January 21, 2016

Dear W. R. Grace & Co. Shareholder:

I am pleased to report that the previously announced separation of the business, assets and liabilities associated with the Grace Construction Products operating segment and the Darex Packaging Technologies business ("GCP") from the remaining W. R. Grace & Co. businesses is expected to become effective on February 3, 2016. GCP Applied Technologies Inc., a Delaware corporation, and wholly-owned subsidiary of W. R. Grace & Co., will become an independent public company on that date.

The separation will be completed by way of a pro rata distribution of common stock of GCP Applied Technologies Inc. to the shareholders of record of Grace common stock as of 5:00 p.m., Eastern Time, on January 27, 2016, the distribution record date. Each holder of Grace common stock will receive one share of GCP common stock for each share of Grace common stock held by the shareholder on the record date. The distribution of these shares will be made in book-entry form, which means that no physical share certificates will be issued. At any time following the distribution, shareholders may request that their shares of GCP common stock be transferred to a brokerage or other account. No fractional shares of GCP common stock will be issued. The distribution agent will aggregate fractional shares into whole shares, sell the whole shares in the open market at prevailing rates and distribute the net cash from proceeds from the sales pro rata to each holder who would otherwise have been entitled to receive a fractional share in the distribution.

The distribution is subject to certain customary conditions including, among other conditions, the receipt of an opinion of counsel, in form and substance satisfactory to Grace in its sole discretion, regarding the U.S. federal income tax treatment of the distribution of shares of GCP common stock and certain related transactions. The distribution is intended to qualify as tax-free to the holders of Grace common stock for U.S. federal income tax purposes.

The distribution does not require shareholder approval, nor do you need to take any action to receive your shares of GCP common stock. Grace common stock will continue to trade on the New York Stock Exchange (“NYSE”) under the symbol “GRA.” GCP has applied to have its common stock listed on the NYSE under the symbol “GCP.”

The enclosed information statement, which we are mailing to all holders of Grace common stock, describes the separation in detail and contains important information about GCP, including its historical combined financial statements. We encourage you to read this information statement carefully.

Thank you for your continued investment in Grace.

|

| |

| | Sincerely, |

| | |

| | Fred E. Festa |

| | Chairman of the Board and |

| | Chief Executive Officer |

January 21, 2016

Dear GCP Applied Technologies Inc. Shareholder:

It is our pleasure to welcome you as a shareholder of GCP Applied Technologies Inc. Our foremost priority as we become an independent public company is to affirm the trust and confidence of our employees, our customers, our communities, and our investors.

Like the very products we sell, we have proven our ability to create value as we protect and build on an industry-leading foundation.

In the following pages, you will read about the past performance of our three operating segments, our strategies for growth, and our focus on our customers.

What is more difficult to convey in an information statement like the accompanying document, is our passion and excitement. We are extraordinarily proud of our place in the long history of W. R. Grace & Co., a pedigree that has given rise to strong relationships with our customers; strong brands; a culture of focus, professionalism, and performance; and a commitment to innovation. Just as our customers expect our products to perform and create value even in the most challenging environments, we expect the same of ourselves and our organization.

As you review our information statement, we believe you will agree we are aligned with our commitment to deliver world-class products, applied knowledge, and service excellence to create value.

Our new logo expresses stepwise movement toward a strong future. Our name acknowledges our proud history with Grace and our unrelenting commitment to technology that works hard for our customers. We believe it’s a formula for success.

Thank you in advance for your investment and your confidence.

|

| |

| Sincerely, | |

| | |

| Ronald C. Cambre | Gregory E. Poling |

| Chairman of the Board of Directors | President and Chief Executive Officer |

| GCP Applied Technologies Inc. | GCP Applied Technologies Inc. |

Information Statement

Distribution of Common Stock of

GCP Applied Technologies Inc.

by

W. R. Grace & Co.

To W. R. Grace & Co. Shareholders

W. R. Grace & Co. ("Grace") is furnishing this information statement in connection with the distribution to Grace shareholders of all of the shares of common stock of GCP Applied Technologies Inc. (the "Company") owned by Grace, which will be 100 percent of the GCP common stock outstanding immediately prior to the distribution. The Company is a wholly-owned subsidiary of Grace that at the time of the distribution will hold the business, assets and liabilities associated with the Grace Construction Products operating segment and the Darex Packaging Technologies business ("GCP").

To implement the distribution, Grace will distribute the shares of GCP common stock on a pro rata basis to the holders of Grace common stock in a transaction that is intended to qualify as tax-free to the holders of Grace common stock for U.S. federal income tax purposes. Each of you, as a holder of Grace common stock, will receive one share of GCP common stock for each share of Grace common stock that you hold at 5:00 p.m., Eastern Time, on January 27, 2016, the record date for the distribution.

The distribution is expected to occur after the New York Stock Exchange (“NYSE”) market closing on February 3, 2016. Immediately after Grace completes the distribution, the Company will be an independent, publicly traded company. It is a condition to the completion of the separation that Grace obtains an opinion of counsel, in form and substance satisfactory to Grace in its sole discretion, regarding the U.S. federal income tax treatment of the distribution of shares of GCP common stock and certain related transactions.

No vote of Grace shareholders is required in connection with this distribution. Grace shareholders will not be required to pay any consideration for the shares of GCP common stock they receive in the distribution, and they will not be required to surrender or exchange shares of their Grace common stock or take any other action in connection with the distribution.

As Grace currently owns all of the outstanding shares of GCP common stock, there currently is no public trading market for the GCP common stock. We have applied to have the GCP common stock authorized for listing on the NYSE under the ticker symbol “GCP.” Assuming that the NYSE authorizes the GCP common stock for listing, we anticipate that a limited market, commonly known as a “when-issued” trading market, for GCP common stock will develop on or shortly before the record date for the distribution and will continue up to and including the distribution date, and we expect that the “regular-way” trading of GCP common stock will begin on the first trading day following the distribution date.

In reviewing this information statement, you should carefully consider the matters described in the section entitled “Risk Factors” of this information statement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of any of the securities of GCP Applied Technologies Inc. or determined whether this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this information statement is January 21, 2016.

This information statement was first mailed to holders of Grace common stock on or about January 21, 2016.

TABLE OF CONTENTS

|

| |

| |

| Our Company | |

| Our Strengths | |

| Our Business Strategy | |

| Summary of Risk Factors | |

| The Separation | |

| Questions and Answers About the Separation and Distribution | |

| Summary of the Separation and Distribution | |

| Corporate Information | |

| Reason for Furnishing this Information Statement | |

| |

| Risks Relating to Our Business | |

| Risks Relating to the Separation | |

| Risks Relating to Ownership of GCP Common Stock | |

| |

| |

| |

| |

| |

| Business Overview | |

| Products | |

| Sales and Marketing | |

| Manufacturing, Raw Materials and Supply Chain | |

| Financial Information about Industry Segments and Geographic Areas | |

| Backlog of Orders | |

| Research Activities; Intellectual Property | |

| Environment, Health and Safety Matters | |

| Employee Relations | |

| Properties | |

| Legal Proceedings | |

| |

| General | |

| Reasons for the Separation | |

| The Number of Shares You Will Receive | |

| Treatment of Fractional Shares | |

| When and How You Will Receive the Distribution | |

| Treatment of Equity-Based Compensation | |

| Results of the Distribution | |

| Incurrence of Debt | |

| Market for GCP Common Stock | |

| Trading Between Record Date and Distribution Date | |

| Conditions to the Distribution | |

Reason for Furnishing this Information Statement

| |

| |

| |

| |

|

| |

| |

| Executive Officers Following the Distribution | |

| Board of Directors Following the Distribution | |

| Corporate Governance Principles | |

| Director Independence | |

| Committees of the Board of Directors | |

| Compensation Committee Interlocks and Insider Participation | |

| Corporate Governance | |

| Board Leadership Structure | |

| Board Risk Oversight | |

| Communications with the Board of GCP | |

| |

| Grace 2014 Executive Compensation | |

| Effects of the Separation on Outstanding Executive Compensation Awards | |

| GCP Compensation Programs | |

| |

| |

| |

| |

| The Separation from Grace | |

| Related Party Transactions | |

| Agreements with Grace | |

| |

| |

| General | |

| Distributions of Securities | |

| Common Stock | |

| Preferred Stock | |

| Restrictions on Payment of Dividends | |

| Transfer Restrictions | |

| Size of Board and Vacancies; Removal | |

| Shareholder Action by Written Consent | |

| Shareholder Meetings | |

| Requirements for Advance Notice of Shareholder Nominations and Proposals | |

| No Cumulative Voting | |

| Stock Exchange Listing | |

| Limitation on Liability of Directors and Indemnification of Directors and Officers | |

| Anti-Takeover Effects of Various Provisions of Delaware Law and GCP’s Certificate of Incorporation and Bylaws | |

| Exclusive Forum | |

| Transfer Agent and Registrar | |

| |

| |

NOTE REGARDING THE USE OF CERTAIN TERMS

Except as otherwise indicated, we use the following terms to refer to the items indicated:

“W. R. Grace & Co.” refers to W. R. Grace & Co., a Delaware corporation, and “Grace” refers to W. R. Grace & Co. and its consolidated subsidiaries, in each case unless otherwise indicated or the context otherwise requires. “Grace Conn” refers to W. R. Grace & Co.—Conn., a direct wholly owned subsidiary of W. R. Grace & Co. “Grace common stock” refers to the common stock, par value $0.01 per share, of W. R. Grace & Co.

“GCP” refers collectively to the business, assets and liabilities associated with the Grace Construction Products operating segment and the Darex Packaging Technologies business that at the time of the distribution will be held by the Company.

Except as otherwise noted, “we,” “us,” and “our,” refer to GCP and, unless otherwise indicated or the context otherwise requires, the management of GCP and/or the Company.

The “Company” refers to GCP Applied Technologies Inc., a Delaware corporation, that prior to the separation is a wholly owned subsidiary of Grace and that at the time of the separation will hold GCP. Where appropriate in context and except as noted, this term includes the subsidiaries of the Company. “GCP common stock” refers to the common stock, par value $0.01 per share, of the Company.

“Separation” or “separation” refers to the separation of GCP from Grace’s other businesses and the creation of an independent, publicly traded company holding GCP through a distribution of shares of GCP common stock to the holders of Grace common stock as of the record date.

“Distribution” or “distribution” refers to the distribution of all of the shares of GCP common stock owned by Grace to shareholders of Grace as of the record date.

“Distribution Date” means the date on which the Distribution occurs.

Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement, including the combined financial statements of GCP, assumes the completion of all the transactions referred to in this information statement in connection with the separation and distribution.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This information statement contains forward-looking statements, that is, information related to future, not past, events. Such statements generally include the words “believes,” “plans,” “intends,” “targets,” “will,” “expects,” "estimates," “suggests,” “anticipates,” “outlook,” “continues” or similar expressions. Forward-looking statements include, without limitation, expected financial positions; results of operations; cash flows; financing plans; business strategy; operating plans; capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new technology and cost reduction initiatives, plans and objectives; and markets for securities. Like other businesses, GCP is subject to risks and uncertainties that could cause its actual results to differ materially from its projections or that could cause other forward-looking statements to prove incorrect. Factors that could cause actual results to materially differ from those contained in the forward-looking statements include, without limitation, risks related to: the cyclical and seasonal nature of the industries GCP serves; the effectiveness of GCP's research and development and new product introductions; the cost and availability of raw materials and energy; foreign operations, especially in emerging regions; changes in currency exchange rates; developments affecting the Company’s outstanding liquidity and indebtedness, including debt covenants and interest rate exposure; developments affecting the Company’s funded and unfunded pension obligations; acquisitions and divestitures of assets and gains and losses from dispositions; warranty and product liability claims; hazardous materials and costs of environmental compliance; the separation, such as: uncertainties that may delay or negatively impact the separation and distribution or cause the separation and distribution to not occur at all, the Company’s lack of history as a public company and the costs of the separation, the Company’s ability to realize the anticipated benefits of the separation and distribution, and the value of GCP common stock following the separation; and those additional factors set forth in this information statement and W. R. Grace & Co.’s most recent Annual Report on Form 10-K, quarterly report on Form 10-Q and current reports on Form 8‑K, which have been filed with the Securities and Exchange Commission and are readily available on the Internet at www.sec.gov.

In particular, information included under “The Separation and Distribution,” “Risk Factors,” “Dividend Policy,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contains forward-looking statements.

You should consider the areas of risk described above, as well as those set forth in the section entitled “Risk Factors” included elsewhere in this information statement, in connection with considering any forward-looking statements that may be made by us and our businesses generally. We cannot assure you that projected results or events reflected in the forward-looking statements will be achieved or occur. The forward-looking statements included in this document are made as of the date of this information statement. Except as may be required by law, we undertake no obligation to publicly release any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events.

INDUSTRY DATA

The data included in this information statement regarding industry size and relative industry position is derived from a variety of sources, including company research, third‑party studies and surveys, industry and general publications and estimates based on our knowledge and experience in the industries in which we operate. Our estimates have been based on information obtained from our customers, suppliers, trade and business organizations and other contacts in the industry. In using this information, you should consider the methods by which we obtained the data for our estimates and recognize that this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties.

TRADEMARKS AND TRADE NAMES

As of the date of this information statement, Grace owns, has rights or will own or acquire rights to trademarks, service marks, copyrights and trade names that we use in conjunction with the operation of our business, including Grace®, and, except as otherwise indicated, the other trademarks, service marks or trade names used in this information statement. This information statement may include trademarks, service marks and trade names of other companies. Each trademark, service mark or trade name of any other company appearing in this information statement belongs to its holder. Unless otherwise indicated, use or display by us of other parties’ trademarks, service marks, or trade names is not intended to and does not imply a relationship with the trade name owner, or endorsement or sponsorship by us of the trademark, service mark, or trade name owner.

SUMMARY

This summary highlights selected information from this information statement relating to GCP, the separation of GCP from W. R. Grace & Co. and the distribution of GCP common stock by W. R. Grace & Co. to holders of Grace common stock. For a more complete understanding of our businesses and the separation and distribution, you should read this information statement carefully, particularly the discussion set forth under “Risk Factors” of this information statement, and our audited and unaudited historical combined financial statements, our unaudited pro forma combined financial statements and the respective notes to those statements appearing elsewhere in this information statement.

Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement, including the combined financial statements of GCP, assumes the completion of all the transactions referred to in this information statement in connection with the separation and distribution.

Our Company

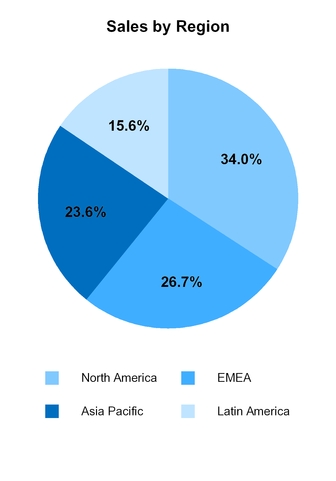

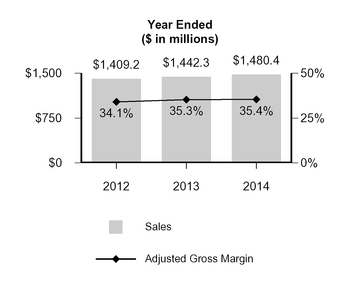

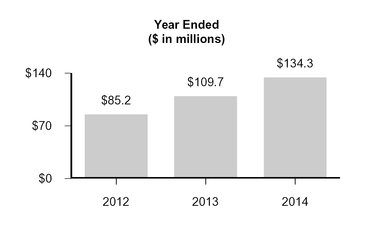

GCP is a leading global provider of products and technology solutions for customers in the specialty construction chemicals, specialty building materials and packaging sealants and coatings industries. We believe our customers derive meaningful value and distinct competitive advantages from our products and technical services. Our products help improve the performance of our customers’ products, increase productivity in their application or manufacturing processes, and meet the increasing regulatory requirements impacting their industry. The result is long-standing relationships with customers that we believe is a durable competitive advantage allowing us to secure high margins. For the year ended December 31, 2014, we had sales of $1.5 billion, and generated net income of $134.3 million.

