Fixed Income Investor Presentation September 2019[Month] [Day], 2019Second Quarter 2022 Earnings Presentation cshares, Inc. Exhibit 99.2

2 Forward-Looking Statements Certain statements in this press release which are not historical in nature are intended to be, and are hereby identified as, "forward-looking statements" for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements about the benefits of the proposed merger of Allegiance and CBTX, Inc. (“CBTX”), including future financial and operating results, statements related to the expected timing of the completion of the merger, the combined company's plans, business and growth strategies, objectives, expectations and intentions, and other statements that are not historical facts, including projections of macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “could,” “scheduled,” “plans,” “intends,” “projects,” “anticipates,” “expects,” “believes,” “estimates,” “potential,” “would,” or “continue” or negatives of such terms or other comparable terminology. All forward-looking statements are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of Allegiance or CBTX to differ materially from any results expressed or implied by such forward-looking statements. Forward-Looking Statements and Non-GAAP Financial Measures Such factors include, among others: (1) the risk that the cost savings and any revenue synergies from the merger may not be fully realized or may take longer than anticipated to be realized; (2) disruption to the parties' businesses as a result of the pendency of the merger; (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (4) the risk that the integration of each party's operations will be materially delayed or will be more costly or difficult than expected or that the parties are otherwise unable to successfully integrate each party's businesses into the other's businesses; (5) the amount of the costs, fees, expenses and charges related to the merger; (6) the ability by each party to obtain required regulatory approvals of the merger (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction); (7) reputational risk and the reaction of each company's customers, suppliers, employees or other business partners to the merger; (8) the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing the merger; (9) the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (10) the dilution caused by CBTX's issuance of additional shares of its common stock in the merger; (11) general competitive, economic, political and market conditions; and (12) other factors that may affect future results of Allegiance and CBTX including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and other actions of the Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, the Texas Department of Banking and Office of the Comptroller of the Currency and legislative and regulatory actions and reforms. Additional factors which could affect future results of Allegiance and CBTX can be found in Allegiance's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and CBTX's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC's website at https://www.sec.gov. Allegiance and CBTX disclaim any obligation and do not intend to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. GAAP Reconciliation of Non-GAAP Financial Measures We use certain non-GAAP financial measures to evaluate our performance. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and that management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, analyzing and comparing past, present and future periods. Specifically, we review return on average tangible common equity, the ratio of tangible equity to tangible assets and adjusted net interest margin on a tax equivalent basis for internal planning and forecasting purposes. We have included in this presentation information relating to these non-GAAP financial measures for the applicable periods presented. These non-GAAP measures should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which we calculate these non-GAAP financial measures may differ from that of other companies reporting measures with similar names. A reconciliation of the non-GAAP financial measures is in the appendix.

3 Allegiance Bancshares, Inc. Overview Franchise Footprint Holding Company for Allegiance Bank; Headquartered in Houston, Texas Company Overview Providing full-service banking services for small- to medium-sized businesses Operational History 26 full-service banking locations (at June 30, 2022) • 25 in the Houston-The Woodlands-Sugar Land MSA • 1 in the Beaumont-Port Arthur MSA, just outside of Houston Since opening in 2007, we have completed three whole bank acquisitions and one branch transaction: • 2019: LoweryBank branch acquisition with $45.0 million in loans and $16.0 million in deposits • 2018: Post Oak Bank, N.A. (Post Oak Bancshares, Inc.) with $1.5 billion in total assets • 2015: Enterprise Bank (F&M Bancshares, Inc.) with $569.7 million in total assets • 2013: Independence Bank, N.A. with $222.1 million in total assets Financial Highlights ABTX Branch Locations (26) Galveston Houston Houston-The Woodlands-Sugar Land MSA Beaumont-Port Arthur MSA 10 10 45 45 Beaumont _____________________ (1) Please refer to the non-GAAP reconciliation in the appendix (2) Annualized as of 2Q 2022 ($ in millions) 6/30/2022 12/31/2021 12/31/2020 12/31/2019 12/31/2018 Total Assets 6,731.8$ 7,105.0$ 6,050.1$ 4,992.7$ 4,655.2$ Total Loans 4,348.8 4,220.5 4,491.8 3,915.3 3,708.3 Total Deposits 5,880.6 6,047.6 4,988.5 4,068.1 3,662.5 Total Equity 705.3 816.5 758.7 709.9 703.0 Loans/Deposits 73.95% 69.79% 90.04% 96.24% 101.25% NPAs/Assets 0.42% 0.34% 0.63% 0.74% 0.72% TCE/TA(1) 7.21% 8.42% 8.90% 9.78% 10.29% NIM (tax equivalent)(2) 3.53% 3.90% 4.08% 4.22% 4.27% ROAA(2) 0.94% 1.24% 0.81% 1.10% 1.11% ROATCE(1)(2) 13.00% 14.93% 9.33% 11.50% 11.20% Ba la nc e Sh ee t Ca pi ta l, Cr ed it & Pr of ita bi lit y

4 Financial Highlights – Second Quarter 2022 Assets of $6.73 billion, loans of $4.35 billion, deposits of $5.88 billion and shareholder's equity of $705.3 million at June 30, 2022 • Core loan growth of $355.4 million, or 7.0%, from second quarter 2021; core loans exclude Paycheck Protection Program (PPP) loans • Deposit growth of $447.3 million, or 8.2%, from the second quarter 2021 Balance Sheet Net income of $16.4 million for the second quarter 2022 compared to $18.7 million for the first quarter 2022 and $22.9 million for the second quarter 2021 Second quarter 2022 earnings were impacted by: • Decreased PPP related revenue: $1.4 million in the second quarter 2022 compared to $2.5 million for the first quarter of 2021 and $6.4 million for the second quarter of 2021 • A $2.2 million operational loss • Acquisition and merger-related expenses of $1.7 million Diluted EPS of $0.80 translated into an annualized return on average assets and average tangible equity(1) of 0.94% and 13.00%, respectively Profitability Net Interest Income and Margin Net interest income increased to $57.5 million for second quarter 2022 compared to $55.2 million for the first quarter 2022 and $56.6 million for the second quarter 2021 • Interest income on securities and deposits in other financial institutions increased $1.1 million in the second quarter 2022 compared to the first quarter 2022 and $3.9 million from the second quarter 2021 • Cost of interest-bearing liabilities increased to 0.56% for the second quarter 2022 from 0.51% for the first quarter 2022 and decreased from 0.67% for the second quarter 2021 _____________________ (1) Please refer to the non-GAAP reconciliation in the appendix. Recognitions and Awards Ranked #39 for Houston Business Journal’s second-annual Middle Market 50 awards for 2022. The list ranks the top 50 for-profit public and private mid-market companies based in Houston Recognized in the Houston Chronicle 100 list for the most successful publicly and privately traded companies in Houston for 2022

5 Announced Merger of Equals with CBTX, Inc. Creates a premier Texas financial institution by combining two of the largest Houston-focused banks Generates significant shareholder value through materially enhanced metrics True merger-of-equals – combined management team and equal board contribution Complementary branch network, with meaningful overlap to support cost savings Shared vision, community focus, and commitment to clients and employees HOUSTON REGION Houston-The Woodlands-Sugar Land and Beaumont-Port Arthur MSAs ABTX BRANCH (26) CBTX BRANCH (34) DALLAS AUSTIN SAN ANTONIO HOUSTON BEAUMONT Highlights

