Q4 and Full Year 2021 Earnings Presentation January 25, 2022 Exhibit 99.1

Important Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements may be identified by the use of words such as “may,” “will,” “continue,” “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” “should,” “could,” “would,” “predict,” “potential,” and “project,” the negative of these terms, or other comparable terminology and similar expressions. Forward-looking statements may include projected financial information and results as well as statements about Daseke’s goals, including its restructuring plans; Daseke’s financial strategy, liquidity and capital required for its business strategy and plans; and general economic conditions. The forward-looking statements contained herein are based on information available as of the date of this news release and current expectations, forecasts and assumptions. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that Daseke anticipates, and readers are cautioned not to place undue reliance on the forward-looking statements. A number of factors, many of which are beyond our control, could cause actual results or outcomes to differ materially from those indicated by the forward-looking statements contained herein. These factors include, but are not limited to, general economic and business risks, such as downturns in customers’ business cycles and disruptions in capital and credit markets (including as a result of the coronavirus (COVID-19) pandemic or other global and national heath epidemics or concerns); Daseke’s ability to adequately address downward pricing and other competitive pressures; driver shortages and increases in driver compensation or owner-operator contracted rates; Daseke’s ability to execute and realize all of the expected benefits of its integration, business improvement and comprehensive restructuring plans; loss of key personnel; Daseke’s ability to realize all of the intended benefits from recent or future acquisitions; Daseke’s ability to complete recent or future divestitures successfully; seasonality and the impact of weather and other catastrophic events; fluctuations in the price or availability of diesel fuel; increased prices for, or decreases in the availability of, new revenue equipment and decreases in the value of used revenue equipment; Daseke’s ability to generate sufficient cash to service all of its indebtedness and Daseke’s ability to finance its capital requirements; restrictions in Daseke’s existing and future debt agreements; increases in interest rates; changes in existing laws or regulations, including environmental and worker health safety laws and regulations and those relating to tax rates or taxes in general; the impact of governmental regulations and other governmental actions related to Daseke and its operations; insurance and claims expenses; and litigation and governmental proceedings. For additional information regarding known material factors that could cause our actual results to differ from those expressed in forward-looking statements, please see Daseke’s filings with the Securities and Exchange Commission (the “SEC”), available at www.sec.gov, including Daseke’s Annual Report on Form 10-K/A filed with the SEC on May, 6, 2021 and subsequent Quarterly Reports on Form 10-Q, particularly the section titled “Risk Factors.” The effect of the COVID-19 pandemic may remain prevalent for a significant period of time and may continue to adversely affect the Company’s business, results of operations and financial condition even after the COVID-19 pandemic has subsided. The extent to which the COVID-19 pandemic impacts the Company will depend on numerous evolving factors and future developments that we are not able to predict. There are no comparable recent events that provide guidance as to the effect the COVID-19 global pandemic may have, and, as a result, the ultimate impact of the pandemic is highly uncertain and subject to change. Additionally, the Company will regularly evaluate its capital structure and liquidity position. From time to time and as opportunities arise, the Company may access the debt capital markets and modify its debt arrangements to optimize its capital structure and liquidity position. Daseke does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date as of when they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. You should not place undue reliance on these forward-looking statements. Non-GAAP Financial Measures This presentation includes non-GAAP financial measures for the Company and its reporting segments. The Company believes its presentation of Non-GAAP financial measures is useful because it provides investors and industry analysts the same information that the Company uses internally for purposes of assessing its core operating performance. You can find the reconciliations of these measures to the nearest comparable GAAP measure in the Appendix of this presentation. We have not reconciled non‐GAAP forward-looking measures to their corresponding GAAP measures because certain items that impact these measures are unavailable or cannot be reasonably predicted without unreasonable efforts. In particular, we have not reconciled our expectations as to forward-looking EBITDA or Adjusted EBITDA to net income due to the difficulty in making an accurate projection as to the change in fair value of warrant liability, which will have a significant impact on our GAAP net income; accordingly, a reconciliation of forward-looking EBITDA or Adjusted EBITDA to net income is not available without unreasonable efforts. Please note that non-GAAP measures are not a substitute for, or more meaningful than, net income (loss), cash flows from operating activities, operating income or any other measure prescribed by GAAP, and there are limitations to using non-GAAP measures. Certain items excluded from these non-GAAP measures are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital, tax structure and the historic costs of depreciable assets. Also, other companies in Daseke’s industry may define these non‐GAAP measures differently than Daseke does, and as a result, it may be difficult to use these non‐GAAP measures to compare the performance of those companies to Daseke’s performance. Because of these limitations, these non-GAAP measures should not be considered a measure of the income generated by Daseke’s business or discretionary cash available to it to invest in the growth of its business. Daseke’s management compensates for these limitations by relying primarily on Daseke’s GAAP results and using these non-GAAP measures supplementally. In the non-GAAP measures discussed below, management refers to certain material items that management believes do not reflect the Company’s core operating performance, which management believes represent its performance in the ordinary, ongoing and customary course of its operations. Management views the Company’s core operating performance as its operating results excluding the impact of items including, but not limited to, stock-based compensation, impairments, amortization of intangible assets, restructuring, business transformation costs, and severance. Management believes excluding these items enables investors to evaluate more clearly and consistently the Company’s core operational performance in the same manner that management evaluates its core operational performance. Daseke defines: EBITDA as net income (loss) plus (i) depreciation and amortization, (ii) interest, and (iii) income taxes. Adjusted EBITDA as net income (loss) plus (i) depreciation and amortization, (ii) interest, (iii) income taxes, and (iv) other material items that management believes do not reflect our core operating performance. Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of total revenue. Adjusted EBITDA less Net Cash Capex is defined as Adjusted EBITDA less purchases of property and equipment and proceeds from sale of property and equipment. Adjusted Net Income (Loss) as net income (loss) tax-adjusted using an adjusted effective tax rate for material items that management believes do not reflect our core operating performance. Adjusted Net Income (Loss) per share as Adjusted Net Income (Loss) divided by the weighted average number of shares of common stock outstanding during the period under the two-class method. Free Cash Flow as net cash provided by operating activities less purchases of property and equipment, plus proceeds from sale of property and equipment as such amounts are shown on the face of the Statements of Cash Flows. Adjusted Operating Income (Loss) as total revenue less Adjusted Operating Expenses. Adjusted Operating Expenses as total operating expenses less: material items that management believes do not reflect our core operating performance. Adjusted Operating Ratio as Adjusted Operating Expenses, as a percentage of total revenue. Revenue excluding fuel surcharge as revenue less fuel surcharges. Net Debt as total debt less cash and cash equivalents. Rate per mile is the period’s revenue less fuel surcharge, brokerage and logistics revenues divided by total number of company and owner-operator miles driven in the period. Revenue per Tractor is the period’s revenue less fuel surcharge, brokerage and logistics revenues divided by the average number of tractors in the period, including owner-operator tractors. The Company uses certain metrics and ratios as a supplement to its GAAP results in evaluating certain aspects of its business, as described below. The Company presents certain measures on an “ex-Aveda” basis. These measures exclude the impact of the Aveda business. Although we ceased generating revenues from the Aveda business and completed the wind-down of our Aveda operations in 2020, we continued to recognize income and expenses, primarily relating to workers compensation claims and insurance proceeds, from the Aveda business in 2021. See the Appendix for directly comparable GAAP measures. Industry and Market Data This presentation includes market data and other statistical information from third party sources, including independent industry publications, government publications and other published independent sources. Although Daseke believes these third-party sources are reliable as of their respective dates, Daseke has not independently verified the accuracy or completeness of this information.

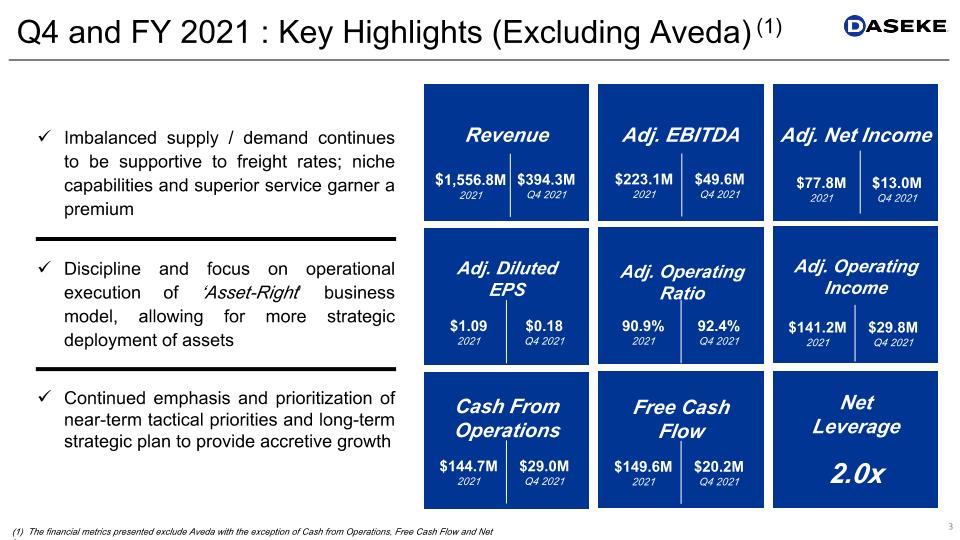

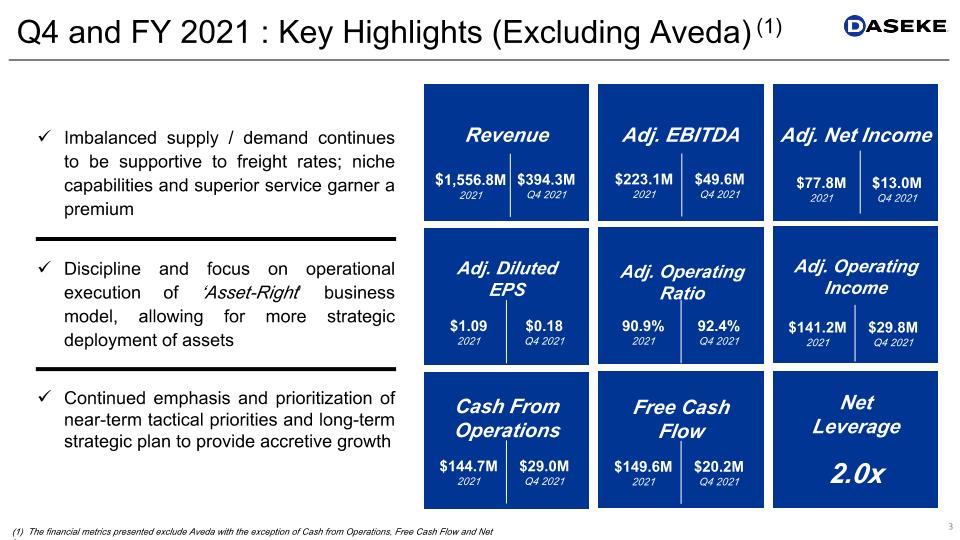

Q4 and FY 2021 : Key Highlights (Excluding Aveda) (1) 88.0% Adj. Operating Ratio 88.8% Operating Ratio Imbalanced supply / demand continues to be supportive to freight rates; niche capabilities and superior service garner a premium Discipline and focus on operational execution of ‘Asset-Right’ business model, allowing for more strategic deployment of assets Continued emphasis and prioritization of near-term tactical priorities and long-term strategic plan to provide accretive growth Cash From Operations Revenue Adj. EBITDA Net Leverage 2.0x Adj. Net Income Adj. Diluted EPS Free Cash Flow Adj. Operating Income 3 $223.1M 2021 $49.6M Q4 2021 $1,556.8M 2021 $394.3M Q4 2021 $1.09 2021 $0.18 Q4 2021 $144.7M 2021 $29.0M Q4 2021 $149.6M 2021 $20.2M Q4 2021 $77.8M 2021 $13.0M Q4 2021 $141.2M 2021 $29.8M Q4 2021 90.9% 2021 92.4% Q4 2021 Adj. Operating Ratio (1) The financial metrics presented exclude Aveda with the exception of Cash from Operations, Free Cash Flow and Net Leverage.

