- XAIR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-8 Filing

Beyond Air (XAIR) S-8Registration of securities for employees

Filed: 13 May 20, 5:21pm

As filed with the Securities and Exchange Commission on May 13, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BEYOND AIR, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 47-3812456 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 825 East Gate Boulevard, Suite 320 Garden City, NY 11530 | 10528 | |

| (Address of Principal Executive Offices) | (Zip Code) |

2ndAmended and Restated 2013 Equity Incentive Plan

(Full title of the plan)

Steven Lisi Chief Executive Officer 825 East Gate Boulevard, Suite 320 Garden City, NY 11530 (516) 665-8200 (Name, address and telephone number, including area code, of agent for service) | Copy to: Gregory Sichenzia, Esq. Avital Perlman, Esq. Sichenzia Ross Ference LLP 1185 Avenue of the Americas, 37th Floor New York, NY 10036 (212) 930-970 |

Indicate by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer”, “small reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [X] | Smaller reporting company | [X] | |

| Emerging growth company | [X] |

CALCULATION OF REGISTRATION FEE

| Title of Securities To Be Registered | Amount to Be Registered (1) | Proposed Maximum (2) | Proposed Maximum (2) | Amount of Registration Fee | ||||||||||||

| Common Stock, par value $0.0001 | 2,600,000 | (2) | $ | 8.00 | $ | 20,800,000 | $ | 2,699.84 | ||||||||

| (1) | The number of shares of common stock, par value $0.0001 per share, of Beyond Air, Inc. (the “Registrant”), stated above consists of the number of additional shares which may be issued under the Second Amended and Restated 2013 Equity Incentive Plan, or the Plan, that have not been previously registered. Pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall be deemed to cover any additional securities that become issuable under the Plan by reason of any stock split, stock dividend, recapitalization or any other similar transaction. | |

| (2) | Estimated pursuant to Rule 457(c) and (h) solely for purposes of calculating the aggregate offering price and the amount of the registration fee based upon the average of the high and low prices reported for the shares on the Nasdaq Capital Market on May 12, 2020. |

EXPLANATORY NOTE

This registration statement on Form S-8 (the “Registration Statement”) relates to an additional 2,600,000 shares of common stock, par value $0.0001 per share of Beyond Air, Inc. (the “Registrant,” the “Company,” “we,” “us” or “our”), which are issuable pursuant to, or upon exercise of, awards that have been granted or may be granted under our Second Amended and Restated 2013 Equity Incentive Plan (the “Plan”). Under the Plan, a total of 4,100,000 shares of common stock have been reserved for issuance upon the grant of awards and exercise of options to officers, directors, employees and consultants of the Company.

The Registrant previously filed a Registration Statement on Form S-8 to register 1,500,000 shares of common stock (File No. 333-227697), filed on October 4, 2018, authorized for issuance under the Plan. Pursuant to General Instruction E to Form S-8, Part I and Items 4-7 and 9 of Part II of the Registrant's Registration Statement on Form S-8 (File No. 333-227697) are incorporated herein by reference except to the extent supplemented, amended or superseded by the information set forth herein. Only those items of Form S-8 containing new information not contained in the earlier registration statement are presented herein.

This Registration Statement also includes a reoffer prospectus prepared in accordance with General Instruction C of Form S-8 and in accordance with the requirements of Part I of Form S-3, to be used in connection with resales of securities registered hereunder by selling stockholders (the “Selling Stockholders”), some of whom may be considered affiliates of the Company, as defined in Rule 405 under the Securities Act of 1933, as amended. The Selling Stockholders may be selling up to an aggregate of 2,595,000 shares of common stock that constitute “restricted securities” which have been issued by the Registrant pursuant to the Plan, prior to the filing of this Registration Statement.

| i |

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information specified in Part I, and the Note to Part I of Form S-8 will be delivered to each of the participants in accordance with Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”), but these documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a Prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item 2. Registrant Information and Employee Annual Information.

Upon written or oral request, any of the documents incorporated by reference in Item 3 of Part II of this Registration Statement (which documents are incorporated by reference in this Section 10(a) Prospectus) and other documents required to be delivered to eligible employers, non-employee directors and consultants pursuant to Rule 428(b) are available without charge by contacting: Adam Newman, General Counsel, Beyond Air, Inc., 825 East Gate Boulevard, Suite 320, Garden City, NY 11530 at (516) 665-8200.

| ii |

REOFFER PROSPECTUS

2,595,000Shares

Beyond Air, Inc.

Common Stock

This reoffer prospectus relates to the public resale, from time to time, of an aggregate of 2,595,000 shares (the “Shares”) of our common stock, $0.0001 par value per share, by certain security holders identified herein in the section entitled “Selling Stockholders”. The amount of Shares to be reoffered or resold by means of this prospectus by each Selling Stockholder, and any other person with whom such Selling Stockholder is acting in concert for the purpose of selling our securities, may not exceed, during any three-month period, the amount specified in Rule 144(e) of the Securities Act of 1933, as amended (the “Securities Act”). Such shares have been or may be acquired in connection with awards granted under the Amended and Restated 2013 Equity Stock Incentive Plan (the “Plan”) of Beyond Air, Inc. (the “Company”). You should read this prospectus carefully before you invest in the common stock.

Such resales shall take place on the Nasdaq Capital Market, or such other stock market or exchange on which our common stock may be listed or quoted, in negotiated transactions or otherwise, at market prices prevailing at the time of the sale or at prices otherwise negotiated (see “Plan of Distribution” starting on page 10 of this prospectus). We will receive no part of the proceeds from sales made under this reoffer prospectus. The Selling Stockholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection with the registration and offering and not borne by the Selling Stockholders will be borne by us.

This reoffer prospectus has been prepared for the purposes of registering the Shares under the Securities Act to allow for future sales by the Selling Stockholders on a continuous or delayed basis to the public without restriction. We have not entered into any underwriting arrangements in connection with the sale of the Shares covered by this reoffer prospectus. The Selling Stockholders identified in this reoffer prospectus, or their pledgees, donees, transferees or other successors-in-interest, may offer the Shares covered by this reoffer prospectus from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 7 of this reoffer prospectus. These are speculative securities.

Our common stock is quoted on the Nasdaq Capital Market under the symbol “XAIR” and the last reported sale price of our common stock on May 12, 2020 was $7.91 per share.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is May 13, 2020

| iii |

TABLE OF CONTENTS

| 1 |

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein may contain forward looking statements within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) that involve risks and uncertainties. All statements other than statements of historical fact contained in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein, including statements regarding future events, our future financial performance, business strategy, and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a highly regulated, very competitive, and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short term and long-term business operations, and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein, and in particular, the risks discussed below and under the heading “Risk Factors” and those discussed in other documents we file with the Securities and Exchange Commission, or the SEC. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statement.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this prospectus to conform our statements to actual results or changed expectations.

| 2 |

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in our Company. You should carefully read the entire prospectus, including all documents incorporated by reference herein. In particular, attention should be directed to our “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes thereto contained herein or otherwise incorporated by reference hereto, before making an investment decision.

