Q2 2022 Earnings Presentation August 2, 2022 Exhibit 99.1

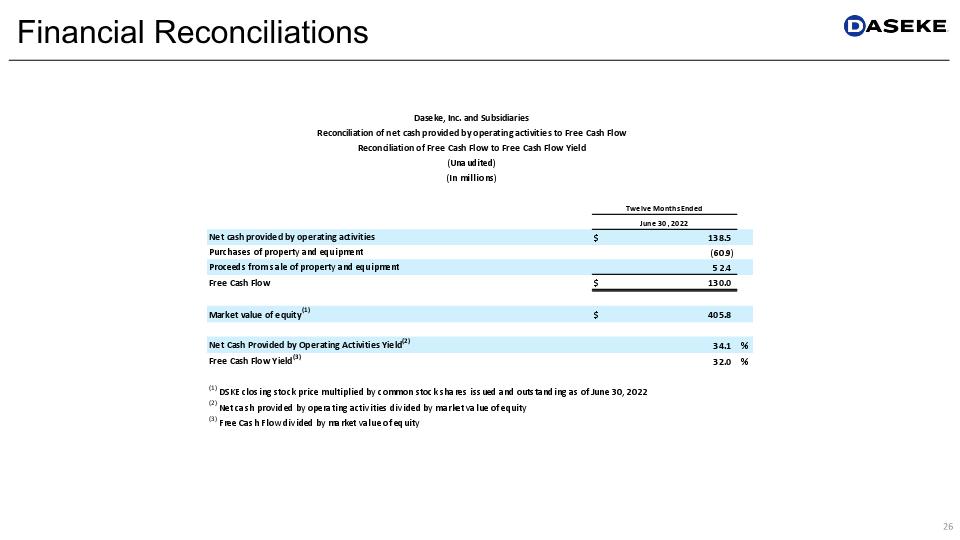

Important Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “may,” “will,” “expect,” “anticipate,” “continue,” “estimate,” “project,” “believe,” “plan,” “should,” “could,” “would,” “forecast,” “seek,” “target,” “predict,” and “potential,” the negative of these terms, or other comparable terminology. Projected financial information, including our guidance outlook, are forward-looking statements. Forward-looking statements may also include statements about the Company’s goals, business strategy and plans; the Company’s financial strategy, liquidity and capital required for its business strategy and plans; the Company’s competition and government regulations; general economic conditions; and the Company’s future operating results. These forward-looking statements are based on information available as of the date of this presentation, and current expectations, forecasts and assumptions. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that the Company anticipates. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date, and the Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Readers are cautioned not to place undue reliance on the forward-looking statements. Forward-looking statements are subject to risks and uncertainties (many of which are beyond our control) that could cause actual results or outcomes to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, general economic and business risks, such as downturns in customers’ business cycles, disruptions in capital and credit markets and inflationary cost pressures, the Company’s ability to adequately address downward pricing and other competitive pressures, the Company’s insurance or claims expense, driver shortages and increases in driver compensation or owner-operator contracted rates, fluctuations in the price or availability of diesel fuel, increased prices for, or decreases in the availability of, new revenue equipment and decreases in the value of used revenue equipment, impact to the Company’s business and operations resulting from the COVID-19 pandemic, seasonality and the impact of weather and other catastrophic events, the Company’s ability to secure the services of third-party capacity providers on competitive terms, loss of key personnel, a failure of the Company’s information systems, including disruptions or failures of services essential to our operations or upon which our information technology platforms rely, data or other security breach, or cybersecurity incidents, the Company’s ability to execute and realize all of the expected benefits of its integration, business improvement and comprehensive restructuring plans, the Company’s ability to realize all of the intended benefits from acquisitions or investments, the Company’s ability to complete divestitures successfully, the Company’s ability to generate sufficient cash to service all of the Company’s indebtedness and the Company’s ability to finance its capital requirements, restrictions in its existing and future debt agreements, increases in interest rates, changes in existing laws or regulations, including environmental and worker health safety laws and regulations and those relating to tax rates or taxes in general, the impact of governmental regulations and other governmental actions related to the Company and its operations, and litigation and governmental proceedings. Additional risks or uncertainties that are not currently known to us, that we currently deem to be immaterial, or that could apply to any company could also materially adversely affect our business, financial condition, or future results. For additional information regarding known material factors that could cause our actual results to differ from those expressed in forward-looking statements, please see Daseke’s filings with the Securities and Exchange Commission, available at www.sec.gov, including Daseke’s most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q, particularly the section titled “Risk Factors”. Non-GAAP Financial Measures This presentation includes non-GAAP financial measures for the Company and its reporting segments, including Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Operating Income, Adjusted Net Income (Loss), Adjusted Earnings Per Share, Adjusted Operating Ratio, Free Cash Flow, Free Cash Flow Yield, Adjusted Return on Equity and Net Debt. Please note that the non-GAAP measures included herein are not a substitute for, or more meaningful than, net income (loss), cash flows from operating activities, operating income or any other measure prescribed by GAAP, and there are limitations to using non-GAAP measures. Certain items excluded from these non-GAAP measures are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital, tax structure and the historic costs of depreciable assets. Also, other companies in Daseke’s industry may define these non‐GAAP measures differently than Daseke does, and as a result, it may be difficult to use these non‐GAAP measures to compare the performance of those companies to Daseke’s performance. Because of these limitations, these non-GAAP measures should not be considered a measure of the income generated by Daseke’s business or discretionary cash available to it to invest in the growth of its business. Daseke’s management compensates for these limitations by relying primarily on Daseke’s GAAP results and using these non-GAAP measures supplementally. You can find the reconciliation of these non‐GAAP measures to the nearest comparable GAAP measures in the Appendix. In the non-GAAP measures discussed below, management refers to certain material items that management believes do not reflect the Company’s core operating performance, which management believes represents its performance in the ordinary, ongoing and customary course of its operations. Management views the Company’s core operating performance as its operating results excluding the impact of items including, but not limited to, stock-based compensation, impairments, amortization of intangible assets, restructuring and business transformation costs, severance, and all income and expenses related to the Aveda Transportation and Energy Services (”Aveda”) business. Management believes excluding these items enables investors to evaluate more clearly and consistently the Company’s core operating performance in the same manner that management evaluates its core operating performance. Although we ceased generating revenues from our Aveda business and completed the wind-down of our Aveda operations in 2020, we continued to recognize certain income and expenses from our Aveda business in 2021 and 2022. Such income and expenses relate primarily to, but is not limited to, workers compensation claims and insurance proceeds. Previously, to provide investors with information about the Company excluding the impact of the Aveda business, the Company presented certain GAAP and non-GAAP measures appended with ex-Aveda, which represented the measure excluding the impact of the Aveda business. However, beginning in the quarter ended March 31, 2022, the Company no longer provides ex-Aveda measures because the impact of the Aveda business is no longer material or meaningful to a discussion of the Company’s operating results or financial condition (e.g., the comparable period in the prior year is now after the completion of the wind-down of the Aveda business). Instead, the income and expenses from our Aveda business will be considered as items that management believes do not reflect our core operating performance. Such income and expenses can be identified in the non-GAAP reconciliations under the adjustment called “Aveda expenses, net” and “Aveda operating expenses, net”. We have not reconciled non‐GAAP forward-looking measures to their corresponding GAAP measures because certain items that impact these measures are unavailable or cannot be reasonably predicted without unreasonable efforts. In particular, we have not reconciled our expectations as to forward-looking Adjusted EBITDA to net income due to the difficulty in making an accurate projection as to stock-based compensation expense. Stock-based compensation expense is affected by future hiring, turnover, and retention needs, as well as the future fair market value of our common stock and performance stock units. In addition, many of our performance stock units are classified as liabilities which vest upon the achievement of specific performance-based conditions related to the Company’s financial performance over a three-year period, modified based on the Company’s Relative Total Shareholder Return, all of which is difficult to predict and require quarterly adjustments to their fair value performed by outside specialists. The actual amount of the excluded stock-based compensation expense will have a significant impact on our GAAP net income; accordingly, a reconciliation of forward-looking Adjusted EBITDA to net income is not available without unreasonable efforts. Daseke defines: Adjusted EBITDA as net income (loss) plus (i) depreciation and amortization, (ii) interest, (iii) income taxes, and (iv) other material items that management believes do not reflect our core operating performance. Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of total revenue. Adjusted Net Income (Loss) net income (loss) adjusted for material items that management believes do not reflect our core operating performance. Adjusted Net Income (Loss) per share as Adjusted Net Income (Loss) available to common stockholders divided by the weighted average number of shares of common stock outstanding during the period under the two-class method. Free Cash Flow as net cash provided by operating activities less purchases of property and equipment, plus proceeds from sale of property and equipment as such amounts are shown on the face of the Statements of Cash Flows. Free Cash Flow Yield as Free Cash Flow as a percentage of market value of equity. Adjusted Return on Equity as adjusted net income attributable to common stockholders as a percentage of market value of equity. Adjusted Operating Income (Loss) as total revenue less Adjusted Operating Expenses. Adjusted Operating Expenses as total operating expenses less: material items that management believes do not reflect our core operating performance. Adjusted Operating Ratio as Adjusted Operating Expenses, as a percentage of total revenue. Revenue excluding fuel surcharge as revenue less fuel surcharges. Net Debt as total debt less cash and cash equivalents. Rate per mile is the period’s revenue less fuel surcharge, brokerage and logistics revenues divided by total number of company and owner-operator miles driven in the period. Revenue per Tractor is the period’s revenue less fuel surcharge, brokerage and logistics revenues divided by the average number of tractors in the period, including owner-operator tractors. Industry and Market Data This presentation includes market data and other statistical information from third party sources, including independent industry publications, government publications and other published independent sources. Although Daseke believes these third-party sources are reliable as of their respective dates, Daseke has not independently verified the accuracy or completeness of this information.

