UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| | |

| ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2018 |

| OR |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Commission File Number 1-137533 |

GCP Applied Technologies Inc.

|

| | |

Delaware (State of Incorporation) | | 47-3936076 (I.R.S. Employer Identification No.) |

62 Whittemore Avenue, Cambridge, Massachusetts 02140-1623

(617) 876-1400

(Address and phone number of principal executive offices)

|

| | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, $.01 par value | | New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | |

Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o | | Smaller reporting company o | | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of GCP Applied Technologies' voting and non-voting common equity held by non-affiliates as of June 29, 2018 (the last business day of the registrant's most recently completed second fiscal quarter) based on the closing sale price of $28.95 as reported on the New York Stock Exchange was $1,645,429,963.

At February 20, 2019, there were 72,330,420 shares of GCP Applied Technologies Common Stock, $.01 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for our 2019 Annual Meeting of Stockholders are incorporated by reference in Part III of this Form 10-K.

TABLE OF CONTENTS

|

| | |

| PART I |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| PART II |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART III |

| | |

| | |

| | |

| | |

| | |

| PART IV |

| | |

| | |

| |

Presentation of Information

Unless the context requires otherwise, references to "GCP Applied Technologies Inc.", "GCP", "we", "us", "our" and "the Company" refer to GCP Applied Technologies Inc., and its consolidated subsidiaries for periods subsequent to its separation from W.R. Grace & Co. on February 3, 2016. For periods prior to February 3, 2016, these terms refer to the combined historical business and operations of W.R. Grace & Co.’s construction products and packaging technologies businesses as they were historically managed as part of W.R. Grace & Co. Unless the context requires otherwise, references to "Grace" refer to W.R. Grace & Co., and its consolidated subsidiaries, which is the Company’s former parent company. References in this Annual Report on Form 10-K to the "Separation" refer to the legal separation and transfer of Grace’s construction products and packaging technologies businesses to the Company through a dividend distribution of all of the then-outstanding common stock of GCP to Grace shareholders on February 3, 2016. Our references to "advanced economies" and "emerging regions" refer to classifications established by the International Monetary Fund.

Forward-Looking Statements

This document contains, and our other public communications may contain, forward-looking statements, that is, information related to future, not historical events. Such statements generally include the words "believes," "plans," "intends," "targets," "will," "expects," "suggests," "anticipates," "outlook," "continues" or similar expressions. Forward-looking statements include, without limitation, expected financial positions; results of operations; cash flows; financing plans; business strategy; operating plans; capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new technology and cost reduction initiatives, plans and objectives; and markets for securities. Like other businesses, we are subject to risks and uncertainties that could cause our actual results to differ materially from our projections or that could cause other forward-looking statements to prove incorrect. Factors that could cause actual results to materially differ from those contained in the forward-looking statements, or that could cause other forward-looking statements to prove incorrect, include, without limitation, risks related to: the cyclical and seasonal nature of the industries that GCP serves; foreign operations, especially in emerging regions; changes in currency exchange rates; the cost and availability of raw materials and energy; the effectiveness of GCP’s research and development, new product introductions and growth investments; acquisitions and divestitures of assets and gains and losses from dispositions; developments affecting GCP’s outstanding liquidity and indebtedness, including debt covenants and interest rate exposure; developments affecting GCP’s funded and unfunded pension obligations; warranty and product liability claims; legal proceedings; the inability to establish or maintain certain business relationships and relationships with customers and suppliers or the inability to retain key personnel; the handling of hazardous materials and the costs of compliance with environmental regulation. These and other factors are identified and described in more detail in Item 1A of this Annual Report on Form 10-K, and GCP's Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, which have been filed with the Securities and Exchange Commission ("SEC") and are available online at www.sec.gov. Our reported results should not be considered as an indication of our future performance. Readers are cautioned not to place undue reliance on GCP's projections and forward-looking statements, which speak only as of the date thereof. GCP undertakes no obligation to publicly release any revision to the projections and forward-looking statements contained in this document, or to update them to reflect events or circumstances occurring after the date of this document.

Trademarks and Trade Names

We own or have rights to trademarks, service marks, copyrights and trade names that we use in conjunction with the operation of our business, including, except as otherwise indicated, the trademarks, service marks or trade names used in this report. A mark designated with a circled “R” (e.g., ADVA®) means that the mark has been registered in the USA or other countries where we sell products. This report may also include trademarks, service marks and trade names of other companies. Each trademark, service mark or trade name of any other company appearing in this Annual Report on Form 10-K belongs to its holder. Unless otherwise indicated, use or display by us of other parties’ trademarks, service marks or trade names is not intended to and does not imply a relationship with the trade name owner, or endorsement or sponsorship by us of the trademark, service mark or trade name owner.

PART I.

ITEM 1. BUSINESS

BUSINESS OVERVIEW

GCP Applied Technologies Inc. is a global provider of construction products technologies that include admixtures and additives for concrete and cement, the VERIFI® in-transit concrete management system, high-performance waterproofing products and specialty systems. The Company is a leader in its two global operating segments. Specialty Construction Chemicals ("SCC") operating segment produces concrete admixtures, which enhance the properties of concrete and other cementitious construction materials, and cement additives, which improve the performance of Portland cement, the most widely used construction material in the world. Specialty Building Materials ("SBM") operating segment produces building envelope, residential and specialty construction products that protect structures from water, vapor transmission, air penetration and fire damage.

GCP Applied Technologies Inc. was incorporated on May 1, 2015 for the purpose of holding the construction products and packaging technologies businesses of W. R. Grace & Co. On February 3, 2016, Grace shareholders received one common share of GCP for every one common share of Grace held and the construction products and packaging technologies businesses of Grace were transferred to GCP, thereby completing our legal separation from Grace ("the Separation"). On February 4, 2016, we began "regular way" trading on the New York Stock Exchange under the ticker symbol "GCP." On July 3, 2017, we completed the sale of our Darex Packaging Technologies ("Darex") business to Henkel AG & Co. KGaA (“Henkel”) for $1.06 billion in cash.

During the year ended December 31, 2018, we generated net sales of $1,125.4 million, income from continuing operations before income taxes of $10.5 million and net income of $15.5 million. Approximately 52% of our 2018 sales were generated outside of the United States. We operate in more than 30 countries.

Business Strategy

GCP's objective is to deliver value to our shareholders by growing our sales, earnings, cash flows and return on invested capital through the implementation of our business strategies. Our SCC and SBM segments produce and market a portfolio of high-performance products for leading global concrete and cement producers, architects, engineers, developers and contractors. Our products must satisfy our customers’ well-defined performance requirements and specifications to provide high value, although they typically represent a low percentage of the total cost of our customers’ end-products or projects.

