UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-41508

LOOP MEDIA, INC.

(Exact name of registrant as specified in its charter)

| ||

| ||

Nevada | | 47-3975872 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification Number) |

| ||

2600 West Olive Avenue, Suite 5470, Burbank, CA 91505 | ||

(Address of principal executive offices) (Zip Code) | ||

| ||

(213) 436-2100 | ||

(Registrant’s telephone number, including area code) N/A (Former Name, Former Address and Former Fiscal Year, | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common stock, $0.0001 par value per share |

| LPTV |

| The NYSE American, LLC |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

Non-accelerated filer ☒ | Smaller reporting company ☒ |

Emerging growth company ☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐Yes ☒No

As of August 7, 2023, the registrant had 59,373,061 shares of common stock issued and outstanding.

TABLE OF CONTENTS

2 | ||

| | |

2 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 31 | |

54 | ||

54 | ||

| | |

54 | ||

| | |

54 | ||

54 | ||

Unregistered Sales of Equity Securities and Use of Proceeds. | 54 | |

55 | ||

55 | ||

55 | ||

55 | ||

57 | ||

PART I — FINANCIAL INFORMATION

Item 1.Financial Statements.

LOOP MEDIA, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | |

| June 30, |

| September 30, | ||

| 2023 | | 2022 | ||

ASSETS | (UNAUDITED) |

| |

| |

Current assets | |

|

| |

|

Cash | $ | 6,386,288 | | $ | 14,071,914 |

Accounts receivable, net |

| 5,500,412 | |

| 12,590,970 |

Prepaid expenses and other current assets |

| 1,413,512 | |

| 1,496,566 |

Content assets - current | | 2,462,777 | | | 745,633 |

Total current assets |

| 15,762,989 | |

| 28,905,083 |

Non-current assets |

|

| |

|

|

Deposits |

| 64,036 | |

| 63,889 |

Content assets - non current | | 579,869 | | | 678,659 |

Deferred offering costs | | 471,473 | | | — |

Property and equipment, net |

| 2,913,159 | |

| 1,633,169 |

Operating lease right-of-use assets |

| — | |

| 76,696 |

Intangible assets, net |

| 506,000 | |

| 590,333 |

Total non-current assets |

| 4,534,537 | |

| 3,042,746 |

Total assets | $ | 20,297,526 | | $ | 31,947,829 |

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

| |

| |

Current liabilities |

|

| |

|

|

Accounts payable | $ | 5,204,563 | | $ | 7,453,801 |

Accrued liabilities | | 2,721,627 | | | 5,620,873 |

Accrued royalties and revenue share | | 3,810,862 | | | 4,559,088 |

Payable on acquisition |

| — | |

| 250,125 |

License content liabilities - current | | 568,906 | | | 1,092,819 |

Deferred Income |

| — | |

| 140,764 |

Lease liability - current | | — | | | 75,529 |

Non-revolving line of credit, related party | | 5,493,289 | | | — |

Non-revolving line of credit |

| 1,967,157 | |

| — |

Total current liabilities |

| 19,766,404 | |

| 19,192,999 |

Non-current liabilities |

|

| |

|

|

Non-revolving line of credit | | 409,632 | | | 1,494,469 |

Non-revolving line of credit, related party | | — | | | 2,575,753 |

Revolving line of credit | | 2,246,060 | | | 3,030,516 |

Total non-current liabilities |

| 2,655,692 | |

| 7,100,738 |

Total liabilities |

| 22,422,096 | |

| 26,293,737 |

| | | | | |

Commitments and contingencies (Note 9) | | — | | | — |

| | | | | |

Stockholders’ equity | | | | | |

Common Stock, $0.0001 par value, 105,555,556 shares authorized, 59,183,668 and 56,381,209 shares issued and outstanding as of June 30, 2023, and September 30, 2022, respectively |

| 5,918 | |

| 5,638 |

Additional paid in capital |

| 117,143,464 | |

| 101,970,318 |

Accumulated deficit |

| (119,273,952) | |

| (96,321,864) |

Total stockholders' equity |

| (2,124,570) | |

| 5,654,092 |

Total liabilities and stockholders' equity | $ | 20,297,526 | | $ | 31,947,829 |

See the accompanying notes to the consolidated financial statements

2

LOOP MEDIA, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | | | | | | | | | | |

| Three months ended June 30, | | Nine months ended June 30, | ||||||||

|

| 2023 | 2022 | |

| 2023 | 2022 | ||||

| | | | | | | | | | | |

Revenue | $ | 5,734,976 | | $ | 10,804,083 | | $ | 25,954,038 | | $ | 18,679,956 |

Cost of revenue | | | | | | | | | | | |

Cost of revenue - Advertising and Legacy and other revenue | | 3,132,568 | |

| 6,742,460 | | | 14,767,807 | |

| 11,045,440 |

Cost of revenue - depreciation and amortization | | 779,165 | | | 275,823 | | | 2,091,876 | | | 933,037 |

Total cost of revenue | | 3,911,733 | | | 7,018,283 | | | 16,859,683 | | | 11,978,477 |

Gross profit | | 1,823,243 | |

| 3,785,800 | | | 9,094,355 | |

| 6,701,479 |

| | | | | | | | | | | |

Operating expenses | |

| |

|

| | |

| |

|

|

Sales, general and administrative | | 6,284,514 | | | 5,942,793 | | | 22,011,961 | | | 14,956,990 |

Stock-based compensation | | 2,592,369 | | | 1,479,774 | | | 6,858,983 | | | 4,202,286 |

Depreciation and amortization | | 295,008 | | | 130,864 | | | 717,733 | | | 195,666 |

Restructuring costs | | 146,672 | | | — | | | 146,672 | | | — |

Total operating expenses | | 9,318,563 | |

| 7,553,431 | | | 29,735,349 | |

| 19,354,942 |

| | | | | | | | | | | |

Loss from operations | | (7,495,320) | |

| (3,767,631) | | | (20,640,994) | |

| (12,653,463) |

| | | | | | | | | | | |

Other income (expense) | |

| |

|

| | |

| |

|

|

Interest income | | — | |

| — | | | — | |

| 200 |

Interest expense | | (962,718) | |

| (978,435) | | | (2,889,745) | |

| (1,976,941) |

Loss on extinguishment of debt | | — | |

| (944,614) | | | — | |

| (944,614) |

Gain on extinguishment of debt | | — | | | — | | | — | | | 490,051 |

Change in fair value of derivatives | | — | |

| 18,395 | | | — | |

| 164,708 |

Employee retention credits | | 648,543 | | | — | | | 648,543 | | | — |

Other expense | | (65,643) | | | — | | | (68,267) | | | — |

Total other income (expense) | | (379,818) | |

| (1,904,654) | | | (2,309,469) | |

| (2,266,596) |

Loss before income taxes | | (7,875,138) | | | (5,672,285) | | | (22,950,463) | | | (14,920,059) |

Income tax (expense)/benefit | | (394) | |

| — | | | (1,624) | |

| (1,051) |

Net loss | $ | (7,875,532) | | $ | (5,672,285) | | $ | (22,952,087) | | $ | (14,921,110) |

| | | |

| | | | | |

| |

Basic and diluted net loss per common share | | (0.14) | | $ | (0.11) | | | (0.41) | | $ | (0.32) |

| | | | | | | | | | | |

Weighted average number of basic and diluted common shares outstanding | | 56,604,812 | |

| 51,172,644 | | | 56,455,743 | |

| 47,061,092 |

See the accompanying notes to the consolidated financial statements

3

LOOP MEDIA, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE NINE MONTHS ENDED JUNE 30, 2023, and 2022

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | |

| | Preferred Stock Series B | | Common Stock | | Additional Paid | | Accumulated | | | | ||||||||

| | Shares | | Amount | | Shares | | Amount | | in Capital | | Deficit | | Total | |||||

Balances, September 30, 2022 |

| — |

| $ | — |

| 56,381,209 |

| $ | 5,638 |

| $ | 101,970,318 |

| $ | (96,321,864) |

| $ | 5,654,092 |

Stock-based compensation | | — | | | — | | — | | | — | | | 1,790,807 | | | — | | | 1,790,807 |

