As filed with the Securities and Exchange Commission on March 12, 2018

RegistrationNo. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMS-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PBF LOGISTICS LP

PBF LOGISTICS FINANCE CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| | | | |

| Delaware | | 4610 | | 35-2470286 |

| Delaware | | 4610 | | 36-4808863 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

Telephone: (973)455-7500

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrants’ Principal Executive Offices)

Trecia M. Canty, Esq.

Senior Vice President, General Counsel and Secretary

PBF Logistics GP LLC

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

Telephone: (973)455-7500

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

Todd E. Lenson, Esq.

Jordan M. Rosenbaum, Esq.

Kramer Levin Naftalis & Frankel LLP

1177 Avenue of the Americas

New York, NY 10036

Telephone: (212) 715-9100

Approximate date of commencement of proposed exchange offer:As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☒ |

| Non-accelerated filer | | ☐ (Do not check if a smaller reporting company) | | Smaller reporting company | | ☐ |

| Emerging growth company | | ☒ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule13e-4(i) (Cross-Border Issue Tender Offer) ☐

Exchange Act Rule14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of Each Class of Securities to be Registered | | Amount to be Registered | | Proposed

Maximum

Offering Price

per Unit | | Proposed

Maximum Aggregate

Offering Price | | Amount of Registration

Fee(1) |

6.875% Senior Notes due 2023 | | $175,000,000 | | 100% | | $175,000,000 | | $21,788 |

Guarantees of the 6.875% Senior Notes due 2023(2) | | $175,000,000 | | N/A | | N/A | | (3) |

|

|

| (1) | Estimated solely for the purpose of calculating the registration fee under Rule 457(f) of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | The entities listed on the Table of Additional Registrant Guarantors on the following page have guaranteed the notes being registered hereby. |

| (3) | Pursuant to Rule 457(n) under the Securities Act, no additional registration fee is due for guarantees. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

| | | | | | | | |

Exact Name of Registrant Guarantor(1) | | State or Other Jurisdiction

of Incorporation or

Formation | | | IRS Employer

Identification Number | |

Delaware City Logistics Company LLC | | | Delaware | | | | 61-1758623 | |

Delaware City Terminaling Company LLC | | | Delaware | | | | 37-1719133 | |

Delaware Pipeline Company LLC | | | Delaware | | | | 27-2198577 | |

Paulsboro Natural Gas Pipeline Company LLC | | | Delaware | | | | 75-2670443 | |

PBF Logistics Products Terminals LLC | | | Delaware | | | | 36-4826036 | |

PBFX Operating Company LLC | | | Delaware | | | | 81-3654373 | |

Toledo Terminaling Company LLC | | | Delaware | | | | 37-1769303 | |

Torrance Valley Pipeline Company LLC | | | Delaware | | | | 30-0887339 | |

PBF Energy Company LLC | | | Delaware | | | | 61-1622166 | |

| (1) | The address for each Registrant Guarantor is One Sylvan Way, Second Floor, Parsippany, New Jersey 07054 and the telephone number for each registrant is(973) 455-7500. |

The information in this prospectus is not complete and may be changed. We may not complete the exchange offer and issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offering is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 12, 2018

PRELIMINARY PROSPECTUS

PBF LOGISTICS LP

PBF LOGISTICS FINANCE CORPORATION

Offer to Exchange (the “exchange offer”)

Up To $175,000,000 of

6.875% Senior Notes due 2023

That Have Not Been Registered Under

The Securities Act of 1933

That Were Issued on October 6, 2017

For

Up To $175,000,000 of

6.875% Senior Notes due 2023

That Have Been Registered Under

The Securities Act of 1933

Terms of the New 6.875% Senior Notes due 2023 Offered in the Exchange Offer:

The terms of the new notes are substantially identical to the terms of the old notes that were issued on October 6, 2017, except that the new notes will be registered under the Securities Act of 1933, as amended, and will not contain restrictions on transfer, registration rights or provisions for payments of additional interest included in the registration rights agreement relating to the old notes. Prior to the sale and issuance of the old notes, there were $350,000,000 aggregate principal amount of 6.875% Senior Notes due 2023 already outstanding under the indenture governing the notes (the “existing registered notes”). The new notes will be treated as a single class with the existing registered notes.

Terms of the Exchange Offer:

We are offering to exchange up to $175,000,000 of our old notes for new notes with substantially identical terms that have been registered under the Securities Act and are freely tradable.

We will exchange all old notes that you validly tender and do not validly withdraw before the exchange offer expires for an equal principal amount of new notes.

The exchange offer expires at 12:00 a.m. midnight, New York City time, on , 2018 unless extended. We do not currently intend to extend the expiration date.

Tenders of old notes may be withdrawn at any time prior to the expiration of the exchange offer.

The exchange of new notes for old notes will not be a taxable event for U.S. federal income tax purposes.

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the expiration date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

You should carefully consider theRisk Factors beginning on page 16 of this prospectus before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2018

This prospectus is part of a registration statement we filed with the U.S. Securities and Exchange Commission (the “SEC”). You should rely only on the information contained in this prospectus and in the accompanying letter of transmittal. We have not authorized anyone to provide you with different information. The prospectus may be used only for the purposes for which it has been published and no person has been authorized to give any information not contained herein. If you receive any other information, you should not rely on it. The information contained in this prospectus is current only as of its date. We are not making an offer to sell these securities or soliciting an offer to buy these securities in any jurisdiction where an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone whom it is unlawful to make an offer or solicitation.

TABLE OF CONTENTS

In this prospectus we refer to the notes to be issued in the exchange offer as the “new notes,” and we refer to the $175,000,000 aggregate principal amount of our 6.875% senior notes due 2023 issued on October 6, 2017, as the “old notes.” This prospectus does not cover the existing registered notes. We refer to the new notes, the existing registered notes and the old notes collectively as the “notes.” In this prospectus, references to “PBFX” or the “issuer” refer to PBF Logistics LP, a Delaware limited partnership, formed on February 25, 2013. In this prospectus, references to the “co-issuer” refer to PBF Logistics Finance Corporation, a Delaware corporation, incorporated on April 27, 2015, and a wholly-owned subsidiary of PBFX. PBF Logistics Finance Corporation has no material assets, and was formed for the purpose of being a co-issuer or guarantor of certain of our indebtedness. References to the “issuers” refer to the issuer and the co-issuer together.

This prospectus incorporates by reference important business and financial information about us from documents filed with the SEC that have not been included herein or delivered herewith. This information is available without charge at the website that the SEC maintains at http://www.sec.gov, as well as from other sources. See “Incorporationby Reference”. In addition, you may request copies of the documents incorporated by reference in this prospectus from us, at no cost, by writing or calling our general partner at the following address or phone number: PBF Logistics GP LLC, One Sylvan Way, Second Floor, Parsippany, New Jersey 07054, Attention: General Counsel (Telephone (973) 455-7500). In order to receive timely delivery of those materials, you must make your requests no later than five business days before expiration of the exchange offer.

ii

INDUSTRY AND MARKET DATA

In this prospectus and in the documents incorporated by reference herein, we refer to information regarding market data and other statistical information obtained from independent industry publications, government publications or other published independent sources. Some data is also based on our good faith estimates. Although we believe these third party sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. Estimates are inherently uncertain, involve risks and uncertainties and are subject to change based on various factors, including those described elsewhere in this prospectus and the documents incorporated by reference herein under the heading “Risk Factors.” Moreover, forecasted information is inherently uncertain and we can provide no assurance that forecasted information will materialize.

iii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and information in and incorporated by reference into this prospectus may constitute “forward-looking statements.” You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “anticipates” or similar expressions that relate to our strategy, plans or intentions. All statements we make relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to our expectations regarding future industry trends are forward-looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. These forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those that we expected. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results.

