UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23063

Horizon Funds

(Exact name of registrant as specified in charter)

6210 Ardrey Kell Road, Suite 300

Charlotte, North Carolina 28277

(Address of principal executive offices) (Zip code)

Matthew Chambers

Horizon Funds

6210 Ardrey Kell Road, Suite 300

Charlotte, North Carolina 28277

(Name and address of agent for service)

(866) 371-2399

Registrant's telephone number, including area code

Date of fiscal year end: November 30, 2021

Date of reporting period: December 1, 2020 through November 30, 2021

Item 1. Reports to Stockholders.

(a)

HORIZON FUNDS | Annual Report |

Horizon Active Asset Allocation Fund | | Horizon Active Risk Assist® Fund |

Investor Class Advisor Class Institutional Class | Shares Shares Shares | AAANX HASAX HASIX | | Investor Class Advisor Class Institutional Class | Shares Shares Shares | ARANX ARAAX ACRIX |

Horizon Active Income Fund | | Horizon Active Dividend Fund |

Investor Class Advisor Class Institutional Class | Shares Shares Shares | AIMNX AIHAX AIRIX | | Investor Class Advisor Class | Shares Shares | HNDDX HADUX |

Horizon Defined Risk Fund | | Horizon U.S. Defensive Equity Fund |

Investor Class Advisor Class | Shares Shares | HNDRX HADRX | | Investor Class Advisor Class | Shares Shares | USRAX USRTX |

Horizon ESG Defensive Core Fund |

Investor Class Advisor Class | Shares Shares | HESGX HESAX |

Investor Information: 1-855-754-7932

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of HORIZON ACTIVE ASSET ALLOCATION FUND, HORIZON ACTIVE RISK ASSIST® FUND, HORIZON ACTIVE INCOME FUND, HORIZON ACTIVE DIVIDEND FUND, HORIZON DEFINED RISK FUND, HORIZON U.S. DEFENSIVE EQUITY FUND and HORIZON ESG DEFENSIVE CORE FUND. Such offering is made only by prospectus, which includes details as to offering price and other material information.

Table of Contents | |

Letter to Shareholders | 1 |

Portfolio Review | 7 |

Portfolio Composition | 14 |

Portfolio of Investments | 16 |

Statements of Assets and Liabilities | 66 |

Statements of Operations | 68 |

Statements of Changes in Net Assets | 70 |

Financial Highlights | 77 |

Notes to Financial Statements | 94 |

Report of Independent Registered Public Accounting Firm | 112 |

Disclosure of Fund Expenses | 114 |

Approval of the Management Agreements | 115 |

Submission of Matters to a Vote of Security Holders | 117 |

Additional Information | 119 |

Privacy Notice | 122 |

Horizon Funds

Letter to Shareholders

November 30, 2021

Dear Shareholder:

In the following paragraphs we will recap the key factors affecting broad markets and the Horizon Funds through the fiscal year ended November 30, 2021.

Horizon Active Asset Allocation Fund

The Horizon Active Asset Allocation Fund (Investor Class) (the Fund) returned 22.63% for the fiscal year ended November 30, 2021. Domestic equities (as measured by the S&P 500 Index) returned 27.92%, while international equities returned 9.90% (as measured by the S&P Global BMI ex-US Index) over the same period.

The positive news around vaccinations in early November 2020 kicked off a strong year for equity markets generally. The early part of the year was characterized by a re-rating in some of the market sectors that were more heavily impacted by the contraction in economic activity in 2020, including emerging market equities, domestic value stocks, and domestic small- and mid-caps. As volatility increased across markets in February and March, however, these early trends gave way to a continuation of the U.S. large cap dominance present for much of 2019 and 2020. There was considerable volatility in equity market leadership for the balance of the year, a reflection of how uncertain the economic outlook remains. Picking up on these trend changes was a key factor in the Fund’s performance throughout the year. The Fund maintained a preference for U.S. equities throughout the year, but managed to take advantage of some of the risk-on market action early in the year through substantial overweights to emerging markets and domestic small- and mid-caps. As the year went on, this positioning was trimmed in favor of higher quality and larger cap domestic stocks. Near the end of the year, the Fund’s positioning in the year’s winners, especially U.S. large-cap growth and technology, was decreased in favor of slightly smaller cap domestic equities in anticipation of investor rebalancing activity after a strong year.

The key driver of Fund performance was U.S. equity positioning, especially allocations to large-cap growth stocks. Small- and mid-cap domestic stocks also contributed strongly to returns when used opportunistically throughout the year. Key detractors include international developed market exposures, including core and regionally focused holdings. Emerging market equity exposure also lagged slightly, although it did contribute strongly to returns in the early part of the year.

Horizon Active Risk Assist Fund

The Horizon Active Risk Assist Fund (Investor Class) (the Fund) realized a return of 20.64% for the fiscal year ended November 30, 2021. Domestic equities (as measured by the S&P 500 Index) returned 27.92%, while international equities returned 9.90% (as measured by the S&P Global BMI ex-US Index) over the same period. The Fund exhibited an average beta of 0.91 to the S&P 500 Index over the period.

As a risk mitigation strategy designed with the goal to mitigate catastrophic loss of portfolio value, the Fund performed in line with expectations during the period. The Fund’s realized volatility for the period was 14.23%, similar to than that of domestic and international equities (realized volatilities for the period of 14.90% and 13.38% respectively). The Fund also realized a maximum drawdown of 5.55%, which was in line with the 5.12% drawdown experienced by the S&P 500 and less than the 7.26% drawdown of the S&P Global BMI ex-US.

The Fund began the year positioned for a pro-cyclical rally in equity markets, including overweights to emerging markets and domestic small- and mid-caps. As cross-asset volatility increased in February and March, the Fund increased domestic equity positioning and moved away from emerging markets. The Fund maintained a general overweight to the U.S. for the remainder of the year, and moved higher up the quality spectrum as the year progressed. Toward the end of the year, the Fund’s positioning in the year’s winners, especially U.S. growth and technology, was

1

Horizon Funds

Letter to Shareholders (Continued)

November 30, 2021

trimmed in favor of slightly smaller cap domestic equities. In terms of performance of the underlying allocations, large-cap domestic growth holdings contributed the most to the Fund’s return, while allocations to international developed markets detracted the most from the Fund’s return over the fiscal year.

The Fund had no de-risking or re-risking activity via the Risk Assist algorithm throughout the fiscal year. The Fund has been fully invested in global equities since July 2020.

Horizon Active Income Fund

The Horizon Active Income Fund (Investor Class) (the Fund) was up 0.11% for the fiscal year ended November 30, 2021, outpacing the -1.15% return for the broader bond market (as measured by Bloomberg U.S. Aggregate Bond Index). Measures of Fund risk, including standard deviation and maximum drawdown, were in line with the benchmark during the period. The Fund displayed significant positive alpha during the period as a result of the Fund’s tactical process and opportunistic allocations to non-traditional fixed income market segments.

It was a fairly volatile year for broad fixed income markets, an environment that afforded the Fund plenty of opportunities. Early in the year, the combination of positive vaccine news and larger than expected fiscal stimulus in the U.S. caused core interest rates to rise and the yield curve to steepen. As inflation increased during the spring and summer, markets reacted by bringing forward actions by the Federal Reserve, leading to a fall in long-term bond yields and higher volatility in short-term interest rates. This flattening price action continued for the rest of the period as the Federal Reserve’s concern around inflation increased. Throughout the period, credit spreads declined broadly as strong corporate earnings and a desire for yield supported risk appetite. Hybrid fixed income exposures, such as convertible bonds and preferred equities, generally struggled in this environment, although they did display some periods of notable strength.

The Fund’s actively managed approach resulted in a below benchmark duration profile throughout the year. However, the Fund did take advantage of tactical opportunities in the yield curve, and meaningfully increased duration and long-end interest rate exposure toward the end of the period. The Fund maintained an overweight to credit, a beneficial tilt as credit spreads declined, and opportunistically rotated through various segments of the investment grade and high yield corporate credit market. Early in the period, exposure to non-traditional fixed income segments, including convertible bonds, preferred equities, and emerging market bonds, was relatively elevated. These less-liquid market segments were more heavily impacted by the increase in bond market volatility that began in February and March, and exposure was decreased substantially toward the end of the year.

The key drivers of Fund performance include corporate credit allocations, especially in various segments of the high yield market, in addition to the opportunistic use of convertible bonds. Long duration allocations in both U.S. government debt and investment-grade corporate bonds were the biggest detractors to performance over the period.

Horizon Defined Risk Fund

For the year ended November 30, 2021, the Defined Risk Fund (Investor Class) (the Fund) had a total return of 12.38% and a standard deviation of 7.97%. Over the same period, the S&P 500 Index had a total return of 27.92% and a standard deviation of 14.90%. The Fund exhibited a 0.50 beta to the S&P 500 Index. The Fund had a maximum drawdown of 2.62% while the S&P 500 Index had a maximum drawdown of 5.12%.

The objective of the Fund is capital appreciation and capital preservation. The Fund pursues its objective by investing in a basket of U.S. large-cap equities that track the S&P 500 Index, while seeking to generate income, hedge volatility, and reduce downside risk by buying and selling put and call options. The Fund’s strategy is intended to outperform the S&P 500 Index in a down market and underperform in an up market, while realizing less volatility in any market. As shown by the performance statistics above, the Fund performed in line with the expectations during the period.

2

Horizon Funds

Letter to Shareholders (Continued)

November 30, 2021

The Fund allows for active positioning within its options collar structure. The goal of this active positioning is to generate income, hedge volatility and reduce downside risk. This active positioning had no material impact to the Fund’s performance over the fiscal year.

