Filed pursuant to Rule 424(b)(4)

Registration Nos. 333-228521 and 333-229461

16,000,000 Units

(each consisting of one American Depositary Share,

one Warrant to purchase one American Depositary Share, and

one Right to Purchase 0.75 of an American Depositary Share)

Nano Dimension Ltd.

This is a firm commitment public offering of 16,000,000 Units, with each Unit consisting of (i) one American Depositary Share, or ADS, (ii) one warrant to purchase one ADS, or Warrant, and (iii) one right to purchase 0.75 of an ADS, or Right to Purchase. The Warrants will have an exercise price of $0.8625 per ADS, will be exercisable immediately and will expire five years from the date of issuance. The Right to Purchase will have an exercise price of $0.75 per ADS, will be exercisable immediately and will expire six months from the date of issuance. The Units will not be issued or certificated. The ADSs, Warrants and Rights to Purchase comprising a Unit are immediately separable and will be issued separately, but will be purchased together in this offering. Each ADS represents five of our ordinary shares, par value NIS 0.10, or Ordinary Shares.

The ADSs issuable from time to time upon exercise of the Warrants and Rights to Purchase and the Ordinary Shares underlying the ADSs are also being offered by this prospectus. We refer to the ADSs, the Warrants, the Right to Purchase, the ADSs issued or issuable upon exercise of the Warrants and Rights to Purchase, and the underlying Ordinary Shares being offered hereby, collectively, as the securities. See “Description of the Offered Securities” for more information.

Our ADSs are listed on the Nasdaq Capital Market under the symbol “NNDM.” The last reported sale price of our ADSs on January 31, 2019 was $0.9604 per ADS. The actual offering price per Unit in this offering was negotiated between us and the underwriter based on market conditions at the time of pricing. We are offering all of the Units offered by this prospectus.

Our Ordinary Shares currently trade on the Tel Aviv Stock Exchange, or TASE, under the symbol “NNDM.” On January 31, 2019, the last reported trading price of our Ordinary Shares on the TASE was NIS 0.767, or $0.2106 per share (based on the exchange rate reported by the Bank of Israel on such date).

There is no established public trading market for the Warrants or the Rights to Purchase, and we do not intend to list the Warrants or the Rights to Purchase on any securities exchange or automated quotation system.

We are an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and are subject to reduced public company reporting requirements.

Investing in oursecurities involves risk. See “Risk Factors” beginning on page 11 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission, the Israel Securities Authority nor any state or other foreign securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per Unit | | | Total | |

| Public offering price | | $ | 0.75 | | | $ | 12,000,000 | |

| Underwriting discounts and commissions(1) | | $ | 0.0503 | | | $ | 805,004 | |

| Proceeds to us (before expenses) | | $ | 0.6997 | | | $ | 11,194,996 | |

| (1) | Does not include a non-accountable expense allowance equal to 1.0% of the gross proceeds of this offering payable to the underwriter, an exercise fee payable to the underwriter equal to 7.0% of the gross proceeds from any Rights to Purchase that are exercised, and reimbursement of certain expenses of the underwriter in the amount of up to $125,000. See “Underwriting” for a description of compensation payable to the underwriter. |

We have granted a 45-day option to the underwriter to purchase up to $1,800,000 of additional Units solely to cover over-allotments, if any.

The underwriter expects to deliver the ADSs to the purchasers in this offering on or about February 5, 2019.

A.G.P.

The date of this prospectus is January 31, 2019

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus, including information incorporated by reference herein, and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not authorized anyone to provide you with information that is different. We are offering to sell our securities, and seeking offers to buy our securities, only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities.

For investors outside of the United States: Neither we nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In this prospectus, “we,” “us,” “our,” the “Company” and “Nano Dimension” refer to Nano Dimension Ltd. and its wholly owned subsidiaries, Nano Dimension Technologies Ltd. and Nano Dimension IP Ltd., Israeli corporations, Nano Dimension USA Inc., a Delaware corporation, and Nano Dimension (HK) Limited, a Hong Kong corporation.

Our reporting currency and functional currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this prospectus to “dollars” or “$” mean U.S. dollars, and references to “NIS” are to New Israeli Shekels.

This prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information contained in such publications.

We report under International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB. None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

PROSPECTUS SUMMARY

This summary does not contain all of the information you should consider before investing in our securities. You should read this summary together with the more detailed information appearing in this prospectus or incorporated by reference herein, including “Risk Factors,” “Selected Historical Financial Data,” and “Business,” before making an investment in our securities.

Our Company

We are a leading additive electronics provider. We believe our flagship proprietary system is the first and only precision system that produces sensors, conductive geometries, antennas, professional multilayer circuit-boards (PCBs) and molded connected devices for rapid prototyping through custom additive manufacturing. We have been actively developing our additive manufacturing technology since 2014, and since that time we have listed our securities on the TASE and Nasdaq, and have spent approximately $50 million to build our additive electronics company.

With our unique additive manufacturing technology for 3D printed electronics, we are targeting the growing demand for electronic devices that require increasingly sophisticated features and rely on printed circuit boards, connected devices and smart products, encapsulated sensors and antennas. Additive manufacturing industry analysts predict that 3D printed electronics is likely to be the next high-growth application for product innovation, with its market size forecasted to reach $2.8 billion by 2025 based on a market study by Smartech Publishing we purchased in 2016.

Traditionally, electronic circuitry is developed through a back-and-forth process that involves design, trial and error and third-party manufacturer outsourcing. We believe that the traditional process for developing complex and advanced electronics is outdated. Until now, additive manufacturing technology has been unable to offer a solution for the electronics market, mainly because of the difficulty of printing multiple layers of electrically conductive and dielectric materials at a high resolution that is suitable for professional electronics. We are the first to develop an integrated solution for additive manufacturing of electronics. We are disrupting, shaping, and defining how electronics are made.

Our DragonFly Pro precision system for additive manufacturing of printed electronics uses our proprietary liquid nano-conductive and dielectric inks that are designed specifically to print multilayer circuitry and 3D electronics. We believe that our DragonFly Pro precision system will obviate the reliance on third-party manufacturers during the development, short run manufacturing and prototyping of smart connected products, such as sensors, conductive geometries, antennas, professional multilayer PCBs and molded connected devices for rapid prototyping and custom additive manufacturing.

Following the launch of our sales and commercialization efforts in the fourth quarter of 2017, and as a part of scaling our operations, we opened four Customer Experience Centers, or CECs, spanning across the United States, Hong Kong and Israel. The CECs are designed to accelerate the adoption of additive manufacturing for electronics development and serve as customer and reseller training facilities and sales support centers.

In order to leverage and expedite our go to market strategy, we partner with value added resellers, or VARs, around the world. The VARs provide customers with services such as sales support, demonstrations, technical support and maintenance. The VARs assign dedicated technical support experts that are trained in installing, operating and maintaining the printer and providing technical support and demonstrations for their customers. Our VARs engage actively in sales and tradeshow activities, as well as with customer care and first response system servicing. We have multiple VAR relationships in the United States, the United Kingdom, Ireland, Canada, Germany, France, Italy, Belgium, Australia, Turkey, China, Taiwan and Korea. As we continue to expand our sales channel presence, we expect to engage with additional top tier VARs operating in the 3D printing industry and ECAD (electronic computer aided design) and MCAD (mechanical computer aided design) software solutions.

Our Strategy

By creating our own installed-base of printers that require our own dedicated inks – we are establishing a “Razor and Blades” business model in which our customers buy the printer first and then continue to purchase the dedicated inks and maintenance over time.

