomic trends (the automation of investment management, the wealth accumulation of the millennial generation, increasing allocation to investment alternatives outside of stocks and bonds, and from pensions to self-managed investments) and feel poised to ride an expected tidal wave of change for years to come. We are constantly evaluating our current products and the competitive landscape to ensure we position ourselves in front of that change as opposed to chasing it.

The signal has become clear enough that many in the private investment industry are now starting to pitch the idea(s) of “perpetual capital” and access for retail investors. But the problem is that that is only part of the solution. We believe they’re missing the software-driven flywheel necessary to successfully re-orient their business. You can’t execute the strategy of tomorrow with yesterday’s way of doing business.

For example, the way many asset managers talk about the key growth metric of “perpetual” capital (to describe a portion of their investment vehicles that are not constituted of time bound commitments of capital) is directionally accurate but lacks context for significant differences in the underlying distribution model, and therefore growth potential. Clearly, the market recognizes that recurring fee, perpetual capital vehicles for retail investors are more valuable than vintage, term-defined funds made up of institutional, bespoke-needs capital. We agree on “the what.” However, we believe the fundamental key to growth is in “the how” - and that the old school, manual, and intermediated distribution is inferior to an integrated technology platform, and that despite the industry’s pivot towards the right type of capital, they will not dominate the next paradigm of the industry because they are not built to be technology companies. They have held on too tightly and for too long to yesterday’s model – trapped by a classic “Innovator’s Dilemma”. To be sure, some of our competitors may pivot in time, or have the resources to acquire a machine that will allow them to compete, but we believe that the paradigm shifts we’ve discussed make it certain that as the next generation comes of age the majority of market share currently held by old line asset managers is up for grabs and, with our technology and substantial lead, we expect can be ours for the taking.

The combination of macro trends referenced above, our company specific strategies, and where we are in our growth trajectory means that the metrics we track and emphasize within our business will evolve as we grow and the macro trends unfold. The majority of our growth today comes from existing customers increasing their investment size as their investable assets grow and we prove our ability to deliver attractive, uncorrelated returns. With a young investor base and perpetual capital, we believe we have decades to grow with our customers. With this multi-decade opportunity in mind, we focus on optimizing our profit potential over a long-term investor relationship as opposed to a more transactional approach. And so, with respect to metrics not demonstrated by financial results, the portion of our customers who are committed to our product offerings through a direct relationship with us over a long-term basis is the result we are focused on maintaining and continually improving.

Our success today is most accurately managed, and therefore measured, by metrics that relate to our customer level economics and broader strategic differentiation. Some of these metrics include the percentage of our assets under management (“AUM”) that is perpetual, the percentage of our account-holding users with whom we have a direct relationship (i.e. not through an intermediary such as a third party investment adviser), and the percentage of our active users with whom we have a recurring monthly investment, among other time-tried technology business metrics such as active investors in our Fundrise Investment Products, new investor growth in our Fundrise Investment Products, AUM growth from existing investors in our Fundrise Investment Products, and retention at both the Investment Product investor and AUM level. As our business matures, our success will continue to be measured by these metrics, in addition to a heavier weighting towards more traditional, enterprise-level metrics like growth in top line revenue, gross margin expansion, EBITDA, free cash flow, and operating leverage.

Looking back over the last few years - from the COVID-19 pandemic, to the non-transitory inflationary period, to pandemic instigated and war-related global supply chain problems - we believe the combination of the right assets (multifamily residential, single-family rental, and last-mile industrial), owned at reasonable basis (often at or below replacement cost), in the right markets (currently primarily in the Sunbelt), and at relatively conservative leverage (generally less than 50% LTV at a portfolio level) all work together to create what we believe is a remarkably stable foundation (or fortress) able to weather a potentially severe economic storm.

While success is never guaranteed, we believe we continue to be on track to build a world class data and technology-enabled alternative asset investment platform.

Results of Operations

For the six months ended June 30, 2023 and 2022, our results of operations are as follows:

| Results | 2023

(in

thousands) | 2022

(in

thousands) | %

Change

(from

2022) | Explanation |

| Operating Revenue |

| Investment management and platform advisory, net | $15,709 | $12,862 | 22% | As our fee structure remained unchanged, the increase was driven by growth in AUM on the Fundrise Platform between the two periods. The increase was bolstered by platform advisory fees growing period-over-period due to continued investor growth. |

| Real estate portfolio strategy | 4,291 | 12,984 | -67% | The decrease in transactional-based real estate portfolio revenues period-over-period is driven by our strategic decision to hold more cash in response to the market slowdown which has continued throughout the first half of the year relative to the market in the comparative period, resulting in originating fewer deals and closing fewer financings. |

| Real estate operating platform | 9,892 | 4,432 | 123% | This increase is driven by growth in AUM of our affiliates for which we provide real estate asset management services as well as additional development fee revenues collected from our affiliates. Refer to Note 2, Summary of Significant Accounting Policies – Real Estate Revenues for more details. |

| Other operating income | 696 | 1,701 | -59% | The decrease was primarily due to higher expense recoupments in the prior year related to waived expenses of the Flagship Fund and Income Real Estate Fund (defined below) pursuant to certain expense limitation agreements for the recently launched funds in the prior year. |

| Total operating revenue | $30,588 | $31,979 | -4% | |

| | | | | |

| Operating Expenses |

| Investment management and platform advisory | Investment management and platform advisory expenses consist of salaries and benefits for teams responsible for investor relations and operations (“investor servicing”) for the Fundrise Investment Products. Certain allocated salaries and benefits in the prior year Consolidated Financial Statements were reclassified from General, administrative and other to Investment management and platform advisory to conform to current year presentation. Refer to Note 2, Summary of Significant Accounting Policies – Basis of Presentation for more details. |