Horizon U.S. Defensive Equity Fund

The Horizon U.S. Defensive Equity Fund (Investor Class) (the Fund) returned 23.70% for the year ended November 30, 2021, while realizing a volatility of 14.65%. The return on the S&P 500 Index for the same period was 27.92%, with a realized volatility of 14.90%. Over the period, the Fund exhibited an average beta of 0.93 to the S&P 500 Index.

The Fund started the fiscal year fully invested and saw no Risk Assist activity. The Risk Assist algorithm was removed from the Fund during this fiscal year, as communicated to investors on January 28, 2021.

The Fund is actively managed, selecting and weighting securities using a proprietary quantitative approach to allocate the Fund’s portfolio between issuers, sectors, and/or factors (e.g. value, momentum, quality, and volatility). This process is designed to be defensive in nature in order to help the Fund navigate volatile market swings. The Fund’s strategy is intended to outperform the S&P 500 Index in a down market and underperform in an up market, while realizing less volatility. As shown by the performance statistics above, the Fund performed in line with the expectations during the period.

Outside of overall market direction, the main driver of the performance of the Fund is stock selection. Key highlights in the period include selection in Information Technology and Healthcare, while selection in Financials and Communication Services lagged in the period.

Horizon ESG Defensive Core Fund

The Horizon ESG Defensive Core Fund (Investor Class) (the Fund) returned 28.91% for the year ended November 30, 2021. The return of domestic equities (as measured by the MSCI USA Index) for the same period was 27.18%. The Fund exhibited an average beta of 0.89 to the MSCI USA Index over the period.

As a risk mitigation strategy designed with the goal to mitigate catastrophic loss of portfolio value, the Fund performance exceeded expectations during the period. The Fund outperformed its benchmark during the period with a lower beta, an indication of positive alpha. The Fund’s realized volatility for the period was 14.19%, which was lower than the 15.56% volatility realized by domestic equities. The Fund also realized a maximum drawdown of 5.55%, which was in line with the 5.14% drawdown experienced by domestic equities.

The Fund had no de-risking or re-risking activity via the Risk Assist algorithm throughout the fiscal year. The Fund has been fully invested in domestic equities since May 2020.

The Fund’s investment sub-adviser, DWS Investment Management Americas, Inc., manages the equity portion of the Fund through a quantitative process while integrating ESG (Environmental, Social, and Governance) criteria. After a challenging 2020 for most quantitative strategies, 2021 saw a rebound in performance for quantitative managers as value stocks kept pace with growth stocks on the back of re-opening of the U.S. economy. The Fund’s quantitative process benefitted from this market environment as well. During a period when there is no Risk Assist activity, stock selection is the primary driver of performance. Key highlights for the period include selection in Technology, Communication Services, Consumer Discretionary, and Consumer Staples, while Healthcare selection was a key detractor during the period.

3

Horizon Funds

Letter to Shareholders (Continued)

November 30, 2021

Horizon Active Dividend Fund

The Horizon Active Dividend Fund (Investor Class) (the Fund) posted a total return of 16.58% for the fiscal year ended November 30, 2021. The Fund’s benchmark, the MSCI World High Dividend Yield Index, returned 12.03% over the same period.

Horizon’s Active Dividend Fund invests in high quality companies with well-supported dividend yields that are trading at a discount to their intrinsic value. This past year saw the stocks of these high quality companies rebound from depressed levels as investors, who sold during the initial COVID scare, returned to markets and began buying following the news that COVID vaccines were approved in the fourth quarter of 2020. The realization that broad-based COVID vaccinations could allow economies to reopen prompted investors to reassess the earnings potential of companies after consumers emerged from lockdowns and re-engaged with the economy. Companies’ earnings potential suddenly improved dramatically, and their stock prices followed.

Energy holdings EOG Resources and Exxon Mobil contributed the most to outperformance during the period. The dramatic rise in energy prices – oil rose nearly 50% and natural gas more than doubled at its peak – drove strong earnings growth for these holdings.

The Fund also benefited from holdings in Semiconductor companies Broadcom, Taiwan Semiconductor, and Qualcomm. Accelerating demand for technology led to increased spending in enterprise, cloud, and broadband applications, driving strong earnings growth despite the semiconductor shortage.

Holdings in the Materials sector benefited from a return to global growth following the re-opening. Air Products & Chemicals, Steel Dynamics, and Reliance Steel contributed the most to Fund outperformance. Companies in the Materials sector benefited broadly from rising commodity prices as a resurgence in economic growth following the reopening spurred a rapid increase in demand in the face of limited supply due to supply chain disruptions.

Consumer Staples holdings detracted the most from performance for the year. Fund holdings Clorox, Walmart and Unilever had the largest impact. As the economic reopening pushed inflation higher, Consumer Staples company’s margins suffered from their inability to raise prices in the face of rising input costs, resulting in disappointing earnings.

* * * * *

We are grateful for the opportunity to manage these Funds, and appreciate your continued investment in Horizon Funds.

Past performance does not guarantee future results.

The S&P 500 Index is an unmanaged composite of 500 large capitalization companies. This index is widely used by professional investors as a performance benchmark for large-cap stocks. The S&P Global ex-US BMI (Broad Market Index) comprises the S&P Developed BMI and S&P Emerging BMI, and is a comprehensive, rules-based index measuring stock market performance globally, excluding the U.S. The Bloomberg Barclays Aggregate Bond Index tracks the U.S. fixed income markets. The index includes government securities, mortgage-backed securities, asset-backed securities and corporate securities to simulate the universe of bonds in the market. The S&P Global 100 Index measures the performance of 100 multi-national, blue-chip companies of major importance in the global equity markets, including 100 large-cap companies drawn from the S&P Global 1200 whose businesses are global in nature, a substantial portion of their operating income, assets, and employees deriving from multiple countries. The MSCI USA Index is a broad measure of the performance of the U.S. equity market, composed of over 600 constituents in the large- and mid-cap market segments. The MSCI World High Dividend Yield Index measures the performance of large- and mid-cap equities in Developed Markets that pay higher than average dividends while omitting lower quality stocks with questionable dividend-sustainability characteristics. You cannot invest directly into an index.

Must be preceded or accompanied by a prospectus.

4

Horizon Funds

Letter to Shareholders (Continued)

November 30, 2021

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the entire market or a benchmark. Beta is calculated by dividing the product of the covariance of the security’s returns and the benchmark’s returns by the product of the variance of the benchmark’s returns over a specified period.

Alpha is a measure of the excess return, after accounting for systematic risk as measured by beta, of a security or a portfolio in comparison to the entire market or a stated benchmark. Alpha is calculated by comparing the security’s returns over a given period with the product of the security’s beta measure and the returns of the benchmark over that same period.

Realized volatility, as known as standard deviation, is a statistical measure of dispersion of returns for a given security or market index over a given period of time. This measure is typically calculated by determining the average deviation from the average price of a financial instrument in the given time period. The higher the realized volatility value, the riskier the security.

Duration is a measure of risk for fixed income securities. It measures the sensitivity of the price of a fixed income instrument or portfolio of fixed income instruments to a change in interest rates. All else equal and for a given change in interest rates, a security or portfolio of securities with a larger duration will exhibit greater price changes than that with a smaller duration.

A call option is a contract that provides the buyer with the right, but not the obligation, to buy a security at a specified price on or before a specified date. A put option is a contract that provides the buyer with the right, but not the obligation, to sell a security at a specified price on or before a specified date.

With regard to the Risk Assist algorithm, a de-risking activity is a sale of a portion of a Fund’s equity portfolio and a purchase of a highly liquid short-term U.S. Treasury obligation, or other cash-like equivalents, with the goal to mitigate catastrophic loss of portfolio value. Similarly, a re-risking activity is a sale of a highly liquid short-term U.S. Treasury obligation, or other cash-like equivalents and a purchase of a portion of a Fund’s equity portfolio, with the goal to reduce the potential performance drag when compared with the fully-invested equity portfolio.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Horizon ESG Defensive Core Fund: Many factors affect the ESG (Environmental, Social, and Corporate Governance) Fund’s performance. The Fund’s share price changes daily based on changes in market conditions in response to economic, political, and financial developments. The direction and extent of those price changes will be affected by the financial condition, industry and economic sector, and geographical location of the securities in which the Fund invests. The Fund is not federally insured or guaranteed by any government agency. You may lose money by investing in the Fund. Investing primarily in investments that meet ESG criteria carries the risk that the Fund may forgo otherwise attractive investment opportunities or increase or decrease its exposure to certain types of companies and, therefore, may underperform funds that do not consider ESG factors.

5

Horizon Funds

Letter to Shareholders (Continued)

November 30, 2021

Mutual fund investing involves risk. Principal loss is possible. In addition to the costs, fees, and expenses involved in investing in ETFs, ETFs are subject to additional risks including the risks that the market price of the shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares. The Funds may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater in emerging markets. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Funds in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Small and Medium capitalization companies tend to have limited liquidity and greater price volatility than large capitalization companies. Investments in Real Estate Investment Trusts (REITs) involve additional risks such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. The Funds may also use options, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities’ prices, interest rates and currency exchange rates. The investment in options is not suitable for all investors.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk. Please refer to the Portfolio of Investments in this report for a complete list of fund holdings.

Earnings growth is not a measure of the Fund’s future performance.

Horizon Funds are distributed by Quasar Distributors, LLC.