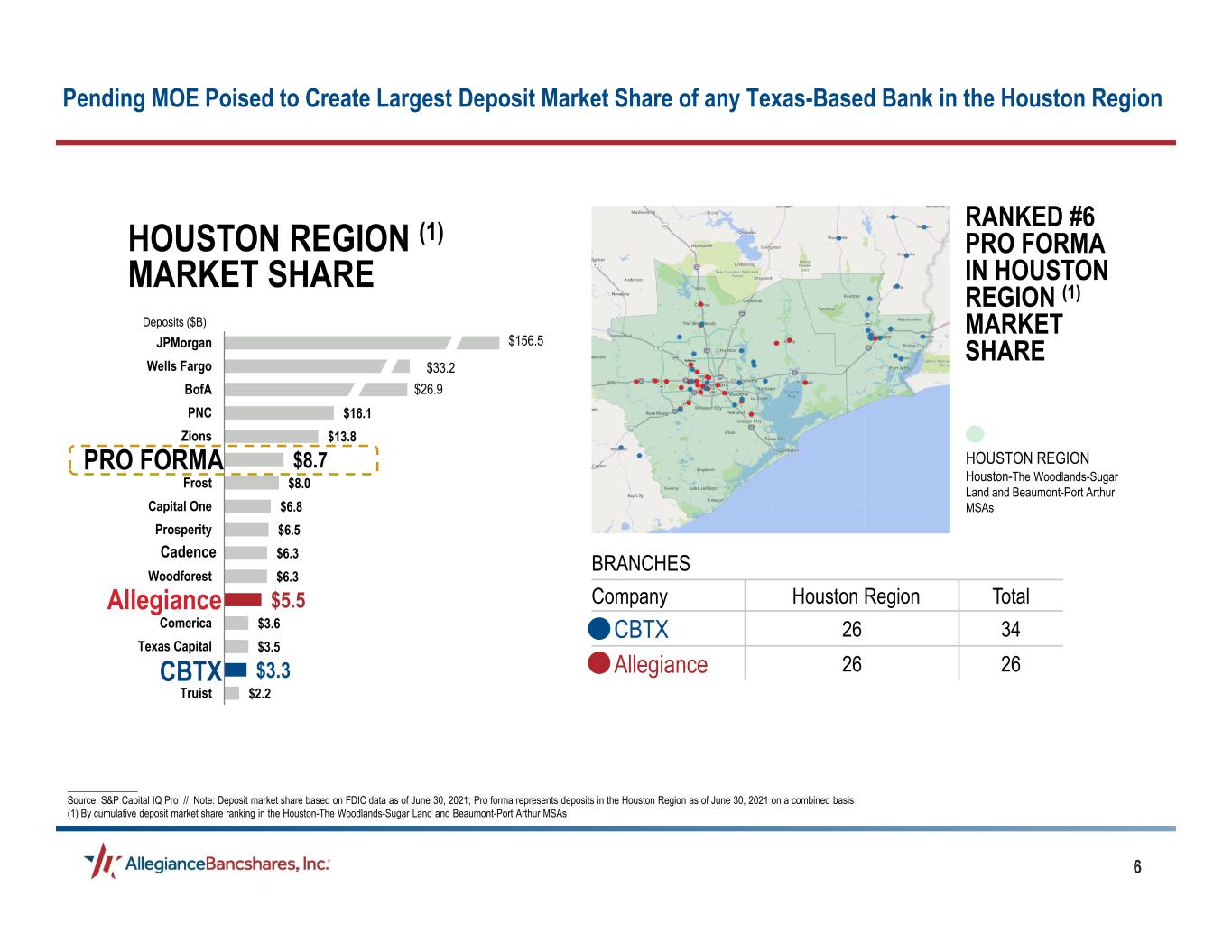

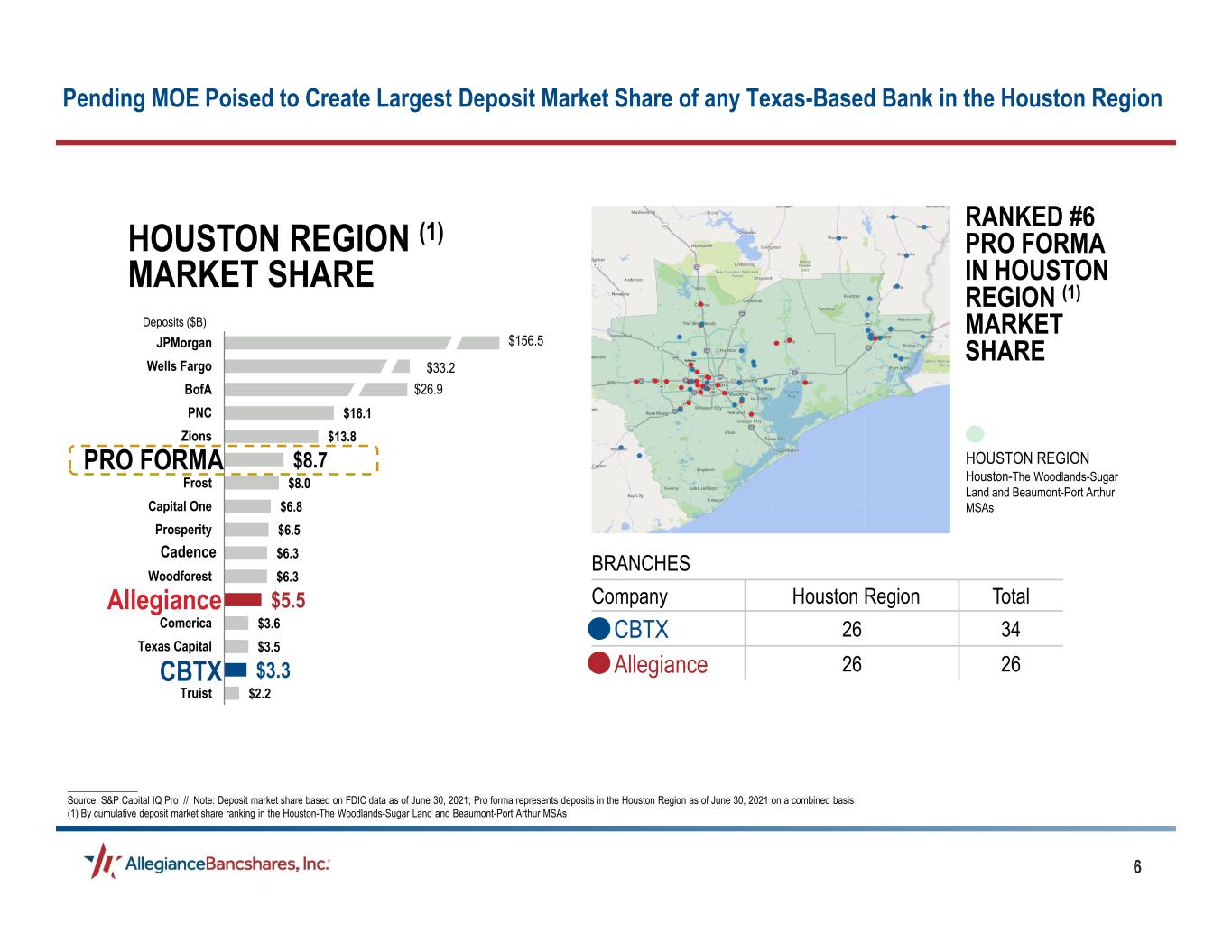

6 $2.2 $3.3 $3.5 $3.6 $5.5 $6.3 $6.3 $6.5 $6.8 $8.0 $8.7 $13.8 $16.1 Truist CHARLIE Texas Capital Comerica ALPHA Woodforest BancorpSouth Prosperity Capital One Frost PRO FORMA Zions PNC BofA Wells Fargo JPMorgan RANKED #6 PRO FORMA IN HOUSTON REGION (1) MARKET SHARE HOUSTON REGION Houston-The Woodlands-Sugar Land and Beaumont-Port Arthur MSAs HOUSTON REGION (1) MARKET SHARE PRO F R Allegiance CBTX BRANCHES Company Houston Region Total CBTX 26 34 Allegiance 26 26 $156.5 $33.2 $26.9 Cadence Deposits ($B) ______________ Source: S&P Capital IQ Pro // Note: Deposit market share based on FDIC data as of June 30, 2021; Pro forma represents deposits in the Houston Region as of June 30, 2021 on a combined basis (1) By cumulative deposit market share ranking in the Houston-The Woodlands-Sugar Land and Beaumont-Port Arthur MSAs Pending MOE Poised to Create Largest Deposit Market Share of any Texas-Based Bank in the Houston Region

