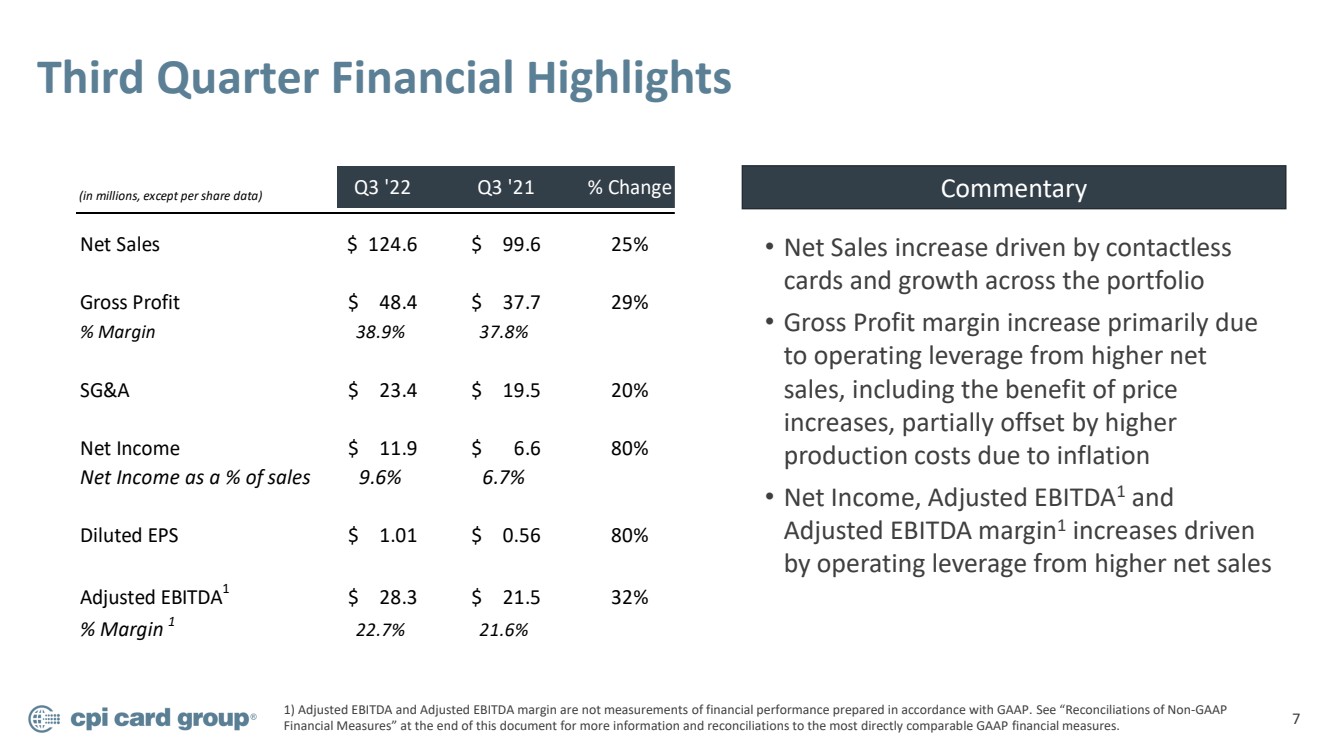

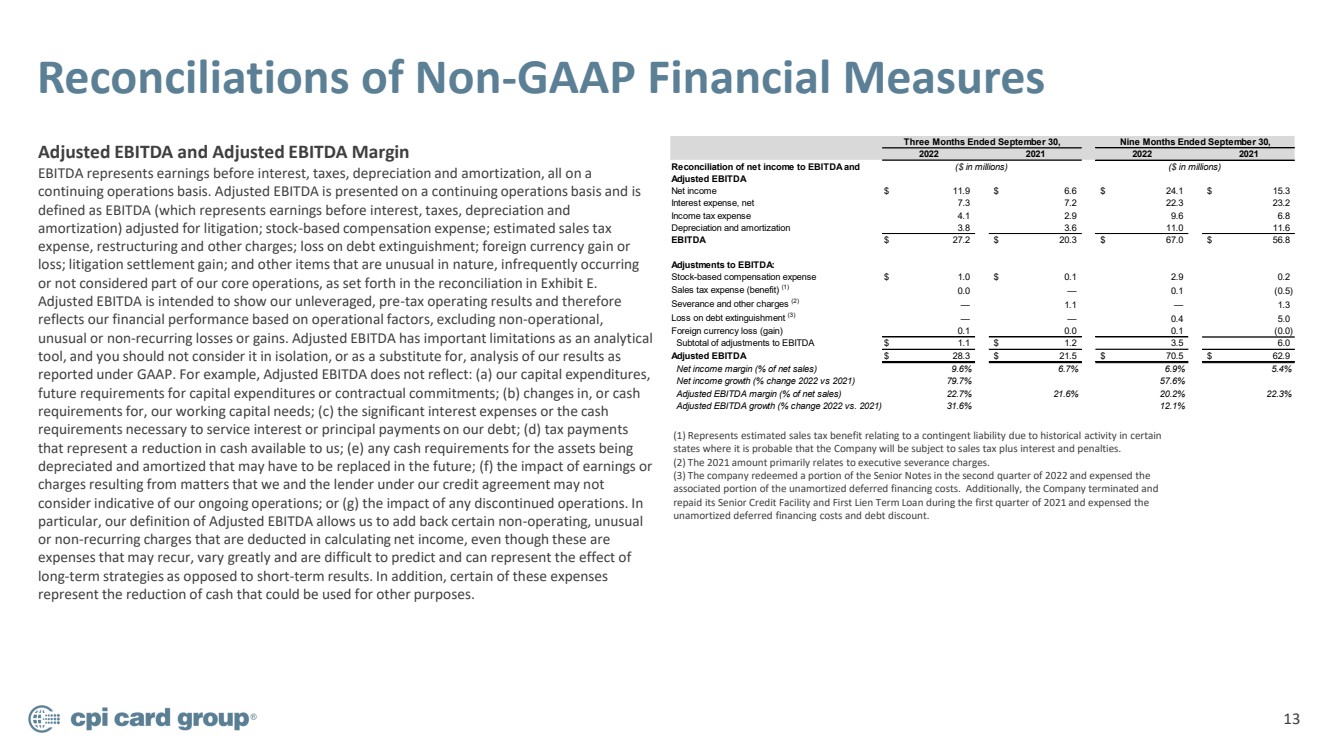

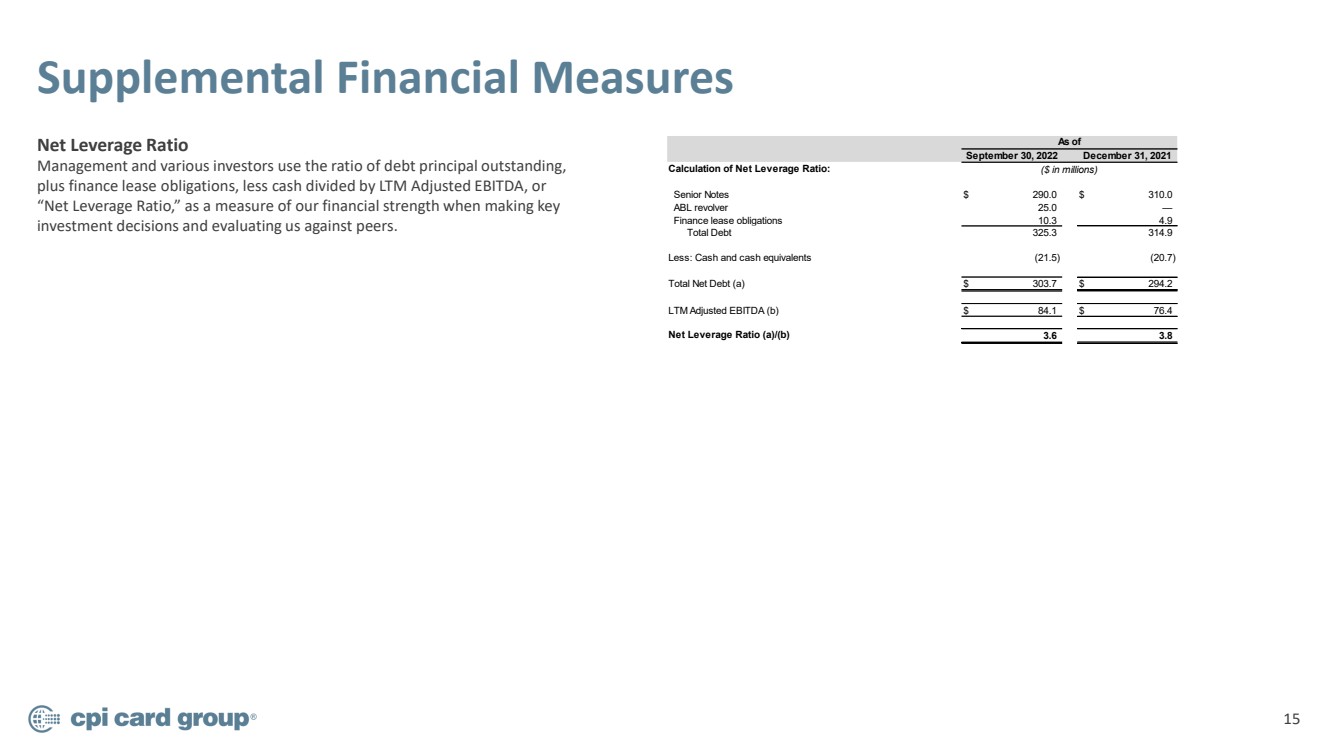

| 2 Cautionary Statements Forward Looking Statements Certain statements and information in this presentation (as well as information included in other written or oral statements we make from time to time) may contain or constitute “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Secur iti es Exchange Act of 1934, as amended. The words “believe,” “estimate,” “project,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” “continue,” “committed,” “attempt,” “target,” “objective,” “guides,” “seek,” “focus,” “pr ovides guidance,” “provides outlook” or other similar expressions are intended to identify forward - looking statements, which are not historical in nature. These forward - looking statements, including statements about our strategic initiatives and m arket opportunities and guidance for our full - year 2022 results, are based on our current expectations and beliefs concerning future developments and their potential effect on us and other information currently available. Such forward - looking statements, because they relate to future events, are by their very nature subject to many important risks and uncertainties that could cause actual results or other events to differ materially from those contemplated. These risks and uncertainties include, but are not limited to: the potential effects of COVID - 19 and responses thereto on our bu siness, including our supply chain, customer demand, workforce, operations and ability to comply with certain covenants related to our indebtedness; our transition to being an accelerated filer and complying with Section 404 of the Sarbanes - Oxley A ct of 2002 and the costs associated with such compliance and implementation of procedures thereunder; our failure to maintain effective internal control over financial reporting or remediate material weaknesses; our inability to recruit, retain and develop qualified personnel, including key personnel; a disruption or other failure in our supply chain, including as a result of the Russia - Ukraine conflict, or labor pool resulting in increased costs and inability to pass those costs on to