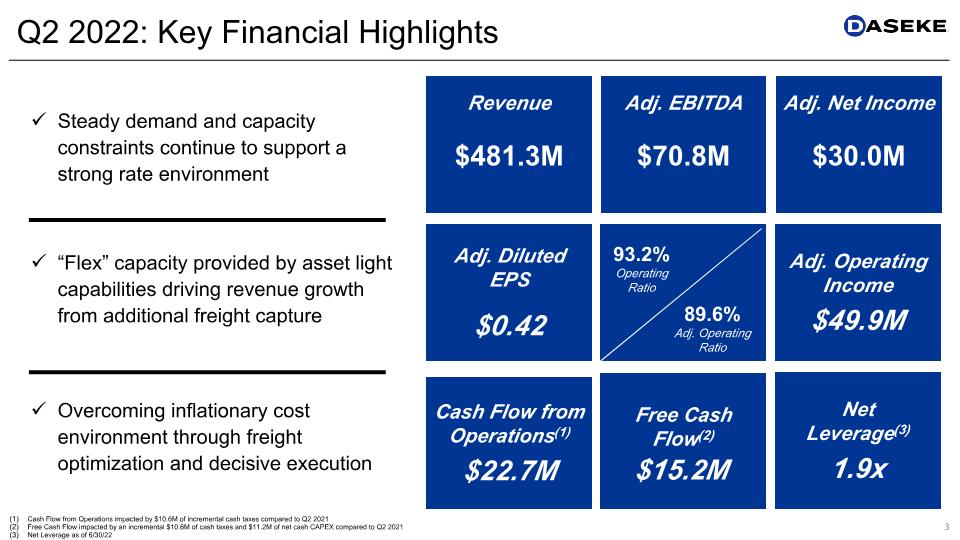

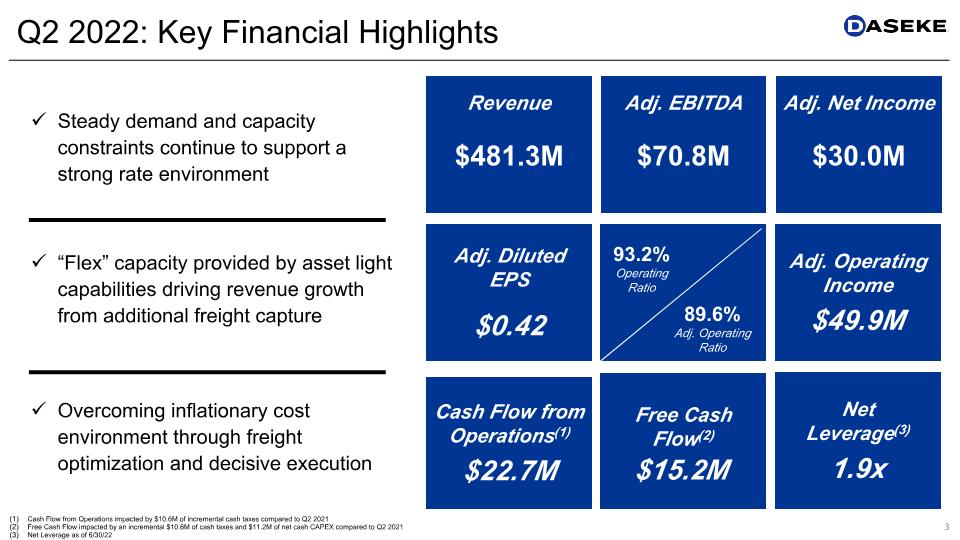

Q2 2022: Key Financial Highlights Steady demand and capacity constraints continue to support a strong rate environment “Flex” capacity provided by asset light capabilities driving revenue growth from additional freight capture Overcoming inflationary cost environment through freight optimization and decisive execution Revenue $481.3M Adj. EBITDA $70.8M Adj. Net Income $30.0M Adj. Diluted EPS $0.42 $34.4m Adj. Operating Income $49.9M Cash Flow from Operations(1) $22.7M Free Cash Flow(2) $15.2M Net �Leverage(3) 1.9x 93.2% Operating Ratio 89.6% Adj. Operating Ratio Cash Flow from Operations impacted by $10.6M of incremental cash taxes compared to Q2 2021 Free Cash Flow impacted by an incremental $10.6M of cash taxes and $11.2M of net cash CAPEX compared to Q2 2021 Net Leverage as of 6/30/22

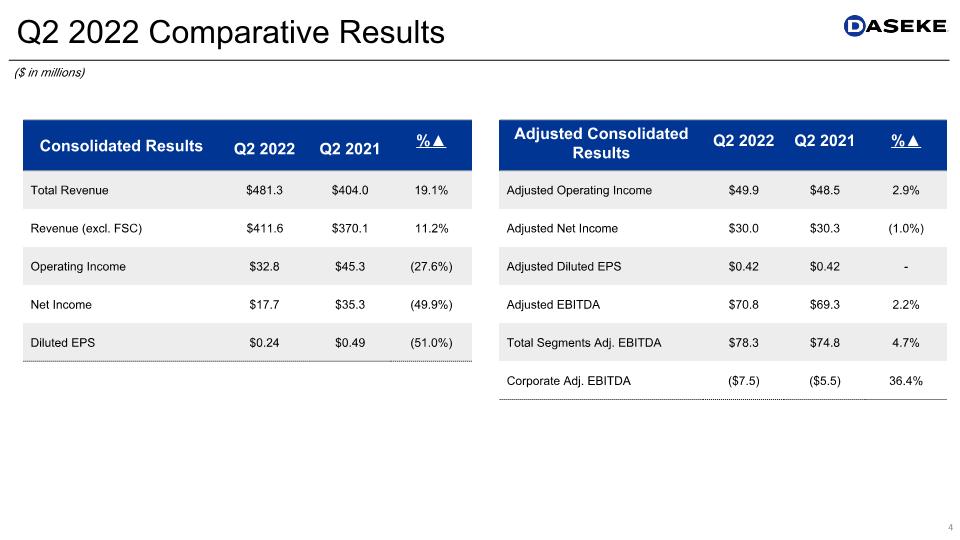

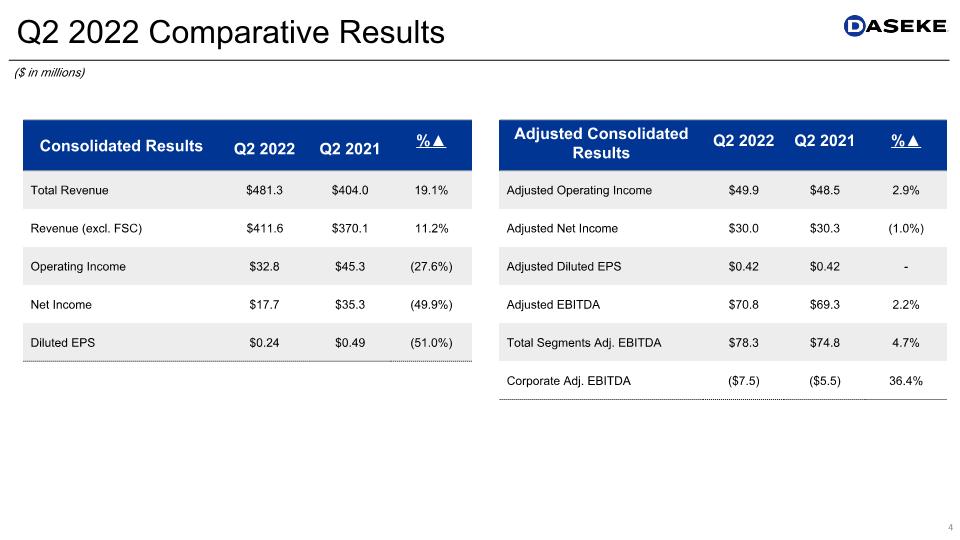

Q2 2022 Comparative Results Consolidated Results Q2 2022 Q2 2021 %▲ Total Revenue $481.3 $404.0 19.1% Revenue (excl. FSC) $411.6 $370.1 11.2% Operating Income $32.8 $45.3 (27.6%) Net Income $17.7 $35.3 (49.9%) Diluted EPS $0.24 $0.49 (51.0%) Adjusted Consolidated Results Q2 2022 Q2 2021 %▲ Adjusted Operating Income $49.9 $48.5 2.9% Adjusted Net Income $30.0 $30.3 (1.0%) Adjusted Diluted EPS $0.42 $0.42 - Adjusted EBITDA $70.8 $69.3 2.2% Total Segments Adj. EBITDA $78.3 $74.8 4.7% Corporate Adj. EBITDA ($7.5) ($5.5) 36.4% ($ in millions)

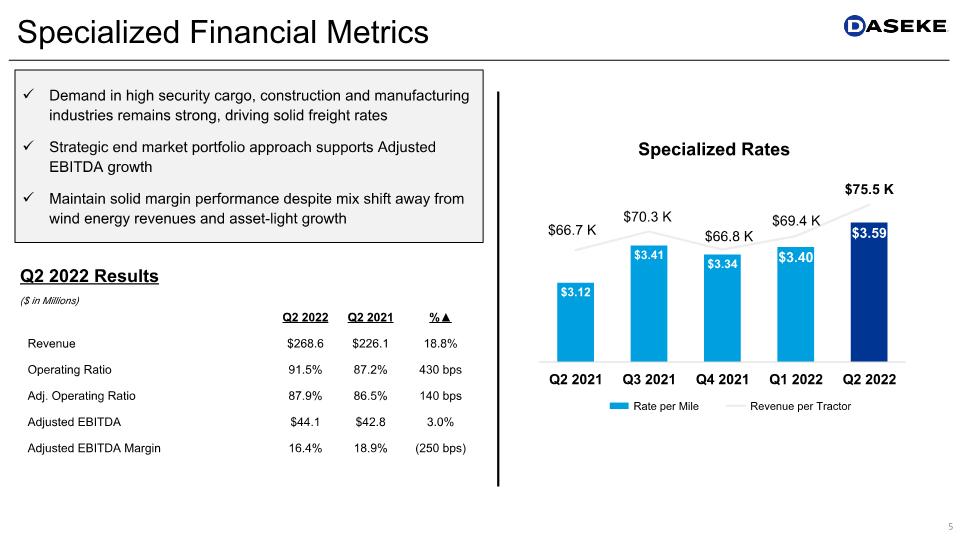

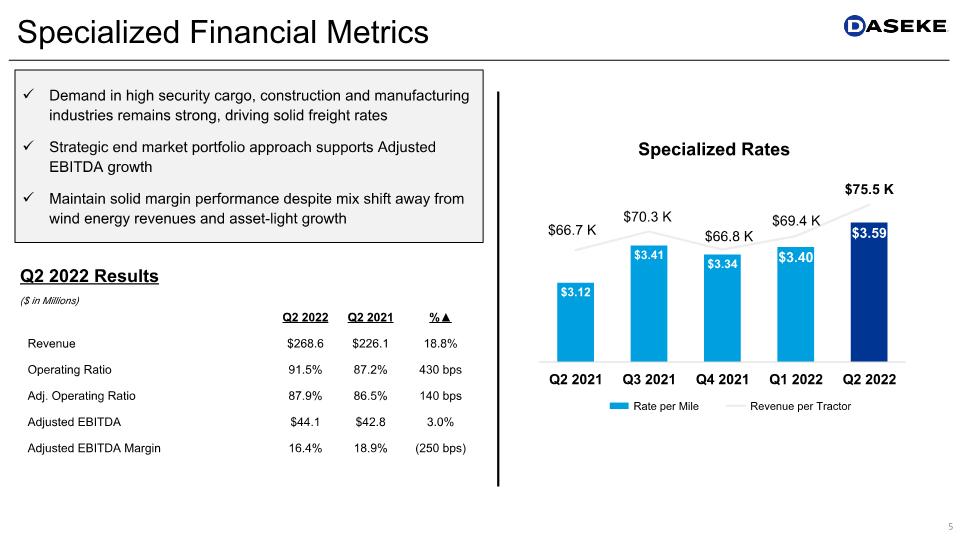

Specialized Financial Metrics Q2 2022 Q2 2021 %▲ Revenue $268.6 $226.1 18.8% Operating Ratio 91.5% 87.2% 430 bps Adj. Operating Ratio 87.9% 86.5% 140 bps Adjusted EBITDA $44.1 $42.8 3.0% Adjusted EBITDA Margin 16.4% 18.9% (250 bps) ($ in Millions) Q2 2022 Results Demand in high security cargo, construction and manufacturing industries remains strong, driving solid freight rates Strategic end market portfolio approach supports Adjusted EBITDA growth Maintain solid margin performance despite mix shift away from wind energy revenues and asset-light growth