Net loss |

| — | |

| — |

| — | |

| — | |

| — | |

| (5,259,439) | |

| (5,259,439) |

Balances, December 31, 2022 |

| — | | $ | — |

| 56,381,209 | | $ | 5,638 | | $ | 103,761,125 | | $ | (101,581,303) | | $ | 2,185,460 |

Stock-based compensation | | — | | | — | | — | | | — | | | 2,475,807 | | | — | | | 2,475,807 |

Short swing profit recovery | | — | | | — | | — | | | — | | | 1,201 | | | — | | | 1,201 |

Issuance costs from uplist of stock | | — | | | — | | — | | | — | | | (86,330) | | | — | | | (86,330) |

Net loss |

| — | |

| — |

| — | |

| — | |

| — | |

| (9,817,117) | |

| (9,817,117) |

Balances, March 31, 2023 |

| — | | $ | — |

| 56,381,209 | | $ | 5,638 | | $ | 106,151,803 | | $ | (111,398,420) | | $ | (5,240,979) |

Stock-based compensation | | — | | | — | | — | | | — | | | 2,547,799 | | | — | | | 2,547,799 |

Warrants issued for consulting fees | | — | | | — | | — | | | — | | | 44,569 | | | — | | | 44,569 |

Warrants issued in conjunction with debt | | — | | | — | | — | | | — | | | 136,103 | | | — | | | 136,103 |

Shares issued for cash under ATM, net | | — | | | — | | 2,779,997 | | | 278 | | | 8,224,782 | | | — | | | 8,225,060 |

Shares issued upon option exercises | | — | | | — | | 22,462 | | | 2 | | | 38,408 | | | — | | | 38,410 |

Net loss |

| — | |

| — |

| — | |

| — | |

| — | |

| (7,875,532) | |

| (7,875,532) |

Balances, June 30, 2023 |

| — | | $ | — |

| 59,183,668 | | $ | 5,918 | | $ | 117,143,464 | | $ | (119,273,952) | | $ | (2,124,570) |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Preferred Stock Series B | | Common Stock | | Additional Paid | | Accumulated | | | | ||||||||

| | Shares | | Amount | | Shares | | Amount | | in Capital | | Deficit | | Total | |||||

Balances, September 30, 2021 |

| 200,000 |

| $ | 20 |

| 44,490,003 |

| $ | 4,449 |

| $ | 69,833,650 |

| $ | (66,842,416) |

| $ | 2,995,703 |

Stock-based compensation | | — | | | — | | — | | | — | | | 1,549,406 | | | — | | | 1,549,406 |

Net loss |

| — | |

| — |

| — | |

| — | |

| — | |

| (4,273,995) | |

| (4,273,995) |

Balances, December 31, 2021 |

| 200,000 | | $ | 20 |

| 44,490,003 | | $ | 4,449 | | $ | 71,383,056 | | $ | (71,116,411) | | $ | 271,114 |

Stock-based compensation | | — | | | — | | — | | | — | | | 1,116,318 | | | — | | | 1,116,318 |

Warrants issued to consultants | | — | | | — | | — | | | — | | | 56,788 | | | — | | | 56,788 |

Payment in kind interest stock issuance | | — | | | — | | 12,378 | | | 1 | | | 88,499 | | | — | | | 88,500 |

Conversion of series B convertible stock to common stock | | (200,000) | | | (20) | | 6,666,666 | | | 667 | | | (647) | | | — | | | — |

Net loss |

| — | |

| — |

| — | |

| — | |

| — | |

| (4,974,830) | |

| (4,974,830) |

Balances, March 31, 2022 |

| — | | $ | — |

| 51,169,047 | | $ | 5,117 | | $ | 72,644,014 | | $ | (76,091,241) | | $ | (3,442,110) |

Stock-based compensation | | — | | | — | | — | | | — | | | 1,282,548 | | | — | | | 1,282,548 |

Warrants issued in conjunction with debt | | — | | | — | | — | | | — | | | 3,036,970 | | | — | | | 3,036,970 |

Beneficial conversion feature of convertible debenture | | — | | | — | | — | | | — | | | 2,079,993 | | | — | | | 2,079,993 |

Warrants issued to consultants | | — | | | — | | — | | | — | | | 197,226 | | | — | | | 197,226 |

Payment in kind interest stock issuance | | — | | | — | | 10,773 | | | 1 | | | 88,497 | | | — | | | 88,498 |

Net loss |

| — | |

| — |

| — | |

| — | |

| — | |

| (5,672,285) | |

| (5,672,285) |

Balances, June 30, 2022 |

| — | | $ | — |

| 51,179,820 | | $ | 5,118 | | $ | 79,329,248 | | $ | (81,763,526) | | $ | (2,429,160) |

See the accompanying notes to the consolidated financial statements

4

LOOP MEDIA, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | |

| Nine months ended June 30, | ||||

| 2023 |

| 2022 | ||

CASH FLOWS FROM OPERATING ACTIVITIES | |

|

| |

|

Net loss | $ | (22,952,087) | | $ | (14,921,110) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

| |

| |

Amortization of debt discount |

| 1,842,003 | | | 1,532,792 |

Depreciation and amortization expense |

| 717,733 | | | 195,666 |

Amortization of content assets | | 2,091,876 | | | 933,036 |

Amortization of right-of-use assets |

| 76,696 | | | 118,719 |

Bad debt expense | | — | | | 20,000 |

Gain on extinguishment of debt | | — | | | (490,051) |

Loss on early extinguishment of convertible debt | | — | | | 944,614 |

Change in fair value of derivative | | — | | | (164,708) |

Stock-based compensation |

| 6,858,983 | | | 4,202,286 |

Stock option exercise | | 38,410 | | | — |

Warrants issued in conjunction with debt | | 136,103 | | | — |

Payment in kind for interest stock issuance | | — | | | 177,000 |

Change in operating assets and liabilities: |

| | |

| |

Accounts receivable |

| 7,090,558 | | | (10,049,799) |

Prepaid income tax | | — | | | (1,842) |

Inventory |

| 4,397 | | | 210,494 |

Prepaid expenses |

| 78,632 | | | (741,364) |

Deposit |

| (147) | | | (29,590) |

Accounts payable |

| (2,605,012) | | | 2,558,353 |

Accrued liabilities | | (2,899,246) | | | 5,269,758 |

Accrued royalties and revenue share | | (748,226) | | | 2,683,245 |

Licensed content liability |

| (4,132,894) | | | (1,109,750) |

Operating lease liabilities |

| (75,529) | | | (123,453) |

Deferred income |

| (140,764) | | | (47,252) |

NET CASH USED IN OPERATING ACTIVITIES |

| (14,618,514) | |

| (8,832,956) |

| | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES |

|

| |

|

|

Purchase of property and equipment |

| (1,483,498) | | | (956,889) |

NET CASH USED IN INVESTING ACTIVITIES |

| (1,483,498) | |

| (956,889) |

| | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES |

|

| |

|

|

Proceeds from issuance of common stock | | 8,318,110 | | | 1,250,000 |

Proceeds from issuance of convertible debt | | — | | | 2,079,993 |

Proceeds from non-revolving line of credit | | — | | | 6,222,986 |

Proceeds from line of credit | | 37,974,347 | | | — |

Payments on line of credit | | (36,262,546) | | | — |

Debt issuance costs | | (538,381) | | | — |

Common stock issuance cost | | (179,380) | | | — |

Deferred offering costs | | (646,840) | | | (500,092) |

Payment of acquisition related consideration | | (250,125) | | | — |

Repayment of convertible debt | | — | | | (2,715,865) |

Short swing profit recovery | | 1,201 | | | — |

NET CASH PROVIDED BY FINANCING ACTIVITIES |

| 8,416,386 | |

| 6,337,022 |

| | | | | |

Change in cash and cash equivalents |

| (7,685,626) | |

| (3,452,823) |

Cash, beginning of period |

| 14,071,914 | |

| 4,162,548 |

Cash, end of period | $ | 6,386,288 | | $ | 709,725 |

| | | | | |

SUPPLEMENTAL DISCLOSURES OF CASH FLOW STATEMENTS |

|

| |

|

|

Cash paid for interest | $ | 945,939 | | $ | 153,009 |

Cash paid for income taxes | $ | 1,624 | | $ | 1,051 |

SUPPLEMENTAL DISCLOSURES OF NON CASH INVESTING AND FINANCING ACTIVITIES |

|

| |

|

|

Payment in kind common stock payment | $ | — | | $ | 177,000 |

Early extinguishment of convertible debt | $ | — | | $ | 944,614 |

Warrants issued in conjunction with debt | $ | 136,103 | | $ | 3,036,970 |

Beneficial conversion feature recorded as discounted debt | $ | — | | $ | 2,079,993 |

