UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-23089

IDX Funds

(Exact name of registrant as specified in charter)

9311 E Via De Ventura, Suite 105

Scottsdale, AZ 85258

(Address of Principal Executive Offices)

The Corporation Trust Company

Corporation Trust Center

1209 Orange St.

Wilmington, DE 19801

(Name and address of agent for service)

With Copies To:

Bo J. Howell

FinTech Law, LLC

6224 Turpin Hills Dr.

Cincinnati, OH 45244

Registrant’s telephone number, including area code: (800) 711-9164

Date of fiscal year end: 12/31/2023

Date of reporting period: 12/31/2023

Item 1. Reports to Stockholders.

IDX FUNDS

IDX Risk-Managed Bitcoin Strategy Fund

INSTITUTIONAL CLASS (BTIDX)

IDX Commodity Opportunities Fund

INSTITUTIONAL CLASS (COIDX)

ANNUAL REPORT

DECEMBER 31, 2023

Dear Investor,

During 2023, the Risk Managed Bitcoin Strategy Fund (BTIDX) Institutional share class returned +28.51% during the year compared to the ICE BofA SOFR Overnight Rate Index at +5.20%. 2023 was a strong year for digital assets as a spot bitcoin ETF was finally approved by the Securities and Exchange Commission. Trading in digital assets during the year was characterized by large spikes and small retracements – generally the least advantageous regime for trend following.

Despite tough trading conditions for trend following in 2023, by better preserving capital in 2022, the Fund didn’t have as large a performance hurdle to overcome. As we look ahead to 2024, we believe the outlook for Bitcoin remains bullish given both the likely approval of a spot ETF (which would open Bitcoin to a much larger audience) as well as the halving (in which Bitcoin supply issuance is cut in half).

While the future remains uncertain, the one thing we, as investors, can know for certain, is that excess volatility can kill portfolio returns over time. Our belief is having the ability to reduce drawdowns, even marginally, can significantly help improve the compounding of returns over time. Strong relative performance and minimal downside capture during a weak period for bitcoin and other digital assets highlights a core tenet of our investing philosophy: you can invest for the path or the destination, but not both. And for assets such as bitcoin – with significantly higher volatility than traditional assets and a wide range of plausible outcomes – we believe that investing for the path is the prudent choice.

IDX Risk-Managed Bitcoin Strategy Fund

Investment Highlights (Unaudited)

December 31, 2023

The primary investment objective of the Fund is to seek long-term capital appreciation.

The Fund’s performance figures* for the period ended December 31, 2023, as compared to its benchmark:

| | 1 Year (a) | Since Inception (a) (b) |

| IDX Risk-Managed Bitcoin Strategy Fund | 28.51% | -10.71% |

| ICE BofA SOFR Overnight Rate Index** | 5.20% | 3.28% |

CME CF Bitcoin Reference Rate (BRR) *** | 157.20% | -13.38% |

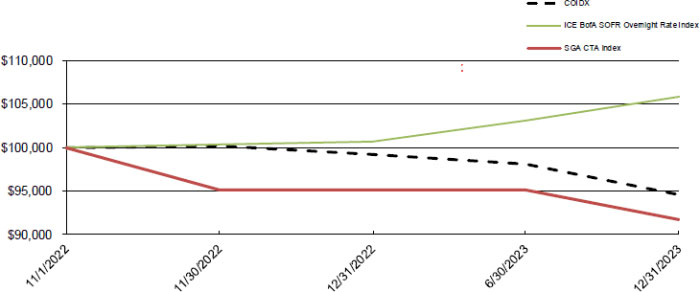

Comparison of the Change in Value of a $100,000 Investment | November 17, 2021 - December 31, 2023

* The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Returns greater than 1 year are averaged. For performance information current to the most recent month-end, please call (800) 711-9164.

The annual net operating expense ratio as provided in the Prospectus dated April 28, 2023 was 2.50% for Institutional class shares. The Fund’s adviser has contractually agreed to reduce its fees and to reimburse expenses, at least until April 30, 2024, to ensure that total annual Fund operating expenses after fee waiver and/or reimbursement (exclusive of interest, borrowing expenses, distribution fees pursuant to Rule 12b-1 plan, Shareholder service fees pursuant to a shareholder service plan, taxes, acquired fund fees and expenses, brokerage fees and commissions, dividend expenses on short sales, litigation expenses, and other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses not incurred in the ordinary course of the Fund’s business) will not exceed 2.49% of average daily net assets. Fee waivers and expense reimbursements are subject to possible recoupment from the Fund in future years on a rolling three-year basis (within the three years after the fees have been waived or reimbursed) if such recoupment can be achieved within the foregoing expense limits. The Fund’s total returns would have been lower had the adviser not waived a portion of the Fund’s expenses. The Fund’s Institutional class shares total gross annual operating expense, before waivers and reimbursements, was 2.91%.

** ICE BofA SOFR Overnight Rate Index tracks the performance of a synthetic asset paying SOFR to a stated maturity. The index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument.

*** CME CF Bitcoin Reference Rate (BRR) is a daily reference rate of the U.S. dollar price of one bitcoin as of 4 p.m. London time. Each day, the BRR aggregates the trade flow of major bitcoin spot exchanges during a specific one-hour calculation window. This one-hour window is then partitioned into 12, five-minute intervals, where the BRR is calculated as the equally-weighted average of the volume-weighted medians of all 12 partitions.

| (a) | Returns are based on traded NAVs; average annual for period greater than a year. |

| (b) | Since inception performance based on Inception date; the IDX Risk-Managed Bitcoin Strategy Fund commenced operations on November 17, 2021. |

IDX Risk-Managed Bitcoin Strategy Fund

Investment Highlights (Unaudited) (Continued)

December 31, 2023

| Top Ten Long Portfolio Holdings | | (% of Net Assets) (c) |

| First American Government Obligations Fund, Class X | 75.40% |

| TOTAL: | 75.40% |

| Potfolio Allocation | (% of Net Assets) (c) |

| Money Market Funds | 75.40% |

| Other Assets in Excess of Liabilities | 24.60% |

| TOTAL: | 100.00% |

| (c) | Based on market value. |

See Consolidated Schedule of Investments for a more detailed breakdown of the Fund’s assets.

IDX Funds

IDX Risk-Managed Bitcoin Strategy Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

| Shares | | | | | Dividend Yield (%) | | | Fair Value | |

| | | | | SHORT TERM INVESTMENTS - 75.40% | | | | | | | | |

| | | | | MONEY MARKET FUNDS - 75.40% | | | | | | | | |

| | 16,185,339 | | | First American Government Obligations Fund, Class X (a) (b) | | | 5.299 | | | | 16,185,339 | |

| | | | | | | | | | | | | |

| | | | | TOTAL SHORT TERM INVESTMENTS - (Cost $16,185,339) | | | | | | | 16,185,339 | |

| | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 75.40% - (Cost $16,185,339) | | | | | | | 16,185,339 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 24.60% | | | | | | | 5,278,693 | |

| | | | | NET ASSETS - 100.00% | | | | | | $ | 21,464,032 | |

| (a) | Fair Value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (b) | The rate shown represents the seven day effective yield at December 31, 2023. |

| The accompanying notes are an integral part of these consolidated financial statements. |

IDX Funds

IDX Risk-Managed Bitcoin Strategy Fund

CONSOLIDATED SCHEDULE OF OPEN FUTURES CONTRACTS

December 31, 2023

| | | Number of

Contracts | | | Expiration Date | | Notional Amount | | | Unrealized

Appreciation | | | Unrealized

(Depreciation) | |

| PURCHASE CONTRACTS | | | | | | | | | | | | | | | | | | |

| CME Bitcoin Futures (a) | | | 73.00 | | | 1/26/2024 | | $ | 15,507,025 | | | $ | — | | | $ | (687,496 | ) |

| TOTAL PURCHASE CONTRACTS | | | | | | | | | | | | | — | | | | (687,496 | ) |

| | | | | | | | | | | | | | | | | | | |

| TOTAL FUTURES CONTRACTS | | | | | | | | | | | | $ | — | | | $ | (687,496 | ) |

| | | | | | | | | | | | | | | | | | | |

| NET UNREALIZED DEPRECIATION | | | | | | | | | | | | | $ | (687,496 | ) |

| (a) | All or a portion of this investment is a holding of IDX Risk-Managed Bitcoin Strategy Subsidiary. |

CME - Chicago Mercantile Exchange

The accompanying notes are an integral part of these consolidated financial statements.