Corporate Information

Beyond Air, Inc. was incorporated on April 24, 2015 as KokiCare, Inc. under the laws of the State of Delaware. On June 25, 2019, the Company changed its name from AIT Therapeutics, Inc. to Beyond Air, Inc., effective June 26, 2019.

Advanced Inhalation Therapies Ltd. (“AIT Ltd.”) was incorporated in Israel on May 1, 2011 and commenced its operations in May 2012 and is a wholly-owned subsidiary of the Company. On August 29, 2014, AIT Ltd. established a wholly-owned subsidiary, Advanced Inhalation Therapies Inc., a Delaware corporation. Effective July 4, 2019, AIT Ltd. changed its name to Beyond Air Ltd.

Our principal executive offices are located at 825 East Gate Boulevard, Suite 320 Garden City, New York 11530, and our telephone number is (516) 665-8200. Our website address is www.beyondair.net. Our website and the information contained on our website, or linked through our website, are not part of this prospectus, and you should not rely on our website or such information in making a decision to invest in our common stock.

Business Overview

We are an emerging medical device and biopharmaceutical company developing a nitric oxide (“NO”) generator and delivery system (the “LungFit™ system”) that is capable of generating NO from ambient air. LungFit™can generate NO up to 400 parts per million (“ppm”) for delivery to a patient’s lungs. LungFit™can deliver NO either continuously or for a fixed amount of time at various flow rates and has the ability to either titrate dose on demand or maintain a constant dose. We believe that LungFit™can be used to treat patients on ventilators that require NO, as well as patients with chronic lung disease or acute severe lung infections via delivery through a breathing mask or similar apparatus. Furthermore, we believe that there is a high unmet medical need for patients suffering from certain severe lung infections that LungFit™can potentially address. Our current areas of focus with the LungFit™ are persistent pulmonary hypertension of the newborn (“PPHN”), severe acute respiratory syndrome coronavirus 2 (SARS CoV-2), bronchiolitis (“BRO”) and nontuberculous mycobacteria (“NTM”). Our current product candidates will be subject to premarket reviews and approvals by the U.S. Food and Drug Administration, or the FDA, as well as similar regulatory agencies in other countries or regions. If approved, our system will be marketed as a medical device in the U.S.

An additional focus of the Company is solid tumors. For this indication the LungFit™system is not utilized due to the ultra-high concentrations of NO used. We have developed a delivery system that can safely delivery NO concentrations in excess of 5,000 ppm directly to a solid tumor. This program is in pre-clinical development and will require FDA, or similar agency in another country, approval to enter human studies.

With respect to PPHN, our novel LungFit™ is designed to deliver a dosage of NO to the lungs that is consistent with current guidelines for delivery of 20 ppm NO with a range of 0.5 ppm – 80 ppm (low-concentration NO). We believe LungFit™ has many competitive advantages over the current approved NO delivery systems in the U.S., European Union, Japan and other markets. For example, LungFit™does not require the use of a high-pressure cylinder, utilizes less space than other similar devices, does not require cumbersome purging procedures and places less burden on hospital staff in carrying out safety procedures.

Our novel LungFit™ can also deliver a high concentration of NO to the lungs, which we believe has the potential to eliminate microbial infections, including bacteria, fungi and viruses, among other benefits. We believe current FDA-approved NO vasodilation treatments would have limited success in treating microbial infections given the low concentrations of NO being delivered. Given that NO is produced naturally by the body as an innate immunity mechanism at a concentration of 200 ppm, supplemental high dose NO should aid in the body’s fight against infection. Based on our clinical studies, we believe that 150 ppm is the minimum therapeutic dose to achieve the desired pulmonary antimicrobial effect of NO. To date, neither the FDA nor equivalent regulatory agencies in other countries or regions have approved any NO formulation and/or delivery system for the delivery of a dosage of NO at 150 ppm or higher to the lungs.

To date, we have conducted the following studies:

| 3 |

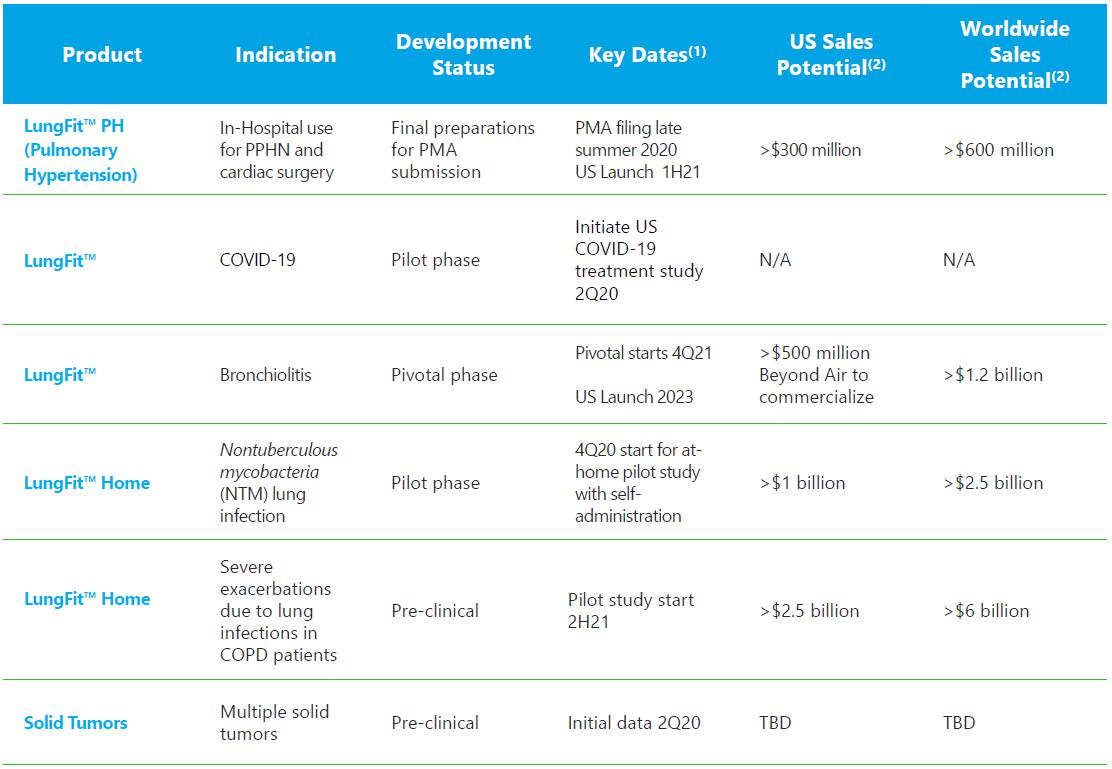

Our active pipeline of product candidates is shown in the table below:

†Caution - LungFit™ is an Investigational Device, Limited by Federal (or United States) Law to Investigational Use.

