Investor Presentation August 4, 2021

2 Forward Looking Statements This investor presentation contains statements reflecting our views about the future performance of Hostess Brands, Inc. and its subsidiaries (referred to as “Hostess Brands” or the “Company”) that constitute “forward-looking statements” that involve substantial risks and uncertainties. Forward-looking statements are generally identified through the inclusion of words such as “believes,” “expects,” “intends,” “estimates,” “projects,” “anticipates,” “will,” “plan,” “may,” “should,” or similar language. Statements addressing our future operating performance and statements addressing events and developments that we expect or anticipate will occur are also considered forward-looking statements. All forward looking statements included herein are made only as of the date hereof. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise. These statements inherently involve risks and uncertainties that could cause actual results to differ materially from those anticipated in such forward-looking statements. These risks and uncertainties include, but are not limited to; our ability to maintain, extend or expand our reputation and brand image; failing to protect our intellectual property rights; our ability to leverage our brand value to compete against lower-priced alternative brands; our ability to correctly predict, identify and interpret changes in consumer preferences and demand and offering new products to meet those changes; our ability to operate in a highly competitive industry; our ability to maintain or add additional shelf or retail space for our products; our ability to continue to produce and successfully market products with extended shelf life; our ability to successfully integrate, achieve expected synergies and manage our acquired businesses and brands; our ability to drive revenue growth in our key products or add products that are faster-growing and more profitable; volatility in commodity, energy, and other input prices and our ability to adjust our pricing to cover any increased costs; the availability and pricing of transportation to distribute our products; our dependence on our major customers; our geographic focus could make us particularly vulnerable to economic and other events and trends in North America; consolidation of retail customers; increased costs to comply with governmental regulation; general political, social and economic conditions; increased healthcare and labor costs; the fact that a portion of our workforce belongs to unions and strikes or work stoppages could cause our business to suffer; product liability claims, product recalls, or regulatory enforcement actions; unanticipated business disruptions; dependence on third parties for significant services; inability to identify or complete strategic acquisitions; our insurance not providing adequate levels of coverage against claims; failures, unavailability, or disruptions of our information technology systems; departure of key personnel or a highly skilled and diverse workforce; and our ability to finance our indebtedness on terms favorable to us; and other risks as set forth under the caption “Risk Factors” from time to time in our Securities and Exchange Commission filings. The impact of COVID-19 may also exacerbate these risks, any of which could have a material effect on the Company. This situation is changing rapidly and additional impacts may arise that the Company is not aware of currently. All subsequent written or oral forward-looking statements attributable to us or persons acting on the Company's behalf are expressly qualified in their entirety by these risk factors. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise. Industry and Market Data In this Investor Presentation, Hostess Brands relies on and refers to information and statistics regarding market shares in the sectors in which it competes and other industry data. Hostess Brands obtained this information and statistics from third-party sources, including reports by market research firms, such as Nielsen. All prior period market data in this presentation reflects the restatement of convenience channel data executed by Nielsen during 2020. Additionally, prior period Nielsen data was adjusted to exclude the Cloverhill® and Big Texas® brands in the periods they were not owned by Hostess. Hostess Brands has supplemented this information where necessary with information from discussions with Hostess customers and its own internal estimates, taking into account publicly available information about other industry participants and Hostess Brands’ management’s best view as to information that is not publicly available. Use of Non-GAAP Financial Measures Adjusted net revenue, adjusted gross profit, adjusted operating income, adjusted net income, adjusted Class A net income, adjusted diluted shares and adjusted EPS collectively referred to as “Non-GAAP Financial Measures,” are commonly used in the Company’s industry and should not be construed as an alternative to net revenue, gross profit, operating income, net income, net income attributed to Class A stockholders or earnings per share as indicators of operating performance (as determined in accordance with GAAP). These Non-GAAP financial measures exclude certain items included in the comparable GAAP financial measure. This Investor Presentation also includes non-GAAP financial measures, including earnings before interest, taxes, depreciation, amortization and other adjustments to eliminate the impact of certain items that we do not consider indicative of our ongoing performance (“Adjusted EBITDA”) and Adjusted EBITDA Margin. Adjusted EBITDA Margin represents Adjusted EBITDA divided by net revenues. Hostess Brands believes that these Non-GAAP Financial Measures provide useful information to management and investors regarding certain financial and business trends relating to Hostess Brands’ financial condition and results of operations. Hostess Brands’ management uses these Non-GAAP Financial Measures to compare Hostess Brands’ performance to that of prior periods for trend analysis, for purposes of determining management incentive compensation, and for budgeting and planning purposes. Hostess Brands believes that the use of these Non-GAAP Financial Measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Management of Hostess Brands does not consider these Non-GAAP Financial Measures in isolation or as an alternative to financial measures determined in accordance with GAAP. Other companies may calculate non-GAAP measures differently, and therefore Hostess Brands’ Non-GAAP Measures may not be directly comparable to similarly titled measures of other companies. The Company does not provide a reconciliation of the forward-looking information to the most directly comparable GAAP measures because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Totals in this Investor Presentation may not add up due to rounding.

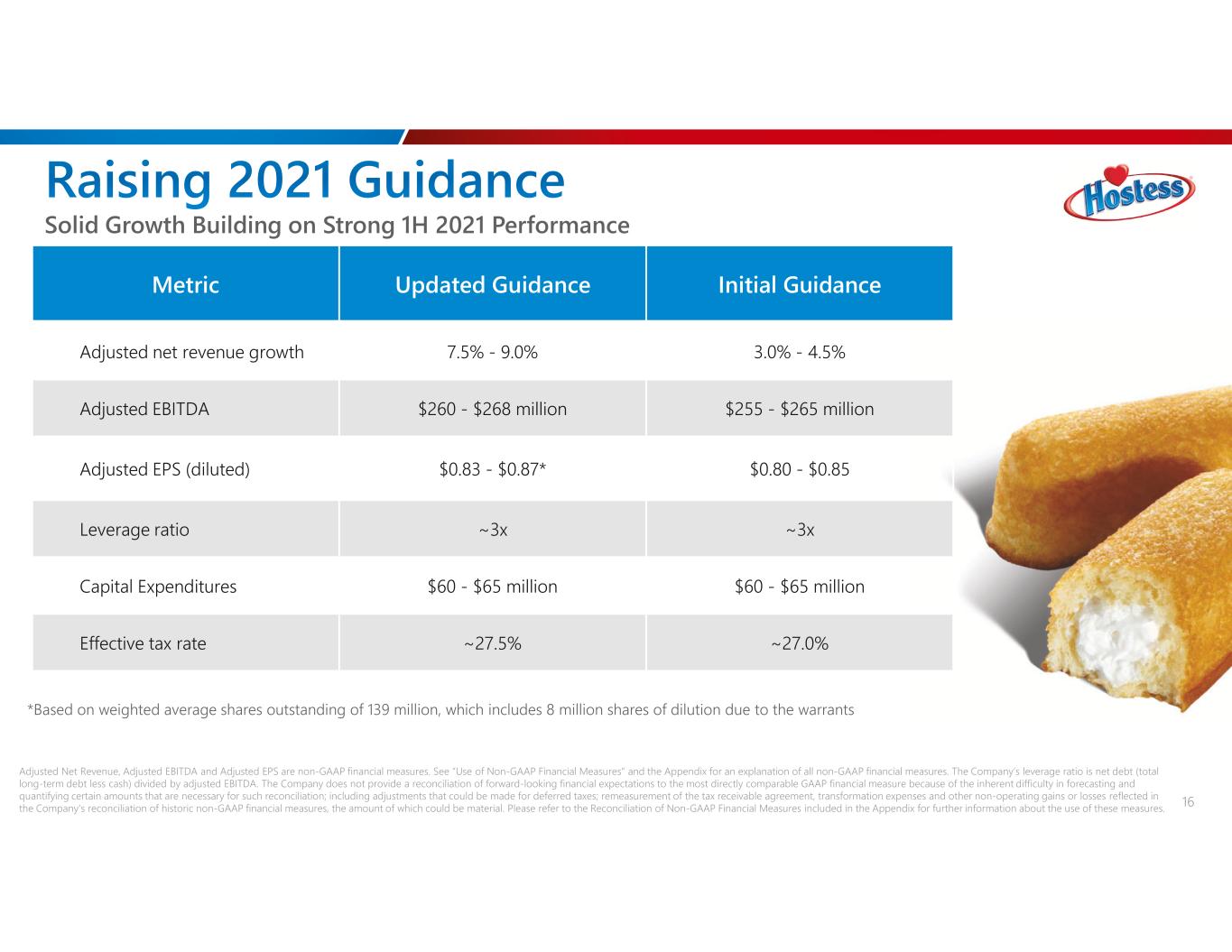

3 Raising Full Year Revenue and Earnings Outlook Our Mission is to Inspire Moments of Joy by Putting our into Everything We Do! Delivered 10.8% adjusted net revenue with broad-based Hostess® branded growth Outstanding retail performance driving continued market share gains and double-digit point-of-sale growth in both Hostess® and Voortman® brands across major channels New products innovation led by Baby Bundts driving incremental growth fueled by our consumer insights-based innovation agenda Price initiatives executed with realization to begin in 2H21 along with continued revenue management and productivity initiatives are expected to offset rising inflation Launched new “Live Your Mostess” advertising campaign to drive growth Increasing 2021 net revenue, EBITDA, and EPS guidance to reflect our strong 1H performance and sustained momentum in 2H

