[Letterhead of Skadden, Arps, Slate, Meagher & Flom LLP]

September 3, 2015

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

Attn: Jeffrey P. Riedler

| | Re: | Patheon Holdings Coöperatief U.A. |

| | | Amendment No. 1 to Registration Statement on Form S-1 |

| | | Filed July 29, 2015 |

| | | File No. 333-204789 |

Dear Mr. Riedler:

On behalf of our client, Patheon Holdings Coöperatief U.A., a Dutch cooperative with excluded liability for its members (coöperatie met uitgesloten aansprakelijkheid) (the “Company”), we file herewith Amendment No. 2 to the above-mentioned Registration Statement (the “Revised Registration Statement”) via the Securities and Exchange Commission (the “Commission”) EDGAR system. In this letter, we respond to the comments of the staff (the “Staff”) of the Division of Corporation Finance of the Commission contained in the Staff’s letter dated August 12, 2015 (the “Comment Letter”).

Set forth below are the Company’s responses to the comments in the Comment Letter. For ease of reference, each comment contained in the Comment Letter is printed below and is followed by the Company’s response. All page references in the responses refer to page numbers in the Revised Registration Statement. Defined terms used but not otherwise defined herein have the meanings ascribed to such terms in Revised Registration Statement.

Consolidated Financial Statements of Patheon Holdings Cooperatief U.A., page F-47

Notes to Consolidated Financial Statements

1. Nature of Business, page F-47

| 1. | We acknowledge your response to our prior comments 9 and 10. Based on your response, it is still unclear how Patheon, Inc. is the accounting acquirer. It appears that DPP was contributed to the partnership by DSM and Patheon, Inc. was acquired by the partnership. To help us understand the transaction, please provide us a diagram(s) that shows the relationship of all parties involved in the transactions (i.e., Contribution agreement, Arrangement agreement, acquisition of Patheon, Inc., the Combination). In this regard, throughout the filing multiple parties are referred to, for example, DSM NewCo B.V., JLL/Delta Patheon G.P., JLL/Delta Patheon Holdings L.P., JLL/Delta Dutch Pledgeco B.V., etc. Please ensure that each party is addressed in your diagram(s) as applicable. |

Response:

Background and Description of the Transaction

In connection with the acquisition of the DPP Business and the transaction to take Patheon Inc. (“legacy Patheon”) private, JLL executed a series of integrated transactions that were simultaneously consummated on March 11, 2014. Each of the following transactions were executed in contemplation of one another and included the following:

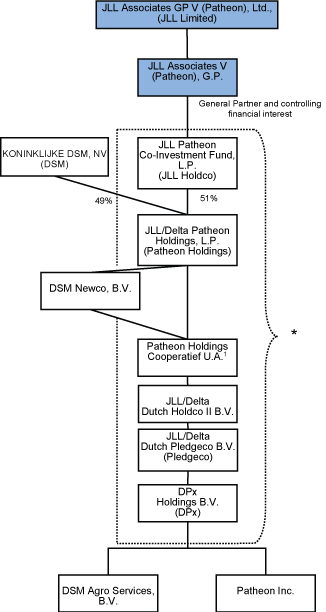

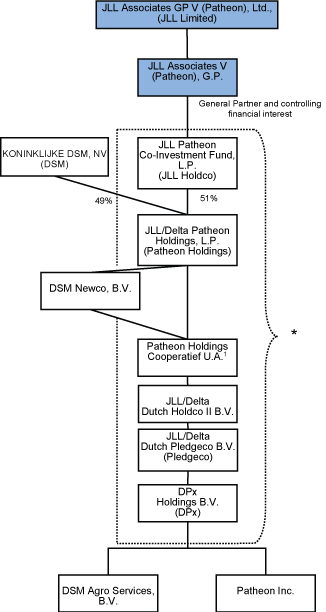

| · | JLL Associates GP V (Patheon), Ltd. (“JLL Limited”), caused the formation of, and maintained a controlling financial interest in, JLL Patheon Co-Investment Fund, L.P. (“JLL Holdco”), through which it contributed capital and certain partnership assets to newly formed JLL/Delta Patheon Holdings, L.P. (“Patheon Holdings”) in exchange for 51% of the limited partnership interests of Patheon Holdings; |