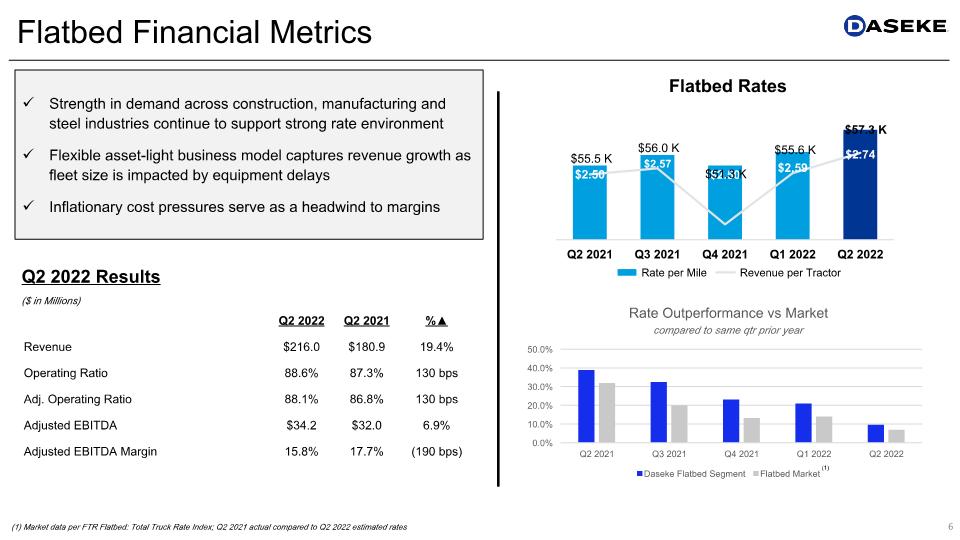

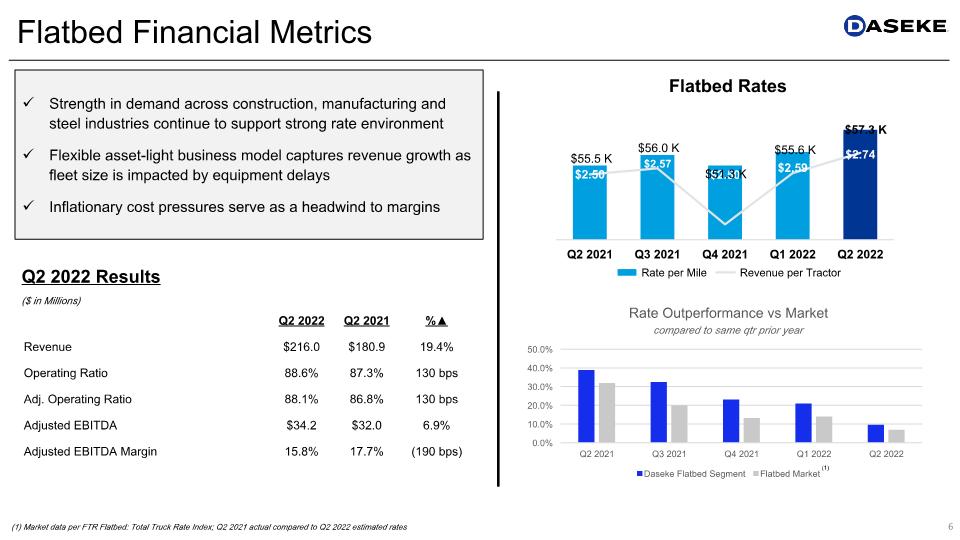

Flatbed Financial Metrics Q2 2022 Q2 2021 %▲ Revenue $216.0 $180.9 19.4% Operating Ratio 88.6% 87.3% 130 bps Adj. Operating Ratio 88.1% 86.8% 130 bps Adjusted EBITDA $34.2 $32.0 6.9% Adjusted EBITDA Margin 15.8% 17.7% (190 bps) ($ in Millions) Q2 2022 Results Strength in demand across construction, manufacturing and steel industries continue to support strong rate environment Flexible asset-light business model captures revenue growth as fleet size is impacted by equipment delays Inflationary cost pressures serve as a headwind to margins (1) Market data per FTR Flatbed: Total Truck Rate Index; Q2 2021 actual compared to Q2 2022 estimated rates (1)

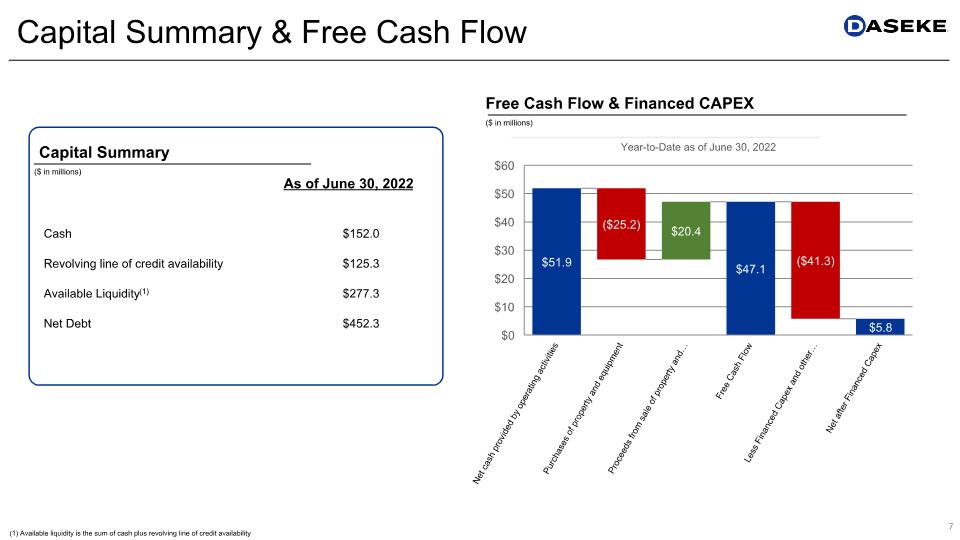

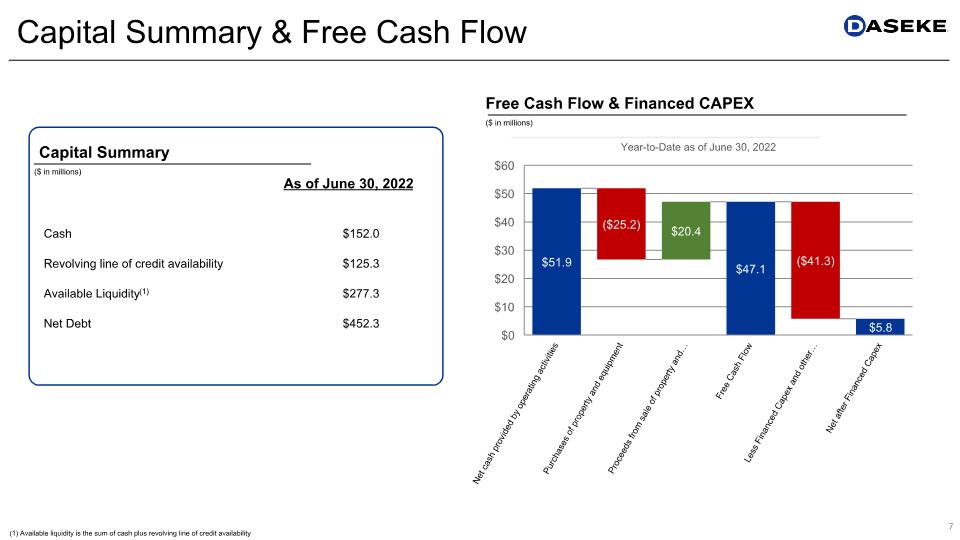

Capital Summary & Free Cash Flow ($ in millions) Free Cash Flow & Financed CAPEX (1) Available liquidity is the sum of cash plus revolving line of credit availability ($ in millions) Capital Summary As of June 30, 2022 Cash $152.0 Revolving line of credit availability $125.3 Available Liquidity(1) $277.3 Net Debt $452.3

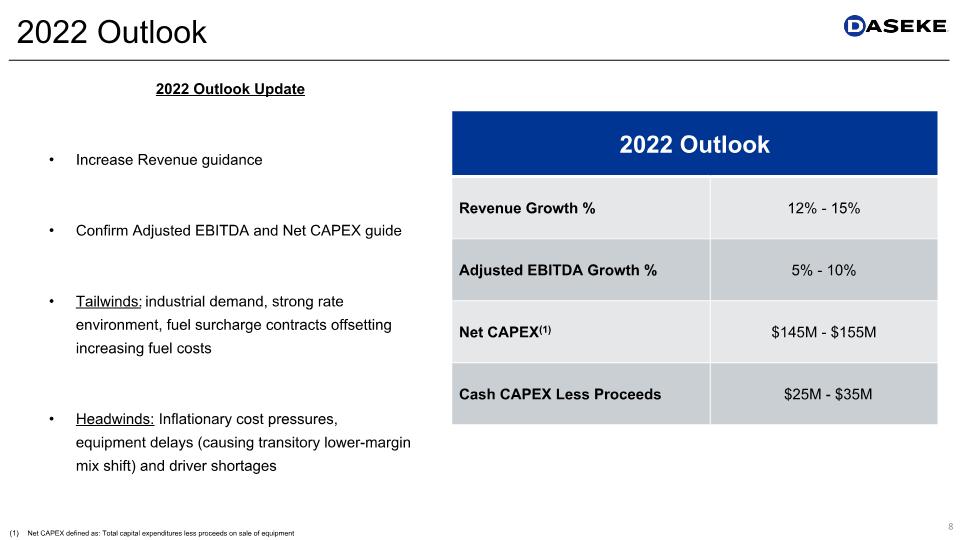

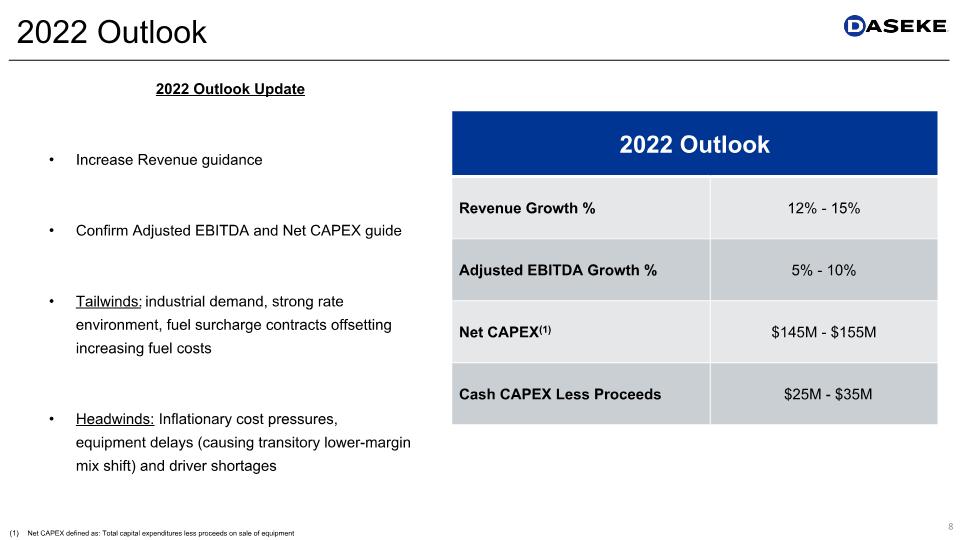

2022 Outlook 2022 Outlook Update Increase Revenue guidance Confirm Adjusted EBITDA and Net CAPEX guide Tailwinds: industrial demand, strong rate environment, fuel surcharge contracts offsetting increasing fuel costs Headwinds: Inflationary cost pressures, equipment delays (causing transitory lower-margin mix shift) and driver shortages 2022 Outlook Revenue Growth % 12% - 15% Adjusted EBITDA Growth % 5% - 10% Net CAPEX(1) $145M - $155M Cash CAPEX Less Proceeds $25M - $35M Net CAPEX defined as: Total capital expenditures less proceeds on sale of equipment