Dear Investor,

For 2023 the IDX Commodity Opportunities Fund (COIDX) Institutional share class returned -2.89% relative to the ICE BofA SOFR Overnight Rate Index of 5.20% and 4.27% for the S&P GSCI Total Return CME Index. Outperformance for the Fund during a choppy and uneven year for broad commodities indices is core to the Fund’s design. For now, markets have turned to 2024 and the potential for a new super cycle for commodities.

When considering the prospects for commodities going forward, we find several reasons that favor commodities, as an asset class, in 2024:

| - | Infrastructure spending: As world governments (particularly the US) start spending on infrastructure projects, we believe the demand for commodities (such as industrial metals) could see sustained demand. |

| - | A Weakening Dollar: Despite talk of “higher for longer”, the market expects the Federal Reserve to decrease rates at some point in 2024 which would likely present headwinds for the USD (and therefore tailwinds for commodity prices). |

| - | A “Fed Pivot”: While “the market” ended up being overly optimistic regarding the speed of Fed rate cuts, we believe a pivot by the Fed is highly likely this year. Against the backdrop of record deficits and fiscal spending, we believe this has the potential to unlock another upswing in commodities. |

The evidence suggests, to us, that we could very well be in the very early days of the next commodity super-cycle (potentially led by precious metals). This doesn’t mean, however, that commodity volatility will decrease (or that investors won’t have to worry about 20%+ drawdowns). For this reason, we strongly favor an active, long-short allocation to this space to potentially moderate the risk (and drawdowns) while capturing the (potentially explosive) growth of this asset class over the next decade.

IDX Commodity Opportunities Fund

Investment Highlights (Unaudited)

December 31, 2023

The primary investment objective of the Fund is to seek total return, which includes long-term capital appreciation.

The Fund’s performance figures* for the period ended December 31, 2023, as compared to its benchmark:

| | 1 Year (a) | Since Inception (a) (b) |

| IDX Commodity Opportunities Fund | (2.89)% | -4.62% |

| ICE BofA SOFR Overnight Rate Index** | 5.20% | 5.05% |

| SGA CTA Index *** | (3.51)% | -7.10% |

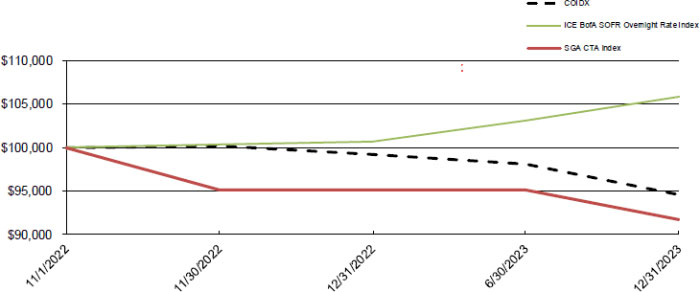

Comparison of the Change in Value of a $100,000 Investment | November 1, 2022 - December 31, 2023

* The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Returns greater than 1 year are averaged. For performance information current to the most recent month-end, please call (800) 711-9164.

The annual net operating expense ratio as provided in the Prospectus dated April 28, 2023 was 1.84% for Institutional class shares. The Fund’s adviser has contractually agreed to reduce its fees and to reimburse expenses, at least until April 30, 2024, to ensure that total annual Fund operating expenses after fee waiver and/or reimbursement (exclusive of interest, borrowing expenses, distribution fees pursuant to Rule 12b-1 plan, Shareholder service fees pursuant to a shareholder service plan, taxes, acquired fund fees and expenses, brokerage fees and commissions, dividend expenses on short sales, litigation expenses, and other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses not incurred in the ordinary course of the Fund’s business) will not exceed 1.79% of average daily net assets. Fee waivers and expense reimbursements are subject to possible recoupment from the Fund in future years on a rolling three-year basis (within the three years after the fees have been waived or reimbursed) if such recoupment can be achieved within the foregoing expense limits. The Fund’s total returns would have been lower had the adviser not waived a portion of the Fund’s expenses. The Fund’s Institutional class shares total gross annual operating expense, before waivers and reimbursements, was 3.63%.

** ICE BofA SOFR Overnight Rate Index tracks the performance of a synthetic asset paying SOFR to a stated maturity. The index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument.

*** The SGA CTA Index provides the market with a reliable daily performance benchmark of major commodity trading advisors (“CTA”). The SG CTA Index calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment. Selection of the pool of qualified CTAs used in construction of the Index will be conducted annually, with re-balancing on January 1st of each year.

| (a) | Returns are based on traded NAVs; average annual for periods greater than a year. |

| (b) | Since inception performance based on Inception date; the IDX Commodity Opportunities Fund commenced operations on November 1, 2022. |

IDX Commodity Opportunities Fund

Investment Highlights (Unaudited) (Continued)

December 31, 2023

| Top Ten Long Portfolio Holdings | (% of Net Assets) (c) |

| First American Government Obligations Fund, Class X | 40.09% |

| VanEck Fallen Angel High Yield Bond ETF | 6.13% |

| iShares iBoxx USD Investment Grade Corporate Bond ETF | 6.05% |

| iShares iBoxx USD High Yield Corporate Bond ETF | 5.99% |

| SPDR Bloomberg Short Term High Yield Bond ETF | 5.82% |

| SPDR Blackstone Senior Loan ETF | 5.72% |

| Simplify MBS ETF | 5.64% |

| Global X MLP ETF | 3.63% |

| SPDR Bloomberg 1-3 Month T-Bill ETF | 3.34% |

| VanEck Energy Income ETF | 2.75% |

| TOTAL: | 85.16% |

| Potfolio Allocation | (% of Net Assets) (c) |

| Money Market Funds | 40.09% |

| Exchange Traded Funds | 47.85% |

| Purchased Options (d) | 0.00% |

| Other Assets in Excess of Liabilities | 12.06% |

| TOTAL: | 100.00% |

| (c) | Based on market value. |

See Consolidated Schedule of Investments for a more detailed breakdown of the Fund’s assets.

IDX Funds

IDX Commodity Opportunities Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE TRADED FUNDS - 47.85% | | | | |

| | | | | COMMODITIES - 2.78% | | | | |

| | 26,500 | | | Global X Silver Miners ETF | | $ | 751,540 | |

| | 25,000 | | | VanEck Gold Miners ETF | | | 775,500 | |

| | | | | | | | 1,527,040 | |

| | | | | CORPORATE - 35.35% | | | | |

| | 42,500 | | | iShares iBoxx USD High Yield Corporate Bond ETF | | | 3,290,138 | |

| | 30,000 | | | iShares iBoxx USD Investment Grade Corporate Bond ETF | | | 3,320,250 | |

| | 60,000 | | | Simplify MBS ETF | | | 3,097,200 | |

| | 75,000 | | | SPDR Blackstone Senior Loan ETF | | | 3,144,375 | |

| | 127,000 | | | SPDR Bloomberg Short Term High Yield Bond ETF | | | 3,194,050 | |

| | 117,000 | | | VanEck Fallen Angel High Yield Bond ETF | | | 3,366,090 | |

| | | | | | | | 19,412,103 | |

| | | | | ENERGY - 2.75% | | | | |

| | 22,000 | | | VanEck Energy Income ETF | | | 1,509,530 | |

| | | | | | | | | |

| | | | | GOVERNMENT - 3.34% | | | | |

| | 20,100 | | | SPDR Bloomberg 1-3 Month T-Bill ETF | | | 1,837,040 | |

| | | | | | | | | |

| | | | | MASTER LIMITED PARTNERSHIPS - 3.63% | | | | |

| | 45,000 | | | Global X MLP ETF | | | 1,993,725 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE TRADED FUNDS - (Cost $25,915,350) | | | 26,279,438 | |

| Number of Contracts | | | | | | | | Notional Amount | | | Fair Value | |

| | | | | PURCHASED OPTIONS - 0.00% (d) | | | | | | | | | | | | |

| | | | | PUT OPTIONS - 0.00% (d) | | | | | | | | | | | | |

| | | | | SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

| | 50 | | | Expiration Date: January 19, 2024, Exercise Price: $370.00 (a) | | | | | | | 2,047,600 | | | | 1,175 | |

| | | | | | | | | | | | | | | | | |

| | | | | TOTAL PURCHASED OPTIONS - (Cost $82,785) | | | | | | | | | | | 1,175 | |

| Shares | | | | | Dividend Yield (%) | | | Fair Value | |

| | | | | SHORT TERM INVESTMENTS - 40.09% | | | | | | | | |

| | | | | MONEY MARKET FUNDS - 40.09% | | | | | | | | |

| | 22,022,255 | | | First American Government Obligations Fund, Class X (b) (c) | | | 5.299 | | | | 22,022,255 | |

| | | | | | | | | | | | | |

| | | | | TOTAL SHORT TERM INVESTMENTS - (Cost $22,022,255) | | | | | | | 22,022,255 | |

| | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 87.94% - (Cost $48,020,390) | | | | | | | 48,302,868 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 12.06% | | | | | | | 6,621,543 | |

| | | | | NET ASSETS - 100.00% | | | | | | $ | 54,924,411 | |

| (a) | Non-income producing security. |

| (b) | Fair Value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (c) | The rate shown represents the seven day effective yield at December 31, 2023. |

| The accompanying notes are an integral part of these consolidated financial statements. |