(1) All dates are based on projections and appropriate financing, anticipated first launch on a global basis pending appropriate regulatory approvals

(2) All figures are Company estimates for peak year sales: Global sales potential includes US sales potential

We plan to submit for premarket approval or (“PMA”) to the FDA during the third quarter of 2020 for the use of the LungFit™in PPHN. We also expect to make certain regulatory filings outside of the U.S. later in 2020. According to the 2019 year-end report from Mallinckrodt Pharmaceuticals, aggregate sales of low concentration NO in the U.S. were in excess of $540 million in 2019, while sales outside of the U.S., where there are multiple market participants, sales were considerably lower than in the U.S. We believe the U.S. sales potential of LungFit™ in PPHN to be greater than $300 million and worldwide sales potential to be greater than $600 million. If regulatory approval is obtained, we anticipate a product launch in both the U.S. and Israel in 2021 and will continue to launch globally throughout 2021 and beyond.

SARS CoV-2 is a global pandemic and has essentially brought life to a slow crawl in most countries. We have submitted an IDE (investigational device exemption) to the FDA for approval to run a study in COVID-19 (the disease caused by SARS CoV-2 infections) patients. On April 16, 2020, the FDA agreed with the initiation of a clinical study in the U.S. using our LungFitTM system to treat COVID-19 patients. We believe there is ample safety and efficacy data in vitro, in animals and in humans with NO to justify a study to treat COVID-19 patients with 150 ppm dosed intermittently using our LungFit™ BRO system. The fact that our system does not need cylinders allows for us to potentially provide a practical solution to this crisis. We have applied for grants related to COVID-19 in the United States and other countries. However, no funding is required to perform the clinical study that we included in our IDE submitted to FDA.

| 4 |

With respect to bronchiolitis, we initiated a trial for infants hospitalized due to bronchiolitis in the fourth quarter of 2019. The trial is complete and we anticipate data for this study to be available in May 2020. If the trial is successful, we would perform another study over the 2021/2022 winter in the United States. This pivotal study was originally set to be performed in the 2020/21 winter, but due to the SARS CoV-2 pandemic hospitals will not be considering any new study proposals not related to SARS CoV-2 or COVID-19., We would submit a PMA to the FDA about 6 months after trial completion. Regulatory filings outside of the U.S., as long as no additional trials are required, would begin after our review process is completed in the U.S. For this indication, we believe U.S. sales potential to be greater than $500 million and worldwide sales potential to be greater than $1.2 billion.

Our nontuberculous mycobacteria (NTM) program has produced data from four compassionate use subjects and nine patients from a multi-center pilot study completed in 2018. All patients suffered from NTMabscessus infection and had underlying cystic fibrosis. One compassion patient was treated with our nitric oxide generator at the National Heart, Lung and Blood Institute (“NHLBI”). The rest were treated with our NO cylinder-based delivery system. All patients were treated with 160 ppm NO at intermittent 30-minute dosing over 21 days, except one patient who was treated over 26 days and another patient who was treated with 250 ppm NO over 28 days. We expected to begin a study by the middle of 2020 where patients would self-administer high concentration NO at home over a period of 12 weeks with LungFit™. Given the SARS CoV-2 global pandemic, we expect this trial initiation to be delayed until the fourth quarter of calendar 2020. We now anticipate preliminary data for this study will be available during the first half of 2021 and that a full dataset will be available in the second half of 2021. If the trial is successful, we would commence a pivotal study in 2022. For this indication, we believe U.S. sales potential to be greater than $1 billion and worldwide sales potential to be greater than $2.5 billion.

For the solid tumor program, we have not yet released any pre-clinical data and anticipate releasing data later in 2020. Due to the SARS CoV2 pandemic the medical conference where we were scheduled to show our data has been postponed.

Our program in chronic obstructive pulmonary disease is in the pre-clinical stage and will remain there, subject to our obtaining additional financing.

For our high concentration platform, as mentioned above, the initial target is lower respiratory tract infections (“LRTI”). Our initial three target indications are COVID-19 patients, infants hospitalized with bronchiolitis (mainly caused by respiratory syncytial virus “RSV”) and patients suffering from NTM and other severe, chronic, refractory lung infections. There are over 1.5 million hospitalizations related to LRTI annually in the U.S., and LRTI is the third leading cause of death worldwide.

NTM lung infection is a rare and serious pulmonary disease associated with increased morbidity and mortality. There is an increasing rate of lung disease caused by NTM, which is an emerging public health concern worldwide. There are approximately 50,000 patients diagnosed with NTM in the U.S., and there are an estimated additional 100,000 patients in the U.S. that have not yet been diagnosed. In Asia, the number of patients suffering from NTM surpasses what is seen in the U.S. To date we have treated only theabscessusform of NTM which comprises approximately 20-25% of all NTM. We will be treating both theabscessus and mycobacterium avium complex (MAC)forms of NTM.

Patients with NTM lung disease may experience a multitude of symptoms such as fever, weight loss, cough, lack of appetite, night sweats, blood in the sputum and fatigue. Patients with NTM lung disease, specificallyabscessus and other forms of NTM that are refractory to antibiotic therapy, frequently require lengthy and repeated hospital stays to manage their condition. There are no treatments specifically indicated for the treatment of NTMabscessuslung disease in North America, Europe or Japan. There is one inhaled antibiotic approved in the U.S. for the treatment of refractory NTM MAC. Current guideline-based approaches to treat NTM lung disease involve multi-drug regimens of anti-biotics that may cause severe, long lasting side effects, and treatment can be as long as 18 months or more. Median survival for NTM MAC patients is approximately 13 years while median survival for patients with other variations of NTM is typically 4.6 years. The prevalence of human disease attributable to NTM has increased over the past two decades. In a study conducted between 1997 and 2007, researchers found that the prevalence of NTM in the U.S. is increasing at approximately 8% per year and that NTM patients on Medicare over the age of 65 are 40% more likely to die over the period of the study than those who did not have the disease (Adjemian et al., 2012). NTMabscessus treatment costs are estimated to be more than double that of NTM MAC. In total, a 2015 publication from co-authors from several U.S. government departments stated that prior year statistics led to a projected 181,037 national annual cases in 2014 costing the U.S. healthcare system approximately $1.7 billion (Strollo et al., 2015).

| 5 |

Over 3 million new cases of bronchiolitis are reported worldwide each year. In the U.S., there are approximately 130,000 annual bronchiolitis hospitalizations among children two years of age or younger and approximately 177,000 annual hospitalizations among the elderly population related to RSV infection only with the number rising higher due to other viruses similar to those that cause bronchiolitis in very young children.

Currently, there is no approved treatment for bronchiolitis. The treatment for acute viral lung infections that cause bronchiolitis in infants is largely supportive care and is based primarily on prolonged hospitalization during which the infant receives a constant flow of oxygen to treat hypoxemia, a reduced concentration of oxygen in the blood. In addition, systemic steroids and inhalation with bronchodilators are sometimes utilized until recovery, but we believe these treatments do not successfully reduce hospital length of stay.

We believe, based on the currently understood mechanisms of action of NO, that our LungFit™can deliver NO at 150 ppm and higher to potentially eliminate bacteria, viruses, fungi and other microbes from the lungs and may also be effective against antibiotic-resistant bacteria. Because our product candidates are not antibiotics, we believe there is a reduced risk of the development of resistant bacteria and there could be synergy with co-administration of antibiotics.