| $3,190 | $2,797 | 14% | The increase was driven by an increase in headcount in our investor servicing teams between the two periods. |

| Real estate strategy and operations | Real estate strategy and operations expenses consist of costs attributable to activities that most directly relate to the acquisition, origination, and operations of real estate investments for real estate operators that are borrowers from, or joint-venture partners with, the Fundrise Investment Products, in addition to the allocated salaries and benefits expense of our real estate team. Certain allocated salaries and benefits in the prior year Consolidated Financial Statements were reclassified from General, administrative and other to Real estate strategy and operations to conform to current year presentation. Refer to Note 2, Summary of Significant Accounting Policies – Basis of Presentation for more details. |

| $6,699 | $5,601 | 20% | The increase was driven by an increase in headcount in our real estate team between the two periods. |

| Technology and product development | Technology and product development expenses consist primarily of salaries and benefits for teams responsible for software engineering, product management, and technology activities; and amortization of internally developed software. These teams work on the development and maintenance of the software and technology assets of the Fundrise Platform, including CorniceTM, BasisTM, and EquitizeTM. Technology and product development is expensed as incurred, except for development and testing costs related to internally developed software that are capitalized and subsequently amortized over the expected useful life. Certain allocated salaries and benefits as well as amortization of internally developed software in the prior year Consolidated Financial Statements were reclassified from General, administrative and other to Technology and product development to conform to current year presentation. Refer to Note 2, Summary of Significant Accounting Policies – Basis of Presentation for more details. |

| $10,429 | $8,520 | 22% | The increase was driven by an increase in headcount in our software engineering and product management teams and an increase in amortization expense of internal use software between the two periods. We capitalized approximately $7,226,000 and $5,222,000 for the six months ended June 30, 2023 and 2022, respectively, in software development costs. |

| Marketing | Marketing expenses consist primarily of the costs associated with engaging and enrolling investors in the Sponsored Programs, including costs attributable to marketing and selling our products. This includes costs of building general brand awareness, and salaries and benefits expenses related to our marketing and design teams. Certain allocated salaries and benefits in the prior year Consolidated Financial Statements were reclassified from General, administrative and other to Marketing to conform to current year presentation. Refer to Note 2, Summary of Significant Accounting Policies – Basis of Presentation for more details. |

| $7,137 | $24,372 | -71% | The decrease was due to a planned pull-back of our marketing spend due to the current economy. |

| General, administrative and other | General, administrative and other expenses consist primarily of software and office expenses, professional fees, and other expenses, which primarily consists of salaries and benefits for our corporate functions (including finance, legal, human resources and IT operations teams), write offs, and other miscellaneous expenses. Certain allocated salaries and benefits in the prior year Consolidated Financial Statements were reclassified from General, administrative and other to Marketing, Real estate strategy and operations, Technology and product development, and Investment management and platform advisory to conform to current year presentation. In addition, certain allocated salaries and benefits in the prior year Consolidated Financial Statements were reclassified from Technology and product development to General, administrative and other to conform to current year presentation. Refer to Note 2, Summary of Significant Accounting Policies – Basis of Presentation for more details. |

| Software and other office expenses | $2,339 | $2,266 | 3% | Software and other office expenses remained consistent period-over-period and are comprised of mainly of software subscription expenses used to maintain and improve operations. |

| Professional fees | 979 | 2,820 | -65% | The decrease was due to a planned pull-back of our spending due to the current economy, particularly in regards to recruiting expenses. Additionally, advisory costs related to regulatory matters decreased in the current period, as certain advisory projects neared conclusion. |

| Other general and administrative | 4,262 | 7,505 | -43% | The decrease was primarily due to a reduction in administrative costs of the Income Interval Fund and Innovation Fund prior to launch incurred in the prior year, as well as a planned pull-back of other discretionary spend. |

| Total operating expenses | $35,035 | $53,881 | -35% | |

Key Factors Impacting Our Current Year Performance

Our historical growth rates in facilitating investments through the Fundrise Platform reflect a deliberate strategy that has allowed us to build and develop the various enterprise functions needed to meet the changing demands of our customers and to support our scale, including operations, risk controls, customer support, compliance and technology. Demand from real estate operators, investors, and the modern financial industry will continue to inform our business and investment product decisions, but we have so far failed to see value for investors in our Fundrise Investment Products in compromising our long-term focus to pursue short-term measures that we believe would result in investment performance below our standards. Given this approach and the dynamic path of our experienced and expected future growth, we have focused this year on a number of important developments within our business that we believe reflect the key factors impacting our performance in 2023. Refer to the Key Factors We Expect to Impact Our Future Performance section below for a description of these key factors.

Key Factors We Expect to Impact Our Future Performance

Investment in Long-Term Growth

The core elements of our growth strategy include enrolling new investors in our Fundrise Investment Products, broadening our investment acquisition capabilities, enhancing our technology infrastructure, expanding our product and feature offerings, and extending customer lifetime value. We plan to continue to invest resources needed to accomplish these goals, and we anticipate that certain operating expenses will continue to increase for the foreseeable future, particularly our technology and product development, and real estate strategy and operations expenses. These investments are intended to contribute to our long-term growth, but they may continue to affect our near-term profitability.

Sources of Capital – Fundrise Investment Products

Investors in our Fundrise Investment Products provide the equity capital into the Fundrise Investment Products through the use of the Fundrise Platform. Our model is built specifically to leverage the economies of scale created by the internet to cut fees, while also lowering execution costs and reducing both time and manual resources. Our end-to-end integrated platform transforms the real estate origination, underwriting, operations, investment processing, and servicing, replacing expensive sales and management teams with online applications, implementing data driven decision making, and automating transactions through payment processing and APIs (application programming interfaces).