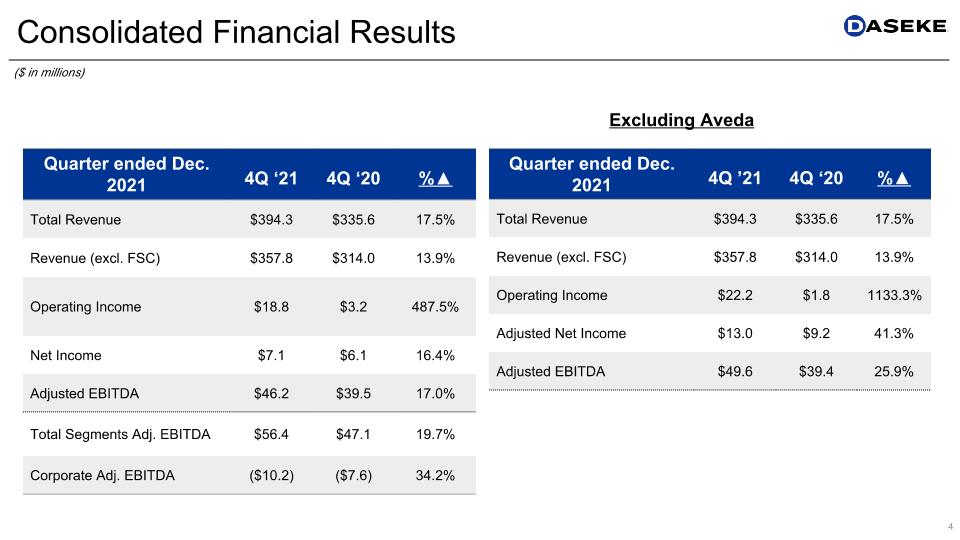

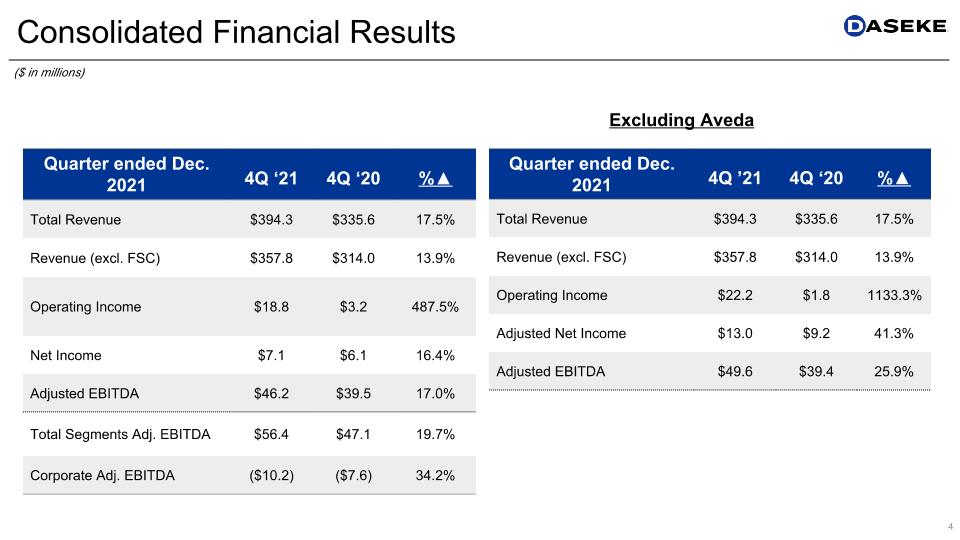

Consolidated Financial Results Quarter ended Dec. 2021 4Q ’21 4Q ‘20 %▲ Total Revenue $394.3 $335.6 17.5% Revenue (excl. FSC) $357.8 $314.0 13.9% Operating Income $22.2 $1.8 1133.3% Adjusted Net Income $13.0 $9.2 41.3% Adjusted EBITDA $49.6 $39.4 25.9% Excluding Aveda ($ in millions) Quarter ended Dec. 2021 4Q ‘21 4Q ‘20 %▲ Total Revenue $394.3 $335.6 17.5% Revenue (excl. FSC) $357.8 $314.0 13.9% Operating Income $18.8 $3.2 487.5% Net Income $7.1 $6.1 16.4% Adjusted EBITDA $46.2 $39.5 17.0% Total Segments Adj. EBITDA $56.4 $47.1 19.7% Corporate Adj. EBITDA ($10.2) ($7.6) 34.2%

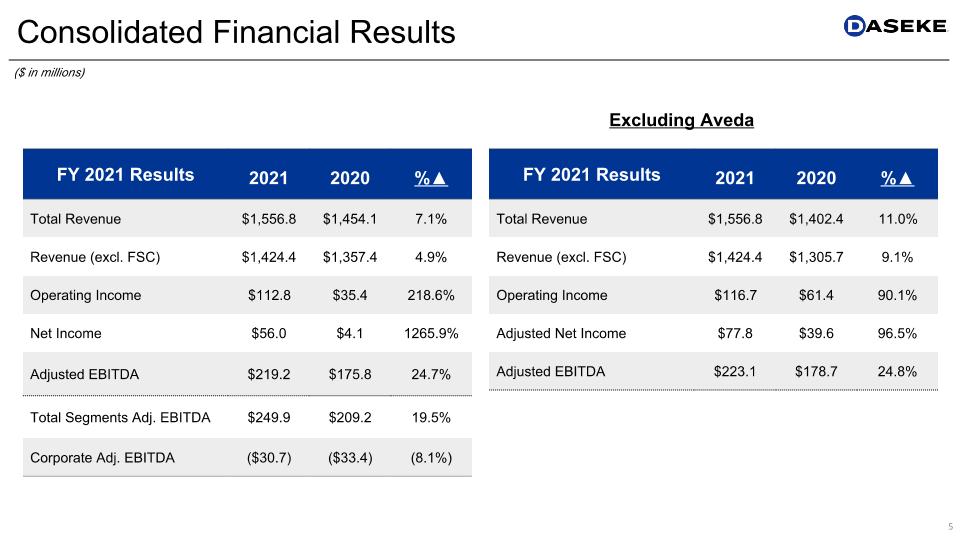

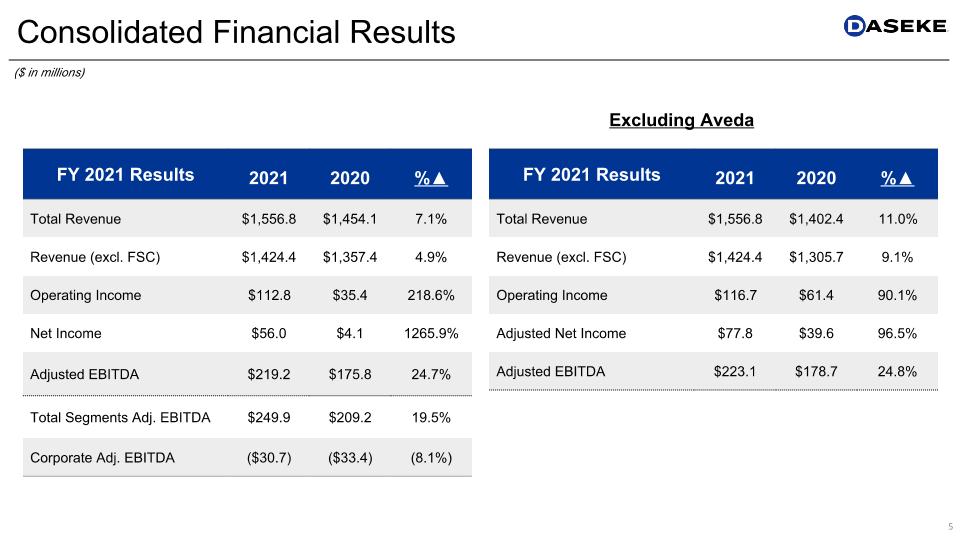

Consolidated Financial Results FY 2021 Results 2021 2020 %▲ Total Revenue $1,556.8 $1,402.4 11.0% Revenue (excl. FSC) $1,424.4 $1,305.7 9.1% Operating Income $116.7 $61.4 90.1% Adjusted Net Income $77.8 $39.6 96.5% Adjusted EBITDA $223.1 $178.7 24.8% Excluding Aveda ($ in millions) FY 2021 Results 2021 2020 %▲ Total Revenue $1,556.8 $1,454.1 7.1% Revenue (excl. FSC) $1,424.4 $1,357.4 4.9% Operating Income $112.8 $35.4 218.6% Net Income $56.0 $4.1 1265.9% Adjusted EBITDA $219.2 $175.8 24.7% Total Segments Adj. EBITDA $249.9 $209.2 19.5% Corporate Adj. EBITDA ($30.7) ($33.4) (8.1%)

