UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2023

Rise Companies Corp.

(Exact name of issuer as specified in its charter)

| Delaware | | 45-4862460 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

11 Dupont Circle NW, 9th Floor

Washington, DC

(Address of principal executive offices) | | 20036

(Zip Code) |

(202) 584-0550

Issuer’s telephone number, including area code

Class B Common Stock

(Title of each class of securities issued pursuant to Regulation A)

TABLE OF CONTENTS

Part II.

STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Rise Companies Corp. (“Rise,” “Rise Companies,” “we,” “our,” the “Company,” and “us”) makes statements in this Annual Report on Form 1-K (“Annual Report”) that are forward-looking statements. The words “outlook,” “believe,” “estimate,” “potential,” “projected,” “expect,” “anticipate,” “intend,” “plan,” “seek,” “may,” “could” and similar expressions or statements regarding future periods are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply in this Annual Report or in the information incorporated by reference into this Annual Report.

The forward-looking statements included in this Annual Report are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors that could have a material adverse effect on our and our Sponsored Programs’ (as defined within the Other Details, Corporate Structure section) operations and future prospects include, but are not limited to:

| | · | our dependence on fee income generated from our Sponsored Programs to support our continued growth and expansion; |

| | · | the ability of our Sponsored Programs to effectively deploy the proceeds raised in their initial and subsequent offerings; |

| | · | our ability to attract and retain shareholders to the online investment platform located at www.fundrise.com (the “Fundrise Platform”); |

| | · | risks associated with breaches of our data security; |

| | · | public health crises, pandemics and epidemics, such as the COVID-19 pandemic; |

| | · | climate change and natural disasters that could adversely affect properties held by the Sponsored Programs and our business; |

| | · | changes in geopolitical and economic conditions generally and the real estate and securities markets specifically; |

| | · | limited ability of our Sponsored Programs to dispose of assets because of the relative illiquidity of real estate investments; |

| | · | intense competition in the real estate market that may limit the ability of our Sponsored Programs to attract or retain tenants or re-lease space; |

| | · | defaults on or non-renewal of leases by tenants of our Sponsored Programs; |

| | · | increased inflation and related impacts, increased interest rates and operating costs; |

| | · | our failure and the failure of our Sponsored Programs to obtain necessary outside financing; |

| | · | decreased rental rates or increased vacancy rates; |

| | · | difficulties of our Sponsored Programs in identifying properties to complete, and in consummating real estate acquisitions, developments, joint ventures and dispositions; |

| | · | failure of our Sponsored Programs to successfully operate acquired properties and operations; |

| | · | exposure to liability relating to environmental and health and safety matters; |

| | · | changes in real estate and zoning laws and increases in real property tax rates; |

| | · | failure of acquisitions to yield anticipated results; |

| | · | our and our Sponsored Programs’ level of debt and the terms and limitations imposed on us by our debt agreements; |

| | · | the need of our Sponsored Programs to invest additional equity in connection with debt refinancing as a result of reduced asset values; |

| | · | our ability to retain our executive officers and other key personnel of our advisor and our other affiliates; |

| | · | expected rates of return provided to investors and investors in our Sponsored Programs; |

| | · | our ability to source, originate and service our loans and other assets, and the quality and performance of these assets; |

| | · | our ability to retain and hire competent employees and appropriately staff our operations; |

| | · | legislative or regulatory changes impacting our business or our assets and Securities and Exchange Commission (“SEC”) guidance related to Regulation A (“Regulation A”) of the Securities Act of 1933, as amended (the “Securities Act”), or the Jumpstart Our Business Startups Act of 2012; |

| | | |

| | · | changes in business conditions and the market value of our and our Sponsored Programs’ assets, including changes in interest rates, prepayment risk, operator or borrower defaults or bankruptcy, and generally the increased risk of loss if our investments fail to perform as expected; |

| | · | our ability to implement effective conflicts of interest policies and procedures among the various real estate investment opportunities sponsored by us; |

| | · | the ability of our Sponsored Programs to access sources of liquidity when they have the need to fund redemptions of common shares in excess of the proceeds from the sales of their common shares in our offerings and the consequential risk that we may not have the resources to satisfy redemption requests; |

| | · | our compliance with applicable local, state and federal laws, including the Investment Advisers Act of 1940 (the “Advisers Act”), the Investment Company Act of 1940, as amended (the “Investment Company Act”) and other laws; and |

| | · | changes to accounting principles generally accepted in the United States of America (“U.S. GAAP”). |

Any of the assumptions underlying forward-looking statements could be inaccurate. You are cautioned not to place undue reliance on any forward-looking statements included in this Annual Report. All forward-looking statements are made as of the date of this Annual Report and the risk that actual results will differ materially from the expectations expressed in this Annual Report will increase with the passage of time. We undertake no obligation to publicly update or revise any forward-looking statements after the date of this Annual Report, whether as a result of new information, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this Annual Report, including, without limitation, the risks described under “Risk Factors,” the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this Annual Report will be achieved.

Item 1. Business

Rise Companies Corp. (“Rise”, “Rise Companies”, “we”, “our”, the “Company” and “us”), together with its affiliate organizations (“Fundrise”), combines modern financial technology and investment management to build the next generation of alternative asset management infrastructure. We generate revenue from fees related to asset management and other services performed for a portfolio of real estate and technology assets. Our technology platform has allowed us to build a differentiated business with what we believe is a significant competitive advantage and a robust, proprietary software infrastructure.

In the pursuit of our mission to democratize investing in private markets, we believe we are now the largest direct-to-investor alternative asset manager in America. With over 250 employees, our aim is to build and own the future of private markets.

For more information, see “Offering Circular Summary—Rise Companies Corp.” in our latest Offering Circular filed with the SEC on October 3, 2023, which may be accessed here.

Our Business

We believe that the direct-to-consumer investment platform has been the untapped future of private markets. Our core innovation is a willingness to redesign everything using technology – from leveraging web and mobile apps for distribution to building data infrastructure for operations and management. The result has lowered the marginal cost per investor to nearly zero and expanded access to alternatives for millions of individual investors. Our technology platform (the “Fundrise Platform”) provides more access to alternatives, more transparently to more people, anywhere, all the time.

We believe traditional private markets resemble the public markets of more than a half century ago. Transactions are performed manually by salespeople. Data is fragmented and markets are opaque. Access is fundamentally preferential to the largest financial institutions. Sophisticated investors capture excess alpha from highly inefficient markets.

We seek to disrupt and reinvent the “private market value chain”.