our cu stomers and extended production lead times and difficulty meeting customers’ delivery expectations; a decline in U.S. and global market and economic conditions and resulting decreases in consumer and business spending and ongoing or accelerating i nfl ationary pressure; our failure to retain our existing customers or identify and attract new customers; system security risks, data protection breaches and cyber - attacks, including as retaliation for U.S. sanctions in connection with the Russia - Ukr aine conflict; our substantial indebtedness, including inability to make debt service payments or refinance such indebtedness; the restrictive terms of our indebtedness and covenants of future agreements governing indebtedness and the res ult ing restraints on our ability to pursue our business strategies; interruptions in our operations, including our information technology (“IT”) systems, or in the operations of the third parties that operate the data centers or computing i nfr astructure on which we rely; disruptions in production at one or more of our facilities; environmental, social and governance preferences and demands of various stakeholders and our ability to conform to such preferences and demands and to com ply with any related regulatory requirements; the effects of climate change, negative perceptions of our products due to the impact of our products and production processes on the environment and other ESG - related risks; disruptions in produc tion due to weather conditions, climate change, political instability or social unrest; our inability to adequately protect our trade secrets and intellectual property rights from misappropriation, infringement claims brought against us and ris ks related to open source software; defects in our software; our limited ability to raise capital in the future; problems in production quality, materials and process; our inability to develop, introduce and commercialize new products; costs and impa cts to our financial results relating to the obligatory collection of sales tax and claims for uncollected sales tax in states that impose sales tax collection requirements on out - of - state businesses, as well as potential new U.S. tax legislation increasi