UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-SA

SEMIANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the Semiannual Period Ended June 30, 2017

RISE COMPANIES CORP.

(Exact name of registrant as specified in its charter)

Commission File Number: 024-10659

| Delaware | | 45-4862460 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

1601 Connecticut Ave. NW, Suite 300

Washington, DC

(Address of principal executive offices) | | 20009

(Zip Code) |

(202) 584-0550

Registrant’s telephone number, including area code

Common Shares

(Title of each class of securities issued pursuant to Regulation A)

ITEM 1: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the unaudited consolidated financial statements and related notes that appear in this semi-annual report. In addition to historical consolidated financial information, the following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements.

Overview

We own and operate the Fundrise Platform, a leading online, direct investment platform located at www.fundrise.com. We believe real estate investment powered by technology is more efficient than conventional financial system mechanisms used to invest in real estate and other alternative assets. Enabled by our proprietary technology, we aggregate thousands of individuals from across the country to create the scale of an institutional investor, without the high fees and overhead typical of the old-fashioned investment business. Individuals can invest through the Fundrise Platform at ultra-low costs for what we believe is a better, more transparent web-based experience. Investors use the Fundrise Platform to potentially earn attractive risk-adjusted returns from asset classes that have generally been closed to many investors and only available to high net worth investors and institutions.

We believe that, as our business scales, while our growth may increase in absolute terms, our individual performance metrics on a standalone basis may not reflect our total performance. Accordingly, it may be insufficient to rely solely on any single performance metric as a measurement of our success.

Since inception, we have originated approximately $252.5 million in both equity and debt investments deployed across more than approximately $1.4 billion of real estate property, while collecting and processing more than 230,000 investor dividends, distributions, investments and principal re-payments since we sponsored our first online investment in 2012. As our business has grown and changed, from offering a platform to facilitate the sponsor of investment, to an active sponsor of specific real estate projects, to the creation and offering of the eREITTM programs, and now the eFundsTM, our real estate debt and equity originations over the same period have changed as well. Our originations have increased over the period starting January 1, 2013 and ending June 30, 2017 from $0.9 million to $252.5 million, an impressive 400% compound annual growth rate, but as we have seen our product lineup change through the first six months of 2017, we have seen our rate of originations change with it.

As of June 30, 2017, none of our sponsored Programs (as described below) have suffered any loss of principal or projected interest; however, there can be no assurance that such performance will continue in the future.

Consolidation of Variable Interest Entities

We consolidate all entities that we control either through a majority voting interest or as the primary beneficiary of variable interest entities. On January 1, 2017, we adopted ASU 2015-2, Consolidation (Topic 810): Amendments to the Consolidation Analysis, which provides a revised consolidation model for all reporting entities to use in evaluating whether to consolidate certain types of legal entities. As a result, we consolidated Fundrise, LP, Fundrise Real Estate Investment Trust, LLC, Fundrise Equity REIT, LLC, Fundrise West Coast Opportunistic REIT, LLC, Fundrise East Coast Opportunistic REIT, LLC, Fundrise Midland Opportunistic REIT, LLC, Fundrise For-Sale Housing eFund – Los Angeles CA, LLC, and Fundrise For-Sale Housing eFund – Washington DC, LLC (“the non-controlling consolidated entities”), under this guidance as variable interest entities.

For years ended December 31, 2016 and December 31, 2015, under previous accounting standards, we had determined the non-controlling consolidated entities to be voting interest entities (“VOEs”) and consolidated them based upon the presumption of a controlling interest in each entity. For further information on our adoption of this consolidation guidance, see Note 3 to the unaudited consolidated financial statements included in this Semi-Annual Report on Form 1-SA.

As of June 30, 2017, the non-controlling consolidated entities held approximately $175.1 million of total assets including $32.1 million of cash, $69.0 million of real estate debt investment, $61.3 million of investments in equity method investees, and $12.7 million in other assets. The assets and liabilities of the non-controlling consolidated entities are generally held within separate legal entities and, as a result, the liabilities of the non-controlling consolidated entities are non-recourse to us. For further information on consolidation of certain entities, see Note 3 to the unaudited consolidated financial statements included in this Semi-Annual Report on Form 1-SA.

Generally, the consolidation of the non-controlling consolidated entities has a gross-up effect on our assets, liabilities and cash flows and has a gross-down effect on the net income attributable to Rise, due to asset management fee and acquisition fee revenue earned by the Company and its wholly owned subsidiaries, but eliminated on consolidation. The net economic ownership interests of the non-controlling consolidated entities are reflected as non-controlling interests in consolidated entities in the accompanying unaudited consolidated financial statements.

Timeline and Milestones

In November 2015, we expanded our product offerings by launching the first ever eREITTM investment, an intended diversified real estate investment trust, available directly to investors online. In May 2017, we expanded our product offerings again by launching our first and second eFundTM investments, both intended diversified real estate investment funds, available directly to investors online. As of June 30, 2017, we had a total of five sponsored eREITsTM and two sponsored eFundsTM qualified under Regulation A. Through the Fundrise Platform, we reduced upfront fees and costs by up to 90% when compared to public non-traded REITs, by eliminating high-fee broker-dealers and investment bankers, while removing the double promote (where sponsors receive returns in more than one place in the distribution waterfall) common with real estate private equity. Our direct online investment model allows us, through our sponsored Programs, to more efficiently raise capital than through conventional institutional capital. The average size of the real estate assets originated by us and our affiliates have decreased from approximately $5.1 million during the six months ended June 30, 2016 to $3.0 million during the six months ended June 30, 2017, respectively. The decrease was mainly due to the Company’s increase in acquisition of single-family residential properties for the eFundsTMwhich drove down the average size of investments for the Company overall.

Other than our co-investments as the sponsor in the various eREITsTMand eFundsTM, we typically do not assume the long-term credit risk of the investments facilitated through the Fundrise Platform. However, from time to time, we or our affiliates, may bridge or warehouse investments for the eREITsTM and eFundsTM or other sponsored Programs. See “Management’s Discussion and Analysis Of Financial Condition And Results Of Operations – Liquidity and Capital Resources – Fundrise, L.P. – Sidecar Investment Fund.” As a result, a portion of our revenue comes from (i) interest earned from real estate assets we hold in this warehousing capacity and (ii) distributions from investments we make in our Programs.

Program investors can invest in eREITTM and eFundTM programs that are offered through the Fundrise Platform, which we refer to in this semi-annual report as our eDIRECTTM program:

| | • | eREITsTM. As of June 30, 2017, we have sponsored five (5) separate eREITsTM, all of which had qualified offerings under Regulation A, allowing any U.S. investor—not just high net worth individuals and other accredited investors—to invest directly in a diversified portfolio of commercial real estate investments. |

| | | |

| | • | eFundsTM As of June 30, 2017, we have sponsored two (2) separate eFundsTM, both of which had qualified offerings under Regulation A, allowing any U.S. investor—not just high net worth individuals and other accredited investors—to invest directly in a diversified portfolio of for-sale housing investments. |

The Company voluntarily suspended issuance of the Project Dependent Notes indefinitely in September 2016:

| | • | Project Dependent Notes Accredited investors interested in the Project Dependent Notes program could invest in promissory notes tied to the performance of specific real estate assets, in offerings exempt from registration pursuant to Section 4(a)(2) and Rule 506 of Regulation D. The Project Dependent Notes are typically issued by the National Commercial Real Estate Trust or a separate limited liability entity, each of which is ultimately under our control. The Project Dependent Notes are settled with cash flows from the underlying real estate assets selected by each investor through the Fundrise Platform. Since the introduction of our eREITTM programs, we have not sponsored any additional series of Project Dependent Notes, and, beginning in September 2016, we suspended, indefinitely, our Project Dependent Notes program. While, as of June 30, 2017, approximately $25.1 million of securities remain outstanding under the Project Dependent Notes program, we have no plans to sponsor the offering of any additional series of Project Dependent Notes in the immediate future. |

Our historical measured growth rates in facilitating investments through the Fundrise Platform reflect a deliberate strategy that allowed us to build and develop the various enterprise functions to support our scale, including operations, risk controls, customer support, compliance and technology. Demand from real estate operators and investors will continue to inform our business and investment product decisions, but we have so far refused to compromise the long-term quality of our underwriting to pursue excessive near-term growth rates that we believe would result in investment performance below our standards.

