AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”). INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PRELIMINARY OFFERING CIRCULAR JULY__, 2024

WEBSTAR TECHNOLOGY GROUP

1100 Peachtree St NE, Suite 200

Atlanta, GA 30309

404-793-1956

OFFERING SUMMARY

Up to 1,428,571 shares of

Class A Common Stock

SEE “SECURITIES BEING OFFERED” AT PAGE 32

| | | Price to Public | | | Underwriting

discount and

commissions | | | Proceeds to

issuer | | | Proceeds to

other persons | |

| Per share | | $ | 7.00 | | | $ | 0.35 | | | $ | 6.475 | | | | 0 | |

| Total Maximum | | $ | 10,000,000 | | | $ | 750,000 | | | $ | 9,250,000 | | | | 0 | |

The Company has not engaged any underwriter, to act as the broker-dealer of record in connection with this Offering. See “Plan of Distribution and Selling Securityholders” for details. To the extent that the Company’s officers and directors make any communications in connection with the Offering they intend to conduct such efforts in accordance with an exemption from registration contained in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, therefore, none of them is required to register as a broker-dealer.

The company expects that, not including state filing fees, the amount of expenses of the offering that we will pay will be approximately $890,000 based on the maximum number of shares sold in this offering.

This offering (the “Offering”) will terminate at the earlier of (1) the date at which the Maximum Offering amount has been sold, (2) the date which is one ye ar from this offering being qualified by the United States Securities and Exchange Commission, or (3) the date at which the offering is earlier terminated by the company at its sole discretion. The Offering is being conducted on a best-efforts basis and there is no minimum number of shares that needs to be sold in order for funds to be released to the company and for this Offering to close, which may mean that the company does not receive sufficient funds to cover the cost of this Offering. The company may undertake one or more closings on a rolling basis. After each closing, funds tendered by investors will be made available to the company. After the initial closing of this offering, we expect to hold closings on at least a monthly basis.

The holders of Webstar Technology Group preferred stock (the “Preferred Stock”) are entitled to an aggregate vote of the following:

Series A – Cumulative Control Voting of 75%

Holders of the Preferred Stock will continue to hold a majority of the voting power of all of the company’s equity stock at the conclusion of this Offering and therefore control the board.

The Company has granted Piggyback Registration Rights for current holders of common stock and the underlying conversion rights of the currently outstanding Convertible Notes.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This offering is inherently risky. See “Risk Factors” on page 4. THERE IS NO ASSURANCE THAT THE NECESSARY FUNDS WILL BE RAISED OR THAT THE ISSUER WILL BE ABLE TO BE SUCCESSFUL IN THEIR BUSINESS OPERATIONS AS DESCRIBED HEREIN.

Sales of these securities will commence approximately 10 days after the approval of this Offering.

The company is following the “Offering Circular” format of disclosure under Regulation A.

TABLE OF CONTENTS

In this Offering Circular, the term “Webstar Technology Group,” “we,” “us, “our” or “the company” refers to WEBSTAR TECHNOLOGY GROUP, a Florida corporation.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

SUMMARY

Webstar Technology Group is an early-stage specialty real estate development company devoted to the identification, partnership and development of specialty real estate projects in the United States. The company will focus on properties that have positive cash flow and a synergy in operation. Main focuses include multitenant buildings that can be upgraded to green/energy efficient status. The company is also focused on entertainment and resort real estate development.

The company will operate under the brand name “Webstar Technology Group” with the consideration given to future name changes due to a diversification of operations outside of the former business. Webstar Technology Group was incorporated in 2015 in Wyoming.

Webstar Technology Group intends to either form operating subsidiaries, enter into joint ventures or provide direct investment into real estate based, positive cash flow operations that provide an opportunity to improve profitability or operations through the implementation of environmentally friendly technologies.

Webstar Technology Group, Inc. has identified the following cash flow positive real estate area for investment opportunities:

The Company will actively incorporate a resort atmosphere into properties to improve attractiveness, lease rates and improved cash flow of the properties. The Company has executed a partnership agreement with a current resort company for inclusion of these features.

Revenue Plan

The company anticipates breaking ground on the Georgia property within 12 months after the approval of this Offering. Over time, the company intends to operate at least three Southeast facilities and expand operations into the Midwest and the Mountain States.

The company intends to generate revenue through the following activities:

| | ● | individual and corporate membership sales, |

| | ● | fractional ownership and timeshare sales, |

| | ● | food and beverage sales, |

| | ● | coaching and instruction services, |

| | ● | suite rentals, |

| | ● | retail sales, |

| | ● | sponsorships, advertising and naming rights, and |

| | ● | contest and qualifier fees and ticket purchases. |

The Offering

| Securities offered | | Common Stock |

| | | |

| Common Stock outstanding before the Offering | | 401,026,365 shares of Common Stock. |

| | | |

| Share Price | | 7.00 per share |

Maximum Common Shares Offered | | 1,428,571 |

| | | |

| Minimum Investment | | $10,000 |

Use of Proceeds

Proceeds from this Offering will be used to fund the company’s land acquisition and permitting of Bear Village Resort Asset Holdings – GA, LLC, related marketing efforts and operational expenses. See “Use of Proceeds to Issuer” section of this Offering Circular.