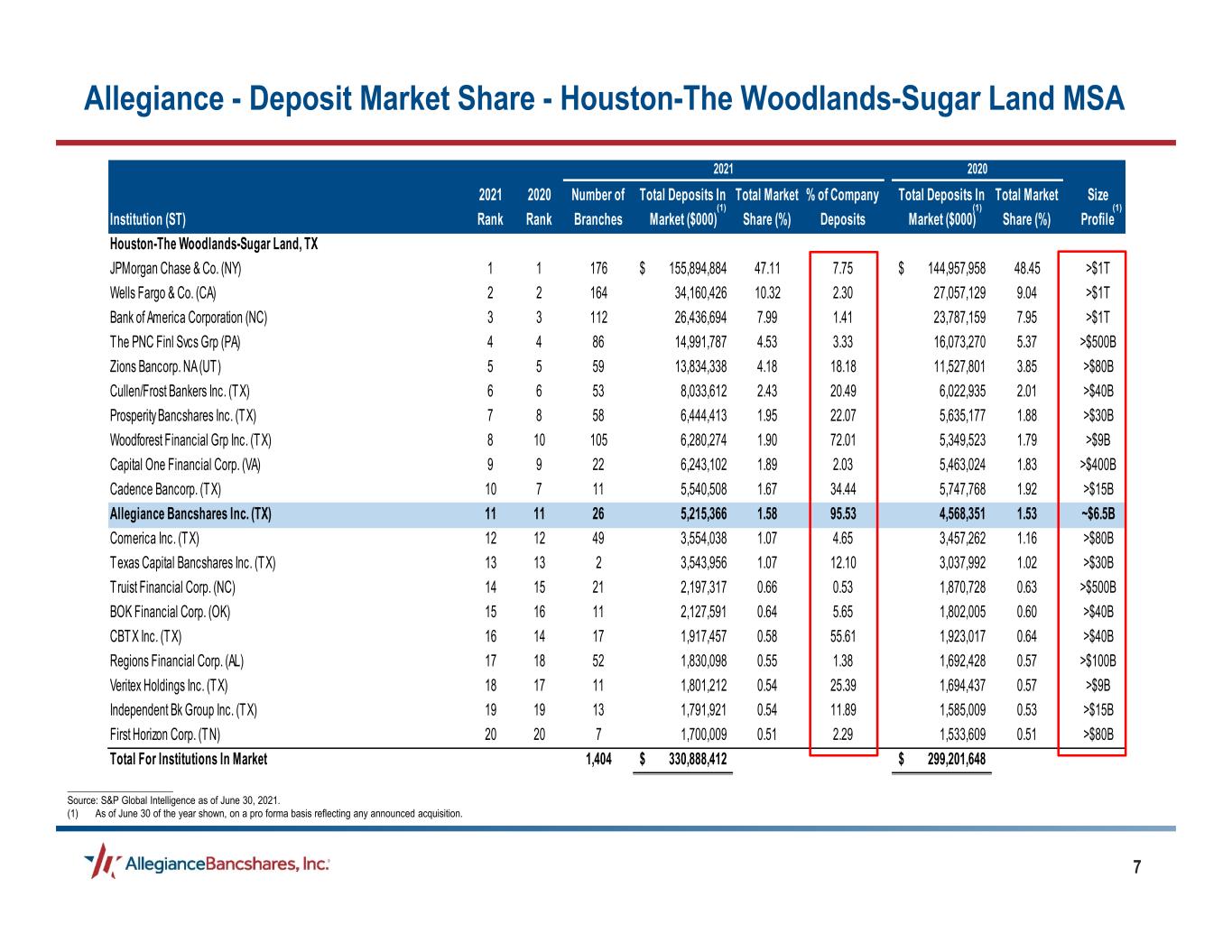

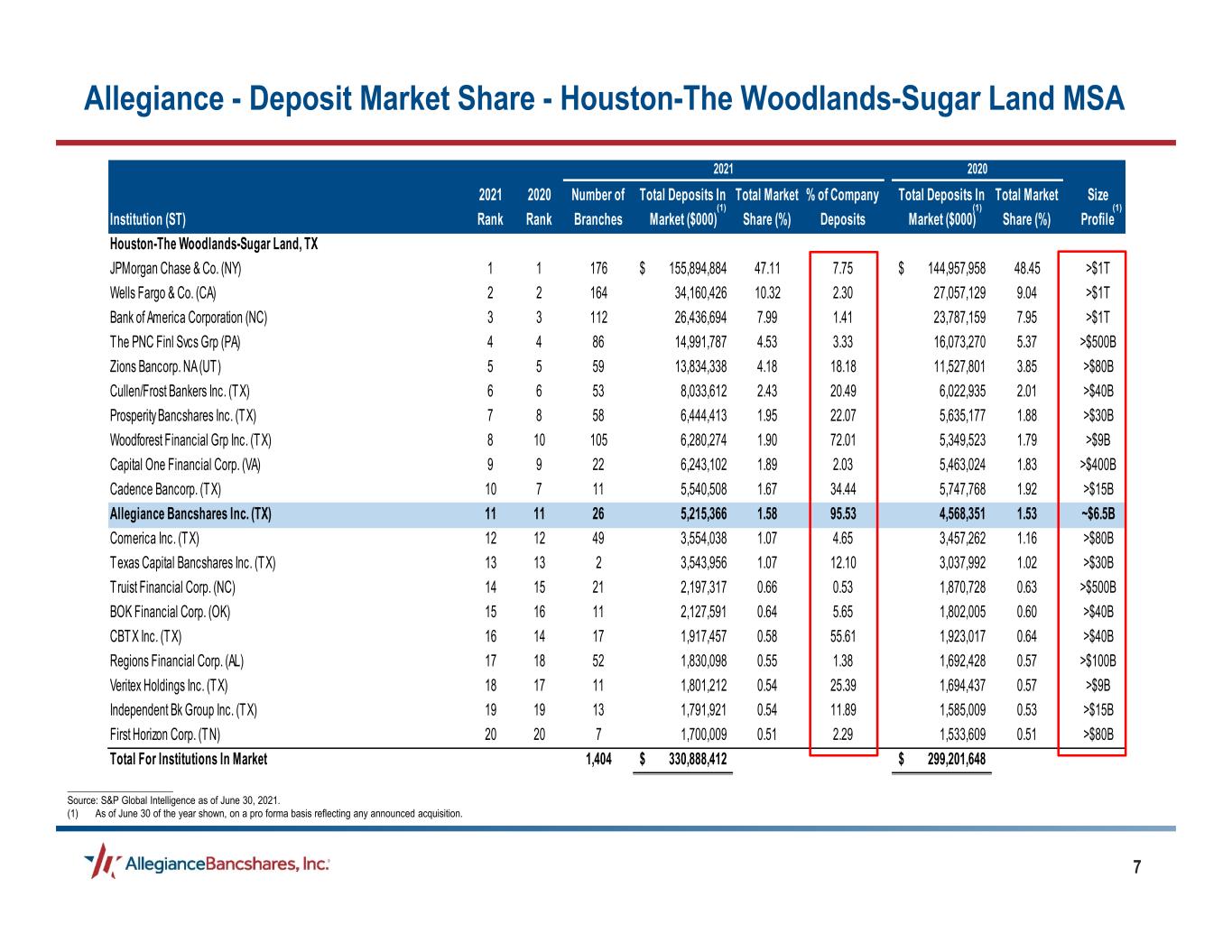

7 Number of Branches Total Deposits In Market ($000) Total Market Share (%) % of Company Deposits Total Deposits In Market ($000) Total Market Share (%) Size Profile Houston-The Woodlands-Sugar Land, TX JPMorgan Chase & Co. (NY) 1 1 176 155,894,884$ 47.11 7.75 144,957,958$ 48.45 >$1T Wells Fargo & Co. (CA) 2 2 164 34,160,426 10.32 2.30 27,057,129 9.04 >$1T Bank of America Corporation (NC) 3 3 112 26,436,694 7.99 1.41 23,787,159 7.95 >$1T The PNC Finl Svcs Grp (PA) 4 4 86 14,991,787 4.53 3.33 16,073,270 5.37 >$500B Zions Bancorp. NA (UT) 5 5 59 13,834,338 4.18 18.18 11,527,801 3.85 >$80B Cullen/Frost Bankers Inc. (TX) 6 6 53 8,033,612 2.43 20.49 6,022,935 2.01 >$40B Prosperity Bancshares Inc. (TX) 7 8 58 6,444,413 1.95 22.07 5,635,177 1.88 >$30B Woodforest Financial Grp Inc. (TX) 8 10 105 6,280,274 1.90 72.01 5,349,523 1.79 >$9B Capital One Financial Corp. (VA) 9 9 22 6,243,102 1.89 2.03 5,463,024 1.83 >$400B Cadence Bancorp. (TX) 10 7 11 5,540,508 1.67 34.44 5,747,768 1.92 >$15B Allegiance Bancshares Inc. (TX) 11 11 26 5,215,366 1.58 95.53 4,568,351 1.53 ~$6.5B Comerica Inc. (TX) 12 12 49 3,554,038 1.07 4.65 3,457,262 1.16 >$80B Texas Capital Bancshares Inc. (TX) 13 13 2 3,543,956 1.07 12.10 3,037,992 1.02 >$30B Truist Financial Corp. (NC) 14 15 21 2,197,317 0.66 0.53 1,870,728 0.63 >$500B BOK Financial Corp. (OK) 15 16 11 2,127,591 0.64 5.65 1,802,005 0.60 >$40B CBTX Inc. (TX) 16 14 17 1,917,457 0.58 55.61 1,923,017 0.64 >$40B Regions Financial Corp. (AL) 17 18 52 1,830,098 0.55 1.38 1,692,428 0.57 >$100B Veritex Holdings Inc. (TX) 18 17 11 1,801,212 0.54 25.39 1,694,437 0.57 >$9B Independent Bk Group Inc. (TX) 19 19 13 1,791,921 0.54 11.89 1,585,009 0.53 >$15B First Horizon Corp. (TN) 20 20 7 1,700,009 0.51 2.29 1,533,609 0.51 >$80B Total For Institutions In Market 1,404 330,888,412$ 299,201,648$ 2020 Institution (ST) 2021 Rank 2020 Rank 2021 Allegiance - Deposit Market Share - Houston-The Woodlands-Sugar Land MSA _____________________ Source: S&P Global Intelligence as of June 30, 2021. (1) As of June 30 of the year shown, on a pro forma basis reflecting any announced acquisition. (1) (1) (1)