We have achieved the following significant milestones since our founding:

| • | In February 2011, we filed a provisional patent application for Systems and Methods for Online Securitization of Illiquid Assets -i.e., real estate crowdfunding. This patent is currently pending. |

| • | In June 2012, we invented online real estate investing (what some refer to as “real estate crowdfunding”), when our founders sponsored the first ever online real estate offering under Regulation A (available to all residents of the District of Columbia and the Commonwealth of Virginia) for a property at 1351 H Street NE, in Washington, DC. |

| • | In April 2013, we continued to lead the evolution of online real estate investing, when our founders sponsored the second ever online real estate offering under Regulation A (available to all residents of the District of Columbia and the Commonwealth of Virginia) for a property located at 906 H Street NE, in Washington, DC. |

| • | In March 2014, we continued to lead the evolution of online real estate investing, when our founders sponsored the third ever online real estate offering under Regulation A (available to all residents of the District of Columbia, the Commonwealth of Virginia and the State of Maryland) for a property located at 1539 7th Street NW, in Washington, DC. |

| • | In April 2014, Renren Inc. led our approximately $24.7 million Series A Preferred Stock financing round. |

| • | In June 2014, we introduced Project Dependent Notes that allowed investors to deploy capital targeting returns tied to select specific real estate assets through a standardized and simplified online investment process. |

| • | In November 2014, we introduced the first generation of the Fundrise Rating, which analyzed 25 key data variables relevant to real estate asset creditworthiness. |

| • | In February 2015, we sponsored an offering of limited liability company interests in Fundrise 3 World Trade Center, LLC, which owned approximately $2 million worth of Revenue Bonds, Series 2014 (backed by the 3 World Trade Center Project), Class 1, which had been issued by the New York Liberty Development Corporation. |

| | • | | In November 2015, we sponsored the first ever online real estate investment trust available to anyone in the U.S. (an eREITTM), called Fundrise Real Estate Investment Trust, LLC (the Income eREITTM). |

| • | For the fiscal year ended December 31, 2015, we had earned a cumulative 13% gross annual return for the entirety of the Project Dependent Notes program, which totaled 43 separate underlying real estate assets. |

| • | In January 2016, we surpassed $100 million in cumulative originations of debt and equity investments across our Programs. |

| • | In February 2016, we sponsored the second ever eREITTM, called Fundrise Equity REIT, LLC (the Growth eREITTM). |

| • | In July 2016, we surpassed 100,000 members on the Fundrise Platform. |

| • | In September 2016, we suspended, indefinitely, our Project Dependent Notes program. |

| • | In September 2016, we sponsored three additional eREITsTM, which vary based on geographic focus— Fundrise West Coast Opportunistic REIT, LLC (the West Coast eREITTM), Fundrise Midland Opportunistic REIT, LLC (the Heartland eREITTM), and Fundrise East Coast Opportunistic REIT, LLC (the East Coast eREITTM), each of which is available to anyone in the U.S., allowing investors to make their investment decisions through a custom product application. |

| • | In October 2016, we surpassed $100 million in assets under management under the eREITTM program. |

| • | In December 2016, we surpassed $200 million in cumulative originations of debt and equity investments across our Programs. |

| • | In December 2016, to our knowledge, the Income eREITTMbecame the first ever issuer to raise $50 million, the maximum amount allowed, pursuant to Regulation A. |

| • | In December 2016, to our knowledge, the Growth eREITTMbecame the second ever issuer to raise $50 million pursuant to Regulation A. |

| • | In February 2017, we initiated our first internet Public Offering (iPO) of Class B common shares to investors through the Fundrise Platform. By February 28, 2017, we had raised over $14 million in total gross proceeds and sold approximately 2.9 million shares of Class B common stock. |

| • | In May 2017, we sponsored our first and second ever online real estate investment funds available to anyone in the U.S. (eFundsTM), called Fundrise For-Sale Housing eFund - Los Angeles CA, LLC (the LA eFundTM) and Fundrise For-Sale Housing eFund – Washington DC, LLC (the DC eFundTM). |

| • | In July 2017, we were qualified to offer additional shares of Class B common stock to investors through the Fundrise Platform. |

| • | In September 2017, we surpassed $200 million in cumulative Regulation A+ offerings across our Programs. |

| • | In September 2017, we partnered with Millennium Trust Company to allow investors to invest IRA funds in our diversified commercial real estate investments through the eDIRECTTM programs. |

For the six months ended June 30, 2017 and June 30, 2016, our total revenue was $6.8 million and $6.2 million, respectively, representing a year-over-year increase of 10%. For the six months ended June 30, 2017 and 2016, we incurred a net loss attributable to Rise Companies Corp. of $3.2 million and $1.4 million, respectively. As of June 30, 2017, we have forty-two (42) full time employees, primarily based in Washington, DC.

Sources of Operating Revenues and Cash Flows

We generate the majority of our revenue from (i) origination fees from debt and equity investments paid by the real estate operators with which we partner, (ii) asset management fees paid quarterly by our Programs, and (iii) interest income. For the years ended December 31, 2014 and December 31, 2015, a significant portion of our revenue was generated from interest income we earned as a result of warehousing investments for the Project Dependent Note program. We have, as of September 2016, suspended the Project Dependent Note program indefinitely, and thus interest income related warehousing investments for the Project Dependent Note program, is not expected to be a material part of our future revenue. The suspension of this program resulted in an overall decrease in notes payable of approximately $6.0 million and $5.6 million for the six months ended June 30, 2017 and June 30, 2016, respectively.

Originations and Acquisitions

The origination fees we receive from originating debt and equity investments range from 0% to 2% of the initial principal amount of the investment. For the six months ended June 30, 2017 and June 30, 2016, our net origination and acquisition fee revenue was $1.0 million and $1.3 million, respectively, representing a year-over-year decrease of approximately 23%. The actual gross origination and acquisition fee revenue for the six months ended June 30, 2017 and June 30, 2016 was $0.9 million and $1.1 million, respectively, which excludes amortization of net origination fees and costs that were previously deferred. The decrease was mainly due to the Company’s increase in acquisition of single-family houses for the eFundsTMwhich are smaller investments on average than those of the eREITSTM; this was to be expected when we expanded our products. We believe that as our eFundsTM continue to grow, the volume of investments in single family residential properties will be a robust source of origination revenues going forward.

With respect to real estate debt and joint venture equity investments in which we originate and perform underwriting services, but which are ultimately acquired by an entity sponsored by us, such as one of the eDIRECTTM programs, we recognize such fees upon acquisition directly by or transfer to the eDIRECTTM programs. Origination and acquisition fees recognized from the eDIRECTTM programs for the six months ended June 30, 2017 and June 30, 2016, but eliminated upon consolidation, total approximately $17,000 and $0, respectively.

Our revenues have grown since 2013 primarily as a result of growth in originations for our Programs. Growth in originations has been driven by the addition of new assets under management, increasing investment from our existing and new investors, and increasing average investment size generally. For the six months ending June 30, 2017 and June 30, 2016, our real estate debt and equity investments totaled $45.7 million and $71.2 million, respectively, a 36% period over period decrease. However, total originated real estate debt and equity investments have increased 22% on a cumulative basis from December 31, 2016 to June 30, 2017. In general, we believe that it is in the best interest of the Company to maintain a high standard for the quality of our investments. We maintain a long-term view. As a result, there may be periods when the rate of growth of assets under management vary. We anticipate that our future growth will continue to depend in part on attracting new investors and real estate operators to our Programs. We plan to increase our sales and marketing spending to attract these customers as well as continuing to increase our origination efforts to better attract potential real estate operators. As we have invested more funds in our digital marketing efforts and focused on developing relationships with real estate operators, we expect to increase our Programs’ investments at a faster rate than in the past.