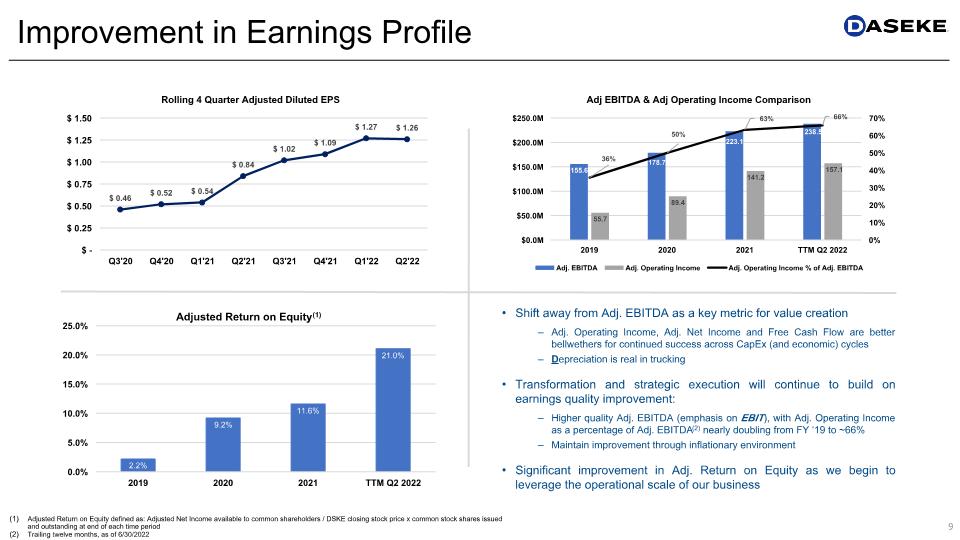

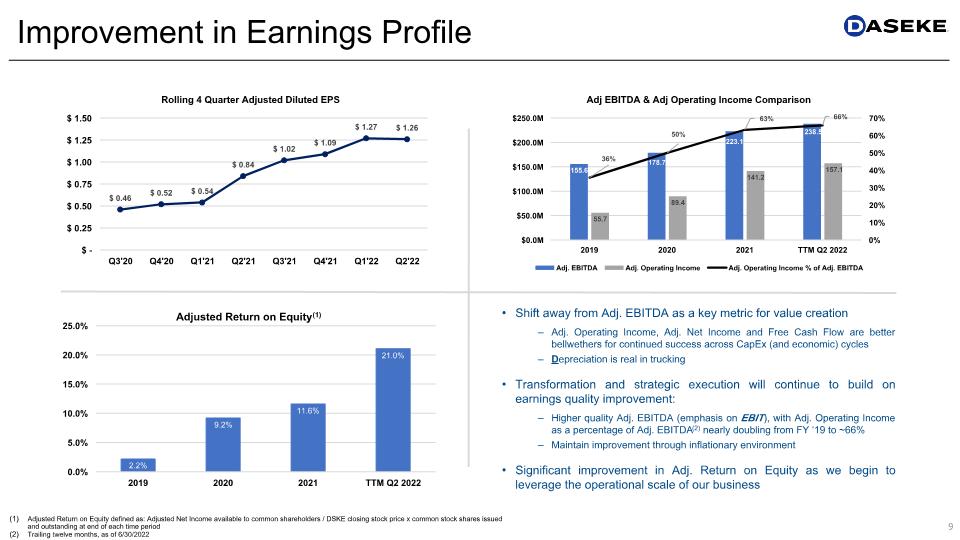

Improvement in Earnings Profile Adjusted Return on Equity defined as: Adjusted Net Income available to common shareholders / DSKE closing stock price x common stock shares issued and outstanding at end of each time period Trailing twelve months, as of 6/30/2022 Shift away from Adj. EBITDA as a key metric for value creation Adj. Operating Income, Adj. Net Income and Free Cash Flow are better bellwethers for continued success across CapEx (and economic) cycles Depreciation is real in trucking Transformation and strategic execution will continue to build on earnings quality improvement: Higher quality Adj. EBITDA (emphasis on EBIT), with Adj. Operating Income as a percentage of Adj. EBITDA(2) nearly doubling from FY ‘19 to ~66% Maintain improvement through inflationary environment Significant improvement in Adj. Return on Equity as we begin to leverage the operational scale of our business

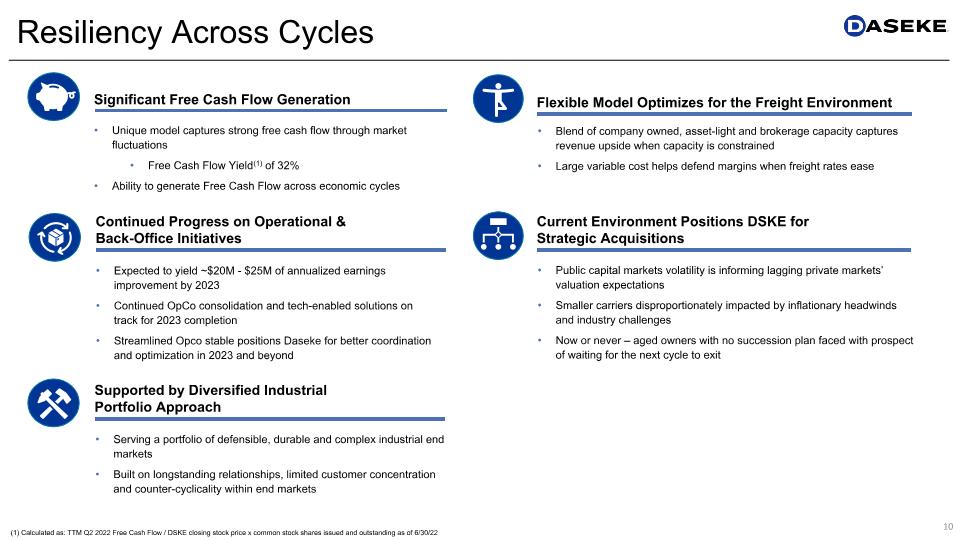

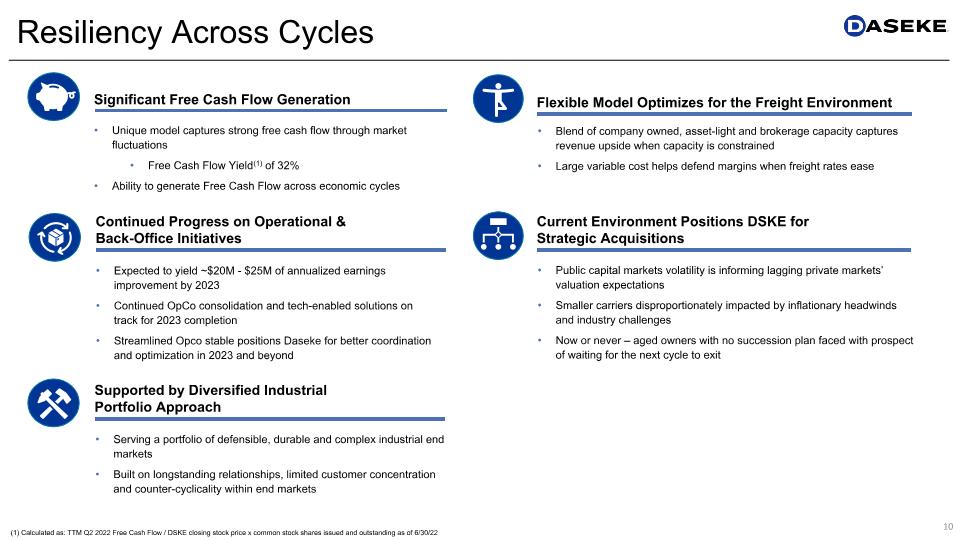

Resiliency Across Cycles (1) Calculated as: TTM Q2 2022 Free Cash Flow / DSKE closing stock price x common stock shares issued and outstanding as of 6/30/22 Unique model captures strong free cash flow through market fluctuations Free Cash Flow Yield(1) of 32% Ability to generate Free Cash Flow across economic cycles Significant Free Cash Flow Generation Expected to yield ~$20M - $25M of annualized earnings improvement by 2023 Continued OpCo consolidation and tech-enabled solutions on track for 2023 completion Streamlined Opco stable positions Daseke for better coordination and optimization in 2023 and beyond Continued Progress on Operational & Back-Office Initiatives Serving a portfolio of defensible, durable and complex industrial end markets Built on longstanding relationships, limited customer concentration and counter-cyclicality within end markets Supported by Diversified Industrial Portfolio Approach Flexible Model Optimizes for the Freight Environment Blend of company owned, asset-light and brokerage capacity captures revenue upside when capacity is constrained Large variable cost helps defend margins when freight rates ease Public capital markets volatility is informing lagging private markets’ valuation expectations Smaller carriers disproportionately impacted by inflationary headwinds and industry challenges Now or never – aged owners with no succession plan faced with prospect of waiting for the next cycle to exit Current Environment Positions DSKE for Strategic Acquisitions