Unpaid deferred offering costs | $ | 157,731 | | $ | 40,017 |

Unpaid additions to property and equipment | $ | 412,256 | | $ | — |

See the accompanying notes to the consolidated financial statements

5

LOOP MEDIA, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(UNAUDITED)

NOTE 1 – BUSINESS

Loop Media, Inc., a Nevada corporation, (collectively, “Loop Media,” the “Company,” “we,” “us” or “our”) is a multichannel digital video platform media company that uses marketing technology, or “MarTech,” to generate our revenue and offer our services. Our technology and vast library of videos and licensed content enable us to curate and distribute short-form videos to out-of-home (“OOH”) dining, hospitality, retail, convenience stores and other locations and venues to enable them to inform, entertain and engage their customers. Our technology provides third-party advertisers with a targeted marketing and promotional tool for their products and services and, in certain instances, allows us to measure the number of potential viewers of such advertising and promotional materials. We also allow our OOH clients to access our service without advertisements by paying a monthly subscription fee.

We offer hand-curated music video content licensed from major and independent record labels, including Universal Music Group (“Universal”), Sony Music Entertainment (“Sony”), and Warner Music Group (“Warner” and collectively with Universal and Sony, the “Music Labels”), as well as non-music video content, which is predominantly licensed or acquired from third parties, including action sports clips, drone and atmospheric footage, trivia, news headlines, lifestyle channels and kid-friendly videos, as well as movie, television and video game trailers, amongst other content. We distribute our content and advertising inventory to digital screens located in OOH locations primarily through (i) our owned and operated platform (the “O&O Platform”) of Loop Media-designed “small-box” streaming Android media players (“Loop Players”) and legacy ScreenPlay computers and (ii) through screens on digital platforms owned and operated by third parties (each a “Partner Platform” and collectively, the “Partner Platforms,” and together with the O&O Platform, the “Loop Platform”).

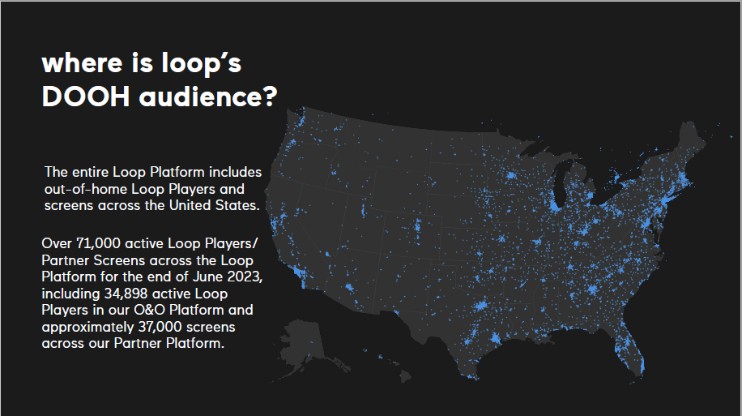

As of June 30, 2023, we had over 71,000 active Loop Players/Partner Screens across the Loop Platform for the end of June 2023, including 34,898 active Loop Players in our O&O Platform and approximately 37,000 screens across our Partner Platform. Please refer to “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Quarterly Active Units.”

Liquidity and management’s plan

As shown in the accompanying consolidated financial statements, we have incurred significant recurring losses resulting in an accumulated deficit. We anticipate further losses in the foreseeable future. We also had negative cash flows used in operations. These factors raise substantial doubt about our ability to continue as a going concern.

We filed a Shelf Registration Statement on Form S-3 that has been declared effective by the Securities and Exchange Commission (“SEC”). On May 12, 2023, we entered into an At Market (“ATM”) Issuance Sales Agreement (the “Sales Agreement”) with B. Riley Securities, Inc. (the “Agent”) pursuant to which we may offer and sell, from time to time through the Agent, shares of our common stock, par value $0.0001 per share (“Common Stock”), for aggregate gross proceeds of up to $50,000,000. During the three and nine months ended June 30, 2023, we issued 2,779,997 shares of Common Stock under the Sales Agreement, resulting in cash proceeds of $8,317,936, net of placement agent’s commission and related fees of $257,435 but before deducting offering costs. From July 1, 2023, through the filing date of this quarterly report on Form 10-Q, we have sold 95,000 shares of Common Stock under the Sales Agreement, resulting in cash proceeds of $247,739, net of placement agent’s commission and related fees of $7,711 but before deducting offering costs.

6

On May 10, 2023, we entered into a Secured Non-Revolving Line of Credit Loan Agreement (the “2023 Secured Loan Agreement”) with several institutions and individuals for aggregate loans of up to $4,000,000 (the “2023 Secured Loan”). As of June 30, 2023, a total principal amount of $900,000 had been drawn on the 2023 Secured Loan.

In addition, on May 31, 2023, we entered into a Secured Non-Revolving Line of Credit Loan Agreement (the “Excel Secured Line of Credit Agreement”) with Excel Family Partners, LLLP (“Excel”), an entity managed by Bruce Cassidy, Chairman of our Board of Directors (the “Excel $2.2M Line of Credit”) for the principal amount of up to $2,200,000. As of June 30, 2023, a total of $2,200,000 had been drawn on the Excel $2.2M Line of Credit.

Based on the available cash balance at June 30, 2023, and these new sources of funding, we believe that we will have sufficient resources to fund our operations for at least twelve months from the date these financial statements were issued and that the substantial doubt in connection with our ability to continue as a going concern is alleviated.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Interim Financial Statements

The following (a) condensed consolidated balance sheet as of September 30, 2022, which has been derived from our audited financial statements, and (b) our unaudited condensed consolidated interim financial statements for the nine months ended June 30, 2023, have been prepared in accordance with accounting principles generally accepted in the United States ("US GAAP") for interim financial information and the instructions to Form 10-Q and Rule 8-03 of Regulation S-X of the Securities Act of 1933. Accordingly, they do not include all of the information and footnotes required by US GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the nine months ended June 30, 2023, are not necessarily indicative of results that may be expected for the year ending September 30, 2023.

These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended September 30, 2022, included in our Annual Report on Form 10-K filed with the SEC on December 20, 2022.

Basis of presentation

The consolidated financial statements include our accounts and our wholly-owned subsidiaries, EON Media Group Pte. Ltd. and Retail Media TV, Inc. The unaudited condensed consolidated financial statements are prepared using the accrual basis of accounting in accordance with US GAAP. All inter-company transactions and balances have been eliminated on consolidation.

Use of estimates

The preparation of the unaudited condensed consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates include assumptions used in the revenue recognition of performance obligations, allowance for doubtful accounts, fair value of stock-based compensation awards, income taxes and going concern.

Segment reporting

We report as one reportable segment because we do not have more than one operating segment. Our business activities, revenues and expenses are evaluated by management as one reportable segment.

7

Cash

Cash and cash equivalents include all highly liquid monetary instruments with original maturities of three months or less when purchased. These investments are carried at cost, which approximates fair value. Financial instruments that potentially subject us to concentrations of credit risk consist primarily of cash deposits. We maintain our cash in institutions insured by the Federal Deposit Insurance Corporation (“FDIC”). At times, our cash and cash equivalent balances may be uninsured or in amounts that exceed the FDIC insurance limits. We have not experienced any losses on such accounts. On June 30, 2023, and September 30, 2022, we had no cash equivalents.

As of June 30, 2023, and September 30, 2022, approximately $6,136,288 and $13,821,914 of cash exceeded the FDIC insurance limits, respectively.

Accounts receivable

Accounts receivable represent amounts due from customers. We assess the collectability of receivables on an ongoing basis. A provision for the impairment of receivables involves significant management judgment and includes the review of individual receivables based on individual customers, current economic trends and analysis of historical bad debts. As of June 30, 2023, and September 30, 2022, we had recorded an allowance for doubtful accounts of $474,218 and $646,013, respectively.

