Fixed Income Investor Presentation September 2019[Month] [Day], 2019Year-End 2021 Earnings Presentation cshares, Inc. Exhibit 99.2

2 Certain statements in this presentation which are not historical in nature are intended to be, and are hereby identified as, “forward-looking statements” for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements about the benefits of the proposed merger of Allegiance and CBTX, including future financial and operating results (including the anticipated impact of the transaction on Allegiance’s and CBTX’s respective earnings and book value), statements related to the expected timing of the completion of the merger, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “scheduled,” “plans,” “intends,” “anticipates,” “expects,” “believes,” “estimates,” “potential,” or “continue” or negatives of such terms or other comparable terminology. All forward-looking statements are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of Allegiance or CBTX to differ materially from any results expressed or implied by such forward-looking statements. Forward-Looking Statements and Non-GAAP Financial Measures Information about the Merger and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, CBTX has filed a registration statement on Form S-4 with the SEC to register the shares of CBTX common stock that will be issued to Allegiance shareholders in connection with the merger. The registration statement includes a joint proxy statement/prospectus. The Form S-4 has not yet become effective. After the Form S-4 is effective, a definitive joint proxy statement/prospectus will be sent to the shareholders of CBTX and Allegiance seeking their approval of the proposed merger. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT ALLEGIANCE, CBTX AND THE PROPOSED MERGER. Investors and security holders may obtain free copies of these documents, once they are filed, and other documents filed with the SEC by Allegiance or CBTX through the website maintained by the SEC at https:///www.sec.gov. Documents filed with the SEC by CBTX will be available free of charge by accessing the CBTX’s website at www.communitybankoftx.com under the heading “Investor Relations” or, alternatively, by directing a request by mail or telephone to CBTX, Inc., 9 Greenway Plaza, Suite 110, Houston, Texas 77046, Attn: Investor Relations, 713-210-7600, and documents filed with the SEC by Allegiance will be available free of charge by accessing Allegiance’s website at www.allegiancebank.com under the heading “Investor Relations” or, alternatively, by directing a request by mail or telephone to Allegiance Bancshares, Inc., 8847 West Sam Houston Parkway, N., Suite 200, Houston, Texas 77040, 281-894-3200. Participants in the Solicitation CBTX, Allegiance and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of CBTX and Allegiance in connection with the proposed merger. Certain information regarding the interests of these participants and a description of their direct or indirect interests, by security holdings or otherwise, are included in the joint proxy statement/prospectus regarding the proposed merger. Additional information about the directors and executive officers of Allegiance and their ownership of Allegiance’s common stock is set forth in Allegiance’s proxy statement for its annual meeting of shareholders, filed with the SEC on March 10, 2021. Additional information about the directors and executive officers of CBTX and their ownership of CBTX’s common stock is set forth in CBTX’s proxy statement for its annual meeting of shareholders, filed with the SEC on April 14, 2021. These documents can be obtained free of charge from the sources described above. Such factors include, among others: (1) the risk that the cost savings and any revenue synergies from the merger may not be fully realized or may take longer than anticipated to be realized; (2) disruption to the parties’ businesses as a result of the announcement and pendency of the merger; (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (4) the risk that the integration of each party’s operations will be materially delayed or will be more costly or difficult than expected or that the parties are otherwise unable to successfully integrate each party’s businesses into the other’s businesses; (5) the failure to obtain the necessary approvals by the shareholders of Allegiance or CBTX; (6) the amount of the costs, fees, expenses and charges related to the merger; (7) the ability by each of Allegiance and CBTX to obtain required governmental approvals of the merger (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction); (8) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the merger; (9) the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing the merger; (10) the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (11) the dilution caused by CBTX’s issuance of additional shares of its common stock in the merger; (12) general competitive, economic, political and market conditions; (13) the costs, effects and results of regulatory examinations, investigations, including the ongoing investigation by the Financial Crimes Enforcement Network of the U.S. Department of Treasury, or FinCEN, of CBTX or the ability of CBTX to obtain required regulatory approvals; (14) the possible results and amount of civil money penalties related to such FinCEN investigation and CBTX’s BSA/AML program; and (15) other factors that may affect future results of CBTX and Allegiance including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and other actions of the Board of Governors of the Federal Reserve System and Office of the Comptroller of the Currency and legislative and regulatory actions and reforms. Additionally, the impact of the COVID-19 pandemic continues to evolve and its future effects on Allegiance are difficult to predict. Additional factors which could affect future results of Allegiance and CBTX can be found in Allegiance’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and the Current Reports on Form 8-K, and CBTX’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at https://www.sec.gov. Allegiance and CBTX disclaim any obligation and do not intend to update or revise any forward- looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. GAAP Reconciliation of Non-GAAP Financial Measures We use certain non-GAAP financial measures to evaluate our performance. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and that management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, analyzing and comparing past, present and future periods. Specifically, we review return on average tangible common equity, the ratio of tangible equity to tangible assets and adjusted net interest margin on a tax equivalent basis for internal planning and forecasting purposes. We have included in this presentation information relating to these non-GAAP financial measures for the applicable periods presented. These non-GAAP measures should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which we calculate these non-GAAP financial measures may differ from that of other companies reporting measures with similar names. A reconciliation of the non-GAAP financial measures is in the appendix.