Summary Risk Factors

Webstar Technology Group is a startup. The company was acquired by the new management team in June 25, 2024 and is still in an early stage of development. The company is not close to profitability as projects take approximately 18 months to develop and construct and may not provide a return on investment for approximately 24 months thereafter. Investing in the company involves a high degree of risk (see “Risk Factors”). As an investor, you should be able to bear a complete loss of your investment. Some of the more significant risks include those set forth below:

| | ● | This is a very young company. |

| | ● | The company’s affiliated entities have no prior performance record. |

| | ● | The company has minimal operating capital and no revenue from operations. |

| | ● | The success of Webstar Technology Group business is dependent on purchasing large parcels of land at favorable prices. |

| | ● | The company may need to raise more capital and future fundraising rounds could result in dilution. |

| | ● | Success in the hospitality and entertainment industry is highly unpredictable, and there is no guarantee the company’s content will be successful in the market. |

| | ● | The COVID-19 pandemic could have material negative effects on Webstar Technology Groups’ planned operations, including facilities where large groups of people gather in close proximity. |

| | ● | Webstar Technology Group operates in a highly competitive market. |

| | ● | Competition in the “alternative venues for recreational pursuits” industry could have a material adverse effect on the company’s business and results of operations. |

| | ● | Customer complaints or litigation on behalf of our customers or employees may adversely affect our business, results of operations or financial condition. |

| | ● | The company’s insurance coverage may not be adequate to cover all possible losses that it could suffer and its insurance costs may increase. |

| | ● | The company may not be able to operate its facilities, or obtain and maintain licenses and permits necessary for such operation, in compliance with laws, regulations and other requirements, which could adversely affect its business, results of operations or financial condition. |

| | ● | The company has concentrated its investments in family entertainment, real estate and facilities, which are subject to numerous risks, including the risk that the values of their investments may decline if there is a prolonged downturn in real estate values. |

| | | |

| | ● | The company works with national hospitality, hotel and local service providers to create an experience for families. Business risks associated with these providers can affect the company’s operations. |

| | ● | The illiquidity of real estate may make it difficult for the company to dispose of one or more of our properties or negatively affect its ability to profitably sell such properties and access liquidity. |

| | ● | The company’s development and growth strategy depend on its ability to fund, develop and open new entertainment venues and operate them profitably. |

| | ● | The company’s development and construction of the Georgia and future Tennessee facilities depend on their ability to obtain favorable mortgage financing. |

| | | |

| | ● | Webstar Technology Group depends on a small management team and may need to hire more people to be successful. |

| | ● | The company will require a general manager, who has not yet been hired. |

| | ● | Webstar Technology Group may not be able to protect all of its intellectual property. |

| | ● | Webstar Technology Group has not yet entered into any master licensing agreements with third party suppliers of technology and Webstar Technology Group has not yet been made a sublicense to the relevant master licensing agreements. |

| | ● | The Offering price has been arbitrarily set by the company. |

| | ● | The officers of Webstar Technology Group control the company and the company does not currently have any independent directors. |

| | ● | Investors in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement and claims where the forum selection provision is applicable, which could result in less favorable outcomes to the plaintiff(s) in any such action. |

| | ● | There is little to no current market for Webstar Technology Groups’ shares. |

| | ● | The interests of Webstar Technology Group and the company’s other affiliates may conflict with your interests. |

RISK FACTORS

The SEC requires the company to identify risks that are specific to its business and its financial condition. The company is still subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally, early-stage companies are inherently riskier than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

Risks relating to our business

This is a very young company.

The control of the company was changed on June 25, 2024. It is a startup company that has not yet started operations, and has not started to build its facilities. There is no history upon which an evaluation of its past performance and future prospects in the hospitality and entertainment industry can be made. Statistically, most startup companies fail.

The company’s affiliated entities have no prior performance record.

Webstar Technology Group has new management in the market, the affiliates of Webstar Technology Group, such as Bear Village Asset Holdings – GA, LLC, (which will provide management services to Webstar Technology Group) do not have a track record of involvement in hospitality and entertainment that investors may assess. Even if an affiliate of Webstar Technology Group did have such prior experience, that experience would not be indicative of its future performance.

The company has minimal operating capital, no significant assets and no revenue from operations.

The company currently has minimal operating capital and for the foreseeable future will be dependent upon its ability to finance its planned operations from the sale of securities or other financing alternatives. There can be no assurance that it will be able to successfully raise operating capital in this or other offerings of securities, or to raise enough funds to fully construct operational entertainment centers. The failure to successfully raise operating capital could result in its inability to execute its business plan and potentially lead to bankruptcy, which would have a material adverse effect on the company and its investors.

The success of Webstar Technology Group business is dependent on purchasing large parcels of land at favorable prices.

Webstar Technology Group is a capital-intensive operation and requires the purchase of large parcels of land prior to construction. As of the date of this Offering Circular the company has a deposit on its Georgia property for the first of two facilities to be developed. The company does not know whether it will be able to obtain additional properties at acceptable purchase terms that are favorable. Finally, if this Offering does not raise enough capital to purchase the land and begin construction, the company will need to procure external financing for the purchase of the land and/or construction of the facility.