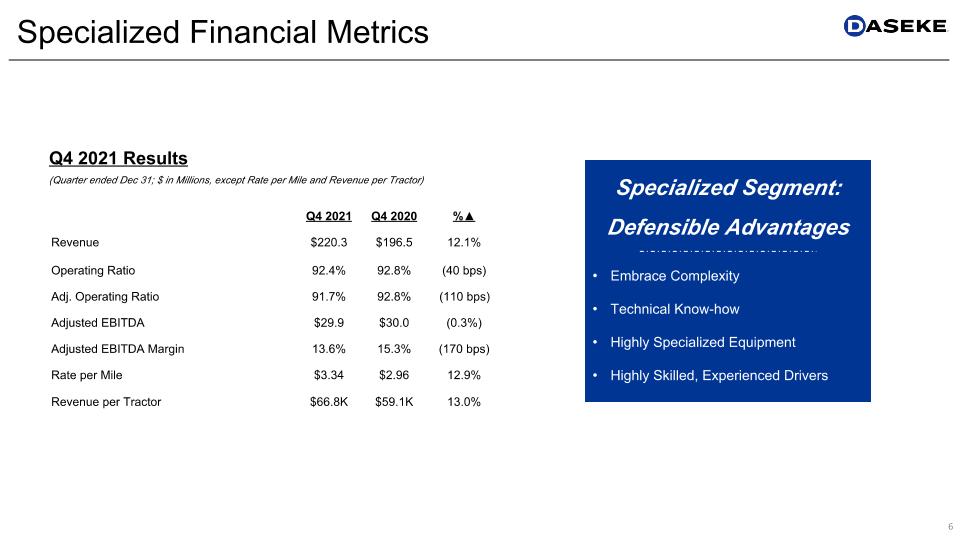

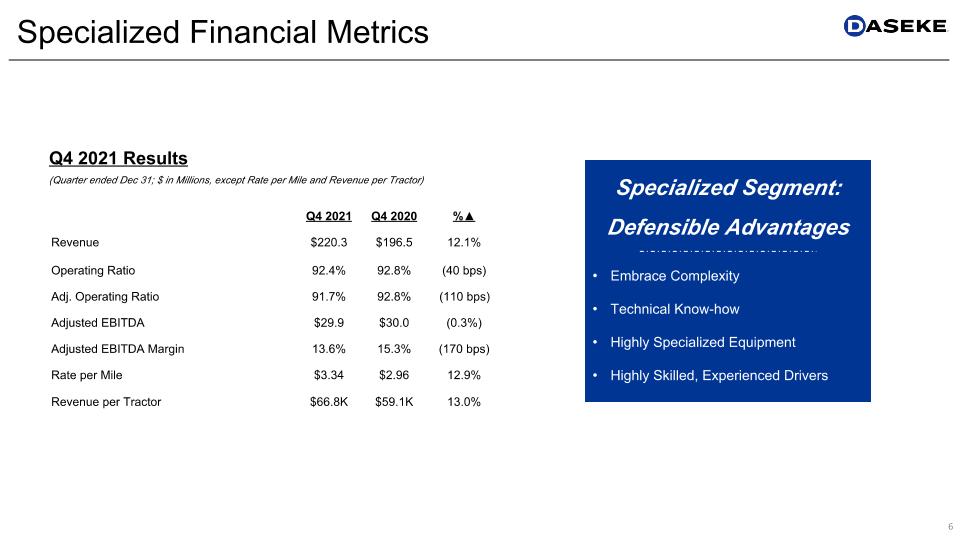

Specialized Financial Metrics Q4 2021 Q4 2020 %▲ Revenue $220.3 $196.5 12.1% Operating Ratio 92.4% 92.8% (40 bps) Adj. Operating Ratio 91.7% 92.8% (110 bps) Adjusted EBITDA $29.9 $30.0 (0.3%) Adjusted EBITDA Margin 13.6% 15.3% (170 bps) Rate per Mile $3.34 $2.96 12.9% Revenue per Tractor $66.8K $59.1K 13.0% (Quarter ended Dec 31; $ in Millions, except Rate per Mile and Revenue per Tractor) Q4 2021 Results Specialized Segment: Defensible Advantages Embrace Complexity Technical Know-how Highly Specialized Equipment Highly Skilled, Experienced Drivers

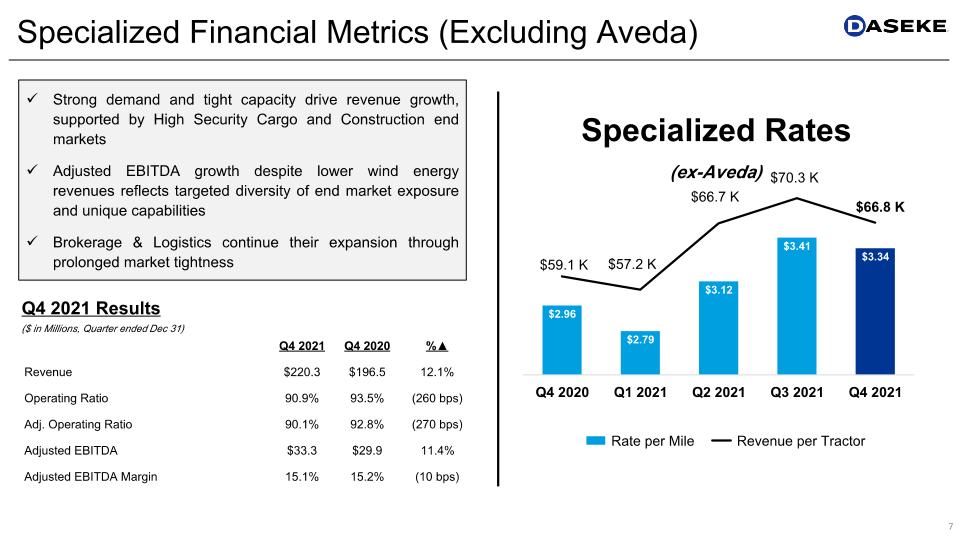

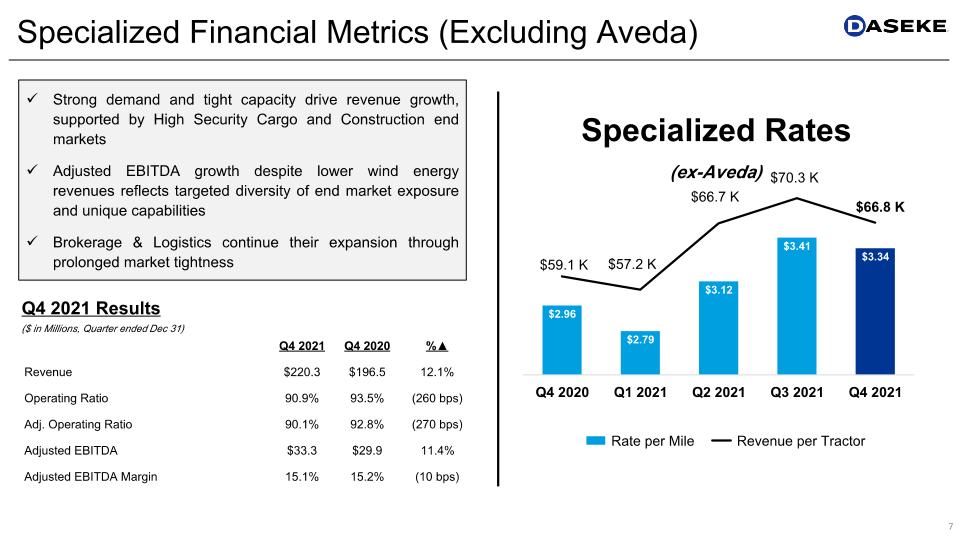

Specialized Financial Metrics (Excluding Aveda) Q4 2021 Q4 2020 %▲ Revenue $220.3 $196.5 12.1% Operating Ratio 90.9% 93.5% (260 bps) Adj. Operating Ratio 90.1% 92.8% (270 bps) Adjusted EBITDA $33.3 $29.9 11.4% Adjusted EBITDA Margin 15.1% 15.2% (10 bps) ($ in Millions, Quarter ended Dec 31) Q4 2021 Results Strong demand and tight capacity drive revenue growth, supported by High Security Cargo and Construction end markets Adjusted EBITDA growth despite lower wind energy revenues reflects targeted diversity of end market exposure and unique capabilities Brokerage & Logistics continue their expansion through prolonged market tightness

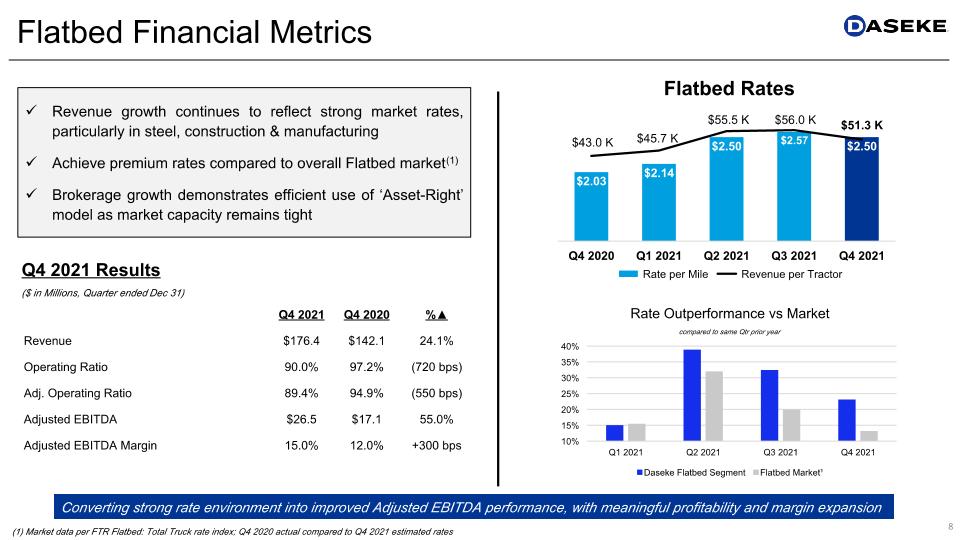

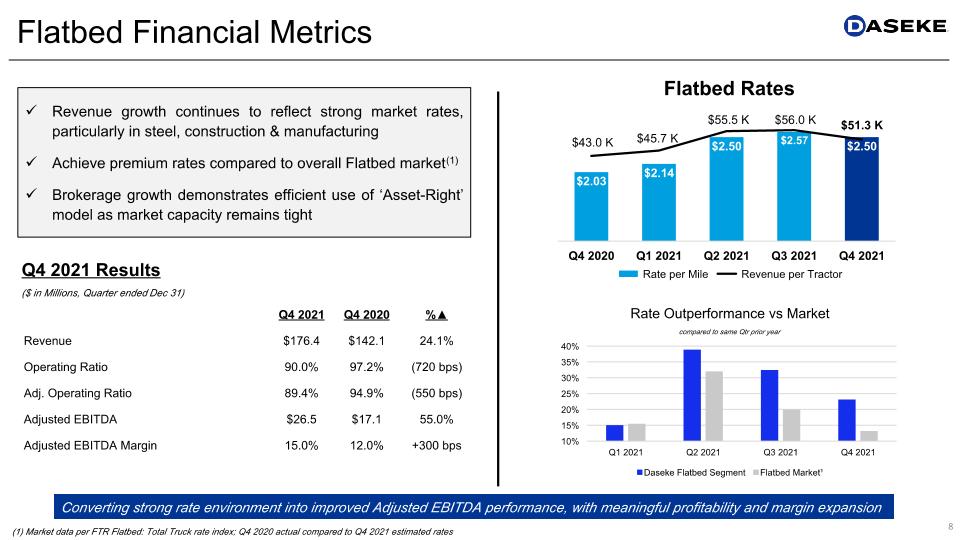

Flatbed Financial Metrics Q4 2021 Q4 2020 %▲ Revenue $176.4 $142.1 24.1% Operating Ratio 90.0% 97.2% (720 bps) Adj. Operating Ratio 89.4% 94.9% (550 bps) Adjusted EBITDA $26.5 $17.1 55.0% Adjusted EBITDA Margin 15.0% 12.0% +300 bps ($ in Millions, Quarter ended Dec 31) Q4 2021 Results Revenue growth continues to reflect strong market rates, particularly in steel, construction & manufacturing Achieve premium rates compared to overall Flatbed market(1) Brokerage growth demonstrates efficient use of ‘Asset-Right’ model as market capacity remains tight (1) Market data per FTR Flatbed: Total Truck rate index; Q4 2020 actual compared to Q4 2021 estimated rates Converting strong rate environment into improved Adjusted EBITDA performance, with meaningful profitability and margin expansion