In addition, our LungFit™ can deliver NO at concentrations of 0.5 – 80 ppm consistent with currently approved NO delivery systems for the treatment of PPHN while providing significant advantages associated with the elimination of the use of high-pressure cylinders.

We have a global, exclusive, perpetual license agreement with NitricGen, Inc. for the eNOGenerator and all associated patents and know how related thereto. Additionally, we have a broad intellectual property portfolio directed to our product candidates and mode of delivery, monitoring parameters and methods of treating specific disease indications. Our intellectual property portfolio consists of issued patents and pending applications, which includes patents we acquired pursuant to the exercise of an option in 2017 granted to us by Pulmonox Technologies Corporation.

Certain Recent Developments

On March 16, 2020, we announced that we had submitted an Investigational Device Exemption (IDE) to the US Food and Drug Administration (FDA for approval to study the use of our LungFit™ -BRO system in patients infected with COVID-19. An IDE approval from the FDA is a necessary step before performing any clinical study with a medical device. The FDA typically responds within 30 days of an IDE submission. On April 16, 2020, the FDA agreed with the initiation of a clinical study in the U.S. using our LungFitTM system to treat COVID-19 patients. The LungFitTM will be used in an open-label study, to treat 20 patients between the ages of 22 and 65 years hospitalized with COVID-19. Subjects will be randomized 1:1 and treated with 80 ppm NO administered over 40 minutes, 4 times per day, in addition to standard of care (SOC) or treated with SOC alone. The primary endpoint is time to clinical deterioration as measured by the need for: 1) non-invasive ventilation: or 2) high flow nasal cannula; or 3) intubation. Other endpoints include reduction in viral load, need for supplemental oxygen, hospital length of stay, mortality, safety and various biomarkers.

On March 17, 2020, our wholly owned subsidiary Beyond Air Ireland Limited (“BAL”) entered into a facility agreement (the “Facility Agreement”) with certain lenders pursuant to which the lenders shall loan to BAL up to $25,000,000 in five tranches of $5,000,000 per tranche at the option of BAL (“Tranches”), provided however that BAL may only utilize tranches three through five following FDA approval of our LungFit™ PH product. The loans bear interest at 10% per year and may be prepaid with certain prepayment penalties. Each tranche shall be repaid in installments commencing June 15, 2023 with all amounts outstanding under any tranche due on March 17, 2025. BAL borrowed the first tranche on March 17, 2020.

In connection with BAL’s utilization of the first tranche, on March 17, 2020 we issued to the lenders five-year warrants to purchase up to 172,187 shares of common stock at an exercise price of $7.26 per share.

On April 2, 2020 we entered into an At-The-Market Equity Offering Sales Agreement (the “Sales Agreement”) with SunTrust Robinson Humphrey, Inc. and Oppenheimer & Co. (collectively, the “Agents”) under which we may offer and sell, from time to time at its sole discretion, shares of our common stock having an aggregate offering price of up to $50,000,000 through the Agents as our sales agent. The issuance and sale, if any, of common stock under the Sales Agreement was pursuant to our shelf registration statement on Form S-3 (File No. 333-231416) declared effective by the SEC on July 2, 2019, the prospectus supplement relating to the offering filed with the SEC on April 2, 2020, and any applicable additional prospectus supplements related to the offering that form a part of the that registration statement.Subject to the terms and conditions of the Sales Agreement, the Agents may sell the common stock by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) of the Securities Act. The Agents will use commercially reasonable efforts to sell the common stock from time to time, based upon instructions from us (including any price, time or size limits or other customary parameters or conditions we may impose). We will pay the Agents a commission equal to up to three percent (3%) of the gross sales proceeds of any common stock sold through the Agents under the Sales Agreement, and also have provided the Agents with certain indemnification rights.

We are not obligated to make any sales of common stock under the Sales Agreement. The offering of shares of common stock pursuant to the Sales Agreement will terminate upon the earlier of (i) the sale of all common stock subject to the Sales Agreement or (ii) termination of the Sales Agreement in accordance with its terms.

| 6 |

An investment in our common stock involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties and other factors described below and in our most recent Annual Report on Form 10-K as supplemented and updated by subsequent quarterly reports on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this prospectus.Our business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely affected by these risks. For more information about our SEC filings, please see “Where You Can Find More Information.”

Our planned LungFit™ BRO COVID-19 program may never enter into clinical testing or be approved.

In response to the global outbreak of COVID-19, we are planning to study our LungFitTM BRO system as a treatment option for patients with COVID-19. If the outbreak is effectively contained or the risk of COVID-19 infection is diminished or eliminated, including if other parties are successful in producing an effective vaccine or other treatment for COVID-19, before we can successfully test our LungFitTM BRO system on patients with COVID-19, the commercial viability of such product candidate for this indication may be diminished. We are also committing financial resources and personnel to this study which may cause delays in or otherwise negatively impact our other development programs, despite uncertainties surrounding the longevity and extent of COVID-19 as a global health concern. Our business could be negatively impacted by our allocation of significant resources to a global health threat that is unpredictable and could rapidly dissipate or against which our LungFitTM BRO system may not be effective. Even if clinical testing shows that our LungFit™ BRO system is an effective treatment option for patients with COVID-19 and we receive clearance from the FDA, other parties may produce a more effective or more cost-effective treatment for COVID-19, which may lead to our LungFit™ BRO system not being adopted in the marketplace or not receiving insurance or government reimbursement. It may also lead to the diversion of governmental and quasi-governmental funding away from us and toward other companies.

Recent trading in our common stock has been volatile and may continue to be volatile in the future.

Our common stock has recently experienced extreme volatility. In the prior 90 days, our common stock has closed as low as $3.94 per share and as high as $10.93 per share, with heavy daily trading volume. After our March 16, 2020 announcement that we had submitted an Investigational Device Exemption (IDE) to the FDA for approval to study the use of our LungFit™ -BRO system in patients infected with COVID-19, the trading price of our common stock increased with high trading volume. Our common stock may continue to be volatile and could materially fall for a number of reasons including:

| ● | Announcements by competitors that they have successfully produced an effective vaccine or other treatment option for COVID-19; | |

| ● | Public announcement that the rapid spread of COVID-19 has receded; | |

| ● | Announcements by us of results from future clinical trials, if any, showing that the use of our LungFitTM BRO system is not an effective treatment option for patients with COVID-19; | |

| ● | The continued large declines in major stock market indexes which causes investors to sell our common stock; | |

| ● | The termination of any other factors which may have created volatility and spike in volume; or | |

| ● | Other possible reasons for volatility which we have disclosed in our reports filed with the SEC and incorporated by reference into this prospectus supplement. |

We cannot assure you that our stock price and volume will remain at current levels in which case investors may sustain large losses.

We may be subject to certain claims by Circassia.

In connection the termination of our license agreement with Circassia, we may be subject to certain claims by Circassia. Adverse outcomes in some or all of these claims may negatively affect our ability to conduct our business. However, as of the date of this prospectus, we cannot estimate the likelihood that we will be subject to any claims or the effects thereof on our business and operations.

| 7 |

We face business disruption and related risks resulting from the recent pandemic of COVID-19, which could have a material adverse effect on our business plan.