The company may raise more capital and future fundraising rounds could result in dilution.

Webstar Technology Group may need to raise additional funds to finance its operations or fund its business plan. Even if the company manages to raise subsequent financing or borrowing rounds, the terms of those borrowing rounds might be more favorable to new investors or creditors than to existing investors such as you. New equity investors or lenders could have greater rights to our financial resources (such as liens over our assets) compared to existing shareholders. Additional financings could also dilute your ownership stake, potentially drastically. See “Dilution” and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations– Plan of Operation” for more information.

Success in the hospitality and entertainment industry is highly unpredictable and there is no guarantee the company’s content will be successful in the market.

The company’s success will depend on the popularity of its hospitality and entertainment facilities. Consumer tastes, trends and preferences frequently change and are notoriously difficult to predict. If the company fails to anticipate future consumer preferences in the hospitality and entertainment business, its business and financial performance will likely suffer. The hospitality and entertainment industries are fiercely competitive. The company may not be able to develop facilities that will become profitable. The company may also invest in facilities that end up losing money. Even if one of its facilities is successful, the company may lose money in others.

Changes in consumer financial condition, leisure tastes and preferences, particularly those affecting the popularity of family resorts, and other social and demographic trends could adversely affect its business. Significant periods of restricted travel or group gatherings, such as Covid-19 or similar circumstances, could result in situations where facilities usage is below historical levels would have a material adverse effect on its business, results of operations and financial condition. If the company cannot attract patrons, retain its existing resident, its financial condition and results of operations could be harmed.

The pandemics could have material negative effects on Webstar Technology Groups’ planned operations, including facilities where large groups of people gather in close proximity.

The impact of COVID-19 on companies is well documented. Vaccines have been administered by the states. Webstar Technology Group operates facilities which include restaurants, gathering points and opportunities for large groups of people can gather in close proximity. In the event of another pandemic the Federal Government and local states may institute restrictions which could affect the Company’s operations.

Webstar Technology Group Resorts will implement strict cleaning and sanitizing procedures across each resort. The vaccine distribution program currently ranges from 50% to 80% based on the state. Future variations or mutations of COVID-19 or other pandemic diseases could cause new social restrictions which could affect Webstar Technology Groups’ operations.

Webstar Technology Group operates in a highly competitive market.

Webstar Technology Group plans to operate in a highly competitive market and faces intense competition. Competitors will include Disney, Six Flags, Dollywood, Great Wolf Lodge and other multi-activity resorts. Many of the company’s current and potential competitors have greater resources, longer histories, more customers, and greater brand recognition. Competitors may secure better terms from vendors, adopt more aggressive pricing and devote more resources to technology, infrastructure, fulfillment, and marketing.

Further, Webstar Technology Groups’ properties will compete on a local and regional level with restaurants and other business, dining and social clubs. The number and variety of competitors in this business will vary based on the location and setting of each facility. Some facilities may be situated in intensely competitive areas characterized by numerous resorts and family attractions. In addition, in most regions, the competitive landscape is in constant flux as new resorts and other family venues open or expand their amenities. As a result of these characteristics, the supply in a given region may exceed the demand for such facilities, and any increase in the number or quality of resorts and family venues, or the products and services they provide, in such region could significantly impact the ability of the company’s properties to attract and retain members, which could harm their business and results of operations.

Competition in the “alternative venues for recreational pursuits” industry could have a material adverse effect on the company’s business and results of operations.

Webstar Technology Group properties compete on a local and regional level with alternative venues for recreational pursuits. The company’s results of operations could be affected by the availability of, and demand for, alternative venues for recreational pursuits, such as multi-use facilities and other town center venues.

Customer complaints or litigation on behalf of our customers or employees may adversely affect our business, results of operations or financial condition.

The company’s business may be adversely affected by legal or governmental proceedings brought by or on behalf of their residents, customers or employees. Regardless of whether any claims against the company are valid or whether they are liable, claims may be expensive to defend and may divert time and money away from operations and hurt our financial performance. A judgment significantly in excess of their insurance coverage or not covered by insurance could have a material adverse effect on the company’s business, results of operations or financial condition. Also, adverse publicity resulting from these allegations may materially affect the company.

The company’s insurance coverage may not be adequate to cover all possible losses that it could suffer and its insurance costs may increase.

The company has not yet acquired insurance. It may not be able to acquire insurance policies that cover all types of losses and liabilities. Additionally, once the company acquires insurance, there can be no assurance that its insurance will be sufficient to cover the full extent of all of its losses or liabilities for which it is insured. Further, insurance policies expire annually and the company cannot guarantee that it will be able to renew insurance policies on favorable terms, or at all. In addition, if it, or other leisure facilities, sustain significant losses or make significant insurance claims, then its ability to obtain future insurance coverage at commercially reasonable rates could be materially adversely affected. If the company’s insurance coverage is not adequate, or it becomes subject to damages that cannot by law be insured against, such as punitive damages or certain intentional misconduct by their employees, this could adversely affect the company’s financial condition or results of operations.