We are a global business with a diverse sales and geographic mix and operations around the world.

We hold global leadership positions in each of our businesses. We manage our business in three operating segments:

| |

| • | Specialty Construction Chemicals. Specialty Construction Chemicals (SCC) provides products, technologies, and services that reduce the cost and improve the performance of cement, concrete, mortar, masonry and other cementitious based construction materials. |

| |

| • | Specialty Building Materials. Specialty Building Materials (SBM) produces and sells sheet and liquid membrane systems and other products that protect both new and existing structures from water, air, vapor penetration, and fire damage. We also manufacture and sell specialized cementitious and chemical grouts used for soil consolidation and leak-sealing applications. |

| |

| • | Darex Packaging Technologies. Darex Packaging Technologies (Darex) produces and sells sealants and coatings for consumer and industrial applications to protect the integrity of packaged products. |

|

| | | | | | | | | |

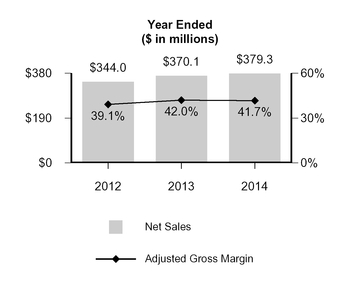

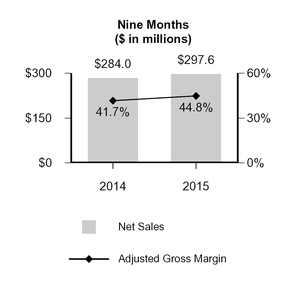

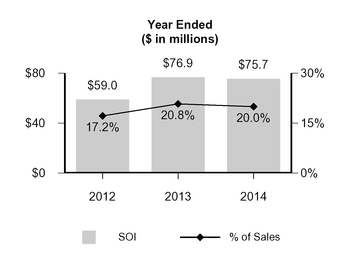

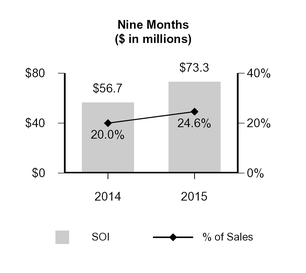

Year Ended December 31, 2014 ($ in millions) | Specialty Construction Chemicals | Specialty Building Materials | Darex Packaging Technologies |

| Net sales | $ | 726.3 |

| $ | 379.3 |

| $ | 374.8 |

|

| Segment operating income | 72.4 |

| 75.7 |

| 74.1 |

|

| Adjusted EBITDA | 90.9 |

| 84.3 |

| 79.6 |

|

| Adjusted EBITDA margin | 12.5 | % | 22.2 | % | 21.2 | % |

| Product groups | Ÿ Concrete admixtures Ÿ Cement additives | Ÿ Building envelope Ÿ Residential building products Ÿ Specialty construction products | Ÿ Sealants and closures Ÿ Coatings |

| End use industries | Ÿ Building and construction | Ÿ Building and construction | Ÿ Packaging Ÿ Food and beverage |

| Annual global industry sales(1) | $7.8 billion |

| $3.5 billion |

| $3.2 billion |

|

| Forecasted annual industry growth rate | 3% - 4%(2) |

| 3% - 4%(2) |

| 2% - 3%(1) |

|

________________________________________________________________________________________________________________

| |

| (1) | Based on GCP's internal estimates. |

| |

| (2) | IHS Global Construction Outlook, Q4 2015. |

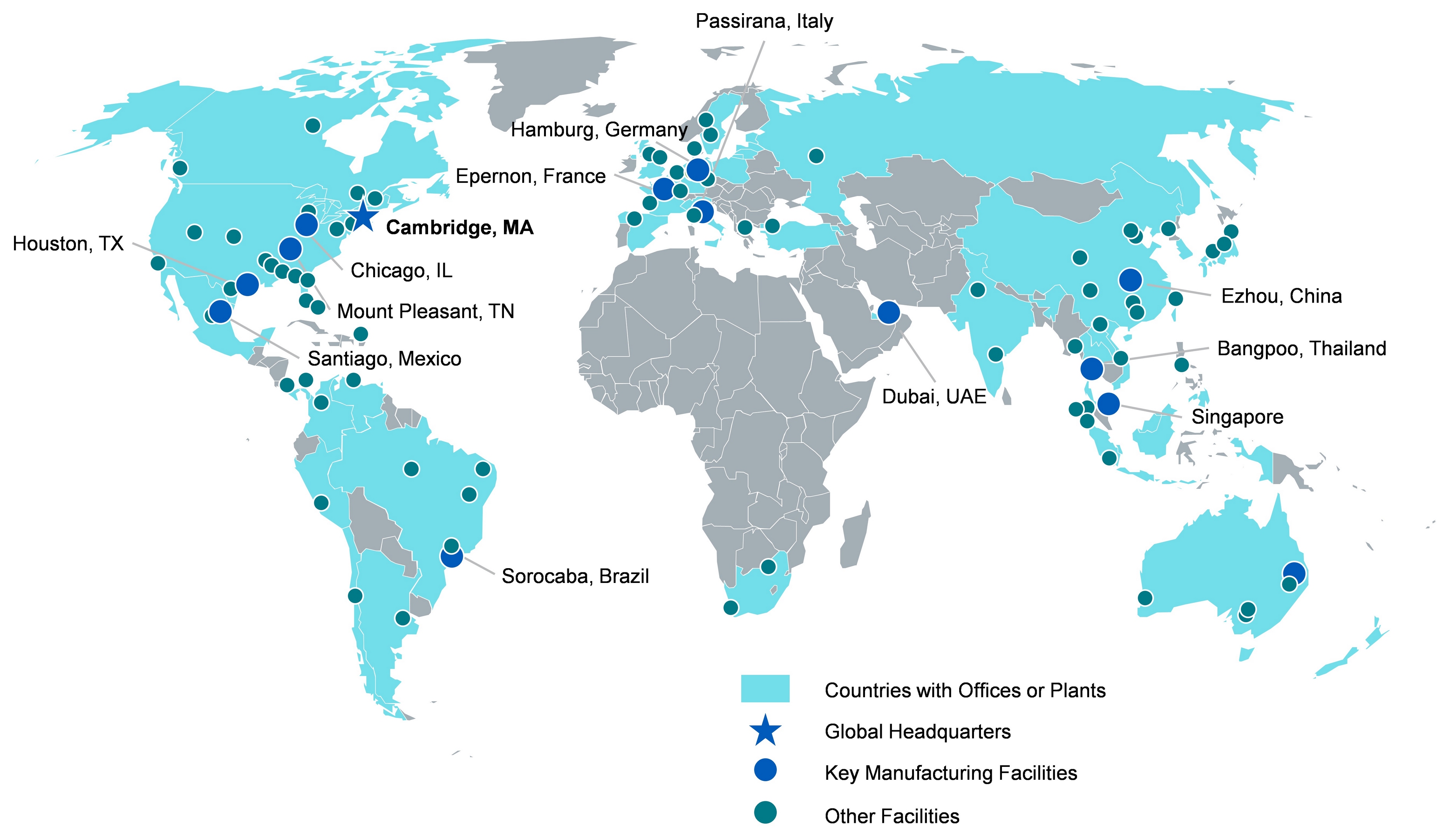

We have manufacturing, research and development (R&D), sales and technical service sites in over 40 countries and on six continents, with approximately 65 manufacturing and technical sites worldwide. As of the date of the separation, we will have approximately 2,850 employees of whom approximately 770 will be employed in the United States.

