Filed pursuant to General Instruction II.L. of Form F-10

File No. 333-205596

A copy of this preliminary prospectus supplement has been filed with the securities regulatory authorities in each of the provinces of Canada, but has not yet become final for the purposes of the sale of securities. Information contained in this preliminary prospectus supplement is not complete and may have to be amended.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This prospectus supplement, together with the accompanying short form base shelf prospectus dated July 16, 2015 to which it relates, and each document incorporated by reference therein constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities in these jurisdictions.

Information has been incorporated by reference in the accompanying prospectus from documents filed with securities commissions or similar authorities in Canada.Copies of the documents incorporated herein by reference may be obtained on request without charge from the Secretary of Concordia Healthcare Corp. at 277 Lakeshore Rd. East, Suite 302, Oakville, Ontario, L6J 1H9, telephone (905) 842-5150, and are also available electronically at www.sedar.com.

SUBJECT TO COMPLETION, DATED SEPTEMBER 21, 2015

PRELIMINARY PROSPECTUS SUPPLEMENT

TO THE SHORT FORM BASE SHELF PROSPECTUS DATED JULY 16, 2015

| | |

| New Issue | | September 21, 2015 |

CONCORDIA HEALTHCARE CORP.

US$[●]

8,000,000 Common Shares

This prospectus supplement (the “Prospectus Supplement”) of Concordia Healthcare Corp. (“Concordia”, or the “Corporation”) qualifies the distribution (the “Offering”) of 8,000,000 common shares of the Corporation (the “Offered Shares”) at a price of US$[●] per Offered Share (the “Offering Price”).

The Offered Shares will be issued pursuant to an underwriting agreement (the “Underwriting Agreement”) dated September [●], 2015, entered into among the Corporation and Goldman, Sachs & Co. and RBC Dominion Securities Inc., as representatives for the Underwriters (as defined below) (together the “Representatives”), Credit Suisse Securities (USA) LLC and Jefferies LLC. Each of the Representatives, Credit Suisse Securities (USA) LLC and Jefferies LLC are acting as joint bookrunners in connection with the Offering. Goldman, Sachs & Co., RBC Dominion Securities Inc., Credit Suisse Securities (USA) LLC and Jefferies LLC are collectively referred to herein as the “Underwriters”. The Offering Price was determined by negotiation between the Corporation and the Representatives on behalf of the Underwriters. See “Plan of Distribution”.

On September 4, 2015, the Corporation entered into an agreement (the “AMCo Purchase Agreement”) to purchase all of the outstanding shares in the capital of Amdipharm Mercury Limited (“AMCo”) from the holders of such shares (the “Vendors”) for aggregate consideration equal to approximately US$3.3 billion (the “Acquisition”). The purchase price for the Acquisition (the “Purchase Price”) will consist of (i) approximately £800 million (approximately US$1.2 billion) in cash (the “Total Cash Consideration”), (ii) 8,490,000 common shares of the Corporation (with a value of approximately US$0.7 billion) (the “Consideration Shares”), and (iii) the repayment of AMCo’s existing senior secured facilities in the respective principal amounts of £581 million and €440 million (approximately US$1.4 billion in the aggregate) plus accrued interest and related cross-currency swaps. In addition, pursuant to the AMCo Purchase Agreement, Concordia will pay the Vendors (i) an amount of £272,801 (approximately US$414,000) accruing daily from June 30, 2015 to the completion of the Acquisition, and (ii) to the extent earned, a cash earn-out in a maximum amount of £144 million (approximately US$220 million) calculated with reference to the future gross profit of the AMCo group over a period of 12 months from October 1, 2015. The US dollar amounts and the value of the Consideration Shares set forth above are based on the GBP/US$ and EUR/US$ foreign exchange rates, and the closing price of the common shares of the Corporation (the “Common Shares”) on the Toronto Stock Exchange (“TSX”), at September 4, 2015. At completion of the Acquisition (the “Acquisition Closing”), Concordia will procure, on behalf of AMCo, the redemption of the capital loan notes held by certain Vendors and the payment of certain other amounts, all of which will be deducted from the Total Cash Consideration. The Acquisition Closing is subject to certain closing conditions. The Corporation intends to use a portion of the net proceeds of the Offering to fund a portion of the Purchase Price. See“Details of the Acquisition”.

| | | | | | | | | | | | |

| | | Price: US$[●] per Offered Share | | | | |

| | | Price to the Public | | | Underwriters’ Fee(1) | | | Net Proceeds to the

Corporation(2) | |

Per Offered Share | | | US$[● | ] | | | US$[● | ] | | | US$[● | ] |

Total(3) | | | US$[● | ] | | | US$[● | ] | | | US$[● | ] |

Notes:

| (1) | In consideration for the services rendered by the Underwriters in connection with the Offering, the Underwriters will be paid a cash commission (the “Underwriters’ Fee”) equal to 3.75% of the Offering Price for each Offered Share purchased on the Closing Date (as defined herein). See “Plan of Distribution”. |

| (2) | After deducting the Underwriters’ Fee, but before deducting expenses of the Offering, including in connection with the preparation and filing of this Prospectus Supplement, which are estimated to be $[●] and which will be paid from the proceeds of the Offering. |

| (3) | The Corporation has granted the Underwriters an option (the “Underwriters’ Option”), exercisable in whole or in part, at any time and from time to time, in the sole discretion of the Underwriters, up to 30 days after and including the Closing Date to purchase up to an additional[●] Common Shares (the “Additional Offered Shares”) at a price of US$[●] per Additional Offered Share, to cover sales by the Underwriters of a greater number of Common Shares than the number set out above, if any. The Additional Offered Shares issuable upon exercise of the Underwriters’ Option are hereby qualified for distribution under this Prospectus Supplement. A person who acquires Additional Offered Shares acquires such Additional Offered Shares under this Prospectus Supplement. If the Underwriters’ Option is exercised in full, the total price to the public, Underwriters’ Fee and net proceeds to the Corporation (before payment of the expenses of the Offering) will be US$[●], US$[●] and US$[●], respectively. Unless the context otherwise requires, references to “Offered Shares” in this Prospectus Supplement include the Additional Offered Shares, if the context requires. See“Plan of Distribution”. |

The following table sets out the number of Additional Offered Shares that may be issued by the Corporation to the Underwriters pursuant to the Underwriters’ Option:

| | | | | | |

Underwriters’ Position | | Number of Securities Available | | Exercise Period | | Exercise Price |

Underwriters’ Option | | [●] Additional Offered Shares | | Up to 30 days after the Closing Date | | US$[●] per Additional Offered Share |

The Common Shares are listed and posted for trading on the TSX under the symbol “CXR”. On [●], 2015, the last trading day prior to the date of this Prospectus Supplement, the closing price of the Common Shares on the TSX was $[●] and on September 18, 2015, the last trading day prior to the announcement of the Offering, the closing price of the Common Shares on the TSX was $96.50. The Common Shares are also listed on the NASDAQ Global Select Market® (“NASDAQ”) under the symbol “CXRX”. On [●], 2015, the last trading day prior to the date of this Prospectus Supplement, the closing price of the Common Shares on NASDAQ was US$[●] and on September 18, 2015, the last trading day prior to the announcement of the Offering, the closing price of the Common Shares on NASDAQ was US$72.23. The Corporation has applied to list the Offered Shares and Additional Offered Shares on the TSX. Listing is subject to the Corporation fulfilling all of the listing requirements of the TSX. The Offered Shares and Additional Offered Shares will be listed on NASDAQ, upon official notice of issuance.

Subject to applicable laws, the Underwriters may, in connection with the Offering, effect transactions intended to stabilize or maintain the market price of the Common Shares at levels other than those which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. See“Plan of Distribution”.

After the Underwriters have made reasonable efforts to sell the Offered Shares at the Offering Price, the Underwriters may decrease the Offering Price for the Offered Shares and may further change the Offering Price from time to time to amounts no greater than the Offering Price. In the event the Offering Price is reduced, the compensation received by the Underwriters will be decreased by the amount that the aggregate price paid by the purchasers for the Offered Shares is less than the gross proceeds paid by the Underwriters for the Offered Shares. Any such reduction will not affect the proceeds received by the Corporation. See“Plan of Distribution”.

The Offering is being made concurrently in the United States and in all of the provinces of Canada on an underwritten basis for 100% of the Offered Shares offered hereunder. Goldman Sachs Canada Inc., RBC Dominion Securities Inc., and Credit Suisse Securities (Canada), Inc. in Canadian jurisdictions and Goldman, Sachs & Co., RBC Capital Markets, LLC, Credit Suisse Securities (USA) LLC, and Jefferies LLC in the United States, as principals, conditionally offer the Offered Shares, subject to prior sale, if, as and when issued by Concordia and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under “Plan of Distribution”, and subject to the approval of certain legal matters on Concordia’s behalf by Sullivan & Cromwell LLP with respect to matters of U.S. law and Fasken Martineau DuMoulin LLP with respect to matters of Canadian law, and on behalf of the Underwriters by Cahill, Gordon &

ii

Reindel LLP with respect to matters of U.S. law and by Blake, Cassels & Graydon LLP with respect to matters of Canadian law. Jefferies LLC is not registered to sell securities in any Canadian jurisdiction and, accordingly, will only sell Offered Shares in the United States.