Sources of Operating Revenues and Cash Flows

We generate revenues from investment management and platform advisory fees, real estate portfolio strategy fees, and real estate operating platform fees. See Note 2, Summary of Significant Accounting Policies - Revenue Recognition in the financial statements for further detail.

Liquidity and Capital Resources

We have incurred operating losses since our inception and have an accumulated deficit of $159.7 million as of June 30, 2023. We have financed our operations primarily through the issuance of equity securities. Our ability to achieve profitability depends on our ability to generate revenue growth in existing product lines, successfully launch new product lines and manage costs. We may continue to incur substantial operating losses while we continue to build the business and invest in new innovation.

As of June 30, 2023 and December 31, 2022, we had $21.8 million and $29.7 million in cash and cash equivalents, respectively. We anticipate that our cash and cash equivalents as of June 30, 2023, and forecasted revenue, will provide sufficient liquidity for more than a twelve-month period from the date of filing these financial statements. The actual amount of cash that we will need to operate is subject to many factors, including, but not limited to our product development and engineering efforts. We are dependent upon significant future financing, including through our Offering described below under Offering Results, to provide the cash necessary to execute our ongoing and future operations, including the continued development of our products.

As of June 30, 2023, and December 31, 2022, our material commitments for capital expenditures consisted of operating leases, as discussed in Note 5, Leases in the Notes to the Consolidated Financial Statements..

In addition, as of December 31, 2022, the Company had a future commitment of approximately $12,069,000 related to a construction mezzanine debt deal with no up front funding from us, as a result of Rise Companies fully consolidating the Fundrise Opportunistic Credit Fund, LLC (“Credit Fund”). Upon the launch of the Credit Fund on February 28, 2023, the fund was deconsolidated and no commitments existed related to the deal.

Fundrise LP – Sidecar Investment Fund

As part of the 2014 Series A Preferred financing round, we raised a $10 million sidecar private fund called Fundrise LP, which was formed to support assets originated and facilitated by the Fundrise Platform and to support our overall growth. See Note 14, Non-Controlling Interests in Consolidated Entities for further detail.

Corporate Debt

As of June 30, 2023 and December 31, 2022, we had corporate debt payable of approximately $2.7 million. In April 2020, we entered into a loan agreement with Citizens Bank as the lender (the “Lender”), pursuant to which the Lender provided a loan (the “PPP Loan”) under the Paycheck Protection Program offered by the U.S. Small Business Administration (the “SBA”) in the principal amount of $2,793,800 pursuant to Title 1 of the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”). We received the full loan amount on April 27, 2020.

As explained more fully in Note 9, Loans Payable – PPP Loans Payable, according to the terms of the Paycheck Protection Program, the subsequent passing of the Paycheck Protection Program Flexibility Act (the “PPPFA Act”), and current guidance from the SBA and U.S. Department of Treasury, all or a portion of loans under the program may be forgiven if certain conditions are met. In July 2021 we applied for such forgiveness. The PPP Loan’s initial maturity date was April 19, 2022 and was subsequently extended to April 19, 2025. As of September 18, 2023, the Company’s PPP loan forgiveness application is currently under review by the SBA. A timeline for SBA’s continued review has not yet been set; accordingly, the Company is uncertain as to when SBA will complete its review, or when SBA will render a final agency decision regarding the timing, amount, and determination of forgiveness.

Other Details

Risk Factors

We face risks and uncertainties that could affect us and our business as well as the real estate industry generally. These risks are outlined under the heading “Risk Factors” contained in our latest Offering Circular filed with the SEC on February 14, 2023, which may be accessed here, as the same may be updated from time to time by our future filings under Regulation A. In addition, new risks may emerge at any time and we cannot predict such risks or estimate the extent to which they may affect our financial performance. These risks could result in a decrease in the value of our common shares.

Offering Results

As of June 30, 2023, we are offering up to $75.0 million in shares of our Class B Common Stock in any rolling twelve-month period under Regulation A (the “Offering”). The Offering is being conducted as a continuous offering pursuant to Rule 251(d)(3) of Regulation A, meaning that while the offering of securities is continuous, active sales of securities may occur sporadically over the term of the Offering. As of June 30, 2023 and December 31, 2022, we had raised total gross offering proceeds of approximately $183.5 million and $169.5 million, respectively, from settled subscriptions.

As of June 30, 2023, we sold 19,575,595 shares of our Class B Common Stock at varying prices as set forth below. This does not include 635,555 shares of Class B Common Stock that were sold in a private placement pursuant to Rule 506(c) of Regulation D.