We market and sell our products and services worldwide, primarily to companies that develop products with electronic components, including companies in the defense industry, including the U.S. Armed Forces, the automotive sector, consumer electronics, semiconductor, aerospace, and medical industries and to research institutes. Our primary market is in the U.S., though we have also experienced growth in Asia Pacific and Europe and expect that trend to increase into 2019.

Our goal is to expedite our growth and to further advance our breakthrough technologies and commercialization efforts. To achieve these objectives, we plan to:

| ● | Increase sales and marketing.We are advancing our commercialization efforts and infrastructure, and allocating more resources to activities executed by our U.S. and Hong Kong headquarters, including increasing sales manpower. |

| ● | Recruit additional value-added resellers globally. We intend to increase the number and use of our resellers in order to increase sales and provide technical services to our customers. |

| ● | Form alliances with industry leaders. We plan to collaborate with companies in the fields of design and manufacturing in order to expedite the adoption of our technology by the market. |

| ● | Increase amount of applications and use cases. In collaboration with our customers, create applications that can expedite the usage of our products for production grade products and consequently increase our sales. Our main focus is in collaboration with customers in the fields of medical devices, automotive, aerospace and defense. |

| ● | Capitalize on our nano-conductive and dielectric inks, and software technology products. We plan to exploit our inks as supplemental products to our DragonFly Pro system. We also plan to increase the software options and enable levels of licensing that we could monetize from. |

Our strategic growth plan includes the following:

| | ● | Current state:Monetize commercially available products and services for additive electronics design. |

| | ● | Horizon 1:Deliver higher speed production-grade additive electronics systems and more materials and services. |

| | ● | Horizon 2:Deliver hybridized capabilities that combine mechanical functionality within electrified geometries. |

Products

Our products currently consist of three main product lines – our DragonFly Pro precision system, proprietary ink products and software.

DragonFly Pro Precision System for additive manufacturing of printed electronics

Our DragonFly Pro can print sensors, conductive geometries, Radio Frequency (RF) devices, antennas, professional multilayer PCBs, and molded connected devices for rapid prototyping and custom additive manufacturing.

Our DragonFly Pro precision system is the first and only system that we are aware of that is customized specifically to print multilayer PCBs for advanced electronics. The Dragonfly Pro is designed to allow users the ability to print ready-to-use electronics and connected devices in-house, within hours. Possible applications of our products include aerospace, smart cars, Internet of Things (IoT)-connected products, RF components and encapsulated sensors for military and civil applications.

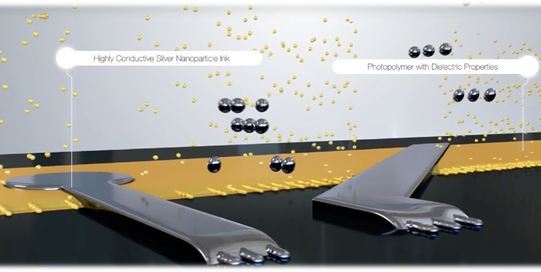

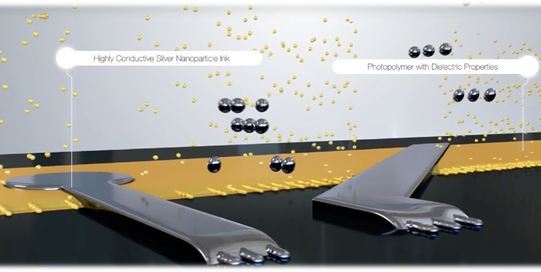

Our DragonFly Pro system is designed to print electronic conductors and dielectric (non-conductive) layers based on a user’s specific design plan. Our DragonFly Pro system uses at least two types of ink (i.e. conductive and dielectric) in order to lay down successive layers that literally build ready-to-use electronics. The printer receives digital files as input and converts them into print jobs in order to build the multilayer PCB, sensors, antenna or circuit. No cutting or drilling is required in the process of additive manufacturing of a multilayer PCB with our DragonFly Pro precision system.

Our DragonFly Pro system includes our dedicated and proprietary print-job editing software named ‘Switch’ and a printing control software named DragonFly, which enable smooth and seamless usage for our customers. Our software is not intended to be a replacement for PCB or computer aided design (CAD) design software, but rather conveniently allow our customers to continue to design their smart parts with their preferred PCB/CAD design software. After the user has concluded the design, the files are simply sent to the DragonFly Pro in Gerber (.gbr) or stereolithographic (.stl) format with a user-friendly interface, similar to the usage of commonplace inkjet and laser printers. Our proprietary software employs traditional methods of 3D printing by virtually converting end products to be printed (such as PCBs) into a large number of thin slices, which are then printed one on top of the other.

Illustration of the inkjet printing process performed by the DragonFly Pro:

Additionally, and depending on the sales channel employed, we will offer different levels of product warranty and after-sales services. We anticipate that channel partners, such as established distributors will typically be key to providing support and warranty services to the wider market. In instances where deeper and more strategic relationships are at stake, we intend to provide dedicated account management, both in terms of support and servicing, which may be fee or subscription-based. We plan to support and train a select number of experienced channel partners with the capabilities to ensure that end customers are satisfied with our products and any after-sales services and support that we may offer in the future.

Our DragonFly Pro system has multiple advantages, including:

| ● | In-house prototypes and low volume production. Our DragonFly Pro system offers its users an efficient, quick, available, accessible and immediate solution for prototype production of smart products such as encapsulated sensors, antennas, multilayer PCBs and free-form geometry 3D Circuits. Currently, electronics companies and others engaged in the development of products based on PCBs are forced to rely on service suppliers that manufacture PCBs through a complex and inefficient process. |

Turn-around of multilayer advanced smart parts can often take weeks and involves significant costs. Also, for electronics in development, several cycles of prototyping are often necessary until the specs of the final electronic part are created. This means that a developer of a new electronic product may have to repeat the process of going through a service supplier several times during lab testing – which may increase cost and slow the momentum of product development.

Our DragonFly Pro system obviates the reliance on external service suppliers and provides electronics companies and others the luxury of an office-friendly system in their in-house research laboratory with the ability to print prototypes of PCBs as required for electronic device development – all during a relatively short period of time.

| ● | Information security and professional secrecy. Contracting with external service suppliers (outsourcing) in order to create prototypes of PCBs during early stages of the development process of novel electronic devices may unnecessarily compromise the security of sensitive and confidential information. Currently, however, there is hardly a practical solution. By allowing companies to bring prototype development in-house, our DragonFly Pro system offers a practical solution to this issue. |

| ● | Industry first. We believe that we are a pioneer and a leader in our industry. We are not aware of any other company in the global electronics market that currently offers a 3D inkjet printer that prints professional grade smart parts. |

Supplementary Products

Conductive Ink

We have developed a uniquely formulated nano-conductive ink for use in our systems. Using advanced nano-technology, we have developed a liquid ink that contains nano-particles of conductive materials such as silver and copper. Nano-particles are particles between 1 and 100 nanometers in size. By employing this technology, we are able to create a liquid ink that maintains its transport properties and electric conductivity. The liquid properties of our nano-conductive ink allow us to take advantage of inkjet printing technology for fast and efficient 3D printing of PCBs.

Our wet-chemistry approach to making silver nano-particles starts with a raw material compound containing silver which may be acquired from a number of chemical suppliers. The patented process, licensed from the Hebrew University, is highly efficient and very clean. We can reliably extract 10 to 100 nano-meter sized particles of pure silver. We are able to control the size, shape and dispersion of the silver nano-particles in accordance with specific printing requirements. We can also formulate inks for a variety of substrates and printing profiles.