8 Historical Balance Sheet Growth Total LoansTotal Assets Total EquityTotal Deposits _____________________ Note: Dollars in millions. (1) Includes $1.50 billion in assets acquired on October 1, 2018. (2) Includes $1.16 billion of acquired loans at fair value on October 1, 2018. (3) Includes $1.29 billion of acquired deposits on October 1, 2018. (4) Includes $45.0 million of loans acquired on February 1, 2019. (5) Includes $16.0 million of deposits acquired on February 1, 2019. $2,860 $4,655 $4,993 $6,050 $7,105 $6,732 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 2017 2018 2019 2020 2021 Q2 2022 Assets Acquired Assets (1) (4) $2,271 $3,708 $3,915 $4,492 $4,220 $4,349 $0 $1,000 $2,000 $3,000 $4,000 $5,000 2017 2018 2019 2020 2021 Q2 2022 Loans Acquired Loans (2) (4) $2,214 $3,663 $4,068 $4,988 $6,048 $5,881 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 2017 2018 2019 2020 2021 Q2 2022 Deposits Acquired Deposits (3) (5) $307 $703 $710 $759 $816 $705 $0 $200 $400 $600 $800 2017 2018 2019 2020 2021 Q2 2022

9 $22.9 $17.6 $37.3 $53.0 $45.5 $81.6 $22.9 $16.4 $1.75 $1.31 $2.37 $2.47 $2.22 $4.01 $1.12 $0.80 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 2016 2017 2018 2019 2020 2021 Q2 2021 Q2 2022 Ea rn in gs p er S ha re ($ ) Ne t I nc om e Net Income Earnings per Share (Diluted) $89.9 $103.7 $128.6 $179.5 $202.7 $228.6 $56.6 $57.5 4.37% 4.34% 4.27% 4.22% 4.08% 3.90% 4.02% 3.53% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 $200.0 $220.0 $240.0 2016 2017 2018 2019 2020 2021 Q2 2021 Q2 2022 Ne t I nt er es t M ar gi n (T ax E qu iv al en t) Ne t I nt er es t I nc om e Net Interest Income Net Interest Margin (TE) Earnings Performance Net Interest Income and Net Interest MarginNet Income and Earnings per Share _____________________ Note: Dollars in millions, except per share numbers. (1) Includes a one-time gain from sale of branches of $1.3 million (after-tax). (2) Includes $1.8 million and $1.7 million of core system conversion and acquisition and merger-related expenses, respectively, and $3.1 million of acquisition accounting adjustments. (3) Includes $9.6 million of acquisition accounting adjustments, $1.4 million of pre-tax severance expense and a $1.1 million FDIC Small Bank Assessment Credit. (1) (2) (3) (4) Includes $3.1 million of acquisition accounting adjustments. (5) Includes $9.6 million of acquisition accounting adjustments. (6) Annualized for the quarter ending June 30 for each respective year. (7) Includes a $2.2 million operational loss and $1.7 million of acquisition and merger-related expenses. (4) (5) (6) (6)(7)

10 (1) Includes $9.6 million of acquisition accounting adjustments, $1.3 million of acquisition and merger related expenses, $1.4 million of pre-tax severance expense, $1.1 million FDIC Small Bank Assessment Credit, $1.5 million of gain on sales of securities offset by $572 thousand of prepayment penalties and $376 thousand of SBIC income (2) Includes $9.6 million of acquisition accounting adjustments, $1.3 million of acquisition and merger related expenses, $1.4 million of pre-tax severance expense, $1.1 million FDIC Small Bank Assessment Credit, $1.5 million of gain on sales of securities offset by $572 thousand of prepayment penalties and $376 thousand of SBIC income (3) Includes $9.6 million of acquisition accounting adjustments, $1.3 million of acquisition and merger related expenses, $1.4 million of pre-tax severance expense, $1.1 million FDIC Small Bank Assessment Credit, $1.5 million of gain on sales of securities offset by $572 thousand of prepayment penalties and $376 thousand of SBIC income (4) Includes $9.6 million of acquisition accounting adjustments, $1.3 million of acquisition and merger related expenses, $1.4 million of pre-tax severance expense, $1.1 million FDIC Small Bank Assessment Credit, $1.5 million of gain on sales of securities offset by $572 thousand of prepayment penalties and $376 thousand of SBIC income (5) blank (6) Includes $9.6 million of acquisition accounting adjustments, $1.3 million of acquisition and merger related expenses, $1.4 million of pre-tax severance expense, $1.1 million FDIC Small Bank Assessment Credit, $1.5 million of gain on sales of securities offset by $572 thousand of prepayment penalties and $376 thousand of SBIC income (7) Represents total noninterest expense divided by the sum of net interest income plus noninterest income, excluding net gains and losses on the sale of loans, securities and assets. Additionally, taxes and provision for loan losses are not part of this calculation. (8) Includes a $2.2 million operational loss and $1.7 million of acquisition and merger-related expenses. 7.38% 9.22% 8.70% 9.52% 9.96% 6.93% 11.20% 11.50% 9.33% 14.93% 17.20% 13.00% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q2 2021 Q2 2022 2.99% 2.82% 2.80% 2.83% 2.53% 2.59% 2.58% 2.50% 2.26% 2.13% 2.07% 2.17% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q2 2021 Q2 2022 69.0% 69.2% 67.8% 65.3% 62.3%63.9% 63.7% 63.0% 60.6% 58.9% 57.1% 63.0% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q2 2021 Q2 2022 0.65% 0.78% 0.75% 0.81% 0.98% 0.65% 1.11% 1.10% 0.81% 1.24% 1.42% 0.94% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q2 2021 Q2 2022 Return on Average Tangible Equity(1)Return on Average Assets Noninterest Expense to Average AssetsEfficiency Ratio(7) _____________________ (1) Please refer to the non-GAAP reconciliation in the appendix. (2) Annualized for the quarter ending June 30 for each respective year. (3) Includes a one-time gain from sale of branches of $1.3 million (after-tax). (4) Includes $1.8 million and $1.7 million of core system conversion and merger-related expenses, respectively. (5) Includes $3.1 million of acquisition accounting adjustments. (3) (4)(5) (6) (6) (6) (4)(5) (4) (3) Earnings Performance, continued (2) (2)(8) (2) (2)(8) (2) (2)(8) (8)

