UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 26, 2023

GD Culture Group Limited

(Exact name of Company as specified in charter)

| Nevada | | 001-37513 | | 47-3709051 |

(State or other jurisdiction

of incorporation) | | (Commission File No.) | | (IRS Employer

Identification No.) |

22F - 810 Seventh Avenue,

New York, NY 10019 |

(Address of Principal Executive Offices) (Zip code)

+1-347-2590292

(Company’s Telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4© under the Exchange Act (17 CFR 240.13(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 | | GDC | | Nasdaq Capital Market |

Item 1.02 Termination of a Material Definitive Agreement.

As previously disclosed in the current reports on Form 8-K of GD Culture Group Limited (the “Company”) filed on September 19, 2022 and February 28, 2023, on September 16, 2022, Makesi IoT Technology (Shanghai) Co., Ltd., a then indirect subsidiary of the Company (“Makesi WFOE”), Shanghai Highlight Media Co., Ltd., a PRC company (“Highlight Media”), and the shareholders of Shanghai Highlight (the “Highlight Media Shareholders”) entered into certain Technical Consultation and Services Agreement., Equity Pledge Agreement, Equity Option Agreement, Voting Rights Proxy and Financial Support Agreement, which was assigned by Makesi WFOE to Shanghai Highlight Entertainment Co., Ltd., an indirect subsidiary of the Company (“Highlight WFOE”) on February 27, 2023 (such agreements, as assigned, the “VIE Agreements”). The VIE Agreements established a “Variable Interest Entity” (VIE) structure, pursuant to which the Company treated Highlight Media as a consolidated affiliated entity and consolidated the financial results and balance sheet of Highlight Media in the Company’s consolidated financial statements under U.S. GAAP.

On September 26, 2023, Highlight WFOE entered into a termination agreement (the “Termination Agreement”) with Highlight Media, the Highlight Media Shareholders and a third party to terminate the VIE Agreements and for the third party to pay the Company $100,000 as consideration to the termination of the VIE Agreements. As a result of such termination, the Company will no longer treat Highlight Media as a consolidated affiliated entity or consolidate the financial results and balance sheet of Highlight Media in the Company’s consolidated financial statements under U.S. GAAP.

The foregoing description of the Termination Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the voting rights proxy and financial support agreement, which is filed as Exhibit 10.1.

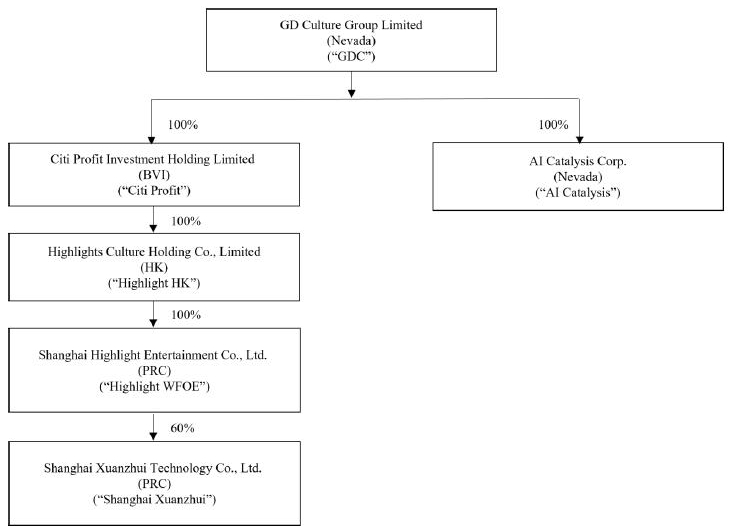

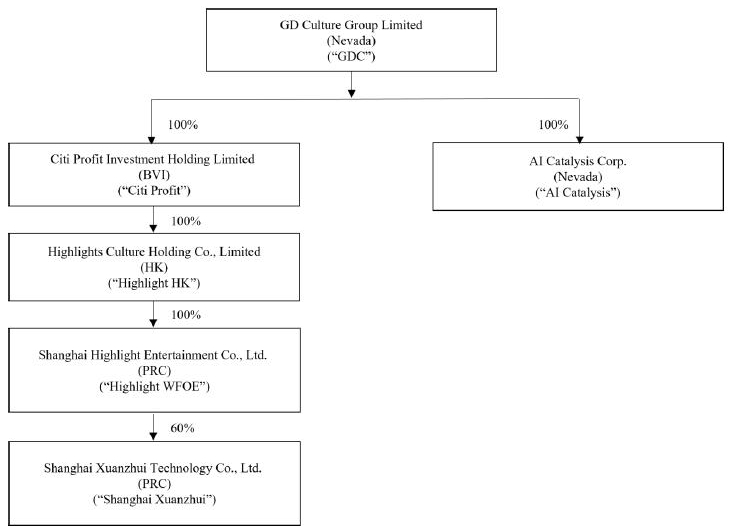

The following diagram illustrates the corporate structure of the Company and its subsidiaries after giving effect to the transaction:

Item 2.01, Completion of Acquisition or Disposition of Assets;

To the extent required by Item 2.01, the disclosure set forth in Item 1.02 above regarding the acquisition pursuant to the SPA is incorporated by reference into this Item 2.01.

Item 9.01 Financial Statements and Exhibits.

(b) Pro forma financial information.

The unaudited Pro Forma Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) of the Company for the six months ended June 30, 2023 and 2022 and the unaudited Pro Forma Condensed Consolidated Balance Sheets of the Company as of June 30, 2023 shall be filed as Exhibit 99.1 by amendment to this Current Report on Form 8-K within four business days from the date of the event described in Item 1.02 and Item 2.01.

(d) Exhibits.

| Exhibit No. | | Description |

| 10.1 | | Termination Agreement, dated September 26, 2023 |

| 99.1* | | Unaudited pro forma condensed consolidated financial statements of the Company |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| * | to be filed by amendment |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | GD CULTURE GROUP LIMITED |

| | |

| Date: September 26, 2023 | By: | /s/ Xiao Jian Wang |

| | Name: | Xiao Jian Wang |

| | Title: | Chief Executive Officer, President and

Chairman of the Board |

3