6

Horizon Active Asset Allocation Fund

Portfolio Review (Unaudited)

November 30, 2021

The chart above assumes an initial gross investment of $10,000 made on January 31, 2012. The Fund’s performance figures are for the year ended November 30, 2021. The Performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

Average Annual Total Returns | One Year | Five Year | Since

Commencement

of Operations (1) |

Horizon Active Asset Allocation Fund - Investor Class(3) | 22.63% | 12.93% | 9.99% |

Horizon Active Asset Allocation Fund - Advisor Class(3) | 22.43% | 12.79% | 11.22% |

Horizon Active Asset Allocation Fund - Institutional Class(3) | 22.82% | 13.06% | 12.56% |

S&P 500 Total Return Index | 27.92% | 17.90% | 15.82%(2) |

S&P Global BMI ex-US Index | 9.90% | 9.59% | 6.72%(2) |

(1) | Inception date is January 31, 2012 for Investor Class Shares, September 4, 2015 for Advisor Class Shares and September 9, 2016 for Institutional Class Shares. |

(2) | The Since Commencement of Operations returns shown are from the commencement date of Horizon Active Asset Allocation Fund - Investor Class. The returns for the S&P 500 Total Return Index and S&P Global BMI ex-US Index since the commencement date of the Horizon Active Asset Allocation Fund - Advisor Class are 17.12% and 8.47%, respectively. The returns for the S&P 500 Total Return Index and S&P Global BMI ex-US Index since the commencement date of the Horizon Active Asset Allocation Fund - Institutional Class are 17.92% and 8.30%, respectively. |

(3) | The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of

the largest U.S. domiciled companies and includes the reinvestment of all dividends. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

The S&P Global BMI ex-US Index is a comprehensive, rules-based index that represents the composition of

global stock markets. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

7

Horizon Active Risk Assist® Fund

PORTFOLIO REVIEW (Unaudited)

November 30, 2021 |

The chart above assumes an initial gross investment of $10,000 made on August 28, 2014. The Fund’s performance figures are for the year ended November 30, 2021. The Performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

Average Annual Total Returns | One Year | Five Year | Since

Commencement

of Operations (1) |

Horizon Active Risk Assist® Fund - Investor Class(3) | 20.64% | 8.56% | 5.46% |

Horizon Active Risk Assist® Fund - Advisor Class(3) | 20.41% | 8.40% | 7.15% |

Horizon Active Risk Assist® Fund - Institutional Class(3) | 20.75% | 8.70% | 8.44% |

Bloomberg Barclays Aggregate Bond Index | -1.15% | 3.65% | 3.09%(2) |

S&P 500 Total Return Index | 27.92% | 17.90% | 14.22%(2) |

S&P Global BMI ex-US Index | 9.90% | 9.59% | 4.90%(2) |

(1) | Inception date is August 28, 2014 for Investor Class Shares, September 4, 2015 for Advisor Class Shares and September 9, 2016 for Institutional Class Shares. |

(2) | The Since Commencement of Operations returns shown are from the commencement date of Horizon Active Risk Assist® Fund - Investor Class. The returns for the Bloomberg Barclays Aggregate Bond Index, S&P 500 Total Return Index, and S&P Global BMI ex-US Index since the commencement date of the Horizon Active Risk Assist® Fund - Advisor Class are 3.29%, 17.12%, and 8.47%, respectively. The returns for the Bloomberg Barclays Aggregate Bond Index, S&P 500 Total Return Index, and S&P Global BMI ex-US Index since the commencement date of the Horizon Active Risk Assist® Fund - Institutional Class are 2.96%, 17.92%, and 8.30%, respectively. |

(3) | The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

The Bloomberg Barclays Aggregate Bond Index is a market-capitalization-weighted index that covers the USD denominated, investment-grade (rated Baa3 or above by Moody’s), fixed-rate, and taxable areas of the bond market. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

The S&P Global BMI ex-US Index is a comprehensive, rules-based index that represents the composition of global stock markets. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

8

Horizon Active Income Fund

PORTFOLIO REVIEW (Unaudited)

November 30, 2021 |

The chart above assumes an initial gross investment of $10,000 made on September 30, 2013. The Fund’s performance figures are for the year ended November 30, 2021. The Performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

Average Annual Total Returns | One Year | Five Year | Since

Commencement

of Operations (1) |

Horizon Active Income Fund - Investor Class(3) | 0.11% | 2.91% | 1.69% |

Horizon Active Income Fund - Advisor Class(3) | -0.05% | 2.75% | 2.05% |

Horizon Active Income Fund - Institutional Class(3) | 0.20% | 2.96% | 1.97% |

Bloomberg Barclays Aggregate Bond Index | -1.15% | 3.65% | 3.31%(2) |

(1) | Inception date is September 30, 2013 for Investor Class Shares, February 8, 2016 for Advisor Class Shares and September 9, 2016 for Institutional Class Shares. |

(2) | The Since Commencement of Operations returns shown are from the commencement date of Horizon Active Income Fund - Investor Class. The returns for the Bloomberg Barclays Aggregate Bond Index since the commencement date of the Horizon Active Income Fund - Advisor Class and the Horizon Active Income Fund - Institutional Class are 3.21% and 2.96%, respectively. |

(3) | The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

The Bloomberg Barclays Aggregate Bond Index is a market-capitalization-weighted index that covers the USD denominated, investment-grade (rated Baa3 or above by Moody’s), fixed-rate, and taxable areas of the bond market. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

9

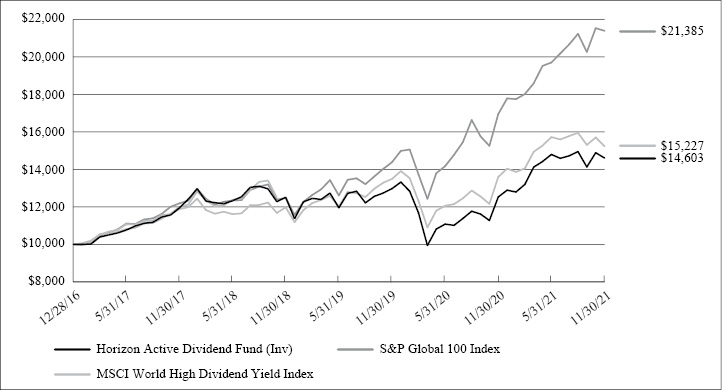

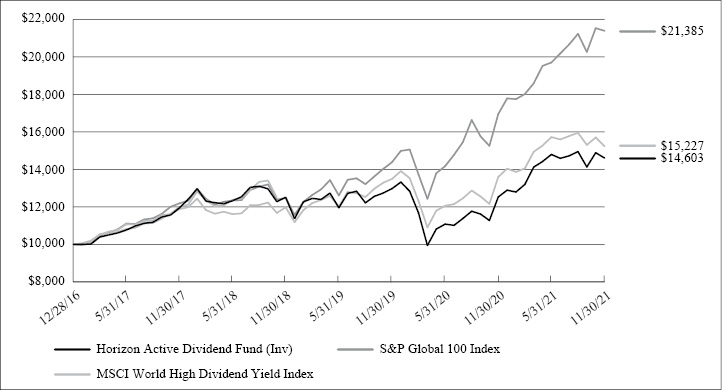

Horizon Active Dividend Fund

PORTFOLIO REVIEW (Unaudited)

November 30, 2021 |

The chart above assumes an initial gross investment of $10,000 made on December 28, 2016. The Fund’s performance figures are for the year ended November 30, 2021. The Performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

Average Annual Total Returns | One Year | Since

Commencement

of Operations (1) |

Horizon Active Dividend Fund - Investor Class(4) | 16.58% | 7.99% |

Horizon Active Dividend Fund - Advisor Class(4) | 16.45% | 6.60% |

MSCI World High Dividend Yield Index(3) | 12.03% | 8.92%(2) |

(1) | Inception date is December 28, 2016 for Investor Class Shares and June 20, 2017 for Advisor Class Shares. |

(2) | The Since Commencement of Operations returns shown are from the commencement date of Horizon Active Dividend Fund - Investor Class. The returns for the MSCI World High Dividend Yield Index and S&P Global 100 Index - Advisor Class are 7.31% and 15.77%, respectively. |

(3) | The MSCI World High Dividend Yield Index has replaced the S&P Global 100 Index as the Fund’s primary bencharmk index. The Advisor believes that the new index is more appropriate given the Fund’s holdings. |

(4) | The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

The MSCI World High Dividend Yield Index is based on the MSCI World Index, its parent index, and includes large- and mid-cap stocks across 23 developed markets countries. The index is designed to reflect the performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average dividend yields that are both sustainable and persistent. The index also applies quality screens and reviews 12-month past performance to omit stocks with potentially deteriorating fundamentals that could force them to cut or reduce dividends. Investors cannot directly invest in an index.

