UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23057

Guggenheim Energy & Income Fund

(Exact name of registrant as specified in charter)

227 West Monroe Street, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Amy J. Lee

227 West Monroe Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 827-0100

Date of fiscal year end: September 30

Date of reporting period: October 1, 2019 – September 30, 2020

Item 1. Reports to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

GUGGENHEIMINVESTMENTS.COM/XGEIX

...YOUR WINDOW TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT GUGGENHEIM ENERGY & INCOME FUND

The shareholder report you are reading right now is just the beginning of the story.

Online at guggenheiminvestments.com/xgeix, you will find:

| • | Daily, weekly and monthly data on NAV, distributions and more |

| • | Portfolio overviews and performance analyses |

| • | Announcements, press releases and special notices and tax characteristics |

Guggenheim Partners Investment Management, LLC and Guggenheim Funds Investment Advisors, LLC are continually updating and expanding shareholder information services on the Fund’s website in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed and the results of our efforts. It is just one more way we are working to keep you better informed about your investment in the Fund.

| | |

| (Unaudited) | September 30, 2020 |

DEAR SHAREHOLDER

The fiscal year ended September 30, 2020, concluded on a cautious note. Even though markets performed well for most of the period, COVID-19 became the deadliest pandemic in a century, causing a steeper plunge in output and employment in two months than during the first two years of the Great Depression. The U.S. Federal Reserve acted quickly to restore market functioning and cushion the economy, cutting rates to zero, engaging in massive asset purchases, and launching an array of lending facilities. Congress also acted much faster than in previous downturns, with the budget deficit headed to the highest level since World War II.

The recovery since the spring has been faster than expected, with consumer confidence holding up due to the temporary nature of layoffs and positive personal income growth thanks to massive fiscal support. However, the outlook for the next several months is more challenging. Fiscal support is fading, so incomes will likely fall in the fourth quarter. Also, colder weather and the reopening of schools make the likelihood of another large COVID wave very high, risking renewed lockdowns and a setback in the recovery. We do not expect a full recovery will be possible until a vaccine has been developed, tested, approved, produced, and administered across the globe. This process will likely take until mid-2021, or possibly longer. As discussed in this shareholder report, these events have had an impact on performance.

We thank you for your investment in the Guggenheim Energy & Income Fund (the “Fund”). This report covers the Fund’s performance for the 12-month period ended September 30, 2020.

Guggenheim Funds Investment Advisors, LLC (the “Adviser”) serves as the investment adviser to the Fund. Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”) serves as the Fund’s investment sub-adviser and is responsible for the management of the Fund’s portfolio of investments. The Adviser and the Sub-Adviser are affiliates of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm. Guggenheim Funds Distributors, LLC serves as the distributor to the Fund and is also an affiliate of Guggenheim.

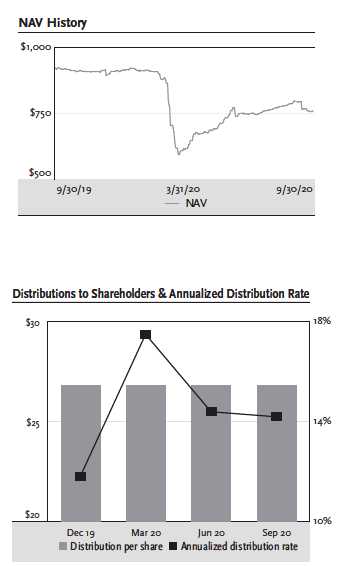

As a non-listed fund, the Fund does not have a market price or market price return. For the 12-month period ended September 30, 2020, the Fund provided a total return based on net asset value (“NAV”) of -5.41%. The NAV return includes the deduction of management fees, operating expenses, and all other Fund expenses. As of September 30, 2020, the Fund’s NAV was $756.73 per share, compared with $922.51 per share on September 30, 2019.

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 3

| | |

| DEAR SHAREHOLDER (Unaudited) continued | September 30, 2020 |

The Fund made four distributions during the period, each for $26.8125 per share. The distribution rate at the end of the period, based on the closing NAV, was 14.17%. The Fund’s distribution rate is not constant and the amount of distributions, when declared by the Fund’s Board of Trustees (the “Board”), is subject to change based on the performance of the Fund. Please see Note 2(g) on page 40 for more information on distributions for the period.

During the period, the Board approved four tender offers, each to purchase for cash up to 2.5% of the Fund’s outstanding common shares. All were successfully completed, the most recent on October 2, 2020. The tender offers are discussed in more detail elsewhere in this report.

We are committed to the safety and prosperity of our clients, our employees, and our shareholders.

Thank you for the trust you place in us.

Sincerely,

Brian E. Binder

President and Chief Executive Officer

Guggenheim Energy & Income Fund

October 31, 2020

4 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT

| | |

| MARKET AND ECONOMIC OVERVIEW (Unaudited) | September 30, 2020 |

While no one anticipated the emergence of a global pandemic a year ago, we anticipated that markets had become overvalued and were vulnerable to some kind of exogenous shock. That shock came in the form of COVID-19, the necessary precautions against which have placed additional burden on already struggling global economies. Faced with the prospect of an economic collapse, policymakers in the U.S. introduced fiscal and monetary policy initiatives that have for the most part shored up the U.S. economy, although more stimulus appears to be necessary. These policy initiatives, particularly on the monetary side, have increased market liquidity and lowered borrowing rates, challenging fixed-income investors with low yields. For the trailing 12-month period ended September 30, 2020, the yield on the two-year Treasury declined by 150 basis points to 0.13% from 1.63%, and the 10-year Treasury fell 99 basis points to 0.69% from 1.68%. The spread between the two-year U.S. Treasury and 10-year U.S. Treasury widened from 5 basis points to 56 basis points.

While the outlook on fiscal policy is contingent on the 2020 presidential election outcome, the monetary policy outlook is far less dependent on it. Our views hold that the U.S. Federal Reserve (the “Fed”) will remain accommodative over the next several years. This is in large part owing to recent revisions to the Fed’s policy framework that resulted in a dovish shift in the policy reaction function.

Fed policymakers revised their Statement on Longer-Run Goals and Monetary Policy Strategy in August 2020. Labor market goals now focus on correcting shortfalls in achieving maximum employment, rather than managing deviations from it, which previously included tightening policy when the Fed thought the labor market was too tight. Instead, the Fed will now tolerate the unemployment rate falling below a level they consider to be maximum employment as long as it does not produce unwanted inflation. On inflation policy, the Fed will aim for core inflation to average 2 percent over an unspecified time period. This allows for inflation readings that are moderately above 2 percent over shorter horizons to make up for periods when inflation falls below its target.

The practical effect of the revised strategy would likely have meant no rate hikes from 2015–2018, as inflation was never above 2 percent for a sustained period and a low unemployment rate is now an insufficient justification for raising rates. But the revised statement, and Fed Chair Jerome Powell’s speech at Jackson Hole, which coincided with the release of the new framework, gave no explanation of how the Fed would actually achieve higher inflation, something it could not attain previously with years of short-term rates at zero and trillions of dollars in quantitative easing. A lack of concrete guidance on the overshoot (with no numerical target and no specified time frame) further weakens the policy and the associated response in inflation expectations, which remain lower than the Fed would favor.

We expect the Fed will have a difficult time in reaching its inflation target in the coming years, let alone exceeding it, in part because core inflation lags real gross domestic product growth by about 18 months, meaning that inflation should trend downward over the next several quarters. In

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 5

| | |

| MARKET AND ECONOMIC OVERVIEW (Unaudited) continued | September 30, 2020 |

addition, elevated unemployment and a high debt burden will weigh on the speed of the recovery. As the last expansion demonstrated, even a strong economy with low unemployment does not necessarily produce inflation in excess of 2 percent, as many components of inflation are not responsive to interest rates or economic conditions.

Below-target inflation may anchor U.S. Treasury yields at low levels. In the near term, concerns over another COVID-19 wave complicated by the flu season, a slowing pace of improvement in the labor market, a lack of additional fiscal stimulus, and election uncertainty, all suggest low U.S. Treasury yields. In addition, comparatively higher yields in the U.S. should continue to attract capital from abroad, further supporting the market.