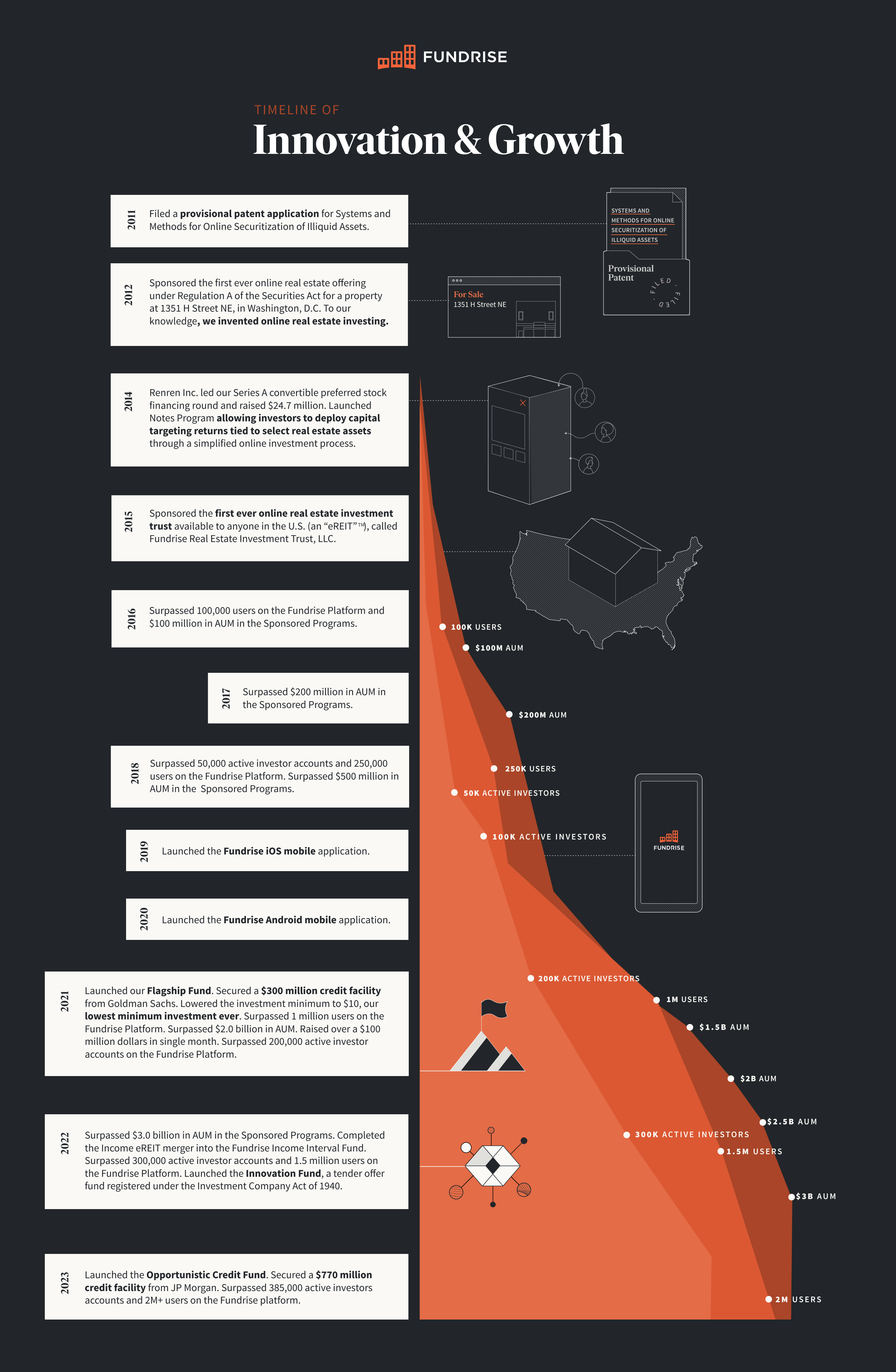

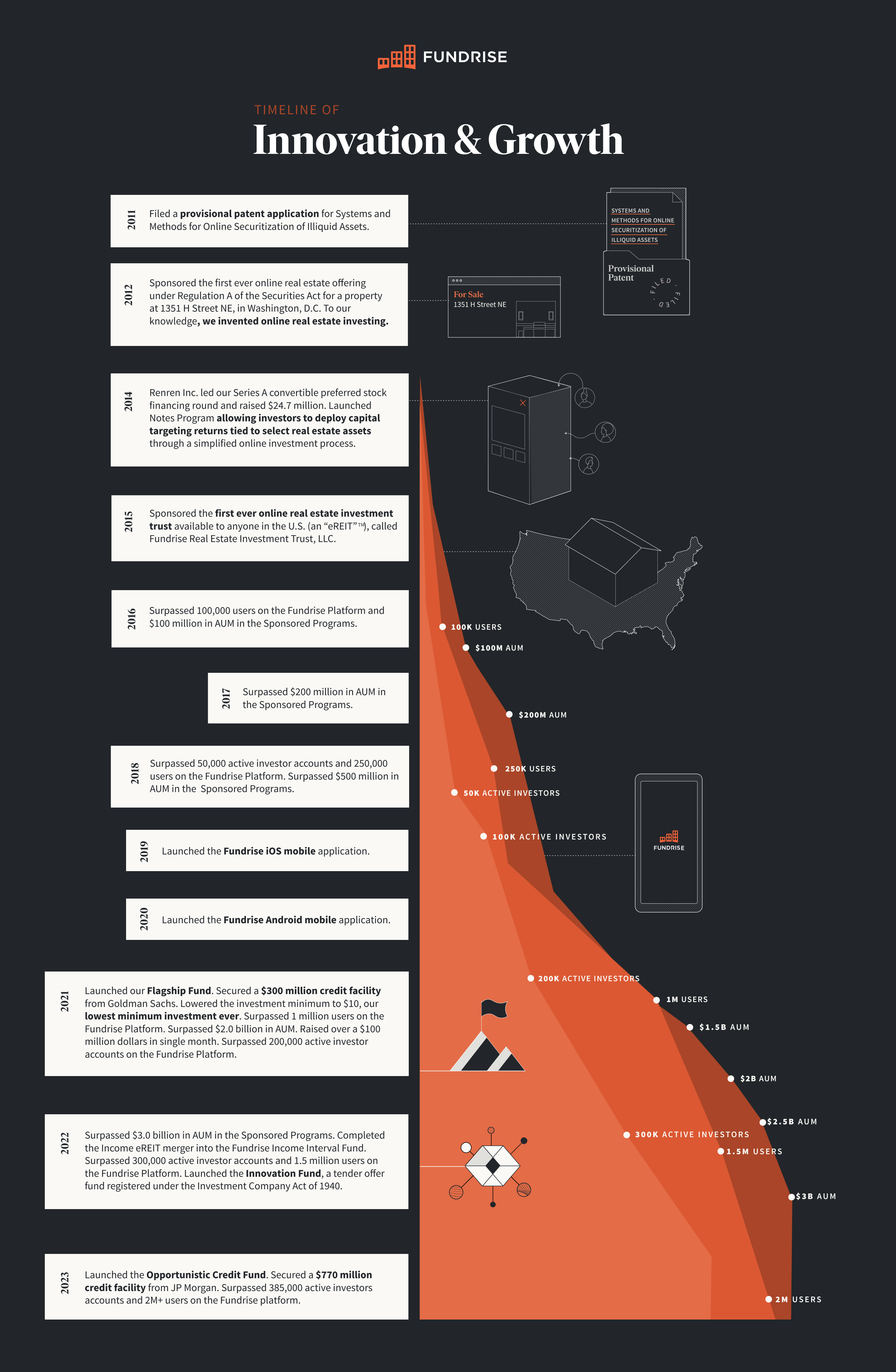

Rise Timeline of Innovation and Growth

Employees

As of the date of this filing, we had 266 employees (all of which were full-time employees), the majority of whom work remotely.

Legal Proceedings

As of the date of the consolidated financial statements, we are not currently named as a defendant in any active or pending material litigation. However, it is possible that the Company could become involved in various litigation matters arising in the ordinary course of our business. Although we are unable to predict with certainty the eventual outcome of any litigation, management is not aware of any litigation likely to occur that we currently assess as being significant to us.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and the related notes. The following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. For further information regarding forward-looking statements, see Statement Regarding Forward Looking Information. Unless otherwise indicated, the latest results discussed below are as of December 31, 2023.

Results of the Business

We are encouraged by both the performance of the managed real estate assets held by our Fundrise Investment Products (as defined within the Other Details, Corporate Structure section) and by our own ability to navigate and continue to grow throughout the economic upheaval and public health crisis brought on by the COVID-19 pandemic, coupled with a period of heightened economic uncertainty due to inflation that is not transitory in nature, rising interest rates putting downward pressure on real estate values, and other factors.

As of December 31, 2023, and 2022, there was approximately $2.87 billion and $3.2 billion in equity assets under management in the Fundrise Platform, respectively. The past twelve months have proven to be one of the single most challenging years for real estate returns since the 2008 Great Financial Crisis, with higher borrowing costs due to increasing interest rates driving real estate valuation decreases across the platform. Although rising interest rates dragged down real estate returns throughout the year, we believe we have reached a turning point with inflation now easing and the Federal Reserve signaling an end to rate hikes. Looking ahead, we believe that just as rising interest rates pulled real estate values down, falling interest rates will act as a strong tailwind, likely pushing real estate values higher and in turn producing potentially positive results for investors going forward. We believe that Fundrise is well positioned to become the go-to platform for the rising generations to invest in the real estate industry and other alternative asset classes, and to leverage data and technology in its efforts to empower and center the individual as the key stakeholder in the financial services markets.

As of December 31, 2023, we have yet to generate any profits from our operations and are incurring net losses while we have invested in the development and expansion of our business through new innovation. For the year ended December 31, 2023 we focused on increasing efficiency while reducing operating expenses as part of our drive towards future profitability.

For further discussion of our performance throughout 2023 and potential impact of current macroeconomic conditions, see the most recent investor letter, originally published December 30, 2023. The contents of the investor letter are not incorporated by reference in or otherwise a part of this Annual Report.