Concentration of credit risk

During the nine months ended June 30, 2023, we had two customers which each individually comprised greater than 10% of net revenue. These customers represented 16% and 14% respectively. No other customer accounted for more than 10% of net revenue during the periods presented.

As of June 30, 2023, one customer accounted for a total of 15% of our accounts receivable balance. No other customer accounted for more than 10% of total accounts receivable.

We grant credit in the normal course of business to our customers. Periodically, we review past due accounts and make decisions about future credit on a customer-by-customer basis. Credit risk is the risk that one party to a financial instrument will cause a loss for the other party by failing to discharge an obligation.

Prepaid expenses

Expenditures paid in one accounting period which will not be consumed until a future period such as insurance premiums and annual subscription fees are accounted for on the balance sheet as a prepaid expense. When the asset is eventually consumed, it is charged to expense.

Content Assets

We capitalize the fixed content fees and corresponding liability when the license period begins, the cost of the content is known, and the content is accepted and available for streaming. If the licensing fee is not determinable or reasonably estimable, no asset or liability is recorded, and licensing costs are expensed as incurred. We amortize licensed content assets into cost of revenue, using the straight-line method over the contractual period of availability. The liability is paid in accordance with the contractual terms of the arrangement. Internally-developed content costs are capitalized in the same manner as licensed content costs, when the cost of the content is known and the content is ready and available for streaming. We amortize internally-developed content assets into cost of revenue, using the straight-line method over the estimated period of streaming.

Long-lived assets

We evaluate the recoverability of long-lived assets, including intangible assets, for impairment when events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Conditions that would

8

necessitate an impairment assessment include a significant decline in the observable market value of an asset, a significant change in the extent or manner that an asset is used, or a significant adverse change that would indicate that the carrying amount of an asset or group of assets is not recoverable. For long-lived assets to be held and used, we recognize an impairment loss only if their carrying amount is not recoverable through the undiscounted cash flows. The impairment loss is based on the difference between the carrying amount and estimated fair value as determined by discounted future cash flows. Our finite long-lived intangible assets are amortized on a straight-line basis over their estimated useful lives, which range from two to nine years.

Property and equipment, net

Property and equipment are stated at cost, less accumulated depreciation. Depreciation is calculated using the straight-line method over the asset’s estimated useful life. Our capitalization policy is to capitalize property and equipment purchases greater than $3,000, as well as internally-developed software enhancements. Expenditures for maintenance and repairs are expensed as incurred. When retired or otherwise disposed, the related carrying value and accumulated depreciation are removed from the respective accounts and the net difference less any amount realized from disposition is reflected in earnings.

Loop Players are capitalized as fixed assets and depreciated over the estimated period of use.

See below for estimated useful lives:

| | |

Loop Players | | 3 years |

Equipment |

| 3-5 years |

Software | | 3 years |

Operating leases

We determine if an arrangement is a lease at inception. Operating lease right-of-use assets (“ROU assets”) and short-term and long-term lease liabilities are included on the face of the consolidated balance sheet.

ROU assets represent the right to use an underlying asset for the lease term and lease liabilities represent our obligation to make lease payments arising from the lease. Operating lease ROU assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As most of our leases do not provide an implicit rate, we use an incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. Our lease terms may include options to extend or terminate the lease when it is reasonably certain that we will exercise that option. Lease expense for lease payments is recognized on a straight-line basis over the lease term. We have lease agreements with lease and non-lease components, which are accounted for as a single lease component. For lease agreements with terms less than twelve months, we have elected the short-term lease measurement and recognition exemption, and we recognize such lease payments on a straight-line basis over the lease term.

Fair value measurement

We determine the fair value of our assets and liabilities using a hierarchy established by the accounting guidance that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurements). The three levels of valuation hierarchy are defined as follows:

| ● | Level 1 inputs to the valuation methodology are quoted prices for identical assets or liabilities in active markets. |

9

| ● | Level 2 inputs to the valuation methodology included quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets in inactive markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. |

| ● | Level 3 inputs to the valuation methodology is one or more unobservable inputs which are significant to the fair value measurement. |

The carrying amount of our financial instruments, including cash, accounts receivable, deposits, short-term portion of notes receivable and notes payable, and current liabilities approximate fair value due to their short-term nature. We do not have financial assets or liabilities that are required under US GAAP to be measured at fair value on a recurring basis. We have not elected to use fair value measurement option for any assets or liabilities for which fair value measurement is not presently required.

We record assets and liabilities at fair value on a nonrecurring basis as required by US GAAP. Assets recognized or disclosed at fair value in the condensed consolidated financial statements on a nonrecurring basis include items such as property and equipment, operating lease assets, goodwill, and other intangible assets, which are measured at fair value if determined to be impaired.

On September 26, 2022, our convertible debentures converted to Common Stock as part of our public offering and uplist to The NYSE American, LLC, in accordance with the terms of the original debt agreements. As of September 30, 2022, the remaining balance of the Derivative Liability was written off as part of the conversion to equity. Thus, there is no fair value measurement of the Derivative Liability balance as of June 30, 2023.

The following table summarizes changes in fair value measurements of the Derivative Liability during the nine months ended June 30, 2022:

| | | |

Balance as of September 30, 2021 | | $ | 1,058,633 |

Derivative Liability issued with convertible debentures | |

| — |

Change in fair value | |

| (164,708) |

Balance as of June 30, 2022 | | $ | 893,925 |

Advertising costs

We expense all advertising costs as incurred. Advertising and marketing costs for the nine months ended June 30, 2023, and 2022, were $8,459,684 and $4,583,602, respectively.

Revenue recognition

We recognize revenue in accordance with ASC 606, Revenue from Contracts with Customers, when it satisfies a performance obligation by transferring control over a product to a customer. Revenue is measured based on the consideration we expect to receive in exchange for those products. In instances where final acceptance of the product is specified by the client, revenue is deferred until all acceptance criteria have been met. For example, we bill subscription services in advance of when the service is performed and revenue is treated as deferred revenue until the service is performed and/or the performance obligation is satisfied. Revenues are recognized under Topic 606 in a manner that reasonably reflects the delivery of our products and services to clients in return for expected consideration and includes the following elements:

| ● | executed contracts with our customers that we believe are legally enforceable; |

| ● | identification of performance obligations in the respective contract; |

| ● | determination of the transaction price for each performance obligation in the respective contract; |

10

| ● | allocation of the transaction price to each performance obligation; and |

| ● | recognition of revenue only when we satisfy each performance obligation. |

Our revenue can be categorized into two revenue streams: Advertising revenue and Legacy and other revenue.

The following table disaggregates our revenue by major type for each of the periods indicated:

| | | | | | | | | | | | |

| | Three months ended June 30, | | Nine months ended June 30, | ||||||||

| | | 2023 | | | 2022 | | | 2023 | | | 2022 |

Advertising revenue | | $ | 5,079,922 | | $ | 10,047,278 | | $ | 23,687,817 | | $ | 14,984,156 |

Legacy and other revenue | | | 655,054 | | | 756,805 | | | 2,266,221 | | | 3,695,800 |

Total | | $ | 5,734,976 | | $ | 10,804,083 | | $ | 25,954,038 | | $ | 18,679,956 |

Performance obligations and significant judgments

Our performance obligations and recognition patterns for each revenue stream are as follows:

Advertising revenue

For the three and nine months ended June 30, 2023, advertising revenue accounts for 89% and 91%, respectively, of our revenue and includes revenue from direct and programmatic advertising as well as sponsorships.

For all advertising revenue sources, we evaluate whether we should be considered the principal (i.e., report revenues on a gross basis) or an agent (i.e., report revenues on a net basis). Our role as principal or agent differs based on our performance obligation for each revenue share arrangement.

For both the O&O and Partner Platforms businesses, advertising inventory provided to advertisers through the use of an advertising demand partner or agency, with whose fees or commission is calculated based on a stated percentage of gross advertising spending, we are considered the agent and our revenues are reported net of agency fees and commissions. We are considered the agent because the demand partner or agency controls all aspects of the transaction (pricing risk, inventory risk, obligation for fulfillment) except for the devices used to show the advertisements, therefore we report this advertising revenue net of agency fees and commissions.