$65.1 $68.4 Q2 2020 Q2 2021 4 Driven by Hostess® Brand Growth $263.0 $291.5 Q2 2020 Q2 2021 (in millions) 10.8% growth 5.1% growth Results are for three months ended June 30, 2021 and 2020. Adjusted Revenue and Adjusted EBITDA are non-GAAP financial measures. See “Use of Non-GAAP Financial Measures” and the Appendix for an explanation of all non-GAAP financial measures and reconciliations to the comparable GAAP measures.

5 Sweet Baked Goods $262.5 $232.6 $29.9 12.9% $500.2 $459.0 $41.2 9.0% Cookies 29.0 30.4 (1.4) (4.6)% 56.7 47.5 9.2 19.4% Total Adjusted Net Revenue $291.5 $263.0 $28.5 10.8% $556.9 $506.5 $50.4 10.0% Sweet Baked Goods net revenue growth driven by strong Hostess® branded sales, most notably in the Convenience, Grocery and Dollar channels. Cookies Q2 2021 revenue reflects sequential growth from Q1 with the YoY decline as we lap the Voortman pipeline fill associated with the conversion to the warehouse distribution model. Adjusted Net Revenue is a non-GAAP financial measure. See “Use of Non-GAAP Financial Measures” in the Appendix for an explanation of all non-GAAP financial measures and reconciliations to the comparable GAAP measures.

2.4% -4.0% 6 Multi-Pack Point-of-Sale Single-Serve Point-of-Sale Source: Nielsen, Total Nielsen Universe for the Company within the SBG Category. Q2 2021 – 13 weeks ended 7/3/21 and prior year comparable periods Q2 2020 Q2 2021 18.8% 5.4% 19.4% 10.5% Q2 2020 Q2 2021 Mobility improving; Hostess® leading single- serve category growth At-home snacking remains elevated; Hostess® leading multi- pack growth 5.4% 18.8% Q2 2019 Q2 2019 2 Yr Stack Growth 15.4% 2 Yr Stack Growth 24.2% Balanced Single-Serve and Multi-Pack Growth Leading the SBG Category

7 Growth in $3.6 Billion SBG Breakfast Sub-Category Driven by Innovation and Retail Execution 34.5% 11.9% 23.0% 4.5% -9.6% 1.4% Breakfast Pastries Doughnut Total Breakfast Hostess SBG Category POS Dollars Growth QTD vs Prior Year Source: Nielsen, Total Nielsen Universe for the Company within the SBG Category. Point of sale (“POS”) changes for the 13 weeks ended 7/3/2021 as compared to the comparable period in the prior year and reflects a scheduled one-week shift in current and prior-year reporting periods performed by Nielsen in April 2021 to better coincide with calendar periods.