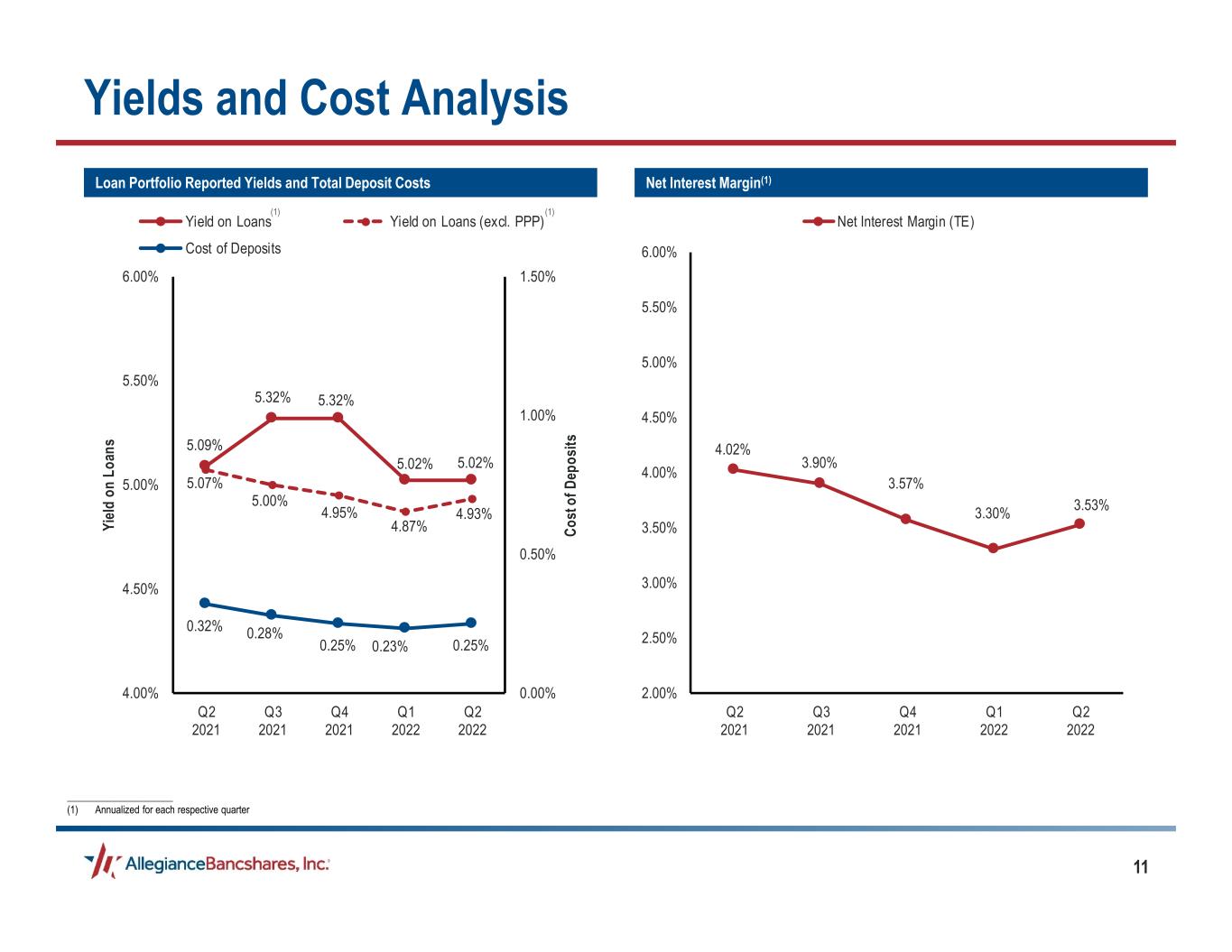

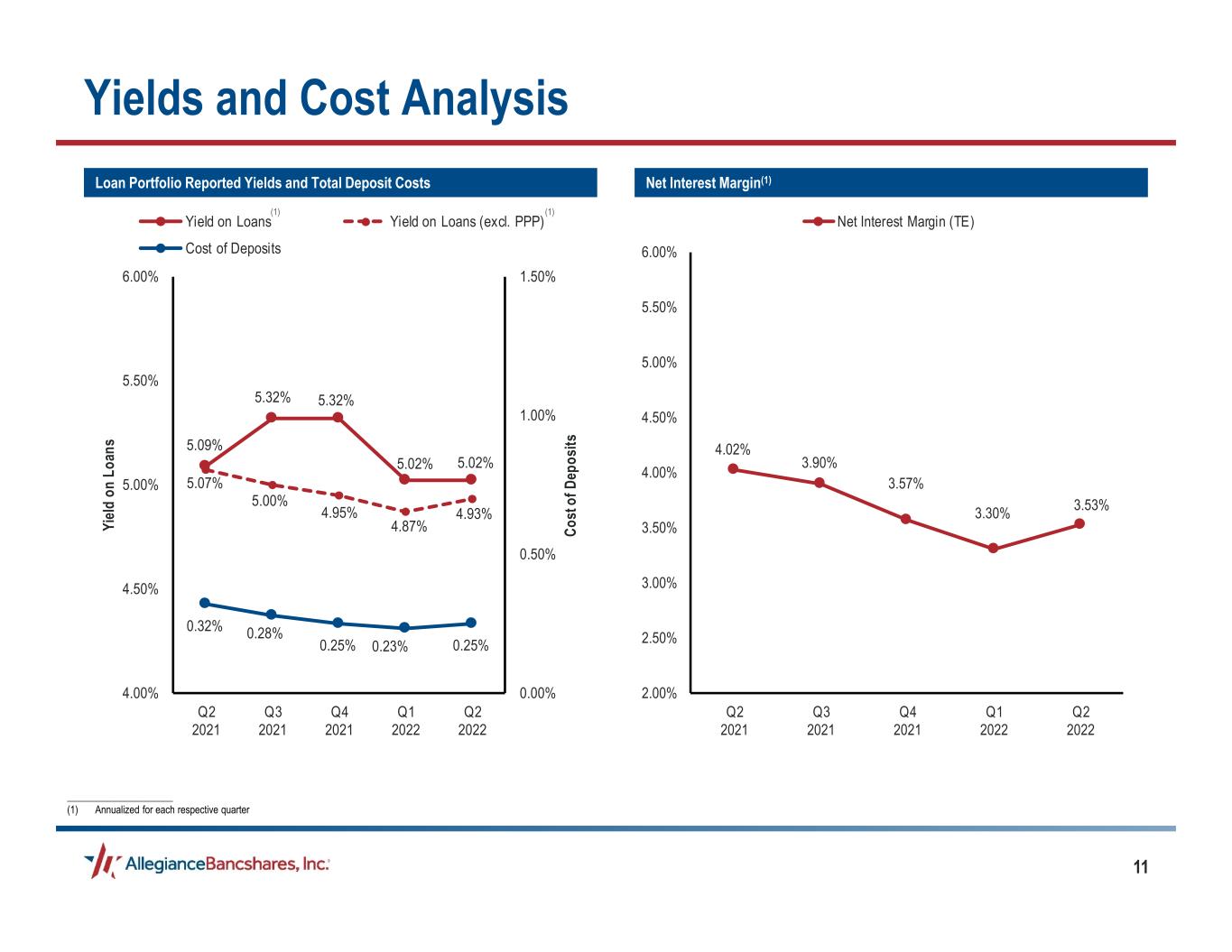

11 5.09% 5.32% 5.32% 5.02% 5.02% 5.07% 5.00% 4.95% 4.87% 4.93% 0.32% 0.28% 0.25% 0.23% 0.25% 0.00% 0.50% 1.00% 1.50% Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 4.00% 4.50% 5.00% 5.50% 6.00% Co st of D ep os its Yi eld o n Lo an s Yield on Loans Yield on Loans (excl. PPP) Cost of Deposits 4.02% 3.90% 3.57% 3.30% 3.53% Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% Net Interest Margin (TE) Yields and Cost Analysis Net Interest Margin(1)Loan Portfolio Reported Yields and Total Deposit Costs _____________________ (1) Annualized for each respective quarter (1) (1)