For the 12-month period ended September 30, 2020, the Standard & Poor’s 500® (“S&P 500”) Index* returned 15.15%. The MSCI Europe-Australasia-Far East (“EAFE”) Index* returned 0.49%. The return of the MSCI Emerging Markets Index* was 10.54%.

In the bond market, the Bloomberg Barclays U.S. Aggregate Bond Index* posted a 6.98% return for the 12-month period, while the Bloomberg Barclays U.S. Corporate High Yield Index* returned 3.25%. The return of the ICE Bank of America (“BofA”) Merrill Lynch 3-Month U.S. Treasury Bill Index* was 1.10% for the 12-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

6 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) | September 30, 2020 |

Guggenheim Energy & Income Fund (the “Fund”) is managed by a team of seasoned professionals at Guggenheim Partners Investment Management, LLC (“GPIM”). This team includes Thomas Hauser, Senior Managing Director and Portfolio Manager; Steven Brown, Senior Managing Director and Portfolio Manager; Adam Bloch, Managing Director and Portfolio Manager; and Richard de Wet, Director and Portfolio Manager. In the following interview, the investment team discusses the market environment and the Fund’s performance for the 12-month period ended September 30, 2020.

What is the Fund’s investment objective and how is it pursued?

The Fund’s investment objective is to provide high income. As a secondary investment objective, the Fund seeks capital appreciation. There can be no assurance the Fund will achieve its investment objectives.

Under normal market conditions, the Fund invests at least 80% of its managed assets (net assets plus financial leverage) in securities of energy companies and income-producing securities of other issuers. Energy companies include those that have at least 50% of their assets, income, sales, or profits committed to, or derived from:

| • | production, exploration, development, mining, extraction, transportation (including marine transportation), refining, processing, storage, distribution, management, marketing, and/or trading of oil, natural gas, natural gas liquids, refined petroleum products, coal, biofuels, or other natural resources used to produce energy, or ethanol; |

| • | generation, transmission, distribution, marketing, sale, and/or trading of all forms of electrical power (including through clean and renewable resources, such as solar energy, wind energy, geothermal energy, or hydropower) or gas; |

| • | manufacturing, marketing, management, sale, and/or trading of equipment, products or other supplies predominantly used by entities engaged in such businesses; and |

| • | provision of services to entities engaged in such businesses. |

Under normal market conditions, the Fund invests at least 70% of its managed assets in securities of energy companies. The Fund intends to focus its energy company investments in debt securities, including bonds, debentures, notes, loans and loan participations, mezzanine and preferred securities, convertible securities, and structured products. Other income-producing securities in which the Fund may invest include corporate bonds, debentures, notes, loans and loan participations, mezzanine and preferred securities, convertible securities, asset-backed securities, commercial paper, U.S. government securities, sovereign government and supranational debt securities, structured products, and dividend-paying common equity securities.

The Fund may invest in debt securities of any credit quality, and may invest without limitation in securities of below-investment-grade quality (also known as high yield securities or junk bonds). Securities of below-investment-grade quality are considered predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal when due. Securities of below-investment-grade quality involve special risks as compared to investment-grade-quality securities.

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 7

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

The Fund may use financial leverage (borrowing) to finance the purchase of additional securities. Although financial leverage may create an opportunity for increased return for shareholders, it also results in additional risks and can magnify the effect of any losses. There is no assurance that the strategy will be successful. If income and gains earned on securities purchased with the financial leverage proceeds are greater than the cost of the financial leverage, common shareholders’ return will be greater than if financial leverage had not been used. Conversely, if the income or gains from the securities purchased with the proceeds of financial leverage are less than the cost of the financial leverage, common shareholders’ return will be less than if financial leverage had not been used.

How did the Fund perform for the period?

For the 12-month period ended September 30, 2020, the Fund provided a total return based on net asset value (“NAV”) of -5.41%. The NAV return includes the deduction of management fees, operating expenses, and all other Fund expenses. As of September 30, 2020, the Fund’s NAV was $756.73 per share, compared with $922.51 per share on September 30, 2019.

What were the Fund’s distributions for the period?

The Fund made four distributions during the period, each for $26.8125 per share. The distribution rate at the end of the period, based on the closing NAV, was 14.17%. The Fund’s distribution rate is not constant and the amount of distributions, when declared by the Fund’s Board of Trustees (the “Board”), is subject to change based on the performance of the Fund. Please see Note 2(g) on page 40 for more information on distributions for the period.

For the year ended September 30, 2020, 2.3% of the distributions were characterized as return of capital and 97.7% of the distributions were characterized as ordinary income. The final determination of the tax character of the distributions paid by the Fund in 2020 will be reported to shareholders in January 2021.

Why did the Fund accrue excise tax during the period?

As a registered investment company, the Fund is subject to a 4% excise tax that is imposed if the Fund does not distribute by the end of any calendar year at least the sum of (i) 98% of its ordinary income (not taking into account any capital gain or loss) for the calendar year and (ii) 98.2% of its capital gain in excess of its capital loss (adjusted for certain ordinary losses) for a one year period generally ending on October 31 of the calendar year (unless an election is made to use the fund’s fiscal year). The Fund generally intends to distribute income and capital gains in the manner necessary to minimize (but not necessarily eliminate) the imposition of such excise tax. While the Fund’s income and capital gains can vary significantly from year to year, the Fund seeks to maintain more stable monthly distributions over time. The Fund may retain income or capital gains and pay excise tax when it is determined that doing so is in the best interest of shareholders. Management, in consultation with the Board, evaluates the costs of the excise tax relative to the benefits of retaining income and capital gains, including that such undistributed amounts (net of the excise tax paid) remain available for investment by the Fund and are available to supplement future distributions, which may facilitate the payment of more stable monthly distributions year over year.

8 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

Why is there no market price for the Fund?

The Fund is a non-listed closed-end fund. It is designed for long-term investors and an investment in the common shares should be considered illiquid. An investment in the common shares is not suitable for investors who need access to the money they invest. Unlike shares of open-end funds (commonly known as mutual funds), which generally are redeemable on a daily basis, the common shares are not redeemable at an investor’s option, and unlike traditional listed closed-end funds, the common shares are not listed on any securities exchange. Investors should not expect to be able to sell their common shares, regardless of how the Fund performs. Investors may not have access to the money invested until a shareholder liquidity event occurs.

What is a shareholder liquidity event?

The Fund intends to complete an event intended to provide liquidity on or before July 28, 2023 (liquidity event date). The Fund’s Board may extend the liquidity event date for one year, to July 28, 2024, without a shareholder vote. The liquidity event date can be further extended beyond July 28, 2024, if approved by 75% of the Board followed by approval by 75% of the outstanding voting securities of the Fund. A shareholder liquidity event will consist of either: termination and liquidation of the Fund, or a tender offer to repurchase 100% of the Fund’s outstanding common shares at a price equal to the then-current NAV. The Fund’s investment objectives and policies are not designed to seek to return to investors who purchased common shares in the initial offering their initial investment on the liquidity event date or any other date. Such initial investors and any investors who purchase common shares after the completion of the offering may receive less than their original investment through any shareholder liquidity event.

Did the Fund provide any liquidity for shareholders during the period?

During the period, the Board approved four tender offers. Each being oversubscribed, in accordance with the terms and conditions specified in the tender offer, the Fund purchased shares from all tendering shareholders on a pro rata basis. Shares that were tendered but not accepted for purchase and shares that were not tendered remain outstanding.

| Tender Offer | | |

| Tender Expiration | (2.5% of outstanding | Shares | Purchase Price |

| Dates | shares as of expiration) | Tendered | (NAV on Expiration) |

January 3, 2020 | 1,530 | 13,164 | $913.71 |

April 7, 2020 | 1,495 | 9,720 | $629.24 |

July 6, 2020 | 1,462 | 8,838 | $750.35 |

October 2, 2020 | 1,429 | 8,905 | $757.99 |

In any given quarter, Guggenheim Funds Investment Advisors, LLC (“the Adviser”) may or may not recommend to the Board that the Fund conduct a tender offer. Accordingly, there may be periods during which no tender offer is made, and it is possible that no further tender offers will be conducted during the term of the Fund.