Outlook and Recent Trends

Our optimism about the Company, our continued evolution, and our future success in executing on our mission is rooted in over a decade-long history of innovative ideas, exceptional engineering talent, patience for and focus on long-term growth rather than short-term results, and a commitment to the mission and our customer, the individual. Our annual growth throughout the past four years since the beginning of the COVID-19 pandemic is an achievement we are incredibly proud of and exemplifies an underlying concept we’ve been passionate about at Rise since the beginning: non-linear growth. It is a common misconception that the growth of companies, when observed over long periods of time, is – or even should be – clear and steady. In actuality, we believe nearly all massively successful businesses in today’s environment have experienced punctuated periods of non-linear growth unlocked through true product or market innovations. This phenomenon has certainly held true in Rise’s over ten-year history, as we have always seen a small number of critical initiatives lead to outsized growth that has allowed us to reach milestones that seemed previously unattainable.

It’s important to remember that while Rise is a technology company focused on finance, our performance reflects aspects of investment management, real estate and alternative asset management, and software as a service businesses. As a result, our performance and potential are not fully captured by metrics used by the companies operating in those industries today, given the generally outdated approach taken by businesses in those industries. We believe that, as our business scales, while our growth may increase in absolute terms, our individual performance metrics on a standalone basis may not reflect our total performance or may require looking at new metrics that reflect the evolution of our business model. In short, we believe the metrics that matter the most to us in operating our business and creating new value for our customers, and therefore in creating an effective measurement of our success, will continue to evolve. Accordingly, it may be insufficient to rely solely on any single performance metric as a measurement of our success.

The Metrics That Matter

In our business today, the metrics that drive our success and direct our attention are those that most effectively describe our geometric growth. Of course, revenue and expense on a gross basis as well as by category are key; the mass adoption of our technology platform and the performance of our advised investment vehicles is also clearly relevant. You can see those metrics within our “Results of the Business” and “Results of Operations” sections herein. And while we are proud of the current year growth reflected by those metrics, we have always been and will continue to be focused on the long-term. We believe we are at the beginning of a multi-decade paradigm shift across many macroeconomic trends (the automation of investment management, the wealth accumulation of the millennial generation, increasing allocation to investment alternatives outside of stocks and bonds, and from pensions to self-managed investments) and feel poised to ride an expected tidal wave of change for years to come. We are constantly evaluating our current products and the competitive landscape to ensure we position ourselves in front of that change as opposed to chasing it.

The signal has become clear enough that many in the private investment industry are now starting to pitch the idea(s) of “perpetual capital” and access for retail investors. But the problem is that that is only part of the solution. We believe they’re missing the software-driven flywheel necessary to successfully re-orient their business. You can’t execute the strategy of tomorrow with yesterday’s way of doing business.

The combination of macro trends referenced above, our company specific strategies, and where we are in our growth trajectory means that the metrics we track and emphasize within our business will evolve as we grow and the macro trends unfold. The majority of our growth today comes from existing customers increasing their investment size as their investable assets grow and we prove our ability to deliver attractive returns uncorrelated to the public markets. With a young investor base and perpetual capital, we believe we have decades to grow with our customers. With this multi-decade opportunity in mind, we focus on optimizing our profit potential over a long-term investor relationship as opposed to a more transactional approach. And so, with respect to metrics not demonstrated by financial results, the portion of our customers who are committed to our product offerings through a direct relationship with us over a long-term basis is the result we are focused on maintaining and continually improving.

Our success today is most accurately managed, and therefore measured, by metrics that relate to our customer level economics and broader strategic differentiation. As our business matures, our success will be measured by a heavier weighting towards more traditional, enterprise-level metrics like growth in top line revenue, gross margin expansion, EBITDA, free cash flow, and operating leverage.

Looking back over the last few years – from the COVID-19 pandemic, to the non-transitory inflationary period, to pandemic instigated and war-related global supply chain problems – we believe the combination of the right assets (multifamily residential, single-family rental, and last-mile industrial), owned at reasonable basis (often at or below replacement cost), in the right markets (currently primarily in the Sunbelt), and at relatively conservative leverage (generally about 50% LTV at the portfolio level) all work together to create what we believe is a remarkably stable foundation able to weather a potentially severe economic storm.

Results of Operations

For the years ended December 31, 2023 and 2022, our results of operations are as follows:

| Results | 2023

(in

thousands) | 2022

(in

thousands) | %

Change

(from

2022) | Explanation |

| Operating Revenue |

| Investment management and platform advisory, net | $31,698 | $28,079 | 13% | As our fee structure remained unchanged, the increase was caused by growth in average annual AUM on the Fundrise Platform throughout the year. The increase was bolstered by additional investment management fees earned related to the Innovation Fund. |

| Real estate portfolio strategy | 9,515 | 17,650 | -46% | The decrease in real estate portfolio revenues period-over-period is driven by our strategic decision to hold more cash in response to the market slowdown which continued throughout the year relative to the market in the comparative period, resulting in fewer deals and fewer financings. |

| Real estate operating platform | 22,394 | 10,929 | 105% | This increase is driven by growth in average annual AUM of our affiliates for which we provide real estate asset management services on our proprietary proptech platform, BasisTM, as well as additional development revenues and real estate asset management revenues collected from our affiliates. Refer to Note 2, Summary of Significant Accounting Policies – Revenue Recognition for more details. |

| Other operating income | 1,815 | 1,958 | -7% | Other operating income remained relatively consistent, with a slight decrease year over year due to increased other investment income offset by fewer expense recoupments in the current year related to waived expenses of the Income Interval Fund and Innovation Fund pursuant to certain expense limitation agreements for the recently launched funds. |

| Total operating revenue | $65,422 | $58,616 | 12% | |

| Operating Expenses |

| Investment management and platform advisory | Investment management and platform advisory expenses consist of salaries and benefits for teams responsible for investor relations and operations (“investor servicing”) for the Fundrise Investment Products. Certain allocated salaries and benefits in the prior year Consolidated Financial Statements were reclassified from General, administrative and other to Investment management and platform advisory to conform to current year presentation. Refer to Note 2, Summary of Significant Accounting Policies – Basis of Presentation for more details. |

| $7,056 | $6,586 | 7% | Investment management and platform advisory expenses remained relatively consistent, with a slight increase year-over-year due to employee turnover resulting in an increase in average salaries in our investor servicing team. |

| Real estate strategy and operations | Real estate strategy and operations expenses consist of costs attributable to activities that most directly relate to the acquisition, origination, and operations of real estate investments for real estate operators that are borrowers from, or joint-venture partners with, the Fundrise Investment Products, in addition to the allocated salaries and benefits expense of our real estate team. Certain allocated salaries and benefits in the prior year Consolidated Financial Statements were reclassified from General, administrative and other to Real estate strategy and operations to conform to current year presentation. Refer to Note 2, Summary of Significant Accounting Policies – Basis of Presentation for more details |

| $13,650 | $13,611 | 0% | Real estate strategy and operations expenses remained consistent year-over-year. |

| Technology and product development | Technology and product development expenses consist primarily of salaries and benefits for teams responsible for software engineering, product management, technology activities, allocated analytics salaries and benefits; and amortization of internally developed software. These teams work on the development and maintenance of the software and technology assets of the Fundrise Platform, including CorniceTM, BasisTM, and EquitizeTM. Technology and product development is expensed as incurred, except for development and testing costs related to internally developed software that are capitalized and subsequently amortized over the expected useful life. Certain allocated salaries and benefits as well as amortization of internally developed software in the prior year Consolidated Financial Statements were reclassified from General, administrative and other to Technology and product development to conform to current year presentation. Refer to Note 2, Summary of Significant Accounting Policies – Basis of Presentation for more details. |

| $22,945 | $19,227 | 19% | The increase was driven by an increase in amortization expense for internal use software. We capitalized approximately $15,144,000 and $12,520,000 for the years ended December 31, 2023 and 2022, respectively, in software development costs. |

| Marketing | Marketing expenses consist primarily of the costs associated with engaging and enrolling investors in the Sponsored Programs, including costs attributable to marketing and selling our products. This includes costs of building general brand awareness, and salaries and benefits expenses related to our marketing and design teams as well as allocated analytics salaries and benefits. Certain allocated salaries and benefits in the prior year Consolidated Financial Statements were reclassified from General, administrative and other to Marketing to conform to current year presentation. Refer to Note 2, Summary of Significant Accounting Policies – Basis of Presentation for more details. |

| $12,312 | $37,700 | -67% | The decrease was due to a strategic decision to reduce corporate marketing spend in light of changing market conditions. |