3 Allegiance Bancshares, Inc. Overview Franchise Footprint Holding Company for Allegiance Bank; Headquartered in Houston, Texas Company Overview Providing full-service banking services for small- to medium-sized businesses Operational History 27 full-service banking locations (at December 31, 2021) • 26 in the Houston-The Woodlands-Sugar Land MSA • 1 in the Beaumont-Port Arthur MSA, just outside of Houston Since opening in 2007, we have completed three whole bank acquisitions and one branch transaction: • 2019: LoweryBank branch acquisition with $45.0 million in loans and $16.0 million in deposits • 2018: Post Oak Bank, N.A. (Post Oak Bancshares, Inc.) with $1.5 billion in total assets • 2015: Enterprise Bank (F&M Bancshares, Inc.) with $569.7 million in total assets • 2013: Independence Bank, N.A. with $222.1 million in total assets Financial Highlights ABTX Branch Locations (27) Galveston Houston Houston-The Woodlands-Sugar Land MSA Beaumont-Port Arthur MSA 10 10 45 45 Beaumont _____________________ (1) Please refer to the non-GAAP reconciliation in the appendix ($ in millions) 12/31/2021 12/31/2020 12/31/2019 12/31/2018 12/31/2017 Total Assets 7,105.0$ 6,050.1$ 4,992.7$ 4,655.2$ 2,860.2$ Total Loans 4,220.5 4,491.8 3,915.3 3,708.3 2,270.9 Total Deposits 6,047.6 4,988.5 4,068.1 3,662.5 2,214.0 Total Equity 816.5 758.7 709.9 703.0 306.9 Loans/Deposits 69.79% 90.04% 96.24% 101.25% 102.57% NPAs/Assets 0.34% 0.63% 0.74% 0.72% 0.49% TCE/TA(1) 8.42% 8.90% 9.78% 10.29% 9.38% NIM (tax equivalent)(2) 3.90% 4.08% 4.22% 4.27% 4.34% ROAA(2) 1.24% 0.81% 1.10% 1.11% 0.65% ROATCE(2) 14.93% 9.33% 11.50% 11.20% 6.93% Ba la nc e Sh ee t Ca pi ta l, Cr ed it & Pr of ita bi lit y

4 Financial Highlights – 2021 Assets of $7.10 billion, loans of $4.22 billion, deposits of $6.05 billion and shareholder's equity of $816.5 million at December 31, 2021 • Deposit growth of $1.06 billion, or 21.2%, from the year 2020 • Asset growth of $1.05 billion, or 17.4%, from the year 2020 • Funded over $1.08 billion in PPP loans in 2020 and 2021 Balance Sheet Growth Record net income of $81.6 million for the year 2021 compared to $45.5 million for the year 2020 2021 earnings were impacted by: • Net interest income growth of $25.9 million, or 12.8%, from the year 2020 • $2.3 million recapture of provision for credit losses compared to a provision for credit losses of $27.4 million in the year 2020 Diluted EPS of $4.01 translated into an annualized return on average assets and average tangible equity(1) of 1.24% and 14.93%, respectively Profitability Net Interest Income and Margin Net interest income increased to $228.6 million for year 2021 compared to $202.7 million for the year 2020 • PPP fees of $26.6 million recognized in the year 2021 compared to $11.0 million in the year 2020 • Cost of interest-bearing liabilities decreased to 0.66% for the year 2021 from 1.19% for the year 2020 Recognitions and Awards Recognized as Houston’s Top Workplaces by the Houston Chronicle for the 12th consecutive year. Allegiance Bank ranked no. 3 in the large companies category and are one of only three companies to have been on the list of Houston’s Top Workplaces for eleven consecutive years _____________________ (1) Please refer to the non-GAAP reconciliation in the appendix.

5 Announced Merger of Equals with CBTX, Inc. Creates a premier Texas financial institution by combining two of the largest Houston-focused banks Generates significant shareholder value through materially enhanced metrics True merger-of-equals – combined management team and equal board contribution Complementary branch network, with meaningful overlap to support cost savings Shared vision, community focus, and commitment to clients and employees HOUSTON REGION Houston-The Woodlands-Sugar Land and Beaumont-Port Arthur MSAs ABTX BRANCH (27) CBTX BRANCH (34) DALLAS AUSTIN SAN ANTONIO HOUSTON BEAUMONT Highlights

6 $2.2 $3.3 $3.5 $3.6 $5.5 $6.3 $6.3 $6.5 $6.8 $8.0 $8.7 $13.8 $16.1 Truist CHARLIE Texas Capital Comerica ALPHA Woodforest BancorpSouth Prosperity Capital One Frost PRO FORMA Zions PNC BofA Wells Fargo JPMorgan RANKED #6 PRO FORMA IN HOUSTON REGION (1) MARKET SHARE HOUSTON REGION Houston-The Woodlands-Sugar Land and Beaumont-Port Arthur MSAs HOUSTON REGION (1) MARKET SHARE PRO F R Allegiance CBTX BRANCHES Company Houston Region(1) Total CBTX 26 34 Allegiance 27 27 $156.5 $33.2 $26.9 Cadence Deposits ($B) ______________ Source: S&P Capital IQ Pro // Note: Deposit market share based on FDIC data as of June 30, 2021; Pro forma represents deposits in the Houston Region as of June 30, 2021 on a combined basis (1) By cumulative deposit market share ranking in the Houston-The Woodlands-Sugar Land and Beaumont-Port Arthur MSAs Pending MOE Poised to Create Largest Deposit Market Share of any Texas-Based Bank in the Houston Region