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 9

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

If no other tender offer is made, shareholders may not be able to sell their common shares as it is unlikely that a secondary market for the common shares will develop or, if a secondary market does develop, shareholders may be able to sell their common shares only at substantial discounts from NAV.

How did the high yield energy market perform in this environment?

For the period, the Energy sector of the Bloomberg Barclays U.S. Corporate High Yield Index returned -9.61%. By subsector, Independent Energy returned -12.91%, Oil Field Services returned -42.13%, and Midstream returned 5.31%. By comparison, the Bloomberg Barclays U.S. Corporate High Yield Index returned 3.25% and the Credit Suisse Leveraged Loan Index returned 0.84%.

What happened to the price of oil over the period?

The price of West Texas Intermediate (WTI) oil traded in the $50 range during the fourth quarter of 2019, as output rose to record levels in the U.S., which produced 12.8 million barrels per day in November 2019. Following the Phase One trade deal between the U.S. and China in mid-December 2019, oil rose above $60 and finished the year at about $61. Oil prices rose again in the first week of January, when a top Iranian general was killed by a U.S. airstrike in Iraq. However, prices began to slip throughout the rest of the month on renewed concerns of weaker global growth and the emergence of COVID-19in China. WTI fell 12% in January 2020 to a three-month low and continued falling in February 2020 as the epidemic began to take shape.

In early March 2020 OPEC (“Organization of the Petroleum Exporting Countries (“OPEC”) members agreed to a 1.5 million barrel per day cut, with two-thirds of the proposed cuts allocated to member countries and the remainder to Russia and the other non-OPEC allies (“OPEC+”). However, the deal was conditional on the agreement of Russia, who rejected the proposal. In addition, OPEC’s existing production cuts expired on April 1st and were not renewed. A price war ensued, with Saudi Arabia slashing their official selling prices and ramping up production to regain market share from shale and other producers. Russia followed suit and increased output as well.

Concerns of weaker global growth and the emergence of COVID-19, contributed to a plunge in prices to about $20 by the end of March 2020, their lowest level since 2001, and briefly below-zero in April 2020 for the first time ever. The demand shock was so large that even with a new commitment from OPEC+ to cut production by 9.7 million barrels per day, global storage capacity could have been exhausted within a few months.

However, the combination of fiscal and monetary support from central banks helped to restart the global economy. The easing of COVID-related restrictions, along with the impact of production cuts, boosted prices to above $30 by June 2020. OPEC+ also extended production cuts through July 2020 and Saudi Arabia added a further voluntary cut, which caused its production to fall to its lowest level in 30 years. Late summer saw a slight improvement in oil markets, as the amount of ship-stored oil fell, and global demand improved, particularly in China. In August 2020, OPEC’s production cut was eased to 7.7 million barrels per day. Oil traded around $40 for most of the third quarter of 2020, but tailed off toward quarter end as the resurgence of COVID-19 cases, a continuation of working from home, and a weakened aviation industry have reduced estimates of demand through the rest of 2020.

10 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

COVID-19 negatively impacted U.S. shale oil production by crippling demand and contributing to a 2 million barrel-per-day fall in U.S. onshore oil production. The price collapse exacerbated the problems of the most indebted companies across all energy subsectors. Facing lower revenue and cash flow, exploration & production companies have continued to delay new projects and shrink costs at existing facilities. The number of active U.S. drilling rigs fell below 200 in June 2020 for the first time since 2009, keeping pressure on oilfield services businesses, as well as midstream players exposed to lower volumes. In downstream energy, COVID-19 restrictions have weakened consumption of both gasoline and jet fuel, hampering refining and fuel distribution businesses. Overall, the entire sector will continue to be under pressure until the demand outlook improves.

Describe the environment for high yield bonds.

The high yield bond market delivered solid fourth quarter performance in 2019 supported by confirmation of the Phase One trade deal with China. The first two months of the first quarter were benign, but changed rapidly with the onset of COVID-19 in March 2020. The high yield market returned -12.7% in the first quarter of 2020 and was the weakest quarter since the fourth quarter of 2008 during the Global Financial Crisis. Lower quality credit sold off and the new issue market was effectively shut for 3 weeks. The COVID-19 outbreak dramatically halted large portions of the U.S. economy to which the U.S. Federal Reserve (the “Fed”) responded quickly. The Federal Open Market Committee cut rates by 125 basis points and implemented a series of liquidity programs to support commercial loans, mortgages, corporations, and municipalities. The Fed also agreed to buy bonds from recent fallen angels, adding a strong technical tailwind to the high yield market.

The combination of the monetary and fiscal support helped to jumpstart the high yield market. The new issue market reopened and issuance has remained robust since. The second and third quarter alone saw $276 billion in issuance which nearly equals full year 2019 levels. Over the same period, the market experienced about $47 billion of inflows into the market from ETFs and mutual funds. Overall the market was up 10.2% and 4.6% in the second and third quarters, respectively. With the market rally, most sectors have exhibited positive performance through the first three quarters of 2020.

How is the portfolio positioned at the end of the period?

The Fund is constructed to generate strong yield and to mitigate downside risk. This has been addressed through focusing on high yield bonds along with secured bank loans. In addition, the Fund has large exposures to midstream assets that face less downside commodity price risk.

The Fund’s portfolio consists of about 35% secured paper, which we believe is more defensive as it places the Fund higher up in the capital structure and is typically secured by substantially all of the assets of the business. The portfolio has about 70% energy exposure with some exposure to strong credits in other industries that present good relative value opportunities. The Fund is overweight midstream and underweight E&P and oil field services relative to the Energy Index, which added to relative outperformance. Guggenheim does not expect a significant shift in the strategy or how the Fund is positioned.

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 11

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

The Fund invests in non-U.S. dollar-denominated assets when the risk-return profile is favorable. The Fund entered forward foreign currency exchange contracts to hedge exchange rate risk for non-U.S. dollar denominated positions, which had a negligible impact to performance. The Fund currently does not hold non-U.S. dollar-denominated assets.

What is the Fund’s leverage strategy?

The Fund may use financial leverage (borrowing) to finance the purchase of additional securities. As of September 30, 2020, the Fund’s leverage was approximately 13% of managed assets (net assets plus financial leverage). The purpose of leverage (borrowing) is to fund the purchase of additional securities that provide increased income and potentially greater appreciation to common shareholders than could be achieved from an unlevered portfolio.

Leverage results in greater NAV volatility and entails more downside risk than an unleveraged portfolio. The Fund expects to employ leverage primarily through indebtedness and engaging in reverse repurchase agreements. The Fund is permitted to issue preferred shares, but has no current intention to do so. There is no guarantee that the Fund’s leverage strategy will be successful.

*Index Definitions

Indices are unmanaged and reflect no expenses. It is not possible to invest directly in an index.

Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

Bloomberg Barclays U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

Credit Suisse Leveraged Loan Index tracks the investable market of the U.S. dollar denominated leveraged loan market. It consists of issues rated “5B” or lower, meaning that the highest rated issues included in this index are Moody’s/S&P ratings of Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries.

ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market Index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

12 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

S&P 500® is a broad-based index, the performance of which is based on the performance of 500 widely held common stocks chosen for market size, liquidity, and industry group representation.

Risks and Other Considerations

The global ongoing crisis caused by the outbreak of COVID-19 is causing materially reduced consumer demand and economic output, disrupting supply chains, resulting in market closures, travel restrictions and quarantines, and adversely impacting local and global economies. Investors should be aware that in light of the current uncertainty, volatility and distress in economies, financial markets, and labor and health conditions all over the world, the Fund’s investments and a shareholder’s investment in the Fund are subject to sudden and substantial losses, increased volatility and other adverse events. Firms through which investors invest with the Fund, the Fund, its service providers, the markets in which it invests and market intermediaries are also impacted by quarantines and similar measures intended to contain the ongoing pandemic, which can obstruct their functioning and subject them to heightened operational risks.

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass.

There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Risk is inherent in all investing, including the loss of your entire principal. Therefore, before investing you should consider the risks carefully.