We implement the following growth strategies to accelerate progress toward achieving our objectives:

| |

| • | Leverage Global Presence and Data Analytics to Generate Sales Growth — We utilize our worldwide manufacturing operations, technical service and support footprint, research and development capabilities, and our sales and marketing organization to increase our geographic and customer penetration worldwide. We make targeted investments to expand our capabilities in geographies and segments where trends and economic cycles present the best opportunities. |

| |

| • | Strengthen and Enhance Our Segment Positions with Product Innovation — We seek to strengthen our position as an industry innovator by investing in research and development activities focused on commercializing differentiated products and services as well as creating new product categories. We introduce and support new technologies and categories at our centralized research and development center in Cambridge, Massachusetts and at our regional global applications labs. Examples of our category creation and technology development successes include our multi-patented VERIFI®, intelligent concrete monitoring system, which provides in-transit data monitoring relative to concrete quality and truck delivery status, our PREPRUFE® fully-bonded pre-applied waterproofing technology, and our ICE & WATER SHIELD® self-adhesive underlayment for sloped roofs. |

| |

| • | Maintain Strong Customer Focus — A key aspect of our strategy is to deliver product and technology solutions to our customers that help improve the performance of their products or the structures they build, as well as the productivity of their manufacturing operations or product application processes. We believe that maintaining a close partnership with our customers, which includes providing on-site technical support, allows us to effectively focus our innovation efforts and respond to their changing demands at a global, regional and local level. Our goal is to demonstrate the layers of value we provide, which include outstanding product performance and technical service, as well as savings through reduced application cost and improved life-cycle performance. |

| |

| • | Grow through Strategic Acquisitions — Consistent with our business strategies, we seek strategic, bolt-on acquisitions and alliances to accelerate our customer and geographic penetration, extend our product portfolio, advance our technological capabilities, and bolster our manufacturing capacity and capability. During 2018, we acquired RIW Limited (the "RIW"), a U.K.-based supplier of waterproofing solutions for commercial and residential construction applications. We have now completed six acquisitions since our separation from Grace, adding unique capabilities with each transaction. |

| |

| • | Increase Productivity by Optimizing Global Operations and Supply Chain — Our productivity strategies focus on our global operations, including our logistics and supply chains. We have developed procurement and product formulation expertise to manage our product costs and production efficiencies. Product formulations are optimized at our regional development labs. These formulations are designed to meet specific customer needs while also considering the costs of different raw material inputs. Our global supply chain organization balances local raw material supply with global contracts that maximize our buying power while ensuring our supply requirements. Our global manufacturing network also maximizes production and delivery efficiencies. |

| |

| • | Drive Cash Flow Conversion and Adjusted EBIT Return on Invested Capital to Deliver Long-Term Value to Our Shareholders — We believe our strategies will allow us to accelerate our cash flow conversion to invest in product development, research and development activities, strategic acquisitions, technical service and sales organizations, manufacturing operations, and to return excess capital to shareholders over time. |

PRODUCTS AND SEGMENTS

Specialty Construction Chemicals Operating Segment

We supply concrete admixtures, polymer fibers and in-transit monitoring systems to concrete producers. These products are used to improve the rheology, workability, quality, durability and other engineering properties of concrete, mortar, masonry and other cementitious construction materials. We also supply additives to cement manufacturers that are used to improve energy efficiency and reduce carbon dioxide in cement processing, enhance the characteristics of finished cement and improve ease of use.

We compete with several large international suppliers and regionally with smaller competitors. Competition for our products is based on product performance, technical support, the breadth of our manufacturing and distribution infrastructure and our ability to bring value to our customers in the construction industry. Our major global competitors are BASF and Sika.

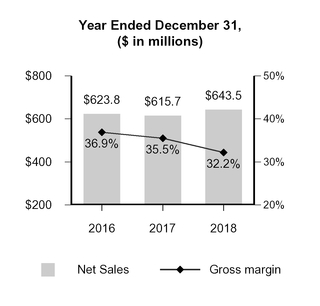

The following table sets forth SCC sales as a percentage of GCP total revenue during the years ended December 31, 2018, 2017 and 2016: |

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2018 | | 2017 | | 2016 |

| (In millions) | Sales | | % of GCP Revenue | | Sales | | % of GCP Revenue | | Sales | | % of GCP Revenue |

| Concrete | $ | 478.9 |

| | 42.6 | % | | $ | 455.6 |

| | 42.0 | % | | $ | 469.1 |

| | 44.7 | % |

| Cement | 164.6 |

| | 14.6 | % | | 160.1 |

| | 14.8 | % | | 154.7 |

| | 14.8 | % |

| Total SCC Revenue | $ | 643.5 |

| | 57.2 | % | | $ | 615.7 |

| | 56.8 | % | | $ | 623.8 |

| | 59.5 | % |

The following table sets forth SCC sales by geographic region as a percentage of SCC total revenue during the years ended December 31, 2018, 2017 and 2016:

|

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2018 | | 2017 | | 2016 |

| (In millions) | Sales | | % of SCC Revenue | | Sales | | % of SCC Revenue | | Sales | | % of SCC Revenue |

| North America | $ | 286.7 |

| | 44.6 | % | | $ | 256.4 |

| | 41.6 | % | | $ | 243.0 |

| | 39.0 | % |

| Europe Middle East Africa (EMEA) | 131.4 |

| | 20.4 | % | | 133.3 |

| | 21.7 | % | | 136.2 |

| | 21.8 | % |

| Asia Pacific | 165.9 |

| | 25.8 | % | | 160.9 |

| | 26.1 | % | | 179.0 |

| | 28.7 | % |

| Latin America | 59.5 |

| | 9.2 | % | | 65.1 |

| | 10.6 | % | | 65.6 |

| | 10.5 | % |

| Total SCC Revenue | $ | 643.5 |

| | 100.0 | % | | $ | 615.7 |

| | 100.0 | % | | $ | 623.8 |

| | 100.0 | % |

SCC consists of two product groups which include concrete and cement.

Concrete

The concrete product group includes concrete and decorative admixtures, as well as concrete production management and engineered systems.

Concrete admixtures allow concrete producers to use a limited selection of locally-sourced raw materials, such as cement and aggregates, to produce concrete and meet a wide variety of performance specifications. Our products are based on a set of core platform technologies formulated regionally into admixtures tailored to local end-use requirements.

Examples of our products include CONCERA® admixtures which enable the production of control flow concrete, a high-flowing, segregation-resistant concrete that allows for easier placement while using conventional mix designs. Our CLARENA® admixture product is a chemical additive that mitigates the effects of clay, which helps quarry owners extend the functional lifespan of their property, and, for ready mix producers, adds controllability to concrete containing aggregates with a high clay content. MIRA® admixtures allow concrete to be produced with a lower amount of water, which improves the compressive strength and the long-term durability of the concrete. ADVA® admixtures are used to make flowable "self-compacting concrete" which is popular in precast concrete manufacturing where the rapid filling of large molds is a major driver of economics. ECLIPSE® admixtures are used to minimize the formation of shrinkage cracks in critical applications, such as bridge decks. STRUX® polymeric fibers are designed to improve the ductility of concrete which is a naturally brittle material. In some cases, STRUX® polymeric fibers may be used to replace steel reinforcement near the surface of concrete that will be exposed to corrosive de-icing salts.

Admixtures for decorative concrete are used to enhance the surface appearance and aesthetics of concrete. PIERI® surface retarders are used to obtain exposed aggregate finishes in precast and cast-in-place concrete, achieving the desired surface appearance. PIERI® release agents allow for the efficient removal of mold forms with a resulting higher-quality concrete surface.