In addition, in July 2016, we filed a patent application with the United States Patent and Trademark Office for the development of a new nano-metric conductive ink, which is based on a unique synthesis. The new nano-particle synthesis further minimizes the size of the silver nano-particles particles in our ink products. The new process achieves silver nano-particles as small as 4 nano-meters. We believe that accurate control of nano-particles’ size and surface properties will allow for improved performance of our DragonFly Pro system. The innovative ink enables lower melting temperatures and more complete sintering (fusing of particles into solid conductive trace), leading to an even higher level of conductivity. The innovative ink has the potential to accelerate printing speeds and save ink for the 3D printing of electronics.

Dielectric Ink

Our proprietary dielectric ink is a unique ink that contains dielectric and dielectric materials that are not electrically conductive. The use of non-conductive ink is crucial in the production of multilayer circuit boards, as the conducting layers that are placed on top of each other must be separated by dielectric layers. Our internally developed, proprietary dielectric ink is a unique one-part-epoxy material. The dielectric ink can withstand high temperature (e.g., five hundred degrees Fahrenheit and more) without distorting its shape, which is a necessary requirement for professional PCBs and electronics components.

Both our nano-conductive and dielectric ink products have completed development stages and we have begun to manufacture these products in-house. We plan to commercialize these ink products as a supplementary product to our systems. Based on our proprietary technology, our ink products may be adjusted specifically for additional uses.

Software

Our proprietary software, the ‘DragonFly’ and ‘Switch’ are used to manage the design file and printing process. The Switch software enables seamless transition into an additive manufacturing workflow.

In July 2016, we completed the development of the initial version of our software package and we’ve been adding features and improvements to it from time to time. The Switch is included in our DragonFly Pro system. The ‘Switch’ software enables preparation of production files of printed electronic circuits using the DragonFly Pro system. The software supports customary formats in the electronics industry such as Gerber files, as well as vertical interconnect access (VIA) and DRILL files. The ‘Switch’ software presents a unique interface that displays Gerber files and an accurate and detailed description of the PCB’s structure, which facilitates a highly precise conversion to a 3D file format.

Multilayer 3D files can be prepared from standard file formats, with the software allowing for adjustments in numerous parameters such as layer order and thickness.

When the print-job is ready the user simply loads the design file from Switch straight into the Dragonfly Pro printer and uses the DragonFly software to manage and control the print.

Recent Developments

| ● | Announced a total of 30 DragonFly Pro system sales in 2018 and that we expect to report revenues of approximately $5.1 million for 2018. |

| ● | Increased Nano Dimension U.S. activity with additional sales and technical support force in our Santa Clara HQ as well as on the East Coast. |

| ● | Received a Commercial and Government Entity (CAGE) Code from the U.S. Department of Defense’s Defense Logistics Agency, and strengthened our position in the defense sector by selling four printers to the U.S. Armed Forces. |

| ● | Built up our reseller network through collaboration agreements and additional channel partnerships in major territories around the world. Reached full coverage of U.S. |

| | ● | Extended Asia-Pacific market coverage through the establishment of our wholly owned subsidiary in Hong Kong – Nano Dimension (HK) Limited. We realized additional DragonFly systems sales, added new resellers in China, and appointed a Hong Kong based regional sales leader and CEC. |

| | ● | We opened four CECs spanning across the U.S., Hong Kong and Israel. The new CECs are designed to accelerate the adoption of additive manufacturing for electronics development and will also serve as customer and reseller training facilities and sales support centers. |

Risks Associated with Our Business

Our business, and investing in our securities, are subject to numerous risks, as more fully described in the section entitled “Risk Factors” beginning on page 11 and other risk factors contained in the documents incorporated by reference herein. You should read these risks before making a decision to invest in our securities. If any of these risks actually occur, our business, financial condition or results of operations would likely be materially adversely affected. In each case, the trading price of our securities would likely decline, and you may lose all or part of your investment. The following is a summary of some of the principal risks we face:

| ● | We are a development-stage company and have a limited operating history on which to assess our business, have incurred significant losses since our inception, and anticipate that we will continue to incur significant losses until we are able to become profitable from sales of our products. Based on the projected cash flows and our cash balance as of June 30, 2018, our management is of the opinion that without further fund raising it will not have sufficient resources to enable it to continue advancing its activities including the development, manufacturing and marketing of its products for a period of at least 12 months from the date of sign-off date of our financial statements. As a result, there is substantial doubt about our ability to continue as a going concern; |

| ● | We depend entirely on the success of our current products, and we may not be able to successfully commercialize them; |

| ● | We rely on highly-skilled technical personnel and if we are unable to attract, retain or motivate key personnel or hire qualified personnel, we may not be able to grow or our business may contract; |

| ● | Even if this offering is successful, we expect that we will need to raise additional funding before we can expect to become profitable from sales of our products; and |

| ● | If we are unable to obtain and maintain effective patent rights for our products, we may not be able to compete effectively in our markets. |

Corporate Information

We are an Israeli corporation based in Ness Ziona and were incorporated in 1960. Our principal executive offices are located at 2 Ilan Ramon St., Ness Ziona 7403635, Israel. Our telephone number in Israel is +972-73-7509142. Our website address iswww.nano-di.com.The information contained on, or that can be accessed through, our website is not part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the JOBS Act. As such, we are eligible to, and intend to, take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not “emerging growth companies” such as not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002. We could remain an “emerging growth company” for up to five years, or until the earliest of (a) the last day of the first fiscal year in which our annual gross revenue exceeds $1.07 billion, (b) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of the securities that are held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in nonconvertible debt during the preceding three-year period.

Implications of being a Foreign Private Issuer

We are subject to the information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those requirements we will file reports with the United States Securities and Exchange Commission, or SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, although we report our financial results on a quarterly basis, we will not be required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of each fiscal year to file our annual reports with the SEC and are not required to file current reports as frequently or promptly as U.S. domestic reporting companies. We also present financial statements pursuant to International Financial Reporting Standards, or IFRS instead of pursuant to U.S. generally accepted accounting principles. Furthermore, although the members of our management and supervisory boards will be required to notify the Israeli Securities Authority, of certain transactions they may undertake, including with respect to our Ordinary Shares, our officers, directors and principal shareholders will be exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we are also not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. In addition, as a foreign private issuer, we are permitted, and follow certain home country corporate governance practices instead of those otherwise required under the listing rules of Nasdaq for domestic U.S. issuers (See “Risk Factors — Risks Related to an Investment in Our Securities and this Offering”). These exemptions and leniencies reduce the frequency and scope of information and protections available to you in comparison to those applicable to a U.S. domestic reporting companies.