The Fund is subject to several risk factors, including investment risk, which could result in the loss of the entire principal amount that you invest. Certain of these risk factors are described below. Please see the Fund’s Prospectus, Statement of Additional Information (“SAI”) and guggenheiminvestments.com/xgeix for a more detailed description of the risks of investing in the Fund. Shareholders may access the Fund’s Prospectus and SAI on the EDGAR Database on the Securities and Exchange Commission’s website at www.sec.gov.The fact that a particular risk below is not specifically identified as being heightened under current conditions does not mean that the risk is not greater than under normal conditions.

Below Investment Grade Securities Risk. High yield, below investment grade and unrated high risk debt securities (which also may be known as “junk bonds”) may present additional risks because these securities may be less liquid, and therefore more difficult to value accurately and sell at an advantageous price or time, and present more credit risk than investment grade bonds. The price of high yield securities tends to be subject to greater volatility due to issuer-specific operating results and outlook and to real or perceived adverse economic and competitive industry conditions. This exposure may be obtained through investments in other investment companies. Generally, the risks associated with high yield securities are heightened during times of weakening economic conditions or rising interest rates and are therefore especially heightened under current conditions.

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 13

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

Concentration Risk. Because the Fund is focused in companies operating in the energy sector of the economy, the Fund may be more susceptible to risks associated with such sector. Therefore, a downturn in the energy sector could have a larger impact on the Fund than on an investment company that does not concentrate in such sector. At times, the performance of securities of companies in the energy sector may lag the performance of other sectors or the broader market as a whole.

Convertible Securities Risk. Convertible securities may be subordinate to other securities. The total return for a convertible security depends, in part, upon the performance of the underlying security into which it can be converted. The value of convertible securities tends to decline as interest rates increase. Convertible securities generally offer lower interest or dividend yields than non-convertible securities of similar quality.

Credit Risk. The Fund could lose money if the issuer or guarantor of a fixed-income instrument or a counterparty to a derivatives transaction or other transaction is unable or unwilling, or perceived to be unable or unwilling, to pay interest or repay principal on time or defaults. The issuer, guarantor or counterparty could also suffer a rapid decrease in credit quality rating, which would adversely affect the volatility of the value and liquidity of the instrument. The risk of the occurrence of these types of events is especially heightened under current conditions. Credit ratings may not be an accurate assessment of liquidity or credit risk.

Energy Companies Risk. Under normal circumstances, the Fund concentrates its investments in the energy sector. Energy Companies are subject to certain risks, including, but not limited to, the following:

Catastrophic Event Risk. Energy infrastructure entities are subject to many dangers inherent in the production, exploration, management, transportation, processing and distribution of natural gas, natural gas liquids, crude oil, refined petroleum and petroleum products and other hydrocarbons. These dangers include leaks, fires, explosions, damage to facilities and equipment resulting from natural disasters, inadvertent damage to facilities and equipment and terrorist acts. These dangers give rise to risks of substantial losses as a result of loss or destruction of commodity reserves; damage to or destruction of property, facilities and equipment; pollution and environmental damage; and personal injury or loss of life and could adversely affect such companies’ financial conditions and ability to pay distributions to shareholders.

Energy Commodity Price Risk. Energy companies may be adversely affected by fluctuations in the prices of energy commodities and by the levels of supply and demand for energy commodities.

Energy Sector Regulatory Risk. Energy companies are subject to significant regulation of nearly every aspect of their operations by federal, state and local governmental agencies. Stricter laws or regulations or stricter enforcement policies with respect to existing regulations would likely increase the costs of regulatory compliance and could have an adverse effect on the financial performance of energy infrastructure entities.

14 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

Industry-Specific Risk. The energy sector involves a number of industry-specific risks including cyclical industry risk, fracturing risk, independent contractor risk, and oil price volatility risk. The energy industry is cyclical and from time to time may experience a shortage of drilling rigs, equipment, supplies, or qualified personnel, or due to significant demand, such services may not be available on commercially reasonable terms. Independent contractors are typically used in operations in the energy industry and there is a risk that such contractors will not operate in accordance with its own safety standards or other policies. In addition, pipeline companies are subject to the demand for natural gas, natural gas liquids, crude oil or refined products in the markets they serve, changes in the availability of products for gathering, transportation, processing or sale.

Reliance on Other Industries and Entities Risk. Energy companies rely heavily on other industries and entities in order to operate. Energy infrastructure entities in which the Fund invests may depend on the ability of such entities to make acquisitions that increase adjusted operating surplus per unit in order to increase distributions to unit holders. To the extent that energy infrastructure entities are unable to make future acquisitions, or such future acquisitions fail to increase the adjusted operating surplus per unit, their growth and ability to make distributions to unit holders will be limited.

Equity Securities Risk. Equity securities include common stocks and other equity and equity-related securities (and securities convertible into stocks). The prices of equity securities generally fluctuate in value more than fixed-income investments, may rise or fall rapidly or unpredictably and may reflect real or perceived changes in the issuing company’s financial condition and changes in the overall market or economy. Equity securities are currently experiencing heightened volatility and therefore, the Fund’s investments in equity securities are subject to heightened risks related to volatility. A decline in the value of equity securities held by the Fund will adversely affect the value of your investment in the Fund.

Interest Rate Risk. Fixed-income and other debt instruments are subject to the possibility that interest rates could change. Changes in interest rates may adversely affect the Fund’s investments in these instruments, such as the value or liquidity of, and income generated by, the investments. Interest rates may change as a result of a variety of factors, and the change may be sudden and significant, with unpredictable impacts on the financial markets and the Fund’s investments. Generally, when interest rates increase, the values of fixed-income and other debt instruments decline and when interest rates decrease, the values of fixed-income and other debt instruments rise. In response to the crisis initially caused by the outbreak of COVID-19, as with other serious economic disruptions, governmental authorities and regulators are enacting significant fiscal and monetary policy changes, including providing direct capital infusions into companies, creating new monetary programs and lowering interest rates considerably. These actions present heightened risks to fixed-income and debt instruments, and such risks could be even further heightened if these actions are unexpectedly or suddenly reversed or are ineffective in achieving their desired outcomes. In light of these actions and current conditions, interest rates and bond yields in the United States

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 15

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

and many other countries are at or near historic lows, and in some cases, such rates and yields are negative. The current very low or negative interest rates are magnifying the Fund’s susceptibility to interest rate risk and diminishing yield and performance.

Investment in Loans Risk. The Fund may invest in loans directly or indirectly through assignments or participations. Investments in loans, including loan syndicates and other direct lending opportunities, involve special types of risks, including credit risk, interest rate risk, counterparty risk, prepayment risk and extension risk, which are heightened under current conditions. Loans may offer a fixed or floating interest rate. Loans are often below investment grade and may be unrated. The Fund’s investments in loans can also be difficult to value accurately and may be more susceptible to liquidity risk than fixed-income instruments of similar credit quality and/or maturity. Participations in loans may subject the Fund to the credit risk of both the borrower and the seller of the participation and may make enforcement of loan covenants, if any, more difficult for the Fund as legal action may have to go through the seller of the participation (or an agent acting on its behalf). Covenants contained in loan documentation are intended to protect lenders and investors by imposing certain restrictions and other limitations on a borrower’s operations or assets and by providing certain information and consent rights to lenders. The Fund invests in or is exposed to loans and other similar debt obligations that are sometimes referred to as “covenant-lite” loans or obligations, which are generally subject to more risk than investments that contain traditional financial maintenance covenants and financial reporting requirements. The terms of many loans and other instruments are tied to the London Interbank Offered Rate (“LIBOR”), which functions as a reference rate or benchmark. It is anticipated that LIBOR will be discontinued at the end of 2021, which may cause increased volatility and illiquidity in the markets for instruments with terms tied to LIBOR or other adverse consequences for these instruments. These events may adversely affect the Fund and its investments in such instruments.

Leverage Risk. The Fund’s use of leverage, through borrowings or instruments such as derivatives, causes the Fund to be more volatile and riskier than if it had not been leveraged.