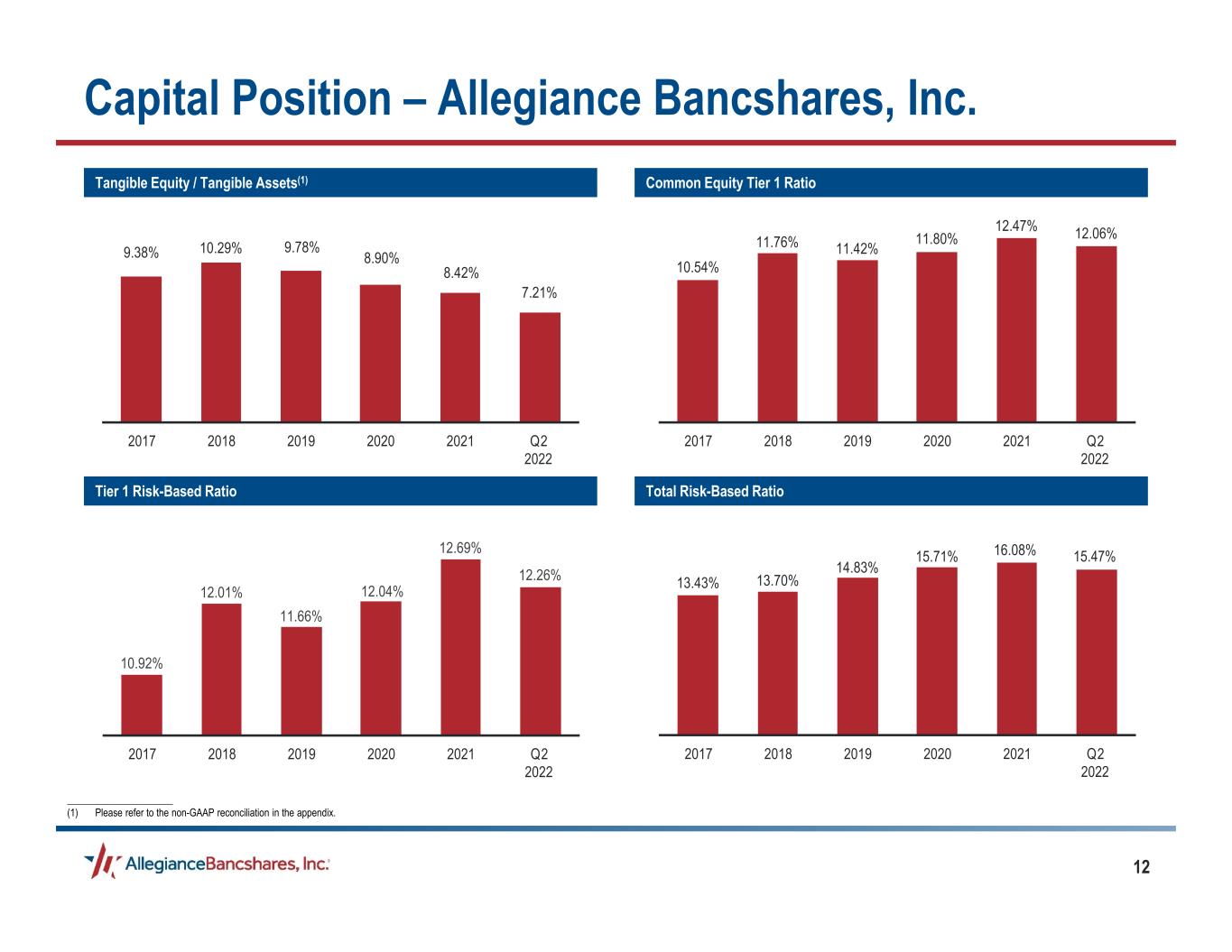

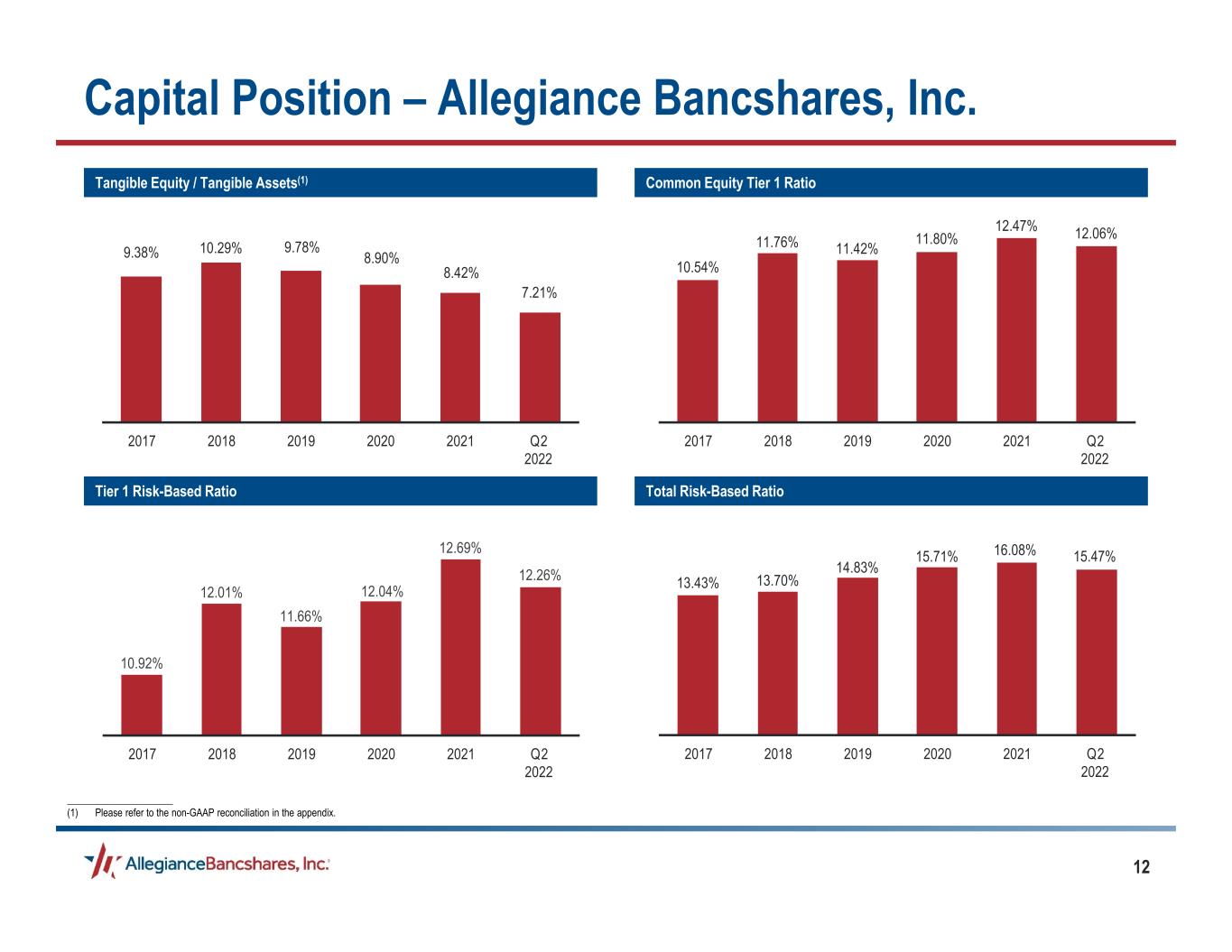

12 Common Equity Tier 1 RatioTangible Equity / Tangible Assets(1) Total Risk-Based RatioTier 1 Risk-Based Ratio Capital Position – Allegiance Bancshares, Inc. _____________________ (1) Please refer to the non-GAAP reconciliation in the appendix. 9.38% 10.29% 9.78% 8.90% 8.42% 7.21% 2017 2018 2019 2020 2021 Q2 2022 10.54% 11.76% 11.42% 11.80% 12.47% 12.06% 2017 2018 2019 2020 2021 Q2 2022 13.43% 13.70% 14.83% 15.71% 16.08% 15.47% 2017 2018 2019 2020 2021 Q2 2022 10.92% 12.01% 11.66% 12.04% 12.69% 12.26% 2017 2018 2019 2020 2021 Q2 2022