We are considered the principal in our arrangements with content providers in our O&O Platform business and with our arrangements with our third-party partners in our Partner Platforms business and thus report revenues on a gross basis (net of agency fees and commissions), wherein the amounts billed to our advertising demand partners, advertising agencies, and direct advertisers and sponsors are recorded as revenues, and amounts paid to content providers and third-party partners are recorded as expenses. We are considered the principal because we control the advertising space, are primarily responsible to our advertising demand partners and other parties filling our advertising inventory, have discretion in pricing and advertising fill rates and typically have an inventory risk.

For advertising revenue, we recognize revenue at the time the digital advertising impressions are filled and the advertisements are played and, for sponsorship revenue, we generally recognize revenue ratably over the term of the sponsorship arrangement as the sponsored advertisements are played.

Legacy and other business revenue

For the three and nine months ended June 30, 2023, legacy and other business revenue accounts for the remaining 11% and 9%, respectively, of total revenue and includes streaming services, subscription content services, and hardware delivery, as described below:

11

| o | Delivery of streaming services including content encoding and hosting. We recognize revenue over the term of the service based on bandwidth usage. Revenue from streaming services is insignificant. |

| o | Delivery of subscription content services in customized formats. We recognize revenue straight-line over the term of the service. |

| o | Delivery of hardware for ongoing subscription content delivery through software. We recognize revenue at the point of hardware delivery. Revenue from hardware sales is insignificant. |

Transaction prices for performance obligations are explicitly outlined in relevant agreements; therefore, we do not believe that significant judgments are required with respect to the determination of the transaction price, including any variable consideration identified.

Customer acquisition costs

Customer acquisition costs consist of marketing costs and affiliate fees associated with the O&O Platform business. They are included in operating expenses and expensed as incurred.

Cost of revenue

Cost of revenue for the O&O Platform and legacy businesses represents the amortized cost of ongoing licensing and hosting fees, which is recognized over time based on usage patterns. The depreciation expense associated with the Loop Players is not included in cost of sales.

Cost of revenue for the Partner Platform business represents hosting fees, amortized costs of internally-developed content, and the revenue share with third party partners (after deduction of allocated infrastructure costs). The cost of revenue is higher with partners within the Partner Platform versus those within the O&O Platform because we leverage our Partner Platform partners’ network of customers and their screens to deliver content and advertising inventory, rather than using our own Loop Players.

Deferred income

As of June 30, 2023, we no longer bill subscription services in advance of when the service period is performed. The deferred income recorded at September 30, 2022, represents our accounting for the timing difference between when the subscription fees are received and when the performance obligation is satisfied.

Net loss per share

We account for net loss per share in accordance with ASC subtopic 260-10, Earnings Per Share (“ASC 260-10”), which requires presentation of basic and diluted earnings per share (“EPS”) on the face of the statement of operations for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS.

Basic net loss per share is computed by dividing net loss attributable to common stockholders by the weighted average number of shares of Common Stock outstanding during each period. It excludes the dilutive effects of any potentially issuable common shares.

Diluted net loss per share is calculated by including any potentially dilutive share issuances in the denominator.

12

The following securities are excluded from the calculation of weighted average diluted shares at June 30, 2023, and September 30, 2022, respectively, because their inclusion would have been anti-dilutive.

| | | | |

|

| June 30, |

| September 30, |

| | 2023 | | 2022 |

Options to purchase Common Stock |

| 8,555,560 |

| 8,174,583 |

Warrants to purchase Common Stock |

| 5,383,175 |

| 5,300,033 |

Restricted Stock Units (RSUs) | | 1,102,004 | | 890,000 |

Series A preferred stock |

| — |

| — |

Series B preferred stock |

| — |

| — |

Convertible debentures |

| — |

| — |

Total Common Stock equivalents |

| 15,040,739 |

| 14,364,616 |

Shipping and handling costs

Loop Players are provided free to our customers. Loop Media absorbs any associated costs of shipping and handling and records as an operational expense at the time of service.

Income taxes

We account for income taxes in accordance with ASC Topic 740, Income Taxes (“ASC 740”). ASC 740 requires a company to use the asset and liability method of accounting for income taxes, whereby deferred tax assets are recognized for deductible temporary differences, and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion, or all of, the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effect of changes in tax laws and rates on the date of enactment.

Under ASC 740, a tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. We have no material uncertain tax positions for any of the reporting periods presented.

We recognize accrued interest and penalties related to unrecognized tax benefits as part of income tax expense. We have also made a policy election to treat the income tax with respect to global intangible low-tax income as a period expense when incurred.

In December 2019, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2019-12, Simplifying the Accounting for Income Taxes, as part of its initiative to reduce complexity in accounting standards. The amendments in the ASU are effective for fiscal years beginning after December 15, 2020, including interim periods therein. The adoption of this standard in the first quarter of 2022 had no impact on our consolidated financial statements.

Stock-based compensation

Stock-based compensation issued to employees is measured at the grant date, based on the fair value of the award, and is recognized as an expense over the requisite service period. We measure the fair value of the stock-based compensation issued to non-employees using the stock price observed in the trading market (for stock transactions) or the fair value of the award (for non-stock transactions), which were more reliably determinable measures of fair value than the value of the services being rendered.

13

Deferred financing costs

Deferred financing costs represent legal, accounting and other direct costs related to our efforts to raise capital through a public or private sale of our Common Stock. Costs related to the public sale of our Common Stock are deferred until the completion of the applicable offering, at which time such costs are reclassified to additional paid-in-capital as a reduction of the proceeds. Costs related to the private sale of our Common Stock are deferred until the completion of the applicable offering, at which time such costs are amortized over the term of the applicable purchase agreement.

Employee retention credits

In March 2020, the Coronavirus Aid, Relief, and Economic Security Act was signed into law, providing numerous tax provisions and other stimulus measures, including the Employee Retention Credit (“ERC”): a refundable tax credit against certain employment taxes. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 and the American Rescue Plan Act of 2021 extended and expanded the availability of the ERC. We qualified for the ERC in the third and fourth quarters of 2020 and the first, second and third quarters of 2021. During the three months ended June 30, 2023, we recorded an aggregate benefit of $648,543 in our condensed combined income statement to reflect the ERC.

Reclassifications

Certain prior year amounts have been reclassified to conform to current year presentation. These reclassifications have no effect on the previously reported financial position, results of operations, or cash flows. Previously reported accounts payable and accrued liabilities have now been disaggregated into accounts payable, accrued liabilities, and accrued royalty. Further, stock-based compensation and depreciation and amortization expenses have now been segregated from sales, general and administrative expenses and separately reported within operating expenses.

Recently adopted accounting pronouncements

In August 2020, the FASB issued ASU 2020-06, Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40). This ASU reduces the number of accounting models for convertible debt instruments and convertible preferred stock as well as amend the guidance for the derivatives scope exception for contracts in an entity’s own equity to reduce form-over-substance-based accounting conclusions. In addition, this ASU improves and amends the related EPS guidance. The ASU is effective for interim and annual periods beginning after December 15, 2021, with early adoption permitted for periods beginning after December 15, 2020. Adoption of the ASU can either be on a modified retrospective or full retrospective basis. We adopted this ASU as of October 1, 2022, and there is no material impact as of June 30, 2023.

Recent accounting pronouncements

In September 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. This guidance requires the measurement of all expected credit losses for financial assets held at the reporting date based on historical experience, current conditions and reasonable and supportable forecasts. This guidance also requires enhanced disclosures regarding significant estimates and judgments used in estimating credit losses. The new guidance is effective for fiscal years beginning after December 15, 2022. We are currently evaluating the impact of this standard on our condensed consolidated financial statements and related disclosures.

NOTE 3 – CONTENT ASSETS

Content Assets

The content we stream to our users is generally acquired by securing the intellectual property rights to the content through licenses from, and paying royalties or other consideration to, rights holders or their agents. The licensing can be for a fixed fee or can be a revenue sharing arrangement. The licensing arrangements specify the period when the content is available for streaming, the territories, the platforms, the fee structure and other standard content licensing terms

14

defining the rights and/or restrictions for how the licensed content can be used by Loop Media. We also develop original content internally, which is capitalized when the content is ready and available for streaming, and generally amortized over a period of two to three years.

As of June 30, 2023, content assets were $2,462,777 recorded as Content asset, net – current and $579,869 recorded as Content asset, net – noncurrent, of which $159,077 was internally-developed content asset, net.