APPENDIX

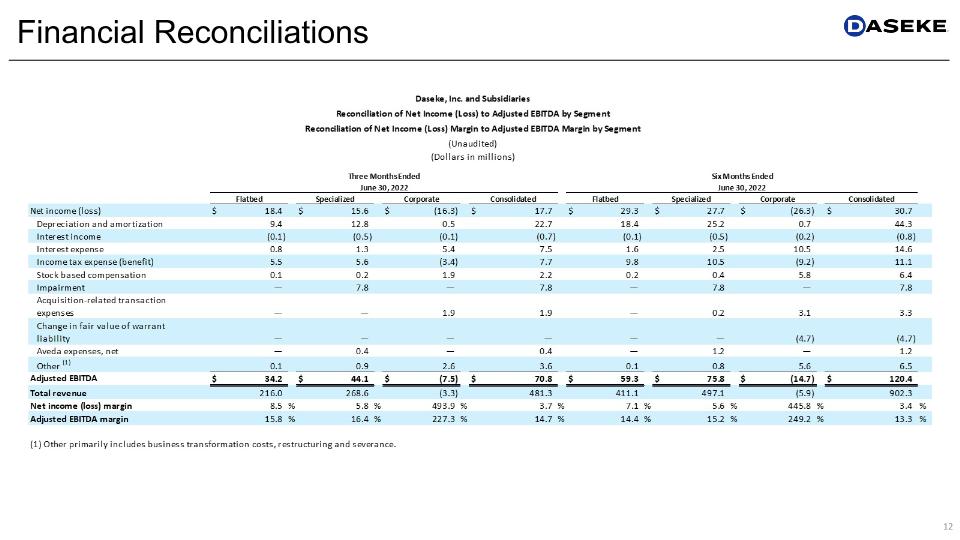

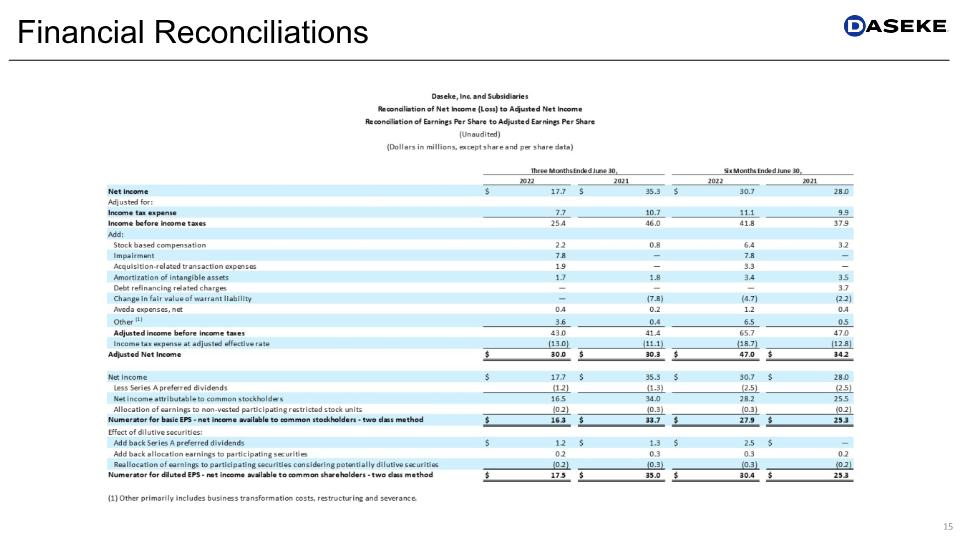

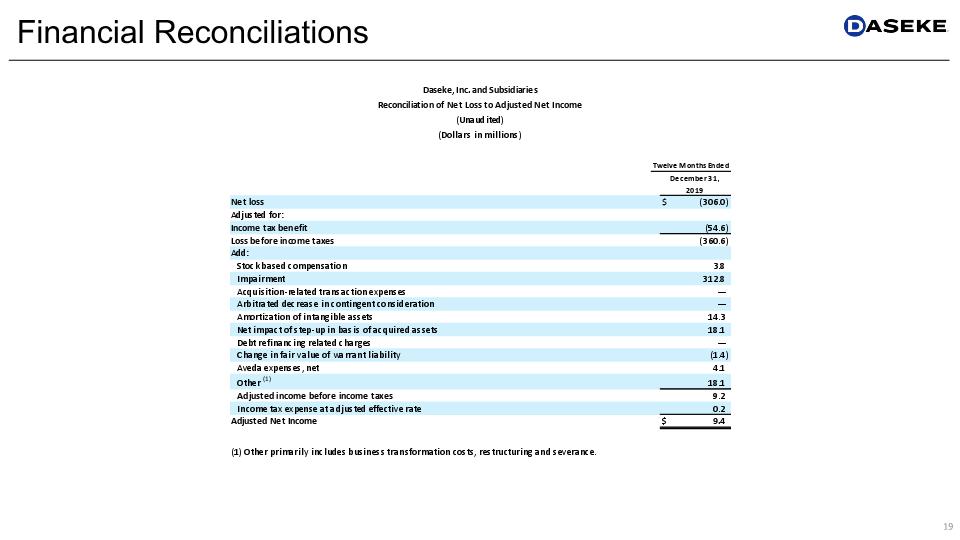

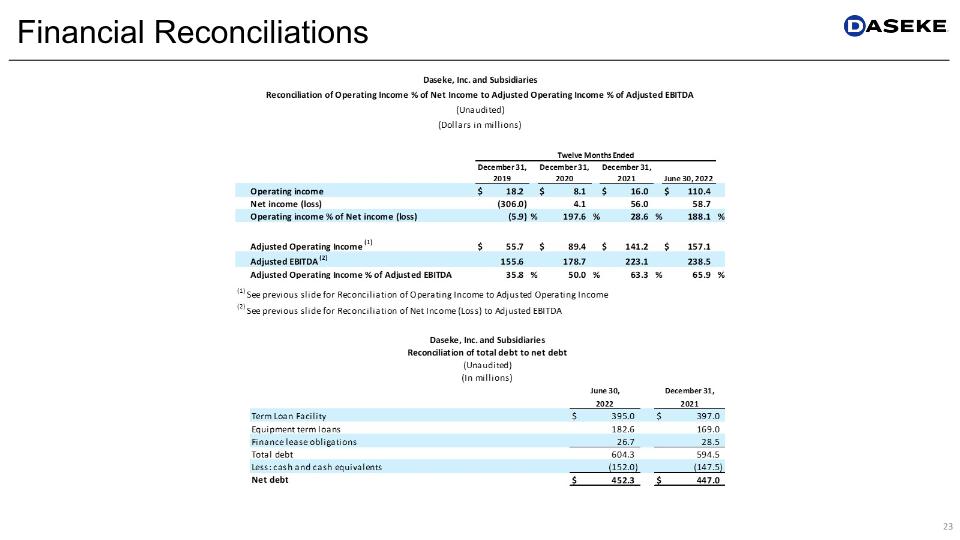

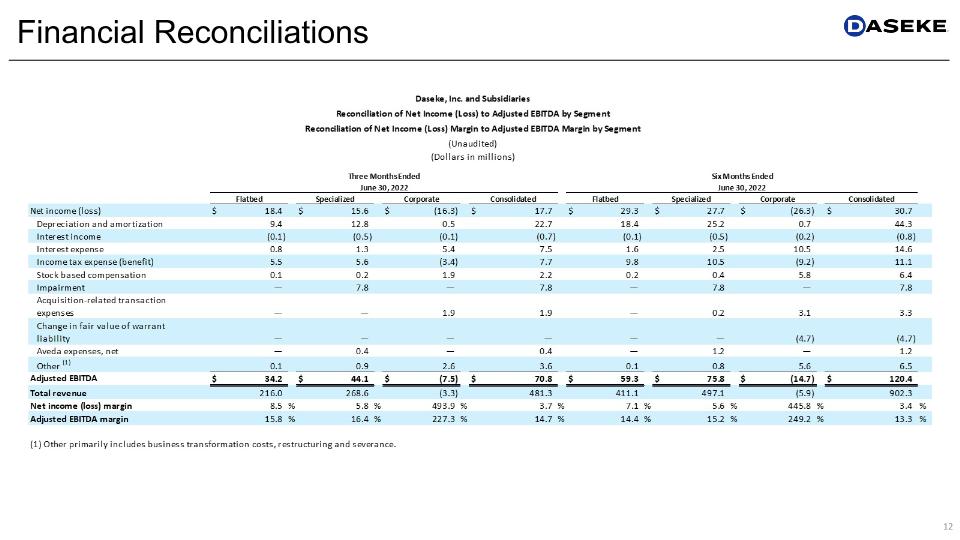

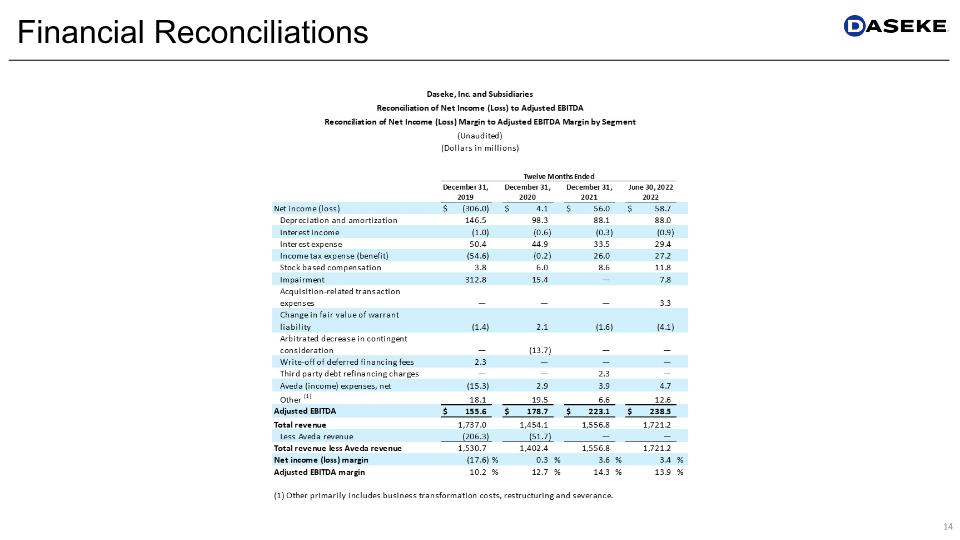

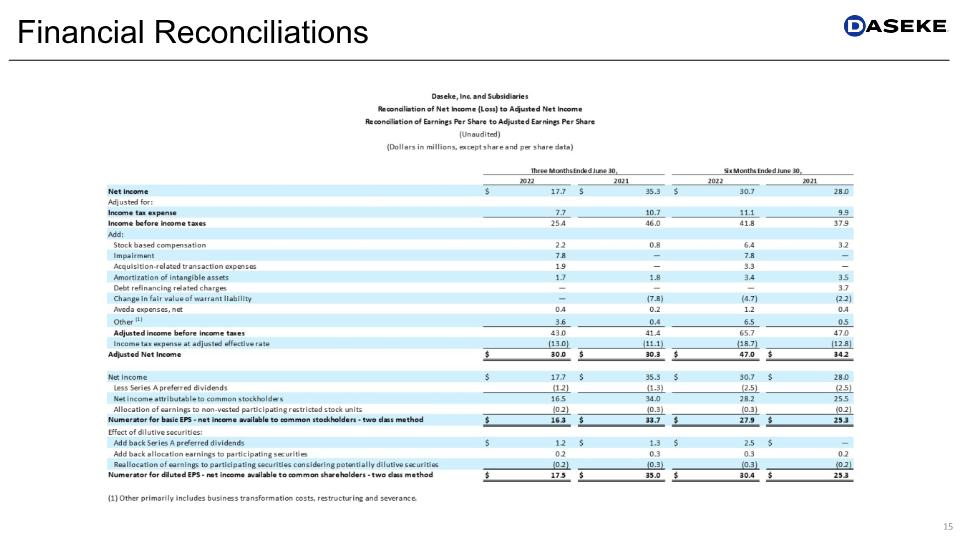

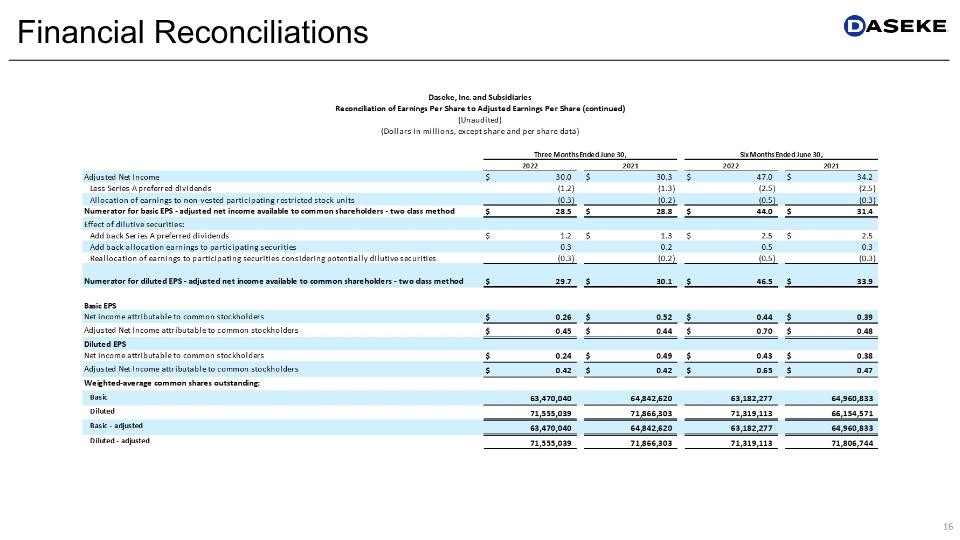

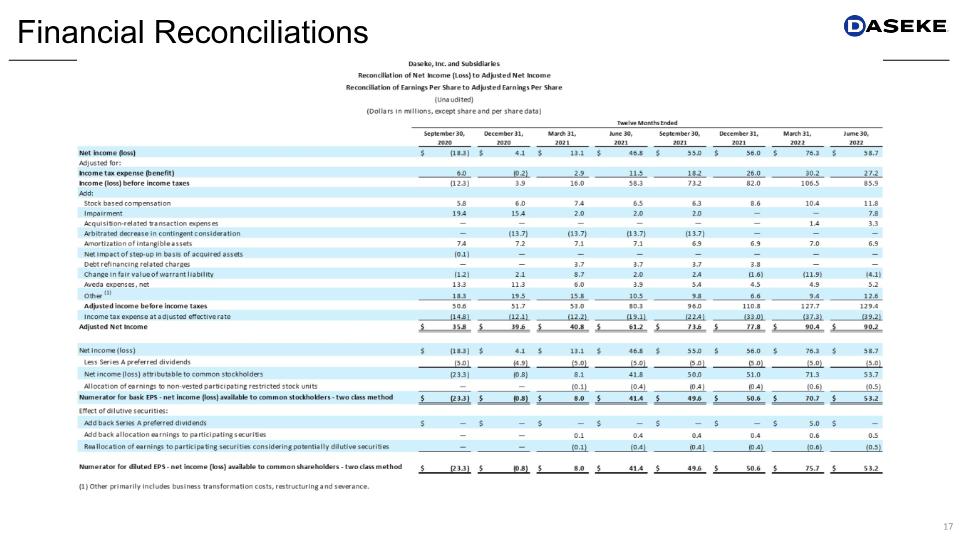

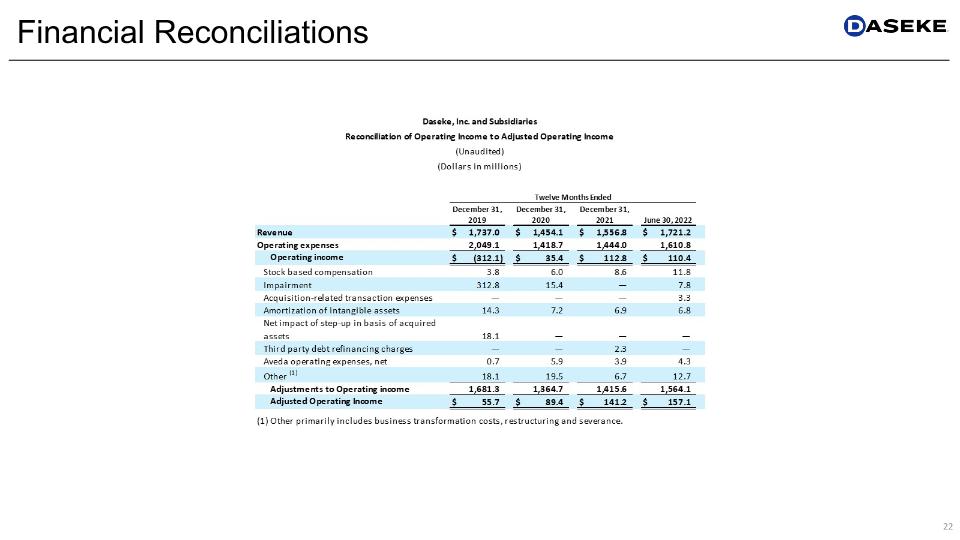

Financial Reconciliations