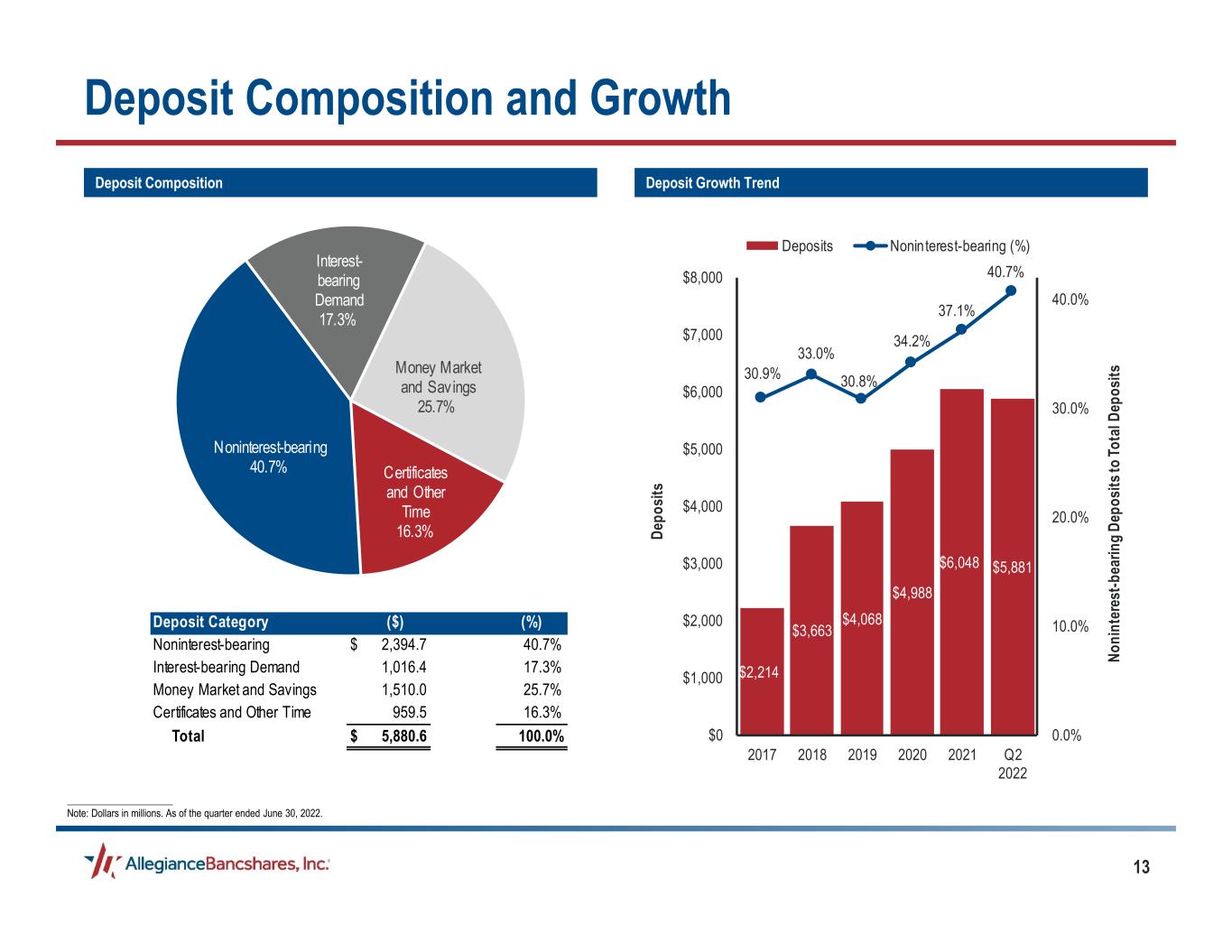

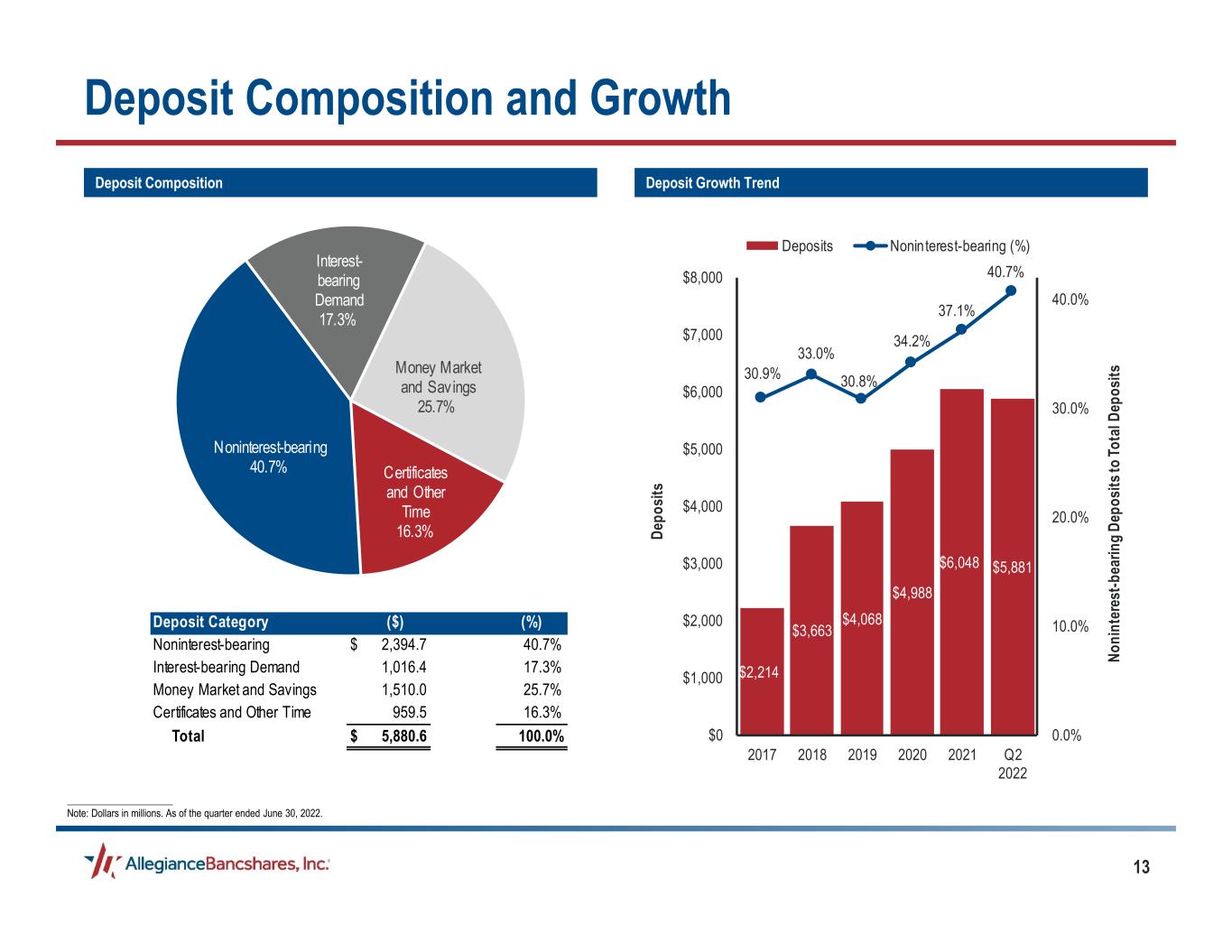

13 Deposit Composition and Growth Deposit Growth TrendDeposit Composition _____________________ Note: Dollars in millions. As of the quarter ended June 30, 2022. Certificates and Other Time 16.3% Noninterest-bearing 40.7% Interest- bearing Demand 17.3% Money Market and Savings 25.7% Deposit Category ($) (%) Noninterest-bearing $ 2,394.7 40.7% Interest-bearing Demand 1,016.4 17.3% Money Market and Savings 1,510.0 25.7% Certificates and Other Time 959.5 16.3% Total $ 5,880.6 100.0% $2,214 $3,663 $4,068 $4,988 $6,048 $5,881 30.9% 33.0% 30.8% 34.2% 37.1% 40.7% 0.0% 10.0% 20.0% 30.0% 40.0% $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 2017 2018 2019 2020 2021 Q2 2022 No ni nt er es t-b ea rin g D ep os its to To ta l D ep os its De po sit s Deposits Noninterest-bearing (%)