Offering Results

| Effective Date of Price per Share | | Price Per

Share | | | Number of Class B

Common Shares Sold | | | Offering Proceeds | |

| January 31, 2017 | | $ | 5.00 | | | | 2,884,129 | | | $ | 14,420,645 | |

| July 28, 2017 | | | 5.50 | | | | 699,880 | | | | 3,849,340 | |

| January 27, 2018 | | | 6.00 | | | | 649,781 | | | | 3,898,686 | |

| May 22, 2018 | | | 6.30 | | | | 240,589 | | | | 1,515,711 | |

| July 23, 2018 | | | 6.60 | | | | 522,878 | | | | 3,450,995 | |

| October 19, 2018 | | | 6.90 | | | | 814,870 | | | | 5,622,603 | |

| January 31, 2019 | | | 7.30 | | | | 1,073,630 | | | | 7,837,499 | |

| May 3, 2019 | | | 7.67 | | | | 457,748 | | | | 3,510,927 | |

| July 26, 2019 | | | 8.05 | | | | 1,029,649 | | | | 8,288,674 | |

| October 18, 2019 | | | 8.45 | | | | 840,831 | | | | 7,105,022 | |

| January 21, 2020 | | | 8.87 | | | | 814,948 | | | | 7,228,589 | |

| July 17, 2020 | | | 9.09 | | | | 1,738,062 | | | | 15,798,984 | |

| February 17, 2021 | | | 9.54 | | | | 1,557,297 | | | | 14,856,613 | |

| April 28, 2021 | | | 10.90 | | | | 492,080 | | | | 5,363,672 | |

| August 16, 2021 | | | 11.44 | | | | 1,002,310 | | | | 11,466,426 | |

| January 24, 2022 | | | 13.08 | | | | 1,495,850 | | | | 19,565,718 | |

| March 7, 2022 | | | 15.00 | | | | 1,167,935 | | | | 17,519,025 | |

| June 3, 2022 | | | 15.15 | | | | 1,458,226 | | | | 22,092,124 | |

| May 3, 2023 | | | 15.90 | | | | 634,902 | | | | 10,094,942 | |

| Totals | | | — | | | | 19,575,595 | | | $ | 183,486,195 | |

Shares are currently offered and are sold on a continuous basis only to existing investors in the Sponsored Programs. The funds received from the issuance of our Class B Common Stock are a primary source of capital for our operating expenditures.

Off-Balance Sheet Arrangements

As of June 30, 2023 and December 31, 2022, we had no off-balance sheet arrangements.

Related Party Arrangements

For further information regarding “Related Party Arrangements,” please see Note 15, Related Party Transactions, in our financial statements.

Critical Accounting Policies

Our accounting policies have been established to conform with U.S. GAAP. The preparation of financial statements in conformity with U.S. GAAP requires us to use judgment in the application of accounting policies, including making estimates and assumptions. These judgments affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Management believes that we have made these estimates and assumptions in an appropriate manner and in a way that accurately reflects our financial condition. We continually test and evaluate these estimates and assumptions using our historical knowledge of the business, as well as other factors, to ensure that they are reasonable for reporting purposes. However, actual results may differ from these estimates and assumptions. If our judgment or interpretation of the facts and circumstances relating to various transactions had been different, it is possible that different accounting policies would have been applied, thus resulting in a different presentation of the financial statements.

We believe the following accounting estimate is the most critical to aid in fully understanding our reported financial results, and it requires our most difficult, subjective or complex judgments, resulting from the need to make estimates about the effect of matters that are inherently uncertain.

Intangible Assets – Internal-Use Software

Internal-use software is capitalized into an intangible asset when preliminary development efforts are successfully completed; it is probable that the project will be completed; and that the software will be used as intended. Capitalized costs for internal-use software primarily consist of payroll-related costs for employees who are directly involved in the development efforts of a specific piece or pieces of software. Costs related to preliminary project activities and post implementation activities, including training and maintenance, are expensed as incurred. Costs incurred for upgrades and enhancements that are considered to be probable to result in additional functionality are capitalized. Capitalized costs of platform and other software applications are included in intangible assets. These costs are amortized over the estimated useful life of the software, generally four years, on a straight-line basis.

Recent Accounting Pronouncements

The Financial Accounting Standards Board has released several Accounting Standards Updates (“ASUs”) that may have an impact on our financial statements. See Note 2, Summary of Significant Accounting Policies – Recent Accounting Pronouncements, in our consolidated financial statements for discussion of the relevant ASUs.

Extended Transition Period

Under Section 107 of the Jumpstart Our Business Startups Act of 2012, we are permitted to use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This permits us to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date that we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in Section 7(a)(2)(B). By electing to extend the transition period for complying with new or revised accounting standards, these consolidated financial statements may not be comparable to companies that adopt accounting standard updates upon the public business entity effective dates.

Corporate Structure

We operate through the following significant consolidated subsidiaries, with the following activities:

| | · | Fundrise, LLC (“Fundrise, LLC”), a wholly-owned subsidiary of Rise Companies, owns and operates the Fundrise Platform that allows investors in our Sponsored Programs to become equity or debt holders in alternative investment opportunities. |

| | · | Fundrise Advisors, LLC (“Fundrise Advisors”), a wholly-owned subsidiary of Rise Companies, is a registered investment adviser with the SEC that acts as the non-member manager for the investment funds sponsored by the Company and offered for investment via the Fundrise Platform. |

��

| | · | Fundrise, L.P. (“Fundrise LP”), is an affiliate of Rise Companies and was created with the intent to directly benefit the Company by driving its growth and profitability. Rise Companies owns approximately 2% of Fundrise LP and has the ability to direct its assets. |

| | · | Fundrise Real Estate, LLC, a wholly-owned subsidiary of Rise Companies, is a real estate operating platform through which all of the vertically integrated real estate assets of our Sponsored Programs are managed. |

| | · | Certain unlaunched investment programs that, as of June 30, 2023, are not yet being offered to investors. |