Important factors that could cause actual results to differ materially from our expectations, which we refer to as “cautionary statements,” are disclosed in this prospectus and the other documents incorporated by reference herein. All forward-looking information in this prospectus and the other documents incorporated by reference herein and subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Some of the factors that we believe could affect our results include:

| | • | | our limited operating history as a separate public partnership; |

| | • | | changes in general economic conditions; |

| | • | | our ability to make, complete and integrate acquisitions from affiliates or third parties; |

| | • | | our ability to have sufficient cash from operations to enable us to pay the minimum quarterly distribution; |

| | • | | competitive conditions in our industry; |

| | • | | actions taken by our customers and competitors; |

| | • | | the supply of, and demand for, crude oil, refined products, natural gas and logistics services; |

| | • | | our ability to successfully implement our business plan; |

| | • | | our dependence on PBF Energy Inc. (“PBF Energy”) for a substantial majority of our revenues subjects us to the business risks of PBF Energy, which includes the possibility that contracts will not be renewed because they are no longer beneficial for PBF Energy; |

| | • | | a substantial majority of our revenue is generated at certain of PBF Energy’s facilities, and any adverse development at any of these facilities could have a material adverse effect on us; |

| | • | | our ability to complete internal growth projects on time and on budget; |

| | • | | the price and availability of debt and equity financing; |

| | • | | operating hazards and other risks incidental to handling crude oil, petroleum products and natural gas; |

| | • | | natural disasters, weather-related delays, casualty losses and other matters beyond our control; |

| | • | | changes in the availability and cost of capital; |

iv

| | • | | the effects of existing and future laws and governmental regulations, including those related to the shipment of crude oil by trains; |

| | • | | changes in insurance markets impacting costs and the level and types of coverage available; |

| | • | | the timing and extent of changes in commodity prices and demand for PBF Energy’s refined products and natural gas and the differential in the prices of different crude oils; |

| | • | | the suspension, reduction or termination of PBF Energy’s obligations under our commercial agreements; |

| | • | | disruptions due to equipment interruption or failure at our facilities, PBF Energy’s facilities or third-party facilities on which our business is dependent; |

| | • | | incremental costs as a separate public partnership; |

| | • | | our general partner and its affiliates, including PBF Energy, have conflicts of interest with us and limited duties to us and our unitholders, and they may favor their own interests to the detriment of us and our other common unitholders; |

| | • | | our partnership agreement restricts the remedies available to holders of our common units for actions taken by our general partner that might otherwise constitute breaches of fiduciary duty; |

| | • | | holders of our common units have limited voting rights and are not entitled to elect our general partner or its directors; |

| | • | | our tax treatment depends on our status as a partnership for U.S. federal income tax purposes, as well as our not being subject to a material amount of entity level taxation by individual states; |

| | • | | changes at any time (including on a retroactive basis) in the tax treatment of publicly traded partnerships, including related impacts on potential dropdown transactions with PBF Energy Company LLC, or an investment in our common units; |

| | • | | our unitholders will be required to pay taxes on their share of our taxable income even if they do not receive any cash distributions from us; |

| | • | | the effects of future litigation; and |

| | • | | other factors discussed elsewhere in more detail under “Risk Factors” of this prospectus and that are incorporated by reference herein. |

We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this prospectus and the documents that are incorporated by reference herein may not in fact occur. Accordingly, investors should not place undue reliance on those statements.

Our forward-looking statements speak only as of the date of this prospectus or as of the date which they are made. Except as required by applicable law, including the securities laws of the United States, we undertake no obligation to update or revise any forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing.

v

INCORPORATION BY REFERENCE

The SEC allows us to incorporate by reference information into this prospectus. This means that we can disclose important information to you by referring you to another document. Any statement contained herein, or in any documents incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded for the purpose of this prospectus to the extent that a subsequent statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

This prospectus incorporates by reference the documents listed below that we have previously filed with the SEC. These documents contain important information about us. Any information referred to in this way is considered part of this prospectus from the date we filed that document.

We incorporate by reference the documents listed below:

| | • | | PBFX’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (the “2017 Annual Report”), as filed with the SEC on February 23, 2018, incorporated by reference herein as set forth above; |

| | • | | All documents filed by PBFX under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) after the date of the initial registration statement and prior to the effectiveness of the registration statement and after the date of this prospectus and before the termination of the exchange offer to which this prospectus relates (other than information furnished pursuant to Item 2.02 or Item 7.01 of any Current Report on Form 8-K, unless expressly stated otherwise therein). |

In reviewing any agreements incorporated by reference, please remember that they are included to provide you with information regarding the terms of such agreements and are not intended to provide any other factual or disclosure information about us. The agreements may contain representations and warranties by us which should not in all instances be treated as categorical statements of fact, but rather as a way of allocating the risk to one of the parties if those statements prove to be inaccurate. The representations and warranties were made only as of the date of the relevant agreement or such other date or dates as may be specified in such agreement and are subject to more recent developments. Accordingly, these representations and warranties alone may not describe the actual state of affairs as of the date they were made or at any other time.

We will provide without charge to each person to whom this prospectus is delivered, upon his or her written or oral request, a copy of any or all documents referred to above which have been or may be incorporated by reference into this prospectus and any exhibit specifically incorporated by reference in those documents. You may request copies of those documents, at no cost, by writing or calling our general partner at the following address or telephone number:

PBF Logistics GP LLC

Attention: Secretary

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

(973) 455-7500

vi

WHERE YOU CAN FIND MORE INFORMATION

We and the guarantors have filed with the SEC a registration statement on Form S-4 under the Securities Act with respect to the new notes. This prospectus, which forms a part of the registration statement, does not contain all of the information set forth in the registration statement. For further information with respect to us, the guarantors and the new notes, reference is made to the registration statement. Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete, and, where such contract or other document is an exhibit to the registration statement, each such statement is qualified by the provisions in such exhibit, to which reference is hereby made. We have historically filed annual, quarterly and current reports and other information with the SEC. The registration statement, such reports and other information can be inspected and copied at the Public Reference Room of the SEC located at 100 F Street, N.E., Washington D.C. 20549. Copies of such materials, including copies of all or any portion of the registration statement, can be obtained from the Public Reference Room of the SEC at prescribed rates. You can call the SEC at 1-800-SEC-0330 to obtain information on the operation of the Public Reference Room. Such materials may also be accessed electronically by means of the SEC’s website athttp://www.sec.gov, and at our website athttp://www.pbflogistics.com. Information on or accessible through our website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus unless we specifically so designate and file with the SEC.