| General, administrative and other | General, administrative and other expenses consist primarily of software and office expenses, professional fees, and other expenses, which primarily consists of salaries and benefits for our corporate functions (including finance, legal, human resources, and IT operations), long-lived asset write offs, and other miscellaneous expenses. Certain allocated salaries and benefits in the prior year Consolidated Financial Statements were reclassified from General, administrative and other to Marketing, Real estate strategy and operations, Technology and product development, and Investment management and platform advisory to conform to current year presentation. In addition, certain allocated salaries and benefits in the prior year Consolidated Financial Statements were reclassified from Technology and product development to General, administrative and other to conform to current year presentation. Refer to Note 2, Summary of Significant Accounting Policies – Basis of Presentation for more details. |

| Software and other office expenses | $4,722 | $4,535 | 4% | Software and other office expenses remained consistent year-over-year and are comprised of mainly software subscription expenses used to maintain and improve operations. |

| Professional fees | 1,353 | 4,034 | -66% | The decrease was due to a planned pull-back of our spending as part of the Company’s drive towards profitability, particularly in regard to recruiting expenses. Additionally, advisory costs related to regulatory matters decreased in the current period as certain advisory projects neared conclusion. |

| Other general and administrative | 8,708 | 13,458 | -35% | The decrease was primarily due to a reduction in administrative costs of the Income Interval Fund and Innovation Fund prior to launch incurred in the prior year, as well as a planned pull-back of other discretionary spend. |

| Total operating expenses | $70,746 | $99,151 | -29% | |

Key Factors Impacting Our Current Year Performance

Our historical growth rates of the Fundrise Platform reflect a deliberate strategy that has allowed us to build and develop the various enterprise functions needed to meet the changing demands of our customers and to support our scale, including operations, risk controls, customer support, compliance and technology. Demand from real estate operators, investors, and the modern financial industry will continue to inform our business and investment product decisions. Given this approach and the dynamic path of our experienced and expected future growth, we have focused this year on a number of important developments within our business that we believe reflect the key factors impacting our performance in 2023. Refer to the Key Factors We Expect to Impact Our Future Performance section below for a description of these key factors.

Key Factors We Expect to Impact Our Future Performance

Investment in Long-Term Growth

The core elements of our growth strategy include enhancing our technology infrastructure, expanding our product and feature offerings, enrolling new investors in our Fundrise Investment Products, broadening our investment acquisition capabilities, and extending customer lifetime value. We plan to continue to invest resources needed to accomplish these goals, and we anticipate that certain operating expenses will continue to increase for the foreseeable future, particularly our technology and product development expenses. These investments are intended to contribute to our long-term growth, but they may continue to affect our near-term profitability.

Sources of Operating Revenues and Cash Flows

We generate revenues from investment management and platform advisory fees, real estate portfolio strategy fees, and real estate operating platform fees. See Note 2, Summary of Significant Accounting Policies - Revenue Recognition in the Notes to the Consolidated Financial Statements for further detail.

Liquidity and Capital Resources

We have incurred operating losses since our inception and have an accumulated deficit of $160.8 million as of December 31, 2023. We have financed our operations primarily through the issuance of equity securities. Our ability to achieve profitability depends on our ability to generate revenue growth in existing product lines, successfully launch new product lines and manage costs. We may continue to incur substantial operating losses while we continue to build the business and invest in new innovation.

As of December 31, 2023 and 2022, we had $41.0 million and $29.7 million in cash and cash equivalents, respectively. We anticipate that our cash and cash equivalents as of December 31, 2023, and forecasted revenue, will provide sufficient liquidity for more than a twelve-month period from the date of filing these financial statements. The actual amount of cash that we will need to operate is subject to many factors, including, but not limited to our product development and engineering efforts. We are dependent upon significant future financing, including through our Offering described below under Offering Results, to provide the cash necessary to execute our ongoing and future operations, including the continued development of our products.

As of December 31, 2023 and 2022, our material commitments for capital expenditures consisted of operating leases, as discussed in Note 5, Leases in the Notes to the Consolidated Financial Statements.

In addition, as of December 31, 2022, the Company had a future commitment of approximately $12,069,000 related to a construction mezzanine debt deal with no up-front funding from us, as a result of Rise Companies fully consolidating the Fundrise Opportunistic Credit Fund, LLC (“Credit Fund”). Upon the launch of the Credit Fund on February 28, 2023, the fund was deconsolidated and no commitments existed related to the deal as of December 31, 2023.

Fundrise LP – Sidecar Investment Fund

As part of the 2014 Series A Preferred financing round, we raised a $10 million sidecar private fund called Fundrise LP, which was formed to support assets originated and facilitated by the Fundrise Platform and to support our overall growth.

Corporate Debt

As of December 31, 2023 and 2022, we had corporate debt payable of approximately $2.7 million. In April 2020, we entered into a loan agreement with Citizens Bank as the lender (the “Lender”), pursuant to which the Lender provided a loan (the “PPP Loan”) under the Paycheck Protection Program offered by the U.S. Small Business Administration (the “SBA”) in the principal amount of $2.8 million pursuant to Title 1 of the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”). We received the full loan amount on April 27, 2020.

As explained more fully in Note 9, Loan Payable – PPP Loan Payable, according to the terms of the Paycheck Protection Program, the subsequent passing of the Paycheck Protection Program Flexibility Act (the “PPPFA Act”), and current guidance from the SBA and U.S. Department of Treasury, all or a portion of loans under the program may be forgiven if certain conditions are met. In July 2021 we applied for such forgiveness. The PPP Loan’s initial maturity date was April 19, 2022 and was subsequently extended to April 19, 2025. As of April 5, 2024, the Company’s PPP loan forgiveness application is currently under review by the SBA. A timeline for SBA’s continued review has not yet been set; accordingly, the Company is uncertain as to when SBA will complete its review, or when SBA will render a final agency decision regarding the timing, amount, and determination of forgiveness.

Other Details

Risk Factors

We face risks and uncertainties that could affect us and our business as well as the real estate industry generally. These risks are outlined under the heading “Risk Factors” contained in our latest Offering Circular filed with the SEC on October 3, 2023, which may be accessed here, as the same may be updated from time to time by our future filings under Regulation A. In addition, new risks may emerge at any time and we cannot predict such risks or estimate the extent to which they may affect our financial performance. These risks could result in a decrease in the value of our common shares.

Offering Results

As of December 31, 2023, we are offering up to $75.0 million in shares of our Class B Common Stock in any rolling twelve-month period under Regulation A (the “Offering”). The Offering is being conducted as a continuous offering pursuant to Rule 251(d)(3) of Regulation A, meaning that while the offering of securities is continuous, active sales of securities may occur sporadically over the term of the Offering. As of December 31, 2023 and 2022, we had raised total gross offering proceeds of approximately $204.6 million and $169.5 million, respectively, from settled subscriptions.

As of December 31, 2023, we sold 20,902,458 shares of our Class B Common Stock at varying prices as set forth below. This does not include 635,555 shares of Class B Common Stock that were sold in a private placement pursuant to Rule 506(c) of Regulation D.

Offering Results

| Effective Date of Price per Share | | Price Per

Share | | | Number of Class B

Common Shares Sold | | | Offering Proceeds | |

| January 31, 2017 | | $ | 5.00 | | | | 2,884,129 | | | $ | 14,420,645 | |

| July 28, 2017 | | | 5.50 | | | | 699,880 | | | | 3,849,340 | |

| January 27, 2018 | | | 6.00 | | | | 649,781 | | | | 3,898,686 | |

| May 22, 2018 | | | 6.30 | | | | 240,589 | | | | 1,515,711 | |

| July 23, 2018 | | | 6.60 | | | | 522,878 | | | | 3,450,995 | |

| October 19, 2018 | | | 6.90 | | | | 814,870 | | | | 5,622,603 | |

| January 31, 2019 | | | 7.30 | | | | 1,073,630 | | | | 7,837,499 | |

| May 3, 2019 | | | 7.67 | | | | 457,748 | | | | 3,510,927 | |

| July 26, 2019 | | | 8.05 | | | | 1,029,649 | | | | 8,288,674 | |

| October 18, 2019 | | | 8.45 | | | | 840,831 | | | | 7,105,022 | |

| January 21, 2020 | | | 8.87 | | | | 814,948 | | | | 7,228,589 | |

| July 17, 2020 | | | 9.09 | | | | 1,738,062 | | | | 15,798,984 | |

| February 17, 2021 | | | 9.54 | | | | 1,557,297 | | | | 14,856,613 | |

| April 28, 2021 | | | 10.90 | | | | 492,080 | | | | 5,363,672 | |

| August 16, 2021 | | | 11.44 | | | | 1,002,310 | | | | 11,466,426 | |

| January 24, 2022 | | | 13.08 | | | | 1,495,850 | | | | 19,565,718 | |

| March 7, 2022 | | | 15.00 | | | | 1,167,935 | | | | 17,519,025 | |

| June 3, 2022 | | | 15.15 | | | | 1,458,226 | | | | 22,092,124 | |

| May 3, 2023 | | | 15.90 | | | | 1,961,765 | | | | 31,192,064 | |

| Totals | | | — | | | | 20,902,458 | | | $ | 204,583,317 | |

Shares are currently offered and are sold on a continuous basis only to existing investors in the Sponsored Programs. The funds received from the issuance of our Class B Common Stock are a primary source of capital for our operating expenditures.