Global Operational Footprint

Our Strengths

We expect to grow our segment leadership positions by leveraging our competitive strengths, which we believe include:

Global Leadership Positions — We maintain global leadership positions in each of our operating segments and hold number one or number two positions, based on sales, that accounted for approximately 66% of our sales for the year ended December 31, 2014, including:

| |

| • | SCC — #1 position in cement additives, and #2 position in concrete admixtures; |

| |

| • | SBM — #1 position in bonded pre-applied waterproofing membranes; and |

| |

| • | Darex — #1 position in can sealants, with leading positions in can coatings and closure sealants. |

Our innovative construction chemicals and materials are used in commercial, residential, and infrastructure projects around the world. They have been widely used in projects with demanding product, performance and engineering requirements ranging from the Getty Center in Los Angeles and the London Underground to Hong Kong’s Bank of China Tower and the Guggenheim Museum Bilbao in Spain. Our packaging technologies are used by many of the world’s most recognized brand owners and are part of over 300 billion food and beverage cans and packages produced each year.

GCP’s leadership positions are the result of our reputation for quality, innovation, specialized technical expertise and industry knowledge, which we believe are significant competitive advantages. We believe these strengths permit us to maintain leading segment positions, grow our sales and generate attractive margins.

Global Manufacturing and Sales and Technical Service Presence — We operate manufacturing, R&D, sales and technical service sites in over 40 countries; with approximately 65 manufacturing and technical sites, we are strategically located near our customers’ sites and in our key geographic areas. Our operating segments share common processes, manufacturing sites, and technical service and sales centers around the world. Our global R&D and technical service organizations deliver innovative products and technology solutions to our customers at a local level by leveraging centralized R&D capabilities, regional technical centers for formulation expertise, and expert field technical service resources.

Ability to Capitalize on Growth Opportunities — We believe our close alignment with our customers and involvement in our local areas allow us to identify changing industry trends and customer dynamics to execute on new growth opportunities. We believe our global infrastructure and low capital manufacturing model enable us to quickly gain customer penetration with minimal capital investment to efficiently invest in new areas and pursue strategic bolt-on acquisitions.

Technology Leadership and Differentiated Products through R&D — Central to our business is our commitment to technology leadership and innovation, sustained by continuing investment in our R&D and technical service capabilities. Our focus on product and formulation development, application expertise, and industry knowledge is a key competitive advantage for GCP.

Our technology position is supported by our intellectual property portfolio consisting of trade secrets, know-how and patents. Additionally, we maintain trademarks including widely recognized brands such as ADVA®, MIRA®, STRUX®, Pieri® and CBA® within specialty construction chemicals; PREPRUFE®, BITUTHENE®, ICE & WATER SHIELD® and MONOKOTE® within specialty building materials; and DAREX®, APPERTA® and CELOX® within packaging technologies. We expect the continued evolution of our product portfolio to allow us to accelerate growth and further our leading global positions. We have over 800 active patents and patent applications in a number of countries around the world, including approximately 150 in the U.S.

Cash Flow Generation — GCP has generated strong cash flow. Driven by differentiated products with high margins, cash flow from operations has been well above $100 million in each of the past three years. Our low capital manufacturing model has also contributed to our strong cash flow. Historically, capital expenditures have been less than 3% of sales on an annual basis. In particular, Darex has provided stable and predictable cash flow supported by the stable can beverage industry. We plan to leverage Darex to support our growth investments across the portfolio as we deploy cash to the highest return projects.

Diverse Customer Base with Long-Standing Relationships — We serve thousands of customers in more than 110 countries with no single customer accounting for more than 5% of sales. Our relationships with many of our customers are long-standing and often span decades. Our products are often specified into customers’ projects, operations or products and we work diligently alongside our customers to tailor solutions to their complex requirements that vary across regions and localities.

Our specialty construction chemicals and specialty building materials products are regularly chosen to meet the demanding product, performance and engineering requirements of our customers. This is reflected in the portfolio of challenging construction projects where our products are used and lends exceptional credibility with architects, engineers, general contractors, specialty contractors and other channel partners, which in turn drives our sales.

Our packaging products consistently and reliably deliver solutions for our customers, including some of the world’s largest packaging companies and most recognizable brand owners for whom quality and reliability are vital to their operations.

Strong Management Team with Extensive Industry Experience — Our global management team has extensive industry experience and a successful track record of managing large global organizations, executing on attractive growth opportunities, reducing costs and driving operating efficiencies, and improving working capital performance.

Our Business Strategy

Our objective is to increase our earnings, cash flow, and return on invested capital to increase shareholder value through the implementation of our business strategies. We use our strengths to pursue these objectives through the following investment and growth strategies:

Grow Sales by Leveraging Strong Segment Leadership Positions — We intend to continue to leverage our global manufacturing and technical service footprint and our research and development and sales organizations to profitably increase geographic and customer penetration. We intend to make targeted investments to expand our geographic footprint in areas and segments where trends and economic cycles present the best opportunities.

Grow Through Strategic Acquisitions — We will continue to seek strategic, bolt-on acquisitions and alliances to accelerate our customer and geographic penetration, broaden our technology and product portfolios, and expand our manufacturing capacity and capability. Darex has provided stable and predictable cash flow and we plan to leverage Darex to help us capture growth opportunities across our portfolio.

Growth and Margin Enhancement Through Product Innovation — We will seek to further our position as an industry innovator by continuing to invest in research and development to commercialize highly valued, technically differentiated products and services to address both global mega trends and regional and local applications critical to our customers. To drive this innovation, we intend to leverage our model of introducing and supporting new technologies through our centralized research and development center in Cambridge, Massachusetts and regional applications labs globally. We may invest in additional regional application labs and field technical support resources as we expand our customer and geographic penetration.

Maintain Strong Customer Focus — A key aspect of our strategy is to continue to deliver product and technology solutions to our customers that help them improve their product performance and productivity in their manufacturing operations. We believe that maintaining a close partnership with our customers allows us to effectively focus our innovation efforts and respond to their changing demands at a global, regional and local level.

Increase Productivity by Leveraging Global Supply Chain — Given the relatively low conversion costs of our products, GCP’s productivity strategies focus on the supply chain. We have established deep procurement and product formulation expertise to manage our product costs and production efficiencies. Product formulations are optimized at our regional development labs around the world. These formulations are designed to meet specific customer needs while also considering the costs of the various raw material options available to meet those needs. Our global supply chain organization balances local raw material supply with global contracts that leverage our buying power. Our strategic manufacturing network also optimizes production and delivery efficiencies.

Drive Cash Flow and Return on Invested Capital to Deliver Long-Term Value to Our Shareholders — We believe these strategies will allow us to generate significant cash flow to invest in our research and development activities, manufacturing operations, technical service and sales organizations and strategic acquisitions and to return excess capital to shareholders.

Summary of Risk Factors

An investment in our company is subject to a number of risks, including risks relating to our business and the separation and distribution. The following list of certain risk factors is a high-level summary and is not exhaustive. For a more thorough description of risks, see “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this information statement.