So long as we are subject to the periodic reporting requirements of the Exchange Act, we are required to furnish the information required to be filed with the SEC to the trustee and the holders of the notes. We have agreed that, even if we are not required under the Exchange Act to furnish such information to the SEC, we will nonetheless continue to furnish information that would be required to be furnished by us by Section 13 or 15(d) of the Exchange Act.

vii

PROSPECTUS SUMMARY

This summary highlights the information contained elsewhere or incorporated by reference in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of this exchange offer, we encourage you to read this prospectus and the documents incorporated by reference in this prospectus. You should read the following summary together with the more detailed information and consolidated financial statements, including the accompanying notes, included elsewhere or incorporated by reference in this prospectus. You should consider, among other things, the matters set forth in “Risk Factors” before deciding to participate in the exchange offer.

Unless the context otherwise requires, references in this prospectus to “PBF Logistics LP,” “PBFX,” the “Partnership,” “we,” “us” or “our” (except as set forth in the section of this prospectus titled “Information Regarding PBF Energy Company LLC”) may refer to PBF Logistics LP, one or more of its consolidated subsidiaries or all of them taken as a whole. References in this prospectus to “our general partner” or “PBF GP” refer to PBF Logistics GP LLC. Unless the context otherwise requires, references in this prospectus to “PBF Energy” refer collectively to PBF Energy Inc. and its subsidiaries, other than PBFX, its subsidiaries and our general partner. References to “PBF LLC” refer to PBF Energy Company LLC, the majority owner of our limited partnership interests and the sole member of our general partner, which provides a limited guarantee of collection of the principal amount of the notes (the “PBF LLC limited guarantee”). Any references in this prospectus to “guarantors” or the “guarantees” exclude PBF LLC and the PBF LLC limited guarantee.

PBF Logistics LP

Our Company

We are a fee-based, growth-oriented, Delaware master limited partnership formed in February 2013 by subsidiaries of PBF Energy (NYSE: PBF) and its indirect subsidiary, PBF GP, to own or lease, operate, develop and acquire crude oil and refined petroleum products terminals, pipelines, storage facilities and similar logistics assets. Our common units trade on the New York Stock Exchange under the symbol “PBFX.” Our general partner, PBF GP, is wholly-owned by PBF LLC, a subsidiary of PBF Energy.

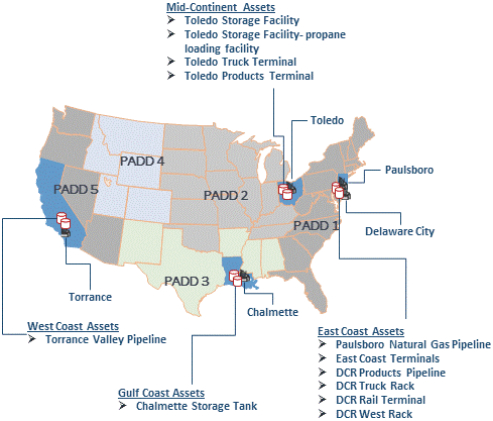

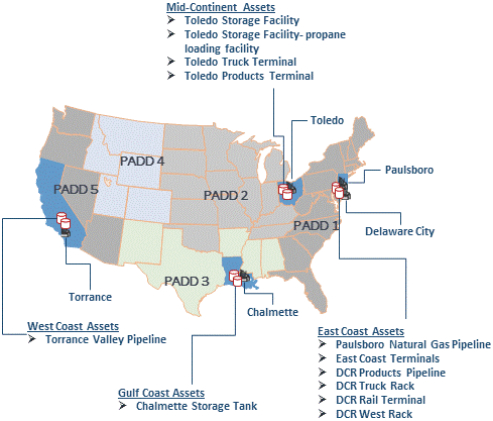

PBF Energy is one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States. It sells its products throughout the Northeast, Midwest, Gulf Coast and West Coast regions of the United States, as well as in other regions of the United States and Canada, and is able to ship products to other international destinations. PBF Energy currently owns and operates five domestic oil refineries in Torrance, California, Delaware City, Delaware, New Orleans, Louisiana, Paulsboro, New Jersey and Toledo, Ohio, with a combined processing capacity, known as throughput, of approximately 900,000 barrels per day (“bpd”) and a weighted average Nelson Complexity Index of 12.2.

Our relationship with PBF Energy is one of our principal strengths. We receive, handle and transfer crude oil, refined products and natural gas from sources located throughout the United States and Canada and store crude oil, refined products and intermediates for PBF Energy in support of its refineries in the Northeast, Midwest, Gulf Coast and Western United States. Since we do not own any of the crude oil, refined products or natural gas that we handle nor engage in the trading of crude oil, refined products or natural gas, we have minimal direct exposure to risks associated with commodity price fluctuations. However, these risks indirectly influence our activities and results of operations over the long-term through their effects on our customer’s operations. A substantial majority of our revenue is derived from PBF Energy under various long-term, fee-based commercial agreements that generally include minimum volume commitments (“MVCs”).

-1-

We intend to continue to seek opportunities to grow our business by acquiring logistics assets fromthird-parties as well as acquiring additional logistics assets from PBF Energy. We also intend to pursue organic growth by constructing new assets and increasing the utilization of our existing assets. We were formed by PBF Energy to be the primary vehicle to expand the logistics assets supporting its business. We expect that PBF Energy will continue to serve as a critical source of our future growth by providing us with opportunities to purchase additional logistics assets that it currently owns or may acquire or develop in the future. PBF Energy owns and operates a substantial portfolio of associated logistics assets supporting its refineries.

Our Assets and Operations

Currently, our business consists of two operating segments: our transportation and terminaling segment and our storage segment.

The following table details our assets and the available throughput or storage capacity per asset:

| | | | |

Transportation and Terminaling | | Capacity | | Products Handled |

DCR Rail Terminal | | 130,000 bpd unloading capacity | | Crude |

| | |

Toledo Truck Terminal | | 22,500 bpd unloading capacity | | Crude |

| | |

DCR West Rack | | 40,000 bpd throughput capacity | | Crude |

| | |

Toledo Storage Facility - propane loading facility | | 11,000 bpd throughput capacity | | Propane |

| | |

DCR Products Pipeline | | 125,000 bpd pipeline capacity | | Refined products |

| | |

DCR Truck Rack | | 76,000 bpd throughput capacity | | Gasoline, distillates and LPGs |

| | |

East Coast Terminals | | various throughput capacity and approximately 4.2 million barrel aggregate shell capacity | | Refined products |

| | |

Torrance Valley Pipeline | | 110,000 bpd pipeline capacity | | Crude |

| | |

Paulsboro Natural Gas Pipeline | | 60,000 dekatherms per day | | Natural gas |

| | |

Toledo Products Terminal | | various throughput capacity and 110,000 barrel aggregate shell capacity | | Refined products |

| | | | |

Storage | | Capacity | | Products Handled |

Toledo Storage Facility | | approximately 3.9 million barrel aggregate shell capacity (a) | | Crude, refined products and intermediates |

| | |

Chalmette Storage Tank | | 625,000 barrel shell capacity | | Crude |

| (a) | Of the approximately 3.9 million barrel aggregate shell capacity, approximately 1.3 million barrels are dedicated to crude and approximately 2.6 million barrels are allocated to refined products and intermediates. |

