UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-23089

IDX Funds

(Exact name of registrant as specified in charter)

2201 E. Camelback Road, Suite 605

Phoenix, AZ 85016

(Address of Principal Executive Offices)

The Corporation Trust Company

Corporation Trust Center

1209 Orange St.

Wilmington, DE 19801

(Name and address of agent for service)

With Copies To:

Bo J. Howell

FinTech Law, LLC

6224 Turpin Hills Dr.

Cincinnati, OH 45244

Registrant’s telephone number, including area code: 216-329-4271

Date of fiscal year end: 12/31/2022

Date of reporting period: 06/30/2022

IDX Risk-Managed Bitcoin

Strategy Fund

Institutional Class (BTIDX)

Semi-Annual REPORT

JUNE 30, 2022

Investors,

Year-to-date through June 30, 2022, the IDX Risk-Managed Bitcoin Strategy Fund (ticker: BTIDX) returned -24.11% relative to -60.45% for the CME CF Bitcoin Reference Rate (ticker: BRR Index). The strategy’s outperformance during the quarter was largely driven by a risk-off posture during multiple significant forced selling events for digital assets.

Digital assets went through a reckoning of sorts during the first half of 2022. Multiple suspicious or spurious tokens have seen their value plummet or go to zero. Tokens or projects with unsound economics or faulty business models such as Luna and Celsius have encountered “death spirals” that should be cautionary tales for future investors. Notably, both Luna and Celsius were absent from our Standard & Poors priced IDX Risk-Managed DeFi Index as we have repeatedly warned about the potential dangers of these types of projects. As the sector fights through this period of forced selling and right-sizing of expectations we believe that it will emerge from this episode stronger and more resilient. We welcome the prospect of strong regulations to protect individual investors from bad actors and to safeguard this evolving industry for those attempting to build new technologies.

When looking to invest in a nascent industry such as digital assets, the tendency for many (if not most) is to focus on the upside while forgetting about the downside. As we have warned, the downside risk to crypto is material, even if one is correct about the eventual endpoint in price. It’s not enough to simply believe the price is eventually going up; as investors we must also respect the path.

During the inevitable ups-and-downs for the young sector is often ignored. Our philosophy is to embrace the ups-and-downs by investing for the path rather than the destination. Put another way, in a sector where the range of potential final outcomes is still quite wide, we ask ourselves, “what would minimize our disadvantage if we were wrong (at least temporarily)?”. We believe that a risk-managed approach to digital assets: only taking risk when it is likely to be compensated by the market is the correct approach.

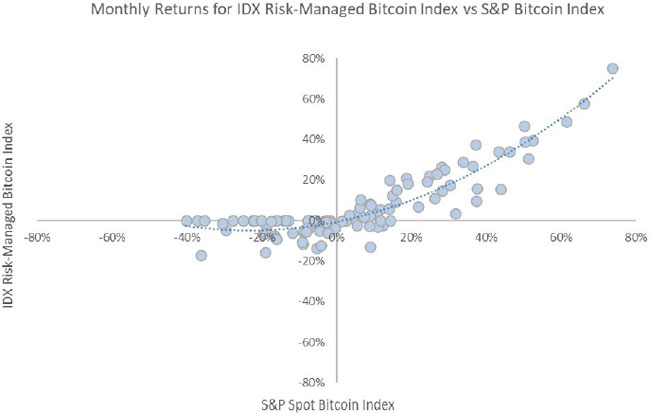

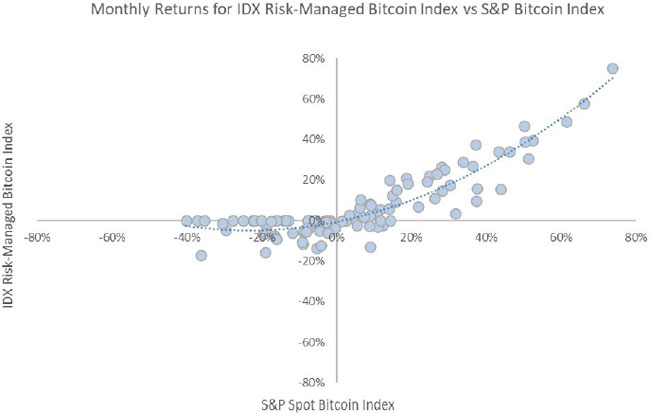

Period shown Jan 2014 through June 2022 for IDX Risk-Managed Bitcoin Index and S&P Bitcoin Index. Source: S&P, IDX

Specifically, the expected payoff for our strategy mimics that of a call option. This seeks to provide the asymmetric exposure to bitcoin (i.e. capturing more upside than downside) in a way that’s more efficient (i.e. cheaper) than buying a call option.