Off-Balance Sheet Arrangements

As of December 31, 2023 and 2022, we had no off-balance sheet arrangements.

Related Party Arrangements

For further information regarding “Related Party Arrangements,” please see Note 16, Related Party Transactions, in our consolidated financial statements.

Recent Accounting Pronouncements

The Financial Accounting Standards Board has released several Accounting Standards Updates (“ASUs”) that may have an impact on our financial statements. See Note 2, Summary of Significant Accounting Policies – Recent Accounting Pronouncements, in our consolidated financial statements for discussion of the relevant ASUs. We are currently evaluating the impact of the ASUs not yet adopted on our consolidated financial statements and determining our plan for adoption.

Extended Transition Period

Under Section 107 of the Jumpstart Our Business Startups Act of 2012, we are permitted to use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This permits us to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date that we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in Section 7(a)(2)(B). By electing to extend the transition period for complying with new or revised accounting standards, these consolidated financial statements may not be comparable to companies that adopt accounting standard updates upon the public business entity effective dates.

Corporate Structure

We operate through the following significant consolidated subsidiaries, with the following activities:

| | · | Fundrise, LLC (“Fundrise, LLC”), a wholly-owned subsidiary of Rise Companies, owns and operates the Fundrise Platform that allows investors in our Sponsored Programs to become equity or debt holders in alternative investment opportunities. |

| | · | Fundrise Advisors, LLC (“Fundrise Advisors”), a wholly-owned subsidiary of Rise Companies, is a registered investment adviser with the SEC that acts as the non-member manager for the investment funds sponsored by the Company and offered for investment via the Fundrise Platform. |

| | · | Fundrise, L.P. (“Fundrise LP”), is an affiliate of Rise Companies and was created with the intent to directly benefit the Company by driving its growth and profitability. Rise Companies owns approximately 2% of Fundrise LP and has the ability to direct its assets. |

| | · | Fundrise Real Estate, LLC (“Fundrise Real Estate”), a wholly-owned subsidiary of Rise Companies, is a real estate operating platform through which all of the vertically integrated real estate assets of our Sponsored Programs are managed. |

The Company has sponsored the following investment programs as of December 31, 2023:

| | · | Fundrise Equity REIT, LLC, Fundrise West Coast Opportunistic REIT, LLC, Fundrise East Coast Opportunistic REIT, LLC, Fundrise Midland Opportunistic REIT, LLC, Fundrise Growth eREIT II, LLC, Fundrise Growth eREIT III, LLC, Fundrise Development eREIT, LLC, Fundrise Growth eREIT VII, LLC, and Fundrise Balanced eREIT II, LLC are real estate investment trust programs (the “eREITs”). The Company previously sponsored eight other eREITs: Fundrise Growth eREIT VI, LLC and Fundrise Balanced eREIT, LLC, which merged into Fundrise Growth eREIT II, LLC and Fundrise Equity REIT, LLC, respectively, on September 1, 2022; and Fundrise Real Estate Investment Trust, LLC, Fundrise Income eREIT II, LLC, Fundrise Income eREIT III, LLC, Fundrise Income eREIT 2019, LLC, Fundrise eREIT XIV, LLC, and Fundrise Income eREIT V, LLC, which merged into Fundrise Income Real Estate Fund, LLC on March 31, 2022. |

| | · | Fundrise eFund, LLC, is a real estate investment fund program (the “eFund”). |

| | · | Fundrise Real Estate Interval Fund, LLC (the “Flagship Fund”) is a Delaware limited liability company that is registered under the Investment Company Act, as a non-diversified, closed-end management investment company that is operated as an interval fund. |

| | · | Fundrise Income Real Estate Fund, LLC (the “Income Interval Fund”) is a Delaware limited liability company, newly organized during 2022, and formed by the merging of Fundrise Real Estate Investment Trust, LLC, Fundrise Income eREIT II, LLC, Fundrise Income eREIT III, LLC, Fundrise Income eREIT 2019, LLC, Fundrise eREIT XIV, LLC, and Fundrise Income eREIT V, LLC, that is registered under the Investment Company Act, as a non-diversified, closed-end management investment company that is operated as an interval fund. |

| | · | Fundrise Growth Tech Fund, LLC (the “Innovation Fund”) is Delaware limited liability company, newly organized during 2022, that is registered under the Investment Company Act, as a non-diversified, closed-end management investment company that is operated as a tender offer fund. |

| | · | Fundrise Opportunity Fund, LP and Fundrise Opportunity Zone OP, LLC (collectively referred to as the “Opportunity Fund” or the “oFund”), make up a tax-advantaged real estate investment fund program offered under Regulation D (“Regulation D”) of the Securities Act. |

| | | |

| | · | Fundrise Opportunistic Credit Fund, LLC (the “Credit Fund”) is a Delaware limited liability company, organized during 2022, that is offered under Regulation D of the Securities Act. |

The eREITs, eFund, oFund, Credit Fund, Flagship Fund, Income Interval Fund and Innovation Fund are referred to, individually or collectively as the context requires, as the “Sponsored Programs” or “Fundrise Investment Products.”

Our office is located at 11 Dupont Circle NW, 9th Floor, Washington, D.C. 20036. Our telephone number is (202) 584-0550. Information regarding the Company is also available on our web site at www.fundrise.com.

Recent Developments

As of the date of filing, we have more than 396,000 active investor accounts and more than 2,157,000 active users on the Fundrise Platform, and more than $2.8 billion in AUM in the Sponsored Programs.

Refer to Note 18, Subsequent Events, for more details on recent developments.

| Item 3. | Directors and Officers |

As of the date of this filing our directors and executive officers are as follows:

| Name | | Age | | Position | | Term of

Office |

| Directors and Executive Officers | | | | | | |

| Benjamin S. Miller | | 47 | | Director, Chief Executive Officer | | March 2012 |

| Brandon T. Jenkins | | 38 | | Director, Chief Operating Officer | | March 2012 |

| Alison A. Staloch | | 43 | | Chief Financial Officer | | June 2021 |

| Charlotte Liu | | 50 | | Independent Director | | July 2022 |

| Tal Kerret | | 53 | | Independent Director | | April 2014 |

| Haniel Lynn | | 54 | | Independent Director | | March 2017 |

| Kenneth J. Shin | | 44 | | Chief Technology Officer | | March 2012 |

| Bjorn J. Hall | | 43 | | General Counsel, Chief Compliance Officer, and Corporate Secretary | | February 2014 |

| Chris Brauckmuller | | 37 | | Chief Strategy Officer | | January 2022 |

| Jonathan Carden | | 35 | | Chief Marketing Officer | | April 2021 |

| Luke Ruth | | 33 | | Chief Product Officer | | January 2022 |

| | | | | | | |

| Significant Employees | | | | | | |

| Kendall Davis | | 35 | | Senior Vice President of Investor Relations and Investor Operations | | June 2014 |

All of our executive officers and significant employees work full-time for us. There are no family relationships between any director, executive officer or significant employee. During the past five years, none of the persons identified above has been involved in any bankruptcy or insolvency proceeding or convicted in a criminal proceeding, excluding traffic violations and other minor offenses.