-2-

Transportation and Terminaling Segment

| | • | | Our Delaware City Rail Unloading Terminal (“DCR Rail Terminal”) is a light crude oil rail unloading terminal and serves PBF Energy’s Delaware City and Paulsboro refineries. The DCR Rail Terminal has a double-loop track, which can hold up to two100-car unit trains and is capable of unloading a single unit train in approximately 14 hours. The facility is connected to the Delaware City refinery’s crude tank farm by DCR’s pipeline. |

| | • | | Our Toledo Truck Unloading Terminal (“Toledo Truck Terminal”) serves PBF Energy’s Toledo refinery, is comprised of six lease automatic custody transfer (“LACT”) units, and has capabilities to provide feedstock sourcing flexibility for the refinery. |

| | • | | Our Delaware City West Heavy Unloading Rack (the “DCR West Rack”) is a heavy crude oil unloading facility and serves PBF Energy’s Delaware City refinery. The DCR West Rack consists of 25 heated unloading stations, is capable of handling 50 cars simultaneously located between two tracks and is equipped with steam and nitrogen to facilitate the unloading of heavy crude oil sourced from Canada. The facility can also unload light crude oil. Additionally, there are six other ladder tracks available, which provide the DCR West Rack with enough capacity to hold two 100-car unit trains. The facility is connected via DCR’s pipeline to the crude tank farm at the Delaware City refinery. |

| | • | | The terminaling facility at our tank farm and related facilities located at PBF Energy’s Toledo refinery, including a propane storage and loading facility (the “Toledo Storage Facility”), consists of 27 propane storage bullets and a truck loading facility. |

| | • | | Our 23.4-mile, 16-inch interstate petroleum products pipeline (the “DCR Products Pipeline”) and our 15-lane truck loading rack (the “DCR Truck Rack”) utilized to distribute gasoline, distillates and liquefied petroleum gases (“LPGs”), serve PBF Energy’s Delaware City refinery and are collectively referred to as “DCR Products Pipeline and Truck Rack.” |

| | • | | Our four refined product terminals located in and around Philadelphia, Pennsylvania (the “East Coast Terminals”) include 57 product tanks, pipeline connections to the Colonial Pipeline Company, Buckeye Partners L.P., Sunoco Logistics Partners L.P. and other proprietary pipeline systems, 26 truck loading lanes and marine facilities capable of handling barges and ships. |

| | • | | Our 189-mile San Joaquin Valley Pipeline system (the “Torrance Valley Pipeline”), which serves PBF Energy’s Torrance refinery and consists of the M55, M1 and M70 pipeline systems, including 11 pipeline stations with storage capacity and truck unloading capability at two of the stations. |

| | • | | Our interstate natural gas pipeline (the “Paulsboro Natural Gas Pipeline”), which is a 24” interstate natural gas pipeline that supports PBF Energy’s Paulsboro refinery. |

| | • | | Our Toledo refined product terminal (the “Toledo Products Terminal”), which supports PBF Energy’s Toledo refinery and is comprised of a ten-bay truck rack with chemicals, clean product and additive storage capacity. |

Storage Segment

| | • | | The Toledo Storage Facility, which services PBF Energy’s Toledo refinery and consists of 30 tanks for storing crude oil, refined products and intermediates. |

| | • | | The crude oil storage tank (the “Chalmette Storage Tank”) located at PBF Energy’s Chalmette refinery. |

-3-

Business Strategies

Our primary business objectives are to maintain stable and predictable cash flows and create value for our stakeholders. We intend to achieve these objectives through the following business strategies:

| | • | | Maintain Safe, Reliable and Efficient Operations. We are committed to maintaining and improving the safety, reliability, environmental compliance and efficiency of our operations. We seek to improve operating performance through our commitment to our preventive maintenance program and to employee training and development programs. We will continue to emphasize safety in all aspects of our operations. We believe these objectives are integral to maintaining stable cash flows and are critical to the success of our business. |

| | • | | Generate Stable, Fee-Based Cash Flow. We believe our long-term, fee-based logistics contracts provide us with stable, predictable cash flows. We generate a substantial majority of our revenue from PBF Energy under various commercial agreements which include minimum quarterly volume commitments, minimum storage commitments, inflation escalators and initial terms of approximately seven to ten years. In addition, we generate third-party revenue from the East Coast Terminals, which include fee-based commercial agreements. Over time, we will continue to seek to enter into similar contracts with PBF Energy and/or third-parties that generate stable and predictable cash flows. |

| | • | | Grow Through Acquisitions and Organic Projects. We were formed by PBF Energy to be the primary vehicle to expand the logistics assets supporting its business. We expect to pursue strategic acquisitions independently and jointly with PBF Energy that complement and grow our asset base. PBF Energy has also granted us a right of first offer to acquire certain of its logistics assets. In addition, PBF Energy may, under certain circumstances, offer us the opportunity to purchase additional logistics assets that it may acquire or construct in the future. Furthermore, we believe that our current asset base and our knowledge of the refining logistics sector will allow us to identify third-party acquisitions that will provide compelling returns to our unitholders. We believe our acquisitions of the Toledo Products Terminal and the East Coast Terminals are examples of such strategic acquisitions. In addition, we pursue strategic organic projects that enhance our existing assets and increase our revenues. The Chalmette Storage Tank is an example of a recently completed organic growth project. |

| | • | | Seek to Optimize Our Existing Assets and Pursue Third-Party Volumes. We intend to enhance the profitability of our existing and future assets by increasing throughput volumes from PBF Energy, attracting third-party volumes, improving operating efficiencies and managing costs. |

Competitive Strengths

We believe we are well positioned to successfully execute our business strategies because of the following competitive strengths:

| | • | | Relationship with PBF Energy. One of our key strengths is our relationship with PBF Energy. We serve as PBF Energy’s primary vehicle to expand the logistics assets supporting its business. We believe that PBF Energy will be incentivized to grow our business as a result of its significant indirect economic interest in us, including 100% ownership of our general partner, a 44.1% limited partnership interest in us and all of our incentive distribution rights (“IDRs”). In particular, we expect to continue to benefit from the following aspects of our relationship with PBF Energy: |

| | • | | Acquisition Opportunities. PBF Energy has granted us a right of first offer on certain logistics assets and may, under certain circumstances, offer us the opportunity to purchase additional logistics assets that it may acquire or construct in the future. We also expect to jointly pursue strategic acquisitions with PBF Energy that complement and grow our asset base. |

| | • | | Strength of PBF Energy’s Refining Business. PBF Energy’s refineries have a combined throughput capacity of 900,000 bpd. PBF Energy’s refineries provide it with buying power |