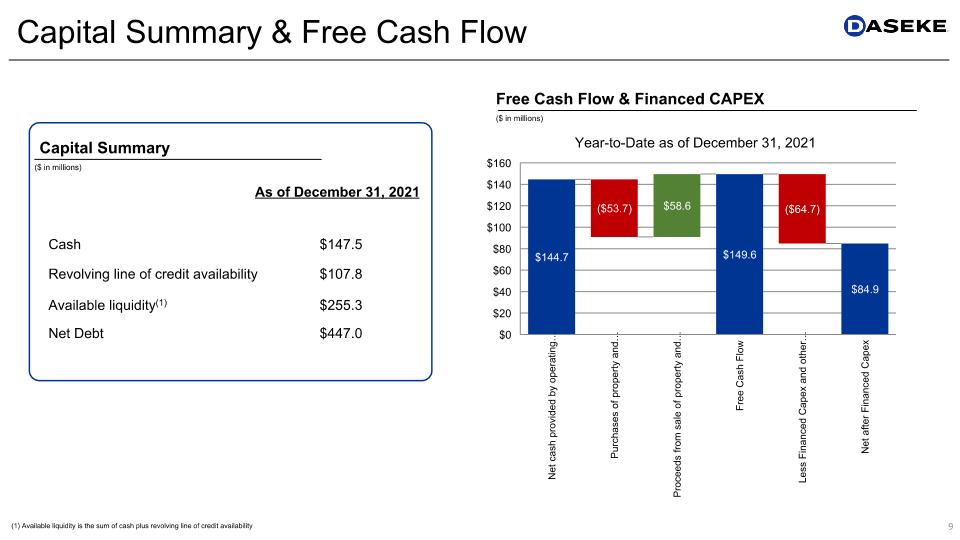

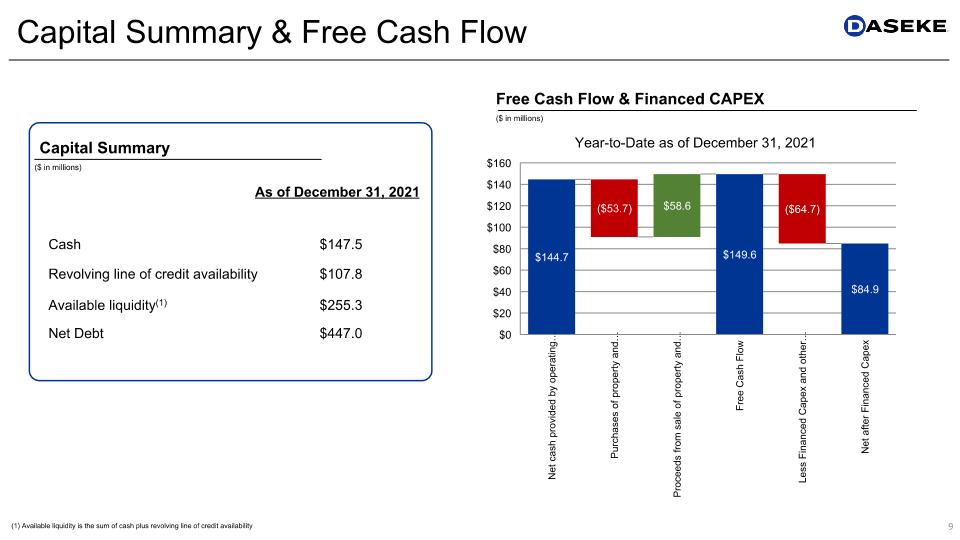

Cash $147.5 Revolving line of credit availability $107.8 Available liquidity(1) $255.3 Net Debt $447.0 Capital Summary & Free Cash Flow (1) Available liquidity is the sum of cash plus revolving line of credit availability ($ in millions) Capital Summary As of December 31, 2021 ($ in millions) Free Cash Flow & Financed CAPEX

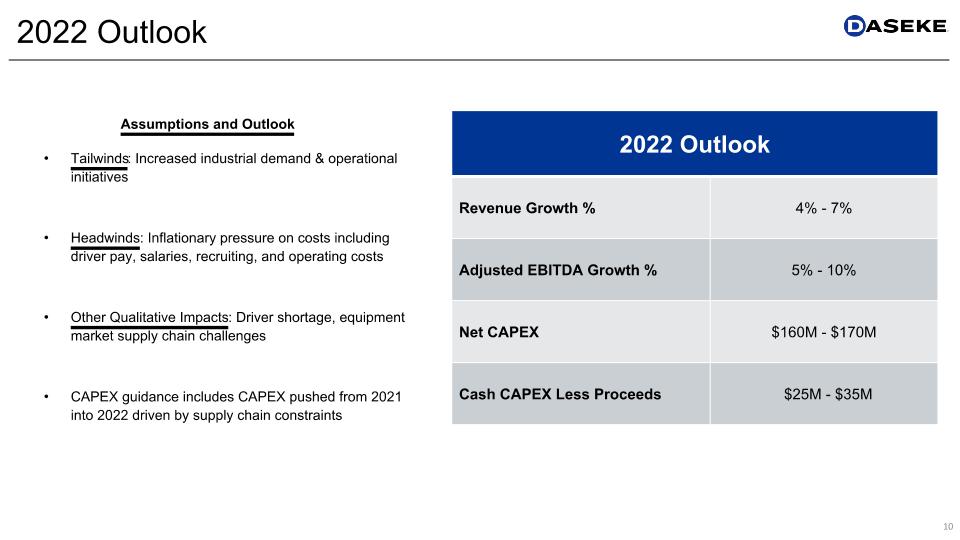

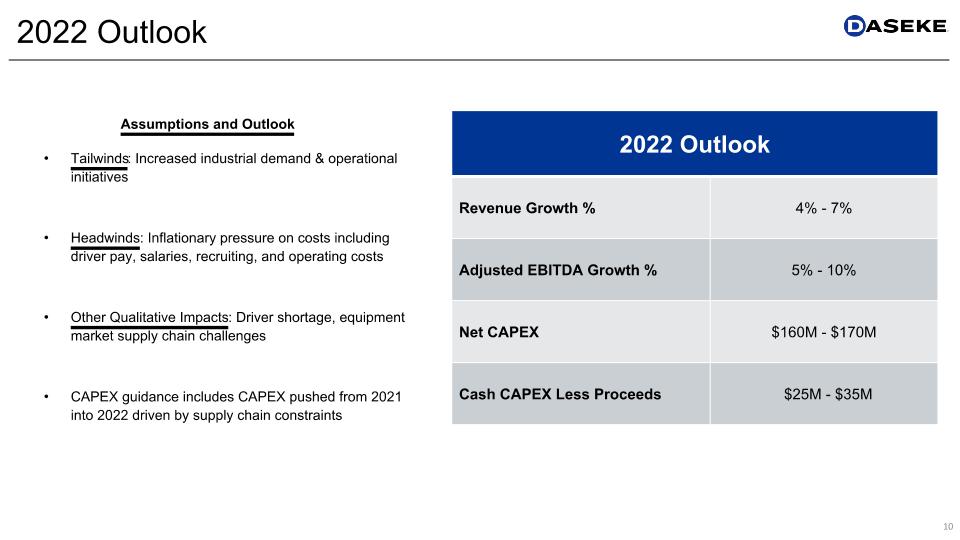

2022 Outlook Assumptions and Outlook Tailwinds: Increased industrial demand & operational initiatives Headwinds: Inflationary pressure on costs including driver pay, salaries, recruiting, and operating costs Other Qualitative Impacts: Driver shortage, equipment market supply chain challenges CAPEX guidance includes CAPEX pushed from 2021 into 2022 driven by supply chain constraints 2022 Outlook Revenue Growth % 4% - 7% Adjusted EBITDA Growth % 5% - 10% Net CAPEX $160M - $170M Cash CAPEX Less Proceeds $25M - $35M