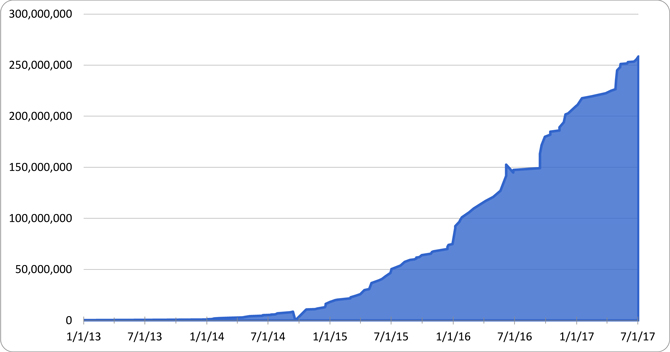

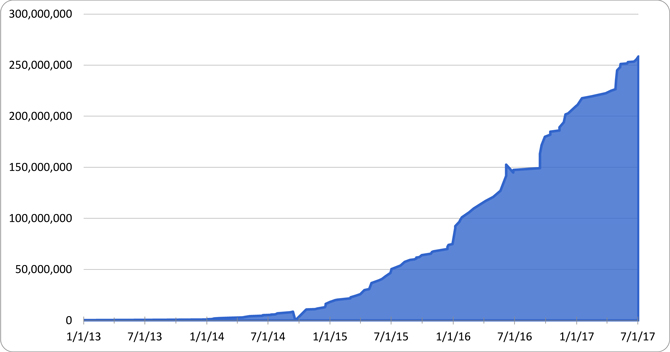

The following graph represents the total, cumulative dollar amount of debt and equity investments that we (or our affiliates) have originated from third-party sources for our Programs since January 2013 through June 30, 2017:

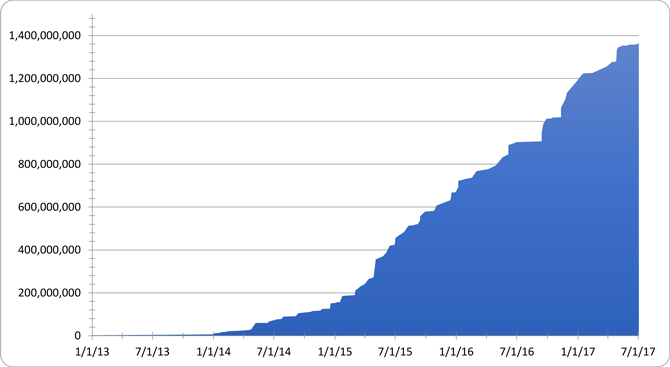

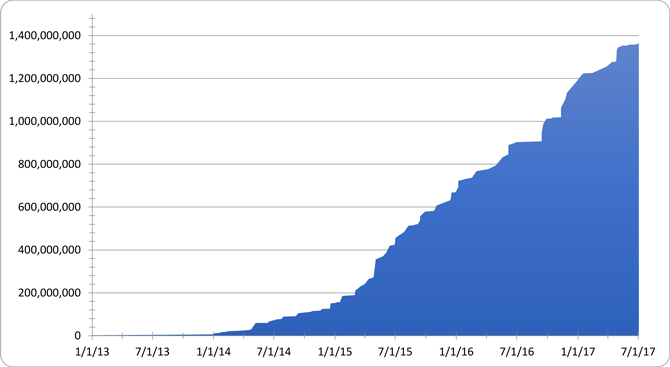

The following graph represents the total cumulative dollar amount of real estate property that we (or our affiliates) have originated from third-party sources for our Programs since January 2013 through June 30, 2017:

Asset Management Fees

Generally, each of the eREITs or eFunds pay us an annual asset management fee that is currently equal to 0.85% annually of the net offering proceeds as of the end of each quarter or the net asset value (“NAV”) at the end of each prior quarter as set forth in the filings of each respective eREITTM. Asset management fees earned by Fundrise Advisors for the six months ending June 30, 2017 and June 30, 2016, respectively, were approximately $433,000 and $60,000, a period-over-period increase of 622%. This increase has been driven by strong growth in our eREITTM program in particular. This is notable because Fundrise Advisors, LLC, our wholly-owned subsidiary and the Manager of the eDIRECTTM programs, agreed to waive asset management fees for the Income eREITTM, the oldest and most mature eREITTM, until December 2017. In addition, Fundrise Advisors agreed to waive asset management fees for each of the eFundsTM through June 2017. The growth in fees, therefore, does not include fees that the Manager could otherwise have collected from the largest and most mature eREITTM or any of the eFundsTM. However, these asset management fee amounts were eliminated upon consolidation and therefore are not reflected in the consolidated financial statements.

Expenses

Our operating expenses consist of sales and marketing, origination and servicing, engineering and product development, and other general and administrative expenses.

Sales and Marketing

Sales and marketing expenses consist primarily of engagement and enrollment of investors in our Programs, including costs attributable to marketing and selling our products. This includes costs of building general brand awareness, and salaries and benefits expenses related to our investments and marketing teams.

Sales and marketing expenses were $0.9 million and $0.4 million respectively, for the six months ended June 30, 2017 and June 30, 2016, an increase of 125%. The increase was primarily due to an increase in marketing headcount and enrollment of investors as we debuted our first and second eFundsTM.

Origination and Servicing

Origination and servicing expenses consist of costs attributable to activities that most directly relate to origination and servicing loans for real estate operators that are borrowers under our eDIRECTTM programs and investors in our eDIRECTTM programs, in addition to the salaries and benefits of our real estate team.

Origination and servicing expenses were $1.0 million and $0.5 million, respectively, for the six months ended June 30, 2017, and June 30, 2016, an increase of 100%. The increase was primarily due an increase in headcount in our real estate underwriting and origination teams.

Engineering and Product Development

Engineering and product development expenses consist primarily of salaries and benefits for our engineering and product management teams that are not capitalized as Internal-use software. These teams work on the development and maintenance of the Fundrise Platform. Engineering and product development expenses also include amortization expense of Internal-use software that has been put in use.

Engineering and product development expenses were $0.8 million and $0.4 million, respectively, for the six months ended June 30, 2017, and June 30, 2016, an increase of 100%. The increase was driven by investment in the Fundrise Platform and product development, which included an increase in personnel-related expenses resulting from increased headcount on our product team.

We capitalized $0.7 million and $0.4 million for the six months ended June 30, 2017 and June 30, 2016, respectively in software development costs.

Other General and Administrative

Other general and administrative expenses consist primarily of salaries and benefits for our accounting, legal, and operations teams, stock-based compensation for all eligible employees, and professional services fees. Other general and administrative expenses also include facilities and depreciation and amortization expenses.

Other general and administrative expenses were for the six months ended June 30, 2017, and June 30, 2016, $2.4 million and $2.0 million, respectively, an increase of 20%. The increase was primarily due to an increase of amortization expenses resulting from the launch of internal-use software.

Key Operating and Financial Metrics

We regularly review a number of metrics to evaluate our business, measure our performance, identify trends, formulate financial projections and make strategic decisions. (Tabular amounts in thousands, except percentages, or as noted.)

| | | June 30,

2017 | | | June 30,

2016 | | | Period

over

Period

Change | |

| | | | | | | | | | |

| Total Operating Revenue(1) | | $ | 1,161 | | | $ | 1,408 | | | | -18 | % |

| | | | | | | | | | | | | |

| Total Revenue | | | 6,815 | | | | 6,204 | | | | 10 | % |

| | | | | | | | | | | | | |

| Total Operating Expenses | | | 4,982 | | | | 3,282 | | | | 52 | % |

| | | | | | | | | | | | | |

| Net Operating Income (Loss) | | | -3,235 | | | | -1,442 | | | | -124 | % |

| | | | | | | | | | | | | |

| Cash and Cash Equivalents | | | 48,274 | | | | 26,820 | | | | 80 | % |

| | | | | | | | | | | | | |

| Distributions Paid by eREITsTMDuring the Six Months Ended | | | 4,455 | | | | 227 | | | | 1863 | % |

| | | | | | | | | | | | | |

| Total Fundrise Platform Distributions Related to the Six Months Ended | | | 16,277 | | | | 3,648 | | | | 346 | % |

(1) Asset management fee revenue is eliminated in consolidation, and not included in this figure or shown on the accompanying consolidated financial statements. Asset management fees earned by Fundrise Advisors for the six months ending June 30, 2017 and June 30, 2016, respectively, were approximately $433,000 and $60,000, a period-over-period increase of 622%.

Key Factors Affecting Our Performance

Investment in Long-Term Growth

The core elements of our growth strategy include enrolling new investors, broadening our origination capabilities, enhancing our technology infrastructure, expanding our product offerings, and extending customer lifetime value. We plan to continue to invest significant resources to accomplish these goals, and we anticipate that our operating expenses will continue to increase for the foreseeable future, particularly our sales and marketing, technology, and origination expenses. These investments are intended to contribute to our long-term growth, but they may affect our near-term profitability.