7 Number of Branches Total Deposits In Market ($000) Total Market Share (%) % of Company Deposits Total Deposits In Market ($000) Total Market Share (%) Size Profile Houston-The Woodlands-Sugar Land, TX JPMorgan Chase & Co. (NY) 1 1 176 155,894,884$ 47.11 7.75 144,957,958$ 48.45 >$1T Wells Fargo & Co. (CA) 2 2 164 34,160,426 10.32 2.30 27,057,129 9.04 >$1T Bank of America Corporation (NC) 3 3 112 26,436,694 7.99 1.41 23,787,159 7.95 >$1T The PNC Finl Svcs Grp (PA) 4 4 86 14,991,787 4.53 3.33 16,073,270 5.37 >$500B Zions Bancorp. NA (UT) 5 5 59 13,834,338 4.18 18.18 11,527,801 3.85 >$80B Cullen/Frost Bankers Inc. (TX) 6 6 53 8,033,612 2.43 20.49 6,022,935 2.01 >$40B Prosperity Bancshares Inc. (TX) 7 8 58 6,444,413 1.95 22.07 5,635,177 1.88 >$30B Woodforest Financial Grp Inc. (TX) 8 10 105 6,280,274 1.90 72.01 5,349,523 1.79 >$9B Capital One Financial Corp. (VA) 9 9 22 6,243,102 1.89 2.03 5,463,024 1.83 >$400B Cadence Bancorp. (TX) 10 7 11 5,540,508 1.67 34.44 5,747,768 1.92 >$15B Allegiance Bancshares Inc. (TX) 11 11 26 5,215,366 1.58 95.53 4,568,351 1.53 ~$6.5B Comerica Inc. (TX) 12 12 49 3,554,038 1.07 4.65 3,457,262 1.16 >$80B Texas Capital Bancshares Inc. (TX) 13 13 2 3,543,956 1.07 12.10 3,037,992 1.02 >$30B Truist Financial Corp. (NC) 14 15 21 2,197,317 0.66 0.53 1,870,728 0.63 >$500B BOK Financial Corp. (OK) 15 16 11 2,127,591 0.64 5.65 1,802,005 0.60 >$40B CBTX Inc. (TX) 16 14 17 1,917,457 0.58 55.61 1,923,017 0.64 >$40B Regions Financial Corp. (AL) 17 18 52 1,830,098 0.55 1.38 1,692,428 0.57 >$100B Veritex Holdings Inc. (TX) 18 17 11 1,801,212 0.54 25.39 1,694,437 0.57 >$9B Independent Bk Group Inc. (TX) 19 19 13 1,791,921 0.54 11.89 1,585,009 0.53 >$15B First Horizon Corp. (TN) 20 20 7 1,700,009 0.51 2.29 1,533,609 0.51 >$80B Total For Institutions In Market 1,404 330,888,412$ 299,201,648$ 2020 Institution (ST) 2021 Rank 2020 Rank 2021 Allegiance - Deposit Market Share - Houston-The Woodlands-Sugar Land MSA _____________________ Source: S&P Global Intelligence as of June 30, 2021. (1) As of June 30 of the year shown, on a pro forma basis reflecting any announced acquisition. (1) (1) (1)

8 Historical Balance Sheet Growth Total LoansTotal Assets Total EquityTotal Deposits _____________________ Note: Dollars in millions. (1) Includes $1.50 billion in assets acquired on October 1, 2018. (2) Includes $1.16 billion of acquired loans at fair value on October 1, 2018. (3) Includes $1.29 billion of acquired deposits on October 1, 2018. (4) Includes $45.0 million of loans acquired on February 1, 2019. (5) Includes $16.0 million of deposits acquired on February 1, 2019. $2,451 $2,860 $4,655 $4,993 $6,050 $7,105 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 2016 2017 2018 2019 2020 2021 Assets Acquired Assets (1) (4) $1,892 $2,271 $3,708 $3,915 $4,492 $4,220 $0 $1,000 $2,000 $3,000 $4,000 $5,000 2016 2017 2018 2019 2020 2021 Loans Acquired Loans (2) (4) $1,870 $2,214 $3,663 $4,068 $4,988 $6,048 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 2016 2017 2018 2019 2020 2021 Deposits Acquired Deposits (3) (5) $280 $307 $703 $710 $759 $816 $0 $200 $400 $600 $800 2016 2017 2018 2019 2020 2021

9 $9.0 $15.8 $22.9 $17.6 $37.3 $53.0 $45.5 $81.6 $1.26 $1.43 $1.75 $1.31 $2.37 $2.47 $2.22 $4.01 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 2014 2015 2016 2017 2018 2019 2020 2021 Ea rn in gs p er S ha re ($ ) Ne t I nc om e Net Income Earnings per Share (Diluted) 46.834 80.166 $89.9 $103.7 $128.6 $179.5 $202.7 $228.6 4.31 4.68 4.37% 4.34% 4.27% 4.22% 4.08% 3.90% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 $200.0 $220.0 $240.0 2014 2015 2016 2017 2018 2019 2020 2021 Ne t I nt er es t M ar gi n (T ax E qu iv al en t) Ne t I nt er es t I nc om e Net Interest Income Net Interest Margin (TE) Earnings Performance Net Interest Income and Net Interest MarginNet Income and Earnings per Share _____________________ Note: Dollars in millions, except per share numbers. (1) Includes a one-time gain from sale of branches of $1.3 million (after-tax). (2) Includes $1.8 million and $1.7 million of core system conversion and acquisition and merger-related expenses, respectively, and $3.1 million of acquisition accounting adjustments. (3) Includes $9.6 million of acquisition accounting adjustments, $1.4 million of pre-tax severance expense and a $1.1 million FDIC Small Bank Assessment Credit. (1) (2) (3) (4) Includes $3.1 million of acquisition accounting adjustments. (5) Includes $9.6 million of acquisition accounting adjustments. (4) (5)