The company may not be able to operate its facilities, or obtain and maintain licenses and permits necessary for such operation, in compliance with laws, regulations and other requirements, which could adversely affect its business, results of operations or financial condition.

Each facility is subject to licensing and regulation by alcoholic beverage control, amusement, health, sanitation, safety, building code and fire agencies in the state, county and/or municipality in which the facility is located.

Each facility is required to obtain a license to sell alcoholic beverages on the premises from a state authority and, in certain locations, county and municipal authorities. Typically, licenses must be renewed annually and may be revoked or suspended for cause at any time. In some states, the loss of a license for cause with respect to one facility may lead to the loss of licenses at all facilities in that state and could make it more difficult to obtain additional licenses in that state. Alcoholic beverage control regulations relate to numerous aspects of the daily operations of each facility, including minimum age of patrons and employees, hours of operation, advertising, wholesale purchasing, inventory control and handling and storage and dispensing of alcoholic beverages. The failure to receive or retain a liquor license, or any other required permit or license, in a particular location, or to continue to qualify for, or renew licenses, could have a material adverse effect on operations and the company’s ability to obtain such a license or permit in other locations.

The company may be subject to “dram shop” statutes in states where its facilities may be located. These statutes generally provide a person injured by an intoxicated person the right to recover damages from an establishment that wrongfully served alcoholic beverages to the intoxicated individual. Recent litigation against restaurant chains has resulted in significant judgments and settlements under dram shop statutes. Because these cases often seek punitive damages, which may not be covered by insurance, such litigation could have an adverse impact on the company’s business, results of operations or financial condition.

As a result of operating certain entertainment games and attractions, including skill-based games that offer redemption prizes, the company is subject to amusement licensing and regulation by the states, counties and municipalities in which its facilities are to be located. These laws and regulations can vary significantly by state, county, and municipality and, in some jurisdictions, may require the company to modify their business operations or alter the mix of redemption games and simulators that they offer.

Moreover, as more states and local communities implement legalized gambling, the laws and corresponding enabling regulations may also be applicable to the company’s redemption games and regulators may create new licensing requirements, taxes or fees, or restrictions on the various types of redemption games the company offers. Furthermore, other states, counties and municipalities may make changes to existing laws to further regulate legalized gaming and illegal gambling. Adoption of these laws, or adverse interpretation of existing laws, could cause the company to modify its plans for its facilities and if the company creates facilities in these jurisdictions it may be required to alter the mix of games, modify certain games, limit the number of tickets that may be won by a customer from a redemption game, change the mix of prizes that the company may offer or terminate the use of specific games, any of which could adversely affect the company’s operations. If the company fails to comply with such laws and regulations, the company may be subject to various sanctions and/or penalties and fines or may be required to cease operations until it achieves compliance, which could have an adverse effect on the company’s business and financial results.

The company has concentrated its investments in family entertainment, real estate and facilities, which are subject to numerous risks, including the risk that the values of their investments may decline if there is a prolonged downturn in real estate values.

The company’s operations will consist almost entirely of family resorts properties, approximately 30-60 acres in size, that encompass a large amount of real estate holdings. Accordingly, the company is subject to the risks associated with holding real estate investments. A prolonged decline in the popularity of resorts could adversely affect the value of its real estate holdings and could make it difficult to sell facilities or businesses.

The company’s real estate holdings will be subject to risks typically associated with investments in real estate. The investment returns available from equity investments in real estate depend in large part on the amount of income earned, expenses incurred and capital appreciation generated by the related properties. In addition, a variety of other factors affect income from properties and real estate values, including governmental regulations, real estate, insurance, zoning, tax and eminent domain laws, interest rate levels and the availability of financing. For example, new or existing real estate zoning or tax laws can make it more expensive and time-consuming to expand, modify or renovate older properties. Under eminent domain laws, governments can take real property. Sometimes this taking is for less compensation than the owner believes the property is worth. Any of these factors could have an adverse impact on our business, financial condition or results of operations.

The company works with national hospitality, hotel and local service providers to create an experience for families. Business risks associated with these providers can affect the company’s operations.

The company’s operations include partnerships with Wyndham Resorts and Choice Hotels to manage and operate the hotel and timeshare operations. The company also plans to partner with local service partners who provide activities based on the resort surroundings. Issues or business risks associated with each of these partner companies could affect the operation of one or more of the company’s resorts.

The illiquidity of real estate may make it difficult for the company to dispose of one or more of our properties or negatively affect its ability to profitably sell such properties and access liquidity.

The company may from time to time decide to dispose of one or more of its real estate assets. Because real estate holdings generally, are relatively illiquid, the company may not be able to dispose of one or more real estate assets on a timely basis. In some circumstances, sales may result in investment losses which could adversely affect the company’s financial condition. The illiquidity of its real estate assets could mean that it continues to operate a facility that management has identified for disposition. Failure to dispose of a real estate asset in a timely fashion, or at all, could adversely affect the company’s business, financial condition and results of operations.

The company’s development and growth strategy depend on its ability to fund, develop and open new entertainment venues and operate them profitably.