We recorded amortization expense in cost of revenue, in the consolidated statements of operations, related to capitalized content assets:

| | | | | | | | | | | | |

| | | | | | |

| | | | ||

| | Three months ended June 30, | | Nine months ended June 30, | ||||||||

| | 2023 |

| 2022 | | 2023 |

| 2022 | ||||

Licensed Content Assets | | $ | 760,951 | | $ | 275,823 | | $ | 2,045,794 | | $ | 933,036 |

Internally-Developed Assets | | | 18,215 | | | — | | | 46,082 | | | — |

Total | | $ | 779,166 | | $ | 275,823 | | $ | 2,091,876 | | $ | 933,036 |

Our content license contracts are typically two to three years. The amortization expense for the next three years for capitalized content assets as of June 30, 2023:

| | | | | | | | | | | | |

| | Remaining in Fiscal Year 2023 | | Fiscal Year 2024 | | Fiscal Year 2025 | | Fiscal Year 2026 | ||||

Licensed Content Assets | | $ | 755,022 | | $ | 2,010,157 | | $ | 115,726 | | $ | 2,664 |

Internally-Developed Assets | |

| 18,215 | |

| 72,860 | |

| 59,440 | |

| 8,562 |

Total | | $ | 773,237 | | $ | 2,083,017 | | $ | 175,166 | | $ | 11,226 |

| | | | | | | | | | | | |

License Content Liabilities

On June 30, 2023, we had $935,664 of obligations comprised of $568,906 in License content liability – current and $366,758 in accounts payable on our consolidated balance sheets. Payments for content liabilities for the nine months ended June 30, 2023, were $4,206,768. The expected timing of payments for these content obligations is $280,320 payable in the fourth quarter of fiscal year 2023 with the remaining payable in the first, second and third quarters of fiscal year 2024.

NOTE 4. PROPERTY AND EQUIPMENT

Our property and equipment, net consisted of the following as of June 30, 2023, and September 30, 2022:

| | | | | | |

|

| June 30, |

| September 30, | ||

| | 2023 | | 2022 | ||

Loop Players | | $ | 2,251,061 | | $ | 1,259,402 |

Equipment | | | 1,195,521 | | | 703,341 |

Software | |

| 815,966 | |

| 404,058 |

| |

| 4,262,548 | |

| 2,366,801 |

Less: accumulated depreciation | |

| (1,349,389) | |

| (733,632) |

Total property and equipment, net | | $ | 2,913,159 | | $ | 1,633,169 |

For the three months ended June 30, 2023, and 2022, depreciation expense, calculated using straight line method, charged to operations amounted to $249,256 and $102,752, respectively.

15

For the nine months ended June 30, 2023, and 2022, depreciation expense, calculated using straight line method, charged to operations amounted to $615,764 and $111,332, respectively.

NOTE 5. INTANGIBLE ASSETS

Our intangible assets, each definite lived assets, consisted of the following as of June 30, 2023, and September 30, 2022:

| | | | | | | | |

| | | | June 30, |

| September 30, | ||

|

| Useful life |

| 2023 |

| 2022 | ||

Customer relationships | | nine years | | $ | 1,012,000 | | $ | 1,012,000 |

Content library | | two years | |

| 198,000 | |

| 198,000 |

Total intangible assets, gross | | | |

| 1,210,000 | |

| 1,210,000 |

| | | | | | | | |

Less: accumulated amortization | | | |

| (704,000) | |

| (619,667) |

Total | | | |

| (704,000) | |

| (619,667) |

Total intangible assets, net | | | | $ | 506,000 | | $ | 590,333 |

Amortization expense charged to operations amounted to $28,111 and $28,111, for the three months ended June 30, 2023, and 2022, respectively.

Amortization expense charged to operations amounted to $84,333 and $84,333, respectively, for the nine months ended June 30, 2023, and 2022.

Annual amortization expense for the next five years and thereafter is estimated to be $28,112 (remaining in fiscal year 2023), $112,444, $112,444, $112,444, $112,444, and $28,112, respectively. The weighted average life of the intangible assets subject to amortization is 4.5 years on June 30, 2023.

NOTE 6 – OPERATING LEASES

Operating leases

As of June 30, 2023, we no longer have operating leases for office space and office equipment in excess of one year. Many of our prior leases included one or more options to renew, some of which included options to extend the leases for a long-term period, and some leases included options to terminate the leases within 30 days. In certain of our prior lease agreements, the rental payments were adjusted periodically to reflect actual charges incurred for capital area maintenance, utilities, inflation and/or changes in other indexes.

Our lease liability consisted of the following as of June 30, 2023, and September 30, 2022:

| | | | | | |

|

| June 30, |

| September 30, | ||

| | 2023 | | 2022 | ||

Short term portion | | $ | — | | $ | 75,529 |

Long term portion | |

| — | |

| — |

Total lease liability | | $ | — | | $ | 75,529 |

We recorded lease expense in sales, general and administration expenses in the consolidated statement of operations:

| | | | | | | | | | | | |

| | Three months ended June 30, | | Nine months ended June 30, | ||||||||

|

| 2023 |

| 2022 | | 2023 |

| 2022 | ||||

Operating lease expense | | $ | 17,495 | | $ | 44,444 | | $ | 79,434 | | $ | 133,332 |

Short-term lease expense | |

| 34,828 | |

| 2,400 | |

| 69,659 | |

| 6,600 |

16

Total lease expense | | $ | 52,323 | | $ | 46,844 | | $ | 149,093 | | $ | 139,932 |

For the nine months ended June 30, 2023, cash payments against lease liabilities totaled $77,929, and accretion on lease liability of $2,737.

For the nine months ended June 30, 2022, cash payments against lease liabilities totaled $138,066, accretion on lease liability of $14,613.

NOTE 7 – ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses consisted of the following as of June 30, 2023, and September 30, 2021:

| | | | | | |

|

| June 30, |

| September 30, | ||

| | 2023 | | 2022 | ||

Accounts payable | | $ | 5,204,563 | | $ | 7,453,801 |

| | | | | | |

Performance bonuses | |

| 1,262,000 | | | 2,970,000 |

Interest payable | | | 439,711 | | | 348,150 |

Professional fees | | | 431,698 | |

| 505,169 |

Marketing | | | 254,206 | | | 344,309 |

Commissions | |

| 57,782 | |

| 425,321 |

Insurance liabilities | | | 31,399 | | | 602,970 |

Other accrued liabilities | | | 244,831 | | | 424,954 |

Accrued liabilities | |

| 2,721,627 | |

| 5,620,873 |

| | | | | | |

Accrued royalties and revenue share | | | 3,810,862 | | | 4,559,088 |

| | | | | | |

Total accounts payable and accrued expenses | | $ | 11,737,052 | | $ | 17,633,762 |

17

NOTE 8 – DEBT

| | | | | | | | | | | | | | | |

Lines of Credit as of June 30, 2023: | | | | | | | | | | | | | | | |

| | | | | | | | Unpaid | | Contractual | | | | | |

| | Net Carrying Value | | Principal | | Interest Rates | | Contractual | | Warrants | |||||

Related party lines of credit: | | Current | | Long Term | | Balance | | Cash | | Maturity Date | | issued | |||

$4,022,986 non-revolving line of credit, amended December 12, 2022 | | $ | 3,293,289 | | $ | — | | $ | 4,022,986 | | 12% | | 5/25/2024 | | 383,141 |

$2,200,000 non-revolving line of credit, May 31, 2023 | | | 2,200,000 | | | — | | | 2,200,000 | | 10.50% | | 8/31/2023 | | — |

$2,650,000 non-revolving line of credit, May 10, 2023 | | | — | | | — | | | — | | 12% | | 5/10/2025 | | — |

Total related party lines of credit, net | | $ | 5,493,289 | | $ | — | | $ | 6,222,986 | | | | | | |

| | | | | | | | | | | | | | | |

Lines of credit: | | | | | | | | | | | | | | | |

$2,200,000 non-revolving line of credit, May 13, 2022 | | $ | 1,967,157 | | $ | — | | $ | 2,200,000 | | 12% | | 11/13/2023 | | 314,286 |

$1,350,000 non-revolving line of credit, May 10, 2023 | | | — | | | 409,632 | | | 900,000 | | 12% | | 5/10/2025 | | 83,142 |