The Company has sponsored the following investment programs as of June 30, 2023:

| | · | Fundrise Equity REIT, LLC, Fundrise West Coast Opportunistic REIT, LLC, Fundrise East Coast Opportunistic REIT, LLC, Fundrise Midland Opportunistic REIT, LLC, Fundrise Growth eREIT II, LLC, Fundrise Growth eREIT III, LLC, Fundrise Development eREIT, LLC, Fundrise Growth eREIT VII, LLC, and Fundrise Balanced eREIT II, LLC are real estate investment trust programs (the “eREITs”). The Company previously sponsored eight other eREITs: Fundrise Growth eREIT VI, LLC and Fundrise Balanced eREIT, LLC, which merged into Fundrise Growth eREIT II, LLC and Fundrise Equity REIT, LLC, respectively, on September 1, 2022; and Fundrise Real Estate Investment Trust, LLC, Fundrise Income eREIT II, LLC, Fundrise Income eREIT III, LLC, Fundrise Income eREIT 2019, LLC, Fundrise eREIT XIV, LLC, and Fundrise Income eREIT V, LLC, which merged into Fundrise Income Real Estate Fund, LLC on March 31, 2022. |

| | · | Fundrise eFund, LLC is a real estate investment fund program (the “eFund”). |

| | · | Fundrise Real Estate Interval Fund, LLC (“Flagship Fund”) is a Delaware limited liability company that is registered under the Investment Company Act, as a non-diversified, closed-end management investment company that is operated as an interval fund. |

| | · | Fundrise Income Real Estate Fund, LLC (the “Income Interval Fund”) is a Delaware limited liability company, newly organized during 2022, and formed by the merging of Fundrise Real Estate Investment Trust, LLC, Fundrise Income eREIT II, LLC, Fundrise Income eREIT III, LLC, Fundrise Income eREIT 2019, LLC, Fundrise eREIT XIV, LLC, and Fundrise Income eREIT V, LLC, that is registered under the Investment Company Act, as a non-diversified, closed-end management investment company that is operated as an interval fund. |

| | · | Fundrise Growth Tech Fund, LLC (the “Innovation Fund”) is Delaware limited liability company, newly organized during 2022, that is registered under the Investment Company Act, as a non-diversified, closed-end management investment company that is operated as a tender offer fund. |

| | · | Fundrise Opportunity Fund, LP and Fundrise Opportunity Zone OP, LLC (collectively referred to as the “Opportunity Fund” or the “oFund”), make up a tax-advantaged real estate investment fund program offered under Regulation D (“Regulation D”) of the Securities Act of 1933, as amended (the “Securities Act”). |

| | · | Fundrise Opportunistic Credit Fund, LLC (the “Credit Fund”) is a Delaware limited liability company, newly organized during 2022, that is offered under Regulation D of the Securities Act. |

The eREITs, eFund, oFund, Credit Fund, Flagship Fund, Income Interval Fund and Innovation Fund are referred to, individually or collectively as the context requires, as the “Sponsored Programs” or “Fundrise Investment Products.”

Our office is located at 11 Dupont Circle NW, 9th Floor, Washington, D.C. 20036. Our telephone number is (202) 584-0550. Information regarding the Company is also available on our web site at www.fundrise.com.

Recent Developments

As of August 31, 2023, we have more than 409,000 active investor accounts and more than 2,055,000 active users on the Fundrise Platform, and more than $3.29 billion in AUM in the Sponsored Programs.

Refer to Note 17, Subsequent Events, for more details on recent developments.

Item 2. Other Information

None.

Item 3. Financial Statements

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS OF RISE COMPANIES CORP. (UNAUDITED)

RISE COMPANIES CORP.

Consolidated Balance Sheets

(Amounts in thousands, except share data)

| | | June 30,

2023 (Unaudited) | | | December 31,

2022 (*) | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 21,774 | | | $ | 29,764 | |

| Restricted cash | | | 314 | | | | 61 | |

| Due from affiliates | | | 6,781 | | | | 7,132 | |

| Note receivable from Sponsored Program | | | 9,000 | | | | - | |

| Other current assets, net | | | 2,885 | | | | 4,035 | |

| Total current assets | | | 40,754 | | | | 40,992 | |

| Investments in Sponsored Programs | | | 2,761 | | | | 2,796 | |

| Property and equipment, net | | | 1,706 | | | | 1,854 | |

| Intangible assets, net | | | 26,780 | | | | 22,420 | |

| Operating lease assets | | | 3,933 | | | | 4,103 | |

| Other assets | | | 2,889 | | | | 1,529 | |

| Total assets | | $ | 78,823 | | | $ | 73,694 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 1,285 | | | $ | 1,029 | |

| Accrued expenses | | | 3,366 | | | | 6,937 | |

| Due to stockholders | | | 757 | | | | 378 | |

| Operating lease liabilities, current | | | 986 | | | | 974 | |

| Other current liabilities | | | 431 | | | | 251 | |

| Total current liabilities | | | 6,825 | | | | 9,569 | |

| Loan payable, non-current | | | 2,690 | | | | 2,690 | |

| Operating lease liabilities, non-current | | | 5,104 | | | | 5,384 | |

| Other liabilities | | | 290 | | | | 271 | |

| Total liabilities | | | 14,909 | | | | 17,914 | |

| | | | | | | | | |

| Commitments and contingencies (Note 16) | | | | | | | | |

| | | | | | | | | |

| STOCKHOLDERS’ EQUITY | | | | | | | | |

| Series A convertible preferred stock, $0.0001 par value; 15,000,000 shares authorized; 11,865,046 shares issued and outstanding; with an aggregate liquidation preference of $25,951 | | | 1 | | | | 1 | |

| Class A common stock, $0.0001 par value; 43,000,000 shares authorized; 2,888,859 shares issued and 2,455,894 shares outstanding | | | - | | | | - | |

| Class B common stock, $0.0001 par value; 38,000,000 shares authorized; 20,211,150 shares issued and 19,531,688 outstanding, 19,322,411 shares issued and 18,758,938 outstanding, respectively | | | 2 | | | | 2 | |

| Class F common stock, $0.0001 par value; 10,000,000 shares authorized; 10,000,000 shares issued and 10,000,000 shares outstanding | | | 1 | | | | 1 | |

| Additional paid-in capital | | | 213,292 | | | | 200,702 | |

| Accumulated deficit | | | (159,709 | ) | | | (155,075 | ) |

| Total stockholders’ equity before non-controlling interests | | | 53,587 | | | | 45,631 | |

| Non-controlling interests in consolidated entity | | | 10,327 | | | | 10,149 | |

| Total stockholders’ equity | | | 63,914 | | | | 55,780 | |

| Total liabilities and stockholders’ equity | | $ | 78,823 | | | $ | 73,694 | |

| * | Derived from audited financial statements. |

The accompanying notes are an integral part of these consolidated financial statements.