| · | Koninklijke DSM N.V. (“DSM”) contributed the DPP Business (comprised of DSM Agro Services, B.V. and its subsidiaries, including DSM NewCo B.V.) to Patheon Holdings in exchange for 49% of the limited partnership interests of Patheon Holdings along with cash and certain preferred partnership interests; and |

| · | Patheon Holdings and its subsidiaries acquired all of the outstanding shares of legacy Patheon. |

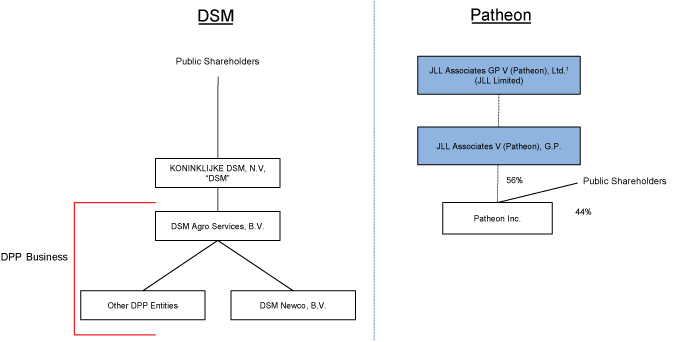

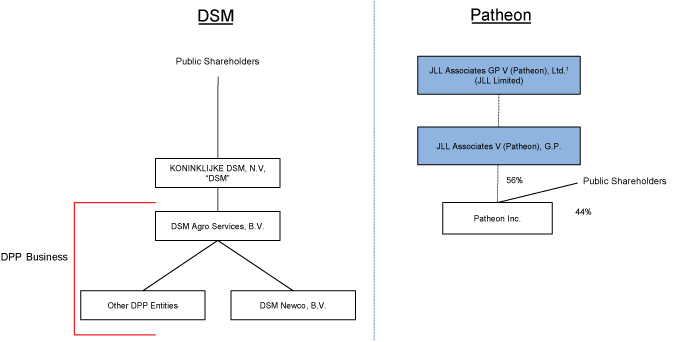

Prior to the March 11, 2014 acquisition of the DPP Business, JLL Limited had a controlling financial interest in legacy Patheon. Public shareholders owned the remaining 44% of legacy Patheon. In addition, JLL did not control DSM, DPP, or the DPP Business, and, further, had no relationship with DSM or DPP. The ownership structure prior to the acquisition of the DPP Business and the transaction to take legacy Patheon price is summarized by the chart on Appendix A.

Between November 2013, when the parties signed definitive agreements related to the transaction, and the consummation of the transactions, JLL Limited formed Patheon Holdings, JLL Holdco (in connection with the formation of Patheon Holdings) and all of the subsidiaries listed on Appendix B (JLL/Delta Dutch Holdco Cooperatief U.A. (renamed Patheon Holdings Cooperatief U.A.), which is the registrant under this registration statement on Form S-1 and referred to herein as “the Company,” JLL/Delta Dutch Holdco II B.V., JLL/Delta Dutch Pledgeco B.V., and DPx Holdings B.V. (“DPx”)), solely for the purpose of consummating the transactions described above that ultimately resulted in the acquisition of the DPP Business. The relationships between these entities and JLL Limited and DSM are shown on Appendix B. Prior to the closing of the acquisition of the DPP Business in January 2014, DPx issued $500.0 million of 7.5% Senior Notes due 2022. However, the proceeds from this debt offering, which were to be used to fund the transactions, were held in escrow and their release was conditioned upon the closing of the acquisition of the DPP Business and the related transactions described above. There were no other significant pre-combination activities of Patheon Holdings or any of its subsidiaries prior to March 11, 2014. JLL Limited maintained a controlling financial interest in the legacy Patheon entity prior to and throughout the series of simultaneous transactions described above and continues to have a controlling financial interest in Patheon Holdings and its subsidiaries.