Benjamin S. Miller has served as our Chief Executive Officer and Director since our inception on March 14, 2012. Prior to serving as our Chief Executive Officer, Mr. Miller had been a Managing Partner of the real estate company WestMill Capital Partners, and before that, was President of Western Development Corporation, one of the largest mixed-use real estate companies in the Washington, DC metro area, after joining the Company as its Chief Operating Officer. Prior, Mr. Miller was an Associate and part of the founding team of Democracy Alliance, a progressive investment collaborative. In 2001, Mr. Miller co-founded and was a Managing Partner of US Nordic Ventures, a private equity and operating company that works with Scandinavian green building firms to penetrate the U.S. market. In 1999, Mr. Miller joined LYTE, a technology start-up building a bricks-and-clicks e-commerce and content platform. From 1997 to 1999, Mr. Miller worked as an analyst for Lubert-Adler Partners, a real estate private equity fund. Mr. Miller has a Bachelor of Arts from the University of Pennsylvania.

Brandon T. Jenkins has served as our Chief Operating Officer since February of 2014, prior to which time he served as our Head of Product Development and Director of Real Estate. Previously, Mr. Jenkins has served as Director of Real Estate for WestMill Capital Partners and spent two and a half years as an investment advisor at Marcus & Millichap. Mr. Jenkins earned his Bachelor of Arts from Duke University.

Alison A. Staloch has served as our Chief Financial Officer since June 2021. Prior to becoming the Chief Financial Officer, Ms. Staloch served as the Chief Accountant of the Division of Investment Management at the U.S. Securities and Exchange Commission from December 2017 to April 2021, and before that, served as Assistant Chief Accountant from November 2015 to November 2017. From 2005 to 2015, Ms. Staloch was with KPMG LLP in the Asset Management practice. Ms. Staloch has a Bachelor of Arts in Psychology from Miami University and received a Master of Accounting from the Ohio State University.

Charlotte Liu has served as a Director since July 2022. Ms. Liu most recently served as Chief Commercial Officer of Springer Nature, a scientific and professional publishing and media company with leading brands such as Nature, Macmillan, Springer, and Scientific American. A member of the company’s management board, she led global sales and marketing organizations responsible for over 1 billion euro in annual revenue. Before that Ms. Liu was Global Managing Director of Asian & World Art at Christie’s, a leading global art auction house, with global divisional P&L and leadership responsibility. Born and raised in Shanghai, she started her career at the Boston Consulting Group, advising multinational companies on their Asia strategy. She also worked with McGraw-Hill in product development and corporate strategy roles for the U.S. market. Ms. Liu has developed unique strategic and operational skills from her global experience, having worked in Shanghai, Hong Kong, Toronto, and New York, with both regional market development experience and global leadership responsibilities. She is currently taking a career sabbatical, while working with Netflix as a consultant and moderator for its in house leadership program. Ms. Liu has an undergraduate degree from Fudan University in Shanghai, and an MBA from the Tuck School of Business at Dartmouth College. Ms. Liu is a Fellow of the Aspen Institute China Fellowship Program.

Tal Kerret has served as a Director since April 2014. Mr. Kerret is President of Silverstein Properties, Inc. (“SPI”), where he is responsible for managing and monitoring the company’s portfolio of assets, devising strategies for growth and acting as a liaison with investors. Mr. Kerret also oversees some of the day-to-day operations of the company. Mr. Kerret joined SPI in 2011 as Executive Vice President. He launched Silver Suites Offices at 7 World Trade Center, and oversees Silver Suites Residences at Silver Towers. In January 2013, Mr. Kerret was promoted to Chief Investment Officer of SPI. Prior to joining SPI, Mr. Kerret was Chairman and Co-Founder of Oberon Media, Inc., the leading casual games platform and solution provider established in 2003. Prior to co-founding Oberon Media, Inc., Mr. Kerret was CEO and co-founder of RichFX, an e-commerce technology infrastructure company, for seven years. Prior to RichFX, Mr. Kerret served as an officer in the Israeli Defense Forces for six years. Mr. Kerret holds degrees in Mathematics and Computer Science from the Tel Aviv University.

Haniel Lynn has served as a Director since March 2017. Mr. Lynn is the Chief Executive Officer of Kastle Systems International, the industry leader in managed security solutions. Mr. Lynn was formerly group president of CEB, now Gartner, a global best practices insights and technology company from 2014 until August 2017 and was a member of CEB’s executive leadership team from 2005. Mr. Lynn had global responsibility for CEB’s best practices and decision support business. From 2005 until 2014, Mr. Lynn led the CEB Sales, Marketing, and Communications and Financial Services practices and the Digital Products and Innovation team. Mr. Lynn joined CEB in 2001 as a managing director in the new product development group, and he later added responsibility for leading CEB’s solutions business. Prior to joining CEB, Mr. Lynn was vice president of business development and strategy at LYTE, Inc., where he developed the business and operating model, led partnership development activities, and raised capital to support the growth of the early-stage company. Prior to LYTE, Mr. Lynn was a consultant with McKinsey & Company, providing counsel on marketing, strategy, operations, and organization design issues. Mr. Lynn holds a BSE from the University of Pennsylvania and an M.B.A. from the Wharton School of the University of Pennsylvania.

Kenneth J. Shin has served as our Chief Technology Officer since our inception in March 2012. Previously, Mr. Shin consulted for Fortune 500 clients in financial services and technology, including Fannie Mae, Oracle, Lockheed Martin and Computer Science Corporation. Mr. Shin has also consulted for government clients including the Federal Bureau of Investigation, Department of Defense and NATO. Mr. Shin earned his Bachelor of Science in Computer Science Engineering from the University of Pennsylvania.

Bjorn J. Hall has served as our General Counsel, Chief Compliance Officer and Corporate Secretary since February 2014. Prior to becoming our General Counsel, from February 2008 to February 2014, Mr. Hall served as a counsel at the law firm of O’Melveny & Myers LLP, where he was a member of the Corporate Finance and Securities Group. Mr. Hall has a Bachelor of Arts from the University of North Dakota and received a J.D. from Georgetown University Law Center.

Chris Brauckmuller has served as our Chief Strategy Officer since January 2022, and prior to that served as our Chief Product Officer beginning in September 2018 and our Director of Design and Creative beginning in December 2012. From March 2010 to December 2012, Mr. Brauckmuller ran his own independent interactive design studio. Previously, Mr. Brauckmuller was employed as an interactive designer at 352 Media Group (now 352 Inc.), based in Gainesville, Florida, where he led creative efforts on accounts ranging from startups to Fortune 500 technology companies, including Microsoft and BAE Systems. Mr. Brauckmuller received a Bachelor of Arts degree from the University of Florida.

Jonathan Carden has served as our Chief Marketing Officer since April 2021, and was previously the Senior Vice President of Marketing since October 2017. Prior to joining Fundrise, Mr. Carden worked for Uber, where he filled a number of marketing roles before leaving as the head of digital content for the Southeastern U.S. region. Before Uber, Mr. Carden worked in major gift fundraising, serving as the Director of Major Gifts for his alma mater, Patrick Henry College. Mr. Carden received a Bachelor of Arts degree from Patrick Henry College.

Luke Ruth has served as our Chief Product Officer since January 2022, and was previously the Senior Vice President of Product since January 2020. Mr. Ruth joined Fundrise in April 2014 as a Front-End Software Engineer and was promoted to Vice President of Product in February 2018. Prior to joining Fundrise, Mr. Ruth worked for a small semantic web startup as a member of the engineering team. Mr. Ruth received a Bachelor of Science degree from the University of Mary Washington.

Kendall Davis has served as our Senior Vice President of Investor Relations and Investor Operations and has led our investments team since June 2014. Previously, Ms. Davis worked at Citigroup within the Institutional Clients Group and the Citi Private Bank. Ms. Davis is a graduate of the University of Virginia.

Election of Directors

Our board of directors is comprised of five (5) members. The holders of outstanding Class A Common Stock and Class F Common Stock are entitled to elect two directors at any election of directors. So long as at least 2,500,000 shares of Series A Preferred Stock remain outstanding, the holders of such shares of Series A Preferred Stock are entitled to elect one director at any election of directors. The remaining director is elected by holders of Series A Preferred Stock (voting on an as-converted basis) and Class A Common Stock and Class F Common Stock, voting as a single class.

Director Independence

Our board of directors has undertaken a review of the independence of Messrs. Kerret, Lynn, Miller, Jenkins, and Ms. Liu. Based on information provided by each director concerning his or her background, employment and affiliations, our board of directors has determined that Messrs. Kerret, Lynn, and Ms. Liu do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors would qualify as “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing standards of the NASDAQ Stock Market LLC, if such rules applied to us. In making these determinations, our board of directors considered the current and prior relationships that these non-employee directors have with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in “Interest of Management and Others in Certain Transactions.”