Risks Relating to Our Business

| |

| • | The length and depth of product and industry business cycles in our segments may result in periods of reduced sales, earnings and cash flows, and portions of our business are subject to seasonality and weather-related effects. |

| |

| • | If we are not able to continue our technological innovation and successful introduction of new products, our customers may turn to other suppliers to meet their requirements. |

| |

| • | Prices for certain raw materials are volatile and can have a significant effect on our manufacturing and supply chain strategies as we seek to maximize our profitability. If we are unable to successfully adjust our strategies in response to volatile raw materials and energy prices, such volatility could have a negative effect on our earnings in future periods. |

| |

| • | The global scope of our operations subjects us to the risks of doing business in foreign countries, which could adversely affect our business, financial condition and results of operations. |

| |

| • | We are exposed to currency exchange rate changes that impact our profitability. |

| |

| • | Following the separation, the Company will have debt obligations that could restrict our business, adversely impact our financial condition, results of operations or cash flows or restrict our ability to return cash to shareholders. |

| |

| • | We intend to pursue acquisitions, joint ventures and other transactions that complement or expand our businesses. We may not be able to complete proposed transactions and even if completed, the transactions may not achieve the earnings, cash flow or returns on investment that we had contemplated. |

Risks Relating to the Separation

| |

| • | We have no history operating as an independent public company. We will incur significant costs to create the corporate infrastructure necessary to operate as an independent public company, and we may experience increased ongoing costs in connection with being an independent public company. |

| |

| • | We may not realize the potential benefits from the separation, and our historical combined and pro forma financial information is not necessarily indicative of our future performance. |

| |

| • | If the distribution and certain related transactions fail to qualify under applicable Internal Revenue Code provisions, Grace, the Company, and Grace shareholders could be subject to significant tax liabilities and, in certain circumstances, the Company could be required to indemnify Grace for material taxes and other related amounts pursuant to indemnification obligations under the Tax Sharing Agreement. |

| |

| • | In connection with our separation from Grace, Grace will indemnify the Company for certain liabilities and the Company will indemnify Grace for certain liabilities. If the Company is required to act on these indemnities to Grace, we may need to divert cash to meet those obligations and our financial results could be negatively impacted. Grace may not be able to satisfy its indemnification obligations to the Company in the future. |

Risks Relating to Ownership of GCP Common Stock

| |

| • | Because there has not been any public market for GCP common stock, the market price and trading volume of its common stock may be volatile and you may not be able to resell your shares at or above the initial market price of the GCP common stock following the separation and distribution. |

| |

| • | A large number of the Company’s shares are or will be eligible for future sale, which may cause the market price for GCP common stock to decline. |

| |

| • | Provisions in the Company’s corporate documents, the Tax Sharing Agreement and Delaware law could delay or prevent a change in control of the Company, even if that change may be considered beneficial by some Company shareholders. |

The Separation

Overview — On February 5, 2015, Grace announced its intent to separate GCP into an independent publicly-traded company. Subject to the satisfaction of specified conditions, the separation will be accomplished by distributing to Grace shareholders all of the shares of common stock of the Company. The Company is a wholly owned subsidiary of Grace that at the time of the separation will hold GCP. Immediately following the distribution, Grace shareholders as of the record date will own 100 percent of the outstanding shares of GCP common stock.

Before the separation of GCP from Grace, the Company and Grace will enter into a Separation and Distribution Agreement and they and/or their respective subsidiaries will enter into several other agreements to effect the separation and distribution. These agreements will provide for the allocation between the Company and Grace of Grace’s assets, liabilities and obligations and will govern the relationship between the Company and Grace after the separation (including with respect to employee matters, tax matters and intellectual property matters). The Company and Grace Conn and/or their respective subsidiaries will also enter into one or more Transition Services Agreements which will provide for, among other things, the provision of transitional services.

Reasons for the Separation. The W. R. Grace & Co. board of directors believes that separating GCP from Grace’s other businesses through the distribution is in the best interests of Grace and its shareholders and has

concluded the separation will provide each company with a number of material opportunities and benefits, including the following:

| |

| • | Enhanced Strategic Focus. Create two strong, more focused operating companies, each with industry-leading customer and technology positions, with Grace well-positioned to pursue distinct growth opportunities in the catalysts and materials businesses, and the Company well-positioned to pursue distinct growth opportunities in the specialty construction chemicals, specialty building materials and packaging products businesses. |

| |

| • | Simplified Operating Structures. Allow management of each company to concentrate that company’s resources wholly on its particular industry segments, customers and core businesses, with greater ability to anticipate and respond to changing industry conditions and new opportunities. Each company will focus on cost productivity and optimizing functional support for its core operations, with greater management focus on customized strategies that can deliver long-term shareholder value. |

| |

| • | Optimized Capital Structures and Financial Flexibility. Establish a capital structure appropriate for each company’s business needs, with each company having direct access to the debt and equity markets to pursue its distinct growth, acquisition and joint venture opportunities, eliminating competition for capital between the two. The separation will provide each company with an independent equity currency that will (1) facilitate the ability of each company to consummate future acquisitions using its common stock if required and (2) facilitate incentive compensation arrangements for employees that are more directly tied to the performance of each company’s business, and enhance employee hiring and retention by, among other things, improving the alignment of management and employee incentives with performance and growth objectives. |

| |

| • | Investor Choice. Provide investors with a more targeted investment opportunity in each company that offers different investment and business characteristics, including different growth opportunities, business models, capital requirements and financial returns. This will allow investors to evaluate the separate and distinct merits, performance and future prospects of each company. |

Questions and Answers About the Separation and Distribution

| |

| Q: | How will W. R. Grace & Co. accomplish the separation of GCP? |

| |

| A: | The separation involves W. R. Grace & Co.’s distribution to holders of Grace common stock of all the shares of GCP common stock that it owns. Following the separation and distribution, the Company will be an independent, publicly traded company separate from Grace, and Grace will not retain any ownership interest in the Company. You do not have to pay any consideration or give up any portion of your Grace common stock to receive GCP common stock in the distribution. |

| |

| Q: | What will I receive in the distribution? |

| |

| A: | W. R. Grace & Co. will distribute one share of GCP common stock for each share of Grace common stock outstanding as of the record date for the distribution. You will pay no consideration nor give up any portion of your Grace common stock to receive shares of GCP common stock in the distribution. |

| |

| Q: | What is the record date for the distribution, and when will the distribution occur? |

| |

| A: | The record date is January 27, 2016, and ownership is determined as of 5:00 p.m. Eastern Time on that date. When we refer to the “record date,” we are referring to that time and date. W. R. Grace & Co. will distribute shares of GCP common stock on or about February 3, 2016, which we refer to as the distribution date. |

| |

| Q: | As a holder of shares of Grace common stock as of the record date, what do I have to do to participate in the distribution? |

| |

| A: | No action is required of shareholders. Holders of Grace common stock on the record date are not required to pay any cash or deliver any other consideration, including any shares of Grace common stock, for the shares of GCP common stock to be distributed to them. No shareholder approval of the distribution is required or sought. You are not being asked for a proxy. |

| |

| Q: | If I sell my shares of Grace common stock before or on the distribution date, will I still be entitled to receive shares of GCP common stock in the distribution? |

| |

| A: | If you sell your shares of Grace common stock prior to or on the distribution date, you may also be selling your right to receive shares of GCP common stock. See “The Separation and Distribution—Trading Between Record Date and Distribution Date.” You are encouraged to consult with your financial advisor regarding the specific implications of selling your Grace common stock prior to or on the distribution date. |

| |

| Q: | How will fractional shares be treated in the distribution? |

| |

| A. | Grace will not distribute any fractional shares of GCP common stock to Grace stockholders. Any fractional share of GCP common stock otherwise issuable to you will be sold on your behalf, and you will receive a cash payment with respect to that fractional share. For an explanation of how the cash payments for fractional shares will be determined, see “The Separation and Distribution—Treatment of Fractional Shares.” |

| |

| Q: | Will the distribution affect the number of shares of Grace common stock that I currently hold? |

| |

| A: | No, the number of shares of Grace common stock held by a shareholder will be unchanged. The market value of each share of Grace common stock, however, will decline to reflect the effect of the separation and distribution. |

| |

| Q: | What are the material U.S. federal income tax consequences of the distribution of shares of GCP common stock to U.S. shareholders? |

| |

| A: | The distribution is conditioned upon, among other things, the receipt by Grace of an opinion of counsel, in form and substance satisfactory to Grace in its sole discretion, regarding the U.S. federal income tax treatment of the distribution of shares of GCP common stock and certain related transactions. We expect that, for U.S. federal income tax purposes, you will not recognize any gain or loss, and no amount will be included in your income, upon your receipt of shares of GCP common stock pursuant to the distribution, except with respect to any cash received in lieu of fractional shares. You should consult your own tax advisor as to the particular consequences of the distribution to you, including the applicability and effect of any U.S. federal, state and local tax laws, as well as foreign tax laws. For more information regarding certain material U.S. federal income tax consequences of the distribution, see the section entitled “Material U.S. Federal Income Tax Consequences.” |