10 (1) Includes $9.6 million of acquisition accounting adjustments, $1.3 million of acquisition and merger related expenses, $1.4 million of pre-tax severance expense, $1.1 million FDIC Small Bank Assessment Credit, $1.5 million of gain on sales of securities offset by $572 thousand of prepayment penalties and $376 thousand of SBIC income (2) Includes $9.6 million of acquisition accounting adjustments, $1.3 million of acquisition and merger related expenses, $1.4 million of pre-tax severance expense, $1.1 million FDIC Small Bank Assessment Credit, $1.5 million of gain on sales of securities offset by $572 thousand of prepayment penalties and $376 thousand of SBIC income (3) Includes $9.6 million of acquisition accounting adjustments, $1.3 million of acquisition and merger related expenses, $1.4 million of pre-tax severance expense, $1.1 million FDIC Small Bank Assessment Credit, $1.5 million of gain on sales of securities offset by $572 thousand of prepayment penalties and $376 thousand of SBIC income (4) Includes $9.6 million of acquisition accounting adjustments, $1.3 million of acquisition and merger related expenses, $1.4 million of pre-tax severance expense, $1.1 million FDIC Small Bank Assessment Credit, $1.5 million of gain on sales of securities offset by $572 thousand of prepayment penalties and $376 thousand of SBIC income (5) Includes $9.6 million of acquisition accounting adjustments, $1.3 million of acquisition and merger related expenses, $1.4 million of pre-tax severance expense, $1.1 million FDIC Small Bank Assessment Credit, $1.5 million of gain on sales of securities offset by $572 thousand of prepayment penalties and $376 thousand of SBIC income (6) Represents total noninterest expense divided by the sum of net interest income plus noninterest income, excluding net gains and losses on the sale of loans, securities and assets. Additionally, taxes and provision for loan losses are not part of this calculation. 6.30% 7.38% 9.22% 8.70% 9.52% 9.96% 6.93% 11.20% 11.50% 9.33% 14.93% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 3.26% 2.99% 2.82% 2.80% 2.83% 2.53% 2.59% 2.58% 2.50% 2.26% 2.13% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 74.4% 69.0% 69.2% 67.8% 65.3% 62.3% 63.9% 63.7% 63.0% 60.6% 58.9% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 0.60% 0.65% 0.78% 0.75% 0.81% 0.98% 0.65% 1.11% 1.10% 0.81% 1.24% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Return on Average Tangible Equity(1)Return on Average Assets Noninterest Expense to Average AssetsEfficiency Ratio(6) _____________________ (1) Please refer to the non-GAAP reconciliation in the appendix. (2) Includes a one-time gain from sale of branches of $1.3 million (after-tax). (3) Includes $1.8 million and $1.7 million of core system conversion and merger-related expenses, respectively. (4) Includes $3.1 million of acquisition accounting adjustments. (2) (3)(4) (5) (5) (5) (3)(4) (3) (2) Earnings Performance, continued