RISE COMPANIES CORP.

Consolidated Statements of Operations

(Amounts in thousands, except share and per share data)

| | | Six Months Ended | | | Six Months Ended | |

| | | June 30, 2023 (Unaudited) | | | June 30, 2022 (Unaudited) | |

| Operating revenue | | | | | | | | |

| Investment management and platform advisory, net | | $ | 15,709 | | | $ | 12,862 | |

| Real estate portfolio strategy | | | 4,291 | | | | 12,984 | |

| Real estate operating platform | | | 9,892 | | | | 4,432 | |

| Other operating income | | | 696 | | | | 1,701 | |

| Total operating revenue | | | 30,588 | | | | 31,979 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Investment management and platform advisory | | | 3,190 | | | | 2,797 | |

| Real estate strategy and operations | | | 6,699 | | | | 5,601 | |

| Technology and product development | | | 10,429 | | | | 8,520 | |

| Marketing | | | 7,137 | | | | 24,372 | |

| General, administrative and other | | | 7,580 | | | | 12,591 | |

| Total operating expenses | | | 35,035 | | | | 53,881 | |

| | | | | | | | | |

| Net operating (loss) income | | | (4,447 | ) | | | (21,902 | ) |

| | | | | | | | | |

| Other income (loss) | | | | | | | | |

| Equity in earnings (losses) | | | 37 | | | | 79 | |

| | | | 37 | | | | 79 | |

| | | | | | | | | |

| Net (loss) income | | | (4,410 | ) | | | (21,823 | ) |

| | | | | | | | | |

| Net income attributable to non-controlling interests | | | 224 | | | | 70 | |

| Net (loss) income attributable to Rise Companies Corp. | | $ | (4,634 | ) | | $ | (21,893 | ) |

| | | | | | | | | |

| Net (loss) earnings per share attributable to common stockholders: | | | | | | | | |

| Basic and diluted earnings (loss) per share* | | $ | (0.15 | ) | | $ | (0.76 | ) |

| Weighted average shares of common stock - Basic and diluted | | | 31,430,025 | | | | 28,783,317 | |

* Basic and diluted earnings (loss) per share amounts pertain to each class of common stock.

The accompanying notes are an integral part of these consolidated financial statements.

In the opinion of management, all adjustments necessary in order to make the interim financial statements not misleading have been included.

RISE COMPANIES CORP.

Consolidated Statements of Changes in Stockholders’ Equity and Non-Controlling Interest

(Unaudited)

(Amounts in thousands, except share data)

| | | Preferred Stock

Class A | | | Common Stock

Class A | | | Common Stock

Class F | | | Common Stock

Class B | | | Additional

Paid-In | | | Accumulated | | | Non-

Controlling | | | Total | |

| | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Interests | | | Equity | |

| Balance at December 31, 2022 | | | 11,865,046 | | | $ | 1 | | | | 2,455,894 | | | $ | - | | | | 10,000,000 | | | $ | 1 | | | | 18,758,938 | | | $ | 2 | | | $ | 200,702 | | | $ | (155,075 | ) | | $ | 10,149 | | | $ | 55,780 | |

| Issuance of Class B Common Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 888,739 | | | | - | | | | 13,940 | | | | - | | | | - | | | | 13,940 | |

| Redemption of Class B Common Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (115,989 | ) | | | - | | | | (1,287 | ) | | | - | | | | - | | | | (1,287 | ) |

| Offering costs for Class B Common Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (63 | ) | | | - | | | | - | | | | (63 | ) |

| Distribution of Member’s Equity of NCI | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (46 | ) | | | (46 | ) |

| Net income (loss) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (4,634 | ) | | | 224 | | | | (4,410 | ) |

| Balance at June 30, 2023 | | | 11,865,046 | | | $ | 1 | | | | 2,455,894 | | | $ | - | | | | 10,000,000 | | | $ | 1 | | | | 19,531,688 | | | $ | 2 | | | $ | 213,292 | | | $ | (159,709 | ) | | $ | 10,327 | | | $ | 63,914 | |

| | | Preferred Stock

Class A | | | Common Stock

Class A | | | Common Stock

Class F | | | Common Stock

Class B | | | Additional

Paid-In | | | Accumulated | | | Non-

Controlling | | | Total | |

| | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Interests | | | Equity | |

| Balance at December 31, 2021 | | | 11,865,046 | | | $ | 1 | | | | 2,455,894 | | | $ | - | | | | 10,000,000 | | | $ | 1 | | | | 15,008,588 | | | $ | 1 | | | $ | 146,541 | | | $ | (114,457 | ) | | $ | 10,031 | | | $ | 42,118 | |

| Issuance of Class B Common Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 2,935,130 | | | | - | | | | 41,195 | | | | - | | | | - | | | | 41,195 | |

| Redemption of Class B Common Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (51,339 | ) | | | - | | | | (389 | ) | | | - | | | | - | | | | (389 | ) |

| Offering costs for Class B Common Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (102 | ) | | | - | | | | - | | | | (102 | ) |

| Distribution of Member’s Equity of NCI | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (132 | ) | | | (132 | ) |

| Net income (loss) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (21,893 | ) | | | 70 | | | | (21,823 | ) |

| Balance at June 30, 2022 | | | 11,865,046 | | | $ | 1 | | | | 2,455,894 | | | $ | - | | | | 10,000,000 | | | $ | 1 | | | | 17,892,379 | | | $ | 1 | | | $ | 187,245 | | | $ | (136,350 | ) | | $ | 9,969 | | | $ | 60,867 | |

The accompanying notes are an integral part of these consolidated financial statements.