Real Estate Originations

We originate our Programs’ real estate investments with the Fundrise Platform and through our in-house real estate team, RSE Capital Partners. We generate revenue from origination fees paid by real estate operators and joint-ventures in connection with debt and equity investment originations. We believe originations are a key indicator of the growth rate of our marketplace, credibility of our brand, scale of our business, strength of our network effect, and economic competitiveness of our products and future growth. Real estate originations have increased significantly over time due to the increased awareness of our brand, our high real estate operator and investor satisfaction rates, the effectiveness of our acquisition channels, a strong track record of investment performance and the expansion of our capital base. Factors that could affect debt and equity investment originations include the interest rate and economic environment, the competitiveness of our cost of capital, the success of our operational efforts to balance demands from investors and real estate operators, our ability to develop new products or enhance existing products for real estate operators and investors, the success of our sales and marketing initiatives and the success of developing relationships with real estate operator and acquiring and retaining investors.

The equity capital our Programs invest in the real estate assets enabled through the Fundrise Platform comes directly from investors. Our model is built specifically to leverage the economies of scale created by the Internet to cut out excessive fees, while also lowering execution costs and reducing both time and manual resources. Our end-to-end integrated web-platform transforms the real estate origination, underwriting, funding, and servicing processes, replacing expensive sales and management teams with online applications, implementing data driven decision making, and automating transactions through payment processing APIs (application programming interfaces).

Liquidity and Capital Resources

Since inception through June 30, 2017, we have financed our operations primarily through private offerings of our equity securities.

We believe that our current capital position is sufficient to meet our current liquidity needs for at least the next 24 months, however, there can be no assurance that our current capital position will meet our liquidity needs for such period.

As of June 30, 2017, and December 31, 2016, respectively, we do not have any material commitments for capital expenditures, nor did we enter into any in the interim period between June 30, 2017 and the time of the filing of this Semi-Annual Report on Form 1-SA.

Equity Financings

On January 19, 2017, the Board of Directors of the Company increased the number of authorized shares of Common Stock to 96,000,000 authorized shares and created a new class of Common Stock, to be designated as Class B Common Stock, consisting of 10,000,000 authorized shares by filing an Amended and Restated Certificate of Incorporation with the State of Delaware. Except as required by applicable law, the holders of our Class B Common Stock are not entitled to vote on any matters submitted to a vote of stockholders. On January 31, 2017, the Company was qualified by the SEC for a Tier 2 offering pursuant to Regulation A to offer up to 2,000,000 shares of our Class B Common Stock to the public at $5.00 per share, with par value of $0.0001. On February 3, 2017, the Company offered an additional 1,000,000 shares of our Class B Common Stock to the public at $5.00 per share, thereby increasing the total offering of Class B Common Stock to 3,000,000 shares. As of February 28, 2017, 2,884,129 Class B common shares were sold for total proceeds of $14.4 million. On June 30, 2017, 3,800 shares were redeemed for $19,000.

On July 28, 2017, the Company was qualified by the SEC to offer up to 2,000,000 additional shares of Class B Common Stock to the public at $5.50 per share, with par value of $0.0001. This continuation of the offering has no minimum investment. As of September 12, 2017, 458,794 shares have been sold under this offering for total proceeds of $2.5 million. Shares are currently offered and are sold on a continuous basis only to existing investors in programs sponsored by the Company on a select basis.

The funds received from the issuance of our Class B common stock are a primary source of capital for our operating expenditures.

Fundrise, L.P. – Sidecar Investment Fund

As part of the 2014 Series A Preferred Stock financing, we raised a $10 million sidecar private fund called Fundrise, L.P., which was formed to provide warehousing and financing support to assets originated and facilitated by the Fundrise Platform. Fundrise, L.P., is managed by Fundrise GP I, LLC, our indirect, wholly-owned subsidiary.

Fundrise, L.P. has issued a $10 million promissory grid note to the Company as a means to provide liquidity during capital raising periods for the Company and its affiliates. For further information on this promissory grid note, please see Note 15 to the unaudited consolidated financial statements included in this Semi-Annual Report on Form 1-SA.

Corporate Debt

As of June 30, 2017, we had no material corporate debt.

| C. | Outlook and Recent Trends |

We believe that the intermediate and long-term growth prospects for the Company are compelling. Given the continued potential of finance technology to improve the efficiencies of real estate origination, operations, and investment, we expect to maintain, if not increase, our growth rate. However, we are wary of the long-sustained bull stock market, as the current economic cycle has been in expansion for more than eight years. The Federal Reserve monetary policy has begun to tighten, which historically has occurred in the later stages of US economic cyclical growth. The resiliency of our direct-to-investor online investment model is likely to be tested during the next financial downturn. We believe our investment model will prove out for our customers, providing good risk-adjusted returns for our investors. Our track record in a recession will be one of the most important aspects of the long-term success of the Company.

We favor an investment strategy for our managed products weighted toward maintaining a margin of safety for each investment, such as targeting senior loans in urban locations, senior preferred or mezzanine investments in new construction apartments, and equity investments in stabilized or value-add multifamily assets. We seek to invest below-the-radar of institutional-sized investors. We believe that our investment strategy, combined with our technology infrastructure and the expertise of our Manager’s management team, will provide opportunities to originate investments with attractive returns, thereby taking advantage of the changing market conditions to seek the best risk-return dynamic for our shareholders.

ITEM 2: OTHER INFORMATION

None.

INDEX TO FINANCIAL STATEMENTS OF RISE COMPANIES CORP.

| Consolidated Balance Sheets as of June 30, 2017, and December 31, 2016 | F-2 |

| | |

| Consolidated Statements of Operations for the six months ended June 30, 2017 and June 30, 2016 | F-3 |

| | |

| Consolidated Statements of Comprehensive Loss for the six months ended June 30, 2017 and June 30, 2016 | F-4 |

| | |

| Consolidated Statements of Changes in Stockholders’ Equity for the six months ended June 30, 2017 and the year-ended December 31, 2016 | F-5 |

| | |

| Consolidated Statements of Cash Flows for the six months ended June 30, 2017 and June 30, 2016 | F-6 |

| | |

| Notes to Consolidated Financial Statements | F-7 |

RISE COMPANIES CORPORATION

Consolidated Balance Sheets

(in thousands, except share and per share amounts)

| | | June 30, 2017 (Unaudited) | | | December 31, 2016 (Audited) | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 48,274 | | | $ | 25,055 | |

| Restricted cash | | | - | | | | 500 | |

| Investments in single-family residential properties, net | | | 475 | | | | - | |

| Real estate available for sale | | | 659 | | | | - | |

| Real estate debt investments, net | | | 37,919 | | | | 30,611 | |

| Accrued interest receivable | | | 1,660 | | | | 1,625 | |

| Accounts receivable, net | | | 52 | | | | 6 | |

| Other current assets | | | 1,906 | | | | 1,651 | |

| Total current assets | | | 90,945 | | | | 59,448 | |

| Real estate debt investments, net (non-current) | | | 56,423 | | | | 56,744 | |

| Investments in equity method investees | | | 61,259 | | | | 49,155 | |

| Accrued interest receivable (non-current) | | | 3,726 | | | | 4,049 | |

| Intangible assets, net | | | 2,387 | | | | 1,915 | |

| Property and equipment, net | | | 404 | | | | 429 | |

| Total assets | | $ | 215,144 | | | $ | 171,740 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Notes payable | | $ | 12,704 | | | $ | 8,631 | |

| Accrued interest payable | | | 2,677 | | | | 3,085 | |

| Settling subscriptions & investments | | | 3,697 | | | | 1,188 | |

| Due to investors | | | 7,547 | | | | 5,126 | |

| Accounts payable | | | 730 | | | | 653 | |

| Accrued compensation and benefits | | | 16 | | | | 243 | |

| Accrued expenses | | | 341 | | | | 639 | |

| Other current liabilities | | | 310 | | | | 117 | |

| Total current liabilities | | | 28,022 | | | | 19,682 | |

| Notes payable (non-current) | | | 12,356 | | | | 22,444 | |

| Total liabilities | | | 40,378 | | | | 42,126 | |

| Commitments and contingencies (see Note 18) | | | | | | | | |

| | | | | | | | | |

| STOCKHOLDERS’ EQUITY | | | | | | | | |

| Series A convertible preferred stock, $0.0001 par value; 15,000,000 shares authorized at June 30, 2017 and December 31, 2016; 11,865,046 shares issued and outstanding at June 30, 2017 and December 31, 2016; with an aggregate liquidation preference of $25,951 at both June 30, 2017 and December 31, 2016 | | | 1 | | | | 1 | |