IDX Funds

IDX Commodity Opportunities Fund

CONSOLIDATED SCHEDULE OF OPEN FUTURES CONTRACTS

December 31, 2023

| | | Number of

Contracts | | | Expiration Date | | Notional

Amount | | | Unrealized

Appreciation | | | Unrealized

(Depreciation) | |

| PURCHASE CONTRACTS | | | | | | | | | | | | | | |

| US Treasury Bond Futures | | | 27.00 | | | 3/19/2024 | | $ | 3,373,313 | | | $ | 44,681 | | | $ | — | |

| Coffee Futures (a) | | | 43.00 | | | 3/15/2024 | | | 3,036,338 | | | | 52,954 | | | | — | |

| Cotton Futures (a) | | | 61.00 | | | 2/22/2024 | | | 2,470,500 | | | | 40,770 | | | | — | |

| Gold Futures (a) | | | 55.00 | | | 2/28/2024 | | | 11,394,900 | | | | 203,256 | | | | — | |

| Orange Juice Futures (a) | | | 1.00 | | | 3/15/2024 | | | 4,688,250 | | | | — | | | | (12,423 | ) |

| No. 11 Sugar Futures (a) | | | 121.00 | | | 3/15/2024 | | | 2,789,002 | | | | — | | | | (267,631 | ) |

| Silver Futures (a) | | | 26.00 | | | 3/27/2024 | | | 3,131,180 | | | | 692 | | | | — | |

| TOTAL PURCHASE CONTRACTS | | | | | | | | | | | | | 342,353 | | | | (280,054 | ) |

| | | | | | | | | | | | | | | | | | | |

| SALE CONTRACTS | | | | | | | | | | | | | | | | | | |

| Brent Crude Last Day Futures (a) | | | (2.00 | ) | | 2/1/2024 | | | (154,080 | ) | | | 4,420 | | | | — | |

| Chicago SRW Wheat Futures (a) | | | (38.00 | ) | | 3/15/2024 | | | (1,193,200 | ) | | | — | | | | (117,662 | ) |

| Copper Futures (a) | | | (9.00 | ) | | 3/27/2024 | | | (875,363 | ) | | | — | | | | (20,419 | ) |

| Corn Futures (a) | | | (46.00 | ) | | 3/15/2024 | | | (1,083,875 | ) | | | 17,029 | | | | — | |

| Crude Oil Futures (a) | | | (3.00 | ) | | 1/22/2024 | | | (214,950 | ) | | | — | | | | (8,376 | ) |

| Henry Hub Natural Gas Futures (a) | | | (19.00 | ) | | 1/29/2024 | | | (477,660 | ) | | | — | | | | (22,268 | ) |

| Lean Hog Futures (a) | | | (20.00 | ) | | 2/16/2024 | | | (543,800 | ) | | | 7,187 | | | | — | |

| Live Cattle Futures (a) | | | (19.00 | ) | | 2/29/2024 | | | (1,280,600 | ) | | | 28,938 | | | | — | |

| NY Harbor ULSD Futures (a) | | | (1.00 | ) | | 1/31/2024 | | | (106,214 | ) | | | 4,622 | | | | — | |

| RBOB Gasoline Futures (a) | | | (1.00 | ) | | 1/31/2024 | | | (88,465 | ) | | | 1,510 | | | | — | |

| Soybean Futures (a) | | | (17.00 | ) | | 3/15/2024 | | | (1,103,300 | ) | | | 6,731 | | | | — | |

| TOTAL SALES CONTRACTS | | | | | | | | | | | | | 70,437 | | | | (168,725 | ) |

| | | | | | | | | | | | | | | | | | | |

| TOTAL FUTURES CONTRACTS | | | | | | | | | | | | $ | 412,790 | | | $ | (448,779 | ) |

| | | | | | | | | | | | | | | | | | | |

| NET UNREALIZED DEPRECIATION | | | | | | | | | | | | | | | | $ | (35,989 | ) |

(a) All or a portion of this investment is a holding of IDX Commodity Subsidiary.

The accompanying notes are an integral part of these consolidated financial statements.

IDX Funds

CONSOLIDATED STATEMENTS OF ASSETS AND LIABILITIES

December 31, 2023

| | | IDX Risk-Managed

Bitcoin Strategy Fund | | | IDX Commodity

Opportunities Fund | |

| ASSETS | | | | | | | | |

| Investments at cost: | | $ | 16,185,339 | | | $ | 48,020,390 | |

| Investments at value: | | $ | 16,185,339 | | | $ | 48,302,868 | |

| Cash | | | 116,980 | | | | — | |

| Deposit with brokers for derivative instruments | | | 7,024,451 | | | | 6,959,287 | |

| Unrealized appreciation of open futures contracts | | | — | | | | 412,790 | |

| Receivables | | | | | | | | |

| Dividends and interest receivable | | | 55,748 | | | | 112,166 | |

| Receivable for fund shares sold | | | 26,309 | | | | 12,073 | |

| Due from advisor | | | 65,146 | | | | — | |

| Prepaid expenses and other assets | | | 168,173 | | | | 146,453 | |

| TOTAL ASSETS | | | 23,642,146 | | | | 55,945,637 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Unrealized depreciation of open futures contracts | | | 687,496 | | | | 448,779 | |

| Payables and accrued liabilities: | | | | | | | | |

| Payable for fund shares redeemed | | | 621,068 | | | | 462,202 | |

| Distribution payable | | | 817,918 | | | | 28,796 | |

| Due to advisor | | | — | | | | 50,675 | |

| Payable to related parties | | | 8,054 | | | | 6,258 | |

| Shareholder servicing payable | | | 6,179 | | | | 6,573 | |

| Accrued expenses and other liabilities | | | 37,399 | | | | 17,943 | |

| TOTAL LIABILITIES | | | 2,178,114 | | | | 1,021,226 | |

| NET ASSETS | | $ | 21,464,032 | | | $ | 54,924,411 | |

| | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | |

| Paid in capital | | $ | 19,051,868 | | | $ | 55,171,194 | |

| Total accumulated distributable earnings/(accumulated losses) | | | 2,412,164 | | | | (246,783 | ) |

| NET ASSETS | | $ | 21,464,032 | | | $ | 54,924,411 | |

| | | | | | | | | |

| Net Asset Value Per Share: | | | | | | | | |

| Net assets | | $ | 21,464,032 | | | $ | 54,924,411 | |

| Shares outstanding (unlimited number of shares | | | | | | | | |

| authorized with no par value) | | | 2,777,337 | | | | 5,805,012 | |

| Net asset value, redemption price and offering | | | | | | | | |

| | | | | | | | | |

| price per share | | $ | 7.73 | | | $ | 9.46 | |

The accompanying notes are an integral part of these consolidated financial statements.