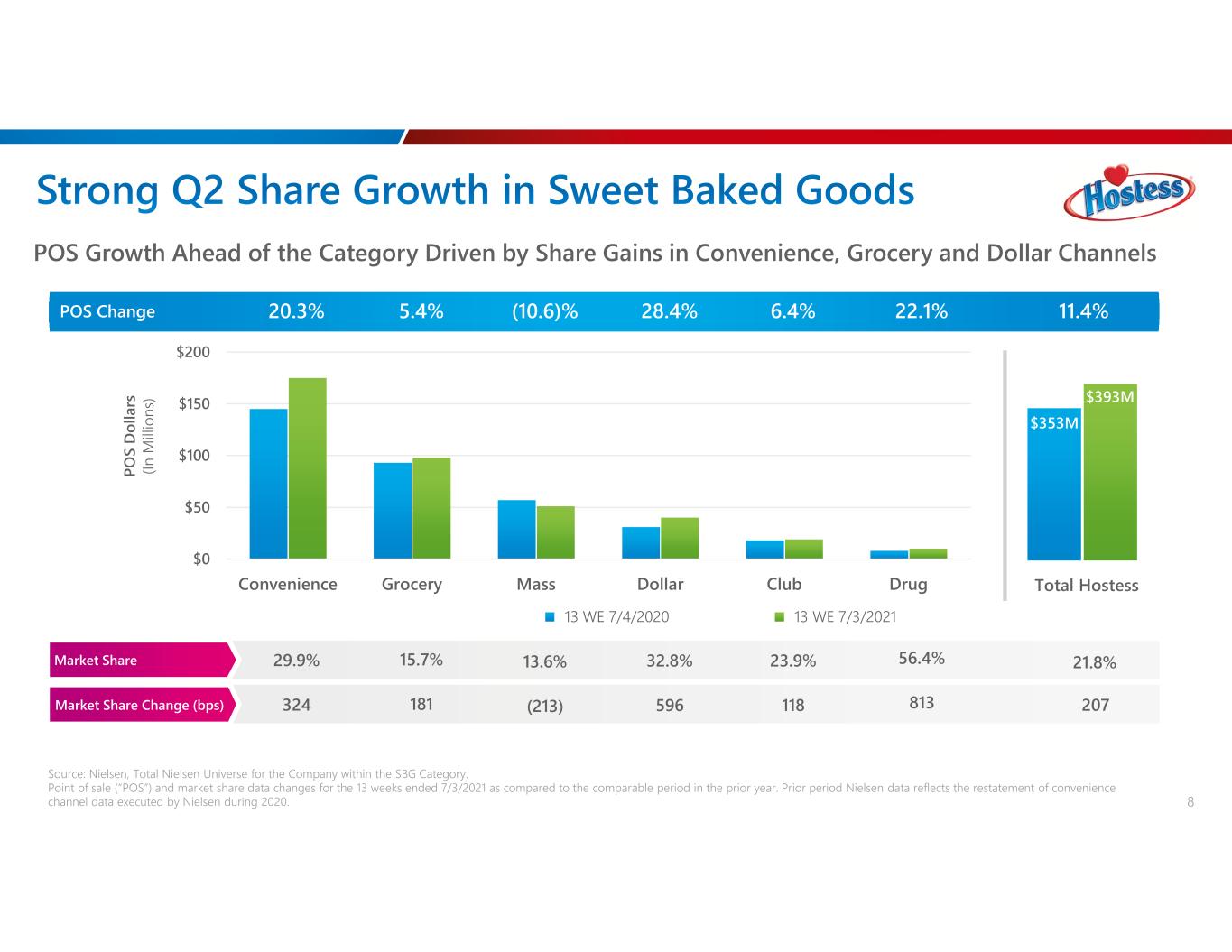

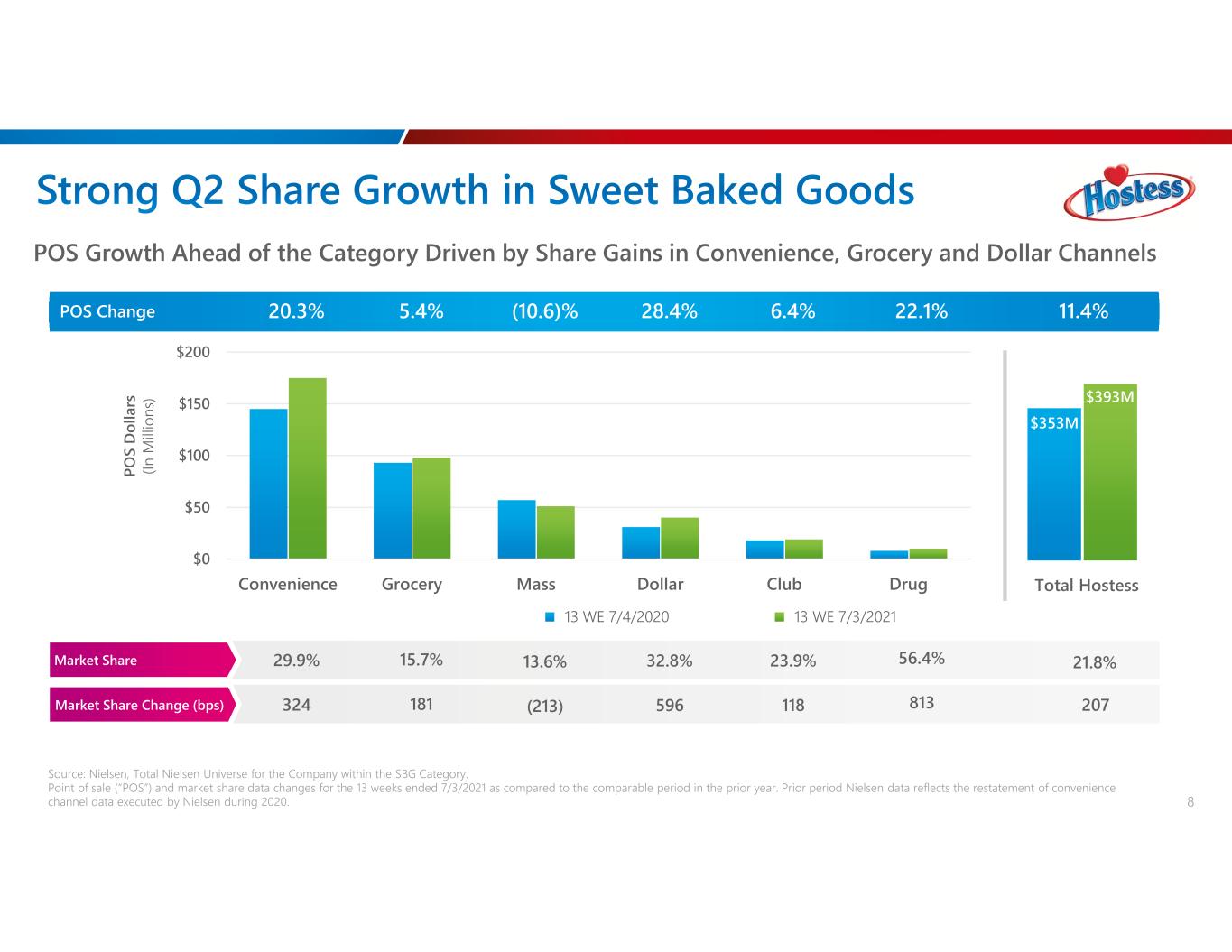

8 POS Growth Ahead of the Category Driven by Share Gains in Convenience, Grocery and Dollar Channels $0 $50 $100 $150 $200 Convenience Grocery Mass Dollar Club Drug 13 WE 7/4/2020 13 WE 7/3/2021 Market Share 29.9% 15.7% 13.6% 32.8% 23.9% 56.4% Market Share Change (bps) 324 181 (213) 596 118 813 POS Change 20.3% 5.4% (10.6)% 28.4% 6.4% 22.1% PO S D ol la rs (In M illi on s) Total Hostess 11.4% 21.8% 207 $393M $353M Source: Nielsen, Total Nielsen Universe for the Company within the SBG Category. Point of sale (“POS”) and market share data changes for the 13 weeks ended 7/3/2021 as compared to the comparable period in the prior year. Prior period Nielsen data reflects the restatement of convenience channel data executed by Nielsen during 2020.