-4-

| | advantages, and it benefits from the cost efficiencies that result from operating five large refineries. In addition, its refinery assets are located in high-demand regions where product demand exceeds refining capacity. |

| | • | | Access to Operational and Industry Expertise. We expect to continue to benefit from PBF Energy’s extensive operational, commercial and technical expertise, as well as its industry relationships throughout the midstream and downstream value chain, as we look to optimize and expand our existing asset base. |

| | • | | Stable Cash Flows Supported by Long-Term, Fee-Based Contracts with Minimum Volume Commitments. We currently generate a substantial majority of our revenue under long-term, fee based contracts with PBF Energy, which include minimum volume or storage commitments and have fees adjusted for changes in the specified inflation indexes and certain increases in our operating costs for providing such services under such agreements, thereby providing us with stable and predictable minimum cash flows. Certain of our commercial agreements at the East Coast Terminals also include minimum lease capacities with fees adjusted for inflation. |

| | • | | Strategically Located and Highly Integrated Assets. Our logistics assets acquired from PBF Energy are integral to the operations of PBF Energy’s refineries. For example, our Torrance Valley Pipeline currently receives a substantial portion of the crude oil processed by the Torrance refinery, and the Toledo Truck Terminal provides important feedstock supply infrastructure for the Toledo refinery. |

| | • | | High-Quality, Well-Maintained Asset Base. We continually invest in the maintenance and integrity of our assets and have developed various programs to help us efficiently monitor and maintain the assets. We employ an asset integrity program, which focuses on risk analysis, assessment, inspection, preventive measures, repair and data integration to provide reliable operations. We also have developed and use industrial processes to monitor and control our operations. In addition, our DCR Rail Terminal, DCR West Rack and Chalmette Storage Tank all commenced operations within the past four years and require a relatively small amount of maintenance capital expenditure, relative to peers with older assets. |

| | • | | Financial Flexibility. We believe that our access to the debt and equity capital markets, as well as the capacity under our five-year $360.0 million revolving credit facility (the “Revolving Credit Facility”), provides us with the financial flexibility to execute our growth strategy. |

| | • | | Experienced Management and Operations Teams with a Demonstrated Track Record of Acquiring, Integrating and Operating Logistics Assets. Both our management and our operations teams have significant experience in the management and operation of logistics assets and the execution of expansion and acquisition strategies. Our management team has a proven track record of working together successfully to operate refining and logistics assets and to execute expansion and acquisition strategies, including while previously at Tosco Corporation and Premcor Inc. |

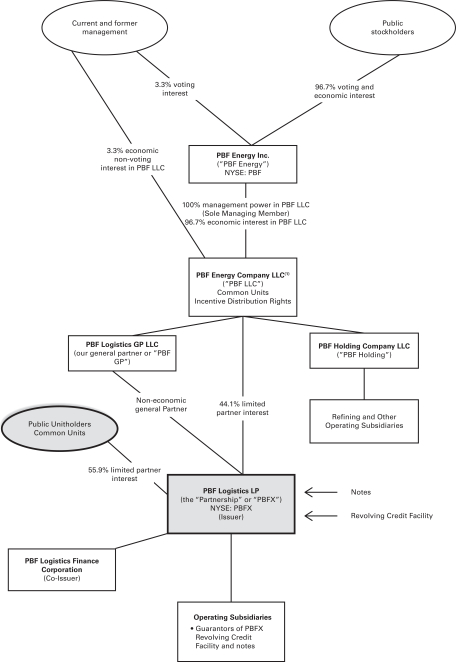

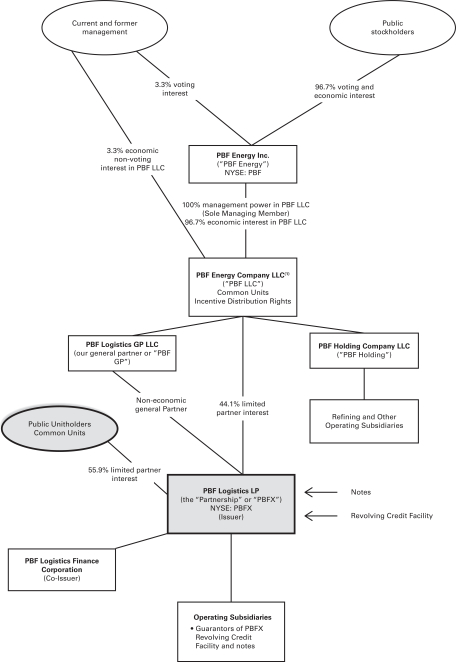

Our Relationship with PBF Energy

PBF Energy is the indirect parent entity of PBF Holding Company LLC (“PBF Holding”), which serves as the parent company for PBF Energy’s refinery operating subsidiaries. PBF Energy is the sole managing member of PBF LLC and operates and controls all of its business and affairs and consolidates the financial results of PBF LLC and its subsidiaries, including PBF Holding. PBF LLC is a holding company for the companies that directly or indirectly own and operate PBF Energy’s business. As of the December 31, 2017, PBF Energy’s primary asset is a controlling economic interest of approximately 96.7% in PBF LLC, with the remaining economic interests in PBF LLC held by certain of PBF Energy’s current and former executive officers and directors and certain employees and others.

-5-

As of the December 31, 2017, PBF LLC holds a 44.1% limited partner interest in us, a non-economic general partner interest and all of our IDRs, with the remaining 55.9% limited partner interest held by public unitholders. We believe PBF Energy will promote and support the successful execution of our business strategies given its significant ownership in us, the importance of our assets to PBF Energy’s refining operations and its stated intention to use us as a primary vehicle to grow its logistics business.

Partnership Structure and Management

PBF Logistics LP is a Delaware limited partnership formed in February 2013. Our general partner is PBF Logistics GP LLC, a Delaware limited liability company. PBF GP owns a non-economic general partner interest in us, and we are managed and operated by its board of directors and executive officers. PBF Energy (through its ownership in PBF LLC) owns all of the ownership interests in our general partner and initially appointed the entire board of directors of our general partner. Subsequent board of directors were appointed by the directors then in office.

PBF Logistics Finance Corporation, our wholly-owned subsidiary, has no material assets or any liabilities other than as a co-issuer or guarantor of some of our indebtedness. Its activities are limited to co-issuing or guaranteeing our indebtedness and engaging in other activities incidental thereto. Each of our existing subsidiaries other than PBF Logistics Finance Corporation, and certain of our future subsidiaries, guarantee the notes.

Our principal executive offices are located at One Sylvan Way, Second Floor, Parsippany, New Jersey 07054, and our telephone number is (973) 455-7500. Our website is located at http://www.pbflogistics.com. We make available our periodic reports and other information filed with or furnished to the SEC, free of charge through our website, as soon as reasonably practicable after those reports and other information is electronically filed with or furnished to the SEC. Information on or accessible through our website or any other website is not incorporated by reference herein (except for reports we filed with the SEC that are expressly incorporated by reference herein) and does not constitute a part of this prospectus.

PBF Energy Company LLC

PBF LLC is a holding company for the companies that directly or indirectly own and operate PBF Energy’s business. PBF LLC provides a limited guarantee of collection of the principal amount of the notes. PBF LLC also provides a similar limited guarantee of collection under our Revolving Credit Facility. Under the PBF LLC limited guarantee, holders will not be entitled to obtain any recovery of principal from PBF LLC after an event of default unless and until holders have first exhausted their remedies against the issuers and guarantors. See “Risk Factors—Risks Related to the Notes—Payment of principal and interest on the notes is effectively subordinated to our senior secured debt to the extent of the value of the assets securing the debt and structurally subordinated as to the indebtedness of any of our subsidiaries that do not guarantee the notes” and “Information Regarding PBF Energy Company LLC.”

PBF LLC’s principal executive offices are located at One Sylvan Way, Second Floor, Parsippany, New Jersey 07054, and PBF LLC’s telephone number is (973) 455-7500.