Compensation of Our Directors and Executive Officers

The following table sets forth information about the annual compensation of each of the three highest paid persons who were executive officers or directors during 2023, which was our last completed fiscal year.

| Name | | Capacities in which

compensation was received | | Cash

Compensation | | | Other

Compensation(1) | | | Total

Compensation | |

| Bjorn J. Hall | | General Counsel, Chief Compliance Officer, and Corporate Secretary | | $ | 520,000 | | | | 9,897 | | | $ | 529,897 | |

| Alison A. Staloch | | Chief Financial Officer | | $ | 455,000 | | | | 9,896 | | | $ | 464,896 | |

| Kenneth J. Shin | | Chief Technology Officer | | $ | 455,000 | | | | 9,896 | | | $ | 464,896 | |

| | (1) | Other compensation consists of 401(k) matching contributions by the Company. |

The aggregate annual compensation of our directors as a group (which consists of 5 persons) during 2023 was approximately $800,000.

Other than the 2014 Stock Option and Grant Plan, of which Mr. Hall, Ms. Staloch, and Mr. Shin (each Officers), and Mr. Miller, Mr. Jenkins, Ms. Liu, Mr. Kerret, and Mr. Lynn (each Directors) have been recipients in previous years and for which RSU’s may be paid in the future, we do not have any other ongoing plans or arrangements whereby equity compensation may be paid in the future.

The average annual total compensation of our officers as a group (which consists of 8 persons) during 2023 was approximately $444,000.

Average compensation to be paid to our officers for 2024 is expected to be at similar levels as 2023.

| Item 4. | Security Ownership of Management and Certain Securityholders |

The following table sets forth certain information regarding the beneficial ownership of our outstanding capital stock as of December 31, 2023 for the following: (i) each of our directors and executive officers, (ii) all persons who are our directors and executive officers as a group and (iii) any person who is known by us to be the beneficial owner of more than 10% of any class of our outstanding capital stock.

We calculated percentage ownership based on 44,974,273 shares of our capital stock outstanding as of December 31, 2023, which consisted of 2,455,894 shares of Class A Common Stock, 20,653,333 shares of Class B Common Stock, 10,000,000 shares of Class F Common Stock, and 11,865,046 shares of Series A Preferred Stock outstanding. In computing the beneficial ownership of outstanding shares of Class A Common Stock, we deemed a person to be the beneficial owner of all restricted shares of Class A Common Stock that were issued to such person under our 2014 Stock Option and Grant Plan regardless of whether such shares have vested, as our 2014 Stock Option and Grant Plan provides that, unless we provide otherwise, a grantee of restricted shares of Class A Common Stock will be entitled to vote such shares regardless of whether such shares have vested.

To our knowledge, except as set forth in the footnotes below, each stockholder identified in the table possesses sole voting and investment power with respect to all shares of our common stock or Series A Preferred Stock shown as beneficially owned by that stockholder. Unless otherwise indicated, the address for each person named in the table below is c/o Rise Companies Corp., 11 Dupont Circle NW, Suite 900, Washington, DC 20036.

| | | Class A | | | Class B | | | Class F | | | Series A

Preferred(1) | | | Voting Power | |

Name of

Beneficial

Owner | | No. of

Shares | | | % of

Class | | | No. of

Shares | | | % of

Class | | | No. of

Shares | | | % of

Class | | | No. of

Shares | | | % of

Class | | | % of

Common

Stock (2) | | | % of

All

Capital

Stock (3) | |

| 10% Stockholders | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Oak Pacific Investment(1) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 11,865,046 | | | | 100 | % | | | — | | | | 6.9 | % |

| Daniel S. Miller | | | — | | | | — | | | | — | | | | — | | | | 5,000,000 | | | | 50 | % | | | 125,391 | | | | 1.1 | % | | | 48.8 | % | | | 43.8 | % |

| Beneficial Ownership Group Created by Voting Agreement(5) | | | 122,900 | | | | 5 | % | | | — | | | | — | | | | 10,000,000 | | | | 100 | % | | | 11,865,046 | | | | 100 | % | | | 97.7 | % | | | 94.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Executive Officers and Directors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Benjamin S. Miller | | | — | | | | — | | | | 1,200 | | | | * | | | | 5,000,000 | | | | 50 | % | | | 433,897 | | | | 3.7 | % | | | 48.8 | % | | | 44.1 | % |

| Brandon T. Jenkins(4) | | | 450,000 | | | | 18.3 | % | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | * | | | | * | |

| Jonathan Carden | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Alison A. Staloch | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Kenneth J. Shin(4) | | | 650,000 | | | | 26.5 | % | | | 202 | | | | * | | | | — | | | | — | | | | — | | | | — | | | | * | | | | * | |

| Bjorn J. Hall(4) | | | 250,000 | | | | 10.2 | % | | | 32 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | * | | | | * | |

| Chris Brauckmuller(4) | | | 250,000 | | | | 10.2 | % | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | * | | | | * | |

| Luke Ruth(4) | | | 50,000 | | | | 2.0 | % | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | * | | | | * | |

| Charlotte Liu | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Tal Kerret(4) | | | 122,900 | | | | 5 | % | | | — | | | | — | | | | — | | | | — | | | | 84,931 | | | | * | | | | * | | | | * | |

| Haniel Lynn | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 22,860 | | | | * | | | | — | | | | * | |

| Executive officers and directors as a group (11 persons) | | | 1,772,900 | | | | 72.2 | % | | | 1,434 | | | | * | | | | 5,000,000 | | | | 50 | % | | | 541,688 | | | | 4.6 | % | | | 50.5 | % | | | 45.8 | % |

* Represents beneficial ownership of less than 1%.

| (1) | Oak Pacific Investment (“OPI”) is a record owner of 7,856,395 shares of Series A Preferred Stock (which amounts to 66.2% of the outstanding shares of Series A Preferred Stock), and certain other holders, some of which are listed in the table above, are record owners of the remaining outstanding shares of Series A Preferred Stock. However, pursuant to the Voting Agreement described in footnote 5 below, OPI is deemed to be the beneficial owner of 100.0% of the outstanding shares of Series A Preferred Stock because, as a majority owner of the outstanding shares of Series A Preferred Stock, (i) OPI is entitled to nominate the one director allocated to the Series A Preferred Stock and (ii) the remaining holders of the Series A Preferred Stock have effectively agreed to vote in accordance with OPI with respect to such director. |

| (2) | Voting power with respect to common stock is calculated by taking into account the votes of Class A Common Stock and Class F Common Stock all voting together as a single class, with Class A Common Stock carrying one (1) vote per share and Class F Common Stock carrying ten (10) votes per share. |

| (3) | Voting power with respect to capital stock is calculated by taking into account the votes of Class A Common Stock, Class F Common Stock and Series A Preferred Stock all voting together as a single class (with Series A Preferred Stock voting on an as-converted basis), with Class A Common Stock carrying one (1) vote per share, Class F Common Stock carrying ten (10) votes per share and Series A Preferred Stock carrying one (1) vote per share. |

| (4) | The holder’s shares of Class A Common Stock are restricted shares issued under our 2014 Stock Option and Grant Plan. As of December 31, 2020 all shares have vested. |

| (5) | On April 14, 2014, in connection with the Series A Preferred Stock financing described in “Interest of Management and Others in Certain Transactions”, we entered into a Voting Agreement (the “Voting Agreement”) with certain Class A and Class F holders of our common stock and Series A holders of our preferred stock, including persons who held more than 10% of any class of our outstanding capital stock, our executive officers and directors, entities with which certain of our officers and directors are affiliated, and family members of certain of our officers and directors. Pursuant to the Voting Agreement, the holders of certain shares of our common stock and preferred stock have agreed to vote their shares on certain matters, including with respect to the election of directors, in accordance with the vote of a majority of the outstanding shares eligible to vote on such matter. The Voting Agreement creates a beneficial ownership group under Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, which group is comprised of certain holders of our Class A Common Stock, all holders of our Class F Common Stock and all holders of our Series A Preferred Stock. |

| Item 5. | Interest of Management and Others in Certain Transactions |

Stock Issuances

In April 2014, in exchange for contributing to us the intellectual property and other assets used by us, Benjamin Miller and Daniel Miller each received 5,000,000 shares of Class F Common Stock.