Concrete production management systems provide sophisticated process monitoring and control while concrete is in transit to the point of placement. Engineered systems combine proprietary products into high-performance offerings that further reduce installation costs. Our patented concrete production management system, sold under the VERIFI® brand name, measures, monitors and manages critical concrete properties and systematically adds water or admixtures to maintain optimum concrete flow properties. Use of VERIFI® also results in increased product quality, lower material costs, fewer rejected loads, increased logistics and jobsite efficiencies, and minimization of costly project delays.

Our patented engineered floor system, which is marketed and sold under the DUCTILCRETE® brand name, enables the placement and long-term performance of smooth and level floors which is a necessity in modern industrial and commercial buildings. The flooring system provides customers with more sustainable, cost-effective, and low-maintenance surfaces with higher load-bearing capacity than traditional construction. The DUCTILCRETE® system is installed by our network of licensed contractors. The system offers labor and time savings while providing customers with higher quality flat floors.

Cement

Portland cement is the binding agent for concrete. National standards usually dictate the compressive strength and other properties that must be met by cement. Cement additives are used to reduce the energy required to mill cement to the desired fineness and improve the handling characteristics of the powdered material. These products are also used to adjust the performance of Portland cement, permitting our customers to optimize production economics.

Examples of our products include OPTEVA® HE quality improvers, which are cement additives that provide options for gaining higher early (HE) strength and are particularly effective for challenging cements. TAVERO® VM grinding aid additives help stabilize vertical roller mills during production by reducing water injection requirements and cement pre-hydration, while at the same time improving cement performance by delivering higher strengths and shorter setting time. HEA2® Cement Additives are used around the world to improve the energy efficiency of cement grinding operations. CBA® Cement Additives are used to produce higher cement strength, which provides a high level of process flexibility to the cement manufacturer. Increasingly, cement manufacturers seek to reduce the environmental impact of their manufacturing processes. Our additives provide greater flexibility in raw materials, enabling customers to achieve improvements such as reductions in energy use and CO2 emissions.

The SCC product portfolio includes the following products:

|

| | | | | | |

| Products | | Uses | | Customers | | Key Brands |

| Concrete admixtures | | Chemicals and polymeric fibers used to reduce the production and in-place costs of concrete, increase the performance of concrete and improve the life cycle cost of structures | | Ready-mix and precast concrete producers, engineers and specifiers | | CONCERA®, CLARENA®, ADVA®, STRUX®, MIRA®, TYTRO®, POLARSET®, ECLIPSE®, DARACEM®, DARASET®, DCI®, RECOVER®, WRDA®, ZYLA® |

| Admixtures for decorative concrete | | Products for architectural concrete include surface retarders, coatings, pigments and release agents used by concrete producers and contractors to enhance the surface appearance and aesthetics of concrete | | Precast concrete producers and architects | | PIERI® |

| Concrete production management and engineered systems | | Proprietary sensors, algorithms and control systems which monitor and adjust the flow properties while in transit to construction sites, providing concrete producers quality control and operational efficiencies | | Ready-mix concrete manufacturers, engineers, specifiers and contractors | | VERIFI®, DUCTILCRETE® |

| Cement additives | | Formulated chemicals added to the milling stage of the cement manufacturing process to improve plant energy efficiency, enhance the performance of the finished cement and help our customers meet environmental regulations and reduce their CO2 footprints | | Cement manufacturers | | OPTEVA® HE, TAVERO® VM, CBA®, SYNCHRO®, HEA2®, TDA®, ESE® |

Specialty Building Materials Operating Segment

We manufacture and sell building and flooring materials used in both new construction and renovation/repair projects for the commercial, residential and infrastructure markets. Our products protect structures from water, vapor transmission, air penetration and fire damage, while reducing energy usage and improving the long-term durability of structures. They include waterproofing membranes, roofing underlayments, polymeric grouts for use in waterproofing and soil stabilization applications, air and vapor barriers, cementitious grouts, passive fire protection, a flooring barrier system and flooring installation products.

Our products are specified and installed on commercial, residential and infrastructure projects around the world. Our technology platforms, project selling competencies and international reach are the foundation of our industry leadership. We are dedicated to understanding local codes and construction practices so that our technology solutions address the regional needs of our customers. Our global specification sales organization emphasizes its technical expertise and has established relationships with key influencers and decision makers across the entire project selling value chain, including architects, engineers, general contractors, specialty contractors and other channel partners. We continue to expand our international presence in targeted regions with our core product lines and by adding new technologies.

Our specialty building materials product sales are global. We engage with global architectural and contracting firms, as well as local specifiers, engineers, contractors and building material distributors that influence the buying decisions for our products. We compete globally with several large international construction materials suppliers, as well as regionally and locally with numerous smaller competitors. Competition for our products is based on product performance, technical support and service, brand name recognition and price. Our major competitors are Sika, RPM and Carlisle.

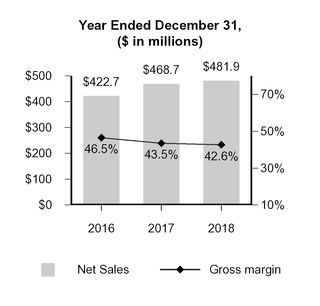

The following table sets forth SBM sales as a percentage of GCP total revenue during the years ended December 31, 2018, 2017 and 2016:

|

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2018 | | 2017 | | 2016 |

| (In millions) | Sales | | % of GCP Revenue | | Sales | | % of GCP Revenue | | Sales | | % of GCP Revenue |

| Building Envelope | $ | 284.4 |

| | 25.3 | % | | $ | 263.3 |

| | 24.3 | % | | $ | 236.3 |

| | 22.7 | % |

| Residential Building Products | 80.9 |

| | 7.2 | % | | 80.3 |

| | 7.4 | % | | 89.2 |

| | 8.5 | % |

| Specialty Construction Products | 116.6 |

| | 10.3 | % | | 125.1 |

| | 11.5 | % | | 97.2 |

| | 9.3 | % |

| Total SBM Revenue | $ | 481.9 |

| | 42.8 | % | | $ | 468.7 |

| | 43.2 | % | | $ | 422.7 |

| | 40.5 | % |

The following table sets forth SBM sales by geographic region as a percentage of SBM total revenue during the years ended December 31, 2018, 2017 and 2016:

|

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2018 | | 2017 | | 2016 |

| (In millions) | Sales | | % of SBM Revenue | | Sales | | % of SBM Revenue | | Sales | | % of SBM Revenue |

| North America | $ | 284.3 |

| | 59.0 | % | | $ | 283.8 |

| | 60.6 | % | | $ | 265.9 |

| | 62.9 | % |

| Europe Middle East Africa (EMEA) | 109.3 |

| | 22.7 | % | | 111.3 |

| | 23.7 | % | | 89.5 |

| | 21.2 | % |

| Asia Pacific | 79.7 |

| | 16.5 | % | | 68.3 |

| | 14.6 | % | | 62.2 |

| | 14.7 | % |

| Latin America | 8.6 |

| | 1.8 | % | | 5.3 |

| | 1.1 | % | | 5.1 |

| | 1.2 | % |

| Total SBM Revenue | $ | 481.9 |

| | 100.0 | % | | $ | 468.7 |

| | 100.0 | % | | $ | 422.7 |

| | 100.0 | % |

SBM consists of three product groups which include building envelope, residential building products and specialty construction products.