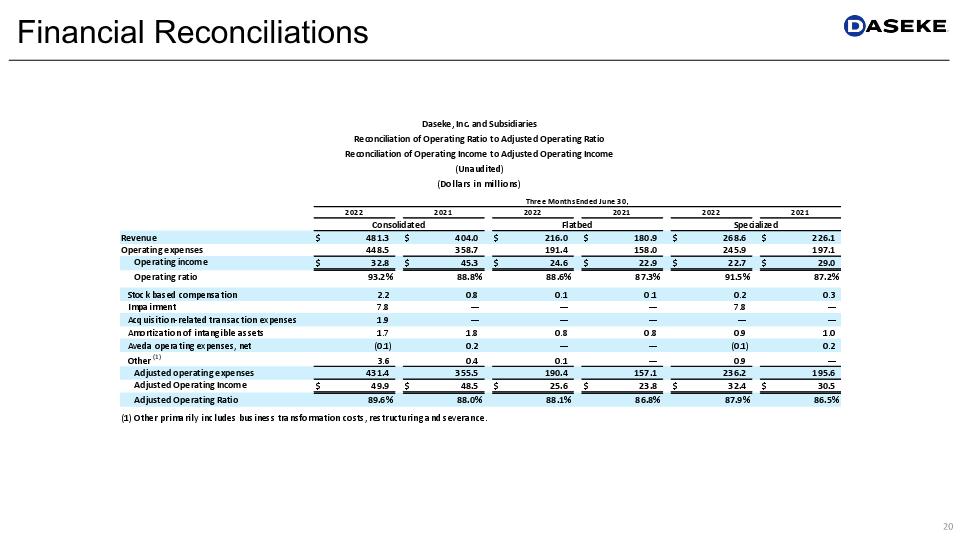

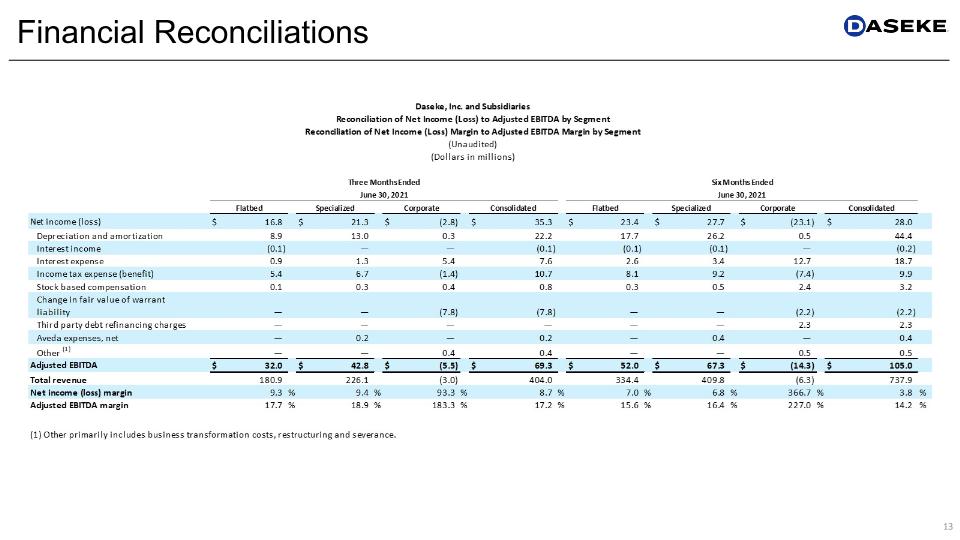

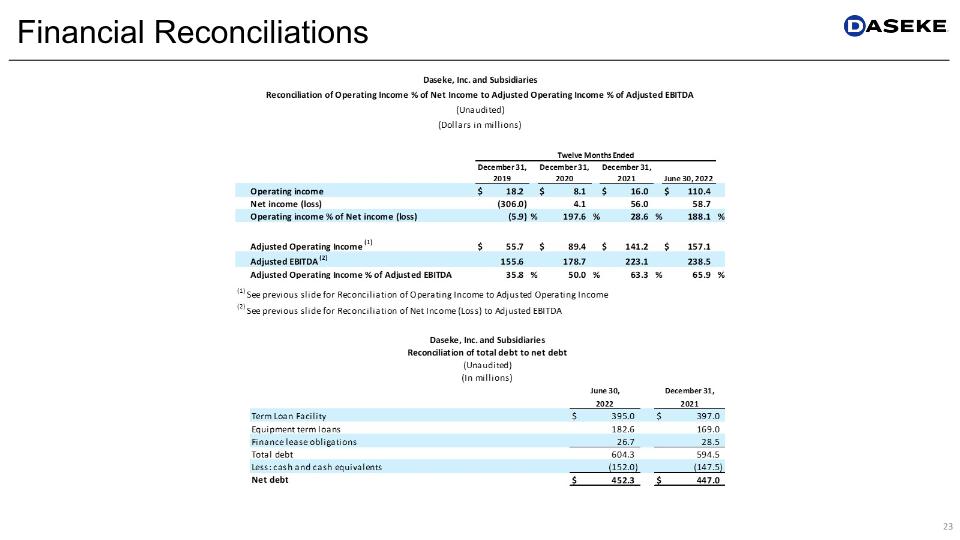

Financial Reconciliations

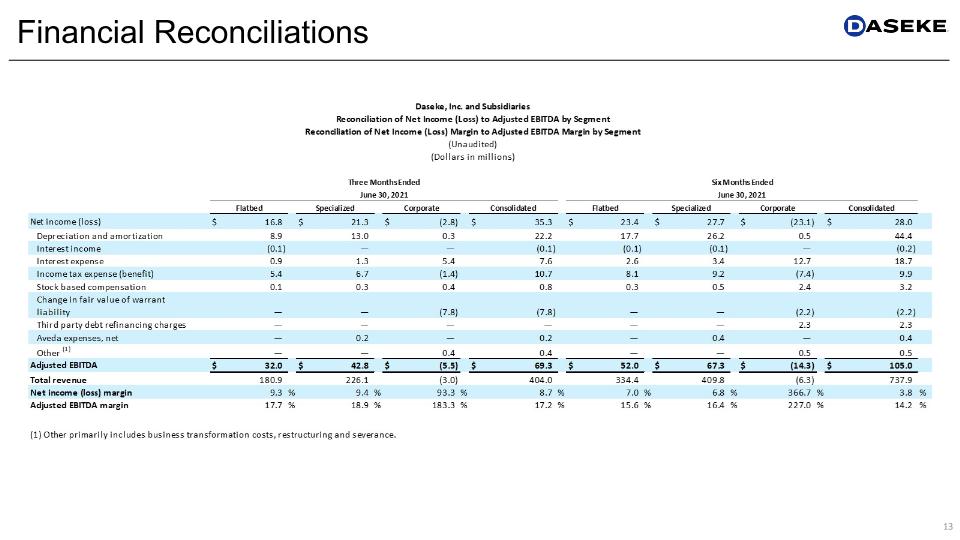

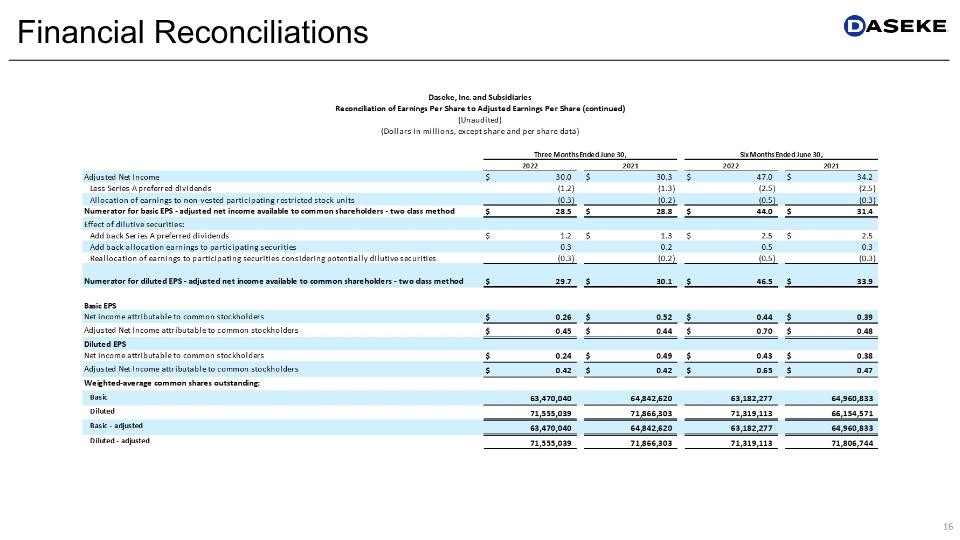

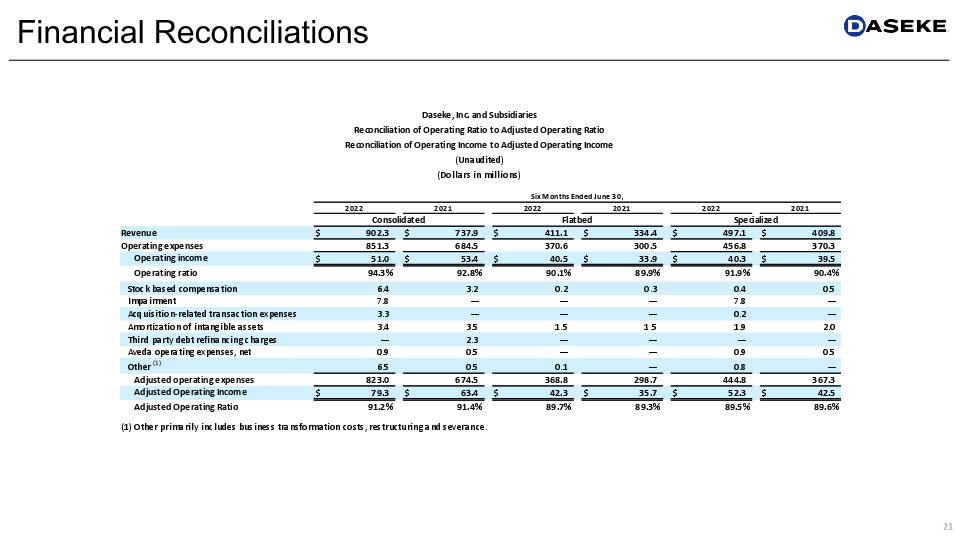

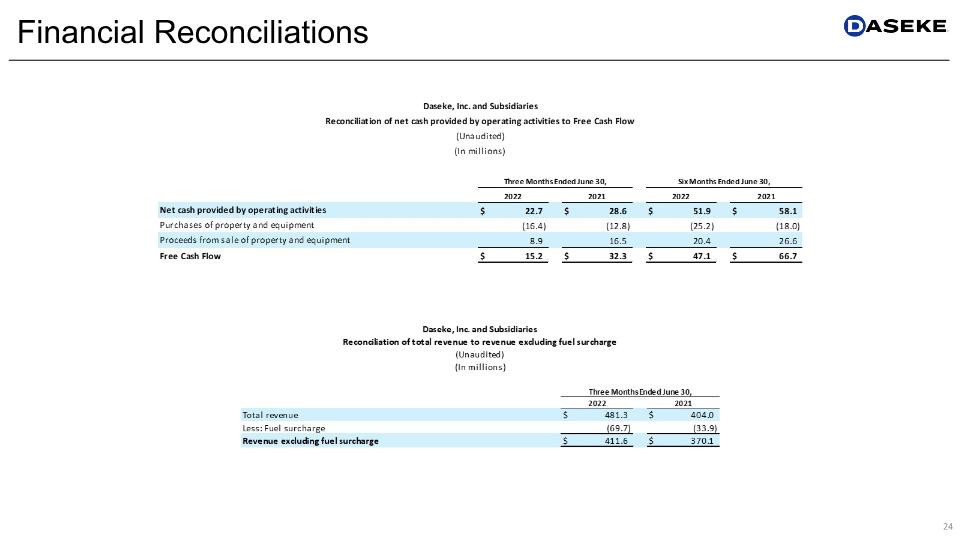

Financial Reconciliations

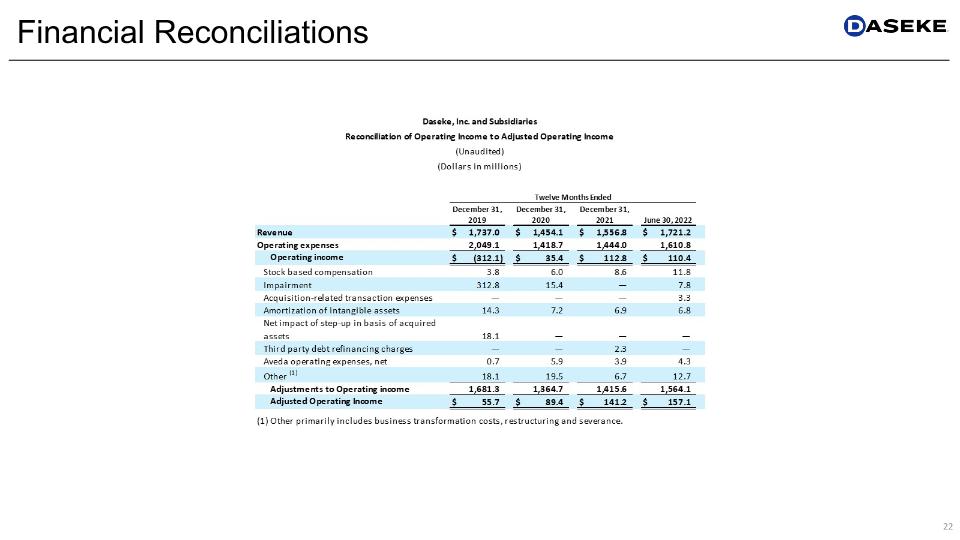

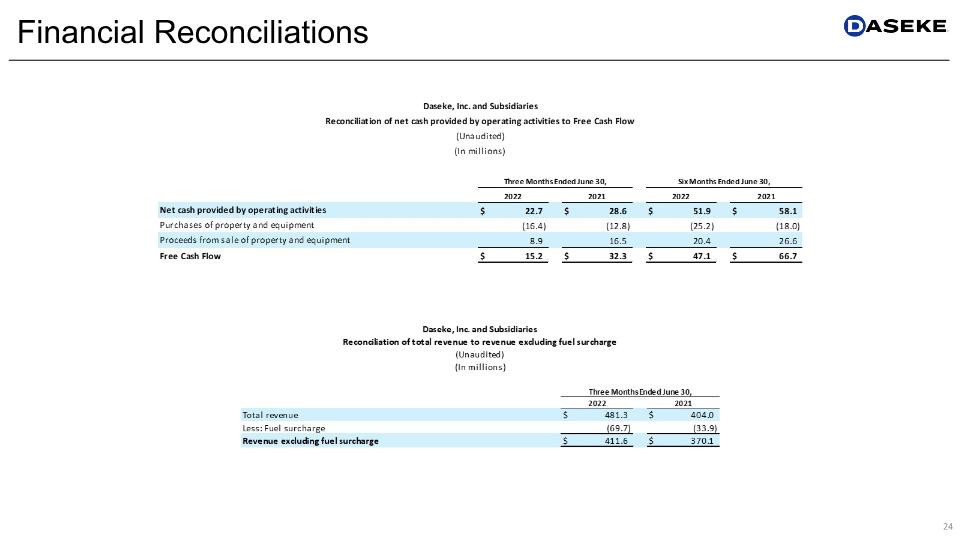

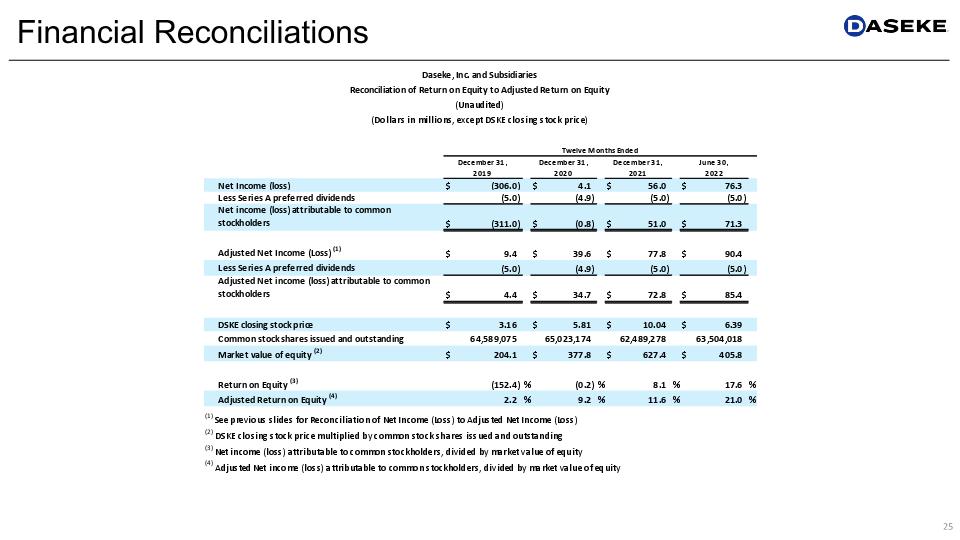