IDX Funds

CONSOLIDATED STATEMENTS OF OPERATIONS

Year ended December 31, 2023

| | | IDX Risk-Managed

Bitcoin Strategy Fund | | | IDX Commodity

Opportunities Fund | |

| INVESTMENT INCOME | | | | | | | | |

| Interest | | $ | 486,592 | | | $ | 101,907 | |

| Dividends | | | 419,884 | | | | 1,659,466 | |

| TOTAL INVESTMENT INCOME | | | 906,476 | | | | 1,761,373 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Investment advisory fees | | | 432,250 | | | | 563,316 | |

| Shareholder servicing fees | | | 32,582 | | | | 56,710 | |

| Interest expense | | | 156,653 | | | | — | |

| Accounting and administrative fees | | | 66,129 | | | | 66,145 | |

| Transfer agent fees | | | 24,972 | | | | 31,081 | |

| Legal Fees | | | 18,816 | | | | 17,502 | |

| Reporting fees | | | 20,387 | | | | 30,002 | |

| Custodian fees | | | 14,399 | | | | 12,099 | |

| Compliance officer fees | | | 17,783 | | | | 15,486 | |

| Insurance fees and expenses | | | 14,223 | | | | 32,508 | |

| Trustee fees and expenses | | | 46,578 | | | | 42,997 | |

| Professional fees | | | 24,928 | | | | 24,928 | |

| Other expenses | | | 50,003 | | | | 53,660 | |

| TOTAL EXPENSES | | | 919,703 | | | | 946,434 | |

| | | | | | | | | |

| Investment advisory fees waived | | | (189,988 | ) | | | (210,383 | ) |

| TOTAL NET EXPENSES | | | 729,715 | | | | 736,051 | |

| | | | | | | | | |

| NET INVESTMENT INCOME | | | 176,761 | | | | 1,025,322 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAIN / (LOSS) ON INVESTMENTS, OPTIONS AND FUTURES | | | | | | | | |

| Net realized gain/ (loss) from: | | | | | | | | |

| Investments | | | (126,567 | ) | | | (783,847 | ) |

| Written options | | | — | | | | 96,961 | |

| Futures contracts | | | 5,426,319 | | | | (1,986,435 | ) |

| Net realized gain/(loss) | | | 5,299,752 | | | | (2,673,321 | ) |

| | | | | | | | | |

| Net change in unrealized appreciation/(depreciation) on: | | | | | | | | |

| Investments | | | 19,174 | | | | 329,637 | |

| Futures contracts | | | (687,496 | ) | | | (63,976 | ) |

| Net change in unrealized appreciation/(depreciation): | | | (668,322 | ) | | | 265,661 | |

| | | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN / (LOSS) ON INVESTMENTS, OPTIONS AND FUTURES | | | 4,631,430 | | | | (2,407,660 | ) |

| | | | | | | | | |

| NET INCREASE / (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 4,808,191 | | | $ | (1,382,338 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

IDX Funds

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS

| | | IDX Risk-Managed Bitcoin Strategy Fund | | | IDX Commodity Opportunities Fund | |

| | | Year Ended

12/31/2023 | | | Year Ended

12/31/2022 | | | Year Ended

12/31/2023 | | | Year Ended

12/31/2022 (1) | |

| FROM OPERATIONS | | | | | | | | | | | | | | | | |

| Net investment income / (loss) | | $ | 176,761 | | | $ | (919,339 | ) | | $ | 1,025,322 | | | $ | 31,225 | |

| Net realized gain / (loss) from: | | | | | | | | | | | | | | | | |

| Investments | | | (126,567 | ) | | | (475,173 | ) | | | (783,847 | ) | | | (68,712 | ) |

| Written options | | | — | | | | — | | | | 96,961 | | | | 1,350 | |

| Securities sold short | | | — | | | | 440,729 | | | | — | | | | — | |

| Futures contracts | | | 5,426,319 | | | | (27,082,083 | ) | | | (1,986,435 | ) | | | (5,793 | ) |

| Net change in unrealized appreciation / (depreciation) on: | | | | | | | | | | | | | | | | |

| Investments | | | 19,174 | | | | 20,556 | | | | 329,637 | | | | (47,160 | ) |

| Securities sold short | | | — | | | | (40,123 | ) | | | — | | | | — | |

| Futures contracts | | | (687,496 | ) | | | — | | | | (63,976 | ) | | | 21,963 | |

| Net increase / (decrease) in net assets resulting from operations | | | 4,808,191 | | | | (28,055,433 | ) | | | (1,382,338 | ) | | | (67,127 | ) |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| Institutional Shares: | | | (1,807,769 | ) | | | | | | | (1,007,872 | ) | | | (32,120 | ) |

| Decrease in net assets from distributions to shareholders | | | (1,807,769 | ) | | | — | | | | (1,007,872 | ) | | | (32,120 | ) |

| | | | | | | | | | | | | | | | | |

| FROM SHARES OF BENEFICIAL INTEREST | | | | | | | | | | | | | | | | |

| Proceeds from shares sold: | | | 17,574,176 | | | | 98,779,398 | | | | 67,258,844 | | | | 18,101,197 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders: | | | 989,852 | | | | — | | | | 979,078 | | | | 32,120 | |

| Payments for shares redeemed: | | | (26,136,684 | ) | | | (76,919,593 | ) | | | (27,138,647 | ) | | | (1,818,724 | ) |

| Net increase / (decrease) in net assets from shares of beneficial interest | | | (7,572,656 | ) | | | 21,859,805 | | | | 41,099,275 | | | | 16,314,593 | |

| | | | | | | | | | | | | | | | | |

TOTAL INCREASE / (DECREASE) IN NET ASSETS | | | (4,572,234 | ) | | | (6,195,628 | ) | | | 38,709,065 | | | | 16,215,346 | |

| | | | | | | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | | | | | | | | |

| Beginning of year/period | | | 26,036,266 | | | | 32,231,894 | | | | 16,215,346 | | | | — | |

| End of year/period | | $ | 21,464,032 | | | $ | 26,036,266 | | | $ | 54,924,411 | | | $ | 16,215,346 | |

| | | | | | | | | | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | | | | | | | | | |

| Institutional Class: | | | | | | | | | | | | | | | | |

| Shares sold | | | 2,625,937 | | | | 11,553,767 | | | | 6,838,801 | | | | 1,813,804 | |

| Shares reinvested | | | 128,219 | | | | — | | | | 103,387 | | | | 3,238 | |

| Shares redeemed | | | (3,962,441 | ) | | | (10,765,224 | ) | | | (2,771,888 | ) | | | (182,330 | ) |

| Net increase / (decrease) in shares of beneficial interest outstanding | | | (1,208,285 | ) | | | 788,543 | | | | 4,170,300 | | | | 1,634,712 | |

| | | | | | | | | | | | | | | | | |

| SHARES OUTSTANDING | | | | | | | | | | | | | | | | |

| Beginning of year/period | | | 3,985,622 | | | | 3,197,079 | | | | 1,634,712 | | | | — | |

| End of year/period | | | 2,777,337 | | | | 3,985,622 | | | | 5,805,012 | | | | 1,634,712 | |

(1) The IDX Commodity Opportunities Fund commenced operations on November 1, 2022.

The accompanying notes are an integral part of these consolidated financial statements.

IDX Funds

CONSOLIDATED FINANCIAL HIGHLIGHTS

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year/Period Presented.

| | | IDX Risk-Managed Bitcoin Strategy Fund | | | IDX Commodity Opportunities Fund | |

| | | Year Ended

12/31/2023 | | | Year Ended

12/31/2022 | | | Period Ended

12/31/2021 (1) | | | Year Ended

12/31/2023 | | | Period Ended

12/31/2022 (2) | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year/Period | | $ | 6.53 | | | $ | 10.08 | | | $ | 10.00 | | | $ | 9.92 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| From investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss) (3) | | | 0.05 | | | | (0.13 | ) | | | (0.04 | ) | | | 0.26 | | | | 0.03 | |

| Net realized and unrealized gain/(loss) on investment activity | | | 1.81 | | | | (3.42 | ) | | | 0.12 | | | | (0.55 | ) | | | (0.09 | ) |

| Total from investment operations | | | 1.86 | | | | (3.55 | ) | | | 0.08 | | | | (0.29 | ) | | | (0.06 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.66 | ) | | | — | | | | — | | | | (0.17 | ) | | | (0.02 | ) |

| Net realized gain | | | — | | | | — | | | | — | | | | (0.00 | ) (10) | | | — | |

| Total distributions | | | (0.66 | ) | | | — | | | | — | | | | (0.17 | ) | | | (0.02 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year/Period | | $ | 7.73 | | | $ | 6.53 | | | $ | 10.08 | | | $ | 9.46 | | | $ | 9.92 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | 28.51 | % | | | (35.19 | )% | | | 0.80 | % (4) | | | (2.89 | )% | | | (0.61 | )% (4) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year/Period (000s) | | $ | 21,464 | | | $ | 26,036 | | | $ | 32,232 | | | $ | 54,924 | | | $ | 16,215 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net expenses to average net assets | | | | | | | | | | | | | | | | | | | | |

| Before waivers | | | 4.24 | % (6) | | | 2.91 | % (6) | | | 4.52 | % (5) (8) | | | 2.49 | % (6) | | | 3.63 | % (5) (6) |

| After waivers | | | 3.36 | % (6) | | | 2.50 | % (6) | | | 3.08 | % (5) (8) | | | 1.94 | % (6) | | | 1.84 | % (5) (6) |

| Ratio of net expenses to average net assets | | | | | | | | | | | | | | | | | | | | |