Subscriptions for the Offered Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. It is expected that the closing of the Offering will occur on or about September 30, 2015, or on such other date (which date shall not be later than 42 days after the date of this Prospectus Supplement) as may be agreed upon by the Corporation and the Representatives, on behalf of the Underwriters (the “Closing Date”).

An investment in the Offered Shares involves significant risks that should be carefully considered by prospective investors before purchasing such securities. The risks outlined in this Prospectus Supplement, the Prospectus (as defined below) and in the documents incorporated by reference therein should be carefully reviewed and considered by prospective investors in connection with an investment in the Offered Shares. See“Cautionary Note Regarding Forward-Looking Information” and“Risk Factors”.

Each of RBC Dominion Securities Inc. and Credit Suisse Securities (Canada), Inc. are respective affiliates of financial institutions that, among other lenders, have provided the Corporation with a portion of the Existing Bank Facilities (as defined herein), and, along with Goldman, Sachs & Co. and Jefferies LLC, have entered into the Commitment Letter (as defined herein) pursuant to which they have agreed to provide, among other things, certain financing in connection with the Acquisition. Consequently, the Corporation may be considered to be a “connected issuer” of Goldman Sachs Canada Inc., RBC Dominion Securities Inc., Credit Suisse Securities (Canada), Inc. and Jefferies LLC under applicable Canadian securities laws. See “Relationship Between the Underwriters and the Corporation”.

The Offering is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada, to prepare this Prospectus Supplement and the accompanying base shelf prospectus dated July 16, 2015 (the “Prospectus”) in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those applicable to issuers in the United States. Certain financial statements incorporated by reference in the Prospectus have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), and may not be comparable to financial statements of United States companies.

Prospective investors should be aware that the acquisition of the Offered Shares may have tax consequences both in the United States and in Canada. Such tax consequences for investors, including investors who are resident in or citizens of the United States, may not be described fully herein.

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Corporation is incorporated under the laws of the Province of Ontario, Canada, that most of its officers and directors are residents of Canada, that some of the experts named in this Prospectus Supplement are residents of Canada, and that all or a substantial portion of the assets of the Corporation and said persons are located outside the United States.

THE OFFERED SHARES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Canadian investors should be aware that Keiter, Certified Public Accountants, auditors of certain financial statements in respect of Donnatal® contained in the business acquisition report of the Corporation dated June 9, 2014, incorporated by reference in the Prospectus, is incorporated, continued, or otherwise organized under the laws of the United States; Crowe Horwath LLP, auditors of the carve-out financial statements for the Covis Business (as defined herein) contained in the business acquisition report of the Corporation dated July 3, 2015 incorporated by reference in the Prospectus, is incorporated, continued, or otherwise organized under the laws of the United States; and that Mr. Edward Borkowski and Ms. Rochelle Fuhrmann, directors of the Corporation, reside outside of Canada. Each of Mr. Borkowski and Ms. Fuhrmann have appointed the Corporation as his or her agent for service of process. Canadian investors are advised that it may not be possible for investors to enforce judgements obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process in Canada.

iii

US investors should be aware that Collins Barrow Toronto LLP, auditors of certain financial statements of the Corporation incorporated by reference in the Prospectus, is incorporated, continued, or otherwise organized under the laws of Canada; and that each of Mr. Jordan Kupinsky and Mr. Doug Deeth, directors of the Corporation, Mr. Mark Thompson, an officer and director of the Corporation, and Mr. Adrian de Saldanha, the Chief Financial Officer of the Corporation, reside outside the United States. Each of Mr. Thompson, Mr. Kupinsky, Mr. Deeth and Mr. de Saldanha have appointed CT Corporation System, located at 111 Eighth Avenue, New York, NY 10011, as their agent for service of process. United States investors are advised that it may not be possible for investors to enforce judgements obtained in the United States against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of the United States, even if the party has appointed an agent for service of process in the United States.

The registered and head office of the Corporation is located at 277 Lakeshore Rd. East, Suite 302, Oakville, Ontario, L6J 1H9. The Corporation’s records office is located at 333 Bay St., Suite 2400, Toronto, Ontario M56 2T6.

iv

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT AND ACCOMPANYING PROSPECTUS

Explanatory Notes

This document is in two parts. The first part is this Prospectus Supplement, which describes the specific terms of the Offered Shares and also adds to and updates certain information contained in the accompanying Prospectus and the documents incorporated by reference therein. The second part, the Prospectus, gives more general information, some of which may not apply to the Offered Shares being offered under this Prospectus Supplement. In this Prospectus Supplement, all capitalized terms used and not otherwise defined herein have the meanings ascribed thereto in the Prospectus.

In this Prospectus Supplement, the Corporation and its subsidiaries are collectively referred to as the “Corporation” or “Concordia”, unless the context otherwise requires. Readers of this Prospectus Supplement should rely only on information contained in this Prospectus Supplement and contained or incorporated by reference in the Prospectus. The Corporation has not authorized anyone to provide the reader with different information. The Corporation takes no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give readers of this Prospectus Supplement.

Readers should not assume that the information contained in this Prospectus Supplement is accurate as of any date other than the date on the front of this Prospectus Supplement or the respective dates of the documents incorporated by reference in the accompanying Prospectus.

The Corporation is not making an offer of the Offered Shares in any jurisdiction where the offer is not permitted. This Prospectus Supplement and the accompanying Prospectus must not be used by anyone for any purpose other than in connection with the Offering. The Corporation does not undertake to update the information contained in this Prospectus Supplement or contained or incorporated by reference in the Prospectus, except as required by applicable securities laws. Information contained on, or otherwise accessed through, the website of the Corporation, www.concordiarx.com, shall not be deemed to be a part of this Prospectus Supplement or the accompanying Prospectus and such information is not incorporated by reference herein or therein and should not be relied upon by readers for the purpose of determining whether to invest in the Offered Shares.

Trademarks

This Prospectus Supplement, or the accompanying Prospectus or documents incorporated by reference therein, include references to trademarks which are protected under applicable intellectual property laws and are the property of the Corporation, AMCo, or their respective affiliates or licensors. Solely for convenience, the trademarks of the Corporation, AMCo, their respective affiliates and/or their respective licensors referred to in this Prospectus Supplement or the accompanying Prospectus, or documents incorporated by reference therein may appear with or without the® or ™ symbol, but such references or the absence thereof are not intended to indicate, in any way, that the Corporation, AMCo, or their respective affiliates or licensors will not assert, to the fullest extent under applicable law, their respective rights to these trademarks. Any other trademarks used in this Prospectus Supplement, or the accompanying Prospectus or documents incorporated by reference therein, are the property of their respective owners.

Market Data

This Prospectus Supplement, or the accompanying Prospectus or documents incorporated by reference therein, contains certain statistical data, market research and industry forecasts that were obtained, unless otherwise indicated, from independent industry and government publications and reports or based on estimates derived from such publications and reports and management of Concordia’s knowledge of, and experience in, the markets in which the Corporation operates. Industry and government publications and reports generally indicate that they have obtained their information from sources believed to be reliable, but do not guarantee the accuracy and completeness of their information. While the Corporation believes this data to be reliable, market and industry data is subject to variation and cannot be verified due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. The Corporation has not independently verified the accuracy or completeness of such information contained in this Prospectus Supplement, the Prospectus, or incorporated by reference therein. In addition, projections, assumptions and estimates of the Corporation’s future performance and the future performance of the industry in which the Corporation operates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described under the heading“Risk Factors” in this Prospectus Supplement and under the heading“Risk Factors” in the AIF (as defined herein).

S-3

Information Pertaining to AMCo

The information contained in this Prospectus Supplement with respect to AMCo and its business has been provided by management of AMCo.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain statements contained in this Prospectus Supplement, the accompanying Prospectus, or in documents incorporated by reference therein, constitute “forward-looking information” within the meaning of applicable Canadian provincial securities laws (“forward-looking statements”), which are based upon the Corporation’s current internal expectations, estimates, projections, assumptions and beliefs. Statements concerning the Corporation’s objectives, goals, strategies, intentions, plans, beliefs, expectations and estimates, and the business, operations, future financial performance and condition of the Corporation and/or AMCo are forward-looking statements. The words “believe”, “expect”, “anticipate”, “estimate”, “intend”, “may”, “will”, “would” and similar expressions, including the negative and grammatical variations of such expressions, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in the forward-looking statements. In addition, this Prospectus Supplement, the accompanying Prospectus, and/or the documents incorporated by reference therein, may contain forward-looking statements attributed to third-party industry sources.