Financial Reconciliations

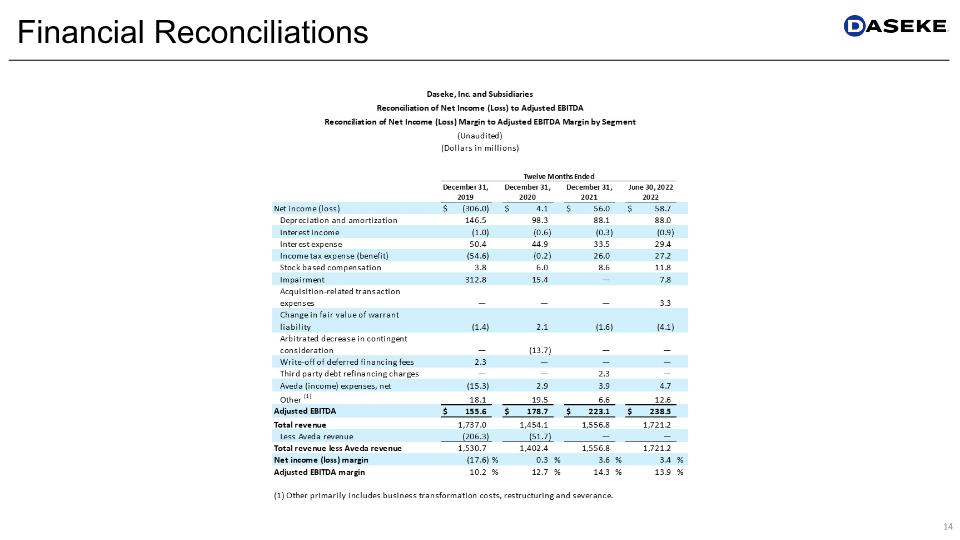

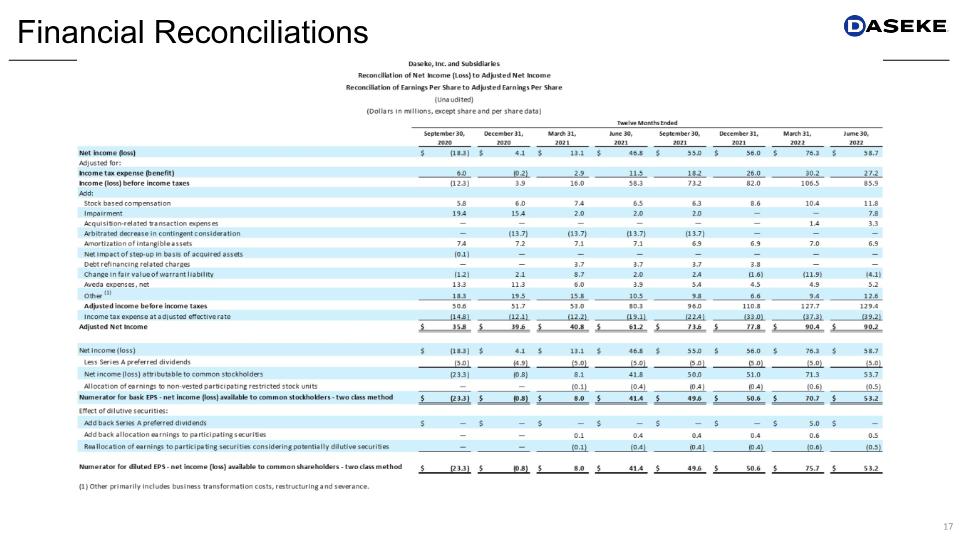

Financial Reconciliations

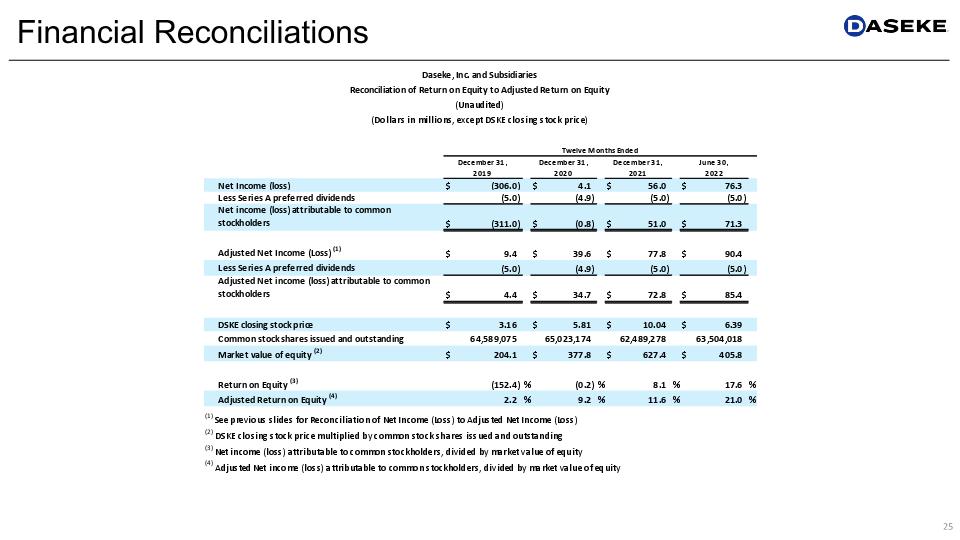

Financial Reconciliations

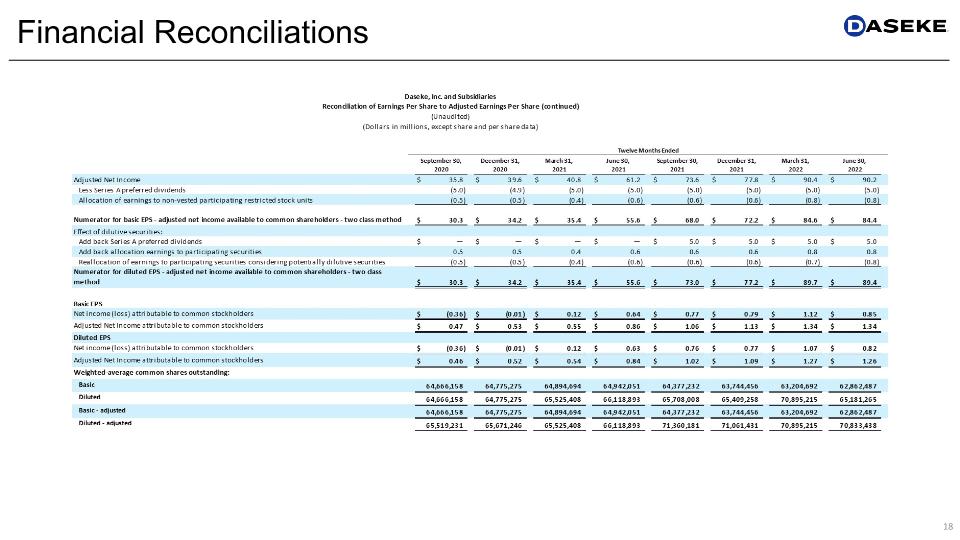

Financial Reconciliations

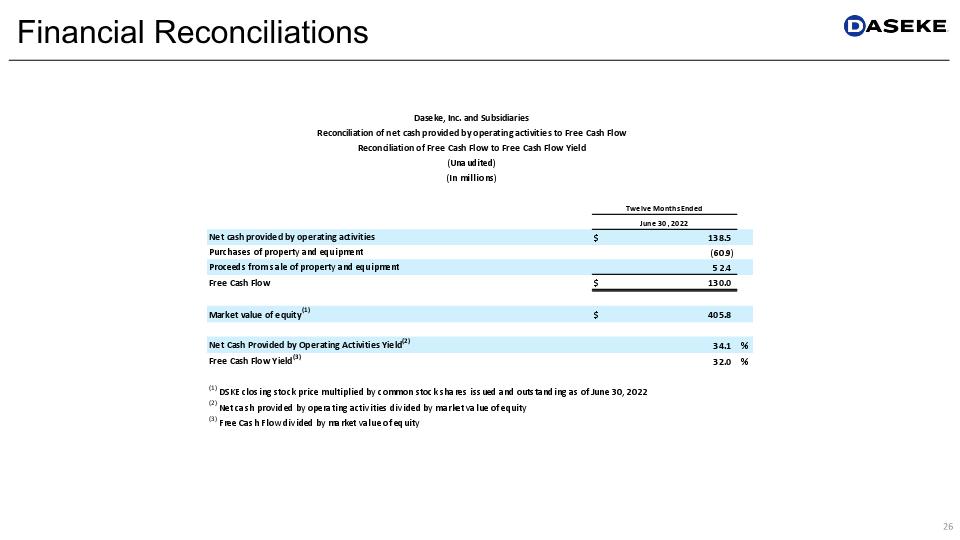

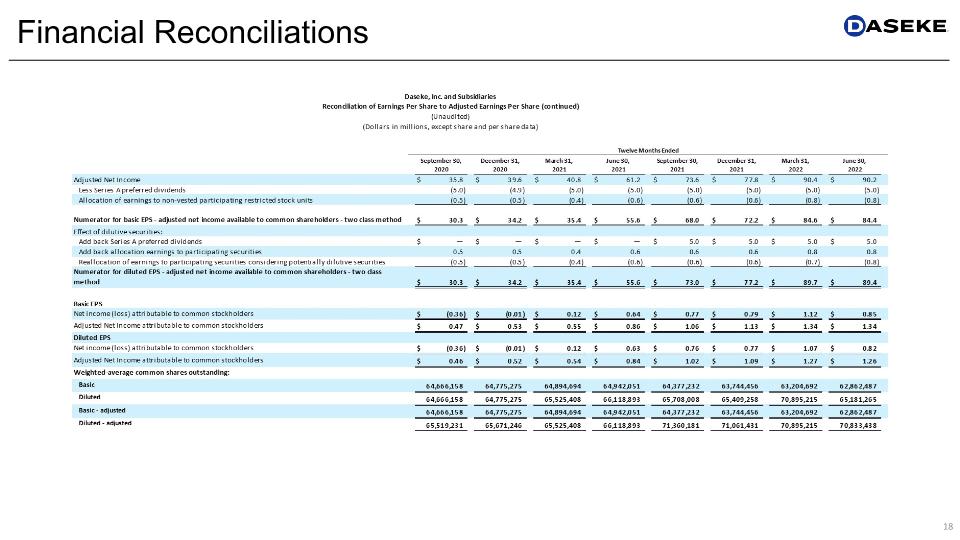

Financial Reconciliations

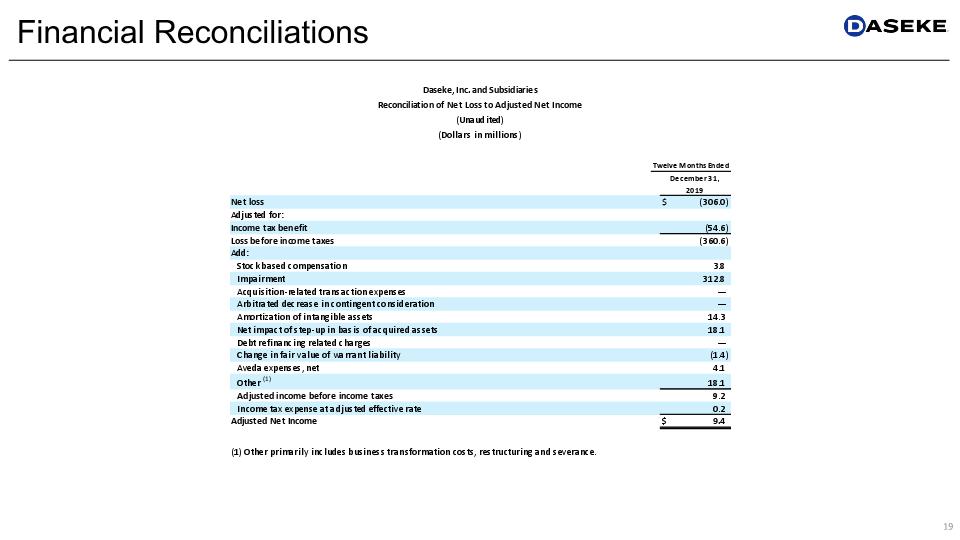