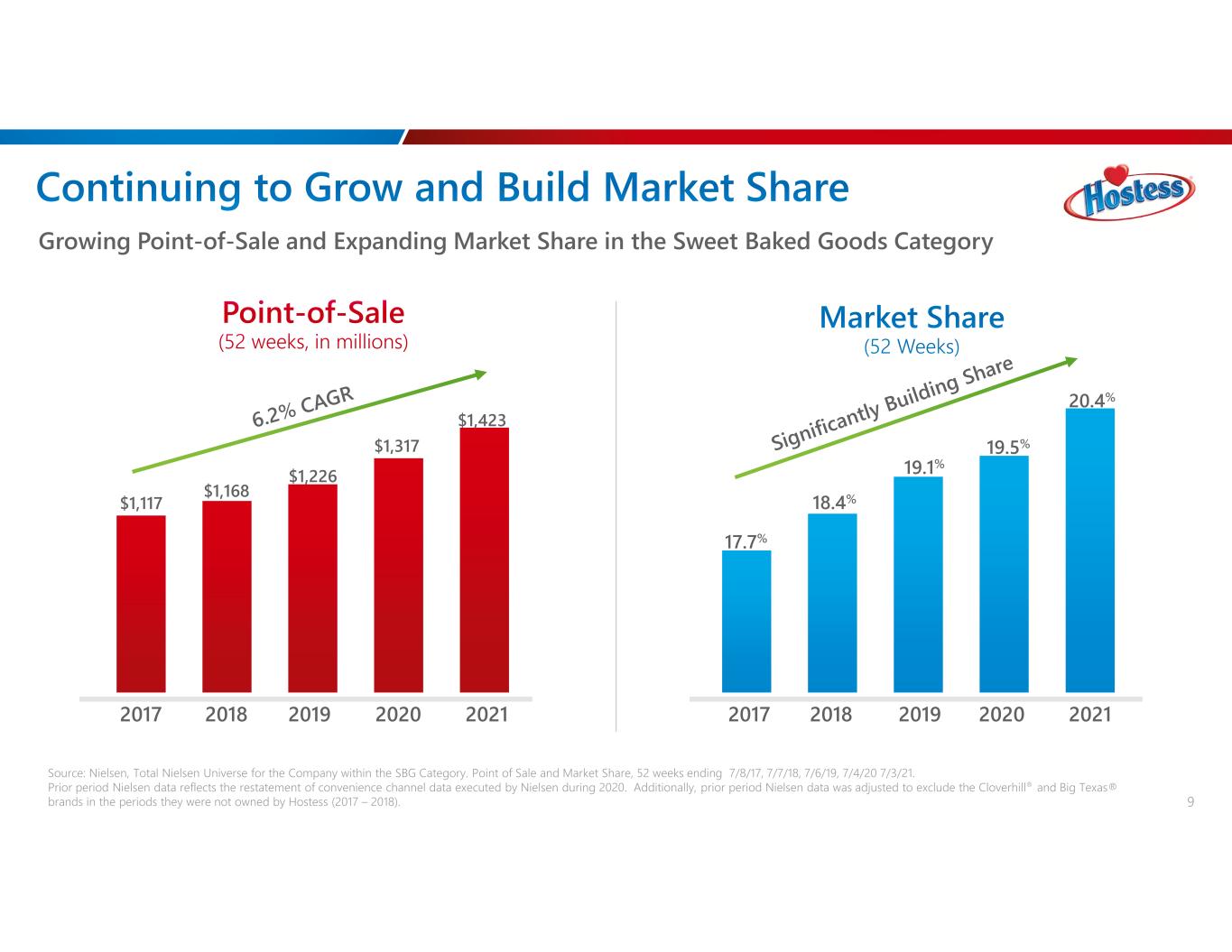

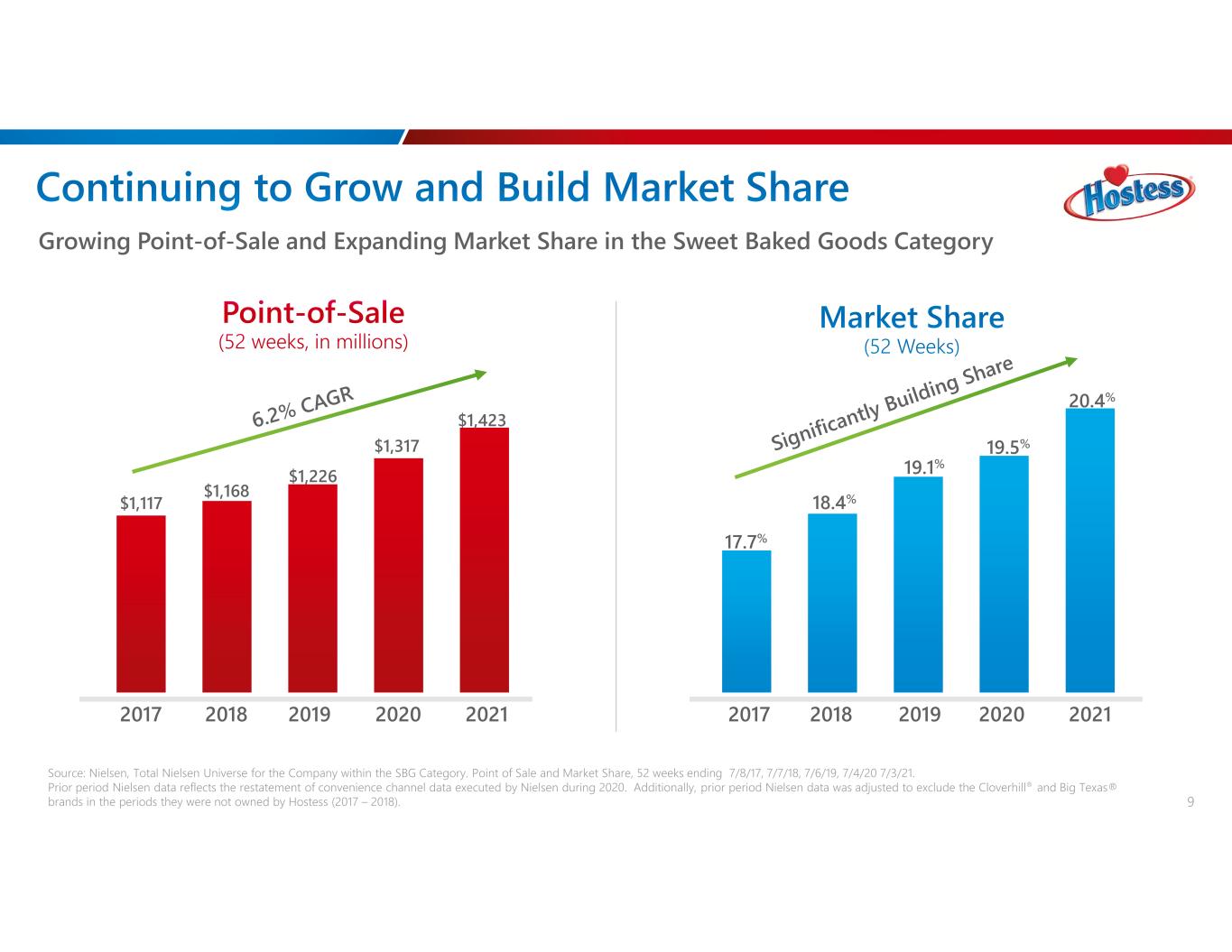

9 Growing Point-of-Sale and Expanding Market Share in the Sweet Baked Goods Category 2017 2018 2019 18.4% 19.1% 19.5% 2017 2018 2019 $1,117 $1,226 $1,317 17.7% 2020 $1,168 2020 Source: Nielsen, Total Nielsen Universe for the Company within the SBG Category. Point of Sale and Market Share, 52 weeks ending 7/8/17, 7/7/18, 7/6/19, 7/4/20 7/3/21. Prior period Nielsen data reflects the restatement of convenience channel data executed by Nielsen during 2020. Additionally, prior period Nielsen data was adjusted to exclude the Cloverhill® and Big Texas® brands in the periods they were not owned by Hostess (2017 – 2018). 20.4% 2021 $1,423 2021