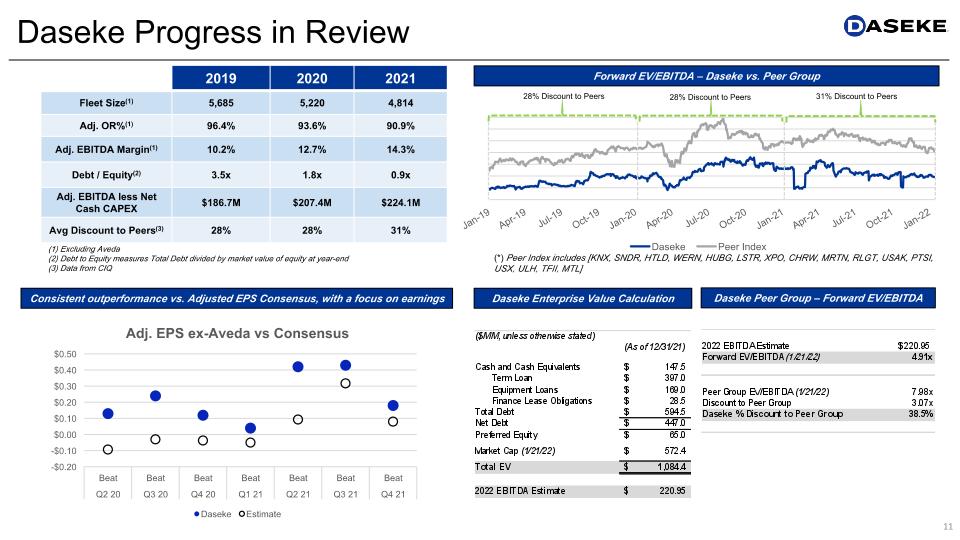

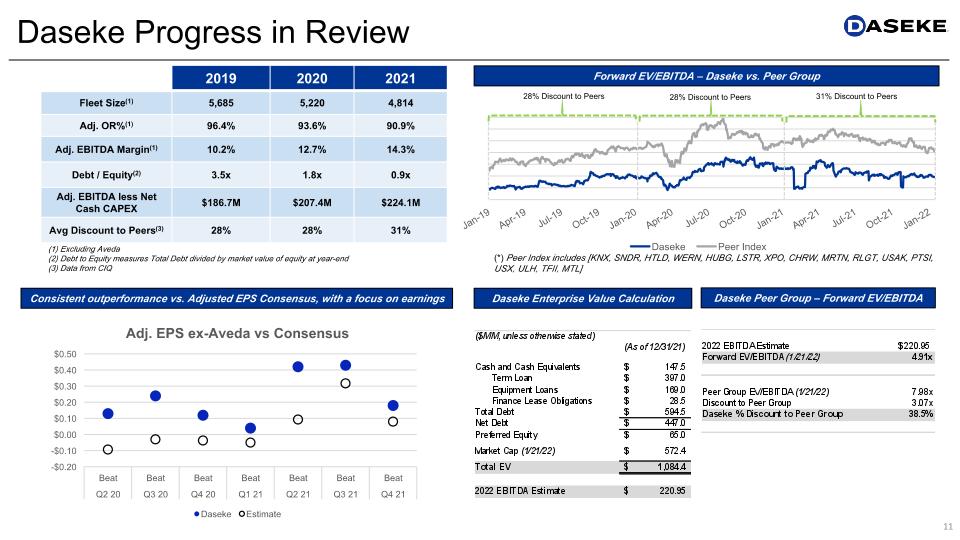

Daseke Progress in Review 2019 2020 2021 Fleet Size(1) 5,685 5,220 4,814 Adj. OR%(1) 96.4% 93.6% 90.9% Adj. EBITDA Margin(1) 10.2% 12.7% 14.3% Debt / Equity(2) 3.5x 1.8x 0.9x Adj. EBITDA less Net Cash CAPEX $186.7M $207.4M $224.1M Avg Discount to Peers(3) 28% 28% 31% (1) Excluding Aveda (2) Debt to Equity measures Total Debt divided by market value of equity at year-end (3) Data from CIQ Consistent outperformance vs. Adjusted EPS Consensus, with a focus on earnings Forward EV/EBITDA – Daseke vs. Peer Group (*) Peer Index includes [KNX, SNDR, HTLD, WERN, HUBG, LSTR, XPO, CHRW, MRTN, RLGT, USAK, PTSI, USX, ULH, TFII, MTL] 28% Discount to Peers 28% Discount to Peers 31% Discount to Peers Daseke Enterprise Value Calculation Daseke Peer Group – Forward EV/EBITDA

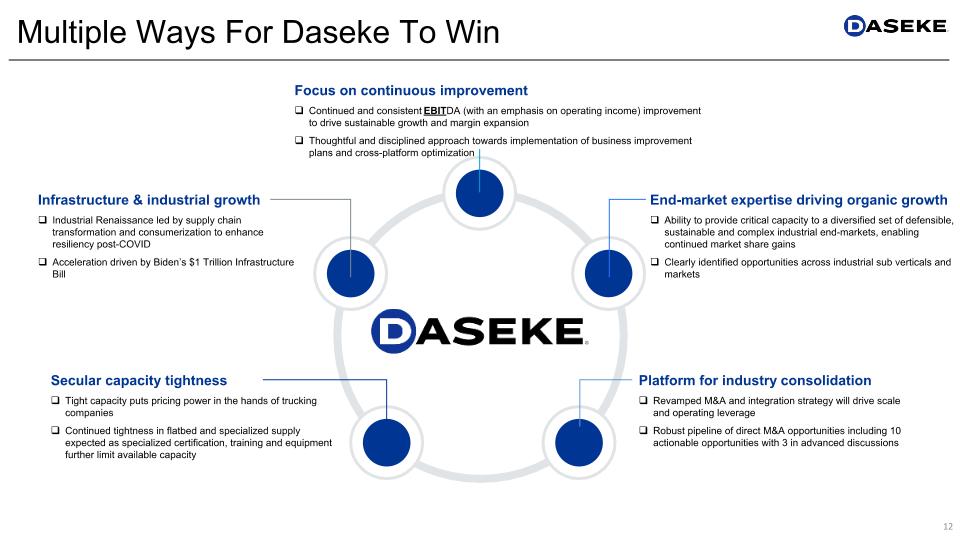

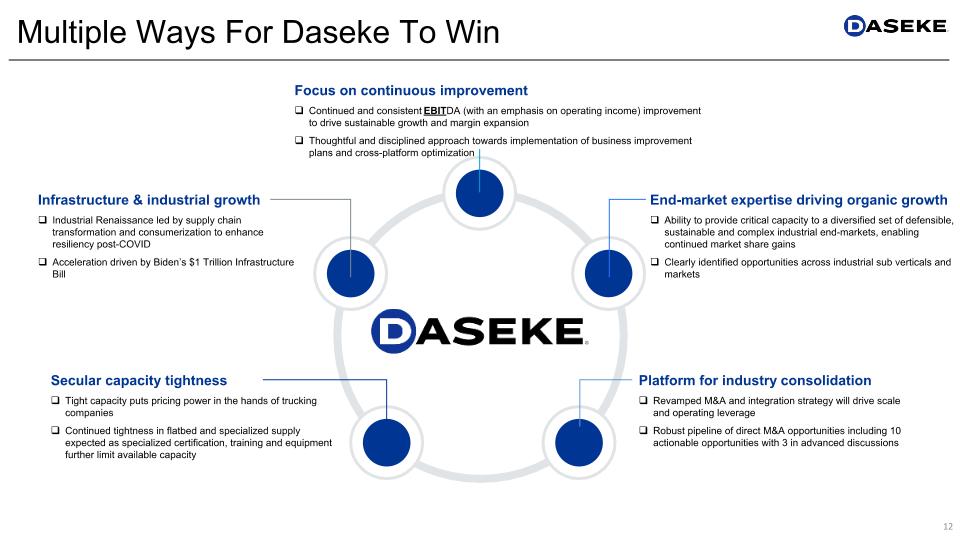

Multiple Ways For Daseke To Win Focus on continuous improvement Continued and consistent EBITDA (with an emphasis on operating income) improvement to drive sustainable growth and margin expansion Thoughtful and disciplined approach towards implementation of business improvement plans and cross-platform optimization End-market expertise driving organic growth Ability to provide critical capacity to a diversified set of defensible, sustainable and complex industrial end-markets, enabling continued market share gains Clearly identified opportunities across industrial sub verticals and markets Platform for industry consolidation Revamped M&A and integration strategy will drive scale and operating leverage Robust pipeline of direct M&A opportunities including 10 actionable opportunities with 3 in advanced discussions Infrastructure & industrial growth Industrial Renaissance led by supply chain transformation and consumerization to enhance resiliency post-COVID Acceleration driven by Biden’s $1 Trillion Infrastructure Bill Secular capacity tightness Tight capacity puts pricing power in the hands of trucking companies Continued tightness in flatbed and specialized supply expected as specialized certification, training and equipment further limit available capacity