As we move into the second half of 2022, there continues to be signs of progress and investment in bitcoin and the broader digital assets sector. The IDX Risk-Managed Bitcoin Strategy Fund will continue to employ a robust, systematic approach to risk-taking in the bitcoin futures market.

Since inception (11/17/2021) the IDX Risk-Managed Bitcoin Strategy Fund has outperformed the reference rate by nearly 50% (-23.50% vs. -69.99%, respectively); and the maximum drawdown for BTIDX since inception is -25.11% relative to -70.61% for the CME CF Bitcoin Reference Rate.

Period shown is 11/15/2021 through 6/30/2022. Source: Bloomberg, IDX

Strong relative performance and minimal downside capture during a weak period for bitcoin and other digital assets highlights a core tenet of our investing philosophy: you can invest for the path or the destination, but not both. And for assets such as bitcoin – with significantly higher volatility than traditional assets and a wide range of plausible outcomes – we believe that investing for the path is the prudent choice.

IDX Risk-Managed Bitcoin

| Strategy Fund | SEMI-ANNUAL REPORT |

Consolidated Schedule of Investments

June 30, 2022

| | | Principal | | | Fair Value | |

| Short-Term Investments - 43.50% | | | | | | | | |

| Money Market Fund - 43.50% | | | | | | | | |

| First American Government Obligations Fund - | | | | | | | | |

| Money Market Portfolio, Class X - 0.02% (cost $27,490,345)(a)(b) | | $ | 27,490,345 | | | | 27,490,345 | |

| | | | | | | | | |

| Total Investments - 43.50% (cost $27,490,345) | | | | | | | 27,490,345 | |

| Assets In Excess of Liabilities - 56.50% | | | | | | | 35,704,267 | |

| Net Assets - 100% | | | | | | $ | 63,194,612 | |

| (a) | Variable rate security; the rate shown represents the seven day effective yield at June 30, 2022. |

| (b) | Security exceeds 25% of the Fund’s total investments. For further information on this security, available upon request at no charge, please go to the Securities Exchange Commission’s website at http://www.sec.gov. |

Consolidated Schedule of Futures Contracts

June 30, 2022

| | | | | | | | | | | | Value/ | |

| | | | | | | | | Notional | | | Unrealized | |

| Futures Contracts | | Contracts | | | Expiration | | | Value | | | Depreciation | |

| Commodities Futures | | | | | | | | | | | | | | | | |

| Micro Bitcoin Futures(c) | | | 1 | | | | 7/28/2022 | | | | 2,132 | | | $ | (256 | ) |

| | | | | | | | | | | | | | | | | |

| Total Futures Contracts | | | | | | | | | | | | | | $ | (256 | ) |

| (c) | All or a portion of this investment is a holding of IDX Bitcoin Subsidiary |

The accompanying notes are an integral part of these consolidated financial statements.

IDX Risk-Managed Bitcoin

| Strategy Fund | SEMI-ANNUAL REPORT |

Consolidated Statement of Assets and Liabilities

June 30, 2022

| Assets: | | | |

| Cash at Broker | | $ | 35,825,205 | |

| Investments in Securities, At Value (cost $27,490,345) | | | 27,490,345 | |

| Deposit with Brokers for Futures Contracts | | | 550 | |

| Receivables | | | | |

| Dividends and Interest | | | 15,670 | |

| Shareholder Subscriptions | | | 19,532 | |

| Prepaid Expenses | | | 50,172 | |

| Total Assets | | | 63,401,474 | |

| | | | | |

| Liabilities: | | | | |

| Payables and Accrued Liabilities: | | | | |

| Accrued Expenses | | | 33,130 | |

| Accrued Accounting and Administration Expenses | | | 10,205 | |

| Advisory Fees Payable | | | 23,946 | |

| Shareholder Redemptions | | | 139,325 | |

| Variation Margin Payable | | | 256 | |

| Total Liabilities | | | 206,862 | |

| | | | | |

| Net Assets | | $ | 63,194,612 | |

| | | | | |

| Net Assets Consist Of: | | | | |

| Paid in Capital | | $ | 81,935,442 | |

| Distributable Earnings | | | (18,740,830 | ) |

| | | $ | 63,194,612 | |

| | | | | |

| Institutional Class: | | | | |

| Net Assets | | $ | 63,194,612 | |

| Shares Outstanding (unlimited number of shares authorized with no par value) | | | 8,261,693 | |

| Net Asset Value, Redemption Price and Offering Price Per Share | | $ | 7.65 | |

The accompanying notes are an integral part of these consolidated financial statements.