Building Envelope Products

Building envelope products protect structures from water and help manage air and vapor transmission through building walls. The majority of sales in this product group are waterproofing products that protect commercial structures, residential structures and infrastructure. Our waterproofing products are used in both above-grade and below-grade applications. Above grade, our products protect the material to which they are applied and minimize water infiltration into occupied spaces. Below grade, our products enable the construction of structures in challenging sites, such as locations with a high existing water table. Examples of these products include our BITUTHENE® self-adhesive rubberized asphalt membrane, our innovative PREPRUFE® pre-applied sheet membrane, and our ELIMINATOR® liquid applied waterproofing system.

Our BITUTHENE® product line is manufactured globally and has a long track record of providing waterproofing in the most challenging conditions. Designers and contractors have relied on BITUTHENE® products for over 40 years and continue to specify our products by using the BITUTHENE® brand name. We also pioneered the pre-applied waterproofing category with our Advanced Bond Technology™ brand in association with PREPRUFE® products. Our unique technology allows a waterproofing membrane to be installed on the ground or on walls before concrete is placed for a foundation. This technology also allows waterproofing of walls normally inaccessible during the construction of a building, such as foundations in densely populated cities. Major projects around the world have successfully installed our PREPRUFE® waterproofing systems which continue to gain recognition for waterproofing performance. Our ELIMINATOR® liquid applied waterproofing systems are used to protect and extend the life of bridges. Major bridge projects in North America, Europe and Asia have used our ELIMINATOR® systems over the last 20 years.

Residential Building Products

Residential building products consist of roofing underlayments, flashings and weather barriers. Roofing underlayments are placed below the outermost roof covering, such as shingles, to protect sloped roofs from water damage caused by wind-driven rain and ice dams. Our ICE & WATER SHIELD® roofing underlayments are known throughout the industry and are sold in North America through a network of distributors. The VYCOR® flashing portfolio consists of high performance self-adhered flashing products that provide premium protection against water infiltration in critical areas such as windows and doors. Our VYCOR® flashing products reduce the risk of mold and rot development, and contribute to energy efficiency by sealing air leakages in the building envelope.

Specialty Construction Products

Specialty construction products include fire protection, chemical grouts, cementitious grouts and mortars, as well as specialty flooring products. Passive fire protection products are marketed under the MONOKOTE® brand. Chemical grouts are sold under the DE NEEF® brand and used for repairing cracks in concrete, sealing water leaks in commercial buildings and infrastructure and stabilizing soil. BETEC® cementitious grouts and mortars are used in applications where specific strength and/or flow are required. Examples of these applications include assembly of concrete precast elements for wind turbines, filling under rails for railroads and providing a high-strength surface for heavy machinery in industrial settings. Our KOVARA® flooring membrane is a branded moisture mitigation membrane that is installed between a concrete subfloor and surface flooring to protect the finished flooring from moisture and alkalinity related damage. Other flooring installation products include seam tapes, underlayments and tools and accessories used for the installation of carpet, ceramic, laminate, stone and other surface flooring.

The SBM product portfolio includes the following products:

|

| | | | | | |

| Products | | Uses | | Customers | | Key Brands |

| Building envelope products | | Structural barrier systems to prevent above and below ground water, vapor and air infiltration of the building envelope of commercial structures, including self-adhered sheet and liquid membranes, joint sealing materials, drainage composites and waterstops. | | Architects, consultants and structural engineers; specialty waterproofing, masons, dry wall contractors and general contractors; specialty distributors | | BITUTHENE®, PREPRUFE®, ADPRUFE®, HYDRODUCT®, ADCOR®, SILCOR®, PERM-A-BARRIER®, ELIMINATOR®, INTEGRITANK® |

| Residential building products | | Specialty roofing membranes and flexible flashings for windows, doors, decks and detail areas, including fully adhered roofing underlayments, synthetic underlayments and self-adhered flashing | | Roofing contractors, home builders and remodelers; building material distributors, lumberyards and home centers; architects and specifiers | | ICE & WATER SHIELD®, TRI-FLEX®, VYCOR® |

| Fire protection materials | | Fire protection products spray-applied to the structural steel frame, encasing and insulating the steel and protecting the building in the event of fire and enhancing the heat resistance during a fire | | Local contractors and specialty subcontractors and applicators; building materials distributors; industrial manufacturers; architects and structural engineers | | MONOKOTE® |

| Chemical grouts | | Products for repair and remediation in waterproofing applications and soil stabilization | | Contractors; specialty distributors; municipalities; and other owners of large infrastructure facilities | | DE NEEF®, HYDRO ACTIVE®, SWELLSEAL®, DE NEEF® PURe™ |

| Cementitious grouts and mortars | | Cementitious grouts and mortars used for under filling and gap filling | | Specialty contractors engaged in the repair of concrete, installation of new precast concrete elements and infrastructure repair | | BETEC® |

| Specialty flooring products | | Flooring moisture barriers and installation products | | Distributors; contractors; home centers; flooring manufacturers; and large commercial end users | | KOVARA®, ORCON® |

SALES AND MARKETING

Our two operating segments maintain global direct sales and technical service teams made up of approximately 660 employees supporting customers in over 130 countries worldwide. Our global team sells products under annual and multi-year global, regional and local agreements and has developed deep segment and product application knowledge. We believe that our in depth understanding of our customers' needs, challenges and operations, as well as our ability to service at a high standard throughout the world, give both of our segments a competitive advantage. The majority of our products require local, regional, country and international code approvals related to their use, storage and performance. Our commercial organization supports and consults on committees and technical associations in order to ensure codes and product standards are consistently applied.

Our sales professionals work with leading architects, engineers and contractors across the globe seeking to have our products specified for use in thousands of projects on an annual basis. Our products have been used to build some of the world's most renowned structures. As part of our "go to market" strategy, the SCC team provides technical services to nearly 9,000 concrete and cement production facilities worldwide. In many cases, we also provide product dispensing equipment to our customers as an integral part of the concrete and cement production process.

MANUFACTURING, RAW MATERIALS AND SUPPLY CHAIN

Our operating segments share global supply chain processes, manufacturing facilities, as well as technical service and sales centers around the world, which provides cost efficiency.

We utilize internal and third-party manufacturing to produce our products to our specifications. Our low capital intensive plants along with third-party manufacturers provide us with flexibility in servicing our customers. Several of our plants ship products internationally, but most of our facilities are positioned to serve local market demand. We have the ability to respond quickly to changes in local demand by establishing or expanding manufacturing capacity with low capital investment. We have numerous multi-year supply and purchasing agreements with both our vendors and customers which helps us minimize volume disruptions. Construction demand is seasonal, resulting in demand variations requiring effective management of our manufacturing and distribution assets. For many of our SCC customers, we install and maintain a chemical dispensing and storage system for our products at their production facilities. We periodically replenish the on-site systems to give our customers instant access to our SCC products in the amounts they require twenty-four hours a day. We also install equipment on ready-mix trucks to monitor and manage concrete in transit to jobsites. This customer-based equipment accounted for approximately 34% of our 2018 annual capital spend.