-6-

Organizational Structure

The following simplified diagram depicts our organizational structure as of December 31, 2017:

| (1) | PBF LLC provides a limited guarantee of collection of the principal amount of the notes. See “Description of Notes—Brief Description of the Notes and the Guarantees—The Note Guarantees.” |

-7-

The Exchange Offer

On October 6, 2017, we completed a private offering of $175,000,000 aggregate principal amount of the old notes. We entered into a registration rights agreement with the initial purchasers in connection with the offering in which we agreed to deliver to you this prospectus and to use commercially reasonable efforts to consummate the exchange offer not later than 365 days after the date of original issuance of the old notes. The new notes will be treated as a single class with the existing registered notes and will have the same terms as those of the existing registered notes.

Exchange Offer | We are offering to exchange new notes for old notes. The terms of the new notes are substantially identical to the terms of the old notes that were issued on October 6, 2017, except that the new notes will be registered under the Securities Act and will not contain restrictions on transfer, registration rights or provisions for payments of additional interest included in the registration rights agreement relating to the old notes. |

| | You may only exchange notes in denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

Expiration Date | The exchange offer will expire at 12:00 a.m. midnight, New York City time, on , 2018, unless we decide to extend it. We do not currently intend to extend the expiration date. |

Resale | Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the new notes issued pursuant to the exchange offer in exchange for old notes may be offered for resale, resold and otherwise transferred by you (unless you are our “affiliate” within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act; provided that: |

| | • | | you are acquiring the new notes in the ordinary course of your business; and |

| | • | | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the new notes. |

| | Each broker-dealer that receives new notes for its own account in exchange for old notes, where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. See “Plan of Distribution.” |

| | Any holder of old notes who: |

| | • | | does not acquire new notes in the ordinary course of its business; or |

-8-

| | • | | tenders its old notes in the exchange offer with the intention to participate, or for the purpose of participating, in a distribution of new notes, |

| | cannot rely on the position of the staff of the SEC enunciated inMorganStanley & Co. Incorporated(available June 5, 1991) andExxon CapitalHoldings Corporation(available May 13, 1988), as interpreted in the SEC’s letter to Shearman & Sterling (available July 2, 1993), or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the new notes. |

Procedures for Tendering Old Notes | If you hold old notes that were issued in book-entry form and are represented by global certificates held for the account of The Depository Trust Company (“DTC”), in order to participate in the exchange offer, you must follow the procedures established by DTC for tendering notes held in book-entry form. These procedures, which we call “ATOP,” require that (i) the exchange agent receive, prior to the expiration date of the exchange offer, a computer generated message known as an “agent’s message” that is transmitted through DTC’s automated tender offer program, and (ii) DTC confirms that: |

| | • | | DTC has received your instructions to exchange your old notes, and |

| | • | | you agree to be bound by the terms of the letter of transmittal for holders of global notes. |

| | If you hold old notes that were issued in definitive, certificated form, in order to participate in the exchange offer, you must deliver the certificates representing your notes, together with a properly completed and duly executed letter of transmittal for holders of definitive notes to the exchange agent. |

| | For more information on tendering your old notes, please refer to the section in this prospectus entitled “Exchange Offer—Terms of the Exchange Offer,” “—Procedures for Tendering,” and “Description of Notes—Book Entry; Delivery and Form.” |

Guaranteed DeliveryProcedures | If you wish to tender your old notes and your old notes are not immediately available or you cannot deliver your old notes, the letter of transmittal or any other required documents, or you cannot comply with the procedures under ATOP for transfer of book-entry interests, prior to the expiration date, you must tender your old notes according to the guaranteed delivery procedures set forth in this prospectus under “Exchange Offer—Guaranteed Delivery Procedures.” |

Withdrawal of Tenders | You may withdraw your tender of old notes at any time prior to the expiration date. To withdraw tenders of notes held in global form, you must submit a notice of withdrawal to the exchange agent using |

-9-

| | ATOP procedures before 12:00 a.m. midnight, New York City time, on the expiration date of the exchange offer. To withdraw tenders of notes held in definitive form, you must submit a written or facsimile notice of withdrawal to the exchange agent before 12:00 a.m. midnight, New York City time, on the expiration date of the exchange offer. Please refer to the section in this prospectus entitled “Exchange Offer—Withdrawal of Tenders.” |

Acceptance of Old Notes and Delivery of New Notes | If you fulfill all conditions required for proper acceptance of old notes, we will accept any and all old notes that you properly tender in the exchange offer before 12:00 a.m. midnight New York City time on the expiration date. We will return any old note that we do not accept for exchange to you without expense promptly after the expiration or termination of the exchange offer. Please refer to the section in this prospectus entitled “Exchange Offer—Terms of the Exchange Offer.” |

Fees and Expenses | We will bear expenses related to the exchange offer. Please refer to the section in this prospectus entitled “Exchange Offer—Fees and Expenses.” |

Use of Proceeds | The issuance of the new notes will not provide us with any new proceeds. We are making this exchange offer solely to satisfy our obligations under the registration rights agreement. |

Consequences of Failure to Exchange Old Notes | If you do not exchange your old notes in this exchange offer, you will no longer be able to require us to register the old notes under the Securities Act except in limited circumstances provided under the registration rights agreement. In addition, you will not be able to resell, offer to resell or otherwise transfer the old notes unless we have registered the old notes under the Securities Act, or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act. |

U.S. Federal Income Tax Consequences | The exchange of new notes for old notes pursuant to the exchange offer will not be a taxable event for U.S. federal income tax purposes. Please read “Material United States Federal Income Tax Consequences.” |

-10-

Exchange Agent | We have appointed Deutsche Bank Trust Company Americas as the exchange agent for the exchange offer. You should direct questions and requests for assistance, requests for additional copies of this prospectus, the letter of transmittal or the notice of guaranteed delivery to the exchange agent as follows: |

| | Deutsche Bank Trust Company Americas |

c/o DB Services Americas, Inc.

5022 Gate Parkway, Suite 200

Jacksonville, Florida 32256

Attn: Reorg Dept

| | For telephone assistance, please call (877) 843-9767. |

-11-

The Terms of the New Notes

The new notes will be substantially identical to the old notes except that the new notes are registered under the Securities Act and will not have restrictions on transfer, registration rights or provisions for additional interest. The new notes will evidence the same debt as the old notes, and the same indenture will govern the new notes, the old notes and the existing registered notes. The new notes will be treated as a single class with the existing registered notes and will have the same terms as those of the existing registered notes.

The following summary contains basic information about the notes and is not intended to be complete. It does not contain all of the information that is important to you. For a more complete understanding of the notes, please refer to the section entitled “Description of Notes.”