IDX Risk-Managed Bitcoin

| Strategy Fund | SEMI-ANNUAL REPORT |

Consolidated Statement of Operations

For the Six Months Ended June 30, 2022

| Investment Income | | | | |

| Dividends | | $ | 10,250 | |

| Interest | | | 28,057 | |

| Total Investment Income | | | 38,307 | |

| | | | | |

| Expenses | | | | |

| Advisory Fees | | | 623,456 | |

| Interest Expense | | | 28,149 | |

| Audit Fees | | | 11,364 | |

| Accounting and Administration Fees | | | 46,704 | |

| Transfer Agent Fees | | | 25,500 | |

| Organizational Costs | | | 11,168 | |

| Registration Fees | | | 20,997 | |

| Offering Costs | | | 5,000 | |

| Custodian Fees | | | 7,022 | |

| Distribution Fees | | | 48,570 | |

| Legal Fees | | | 23,821 | |

| Chief Compliance Officer | | | 14,630 | |

| Trustee Fees | | | 22,749 | |

| Other Expenses | | | 71,056 | |

| Total Expenses | | | 960,186 | |

| Advisory Fees Waived | | | (149,683 | ) |

| Net Expenses | | | 810,503 | |

| | | | | |

| Net Investment Loss | | | (772,196 | ) |

| | | | | |

| Realized and Unrealized Gain (Loss) on Investments and Futures | | | | |

| Net realized gain (Loss) from: | | | | |

| Investments | | | (475,156 | ) |

| Securities Sold Short | | | 440,729 | |

| Futures Contracts | | | (18,236,230 | ) |

| | | | (18,270,657 | ) |

| | | | | |

| Net change in unrealized appreciation (depreciation) from: | | | | |

| Investments | | | 39,730 | |

| Securities Sold Short | | | (40,123 | ) |

| Futures Contracts | | | (256 | ) |

| | | | (649 | ) |

| | | | | |

| Net Realized and Unrealized Gain (Loss) on Investments and Futures | | | (18,271,306 | ) |

| | | | | |

| Net Decrease in Net Assets Resulting From Operations | | $ | (19,043,502 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

IDX Risk-Managed Bitcoin

| Strategy Fund | SEMI-ANNUAL REPORT |

Consolidated Statement of Changes in Net Assets

For the Six Months Ended June 30, 2022

| Increase (Decrease) In Net Assets From Operations | | | | |

| Net Investment Loss | | $ | (772,196 | ) |

| Net Realized Gain on Investments, Securities Sold Short, and Futures Contracts | | | (18,270,657 | ) |

| Net Change in Unrealized Appreciation on Investments, Securities Sold Short, and Futures Contracts | | | (649 | ) |

| Total Investment Income | | | (19,043,502 | ) |

| | | | | |

| Increase (Decrease) In Net Assets From Capital Share Transactions | | | | |

| Proceeds from Shares Sold | | | 75,982,240 | |

| Payments for Shares Redeemed | | | (25,976,020 | ) |

| Capital Share Transactions (see Note 5) | | | 50,006,220 | |

| | | | | |

| Total Increase in Net Assets | | | 30,962,718 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of Period | | | 32,231,894 | |

| | | | | |

| End of Period | | $ | 63,194,612 | |

The accompanying notes are an integral part of these consolidated financial statements.

IDX Risk-Managed Bitcoin

| Strategy Fund | SEMI-ANNUAL REPORT |

Financial Highlights

Per Share Data and Ratios for an Institutional Share Outstanding Throughout the Period

| | | Period Ended(1) | |

| | | 6/30/2022 | |

| Net asset value, beginning of year | | $ | 10.08 | |

| | | | | |

| Income (Loss) From Investment Operations: | | | | |

| Net Investment Income (Loss)(2) | | | (0.11 | ) |

| Net Realized and Unrealized Gain on Investments | | | (2.32 | ) |

| Total From Investment Operations | | | (2.43 | ) |

| | | | | |

| Distributions | | | — | |

| | | | | |

| Net Asset Value, At End Of Year | | $ | 7.65 | |

| | | | | |

| Total Return | | | -24.11 | %(3) |

| | | | | |

| Ratios/Supplemental Data: | | | | |

| Net Assets At End Of Year (Thousands) | | $ | 63,195 | |

| Ratio of Net Expenses to Average Net Assets (5)(6) | | | | |

| Before Waivers | | | (3.11 | )%(4) |

| After Waivers | | | (2.62 | )%(4) |

| Ratio of Net Investment Loss to Average Net Assets (5) | | | | |

| Before Waivers | | | (2.99 | )%(4) |

| After Waivers | | | (2.50 | )%(4) |

| Portfolio Turnover Rate | | | 203.84 | %(3) |

| (1) | For the period ended June 30, 2022 |

| (2) | Net investment income (loss) per share represents net investment income (loss) divided by the monthly average shares of beneficial interest outstanding through the period |

| (5) | Expenses to average net assets including interest and dividend expense |

| (6) | Ratio of net expenses to average net assets excluding interest and dividend expense |

| | Before Waivers | (3.02)% | |

| | After Waivers | (2.49)% | |

The accompanying notes are an integral part of these consolidated financial statements.