The raw materials we use in our products are obtained from a variety of suppliers, including basic chemical and petrochemical producers. Many of our raw materials are organic chemicals derived from olefins, including specialty films and fibers. We also make significant purchases of inorganic materials, such as lignin and specialty materials, including plasticizers, films, ethylene derivatives, and rubber. We have multiple raw material sources and balance our purchasing requirements between local and global sources seeking to maximize performance and profitability. Global supply and demand factors, changes in currency exchange rates and petroleum prices can significantly impact the price of our key raw materials.

Our global supply chain team monitors the global market to identify cost and productivity opportunities. We seek to leverage our overall purchasing volumes for all regions. Since we manufacture a portion of our products in emerging regions using raw materials from suppliers in the U.S., Europe and other advanced economies, changes in the values of the currencies of these emerging regions versus the U.S. dollar and the euro may adversely affect our raw material costs. This effect is partially mitigated by our reliance on local sourcing for some raw materials.

The construction business is cyclical in response to economic conditions, as well as seasonal since it is driven by weather conditions. Demand for our products is primarily driven by global non-residential and infrastructure construction activity and U.S. residential construction activity. We seek to increase profitability and minimize the impact of cyclical downturns in regional economies by introducing technically advanced high-performance products and rationalizing non-profitable geographies.

FINANCIAL INFORMATION ABOUT INDUSTRY SEGMENTS AND GEOGRAPHIC AREAS

Disclosure of financial information about industry segments and geographic areas for the years ended December 31, 2018, 2017 and 2016 is provided in this Annual Report on Form 10-K in Item 8, "Financial Statements and Supplementary Data" under Note 15 "Operating Segment and Geographic Information" to the Consolidated Financial Statements, which is incorporated herein by reference. Disclosure of risks attendant to our foreign operations is provided in Item 1A, "Risk Factors".

BACKLOG OF ORDERS

While at any given time there may be some backlog of orders, backlog is not material in respect to our total annual sales. The changes in the backlog taking place from time to time are not significant.

RESEARCH ACTIVITIES AND INTELLECTUAL PROPERTY

We believe success in our industry is driven by technology and innovation. Growing our businesses and maintaining our margins is dependent on our ability to introduce new products and enhance existing products based on innovative technology, as well as our ability to obtain patent or other intellectual property protection. Our

research and development programs emphasize development of new products and processes, improvement of existing products and processes and application of existing products and processes to new industries and uses.

Our world-class Global Technology Center in Cambridge, Massachusetts houses the product research activities that support both of our operating segments. The global marketing resources that we believe are essential to a successful product development process are also located with our research and development group in Cambridge.

Technologies developed by our Global Technology Center are customized for each region and supported in the field by a network of Regional Technical Centers, including facilities in Sorocaba, Brazil; Toh Guan, Singapore; Beijing, China; Atsugi, Japan; Lügde, Germany; and Heist, Belgium.

We have approximately 270 research and development and technical service employees globally and approximately 13% of our workforce is focused on technology. We believe the collective technical expertise, industry knowledge and professionalism of this team is a significant differentiator for us.

We file patent applications globally on a routine basis and obtain grants in numerous countries around the world in support of our products, formulations, manufacturing processes, monitoring systems, equipment, and improvements. We also benefit from technological and commercial advantages protected under trade secret laws, including know-how and other proprietary information related to many of our products, technologies and internal quality control and testing methodologies. Entering 2019, we have approximately 865-900 active patents and patent applications pending in countries around the world, including approximately 150-160 in the U.S. We estimate that our filing rate is between 50 and 90 patent applications globally on an annual basis, including priority and national stage application filings. The average number of patents filed, pending, granted, and maintained could go up or down from year to year, depending on various factors, some of which may not be within our control. It is our intent to continue to file for patents to protect our proprietary innovations and investments in research.

Research and development expenses were $20.2 million, $20.0 million and $18.4 million, respectively, during the years ended December 31, 2018, 2017 and 2016. These amounts include depreciation and amortization expenses related to research and development assets and expenses incurred in funding external research projects. The amount of research and development expenses relating to government- and customer-sponsored projects (rather than projects that we sponsor) was not material during these periods.

ENVIRONMENT, HEALTH AND SAFETY MATTERS

We are subject, along with other manufacturers of specialty chemicals, to stringent regulations under numerous U.S. federal, state and local, as well as foreign environmental, health and safety laws and regulations related to the generation, storage, handling, discharge, disposition and stewardship of hazardous wastes and other materials. Environmental laws require that certain responsible parties, as defined in the relevant statute, fund remediation actions regardless of legality of original disposal or ownership of a disposal site. We are involved in remediation actions to address hazardous wastes or other materials as required by U.S. federal, state and local and foreign laws.

We continuously seek to improve our environment, health and safety performance. We have expended funds to comply with environmental laws and regulations and expect to continue to do so in the future.

EMPLOYEE RELATIONS

As of December 31, 2018, we had approximately 2,100 employees, of which approximately 750 were employed in the United States. Of our total employees, approximately 1,750 were salaried and 350 were hourly.

Approximately 50 of our manufacturing employees in the United States are represented by five different local collective bargaining groups. We have operated without a labor work stoppage for more than 11 years.

We have works councils representing eight of the European countries in which we do business covering approximately 270 employees.

AVAILABLE INFORMATION

We maintain an Internet website at www.gcpat.com. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available, free of charge, on our website as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the Securities and Exchange Commission, or "SEC." Further, the SEC's website, www.sec.gov, contains reports and other information regarding our filings. These reports may be accessed through our website's investor relations page.

In addition, the charters for the Audit, Compensation, Nominating and Governance, and Corporate Responsibility Committees of our Board of Directors, our corporate governance principles and code of ethics are available, free of charge, on our website at http://investor.gcpat.com/corporate-governance/governance-documents. Printed copies of the charters, governance guidelines and code of ethics may be obtained free of charge by contacting GCP Shareholder Services by emailing investors@gcpat.com or by calling (617) 876-1400. The information on our website is not, and shall not be deemed to be, a part of this report or incorporated into any other filings we make with the SEC.

ITEM 1A. RISK FACTORS

Our operations are subject to a number of risks, including those listed below. When considering investments in our company, you should carefully consider each of the following risk factors and all of the other information set forth in this Annual Report on Form 10-K. Based on the information currently known to us, we believe that the following information identifies the most significant risk factors affecting the Company and our business in each of these categories of risks. However, the risks and uncertainties the Company faces are not limited to those set forth in the risk factors described below. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business and may be material. In addition, past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods.

If any of the following risks and uncertainties develops into actual events, these events could have a material adverse effect on our business, financial condition or results of operations. In such case or in the case that an additional risk or uncertainty not presently known to us or that we currently believe to be immaterial develops into actual events or the materiality increases, the trading price of our common stock could decline.