The development of our product candidates could be disrupted and materially adversely affected by the recent outbreak of COVID-19. As a result of measures imposed by the governments in affected regions, businesses and schools have been suspended due to quarantines intended to contain this outbreak. The spread of SARS CoV-2 from China to other countries has resulted in the Director General of the World Health Organization declaring COVID-19 a pandemic on March 11, 2020. International stock markets have begun to reflect the uncertainty associated with the slow-down in the Chinese economy and the reduced levels of international travel experienced since the beginning of January and the significant declines in the Dow Industrial Average at the end of February and in March 2020 was largely attributed to the effects of COVID-19. We are still assessing our business plans and the impact COVID-19 may have on our ability to conduct our preclinical studies and clinical trials or rely on our third-party manufacturing and supply chain, but there can be no assurance that this analysis will enable us to avoid part or all of any impact from the spread of COVID-19 or its consequences, including downturns in business sentiment generally or in our sector in particular. Site initiation and patient enrollment for non-COVID-19 studies may be delayed or disrupted due to prioritization of hospital and medical resources toward the COVID-19 pandemic or inability to access hospital and other clinical sites. The extent to which the COVID-19 pandemic and global efforts to contain its spread will impact our operations will depend on future developments, which are highly uncertain and cannot be predicted at this time, and include the duration, severity and scope of the pandemic and the actions taken to contain or treat the COVID-19 pandemic.

Our amended and restated certificate of incorporation provides that the Court of Chancery of the State of Delaware will be the exclusive forum for substantially all disputes between us and our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees.

Our certificate of incorporation provides that the Court of Chancery of the State of Delaware is the exclusive forum for (A) any derivative action or proceeding brought on behalf of us; (B) any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders; (C) any action asserting a claim against us arising pursuant to any provision of the Delaware General Corporation Law, our Amended and Restated Certificate of Incorporation or our Bylaws; or (D) any action asserting a claim against us governed by the internal affairs doctrine. Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. As a result, the exclusive forum provision will not apply to suits brought to enforce any duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. In addition, Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. As a result, the exclusive forum provision will not apply to suits brought to enforce any duty or liability created by the Securities Act or any other claim for which the federal and state courts have concurrent jurisdiction.

The choice of forum provision may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or our directors, officers or other employees, which may discourage such lawsuits against us and our directors, officers and other employees. Alternatively, if a court were to find the choice of forum provision contained in our certificate of incorporation to be inapplicable or unenforceable in an action, we may incur additional costs associated with resolving such action in other jurisdictions, which could adversely affect our business and financial condition.

The shares which may be sold under this reoffer prospectus will be sold for the respective accounts of each of the Selling Stockholders listed herein (which includes our officers and directors). Accordingly, we will not realize any proceeds from the sale of the shares of our common stock. We will receive proceeds from the exercise of the options; however, no assurance can be given as to when or if any or all of the options will be exercised. If any options are exercised, the proceeds derived therefrom will be used for working capital and general corporate purposes. All expenses of the registration of the shares will be paid by us. See “Selling Stockholders” and “Plan of Distribution.”

| 8 |

We are registering for resale the Shares covered by this reoffer prospectus to permit the Selling Stockholders identified below and their pledgees, donees, transferees and other successors-in-interest that receive their securities from a Selling Stockholder as a gift, partnership distribution or other non-sale related transfer after the date of this prospectus to resell the Shares when and as they deem appropriate. The Selling Stockholders may acquire these Shares from us pursuant to the Plan. The Shares may not be sold or otherwise transferred by the Selling Stockholders unless and until the applicable awards vest and are exercised, as applicable, in accordance with the terms and conditions of the Plan.

The following table sets forth:

| ● | the name of each Selling Stockholder; | |

| ● | the number and percentage of shares of our common stock that each Selling Stockholder beneficially owned as of May 7, 2020 prior to the offering for resale of the Shares under this prospectus; | |

| ● | the number of shares of our common stock that may be offered for resale for the account of each Selling Stockholder under this prospectus; and | |

| ● | the number and percentage of shares of our common stock to be beneficially owned by each Selling Stockholder after the offering of the resale shares (assuming all of the offered resale shares are sold by such Selling Stockholder). |

Information with respect to beneficial ownership is based upon information obtained from the Selling Stockholders. Because the Selling Stockholders may offer all or part of the shares of common stock, which they own pursuant to the offering contemplated by this reoffer prospectus, and because its offering is not being underwritten on a firm commitment basis, no estimate can be given as to the amount of shares that will be held upon termination of this offering.

The number of shares in the column “Number of Shares Being Offered Hereby” represents all of the shares of our common stock that each Selling Stockholder may offer under this prospectus. We do not know how long the Selling Stockholders will hold the shares before selling them or how many shares they will sell. The shares of our common stock offered by this prospectus may be offered from time to time by the Selling Stockholders listed below. We cannot assure you that any of the Selling Stockholders will offer for sale or sell any or all of the shares of common stock offered by them by this prospectus.

| Percentage of | Number of | Percentage of | ||||||||||||||||||||

| Number of Shares | Shares to be | Shares | Shares to be | |||||||||||||||||||

| To Beneficially | Beneficially | Number of | Beneficially | Beneficially | ||||||||||||||||||

| Owned | Owned Prior | Shares | Owned Upon | Owned Upon | ||||||||||||||||||

| Name of Selling | Prior to | to the | Being Offered | Completion of | Completion of | |||||||||||||||||

| Stockholder | the Offering (1) (2) | Offering | Hereby | the Offering (1)(2) | the Offering | |||||||||||||||||

| Adam Newman | (3) | 304,339 | 1.8 | % | 250,000 | 54,339 | * | |||||||||||||||

| Ali Ardakani | (4) | 90,370 | 0.5 | % | 60,000 | 30,370 | * | |||||||||||||||

| Amir Avniel | (5) | 854,066 | 5.1 | % | 302,000 | 552,066 | 3.3 | % | ||||||||||||||

| Andrew Colin | 10,000 | 0.1 | % | 10,000 | - | N/A | ||||||||||||||||

| Ari Raved | 316,940 | 1.9 | % | 24,000 | 292,940 | 1.8 | % | |||||||||||||||

| Asher Tal | (6) | 55,416 | * | 30,000 | 25,416 | * | ||||||||||||||||

| Beverly Fuerbringer | 5,000 | * | 5,000 | - | N/A | |||||||||||||||||

| Corporate Profile LLC | (7) | 30,000 | * | 30,000 | - | N/A | ||||||||||||||||

| Craig Tolmie | 5,000 | * | 5,000 | - | N/A | |||||||||||||||||

| Daniel Fischetti | (8) | 16,195 | * | 15,500 | 695 | * | ||||||||||||||||

| David Christensen | (9) | 39,000 | * | 38,000 | 1,000 | * | ||||||||||||||||

| David Greenberg | 313,411 | 1.9 | % | 5,000 | 308,411 | 1.9 | % | |||||||||||||||