The S&P Global 100 Index measures the performance of multi-national, blue chip companies of major importance in the global equity markets. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

10

Horizon Defined Risk Fund

PORTFOLIO REVIEW (Unaudited)

November 30, 2021 |

The chart above assumes an initial gross investment of $10,000 made on December 28, 2017. The Fund’s performance figures are for the year ended November 30, 2021. The Performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

Average Annual Total Returns | One Year | Since

Commencement

of Operations (1) |

Horizon Defined Risk Fund - Investor Class(3) | 12.38% | 6.82% |

Horizon Defined Risk Fund - Advisor Class(3) | 12.22% | 6.54% |

Bloomberg Barclays US Treasury 1-3 Years Index | -0.34% | 2.02%(2) |

S&P 500 Total Return Index | 27.92% | 16.56%(2) |

(1) | Inception date is December 28, 2017 for Investor Class Shares and February 2, 2018 for Advisor Class Shares. |

(2) | The Since Commencement of Operations returns shown are from the commencement date of Horizon Defined Risk Fund - Investor Class. The returns for the Bloomberg Barclays US Treasury 1-3 Years Index and the S&P 500 Total Return Index since the commencement date of the Horizon Defined Risk Fund - Advisor Class are 2.15%, and 16.15%, respectively. |

(3) | The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

The Bloomberg Barclays U S Treasury 1-3 Years Index measures the performance of the US government bond market and includes public obligations of the U.S. Treasury with a maturity between 1 and up to (but not including) 3 years. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

11

Horizon U.S. Defensive Equity Fund

PORTFOLIO REVIEW (Unaudited)

November 30, 2021 |

The chart above assumes an initial gross investment of $10,000 made on June 26, 2019. The Fund’s performance figures are for the year ended November 30, 2021. The Performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

Average Annual Total Returns | One Year | Since

Commencement

of Operations (1) |

Horizon U.S. Defensive Equity Fund - Investor Class(3) | 23.70% | 13.10% |

Horizon U.S. Defensive Equity Fund - Advisor Class(3) | 23.53% | 14.37% |

S&P 500 Total Return Index | 27.92% | 22.38%(2) |

(1) | Inception date is June 26, 2019 for Investor Class Shares and January 31, 2020 for Advisor Class Shares |

(2) | The Since Commencement of Operations returns shown are from the commencement date of Horizon U.S. Defensive Equity Fund - Investor Class. The returns for the S&P 500 Total Return Index since the commencement date of the Horizon U.S. Defensive Equity Fund - Advisor Class are 22.89%. |

(3) | The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

12

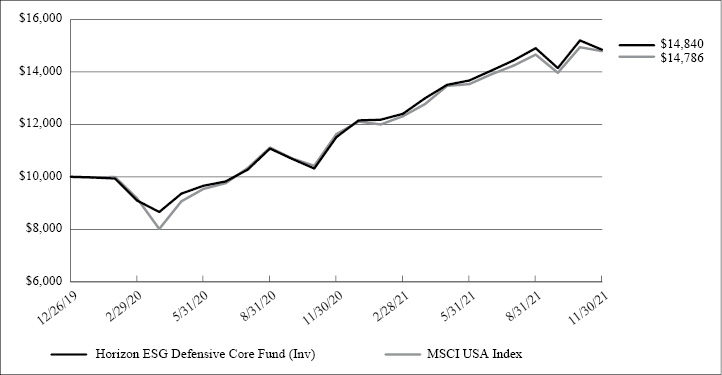

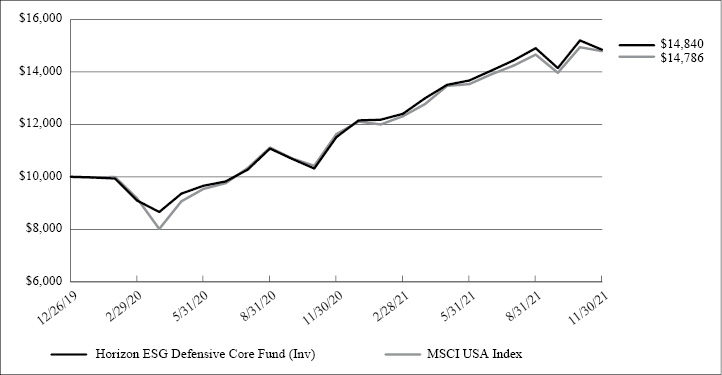

Horizon ESG Defensive Core Fund

PORTFOLIO REVIEW (Unaudited)

November 30, 2021 |

The chart above assumes an initial gross investment of $10,000 made on December 26, 2019. The Fund’s performance figures are for the year ended November 30, 2021. The Performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

Average Annual Total Returns | One Year | Since

Commencement

of Operations (1) |

Horizon ESG Defensive Core Fund - Investor Class(3) | 28.91% | 22.68% |

Horizon ESG Defensive Core Fund - Advisor Class(3) | 28.69% | 22.73% |

MSCI USA Index | 27.18% | 22.44%(2) |

(1) | Inception date is December 26, 2019 for Investor Class Shares and January 8, 2020 for Advisor Class Shares. |

(2) | The Since Commencement of Operations returns shown are from the commencement date of Horizon ESG Defensive Core Fund - Investor Class. The return for the MSCI USA Index since the commencement date of the Horizon ESG Defensive Core Fund - Advisor Class is 22.56%. |

(3) | The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

The MSCI USA Index is designed to measure the performance of the large and mid cap segments of the US market. With 616 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

13

Horizon Funds

Portfolio Composition (Unaudited)

November 30, 2021

Horizon Active Asset Allocation Fund Portfolio Composition as of November 30, 2021:

| | % of Total

Investments |

Investment Companies | 82.0% |

Short-Term Investments | 0.4% |

Investments Purchased With Proceeds From Securities Lending | 17.6% |

| | 100.0% |

Horizon Active Risk Assist® Fund Portfolio Composition as of November 30, 2021:

| | % of Total

Investments |

Investment Companies | 85.8% |

Common Stocks | 1.2% |

Purchased Call Options | 0.0%(a) |

Purchased Put Options | 0.1% |

Short-Term Investments | 0.5% |

Investments Purchased With Proceeds From Securities Lending | 12.4% |

| | 100.0% |

Horizon Active Income Fund Portfolio Composition as of November 30, 2021:

| | % of Total

Investments |

Investment Companies | 80.3% |

Short-Term Investments | 0.6% |

Investments Purchased With Proceeds From Securities Lending | 19.1% |

| | 100.0% |

Horizon Active Dividend Fund Portfolio Composition as of November 30, 2021:

| | % of Total

Investments |

Common Stocks | 87.4% |

Preferred Stocks | 0.3% |

Short-Term Investments | 1.6% |

Investments Purchased With Proceeds From Securities Lending | 10.7% |

| | 100.0% |

14

Horizon Funds

PORTFOLIO COMPOSITION (Unaudited) (Continued)

November 30, 2021 |

Horizon Defined Risk Fund Portfolio Composition as of November 30, 2021:

| | % of Total

Investments |

Common Stocks | 91.6% |

Purchased Call Options | 0.0%(a) |

Purchased Put Options | 1.9% |

Short-Term Investments | 1.7% |

Investments Purchased With Proceeds From Securities Lending | 4.8% |

| | 100.0% |

Horizon U.S. Defensive Equity Fund Portfolio Composition as of November 30, 2021:

| | % of Total

Investments |

Common Stocks | 91.5% |

Short-Term Investments | 0.6% |

Investments Purchased With Proceeds From Securities Lending | 7.9% |

| | 100.0% |

Horizon ESG Defensive Core Fund Portfolio Composition as of November 30, 2021:

| | % of Total

Investments |

Common Stocks | 88.5% |

Short-Term Investments | 1.7% |

Investments Purchased With Proceeds From Securities Lending | 9.8% |

| | 100.0% |

Data expressed excludes written options. Please refer to the Portfolio of Investments in this report for a detailed analysis of the Funds’ holdings.

(a) | Rounds to less than 0.1% |

15

Horizon Active Asset Allocation Fund

Portfolio of Investments

November 30, 2021

| | Shares | | | | | | | | Value | |

| | | | | INVESTMENT COMPANIES - 99.6% | | | | | | | | |

| | | | | Exchange Traded Funds - 99.6% | | | | | | | | |

| | | 234,713 | | Invesco QQQ Trust Series 1 (a) | | | | | | $ | 92,434,674 | |

| | | 471,534 | | Invesco S&P 500 Equal Weight ETF (a) | | | | | | | 72,422,907 | |

| | | 1,039,935 | | iShares Core MSCI International Developed Markets ETF | | | | | | | 68,625,311 | |

| | | 532,089 | | iShares Edge MSCI USA Quality Factor ETF (a) | | | | | | | 75,040,512 | |

| | | 731,945 | | iShares MSCI Eurozone ETF (a) | | | | | | | 34,840,582 | |

| | | 396,395 | | iShares MSCI USA Minimum Volatility ETF | | | | | | | 30,110,164 | |

| | | 286,159 | | iShares MSCI USA Momentum Factor ETF (a) | | | | | | | 52,410,021 | |

| | | 257,138 | | iShares Select Dividend ETF (a) | | | | | | | 29,596,584 | |

| | | 537,696 | | Principal US Mega-Cap ETF | | | | | | | 22,674,640 | |

| | | 107,218 | | Schwab U.S. Large-Cap Value ETF (a) | | | | | | | 7,436,640 | |

| | | 1,220,536 | | SPDR Portfolio S&P 400 Mid Cap ETF (a) | | | | | | | 57,890,023 | |

| | | 865,984 | | SPDR Portfolio S&P 500 Growth ETF (a) | | | | | | | 61,380,946 | |

| | | 1,220,444 | | SPDR Portfolio S&P 500 Value ETF (a) | | | | | | | 48,146,516 | |

| | | 54,024 | | SPDR S&P Kensho New Economies Composite ETF | | | | | | | 3,312,211 | |

| | | 878,339 | | Xtrackers MSCI USA ESG Leaders Equity ETF | | | | | | | 37,584,126 | |

| | | 184,595 | | Xtrackers S&P 500 ESG ETF (a) | | | | | | | 7,592,392 | |

| | | 608,811 | | WisdomTree U.S. Quality Dividend Growth Fund | | | | | | | 37,654,960 | |

| | | | | TOTAL INVESTMENT COMPANIES (Cost - $685,088,244) | | | | | | | 739,153,209 | |

| | | | | | | | | | | | | |

| | | | | SHORT TERM INVESTMENTS - 0.5% | | | | | | | | |

| | | | | Money Market Funds - 0.5% | | | | | | | | |

| | | 3,597,009 | | First American Treasury Obligations Fund, Class X, 0.01% (b) | | | | | | | 3,597,009 | |

| | | | | TOTAL SHORT TERM INVESTMENTS (Cost - $3,597,009) | | | | | | | 3,597,009 | |

| | | | | | | | | | | | | |

| | | | | INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING - 21.3% | | | | | | | | |

| | | 158,269,436 | | Mount Vernon Liquid Assets Portfolio, LLC, 0.10% (b) | | | | | | | 158,269,436 | |

| | | | | TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost - $158,269,436) | | | | | | | 158,269,436 | |

| | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 121.4% (Cost - $846,954,689) | | | | | | | 901,019,654 | |

| | | | | Liabilities in Excess of Other Assets - (21.4)% | | | | | | | (158,715,293 | ) |

| | | | | NET ASSETS - 100.0% | | | | | | $ | 742,304,361 | |

Percentages are stated as a percent of net assets.