THE OFFERING

| Ordinary Shares currently outstanding | | 96,571,661 Ordinary Shares |

| | | |

| Units offered by us | | We are offering 16,000,000 Units. Each Unit will consist of (i) one ADS, (ii) one Warrant to purchase one ADS, and (iii) one Right to Purchase 0.75 of an ADS. The Units will not be issued or certificated and the ADSs and the Warrants and Rights to Purchase that are part of such Units are immediately separable and will be issued separately, but will be purchased together in this offering. |

| | | |

| Ordinary Shares to be outstanding after this offering | | 176,571,661 Ordinary Shares (assuming no exercise of the Warrants and the Rights to Purchase) |

| | | |

| The ADSs | | Each ADS represents five of our Ordinary Shares, par value NIS 0.10. The ADSs may be evidenced by American Depositary Receipts, or ADRs. The depositary will be the holder of the Ordinary Shares underlying the ADSs and you will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary and owners and beneficial owners of ADSs from time to time. |

| | | |

| | | To better understand the terms of the ADSs, you should carefully read the section in this prospectus entitled “Description of the Offered Securities.” We also encourage you to read the deposit agreement, which is incorporated by reference as an exhibit to the registration statement that includes this prospectus. |

| | | |

| The Warrants | | Each Warrant will have an exercise price of $0.8625 per ADS, will be immediately exercisable and will expire five years from the date of issuance. To better understand the terms of the Warrants, you should carefully read the “Description of the Offered Securities” section of this prospectus. You should also read the form of Warrant, which is filed as an exhibit to the registration statement that includes this prospectus. |

| | | |

| Right to Purchase | | Each Right to Purchase will have an exercise price of $0.75 per ADS, will be immediately exercisable and will expire six months from the date of issuance. To better understand the terms of the Right to Purchase, you should carefully read the “Description of the Offered Securities” section of this prospectus. You should also read the form of Right to Purchase, which is filed as an exhibit to the registration statement that includes this prospectus. |

| | | |

| Underwriter’s option to purchase additional securities | | We have granted to the underwriter an over-allotment option exercisable not later than 45 days after the date of this prospectus to purchase up to 2,400,000 additional Units (15% of the Units sold in this offering) from us to cover over-allotments, if any. If the underwriter exercises all or part of this option, it will purchase Units covered by the option at the public offering price per Unit, less the underwriting discounts and commissions. See “Underwriting.” |

| | | |

| Use of proceeds | | We expect to receive approximately $10.585 million in net proceeds from the sale of 16,000,000 Units offered by us in this offering (approximately $12.241 million if the underwriter exercises its over-allotment option in full), based upon a public offering price of $0.75 per Unit, and excluding any proceeds from the exercise of Warrants and Rights to Purchase. The actual offering price per Unit in this offering was negotiated between us and the underwriter based on market conditions at the time of pricing. |

| | | |

| | | We currently expect to use the net proceeds from this offering for the following purposes: ● $7 million for scaling up sales and marketing globally; ● $2 million for increasing production capabilities; and ● The remainder for working capital and general corporate purposes, possible in licensing of additional intellectual property and product candidates, and next generation product development. |

| Depositary | | The Bank of New York Mellon. |

| | | |

| Risk factors | | You should read the “Risk Factors” section starting on page 11 of this prospectus, and “Item 3. - Key Information – D. Risk Factors” in our 2017 Annual Report incorporated by reference herein, and other information included or incorporated by reference in this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities. |

| | | |

| Nasdaq Capital Market Symbol and Tel Aviv Stock Exchange symbol | | “NNDM” |

The number of our ADSs and Ordinary Shares to be outstanding immediately after this offering as shown above assumes that all of the ADSs offered hereby are sold and is based on 96,571,661 Ordinary Shares outstanding as of January 31, 2019. This number excludes:

| | ● | 1,306,457 Ordinary Shares issuable upon the exercise of warrants outstanding as of January 31, 2019, of which 730,289 were vested as of such date; |

| | ● | 527,032 Ordinary Shares held by the Company as treasury shares; |

| | ● | 7,210,590 Ordinary Shares issuable upon the exercise of options to directors and employees under our equity incentive plan, outstanding as of January 31, 2019; |

| | ● | 80,000,000 Ordinary Shares issuable upon the exercise of the Warrants offered hereby; and |

| ● | 60,000,000 Ordinary Shares issuable upon the exercise of the Rights to Purchase offered hereby. |

Unless otherwise indicated, all information in this prospectus assumes no exercise of the Warrants and Rights to Purchase offered hereby and no exercise of the underwriter’s over-allotment option.

SUMMARY CONSOLIDATED FINANCIAL DATA

The selected consolidated financial data set forth in the table below have been derived from our unaudited interim condensed consolidated financial statements and notes thereto as of June 30, 2018. The selected financial data should be read in conjunction with our unaudited interim condensed consolidated financial statements, and are qualified entirely by reference to such financial statements.

| (in thousands of U.S. dollars except per share data) | | Six Months Ended June 30, | |

| | | (*) 2017 | | | 2018 | |

| Consolidated Statements of Profit or Loss and Other Comprehensive Income Data: | | | | | | |

| Revenues | | | 260 | | | | 1,723 | |

| Cost of revenues | | | 82 | | | | 1,124 | |

| Cost of revenues- amortization of intangible | | | 365 | | | | 386 | |

| Gross profit (loss) | | | (187 | ) | | | 213 | |

| Research and development expenses, net | | | 5,370 | (**) | | | 4,611 | |

| General and administrative expenses | | | 1,944 | (**) | | | 1,494 | |

| Sales and marketing expenses | | | 922 | (**) | | | 1,872 | |

| Operating loss | | | 8,423 | | | | 7,764 | |

| Finance expenses, net | | | 803 | | | | 129 | |

| Total loss | | | 9,226 | | | | 7,893 | |

| Basic and diluted loss per Ordinary Share | | | 0.18 | | | | 0.09 | |

| Weighted average of number of Ordinary Shares used in the calculation of the basic and diluted loss per Ordinary Share | | | 51,134,245 | | | | 86,920,197 | |

| (*) | Presented according to the change in our functional and presentation currency from NIS to U.S. dollars, effective January 1, 2018. The change in functional currency is accounted for prospectively from that date. Accordingly, comparative profit or loss figures have been translated into U.S. dollars using average exchange rates for the reporting periods. |

| (**) | Reclassified - In the fourth quarter of 2017, we decided to present our sales and marketing expenses separate from other operating expenses. Thus, for comparison we have reclassified the expenses in the previous years. |

| (in thousands of U.S. dollars except share data) | | As of June 30, | |

| | | (*) 2017 | | | 2018 | |

| Consolidated Statement of Financial Position Data: | | | | | | |

| Cash | | | 16,495 | | | | 11,601 | |

| Total assets | | | 29,680 | | | | 27,336 | |

| Total non-current liabilities | | | 1,103 | | | | 1,206 | |

| Accumulated loss | | | 27,845 | | | | 44,015 | |

| Total equity | | | 25,573 | | | | 23,039 | |

| Number of shares outstanding | | | 61,772,211 | | | | 96,571,661 | |

(*) Presented according to the change in our functional and presentation currency from NIS to U.S. dollars, effective January 1, 2018. The change in functional currency is accounted for prospectively from that date. Accordingly, comparative profit or loss figures have been translated into U.S. dollars using average exchange rates for the reporting periods.

RISK FACTORS

You should carefully consider the risks described below and the risks described in our 2017 Annual Report which are incorporated by reference herein, as well as the financial or other information included in this prospectus or incorporated by reference in this prospectus, including our consolidated financial statements and the related notes, before you decide to buy our securities. The risks and uncertainties described below are not the only risks facing us. We may face additional risks and uncertainties not currently known to us or that we currently deem to be immaterial. Any of the risks described below, and any such additional risks, could materially adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your original investment.

Risks Related to an Investment in Our Securities and this Offering

Our management team will have immediate and broad discretion over the use of the net proceeds from this offering and may not use them effectively.