| Class A common stock, $0.0001 par value; 43,000,000 shares authorized at June 30, 2017 and December 31, 2016; 2,540,962 and 2,640,775 shares issued and outstanding at June 30, 2017 and December 31, 2016, respectively | | | - | | | | - | |

| Class B common stock, $0.0001 par value; 96,000,000 and 0 shares authorized at June 30, 2017 and December 31, 2016; 2,880,329 and 0 shares issued and outstanding at June 30, 2017 and December 31, 2016, respectively | | | - | | | | - | |

| Class F common stock, $0.0001 par value; 10,000,000 shares authorized at June 30, 2017 and December 31, 2016; 10,000,000 shares issued and outstanding at June 30, 2017 and December 31, 2016 | | | 1 | | | | 1 | |

| Class M common stock, $0.0001 par value; 18,000,000 shares authorized at June 30, 2017 and December 31, 2016; 0 shares issued and outstanding at June 30, 2017 and December 31, 2016 | | | - | | | | - | |

| Additional paid-in capital | | | 39,811 | | | | 25,364 | |

| Accumulated deficit | | | (17,361 | ) | | | (14,126 | ) |

| Total stockholders’ equity before non-controlling interests | | | 22,452 | | | | 11,240 | |

| Non-controlling interests in consolidated entities | | | 152,314 | | | | 118,374 | |

| Total stockholders’ equity | | | 174,766 | | | | 129,614 | |

| Total liabilities and stockholders’ equity | | $ | 215,144 | | | $ | 171,740 | |

The accompanying notes are an integral part of these consolidated financial statements.

RISE COMPANIES CORPORATION

Consolidated Statements of Operations

(in thousands, except share and per share amounts)

| | | Six months ended | | | Six months ended | |

| | | June 30, | | | June 30, | |

| | | 2017 (Unaudited) | | | 2016 (Unaudited) | |

| Operating revenue | | | | | | | | |

| Origination/Acquisition fees, net | | $ | 1,002 | | | $ | 1,280 | |

| Management fees | | | 57 | | | | 104 | |

| Other revenue | | | 102 | | | | 24 | |

| Total operating revenue | | | 1,161 | | | | 1,408 | |

| | | | | | | | | |

| Interest income | | | | | | | | |

| Interest income | | | 5,654 | | | | 4,796 | |

| Total interest income | | | 5,654 | | | | 4,796 | |

| | | | | | | | | |

| Total revenue | | | 6,815 | | | | 6,204 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Sales and marketing | | | 876 | | | | 397 | |

| Origination and servicing | | | 980 | | | | 516 | |

| Engineering and product development | | | 759 | | | | 409 | |

| Other general and administrative | | | 2,367 | | | | 1,960 | |

| Total operating expenses | | | 4,982 | | | | 3,282 | |

| | | | | | | | | |

| Interest expense | | | | | | | | |

| Interest expense | | | 2,145 | | | | 2,928 | |

| Total interest expense | | | 2,145 | | | | 2,928 | |

| | | | | | | | | |

| Total expenses | | | 7,127 | | | | 6,210 | |

| | | | | | | | | |

| Other income | | | | | | | | |

| Income from equity method investees | | | 343 | | | | 94 | |

| Realized gain on available for sale securities | | | - | | | | 114 | |

| Total other income | | | 343 | | | | 208 | |

| | | | | | | | | |

| Net Income | | | 31 | | | | 202 | |

| Less: Net income from non-controlling interests | | | 3,266 | | | | 1,644 | |

| Net loss attributable to Rise Companies Corporation | | $ | (3,235 | ) | | $ | (1,442 | ) |

| | | | | | | | | |

| Net loss per share attributable to common stockholders: | | | | | | | | |

| Basic | | $ | (0.26 | ) | | $ | (0.13 | ) |

| Weighted average shares of common stock – Basic | | | 12,248,282 | | | | 10,914,425 | |

The accompanying notes are an integral part of these consolidated financial statements.

In the opinion of management, all adjustments necessary in order to make the interim financial statements not misleading have been included.

RISE COMPANIES CORPORATION

Consolidated Statements of Comprehensive Loss

(in thousands)

| | | Six months ended | | | Six months ended | |

| | | June 30, | | | June 30, | |

| | | 2017 (Unaudited) | | | 2016 (Unaudited) | |

| Net income | | $ | 31 | | | $ | 202 | |

| Less: Comprehensive income attributable to non-controlling interests | | | 3,266 | | | | 1,644 | |

| Comprehensive loss attributable to Rise Companies Corporation | | $ | (3,235 | ) | | $ | (1,442 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

RISE COMPANIES CORPORATION

Consolidated Statements of Changes in Stockholders’ Equity

(Unaudited)

(in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | |

| | | Preferred Stock | | | Common Stock | | | Common Stock | | | Common Stock | | | Common Stock | | | Additional | | | | | | Other | | | Non- | | | Total | |

| | | Series A | | | Class A | | | Class F | | | Class M | | | Class B | | | Paid-In | | | Accumulated | | | Comprehensive | | | Controlling | | | Stockholders’ | |

| | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Income | | | Interests | | | Equity | |

| Balance at December 31, 2015 | | | 11,865,046 | | | $ | 1 | | | | 1,749,150 | | | $ | - | | | | 10,000,000 | | | $ | 1 | | | | - | | | $ | - | | | | - | | | $ | - | | | $ | 24,833 | | | $ | (10,495 | ) | | $ | 48 | | | $ | 22,557 | | | $ | 36,945 | |

| Recognition of previously unrecognized gains | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (48 | ) | | | - | | | | (48 | ) |

| Stock-based compensation | | | - | | | | - | | | | 891,925 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 531 | | | | - | | | | - | | | | - | | | | 531 | |

| Issuance of Class M Common Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 18,000,000 | | | | 2 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 2 | |

| Redemption of Class M Common Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (18,000,000 | ) | | | (2 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (2 | ) |

| Non-controlling interests acquired | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 108,150 | | | | 108,150 | |

| Derecognition of non-controlling interests | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (2,000 | ) | | | (2,000 | ) |

| Accumulated amortization of deferred offering costs for non-controlling interests | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (2,023 | ) | | | (2,023 | ) |

| Distributions declared on common shares for non-controlling interest | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (7,263 | ) | | | (7,263 | ) |

| Redemptions on common shares for non-controlling interests | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (2,123 | ) | | | (2,123 | ) |

| Net income/(loss) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (3,631 | ) | | | - | | | | 1,076 | | | | (2,555 | ) |

| Balance at December 31, 2016 | | | 11,865,046 | | | $ | 1 | | | | 2,640,775 | | | $ | - | | | | 10,000,000 | | | $ | 1 | | | | - | | | $ | - | | | | - | | | $ | - | | | $ | 25,364 | | | $ | (14,126 | ) | | $ | - | | | $ | 118,374 | | | $ | 129,614 | |

| Stock-based compensation | | | - | | | | - | | | | (99,813 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 570 | | | | - | | | | - | | | | - | | | | 570 | |

| Issuance of Class B Common Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 2,884,129 | | | | - | | | | 14,421 | | | | - | | | | - | | | | - | | | | 14,421 | |

| Redemption of Class B Common Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (3,800 | ) | | | - | | | | (19 | ) | | | — | | | | — | | | | — | | | | (19 | ) |

| Offering costs for Class B Common Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (525 | ) | | | - | | | | - | | | | - | | | | (525 | ) |

| Non-controlling interests acquired | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 40,511 | | | | 40,511 | |

| Redemptions on common shares for non-controlling interests | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,916 | ) | | | (1,916 | ) |

| Distributions declared on common shares for non-controlling interests | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (7,197 | ) | | | (7,197 | ) |

| Accumulated amortization of deferred offering costs for non-controlling interests | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (724 | ) | | | (724 | ) |

| Net income/(loss) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (3,235 | ) | | | - | | | | 3,266 | | | | 31 | |

| Balance at June 30, 2017 | | | 11,865,046 | | | $ | 1 | | | | 2,540,962 | | | $ | - | | | | 10,000,000 | | | $ | 1 | | | | - | | | $ | - | | | | 2,880,329 | | | $ | - | | | $ | 39,811 | | | $ | (17,353 | ) | | $ | - | | | $ | 152,314 | | | $ | 174,766 | |

The accompanying notes are an integral part of these consolidated financial statements.