| |

| Q: | Will I receive a stock certificate for shares of GCP common stock distributed as a result of the distribution? |

| |

| A: | No. Registered holders of Grace common stock who are entitled to participate in the distribution will receive a book-entry account statement reflecting their ownership of GCP common stock. For additional information, registered shareholders in the United States, Canada or Puerto Rico should contact W. R. Grace & Co.’s transfer agent, Wells Fargo Shareowner Services, at 800-648-8392 or through its website at shareowneronline.com. Shareholders from outside the United States, Canada and Puerto Rico may call 651-450-4064. See “The Separation and Distribution—When and How You Will Receive the Distribution.” |

| |

| Q: | What if I hold my shares through a broker, bank or other nominee? |

| |

| A: | Holders of Grace common stock who hold their shares through a broker, bank or other nominee will have their brokerage account credited with GCP common stock. For additional information, those shareholders should contact their broker or bank directly. |

| |

| Q: | What if I have stock certificates reflecting my shares of Grace common stock? Should I send them to the transfer agent or to W. R. Grace & Co.? |

| |

| A: | No, you should not send your stock certificates to the transfer agent or to W. R. Grace & Co. You should retain your Grace common stock certificates. |

| |

| Q: | Why is the separation of the two companies structured as a distribution of shares of GCP common stock? |

| |

| A: | Grace believes a distribution of shares of GCP common stock to holders of Grace common stock is the most efficient way to separate the companies. |

| |

| Q: | Can Grace decide to cancel the distribution of the GCP common stock even if all the conditions have been met? |

| |

| A: | Yes. Grace has the right to terminate the distribution at any time prior to the distribution date, even if all of the conditions are satisfied, if at any time Grace’s board determines that the distribution is not in the best interests of Grace and its shareholders. In the event the W. R. Grace & Co. board of directors determines to abandon, modify or change the terms of the distribution, the Company and W. R. Grace & Co. intend to promptly issue a press release and file a Current Report on Form 8-K to report such event. |

| |

| Q: | Will GCP incur any debt prior to or at the time of the distribution? |

| |

| A: | Yes. We intend to enter into new financing arrangements in anticipation of the distribution for borrowings of approximately $810 million. Approximately $750 million of the debt proceeds are expected to be distributed to Grace and the balance is expected to be retained to meet operating requirements. See “Risk Factors” and “Description of Material Indebtedness.” |

| |

| Q: | Does GCP intend to pay cash dividends? |

| |

| A: | GCP does not anticipate paying cash dividends on GCP common stock in the immediate future. The declaration and amount of future dividends, however, will be determined by our board of directors and will depend on our financial condition, earnings and cash flow, capital requirements, legal requirements, regulatory constraints and any other factors that our board of directors believes are relevant. See “Dividend Policy.” |

| |

| Q: | Will GCP common stock trade on a stock market? |

| |

| A: | Currently, there is no public market for GCP common stock. Subject to the consummation of the distribution, we have applied to list GCP common stock on the NYSE under the symbol “GCP.” We cannot predict the trading prices for GCP common stock when such trading begins. |

| |

| Q: | Will my shares of Grace common stock continue to trade? |

| |

| A: | Yes. Grace common stock will continue to be listed and trade on the NYSE under the symbol “GRA.” |

| |

| Q: | Will the separation affect the trading price of my Grace stock? |

| |

| A: | Yes. The trading price of shares of Grace common stock immediately following the distribution is expected to be lower than immediately prior to the distribution because the trading price will no longer reflect the value of GCP. We cannot provide you with any assurance regarding the price at which shares of Grace common stock will trade following the separation. |

| |

| Q: | What will happen to W. R. Grace & Co. stock options and other equity-based compensation awards? |

| |

| A: | For information on the treatment of W. R. Grace & Co. equity-based compensation awards, see “The Separation and Distribution—Treatment of Equity-Based Compensation” and “Certain Relationships and Related Transactions—Agreements with Grace-Employee Matters Agreement." |

| |

| Q: | What will the relationship be between Grace and GCP following the separation? |

| |

| A: | After the separation, Grace will not own any shares of GCP common stock, and each of Grace and GCP will be independent, publicly traded companies with their own management teams and boards of directors. However, in connection with the separation, we expect to enter into a number of agreements with Grace that will govern the separation and allocate responsibilities for obligations arising before and after the separation, including, among others, obligations relating to our employees, tax matters, |

intellectual property matters and transitional services. See “Certain Relationships and Related Transactions—Agreements with Grace.”

| |

| Q: | How much will the separation cost and who will bear that cost? |

| |

| A: | The separation is expected to cost approximately $100 million, of which approximately 65% is expected to be incurred prior to the separation. Grace will bear all costs prior to the separation. GCP will bear its costs after the separation which we expect to be approximately $10 million to $15 million. |

| |

| Q: | Will I have appraisal rights in connection with the separation and distribution? |

| |

| A: | No. Holders of Grace common stock are not entitled to appraisal rights in connection with the separation and distribution. |

| |

| Q: | Who is the transfer agent for the GCP common stock? |

| |

| A: | Wells Fargo Shareowner Services |

P.O. Box 64874

St. Paul, MN 55164-0874

Telephone: 800-648-8392 or 651-450-4064 (outside the United States, Canada and Puerto Rico).

| |

| Q: | Who is the distribution agent for the distribution? |

| |

| A: | Wells Fargo Shareowner Services |

P.O. Box 64874

St. Paul, MN 55164-0874

Telephone: 800-648-8392 or 651-450-4064 (outside the United States, Canada and Puerto Rico).

| |

| Q: | Whom can I contact for more information? |

| |

| A: | If you have questions relating to the mechanics of the distribution of shares of GCP common stock, you should contact the distribution agent: |

Wells Fargo Shareowner Services

P.O. Box 64874

St. Paul, MN 55164-0874

Telephone: 800-648-8392 or 651-450-4064 (outside the United States, Canada and Puerto Rico).

Before the separation, if you have questions relating to the separation and distribution, you should contact Grace at:

W. R. Grace & Co.

7500 Grace Drive

Columbia, MD 21044

Attention: Investor Relations/Shareholder Services

Telephone: 410-531-4000

Email: investor.relations@grace.com

Summary of the Separation and Distribution

The following is a summary of the material terms of the separation, distribution and other related transactions.

|

| | |

| Distributing company | | W. R. Grace & Co., a Delaware corporation. After the distribution, W. R. Grace & Co. will not own any shares of GCP common stock. |

| | | |

| Distributed company | | GCP Applied Technologies Inc., a Delaware corporation, the Company, an indirect wholly owned subsidiary of W. R. Grace & Co. that was formed in 2015. At the time of the distribution, the Company will hold the businesses, assets and liabilities associated with the Grace Construction Products operating segment and the Darex Packaging Technologies business. After the distribution, the Company will be an independent, publicly traded entity. |

| | | |

| Record date | | The record date for the distribution is 5:00 p.m. Eastern Time on January 27, 2016. |

| | | |

| Distribution date | | The distribution date is February 3, 2016. |

| | | |

| Distributed securities | | Grace will distribute 100 percent of the shares of GCP common stock outstanding immediately prior to the distribution. Based on the approximately 70.5 million shares of Grace common stock outstanding on January 11, 2016, and applying the distribution ratio of one share of GCP common stock for each share of Grace common stock, Grace will distribute approximately 70.5 million shares of GCP common stock to Grace shareholders who hold Grace common stock as of the record date. |

| | | |

| Distribution ratio | | Each holder of Grace common stock will receive one share of GCP common stock for each share of Grace common stock held at 5:00 p.m. Eastern Time on January 27, 2016. |

| | | |

| Fractional shares | | Grace will not distribute any fractional shares of GCP common stock to Grace stockholders. Instead, as soon as practicable on or after the distribution date, the distribution agent will aggregate fractional shares into whole shares, sell the whole shares in the open market and distribute the aggregate cash proceeds, net of brokerage fees and other costs, from the sales pro rata to each holder who would otherwise have been entitled to receive a fractional share in the distribution. The distribution agent will determine when, how, through which broker-dealers and at what prices to sell the aggregated fractional shares. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts of payments made in lieu of fractional shares. The receipt of cash in lieu of fractional shares generally will be taxable to the recipient stockholders for U.S. federal income tax purposes as described in “Material U.S. Federal Income Tax Consequences” in this information statement. |