By their nature, forward-looking statements involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts and projections that constitute forward-looking statements will not occur. Such forward-looking statements in this Prospectus Supplement, in the accompanying Prospectus, or in documents incorporated by reference therein, speak only as of the date of such document. Forward-looking statements in this Prospectus Supplement, in the accompanying Prospectus, or in documents incorporated by reference therein, include, but are not limited to, statements with respect to:

| | • | | the proposed settlement agreement with the FTC (as defined herein); |

| | • | | the use of net proceeds of the Offering; |

| | • | | the Acquisition, including but not limited to: |

| | • | | the completion and timing thereof; |

| | • | | synergies resulting from the Acquisition; |

| | • | | the completion of the related debt financings and the expected terms of those financings; |

| | • | | the entering into of documentation with respect to the related debt financings; and |

| | • | | the impact of the Acquisition on Concordia’s financial performance (including with respect to its revenues, margins, Adjusted EPS, EBITDA and Adjusted EBITDA); |

| | • | | the performance of the Corporation’s and AMCo’s business and operations; |

| | • | | the ability of the Corporation to integrate the business of AMCo with that of the Corporation; |

| | • | | the retention of key personnel of AMCo; |

| | • | | the Corporation’s capital expenditure programs; |

| | • | | the future development of the Corporation, its growth strategy and the timing thereof; |

| | • | | the acquisition strategy of the Corporation; |

| | • | | the completion and timing of the Offering; |

| | • | | the estimated future contractual obligations of the Corporation; |

| | • | | the Corporation’s future liquidity and financial capacity; |

| | • | | the supply and demand for pharmaceutical products and services similar to the Corporation’s and AMCo’s products and services; |

| | • | | cost and reimbursement for the Corporation’s and AMCo’s products; |

| | • | | expectations regarding the Corporation’s ability to raise capital; |

| | • | | the Corporation’s treatment under government regulatory and taxation regimes; |

| | • | | the Corporation’s and AMCo’s net sales of all or any one of their respective products; |

| | • | | sales relating to the specialty healthcare distribution division; and |

| | • | | potential synergies available through the combination with AMCo. |

With respect to the forward-looking statements contained in this Prospectus Supplement, in the accompanying Prospectus, or in documents incorporated by reference therein, the Corporation has made assumptions regarding, among other things:

S-4

| | • | | the ability of the Corporation to comply with its contractual obligations, including, without limitation, its obligations under debt arrangements; |

| | • | | the ability of the Corporation to complete the Acquisition and the related debt financings on certain terms; |

| | • | | the successful licensing of products to third parties to market and distribute such products on terms favorable to the Corporation; |

| | • | | the ability of the Corporation to maintain key strategic alliances, and licensing and partnering arrangements, including in relation to the business of AMCo, now and in the future; |

| | • | | the ability of the Corporation to maintain its and AMCo’s distribution networks and distribute its products effectively despite significant geographical expansion; |

| | • | | the general regulatory environment in which the Corporation and AMCo operate, including the areas of taxation, environmental protection, consumer safety and health regulation; |

| | • | | the timely receipt of any required regulatory approvals; |

| | • | | the general economic, financial, market and political conditions impacting the industry in which the Corporation and AMCo operate; |

| | • | | the tax treatment of the Corporation, AMCo, and their subsidiaries and the materiality of legal proceedings; |

| | • | | the ability of the Corporation to sustain or increase profitability, fund its operations with existing capital, and/or raise additional capital to fund future acquisitions; |

| | • | | the ability of the Corporation to acquire any necessary technology, products or businesses and effectively integrate such acquisitions, including the ability to complete the Acquisition and integrate AMCo; |

| | • | | the development and clinical testing of products under development; |

| | • | | the ability of the Corporation and AMCo to obtain necessary approvals for commercialization of the Corporation’s products from the United States Food and Drug Administration or other regulatory authorities; |

| | • | | future currency exchange and interest rates; |

| | • | | reliance on third party contract manufacturers to manufacture the Corporation’s and AMCo’s products on favourable terms; |

| | • | | the ability of the Corporation to generate sufficient cash flow from operations and to access existing and proposed credit facilities and the capital markets to meet its future obligations on acceptable terms; |

| | • | | the availability of raw materials and finished products necessary for the Corporation’s and AMCo’s products; |

| | • | | the impact of increasing competition; |

| | • | | the ability of the Corporation and AMCo to obtain and retain qualified staff, equipment and services in a timely and efficient manner; |

| | • | | the ability of the Corporation and AMCo to maintain and enforce the protection afforded by any patents or other intellectual property rights; |

| | • | | the ability of the Corporation and AMCo to conduct operations in a safe, efficient and effective manner; |

| | • | | the results of continuing and future safety and efficacy studies by industry and government agencies related to the Corporation’s and AMCo’s products; and |

| | • | | the ability of the Corporation to successfully market its products and services and the products and services of AMCo upon completion of the Acquisition. |

Forward-looking statements contained in this Prospectus Supplement, in the accompanying Prospectus, or in documents incorporated by reference therein, are based on the key assumptions described herein or therein. The reader is cautioned that such assumptions, although considered reasonable by the Corporation, may prove to be incorrect. Actual results achieved during the forecast period will vary from the information provided in this Prospectus Supplement, in the accompanying Prospectus, or in documents incorporated by reference therein, as a result of numerous known and unknown risks and uncertainties and other factors. The Corporation cannot guarantee future results.

Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this Prospectus Supplement, in the accompanying Prospectus, or in documents incorporated by reference therein, include, but are not limited to, the risk factors included under the heading“Risk Factors” in this Prospectus Supplement and under the heading“Risk Factors” in the AIF.

Forward-looking statements contained in this Prospectus Supplement, in the accompanying Prospectus, or in documents incorporated by reference therein, are based on management’s current plans, expectations, estimates, projections, beliefs and opinions and the assumptions relating to those plans, expectations, estimates, projections, beliefs and opinions may change. Management of the Corporation has included the above summary of assumptions and risks related to forward-looking statements included in this Prospectus Supplement, in the accompanying Prospectus, or in documents incorporated by reference therein, for the purpose of assisting the reader in understanding management’s current views regarding those future outcomes.Readers are cautioned that this information may not be

S-5

appropriate for other purposes. Readers are cautioned that the lists of assumptions and risk factors contained herein are not exhaustive. Neither the Corporation nor any other person assumes responsibility for the accuracy or completeness of the forward-looking statements contained herein.

Such forward-looking statements are made as of the date of this Prospectus Supplement, or in the case of the accompanying Prospectus or any documents incorporated by reference therein, as of the dates of such documents, and the Corporation disclaims any intention or obligation to update publicly any such forward-looking statements, whether as a result of new information, future events or results or otherwise, other than as required by applicable Canadian securities laws.

All of the forward-looking statements made in this Prospectus Supplement, in the accompanying Prospectus, or in documents incorporated by reference therein are expressly qualified by these cautionary statements and other cautionary statements or factors contained or incorporated by reference herein or therein, and there can be no assurances that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Corporation.

CAUTIONARY NOTE REGARDING FUTURE-ORIENTED FINANCIAL INFORMATION

To the extent any forward-looking statements in this Prospectus Supplement, in the accompanying Prospectus, or in documents incorporated by reference therein, constitute “future-oriented financial information” or “financial outlooks” within the meaning of applicable Canadian securities laws, such information is being provided to demonstrate the potential benefits of the Acquisition and the debt financings described herein and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such future-oriented financial information and financial outlooks. Future-oriented financial information and financial outlooks, as with forward-looking statements generally, are, without limitation, based on the assumptions and subject to the risks set out above under the heading“Cautionary Note Regarding Forward-Looking Information”.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

All references to “$” in this Prospectus Supplement refer to Canadian dollars, all references to “US$” are to United States dollars, all references to “£” or “GBP” are to United Kingdom pounds sterling, and all references to “€” or “EUR” are to European Union Euro, unless otherwise indicated. The following table reflects the high and low rates of exchange for one United States dollar, expressed in Canadian dollars, during the periods noted, the rates of exchange at the end of such periods, and the average rates of exchange during such periods, based on the Bank of Canada noon spot rate of exchange.

| | | | | | | | | | | | | | | | |

| | | Six months ended June 30 | | | Year ended December 31, | |

| | | 2015 | | | 2014 | | | 2014 | | | 2013 | |

High for the period | | | 1.2803 | | | | 1.1251 | | | | 1.1643 | | | | 1.0697 | |

Low for the period | | | 1.1728 | | | | 1.0614 | | | | 1.0614 | | | | 0.9839 | |

Rate at the end of the period | | | 1.2474 | | | | 1.0676 | | | | 1.1601 | | | | 1.0636 | |

Average noon spot rate for the period | | | 1.2354 | | | | 1.0968 | | | | 1.1045 | | | | 1.0299 | |

On September 18, 2015, the Bank of Canada noon rate of exchange for US$ was US$1.00 = $1.3147.