A key element of the company’s growth strategy is to develop and open family entertainment venues. The company has identified a number of locations for potential future entertainment venues and is still the process of identifying more locations and analyzing the locations. The company’s ability to fund, develop and open these venues on a timely and cost-effective basis, or at all, is dependent on a number of factors, many of which are beyond its control, including but not limited to our ability to:

| | ● | Reach acceptable agreements regarding the lease or purchase of locations, and comply with our commitments under our lease agreements during the development and construction phases. |

| | ● | Comply with applicable zoning, licensing, land use and environmental regulations. |

| | ● | Raise or have available an adequate amount of cash or currently available financing and mortgage terms for construction and opening costs. |

| | ● | Adequately complete construction for operations. |

| | | |

| | ● | Timely hire, train and retain the skilled management and other employees’ necessary to meet staffing needs. |

| | ● | Obtain, for acceptable cost, required permits and approvals, including liquor licenses; and |

| | ● | Efficiently manage the amount of time and money used to build and open each new venue. |

If the company succeeds in opening family entertainment facilities on a timely and cost-effective basis, the company may nonetheless be unable to attract enough real estate buyers, visitors or customers to these new venues because potential customers may be unfamiliar with its venue or concept, entertainment and other resort options might not appeal to them and the company may face competition from other resorts and leisure venues or governmental regulations at the federal and state levels may restrict travel or group gatherings.

The company’s development and construction of its Georgia facility depends on its ability to obtain favorable construction and mortgage financing.

The company intends to secure both construction and mortgage financing to fund up to 70% of its Georgia resort and plans to use this debt financings to development and construct subsequent facilities. There is no guarantee that the company will be able to obtain financing on favorable terms. In the event that the company is unable to obtain such financing it may limit the company’s ability to effectuate its plans and will increase the costs and expenses of the company, thereby negatively impacting its financial prospects.

Webstar Technology Group depends on a small management team and may need to hire more people to be successful.

The success of Webstar Technology Group will greatly depend on the skills, connections and experiences of the executives, Rick Haynes and Lance Lehr. Webstar Technology Group has not entered into employment agreements with the aforementioned executives. There is no guarantee that the executives will agree to terms and execute employment agreements that are favorable to the company. Should any of them discontinue working for Webstar Technology Group, there is no assurance that the company will continue. Further, there is no assurance that the company will be able to identify, hire and retain the right people for the various key positions.

The company will require a general manager, who has not yet been hired.

Webstar Technology Group is currently performing an executive search for the general manager and operator of Webstar Technology Group. There is no way to be certain that the general manager of Webstar Technology Group, once appointed, will be able to execute the same vision as Webstar Technology Group itself. If an appropriate person is not identified and hired, the company will not succeed and since its performance will depend on that person’s performance, it is possible that other Webstar Technology Group subsidiaries will be more successful than the company.

Webstar Technology Group may not be able to protect all of its intellectual property.

Webstar Technology Group, will be using the intellectual property of its parent, including the following trademarks that will be filed: Webstar Technology Group, Webstar Technology Group Family Resorts and Come See the Bear. The profitability of Webstar Technology Group may depend in part on Webstar Technology Group’ ability, to effectively protect its intellectual property and the ability of Webstar Technology Group and, in the future, each of the other subsidiaries to operate without inadvertently infringing on the proprietary rights of others. Any litigation protecting the Webstar Technology Groups’ intellectual property and defending its original content could have a material adverse effect on the business, operating results and financial condition regardless of the outcome of such litigation.

Webstar Technology Group has not yet entered into any master licensing agreements with third party suppliers and Webstar Technology Group has not yet been made a sublicense to the relevant master licensing agreements.

Webstar Technology Group intends to use Wyndham Hotel and Resorts as the operating facilities of all of its subsidiaries. At the current time negotiations are taking place but a final master licensing agreement has not been entered into at this time.

Risks relating to this Offering and our shares

The Offering price has been arbitrarily set by the company.

Webstar Technology Group has set the price of its Common Stock at $7.00 per share. Valuations for companies at Webstar Technology Group stage are purely speculative. The company’s valuation has not been validated by any independent third party and may fall precipitously. It is a question of whether you, the investor, are willing to pay this price for a percentage ownership of a start-up company. You should not invest if you disagree with this valuation.

The officers of Webstar Technology Group control the company and the company does not currently have any independent directors.

The Founders are currently the company’s controlling shareholders. Moreover, they are the company’s executive officers and directors, through their ownership in Webstar Technology Group. This could lead to unintentional subjectivity in matters of corporate governance, especially in matters of compensation and related party transactions. The company does not benefit from the advantages of having independent directors, including bringing an outside perspective on strategy and control, adding new skills and knowledge that may not be available within Webstar Technology Group, and having extra checks and balances to prevent fraud and produce reliable financial reports.

Investors in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement and claims where the forum selection provision is applicable, which could result in less favorable outcomes to the plaintiff(s) in any such action.

Investors in this offering will be bound by the subscription agreement, which includes a provision under which investors waive the right to a jury trial of any claim they may have against the company arising out of or relating to the subscription agreement. Section 27 of the Exchange Act does create exclusive federal jurisdiction over all suits brought to enforce and duty or liability created by the Exchange Act or the rules and regulations thereunder. Section 22 of the Securities Act creates a concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the by the Securities Act or the rules and regulations thereunder.