| David Kelly | 2,500 | * | 2,500 | - | N/A | |||||||||||||||||

| Dennis Tubbs | 7,500 | * | 7,500 | - | N/A | |||||||||||||||||

| Douglas Beck | (10) | 150,460 | * | 135,000 | 15,460 | * | ||||||||||||||||

| Duncan Bathe | (11) | 98,197 | * | 67,000 | 31,197 | * | ||||||||||||||||

| Duncan Fatkin | (12) | 220,967 | 1.3 | % | 145,000 | 75,967 | * | |||||||||||||||

| Enoch Bortey | 50,000 | * | 50,000 | - | N/A | |||||||||||||||||

| Erick Lucera | (13) | 46,171 | * | 45,000 | 1,171 | * | ||||||||||||||||

| Fred Montgomery | (14) | 95,767 | * | 67,000 | 28,767 | * | ||||||||||||||||

| Georgina Guadron | (15) | 34,889 | * | 33,500 | 1,389 | * | ||||||||||||||||

| Hila Confino | (16) | 25,971 | * | 25,000 | 971 | * | ||||||||||||||||

| Johnathan Morr | 40,000 | * | 40,000 | - | N/A | |||||||||||||||||

| Mark Rimkus | (17) | 67,000 | * | 64,000 | 3,000 | * | ||||||||||||||||

| Matan Goldstein | 3,000 | * | 3,000 | - | N/A | |||||||||||||||||

| Meitel Hatan | (18) | 25,100 | * | 24,500 | 600 | * | ||||||||||||||||

| Michael Gaul | 50,000 | * | 50,000 | - | N/A | |||||||||||||||||

| Pamela Golden | 35,000 | * | 35,000 | - | N/A | |||||||||||||||||

| Rhona Shanker | (19) | 65,000 | * | 62,000 | 3,000 | * | ||||||||||||||||

| Rinat Kalaora | (20) | 52,777 | * | 52,000 | 777 | * | ||||||||||||||||

| Robert Carey | 70,418 | * | 51,000 | 19,418 | * | |||||||||||||||||

| Ron BenTsur | (21) | 405,918 | 2.5 | % | 49,000 | 356,918 | 2.2 | % | ||||||||||||||

| Ronit Hadass | (22) | 27,086 | * | 26,000 | 1,086 | * | ||||||||||||||||

| Shay Yarkoni | (23) | 29,500 | * | 28,500 | 1,000 | * | ||||||||||||||||

| Steven Lisi | (24) | 1,391,784 | 8.3 | % | 540,000 | 851,784 | 5.1 | % | ||||||||||||||

| Thomas Kohlman | 7,500 | * | 7,500 | - | N/A | |||||||||||||||||

| Vincent Vega | (25) | 35,000 | * | 35,000 | - | N/A | ||||||||||||||||

| Vladislava Zamfirova | (26) | 37,500 | * | 37,500 | - | N/A | ||||||||||||||||

| Wade Anderson | (27) | 28,471 | * | 27,500 | 971 | * | ||||||||||||||||

| William Forbes | 62,855 | * | 58,000 | 4,855 | * | |||||||||||||||||

| William Rush | 12,500 | * | 12,500 | - | N/A | |||||||||||||||||

| Yoori Lee | (28) | 49,539 | * | 40,000 | 9,539 | * | ||||||||||||||||

| * | Less than one percent. | |

| N/A | Not applicable | |

| (1) | Based on 16,447,769 shares issued and outstanding as of May 7, 2020 | |

| (2) | Under the terms of warrants issued in 2017 (the “January 2017 Warrants”) and 2018 (the “February 2018 Warrants”), no holder may exercise a warrant to the extent such exercise would cause such holder, together with its affiliates and any other persons acting as a group with such holder or any of its affiliates, to have acquired a number of shares of common stock which would exceed 4.99%, or, in the case of certain holders, 9.985% (subject to an increase of such percentage to 9.99% on 61 days’ notice by the holder to the Company) of our then outstanding common stock, excluding for purposes of such determination shares of common stock issuable upon exercise of warrants that have not been exercised. We refer to the foregoing limitation applicable to each holder or group as the “Ownership Cap”. As a result, in order to exercise certain of their warrants, certain of the selling stockholders would first be required to sell a sufficient amount of common stock such that their exercise of such warrants would not result in their ownership percentage of our then outstanding common stock exceeding the applicable Ownership Cap | |

| (3) | Includes 93,100 of restricted stock | |

| (4) | Includes 40,000 of restricted stock and 11,710 shares of common stock issuable upon exercise of the January 2017 Warrants and the February 2018 Warrants | |

| (5) | Includes 105,100 of restricted stock and 45,676 shares of common stock issuable upon exercise of the January 2017 Warrants and the February 2018 Warrants. Also includes 32,666 shares of common stock held by Dandelion Investments Ltd., over which Mr. Avniel has sole voting and dispositive power | |

| (6) | Includes 10,000 of restricted stock and 23,416 shares of common stock issuable upon exercise of the February 2018 Warrants | |

| (7) | Consist of 30,000 of restricted stock | |

| (8) | Includes 3,000 of restricted stock | |

| (9) | Includes 8,000 of restricted stock | |

| (10) | Includes 15,000 of restricted stock | |

| (11) | Includes 27,000 of restricted stock and 10,000 shares of common stock issuable upon exercise of the February 2018 Warrants | |

| (12) | Includes 25,000 of restricted stock | |

| (13) | Included 1,171 shares of common stock issuable upon exercise of the February 2018 Warrants | |

| (14) | Includes 27,000 of restricted stock and 9,300 shares of common stock issuable upon exercise of the February 2018 Warrants | |

| (15) | Includes 12,500 of restricted stock | |

| (16) | Includes 5,000 of restricted stock | |

| (17) | Includes 34,000 of restricted stock | |

| (18) | Includes 7,000 of restricted stock | |

| (19) | Includes 35,000 of restricted stock. | |

| (20) | Includes 20,000 of restricted stock | |

| (21) | Includes 73,419 shares of common stock issuable upon exercise of the January 2017 Warrants and the February 2018 Warrants | |

| (22) | Includes 7,000 of restricted stock | |

| (23) | Includes 11,000 of restricted stock | |

| (24) | Includes 202,100 of restricted stock and 200,466 shares of common stock issuable upon the exercise of the January 2017 Warrants and February 2018 Warrants | |

| (25) | Includes 10,000 of restricted stock | |

| (26) | Includes 10,000 of restricted stock | |

| (27) | Includes 5,000 shares of restricted stock | |

| (28) | Includes 2,342 shares of common stock issuable upon exercise of the February 2018 Warrants |

| 9 |

Our common stock is quoted on the Nasdaq Capital Market under the symbol “XAIR.”

The selling stockholders will act independently of us in making decisions with respect to the timing, manner and size of each and any sale.