We currently intend to use the net proceeds of this offering for scaling up sales and marketing globally, increasing production capabilities, and the remainder for working capital and general corporate purposes, possible in licensing of additional intellectual property and product candidates, and next generation product development. See “Use of Proceeds.” However, our management will have broad discretion in the application of the net proceeds. Our shareholders may not agree with the manner in which our management chooses to allocate the net proceeds from this offering. The failure by our management to apply these funds effectively could have a material adverse effect on our business, financial condition and results of operation. Pending their use, we may invest the net proceeds from this offering in a manner that does not produce income. The decisions made by our management may not result in positive returns on your investment and you will not have an opportunity to evaluate the economic, financial or other information upon which our management bases its decisions.

We will need additional capital in the future. If additional capital is not available, we may not be able to continue to operate our business pursuant to our business plan or we may have to discontinue our operations entirely.

We have incurred losses in each year since our inception. If we continue to use cash at our historical rates of use we will need significant additional financing, which we may seek through a combination of private and public equity offerings, debt financings and collaborations and strategic and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interest will be diluted, and the terms of any such offerings may include liquidation or other preferences that may adversely affect the then existing shareholders rights. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions such as incurring debt or making capital expenditures. If we raise additional funds through collaboration, strategic alliance or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams or product candidates, or grant licenses on terms that are not favorable to us.

You will experience immediate dilution in book value of any ADSs you purchase.

Because the price per ADS being offered is substantially higher than our net tangible book value per ADS, you will suffer substantial dilution in the net tangible book value of any ADSs you purchase in this offering. After giving effect to the sale by us of ADSs in this offering, based on a public offering price of $0.75 per Unit, and after deducting underwriter’s discount and commission and offering expenses payable by us, our as adjusted net tangible book value of our ADSs would be approximately $18.850 million, or approximately $0.53 per ADS, as of June 30, 2018. If you purchase ADSs in this offering, you will suffer immediate and substantial dilution of our as adjusted net tangible book value of approximately $0.22 per ADS. To the extent outstanding options, warrants or offered Warrants or Rights to Purchase are exercised, you will incur further dilution. See “Dilution” on page 21 for a more detailed discussion of the dilution you will incur in connection with this offering.

The exercise of the Warrants and Rights to Purchase offered hereby will cause significant dilution to holders of our equity securities.

Holders of the Warrants may exercise their warrants into 16,000,000 of our ADSs, and the holders of the Rights to Purchase may exercise their warrants into an additional 12,000,000 of our ADSs. In the event that the Warrants and/or Rights to Purchase are exercised in full, the ownership interest of existing holders of our equity securities will be diluted. See “Dilution” for further information.

ADSs, Warrants and Rights to Purchase representing a substantial percentage of our outstanding shares may be sold in this offering, which could cause the price of our ADSs and Ordinary Shares to decline.

We have offered 16,000,000 Units representing 80,000,000 Ordinary Shares, or approximately 83%, of our outstanding Ordinary Shares as of January 31, 2019. In addition, the investors in this offering will be issued Warrants to purchase up to 16,000,000 ADSs representing 80,000,000 Ordinary Shares and Rights to Purchase up to 12,000,000 ADSs representing 60,000,000 Ordinary Shares. This sale and any future sales of a substantial number of ADSs in the public market, or the perception that such sales may occur, could materially adversely affect the price of our ADSs and Ordinary Shares. We cannot predict the effect, if any, that market sales of those ADSs or the availability of those ADSs for sale will have on the market price of our ADSs and Ordinary Shares.

Significant holders or beneficial holders of our Ordinary Shares may not be permitted to exercise Warrants and Rights to Purchase that they hold.

The terms of the Warrants and Rights to Purchase being offered hereby will prohibit a holder from exercising its Warrants and/or Rights to Purchase if doing so would result in such holder (together with such holder’s affiliates and any other persons acting as a group together with such holder or any of such holder’s affiliates) beneficially owning more than 4.99% of our Ordinary Shares outstanding immediately after giving effect to the exercise, provided that, at the election of a holder and notice to us, such beneficial ownership limitation may be increased or decreased, from time to time, to any other percentage not in excess of 9.99%. As a result, you may not be able to exercise your Warrants and Rights to Purchase at a time when it would be financially beneficial for you to do so.

You may not be able to resell the Warrants and/or Rights to Purchase being offered by this prospectus, or obtain a return on your investment in the warrants.

There is no established public trading market for the Warrants and Rights to Purchase being offered by this prospectus and we do not intend to have the Warrants or Rights to Purchase listed on a national securities exchange or any other recognized trading system in the future. Without an active market, the liquidity of any Warrants and/or Rights to Purchase sold by means of this prospectus will be limited. If your Warrants and/or Rights to Purchase cannot be resold, you will have to depend upon any appreciation in the value of our Ordinary Shares and the ADSs over the exercise price of the respective Warrants and/or Rights to Purchase in order to realize a return on your investment in the Warrants and/or Rights to Purchase.

Raising additional capital by issuing securities may cause dilution to existing shareholders.

We may seek additional capital through a combination of private and public equity offerings, debt financings and collaborations and strategic and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interest will be diluted, and the terms of any such offerings may include liquidation or other preferences that may adversely affect the then existing shareholders rights. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions such as incurring debt or making capital expenditures. If we raise additional funds through collaboration, strategic alliance or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams or product candidates, or grant licenses on terms that are not favorable to us.

We do not know whether a market for the ADSs and Ordinary Shares will be sustained or what the trading price of the ADSs will be and as a result it may be difficult for you to sell your ADSs or Ordinary Shares.

Although our ADSs now trade on Nasdaq and our Ordinary Shares trade on TASE, an active trading market for the ADSs or Ordinary Shares may not be sustained. It may be difficult for you to sell your ADSs or Ordinary Shares without depressing the market price for the ADSs or Ordinary Shares. As a result of these and other factors, you may not be able to sell your ADSs. Further, an inactive market may also impair our ability to raise capital by selling ADSs and Ordinary Shares and may impair our ability to enter into strategic partnerships or acquire companies or products by using our Ordinary Shares as consideration.

The Warrants and Rights to Purchase are speculative in nature.

The Warrants and Rights to Purchase offered by us in this offering do not confer any rights of ownership of Ordinary Shares or ADSs on their holders, such as voting rights or the right to receive dividends, but only represent the right to acquire ADSs at a fixed price, for a limited period of time. Specifically, commencing on the date of issuance, holders of the Warrants may exercise their right to acquire ADSs and pay an exercise price per share of $0.8625, equal to 115% of the offering price of the Units, subject to adjustment upon certain events, prior to five years from the date of issuance, after which date any unexercised Warrants will expire and have no further value. In addition, commencing on the date of issuance, holders of the Rights to Purchase may exercise their right to acquire ADSs and pay an exercise price per share of $0.75, equal to 100% of the offering price of the Units, subject to adjustment upon certain events, prior to six months from the date of issuance, after which date any unexercised Rights to Purchase will expire and have no further value.

Holders of our Warrants and Rights to Purchase will have no rights as shareholders until such holders exercise their Warrants and Rights to Purchase and acquire our ADSs.

Until holders of the Warrants and Rights to Purchase acquire our ADSs upon exercise of the Warrants and Rights to Purchase, holders of the Warrants and Rights to Purchase will have no rights with respect to our ADSs or Ordinary Shares underlying such Warrants and Rights to Purchase. Upon exercise of the Warrants and Rights to Purchase, the holders thereof will be entitled to exercise the rights of a holder of ADSs only as to matters for which the record date occurs after the exercise date.