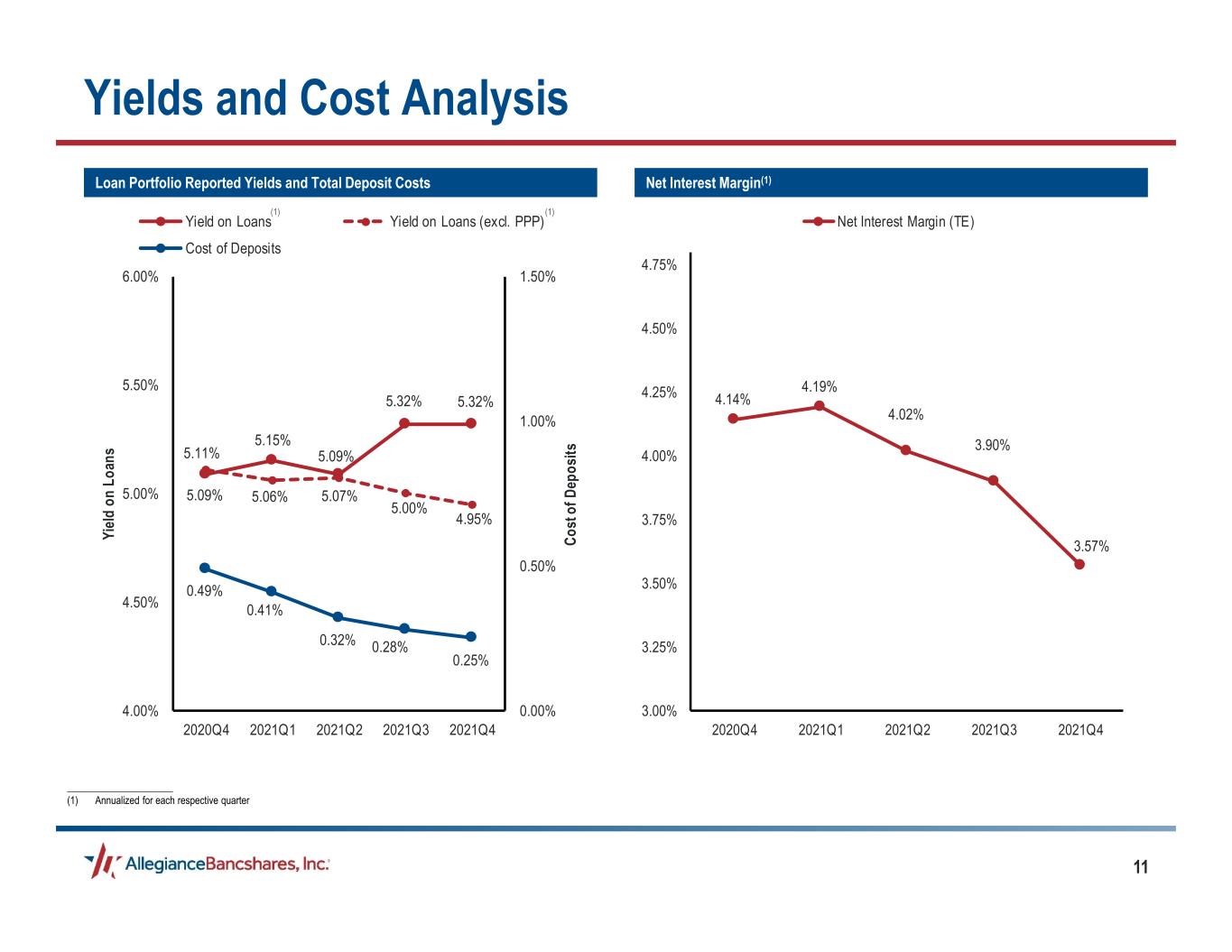

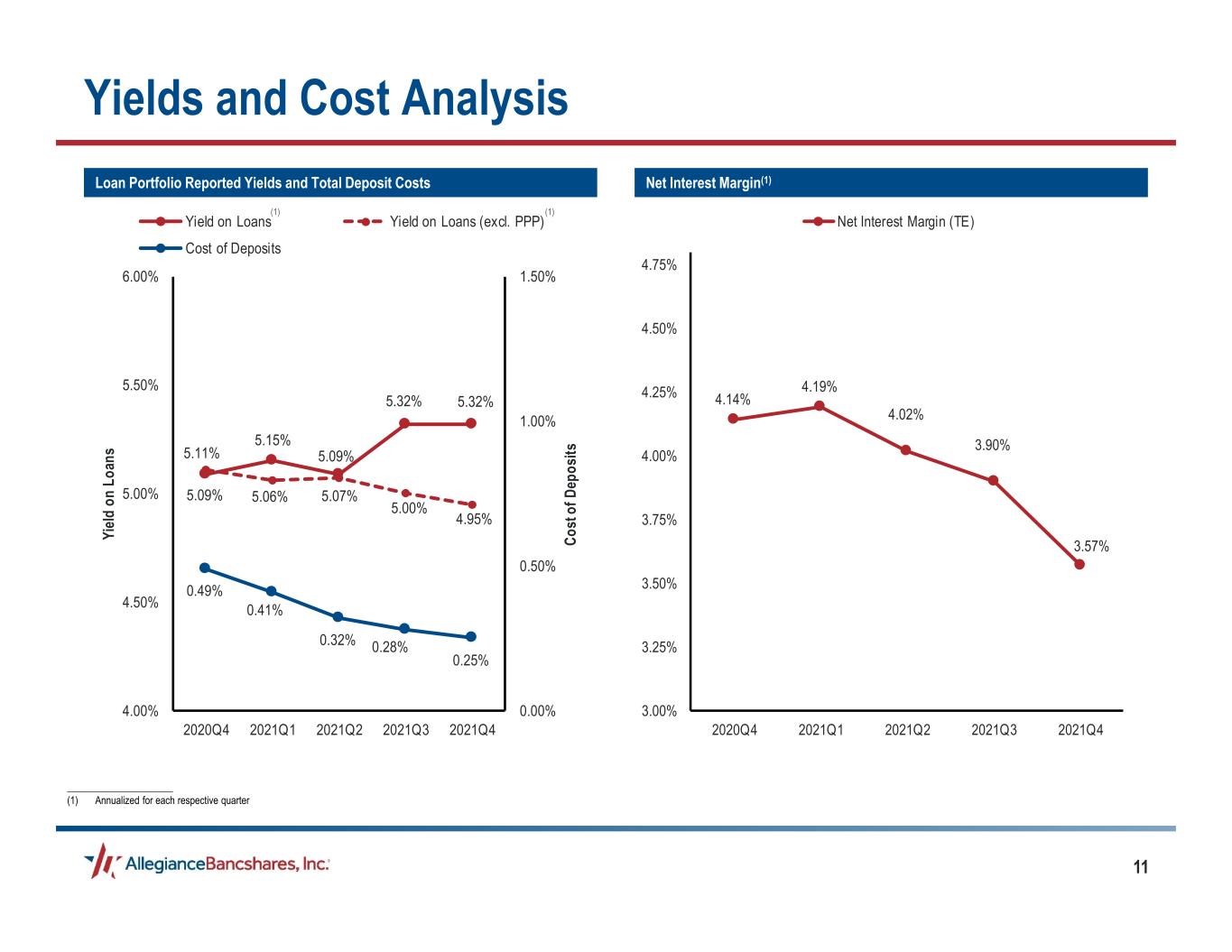

11 5.09% 5.15% 5.09% 5.32% 5.32% 5.11% 5.06% 5.07% 5.00% 4.95% 0.49% 0.41% 0.32% 0.28% 0.25% 0.00% 0.50% 1.00% 1.50% 2020Q4 2021Q1 2021Q2 2021Q3 2021Q4 4.00% 4.50% 5.00% 5.50% 6.00% Co st of D ep os its Yi eld o n Lo an s Yield on Loans Yield on Loans (excl. PPP) Cost of Deposits 4.14% 4.19% 4.02% 3.90% 3.57% 2020Q4 2021Q1 2021Q2 2021Q3 2021Q4 3.00% 3.25% 3.50% 3.75% 4.00% 4.25% 4.50% 4.75% Net Interest Margin (TE) Yields and Cost Analysis Net Interest Margin(1)Loan Portfolio Reported Yields and Total Deposit Costs _____________________ (1) Annualized for each respective quarter (1) (1)

12 Common Equity Tier 1 RatioTangible Equity / Tangible Assets(1) Total Risk-Based RatioTier 1 Risk-Based Ratio Capital Position – Allegiance Bancshares, Inc. _____________________ (1) Please refer to the non-GAAP reconciliation in the appendix. 9.82% 9.38% 10.29% 9.78% 8.90% 8.42% 2016 2017 2018 2019 2020 2021 11.30% 10.54% 11.76% 11.42% 11.80% 12.47% 2016 2017 2018 2019 2020 2021 12.57% 13.43% 13.70% 14.83% 15.71% 16.08% 2016 2017 2018 2019 2020 2021 11.73% 10.92% 12.01% 11.66% 12.04% 12.69% 2016 2017 2018 2019 2020 2021