The following table reflects the high and low rates of exchange for one GBP, expressed in Canadian dollars, during the periods noted, the rates of exchange at the end of such periods, and the average rates of exchange during such periods, based on the Bank of Canada noon spot rate of exchange

| | | | | | | | | | | | | | | | |

| | | Six months ended June 30 | | | Year ended December 31, | |

| | | 2015 | | | 2014 | | | 2014 | | | 2013 | |

High for the period | | | 1.9614 | | | | 1.8594 | | | | 1.8594 | | | | 1.7639 | |

Low for the period | | | 1.7856 | | | | 1.7432 | | | | 1.7432 | | | | 1.5263 | |

Rate at the end of the period | | | 1.9614 | | | | 1.8261 | | | | 1.8071 | | | | 1.7627 | |

Average noon spot rate for the period | | | 1.8816 | | | | 1.8306 | | | | 1.8190 | | | | 1.6113 | |

On September 18, 2015, the Bank of Canada noon rate of exchange for GBP was £1.00 = $2.0471.

S-6

On September 18, 2015, the Bank of Canada noon rate of exchange for EUR was €1.00 = $1.4932.

PRESENTATION OF FINANCIAL INFORMATION

The financial statements of the Corporation incorporated by reference in the Prospectus are reported in United States dollars and have been prepared in accordance with IFRS as issued by the IASB.

The financial statements of AMCo included in this Prospectus Supplement are reported in GBP and have been prepared in accordance with IFRS as issued by the IASB.

The: (i) financial statements and information contained in the business acquisition report dated July 3, 2015 relating to the acquisition of substantially all of the commercial assets of Covis Pharma S.à.r.l (“Covis Pharma”) and Covis Injectables S.à.r.l (collectively, the “Covis Business”) incorporated by reference in the Prospectus; (ii) financial statements and information contained in the business acquisition report dated June 9, 2014 relating to the acquisition of Donnatal® incorporated by reference in the Prospectus; and (iii) financial statements and information contained in the business acquisition report dated December 12, 2014 relating to the acquisition of Zonegran® incorporated by reference in the Prospectus, each are reported in United States dollars and have been prepared in accordance with IFRS or United States generally accepted accounting principles (“U.S. GAAP”), as the case may be, and may not be comparable to the financial statements of the Corporation or any companies prepared in accordance with IFRS.

NON-IFRS MEASURES

This Prospectus Supplement contains references to certain measures that are not recognized under IFRS. These non-IFRS measures are used as indicators of financial performance and may differ from similar computations as reported by other similar entities and, accordingly, may not be comparable. The Corporation believes these measures provide useful supplemental information that may assist investors in assessing an investment in the Offered Shares.

The non-IFRS measures used in relation to the Corporation in this Prospectus Supplement are EBITDA, Adjusted EBITDA and Adjusted EPS of the Corporation and/or AMCo, which have the following meanings:

“EBITDA” is defined as net income adjusted for net interest expense, income tax expense, depreciation and amortization. Management uses EBITDA to assess the Corporation’s operating performance, as applicable.

“Adjusted EBITDA” is defined as EBITDA adjusted for one-time charges, including costs associated with acquisitions, exchange listing expenses, non-recurring gains, non-cash items such as unrealized gains/losses on derivative instruments, share based compensation, changes in fair value of contingent consideration, and realized/unrealized gains/losses related to foreign exchange revaluation.

“Adjusted EPS” is earnings per share presented on a fully diluted basis and is calculated as net income, adding back one-time charges, including costs associated with acquisitions, exchange listing expenses, non-recurring gains, non-cash items such as unrealized gains/losses on derivative instruments, share based compensation, changes in fair value of contingent consideration, and realized/unrealized gains/losses related to foreign exchange revaluation, depreciation, amortization, accretion, and tax effect of all adjustments, divided by the weighted average number of Common Shares outstanding on a fully-diluted basis.

Investors are cautioned that these non-IFRS measures should not be considered an alternative to net earnings for the period (as determined in accordance with IFRS) as an indicator of the Corporation’s performance, or an alternative to cash flows from operating, financing and investing activities as a measure of liquidity. The Corporation’s method of calculating such non-IFRS measures may differ from the methods used by other issuers and, accordingly, non-IFRS measures used in relation to the Corporation may not be comparable to similar measures used by other issuers.

Please refer to“Summary - Selected Pro Forma Consolidated Financial Information” for a reconciliation of the non-IFRS measures used in relation to the Corporation in this Prospectus Supplement.

S-7

SUMMARY

The following is a summary of the principal features of the Offering and the Acquisition and should be read together with the more detailed information and financial data and statements contained elsewhere in this Prospectus Supplement.

CONCORDIA HEALTHCARE CORP.

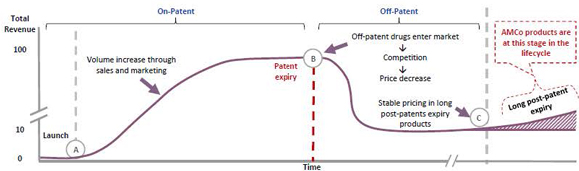

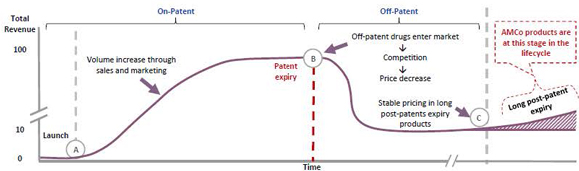

Concordia is a diverse healthcare company that is primarily focused on sustainable established legacy pharmaceutical products, which are off-patent drugs and have a track record of safety and efficacy, a history of stable prescription demand, and competitive barriers to entry. Some of Concordia’s products are often difficult to manufacture, have specialized regulatory status and/or possess strong brand loyalty that allows them to maintain ongoing sales after patent expiration. Concordia’s business strategy involves seeking to acquire products and maximize their value through:

| | • | | optimizing the sales and pricing strategy; |

| | • | | managing regulatory affairs and supply chain; |

| | • | | optimizing its corporate structure; |

| | • | | identifying authorized generic opportunities; and |

| | • | | exploring targeted promotion or co-promotion. |

The Corporation has utilized this strategy in six acquisitions since 2013 (not including the Acquisition), which has added a portfolio of products, including branded products such as Nilandron®, for the treatment of metastatic prostate cancer; Dibenzyline®, for the treatment of pheochromocytoma; Lanoxin®, for the treatment of mild-to moderate heart failure and atrial fibrillation; Plaquenil®, for the treatment of lupus and rheumatoid arthritis; Donnatal® for the treatment of irritable bowel syndrome; and Zonegran® (zonisamide) for treatment of partial seizures in adults with epilepsy. Donnatal® accounted for 21% of the Corporation’s 2014 total revenue, Lanoxin® accounted for 16% of 2014 total revenue, Plaquenil® accounted for 9% of 2014 total revenue, and each of Zonegran® and Dibenzyline® accounted for 8% of 2014 total revenue.

After giving effect to the Acquisition, the Corporation will have a high level of financial diversification with sales in over 100 countries and no single product representing more than 10% of revenues. Concordia’s global operations after the Acquisition are expected to provide the Corporation with the opportunity to maximize brand value worldwide as well as to identify products that may have specialized value propositions in certain specific markets.

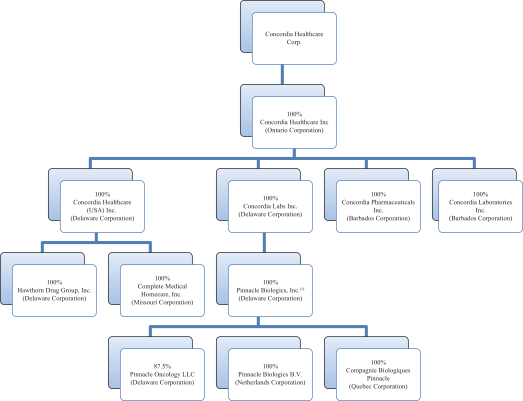

Concordia also markets orphan drugs through an Orphan Drug Division, currently consisting of Photofrin® for the treatment of rare forms of cancer. The Corporation is currently undergoing testing for multiple new indications for Photofrin® in order to enable expanded usage if approved. In addition, Concordia operates a Specialty Healthcare Distribution Division that provides a distribution capability for specialty pharmaceutical products and orphan drugs once acquired and/or developed. Concordia currently operates out of facilities in Oakville, Ontario; Bridgetown, Barbados; Roanoke, Virginia; Kansas City, Missouri; and Chicago, Illinois.

For a description of Concordia’s business and certain recent developments, including the acquisition of the Covis Business completed in April 2015, see the section titled “General Development and Description of the Business” in the AIF and the section titled “Company Overview” in the Interim MD&A. The AIF and the Interim MD&A are incorporated by reference into the Prospectus and this Prospectus Supplement, respectively.

THE ACQUISITION

On September 4, 2015, the Corporation entered into the AMCo Purchase Agreement with the Vendors pursuant to which the Corporation agreed to acquire all of the outstanding shares in the capital of AMCo from the Vendors.