ng the corporate income tax rate and challenges to our income tax positions; our inability to successfully execute on our divestitures or acquisitions; our inability to realize the full value of our long - lived assets; costs relating to product defect s and any related product liability and/or warranty claims; our inability to renew licenses with key technology licensors; th e highly competitive, saturated and consolidated nature of our marketplace; the effects of delays or interruptions in our abili ty to source raw materials and components used in our products from foreign countries; failure to comply with regulations, customer contractual requirements and evolving industry standards regarding consumer privacy and data use and security; new a nd developing technologies that make our existing technology solutions and products obsolete or less relevant or our failure to introduce new products and services in a timely manner; quarterly variation in our operating results; our failure to operate our business in accordance with the Payment Card Industry Security Standards Council security standards or other industry standards; our failure to comply with environmental, health and safety laws and regulations that apply to our produc ts and the raw materials we use in our production processes; risks associated with the majority stockholders’ ownership of our stock; potential conflicts of interest that may arise due to our board of directors being comprised in part of directors who are principals of our majority stockholders; the influence of securities analysts over the trading market for and price of ou r common stock; failure to meet the continued listing standards of the Nasdaq Global Market; certain provisions of our organiza tio nal documents and other contractual provisions that may delay or prevent a change in control and make it difficult for stockholders other than our majority stockholders to change the composition of our board of directors; our ability to comply wit h a wide variety of complex laws and regulations and the exposure to liability for any failure to comply; the effect of legal and regulatory proceedings; and other risks that are described in Part I, Item 1A – Risk Factors in our