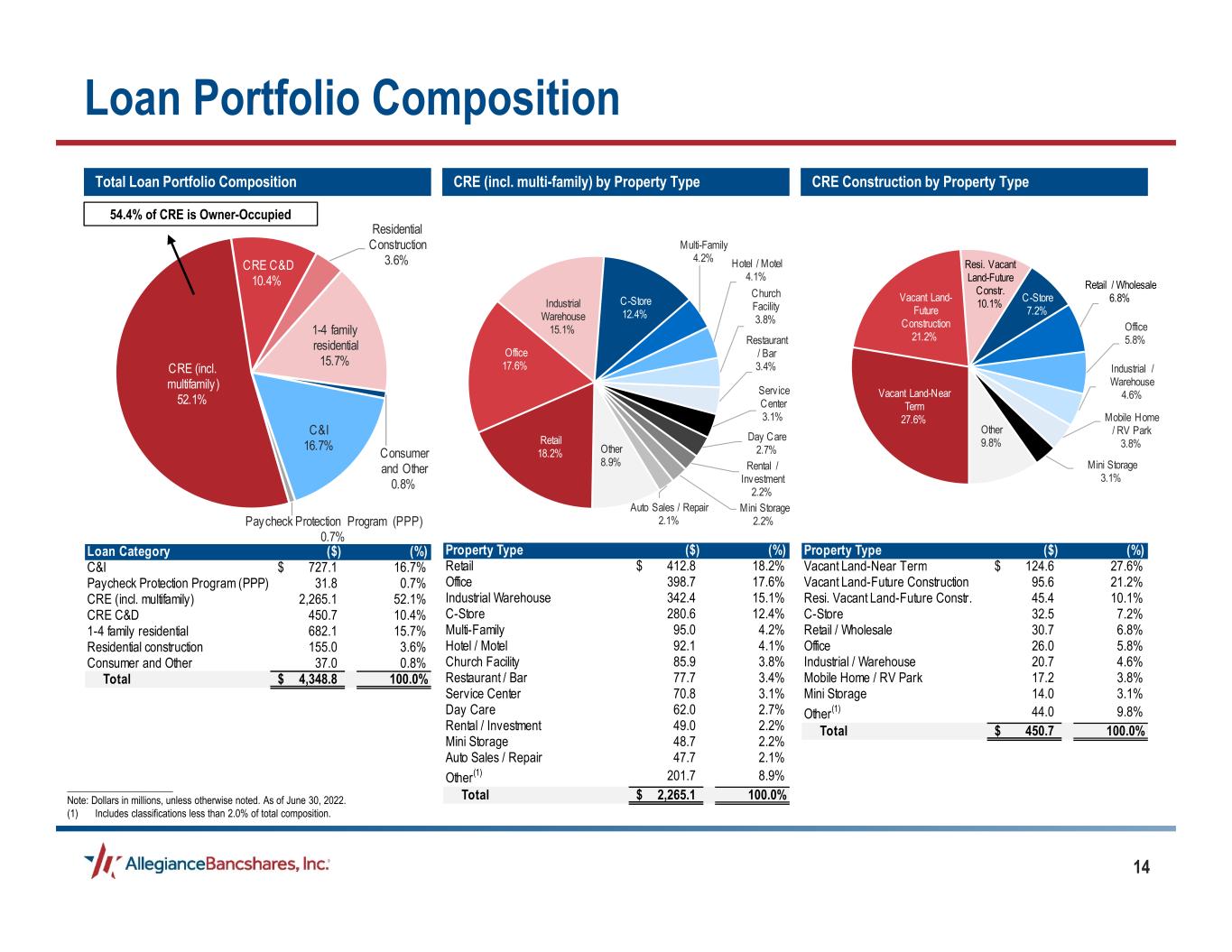

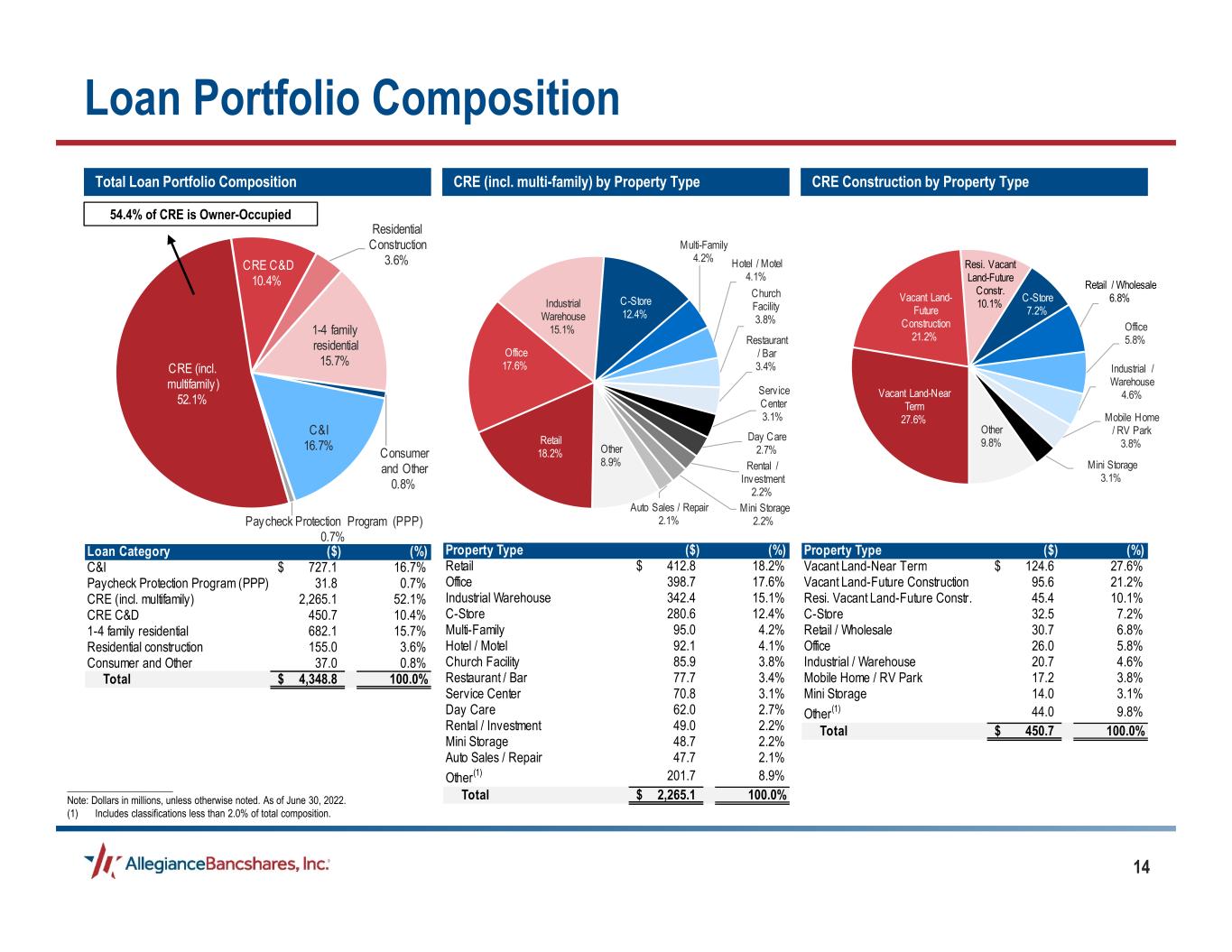

14 C&I 16.7% Paycheck Protection Program (PPP) 0.7% CRE (incl. multifamily) 52.1% CRE C&D 10.4% Residential Construction 3.6% 1-4 family residential 15.7% Consumer and Other 0.8% Total Loan Portfolio Composition 54.4% of CRE is Owner-Occupied CRE (incl. multi-family) by Property Type CRE Construction by Property Type _____________________ Note: Dollars in millions, unless otherwise noted. As of June 30, 2022. (1) Includes classifications less than 2.0% of total composition. Loan Portfolio Composition Loan Category ($) (%) C&I 727.1$ 16.7% Paycheck Protection Program (PPP) 31.8 0.7% CRE (incl. multifamily) 2,265.1 52.1% CRE C&D 450.7 10.4% 1-4 family residential 682.1 15.7% Residential construction 155.0 3.6% Consumer and Other 37.0 0.8% Total 4,348.8$ 100.0% Retail 18.2% Office 17.6% Industrial Warehouse 15.1% C-Store 12.4% Multi-Family 4.2% Hotel / Motel 4.1% Church Facility 3.8% Restaurant / Bar 3.4% Service Center 3.1% Day Care 2.7% Rental / Investment 2.2% Mini Storage 2.2% Auto Sales / Repair 2.1% Other 8.9% Vacant Land-Near Term 27.6% Vacant Land- Future Construction 21.2% Resi. Vacant Land-Future Constr. 10.1% C-Store 7.2% Retail / Wholesale 6.8% Office 5.8% Industrial / Warehouse 4.6% Mobile Home / RV Park 3.8% Mini Storage 3.1% Other 9.8% Property Type ($) (%) Retail 412.8$ 18.2% Office 398.7 17.6% Industrial Warehouse 342.4 15.1% C-Store 280.6 12.4% Multi-Family 95.0 4.2% Hotel / Motel 92.1 4.1% Church Facility 85.9 3.8% Restaurant / Bar 77.7 3.4% Service Center 70.8 3.1% Day Care 62.0 2.7% Rental / Investment 49.0 2.2% Mini Storage 48.7 2.2% Auto Sales / Repair 47.7 2.1% Other(1) 201.7 8.9% Total 2,265.1$ 100.0% Property Type ($) (%) Vacant Land-Near Term 124.6$ 27.6% Vacant Land-Future Construction 95.6 21.2% Resi. Vacant Land-Future Constr. 45.4 10.1% C-Store 32.5 7.2% Retail / Wholesale 30.7 6.8% Office 26.0 5.8% Industrial / Warehouse 20.7 4.6% Mobile Home / RV Park 17.2 3.8% Mini Storage 14.0 3.1% Other(1) 44.0 9.8% Total 450.7$ 100.0%

15 Allowance / Total LoansAllowance / Nonperforming Loans Net Charge-offs / Average Loans(1)Nonperforming Loans / Total Loans Strong Asset Quality 121.0% 258.8% 259.0% 252.7% 107.3% 177.4% 79.9% 103.8% 184.0% 198.7% 178.0% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q2 2022 1.13% 0.80% 0.82% 0.78% 0.95% 1.04% 0.71% 0.75% 1.18% 1.14% 1.16% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q2 2022 0.94% 0.31% 0.32% 0.31% 0.88% 0.59% 0.89% 0.72% 0.64% 0.57% 0.65% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q2 2022 0.25% 0.02% 0.06% 0.06% 0.04% 0.36% 0.06% 0.07% 0.18% 0.05% 0.05% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q2 2022 (1) Annualized for the quarter ending June 30, 2022.

16 Our management uses certain non-GAAP financial measures in its analysis of our performance: “Tangible Shareholders’ Equity” is a non-GAAP measure generally used by financial analysts and investment bankers to evaluate financial institutions. Tangible shareholders’ equity is defined as total shareholders’ equity reduced by goodwill and core deposit intangibles, net of accumulated amortization. This measure is important to investors interested in changes from period to period in shareholders’ equity, exclusive of changes in intangible assets. For tangible shareholders’ equity, the most directly comparable financial measure calculated in accordance with GAAP is total shareholders’ equity. Goodwill and other intangible assets have the effect of increasing total shareholders’ equity while not increasing our tangible shareholders’ equity. “Tangible Equity to Tangible Assets” is a non-GAAP measure generally used by financial analysts and investment bankers to evaluate financial institutions. Tangible equity to tangible assets is defined as total shareholders’ equity reduced by goodwill and core deposit intangibles, net of accumulated amortization, divided by tangible assets, which are total assets reduced by goodwill and core deposit intangibles, net of accumulated amortization. This measure is important to investors interested in changes from period to period in equity and total assets, each exclusive of changes in intangible assets. For tangible equity to tangible assets, the most directly comparable financial measure calculated in accordance with GAAP is total shareholders’ equity to total assets. Goodwill and other intangible assets have the effect of increasing both total shareholders’ equity and assets while not increasing our tangible common equity or tangible assets. Appendix: Non-GAAP Reconciliation _____________________ Note: Dollars in thousands. (1) Annualized for each respective quarter. For the Years Ended December 31, For the Quarters Ended June 30, 2017 2018 2019 2020 2021 2021(1) 2022(1) Total Shareholders' Equity 306,865$ 702,984$ 709,865$ 758,669$ 816,468$ 789,150$ 705,329$ Less: Goodwill and Core Deposit Intangibles, net 42,663 249,712 245,518 241,596 238,300 239,948 236,798 Tangible Shareholders' Equity 264,202$ 453,272$ 464,347$ 517,073$ 578,168$ 549,202$ 468,531$ Total Assets 2,860,231$ 4,655,249$ 4,992,654$ 6,050,128$ 7,104,954$ 6,508,667$ 6,731,764$ Less: Goodwill and Core Deposit Intangibles, net 42,663 249,712 245,518 241,596 238,300 239,948 236,798 Tangible Assets 2,817,568$ 4,405,537$ 4,747,136$ 5,808,532$ 6,866,654$ 6,268,719$ 6,494,966$ Tangible Equity to Tangible Assets 9.38% 10.29% 9.78% 8.90% 8.42% 8.76% 7.21% For the Quarters Ended June 30, 2017 2018 2019 2020 2021 2021(1) 2022(1) Net Income Attributable to Shareholders 17,632$ 37,309$ 52,959$ 45,534$ 81,553$ 22,925$ 16,437$ Average Shareholders' Equity 297,627 413,441 708,269 731,688 786,036 774,803 744,126 Less: Average Goodwill and Core Deposit Intangibles, net 43,050 80,384 247,854 243,513 239,916 240,331 237,153 Average Tangible Shareholders’ Equity 254,577$ 333,057$ 460,415$ 488,175$ 546,120$ 534,472$ 506,973$ Return on Average Tangible Equity 6.93% 11.20% 11.50% 9.33% 14.93% 17.20% 13.00% For the Year Ended December 31,