The Purchase Price for the Acquisition is expected to be equal to approximately US$3.3 billion, comprising (i) approximately £800 million (approximately US$1.2 billion) in cash; (ii) 8,490,000 Consideration Shares (with a value of approximately US$0.7 billion); and (iii) the repayment of AMCo’s existing senior secured facilities in the respective

S-8

principal amounts of £581 million and €440 million (approximately US$1.4 billion in the aggregate) plus accrued interest and related cross-currency swaps. In addition, pursuant to the AMCo Purchase Agreement, Concordia will pay the Vendors (i) an amount of £272,801 (approximately US$414,000) accruing daily from June 30, 2015 to the completion of the Acquisition, and (ii) to the extent earned, a cash earn-out in a maximum amount of £144 million (approximately US$220 million) calculated with reference to the future gross profit of the AMCo group over a period of 12 months from October 1, 2015. The US dollar amounts and the value of the Consideration Shares set forth above are based on the GBP/US$ and EUR/US$ foreign exchange rates, and the closing price of the Common Shares on the TSX, at September 4, 2015. On the Acquisition Closing, Concordia will procure, on behalf of AMCo, the redemption of the capital loan notes held by certain Vendors and the payment of certain other amounts, all of which will be deducted from the Total Cash Consideration. In addition, pursuant to the AMCo Purchase Agreement, if the Corporation acquires certain specified pharmaceutical products from a specified third party introduced to the Corporation by certain of the Vendors within 12 months of the Acquisition Closing, the Corporation will pay to the Vendors an additional US$72 million.

Completion of the Acquisition is subject to certain closing conditions. The Acquisition will be financed through the net proceeds of the Offering and certain debt financings described in this Prospectus Supplement. In addition, a portion of the Purchase Price will be satisfied through the issuance of the Consideration Shares. See“The Acquisition” and“Details of the Acquisition”.

DESCRIPTION OF THE AMCO BUSINESS

General Description of the AMCo Business

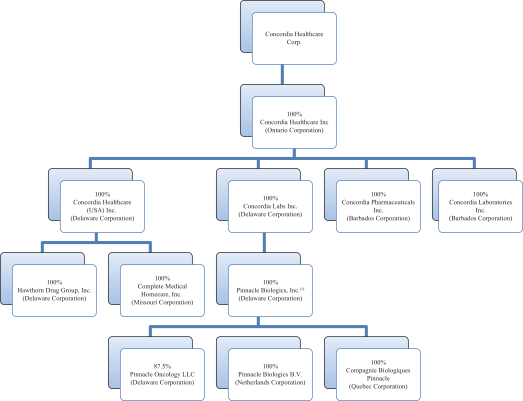

AMCo is an international specialty pharmaceutical company, owning a diversified portfolio of branded and generic prescription products which are sold to wholesalers, hospitals and pharmacies in over 100 countries. AMCo specializes in the acquisition and development of hard-to-make, niche, off-patent prescription medicines in selected therapeutic areas. AMCo’s medicines are manufactured and sold through an out-sourced production and distribution network and marketed internationally through a combination of direct sales and local partnerships.

As of December 31, 2014, AMCo had a diversified product portfolio consisting of 180 molecules that represent a range of dosage strengths, formulations and geographic markets, covering a range of therapeutic categories, including endocrinology, ophthalmology and urology. As of June 30, 2015, AMCo’s product portfolio had increased to 190 molecules. For the year ended December 31, 2014, the largest molecule by revenue in AMCo’s portfolio accounted for less than 10% of total revenue, and the top ten molecules in AMCo’s portfolio accounted for less than 60% of total revenue.

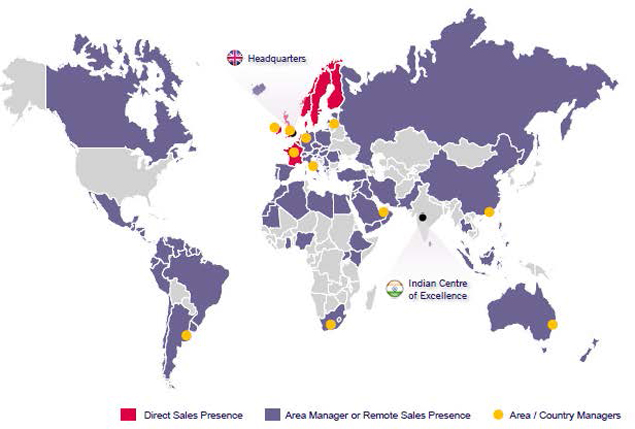

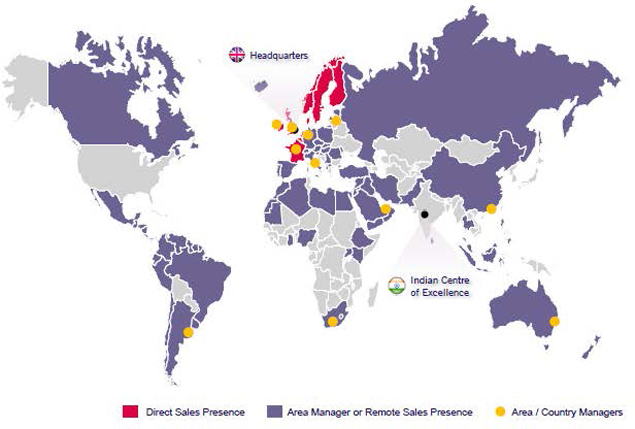

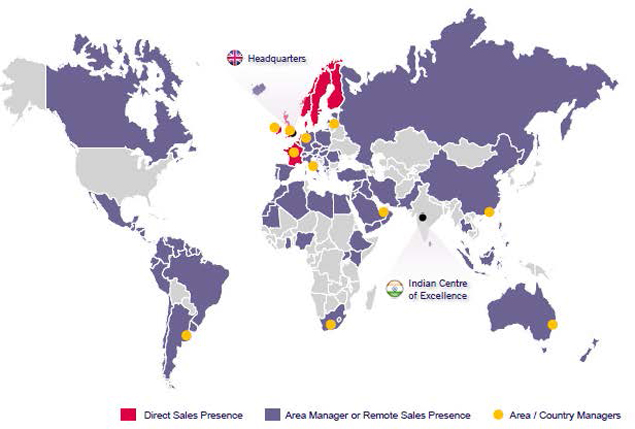

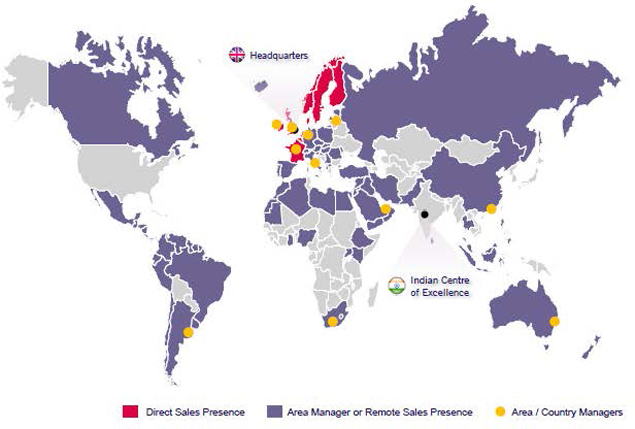

As at the date of this Prospectus Supplement, AMCo has a direct sales presence in the United Kingdom, Ireland, France, the Nordic region, the Benelux region and the Middle East and North African (“MENA”) region and a distribution network worldwide. AMCo utilizes an asset-light business model with a core management team in the United Kingdom and Ireland supported by commercial and regulatory teams in certain international markets and a Centre of Excellence in India that has operational functions ranging from regulatory, supply chain, medical marketing, customer service, information technology and finance. AMCo focuses on the registration and regulatory maintenance of acquired, in-licensed and own-developed products. This model requires no basic research and minimal development spend. New products are acquired and in-licensed as well as developed by contract research organizations that are managed by an AMCo in-house team, mainly to develop new formulations and dosage strengths of existing products. AMCo outsources all product manufacturing services to over 73 well-known, reputable third-party contract manufacturers in the United Kingdom and Europe.

AMCo Business Divisions

AMCo’s operations are divided into two major business divisions, direct markets and distributor markets, which are the basis for its segment reporting in its financial results.

Direct markets

AMCo’s Direct markets division is engaged in direct sales through commercial teams in each geographic region that target public health organizations (for example, Clinical Commissioning Groups (“CCGs”) in the United Kingdom), key opinion leaders, wholesalers, pharmacies, and general and specialist physicians. AMCo’s revenue from the Direct

S-9

markets division increased from £182.5 million in 2013 to £232.3 million in 2014. For the year ended December 31, 2014, the Direct markets division accounted for 79.4% of AMCo’s revenue and included AMCo’s operations in the United Kingdom, Ireland, France, the Nordic region and the Benelux region.

Distributor markets

AMCo’s Distributor markets division is engaged in sales worldwide through distribution partnerships monitored both on the ground by an area or country manager and remotely from AMCo’s United Kingdom headquarters and/or its operations center in India. AMCo’s revenue from the Distributor markets division increased from £58.5 million in 2013 to £60.5 million in 2014. For the year ended December 31, 2014, the Distributor markets division accounted for 20.6% of AMCo’s revenue. The Distributor markets division in 2014 included AMCo’s operations in the Middle-East, the Americas, Asia-Pacific, Southern Europe, Eastern Europe and South Africa.