(a) | All or a portion of this security is out on loan as of November 30, 2021. |

(b) | Interest rate reflects the seven-day yield on November 30, 2021. |

See accompanying notes to financial statements.

16

Horizon Active Risk Assist® Fund

PORTFOLIO OF INVESTMENTS

November 30, 2021 |

| | Shares | | | | | | | | Value | |

| | | | | INVESTMENT COMPANIES - 98.0% | | | | | | | | |

| | | | | Exchange Traded Funds - 98.0% | | | | | | | | |

| | | 250,166 | | Invesco QQQ Trust Series 1 (f) | | | | | | $ | 98,520,374 | |

| | | 698,133 | | Invesco S&P 500 Equal Weight ETF (f) | | | | | | | 107,226,247 | |

| | | 855,730 | | iShares Edge MSCI USA Quality Factor ETF | | | | | | | 120,683,602 | |

| | | 809,882 | | iShares MSCI EAFE Minimum Volatility ETF (f) | | | | | | | 60,587,272 | |

| | | 1,593,747 | | iShares MSCI USA Minimum Volatility ETF (f) | | | | | | | 121,061,022 | |

| | | 295,851 | | iShares MSCI USA Momentum Factor ETF (f) | | | | | | | 54,185,111 | |

| | | 310,155 | | iShares Select Dividend ETF | | | | | | | 35,698,840 | |

| | | 885,248 | | Principal US Mega-Cap ETF (f) | | | | | | | 37,330,908 | |

| | | 4,695,801 | | SPDR Portfolio Developed World ex-US ETF (f) | | | | | | | 167,264,432 | |

| | | 1,226,825 | | SPDR Portfolio S&P 400 Mid Cap ETF | | | | | | | 58,188,310 | |

| | | 1,218,624 | | SPDR Portfolio S&P 500 Growth ETF (e) | | | | | | | 86,376,069 | |

| | | 2,264,737 | | SPDR Portfolio S&P 500 Value ETF (f) | | | | | | | 89,343,875 | |

| | | 86,857 | | SPDR S&P Kensho New Economies Composite ETF | | | | | | | 5,325,203 | |

| | | 979,116 | | WisdomTree U.S. Quality Dividend Growth Fund (f) | | | | | | | 60,558,325 | |

| | | 1,412,582 | | Xtrackers MSCI USA ESG Leaders Equity ETF | | | | | | | 60,444,384 | |

| | | 296,873 | | Xtrackers S&P 500 ESG ETF (e)(f) | | | | | | | 12,210,386 | |

| | | | | TOTAL INVESTMENT COMPANIES (Cost - $1,067,405,308) | | | | | | | 1,175,004,360 | |

| | | | | | | | | | | | | |

| | | | | COMMON STOCKS - 1.3% | | | | | | | | |

| | | | | Accommodation and Food Services - 0.0% (b) | | | | | | | | |

| | | 141 | | Caesars Entertainment, Inc. (a)(f) | | | | | | | 12,700 | |

| | | | | | | | | | | | | |

| | | | | Advertising - 0.0% (b) | | | | | | | | |

| | | 5,251 | | Interpublic Group of Cos., Inc. (f) | | | | | | | 174,281 | |

| | | 978 | | Omnicom Group, Inc. (f) | | | | | | | 65,829 | |

| | | | | | | | | | | | 240,110 | |

| | | | | Aerospace/Defense - 0.0% (b) | | | | | | | | |

| | | 163 | | General Dynamics Corp. | | | | | | | 30,802 | |

| | | 1,614 | | Howmet Aerospace, Inc. (f) | | | | | | | 45,402 | |

| | | 124 | | L3Harris Technologies, Inc. (f) | | | | | | | 25,926 | |

| | | 275 | | Teledyne Technologies, Inc. (a) | | | | | | | 114,204 | |

| | | 16 | | TransDigm Group, Inc. (a) | | | | | | | 9,249 | |

| | | | | | | | | | | | 225,583 | |

| | | | | Agriculture - 0.0% (b) | | | | | | | | |

| | | 189 | | Archer Daniels Midland Co. (f) | | | | | | | 11,758 | |

| | | 366 | | Philip Morris International, Inc. | | | | | | | 31,454 | |

| | | | | | | | | | | | 43,212 | |

| | | | | Airlines - 0.0% (b) | | | | | | | | |

| | | 1,181 | | Alaska Air Group, Inc. (a) | | | | | | | 57,361 | |

| | | 2,641 | | American Airlines Group, Inc. (a)(f) | | | | | | | 46,719 | |

| | | 353 | | Delta Air Lines, Inc. (a) | | | | | | | 12,779 | |

| | | 240 | | Southwest Airlines Co. (a)(f) | | | | | | | 10,656 | |

See accompanying notes to financial statements.

17

Horizon Active Risk Assist® Fund

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2021 |

| | Shares | | | | | | | | Value | |

| | | 601 | | United Airlines Holdings, Inc. (a)(f) | | | | | | $ | 25,398 | |

| | | | | | | | | | | | 152,913 | |

| | | | | Apparel - 0.0% (b) | | | | | | | | |

| | | 2,295 | | Hanesbrands, Inc. (f) | | | | | | | 37,064 | |

| | | 699 | | PVH Corp. | | | | | | | 74,639 | |

| | | 503 | | Ralph Lauren Corp., Class A (f) | | | | | | | 58,368 | |

| | | 2,612 | | Tapestry, Inc. | | | | | | | 104,794 | |

| | | 3,870 | | Under Armour, Inc., Class A (a) | | | | | | | 91,293 | |

| | | 105 | | VF Corp. (f) | | | | | | | 7,532 | |

| | | | | | | | | | | | 373,690 | |

| | | | | Auto Manufacturers - 0.0% (b) | | | | | | | | |

| | | 32 | | Cummins, Inc. | | | | | | | 6,712 | |

| | | 3,439 | | Ford Motor Co. | | | | | | | 65,994 | |

| | | 160 | | General Motors Co. (a) | | | | | | | 9,259 | |

| | | 85 | | PACCAR, Inc. | | | | | | | 7,091 | |

| | | | | | | | | | | | 89,056 | |

| | | | | Auto Parts & Equipment - 0.0% (b) | | | | | | | | |

| | | 224 | | Aptiv PLC (a) | | | | | | | 35,918 | |

| | | 678 | | BorgWarner, Inc. (f) | | | | | | | 29,344 | |

| | | | | | | | | | | | 65,262 | |

| | | | | Banks - 0.1% | | | | | | | | |

| | | 3,418 | | Bank of America Corp. (f) | | | | | | | 151,998 | |

| | | 630 | | Bank of New York Mellon Corp. (f) | | | | | | | 34,518 | |

| | | 777 | | Citizens Financial Group, Inc. | | | | | | | 36,729 | |

| | | 1,032 | | Comerica, Inc. (f) | | | | | | | 85,171 | |

| | | 686 | | Fifth Third Bancorp | | | | | | | 28,915 | |

| | | 212 | | First Republic Bank | | | | | | | 44,448 | |

| | | 171 | | Goldman Sachs Group, Inc. | | | | | | | 65,149 | |

| | | 2,458 | | Huntington Bancshares, Inc. (f) | | | | | | | 36,477 | |

| | | 1,465 | | KeyCorp (f) | | | | | | | 32,875 | |

| | | 180 | | M&T Bank Corp. (f) | | | | | | | 26,390 | |

| | | 945 | | Morgan Stanley | | | | | | | 89,605 | |

| | | 159 | | Northern Trust Corp. | | | | | | | 18,396 | |

| | | 42 | | PNC Financial Services Group, Inc. | | | | | | | 8,274 | |

| | | 1,702 | | Regions Financial Corp. (f) | | | | | | | 38,721 | |

| | | 163 | | State Street Corp. | | | | | | | 14,502 | |

| | | 110 | | SVB Financial Group (a)(f) | | | | | | | 76,156 | |

| | | 111 | | Truist Financial Corp. | | | | | | | 6,583 | |

| | | 1,394 | | Wells Fargo & Co. | | | | | | | 66,605 | |

| | | 1,454 | | Zions Bancorp NA (f) | | | | | | | 91,718 | |

| | | | | | | | | | | | 953,230 | |

| | | | | Beverages - 0.0% (b) | | | | | | | | |

| | | 85 | | Brown-Forman Corp., Class B | | | | | | | 5,981 | |

See accompanying notes to financial statements.