Management Risk. The Fund is actively managed, which means that investment decisions are made based on investment views. There is no guarantee that the investment views will produce the desired results or expected returns, causing the Fund to fail to meet its investment objective or underperform its benchmark index or funds with similar investment objectives and strategies.

Market Risk. The value of, or income generated by, the investments held by the Fund are subject to the possibility of rapid and unpredictable fluctuation. The value of certain investments (e.g., equity securities) tends to fluctuate more dramatically over the shorter term than do the value of other asset classes. These movements may result from factors affecting individual companies, or from broader influences, including real or perceived changes in prevailing interest rates, changes in inflation or expectations about inflation, investor confidence or economic, political, social or financial market conditions, environmental disasters, governmental actions, public health emergencies (such as the spread of infectious diseases, pandemics and epidemics) and other similar events, each of which may be temporary or last for extended periods. For example, the crisis initially

16 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

caused by the outbreak of COVID-19 is causing materially reduced consumer demand and economic output, disrupting supply chains, resulting in market closures, travel restrictions and quarantines, and adversely impacting local and global economies. As with other serious economic disruptions, governmental authorities and regulators are responding to this crisis with significant fiscal and monetary policy changes, which could further increase volatility in securities and other financial markets, reduce market liquidity, heighten investor uncertainty and adversely affect the value of the Fund’s investments and the performance of the Fund. Administrative changes, policy reform and/or changes in law or governmental regulations can result in expropriation or nationalization of the investments of a company in which the Fund invests.

Non-Listed Closed-End Fund Risk. The Fund is designed for long-term investors who are prepared to hold the Common Shares of the Fund until the end of the Fund’s term and not as a trading vehicle. An investment in the Common Shares, unlike an investment in a traditional listed closed-end fund, should be considered illiquid. The Common Shares are appropriate only for investors who are seeking an investment in less liquid portfolio investments within an illiquid fund. An investment in Common Shares is not suitable for investors who need access to the money they invest. Unlike shares of open-end funds (commonly known as mutual funds), which generally are redeemable on a daily basis, the Common Shares will not be redeemable at an investor’s option. Unlike traditional listed closed-end funds, the Fund does not intend to list the Common Shares for trading on any securities exchange, and the Fund does not expect any secondary market to develop for the Common Shares in the foreseeable future. The net asset value of the Common Shares may be volatile and the Fund’s use of leverage will increase this volatility. As the Common Shares are not traded, investors may not be able to dispose of their investment in the Fund no matter how poorly the Fund performs.

Preferred Securities Risk. A company’s preferred stock generally pays dividends only after the company makes required payments to holders of its bonds and other debt. For this reason, the value of preferred stock will usually react more strongly than bonds and other debt to actual or perceived changes in the company’s financial condition or prospects. In addition, preferred securities may contain provisions that permit the issuer, at its discretion, to defer distributions for a stated period without any adverse consequences to the issuer, which may require the Fund to report income for tax purposes although it has not yet received such income. Generally, preferred security holders (such as the Fund) have no voting rights with respect to the issuing company unless preferred dividends have been in arrears for a specified number of periods, and in some cases, an issuer of preferred securities may redeem the securities prior to a specified date.

Risk of Investing in Master Limited Partnership Units. The Fund’s investments in master limited partnership (“MLP”) units expose the Fund to risks that differ from a similar investment in equity securities, such as common stock, of a corporation. Holders of MLP units have the rights typically afforded to limited partners in a limited partnership. As compared to common shareholders of a corporation, holders of MLP units have more limited control and limited rights to vote on matters affecting the partnership. There are certain tax risks associated with an investment in MLP units. To the extent a distribution received by the Fund from an MLP is treated as a return of capital, the Fund’s adjusted tax basis in the interests of the MLP may be reduced, which will result in an increase

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 17

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

in an amount of income or gain (or decrease in the amount of loss) that will be recognized by the Fund for tax purposes upon the sale of any such interests or upon subsequent distributions in respect of such interests. Furthermore, any return of capital distribution received from the MLP may require the Fund to restate the character of its distributions and amend any shareholder tax reporting previously issued. Additionally, conflicts of interest may exist between common unit holders, subordinated unit holders and the general partner of an MLP.

Prepayment Risk. Certain debt instruments, including loans and mortgage- and other asset-backed securities, are subject to the risk that payments on principal may occur more quickly or earlier than expected. In this event, the Fund might be forced to forego future interest income on the principal repaid early and to reinvest income or proceeds at generally lower interest rates, thus reducing the Fund’s yield. These types of instruments are particularly subject to prepayment risk, and offer less potential for gains, during periods of declining interest rates.

Shareholder Liquidity Event Risk. The Fund intends to complete an event intended to provide liquidity for the holders of Common Shares (“Shareholder Liquidity Event”) on or before July 28, 2023 (the “Liquidity Event Date”). If the Board determines that under then current market conditions it is in the best interests of the Fund to do so, the Fund may extend the Liquidity Event Date for one year, to July 28, 2024, without a shareholder vote. The Fund’s investment objectives and policies are not designed to seek to return to investors that purchased Common Shares in the initial offering or any other offering their initial investment on the Liquidity Event Date or any other date. Investors may receive less than their original investment through the Shareholder Liquidity Event.

Valuation Risk. The Fund may invest without limitation in unregistered securities, restricted securities and securities for which there is no readily available trading market. It may be difficult for the Fund to purchase and sell a particular investment at the price at which it has been valued by the Investment Adviser or Sub-Adviser for purposes of the Fund’s net asset value, causing the Fund to be unable to realize what the Adviser or Sub-Adviser believes should be the price of the investment. Valuation of portfolio investments may be difficult, such as during periods of market turmoil or reduced liquidity, and for investments that may, for example, trade infrequently or irregularly. In these and other circumstances, an investment may be valued using fair value methodologies, which are inherently subjective, reflect good faith judgments based on available information and may not accurately estimate the price at which the Fund could sell the investment at that time. Based on its investment strategies, a significant portion of the Fund’s investments can be difficult to value and thus particularly prone to the foregoing risks.

In addition to the foregoing risks, investors should note that the Fund reserves the right to merge or reorganize with another fund, liquidate or convert into an open-end fund, in each case subject to applicable approvals by shareholders and the Fund’s Board as required by law and the Fund’s governing documents.

18 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | September 30, 2020 |

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 19

| | | | |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | | September 30, 2020 |

|

| Fund Statistics | | | |

Net Asset Value | | | $756.73 |

Net Assets ($000) | | | $43,373 |

| AVERAGE ANNUAL TOTAL RETURNS | | | |

| FOR THE PERIOD ENDED September 30, 2020 | | | |

| | | Since |

| One | Three | Five Inception |

| Year | Year | Year (08/13/15) |

Guggenheim Energy & Income Fund | | | |

| NAV | (5.41%) | (1.07%) | 6.17% 5.22% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. All NAV returns include the deduction of management fees, operating expenses and all other Fund expenses. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com/xgeix. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

| Portfolio Breakdown | % of Net Assets |

| Investments | |

Corporate Bonds | 79.6% |

Senior Floating Rate Interests | 25.1% |

Common Stocks | 6.6% |

Asset-Backed Securities | 0.7% |

Money Market Fund | 0.6% |

Preferred Stocks | 0.5% |

| Total Investments | 113.1% |

| Other Assets & Liabilities, net | (13.1)% |

| Net Assets | 100.0% |

20 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT

| | |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | September 30, 2020 |

|

| Ten Largest Holdings | (% of Total Net Assets) |

TexGen Power LLC | 5.0% |

Comstock Resources, Inc., 7.50% | 4.3% |

Sunoco Logistics Partners Operations, LP, 5.95% | 3.9% |

Gulfstream Natural Gas System LLC, 4.60% | 3.9% |

Newfield Exploration Co., 5.38% | 3.4% |

Accuride Corp., 6.25% | 3.3% |

Hess Corp., 4.30% | 2.9% |

LBC Tank Terminals Holding Netherlands BV, 6.88% | 2.6% |

MPLX, LP, 4.88% | 2.6% |

PowerTeam Services LLC, 9.03% | 2.5% |

Top Ten Total | 34.4% |

“Ten Largest Holdings” excludes any temporary cash or derivative investments.