If the company opposed a jury trial demand based on the waiver, a court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. To the company’s knowledge, the enforceability of a contractual pre-dispute, jury trial waiver in connection with claims arising under the state or federal securities laws has not been finally adjudicated by the courts. However, the company believes that a contractual pre-dispute jury trial waiver provision is generally enforceable. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently prominent such that a party knowingly, intelligently and voluntarily waived the right to a jury trial. The company believes that this is the case with respect to the subscription agreement. Investors should consult legal counsel regarding the jury waiver provision before entering into the subscription agreement.

If an investor brings a claim against the company in connection with matters arising under the subscription agreement, including claims under federal securities laws, an investor may not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits against the company. If a lawsuit is brought against the company under the subscription agreement, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the subscription agreement with a jury trial. No condition, stipulation or provision of the subscription agreement serves as a waiver by any holder of common shares or by Webstar Technology Group of compliance with any substantive provision of the federal securities laws and the rules and regulations promulgated under those laws.

In addition, when the shares are transferred, the transferee is required to agree to all the same conditions, obligations and restrictions applicable to the shares or to the transferor with regard to ownership of the shares, that were in effect immediately prior to the transfer of the shares, including but not limited to the subscription agreement.

There is little to no current market for Webstar Technology Groups’ shares.

There is little to no formal marketplace for the resale of our securities. Shares of the company’s Common Stock may eventually be traded to the extent any demand and/or trading platform(s) exists. However, there is no guarantee there will be demand for the shares, or a trading platform that allows you to sell them. Investors should assume that they may not be able to liquidate their investment or pledge their shares as collateral for some time.

Risks Related to Certain Conflicts of Interest

The interests of Webstar Technology Group, Bear Village Asset Holdings – GA, LLC and the company’s other affiliates may conflict with your interests.

The company’s Amended and Restated Certificate of Incorporation, bylaws and Florida law provide company management with broad powers and authority that could result in one or more conflicts of interest between your interests and those of the officers and directors of Webstar Technology Group, Bear Village Asset Holdings – GA, LLC, and the company’s other affiliates. This risk is increased by the affiliated entities being controlled by Webstar Technology Group and all our officers and directors currently have an interest in Webstar Technology Group, through ownership, as an officer or director in Webstar Technology Group contractually or any combination thereof. Potential conflicts of interest include, but are not limited to, the following:

| | ● | Webstar Technology Group and the company’s other affiliates will not be required to disgorge any profits or fees or other compensation they may receive from any other business they own separate from the company, and you will not be entitled to receive or share in any of the profits, return, fees or compensation from any other business owned and operated by the management and their affiliates for their own benefit. |

| | ● | The company may engage Webstar Technology Group, or other companies affiliated with Webstar Technology Group to perform services, and determination for the terms of those services will not be conducted at arms’ length negotiations; and |

| | ● | The company’s officers and directors are not required to devote all of their time and efforts to the affairs of the company. |

DILUTION

Dilution means a reduction in value, control or earnings of the shares the investor owns.

Immediate dilution

An early-stage company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash investments from outside investors, like you, the new investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of your stake is diluted because all the shares are worth the same amount, and you paid more than earlier investors for your shares. If you invest in our Preferred Stock, your interest will be diluted immediately to the extent of the difference between the Offering price per share of our Preferred Stock and the pro forma net tangible book value per share of our Preferred Stock after this Offering.

As of March 31, 2024, the net tangible book value of the Company was a deficit of $4,596,323. Based on the number of shares of Common Stock issued and outstanding as of the date of the offering (401,026,365) that equates to a net tangible book value of approximately ($0.011) per share of Common Stock on a pro forma basis. Based on the total number of shares of Common Stock that would be outstanding assuming full subscription (402,454,936) at total net proceeds of $10,000,000, that equates to approximately $0.013 of tangible net book value per share. The full dilution table based on percentage of the subscription in:

| DILUTION TABLE |

| | | 25% | | | 50% | | | 75% | | | 100% | |

| Public Price | | $ | 7.00 | | | $ | 7.00 | | | $ | 7.00 | | | $ | .007 | |

| Net Tangible Book Valve | | | -0.01146 | | | | -0.01146 | | | | -0.01146 | | | | -0.01146 | |

| Change Net Tangible Book | | | 0.0062 | | | | 0.0124 | | | | 0.0186 | | | | 0.0248 | |

| Net Tangible After | | | -0.0052 | | | | 0.0010 | | | | 0.0072 | | | | 0.0134 | |

| Dilution | | | 7.005 | | | | 7.000 | | | | 6.993 | | | | 6.986 | |

Thus, if the Offering is fully subscribed, the net tangible book value per share of Common Stock owned by our current stockholders will have immediately increased by approximately $0.025 without any additional investment on their behalf and the net tangible book value per share for new investors will be immediately diluted by $6.986 per share. These calculations do include the costs of the Offering, and such expenses will not cause further dilution.

Future dilution

Another important way of looking at dilution is the dilution that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the company issuing additional shares. In other words, when the company issues more shares, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in number of shares outstanding could result from a stock offering (such as a venture capital round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g., convertible bonds, preferred shares or warrants) into stock.