The following figure shows AMCo’s geographic presence as of December 31, 2014.

Products

AMCo has a diversified product portfolio, with over 190 molecules across several therapeutics areas, sold in over 100 countries. In 2014, no one molecule accounted for more than 10% of AMCo’s total revenue, and AMCo’s top ten molecules accounted for less than 60% of total revenue. AMCo’s top ten molecules in the United Kingdom (its largest market) accounted for less than 44% of total revenue.

AMCo specializes in the acquisition and development of hard-to-make, niche, off-patent prescription medicines in selected therapeutic areas. The following table provides an overview of AMCo’s top ten molecules during the year ended December 31, 2014 and illustrates the level of diversity across AMCo’s product portfolio:

S-10

| | | | | | | | | | | | |

AMCo’s Top 10 Molecules | |

Molecule | | Indication | | Sold in no. of

countries | | International

Rights | | FY 2014 Revenue

(£ million) | | % of FY 2014

Revenue | |

Levothyroxine Sodium | | Hypothyroidism | | 12 | | ü | | 28.7 | | | 9.8 | % |

| | | | | |

Nitrofurantoin | | Urinary tract infections | | 16 | | ü | | 26.9 | | | 9.2 | % |

| | | | | |

Prednisolone | | Inflammatory conditions | | 2 | | ü | | 21.0 | | | 7.2 | % |

| | | | | |

Carbimazole | | Hyperthyroidism | | 27 | | Defined

territories | | 17.4 | | | 5.9 | % |

| | | | | |

Liothyronine

Sodium | | Severe

hypothyroid states | | 9 | | ü | | 16.6 | | | 5.7 | % |

| | | | | |

Fusidic Acid | | Bacterial conjunctivitis | | 70 | | ü | | 15.8 | | | 5.4 | % |

| | | | | |

Erythromycin | | Bacterial infections | | 37 | | Defined

territories | | 13.4 | | | 4.6 | % |

| | | | | |

Codeine

Phosphate + Paracetamol | | Moderate/severe pain | | 3 | | ü | | 12.0 | | | 4.1 | % |

| | | | | |

Biperiden Hydrochloride | | Parkinson’s disease | | 19 | | Defined

territories | | 6.9 | | | 2.3 | % |

| | | | | |

Tranylcypromine Sulphate | | Depression | | 11 | | ü | | 6.6 | | | 2.3 | % |

Launch of New Products

AMCo grows and diversifies its product portfolio through acquisitions and organic growth, pursuant to which AMCo has developed a pipeline of products which consists of approximately 60 product launches over the next three years, mostly in the form of new dosages or formulations of existing drugs. This pipeline consists of reformulations or new dosages of existing products, which are developed in-house, the launch of existing products in new countries and in-licensed products that reach across AMCo’s various markets. In-licensed products include niche branded or un-branded products that are currently sold by other companies. AMCo identifies in-licensing opportunities and seeks to reach an agreement with these companies to allow AMCo to market the product in some or all geographic regions, typically in return for milestone payments and/or profit share agreements.

Production and Supply

AMCo outsources all product manufacturing services to over 73 third-party contract manufacturers (“CMOs”) in the United Kingdom and Europe. AMCo partners with well-known, reputable CMOs. AMCo has purposefully concentrated its supplier base in Europe in order to be close to its manufacturers, which allows AMCo to more readily monitor the manufacturing process and reduce the risk of any supply disruptions.

AMCo’s operations are managed by a core management team in the United Kingdom and Ireland supported by commercial and regulatory teams in certain international markets and a Centre of Excellence in India that has operational functions ranging from regulatory, supply chain, medical marketing, customer service, information technology and finance. AMCo operates a Centre of Excellence in India to support its main operations team in the United Kingdom and Ireland and its other teams globally. In 2014, the cost of AMCo’s Centre of Excellence in India was equivalent to 1.4% of AMCo’s total revenue.

S-11

See “Description of the AMCo Business.”

ACQUISITION RATIONALE

Concordia believes the Acquisition is aligned with its strategy of pursuing accretive acquisitions of legacy pharmaceutical products. The Corporation believes the Acquisition is highly complementary to its existing business and is expected to result in the following significant strategic and financial benefits to Concordia:

| | • | | Strong Financial Returns - The Acquisition is expected to be accretive to both revenue and adjusted earnings per share; |

| | • | | Platform for International Expansion - The Corporation anticipates that AMCo will provide it with an international platform for continued expansion; |

| | • | | Commercial Footprint - AMCo conducts business in over 100 countries, which will significantly expand the Corporation’s geographical commercial reach after the Acquisition; |

| | • | | Diversification - AMCo will diversify the Corporation’s product portfolio by adding more than 190 complementary, niche pharmaceutical products that may present technical barriers to entry as they are difficult to manufacture, and entail complex regulatory approval processes (88% of AMCo’s product portfolio is estimated to have two or fewer competitors), with no AMCo product representing more than 10% of AMCo’s total revenue in 2014; |

| | • | | Meaningful Operating Leverage - AMCo’s Indian operations provide a low-cost operations support centre that includes functions such as regulatory, supply chain, medical marketing, customer service, information technology and finance; |

| | • | | Complementary Business Strategy - AMCo’s flexible and asset-light business strategy, with an operating model based on the Indian operations support centre, third party manufacturers, and a limited marketing and promotion spend, is a strategic fit for Concordia and mirrors Concordia’s philosophy of focusing on niche life-cycle management opportunities for off-patent prescription drugs; |

| | • | | Opportunities for Organic Growth - The Acquisition is expected to present the Corporation with attractive growth opportunities through the continued optimization of AMCo’s existing portfolio and its pipeline consisting of over 60 product launches based on reformulations and new dosages; |

| | • | | Financial Scale for Future Acquisitions - The Acquisition is expected to enable the Corporation to focus its investments and resources on further growing its business by providing the financial scale to pursue future acquisitions and increase Concordia’s ability to compete for global, quality assets; |

| | • | | Improved Access to Capital - The Acquisition is expected to improve Concordia’s access to the capital markets as a result of enhanced size and diversification, as well benefit the Corporation’s credit profile by providing the Corporation with the ability to manage its indebtedness and de-lever over time; and |

| | • | | Experienced Management Team - The Acquisition provides the Corporation with a complementary team of senior executives that have extensive experience in the pharmaceutical industry. |

See“Acquisition Rationale”.

CONCORDIA FOLLOWING THE ACQUISITION

Concordia believes that, subsequent to the completion of the Acquisition, the Corporation will possess a number of attributes and competitive advantages that should enable it to maintain and grow revenues and operating cash flow.

| | • | | Sustainable Products Portfolio -Concordia’s portfolio pro forma for the Acquisition will consist of established, branded, off-patent and authorized generic products. The majority of the Corporation’s products and the products of AMCo have a long prescription |

S-12

| | history, an established prescriber base and a proven safety and efficacy profile. The United Kingdom has historically represented a large market for generic pharmaceutical products in Europe, with a value of approximately £6.5 billion in 2014 and forecasted growth of approximately 4% until 2019. Additionally, some of Concordia’s products benefit from barriers to entry such as complex formulation, manufacturing or regulatory challenges. The Corporation believes products with these characteristics will face a lesser degree of competition. |

| | • | | Diversified Revenue Stream - Giving effect to the Acquisition, the Corporation’s product portfolio will be comprised of a total of over 190 products across several therapeutics areas. As a result, Concordia expects that the Acquisition will significantly increase its size and scale while reducing its reliance on any individual product. No single product will represent more than 10% of pro forma 2014 revenue. After giving effect to the Acquisition, Donnatal® would account for approximately 8% of 2014 pro forma total revenue, Lanoxin®, Eltroxin, and Macrobid would each represent 6% of 2014 pro forma total revenue and Predsol would account for approximately 4% of 2014 pro forma total revenue. The Corporation believes that this enhanced diversification will increase the expected stability of its aggregate revenue base going forward. In addition, AMCo has developed a pipeline of products which consists of approximately 60 product launches over the next three years mostly in the form of new dosages or formulations of existing drugs. |

| | • | | Scalable Business Model with Reliable Outsourcing - Concordia’s and AMCo’s partnerships with service providers, including CMOs, are expected to continue to enable the Corporation to produce and deliver quality, safe and reliable products without being exposed to the headcount and fixed costs of operating a pharmaceutical manufacturing facility. The Corporation believes that its limited fixed costs and capital investments together with its targeted development and promotional spending will continue to enable the Corporation to maintain attractive Adjusted EBITDA margins and generate free cash flow. The acquisition of AMCo adds further capabilities as the Centre of Excellence in India provides operational functions ranging from regulatory, supply chain, medical marketing, customer service, information technology and finance that can be leveraged by Concordia. |

| | • | | Strong Financial Profile with High Margins and Cash Flow Generation - Concordia benefits from a high cash flow conversion profile. The Corporation’s cash flow generation can be attributed to attractive gross margins, controlled operating expenses and modest capital expenditures. The Corporation expects that the Acquisition will further enhance its ability to generate cash flow. For the twelve months ended December 31, 2014, the pro forma Adjusted EBITDA margin for the Corporation was 59%. The Corporation intends to employ its cash flow to manage its indebtedness and de-lever over time while opportunistically pursuing its acquisition-driven growth strategy to continue to enhance its product portfolio. |

| | • | | Track Record of Successfully Growing the Business through Acquisitions - The current Concordia management team has a demonstrated track record of successfully identifying, acquiring and integrating products and businesses in order to drive growth and realize synergies. Since 2013, the Corporation has successfully completed six acquisitions (not including the Acquisition) of varying size and complexity. |

| | • | | Strong Management with Extensive Industry Experience - Certain members of the Corporation’s executive management team and Board have, on average, 15 years of pharmaceutical product acquisition and operational experience. The Acquisition of AMCo and its experienced senior management team is expected to be complementary to and enhance the Corporation’s management team. |

See“Concordia Following the Acquisition”.