IDX Risk-Managed Bitcoin

Strategy Fund | SEMI-ANNUAL REPORT |

Notes to the Consolidated Financial Statements (Unaudited)

June 30, 2022

The IDX Risk-Managed Bitcoin Strategy Fund (the “Fund”) is a series of IDX Funds (the “Trust”). The Trust was organized on May 29, 2015 as a Delaware statutory trust (formerly, M3Sixty Funds Trust). The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”).

The Fund seeks long-term capital appreciation through actively managed exposure to bitcoin futures contracts. The Fund does not invest in bitcoin or other digital assets directly or through other funds. Additionally, the Fund does not invest in, or seek exposure to, the current “spot” or cash price of Bitcoin. The Fund’s investment adviser is IDX Advisors, LLC (the “Adviser”).

The Fund has two classes of shares, Investor Class Shares and Institutional Class Shares. The Fund’s Institutional Class Shares commenced operations on November 17, 2021. The Investor Class Shares have yet to commence operations.

Income and realized/unrealized gains or losses are allocated to each class of the Fund on the basis of the net asset value of each class in relation to the net asset value of the Fund.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is an investment company that follows the accounting and reporting guidance of FASB Accounting Standards Codification Topic 946 applicable to investment companies.

| a) | Security Valuation – All investments in securities are recorded at fair value, as described in note 3. |

| b) | Cryptocurrency Risk. Cryptocurrency (notably, Bitcoin), often referred to as "virtual currency" or "digital currency," operates as a decentralized, peer-to-peer financial exchange and value storage that is used like money. The Fund may have exposure to Bitcoin, a cryptocurrency, indirectly through an investment in an investment vehicle. Cryptocurrencies operate without central authority or banks and is not backed by any government. Cryptocurrencies may experience very high volatility and related investment vehicles may be affected by such volatility. Cryptocurrency is not legal tender. Federal, state or foreign governments may restrict the use and exchange of cryptocurrency, and regulation in the U.S. is still developing. Cryptocurrency exchanges may stop operating or permanently shut down due to fraud, technical glitches, hackers or malware. |

| c) | The Fund’s use of futures involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) leverage risk (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the futures contract may not correlate perfectly with the reference asset. Investments in futures involve leverage, which means a small percentage of assets invested in futures can have a disproportionately large impact on the Fund. Counterparty credit risk exists with respect to initial and variation margin deposited/paid by the Fund that is held in futures commission merchant, broker and/or clearinghouse accounts for such exchange-traded derivatives. |

| d) | Exchange Traded Funds – The Fund may invest in Exchange Traded Funds (“ETFs”). ETFs are a type of fund bought and sold on a securities exchange. An ETF trades like common stock and represents a portfolio of securities. The Fund may purchase an ETF to gain exposure to a specific asset class. The risks of owning an ETF generally reflect the risks of owning the underlying securities they are designed to track, although the lack of liquidity on an ETF could result in it being more volatile. Additionally, ETFs have fees and expenses that reduce their value. |

| e) | Short Sales of Investments – The Fund may engage in short sales of securities to realize appreciation when a security that the Fund does not own declines in value. A short sale is a transaction in which the Fund sells a security it does not own to a third party by borrowing the security in anticipation of purchasing the same security at the market price on a later date to close out the borrow and thus the short position. The price the Fund pays at the later date may be more or less than the price at which the Fund sold the security. If the price of the security sold short increases between the short sale and when the Fund closes out the short sale, the Fund will incur a loss, which is theoretically unlimited. The Fund will realize a gain, which is limited to the Price at which the fund sold the security short, if the security declines in value between those dates. Dividends on securities sold short are recorded as dividend expense for short sales in the Consolidated statement of operations. While the short position is open, the Fund will post cash or liquid assets at least equal in value to the fair value of the securities should short. While the short position is open, the Fund will post cash or liquid assets at least equal in an amount which corresponds to i) the internal policies of the broker lending the applicable securities, and additionally ii) Regulation T of the Board of Governors of the Federal Reserve System, FINRA Rule 4210, Regulation X of the Board of Governors of the Federal Reserve System and other applicable regulatory requirements. Interest related to the loan is included in interest expense for short sales in the Consolidated Statement of Operations. All collateral is marked to market daily. The Fund may also be required to pledge on the books of the Fund additional assets for the benefit of the security and cash lender. Risk of loss may exceed amounts recognized on the Consolidated Statement of Assets and Liabilities. Short positions, if any, are reported at value and listed after the Fund’s portfolio on the Consolidated Schedule of Investments. |

IDX Risk-Managed Bitcoin

Strategy Fund | SEMI-ANNUAL REPORT |

Notes to the Consolidated Financial Statements (Unaudited)