If the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share (though this typically occurs only if the company offers dividends, and most early-stage companies are unlikely to offer dividends, preferring to invest any earnings into the company).

The type of dilution that hurts early-stage investors most often occurs when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings. An example of how this might occur is as follows (numbers are for illustrative purposes only):

| | ● | In June 2014 Jane invests $20,000 for shares that represent 2% of a company valued at $1 million. |

| | | |

| | ● | In December, the company is doing very well and sells $5 million in shares to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake is worth $200,000. |

| | | |

| | ● | In June 2015, the company has run into serious problems and in order to stay afloat it raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of the company and her stake is worth only $26,660. |

This type of dilution might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more shares than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the convertible notes get more shares for their money than new investors. In the event that the financing is a “down round” the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more shares for their money. Investors should pay careful attention to number of convertible notes that the company has issued and may issue in the future, and the terms of those notes.

If you are making an investment expecting to own a certain percentage of the company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share.

PLAN OF DISTRIBUTION AND SELLING SECURITYHOLDERS

Plan of Distribution

Webstar Technology Group is offering a maximum of 1,428,571 shares of Common Stock on a “best efforts” basis.

The cash price per share of Common Stock is Seven Dollars (USD $7.00).

The company intends to market the shares in this Offering both through online and offline means. Online marketing may take the form of contacting potential investors through electronic media and posting our Offering Circular or “testing the waters” materials on an online investment platform.

The offering will terminate at the earliest of: (1) the date at which the maximum offering amount has been sold, (2) the date which is one year from this offering being qualified by the Commission, and (3) the date at which the offering is earlier terminated by Webstar Technology Group in its sole discretion.

The company may undertake one or more closings on an ongoing basis. After each closing, funds tendered by investors will be available to the company. After the initial closing of this offering, the company expects to hold closings on at least a monthly basis.

The company is offering its securities in all states.

TAX CONSEQUENCES FOR RECIPIENT (INCLUDING FEDERAL, STATE, LOCAL AND FOREIGN INCOME TAX CONSEQUENCES) WITH RESPECT TO THE INVESTMENT PURCHASE PACKAGES ARE THE SOLE RESPONSIBILITY OF THE INVESTOR. INVESTORS MUST CONSULT WITH THEIR OWN PERSONAL ACCOUNTANT(S) AND/OR TAX ADVISOR(S) REGARDING THESE MATTERS.

Selling Shareholders

No founders will be selling securities into the offering; all net proceeds in this offering will go to Webstar Technology Group.

Piggyback Rights

Existing holders of common stock, convertible preferred shares and convertible notes will be eligible to obtain Piggyback Rights with respect to their ability to remove restrictive legends from their shares and obtain free trading stock.

Investors’ Tender of Funds

After the Offering Statement has been qualified by the Securities and Exchange Commission (the “SEC”), the company will accept tenders of funds to purchase the shares. Prospective investors who submitted non-binding indications of interest during the “test the waters” period will receive an automated message from us indicating that the Offering is open for investment. (NOTE: AT THIS TIME NO “TEST THE WATER” PRESENTATIONS HAVE BEEN MADE, NO PROSPECTIVE INVESTIONS HAVE SUBMITTED INDICATIONS OF INTEREST AND NO PRESENTATION MATERIALS ARE AVAILABLE). We will conduct multiple closings on investments (so not all investors will receive their shares on the same date). Each time the company accepts funds transferred from the Escrow Agent is defined as a “Closing.”

Process of Subscribing

You will be required to complete a subscription agreement in order to invest. The subscription agreement includes a representation by the investor to the effect that, if you are not an “accredited investor” as defined under securities law, you are investing an amount that does not exceed the greater of 10% of your annual income or 10% of your net worth (excluding your principal residence).

Any potential investor will have ample time to review the Subscription Agreement, along with their counsel, prior to making any final investment decision.

If a subscription is rejected, all funds will be returned to subscribers within thirty days of such rejection without deduction or interest. Upon acceptance by us of a subscription, a confirmation of such acceptance will be sent to the subscriber. Escrow Agent has not investigated the desirability or advisability of investment in the shares nor approved, endorsed or passed upon the merits of purchasing the securities.

The company intends to engage a registered transfer agent with the SEC, who will serve as transfer agent to maintain shareholder information on a book-entry basis; there are no set up costs for this service, fees for this service will be limited to secondary market activity. The company estimates the aggregate fee due to the transfer agent for the above services to be $35,000 annually.

USE OF PROCEEDS TO ISSUER

The following discussion addresses the use of proceeds from this Offering. The company currently estimates that, at a per share price of Seven Dollars (USD $7.00), the net proceeds from the sale of the 1,428,571 shares of Preferred Stock will likely be $9,110,000 after deducting the estimated offering expenses of approximately $890,000.