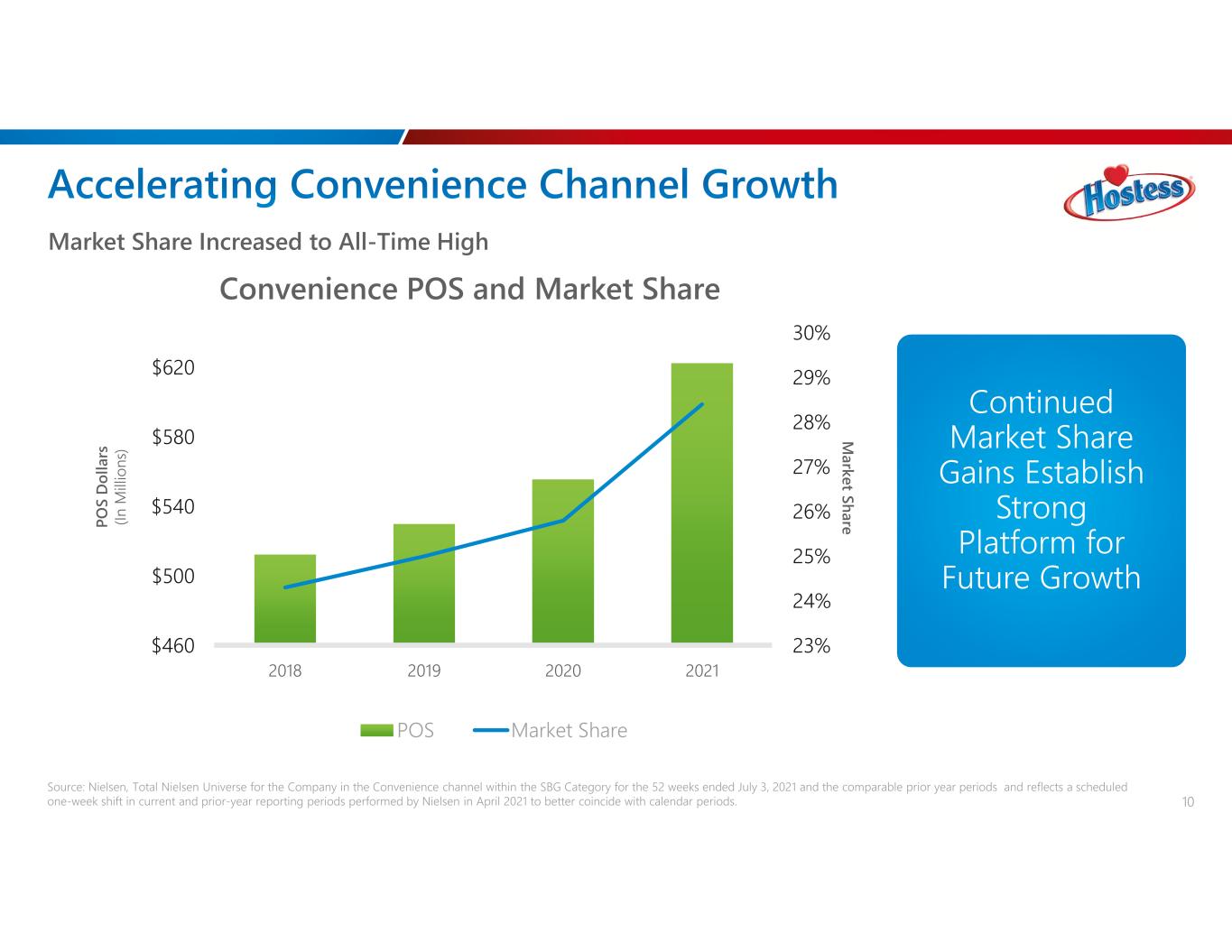

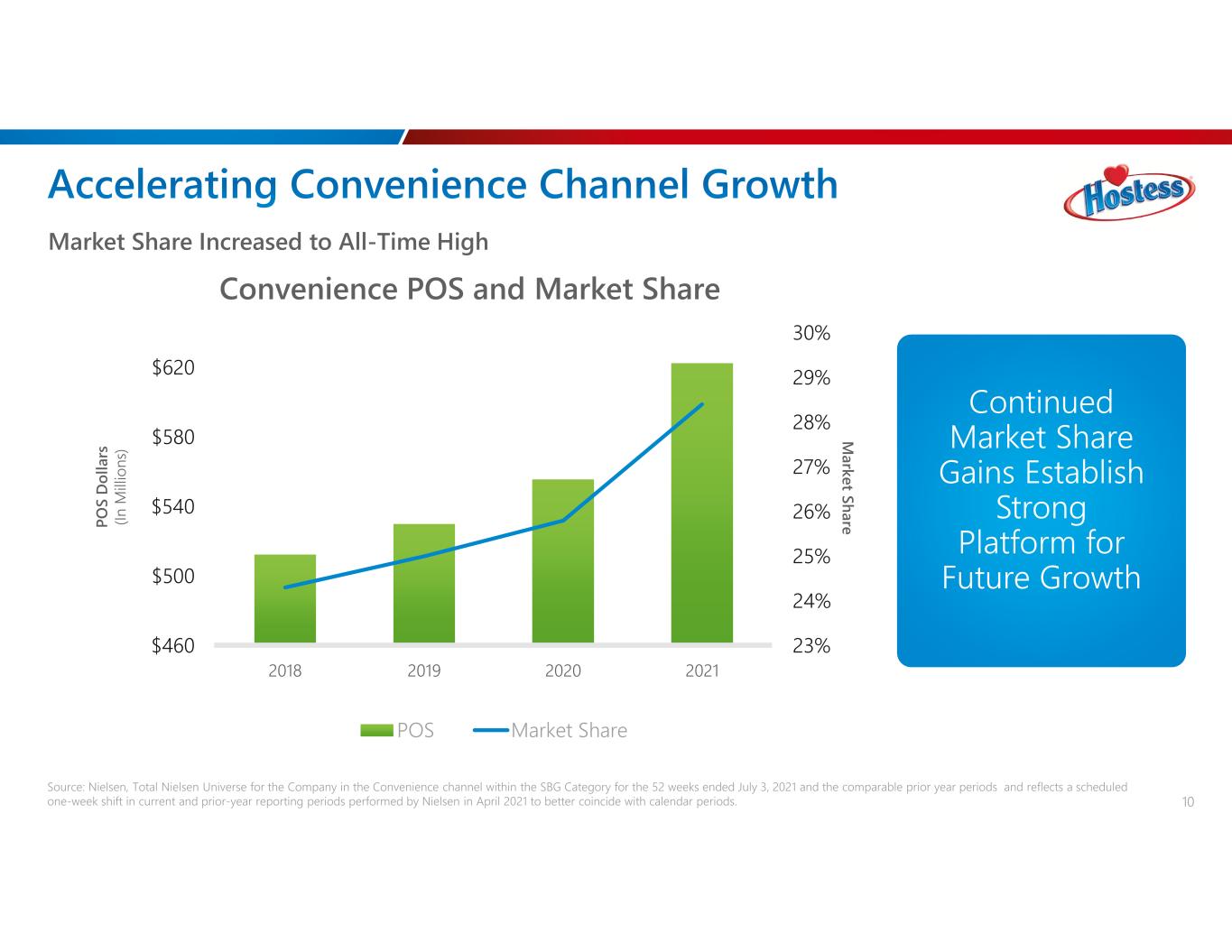

23% 24% 25% 26% 27% 28% 29% 30% $460 $500 $540 $580 $620 2018 2019 2020 2021 POS Market Share 10 Market Share Increased to All-Time High Convenience POS and Market Share Source: Nielsen, Total Nielsen Universe for the Company in the Convenience channel within the SBG Category for the 52 weeks ended July 3, 2021 and the comparable prior year periods and reflects a scheduled one-week shift in current and prior-year reporting periods performed by Nielsen in April 2021 to better coincide with calendar periods. PO S D ol la rs (In M illi on s) M arket Share Continued Market Share Gains Establish Strong Platform for Future Growth

11 Multi-pronged Approach to Innovation Pipeline Establishing New Platforms for Continued Incremental Growth Core Development Building on Iconic Brand Favorites with Flavor Extensions Expanding Breakfast Accelerating Growth within Fastest Growing Subsegment of Category Limited-Time-Offers Keeping Products Relevant and Engaging for Consumers New Platforms Expanding into New Consumer Need States Targeting Younger Consumers Voortman Channel Expansion Penetrating Convenience Channel with Single-serve Usage Occasion

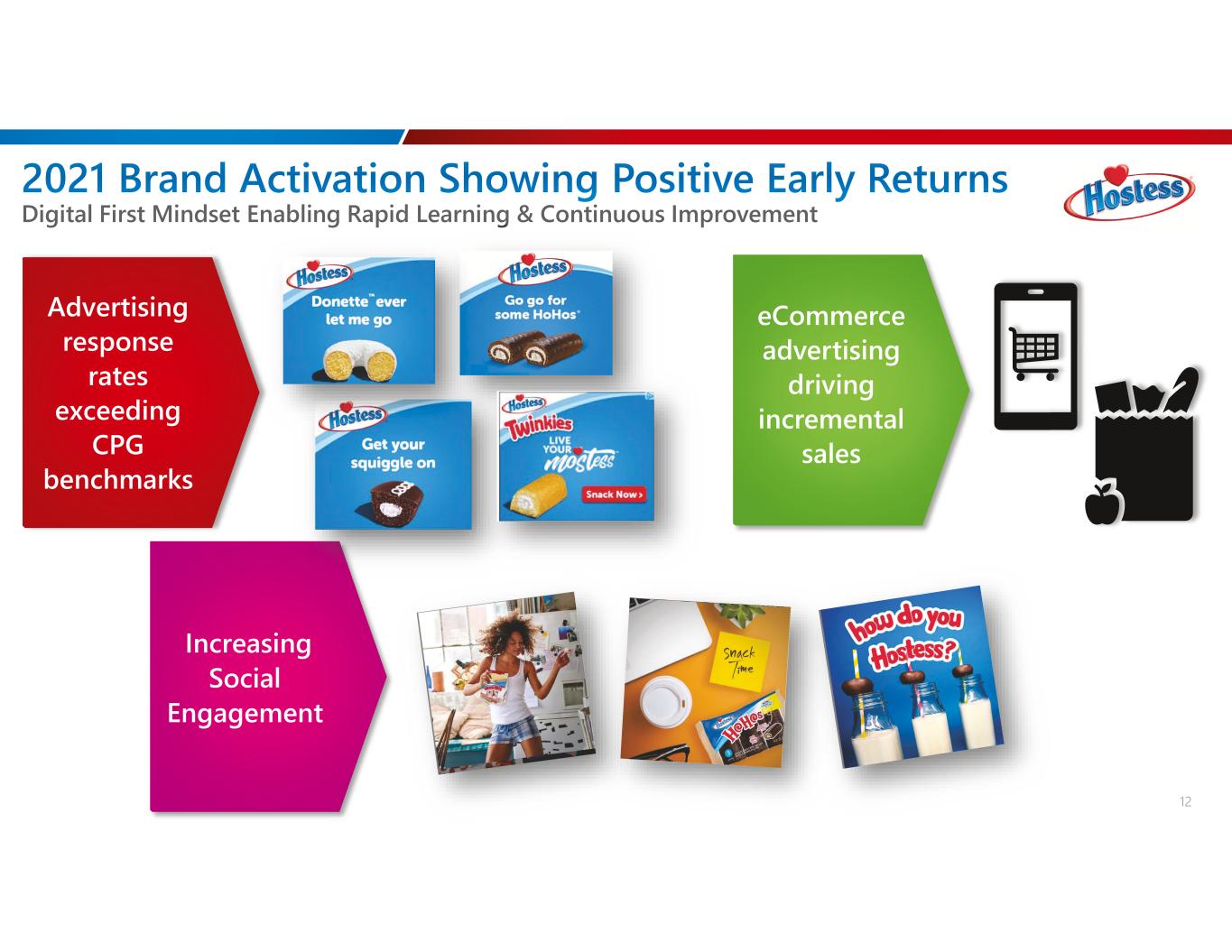

Digital First Mindset Enabling Rapid Learning & Continuous Improvement Advertising response rates exceeding CPG benchmarks eCommerce advertising driving incremental sales Increasing Social Engagement 12