13 Deposit Composition and Growth Deposit Growth TrendDeposit Composition _____________________ Note: Dollars in millions. As of the quarter ended December 31, 2021. Certificates and Other Time 21.3% Noninterest-bearing 37.1% Interest- bearing Demand 14.4% Money Market and Savings 27.2% Deposit Category ($) (%) Noninterest-bearing $ 2,243.1 37.1% Interest-bearing Demand 870.0 14.4% Money Market and Savings 1,643.7 27.2% Certificates and Other Time 1,290.8 21.3% Total $ 6,047.6 100.0% $1,870 $2,214 $3,663 $4,068 $4,988 $6,048 31.7% 30.9% 33.0% 30.8% 34.2% 37.1% 0.0% 10.0% 20.0% 30.0% 40.0% $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 2016 2017 2018 2019 2020 2021 No ni nt er es t-b ea rin g D ep os its to To ta l D ep os its De po sit s Deposits Noninterest-bearing (%)

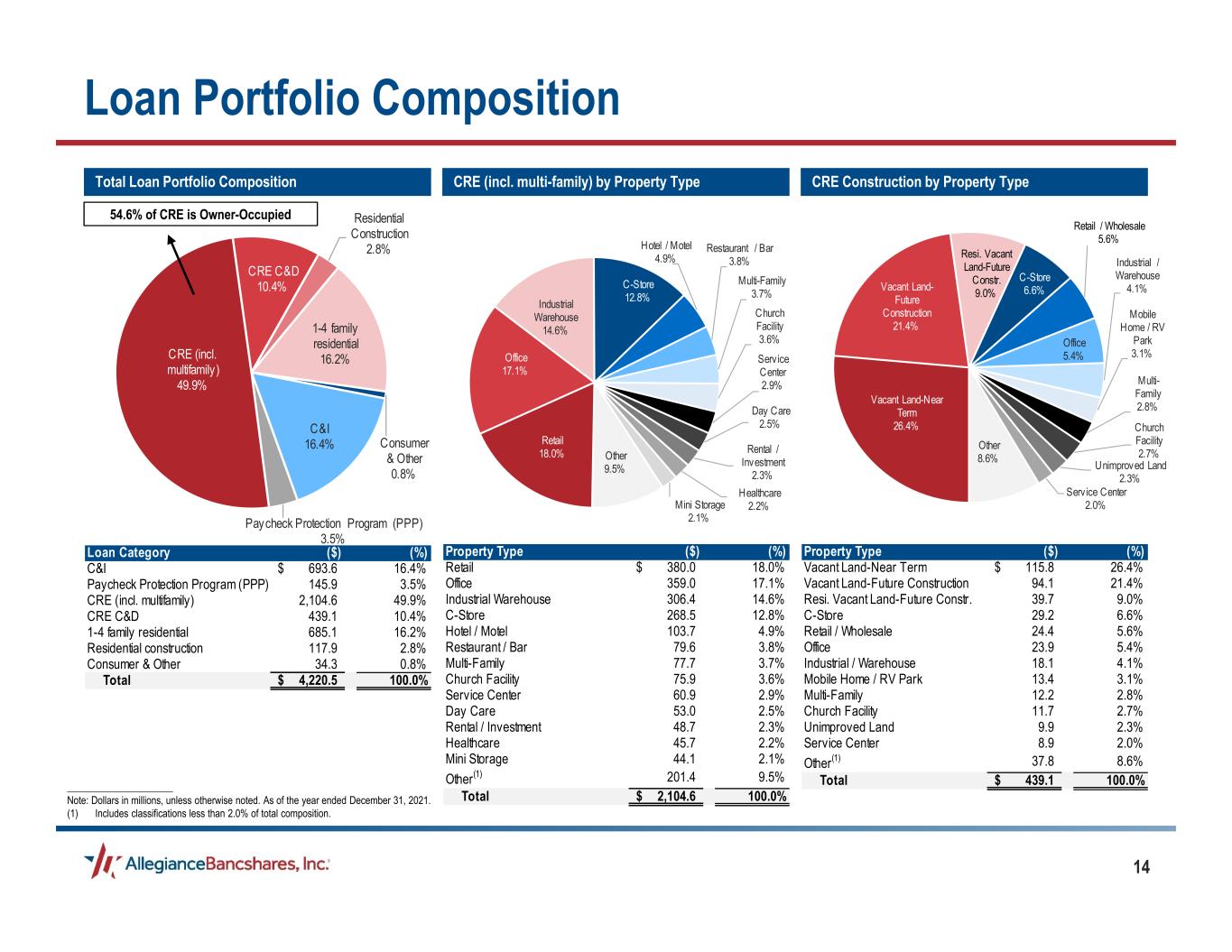

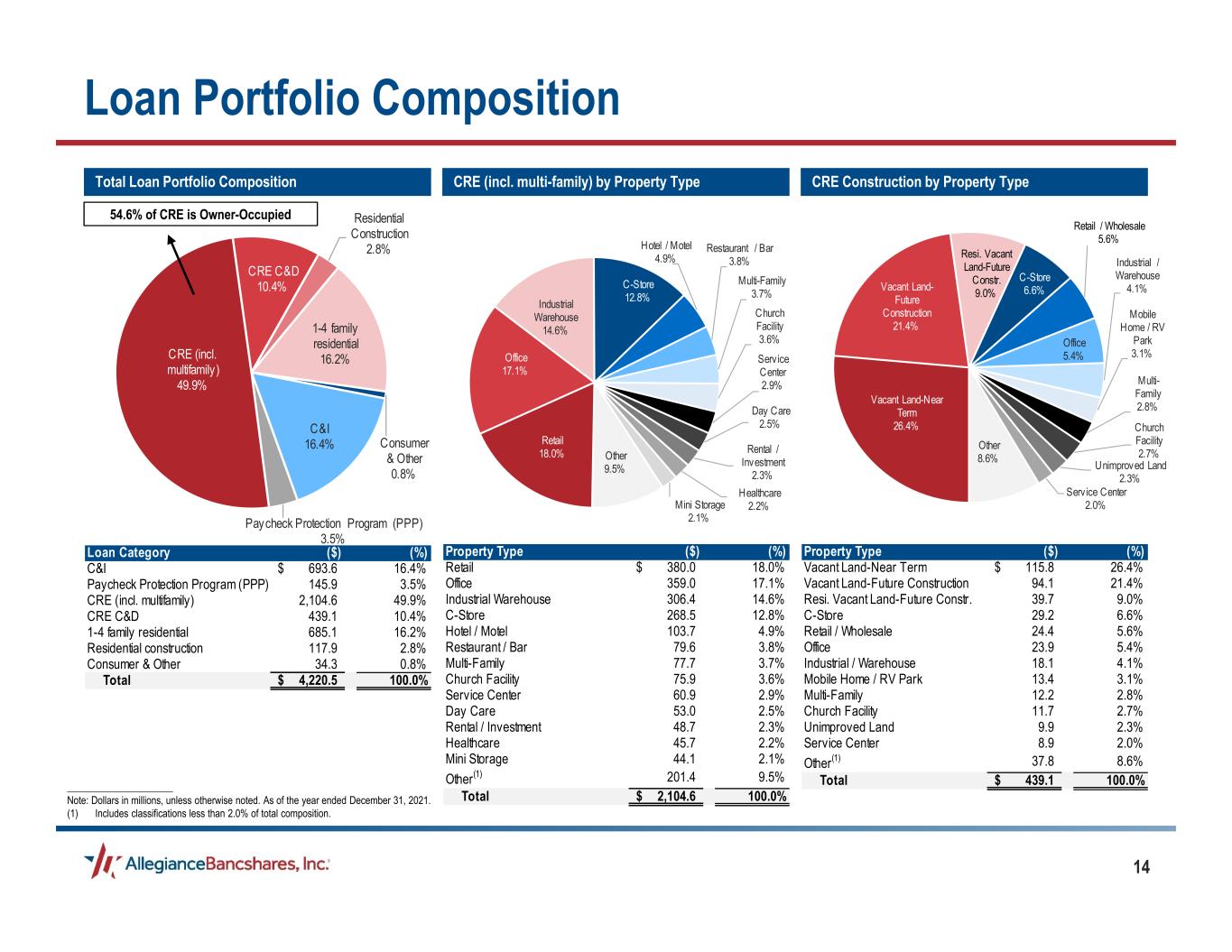

14 C&I 16.4% Paycheck Protection Program (PPP) 3.5% CRE (incl. multifamily) 49.9% CRE C&D 10.4% Residential Construction 2.8% 1-4 family residential 16.2% Consumer & Other 0.8% Total Loan Portfolio Composition 54.6% of CRE is Owner-Occupied CRE (incl. multi-family) by Property Type CRE Construction by Property Type _____________________ Note: Dollars in millions, unless otherwise noted. As of the year ended December 31, 2021. (1) Includes classifications less than 2.0% of total composition. Loan Portfolio Composition Loan Category ($) (%) C&I 693.6$ 16.4% Paycheck Protection Program (PPP) 145.9 3.5% CRE (incl. multifamily) 