Portfolio breakdown and holdings are subject to change daily. For more information, please visit guggenheiminvestments.com/xgeix. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results.

Portfolio Composition by Quality Rating1 | |

| Rating | % of Total Investments |

| Fixed Income Instruments | |

| BBB | 25.4% |

| BB | 27.5% |

| B | 29.0% |

| CCC | 9.7% |

| CC | 0.2% |

NR2 | 2.3% |

| Other Instruments | 5.9% |

| Total Investments | 100.0% |

1 | Source: BlackRock Solutions. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All securities except for those labeled “NR” have been rated by Moody’s, Standard & Poor’s (“S&P”), or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (“NRSRO”). For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments has converted Moody’s and Fitch ratings to the equivalent S&P rating. Security ratings are determined at the time of purchase and may change thereafter. |

2 | NR (not rated) securities do not necessarily indicate low credit quality. |

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 21

| | |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | September 30, 2020 |

|

For the year ended September 30, 2020, 2.3% of the distributions were characterized as return of capital and 97.7% of the distributions were characterized as ordinary income. The final determination of the tax character of the distributions paid by the Fund in 2020 will be reported to shareholders in January 2021.

22 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT

| SCHEDULE OF INVESTMENTS | | September 30, 2020 |

| Shares | Value |

|

COMMON STOCKS† – 6.6% | | |

| Utilities – 5.1% | | |

TexGen Power LLC††† | 65,297 | $ 2,187,449 |

|

| Energy – 1.4% | | |

Whiting Petroleum Corp.* | 31,549 | 545,482 |

SandRidge Energy, Inc.* | 38,619 | 63,722 |

| Total Energy | | 609,204 |

|

| Consumer, Non-cyclical – 0.1% | | |

ATD New Holdings, Inc.* | 3,845 | 61,520 |

| Total Common Stocks | | |

| (Cost $5,466,736) | | 2,858,173 |

|

PREFERRED STOCKS†† – 0.5% | | |

| Financial – 0.5% | | |

American Equity Investment Life Holding Co., 5.95% | 8,000 | 195,600 |

| Total Preferred Stocks | | |

| (Cost $200,000) | | 195,600 |

|

| MONEY MARKET FUND† – 0.6% | | |

Dreyfus Treasury Securities Cash Management Fund — Institutional Shares, 0.01%1 | 273,389 | 273,389 |

| Total Money Market Fund | | |

| (Cost $273,389) | | 273,389 |

| Face | |

| Amount | Value |

|

CORPORATE BONDS†† – 79.6% | | |

| Energy – 46.1% | | |

Comstock Resources, Inc. | | |

7.50% due 05/15/252 | $ 2,000,000 | 1,880,000 |

Sunoco Logistics Partners Operations, LP | | |

5.95% due 12/01/253 | 1,500,000 | 1,712,302 |

Gulfstream Natural Gas System LLC | | |

4.60% due 09/15/252,3 | 1,500,000 | 1,710,194 |

Hess Corp. | | |

| 4.30% due 04/01/27 | 1,200,000 | 1,253,373 |

| 7.88% due 10/01/29 | 200,000 | 250,366 |

Newfield Exploration Co. | | |

5.38% due 01/01/263 | 1,550,000 | 1,455,652 |

MPLX, LP | | |

4.88% due 12/01/243 | 1,000,000 | 1,117,187 |

Global Partners Limited Partnership / GLP Finance Corp. | | |

| 7.00% due 08/01/27 | 900,000 | 917,217 |

6.88% due 01/15/292 | 150,000 | 151,500 |

American Midstream Partners Limited Partnership / American Midstream Finance Corp. | | |

9.50% due 12/15/212 | 1,020,000 | 1,012,350 |

See notes to financial statements.

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 23

| | | | |

| SCHEDULE OF INVESTMENTS continued | | | September 30, 2020 |

|

|

|

| | Face | |

| | Amount | Value |

|

CORPORATE BONDS†† – 79.6% (continued) | | | |

| Energy – 46.1% (continued) | | | |

Exterran Energy Solutions Limited Partnership / EES Finance Corp. | | | |

| 8.13% due 05/01/25 | $ 1,175,000 | $ 1,003,156 |

NuStar Logistics, LP | | | |

| 6.38% due 10/01/30 | | 550,000 | 570,625 |

| 6.00% due 06/01/26 | | 250,000 | 250,705 |

| 5.63% due 04/28/27 | | 150,000 | 148,153 |

Indigo Natural Resources LLC | | | |

6.88% due 02/15/262 | | 930,000 | 905,150 |

Sabine Pass Liquefaction LLC | | | |

| 5.63% due 04/15/23 | | 750,000 | 821,527 |

Crestwood Midstream Partners Limited Partnership / Crestwood Midstream Finance Corp. | | |

| 6.25% due 04/01/23 | | 500,000 | 488,805 |

5.63% due 05/01/272 | | 250,000 | 223,317 |

Cheniere Corpus Christi Holdings LLC | | | |

| 5.88% due 03/31/25 | | 600,000 | 683,901 |

Phillips 66 Partners, LP | | | |

3.55% due 10/01/263 | | 500,000 | 526,443 |

PDC Energy, Inc. | | | |

| 6.13% due 09/15/24 | | 450,000 | 428,625 |

TransMontaigne Partners Limited Partnership / TLP Finance Corp. | | | |

| 6.13% due 02/15/26 | | 400,000 | 414,000 |

CVR Energy, Inc. | | | |

5.75% due 02/15/282 | | 400,000 | 340,000 |

Antero Midstream Partners Limited Partnership / Antero Midstream Finance Corp. | | | |

5.75% due 01/15/282 | | 400,000 | 329,000 |

Rattler Midstream, LP | | | |

5.63% due 07/15/252 | | 300,000 | 302,250 |

Callon Petroleum Co. | | | |

| 6.13% due 10/01/24 | | 1,000,000 | 285,000 |

Viper Energy Partners, LP | | | |

5.38% due 11/01/272 | | 275,000 | 270,875 |

Parkland Corp. | | | |

6.00% due 04/01/262 | | 175,000 | 183,313 |

Unit Corp. | | | |

due 05/15/214 | | 988,000 | 134,200 |

Basic Energy Services, Inc. | | | |

due 10/15/234,5 | | 650,000 | 133,250 |

CNX Resources Corp. | | | |

| 5.88% due 04/15/22 | | 112,000 | 112,000 |

| Total Energy | | | 20,014,436 |

|

| Utilities – 9.5% | | | |

AmeriGas Partners Limited Partnership / AmeriGas Finance Corp. | | | |

| 5.50% due 05/20/25 | | 800,000 | 859,040 |

| 5.75% due 05/20/27 | | 725,000 | 793,875 |

| See notes to financial statements. | | | |

24 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT | | | |

| | | |

| SCHEDULE OF INVESTMENTS continued | | September 30, 2020 |

|

|

|

| Face | |

| Amount | Value |

|

CORPORATE BONDS†† – 79.6% (continued) | | |

| Utilities – 9.5% (continued) | | |

AES Corp. | | |

| 5.50% due 04/15/25 | $ 1,000,000 | $ 1,031,070 |

Terraform Global Operating LLC | | |

6.13% due 03/01/262 | 875,000 | 890,313 |

Clearway Energy Operating LLC | | |

| 5.75% due 10/15/25 | 400,000 | 420,000 |

Pattern Energy Operations Limited Partnership / Pattern Energy Operations, Inc. | | |

4.50% due 08/15/282 | 125,000 | 129,687 |

| Total Utilities | | 4,123,985 |

|

| Consumer, Cyclical – 7.6% | | |

LBC Tank Terminals Holding Netherlands BV | | |

6.88% due 05/15/232 | 1,130,000 | 1,121,525 |

Suburban Propane Partners Limited Partnership/Suburban Energy Finance Corp. | | |

| 5.88% due 03/01/27 | 950,000 | 976,125 |

Superior Plus Limited Partnership / Superior General Partner, Inc. | | |

7.00% due 07/15/262,3 | 800,000 | 854,000 |

Delta Air Lines, Inc. | | |

7.00% due 05/01/252 | 275,000 | 301,957 |

Brookfield Residential Properties Incorporated / Brookfield Residential US Corp. | | |