The Selling Stockholders may, from time to time, sell all or a portion of the shares of common stock on any market where our common stock may be listed or quoted (currently the Nasdaq Capital Market), in privately negotiated transactions or otherwise. Such sales may be at fixed prices prevailing at the time of sale, at prices related to the market prices or at negotiated prices. The shares of common stock being offered for resale by this Prospectus may be sold by the Selling Stockholders by one or more of the following methods:

| ● | block trades in which the broker or dealer so engaged will attempt to sell the shares of common stock as agent but may position and resell a portion of the block as principal to facilitate the transaction; | |

| ● | purchases by broker or dealer as principal and resale by the broker or dealer for its account pursuant to this prospectus; | |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; | |

| ● | ordinary brokerage transactions and transactions in which the broker solicits purchasers; | |

| ● | privately negotiated transactions; | |

| ● | market sales (both long and short to the extent permitted under the federal securities laws); | |

| ● | at the market to or through market makers or into an existing market for the shares; | |

| ● | through transactions in options, swaps or other derivatives (whether exchange listed or otherwise); and | |

| ● | a combination of any of the aforementioned methods of sale. |

In the event of the transfer by any of the Selling Stockholders of its options or shares of common stock to any pledgee, donee or other transferee, we will amend this prospectus and the Registration Statement of which this prospectus forms a part by the filing of a prospectus supplement or a post-effective amendment in order to have the pledgee, donee or other transferee in place of the Selling Stockholder who has transferred his, her or its shares.

In effecting sales, brokers and dealers engaged by the Selling Stockholders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions or discounts from a selling stockholder or, if any of the broker-dealers act as an agent for the purchaser of such shares, from a purchaser in amounts to be negotiated which are not expected to exceed those customary in the types of transactions involved. Broker-dealers may agree with a selling stockholder to sell a specified number of the shares of common stock at a stipulated price per share. Such an agreement may also require the broker-dealer to purchase as principal any unsold shares of common stock at the price required to fulfill the broker-dealer commitment to the selling stockholder if such broker-dealer is unable to sell the shares on behalf of the selling stockholder. Broker-dealers who acquire shares of common stock as principal may thereafter resell the shares of common stock from time to time in transactions which may involve block transactions and sales to and through other broker-dealers, including transactions of the nature described above. Such sales by a broker-dealer could be at prices and on terms then prevailing at the time of sale, at prices related to the then-current market price or in negotiated transactions. In connection with such resales, the broker-dealer may pay to or receive from the purchasers of the shares commissions as described above.

| 10 |

The Selling Stockholders and any broker-dealers or agents that participate with the Selling Stockholders in the sale of the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act in connection with these sales. In that event, any commissions received by the broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

From time to time, any of the Selling Stockholders may pledge shares of common stock pursuant to the margin provisions of customer agreements with brokers. Upon a default by a selling stockholder, their broker may offer and sell the pledged shares of common stock from time to time. Upon a sale of the shares of common stock, the Selling Stockholders intend to comply with the Prospectus delivery requirements under the Securities Act by delivering a Prospectus to each purchaser in the transaction. We intend to file any amendments or other necessary documents in compliance with the Securities Act which may be required in the event any of the Selling Stockholders defaults under any customer agreement with brokers.

To the extent required under the Securities Act, a post-effective amendment to this Registration Statement will be filed disclosing the name of any broker-dealers, the number of shares of common stock involved, the price at which the common stock is to be sold, the commissions paid or discounts or concessions allowed to such broker-dealers, where applicable, that such broker-dealers did not conduct any investigation to verify the information set out or incorporated by reference in this Prospectus and other facts material to the transaction. We and the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations under it, including, without limitation, Rule 10b-5 and, insofar as a selling stockholder is a distribution participant and we, under certain circumstances, may be a distribution participant, under Regulation M.

All of the foregoing may affect the marketability of the common stock.

Any commissions, discounts or other fees payable to brokers or dealers in connection with any sale of the shares of common stock will be borne by the Selling Stockholders, the purchasers participating in such transaction, or both.

Any shares of common stock covered by this Prospectus which qualify for sale pursuant to Rule 144 under the Securities Act, as amended, may be sold under Rule 144 rather than pursuant to this Prospectus.

The validity of the issuance of the common stock described in this Prospectus will be passed upon for us by Sichenzia Ross Ference LLP at 1185 Avenue of the Americas, 37th Floor, New York, NY 10036.

The consolidated financial statements of Beyond Air, Inc. and subsidiaries as of March 31, 2018 and December 31, 2017, for the transition period ended March 31, 2018, and for the fiscal year ended December 31, 2017, have been incorporated by reference in this prospectus in reliance upon the report of Kost Forer Gabbay & Kasierer, a Member of Ernst & Young Global, predecessor independent registered public accounting firm, and upon the authority of said firm as experts in accounting and auditing.

The consolidated financial statements of Beyond Air, Inc. and subsidiaries as of and for the year ended March 31, 2019 have been incorporated by reference in this prospectus in reliance upon the report of Friedman LLP, independent registered public accounting firm, and upon the authority of said firm as experts in accounting and auditing.

| 11 |

INCORPORATION OF DOCUMENTS BY REFERENCE

We are “incorporating by reference” in this prospectus certain documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information in the documents incorporated by reference is considered to be part of this prospectus. Statements contained in documents that we file with the SEC and that are incorporated by reference in this prospectus will automatically update and supersede information contained in this prospectus, including information in previously filed documents or reports that have been incorporated by reference in this prospectus, to the extent the new information differs from or is inconsistent with the old information. We incorporate by reference the following information or documents that we have filed with the SEC (excluding those portions of any Form 8-K that are not deemed “filed” pursuant to the General Instructions of Form 8-K):

| ● | Our Annual Report on Form 10-K for the fiscal year ended March 31, 2019, filed with the SEC on June 28, 2019; | |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended December 31, 2019, filed with the SEC on February 7, 2020; | |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended September 30, 2019, filed with the SEC on November 6, 2019; | |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, filed with the SEC on August 14, 2019; |

| ● | Our Current Reports on Form 8-K filed with the SEC on April 17, 2019; May 3, 2019, June 7, 2019, June 28, 2019, July 15, 2019, November 27, 2019, December 9, 2019, December 12, 2019, December 20, 2019, March 5, 2020, March 18, 2020, March 20, 2020, April 3, 2020 and April 16, 2020; and | |

| ● | The description of certain capital stock contained in our Registration Statement 8-A filed on May 3, 2019, as it may further be amended from time to time. |

Any information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information in this prospectus supplement or the accompanying prospectus or in a later filed document that is incorporated or deemed to be incorporated herein by reference modifies or replaces such information.