Holders of ADSs may not receive the same distributions or dividends as those we make to the holders of our ordinary shares, and, in some limited circumstances, you may not receive dividends or other distributions on our ordinary shares and you may not receive any value for them, if it is illegal or impractical to make them available to you.

The Depositary for the ADSs has agreed to pay to you the cash dividends or other distributions it or the custodian receives on Ordinary Shares or other deposited securities underlying the ADSs, after deducting its fees and expenses. You will receive these distributions in proportion to the number of Ordinary Shares your ADSs represent. However, the Depositary is not responsible if it decides that it is unlawful or impractical to make a distribution available to any holders of ADSs. For example, it would be unlawful to make a distribution to a holder of ADSs if it consists of securities that require registration under the Securities Act, but that are not properly registered or distributed under an applicable exemption from registration. In addition, conversion into U.S. dollars from foreign currency that was part of a dividend made in respect of deposited Ordinary Shares may require the approval or license of, or a filing with, any government or agency thereof, which may be unobtainable. In these cases, the Depositary may determine not to distribute such property and hold it as “deposited securities” or may seek to effect a substitute dividend or distribution, including net cash proceeds from the sale of the dividends that the Depositary deems an equitable and practicable substitute. We have no obligation to register under U.S. securities laws any ADSs, Ordinary Shares, rights or other securities received through such distributions. We also have no obligation to take any other action to permit the distribution of ADSs, Ordinary Shares, rights or anything else to holders of ADSs. In addition, the Depositary may withhold from such dividends or distributions its fees and an amount on account of taxes or other governmental charges to the extent the Depositary believes it is required to make such withholding. This means that you may not receive the same distributions or dividends as those we make to the holders of our Ordinary Shares, and, in some limited circumstances, you may not receive any value for such distributions or dividends if it is illegal or impractical for us to make them available to you. These restrictions may cause a material decline in the value of the ADSs.

Holders of ADSs must act through the Depositary to exercise their rights as shareholders of our company.

Holders of our ADSs do not have the same rights of our shareholders and may only exercise the voting rights with respect to the underlying Ordinary Shares in accordance with the provisions of the Deposit Agreement. Under Israeli law and our articles of association, the minimum notice period required to convene a shareholders meeting is no less than 21 or 35 calendar days, depending on the proposals on the agenda for the shareholders meeting. When a shareholder meeting is convened, holders of ADSs may not receive sufficient notice of a shareholders’ meeting to permit them to withdraw their Ordinary Shares to allow them to cast their vote with respect to any specific matter. In addition, the Depositary and its agents may not be able to send voting instructions to holders of ADSs or carry out their voting instructions in a timely manner. We will make all reasonable efforts to cause the Depositary to extend voting rights to holders of the ADSs in a timely manner, but we cannot assure holders that they will receive the voting materials in time to ensure that they can instruct the Depositary to vote their Ordinary Shares underlying the ADSs. Furthermore, the Depositary and its agents will not be responsible for any failure to carry out any instructions to vote, for the manner in which any vote is cast or for the effect of any such vote. As a result, holders of our ADSs may not be able to exercise their right to vote and they may lack recourse if their Ordinary Shares underlying the ADSs are not voted as they requested. In addition, in the capacity as a holder of ADSs, they will not be able to call a shareholders’ meeting.

ADSs holders may not be entitled to a jury trial with respect to claims arising under the deposit agreement, which could augur less favorable results to the plaintiff(s) in any such action.

The deposit agreement governing the ADSs representing our ordinary shares provides that holders and beneficial owners of ADSs irrevocably waive the right to a trial by jury in any legal proceeding arising out of or relating to the deposit agreement or the ADSs, including claims under federal securities laws, against us or the depositary to the fullest extent permitted by applicable law. If this jury trial waiver provision is prohibited by applicable law, an action could nevertheless proceed under the terms of the deposit agreement with a jury trial. To our knowledge, the enforceability of a jury trial waiver under the federal securities laws has not been finally adjudicated by a federal court. However, we believe that a jury trial waiver provision is generally enforceable under the laws of the State of New York, which govern the deposit agreement, by a court of the State of New York or a federal court, which have non-exclusive jurisdiction over matters arising under the deposit agreement, applying such law. In determining whether to enforce a jury trial waiver provision, New York courts and federal courts will consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently prominent such that a party has knowingly waived any right to trial by jury. We believe that this is the case with respect to the deposit agreement and the ADSs. In addition, New York courts will not enforce a jury trial waiver provision in order to bar a viable setoff or counterclaim sounding in fraud or one which is based upon a creditor’s negligence in failing to liquidate collateral upon a guarantor’s demand, or in the case of an intentional tort claim (as opposed to a contract dispute), none of which we believe are applicable in the case of the deposit agreement or the ADSs. No condition, stipulation or provision of the deposit agreement or ADSs serves as a waiver by any holder or beneficial owner of ADSs or by us or the depositary of compliance with any provision of the federal securities laws. If you or any other holder or beneficial owner of ADSs brings a claim against us or the depositary in connection with matters arising under the deposit agreement or the ADSs, you or such other holder or beneficial owner may not be entitled to a jury trial with respect to such claims, which may have the effect of limiting and discouraging lawsuits against us and / or the depositary. If a lawsuit is brought against us and / or the depositary under the deposit agreement, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may augur different results than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in any such action, depending on, among other things, the nature of the claims, the judge or justice hearing such claims, and the venue of the hearing.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements made under “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this prospectus, including in our 2017 Annual Report incorporated by reference herein, and other information included or incorporated by reference in this prospectus, constitute forward-looking statements. Forward-looking statements are often characterized by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,” “estimate,” “continue,” “believe,” “should,” “intend,” “project” or other similar words, but are not the only way these statements are identified.

These forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate.

Important factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking statements include, among other things:

| | ● | the overall global economic environment; |

| | | |

| | ● | the impact of competition and new technologies; |

| | | |

| | ● | general market, political and economic conditions in the countries in which we operate; |

| | | |

| | ● | projected capital expenditures and liquidity; |

| | | |

| | ● | changes in our strategy; |

| | | |

| | ● | litigation; and |

| | | |

| | ● | those factors referred to in our 2017 Annual Report incorporated by reference herein in “Item 3. Key Information - D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects,” as well as in our 2017 Annual Report generally, which is incorporated by reference into this prospectus. |

These statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in this prospectus in greater detail under the heading “Risk Factors” and other risk factors contained in the documents incorporated by reference herein. You should not rely upon forward-looking statements as predictions of future events.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this prospectus.