Financial Reconciliations

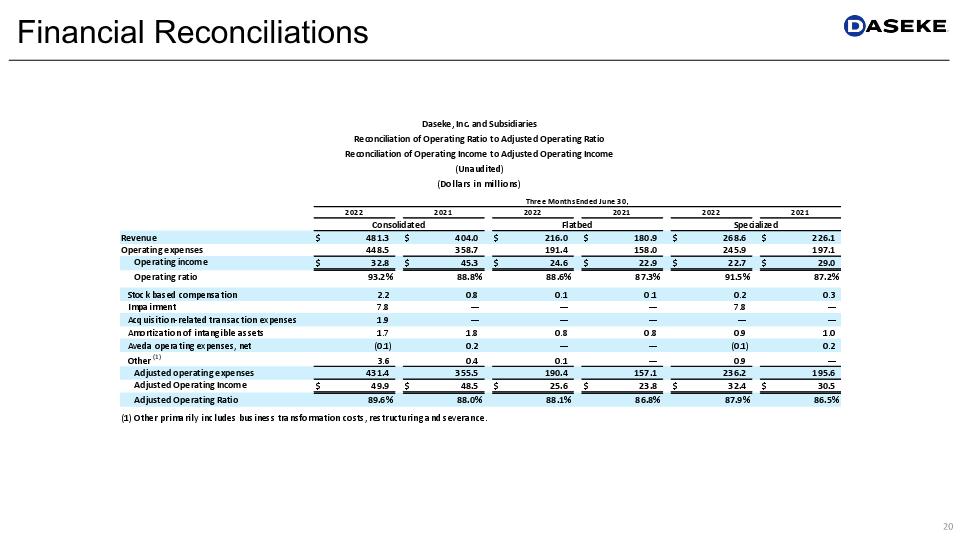

Financial Reconciliations

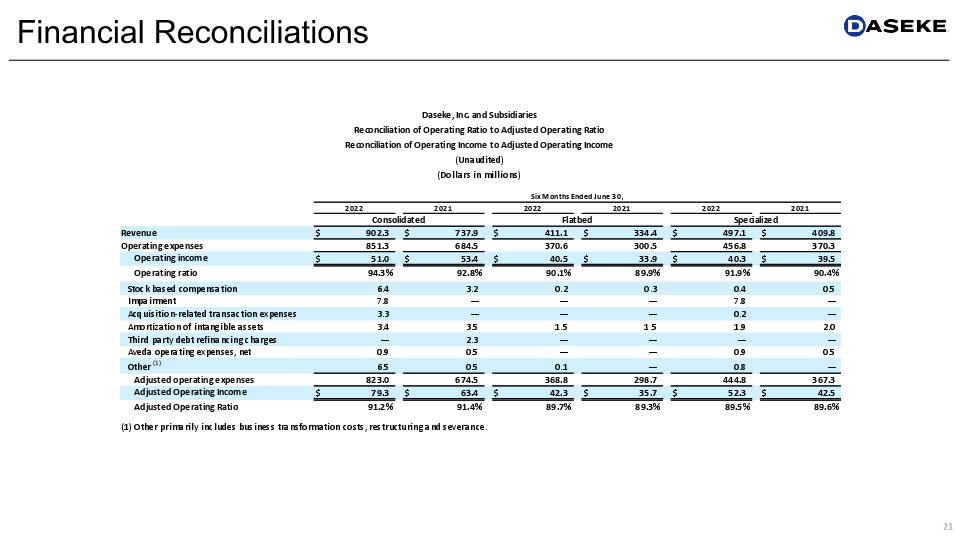

Financial Reconciliations

Financial Reconciliations

Financial Reconciliations

Financial Reconciliations

Financial Reconciliations

Daseke, Inc. 15455 Dallas Parkway, Ste 550�Addison, TX 75001 www.Daseke.com Investor Relations Joe Caminiti or Ashley Gruenberg, Alpha IR 312-445-2870 DSKE@alpha-ir.com Contact Information