4.88% due 02/15/302 | 30,000 | 28,080 |

| Total Consumer, Cyclical | | 3,281,687 |

|

| Communications – 4.5% | | |

EIG Investors Corp. | | |

| 10.88% due 02/01/24 | 834,000 | 867,360 |

Cengage Learning, Inc. | | |

9.50% due 06/15/242 | 572,000 | 377,520 |

McGraw-Hill Global Education Holdings LLC / McGraw-Hill Global Education Finance | | |

7.88% due 05/15/242 | 466,000 | 250,475 |

Houghton Mifflin Harcourt Publishers, Inc. | | |

9.00% due 02/15/252 | 250,000 | 240,000 |

CSC Holdings LLC | | |

4.63% due 12/01/302 | 200,000 | 201,500 |

| Total Communications | | 1,936,855 |

|

| Industrial – 4.1% | | |

PowerTeam Services LLC | | |

9.03% due 12/04/252 | 1,025,000 | 1,080,094 |

New Enterprise Stone & Lime Company, Inc. | | |

9.75% due 07/15/282 | 250,000 | 270,000 |

Grinding Media Inc. / MC Grinding Media Canada Inc. | | |

7.38% due 12/15/232 | 250,000 | 253,125 |

See notes to financial statements.

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 25

| | | |

| SCHEDULE OF INVESTMENTS continued | | September 30, 2020 |

|

|

|

| Face | |

| Amount | Value |

|

CORPORATE BONDS†† – 79.6% (continued) | | |

| Industrial – 4.1% (continued) | | |

Cleaver-Brooks, Inc. | | |

7.88% due 03/01/232 | $ 200,000 | $ 193,000 |

| Total Industrial | | 1,796,219 |

|

| Consumer, Non-cyclical – 3.9% | | |

KeHE Distributors LLC / KeHE Finance Corp. | | |

8.63% due 10/15/262 | 725,000 | 784,813 |

Beverages & More, Inc. | | |

11.50% due 06/15/225 | 500,000 | 420,000 |

Sabre GLBL, Inc. | | |

7.38% due 09/01/252 | 250,000 | 252,500 |

Sotheby’s | | |

7.38% due 10/15/272,3 | 225,000 | 225,000 |

| Total Consumer, Non-cyclical | | 1,682,313 |

|

| Basic Materials – 3.4% | | |

Illuminate Buyer LLC / Illuminate Holdings IV, Inc. | | |

9.00% due 07/01/282 | 750,000 | 806,250 |

United States Steel Corp. | | |

12.00% due 06/01/252 | 400,000 | 425,796 |

6.88% due 08/15/253 | 250,000 | 183,767 |

Compass Minerals International, Inc. | | |

6.75% due 12/01/272 | 50,000 | 54,000 |

| Total Basic Materials | | 1,469,813 |

|

| Financial – 0.5% | | |

USI, Inc. | | |

6.88% due 05/01/252 | 200,000 | 202,500 |

|

| Technology – 0.0% | | |

NCR Corp. | | |

6.13% due 09/01/292 | 25,000 | 26,473 |

|

| Utility – 0.0% | | |

Bruce Mansfield | | |

due 08/01/234 | 718,000 | 1,795 |

| Total Corporate Bonds | | |

| (Cost $36,675,445) | | 34,536,076 |

|

SENIOR FLOATING RATE INTERESTS††3,6 – 25.1% | | |

| Utilities – 6.7% | | |

Stonewall | | |

| 6.50% (3 Month USD LIBOR + 5.50%, Rate Floor: 6.50%) due 11/13/21 | 852,822 | 767,540 |

Carroll County Energy LLC | | |

| 3.72% (3 Month USD LIBOR + 3.50%, Rate Floor: 3.50%) due 02/16/26 | 738,037 | 731,270 |

| See notes to financial statements. | | |

26 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT | | |

| | | |

| SCHEDULE OF INVESTMENTS continued | | September 30, 2020 |

| Face | |

| Amount | Value |

|

SENIOR FLOATING RATE INTERESTS††3,6 – 25.1% (continued) | | |

| Utilities – 6.7% (continued) | | |

Granite Generation LLC | | |

| 4.75% (1 Month USD LIBOR + 3.75% and 3 Month USD LIBOR + 3.75%, | | |

| Rate Floor: 4.75%) due 11/09/26 | $ 724,393 | $ 719,416 |

UGI Energy Services, Inc. | | |

| 3.90% (1 Month USD LIBOR + 3.75%, Rate Floor: 3.75%) due 08/13/26 | 691,250 | 686,639 |

| Total Utilities | | 2,904,865 |

|

| Consumer, Cyclical – 6.5% | | |

Accuride Corp. | | |

| 6.25% (3 Month USD LIBOR + 5.25%, Rate Floor: 6.25%) due 11/17/23 | 1,835,175 | 1,413,084 |

Mavis Tire Express Services Corp. | | |

| 3.47% (3 Month USD LIBOR + 3.25%, Rate Floor: 3.25%) due 03/20/25 | 735,327 | 696,266 |

EnTrans International, LLC | | |

| 6.15% (1 Month USD LIBOR + 6.00%, Rate Floor: 6.00%) due 11/01/24 | 344,127 | 301,111 |

Blue Nile, Inc. | | |

| 7.50% (3 Month USD LIBOR + 6.50%, Rate Floor: 7.50%) due 02/17/23 | 233,750 | 146,094 |

Playtika Holding Corp. | | |

| 7.00% (3 Month USD LIBOR + 6.00%, Rate Floor: 7.00%) due 12/09/24 | 130,866 | 130,818 |

NES Global Talent | | |

6.50% (3 Month USD LIBOR + 5.50%, Rate Floor: 6.50%) due 05/11/23††† | 99,231 | 89,308 |

American Tire Distributors, Inc. | | |

| 7.00% (3 Month USD LIBOR + 6.00%, Rate Floor: 7.00%) due 09/01/23 | 35,482 | 34,773 |

| 8.50% (1 Month USD LIBOR + 7.50% and 3 Month USD LIBOR + 7.50%, | | |

Rate Floor: 8.50%) due 09/02/24 | 23,243 | 19,690 |

| Total Consumer, Cyclical | | 2,831,144 |

|

| Energy – 6.2% | | |

Buckeye Partners LP | | |

| 2.90% (1 Month USD LIBOR + 2.75%, Rate Floor: 2.75%) due 11/02/26 | 995,000 | 975,100 |

Penn Virginia Holding Corp. | | |

8.00% (1 Month USD LIBOR + 7.00%, Rate Floor: 8.00%) due 09/29/22††† | 1,275,000 | 892,500 |

Stonepeak Lonestar Holdings LLC | | |

| 4.77% (3 Month USD LIBOR + 4.50%, Rate Floor: 4.50%) due 10/19/26 | 669,854 | 658,553 |

Summit Midstream Partners, LP | | |

| 7.00% (3 Month USD LIBOR + 6.00%, Rate Floor: 7.00%) due 05/13/22 | 463,808 | 92,762 |

Permian Production Partners LLC | | |

due 05/20/24†††,4 | 1,662,500 | 83,125 |

| Total Energy | | 2,702,040 |

See notes to financial statements.