2,104.6 49.9% CRE C&D 439.1 10.4% 1-4 family residential 685.1 16.2% Residential construction 117.9 2.8% Consumer & Other 34.3 0.8% Total 4,220.5$ 100.0% Retail 18.0% Office 17.1% Industrial Warehouse 14.6% C-Store 12.8% Hotel / Motel 4.9% Restaurant / Bar 3.8% Multi-Family 3.7% Church Facility 3.6% Service Center 2.9% Day Care 2.5% Rental / Investment 2.3% Healthcare 2.2%Mini Storage 2.1% Other 9.5% Vacant Land-Near Term 26.4% Vacant Land- Future Construction 21.4% Resi. Vacant Land-Future Constr. 9.0% C-Store 6.6% Retail / Wholesale 5.6% Office 5.4% Industrial / Warehouse 4.1% Mobile Home / RV Park 3.1% Multi- Family 2.8% Church Facility 2.7% Unimproved Land 2.3% Serv ice Center 2.0% Other 8.6% Property Type ($) (%) Retail 380.0$ 18.0% Office 359.0 17.1% Industrial Warehouse 306.4 14.6% C-Store 268.5 12.8% Hotel / Motel 103.7 4.9% Restaurant / Bar 79.6 3.8% Multi-Family 77.7 3.7% Church Facility 75.9 3.6% Service Center 60.9 2.9% Day Care 53.0 2.5% Rental / Investment 48.7 2.3% Healthcare 45.7 2.2% Mini Storage 44.1 2.1% Other(1) 201.4 9.5% Total 2,104.6$ 100.0% Property Type ($) (%) Vacant Land-Near Term 115.8$ 26.4% Vacant Land-Future Construction 94.1 21.4% Resi. Vacant Land-Future Constr. 39.7 9.0% C-Store 29.2 6.6% Retail / Wholesale 24.4 5.6% Office 23.9 5.4% Industrial / Warehouse 18.1 4.1% Mobile Home / RV Park 13.4 3.1% Multi-Family 12.2 2.8% Church Facility 11.7 2.7% Unimproved Land 9.9 2.3% Service Center 8.9 2.0% Other(1) 37.8 8.6% Total 439.1$ 100.0%