RISE COMPANIES CORPORATION

Consolidated Statements of Cash Flows

(in thousands)

| | | Six months ended | | | Six months ended | |

| | | June 30, | | | June 30, | |

| | | 2017 (Unaudited) | | | 2016 (Unaudited) | |

| OPERATING ACTIVITIES: | | | | | | | | |

| Net income | | $ | 31 | | | $ | 202 | |

| Adjustments to reconcile net income to net cash used by operating activities: | | | | | | | | |

| Accretion of deferred loan fees and costs | | | (106 | ) | | | (188 | ) |

| Earnings from equity method investees | | | (343 | ) | | | (95 | ) |

| Stock-based compensation | | | 570 | | | | 25 | |

| Depreciation and amortization | | | 337 | | | | 146 | |

| Loss (gain) on sale of securities available for sale | | | - | | | | (232 | ) |

| Net change in operating assets and liabilities: | | | | | | | | |

| Accrued interest receivable | | | 288 | | | | (1,855 | ) |

| Accounts receivable | | | (46 | ) | | | (16 | ) |

| Other current assets | | | (15 | ) | | | (269 | ) |

| Accrued interest payable | | | (408 | ) | | | 1,086 | |

| Accounts payable | | | 77 | | | | 387 | |

| Accrued expenses and other current liabilities | | | (332 | ) | | | (1,163 | ) |

| Net cash provided by (used in) operating activities | | | 53 | | | | (1,972 | ) |

| INVESTING ACTIVITIES: | | | | | | | | |

| Purchase of real estate debt investments | | | (26,295 | ) | | | (34,115 | ) |

| Investments in single family residential properties | | | (475 | ) | | | - | |

| Investments in real estate available for sale | | | (659 | ) | | | - | |

| Deposits for real estate assets | | | (16 | ) | | | - | |

| Principal payments from real estate debt investments | | | 19,414 | | | | 8,459 | |

| Investments in equity method investees | | | (15,658 | ) | | | (17,894 | ) |

| Dividends received from equity method investees | | | 3,897 | | | | - | |

| Change in restricted cash | | | 500 | | | | 1,444 | |

| Purchase of intangible assets | | | (749 | ) | | | (404 | ) |

| Proceeds from sales of securities available for sale | | | - | | | | 2,246 | |

| Purchases of property and equipment | | | (35 | ) | | | (5 | ) |

| Net cash used in investing activities | | | (20,076 | ) | | | (40,269 | ) |

| FINANCING ACTIVITIES: | | | | | | | | |

| Change in payable to investors | | | - | | | | 2,981 | |

| Proceeds from issuance of notes payable | | | - | | | | 3,542 | |

| Principal payments on notes payable | | | (6,015 | ) | | | (9,190 | ) |

| Proceeds (settlement) from subscriptions not settled by year end | | | 2,509 | | | | 1,421 | |

| Proceeds from sale of interests in consolidated non-controlling entities, net of offering costs | | | 39,298 | | | | 45,961 | |

| Proceeds from the issuance of Class B common stock, net of offering costs | | | 14,161 | | | | - | |

| Redemptions of Class B common stock | | | (19 | ) | | | - | |

| Distributions to non-controlling interest holders | | | (4,465 | ) | | | - | |

| Redemptions by non-controlling interest holders | | | (2,227 | ) | | | - | |

| Net cash provided by financing activities | | | 43,242 | | | | 44,715 | |

| | | | | | | | | |

| Net increase in cash and cash equivalents | | | 23,219 | | | | 2,474 | |

| Cash and cash equivalents, beginning of period | | | 25,055 | | | | 24,346 | |

| Cash and cash equivalents, end of period | | $ | 48,274 | | | $ | 26,820 | |

| | | | | | | | | |

| Supplemental cash flow information: | | | | | | | | |

| | | | | | | | | |

| Cash paid for interest | | $ | 2,553 | | | $ | 1,985 | |

The accompanying notes are an integral part of these consolidated financial statements.

Rise Companies Corporation

Notes to Consolidated Financial Statements

(Unaudited)

(Tabular amounts in thousands, except share and per share amounts, ratios, or as noted)

1. Formation and Organization

Rise Companies Corporation (“Rise”, “Rise Companies Corp”, “we”, “our”, the “Company”, and “us”) is the parent company of Fundrise, LLC (“Fundrise”), a wholly-owned subsidiary. Fundrise, LLC owns and operates an online investment platform, www.fundrise.com, (the “Fundrise Platform”) that allows investors to become equity or debt holders in alternative investment opportunities. Fundrise Lending, LLC (“Fundrise Lending”) is a wholly-owned subsidiary of Rise and a licensed finance lender in the State of California that facilitates real estate loans (“Loans”). National Commercial Real Estate Trust (the “Trust”) is a Delaware statutory trust that is a wholly-owned subsidiary of Rise and that has historically acquired loans from Fundrise Lending, LLC and held them for the sole benefit of certain investors that have purchased Project-Dependent Notes (“Notes”) issued by the Trust and that are related to specific underlying loans for the benefit of the investor. Fundrise Advisors, LLC (“Fundrise Advisors”) is a registered investment advisor with the Securities and Exchange Commission (SEC) and a wholly-owned subsidiary of Rise that acts as the non-member manager for the real estate investment trusts sponsored by the Company and offered for investment via the Fundrise Platform. Fundrise Real Estate Investment Trust, LLC, Fundrise Equity REIT, LLC, Fundrise West Coast Opportunistic REIT, LLC, Fundrise East Coast Opportunistic REIT, LLC, and Fundrise Midland Opportunistic REIT, LLC are the real estate investment trust sponsored programs (the “eREITs”). Fundrise For-Sale Housing eFund – Los Angeles CA, LLC and Fundrise For-Sale Housing eFund – Washington DC, LLC are the real estate investment fund sponsored programs (the “eFunds”). Fundrise LP, a Delaware limited partnership (“Fundrise LP”), is an affiliate of Rise and was created with the intent to directly benefit Rise by driving its growth and profitability. Additionally, Rise owns 1.96% of Fundrise LP and has the ability to direct its assets. As discussed further inNote 3 – Summary of Significant Accounting Policies, the Company has determined the eREITs, the eFunds, and Fundrise LP to be Variable Interest Entities (“VIEs”), and consolidates such entities given the Company’s control.

The Company was conceived of by Benjamin Miller, and founded by Benjamin Miller and Daniel Miller (together, the “Founders”) in 2012.

The Company publicly filed an offering statement on Form 1-A with the SEC with respect to an offering (the “Offering”) of Class B common shares in January 2017 and the SEC qualified this offering on January 31, 2017.

2. Basis of Presentation

The accompanying consolidated financial statements include Rise, its wholly-owned subsidiaries, affiliated entities where Rise is the primary beneficiary of variable interest entities (VIEs), and entities that it controls through a majority voting interest or otherwise. All intercompany transactions have been eliminated.

The accompanying balance sheets, statements of operations, statements of comprehensive loss, statements of stockholders’ equity, statements of cash flows and related notes to the financial statements of the Company are prepared on the accrual basis of accounting and conform to accounting principles generally accepted in the United States of America (“GAAP”) for interim financial reporting and the instructions to Form 1-SA and Rule 8-03(b) of Regulation S-X of the rules and regulations of the SEC. Accordingly, certain information and note disclosures normally included in the financial statements prepared under U.S. GAAP have been condensed or omitted.

In the opinion of management, all adjustments considered necessary for a fair presentation of the Company’s financial position, results of operations and cash flows have been included and are of a normal and recurring nature. Interim results are not necessarily indicative of operating results for any other interim period or for the entire year. The December 31, 2016 balance sheet and certain related disclosures are derived from the Company’s December 31, 2016 audited financial statements filed on Form 1-K. These financial statements should be read in conjunction with the Company’s financial statements and notes thereto included in the Company’s form 1-K, which was filed with the SEC.

The Company adopted the calendar year as its basis of reporting.

The preparation of our consolidated financial statements and related disclosures in conformity with GAAP requires management to make estimates and assumptions that affect reported amounts of assets and liabilities and the disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could materially differ from those estimates.