18

Horizon Active Risk Assist® Fund

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2021 |

| | Shares | | | | | | | | Value | |

| | | 35 | | Constellation Brands, Inc., Class A | | | | | | $ | 7,886 | |

| | | 926 | | Molson Coors Brewing Co., Class B (f) | | | | | | | 41,151 | |

| | | 69 | | Monster Beverage Corp. (a) | | | | | | | 5,781 | |

| | | 302 | | PepsiCo, Inc. (f) | | | | | | | 48,254 | |

| | | | | | | | | | | | 109,053 | |

| | | | | Biotechnology - 0.0% (b) | | | | | | | | |

| | | 22 | | Biogen, Inc. (a) | | | | | | | 5,186 | |

| | | 34 | | Bio-Rad Laboratories, Inc., Class A (a) | | | | | | | 25,609 | |

| | | 337 | | Corteva, Inc. | | | | | | | 15,165 | |

| | | 23 | | Illumina, Inc. (a) | | | | | | | 8,403 | |

| | | 164 | | Incyte Corp. (a) | | | | | | | 11,106 | |

| | | 8 | | Regeneron Pharmaceuticals, Inc. (a) | | | | | | | 5,092 | |

| | | 15 | | Vertex Pharmaceuticals, Inc. (a) | | | | | | | 2,804 | |

| | | | | | | | | | | | 73,365 | |

| | | | | Building Materials - 0.0% (b) | | | | | | | | |

| | | 708 | | Carrier Global Corp. | | | | | | | 38,317 | |

| | | 204 | | Fortune Brands Home & Security, Inc. | | | | | | | 20,508 | |

| | | 537 | | Johnson Controls International PLC | | | | | | | 40,146 | |

| | | 65 | | Martin Marietta Materials, Inc. (f) | | | | | | | 26,228 | |

| | | 247 | | Masco Corp. (f) | | | | | | | 16,278 | |

| | | 91 | | Vulcan Materials Co. | | | | | | | 17,439 | |

| | | | | | | | | | | | 158,916 | |

| | | | | Chemicals - 0.1% | | | | | | | | |

| | | 328 | | Albemarle Corp. (f) | | | | | | | 87,409 | |

| | | 144 | | Celanese Corp. | | | | | | | 21,796 | |

| | | 1,210 | | CF Industries Holdings, Inc. | | | | | | | 73,314 | |

| | | 119 | | Dow, Inc. (f) | | | | | | | 6,536 | |

| | | 239 | | Eastman Chemical Co. | | | | | | | 24,925 | |

| | | 136 | | FMC Corp. (f) | | | | | | | 13,626 | |

| | | 187 | | International Flavors & Fragrances, Inc. | | | | | | | 26,586 | |

| | | 117 | | Linde PLC | | | | | | | 37,222 | |

| | | 115 | | LyondellBasell Industries NV, Class A | | | | | | | 10,020 | |

| | | 1,908 | | Mosaic Co. | | | | | | | 65,292 | |

| | | 58 | | PPG Industries, Inc. | | | | | | | 8,942 | |

| | | 79 | | Sherwin-Williams Co. (f) | | | | | | | 26,168 | |

| | | | | | | | | | | | 401,836 | |

| | | | | Commercial Services - 0.1% | | | | | | | | |

| | | 65 | | Automatic Data Processing, Inc. (f) | | | | | | | 15,008 | |

| | | 19 | | Cintas Corp. | | | | | | | 8,022 | |

| | | 157 | | Equifax, Inc. | | | | | | | 43,748 | |

| | | 107 | | FleetCor Technologies, Inc. (a) | | | | | | | 22,163 | |

| | | 427 | | Gartner, Inc. (a) | | | | | | | 133,331 | |

| | | 52 | | Global Payments, Inc. | | | | | | | 6,190 | |

| | | 4,870 | | H&R Block, Inc. | | | | | | | 115,322 | |

See accompanying notes to financial statements.

19

Horizon Active Risk Assist® Fund

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2021 |

| | Shares | | | | | | | | Value | |

| | | 82 | | IHS Markit, Ltd. | | | | | | $ | 10,481 | |

| | | 26 | | MarketAxess Holdings, Inc. (f) | | | | | | | 9,170 | |

| | | 14 | | Moody’s Corp. (f) | | | | | | | 5,469 | |

| | | 2,966 | | Nielsen Holdings PLC (f) | | | | | | | 56,829 | |

| | | 685 | | Quanta Services, Inc. | | | | | | | 77,939 | |

| | | 778 | | Robert Half International, Inc. | | | | | | | 86,490 | |

| | | 144 | | United Rentals, Inc. (a) | | | | | | | 48,778 | |

| | | 38 | | Verisk Analytics, Inc. | | | | | | | 8,545 | |

| | | | | | | | | | | | 647,485 | |

| | | | | Computers - 0.1% | | | | | | | | |

| | | 285 | | Accenture PLC, Class A | | | | | | | 101,859 | |

| | | 198 | | Cognizant Technology Solutions Corp., Class A | | | | | | | 15,440 | |

| | | 7,007 | | DXC Technology Co. (a) | | | | | | | 210,140 | |

| | | 336 | | Fortinet, Inc. (a)(f) | | | | | | | 111,589 | |

| | | 4,488 | | Hewlett Packard Enterprise Co. | | | | | | | 64,403 | |

| | | 1,070 | | HP, Inc. | | | | | | | 37,749 | |

| | | 38 | | International Business Machines Corp. | | | | | | | 4,450 | |

| | | 424 | | Leidos Holdings, Inc. | | | | | | | 37,274 | |

| | | 1,485 | | NetApp, Inc. (f) | | | | | | | 131,987 | |

| | | 1,172 | | Western Digital Corp. (a) | | | | | | | 67,788 | |

| | | | | | | | | | | | 782,679 | |

| | | | | Cosmetics/Personal Care - 0.0% (b) | | | | | | | | |

| | | 18,481 | | Coty, Inc., Class A (a)(f) | | | | | | | 179,820 | |

| | | 98 | | Estee Lauder Cos., Inc., Class A (f) | | | | | | | 32,543 | |

| | | 401 | | Procter & Gamble Co. (f) | | | | | | | 57,977 | |

| | | | | | | | | | | | 270,340 | |

| | | | | Distribution/Wholesale - 0.0% (b) | | | | | | | | |

| | | 78 | | Copart, Inc. (a) | | | | | | | 11,322 | |

| | | 171 | | Fastenal Co. | | | | | | | 10,118 | |

| | | 1,092 | | LKQ Corp. (f) | | | | | | | 61,043 | |

| | | 32 | | WW Grainger, Inc. | | | | | | | 15,405 | |

| | | | | | | | | | | | 97,888 | |

| | | | | Diversified Financial Services - 0.1% | | | | | | | | |

| | | 76 | | Ameriprise Financial, Inc. (f) | | | | | | | 22,010 | |

| | | 91 | | Capital One Financial Corp. | | | | | | | 12,788 | |

| | | 224 | | CBOE Global Markets, Inc. | | | | | | | 28,883 | |

| | | 831 | | Charles Schwab Corp. | | | | | | | 64,311 | |

| | | 221 | | Discover Financial Services | | | | | | | 23,835 | |

| | | 1,029 | | Franklin Resources, Inc. | | | | | | | 33,340 | |

| | | 3,934 | | Invesco, Ltd. | | | | | | | 87,846 | |

| | | 209 | | Nasdaq, Inc. | | | | | | | 42,475 | |

| | | 610 | | Raymond James Financial, Inc. | | | | | | | 59,957 | |

| | | 525 | | Synchrony Financial (f) | | | | | | | 23,515 | |

| | | 56 | | T. Rowe Price Group, Inc. | | | | | | | 11,197 | |

See accompanying notes to financial statements.