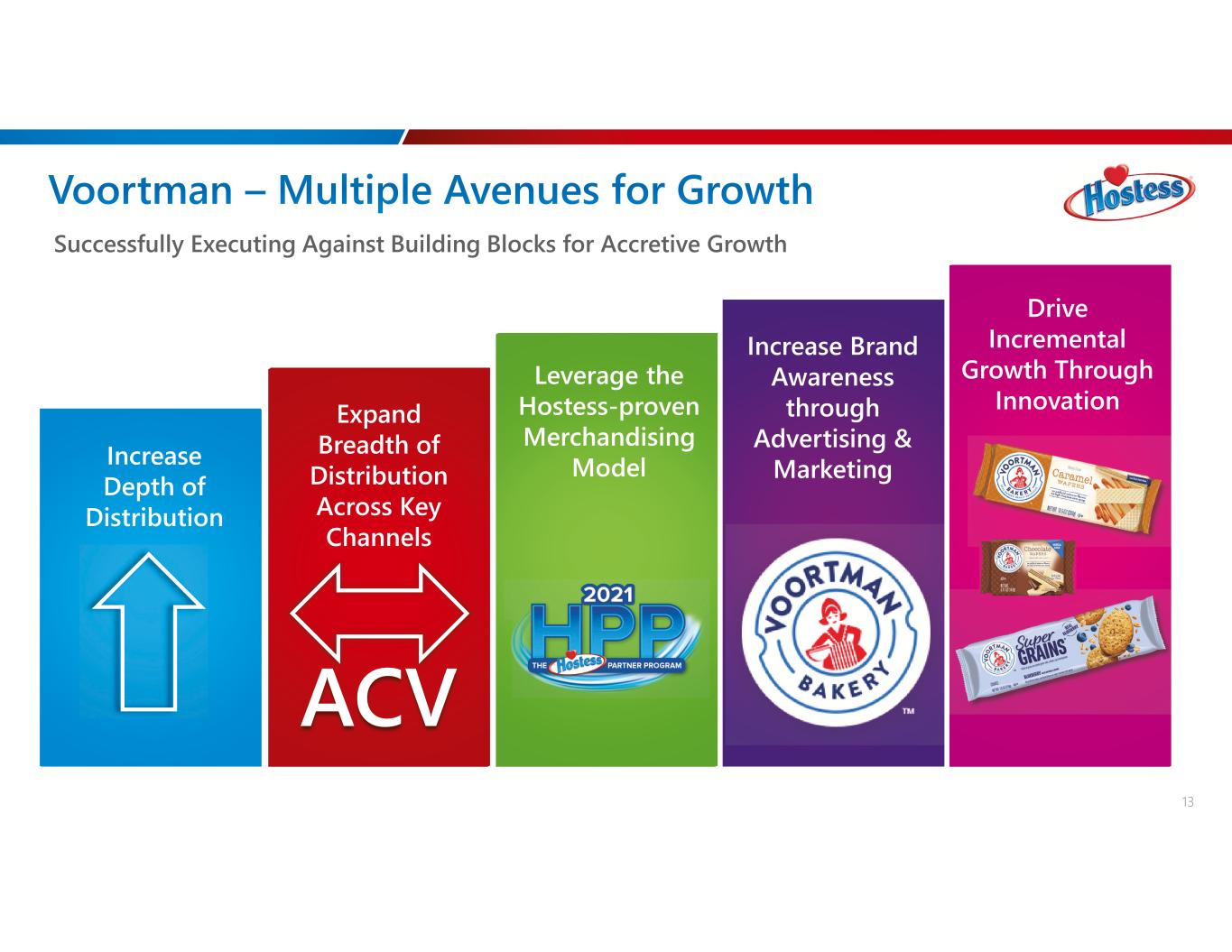

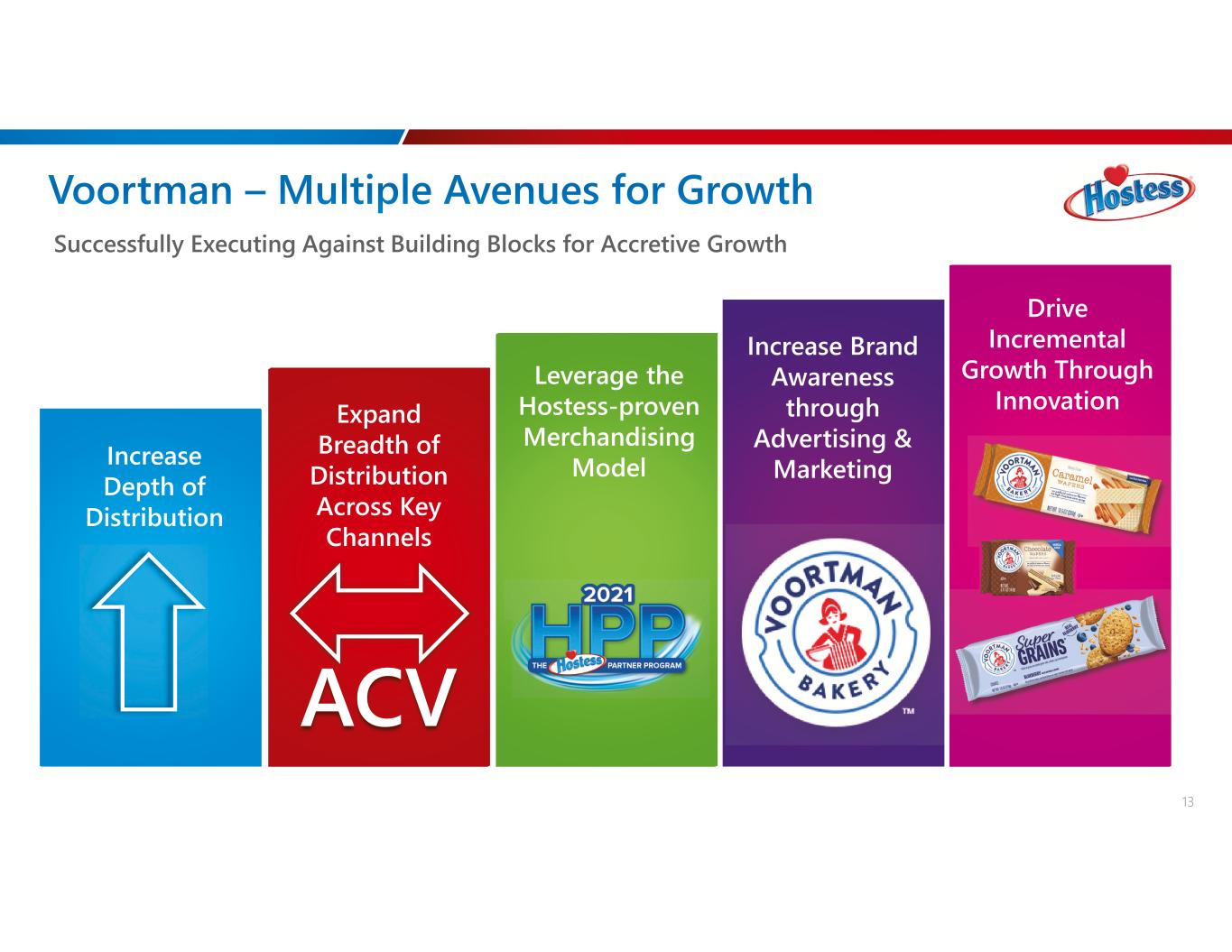

13 Successfully Executing Against Building Blocks for Accretive Growth Increase Depth of Distribution Increase Brand Awareness through Advertising & Marketing Leverage the Hostess-proven Merchandising Model ACV Expand Breadth of Distribution Across Key Channels Drive Incremental Growth Through Innovation

14 Provides Flexibility to Invest in Growth and Generate Shareholder Value Disciplined Approach to Cash Management Reinvest in business for future growth Deleverage the balance sheet Strategic acquisitions Return capital to shareholders through securities repurchases ($25M executed through July ’21) History of successfully reducing leverage while increasing shareholder value through accretive acquisitions and disciplined investments for growth Q2 2020 4.3x** Target Long-Term Leverage 3.0-4.0x * Net Leverage ratio is net debt (total long-term debt less lease obligations, unamortized debt premiums and cash and cash equivalents) divided by adjusted EBITDA for the trailing twelve-month period. ** 2020 proforma leverages included an assumption of $25 million of incremental EBITDA from the acquisition of Voortman and removal of $1.2 million of historical in-store bakery EBITDA 3.4x Q2 2021

15 Double-Digit YTD Net Revenue and Earnings Growth Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted EPS are non-GAAP financial measures. See “Use of Non-GAAP Financial Measures” in the Appendix for an explanation of all non-GAAP financial measures and reconciliations to the comparable GAAP measures. Adjusted Net Revenue $291.5 $263.0 $28.5 10.8% $556.9 $506.5 $50.4 10.0% Adjusted Gross Profit $105.3 $98.1 $7.2 7.3% $200.8 $182.4 $18.4 10.1% Adjusted Gross Margin 36.1% 37.3% (118bps) 36.0% 36.0% 4bps Adjusted Operating Income $54.2 $49.0 $5.2 10.6% $101.2 $85.3 $15.9 18.6% Adjusted EBITDA $68.4 $65.1 $3.3 5.1% $130.8 $116.1 $14.7 12.7% Adjusted EBITDA Margin 23.5% 24.8% (129bps) 23.5% 22.9% 58bps Adjusted EPS $0.23 $0.22 $0.01 5.2% $0.43 $0.36 $0.07 18.9%