Financial Tables & Reconciliations

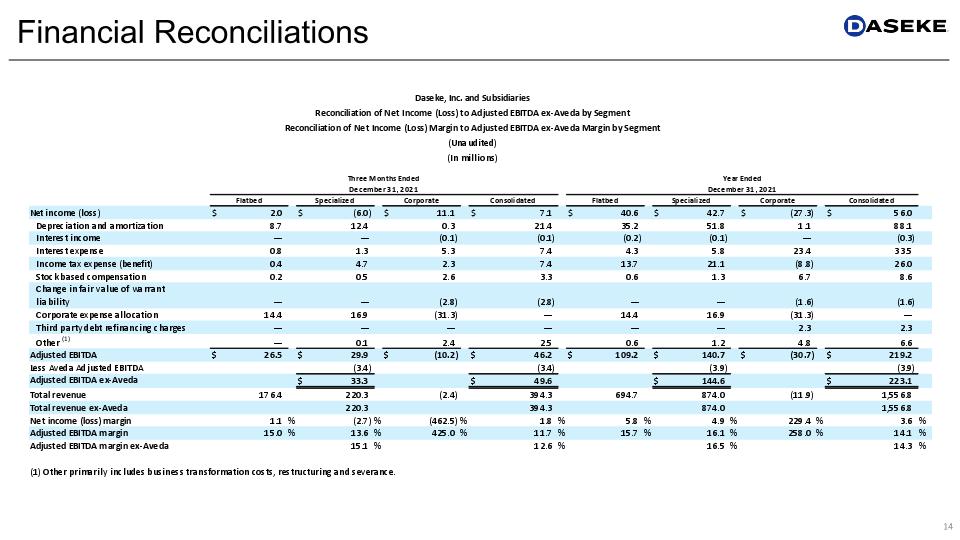

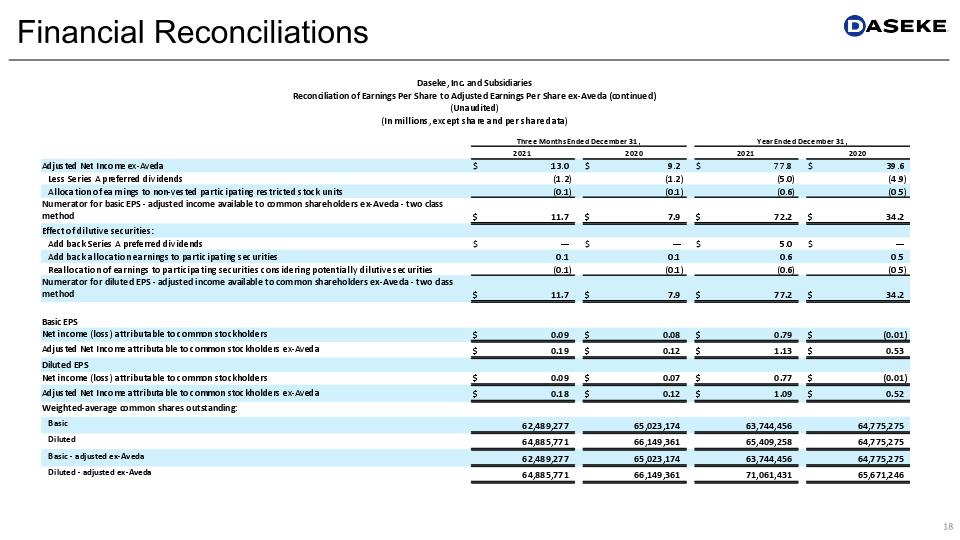

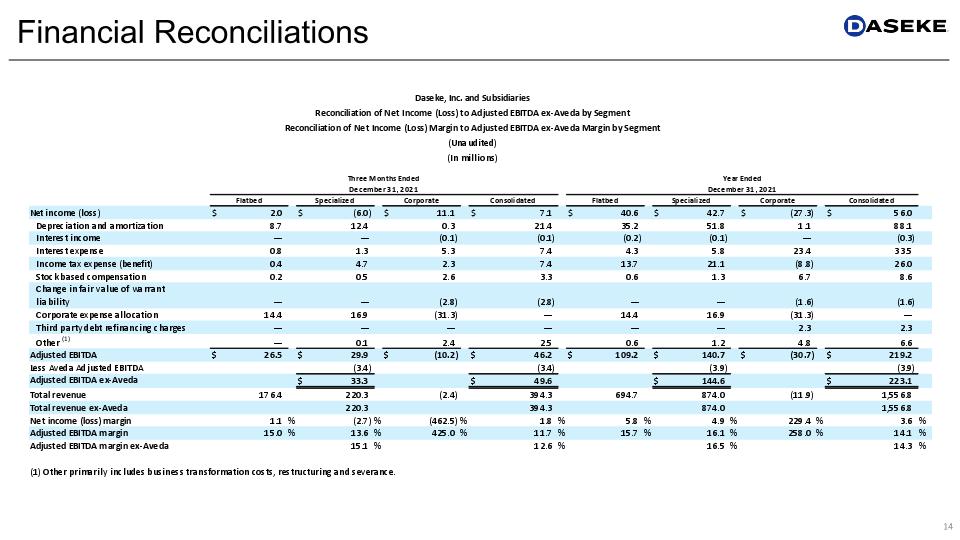

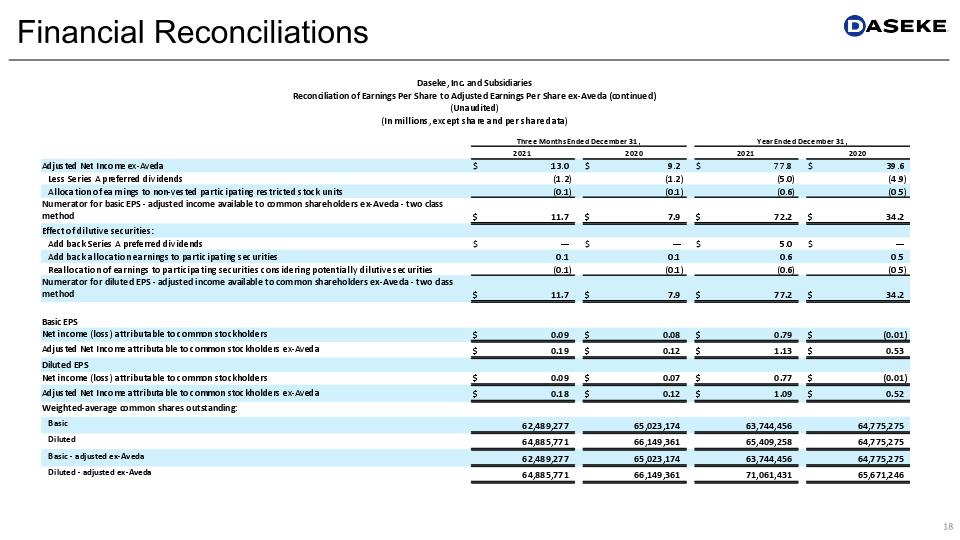

Financial Reconciliations

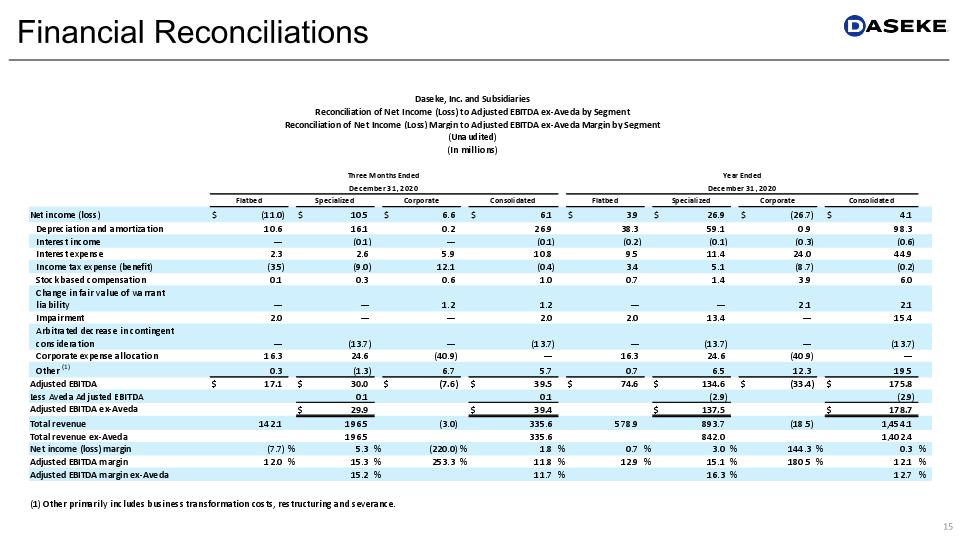

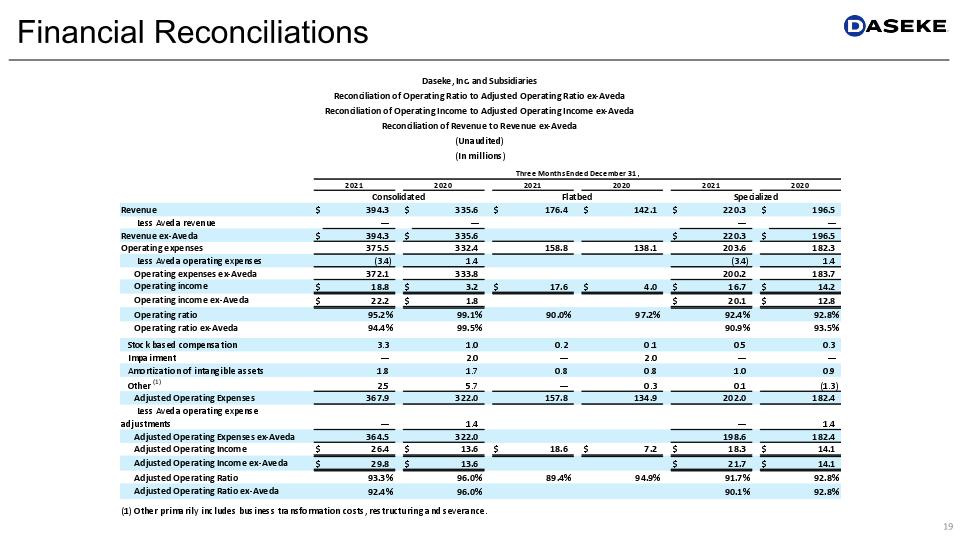

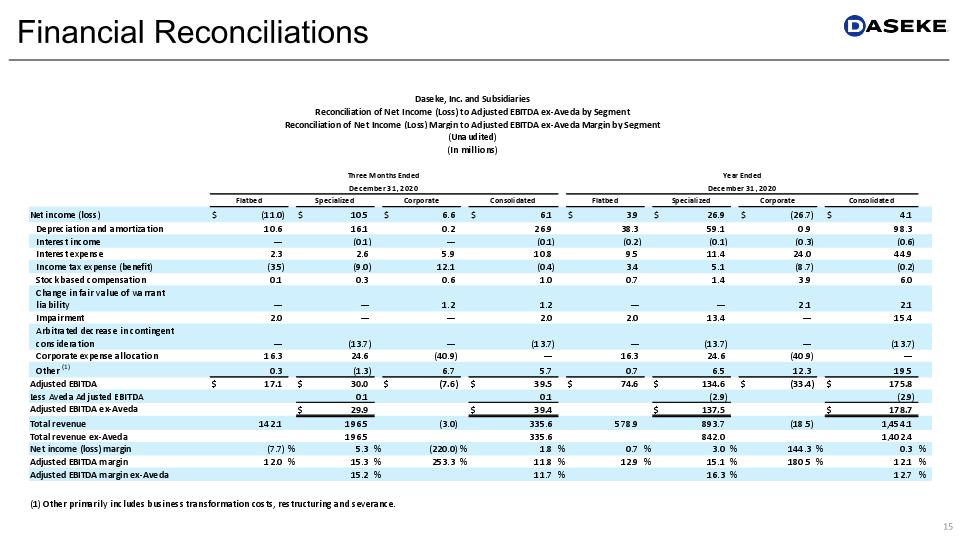

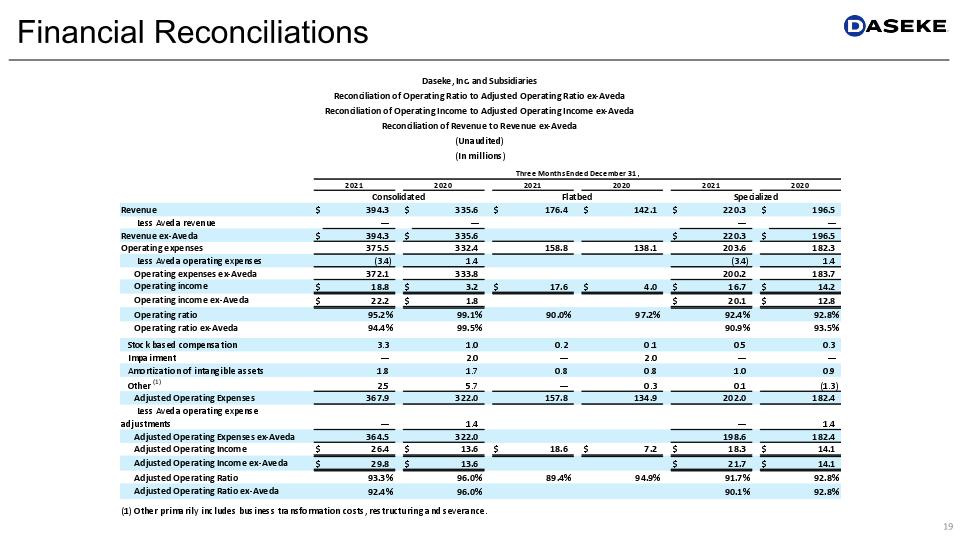

Financial Reconciliations

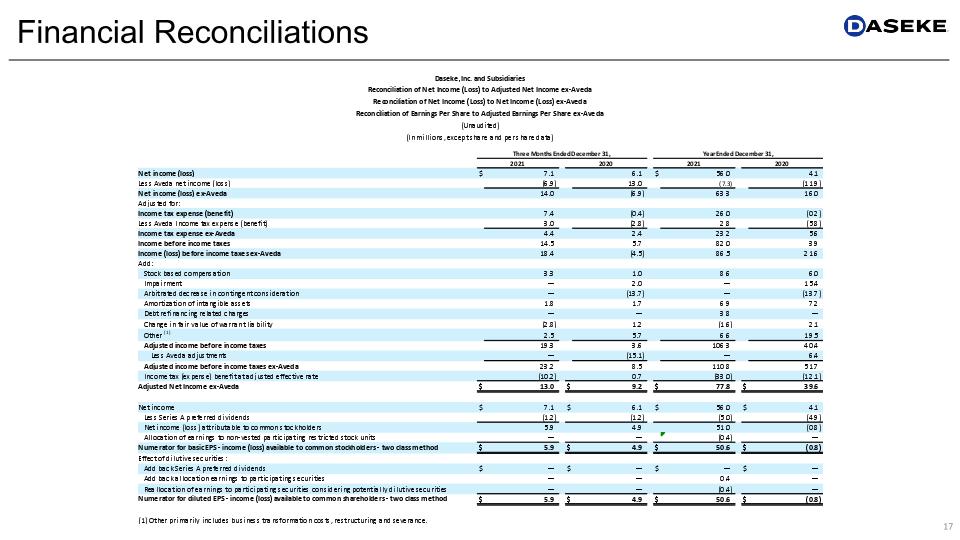