15 Total PPP Loan Composition _____________________ (1) Includes classifications less than 2.0% of total composition. PPP Loan Success – Over $1.08 Billion Funded Tremendous support to our customers and non-customers SBA Preferred Lender, Ranked #3 in PPP lending in Houston Region Supported over 123,000 jobs Approximately 4,000 new customers from the PPP effort Customer retention program to retain our “new to bank” customers and expand “existing customer” relationships Net fees from PPP programs amortized over the life of the loan Net fees recognized in the year ended 2021 of $26.6 million Net fees recognized in the year ended 2020 of $11.0 million Unamortized net fees of $4.9 million as of December 31, 2021 Serv ices 23.7% Commercial Construction 17.6% Manufacturing 13.2% Retail / Wholesale 9.5% Restaurants / Bars 9.8% Health Care / Social Assistance 7.6% Real Estate, Rental, Leasing 4.2%Oil and Gas 3.6% Transportation 3.1% Finance / Insurance 2.2% Other(1) 5.5% PPP Program Number of Loans Funded Amount of Loans Funded (in thousands) Average Funded Loan Size (in thousands) Weighted Average Fee Amount of Funded Loans under $150,000 (in thousands) Balance of Funded Loans (in thousands) 2020 6,334 710,234$ 112.1$ 3.32% 340,314$ 13,772$ 2021 3,708 374,594 101.0$ 4.95% 120,510 132,170 Total 10,042 1,084,828$ 460,824$ 145,942$ As of December 31, 2021

16 Loan Deferral Composition as of December 31, 2021 _____________________ Note: Dollars in thousands. Loan Category Outstanding Loan Balance Loan Balance Percent Loan Balance Percent Loan Balance Percent Commercial and industrial 693,559$ 1,040$ 5.7% 69,754$ 9.8% 70,794$ 9.7% Paycheck Protection Program (PPP) 145,942 - 0.0% - 0.0% - 0.0% Real estate: Commercial real estate (including multi-family residential) 2,104,621 16,851 92.5% 539,043 76.1% 555,894 76.5% Commercial real estate construction and land developmen 439,125 95 0.5% 30,317 4.3% 30,412 4.2% 1-4 family residential (including home equity) 685,071 231 1.3% 67,944 9.6% 68,175 9.4% Residential construction 117,901 - 0.0% 737 0.1% 737 0.1% Consumer and other 34,267 - 0.0% 462 0.1% 462 0.1% Total loans 4,220,486$ 18,217$ 100.0% 708,257$ 100.0% 726,474$ 100.0% Inside of Deferral Period Outside of Deferral Period Total Loans That Have Had a Deferral

17 Allowance / Total LoansAllowance / Nonperforming Loans Net Charge-offs / Average LoansNonperforming Loans / Total Loans Strong Asset Quality 300.0% 121.0% 258.8% 259.0% 252.7% 107.3% 177.4% 79.9% 103.8% 184.0% 198.7% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 1.20% 1.13% 0.80% 0.82% 0.78% 0.95% 1.04% 0.71% 0.75% 1.18% 1.14% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 0.02% 0.94% 0.31% 0.32% 0.31% 0.88% 0.59% 0.89% 0.72% 0.64% 0.57% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 0.25% 0.25% 0.02% 0.06% 0.06% 0.04% 0.36% 0.06% 0.07% 0.18% 0.05% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

18 Our management uses certain non-GAAP financial measures in its analysis of our performance: “Tangible Shareholders’ Equity” is a non-GAAP measure generally used by financial analysts and investment bankers to evaluate financial institutions. Tangible shareholders’ equity is defined as total shareholders’ equity reduced by goodwill and core deposit intangibles, net of accumulated amortization. This measure is important to investors interested in changes from period to period in shareholders’ equity, exclusive of changes in intangible assets. For tangible shareholders’ equity, the most directly comparable financial measure calculated in accordance with GAAP is total shareholders’ equity. Goodwill and other intangible assets have the effect of increasing total shareholders’ equity while not increasing our tangible shareholders’ equity. “Tangible Equity to Tangible Assets” is a non-GAAP measure generally used by financial analysts and investment bankers to evaluate financial institutions. Tangible equity to tangible assets is defined as total shareholders’ equity reduced by goodwill and core deposit intangibles, net of accumulated amortization, divided by tangible assets, which are total assets reduced by goodwill and core deposit intangibles, net of accumulated amortization. This measure is important to investors interested in changes from period to period in equity and total assets, each exclusive of changes in intangible assets. For tangible equity to tangible assets, the most directly comparable financial measure calculated in accordance with GAAP is total shareholders’ equity to total assets. Goodwill and other intangible assets have the effect of increasing both total shareholders’ equity and assets while not increasing our tangible common equity or tangible assets. Appendix: Non-GAAP Reconciliation _____________________ Note: Dollars in thousands. For the Years Ended December 31, 2017 2018 2019 2020 2021 Total Shareholders' Equity 306,865$ 702,984$ 709,865$ 758,669$ 816,468$ Less: Goodwill and Core Deposit Intangibles, net 42,663 249,712 245,518 241,596 238,300 Tangible Shareholders' Equity 264,202$ 453,272$ 464,347$ 517,073$ 578,168$ Total Assets 2,860,231$ 4,655,249$ 4,992,654$ 6,050,128$ 7,104,954$ Less: Goodwill and Core Deposit Intangibles, net 42,663 249,712 245,518 241,596 238,300 Tangible Assets 2,817,568$ 4,405,537$ 4,747,136$ 5,808,532$ 6,866,654$ Tangible Equity to Tangible Assets 9.38% 10.29% 9.78% 8.90% 8.42% 2017 2018 2019 2020 2021 Net Income Attributable to Shareholders 17,632$ 37,309$ 52,959$ 45,534$ 81,553$ Average Shareholders' Equity 297,627 413,441 708,269 731,688 786,036 Less: Average Goodwill and Core Deposit Intangibles, net 43,050 80,384 247,854 243,513 239,916 Average Tangible Shareholders’ Equity 254,577$ 333,057$ 460,415$ 488,175$ 546,120$ Return on Average Tangible Equity 6.93% 11.20% 11.50% 9.33% 14.93% For the Year Ended December 31,