Annual Report on F orm 10 - K for the year ended December 31, 2021 filed with the Securities and Exchange Commission (“SEC”) on March 8, 2022, in Part II, Item 1A – Risk Factors in our Quarterly Report on Form 10 - Q for the quarter ended September 30, 2022 filed wit h the SEC on November 3, 2022 , and our other reports filed from time to time with the SEC. We caution and advise readers not to place undue reliance on forward - looking statements, which speak only as of the date hereof. These statements are based on assumptions that may not be realized and involve risks and uncertainties that could cause actual results or other events to differ materially from the expectations and beliefs contained herein. We undertake no ob ligation to publicly update or revise any forward - looking statements after the date they are made, whether as a result of new information, future events or otherwise. Non - GAAP Financial Measures In addition to financial results reported in accordance with U .. S .. generally accepted accounting principles (“GAAP”), we have provided the following non - GAAP financial measures in this presentation, all reported on a continuing operations basis : EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, LTM Adjusted EBITDA, Net Leverage Ratio, and Free Cash Flow .. These non - GAAP financial measures are utilized by management in comparing our operating performance on a consistent basis between fiscal periods .. We believe that these financial measures are appropriate to enhance an overall understanding of our underlying operating performance trends compared to historical and prospective periods and our peers .. Management also believes that these measures are useful to investors in their analysis of our results of operations and provide improved comparability between fiscal periods .. Non - GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information calculated in accordance with GAAP .. Our non - GAAP measures may be different from similarly titled measures of other companies .. Investors are encouraged to review the reconciliation of these historical non - GAAP measures to their most directly comparable GAAP financial measures included in the appendix to this presentation .. |