Risks Relating to Our Business

We face significant competition and, if we are not able to respond to competition, our revenues may decrease.

We face significant competition from a variety of competitors in each of our markets. Some of our competitors have substantially greater financial, marketing, personnel and other resources than we do. New competitors also could enter our markets, certain or our competitors could consolidate and/ or certain of our customers could decide to self-manufacture or otherwise enter our markets, which may result in increased competitive pressures. We consider product quality, performance, customer service, on-time delivery, price, distribution capabilities and breadth of product offerings to be the primary competitive factors in our markets. Our competitors may be able to offer more attractive pricing, duplicate our strategies, or develop enhancements to products that could offer performance features that are superior to our products. Competitive pressures, including those described above, could adversely affect our competitive position, leading to a loss of market share or decreases in prices, either of which could have a material adverse effect on our business, financial condition or results of operations.

If we are not able to continue our technological innovation and successful introduction of new products, our customers may turn to other suppliers to meet their requirements.

The specialty chemicals and building materials industries, as well as the end-use applications into which we sell our products, experience ongoing technological change and product improvements. A key element of our business strategy is to invest in research and development activities with the goal of introducing new high-performance, technically differentiated products and innovative Internet of Things (IoT) solutions. We may not be

successful in developing new technology and products that successfully compete with products introduced by our competitors, and our customers may not accept or may have lower demand for our new products. If we fail to keep pace with evolving technological innovations or fail to improve our products in response to our customers’ needs, then our business, financial condition and results of operations could be adversely affected as a result of reduced sales of our products.

When consistent with our business strategies, we intend to pursue acquisitions, joint ventures and other transactions that complement or expand our businesses. We may not be able to complete proposed transactions and even if completed, the transactions may not achieve the earnings, cash flows or returns on investment that we had contemplated.

We have recently completed a number of acquisitions that we believe will contribute to our future success. We intend to continue to pursue opportunities to buy other businesses or technologies that could complement, enhance or expand our current businesses or product lines or might otherwise offer us growth opportunities. We may have difficulty identifying appropriate opportunities or, if we do identify opportunities, we may not be successful in completing transactions for a number of reasons. Any transactions that we are able to identify and complete may involve a number of risks, including:

| |

| • | the diversion of management's attention from our existing businesses to integrate the operations and personnel of the acquired or combined business or joint venture; |

| |

| • | possible adverse effects on our operating results during the integration process; |

| |

| • | failure of the acquired business to achieve expected operational objectives; and |

| |

| • | our possible inability to achieve the intended objectives of the transaction. |

In addition, we may not be able to successfully or profitably integrate, operate, maintain and manage any newly acquired operations or their employees. We may not be able to maintain uniform standards, controls, procedures and policies, which may lead to operational inefficiencies.

The length and depth of product and industry business cycles in our segments may result in periods of reduced sales, earnings and cash flows, and portions of our business are subject to seasonality and weather-related effects.

Our construction business is cyclical in response to economic conditions and construction demand and is also seasonal and dependent on favorable weather conditions, with a decrease in construction activity during the winter months.

Prices for certain raw materials are volatile and can have a significant effect on our manufacturing and supply chain strategies as we seek to maximize our profitability. If we are unable to successfully adjust our strategies in response to volatile raw material prices, such volatility could have a negative effect on our earnings.

We use petroleum-based materials, natural gas derivatives and other materials to manufacture our products. Prices for these materials are volatile and can have a significant effect on our pricing, sales, manufacturing and supply chain strategies as we seek to maximize our profitability. Our ability to successfully adjust strategies in response to volatile raw material prices by increasing prices for our products and services, reducing costs or taking other actions is a significant factor in maintaining or improving our profitability. If we are unable to successfully adjust our strategies in response to volatile raw material prices, such volatility could have a negative effect on our sales and earnings in future periods.

A substantial portion of our raw materials are commodities whose prices fluctuate as market supply and demand fundamentals change. We attempt to manage exposure to price volatility of major commodities through:

| |

| • | long-term supply contracts; |

| |

| • | customer contracts that permit adjustments for changes in prices of commodity-based materials and energy; and |

| |

| • | forward buying programs that layer in our expected requirements systematically over time; |

Although we regularly assess our exposure to raw material price volatility, we cannot always predict the prospects of volatility and we cannot always cover the risks we face in a cost-effective manner.

We have a policy of maintaining, when available, multiple sources of supply for raw materials. However, certain of our raw materials may be provided by single sources of supply. We may not be able to obtain sufficient raw materials due to unforeseen developments that would cause an interruption in supply. Even if we have multiple sources of supply for raw materials, these sources may not make up for the loss of a major supplier.

The global scope of our operations subjects us to the risks of doing business in foreign countries, which could adversely affect our business, financial condition and results of operations.

We operate our business on a global scale with approximately 52% of our 2018 sales generated outside of the United States. We operate in over 30 countries and in over 30 currencies. We currently have many production facilities, technical centers and administrative and sales offices located outside of North America, including facilities and offices in Europe, Middle East, Africa, Asia Pacific and Latin America. We expect non-U.S. sales to continue to represent a majority of our revenue. Accordingly, our business is subject to risks related to the differing legal, political, social and economic conditions and regulatory requirements of many jurisdictions, as well as risks related to the political relationship between the foreign countries in which we conduct business and the United States. Risks inherent in non-U.S. operations include the following:

| |

| • | commercial agreements may be more difficult to enforce and receivables more difficult to collect; |

| |

| • | intellectual property rights may be more difficult to enforce; |

| |

| • | we may experience increased shipping costs, disruptions in shipping or reduced availability of freight transportation; |

| |

| • | we may have difficulty transferring our profits or capital from foreign operations to other countries where such funds could be more profitably deployed; |

| |

| • | we may experience unexpected adverse changes in export duties, quotas and tariffs and difficulties in obtaining export licenses; |

| |

| • | some foreign countries have adopted, and others may impose, additional withholding taxes or other restrictions on foreign trade or investment, including currency exchange and capital controls; |

| |

| • | foreign governments may nationalize private enterprises; |

| |

| • | our business and profitability in a particular country could be affected by differing legal systems and customs and by political or economic repercussions on a domestic, country specific or global level from terrorist activities and the response to such activities. |

In addition, our international sales and operations are subject to risks associated with changes in local government laws, regulations and policies, including those related to tariffs and trade barriers, investments, taxation, exchange controls, capital controls, employment regulations, and repatriation of earnings. Government policies on international trade and investments, such as import quotas, capital controls, taxes or tariffs, whether adopted by individual governments or regional trade blocs, can affect demand for our products and services, impact the competitive position or our products or prevent us from being able to manufacture or sell products in certain countries. The implementation of more restrictive trade policies, including the imposition of tariffs, or the renegotiation of existing trade agreements by the U.S. or by countries where we sell large quantities of products and services or procure supplies and other materials incorporated into our products, including in connection with the U.K.'s pending withdrawal from the EU ("Brexit"), could negatively impact our business, results of operations and financial condition. For example, a government's policies on tariffs and trade, or retaliation by another government against such policies, could have a negative impact on our results of operations. Our international sales and operations are also sensitive to changes in foreign national priorities, as well as to political and economic instability. Our success as a global business will depend, in part, upon our ability to succeed in differing legal, regulatory, economic, social and political conditions by developing, implementing and maintaining policies and strategies that are effective in each location where we do business.