Evaluation of the Accounting Acquirer

In evaluating the appropriate accounting treatment for the transaction, the Company analyzed the factors outlined in the accounting guidance and concluded that legacy Patheon was the accounting acquirer. The Company concluded that neither Patheon Holdings nor any of its subsidiaries (including DPx) was the accounting acquirer.

In arriving at that conclusion, the Company considered the guidance in ASC 805-10-55-15 in evaluating whether Patheon Holdings or any of its subsidiaries would be considered the accounting acquirer. The Company noted that ASC 805-10-55-15 states the following:

“A new entity formed to effect a business combination is not necessarily the acquirer. If a new entity is formed to issue equity interests to effect a business combination, one of the combining entities that existed before the business combination shall be identified as the acquirer by applying the guidance in paragraphs 805-10-55-10 through 55-14. In contrast, a new entity that transfers cash or other assets or incurs liabilities as consideration may be the acquirer.”

The Company evaluated Patheon Holdings and its subsidiaries and determined that they were non-substantive entities formed solely for the purpose of facilitating the aforementioned transactions. This conclusion was based on the fact that there were no significant pre-combination activities other than to issue equity to the equityholders of the combining companies. In arriving at its conclusion with regard to the debt issued by DPx described above, the Company considered the fact that the proceeds from the issued debt were held in escrow and would have been returned to the lenders, including interest, in the event that the acquisition of DPP and the related transactions were not consummated. Further, the formation of Patheon Holdings and related transactions did not result in a change of control (or loss of control) by JLL Limited as described above. Accordingly, the structure of the legal entities and financing transaction was under the control of JLL Limited.

In evaluating which of the combining entities would be identified as the accounting acquirer in the transaction, the Company analyzed the factors outlined in ASC 805-10-55-12 and concluded that legacy Patheon was the accounting acquirer. We respectfully advise the staff of our response to prior comment 10 in our letter dated July 29, 2015, which addresses our analysis of how we reached this conclusion.

Analysis of Transfers among Entities with Common Control

Because JLL Limited maintained its controlling financial interest throughout the series of transactions described above, the Company viewed the simultaneous transactions involving legacy Patheon and Patheon Holdings and its subsidiaries as being among entities under common control as per ASC 805-50. For purposes of evaluating the transfer of legacy Patheon to be reflected in the financial statements of the Company, the Company also considered such guidance to evaluate the appropriate basis to be reflected in its historical financial statements (predecessor financial statements). For the reasons discussed above, the Company concluded that Patheon Holdings and its subsidiaries were non-substantive entities for both the acquisition of the DPP Business and for purposes of the common control transaction. In addition, legacy Patheon, Patheon Holdings and its subsidiaries were under the common control of JLL Limited at all times. As a result, although the legal form of the transaction was the transfer of legacy Patheon to subsidiaries of Patheon Holdings, legacy Patheon was considered to be the receiving entity and therefore this transfer was recorded in the Company’s financial statements based on the carrying amounts in legacy Patheon’s historical financial statements.

3. Business combinations, page F-55

Gallus BioPharmaceuticals Acquisition

Valuations of intangible assets acquired, page F-56

| 2. | We acknowledge your revised disclosure in response to our prior comment 13. In your disclosure, please revise to include a description of the significant inputs used in the fair value measurements as required by ASC 820-10-50-1B(bbb). |

Response:

The Company has revised the disclosure in the footnotes to its consolidated financial statements on pages F-56 of the Revised Registration Statement in response to the Staff’s comment.