We base our estimates on historical experience and on various other factors we believe to be reasonable under the circumstances; the results of which form the basis for making judgments about the carrying values of certain assets and liabilities. These judgments, assumptions, and estimates include but are not limited to the following: (i) impairment/allowance determinations for loans; (ii) fair value determinations for certain equity method investments, investments in single family residential properties, and real estate available for sale; and (iii) stock-based compensation. These judgments, estimates, and assumptions are inherently subjective in nature and actual results may differ from these estimates and assumptions, and the differences could be material.

3. Summary of Significant Accounting Policies

Revenue Recognition

Origination and Acquisition Fees

Deal origination fees are paid by borrowers and are determined by the term and credit grade of the loan. Origination fees generally range from 0.0% to 2.0% of the aggregate loan amount. Origination fees are included in the annual percentage rate calculation provided to the borrower and are subtracted from the gross loan proceeds prior to disbursement of the loan funds to the borrower. A loan is considered issued when upon completion of a wire transaction, initiated by us, to transfer funds from our bank account to the borrower’s settlement agent or borrower’s bank account.

Acquisition fees are typically fixed at 1.5% to 2.0% based on the committed amount of equity provided by an affiliate of the Company, such as the eREITs and eFunds, to acquire a real estate asset. Such fees are recognized upon acquisition of the real estate asset by the affiliate.

In the instances of real estate loans held by one of the wholly-owned subsidiaries of Rise Companies Corp typically for the purpose of offering investment derived from the performance of the assets via the Project-Dependent Notes Program, origination fee revenue is reduced by the deferral of net origination fees less origination costs in accordance with Accounting Standards Codification (“ASC”) 310. The net amount of origination fees less origination costs is amortized over the expected life of the loan as non-interest operating revenue beginning at loan issuance. The net deferred amount, less amortization, is included in the carrying value of the real estate debt investments on the consolidated balance sheets.

With respect to real estate debt and joint venture equity investments in which the Company originates and performs underwriting services, but which are ultimately acquired by an entity sponsored by the Company, such as one of the eREITs or eFunds, the Company recognizes such origination or acquisition fees upon acquisition directly by or transfer to the eREITs or eFunds. Such fees are paid to the Company at closing of an acquisition, generally from the unrelated borrower entity or joint-venture.

With respect to direct equity investments, such as investments in single-family residential properties, in which the Company originates and performs underwriting services, but which are ultimately acquired by an entity sponsored by the Company, such as one of the eFunds, the Company recognizes such origination or acquisition fees upon acquisition directly by or transfer to the eFunds. Such fees are paid to the Company at closing of an acquisition by the eFund to the Company in the event of equity investments. This revenue is eliminated upon consolidation, and is therefore not reflected on the statement of operations.

Real estate assets originated during the six months ended June 30, 2017 were acquired directly by or transferred to the eREITs and eFunds. Thus, the Company recognized such origination and acquisition fees as revenues once all significant services have been rendered with respect to such acquisition, which generally occurs concurrently with the closing of the acquisition.

Due Diligence Fees

Due diligence fees are included in origination fees in the operating revenue section of the consolidated statements of operations. These fees are paid by borrowers and are assessed to commensurate with the time required to perform diligence when underwriting a loan. Due diligence fees are assessed prior to the loan origination and are recognized either: 1) over the life of the loan beginning once origination of the loan has concluded if originated by one of the wholly-owned subsidiaries of the Company, or 2) upon acquisition directly by or transfer to the eREITs or eFunds. In the event Rise elects not to underwrite the underlying loan, due diligence revenue is recognized upon communication of that decision to the prospective borrower.

Servicing Fees

Servicing fees are included in management fees in the operating revenue section of the consolidated statements of operations. Servicing fees are paid by Note investors and based on the principal and interest payments serviced on the related loan. The servicing fee compensates the Company for managing payments from borrowers and to investors and maintaining investors’ account portfolios. The Company records servicing fees as a component of non-interest operating revenue when earned. Servicing fees can be, and have been, modified or waived at the discretion of the management of the Company.

Asset Management Fees

Asset management fees are paid by investors via wholly-owned, affiliated, or managed entities based on various agreements with those entities. Management fees are a component of non-interest operating revenue and are recorded as earned. Management fees can be, and have been, modified or waived at the discretion of management.

Fundrise Advisors, LLC is entitled to a quarterly asset management fee for the qualified eREITs and eFunds in which it manages. At its sole discretion, Fundrise Advisors can choose to waive its asset management fee in whole or in part due from each or any of the programs that it manages and will, as a result, forfeit any portion of the asset management fee that is waived. Fundrise Advisors has agreed to waive its asset management fee due from Fundrise Real Estate Investment Trust, LLC, until December 31, 2017.

The asset management fee paid/payable by the eREITs and eFunds to Fundrise Advisors is an intercompany transaction, and thus eliminated upon consolidation. For the six months ended June 30, 2017 and June 30, 2016, respectively, asset management fees earned by Fundrise Advisors but eliminated in consolidation were approximately $433,000 and $60,000.

Other Revenue

Other revenue consists primarily of a 0.2% trust custody fee paid to National Commercial Real Estate Trust, a wholly-owned subsidiary of Rise Companies, by Note investors, and fees paid by real estate borrowers at the initial maturity date to extend the maturity date for a real estate debt investment.

Principles of Consolidation

The Company consolidates all entities that it controls either through a majority voting interest or as the primary beneficiary of variable interest entities (“VIEs”). On January 1, 2017, the Company adopted ASU 2015-2, Consolidation (Topic 810): Amendments to the Consolidation Analysis, which provides a revised consolidation model for all reporting entities to use in evaluating whether to consolidate certain types of legal entities. Accordingly, the consolidation of the eREITs, eFunds, and Fundrise LP remains appropriate.

The Company evaluates (1) whether it holds a variable interest in an entity, (2) whether the entity is a VIE, and (3) whether the Company's involvement would make it the primary beneficiary. In evaluating whether the Company holds a variable interest, fees (including management fees) that are customary and commensurate with the level of services provided, and where the Company does not hold other economic interests in the entity that would absorb more than an insignificant amount of the expected losses or returns of the entity, are not considered variable interests. The Company considers all economic interests, including indirect interests, to determine if a fee is considered a variable interest.

For those entities where the Company holds a variable interest, the Company determines whether each of these entities qualifies as a VIE and, if so, whether or not the Company is the primary beneficiary. The assessment of whether the entity is a VIE is generally performed qualitatively, which requires judgment. These judgments include: (a) determining whether the equity investment at risk is sufficient to permit the entity to finance its activities without additional subordinated financial support, (b) evaluating whether the equity holders, as a group, can make decisions that have a significant effect on the economic performance of the entity, (c) determining whether two or more parties' equity interests should be aggregated, and (d) determining whether the equity investors have proportionate voting rights to their obligations to absorb losses or rights to receive returns from an entity.

For entities that are determined to be VIEs, the Company consolidates those entities where it has concluded it is the primary beneficiary. The primary beneficiary is defined as the variable interest holder with (a) the power to direct the activities of a VIE that most significantly impact the entity’s economic performance and (b) the obligation to absorb losses of the entity or the right to receive benefits from the entity that could potentially be significant to the VIE. In evaluating whether the Company is the primary beneficiary, the Company evaluates its economic interests in the entity held either directly or indirectly by the Company. Entities that do not qualify as VIEs are generally assessed for consolidation as voting interest entities. Under the voting interest entity model, the Company consolidates those entities it controls through a majority voting interest.

As of June 30, 2017, the total assets of Fundrise LP, the eREITs, and the eFunds reflected on the consolidated balance sheets were $175.1 million, which includes $32.1 million of cash, $69.0 million of real estate debt investments and $61.3 million of investments in equity method investees, and $12.7 million other assets, respectively. As of December 31, 2016, total assets and liabilities of Fundrise LP and the eREITs, reflected in the consolidated balance sheets was $125.5 million, which includes $20.4 million of cash, $52.6 million of real estate debt investments and $49.2 million of investments in equity method investees, and $6.6 million of other assets, respectively. Additionally, total interest income of Fundrise LP, the eREITs, and the eFunds on the consolidated statements of operations was $3.4 million, and $1.6 million for six months ended June 30, 2017, and June 30, 2016, respectively.