$6,000,000 revolving line of credit, July 29, 2022 | | | — | | | 2,246,060 | | | 3,155,361 | | Greater of 4% or Prime | | 7/29/2024 | | — |

Total lines of credit, net | | $ | 1,967,157 | | $ | 2,655,692 | | $ | 6,255,361 | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Lines of Credit as of September 30, 2022: | | | | | | | | | | | | | | | |

| | | | | | | | Unpaid | | Contractual | | | | | |

| | Net Carrying Value | | Principal | | Interest Rates | | Contractual | | Warrants | |||||

Related party lines of credit: | | Current | | Long Term | | Balance | | Cash | | Maturity Date | | issued | |||

$4,022,986 non-revolving line of credit, April 25, 2022 | (1) | $ | — | | $ | 2,575,753 | | $ | 4,022,986 | | 12% | | 10/25/2023 | | 383,141 |

Total related party lines of credit, net | | $ | — | | $ | 2,575,753 | | $ | 4,022,986 | | | | | | |

| | | | | | | | | | | | | | | |

Lines of credit: | | | | | | | | | | | | | | | |

$2,200,000 non-revolving line of credit, May 13, 2022 | (2) | $ | — | | $ | 1,494,469 | | $ | 2,200,000 | | 12% | | 11/13/2023 | | 314,286 |

$6,000,000 revolving line of credit, July 29, 2022 | | | — | | | 3,030,516 | | | 4,543,560 | | Greater of 4% or Prime | | 7/29/2024 | | — |

Total lines of credit, net | | $ | — | | $ | 4,524,985 | | $ | 6,743,560 | | | | | | |

18

The following table presents the interest expense related to the contractual interest coupon and the amortization of debt discounts on the lines of credit:

| | | | | | | | | | | | |

| | Three months ended June 30, | | Nine months ended June 30, | ||||||||

| | | 2023 | | | 2022 | | | 2023 | | | 2022 |

Interest expense | | $ | 364,604 | | $ | 247,622 | | $ | 1,037,499 | | $ | 502,310 |

Amortization of debt discounts | | | 597,674 | | | 819,313 | | | 1,842,003 | | | 1,532,792 |

Total | | $ | 962,278 | | $ | 1,066,935 | | $ | 2,879,502 | | $ | 2,035,102 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Maturity analysis under the line of credit agreements for the fiscal years ended September 30, | | | | | | | | | | | | |

2023 | | $ | 2,200,000 | | | | | | | | | |

2024 | | | 9,378,347 | | | | | | | | | |

2025 | | | 900,000 | | | | | | | | | |

2026 | | | — | | | | | | | | | |

2027 | | | — | | | | | | | | | |

Lines of credit, related and non-related party | | | 12,478,347 | | | | | | | | | |

Less: Debt discount on lines of credit payable | | | (2,362,186) | | | | | | | | | |

Total Lines of credit payable, related and non-related party, net | | $ | 10,116,161 | | | | | | | | | |

Non-Revolving Lines of Credit

Excel Non-Revolving Loan

On February 23, 2022, we entered into a Non-Revolving Line of Credit Loan Agreement (the “Prior Excel Loan Agreement”) with Excel, an entity managed by Bruce Cassidy, Chairman of our Board of Directors, for aggregate principal amount of $1,500,000, which was amended on April 13, 2022, to increase the aggregate

19

principal amount to $2,000,000 (the “$2m Loan”). Effective as of April 25, 2022, we entered into a Non-Revolving Line of Credit Loan Agreement with Excel (the “Excel Non-Revolving Loan Agreement”) for an aggregate principal amount of $4,022,986 (the “Excel Non-Revolving Loan”). The Excel Non-Revolving Loan matures eighteen (18) months from the date of the Excel Non-Revolving Loan Agreement and accrues interest, payable semi-annually in arrears, at a fixed rate of interest equal to twelve (12) percent per year. On April 25, 2022, we used $2,000,000 of the proceeds of the Excel Non-Revolving Loan to prepay all of the remaining outstanding principal and interest of the $2m Loan and the Prior Excel Loan Agreement was terminated in connection with such prepayment. Under the Excel Non-Revolving Loan Agreement, we granted to the lender a security interest in all of our present and future assets and properties, real or personal, tangible or intangible, wherever located, including products and proceeds thereof (which was subsequently subordinated in connection with our Revolving Loan Agreement (as defined below)). In connection with the Excel Non-Revolving Loan, on April 25, 2022, we issued a warrant for an aggregate of up to 383,141 shares of our Common Stock. The warrant has an exercise price of $5.25 per share, expires on April 25, 2025, and shall be exercisable at any time prior to the expiration date. Effective as of December 14, 2022, we entered into a Non-Revolving Line of Credit Agreement Amendment and a Non-Revolving Line of Credit Promissory Note Amendment with Excel to extend the maturity date of the Excel Non-Revolving Loan from eighteen (18) months to twenty-four (24) months from the date of the Excel Non-Revolving Loan. Effective as of May 10, 2023, we entered into a Non-Revolving Line of Credit Agreement Amendment No. 2 and a Non-Revolving Line of Credit Promissory Note Amendment No. 2 with Excel to extend the maturity date of the Excel Non-Revolving Loan from twenty-four (24) months to twenty-five (25) months from the date of the Excel Non-Revolving Loan.

The Excel Non-Revolving Loan had a balance, including accrued interest, amounting to $4,352,871 and $4,226,181 as of June 30, 2023, and September 30, 2022, respectively. We incurred interest expense for the Excel Non-Revolving Loan in the amount of $1,080,945 and $331,548 for the nine months ended June 30, 2023, and 2022, respectively.

RAT Non-Revolving Loan

Effective as of May 13, 2022, we entered into a Secured Non-Revolving Line of Credit Loan Agreement (the “RAT Non-Revolving Loan Agreement”) with several institutions and individuals and RAT Investment Holdings, LP, as administrator of the loan (the “Loan Administrator”) for an aggregate principal amount of $2,200,000 (the “RAT Non-Revolving Loan”). The RAT Non-Revolving Loan matures eighteen (18) months from the effective date of the RAT Non-Revolving Loan Agreement and accrues interest, payable semi-annually in arrears, at a fixed rate of interest equal to twelve (12) percent per year. Under the RAT Non-Revolving Loan Agreement, we granted to the lenders under the RAT Non-Revolving Loan Agreement a security interest in all of our present and future assets and properties, real or personal, tangible or intangible, wherever located, including products and proceeds thereof, which security interest is pari passu with the Excel Non-Revolving Loan Agreement (which was subsequently subordinated in connection with our Revolving Loan Agreement). In connection with the RAT Non-Revolving Loan Agreement, on May 13, 2022, we issued a warrant to each lender under the RAT Non-Revolving Loan Agreement for an aggregate of up to 209,522 shares of our Common Stock. Each warrant has an exercise price of $5.25 per share, expires on May 13, 2025, and shall be exercisable at any time prior to the expiration date.

The warrants were accounted for as equity awards. We allocated the debt and warrant on a relative fair value basis to the proceeds received for the non-revolving lines of credit. We further allocated the fair value of $2,975,261 of the warrants at inception as a debt discount and recorded the straight-line amortization of debt discount as interest expense.

The RAT Non-Revolving Loan had a balance, including accrued interest, amounting to $2,234,356 and $2,301,260 as of June 30, 2023, and September 30, 2022, respectively. We incurred interest expense for the RAT Non-Revolving Loan in the amount of $670,146 and $118,970 for the nine months ended June 30, 2023, and 2022, respectively.

20

2023 Secured Loan

Effective as of May 10, 2023, we entered into the 2023 Secured Loan Agreement with several individuals and institutional lenders (each individually a “Lender” and collectively, the “Lenders”) with several individuals and institutional lenders (each individually a “Lender” and collectively, the “Lenders”) for aggregate loans of up to $4.0 million (the “2023 Secured Loan”), evidenced by Secured Non-Revolving Line of Credit Promissory Notes (each a “2023 Secured Note” and collectively, the “2023 Secured Notes”), also effective as of May 10, 2023. The 2023 Secured Loan matures twenty-four (24) months from the date of the 2023 Secured Loan Agreement and accrues interest, payable semi-annually in arrears, at a fixed rate of interest equal to twelve (12) percent per year. Excel, an entity managed by Bruce Cassidy, Chairman of our Board of Directors, has committed to be a Lender under the 2023 Secured Loan Agreement for an aggregate loan of $2.65 million. As of the date of this filing, Excel has not loaned any funds to us under the 2023 Secured Loan. As of June 30, 2023, a total principal amount of $900,000 had been drawn on the 2023 Secured Loan.