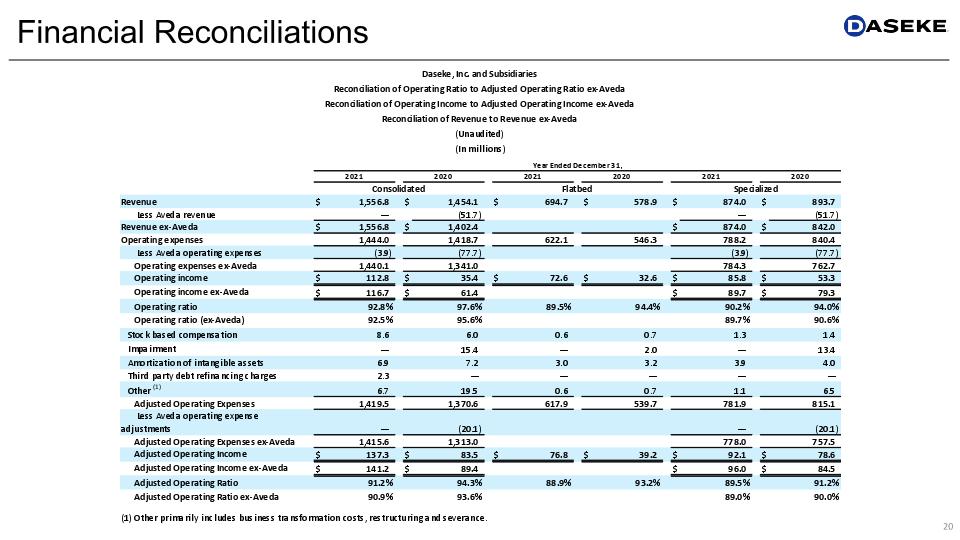

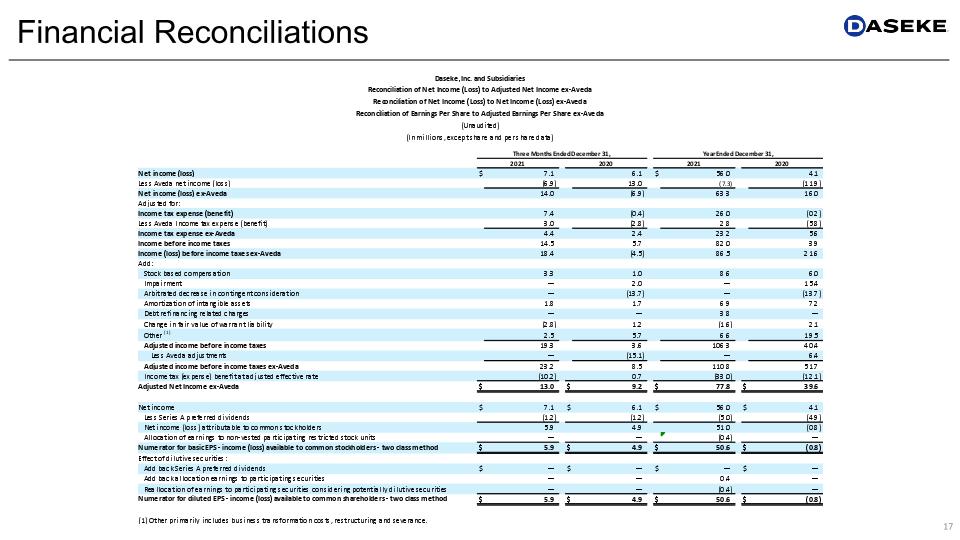

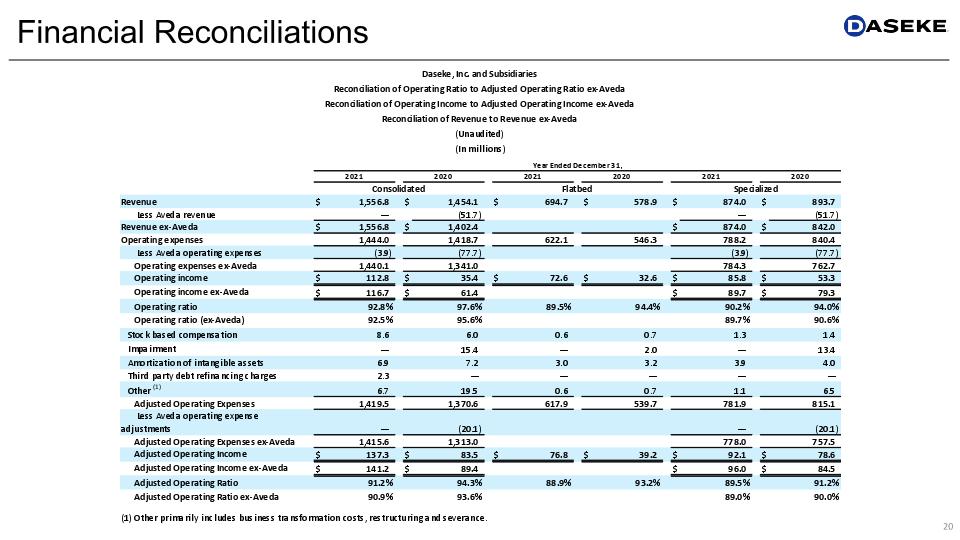

Financial Reconciliations

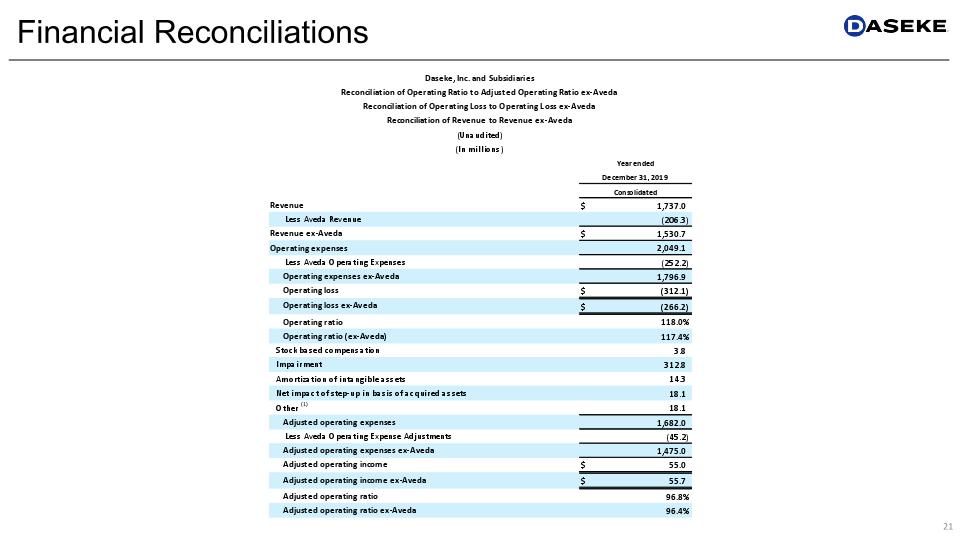

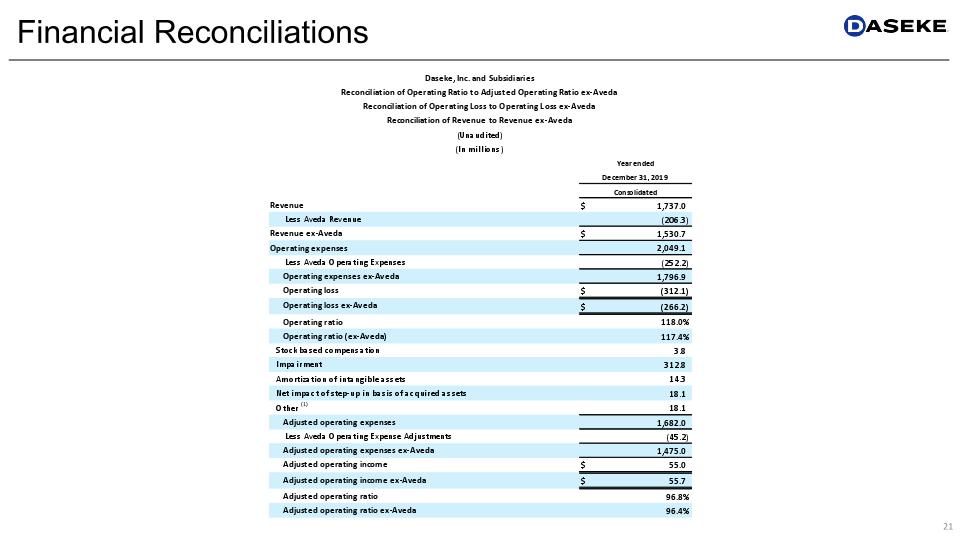

Financial Reconciliations

Financial Reconciliations

Financial Reconciliations

Financial Reconciliations

Financial Reconciliations

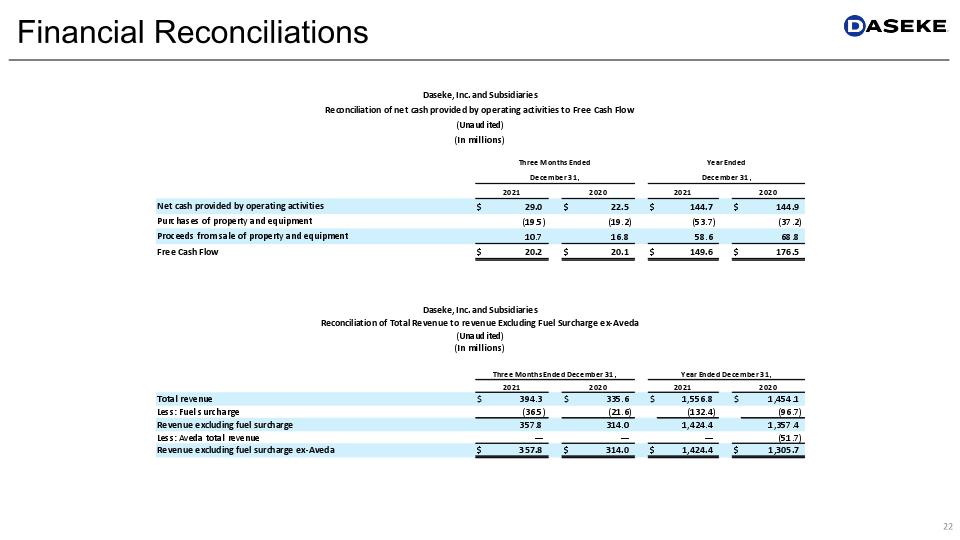

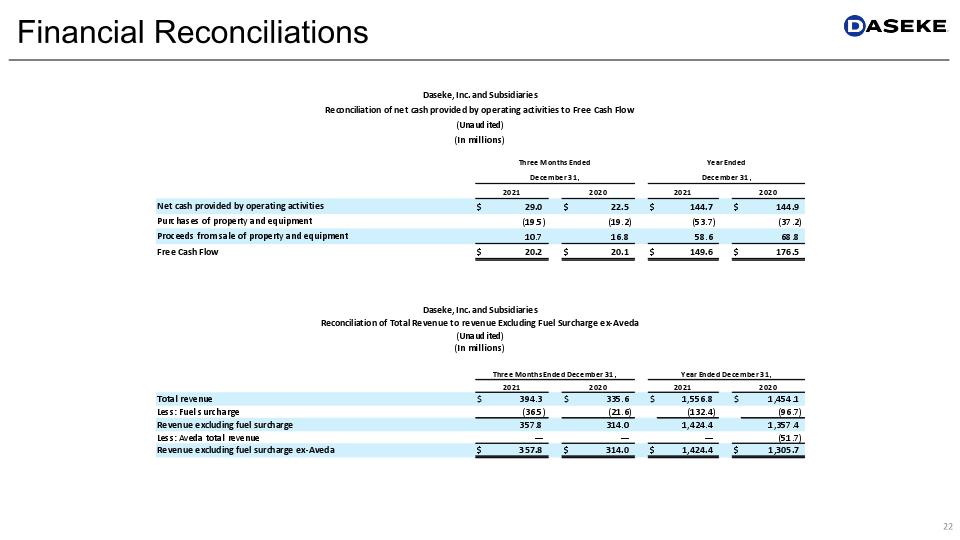