June 30, 2022

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| f) | Consolidation of Subsidiary IDX Bitcoin Subsidiary – The consolidated financial statements of the Fund include the accounts of IDX Bitcoin Subsidiary, a wholly-owned and controlled subsidiary of the Fund (the “Subsidiary”). All inter-company accounts and transactions have been eliminated in consolidation. The Fund may invest up to 25% of its total assets in the Subsidiary, which acts as an investment vehicle in order to affect certain investments consistent with the Fund’s investment objectives and policies. The Subsidiary commenced operations on November 17, 2021 and is an exempted Cayman Islands company with limited liability. As of June 30, 2022, the Subsidiary had net assets of $15,047,687 comprising 23.81% of the Net Assets of the Fund. |

| g) | Non-Diversified Fund Risk – A non-diversified fund’s greater investment in a single issuer makes the Fund more susceptible to financial, economic or market events impacting such issuer. A decline in the value of or default by a single investment may have a greater negative effect than a similar decline or default by a single security in a diversified portfolio. |

| h) | Federal Income Taxes – The Fund has qualified and intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required. The Fund recognizes tax benefits of uncertain tax positions only where the position is more-likely-than-not to be sustained assuming examination by tax authorities. |

Management has analyzed the Fund’s tax positions taken on all open tax years and expected to be taken as of and during the period ended June 30, 2022 and has concluded that the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Consolidated Statement of Operations. During the period ended June 30, 2022, the Fund did not incur any interest or penalties. The Fund identifies its major tax jurisdictions as U.S. Federal and State of Delaware.

For tax purposes, the Subsidiary is an exempted Cayman Islands investment company. The Subsidiary has received an undertaking from the Government of the Cayman Islands exempting it from all local income, profits and capital gains taxes. No such taxes are levied in the Cayman Islands at the present time. For U.S. income tax purposes, the Subsidiary is a Controlled Foreign Corporation and as such is not subject to U.S. income tax. However, a portion of the Subsidiary’s net income and capital gain, to the extent of its earnings and profits, will be included each year in the Fund’s investment company taxable income.

| i) | Cash and Cash Equivalents – Cash is held with a financial institution. The assets of the Fund may be placed in deposit accounts at U.S. banks and such deposits generally exceed Federal Deposit Insurance Corporation (“FDIC”) insurance limits. The FDIC insures deposit accounts up to $250,000 for each account holder. The counterparty is generally a single bank rather than a group of financial institutions; thus there may be a greater counterparty credit risk. The Fund places deposits only with those counterparties which are believed to be creditworthy. |

| j) | Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. GAAP requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in capital or net realized gains. There were no reclassifications for the six month period ended June 30, 2022. |

IDX Risk-Managed Bitcoin

Strategy Fund | SEMI-ANNUAL REPORT |

Notes to the Consolidated Financial Statements (Unaudited)

June 30, 2022

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| k) | Expenses – Expenses incurred by the Trust that do not relate to a specific Fund of the Trust may be allocated equally across all Funds of the Trust, or to the individual Funds based on each Fund’s relative net assets or another basis (as determined by the Board), whichever method is deemed appropriate as stated in the Trust’s expense allocation policy. Expenses incurred specific to a particular Fund are allocated entirely to that Fund. |

| l) | Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. |

| m) | Other – Investment and shareholder transactions are recorded on trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the identified cost of the security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. |

| n) | Guarantees and Indemnifications – In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under the arrangement is unknown and would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote. |

Processes and Structure

The Fund’s Board of Trustees (the “Board”) has adopted guidelines for valuing investments and other derivative instruments including in circumstances in which market quotes are not readily available and has delegated authority to the Adviser to apply those guidelines in determining fair value prices, subject to review by the Board.

Hierarchy of Fair Value Inputs

The Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| ● | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| ● | Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| ● | Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

IDX Risk-Managed Bitcoin

Strategy Fund | SEMI-ANNUAL REPORT |

Notes to the Consolidated Financial Statements (Unaudited)

June 30, 2022

| 3. | INVESTMENT VALUATIONS (continued) |

Fair Value Measurements

A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stock) – Securities traded on a national securities exchange (or reported on the NASDAQ national market) are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. Certain foreign securities may be fair valued using a pricing service that considers the correlation of the trading patterns of the foreign security to the intraday trading in the U.S. markets for investments such as American depositary receipts, financial futures, ETFs, and the movement of certain indexes of securities based on a statistical analysis of the historical relationship and are categorized in Level 2. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are also categorized in Level 2.

Money market funds – Money market funds are valued at their net asset value of $1.00 per share and are categorized as Level 1 of the fair value hierarchy.

Derivative instruments (futures contracts) – Listed derivative instruments that are actively traded, including futures contracts, are valued based on quoted prices from the exchange and are categorized in Level 1 of the fair value hierarchy.