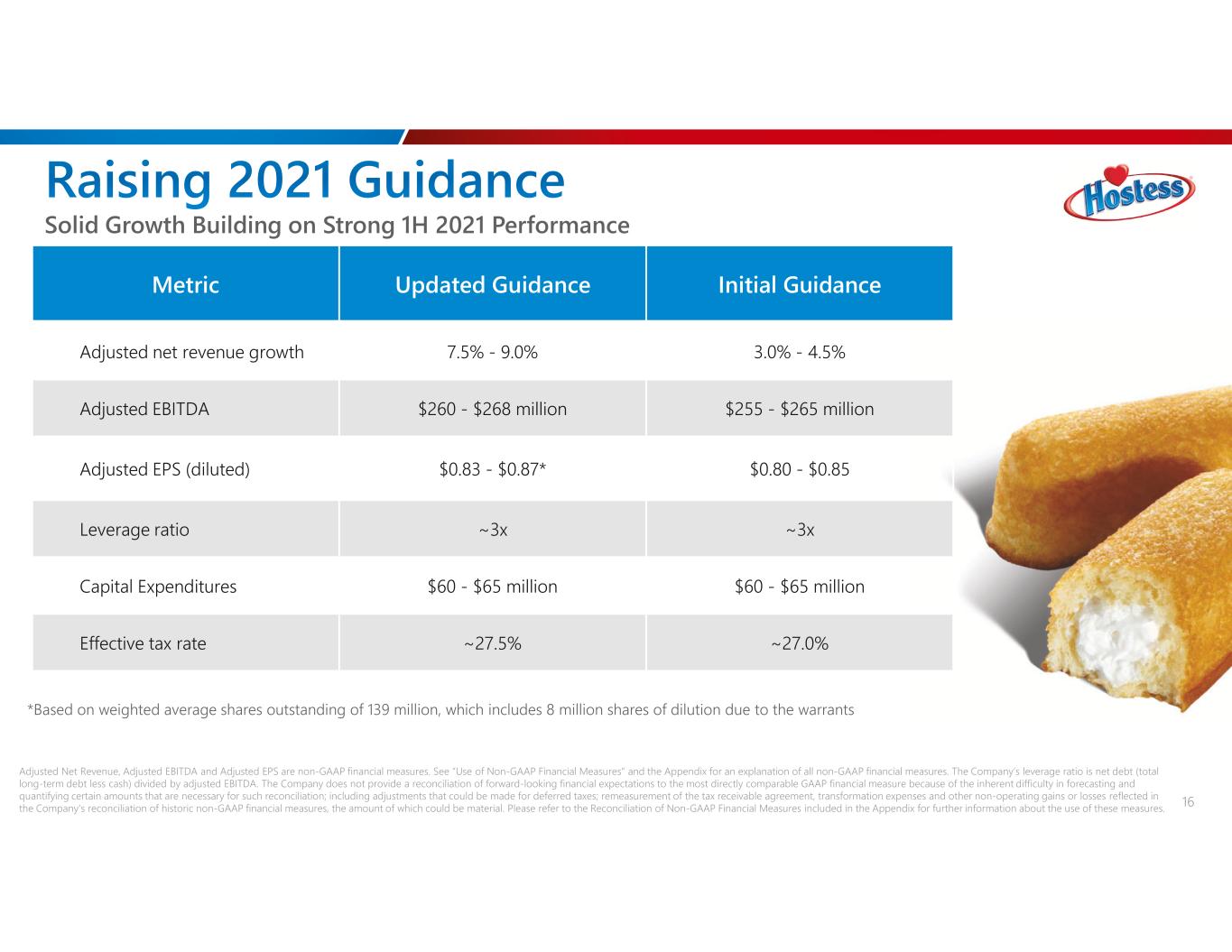

16 Adjusted Net Revenue, Adjusted EBITDA and Adjusted EPS are non-GAAP financial measures. See “Use of Non-GAAP Financial Measures” and the Appendix for an explanation of all non-GAAP financial measures. The Company’s leverage ratio is net debt (total long-term debt less cash) divided by adjusted EBITDA. The Company does not provide a reconciliation of forward-looking financial expectations to the most directly comparable GAAP financial measure because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation; including adjustments that could be made for deferred taxes; remeasurement of the tax receivable agreement, transformation expenses and other non-operating gains or losses reflected in the Company's reconciliation of historic non-GAAP financial measures, the amount of which could be material. Please refer to the Reconciliation of Non-GAAP Financial Measures included in the Appendix for further information about the use of these measures. Solid Growth Building on Strong 1H 2021 Performance Metric Updated Guidance Initial Guidance Adjusted net revenue growth 7.5% - 9.0% 3.0% - 4.5% Adjusted EBITDA $260 - $268 million $255 - $265 million Adjusted EPS (diluted) $0.83 - $0.87* $0.80 - $0.85 Leverage ratio ~3x ~3x Capital Expenditures $60 - $65 million $60 - $65 million Effective tax rate ~27.5% ~27.0% *Based on weighted average shares outstanding of 139 million, which includes 8 million shares of dilution due to the warrants

Organic Revenue Growth Top Quartile of Peer Group1 17 Objective: Long-term leading performance in our peer group Delivering Industry-Leading Total Shareholder Returns Adjusted EBITDA Margin Top Quartile of Peer Group1 Free Cash Flow Conversion2 Top Quartile of Peer Group1 1. Peer group defined as S&P Composite 1500 Packaged Foods and Meats Sub Index. 2. Free Cash Flow conversion is defined as (operating cash flow- capital expenditures)/net income.