We also incorporate by reference any future filings (excluding information furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, until we sell all of the securities offered by this prospectus supplement. Information in such future filings updates and supplements the information provided in this prospectus supplement. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

You may request, orally or in writing, a copy of these documents, which will be provided to you at no cost (other than exhibits, unless such exhibits are specifically incorporate by reference), by contacting Steven Lisi, c/o Beyond Air, Inc., at 825 East Gate Boulevard, Suite 320, Garden City, New York 11530. Our telephone number is (516) 665-8200. Information about us is also available at our website at http://www.beyondair.net. The information in our website is not a part of this prospectus and is not incorporated by reference.

| 12 |

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION

FOR SECURITIES ACT LIABILITIES

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the registrant, the registrant has been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC under the Securities Act a Registration Statement on Form S-8, of which this prospectus forms a part, with respect to the shares being offered in this offering. This prospectus does not contain all of the information set forth in the Registration Statement, certain items of which are omitted in accordance with the rules and regulations of the SEC. The omitted information may be inspected and copied at the Public Reference Room maintained by the SEC at 100 F. Street, N.E., Washington, D.C. 20549. You can obtain information about operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document we file with the SEC (including exhibits to such documents) at the SEC’s Public Reference Room at 100 F. Street, N.E., Room 1580, Washington, D.C. 20549. You may obtain additional information about the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a site on the Internet at http://www.sec.gov/ that contains reports, proxy statements and other information that we file electronically with the SEC.

Statements contained in this prospectus as to the contents of any contract or other document filed as an exhibit to the Registration Statement are not necessarily complete and in each instance reference is made to the copy of the document filed as an exhibit to the Registration Statement, each statement made in this Prospectus relating to such documents being qualified in all respect by such reference. For further information with respect to us and the securities being offered hereby, reference is hereby made to the Registration Statement, including the exhibits thereto.

| 13 |

REOFFER PROSPECTUS

Beyond Air, Inc.

2,595,000shares of

Common Stock

May 13, 2020

| 14 |

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

We are “incorporating by reference” in this prospectus certain documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information in the documents incorporated by reference is considered to be part of this prospectus. Statements contained in documents that we file with the SEC and that are incorporated by reference in this prospectus will automatically update and supersede information contained in this prospectus, including information in previously filed documents or reports that have been incorporated by reference in this prospectus, to the extent the new information differs from or is inconsistent with the old information. We incorporate by reference the following information or documents that we have filed with the SEC (excluding those portions of any Form 8-K that are not deemed “filed” pursuant to the General Instructions of Form 8-K):

| ● | Our Annual Report on Form 10-K for the fiscal year ended March 31, 2019, filed with the SEC on June 28, 2019; | |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended December 31, 2019, filed with the SEC on February 7, 2020; | |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended September 30, 2019, filed with the SEC on November 6, 2019; | |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, filed with the SEC on August 14, 2019; |

| ● | Our Current Reports on Form 8-K filed with the SEC on April 17, 2019; May 3, 2019, June 7, 2019, June 28, 2019, July 15, 2019, November 27, 2019, December 9, 2019, December 12, 2019, December 20, 2019, March 5, 2020, March 18, 2020, March 20, 2020, April 3, 2020 and April 16, 2020; and | |

| ● | The description of certain capital stock contained in our Registration Statement 8-A filed on May 3, 2019, as it may further be amended from time to time. |

Any information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information in this prospectus supplement or the accompanying prospectus or in a later filed document that is incorporated or deemed to be incorporated herein by reference modifies or replaces such information.

We also incorporate by reference any future filings (excluding information furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, until we sell all of the securities offered by this prospectus supplement. Information in such future filings updates and supplements the information provided in this prospectus supplement. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

You may request, orally or in writing, a copy of these documents, which will be provided to you at no cost (other than exhibits, unless such exhibits are specifically incorporate by reference), by contacting Steven Lisi, c/o Beyond Air, Inc., at 825 East Gate Boulevard, Suite 320, Garden City, New York 11530. Our telephone number is (516) 665-8200. Information about us is also available at our website at http://www.beyondair.net. The information in our website is not a part of this prospectus and is not incorporated by reference.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

| II-1 |

Item 6. Indemnification of Directors and Officers.

Incorporated in the State of Delaware, the Company is subject to the Delaware General Corporation Law (the “DGCL”). Section 145 of the DGCL empowers a Delaware corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation) by reason of the fact that such person is or was a director, officer, employee or agent of such corporation, or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation or enterprise. A corporation may, in advance of the final action of any civil, criminal, administrative or investigative action, suit or proceeding, pay the expenses (including attorneys’ fees) incurred by any officer, director, employee or agent in defending such action, provided that the director or officer undertakes to repay such amount if it shall ultimately be determined that he or she is not entitled to be indemnified by the corporation. A corporation may indemnify such person against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful.

A Delaware corporation may indemnify officers and directors in an action by or in the right of the corporation to procure a judgment in its favor under the same conditions, except that no indemnification is permitted without judicial approval if the officer or director is adjudged to be liable to the corporation. Where an officer or director is successful on the merits or otherwise in the defense of any action referred to above, the corporation must indemnify him or her against the expenses (including attorneys’ fees) which he or she actually and reasonably incurred in connection therewith. The indemnification provided is not deemed to be exclusive of any other rights to which an officer or director may be entitled under any corporation’s by-law, agreement, vote or otherwise.

Our Amended and Restated Certificate of Incorporation provides that we shall indemnify our directors, officers and agents (and any other persons to which applicable law permits the Company to provide indemnification) whether serving us or at our request, any other entity, to the full extent required or permitted by the DGCL, including the advancement of expenses under the procedures and to the full extent permitted by law.

Our Amended and Restated By-laws (“Bylaws”) provide that, we shall indemnify our directors and executive officers (“executive officers” shall have the meaning defined in Rule 3b-7 promulgated under the 1934 Act) to the extent not prohibited by the DGCL or any other applicable law; provided, however, that we may modify the extent of such indemnification by individual contracts with our directors and executive officers; and, provided, further, that we shall not be required to indemnify any director or executive officer in connection with any proceeding (or part thereof) initiated by such person unless (i) such indemnification is expressly required to be made by law, (ii) the proceeding was authorized by the Board of Directors of the corporation, (iii) such indemnification is provided by us, in our sole discretion, pursuant to the powers vested in the Company under the DGCL or any other applicable law or (iv) such indemnification is required to be made under section 44(d) of the Bylaws.

Item 7. Exemption From Registration Claimed.

The grant of our securities were issued as compensation awards or as enticement or incentive awards. These grants were exempt from registration pursuant to Section 4(2) of the Securities Act.

| II-2 |

Item 8. Exhibits.

* Filed herewith

Item 9. Undertakings.

(a) The undersigned Company hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the Company pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Company hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Company’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

| II-3 |

SIGNATURES

Pursuant to the requirements of the Securities Act, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in Garden City, New York, on the 13th of May, 2020.

| BEYOND AIR, INC. | ||

| By: | /s/ Steven Lisi | |

| Steven Lisi | ||

Chief Executive Officer and Chairman of the Board of Directors | ||

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Steven Lisi their true and lawful attorneys-in-fact and agent, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments, to this Registration Statement on Form S-8, and to file the same, with exhibits thereto and other documents in connection therewith, with the SEC granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that each of said attorney-in-fact and agent, or his substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

| Name | Position | Date | ||

| /s/ Steven Lisi | Chairman and Chief Executive Officer (Principal Executive Officer) | May 13, 2020 | ||

| Steven Lisi | ||||

| /s/ Douglas Beck | Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) | May 13, 2020 | ||

| Douglas Beck | ||||