In connection with the 2023 Secured Loan, on May 10, 2023, we agreed to issue a warrant to each Lender, upon drawdown, under the 2023 Secured Loan Agreement to purchase up to an aggregate of 369,517 shares of our Common Stock. The warrants have an exercise price of $4.33 per share, expire on May 10, 2026, and shall be exercisable at any time prior to such date. As of June 30, 2023, we had issued warrants for a total of 83,142 warrant shares to Lenders in connection with the 2023 Secured Loan.

Under the 2023 Secured Loan Agreement, we have granted to the lenders a security interest in all of our present and future assets and properties, real or personal, tangible or intangible, wherever located, including products and proceeds thereof. In connection with the 2023 Secured Loan Agreement, the lenders delivered subordination agreements to GemCap Solutions, LLC, as successor and assign to Industrial Funding Group, Inc.(the “Senior Lender” or “GemCap”), pursuant to which our obligations to the lenders and the indebtedness under the 2023 Secured Loan Agreement are subordinate and junior in right of payment to the indebtedness under our account receivable facility evidenced by that certain Loan and Security Agreement dated as of July 29, 2022, with the Senior Lender (the “Revolving Loan Agreement”).

The 2023 Secured Loan had a balance, including accrued interest, amounting to $915,000 and $0 as of June 30, 2023, and September 30, 2022, respectively. We incurred interest expense for the 2023 Secured Loan in the amount of $40,736 and $0 for the nine months ended June 30, 2023, and 2022, respectively.

Excel $2.2M Line of Credit

On May 31, 2023, we entered into the Excel Secured Line of Credit Agreement with Excel, an entity managed by Bruce Cassidy, Chairman of our Board of Directors for the Excel $2.2M Line of Credit, evidenced by a Non-Revolving Line of Credit Promissory Note. The Excel $2.2M Line of Credit matures ninety (90) days from the date of the Excel Secured Line of Credit Agreement and accrues interest, payable in arrears on the Excel $2.2M Line of Credit maturity date, at a fixed rate of interest equal to ten and one half (10.5) percent per year.

Under the Excel Secured Line of Credit Agreement, we granted to Excel a security interest in all of our present and future assets and properties, real or personal, tangible or intangible, wherever located, including products and proceeds thereof. In connection with the Excel Secured Line of Credit Agreement, Excel delivered a subordination agreement to the Senior Lender, pursuant to which our obligations to Excel and the indebtedness under the Excel Secured Line of Credit Agreement are subordinate and junior in right of payment to the indebtedness under the account receivable facility evidenced by the Revolving Loan Agreement.

21

The Excel $2.2M Line of Credit had a balance, including accrued interest, amounting to $2,219,250 and $0 as of June 30, 2023, and September 30, 2022, respectively. We incurred interest expense for the Excel $2.2M Line of Credit in the amount of $19,250 and $0 for the three months ended June 30, 2023, and 2022, respectively, and $19,250 and $0 for the nine months ended June 30, 2023, and 2022, respectively.

Revolving Loan Agreement

Effective as of July 29, 2022, we entered into the Revolving Loan Agreement with Industrial Funding Group, Inc. (the “Initial Lender”) for a revolving loan credit facility for the initial principal sum of up to $4,000,000, and through the exercise of an accordion feature, a total sum of up to $10,000,000, evidenced by a Revolving Loan Secured Promissory Note, also effective as of July 29, 2022 (the “Revolving Loan”). Shortly after the effective date of the Revolving Loan, the Initial Lender assigned the Revolving Loan Agreement, and the loan documents related thereto, to the Senior Lender. Availability for borrowing under the Revolving Loan Agreement is dependent upon our assets in certain eligible accounts and measures of revenue, subject to reduction for reserves that the Senior Lender may require in its discretion, and the accordion feature is a provision whereby we may request that the Senior Lender increase availability under the Revolving Loan Agreement, subject to its sole discretion. Effective as of October 27, 2022, we entered into Amendment Number 1 to the Revolving Loan Agreement with the Senior Lender to increase the principal sum available from $4,000,000 to $6,000,000. As of June 30, 2023, we had borrowed $3,155,361 under the Revolving Loan. The Revolving Loan matures on July 29, 2024, and began accruing interest on the unpaid principal balance of advances, payable monthly in arrears, on September 7, 2022, at an annual rate equal to the greater of (I) the sum of (i) the “Prime Rate” as reported in the “Money Rates” column of The Wall Street Journal, adjusted as and when such Prime Rate changes, plus (ii) zero percent (0.00%), and (II) four percent (4.00%). Under the Revolving Loan Agreement, we have granted to the Senior Lender a first-priority security interest in all of our present and future property and assets, including products and proceeds thereof. In connection with the loan, our existing secured lenders (the “Subordinated Lenders”) delivered subordination agreements (the “Revolving Loan Subordination Agreements”) to the Senior Lender. We are permitted to make regularly scheduled payments, including payments upon maturity, to such subordinated lenders and potentially other payments subject to a measure of cash flow and receiving certain financing activity proceeds, in accordance with the terms of the Revolving Loan Subordination Agreements. In connection with the delivery of the Revolving Loan Subordination Agreements by the Subordinated Lenders, on July 29, 2022, we issued warrants to each Subordinated Lender on identical terms for an aggregate of up to 296,329 shares of our Common Stock. Each warrant has an exercise price of $5.25 per share, expires on July 29, 2025, and shall be exercisable at any time prior to such date. One warrant for 191,570 warrant shares was issued to Eagle Investment Group, LLC, an entity managed by Bruce Cassidy, Chairman of our Board of Directors, as directed by its affiliate, Excel, one of the Subordinated Lenders. The Subordinated Lenders receiving warrants for the remaining 104,759 warrant shares were also entitled to receive a cash payment of $22,000 six months from the date of the Revolving Loan Subordination Agreements, representing one percent (1.00%) of the outstanding principal amount of the loan held by such Subordinated Lenders. This cash payment was made to such Subordinated Lenders on January 25, 2023.

The warrants were accounted for as equity awards. We allocated the debt and warrant on a relative fair value basis to the proceeds received for the revolving loan agreement. We further allocated the fair value of the $1,347,719 of the warrants at inception as a debt discount and recorded the straight-line amortization of debt discount as interest expense.

The Revolving Loan had a balance, including accrued interest, amounting to $3,196,581 and $4,587,255 as of June 30, 2023, and September 30, 2022, respectively. We incurred interest expense for the Revolving Loan in the amount of $1,068,425 and $0 for the nine months ended June 30, 2023, and 2022, respectively.

22

NOTE 9 – COMMITMENTS AND CONTINGENCIES

We may be involved in legal proceedings, claims and assessments arising in the ordinary course of business. Such matters are subject to many uncertainties, and outcomes are not predictable with assurance. There are no such loss contingencies that are included in the financial statements as of June 30, 2023.

NOTE 10 – RELATED PARTY TRANSACTIONS

Related parties are natural persons or other entities that have the ability, directly or indirectly, to control another party or exercise significant influence over the party making financial and operating decisions. Related parties include other parties that are subject to common control or that are subject to common significant influences.

Revolving Loan Agreement

Effective as of July 29, 2022, we entered into the Revolving Loan Agreement. In connection with the loan under the Revolving Loan Agreement, the Subordinated Lenders delivered the Revolving Loan Subordination Agreements to the Senior Lender. In connection with the delivery of the Revolving Loan Subordination Agreements by the Subordinated Lenders, on July 29, 2022, we issued warrants to each Subordinated Lender on identical terms for an aggregate of up to 296,329 shares of our Common Stock. Each warrant has an exercise price of $5.25 per share, expires on July 29, 2025. One warrant for 191,570 warrant shares was issued to Eagle Investment Group, LLC, an entity managed by Bruce Cassidy, Chairman of our Board of Directors, as directed by its affiliate, Excel, one of the Subordinated Lenders.

Excel Non-Revolving Loan Agreement