SELECTED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION

The following tables set forth Concordia’s selected unaudited pro forma consolidated financial information (i) for the year ended December 31, 2014, (ii) for the year ended December 31, 2014 after giving effect to the acquisition of Donnatal®, the acquisition of Zonegran®, the acquisition of the Covis Business, and the Acquisition, in each case as if such acquisitions had been effective on January 1, 2014, (iii) as at June 30, 2015 and for the six months ended June 30, 2015; and (iv) as at June 30, 2015 and for the six months ended June 30, 2015 after giving effect to the acquisition of the Covis Business and the Acquisition, in each case as if such acquisitions had been effective on January 1, 2014.

The selected unaudited pro forma consolidated financial information set forth below and included elsewhere in this Prospectus Supplement are for illustrative purposes only and not necessarily indicative of results of operations that

S-13

would have occurred as at or for the year ended December 31, 2014 or for the six months ended June 30, 2015 had the acquisitions of Donnatal® and Zonegran®, the Covis Business, and the Acquisition been effective January 1, 2014, or of the results of operations expected in 2015 and future years. The following pro forma financial information has been prepared by management of the Corporation on the basis of the information contained in this Prospectus Supplement, the Prospectus, or in documents incorporated by reference therein. This pro forma financial information is not a forecast or a projection of future results. The actual results of the combined operations for any period, whether before or after the Acquisition Closing, will likely vary from the amounts set forth in the following pro forma financial information and such variation may be material. See “Non-IFRS Measures” and “Risk Factors - Risk Factors Related to the Acquisition and the Debt Financing”.

Year ended December 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31, 2014 (US$ thousands) | | Concordia

Healthcare

Corp. | | | Donnatal®

Jan 1 - May

15, 2014 | | | Zonegran®

Jan 1 - Sep

30, 2014 | | | | | | Amdipharm

Mercury

Limited | | | Adjustments | | | Concordia

Healthcare | |

| | | | | Covis

Portfolio | | | | Pro Forma

Adjustments

(1)(2) | | | Corp. Pro

Forma

Consolidated(2) | |

Consolidated Statement of Earnings | | | | | | | | | | | | | | | | | | | | |

Revenue | | | 122,191 | | | | 17,607 | | | | 17,281 | | | | 151,534 | | | | 482,248 | | | | — | | | | 790,861 | |

Cost of sales | | | 17,989 | | | | 900 | | | | 4,311 | | | | 12,939 | | | | 120,618 | | | | — | | | | 156,757 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 104,202 | | | | 16,707 | | | | 12,970 | | | | 138,595 | | | | 361,630 | | | | — | | | | 634,104 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating expenses | | | | | | | | | | | | | | | | |

General and administrative | | | 20,663 | | | | 3,280 | | | | 1,994 | | | | 32,920 | | | | 77,315 | | | | — | | | | 136,172 | |

Acquisition, restructuring and other | | | 13,521 | | | | — | | | | — | | | | — | | | | 7,627 | | | | (12,163 | ) | | | 8,985 | |

Selling and marketing | | | 10,229 | | | | 1,159 | | | | 566 | | | | — | | | | 37,069 | | | | — | | | | 49,023 | |

Research and development | | | 9,301 | | | | 94 | | | | — | | | | — | | | | 5,076 | | | | — | | | | 14,471 | |

Share-based compensation | | | 4,484 | | | | — | | | | — | | | | 2,690 | | | | — | | | | — | | | | 7,174 | |

Amortization of intangible assets | | | 11,039 | | | | — | | | | — | | | | 36,117 | | | | 73,702 | | | | (36,117 | ) | | | 163,862 | |

| | | | | | | | | | | | | | | 47,822 | | | | | |

| | | | | | | | | | | | | | | 8,696 | | | | | |

| | | | | | | | | | | | | | | 22,603 | | | | | |

Depreciation expense | | | 131 | | | | 114 | | | | — | | | | — | | | | 1,476 | | | | — | | | | 1,721 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 69,368 | | | | 4,647 | | | | 2,560 | | | | 71,727 | | | | 202,265 | | | | 30,841 | | | | 381,408 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 34,834 | | | | 12,060 | | | | 10,410 | | | | 66,868 | | | | 159,365 | | | | (30,841 | ) | | | 252,696 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other income and expenses | | | | | | | | | | | | | | | | | | | | |

Interest and accretion expense | | | 12,194 | | | | — | | | | — | | | | 10,523 | | | | 160,194 | | | | (10,523 | ) | | | 223,601 | |

| | | | | | | | | | | | | | | (6,332 | ) | | | | |

| | | | | | | | | | | | | | | 78,763 | | | | | |

| | | | | | | | | | | | | | | 6,113 | | | | | |

| | | | | | | | | | | | | | | 162,957 | | | | | |

| | | | | | | | | | | | | | | (30,094 | ) | | | | |

| | | | | | | | | | | | | | | (160,194 | ) | | | | |

Finance income | | | — | | | | — | | | | — | | | | — | | | | (1,304 | ) | | | — | | | | (1,304 | ) |

Change in fair value of contingent consideration | | | 2,629 | | | | — | | | | — | | | | — | | | | 1,820 | | | | — | | | | 4,449 | |

Foreign exchanges loss (gain) | | | 696 | | | | — | | | | — | | | | — | | | | (15,055 | ) | | | 15,055 | | | | 696 | |

Other (income) expense | | | 203 | | | | — | | | | 38 | | | | (159 | ) | | | (545 | ) | | | — | | | | (463 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before tax | | | 19,112 | | | | 12,060 | | | | 10,372 | | | | 56,504 | | | | 14,255 | | | | (86,586 | ) | | | 25,717 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income taxes | | | 7,522 | | | | — | | | | 3,994 | | | | 3,353 | | | | 4,040 | | | | (24,507 | ) | | | 43,416 | |

Net income (loss) | | | 11,590 | | | | 12,060 | | | | 6,378 | | | | 53,151 | | | | 10,215 | | | | (111,093 | ) | | | (17,699 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

S-14

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31, 2014 (US$ thousands) | | Concordia

Healthcare

Corp. | | | | | | Covis

Portfolio | | | Amdipharm

Mercury

Limited | | | Adjustments | | | Concordia

Healthcare | |

| | | Donnatal®

Jan 1 - May

15, 2014 | | | Zonegran®

Jan 1 - Sep

30, 2014 | | | | | Pro Forma

Adjustments

(1)(2) | | | Corp. Pro

Forma

Consolidated(2) | |

Other financial and operating metrics: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA (3) | | | 64,009 | | | | 12,174 | | | | 10,410 | | | | 123,507 | | | | 255,572 | | | | | | | | 463,065 | |

Adjusted EBITDA margin(4) | | | 52 | % | | | 69 | % | | | 60 | % | | | 82 | % | | | 53 | % | | | | | | | 59 | % |

Pro forma Adjusted EBITDA (3)(5) | | | | | | | | | | | | | | | | | | | | | | | | | | | 500,617 | |

Reconciliation of net income to EBITDA and Adjusted EBITDA: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | 11,590 | | | | 12,060 | | | | 6,378 | | | | 53,151 | | | | 10,215 | | | | (111,093 | ) | | | (17,699 | ) |

Depreciation and amortization (6) | | | 11,170 | | | | 114 | | | | — | | | | 36,280 | | | | 75,177 | | | | 42,842 | | | | 165,583 | |

Interest expense | | | 12,194 | | | | — | | | | — | | | | 10,523 | | | | 160,194 | | | | 40,690 | | | | 223,601 | |

Finance income | | | — | | | | — | | | | — | | | | — | | | | (1,304 | ) | | | — | | | | (1,304 | ) |