Issuers | PBF Logistics LP and PBF Logistics Finance Corporation. |

| | PBF Logistics Finance Corporation is a wholly-owned subsidiary of PBF Logistics LP that has no material assets and was formed for the sole purpose of being a co-issuer or guarantor of certain of our indebtedness. |

Securities | $175.0 million aggregate principal amount of 6.875% Senior Notes due 2023 (the “new notes”). |

Maturity date | May 15, 2023. |

Interest payment dates | May 15 and November 15 of each year, commencing on May 15, 2018. Interest on each new note accrues from the last interest payment date on which interest was paid on the surrendered old note or, if no interest has been paid on such old note, from May 15, 2017. |

Ranking | The new notes will be our general senior unsecured obligations. The new notes will: |

| | • | | rank equally in right of payment with all of our existing and future senior indebtedness, including amounts outstanding under our Revolving Credit Facility, and the existing registered notes; |

| | • | | be effectively subordinated to any of our secured indebtedness, including our obligations in respect of our Revolving Credit Facility, to the extent of the value of the collateral securing such indebtedness; |

| | • | | rank senior in right of payment to any of our future subordinated indebtedness; and |

| | • | | be structurally subordinated to all indebtedness and obligations of our subsidiaries that do not guarantee the new notes. |

| | As of December 31, 2017, we have $29.7 million of secured indebtedness and $3.6 million of letters of credit outstanding under our Revolving Credit Facility, $525.0 million of unsecured indebtedness consisting of the notes, and an additional $326.7 million of total unused borrowing capacity under the Revolving Credit Facility. Subsequent to the issuance of the old notes, we used the net proceeds to pay down the Revolving Credit Facility and for general partnership purposes. |

-12-

Guarantees | The new notes will be jointly and severally guaranteed by all of our existing subsidiaries (other than PBF Logistics Finance Corporation) and by certain of our future subsidiaries, which we refer to as “the guarantors.” The guarantors own substantially all of our consolidated assets. Each guarantee of the new notes will: |

| | • | | be a general unsecured obligation of the subsidiary guarantor; |

| | • | | rank equally in right of payment with all existing and future senior indebtedness of that subsidiary guarantor, including its guarantee of indebtedness under our Revolving Credit Facility and the existing registered notes; |

| | • | | be effectively subordinated to any secured indebtedness of that subsidiary guarantor, including its secured guarantee of indebtedness under the Revolving Credit Facility, to the extent of the value of the collateral securing such indebtedness; |

| | • | | rank senior in right of payment to any future subordinated indebtedness of that subsidiary guarantor; and |

| | • | | be structurally subordinated to all future liabilities of any guarantor’s subsidiary that does not guarantee the new notes. |

| | A guarantor’s guarantee of the new notes will be released under certain circumstances, including if such guarantor’s guarantee of the Revolving Credit Facility is released. See “Description of Notes—Brief Description of the Notes and the Guarantees—Note Subsidiary Guarantees” for a description of other circumstances in which a guarantor’s guarantee of the new notes may be released. |

| | PBF LLC provides a limited guarantee of collection of the principal amount of the new notes. Under the PBF LLC limited guarantee, PBF LLC would not have any obligation to make principal payments with respect to the notes unless all remedies, including in the context of bankruptcy proceedings, have first been fully exhausted against us with respect to such payment obligation, and holders of the notes are still owed amounts in respect of the principal of the notes. PBF LLC is not otherwise subject to the covenants of the indenture governing the notes. See “Description of Notes—Brief Description of the Notes and the Guarantees—The Note Guarantees.” |

Optional redemption | At any time prior to May 15, 2018, we may on any one or more occasions redeem up to 35% of the aggregate principal amount of the new notes in an amount not greater than the net cash proceeds of certain equity offerings at a redemption price equal to 106.875% of the principal amount of the new notes, plus any accrued and unpaid interest to the date of redemption. |

-13-

| | On or after May 15, 2018, we may redeem all or part of the new notes, in each case at the redemption prices described under “Description of Notes—Optional Redemption,” together with any accrued and unpaid interest to the date of redemption. |

| | In addition, prior to May 15, 2018, we may redeem all or part of the new notes at a “make-whole” redemption price described under “Description of Notes—Optional Redemption,” together with any accrued and unpaid interest to the date of redemption. |

Mandatory offers to purchase | If we undergo certain change of control events, holders of the new notes will have the right to require us to purchase all or any part of the notes at a price equal to 101% of the aggregate principal amount of the notes, together with any accrued and unpaid interest to the date of purchase. See “Description of Notes—Repurchase at the Option of Holders—Change of Control Triggering Event.” In connection with certain asset dispositions, we will be required to use the net cash proceeds of the asset dispositions (subject to our right to reinvest such net cash proceeds) to make an offer to purchase the new notes at 100% of the principal amount, together with any accrued and unpaid interest to the date of purchase. See “Description of Notes—Repurchase at the Option of Holders—Asset Sales.” |

Certain covenants | The indenture governing the notes, among other things, limits our ability and the ability of our restricted subsidiaries to: |

| | • | | incur additional indebtedness or issue preferred units; |

| | • | | pay dividends or make distributions on units or redeem or repurchase our subordinated debt; |

| | • | | incur dividend or other payment restrictions affecting subsidiaries; |

| | • | | merge or consolidate with other entities; and |

| | • | | enter into transactions with affiliates. |

| | These covenants are subject to important exceptions and qualifications. In addition, many of the covenants will terminate before the notes mature if both Moody’s and Standard & Poor’s assign the notes an investment grade rating in the future and no events of default exist under the indenture. Any covenants that cease to apply to us as a result of achieving an investment grade rating will not be restored, even if the credit rating assigned to the notes later falls below an investment grade rating. See “Description of Notes—Certain Covenants—Covenant Termination.” |

-14-

Transfers; Absence of a Public Market for the New Notes | The new notes generally will be freely transferable, but will also be new securities for which there will not initially be a market. There can be no assurance as to the development or liquidity of any market for the new notes. We do not intend to apply for a listing of the new notes on any securities exchange or any automated dealer quotation system. See “Risk Factors—Risks Related to the Exchange Offer—Your ability to transfer the new notes may be limited by the absence of a trading market.” |

Risk factors | You should carefully consider all the information in the prospectus prior to exchanging your old notes. See “Risk Factors” for a description of some of the risks you should consider in evaluating whether or not to tender your old notes. |

-15-

RISK FACTORS

An investment in the new notes involves risks. In addition to the risks described below, you should carefully read all of the other information included in this prospectus and the documents we have incorporated by reference into this prospectus before deciding whether to participate in the exchange offer (including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes in our 2017 Annual Report, as well as “Description of Notes” in this prospectus). If any of these risks were to occur, our business, financial condition, results of operations or prospects could be materially adversely affected. In that case, our ability to fulfill our obligations under the notes and the trading price of the notes could be materially affected, and you could lose all or part of your investment.

The risks described below and in such documents incorporated by reference into this prospectus are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial individually or in the aggregate may also impair our business operations.

This prospectus and the documents we have incorporated by reference into this prospectus also contain forward-looking statements that involve risks and uncertainties, some of which are described in the documents incorporated by reference into this prospectus. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including the risks and uncertainties faced by us described below or incorporated by reference into this prospectus. See “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to the Exchange Offer

If you choose not to exchange your old notes in the exchange offer, the transfer restrictions currently applicable to your old notes will remain in force and the market price of your old notes could decline.

If you do not exchange your old notes for new notes in the exchange offer, then you will continue to be subject to the transfer restrictions on the old notes as set forth in the offering memorandum distributed in connection with the private offering of the old notes. In general, the old notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not intend to register resales of the old notes under the Securities Act.

If you do not exchange your old notes for new notes in the exchange offer and other holders of old notes tender their old notes in the exchange offer, the total principal amount of the old notes remaining after the exchange offer will be less than it was prior to the exchange offer, which may have an adverse effect upon and increase the volatility of, the market price of the old notes due to reduction in liquidity.

Your ability to transfer the new notes may be limited by the absence of a trading market.