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 27

| SCHEDULE OF INVESTMENTS continued | September 30, 2020 |

| Face | |

| Amount | Value |

|

SENIOR FLOATING RATE INTERESTS††3,6 – 25.1% (continued) | | |

| Industrial – 3.1% | | |

Diversitech Holdings, Inc. | | |

| 8.50% (3 Month USD LIBOR + 7.50%, Rate Floor: 8.50%) due 06/02/25 | $ 500,000 | $ 476,250 |

Sundyne (Star US Bidco) | | |

| 5.25% (1 Month USD LIBOR + 4.25%, Rate Floor: 5.25%) due 03/17/27 | 498,750 | 472,980 |

YAK MAT (YAK ACCESS LLC) | | |

| 10.22% (3 Month USD LIBOR + 10.00%, Rate Floor: 10.00%) due 07/10/26 | 550,000 | 397,831 |

| Total Industrial | | 1,347,061 |

|

| Financial – 1.2% | | |

Teneo Holdings LLC | | |

| 6.25% (1 Month USD LIBOR + 5.25%, Rate Floor: 6.25%) due 07/11/25 | 544,500 | 524,081 |

|

| Basic Materials – 1.2% | | |

PetroChoice Holdings | | |

| 6.00% (3 Month USD LIBOR + 5.00%, Rate Floor: 6.00%) due 08/19/22 | 588,172 | 506,316 |

|

| Communications – 0.2% | | |

Cengage Learning Acquisitions, Inc. | | |

| 5.25% (3 Month USD LIBOR + 4.25%, Rate Floor: 5.25%) due 06/07/23 | 104,071 | 86,750 |

| Total Senior Floating Rate Interests | | |

| (Cost $14,099,394) | | 10,902,257 |

|

ASSET-BACKED SECURITIES†† – 0.7% | | |

| Collateralized Loan Obligations – 0.7% | | |

Jamestown CLO V Ltd. | | |

2014-5A, 5.37% (3 Month USD LIBOR + 5.10%, Rate Floor: 0.00%) due 01/17/272,6 | 500,000 | 287,276 |

| Total Asset-Backed Securities | | |

| (Cost $447,885) | | 287,276 |

| Total Investments – 113.1% | | |

| (Cost $57,162,849) | | $ 49,052,771 |

| Other Assets & Liabilities, net – (13.1)% | | (5,679,328) |

| Total Net Assets – 100.0% | | $ 43,373,443 |

See notes to financial statements.

28 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT| SCHEDULE OF INVESTMENTS continued | September 30, 2020 |

| * | Non-income producing security. |

| † | Value determined based on Level 1 inputs, unless otherwise noted — See Note 6. |

| †† | Value determined based on Level 2 inputs, unless otherwise noted — See Note 6. |

| ††† | Value determined based on Level 3 inputs — See Note 6. |

| 1 | Rate indicated is the 7-day yield as of September 30, 2020. |

| 2 | Security is a 144A or Section 4(a)(2) security. These securities have been determined to be liquid under |

| | guidelines established by the Board of Trustees. The total market value of 144A or Section 4(a)(2) |

| | securities is $16,563,833 (cost $16,825,578), or 38.2% of total net assets. |

| 3 | All or a portion of these securities have been physically segregated or earmarked in connection with |

| | reverse repurchase agreements. As of September 30, 2020, the total market value of segregated or |

| | earmarked securities was $17,700,715. See Note 7. |

| 4 | Security is in default of interest and/or principal obligations. |

| 5 | Security is a 144A or Section 4(a)(2) security. These securities have been determined to be illiquid and |

| | restricted under guidelines established by the Board of Trustees. The total market value of 144A or |

| | Section 4(a)(2) illiquid and restricted securities is $553,250 (cost $1,110,287), or 1.3% of total net |

| | assets — See Note 10. |

| 6 | Variable rate security. Rate indicated is the rate effective at September 30, 2020. In some instances, |

| | the effective rate is limited by a minimum rate floor or a maximum rate cap established by the issuer. |

| | The settlement status of a position may also impact the effective rate indicated. In some cases, a |

| | position may be unsettled at period end and may not have a stated effective rate. In instances where |

| | multiple underlying reference rates and spread amounts are shown, the effective rate is based on a |

| | weighted average. |

CLO LIBOR LLC | Collateralized Loan Obligation London Interbank Offered Rate Limited Liability Company |

See Sector Classification in Other Information section.

See notes to financial statements.

GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT l 29

| SCHEDULE OF INVESTMENTS continued | September 30, 2020 |

The following table summarizes the inputs used to value the Fund’s investments at September 30, 2020 (See Note 6 in the Notes to Financial Statements):

| | | | | Level 2 | | | Level 3 | | | | |

| | Level 1 | | | Significant | | | Significant | | | | |

| Investments in | | Quoted | | | Observable | | | Unobservable | | | | |

| Securities (Assets) | | Prices | | | Inputs | | | Inputs | | | Total | |

Common Stocks | | $ | 670,724 | | | $ | — | | | $ | 2,187,449 | | | $ | 2,858,173 | |

Preferred Stocks | | | — | | | | 195,600 | | | | — | | | | 195,600 | |

Money Market Fund | | | 273,389 | | | | — | | | | — | | | | 273,389 | |

Corporate Bonds | | | — | | | | 34,536,076 | | | | — | | | | 34,536,076 | |

Senior Floating Rate Interests | | | — | | | | 9,837,324 | | | | 1,064,933 | | | | 10,902,257 | |

Asset-Backed Securities | | | — | | | | 287,276 | | | | — | | | | 287,276 | |

Total Assets | | $ | 944,113 | | | $ | 44,856,276 | | | $ | 3,252,382 | | | $ | 49,052,771 | |

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of the period end, reverse repurchase agreements of $6,364,387 are categorized as Level 2 within the disclosure hierarchy — See Note 7.

The following is a summary of significant unobservable inputs used in the fair valuation of assets and liabilities categorized within Level 3 of the fair value hierarchy:

| Ending Balance at | Valuation | Unobservable | | Weighted |

| Category | September 30, 2020 | Technique | Inputs | Input Range | Average* |

| Assets: | | | | | |

Common Stocks | $2,187,449 | Third Party | Broker Quote | — | — |

| | Pricing | | | |

Senior Floating Rate Interests | 1,064,933 | Third Party | Broker Quote | — | — |

| | Pricing | | | |

Total Assets | $3,252,382 | | | | |

Significant changes in a quote would generally result in significant changes in the fair value of the security.

See notes to financial statements.

30 l GEI l GUGGENHEIM ENERGY & INCOME FUND ANNUAL REPORT

| SCHEDULE OF INVESTMENTS continued | September 30, 2020 |

The Fund’s fair valuation leveling guidelines classify a single daily broker quote, or a vendor price based on a single daily or monthly broker quote, as Level 3, if such a quote or price cannot be supported with other available market information.

Transfers between Level 2 and Level 3 may occur as markets fluctuate and/or the availability of data used in an investment’s valuation changes. For the year ended September 30, 2020, the Fund had securities with a total value of $1,133,844 transfer out of Level 3 to Level 2 due to the availability of current and reliable market-based data provided by a third-party pricing service which utilizes significant observable inputs.

Summary of Fair Value Level 3 Activity

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value for the period ended September 30, 2020:

| | Assets

| | | | | | Liabilities | |

| | Senior Floating | | | Common | | | | | | Unfunded Loan | |

| | Rate Interests | | | Stocks | | | Total Assets | | | Commitments | |

Beginning Balance | | $ | 4,207,472 | | | $ | 2,611,880 | | | $ | 6,819,352 | | | $ | (1,101 | ) |

Purchases/(Receipts) | | | 226,100 | | | | — | | | | 226,100 | | | | (656 | ) |

(Sales, maturities and | | | | | | | | | | | | | | | | |

paydowns)/Fundings | | | (1,043,330 | ) | | | (148,225 | ) | | | (1,191,555 | ) | | | 890 | |

Amortization of premiums/discounts | | | 21,186 | | | | — | | | | 21,186 | | | | — | |

Total realized gains (losses) included | | | | | | | | | | | | | | | | |

in earnings | | | 77 | | | | — | | | | 77 | | | | 3 | |

Total change in unrealized appreciation | | | | | | | | | | | | | | | | |

(depreciation) included in earnings | | | (1,212,728 | ) | | | (276,206 | ) | | | (1,488,934 | ) | | | 864 | |

Transfers into Level 3 | | | — | | | | — | | | | — | | | | — | |

Transfers out of Level 3 | | | (1,133,844 | ) | | | — | | | | (1,133,844 | ) | | | — | |

Ending Balance | | $ | 1,064,933 | | | $ | 2,187,449 | | | $ | 3,252,382 | | | $ | — | |

Net change in unrealized appreciation | | | | | | | | | | | | | | | | |

(depreciation) for investments in Level 3 | | | | | | | | | | | | | | | | |