| Before waivers | | | 3.37 | % (7) | | | 2.79 | % (7) | | | 3.93 | % (5) (9) | | | 2.34 | % (7) | | | 3.49 | % (5) (7) |

| After waivers | | | 2.49 | % (7) | | | 2.39 | % (7) | | | 2.49 | % (5) (9) | | | 1.79 | % (7) | | | 1.69 | % (5) (7) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income/(loss) to average net assets | | | | | | | | | | | | | | | | | | | | |

| Before waivers | | | (0.06 | )% (6) | | | (2.01 | )% (6) | | | (4.51 | )% (5) (8) | | | 2.15 | % (6) | | | 0.10 | % (5) (6) |

| After waivers | | | 0.81 | % (6) | | | (1.61 | )% (6) | | | (3.07 | )% (5) (8) | | | 2.70 | % (6) | | | 1.89 | % (5) (6) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio Turnover Rate | | | 236.30 | %(11) | | | 1036.03 | % | | | 231.71 | % (4) | | | 342.03 | % | | | 176.26 | % (4) |

| (1) | The Fund commenced operations on November 17, 2021. |

| (2) | The Fund commenced operations on November 1, 2022. |

| (3) | Net investment income/(loss) per share has been calculated based on average shares outstanding during the year/period. |

| (6) | Expenses to average net assets including shareholder servicing, interest, and dividend expense. |

| (7) | Expenses to average net assets excluding shareholder servicing, interest, and dividend expense. |

| (8) | Expenses to average net assets including interest and dividend expense. |

| (9) | Expenses to average net assets excluding interest and dividend expense. |

| (10) | Less than $0.01 per share. |

| (11) | Portfolio turnover decreased from 2022 to 2023 as market conditions in 2023 demonstrated signficantly less volatility. |

The accompanying notes are an integral part of these consolidated financial statements.

Notes to the Consolidated Financial Statements

December 31, 2023

IDX Funds (the “Trust”) was organized on May 29, 2015, as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). Each fund is an investment company and follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services-Investment Companies. The IDX Risk-Managed Bitcoin Strategy Fund (the “Bitcoin Fund”) and the IDX Commodity Opportunities Fund (the “Commodity Fund”) (individually a “Fund” and collectively the “Funds”) are each a series within the Trust. The Funds are each non-diversified funds.

The Bitcoin Fund’s primary investment objective seeks long-term capital appreciation. In order to achieve their investment objective, the Fund seeks long-term capital appreciation through actively managed exposure to bitcoin futures contracts. The Fund does not invest in bitcoin or other digital assets directly or through other funds. Additionally, the Fund does not invest in, or seek exposure to, the current “spot” or cash price of Bitcoin.

The Commodity Fund’s primary investment objective seeks total return, which includes long-term capital appreciation. The Fund pursues its investment objective by investing globally across a wide range of asset classes, including commodities, equities, fixed income, and currencies, and may take both long and short positions in each of the asset classes or Instruments (as defined below). The Adviser expects that the Fund will predominantly invest in long and short derivative positions within commodities, but it will make strategic allocations to other asset classes as it deems appropriate. The Fund has the flexibility to shift its allocation across asset classes and markets around the world based on the investment adviser’s assessment of their relative attractiveness. This means the Fund may concentrate its investments in any one asset class or geographic region, subject to any limitations imposed by the federal securities and tax laws, including the 1940 Act.

The Funds’ investment adviser is IDX Advisors, LLC (the “Adviser”).

Wholly owned and Controlled Subsidiaries

In order to achieve their investment objectives, the Funds each invest up to 25% of their total assets (measured at the time of purchase) in wholly owned subsidiaries, IDX Bitcoin Subsidiary (“IDXBS”) and IDX Commodity Subsidiary (“IDXCS”), respectively (collectively the “Subsidiaries”); each company is incorporated under the laws of the Cayman Islands. IDXBS and IDXCS commenced operations on November 17, 2021, and November 1, 2022, respectively, each as an exempted Cayman Islands company with limited liability. The Subsidiaries act as investment vehicles in order to enter into certain investments for the Subsidiaries, consistent with their investment objectives and policies specified in the Prospectuses and Statement of Additional Information.

As of December 31, 2023, investments in the Subsidiaries represented 20.11% and 5.69% of the total net assets of Bitcoin Fund and Commodity Fund, respectively.

Share Classes

Each Fund has two classes of shares, Investor Class Shares, and Institutional Class Shares. The Bitcoin Fund’s Institutional Class Shares commenced operations on November 17, 2021. The Commodity Fund’s Institutional Class Shares commenced operations on November 1, 2022. The Investor Class Shares have yet to commence operations for either Fund.

Income and realized/unrealized gains or losses are allocated to each class of each Fund on the basis of the net asset value of each class in relation to the net asset value of each Fund.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of the significant accounting policies followed by the Funds in the preparation of its financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

| a) | Security Valuation – All investments in securities are recorded at fair value, as described in note 3. |

| b) | Cryptocurrency Risk - Cryptocurrency (notably, Bitcoin), often referred to as “virtual currency” or “digital currency,” operates as a decentralized, peer-to-peer financial exchange and value storage that is used like money. The Bitcoin Fund may have exposure to Bitcoin, a cryptocurrency, indirectly through an investment in an investment vehicle. Cryptocurrencies operate without central authority or banks and are not backed by any government. Cryptocurrencies may experience very high volatility and related investment vehicles may be affected by such volatility. Cryptocurrency is not legal tender. Federal, state, or foreign governments may restrict the use and exchange of cryptocurrency, and regulation in the U.S. is still developing. Cryptocurrency exchanges may stop operating or permanently shut down due to fraud, technical glitches, hackers, or malware. |

| c) | Commodity Investments – The Commodity Fund may allocate assets among various commodity sectors (including agricultural, energy, livestock, softs (e.g., non-grain agricultural products such as coffee, sugar, cocoa, etc.) and precious and base metals). The Fund will obtain exposure to commodity sectors by investing in commodity-linked Derivatives, directly or through the subsidiary, not through direct investments in physical commodities. Certain investments such as commodity pools are measured based upon NAV as a practical expedient to determine fair value and are not required to be categorized in the fair value hierarchy. |

Notes to the Consolidated Financial Statements (Continued)

December 31, 2023

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| d) | Exchange Traded Funds – The Funds may invest in Exchange Traded Funds (“ETFs”). ETFs are a type of fund bought and sold on a securities exchange. An ETF trades like common stock and represents a portfolio of securities. The Funds may purchase an ETF to gain exposure to a specific asset class. The risks of owning an ETF generally reflect the risks of owning the underlying securities they are designed to track, although the lack of liquidity on an ETF could result in it being more volatile. Additionally, ETFs have fees and expenses that reduce their value. |

| e) | Futures Contracts - The Funds use of futures involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) leverage risk (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the futures contract may not correlate perfectly with the reference asset. Investments in futures involve leverage, which means a small percentage of assets invested in futures can have a disproportionately large impact on the Funds. Counterparty credit risk exists with respect to initial and variation margin deposited/paid by the Fund that is held in futures commission merchant, broker and/or clearinghouse accounts for such exchange-traded derivatives. |

| f) | Short Sales of Investments – The Funds may engage in short sales of securities to realize appreciation when a security that the Funds do not own declines in value. A short sale is a transaction in which a fund sells a security it does not own to a third party by borrowing the security in anticipation of purchasing the same security at the market price on a later date to close out the borrow and thus the short position. The price a fund pays at the later date may be more or less than the price at which the fund sold the security. If the price of the security sold short increases between the short sale and when the fund closes out the short sale, the fund will incur a loss, which is theoretically unlimited. The Funds will realize a gain, which is limited to the price at which the fund sold the security short if the security declines in value between those dates. Dividends on securities sold short are recorded as dividend expense for short sales in the Consolidated Statements of Operations. While the short positions are open, the Funds will post cash or liquid assets at least equal in value to the fair value of the securities should short. |

Interest related to the loan is included in interest expense for short sales in the Consolidated Statements of Operations. All collateral is marked to market daily. The Funds may also be required to pledge on the books of the Funds’ additional assets for the benefit of the security and cash lender. Risk of loss may exceed amounts recognized on the Consolidated Statements of Assets and Liabilities. Short positions, if any, are reported at value and listed on the Funds’ Consolidated Schedules of Investments.

| g) | Options on Securities - The Funds may purchase and write (i.e., sell) put and call options. Such options may relate to particular securities or stock indices and may or may not be listed on a domestic or foreign securities exchange and may or may not be issued by the Options Clearing Corporation. Option trading is a highly specialized activity that entails greater than ordinary investment risk. Options may be more volatile than the underlying instruments, and therefore, on a percentage basis, an investment in options may be subject to greater fluctuation than an investment in the underlying instruments themselves. |

A call option for a particular security gives the purchaser of the option the right to buy, and the writer (seller) the obligation to sell, the underlying security at the stated exercise price at any time prior to the expiration of the option, regardless of the market price of the security. The premium paid to the writer is in consideration for undertaking the obligation under the option contract. A put option for a particular security gives the purchaser the right to sell the security at the stated exercise price at any time prior to the expiration date of the option, regardless of the market price of the security.