Financial Reconciliations

Financial Reconciliations

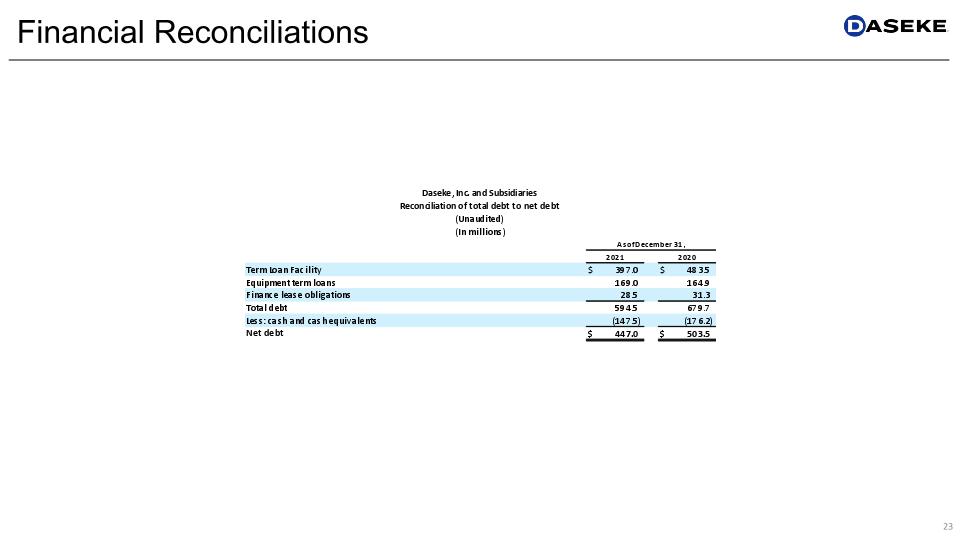

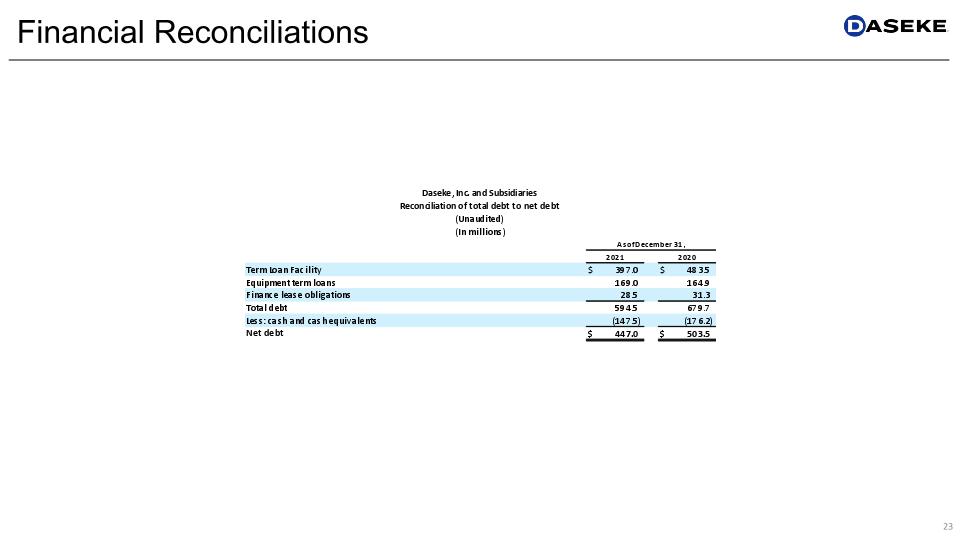

Financial Reconciliations

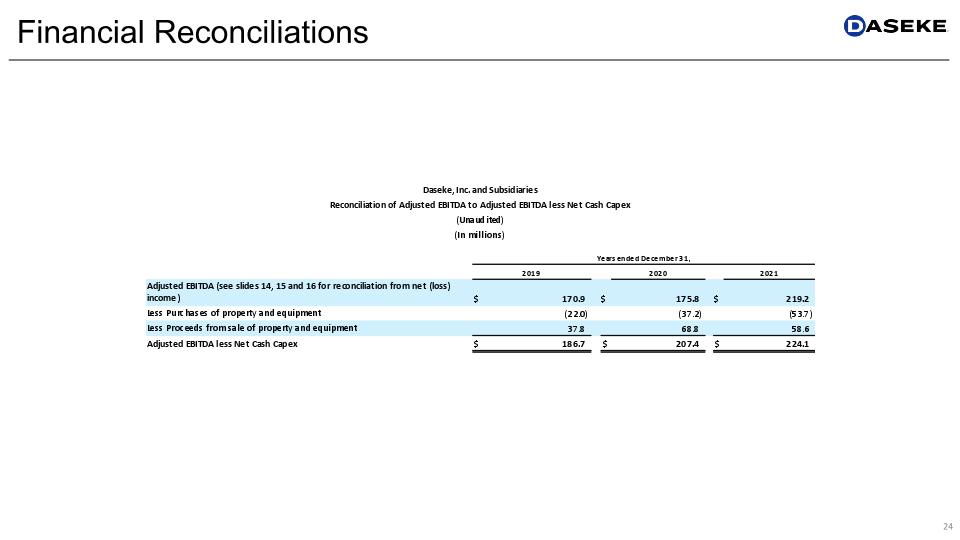

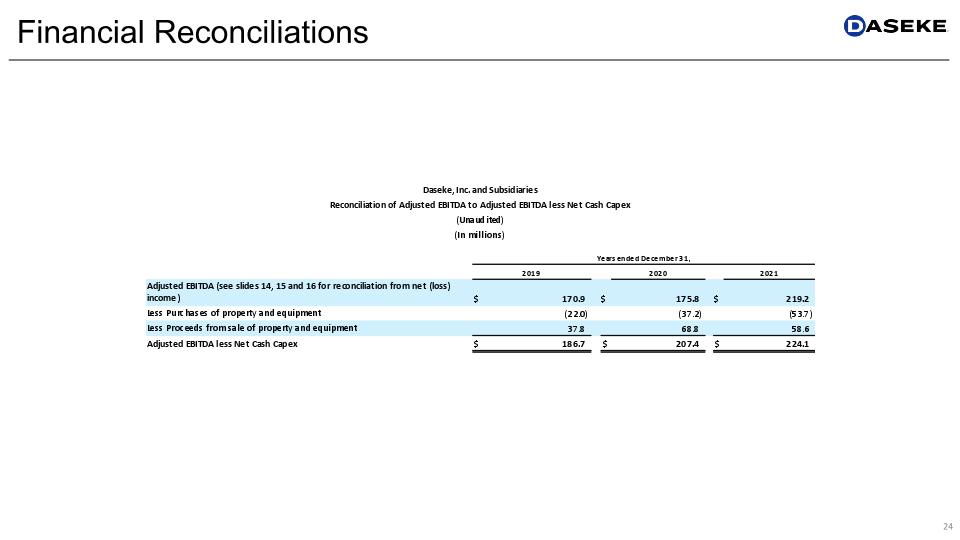

Daseke, Inc. 15455 Dallas Parkway, Ste 550�Addison, TX 75001 www.Daseke.com Investor Relations Joe Caminiti or Ashley Gruenberg Alpha IR Group 312-445-2870 DSKE@alpha-ir.com Contact Information