We are exposed to currency exchange rate changes that impact our profitability and these risks could increase as a result of global political uncertainty and other risks in international markets.

We are exposed to currency exchange rate risk through our U.S. and non-U.S. operations. Changes in currency exchange rates may materially affect our operating results. For example, changes in currency exchange rates may affect the relative prices at which we and our competitors sell products in the same region and the cost of materials used in our operations. A substantial portion of our net sales and assets are denominated in currencies other than the U.S. dollar. When the U.S. dollar strengthens against other currencies, at a constant level of business, our reported sales, earnings, assets and liabilities are reduced because the foreign currencies translate into fewer U.S. dollars. In addition, since we manufacture a portion of our construction products in emerging regions using raw materials from suppliers in the U.S., Europe and other advanced economies, changes in the values of the currencies of these emerging regions versus the U.S. dollar, the euro and the currencies of other advanced economies in which we purchase raw materials, may adversely affect our raw material costs.

We incur currency transaction risk whenever one of our operating subsidiaries enters into either a purchase or a sales transaction using a currency different from the operating subsidiary's functional currency. Given the volatility of exchange rates, we may not be able to manage our currency transaction risks effectively, which may expose our financial condition or results of operations to significant additional risk.

Our operations in Venezuela have been adversely affected by political and economic instability in the country.

Our ability to manage our Venezuelan operations has been negatively affected by difficult conditions in Venezuela, including continuing high inflation and the significant devaluation of the Venezuelan bolivar. Government regulations regarding price increases limited our ability to offset the effects of high inflation and the currency devaluations. Import authorization controls and the limited availability of foreign exchange limited our ability to import raw materials needed for the production of our products. In addition, labor laws limited our ability to manage overhead costs and, at times, production has been negatively impacted by local labor issues. As a result of these conditions, combined with the loss of scale in Venezuela resulting from the sale of our Darex-related operations and assets in Venezuela, we deconsolidated our Venezuelan operations as of July 3, 2017. During the year ended December 31, 2018, we sold our remaining SCC operations within the Venezuela subsidiary. As of December 31, 2018, the remaining operations in Venezuela represent the Darex operations expected to be sold to Henkel within the next 12 months under a delayed close arrangement. Our operations in Venezuela were not significant to our financial condition, results of operations and cash flows during the year ended December 31, 2018.

Certain of our customer relationships outside of the United States are with governmental entities and we could be materially and adversely affected by violations of the U.S. Foreign Corrupt Practices Act ("FCPA") and similar worldwide anti-bribery laws in non-U.S. jurisdictions.

The FCPA and similar worldwide anti-bribery laws in non-U.S. jurisdictions generally prohibit companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. Because certain of our customer relationships outside of the United States are with governmental entities, we are subject to such anti-bribery laws. Our policies mandate compliance with these anti-bribery laws. We operate in many parts of the world that have experienced governmental corruption to some degree, and in certain circumstances strict compliance with anti-bribery laws may conflict with local customs and practices. Despite our training and compliance programs, our internal control policies and procedures may not always protect us from reckless or criminal acts committed by our employees or agents. Violations of anti-bribery laws or allegations of such violations, could disrupt our business and result in a material adverse effect on our results of operations, financial condition and cash flows.

We have debt obligations that could restrict our business, adversely impact our financial condition, results of operations or cash flows or restrict our ability to return cash to shareholders.

As of December 31, 2018, we had $356.7 million of indebtedness outstanding. The amount of and terms governing the Company's indebtedness may have material effects on our business, including to:

| |

| • | require us to dedicate a substantial portion of our cash flow to debt payments, thereby reducing funds available for working capital, capital expenditures, acquisitions, research and development, distributions to holders of company common stock and other purposes; |

| |

| • | restrict us from making strategic acquisitions or taking advantage of favorable business opportunities; |

| |

| • | limit our flexibility in planning for or reacting to, changes in our business and the industries in which we operate; |

| |

| • | increase our vulnerability to adverse economic, credit and industry conditions, including recessions; |

| |

| • | make it more difficult for us to satisfy our debt service and other obligations; |

| |

| • | place us at a competitive disadvantage compared to our competitors that have relatively less debt; and |

| |

| • | limit our ability to borrow additional funds or to dispose of assets to raise funds, if needed, for working capital, capital expenditures, acquisitions, research and development and other purposes. |

We may also incur substantial additional indebtedness in the future. If we incur additional debt, the risks related to our indebtedness may intensify.

We require liquidity to service the Company's debt and fund operations, capital expenditures, research and development efforts, acquisitions and other corporate expenses.

Our ability to fund operations, capital expenditures, research and development efforts, acquisitions and other corporate expenses, including repayment of our debt, depends on our ability to generate cash through future operating performance, which is subject to economic, financial, competitive, legislative, regulatory and other factors. Many of these factors are beyond our control. We cannot be certain that our businesses will generate sufficient cash or that future borrowings will be available to us in the amounts sufficient to fund all of our requirements. If we are unable to generate sufficient cash to fund all of our requirements, we may need to pursue one or more alternatives, such as to:

| |

| • | reduce or delay planned capital expenditures, research and development spending or acquisitions; |

| |

| • | obtain additional financing or restructure or refinance all or a portion of our debt on or before maturity; |

| |

| • | sell assets or businesses; and |

Any reduction or delay in planned capital expenditures, research and development spending or acquisitions or sales of assets or businesses may materially and adversely affect our future revenue prospects. In addition, we cannot be certain that we will be able to raise additional equity capital, restructure or refinance any of our debt or obtain additional financing on commercially favorable or reasonable terms or at all.

Restrictions imposed by agreements governing our indebtedness limit our ability to operate our business, finance our future operations or capital needs or engage in other business activities. If we fail to comply with certain restrictions under these agreements, our debt could be accelerated and the Company may not have sufficient cash to pay the accelerated debt.

The agreements governing our indebtedness contain various covenants that limit, among other things, our ability, and the ability of certain of our subsidiaries, to:

| |

| • | enter into sale and leaseback transactions; and |

| |

| • | consolidate, merge or sell all or substantially all of our assets or the assets of our guarantors. |

As a result of these covenants, we are limited in the manner in which we can conduct our business, and may be unable to engage in favorable business activities or finance future operations or capital needs. Accordingly, these restrictions may limit our flexibility to operate our business. A failure to comply with the restrictions contained in these agreements, including maintaining the financial ratios required by our credit facilities, could lead to an event of default which could result in an acceleration of the indebtedness. We cannot assure you that our future operating results will be sufficient to enable us to comply with the covenants contained in the agreements governing our indebtedness or to remedy any such default. In addition, in the event that repayment of our debt is accelerated pursuant to the terms of these agreements, we may not have or be able to obtain sufficient funds to make such accelerated payments.