The following table summarizes the investments by level of inputs used to value the Fund’s assets and liabilities measured at fair value as of June 30, 2022:

| Categories(a) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets/(Liabilities): | | | | | | | | | | | | | | | | |

| Money Market Fund (b) | | $ | 27,490,345 | | | $ | — | | | $ | — | | | $ | 27,490,345 | |

| | | $ | 27,490,345 | | | $ | — | | | $ | — | | | $ | 27,490,345 | |

| Futures Contracts (c) | | $ | (256 | ) | | $ | — | | | $ | — | | | $ | (256 | ) |

(a) As of and during the period ended June 30, 2022, the Fund held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable.

(b) All common stock and money market funds held in the Fund are Level 1 securities. For a detailed break-out of common stock by industry, please refer to the Consolidated Schedule of Investments.

(c) Futures contracts include cumulative unrealized gain/loss on contracts open at June 30, 2022.

| 4. | DERIVATIVE TRANSACTIONS |

The Fund may buy or sell futures to increase exposure to the market, hedge market exposure of an existing portfolio, or decrease overall market exposure. The Adviser may invest in futures in this way to achieve a desired portfolio exposure.

The Fund currently invests only in exchange-traded futures and they are standardized as to maturity date and underlying financial instrument. Initial margin deposits required upon entering into futures contracts are satisfied by the segregation of specific securities or cash as collateral at the futures commission merchant (broker) and are recorded within Deposit with Brokers for Futures Contracts on the Consolidated Statement of Assets and Liabilities. During the period the futures contracts are open, changes in the value of the contracts are recognized as unrealized gains or losses by recalculating the value of the contracts on a daily basis. Subsequent or variation margin payments are received or made depending upon whether unrealized gains or losses are incurred. These amounts are reflected as receivables or payables on the Consolidated Statement of Assets and Liabilities. When the contracts are closed or expire, the Fund recognizes a realized gain or loss equal to the difference between the proceeds from, or cost of, the closing transaction and the Fund’s basis in the contract. The net realized gain (loss) and the change in unrealized gain (loss) on futures contracts held during the period is included on the Consolidated Statement of Operations.

IDX Risk-Managed Bitcoin

Strategy Fund | SEMI-ANNUAL REPORT |

Notes to the Consolidated Financial Statements (Unaudited)

June 30, 2022

| 4. | DERIVATIVE TRANSACTIONS (continued) |

The fair value of derivative instruments, not accounted for as hedging instruments, as reported within the Statements of Assets and Liabilities as of June 30, 2022 was as follows:

| | | | | | Fair Value | | | Average Monthly

Notional Value During the

Six Months Ended

June 30, 2022(a) | |

| Type of Derivative | | Commodity Risk | | | Asset

Derivatives | | Liability

Derivatives | | | |

| Long Futures Contracts | | | Variation Margin Receivable/Payable(b) | | | $ | — | | | $ | (256 | ) | | $ | 16,381,792 | |

| | | | | | | | | | | | | | | | | | |

(a) The Fund considers the average monthly notional amounts during the period, categorized by primary underlying risk, to be representative of its derivate activities for the period ended June 30, 2022.

(b) Includes cumulative appreciation (depreciation) of futures contracts from the date the contracts were opened through June 30, 2022. Only current variation margin receivable/payable is reported on the Statement of Assets and Liabilities.

For the period ended June 30, 2022, financial derivative instruments had the following effect on the Consolidated Statement of Operations:

| Type of Derivative | | Realized Loss | | | Change in

Unrealized

Appreciation | | | Total | | |

| Long Futures Contracts | | $ | (18,236,451) | | | $ | (256) | | | $ | (18,236,707) | | |

| | | | | | | | | | | | | | |

| 5. | CAPITAL SHARE TRANSACTIONS |

Transactions in shares of capital stock during the period ended June 30, 2022 for the Fund were as follows:

| IDX Risk-Managed Bitcoin Strategy Fund: | | Sold | | | Redeemed | | | Reinvested | | | Net Increase | |

| Institutional Class Shares | | | | | | | | | | | | | | | | |

| Shares | | | 8,312,311 | | | | (3,247,697 | ) | | | — | | | | 5,064,614 | |

| Value | | $ | 75,982,240 | | | $ | (25,976,020 | ) | | $ | — | | | $ | 50,006,220 | |

| 6. | INVESTMENT TRANSACTIONS |

For the period ended June 30, 2022 aggregate purchases and sales of investment securities (excluding short-term investments) were as follows:

| Fund | | Purchases | | | Sales | |

| IDX Risk-Managed Futures Strategy Fund | | $ | 22,163,091 | | | $ | 25,989,440 | |

| | | | | | | | | |

There were no government securities purchased or sold during the period.