A fund’s obligation to sell an instrument subject to a call option written by it, or to purchase an instrument subject to a put option written by it, may be terminated prior to the expiration date of the option by the fund’s execution of a closing purchase transaction, which is effected by purchasing on an exchange an option of the same series (i.e., same underlying instrument, exercise price and expiration date) as the option previously written. A closing purchase transaction will ordinarily be affected to realize a profit on an outstanding option, to prevent an underlying instrument from being called, to permit the sale of the underlying instrument or to permit the writing of a new option containing different terms on such underlying instrument. The cost of such a liquidation purchase plus transactions costs may be greater than the premium received upon the original option, in which event the Fund will have incurred a loss in the transaction. There is no assurance that a liquid secondary market will exist for any particular option. An option writer unable to affect a closing purchase transaction will not be able to sell the underlying instrument or liquidate the assets held in a segregated account, as described below, until the option expires, or the optioned instrument is delivered upon exercise. In such circumstances, the writer will be subject to the risk of market decline or appreciation in the instrument during such period.

| h) | U.S. Government Securities - The Funds invest in U.S. government securities. Risks arise from investments in U.S. government securities due to possible market illiquidity. U.S. government securities are also sensitive to changes in interest rates and economic conditions. The Funds have established procedures to actively monitor market risk and minimize credit risk, although there can be no assurance that they will, in fact, succeed in doing so. |

Notes to the Consolidated Financial Statements (Continued)

December 31, 2023

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| i) | Consolidation of the Subsidiaries – The Consolidated Financial Statements of the Bitcoin Fund and the Commodity Fund each include the investment activity and financial statements of IDXBS and IDXCS, respectively. All intercompany accounts and transactions have been eliminated in consolidation. Because each Fund may invest a substantial portion of its assets in its respective subsidiary, the Funds may be considered to be investing indirectly in some of those investments through its Subsidiaries. For that reason, references to the Funds may also encompass its subsidiary. The Subsidiaries will be subject to the same investment restrictions and limitations and follow the same compliance policies and procedures as the Funds when viewed on a consolidated basis. Each Fund and its subsidiary are a “commodity pool” under the U.S. Commodity Exchange Act and the Adviser is a “commodity pool operator” registered with and regulated by the Commodity Futures Trading Commission (“CFTC”). As a result, additional CFTC-mandated disclosure, reporting, and recordkeeping obligations apply with respect to each Fund and its respective subsidiary under CFTC and the U.S. Securities and Exchange Commission (the “SEC”) harmonized regulations. As of December 31, 2023, IDXBS had net assets of $4,316,861 comprising 20.11% of the net assets and IDXCS had net assets of $3,126,850 comprising 5.69% of the net assets of the Bitcoin Fund and the Commodity Fund, respectively. |

| j) | Federal Income Taxes – The Funds have qualified and intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Funds to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required. The Funds recognize tax benefits of uncertain tax positions only where the position is more-likely-than-not-to be sustained assuming examination by tax authorities. |

Management has analyzed the Funds’ tax positions taken on all open tax years and expected to be taken as of and during the year ended December 31, 2023, and has concluded that the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Consolidated Statements of Operations when incurred. During the year ended December 31, 2023, the Funds did not incur any interest or penalties. The Funds identify its major tax jurisdictions as U.S. Federal and State of Delaware.

For tax purposes, the Funds’ Subsidiaries are exempted Cayman Islands investment companies. The Subsidiaries have received an undertaking from the Government of the Cayman Islands exempting them from all local income, profits, and capital gains taxes. No such taxes are levied in the Cayman Islands at the present time. For U.S. income tax purposes, the Subsidiaries are a Controlled Foreign Corporations (“CFCs”) and as such are not subject to U.S. income tax. However, as a wholly-owned CFC, the net income and capital gain of each CFC, to the extent of its earnings and profits, will be included each year in the respective Funds’ investment company taxable income.

| k) | Cash and Cash Equivalents – Cash is held with a financial institution, if any. The assets of the Funds may be placed in deposit accounts at U.S. banks and such deposits generally exceed Federal Deposit Insurance Corporation (“FDIC”) insurance limits. The FDIC insures deposit accounts up to $250,000 for each account holder. The counterparty is generally a single bank rather than a group of financial institutions; thus, there may be a greater counterparty credit risk. The Funds place deposits only with those counterparties which are believed to be creditworthy. |

| l) | Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. GAAP requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in capital or net realized gains. |

| m) | Expenses – Expenses incurred by the Trust that do not relate to a specific Fund of the Trust may be allocated equally across all Funds of the Trust, or to the individual Fund based on each Fund’s relative net assets or another basis as determined by the Board of Trustees (the “Board”), whichever method is deemed appropriate as stated in the Trust’s expense allocation policy. Expenses incurred specific to a particular Fund are allocated entirely to that Fund. |

| n) | Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increase/decrease in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| o) | Other – Investment and shareholder transactions are recorded on trade date. The Funds determines the gain or loss realized from the investment transactions by comparing the identified cost of the security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Funds and interest income is recognized on an accrual basis and includes the amortization / accretion of premiums and discounts based on effective yield. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates. |

Notes to the Consolidated Financial Statements (Continued)

December 31, 2023

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| p) | Guarantees and Indemnifications – In the normal course of business, the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under the arrangement is unknown and would involve future claims against the Fund that have not yet occurred. Based on experience, the Funds expects the risk of loss to be remote. |

Processes and Structure

The Funds’ Board has adopted guidelines for valuing investments and derivative instruments including in circumstances in which market quotes are not readily available and has delegated authority to the Valuation Designee to apply those guidelines in determining fair value prices, subject to review by the Board.

Hierarchy of Fair Value Inputs

The Funds utilizes various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| ● | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| ● | Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| ● | Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Fair Value Measurements

A description of the valuation techniques applied to the Funds’ major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities - Securities traded on a national securities exchange (or reported on the NASDAQ national market), including common stock, ETFs, and options purchased, are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. Certain foreign securities may be fair valued using a pricing service that considers the correlation of the trading patterns of the foreign security to the intraday trading in the U.S. markets for investments such as American depositary receipts, financial futures, ETFs, and the movement of certain indexes of securities based on a statistical analysis of the historical relationship and are categorized in Level 2. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are also categorized in Level 2.

Fixed Income Securities - Fixed income securities and certificates of deposit with maturities more than 60 days when acquired generally are valued using an evaluated price supplied by an independent pricing service. Inputs used by the pricing service for U.S. government and treasury securities are normally valued using a model that incorporates market observable data such as reported sales of similar securities, broker dealer quotes, yields, bids, offers and reference data. Agency issued debt securities, foreign issued bonds and municipal bonds are generally valued in a manner similar to U.S. government securities. Evaluations for corporate bonds are typically based on valuation methodologies such as market pricing and other analytical pricing models as well as market transactions and dealer quotations based on observable inputs. Fixed income securities are generally categorized in Level 2 of the fair value hierarchy depending on inputs used and market activity levels for specific securities.

Money Market Funds – Money market funds are valued at their net asset value of $1.00 per share and are categorized as Level 1 of the fair value hierarchy.

Derivative Instruments – Listed derivative instruments that are actively traded, including futures contracts, are valued based on quoted prices from the exchange and are categorized in Level 1 of the fair value hierarchy.