EXCHANGE RATE INFORMATION

The following table sets forth information regarding the exchange rates of U.S. dollars per NIS for the periods indicated. Average rates are calculated by using the daily representative rates as reported by the Bank of Israel on the last day of each month during the periods presented.

| | | NIS per U.S. dollars | |

| Year Ended December 31, | | High | | | Low | | | Average | | | Period End | |

| 2019 (through January 31, 2019) | | | 3.746 | | | | 3.642 | | | | 3.687 | | | | 3.642 | |

| 2018 | | | 3.781 | | | | 3.388 | | | | 3.597 | | | | 3.748 | |

| 2017 | | | 3.860 | | | | 3.467 | | | | 3.600 | | | | 3.467 | |

| 2016 | | | 3.983 | | | | 3.746 | | | | 3.840 | | | | 3.845 | |

| 2015 | | | 4.053 | | | | 3.761 | | | | 3.884 | | | | 3.902 | |

| 2014 | | | 3.994 | | | | 3.402 | | | | 3.577 | | | | 3.889 | |

The following table sets forth the high and low daily representative rates for the NIS as reported by the Bank of Israel for each of the prior six months.

| | | NIS per U.S. dollars | |

| Month | | High | | | Low | | | Average | | | Period End | |

| January 2019 (through January 31, 2019) | | | 3.746 | | | | 3.642 | | | | 3.687 | | | | 3.642 | |

| December 2018 | | | 3.781 | | | | 3.718 | | | | 3.752 | | | | 3.748 | |

| November 2018 | | | 3.743 | | | | 3.668 | | | | 3.705 | | | | 3.701 | |

| October 2018 | | | 3.721 | | | | 3.62 | | | | 3.656 | | | | 3.721 | |

| September 2018 | | | 3.627 | | | | 3.564 | | | | 3.592 | | | | 3.627 | |

| August 2018 | | | 3.71 | | | | 3.604 | | | | 3.6664 | | | | 3.604 | |

| July 2018 | | | 3.667 | | | | 3.618 | | | | 3.6453 | | | | 3.664 | |

| June 2018 | | | 3.65 | | | | 3.565 | | | | 3.6045 | | | | 3.65 | |

PRICE HISTORY OF OUR ORDINARY SHARES AND ADSs

Our Ordinary Shares have been trading on the TASE under the symbol “NNDM” since 1977. Our ADSs commenced trading on the OTCQB and OTCQX under the symbol “NNDMY” on July 29, 2015, and September 17, 2015, respectively. On March 7, 2016, our ADSs, each of which represents five of our Ordinary Shares, commenced trading on the Nasdaq Capital Market under the symbol “NNDM.”

The following table sets forth, for the periods indicated, the reported high and low sale prices of our Ordinary Shares on the TASE in NIS and U.S. dollars. U.S. dollar per Ordinary Share amounts are calculated using the U.S. dollar representative rate of exchange on the date to which the high or low market price is applicable, as reported by the Bank of Israel.

| | | NIS

Price Per Ordinary Share | | | U.S.$

Price Per Ordinary Share | |

| | | High | | | Low | | | High | | | Low | |

| Annual: | | | | | | | | | | | | |

| 2019 (through January 31, 2019) | | | 0.95 | | | | 0.76 | | | | 0.26 | | | | 0.21 | |

| 2018 | | | 2.60 | | | | 0.77 | | | | 0.76 | | | | 0.20 | |

| 2017 | | | 5.33 | | | | 2.07 | | | | 1.47 | | | | 0.59 | |

| 2016 | | | 6.52 | | | | 4.47 | | | | 1.70 | | | | 1.16 | |

| 2015 | | | 7.99 | | | | 1.51 | | | | 2.07 | | | | 0.39 | |

| 2014 | | | 5.05 | | | | 0.81 | | | | 1.45 | | | | 0.23 | |

| | | | | | | | | | | | | | | | | |

| Quarterly: | | | | | | | | | | | | | | | | |

| First Quarter 2019 (through January 31, 2019) | | | 0.95 | | | | 0.76 | | | | 0.26 | | | | 0.21 | |

| Fourth Quarter 2018 | | | 1.54 | | | | 0.77 | | | | 0.42 | | | | 0.20 | |

| Third Quarter 2018 | | | 1.70 | | | | 1.37 | | | | 0.47 | | | | 0.37 | |

| Second Quarter 2018 | | | 1.98 | | | | 0.92 | | | | 0.55 | | | | 0.25 | |

| First Quarter 2018 | | | 2.60 | | | | 1.28 | | | | 0.76 | | | | 0.36 | |

| Fourth Quarter 2017 | | | 4.05 | | | | 2.07 | | | | 1.16 | | | | 0.59 | |

| Third Quarter 2017 | | | 4.42 | | | | 3.02 | | | | 1.26 | | | | 0.84 | |

| Second Quarter 2017 | | | 5.06 | | | | 4.24 | | | | 1.38 | | | | 1.21 | |

| First Quarter 2017 | | | 5.33 | | | | 4.25 | | | | 1.47 | | | | 1.12 | |

| Fourth Quarter 2016 | | | 5.64 | | | | 4.47 | | | | 1.49 | | | | 1.16 | |

| Third Quarter 2016 | | | 6.39 | | | | 5.08 | | | | 1.69 | | | | 1.31 | |

| Second Quarter 2016 | | | 6.24 | | | | 4.98 | | | | 1.64 | | | | 1.29 | |

| First Quarter 2016 | | | 6.52 | | | | 4.49 | | | | 1.70 | | | | 1.16 | |

| | | | | | | | | | | | | | | | | |

| Most Recent Six Months: | | | | | | | | | | | | | | | | |

| January 2019 | | | 0.95 | | | | 0.76 | | | | 0.26 | | | | 0.21 | |

| December 2018 | | | 1.18 | | | | 0.77 | | | | 0.32 | | | | 0.20 | |

| November 2018 | | | 1.52 | | | | 1.15 | | | | 0.41 | | | | 0.31 | |

| October 2018 | | | 1.54 | | | | 1.31 | | | | 0.42 | | | | 0.35 | |

| September 2018 | | | 1.66 | | | | 1.49 | | | | 0.46 | | | | 0.41 | |

| August 2018 | | | 1.70 | | | | 1.37 | | | | 0.47 | | | | 0.37 | |

| July 2018 | | | 1.70 | | | | 1.37 | | | | 0.46 | | | | 0.37 | |

The following table sets forth, for the periods indicated, the reported high and low closing sale prices of the ADSs in U.S. dollars.

| | | U.S.$

Price Per ADS | |

| | | High | | | Low | |

| Annual: | | | | | | |

| 2019 (through January 31, 2019) | | | 1.34 | | | | 0.96 | |

| 2018 | | | 3.73 | | | | 0.95 | |

| 2017 | | | 7.19 | | | | 2.95 | |

| 2016 | | | 8.89 | | | | 5.77 | |

| 2015 (Since July 29, 2015) | | | 10.00 | | | | 7.04 | |

| | | | | | | | | |

| Quarterly: | | | | | | | | |

| First Quarter 2019 (through January 31, 2019) | | | 1.34 | | | | 0.96 | |

| Fourth Quarter 2018 | | | 2.13 | | | | 0.95 | |

| Third Quarter 2018 | | | 2.33 | | | | 1.88 | |

| Second Quarter 2018 | | | 2.84 | | | | 1.24 | |

| First Quarter 2018 | | | 3.73 | | | | 1.83 | |

| Fourth Quarter 2017 | | | 5.72 | | | | 2.95 | |

| Third Quarter 2017 | | | 6.23 | | | | 4.22 | |

| Second Quarter 2017 | | | 6.92 | | | | 6.00 | |

| First Quarter 2017 | | | 7.19 | | | | 5.64 | |

| Fourth Quarter 2016 | | | 7.43 | | | | 5.89 | |

| Third Quarter 2016 | | | 8.61 | | | | 6.69 | |

| Second Quarter 2016 | | | 8.34 | | | | 6.47 | |

| First Quarter | | | 8.89 | | | | 5.77 | |

| | | | | | | | | |

| Most Recent Six Months: | | | | | | | | |

| January 2019 | | | 1.34 | | | | 0.96 | |

| December 2018 | | | 1.62 | | | | 0.95 | |

| November 2018 | | | 2.13 | | | | 1.62 | |

| October 2018 | | | 2.04 | | | | 1.69 | |

| September 2018 | | | 2.30 | | | | 1.97 | |

| August 2018 | | | 2.31 | | | | 1.88 | |

| July 2018 | | | 2.33 | | | | 1.92 | |

USE OF PROCEEDS

We expect to receive approximately $10.585 million in net proceeds from the sale of Units offered by us in this offering (approximately $12.241 million if the underwriter exercises its over-allotment option in full). These estimates exclude the proceeds, if any, from the exercise of the Warrants and Rights to Purchase offered hereby. If all of the Warrants sold in this offering were to be exercised in cash at the exercise price of $0.8625, and all of the Rights to Purchase sold in this offering were to be exercised in cash at the exercise price of $0.75, we would receive additional proceeds of approximately $22,800,000. However, the Warrants and Rights to Purchase contain a cashless exercise provision that permits exercise of the Warrants and Rights to Purchase on a cashless basis at any time where there is no effective registration statement under the Securities Act covering the issuance of the underlying ADSs. We cannot predict when or if these Warrants and/or Rights to Purchase will be exercised or whether they will be exercised for cash. It is possible that Warrants and/or Rights to Purchase may be exercised solely on a cashless basis.