RISE COMPANIES CORP.

Consolidated Statements of Cash Flows

(Amounts in thousands)

| | | Six Months ended

June 30, 2023 (Unaudited) | | | Six Months ended

June 30, 2022 (Unaudited) | |

| Cash flows from operating activities | | | | | | | | |

| Net (loss) income | | $ | (4,410 | ) | | $ | (21,823 | ) |

| Adjustments to reconcile net (loss) income to net cash provided (used) by operating activities: | | | | | | | | |

| Depreciation and amortization | | | 3,456 | | | | 2,024 | |

| (Earnings) from equity method investees | | | (37 | ) | | | (79 | ) |

| Return on capital from Sponsored Programs | | | 158 | | | | 69 | |

| Impairment of intangible assets | | | 110 | | | | 19 | |

| Amortization of capitalized promotions | | | 287 | | | | - | |

| Change in assets and liabilities: | | | | | | | | |

| Net (increase) decrease in other assets | | | (413 | ) | | | (1,905 | ) |

| Net increase (decrease) in accounts payable and other liabilities | | | (3,215 | ) | | | 1,233 | |

| Net (increase) decrease in due from affiliates | | | 351 | | | | (6,110 | ) |

| Net (increase) decrease in interest receivable | | | (181 | ) | | | - | |

| Net cash (used in) provided by operating activities | | | (3,894 | ) | | | (26,572 | ) |

| Cash flows from investing activities | | | | | | | | |

| Additions to intangible assets | | | (7,744 | ) | | | (5,209 | ) |

| Purchases of property and equipment | | | (34 | ) | | | (553 | ) |

| Note receivable from Sponsored Program | | | (9,000 | ) | | | - | |

| Distributions of capital from Sponsored Programs | | | 17 | | | | 12 | |

| Investments in Sponsored Programs | | | (5 | ) | | | (100 | ) |

| Net cash (used in) provided by investing activities | | | (16,766 | ) | | | (5,850 | ) |

| Cash flows from financing activities | | | | | | | | |

| Distribution of Member’s Equity of NCI | | | (46 | ) | | | (132 | ) |

| Proceeds from the issuance of Class B Common Stock, net of offering costs | | | 13,877 | | | | 41,093 | |

| Redemptions of Class B Common Stock | | | (908 | ) | | | (436 | ) |

| Loan payable | | | - | | | | (104 | ) |

| Proceeds from settling subscriptions | | | - | | | | 2,091 | |

| Net cash provided by (used in) financing activities | | | 12,923 | | | | 42,512 | |

| Net increase (decrease) in cash and cash equivalents | | | (7,737 | ) | | | 10,090 | |

| Cash, restricted cash and cash equivalents, beginning of period | | | 29,825 | | | | 27,435 | |

| Cash, restricted cash and cash equivalents, end of period | | $ | 22,088 | | | $ | 37,525 | |

| | | | | | | | | |

| Supplemental disclosures of non-cash activity: | | | | | | | | |

| Redemptions payable | | $ | 757 | | | $ | 243 | |

| Supplemental disclosures of cash flow information: | | | | | | | | |

| Cash paid for interest | | $ | - | | | $ | 53 | |

The accompanying notes are an integral part of these consolidated financial statements.

Rise Companies Corp.

Notes to Consolidated Financial Statements (unaudited)

| 1. | Formation and Organization |

Rise Companies Corp. (“Rise”, “Rise Companies”, “we”, “our”, the “Company”, and “us”) is a financial technology company, that owns and operates a leading web-based and mobile application direct investment platform, located at www.fundrise.com (the “Fundrise Platform”).

We operate through the following significant consolidated subsidiaries, with the following activities:

| | · | Fundrise, LLC (“Fundrise, LLC”), a wholly-owned subsidiary of Rise Companies, owns and operates the Fundrise Platform that allows investors in our Sponsored Programs to become equity or debt holders in alternative investment opportunities. |

| | · | Fundrise Advisors, LLC (“Fundrise Advisors”), a wholly-owned subsidiary of Rise Companies, is a registered investment adviser with the SEC that acts as the non-member manager for the investment funds sponsored by the Company and offered for investment via the Fundrise Platform. |

| | · | Fundrise, L.P. (“Fundrise LP”), is an affiliate of Rise Companies and was created with the intent to directly benefit the Company by driving its growth and profitability. Rise Companies owns approximately 2% of Fundrise LP and has the ability to direct its assets. |

| | · | Fundrise Real Estate, LLC (“Fundrise Real Estate”), a wholly-owned subsidiary of Rise Companies, is a real estate operating platform through which all of the vertically integrated real estate assets of our Sponsored Programs are managed. |

| | · | Certain unlaunched investment programs that, as of June 30, 2023, are not yet being offered to investors. |