Notes to the Consolidated Financial Statements (Continued)

December 31, 2023

| 3. | INVESTMENT VALUATIONS (Continued) |

The following table summarizes the Bitcoin Fund’s consolidated investments and other financial instruments as of December 31, 2023:

| Security Classification (a) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Investments | | | | | | | | | | | | | | | | |

| Short-Term Investments (b) | | $ | 16,185,339 | | | $ | — | | | $ | — | | | $ | 16,185,339 | |

| Total Investments | | $ | 16,185,339 | | | $ | — | | | $ | — | | | $ | 16,185,339 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

| Futures Contracts (b) (c) | | | | | | | | | | | | | | | | |

| Unrealized appreciation of open futures contracts | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Unrealized depreciation of open futures contracts | | | (687,496 | ) | | | — | | | | — | | | | (687,496 | ) |

| Total Futures Contracts | | $ | (687,496 | ) | | $ | — | | | $ | — | | | $ | (687,496 | ) |

| Total Other Financial Instruments | | $ | (687,496 | ) | | $ | — | | | $ | — | | | $ | (687,496 | ) |

| (a) | As of and during the year ended December 31, 2023, the Fund held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). |

| (b) | Short-term investments and future contracts held in the Fund are Level 1 securities. For a detailed break-out by industry, please refer to the Consolidated Schedules of Investments and Open Future Contracts. |

| (c) | Other financial instruments are derivative financial instruments not reflected in the Schedules of Investments, such as futures contracts. These contracts are valued at the unrealized appreciation / (depreciation) on the instrument. |

The following table summarizes the Commodity Fund’s consolidated investments and other financial instruments as of December 31, 2023:

| Security Classification (a) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Investments | | | | | | | | | | | | | | | | |

| Exchange Traded Funds (b) | | $ | 26,279,438 | | | $ | — | | | $ | — | | | $ | 26,279,438 | |

| Purchased Options (b) | | | 1,175 | | | | — | | | | — | | | | 1,175 | |

| Short-Term Investments (b) | | | 22,022,255 | | | | — | | | | — | | | | 22,022,255 | |

| Total Investments | | $ | 48,302,868 | | | $ | — | | | $ | — | | | $ | 48,302,868 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

| Futures Contracts (b) (c) | | | | | | | | | | | | | | | | |

| Unrealized appreciation of open futures contracts | | $ | 412,790 | | | $ | — | | | $ | — | | | $ | 412,790 | |

| Unrealized depreciation of open futures contracts | | | (448,779 | ) | | | — | | | | — | | | | (448,779 | ) |

| Total Futures Contracts | | $ | (35,989 | ) | | $ | — | | | $ | — | | | $ | (35,989 | ) |

| Total Other Financial Instruments | | $ | (35,989 | ) | | $ | — | | | $ | — | | | $ | (35,989 | ) |

| (a) | As of and during the year ended December 31, 2023, the Fund held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). |

| (b) | Exchange traded funds, purchased options, short-term investments and future contracts held in the Fund are Level 1 securities. For a detailed break-out by industry, please refer to the Consolidated Schedules of Investments and Open Future Contracts. |

| (c) | Other financial instruments are derivative financial instruments not reflected in the Schedules of Investments, such as futures contracts. These contracts are valued at the unrealized appreciation / (depreciation) on the instrument. |

| 4. | DERIVATIVE TRANSACTIONS |

The Funds may buy or sell future contracts to increase exposure to the market, hedge market exposure of an existing portfolio, or decrease overall market exposure. The Adviser may invest in futures in this way to achieve a desired portfolio exposure. The Funds currently invest only in exchange-traded futures, which are standardized as to maturity date and underlying financial instrument. Initial margin deposits required upon entering into futures contracts are satisfied by the segregation of specific securities or cash as collateral at the futures commission merchant (broker) and are recorded within deposit with brokers for derivative instruments on the Consolidated Statements of Assets and Liabilities. During the year, the futures contracts are open, changes in the value of the contracts are recognized as unrealized gains or losses by recalculating the value of the contracts daily. Subsequent or variation margin payments are received or made depending upon whether unrealized gains or losses are incurred. These amounts are reflected as unrealized appreciation or depreciation on the Consolidated Statements of Assets and Liabilities. When the contracts are closed or expire, the Funds recognize a realized gain or loss equal to the difference between the proceeds from, or cost of, the closing transaction and the Funds’ basis in the contract. The net realized gain (loss) and the change in unrealized gain (loss) on futures contracts held during the period is included in the Consolidated Statements of Operations.

Notes to the Consolidated Financial Statements (Continued)

December 31, 2023

| 4. | DERIVATIVE TRANSACTIONS (Continued) |

The fair value of derivative instruments, not accounted for as hedging instruments, as reported within the Consolidated Statements of Assets and Liabilities as of December 31, 2023, for the Bitcoin Fund was as follows:

| | | | | | | | | | | | | | Fair Value | |

| Type of Derivative | | Location | | Interest Rate Risk | | | Equity Risk | | | Commodity Risk | | | Asset

Derivatives | | | Liability

Derivatives | |

| Put Options Purchased | | Investment at value | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Future Contracts | | Unrealized depreciation of open futures contracts | | | — | | | | — | | | | (687,496 | ) | | | — | | | | (687,496 | ) |

For the year ended December 31, 2023, the Bitcoin Fund financial derivative instruments had the following average notional values (indicating average volume for the year):

| Type of Derivative | | Average Monthly Notional Value (a) | | |

| Put Options Purchased (b) | | $ | 58,983 | | |

| Future Contracts | | | 11,695,806 | | |

| (a) | The Fund considers the average monthly notional amounts during the year, categorized by derivative instrument, to be representative of its derivate activities for the year ended December 31, 2023. The Fund did not engage in short future contract activity during the year ended December 31, 2023. |

| | |

| (b) | The Fund held purchased put options as of December 31, 2022 until their expiration in January of 2023. No other purchased option activity noted during the year ended December 31, 2023. |

For the year ended December 31, 2023, financial derivative instruments had the following effect on the Consolidated Statements of Operations for the Bitcoin Fund:

| Type of Derivative | Risk Type | | | Realized

Gain/(Loss) | | | Change in Unrealized

Appreciation /

(Depreciation) | |

| Put Options Purchased | Equity | | | $ | (70,109 | ) | | $ | 23,109 | |

| Future Contracts | Commodity | | | | 5,426,319 | | | | (687,496 | ) |

| Total | | | | $ | 5,356,210 | | | $ | (664,387 | ) |

The fair value of derivative instruments, not accounted for as hedging instruments, as reported within the Consolidated Statements of Assets and Liabilities as of December 31, 2023, for the Commodity Fund was as follows:

| | | | | | | | | | | | | | Fair Value | |

Type of Derivative | | Location | | Interest Rate Risk | | | Equity Risk | | | Commodity Risk | | | Asset

Derivatives | | | Liability

Derivatives | |

| Call Options Purchased | | Investment at value | | $ | — | | | $ | 1,175 | | | $ | — | | | $ | 1,175 | | | $ | — | |

| Future Contracts | | Unrealized appreciation of open futures contracts | | | 44,681 | | | | — | | | | 368,109 | | | | 412,790 | | | | — | |

| Future Contracts | | Unrealized depreciation of open futures contracts | | | — | | | | — | | | | (448,779 | ) | | | — | | | | (448,779 | ) |

For the year ended December 31, 2023, the Commodity Fund financial derivative instruments had the following average notional values (indicating average volume for the year):

| Type of Derivative | | Average Monthly Notional Value (a) | | |

| Call Options Purchased | | $ | 126,958 | | |

| Put Options Purchased | | | 4,164,167 | | |

| Call Options Written | | | (37,633 | ) | |

| Put Options Written | | | (3,378,550 | ) | |

| Future Long Contracts | | | 21,061,280 | | |

| Future Short Contracts | | | (4,782,697 | ) | |

| (a) | The Fund considers the average monthly notional amounts during the year, categorized by derivative instrument, to be representative of its derivate activities for the year ended December 31, 2023. |

For the year ended December 31, 2023, financial derivative instruments had the following effect on the Consolidated Statements of Operations for the Commodity Fund:

| Type of Derivative | Risk Type | | | Realized

Gain/(Loss) | | | Change in Unrealized

Appreciation /

(Depreciation) | |

| Call/Put Options Purchased | Equity | | | $ | (499,150 | ) | | $ | (81,610 | ) |

| Call/Put Options Written | Equity | | | | 96,961 | | | | — | |

| Future Contracts | Interest Rate | | | | 20,696 | | | | 41,692 | |

| Future Contracts | Equity | | | | 77,014 | | | | (31,079 | ) |

| Future Contracts | Commodity | | | | (2,084,145 | ) | | | (74,589 | ) |

| Total | | | | $ | (2,388,624 | ) | | $ | (145,586 | ) |

Notes to the Consolidated Financial Statements (Continued)