20

Horizon Active Risk Assist® Fund

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2021 |

| | Shares | | | | | | | | Value | |

| | | 2,503 | | Western Union Co. (f) | | | | | | $ | 39,597 | |

| | | | | | | | | | | | 449,754 | |

| | | | | Electric - 0.0% (b) | | | | | | | | |

| | | 898 | | AES Corp. | | | | | | | 20,995 | |

| | | 314 | | Alliant Energy Corp. (f) | | | | | | | 17,204 | |

| | | 135 | | Ameren Corp. (f) | | | | | | | 11,015 | |

| | | 61 | | American Electric Power Co., Inc. (f) | | | | | | | 4,944 | |

| | | 1,497 | | CenterPoint Energy, Inc. (f) | | | | | | | 38,787 | |

| | | 188 | | CMS Energy Corp. | | | | | | | 11,064 | |

| | | 108 | | Consolidated Edison, Inc. (f) | | | | | | | 8,385 | |

| | | 76 | | DTE Energy Co. | | | | | | | 8,234 | |

| | | 202 | | Duke Energy Corp. | | | | | | | 19,596 | |

| | | 203 | | Edison International | | | | | | | 13,252 | |

| | | 105 | | Entergy Corp. (f) | | | | | | | 10,536 | |

| | | 195 | | Evergy, Inc. (f) | | | | | | | 12,343 | |

| | | 91 | | Eversource Energy | | | | | | | 7,486 | |

| | | 527 | | Exelon Corp. (f) | | | | | | | 27,789 | |

| | | 448 | | FirstEnergy Corp. | | | | | | | 16,872 | |

| | | 397 | | NextEra Energy, Inc. (f) | | | | | | | 34,452 | |

| | | 1,256 | | NRG Energy, Inc. (f) | | | | | | | 45,241 | |

| | | 335 | | Pinnacle West Capital Corp. | | | | | | | 21,792 | |

| | | 374 | | PPL Corp. (f) | | | | | | | 10,408 | |

| | | 139 | | Public Service Enterprise Group, Inc. (f) | | | | | | | 8,686 | |

| | | 49 | | Sempra Energy | | | | | | | 5,874 | |

| | | 70 | | WEC Energy Group, Inc. | | | | | | | 6,085 | |

| | | 84 | | Xcel Energy, Inc. | | | | | | | 5,353 | |

| | | | | | | | | | | | 366,393 | |

| | | | | Electrical Components & Equipment - 0.0% (b) | | | | | | | | |

| | | 92 | | AMETEK, Inc. | | | | | | | 12,558 | |

| | | 79 | | Emerson Electric Co. | | | | | | | 6,939 | |

| | | | | | | | | | | | 19,497 | |

| | | | | Electronics - 0.0% (b) | | | | | | | | |

| | | 247 | | Agilent Technologies, Inc. | | | | | | | 37,272 | |

| | | 229 | | Allegion PLC | | | | | | | 28,314 | |

| | | 302 | | Amphenol Corp., Class A (f) | | | | | | | 24,335 | |

| | | 112 | | Fortive Corp. | | | | | | | 8,273 | |

| | | 116 | | Garmin, Ltd. (f) | | | | | | | 15,491 | |

| | | 411 | | Keysight Technologies, Inc. (a) | | | | | | | 79,931 | |

| | | 12 | | Mettler-Toledo International, Inc. (a) | | | | | | | 18,170 | |

| | | 256 | | PerkinElmer, Inc. (f) | | | | | | | 46,633 | |

| | | 13 | | Roper Technologies, Inc. | | | | | | | 6,034 | |

| | | 164 | | TE Connectivity, Ltd. | | | | | | | 25,245 | |

| | | 44 | | Vontier Corp. | | | | | | | 1,386 | |

See accompanying notes to financial statements.

21

Horizon Active Risk Assist® Fund

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2021 |

| | Shares | | | | | | | | Value | |

| | | 162 | | Waters Corp. (a) | | | | | | $ | 53,147 | |

| | | | | | | | | | | | 344,231 | |

| | | | | Engineering & Construction - 0.0% (b) | | | | | | | | |

| | | 185 | | Jacobs Engineering Group, Inc. (f) | | | | | | | 26,374 | |

| | | | | | | | | | | | | |

| | | | | Entertainment - 0.0% (b) | | | | | | | | |

| | | 1,048 | | Live Nation Entertainment, Inc. (a) | | | | | | | 111,769 | |

| | | | | | | | | | | | | |

| | | | | Environmental Control - 0.0% (b) | | | | | | | | |

| | | 585 | | Pentair PLC | | | | | | | 43,109 | |

| | | 281 | | Republic Services, Inc. | | | | | | | 37,165 | |

| | | 250 | | Waste Management, Inc. | | | | | | | 40,167 | |

| | | | | | | | | | | | 120,441 | |

| | | | | Finance and Insurance - 0.0% (b) | | | | | | | | |

| | | 255 | | Brown & Brown, Inc. (f) | | | | | | | 16,425 | |

| | | | | | | | | | | | | |

| | | | | Food - 0.0% (b) | | | | | | | | |

| | | 352 | | Campbell Soup Co. (f) | | | | | | | 14,196 | |

| | | 379 | | Conagra Brands, Inc. (f) | | | | | | | 11,579 | |

| | | 107 | | General Mills, Inc. (f) | | | | | | | 6,609 | |

| | | 155 | | Hershey Co. | | | | | | | 27,511 | |

| | | 177 | | Hormel Foods Corp. (f) | | | | | | | 7,328 | |

| | | 162 | | J.M. Smucker Co. | | | | | | | 20,488 | |

| | | 169 | | Kellogg Co. (f) | | | | | | | 10,339 | |

| | | 215 | | Kraft Heinz Co. (f) | | | | | | | 7,226 | |

| | | 633 | | Kroger Co. (f) | | | | | | | 26,289 | |

| | | 380 | | Lamb Weston Holdings, Inc. | | | | | | | 19,730 | |

| | | 92 | | McCormick & Co., Inc. | | | | | | | 7,895 | |

| | | 113 | | Sysco Corp. | | | | | | | 7,915 | |

| | | 372 | | Tyson Foods, Inc., Class A | | | | | | | 29,373 | |

| | | | | | | | | | | | 196,478 | |

| | | | | Forest Products & Paper - 0.0% (b) | | | | | | | | |

| | | 310 | | International Paper Co. | | | | | | | 14,111 | |

| | | | | | | | | | | | | |

| | | | | Gas - 0.0% (b) | | | | | | | | |

| | | 181 | | Atmos Energy Corp. | | | | | | | 16,348 | |

| | | 1,068 | | NiSource, Inc. (f) | | | | | | | 26,177 | |

| | | | | | | | | | | | 42,525 | |

| | | | | Hand/Machine Tools - 0.0% (b) | | | | | | | | |

| | | 177 | | Snap-on, Inc. (f) | | | | | | | 36,446 | |

| | | 49 | | Stanley Black & Decker, Inc. | | | | | | | 8,563 | |

| | | | | | | | | | | | 45,009 | |

See accompanying notes to financial statements.

22

Horizon Active Risk Assist® Fund

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2021 |

| | Shares | | | | | | | | Value | |

| | | | | Healthcare Products - 0.0% (b) | | | | | | | | |

| | | 83 | | ABIOMED, Inc. (a) | | | | | | $ | 26,127 | |

| | | 33 | | Align Technology, Inc. (a) | | | | | | | 20,180 | |

| | | 82 | | Baxter International, Inc. | | | | | | | 6,115 | |

| | | 127 | | Boston Scientific Corp. (a) | | | | | | | 4,835 | |

| | | 44 | | Cooper Cos., Inc. (f) | | | | | | | 16,565 | |

| | | 178 | | Danaher Corp. | | | | | | | 57,252 | |

| | | 626 | | Dentsply Sirona, Inc. | | | | | | | 30,511 | |

| | | 369 | | Edwards Lifesciences Corp. (a) | | | | | | | 39,597 | |

| | | 245 | | Hologic, Inc. (a) | | | | | | | 18,309 | |

| | | 56 | | IDEXX Laboratories, Inc. (a) | | | | | | | 34,052 | |

| | | 146 | | ResMed, Inc. | | | | | | | 37,208 | |

| | | 109 | | STERIS PLC | | | | | | | 23,820 | |

| | | 51 | | Teleflex, Inc. | | | | | | | 15,168 | |

| | | 98 | | West Pharmaceutical Services, Inc. | | | | | | | 43,381 | |

| | | 70 | | Zimmer Biomet Holdings, Inc. | | | | | | | 8,372 | |

| | | | | | | | | | | | 381,492 | |

| | | | | Healthcare Services - 0.0% (b) | | | | | | | | |

| | | 17 | | Anthem, Inc. (f) | | | | | | | 6,906 | |

| | | 153 | | Centene Corp. (a) | | | | | | | 10,926 | |

| | | 310 | | DaVita, Inc. (a) | | | | | | | 29,295 | |

| | | 232 | | HCA Healthcare, Inc. | | | | | | | 52,337 | |

| | | 14 | | Humana, Inc. | | | | | | | 5,876 | |

| | | 143 | | IQVIA Holdings, Inc. (a) | | | | | | | 37,055 | |

| | | 82 | | Laboratory Corp. of America Holdings (a) | | | | | | | 23,397 | |

| | | 153 | | Quest Diagnostics, Inc. (f) | | | | | | | 22,748 | |

| | | 282 | | Universal Health Services, Inc., Class B | | | | | | | 33,482 | |

| | | | | | | | | | | | 222,022 | |

| | | | | Home Builders - 0.0% (b) | | | | | | | | |

| | | 100 | | DR Horton, Inc. (f) | | | | | | | 9,770 | |

| | | 103 | | Lennar Corp., Class A (f) | | | | | | | 10,820 | |

| | | 10 | | NVR, Inc. (a)(f) | | | | | | | 52,253 | |

| | | 358 | | PulteGroup, Inc. | | | | | | | 17,911 | |

| | | | | | | | | | | | 90,754 | |

| | | | | Home Furnishings - 0.0% (b) | | | | | | | | |

| | | 861 | | Leggett & Platt, Inc. (f) | | | | | | | 34,776 | |

| | | 100 | | Whirlpool Corp. (f) | | | | | | | 21,774 | |

| | | | | | | | | | | | 56,550 | |

| | | | | Household Products/Wares - 0.0% (b) | | | | | | | | |

| | | 163 | | Avery Dennison Corp. | | | | | | | 33,426 | |

| | | 107 | | Church & Dwight Co., Inc. (f) | | | | | | | 9,564 | |

| | | 40 | | Clorox Co. (f) | | | | | | | 6,514 | |

See accompanying notes to financial statements.