The Company has sponsored the following investment programs as of June 30, 2023:

| | · | Fundrise Equity REIT, LLC, Fundrise West Coast Opportunistic REIT, LLC, Fundrise East Coast Opportunistic REIT, LLC, Fundrise Midland Opportunistic REIT, LLC, Fundrise Growth eREIT II, LLC, Fundrise Growth eREIT III, LLC, Fundrise Development eREIT, LLC, Fundrise Growth eREIT VII, LLC, LLC and Fundrise Balanced eREIT II, LLC are real estate investment trust programs (the “eREITs”). The Company previously sponsored eight other eREITs: Fundrise Growth eREIT VI, LLC and Fundrise Balanced eREIT, LLC, which merged into Fundrise Growth eREIT II, LLC and Fundrise Equity REIT, LLC, respectively, on September 1, 2022; and Fundrise Real Estate Investment Trust, LLC, Fundrise Income eREIT II, LLC, Fundrise Income eREIT III, LLC, Fundrise Income eREIT 2019, LLC, Fundrise eREIT XIV, LLC, and Fundrise Income eREIT V, LLC, which merged into Fundrise Income Real Estate Fund, LLC on March 31, 2022. |

| | · | Fundrise eFund, LLC is a real estate investment fund program (the “eFund”). |

| | · | Fundrise Real Estate Interval Fund, LLC (“Flagship Fund”) is a Delaware limited liability company that is registered under the Investment Company Act, as a non-diversified, closed-end management investment company that is operated as an interval fund. |

| | · | Fundrise Income Real Estate Fund, LLC (the “Income Interval Fund”) is a Delaware limited liability company, newly organized during 2022 and formed by the merging of Fundrise Real Estate Investment Trust, LLC, Fundrise Income eREIT II, LLC, Fundrise Income eREIT III, LLC, Fundrise Income eREIT 2019, LLC, Fundrise eREIT XIV, LLC, and Fundrise Income eREIT V, LLC, that is registered under the Investment Company Act, as a non-diversified, closed-end management investment company that is operated as an interval fund. |

| | · | Fundrise Growth Tech Fund, LLC (the “Innovation Fund”) is a Delaware limited liability company, newly organized during 2022, that is registered under the Investment Company Act, as a non-diversified, closed-end management investment company that is operated as a tender offer fund. |

| | · | Fundrise Opportunity Fund, LP and Fundrise Opportunity Zone OP, LLC (collectively referred to as the “Opportunity Fund” or the “oFund”), make up a tax-advantaged real estate investment fund program offered under Regulation D (“Regulation D”) of the Securities Act of 1933, as amended (the “Securities Act”). |

| | · | Fundrise Opportunistic Credit Fund, LLC (the “Credit Fund”) is a Delaware limited liability company, newly organized during 2022, offered under Regulation D of the Securities Act. |

The eREITs, eFund, oFund, Credit Fund, Flagship Fund, Income Interval Fund and Innovation Fund are referred to, individually or collectively as the context requires, as the “Sponsored Programs” or “Fundrise Investment Products”.

Liquidity and Capital Resources

We have incurred operating losses since our inception and have an accumulated deficit of $159.7 million as of June 30, 2023. We have financed our operations primarily through the issuance of equity securities. Our ability to achieve profitability depends on our ability to generate revenue growth in existing product lines, successfully launch new product lines and manage costs. We may continue to incur substantial operating losses while we continue to build the business and invest in new innovation.

As of June 30, 2023 and December 31, 2022, we had $21.8 million and $29.7 million in cash and cash equivalents, respectively. We anticipate that our cash and cash equivalents as of June 30, 2023, and forecasted revenue, will provide sufficient liquidity for more than a twelve-month period from the date of filing these financial statements. The actual amount of cash that we will need to operate is subject to many factors, including, but not limited to our product development and engineering efforts. We are dependent upon significant future financing, including through our Offering described below, to provide the cash necessary to execute our ongoing and future operations, including the continued development of our products.

As of June 30, 2023, we are offering up to $75.0 million in shares of our Class B Common Stock in any rolling twelve-month period under Regulation A (the “Offering”). The Offering is being conducted as a continuous offering pursuant to Rule 251(d)(3) of Regulation A, meaning that while the offering of securities is continuous, active sales of securities may occur sporadically over the term of the Offering. As of June 30, 2023 and December 31, 2022, we had raised total gross offering proceeds of approximately $183.5 million and $169.5 million, respectively, from settled subscriptions.

| 2. | Summary of Significant Accounting Policies |

Basis of Presentation

The accompanying consolidated financial statements of the Company are prepared on the accrual basis of accounting and conform to accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial reporting and the instructions to Form 1-SA and Rule 8-03 of Regulation S-X of the rules and regulations of the SEC. Accordingly, certain information and note disclosures normally included in the financial statements prepared under U.S. GAAP have been condensed or omitted.

Certain amounts in the prior year’s Consolidated Financial Statements and Notes to Consolidated Financial Statements have been reclassified to conform to current year presentation. Receivables from Sponsored Programs are presented as Due from affiliates on the current year consolidated balance sheets. Origination and acquisition fees are presented as Real estate portfolio strategy, Investment management fees, net are presented as Investment management and platform advisory, net, Real estate platform fees are presented as Real estate operating platform, and Origination and servicing expenses are presented as Real estate strategy and operations on the current year consolidated statements of operations. Capital markets fees, defined below within Note 2, Summary of Significant Accounting Policies, Revenue Recognition, have been reclassified from Real estate operating platform to Real estate portfolio strategy on the current year consolidated statements of operations. Amortization of internally developed software has been reclassified from General, administrative and other to Technology and product development.

Additionally, certain allocated salaries and benefits in the prior year’s Consolidated Financial Statements have been reclassified to conform to current year presentation. Salaries and benefits for finance personnel supporting real estate operations have been reclassified from General, administrative and other to Real estate strategy and operations. Salaries and benefits for investor servicing personnel have been reclassified from General, administrative and other to Investment management and platform advisory. Salaries and benefits related to IT Operations personnel have been reclassified from Technology and product development to General, administrative and other. Salaries and benefits for certain of our executives have been reclassified from General, administrative and other to Marketing and Technology and product development.