Income taxes | | | 7,522 | | | | — | | | | 3,994 | | | | 3,353 | | | | 4,040 | | | | 24,507 | | | | 43,416 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA(3) | | | 42,476 | | | | 12,174 | | | | 10,372 | | | | 103,307 | | | | 248,322 | | | | (3,054 | ) | | | 413,597 | |

Change in fair value of contingent consideration | | | 2,629 | | | | — | | | | — | | | | — | | | | 1,820 | | | | | | | | 4,449 | |

Stock-based compensation | | | 4,484 | | | | — | | | | — | | | | 2,690 | | | | — | | | | — | | | | 7,174 | |

Acquisition, restructuring and other (7) | | | 13,521 | | | | — | | | | — | | | | 2,445 | | | | 7,627 | | | | (14,608 | ) | | | 8,985 | |

Foreign exchange loss (gain) | | | 696 | | | | — | | | | — | | | | — | | | | (15,055 | ) | | | 15,055 | | | | 696 | |

Other (income) expense | | | 203 | | | | — | | | | 38 | | | | (159 | ) | | | (545 | ) | | | — | | | | (463 | ) |

Discontinued sales & marketing expenses (8) | | | — | | | | — | | | | — | | | | 15,224 | | | | — | | | | — | | | | 15,224 | |

Other non-recurring costs (9) | | | — | | | | — | | | | — | | | | — | | | | 13,403 | | | | — | | | | 13,403 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA(3) | | | 64,009 | | | | 12,174 | | | | 10,410 | | | | 123,507 | | | | 255,572 | | | | (2,607 | ) | | | 463,065 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Pro forma adjustment for acquisition of pharmaceutical products(10) | | | | | | | | | | | | | | | | | | | | | | | | | | | 26,023 | |

Impact of AMCo’s cost savings programs(11) | | | | | | | | | | | | | | | | | | | | | | | | | | | 11,529 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Pro forma Adjusted

EBITDA (3)(5) | | | | | | | | | | | | | | | | | | | | | | | | | | | 500,617 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Notes:

| (1) | See the pro forma financial statements of the Corporation attached hereto as Appendix “C” for details regarding the pro forma adjustments. |

| (2) | Includes estimated gross proceeds from the Offering of US$577,840, assuming the issuance of 8,000,000 Offered Shares at a price of US$72.23, which was the closing price of the Common Shares on NASDAQ on September 18, 2015. |

| (3) | EBITDA, Adjusted EBITDA and pro forma Adjusted EBITDA each represent non-IFRS measures. See “Non-IFRS Measures” for the definitions of EBITDA and Adjusted EBITDA. Please refer to the above table for a reconciliation of reported net income to EBITDA and Adjusted EBITDA. Pro forma Adjusted EBITDA includes additional pro forma adjustments related to AMCo which were not included in the pro forma financial statements attached hereto as Appendix “C”. |

| (4) | Adjusted EBITDA margin represents Adjusted EBITDA divided by revenue. |

| (5) | Pro forma Adjusted EBITDA includes additional pro forma adjustments related to AMCo which were not included in the pro forma financial statements attached hereto as Appendix “C”. |

| (6) | Includes $36,117 of amortization and $163 of depreciation expense included in the Covis Business’ general and administrative expenses. |

| (7) | Acquisition related costs of $2,445 are included in the Covis Business’ general and administrative expenses. |

| (8) | Represents one-time costs related to a selling and marketing initiative, which was discontinued in October 2014. |

| (9) | Represents non-recurring one-time costs primarily related to dual sourcing and other non-recurring special projects. |

| (10) | Represents EBITDA from acquisitions that are not included in AMCo’s results. |

| (11) | Represents the pro forma impact of cost savings initiatives implemented by AMCo during the year ended December 31, 2014. |

Six months ended June 30, 2015

| | | | | | | | | | | | | | | | | | | | |

6 months ended June 30, 2015 (US$ thousands) | | Concordia

Healthcare

Corp.(1) | | | Covis

Portfolio(2) | | | Amdipharm

Mercury

Limited | | | Adjustments | | | Concordia

Healthcare | |

| | | | | Pro Forma

Adjustments

(3)(4) | | | Corp. Pro

Forma

Consolidated(4) | |

Consolidated Statement of Earnings | | | | | | | | | | | | | | | | | | | | |

Revenue | | | 113,949 | | | | 60,880 | | | | 251,729 | | | | (2,124 | ) | | | 424,434 | |

Cost of sales | | | 11,150 | | | | 5,638 | | | | 69,775 | | | | (106 | ) | | | 86,457 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 102,779 | | | | 55,242 | | | | 181,954 | | | | (2,018 | ) | | | 337,977 | |

| | | | | | | | | | | | | | | | | | | | |

Operating Expenses | | | | | | | | | | | | | | | | | | | | |

General and administrative | | | 14,616 | | | | 5,280 | | | | 33,109 | | | | — | | | | 53,005 | |

Acquisition, restructuring and other | | | 12,556 | | | | — | | | | 3,548 | | | | (10,820 | ) | | | 5,284 | |

S-15

| | | | | | | | | | | | | | | | | | | | |

6 months ended June 30, 2015 (US$ thousands) | | Concordia

Healthcare

Corp.(1) | | | Covis

Portfolio(2) | | | Amdipharm

Mercury

Limited | | | Adjustments | | | Concordia

Healthcare | |

| | | | | Pro Forma

Adjustments

(3)(4) | | | Corp. Pro

Forma

Consolidated(4) | |

Selling and marketing | | | 7,329 | | | | — | | | | 18,297 | | | | — | | | | 25,626 | |

Research and development | | | 5,792 | | | | — | | | | 620 | | | | — | | | | 6,412 | |

Share-based compensation | | | 5,017 | | | | 698 | | | | — | | | | — | | | | 5,715 | |

Exchange listing expenses | | | 574 | | | | — | | | | — | | | | — | | | | 574 | |

Amortization of intangible assets | | | 20,260 | | | | 10,522 | | | | 36,434 | | | | (10,522 | ) | | | 80,369 | |

| | | | | | | | | | | | | | | 11,956 | | | | | |

| | | | | | | | | | | | | | | 11,719 | | | | | |

Depreciation expense | | | 128 | | | | — | | | | 905 | | | | — | | | | 1,033 | |

| | | | | | | | | | | | | | | | | | | | |

Total Operating Expenses | | | 66,272 | | | | 16,500 | | | | 92,913 | | | | 2,333 | | | | 178,018 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 36,527 | | | | 38,742 | | | | 89,041 | | | | (4,351 | ) | | | 159,959 | |

| | | | | | | | | | | | | | | | | | | | |

Other income and expenses | | | | | | | | | | | | | | | | | | | | |

Interest and accretion expense | | | 27,653 | | | | 2,598 | | | | 89,597 | | | | (2,598 | ) | | | 108,180 | |

| | | | | | | | | | | | | | | (8,641 | ) | | | | |

| | | | | | | | | | | | | | | 19,691 | | | | | |

| | | | | | | | | | | | | | | 1,528 | | | | | |

| | | | | | | | | | | | | | | 81,479 | | | | | |

| | | | | | | | | | | | | | | (13,530 | ) | | | | |

| | | | | | | | | | | | | | | (89,597 | ) | | | | |

Finance income | | | — | | | | — | | | | (631 | ) | | | — | | | | (631 | ) |

Impairment loss | | | 668 | | | | — | | | | — | | | | — | | | | 668 | |

Change in fair value of contingent consideration | | | (6,224 | ) | | | — | | | | — | | | | — | | | | (6,224 | ) |

Foreign exchanges loss (gain) | | | (282 | ) | | | — | | | | (52,139 | ) | | | 52,139 | | | | (282 | ) |

Fair value loss on foreign exchange forward contract | | | 5,126 | | | | — | | | | — | | | | — | | | | 5,126 | |

Other (income) expense | | | 400 | | | | (78 | ) | | | (238 | ) | | | — | | | | 84 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before tax | | | 9,186 | | | | 36,222 | | | | 52,452 | | | | (44,822 | ) | | | 53,038 | |

| | | | | | | | | | | | | | | | | | | | |

Income taxes | | | | | | | | | | | | | | | | | | | | |

Current | | | 475 | | | | 3,412 | | | | 16,642 | | | | 7,088 | | | | 27,617 | |

Deferred | | | 3,598 | | | | — | | | | (4,373 | ) | | | (2,344 | ) | | | (3,119 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | 5,113 | | | | 32,810 | | | | 40,183 | | | | (49,566 | ) | | | 28,540 | |

| | | | | | | | | | | | | | | | | | | | |

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | | 140,207 | | | | n/a | | | | 67,910 | | | | (114,132) | | | | 93,985 | |

Working capital balance(5) | | | 168,426 | | | | n/a | | | | 123,736 | | | | (114,132) | | | | 178,030 | |

Total assets | | | 1,938,452 | | | | n/a | | | | 1,750,534 | | | | 2,196,012 | | | | 5,884,998 | |

Total debt(6) | | | 1,295,927 | | | | n/a | | | | 1,472,323 | | | | 867,720 | | | | 3,635,970 | |