Our indebtedness exposes us to interest expense increases if interest rates increase.

As of December 31, 2018, we had approximately $11 million, or 3%, of our borrowings at variable interest rates exposing us to interest rate risk. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed would remain the same, and our net income would decrease.

We have unfunded and underfunded pension plan liabilities. We will require future operating cash flow to fund these liabilities. We have no assurance that we will generate sufficient cash to satisfy these obligations.

We maintain U.S. and non-U.S. defined benefit pension plans covering current and former employees who meet or met age and service requirements. Our net pension liability and cost is materially affected by the discount rate used to measure pension obligations, the longevity and actuarial profile of our workforce, the level of plan assets available to fund those obligations and the actual and expected long-term rate of return on plan assets. Significant changes in investment performance or a change in the portfolio mix of invested assets can result in corresponding increases and decreases in the valuation of plan assets or in a change in the expected rate of return on plan assets. In addition, any changes in the discount rate could result in a significant increase or decrease in the valuation of pension obligations, affecting the reported funded status of our pension plans, as well as the net periodic pension cost in the following years. Similarly, changes in the expected return on plan assets can result in significant changes in the net periodic pension cost in the following years.

The divestiture of our Darex business could adversely affect our results of operations.

In July 2017, we completed the sale of our Darex business to Henkel AG & Co. KGaA. Following the divestiture of our Darex business, we have become a smaller, less diversified company with a narrower business focus and lower operational scale, and we may be more vulnerable to changing market conditions, which could adversely affect our business and results of operations.

Our results of operations could be adversely affected by warranty claims and product liability.

We provide standard warranties that our products perform according to their specifications and do not have material defects. In particular, for a limited number of high value construction projects we warrant the performance of some products for periods of 5 to 25 years. Our products are generally sold to the commercial, residential and infrastructure construction markets, and they often constitute an integral part of our customers’ products. If our products do not meet specifications, are otherwise defective, or are used contrary to our instructions or in applications for which they are not designed, they may contribute to damage to our customers’ products, the end users of our customers’ products and buildings and other installations that contain our products. Although we take measures to avoid product defects and instruct our customers on the proper use of our products, if a substantial warranty claim or product liability lawsuit is brought against us, the cost of defending the claim or lawsuit could be significant and any adverse determination could have a material adverse effect on our results of operations.

We manufacture and sell products into many global jurisdictions where our efforts to contractually limit our liability (e.g., by defining a maximum liability, disclaiming implied or other statutory forms of liability or by waiving certain types of damages, including consequential, indirect and non-proximately caused damages) may not be enforceable or may be found by a court to not apply in a particular situation.

We work with dangerous materials that can injure our employees, damage our facilities and disrupt our operations.

Some of our operations involve the handling of hazardous materials that may pose the risk of fire, explosion or the release of hazardous substances. Such events could result from terrorist attacks, natural disasters or operational failures, and might cause injury or loss of life to our employees and others, environmental contamination, and property damage. These events might cause a temporary shutdown of an affected plant or portion thereof, and we could be subject to penalties or claims as a result. A disruption of our operations caused by these or other events could have a material adverse effect on our results of operations.

We may be required to spend significant amounts of financial resources on environmental compliance.

As a manufacturer of specialty chemicals and specialty building materials, we are subject to stringent regulations under numerous U.S. federal, state, local and foreign environmental, health and safety laws and regulations relating to the generation, storage, handling, discharge, disposition and stewardship of hazardous wastes and other materials. We expend funds to comply with such laws and regulations and attempt to implement sustainable practices across our global operations, including the minimization of our emissions to the environment. Nevertheless, legislative, regulatory and economic uncertainties (including existing and potential laws and regulations pertaining to climate change) make it difficult for us to project future spending for these purposes and we may be required to expend additional funds to remain in compliance.

Our business could be adversely affected if we are unable to retain or motivate key personnel or hire qualified personnel.

The market for highly-skilled workers and leaders in our industry is competitive. We believe that our future success depends in substantial part on our ability to recruit and retain talented and highly-skilled personnel for all areas of our organization. Doing so may be impacted by a number of factors, including fluctuations in economic and industry conditions, competitors’ hiring practices, and the effectiveness of our compensation programs. Our continued ability to compete effectively depends on our ability to retain and motivate our executives and other existing employees and attract new employees. If we do not succeed in retaining and motivating our existing key employees and attracting new key personnel, our results of operations could be negatively impacted.

Some of our employees are unionized, represented by works councils or employed subject to local laws that are less favorable to employers than the laws in the United States.

As of December 31, 2018, we had approximately 2,100 total employees, of which approximately 750 were employed in the United States. Of our total U.S. employees, approximately 50 are unionized. In addition, a large number of our employees are employed in countries in which employment laws provide greater bargaining or other rights to employees than the laws in the United States. Such employment rights require us to work collaboratively with the legal representatives of the employees to effect any changes to labor arrangements. For example, most of our employees in Europe are represented by works councils that have co-determination rights on any changes in conditions of employment, including salaries and benefits and staff changes, and may impede efforts to restructure our workforce. A strike, work stoppage or slowdown by our employees or significant dispute with our employees, whether or not related to these negotiations, could result in a significant disruption of our operations or higher ongoing labor costs.

We may be subject to claims of infringement of the intellectual property rights of others, which could hurt our business or financial performance.

Although each of our core businesses monitors and conducts watches on third-party patents, conducts global trademark clearance searches as part of new product branding exercises, and otherwise creates its own product and promotional literature under its own copyrights in an attempt to avoid encroaching upon the intellectual property of others, from time to time we may receive claims from our competitors or others alleging that their patents, trademarks, copyrights, or other intellectual property rights have been infringed. Any claims that our products or processes or promotional materials infringe or interfere with the intellectual property rights of others, regardless of the merit or resolution of the claims, could cause us to incur significant costs in responding to, defending and resolving the claims, and may divert the efforts and attention of our management and technical personnel from our business. For example, a third-party could file an action against our company and/or its customers and allege that it is entitled to damages for the sale, use, or manufacture of company products believed to infringe the third-party patent, for the sale of non-infringing product used by the customer in a manner that infringes a third-party use patent, or for the sale of non-infringing products to a customer who combines the products with customer materials which in combination are believed to give rise to contributory type infringement of the third-party patent. We may experience delays as we pursue one or more of our commercial options: e.g., cease selling or manufacturing the allegedly infringing product, contest the validity or enforceability of the

third-party patent, redesign our products or processes to avoid the third-party patent, pay a license fee in order to commercialize under the third-party patent, obtain a legal opinion regarding non-infringement and/or invalidity of the third-party patent, and/or take other measures (e.g., negotiating a cross-license under one of our patent families as desired by the third-party) to avoid costs of litigation. Even if we ultimately prevail, the existence of the lawsuit could prompt our customers to switch to products that are not the subject of infringement suits.

We are subject to business continuity risks associated with centralization of certain administrative functions.

We have centralized certain administrative functions in designated centers around the world to improve efficiency and reduce costs. To the extent that these central locations are disrupted or disabled, key business processes, such as invoicing, payments and general management operations, could be interrupted.