| | |

| 7. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

| | |

The Fund has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Pursuant to the Advisory Agreement, the Adviser manages the operations of the Fund and manages the Fund’s investments in accordance with the stated policies of the Fund. As compensation for the investment advisory services provided to the Fund, the Adviser receives a monthly management fee equal to an annual rate of the Fund’s net assets as follows:

IDX Risk-Managed Bitcoin

Strategy Fund | SEMI-ANNUAL REPORT |

Notes to the Consolidated Financial Statements (Unaudited)

June 30, 2022

| | |

| 7. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS (continued) |

| | |

| | | Management Fee

Rate | | | Management Fees

Accrued | |

| IDX Risk-Managed Bitcoin Strategy Fund | | | 1.99 | % | | $ | 623,456 | |

| | | | | | | | | |

The Adviser has entered into an Expense Limitation Agreement with the Fund under which it has agreed to waive its fees and reimburse expenses of the Fund, if necessary, in an amount that limits the Fund’s annual operating expenses (exclusive of interest, borrowing expenses, distribution fees pursuant to Rule 12b-1 plan, taxes, acquired fund fees and expenses, brokerage fees and commissions, dividend expenses on short sales, litigation expenses, other expenditures which are capitalized in accordance with GAAP and other extraordinary expenses not incurred in the ordinary course of the Fund’s business) to not more than 2.49% through at least November 30, 2023. During the period ended June 30, 2022, the Adviser waived fees as follows:

| | | Management Fees

Waived | |

| IDX Risk-Managed Bitcoin Strategy Fund | | $ | 149,683 | |

| | | | | |

Subject to approval by the Fund’s Board of Trustees, any waiver or reimbursement under the Expense Limitation Agreement is subject to repayment by the Fund within the three fiscal years following the date of such waiver provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped.

As of June 30, 2022, the cumulative unreimbursed amounts paid and/or waived by the Adviser on behalf of the Fund that may be recouped no later than the date stated below are as follows:

| | | December 31, 2024 | |

| IDX Risk-Managed Bitcoin Strategy Fund | | $ | 145,030 | |

| | | | | |

The Fund has entered into a Master Services Agreement (“Services Agreement”) with Gryphon Fund Group, LLC (“Gryphon”). Under the Services Agreement, Gryphon is responsible for a wide variety of functions, including but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Fund’s portfolio investments; (d) pricing the Fund’s shares; (e) assistance in preparing tax returns; and (f) preparation and filing of required regulatory reports. Certain officers of the Trust are also employees or officers of Gryphon. For the period ended June 30, 2022, the Fund incurred fees pursuant to the Services Agreement in the amount of $52,914.

During the period ended June 30, 2022, certain officers and an Interested Trustee of the Trust were employees of Matrix 360 Distributors, LLC (“Distributor”) and M3Sixty Administration, LLC (“Transfer Agent”). For the period ended June 30, 2022, the Fund incurred Distributor and Transfer Agent fees in the amounts of $2,833 and $16,668, respectively.

For U.S. Federal income tax purposes, the cost of securities owned, gross appreciation, gross depreciation, and net unrealized appreciation of investments and securities sold short on June 30, 2022 were as follows:

| Fund | | Tax Cost | | | Gross

Unrealized

Appreciation | | | Gross

Unrealized

Depreciation | | | Net Unrealized Appreciation | |

| IDX Risk-Managed Bitcoin Strategy Fund | | $ | 27,490,345 | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | |

IDX Risk-Managed Bitcoin

Strategy Fund | SEMI-ANNUAL REPORT |

Notes to the Consolidated Financial Statements (Unaudited)

June 30, 2022

| 8. | TAX MATTERS (continued) |

The Fund’s tax basis distributable earnings are determined only at the end of each fiscal year. As of December 31, 2021, the components of distributable earnings presented on an income tax basis were as follows:

| Fund | | | | | Undistributed

Ordinary

Income | | | Undistributed Long-Term Capital Gains | | | Other Accumulated Earnings | | | Net Unrealized

Appreciation | | | Total Distributable Earnings | |

| IDX Risk-Managed Bitcoin Strategy Fund | | | $ | — | | | $ | — | | | $ | 350,820 | | | $ | (48,148) | | | $ | 302,672 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Undistributed income or net realized gains for financial statement purposes may differ from amounts recognized for federal income tax purposes due to differences in the recognition and characterization of income, expense, and capital gain items. The primary difference between book basis and tax basis undistributed ordinary income, unrealized appreciation/(depreciation), and other accumulated earnings relates to the tax amortization of organizational costs, deferral of losses due to wash sales, and tax adjustments related to the Fund’s investment in IDX Bitcoin Subsidiary.

Under current law, capital losses and specified gains realized after October 31 may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. For the current period, the Fund did not elect to defer any post-October and late year losses.