We currently expect to use the net proceeds from this offering for the following purposes:

| | ● | $7 million for scaling up sales and marketing globally; |

| | | |

| | ● | $2 million for increasing production capabilities; and |

| | | |

| | ● | The remainder for working capital and general corporate purposes, possible in licensing of additional intellectual property and product candidates, and next generation product development. |

The amounts and schedule of our actual expenditures will depend on multiple factors. Therefore, our management will retain broad discretion over the use of the proceeds from this offering. We may ultimately use the proceeds for different purposes than what we project. If the anticipated proceeds will not be sufficient to fund all the proposed purposes, our management will determine the order of priority for using the proceeds, and, if necessary, as well as the amount and sources of other funds needed.

Pending our use of the net proceeds from this offering, we may invest the net proceeds in a variety of capital preservation investments, including short-term, investment grade, interest bearing instruments and U.S. government securities.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our Ordinary Shares and do not anticipate paying any cash dividends in the foreseeable future. Payment of cash dividends, if any, in the future will be at the discretion of our board of directors and will depend on then-existing conditions, including our financial condition, operating results, contractual restrictions, capital requirements, business prospects and other factors our board of directors may deem relevant.

The Israeli Companies Law imposes further restrictions on our ability to declare and pay dividends.

Payment of dividends may be subject to Israeli withholding taxes. See “Item 10. – Additional Information – E. “Taxation — Israeli Tax Considerations and Government Programs” in our 2017 Annual Report incorporated by reference herein for additional information.

CAPITALIZATION

The following table sets forth our cash and cash equivalents and our capitalization as of June 30, 2018:

| | ● | on an actual basis; and |

| | | |

| | ● | on an as adjusted basis to give effect to the sale of 16,000,000 Units in this offering at a public offering price of $0.75 per Unit, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, as if the sale of the Units had occurred on June 30, 2018. |

You should read this table in conjunction with the sections titled “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus and/or in our 2017 Annual Report incorporated by reference herein.

| | | As of June 30, 2018 | |

| (in thousands USD) | | Actual | | | As

Adjusted | |

| Cash and cash equivalents | | | 11,601 | | | | 22,186 | |

| | | | | | | | | |

| Liability in respect of government grants | | | 934 | | | | 934 | |

| Warrants and Rights to Purchase measured in fair value | | | - | | | | 8,405 | |

| Total liabilities | | | 4,297 | | | | 12,702 | |

| Shareholders’ equity: | | | | | | | | |

| Share capital | | | 3,291 | | | | 5,483 | |

| Share premium | | | 58,613 | | | | 59,592 | |

| Treasury shares | | | (1,509 | ) | | | (1,509 | ) |

| Warrants | | | 13 | | | | 13 | |

| Presentation currency translation reserve | | | 1,431 | | | | 1,431 | |

| Capital reserve from transactions with controlling shareholders | | | 63 | | | | 63 | |

| Capital reserve for share-based payments | | | 5,152 | | | | 5,152 | |

| Accumulated loss | | | (44,015 | ) | | | (45,006 | ) |

| Total shareholders’ equity | | | 23,039 | | | | 25,219 | |

| Total capitalization | | | 27,336 | | | | 37,921 | |

DILUTION

If you invest in our securities, your interest will be diluted immediately to the extent of the difference between the public offering price per Unit you will pay in this offering and the pro forma net tangible book value per ADS after this offering. At June 30, 2018, we had net tangible book value of $16,670,000, corresponding to a net tangible book value of $0.17 per Ordinary Share or $0.86 per ADS (using the ratio of five Ordinary Shares to one ADS). Net tangible book value per share or per ADS represents the amount of our total tangible assets less our total liabilities, divided by 96,571,661, the total number of Ordinary Shares outstanding at June 30, 2018, or 19,314,332, the total number of ADSs that would represent such total number of shares based on a share-to-ADS ratio of five-to-one.

After giving effect to the sale of the Units offered by us in this offering and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, and excluding the proceeds, if any, from the exercise of the Warrants and Rights to Purchase issued in this offering, our pro forma net tangible book value estimated at June 30, 2018 would have been approximately $18,849,990, representing $0.11 per Ordinary Share or $0.53 per ADS. At the public offering price for this offering of $0.75 per Unit, this represents an immediate decrease in historical net tangible book value of $0.07 per Ordinary Share or $0.33 per ADS to existing shareholders and an immediate dilution in net tangible book value of $0.04 per Ordinary Share or $0.22 per ADS to purchasers of Units in this offering. Dilution for this purpose represents the difference between the price per Unit paid by these purchasers and pro forma net tangible book value per Unit immediately after the completion of this offering.

The following table illustrates this dilution of $0.22 per Unit to purchasers of Units in this offering:

| Public offering price per Unit | | $ | 0.75 | |

| Historical net tangible book value per ADS as of June 30, 2018 | | | 0.86 | |

| Decrease in net tangible book value per ADS attributable to new investors | | | 0.33 | |

| Pro forma net tangible book value per ADS after this offering | | | 0.53 | |

| Dilution per ADS to new investors | | | 0.22 | |

| Percentage of dilution in net tangible book value per ADS for new investors | | | 29 | % |

The above discussion and table are based on 96,571,661 ordinary shares outstanding as of June 30, 2018, and excludes the following as of such date:

| | ● | 7,286,258 Ordinary Shares issuable upon the exercise of options outstanding under our 2015 Stock Option Plan; |

| | ● | 613,742 Ordinary Shares reserved for issuance and available for future grant under our 2015 Stock Option Plan; |

| | ● | 1,381,457 Ordinary Shares issuable upon the exercise of outstanding warrants; |

| | ● | 527,032 Ordinary Shares held by the Company as treasury shares; |

| | ● | 80,000,000 Ordinary Shares issuable upon the exercise of Warrants offered hereby; and |

| | | |

| | ● | 60,000,000 Ordinary Shares issuable upon the exercise of Right to Purchase offered hereby. |

To the extent that outstanding options, warrants or Rights to Purchase are exercised or we issue additional ordinary shares under our equity incentive plans, you may experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe that we have sufficient funds for our current and future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of those securities could result in further dilution to the holders of our ordinary shares and ADSs.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our financial statements and related notes included elsewhere in this prospectus. This discussion and other parts of this prospectus contain forward-looking statements based upon current expectations that involve risks and uncertainties. Our actual results and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of several factors, including those set forth under “Risk Factors” and elsewhere in this prospectus or incorporated by reference in this prospectus. We report financial information under IFRS as issued by the IASB and none of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

Overview