Additionally, we have granted restricted shares of Class A Common Stock under our 2014 Stock Option and Grant Plan to our executive officers, directors and certain holders of more than 10% of a given class of our outstanding capital stock, in their capacities as our employees.

Series A Preferred Stock Financing

From April 14, 2014 through October 10, 2014, we sold an aggregate of 11,865,046 shares of our Series A Preferred Stock at a cash purchase price of $2.1872 per share or pursuant to the automatic conversion of certain convertible promissory notes, for an aggregate purchase price of approximately $24.7 million (including the purchase price paid for the convertible promissory notes).

The following table summarizes the Series A Preferred Stock purchased between April 14, 2014 and October 10, 2014 that continues to be held by our executive officers, directors, holders of more than 10% of a given class of our outstanding capital stock or any immediate family member as of December 31, 2023.

| Name of Stockholder | | Shares of

Series A

Preferred

Stock | | | Total

Purchase

Price | |

| Benjamin Miller | | | 433,897 | | | $ | 949,008 | |

| Herbert Miller, Patrice Miller, David Miller and Caroline Miller (1) | | | 374,757 | | | $ | 449,713 | |

| Daniel Miller | | | 125,391 | | | $ | 274,251 | |

| | (1) | Each of these individuals are immediate family members of Benjamin Miller. Consists of 131,643 shares of Series A Preferred purchased by Herbert Miller, 109,348 shares of Series A Preferred purchased by Patrice Miller, 66,883 shares of Series A stock purchased by David Miller and 66,883 shares of Series A stock purchased by Caroline Miller, each upon the conversion of outstanding convertible promissory notes and at a price per share of approximately $1.20. |

Investors’ Rights Agreement

On April 14, 2014, in connection with the Series A Preferred Stock financing described above, we entered into an Investors’ Rights Agreement (the “IRA”) with certain holders of our Class F Common Stock and Series A Preferred Stock, including persons who held more than 10% of any class of our outstanding capital stock, certain of our executive officers and directors, entities with which certain of our officers and directors are affiliated, and family members of certain of our officers and directors. Pursuant to the IRA, the holders of certain shares of our common stock and preferred stock are entitled to certain registration rights, information rights and preemptive rights. The related parties who are signatories to the IRA include Benjamin Miller, Daniel Miller, Herbert Miller, Patrice Miller, Renren Lianhe Holdings (whose investment is now held by Oak Pacific Investment), David Miller, Caroline Miller, and Tal Kerret. Certain other individuals who are not related parties are also signatories to the IRA.

Right of First Refusal and Co-Sale Agreement

On April 14, 2014, in connection with the Series A Preferred Stock financing described above, we entered into a First Refusal and Co-Sale Agreement (“Co-Sale Agreement”) with certain holders of our common stock and preferred stock, including persons who hold more than 10% of our outstanding capital stock, certain of our executive officers and directors, entities with which certain of our officers and directors are affiliated, and family members of certain of our officers and directors. Pursuant to the Co-Sale Agreement, the holders of our preferred stock have rights of first refusal and Co-Sale with respect to certain transfers made by certain holders of our common stock. The related parties who are signatories to the Co-Sale Agreement include Benjamin Miller, Daniel Miller, Herbert Miller, Patrice Miller, Renren Lianhe Holdings (whose investment is now held by Oak Pacific Investment), David Miller, Caroline Miller, and Tal Kerret. Certain other individuals who are not related parties are also signatories to the Co-Sale Agreement.

Voting Agreement

On April 14, 2014, in connection with the Series A Preferred Stock financing described above, we entered into a Voting Agreement (the “Voting Agreement”) with certain holders of our common stock and preferred stock, including persons who held more than 10% of any class of our outstanding capital stock, our executive officers and directors, entities with which certain of our officers and directors are affiliated, and family members of certain of our officers and directors. Pursuant to the Voting Agreement, the holders of certain shares of our common stock and preferred stock have agreed to vote their shares on certain matters, including with respect to the election of directors, in accordance with the vote of a majority of the outstanding shares eligible to vote on such matter. The related parties who are signatories to the Voting Agreement include Benjamin Miller, Daniel Miller, Herbert Miller, Patrice Miller, Renren Lianhe Holdings (whose investment is now held by Oak Pacific Investment), David Miller, Caroline Miller, and Tal Kerret. Certain other individuals who are not related parties are also signatories to the Voting Agreement.

Real Estate Transactions

The initial three real estate properties we used to assess the effectiveness of the Fundrise Platform were managed and owned by Benjamin Miller and Daniel Miller. Specifically, from 2011 to 2014, each of 1351 H Street NE, LLC, 906 H Street NE, LLC, and 1539 7th Street NW, LLC, all of which invested in properties located in Washington, DC, utilized the Fundrise Platform to conduct three separate Regulation A offerings to raise $325,000, $350,000, and $350,000, respectively. We received no transaction-based compensation from these deals and, at the time, we were wholly-owned by Benjamin Miller and Daniel Miller. 1351 H Street NE, LLC currently continues to use the Fundrise Platform solely for online investor relations and dividend distributions.

Investments in Company Convertible Notes

Through April 2014, we raised $3,359,041 in convertible notes from a number of parties, including related parties. Convertible notes of $545,825 from Benjamin Miller, $545,825 from Daniel Miller, and $806,365 from WestMill Capital Partners LLC, a private limited liability company jointly and equally owned in its entirety by Benjamin Miller and Daniel Miller, were converted into a total of 867,793 shares of our Series A Preferred Stock. Additional related party investments in the convertible notes included Herbert Miller (Messrs. Millers’ father), Patrice Miller (Messrs. Millers’ stepmother and mother, respectively), David Miller (Messrs. Millers’ brother), and Caroline Miller (Messrs. Millers’ sister), which investment amounts totaled $157,193, $131,219, $80,260, and $80,260 respectively. These related party investments were made under the same terms as other investors in the convertible notes.

Investments in Sponsored Programs

Many of the Company’s executive officers and directors (including immediate family members) have opened investor accounts on the Fundrise Platform. All investments (and redemptions, where applicable) were made in the ordinary course of business and transacted on terms and conditions that were not more favorable than those obtained by third-party investors.

Future Transactions

We intend that all future affiliated transactions be made or entered into on terms that are no less favorable to us than those that can be obtained from any unaffiliated third party. We previously implemented a conflicts of interest policy, which requires a majority of the independent, disinterested members of our board of directors to approve affiliated transactions.

None.

| Item 7. | Financial Statements |

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS OF RISE COMPANIES CORP.

Independent Auditors’ Report

Board of Directors and Stockholders

Rise Companies Corp.:

Opinion

We have audited the consolidated financial statements of Rise Companies Corp. and its subsidiaries (the Company), which comprise the consolidated balance sheets as of December 31, 2023 and 2022, and the related consolidated statements of operations, changes in stockholders’ equity and non-controlling interest, and cash flows for the years then ended, and the related notes to the consolidated financial statements.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2023 and 2022, and the results of its operations and its cash flows for the years then ended in accordance with U.S. generally accepted accounting principles.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with U.S. generally accepted accounting principles, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the consolidated financial statements are available to be issued.

Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements.

In performing an audit in accordance with GAAS, we:

| ● | Exercise professional judgment and maintain professional skepticism throughout the audit. |

| ● | Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. |

| ● | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. |

| ● | Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. |

| ● | Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. |

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit.

Philadelphia, Pennsylvania

April 5, 2024

RISE COMPANIES CORP.

Consolidated Balance Sheets

(Amounts in thousands, except share data)

| | | December 31,

2023 | | | December 31,

2022 | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 40,966 | | | $ | 29,764 | |

| Restricted cash | | | 99 | | | | 61 | |

| Due from affiliates | | | 7,941 | | | | 7,132 | |

| Note receivable from Sponsored Program | | | 9,000 | | | | - | |

| Other current assets, net | | | 2,590 | | | | 4,035 | |

| Total current assets | | | 60,596 | | | | 40,992 | |

| Investments in Sponsored Programs | | | 2,756 | | | | 2,796 | |

| Property, software and equipment, net | | | 31,263 | | | | 24,021 | |

| Operating lease assets | | | 3,753 | | | | 4,103 | |

| Other assets, net | | | 3,183 | | | | 1,782 | |

| Total assets | | $ | 101,551 | | | $ | 73,694 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 657 | | | $ | 1,029 | |