| | | |

| Distribution method | | GCP common stock will be issued only by direct registration in book-entry form. Registration in book-entry form is a method of recording stock ownership when no physical paper share certificates are issued to shareholders, as is the case in this distribution. |

| | | |

| Conditions to the distribution | | The distribution is subject to the satisfaction or waiver by Grace of the following condition, as well as other conditions described in this information statement in “The Separation and Distribution-Conditions to the Distribution.” • The receipt of an opinion of counsel, in form and substance satisfactory to Grace in its sole discretion, regarding the U.S. federal income tax treatment of the distribution and certain related transactions.The fulfillment of the foregoing condition and the other conditions to the distribution does not create any obligations on Grace’s part to effect the distribution, and the Grace board of directors has reserved the right, in its sole discretion, to abandon, modify or change the terms of the distribution, including by accelerating or delaying the timing of the consummation of all or part of the distribution, at any time prior to the distribution date. |

| | | |

|

| | |

| Stock exchange listing | | GCP has applied to have the GCP common stock listed on the NYSE under the symbol “GCP.” |

| | | |

| Dividend policy | | While remaining at the discretion of the Company's board of directors, the Company does not anticipate paying cash dividends on GCP common stock in the immediate future. |

| | | |

| Transfer agent | | Wells Fargo Shareowner Services P.O. Box 64874 St. Paul, MN 55164-0874 Telephone: 800-648-8392 or 651-450-4064 (outside the United States, Canada and Puerto Rico). |

| | | |

| U.S. federal income tax consequences | | It is a condition to the completion of the distribution that Grace obtains an opinion of counsel, in form and substance satisfactory to Grace in its sole discretion, regarding the U.S. federal income tax treatment of the distribution of shares of GCP common stock and certain related transactions. We expect that, for U.S. federal income tax purposes, a holder of Grace common stock will not recognize any gain or loss, and no amount will be included in the income of a holder of Grace common stock, upon the receipt of shares of GCP common stock pursuant to the distribution, except with respect to any cash received in lieu of fractional shares. You should consult your own tax advisor as to the particular tax consequences of the distribution to you, including the applicability and effect of any U.S. federal, state and local tax laws, as well as foreign tax laws. For more information regarding certain material U.S. federal income tax consequences of the distribution, see “Material U.S. Federal Income Tax Consequences.” |

Corporate Information

The Company was formed in 2015 and will, at the time of the distribution, hold the businesses, assets and liabilities associated with the Grace Construction Products operating segment and the Darex Packaging Technologies business. Our headquarters will be located at 62 Whittemore Avenue, Cambridge, MA 02140 and our general telephone number is 617-876-1400. Our Internet website is www.gcpat.com. Our website and information contained on that site, or connected to that site, are not incorporated by reference into this information statement.

Reason for Furnishing this Information Statement

This information statement is being furnished solely to provide information to Grace shareholders who are entitled to receive shares of GCP common stock in the distribution. The information statement is not, and is not to be construed as, an inducement or encouragement to buy, hold or sell any of our securities. We believe the information contained in this information statement is accurate as of the date set forth on the cover. Changes may occur after that date and neither Grace nor we undertake any obligation to update such information except in the normal course of our respective public disclosure obligations.

RISK FACTORS

You should carefully consider each of the following risk factors and all of the other information set forth in this information statement. The risk factors generally have been separated into three groups: (1) risks relating to our business, (2) risks relating to the separation and (3) risks relating to the ownership of GCP common stock. Based on the information currently known to us, we believe that the following information identifies the most significant risk factors affecting the Company and our business in each of these categories of risks. However, the risks and uncertainties the Company faces are not limited to those set forth in the risk factors described below. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business. In addition, past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods.

If any of the following risks and uncertainties develops into actual events, these events could have a material adverse effect on our business, financial condition or results of operations. In such case, the trading price of our common stock could decline.

Risks Relating to Our Business

The length and depth of product and industry business cycles in our segments may result in periods of reduced sales, earnings and cash flows, and portions of our business are subject to seasonality and weather-related effects.

Our operating segments are sensitive to the cyclical nature of the industries they serve. Our construction business is cyclical in response to economic conditions and construction demand and is also seasonal and dependent on favorable weather conditions, with a decrease in construction activity during the winter months. Our packaging products are affected by seasonal and weather-related factors including the consumption of beverages and the size and quality of food crops.

If we are not able to continue our technological innovation and successful introduction of new products, our customers may turn to other suppliers to meet their requirements.

The specialty chemicals industry and the end-use applications into which we sell our products experience ongoing technological change and product improvements. A key element of our business strategy is to invest in research and development activities with the goal of introducing new high-performance, technically differentiated products. We may not be successful in developing new technology and products that successfully compete with products introduced by our competitors, and our customers may not accept, or may have lower demand for, our new products. If we fail to keep pace with evolving technological innovations or fail to improve our products in response to our customers’ needs, then our business, financial condition and results of operations could be adversely affected as a result of reduced sales of our products.

Prices for certain raw materials are volatile and can have a significant effect on our manufacturing and supply chain strategies as we seek to maximize our profitability. If we are unable to successfully adjust our strategies in response to volatile raw materials prices, such volatility could have a negative effect on our earnings in future periods.

We use petroleum-based materials, natural gas derivatives and other materials in the manufacture of our products. Prices for these materials are volatile and can have a significant effect on our pricing, sales, manufacturing and supply chain strategies as we seek to maximize our profitability. Our ability to successfully adjust strategies in response to volatile raw material prices by increasing prices, reducing costs or taking other actions is a significant factor in maintaining or improving our profitability. If we are unable to successfully adjust our strategies in response to volatile prices, such volatility could have a negative effect on our sales and earnings in future periods.

A substantial portion of our raw materials are commodities whose prices fluctuate as market supply and demand fundamentals change. We attempt to manage exposure to price volatility of major commodities through:

| |

| • | long-term supply contracts; |

| |

| • | customer contracts that permit adjustments for changes in prices of commodity-based materials and energy; |

| |

| • | forward buying programs that layer in our expected requirements systematically over time; and |

| |

| • | limited use of financial instruments. |

Although we regularly assess our exposure to raw material price volatility, we cannot always predict the prospects of volatility and we cannot always cover the risk in a cost-effective manner.

We have a policy of maintaining, when available, multiple sources of supply for raw materials. However, certain of our raw materials may be provided by single sources of supply. We may not be able to obtain sufficient raw materials due to unforeseen developments that would cause an interruption in supply. Even if we have multiple sources of supply for raw materials, these sources may not make up for the loss of a major supplier.

The global scope of our operations subjects us to the risks of doing business in foreign countries, which could adversely affect our business, financial condition and results of operations.

We operate our business on a global scale with approximately 68% of our 2014 sales outside the United States. We conduct business in over 40 countries and in approximately 40 currencies. We currently have many production facilities, technical centers and administrative and sales offices located outside North America, including facilities and offices in Europe, the Middle East, Africa, Asia and Latin America. We expect non-U.S. sales to continue to represent a substantial majority of our revenue. Accordingly, our business is subject to risks related to the differing legal, political, social and economic conditions as well as regulatory requirements of many jurisdictions. Risks inherent in non-U.S. operations include the following:

| |

| • | commercial agreements may be more difficult to enforce and receivables more difficult to collect; |

| |

| • | intellectual property rights may be more difficult to enforce; |

| |

| • | we may experience increased shipping costs, disruptions in shipping or reduced availability of freight transportation; |

| |

| • | we may have difficulty transferring our profits or capital from foreign operations to other countries where such funds could be more profitably deployed; |

| |

| • | we may experience unexpected adverse changes in export duties, quotas and tariffs and difficulties in obtaining export licenses; |

| |

| • | some foreign countries have adopted, and others may impose, additional withholding taxes or other restrictions on foreign trade or investment, including currency exchange and capital controls; |

| |

| • | foreign governments may nationalize private enterprises; |

| |

| • | our business and profitability in a particular country could be affected by political or economic repercussions on a domestic, country specific or global level from terrorist activities and the response to such activities; |

| |

| • | we may be affected by unexpected adverse changes in foreign laws or regulatory requirements; and |

| |

| • | unanticipated events, such as geopolitical changes, could adversely affect our foreign operations. |

Our success as a global business will depend, in part, upon our ability to succeed in differing legal, regulatory, economic, social and political conditions by developing, implementing and maintaining policies and strategies that are effective in each location where we do business.