23

Horizon Active Risk Assist® Fund

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2021 |

| | Shares | | | | | | | | Value | |

| | | 31 | | Kimberly-Clark Corp. | | | | | | $ | 4,040 | |

| | | | | | | | | | | | 53,544 | |

| | | | | Housewares - 0.0% (b) | | | | | | | | |

| | | 1,591 | | Newell Brands, Inc. (f) | | | | | | | 34,159 | |

| | | | | | | | | | | | | |

| | | | | Information - 0.0% (b) | | | | | | | | |

| | | 8 | | Kyndryl Holdings, Inc. (a) | | | | | | | 120 | |

| | | 4,514 | | Lumen Technologies, Inc. (f) | | | | | | | 55,703 | |

| | | | | | | | | | | | 55,823 | |

| | | | | Insurance - 0.1% | | | | | | | | |

| | | 210 | | Aflac, Inc. (f) | | | | | | | 11,369 | |

| | | 76 | | Allstate Corp. (f) | | | | | | | 8,263 | |

| | | 774 | | American International Group, Inc. (f) | | | | | | | 40,712 | |

| | | 157 | | Aon PLC, Class A (f) | | | | | | | 46,436 | |

| | | 232 | | Arthur J Gallagher & Co. | | | | | | | 37,793 | |

| | | 230 | | Assurant, Inc. | | | | | | | 34,983 | |

| | | 32 | | Chubb Ltd. | | | | | | | 5,743 | |

| | | 208 | | Cincinnati Financial Corp. | | | | | | | 23,691 | |

| | | 123 | | Everest Re Group Ltd. | | | | | | | 31,535 | |

| | | 297 | | Globe Life, Inc. | | | | | | | 25,702 | |

| | | 431 | | Hartford Financial Services Group, Inc. | | | | | | | 28,489 | |

| | | 1,060 | | Lincoln National Corp. (f) | | | | | | | 70,310 | |

| | | 597 | | Loews Corp. | | | | | | | 31,916 | |

| | | 298 | | Marsh & McLennan Cos., Inc. | | | | | | | 48,878 | |

| | | 162 | | MetLife, Inc. | | | | | | | 9,503 | |

| | | 478 | | Principal Financial Group, Inc. (f) | | | | | | | 32,781 | |

| | | 126 | | Prudential Financial, Inc. | | | | | | | 12,885 | |

| | | 66 | | Travelers Cos., Inc. (f) | | | | | | | 9,699 | |

| | | 3,507 | | Unum Group (f) | | | | | | | 81,012 | |

| | | 299 | | WR Berkley Corp. | | | | | | | 22,915 | |

| | | | | | | | | | | | 614,615 | |

| | | | | Internet - 0.1% | | | | | | | | |

| | | 85 | | Alphabet, Inc., Class A (a) | | | | | | | 241,226 | |

| | | 281 | | CDW Corp. | | | | | | | 53,210 | |

| | | 446 | | eBay, Inc. | | | | | | | 30,087 | |

| | | 159 | | Expedia Group, Inc. (a) | | | | | | | 25,613 | |

| | | 562 | | F5 Networks, Inc. (a)(f) | | | | | | | 127,900 | |

| | | 98 | | Netflix, Inc. (a)(f) | | | | | | | 62,906 | |

| | | 1,924 | | NortonLifeLock, Inc. (f) | | | | | | | 47,812 | |

| | | 351 | | Twitter, Inc. (a) | | | | | | | 15,423 | |

| | | 102 | | VeriSign, Inc. (a) | | | | | | | 24,471 | |

| | | | | | | | | | | | 628,648 | |

| | | | | Iron/Steel - 0.0% (b) | | | | | | | | |

| | | 527 | | Nucor Corp. | | | | | | | 55,999 | |

See accompanying notes to financial statements.

24

Horizon Active Risk Assist® Fund

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2021 |

| | Shares | | | | | | | | Value | |

| | | | | Leisure Time - 0.0% (b) | | | | | | | | |

| | | 1,633 | | Carnival Corp. (a)(f) | | | | | | $ | 28,774 | |

| | | 3,163 | | Norwegian Cruise Line Holdings Ltd. (a)(f) | | | | | | | 61,710 | |

| | | 243 | | Royal Caribbean Cruises Ltd. (a) | | | | | | | 16,966 | |

| | | | | | | | | | | | 107,450 | |

| | | | | Lodging - 0.0% (b) | | | | | | | | |

| | | 230 | | Hilton Worldwide Holdings, Inc. (a) | | | | | | | 31,066 | |

| | | 122 | | Las Vegas Sands Corp. (a) | | | | | | | 4,346 | |

| | | 67 | | Marriott International, Inc., Class A (a)(f) | | | | | | | 9,887 | |

| | | 1,209 | | MGM Resorts International (f) | | | | | | | 47,852 | |

| | | 344 | | Wynn Resorts Ltd. (a)(f) | | | | | | | 27,867 | |

| | | | | | | | | | | | 121,018 | |

| | | | | Machinery - Diversified - 0.0% (b) | | | | | | | | |

| | | 210 | | Dover Corp. | | | | | | | 34,409 | |

| | | 1,894 | | Flowserve Corp. (f) | | | | | | | 56,782 | |

| | | 82 | | IDEX Corp. | | | | | | | 18,416 | |

| | | 378 | | Ingersoll Rand, Inc. (f) | | | | | | | 22,053 | |

| | | 120 | | Otis Worldwide Corp. | | | | | | | 9,648 | |

| | | 91 | | Rockwell Automation, Inc. | | | | | | | 30,594 | |

| | | 276 | | Wabtec Corp. | | | | | | | 24,501 | |

| | | 276 | | Xylem, Inc. (f) | | | | | | | 33,426 | |

| | | | | | | | | | | | 229,829 | |

| | | | | Manufacturing - 0.1% | | | | | | | | |

| | | 195 | | AstraZeneca PLC ADR | | | | | | | 10,692 | |

| | | 34 | | Bio-Techne Corp. | | | | | | | 16,049 | |

| | | 79 | | Enphase Energy, Inc. (a) | | | | | | | 19,750 | |

| | | 52 | | Generac Holdings, Inc. (a)(f) | | | | | | | 21,905 | |

| | | 246 | | Moderna, Inc. (a) | | | | | | | 86,698 | |

| | | 31 | | Monolithic Power Systems, Inc. | | | | | | | 17,157 | |

| | | 3,920 | | NOV, Inc. (f) | | | | | | | 46,726 | |

| | | 842 | | Seagate Technology Holdings Plc | | | | | | | 86,448 | |

| | | 28 | | Sylvamo Corp. (a) | | | | | | | 848 | |

| | | 211 | | Tesla, Inc. (a)(f) | | | | | | | 241,544 | |

| | | | | | | | | | | | 547,817 | |

| | | | | Media - 0.0% (b) | | | | | | | | |

| | | 7 | | Charter Communications, Inc., Class A (a)(f) | | | | | | | 4,524 | |

| | | 2,226 | | Discovery, Inc., Class A (a)(f) | | | | | | | 51,799 | |

| | | 1,124 | | DISH Network Corp., Class A (a)(f) | | | | | | | 35,125 | |

| | | 1,591 | | Fox Corp., Class A (f) | | | | | | | 56,815 | |

| | | 4,713 | | News Corp., Class A | | | | | | | 101,895 | |

| | | 960 | | ViacomCBS, Inc., Class B | | | | | | | 29,712 | |

| | | | | | | | | | | | 279,870 | |

See accompanying notes to financial statements.

25

Horizon Active Risk Assist® Fund

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2021 |

| | Shares | | | | | | | | Value | |

| | | | | Mining - 0.0% (b) | | | | | | | | |

| | | 1,068 | | Freeport-McMoRan, Inc. (a)(f) | | | | | | $ | 39,601 | |

| | | 63 | | Newmont Goldcorp Corp. | | | | | | | 3,460 | |

| | | | | | | | | | | | 43,061 | |

| | | | | Mining, Quarrying, and Oil and Gas Extraction - 0.0% (b) | | | | | | | | |

| | | 3,851 | | APA Corp. (f) | | | | | | | 99,240 | |

| | | | | | | | | | | | | |

| | | | | Miscellaneous Manufacturing - 0.0% (b) | | | | | | | | |

| | | 440 | | AO Smith Corp. | | | | | | | 34,782 | |

| | | 214 | | Eaton Corp PLC | | | | | | | 34,681 | |

| | | 40 | | Parker-Hannifin Corp. | | | | | | | 12,083 | |

| | | 909 | | Textron, Inc. | | | | | | | 64,357 | |

| | | 56 | | Trane Technologies PLC | | | | | | | 10,452 | |

| | | | | | | | | | | | 156,355 | |

| | | | | Office/Business Equipment - 0.0% (b) | | | | | | | | |

| | | 7,129 | | Xerox Holdings Corp. (f) | | | | | | | 131,316 | |

| | | 176 | | Zebra Technologies Corp., Class A (a) | | | | | | | 103,625 | |

| | | | | | | | | | | | 234,941 | |

| | | | | Oil & Gas - 0.1% | | | | | | | | |

| | | 1,162 | | Cabot Oil & Gas Corp. (f) | | | | | | | 23,333 | |

| | | 1,574 | | ConocoPhillips (f) | | | | | | | 110,385 | |

| | | 6,000 | | Devon Energy Corp. (f) | | | | | | | 252,360 | |

| | | 1,293 | | Diamondback Energy, Inc. (f) | | | | | | | 138,002 | |

| | | 206 | | EOG Resources, Inc. | | | | | | | 17,922 | |

| | | 343 | | Hess Corp. | | | | | | | 25,560 | |

| | | 2,487 | | HollyFrontier Corp. (f) | | | | | | | 80,380 | |

| | | 12,227 | | Marathon Oil Corp. | | | | | | | 189,396 | |

| | | 296 | | Marathon Petroleum Corp. (f) | | | | | | | 18,012 | |

| | | 2,251 | | Occidental Petroleum Corp. (f) | | | | | | | 66,742 | |

| | | 133 | | Phillips 66 | | | | | | | 9,200 | |

| | | 129 | | Pioneer Natural Resources Co. (f) | | | | | | | 23,003 | |

| | | 196 | | Valero Energy Corp. | | | | | | | 13,120 | |

| | | | | | | | | | | | 967,415 | |

| | | | | Oil & Gas Services - 0.0% (b) | | | | | | | | |

| | | 1,339 | | Baker Hughes & GE Co., Class A (f) | | | | | | | 31,252 | |

| | | 1,166 | | Halliburton Co. (f) | | | | | | | 25,174 | |