Cash and Cash Equivalents

Cash and cash equivalents include unrestricted deposits with financial institutions in checking, money market and short-term certificate of deposit accounts. The Company considers all highly liquid investments with stated maturity dates of three months or less from the date of purchase to be cash equivalents.

As of June 30, 2017 and December 31, 2016, custodial escrow accounts relating to loans serviced by the Company totaled $1.9 million and $2.7 million, respectively. These amounts are not included in the accompanying consolidated balance sheets as such amounts are not Company assets.

Restricted Cash

Restricted cash consisted primarily of checking, money market, and certificate of deposit accounts that are escrow deposits held by 3rd parties, relating to real estate investments not yet closed.

At June 30, 2017 and December 31, 2016, restricted cash balances are as follows:

| | | June 30, | | | December 31, | |

| | | 2017 | | | 2016 | |

| | | | | | | |

| Escrow deposit | | | - | | | | 500 | |

| Total restricted cash | | $ | - | | | $ | 500 | |

Real Estate Debt Investments

The Company, by way of its affiliates and wholly-owned subsidiaries, is engaged in real estate lending. In general, these real estate debt investments are either real estate loans made by Fundrise Lending and held by the Trust related to corresponding Project-Dependent Notes (“Notes”), or real estate debt investments held by a consolidated entity. To maximize the value of the real estate debt investment, the Company intends to hold all real estate debt investments until the stated maturity date. Since management has the positive intent and ability to hold the real estate debt investments to maturity, they are classified and valued as held to maturity. Accordingly, these assets are carried at cost, net of deferred loan origination fee revenue, repayments, and unfunded commitments, if applicable, unless such loans are deemed to be impaired.

The Loans are generally secured, unsecuritized debt securities. The Notes are unsecured debt securities not subsequently securitized. The Trust is contractually obligated to pay proceeds from a certain loan to the note holder. Due to the regulatory uncertainty surrounding the ability of an online platform to sponsor both public offerings under Regulation A and private offerings under Rule 506(b), in September 2016, the Company voluntarily suspended its Rule 506(b) programs indefinitely which, in turn, suspended the issuance of new Project-Dependent Notes related to the economics and performance of the underlying real estate debt investment. As such, real estate assets originated during the six months ended June 30, 2017 were acquired directly by or transferred to the eREITs, thus not offered for investment via the Project-Dependent Notes Program.

Held-to-maturity securities are recorded as either short term (current) or long term (non-current) on the consolidated balance sheets, based on the contractual maturity date and are stated at amortized cost. Actual maturities may differ from contractual maturities as some borrowers have the right to prepay obligations with or without prepayment penalties.

Amortization of Loan Origination Fees and Costs

For loans held by wholly-owned subsidiaries of the Company, typically the Trust or Fundrise Lending, where it is the intent of management to hold the loan until the stated maturity date, loan origination fees and related incremental direct loan origination costs are deferred and amortized to income using the interest method over the contractual life of the loans, adjusted for actual prepayments. The amortization of deferred fees and costs is discontinued on loans that are contractually 120 days past due or when collection of interest appears doubtful. Any remaining deferred fees or costs associated with loans that pay off prior to contractual maturity are included within income in the period of payoff.

Allowance for Loan Impairment

The Company’s real estate debt investments and preferred equity investments, and those of its consolidated entities, that earn interest based on debt-like terms are typically secured by senior liens on real estate properties, mortgage payments, mortgage loans, or interests in entities that have interests in real estate similar to the interests just described. The Company considered investments for which it expects to receive full payment of contractual principal and interest payments as “performing.”

The allowance for loan impairment is maintained at an amount management deems adequate to cover inherent loan losses at the balance sheet date. The Company has implemented and adheres to an internal review system and impairment allowance methodology designed to provide for the detection of problem receivables and an adequate allowance to cover loan losses.

In determining the allowance for loan impairment, the Company evaluates the loans on an individual basis, including an analysis of the borrower’s credit worthiness, cash flows and financial status, and the condition and estimated value of the collateral. Those amounts may be adjusted based on an analysis of macro-economic and other trends that are likely to affect the borrower’s ability to repay the loan according to the loan terms. Given these evaluations, the amount of the allowance is based on the summation of general valuation allowances and allocated allowances.

General loan impairment allowances relate to loans with no well-defined deficiency or weakness and are determined by applying against such receivable balances loss factors for each major loan type that consider past loss experience and loan duration. Allocated allowances relate to loans with well-defined deficiencies or weaknesses and are generally determined by loss factors based on loss statistics or are determined by the excess of the recorded investment in the loan over the fair value of the collateral, where appropriate.

The Company considers a loan to be impaired when, based on current information and events, it believes it is probable that the Company will be unable to collect all amounts due according to the contractual terms of the loan agreement. Impairment losses are included in the allowance for loan impairment through a charge to allowance for loan impairment. Adjustments to impairment losses due to changes in the fair value of collateral of impaired loans are included in the allowance for loan impairment. Upon disposition of an impaired loan, loss of principal, if any, is recorded through a charge-off to the allowance for loan impairment.

As of June 30, 2017 and December 31, 2016, management did not deem any loans impaired. Additionally, the Company did not have any historical trend of loan losses off which to base an estimate for allowance for loan impairment.

Deferred Offering Costs and Related Costs of eREITs and eFunds

Organizational and offering costs of the Company sponsored programs (i.e. eREITS and eFunds) are initially being paid by Fundrise Advisors, manager of the sponsored programs, on behalf of such sponsored programs. Offering costs include all expenses incurred by sponsored programs in connection with the qualification of the offering, and the marketing and distribution of shares, including, without limitation, expenses for printing, and amending offering statements or supplementing offering circulars, mailing and distributing costs, telephones, Internet and other telecommunications costs, all advertising and marketing expenses, charges of experts and fees, expenses and taxes related to the filing, registration and qualification of the sale of shares under federal and state laws, including taxes and fees and accountants’ and attorneys’ fees.

Offering costs are amortized ratably as a reduction to equity based on the proportion of gross proceeds raised to the total gross proceeds expected to be raised when the sponsored offering is complete. Total offering costs incurred for the eREIT programs that were qualified by the SEC as of the date of these financial statements were $4.5 million and $3.3 million as of June 30, 2017 and December 31, 2016, respectively. The deferred offering costs balance of $1.7 million and $1.2 million as of June 30, 2017 and December 31, 2016, respectively, are net of $2.8 million and $2.1 million in accumulated amortization and are included in other current assets on the accompanying consolidated balance sheets

The Company intends to establish and sponsor a number of programs as real estate investment trusts that will be similar in structure to the SEC qualified eREITs. Accordingly, the Company, via Fundrise Advisors, has agreed to allocate legal fees incurred in establishing the first ten eREIT programs (including the five (5) eREITs qualified with the SEC as of June 30, 2017 and as of December 31, 2016) that exceed the estimated legal fees of $312,500 per program, to other programs sponsored by the Company. As a result, each of these ten eREIT sponsored programs will be required to reimburse Fundrise Advisors for up to $312,500 in legal fees incurred in preparing such offerings. The Company believes that this allocation of legal fees to future similar programs is the most equitable way to ensure that all of the first ten programs bear the burden of establishing a working framework for similar offerings under the newly revised rules of Regulation A. If the Company is not successful in organizing an offering for each of the other five programs, the Company will bear the legal costs that exceed the portion allocated to the existing eREITs.

The Company anticipates that, pursuant to the operating agreements of the eREITs, the eREITs will be obligated to reimburse Fundrise Advisors for organizational and offering costs that have been paid by Fundrise Advisors, the Company, or one of our affiliates. When Fundrise Advisors requires such reimbursements, payments will be made in monthly installments; however, the aggregate monthly amount reimbursed can never exceed 0.50% of the aggregate gross offering proceeds from a particular offering for the eREITS. If the sum of the total unreimbursed amount of such organizational and offering costs for any particular offering, plus new costs incurred since the last reimbursement payment, exceed the reimbursement limit described above for the applicable monthly installment, the excess will be eligible for reimbursement in subsequent months (subject to the 0.50% limit), calculated on an accumulated basis, until Fundrise Advisors has been reimbursed in full.

During the six months ended June 30, 2017 and six months ended June 30, 2016, the eREITs have made reimbursement payments to Fundrise Advisors in the amount of $1.3 million and $0, respectively.