December 31, 2023

| 5. | INVESTMENT TRANSACTIONS |

For the year ended December 31, 2023, aggregate purchases, and sales of investment securities (excluding short-term investments) were as follows:

| | | | | U.S. Government Obligations | | | | All Other | |

| Fund | | | | Purchases | | | | Sales | | | | Purchases | | | | Sales | |

| The Bitcoin Fund | | | $ | 11,483,130 | | | $ | (11,574,899 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | |

| The Commodity Fund | | | | — | | | | — | | | | 50,563,719 | | | | (29,159,464 | ) |

| 6. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

The Funds have entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Pursuant to the Advisory Agreement, the Adviser manages the operations and investments of the Funds in accordance with their stated policies. As compensation for the investment advisory services provided to the Funds, the Adviser receives a monthly management fee equal to an annual rate of the Funds’ net assets as follows:

| Fund | | | Management Fee Rate | | | Management

Fees Accrued | |

| The Bitcoin Fund | | | | 1.99 | % | | $ | 432,250 | |

| | | | | | | | | | |

| The Commodity Fund | | | | 1.49 | % | | $ | 563,316 | |

The Adviser has entered into an Expense Limitation Agreement with the Funds under which it has agreed to waive its fees and reimburse expenses of the Funds, if necessary, in an amount that limits the Funds’ annual operating expenses (exclusive of interest, borrowing expenses, distribution fees pursuant to Rule 12b-1 plan, shareholder service fees pursuant to a shareholder service plan, taxes, acquired fund fees and expenses, brokerage fees and commissions, dividend expenses on short sales, litigation expenses, other expenditures which are capitalized in accordance with GAAP and other extraordinary expenses not incurred in the ordinary course of the Funds’ business) to not more than 2.49% and 1.79% for the Bitcoin Fund and the Commodity Fund, respectively, through at least April 30, 2024. During the year ended December 31, 2023, the Adviser waived fees as follows:

| Fund | | | Expense Limitation

Rate | | | Management

Fees Waived | |

| The Bitcoin Fund | | | | 2.49 | % | | $ | (189,988 | ) |

| | | | | | | | | | |

| The Commodity Fund | | | | 1.79 | % | | $ | (210,383 | ) |

Subject to approval by the Funds’ Board of Trustees, any waiver or reimbursement under the Expense Limitation Agreement is subject to repayment by the Funds within the three years following the date of such waiver on reimbursement, provided that the Fund can make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is repaid.

As of December 31, 2023, the cumulative unreimbursed amounts paid or waived by the Adviser on behalf of the Funds that may be recouped no later than the date stated below are as follows:

Fund | | | Subject to Recovery on

or Before Fiscal Year Ending

December 31, | | | Management Fees

Waived Subject to

Recovery | |

| The Bitcoin Fund | | | | 2026 | | | $ | (189,988 | ) |

| | | | | 2025 | | | | (229,313 | ) |

| | | | | 2024 | | | | (46,663 | ) |

| Total: | | | | | | | $ | (465,964 | ) |

| | | | | | | | | | |

| The Commodity Fund | | | | 2026 | | | $ | (210,383 | ) |

| | | | | 2025 | | | | (29,601 | ) |

| Total: | | | | | | | $ | (239,984 | ) |

The Funds have entered into a Master Services Agreement (“Services Agreement”) with Gryphon 17, LLC d/b/a Gryphon Fund Group (“Gryphon”). Under the Services Agreement, Gryphon is responsible for a wide variety of functions, including but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Fund’s portfolio investments; (d) pricing the Fund’s shares; (e) assistance in preparing tax returns; and (f) preparation and filing of required regulatory reports. For the year ended December 31, 2023, the Bitcoin Fund and the Commodity Fund incurred fees pursuant to the Services Agreement of $91,101 and $97,226, respectively.

Notes to the Consolidated Financial Statements (Continued)

December 31, 2023

For U.S. Federal income tax purposes, the cost of securities owned (excluding derivatives), gross appreciation, gross depreciation, and net unrealized depreciation of investments on December 31, 2023, were as follows:

| Fund | | | Tax Cost | | | Gross Unrealized Appreciation | | | Gross Unrealized Depreciation | | | Net Unrealized

Appreciation / (Depreciation) | |

| The Bitcoin Fund | | | $ | 16,185,339 | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | |

| The Commodity Fund | | | $ | 48,080,474 | | | $ | 921,506 | | | $ | (699,112 | ) | | $ | 222,394 | |

The Funds’ tax basis distributable earnings are determined only at the end of each fiscal year. As of December 31, 2023, the components of distributable earnings/accumulated losses presented on an income tax basis were as follows:

| Fund | | | Undistributed

Ordinary Income | | | Undistributed Long-

Term Capital Gains | | | Other Accumulated

Earnings / (Losses) | | | Net Unrealized

Appreciation /

(Depreciation) | | | Total Accumulated Distributable Earnings/

(Accumulated Losses) | |

| The Bitcoin Fund | | | $ | 391,313 | | | $ | — | | | $ | 2,020,851 | | | $ | — | | | $ | 2,412,164 | |

| | | | | | | | | | | | | | | | | | | | | | |

| The Commodity Fund | | | $ | 26,562 | | | $ | — | | | $ | (495,739 | ) | | $ | 222,394 | | | $ | (246,783 | ) |

Undistributed income or net realized gains for financial statement purposes may differ from amounts recognized for federal income tax purposes due to differences in the recognition and characterization of income, expense, and capital gain items. The primary difference between book basis and tax basis undistributed ordinary income, undistributed long-term capital gains, unrealized appreciation/(depreciation), and other accumulated earnings relates to the tax amortization of organizational costs, deferral of losses due to wash sales, and tax adjustments related to the Funds’ investments in their Subsidiaries.

Under current law, capital losses and specified gains realized after October 31 may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. For the current period, the Funds did not elect to defer any post-October and late year losses.

As of December 31, 2023, the Funds had the following capital loss carryforwards for federal income tax purposes available to offset future capital gains:

| | | | Capital Loss Carryover | | | | | |

| Fund | | | | Short-Term | | | | Long-Term | | | | Year of Expiration | |

| The Bitcoin Fund | | | $ | 209,553 | | | $ | — | | | | Indefinitely | |

| | | | | | | | | | | | | | |

| The Commodity Fund | | | $ | 565,637 | | | $ | — | | | | Indefinitely | |

In accordance with GAAP, the Funds may record reclassifications in the capital accounts, if necessary. These reclassifications have no impact on the net asset value of the Funds and are designed generally to present total distributable earnings and paid-in capital on a tax basis, which is considered to be more informative to the shareholder. the following reclassifications were made as of December 31, 2023:

Fund | | | Total Distributable Accumulated Earnings / (Accumulated Losses) | | | Paid-in Capital | | |

| The Bitcoin Fund | | | $ | (501,955 | ) | | $ | 501,955 | | |

| | | | | | | | | | | |

| The Commodity Fund | | | $ | 2,236,797 | | | $ | (2,236,797 | ) | |

The Funds’ reclassifications are primarily attributable to non-deductible expenses, utilization of earnings and profits distributed to shareholders on redemption of shares, and the Funds’ investment in their Subsidiaries.

| During the year ended December 31, 2023, the Funds paid the following distributions: | |

| Fund | | Ordinary Income | | | Long Term Capital Gains | | | Return of Capital | | | Total | |

| The Bitcoin Fund | | $ | 1,807,769 | | | $ | — | | | $ | — | | | $ | 1,807,769 | |

| | | | | | | | | | | | | | | | | |

| The Commodity Fund | | $ | 998,760 | | | $ | 9,112 | | | $ | — | | | $ | 1,007,872 | |

There were no distributions paid by the IDX Risk-Managed Bitcoin Strategy Fund during the year ended December 31, 2022.

During the period ended December 31, 2022 The IDX Commodity Opportunities Fund paid the following distributions.

| Fund | | Ordinary Income | | | Long Term Capital Gains | | | Return of Capital | | | Total | |

| The Commodity Fund | | $ | 32,120 | | | $ | — | | | $ | — | | | $ | 32,120 | |

The following risks are specifically attributable to making investments in bitcoin. Each of these risks could adversely impact the value of an investment in the Fund.

New Technology Adoption Risks - Investing in bitcoin represents an investment in a new technological innovation with a limited history. The limited market trading history may limit the ability of the Adviser to assess opportunities and risks.

Notes to the Consolidated Financial Statements (Continued)

December 31, 2023

| 8. | BITCOIN RISK (Continued) |

Industry Uncertainty Risks - Bitcoin and the marketplace for bitcoin is relatively new, which means that this type of investment is subject to a high degree of uncertainty. Uncertainty surrounding the adoption of bitcoin, growth in its usage and in the blockchain for various applications and an accommodating regulatory environment creates a risk for the Fund.