The new notes will be new securities for which currently there is no trading market. We do not currently intend to apply for listing of the new notes on any securities exchange or stock market. Although the initial purchasers informed us that they intended to make a market in the notes, they are not obligated to do so. In addition, they may discontinue any such market making at any time without notice. The liquidity of any market for the new notes will depend on the number of holders of those notes, the interest of securities dealers in making a market in those notes and other factors. Accordingly, we cannot assure you as to the development or liquidity of any market for the new notes. Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the new notes. We cannot assure you that the market, if any, for the new notes will be free from similar disruptions. Any such disruption may adversely affect the note holders.

-16-

Future trading prices of the new notes will depend on many factors, including:

| | • | | our subsidiaries’ operating performance and financial condition; |

| | • | | the interest of the securities dealers in making a market in the new notes; and |

| | • | | the market for similar securities. |

You may not receive the new notes in the exchange offer if the exchange offer procedures are not properly followed.

We will issue the new notes in exchange for your old notes only if you properly tender the old notes before expiration of the exchange offer. Neither we nor the exchange agent are under any duty to give notification of defects or irregularities with respect to the tenders of the old notes for exchange. If you are the beneficial holder of old notes that are held through your broker, dealer, commercial bank, trust company or other nominee, and you wish to tender such notes in the exchange offer, you should promptly contact the person or entity through which your old notes are held and instruct that person or entity to tender on your behalf.

Broker-dealers may become subject to the registration and prospectus delivery requirements of the Securities Act and any profit on the resale of the new notes may be deemed to be underwriting compensation under the Securities Act.

Any broker-dealer that acquires new notes in the exchange offer for its own account in exchange for old notes which it acquired through market-making or other trading activities must acknowledge that it will comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction by that broker-dealer. Any profit on the resale of the new notes and any commission or concessions received by a broker-dealer may be deemed to be underwriting compensation under the Securities Act.

Risks Related to the Notes

Debt we incur in the future may limit our flexibility to obtain financing and to pursue other business opportunities.

We and our subsidiaries may be able to incur substantial indebtedness in the future. Our future level of debt could have important consequences to us, including the following:

| | • | | our ability to obtain additional financing, if necessary, for working capital, capital expenditures or other purposes may be impaired, or such financing may not be available on favorable terms; |

| | • | | our funds available for operations, future business opportunities and distributions to unitholders will be reduced by that portion of our cash flow required to make interest payments on our debt; |

| | • | | we may be more vulnerable to competitive pressures or a downturn in our business or the economy generally; and |

| | • | | our flexibility in responding to changing business and economic conditions may be limited. |

Our ability to service our debt will depend upon, among other things, our future financial and operating performance, which will be affected by prevailing economic conditions and financial, business, regulatory and other factors, some of which are beyond our control. If our operating results are not sufficient to service any future indebtedness, we will be forced to take actions such as reducing distributions, reducing or delaying our business activities, acquisitions, organic growth projects, investments or capital expenditures, selling assets or issuing equity. We may not be able to effect any of these actions on satisfactory terms or at all.

Any borrowings and letters of credit issued under our Revolving Credit Facility will be secured, and as a result, effectively senior to the notes and the guarantees of the notes by the guarantors, to the extent of the value

-17-

of the collateral securing that indebtedness. In addition, the holders of any future debt we may incur that ranks equally with the notes will be entitled to share ratably with the holders of the notes in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding-up of us. This may have the effect of reducing the amount of proceeds paid to you.

Our current and future debt levels may limit our flexibility to obtain financing and to pursue other business opportunities.

As of December 31, 2017, we have $29.7 million of secured indebtedness and $3.6 million of letters of credit outstanding under our Revolving Credit Facility, $525.0 million of unsecured indebtedness consisting of the notes, and an additional $326.7 million of total unused borrowing capacity under the Revolving Credit Facility. Subsequent to the issuance of the old notes, we used the net proceeds to pay down the Revolving Credit Facility and for general partnership purposes. Our level of indebtedness could have important consequences to us, including the following:

| | • | | our ability to obtain additional financing, if necessary, for working capital, capital expenditures, acquisitions or other purposes may be impaired or such financing may not be available on favorable terms; |

| | • | | covenants contained in our existing and future credit and debt arrangements will require us to meet financial tests that may affect our flexibility in planning for and reacting to changes in our business, including possible acquisition opportunities; |

| | • | | we will need a substantial portion of our cash flow to make principal and interest payments on our indebtedness, reducing the funds that would otherwise be available for operations, future business opportunities and payments of our debt obligations, including the notes; and |

| | • | | our debt level will make us more vulnerable than our competitors with less debt to competitive pressures or a downturn in our business or the economy generally. |

Any of these factors could result in a material adverse effect on our business, financial condition, results of operations, business prospects and ability to satisfy our obligations under the notes.

Our ability to service our indebtedness will depend upon, among other things, our future financial and operating performance, which will be affected by prevailing economic conditions and financial, business, regulatory and other factors, some of which are beyond our control. If our operating results are not sufficient to service our current or future indebtedness, we will be forced to take actions such as reducing distributions to our unitholders, reducing or delaying our business activities, acquisitions, investments and/or capital expenditures, selling assets, restructuring or refinancing our indebtedness, or seeking additional equity capital or bankruptcy protection. We may not be able to effect any of these remedies on satisfactory terms, or at all.

We do not have the same flexibility as other types of organizations to accumulate cash which may limit cash available to service the notes or to repay them at maturity.

Subject to the limitations on restricted payments contained in the indenture governing the notes and in our Revolving Credit Facility and any other indebtedness, we distribute all of our “available cash” each quarter to our unitholders of record on the applicable record date. Available cash generally means, for any quarter, all cash on hand at the end of that quarter:

| | • | | less, the amount of cash reserves established by our general partner to: |

| | • | | provide for the proper conduct of our business (including cash reserves for our future capital expenditures and anticipated future debt service requirements subsequent to that quarter); |

| | • | | comply with applicable law, any of our debt instruments or other agreements; or |

-18-

| | • | | provide funds for distributions to our unitholders and to our general partner for any one or more of the next four quarters (provided that our general partner may not establish cash reserves for distributions if the effect of the establishment of such reserves will prevent us from distributing the minimum quarterly distribution on all common units and any cumulative arrearages on such common units for the current quarter); |

| | • | | plus, if our general partner so determines, all or any portion of the cash on hand on the date of determination of available cash for the quarter resulting from working capital borrowings made subsequent to the end of such quarter. |

The purpose and effect of the last bullet point above is to allow our general partner, if it so decides, to use cash from working capital borrowings made after the end of the quarter but on or before the date of determination of available cash for that quarter to pay distributions to unitholders. Under our partnership agreement, working capital borrowings are generally borrowings that are made under a credit facility, commercial paper facility or similar financing arrangement, and in all cases are used solely for working capital purposes or to pay distributions to unitholders, and with the intent of the borrower to repay such borrowings within twelve months with funds other than from additional working capital borrowings.

As a result, we do not accumulate significant amounts of cash and thus do not have the same flexibility as corporations or other entities that do not pay dividends or have complete flexibility regarding the amounts they will distribute to their equity holders. The timing and amount of our distributions could significantly reduce the cash available to pay the principal, premium (if any) and interest on the notes. The board of directors of our general partner will determine the amount and timing of such distributions and has broad discretion to establish and make additions to our reserves or the reserves of our operating subsidiaries as it determines are necessary or appropriate.