18 Appendix

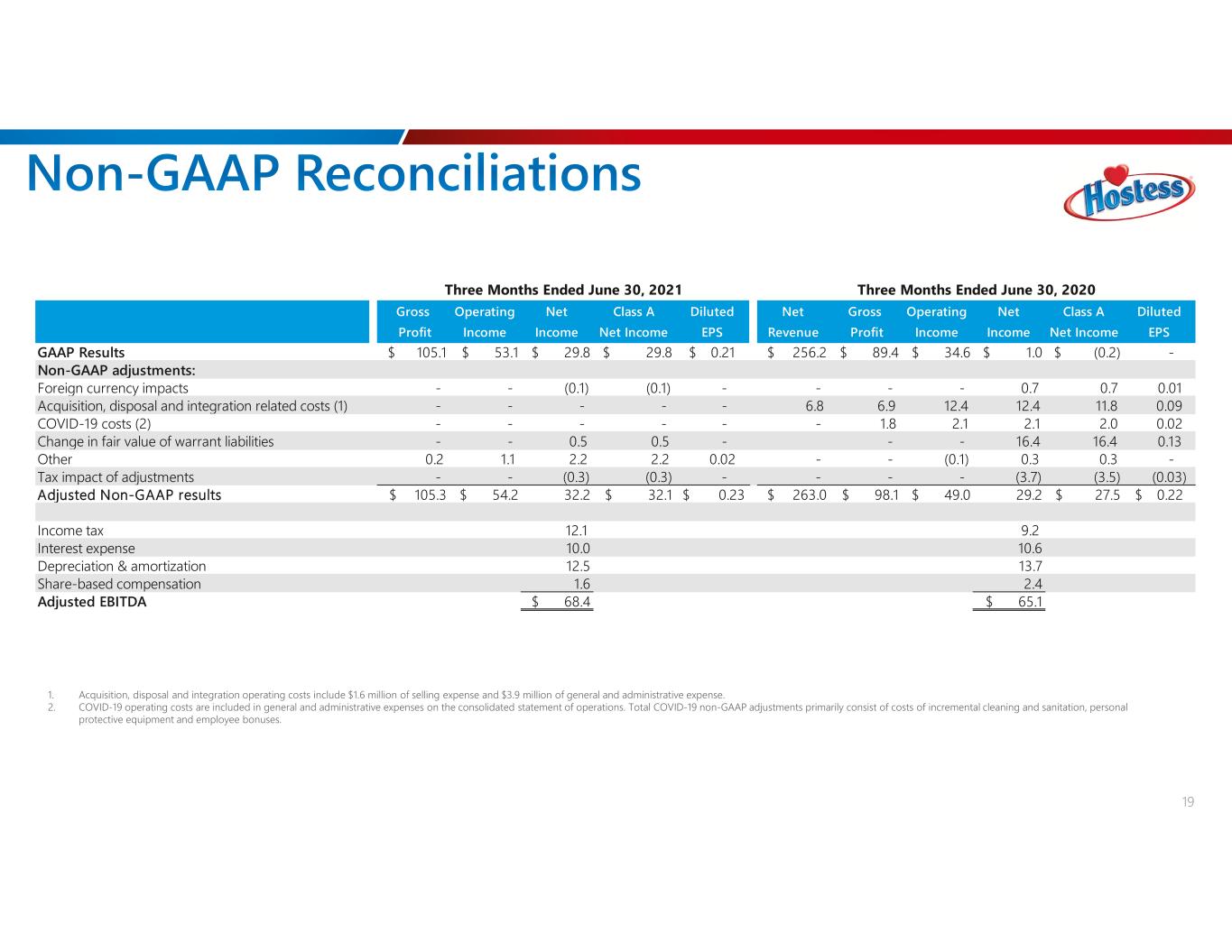

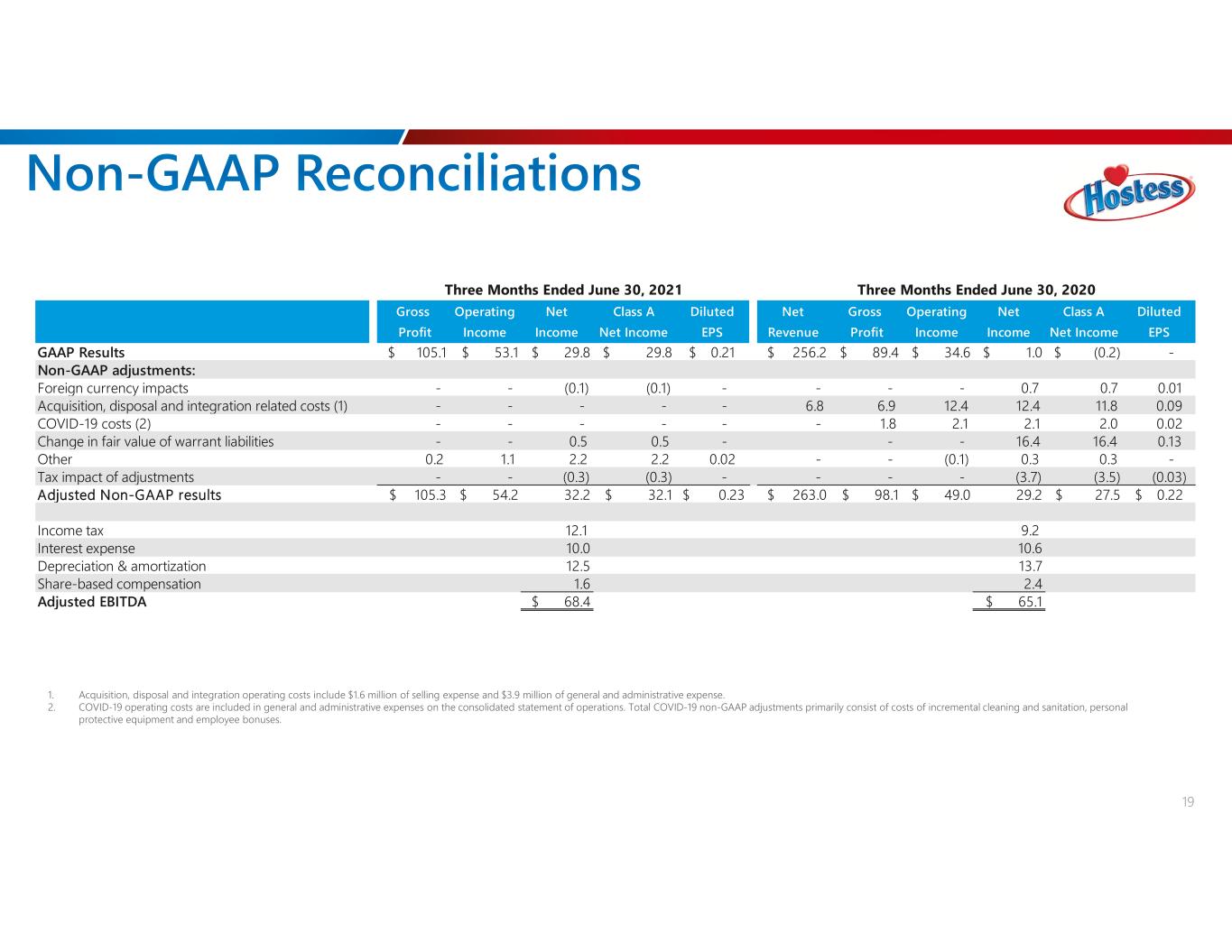

19 1. Acquisition, disposal and integration operating costs include $1.6 million of selling expense and $3.9 million of general and administrative expense. 2. COVID-19 operating costs are included in general and administrative expenses on the consolidated statement of operations. Total COVID-19 non-GAAP adjustments primarily consist of costs of incremental cleaning and sanitation, personal protective equipment and employee bonuses. Gross Operating Net Class A Diluted Net Gross Operating Net Class A Diluted Profit Income Income Net Income EPS Revenue Profit Income Income Net Income EPS GAAP Results $ 105.1 $ 53.1 $ 29.8 $ 29.8 $ 0.21 $ 256.2 $ 89.4 $ 34.6 $ 1.0 $ (0.2) - Non-GAAP adjustments: Foreign currency impacts - - (0.1) (0.1) - - - - 0.7 0.7 0.01 Acquisition, disposal and integration related costs (1) - - - - - 6.8 6.9 12.4 12.4 11.8 0.09 COVID-19 costs (2) - - - - - - 1.8 2.1 2.1 2.0 0.02 Change in fair value of warrant liabilities - - 0.5 0.5 - - - 16.4 16.4 0.13 Other 0.2 1.1 2.2 2.2 0.02 - - (0.1) 0.3 0.3 - Tax impact of adjustments - - (0.3) (0.3) - - - - (3.7) (3.5) (0.03) Adjusted Non-GAAP results $ 105.3 $ 54.2 32.2 $ 32.1 $ 0.23 $ 263.0 $ 98.1 $ 49.0 29.2 $ 27.5 $ 0.22 Income tax 12.1 9.2 Interest expense 10.0 10.6 Depreciation & amortization 12.5 13.7 Share-based compensation 1.6 2.4 Adjusted EBITDA $ 68.4 $ 65.1 Three Months Ended June 30, 2020Three Months Ended June 30, 2021

20 1. Acquisition, disposal and integration operating costs include $0.8 million of selling expense, $7.2 million of general and administrative expenses and $4.3 million of business combination transaction costs. 2. COVID-19 operating costs are included in general and administrative expenses on the consolidated statement of operations. Total COVID-19 non-GAAP adjustments primarily consist of costs of incremental cleaning and sanitation, personal protective equipment and employee bonuses. Gross Operating Net Class A Diluted Net Gross Operating Net Class A Diluted Profit Income Income Net Income EPS Revenue Profit Income Income Net Income EPS GAAP Results $ 200.3 $ 100.1 $ 56.6 $ 56.6 $ 0.41 $ 499.7 $ 168.7 $ 49.7 $ 82.7 $ 81.2 $ 0.02 Non-GAAP adjustments: Foreign currency impacts - - 0.1 0.1 - - - - 1.0 1.0 0.01 Acquisition, disposal and integration related costs (1) - - - - - 6.8 7.9 27.4 27.3 25.9 0.21 Facility transition costs - - - - - - 3.7 5.7 5.7 5.4 0.04 COVID-19 costs (2) - - - - - - 2.1 2.4 2.4 2.2 0.02 Change in fair value of warrant liabilities - - 0.4 0.4 - (62.7) (62.7) 0.13 Other 0.2 1.1 2.4 2.4 0.02 - - 0.1 0.6 0.6 - Tax impact of adjustments - - (0.4) (0.4) - - - - (9.2) (9.0) (0.07) Adjusted Non-GAAP results $ 200.5 $ 101.2 $ 59.1 $ 59.1 $ 0.43 $ 506.5 $ 182.4 $ 85.3 $ 47.8 $ 44.6 $ 0.36 Income tax 22.1 15.0 Interest expense 20.0 22.3 Depreciation & amortization 25.2 26.5 Share-based compensation 4.4 4.5 Adjusted EBITDA $ 130.8 $ 116.1 Six Months Ended June 30, 2020Six Months Ended June 30, 2021