As of December 31, 2021, the Fund had no capital loss carryforwards for federal income tax purposes available to offset future capital gains.

In accordance with GAAP, the Fund may record reclassifications in the capital accounts, if necessary. These reclassifications have no impact on the net asset value of the Fund and are designed generally to present total distributable earnings and paid-in capital on a tax basis which is considered to be more informative to the shareholder. the following reclassifications were made as of December 31, 2021:

| Fund | | | Total Distributable

Earnings/

(Accumulated Losses) | | Paid-in Capital | |

| IDX Risk-Managed Bitcoin Strategy Fund | | | $ | 18,696 | | $ | (18,696) | |

| | | | | | | | | |

The Fund’s reclassifications are primarily attributable to the net operating loss forfeiture, non-deductible expenses, and the Fund’s investment in IDX Bitcoin Subsidiary.

There were no distributions paid by the Fund during period ended December 31, 2021 or June 30, 2022.

| 9. | COMMITMENTS AND CONTINGENCIES |

In the normal course of business, the Trust may enter into contracts that may contain a variety of representations and warranties and provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, management considers the risk of loss from such claims to be remote.

As of June 30, 2022, Management has evaluated the impact of all other subsequent events of the Fund through the date the financial statements were issued, and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

IDX Risk-Managed Bitcoin

Strategy Fund | SEMI-ANNUAL REPORT |

Additional Information (Unaudited)

June 30, 2021

| 1. | PROXY VOTING POLICIES AND VOTING RECORD |

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-216-329-4271; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent period ended June 30, 2022 is available without charge, upon request, by calling 1-216-329-4271; and on the Commission’s website at http://www.sec.gov.

The Fund files its complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Forms N-PORT will be available on the Commission’s website at http://www.sec.gov. The Fund’s Forms N-PORT may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

| (a) | The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| (b) | During the period covered by this report, there were no amendments to any provision of the code of ethics. |

| (c) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

| | |

| (d) | The registrant’s Code of Ethics is filed herewith. |

| | ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

| | The registrant’s Board of Trustees has determined that Kelley J. Brennan serve on its audit committee as the “audit committee financial expert” as defined in Item 3 of Form N-CSR. |

| | ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

(a) | Audit Fees. The aggregate fees billed from November 17, 2021 (date of inception) through December 31, 2021 for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $15,300 with respect to the Fund’s fiscal year ended December 31, 2021. These fees were paid to Cohen & Company, LTD. |

| | |

| (b) | Audit-Related Fees. There were no fees billed since inception for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this item. |

| (c) | Tax Fees. The aggregate fees billed from November 17, 2021 (date of inception) through December 31, 2021 for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning were $6,500. The services comprising these fees are the preparation of the registrant’s federal income and excise tax returns. The December 31, 2021 fees were paid to Cohen & Company, LTD. |

| (d) | All Other Fees. The aggregate fees billed from November 17, 2021 (date of inception) through December 31, 2021 for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0. |

| | |

| (e)(1) | The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| (e)(2) | There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| | |

| (f) | Not applicable. The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was zero percent (0%). |

| | |

| (g) | All non-audit fees billed by the registrant’s principal accountant for services rendered for the fiscal year ended December 31, 2021 respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant’s principal accountant for the registrant’s adviser. |

| | |

| (h) | The registrant’s audit committee has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining the principal accountant’s independence and has determined that the provision of such non-audit services is compatible with maintaining the principal accountant’s independence. |

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable to the registrant.

| ITEM 6. | SCHEDULES OF INVESTMENTS |

Included in Annual Report to shareholders filed under Item 1 of this Form N-CSR.

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable as the Funds are open-end management investment companies.

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES |

Not applicable as the Funds are open-end management investment companies.

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable as the Funds are open-end management investment companies.

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

Not applicable at this time.

| ITEM 11. | CONTROLS AND PROCEDURES. |

| | (a) | The registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the 1940 Act, are effective, as of a date within 90 days of the filing date of this report, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act and Rule 15d-15(b) under the Securities Exchange Act of 1934, as amended. |

| | (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| ITEM 12. | DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable as the Funds are open-end management investment companies.

| | (1) | Code of Ethics for Principal Executive and Senior Financial Officers is attached hereto. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

IDX Funds

| /s/ Christopher MacLaren | |

| By Christopher MacLaren | |

| Principal Executive Officer |

| |

| Date: August 26, 2022 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following person on behalf of the registrant and in the capacities and on the date indicated.

| /s/ Christopher MacLaren | |

| By Christopher MacLaren | |

| Principal Executive Officer |

| |

| Date: August 26, 2022 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following person on behalf of the registrant and in the capacities and on the date indicated.

| /s/ Gordon M. Jones | |

| By Gordon M. Jones | |

| Treasurer and Principal Financial Officer |

| |

| Date: August 26, 2022 | |