We are exposed to currency exchange rate changes that impact our profitability.

We are exposed to currency exchange rate risk through our U.S. and non-U.S. operations. Changes in currency exchange rates may materially affect our operating results. For example, changes in currency exchange rates may affect the relative prices at which we and our competitors sell products in the same region and the cost of materials used in our operations. A substantial portion of our net sales and assets are denominated in currencies other than the U.S. dollar. When the U.S. dollar strengthens against other currencies, at a constant level of business, our reported sales, earnings, assets and liabilities are reduced because the non-U.S. currencies translate into fewer U.S. dollars. In addition, since we manufacture a portion of our construction products and packaging products in emerging regions using raw materials from suppliers in the U.S., Europe and other

advanced economies, changes in the values of the currencies of these emerging regions versus the U.S. dollar and the euro may adversely affect our raw material costs.

We incur a currency transaction risk whenever one of our operating subsidiaries enters into either a purchase or a sales transaction using a currency different from the operating subsidiary's functional currency. Given the volatility of exchange rates, we may not be able to manage our currency transaction risks effectively, or volatility in currency exchange rates may expose our financial condition or results of operations to significant additional risk.

Following the separation, the Company will have debt obligations that could restrict our business, adversely impact our financial condition, results of operations or cash flows or restrict our ability to return cash to shareholders.

As of December 31, 2014, we had $79.0 million of unsecured indebtedness outstanding. Immediately following the separation, we expect the Company will bear a total combined indebtedness for borrowed money of approximately $820 million, including approximately $750 million borrowed to pay a distribution to Grace prior to the separation. The Company's indebtedness may have material effects on our business, including to:

| |

| • | require us to dedicate a substantial portion of our cash flow to debt payments, thereby reducing funds available for working capital, capital expenditures, acquisitions, research and development, distributions to holders of GCP common stock and other purposes; |

| |

| • | restrict us from making strategic acquisitions or taking advantage of favorable business opportunities; |

| |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industries in which we operate; |

| |

| • | increase our vulnerability to adverse economic, credit and industry conditions, including recessions; |

| |

| • | make it more difficult for us to satisfy our debt service and other obligations; |

| |

| • | place us at a competitive disadvantage compared to our competitors that have relatively less debt; and |

| |

| • | limit the Company's ability to borrow additional funds, or to dispose of assets to raise funds, if needed, for working capital, capital expenditures, acquisitions, research and development and other purposes. |

The Company may also incur substantial additional indebtedness in the future. If the Company incurs additional debt, the risks related to the Company's indebtedness may intensify.

We require liquidity to service the Company's debt and to fund operations, capital expenditures, research and development efforts, acquisitions and other corporate expenses.

Our ability to fund operations, capital expenditures, research and development efforts, acquisitions and other corporate expenses, including repayment of our debt, depends on our ability to generate cash through future operating performance, which is subject to economic, financial, competitive, legislative, regulatory and other factors. Many of these factors are beyond our control. We cannot be certain that our businesses will generate sufficient cash or that future borrowings will be available to us in amounts sufficient to fund all of our requirements. If we are unable to generate sufficient cash to fund all of our requirements, we may need to pursue one or more alternatives, such as to:

| |

| • | reduce or delay planned capital expenditures, research and development spending or acquisitions; |

| |

| • | obtain additional financing or restructure or refinance all or a portion of our debt on or before maturity; |

| |

| • | sell assets or businesses; and |

Any reduction or delay in planned capital expenditures, research and development spending or acquisitions or sale of assets or businesses may materially and adversely affect our future revenue prospects. In addition, we

cannot be certain that we will be able to raise additional equity capital, restructure or refinance any of our debt or obtain additional financing on commercially reasonable terms or at all.

We expect restrictions imposed by agreements governing the Company's indebtedness may limit our ability to operate our business, finance our future operations or capital needs or engage in other business activities. If we fail to comply with certain restrictions under these agreements, the Company's debt could be accelerated and the Company may not have sufficient cash to pay the accelerated debt.

We expect the agreements governing our indebtedness may contain various covenants that limit, among other things, our ability, and the ability of certain of our subsidiaries, to:

| |

| • | enter into sale and leaseback transactions; and |

| |

| • | consolidate, merge or sell all or substantially all of our assets or the assets of our guarantors. |

As a result of these covenants, we will be limited in the manner in which we can conduct our business, and may be unable to engage in favorable business activities or finance future operations or capital needs. Accordingly, these restrictions may limit our flexibility to operate our business. A failure to comply with the restrictions contained in these agreements, including maintaining the financial ratios that we expect to be required by our credit facilities, could lead to an event of default which could result in an acceleration of the indebtedness. We cannot assure you that our future operating results will be sufficient to enable us to comply with the covenants contained in the agreements that we expect to govern our indebtedness or to remedy any such default. In addition, in the event of an acceleration, we may not have or be able to obtain sufficient funds to make any accelerated payments.

Our indebtedness exposes us to interest expense increases if interest rates increase.

As of the time of the separation and distribution, we expect that $295 million, or approximately 36%, of our borrowings, will be at variable interest rates and expose us to interest rate risk. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed would remain the same, and our net income would decrease. An increase of 1% in the interest rates payable on the variable rate indebtedness we expect to have at the time of the separation and distribution would increase our annual estimated debt-service requirements by $3 million, assuming our consolidated variable interest rate indebtedness outstanding as of the time of the separation and distribution remains the same.

We have unfunded and underfunded pension plan liabilities. We will require future operating cash flow to fund these liabilities. We have no assurance that we will generate sufficient cash to satisfy these obligations.

We maintain U.S. and non-U.S. defined benefit pension plans covering current and former employees who meet or met age and service requirements. Our net pension liability and cost is materially affected by the discount rate used to measure pension obligations, the longevity and actuarial profile of our workforce, the level of plan assets available to fund those obligations and the actual and expected long-term rate of return on plan assets. Significant changes in investment performance or a change in the portfolio mix of invested assets can result in corresponding increases and decreases in the valuation of plan assets or in a change in the expected rate of return on plan assets. In addition, any changes in the discount rate could result in a significant increase or decrease in the valuation of pension obligations, affecting the reported funded status of our pension plans as well as the net periodic pension cost in the following years. Similarly, changes in the expected return on plan assets can result in significant changes in the net periodic pension cost in the following years.

We intend to pursue acquisitions, joint ventures and other transactions that complement or expand our businesses. We may not be able to complete proposed transactions and even if completed, the transactions may not achieve the earnings, cash flow or returns on investment that we had contemplated.

We have recently completed a number of acquisitions that we believe will contribute to our future success. We intend to continue to pursue opportunities to buy other businesses or technologies that could complement, enhance or expand our current businesses or product lines or that might otherwise offer us growth opportunities. We may have difficulty identifying appropriate opportunities or, if we do identify opportunities, we may not be

successful in completing transactions for a number of reasons. Any transactions that we are able to identify and complete may involve a number of risks, including:

| |

| • | the diversion of management's attention from our existing businesses to integrate the operations and personnel of the acquired or combined business or joint venture; |

| |

| • | possible adverse effects on our operating results during the integration process; |

| |

| • | failure of the acquired business to achieve expected operational objectives; and |

| |

| • | our possible inability to achieve the intended objectives of the transaction. |