DSM Pharmaceutical Products Group

Notes to the non-statutory combined financial statements

2. Basis of Preparation, page F-125

| 3. | We acknowledge your response to our prior comment 16. While you have quantified the carve-out adjustments described on pages F-125 and F-126 in your response, these adjustments only represents €43.6 million of the total ‘Receivables from related parties for carve-out adjustments’ amount of €146.5 million at December 31, 2013. Please reconcile for us the other components that make up the remaining portion in ‘Receivables from related parties for carve-out adjustments. |

Response:

The following provides a reconciliation of the components that make up the ‘Receivable from related parties for carve-out adjustments’ which was not complete in our original response.

| Description(in € million.) | 2013 | 2012 | 2011 |

| Greenville land | € 1.8 | € 1.9 | € 2.0 |

| Shares in subsidiaries - non-DPP entities | € 146.5 | € 149.7 | € 270.5 |

| Taxes | € 10.4 | € 10.4 | € 10.4 |

| Corporate income taxes payable related to non-DPP entities | € - 12.2 | € 0.0 | € 0.0 |

| Total receivable from related parties for carve-out adjustments | € 146.5 | € 162.0 | € 282.9 |

The receivable from related parties represents net investments in DSM entities, tax positions and certain assets (as described above) that were recorded in the financial records of DPP but were not purchased in connection with the acquisition. This receivable was effectively settled on the transaction date (March 10, 2014) and thus was treated as a receivable from DSM in the combined balance sheets of DPP as of December 31, 2013, 2012, and 2011. The ‘Corporate provisions’ (as described in note 2 of the financial statements) were not settled with DSM on March 10, 2014 and, as such, were not recorded within the line item ‘Receivable from related parties for carve-out adjustments.’ The ‘Corporate provisions’ were recorded within the non-current provisions and current provisions in the accompanying combined balance sheets of DPP.

| 4. | We acknowledge your response to our prior comment 17 however we did not note any changes made to the filing as indicated in your response. In this regard, please indicate one basis of accounting that the consolidated financial statements were prepared. This basis should be consistent with the basis your auditors have opined in their audit report (i.e., International Financial Reporting Standards as issued by the International Accounting Standards Board). |

Response:

As stated in our response to the prior comment 17, the Company submits that the difference between IFRS as adopted by the EU and IFRS is related to macro-hedge and portfolio hedging (as outlined in IAS 39), which did not have any impact on the financial statements of DPP. As a result, the Company believes that the DPP financial statements are prepared in accordance with IFRS applied on a consistent basis.

Accordingly, the Company has revised the disclosure on page F-126 of the financial statements included in Amendment No. 1 to the Registration Statement Form S-1 (as filed with the SEC on July 29, 2015) to remove the paragraph referencing the submission of the single entities reporting packages in accordance with IFRS as adopted by the EU. In response to the Staff’s comment, the Company has further revised the disclosure on page F-126 of the Revised Registration Statement to remove the reference to IFRS effective at 1 January 2013. Accordingly, the revised disclosure states that the combined financial statements of DPP have been prepared in accordance with IFRS as issued by the International Accounting Standards Board (IASB), which is consistent with the basis that our auditors have opined in their audit report.

* * *

Please do not hesitate to contact the undersigned at (212) 735-3416 with any questions or comments regarding this letter.

| | Sincerely, | |

| | | |

| | /s/ Andrea Nicolas | |

| | Andrea Nicolas | |

| cc: | Eric Sherbet, General Counsel and Secretary, Patheon Holdings Coöperatief U.A.

Deanna Kirkpatrick, Davis Polk & Wardwell LLP |

Appendix A

Prior to Contribution and Acquisition Transactions

1 JLL Limited is the ultimate GP of a series of funds and investment vehicles, including JLL Associates V (Patheon), G.P., the general partner that holds a controlling financial interest in Patheon Inc.

Appendix B

Post-Transactions Structure

* The entities within the dotted lines are the non-substantive entities created solely for the purpose of facilitating the transactions.

1 This entity, named JLL/Delta Dutch Holdco Coöperatief U.A. at the time of the closing of the transactions, was subsequently renamed as set forth in the chart.