The following table breaks down the use of proceeds into different categories under various funding scenarios:

| | | 25% | | | 50% | | | 75% | | | 100% | |

| Gross Proceeds | | $ | 2,500,000 | | | $ | 5,000,000 | | | $ | 7,500,000 | | | $ | 10,000,000 | |

| Estimated Offering Expenses1 | | $ | 100,000 | | | $ | 200,000 | | | $ | 300,000 | | | $ | 890,000 | |

| Net Proceeds2 | | $ | 2,375,000 | | | $ | 4,750,000 | | | $ | 7,125,000 | | | $ | 9,110,000 | |

| | | | | | | | | | | | | | | | | |

| Overhead - 12 months | | $ | 237,500 | | | $ | 475,000 | | | $ | 712,500 | | | $ | 950,000 | |

| | | | | | | | | | | | | | | | | |

| Land Acquisition, Engineering and Design3 | | $ | 2,137,500 | | | $ | 4,275,000 | | | $ | 6,412,500 | | | $ | 8,160,000 | |

| | 1 | Offering Expenses Estimated |

| | 2 | Short Term Financing Needs will be adjusted in accordance with Net Proceeds. Adjustments will be made to the schedule to prioritize timeshare sales to finance development of the resorts. If timeshare proceeds are not required for development and construction then those proceeds will be used to identify, acquire and construct future projects. timeshare proceeds assumptions and calculations are presented in “THE COMPANY PROPERTIES” below. |

| | 3 | Traditional financing for construction has not yet been secured. Agreements are pending with CBRE and the land acquisition in Commerce, Georgia. |

THE COMPANY’S BUSINESS

WEBSTAR TECHNOLOGY GROUP MISSION STATEMENT

Webstar Technology Group is committed to consistently providing our buyers and guests with a superior experience by presenting a unique atmosphere and world class hospitality in a state of the art, multi-faceted resort community that highlights and promotes the Commerce, Georgia features. By committing to supporting the environment, conservation and the preservation of the earth through education, Webstar Technology Group will enhance the lives of owners, guests and the community through its mission. Webstar Technology Group understands that excellence in customer experience and investor return can only be delivered through excellence in Management, associate training and through becoming an asset to the community.

WEBSTAR TECHNOLOGY GROUP VISION

The mission of Webstar Technology Group resorts is to be the premier destination Hotel & Resort by distinguishing its services not only as unique but above and beyond all other competing resorts.

To accomplish this goal, we are committed to hiring the most skilled management company who will in turn ensure our staff will be well trained, friendly and always willing to go above and beyond the call of duty to cater to our guests’ individualized needs. We will place the strongest degree of attention and commitment on service, atmosphere, quality and personal experience.

OVERVIEW

Webstar Technology Group has identified the drive to destination resort market as its primary interest and has focused its efforts on the development of premiere Family Destination Resort featuring Eco-Friendly, Eco-Tourism in conjunction with education in a heavily themed Resort. The initial developments will primarily focus on Georgia, Tennessee, North Carolina and South Carolina. The Company has one resort in development. The first, in Commerce, Georgia, is the furthest in development with water/sewer utilities available to the property and a preliminary master design to be submitted to Banks County in Georgia in the near future. A second proposed property located in Sevier County, Tennessee, is undergoing initial site layout. Additional properties will be acquired as destination resort demographics are evaluated. The goal is to provide family get away resorts from cities and suburb communities within a four or five-hour driving radius of the resorts.

Each resort will be owned and managed by a locally established “Bear Village Asset Holdings - “Location Identifier”, LLC. Strategic partners will own portions of the assets and business within each Resort. The daily operations and general management of the hotel portion of the resorts will be performed by Hybrid Hospitality LLC, working in unison with Bear Village Asset Holdings, and their collective team of industry professionals each with over 20 years in the hospitality industry. Hybrid Hospitality will provide a professional, experienced on-site management team.

Quality family entertainment and experiences is the primary focus of Bear Village Asset Holdings. The construction and commercialization of the proposed resorts is factored into the initial development phase detailed within.

The first resort to be developed is Bear Village – GA will be owned by Bear Village Asset Holdings – GA, LLC, a wholly owned division of Webstar Technology Group which will be situated on approximately 66 acres in Commerce, Georgia. The company’s proposed resort will be designed to provide the type of facilities the current market demands. Situated on the land will be 600 timeshares, 600 room resort hotel, 80,000+ and 150,000+ sq ft. Outdoor and Indoor Water Park, respectively, 65,000+ and 120,000+ Indoor and Outdoor Cart Track and Adventure Centers, respectively, 15,000 Gallon Fresh Water Aquarium, 50,000+ sq. ft. Family Entertainment Center and 20,000+ sq. ft. banquet and conference center. Within the resort facilities will be numerous revenue centers including multiple food and beverage outlets, unique retail outlets, chair lift unique photo opportunities, our unique Family Entertainment Center.

RESORT CONCEPT

Bear Village Asset Holdings LLCs will each construct, own, and operate a mixed-use, unique destination, resorts and condominiums themed primarily around wildlife habitats, mountain ecosystems and waterfront (rivers, lakes and waterfalls) easily accessible to the resort visitors and residents.

Thunder Energy Resorts, will be a place where every moment is crafted to indulge owners and visitors’ senses and create a spirit of adventure. Located in Commerce Georgia, the first Webstar Technology Group Resort offers a diverse range of experiences tailored to engage every type of traveler. This resort concept aims to cater to a wide range of interests and preferences, ensuring that every guest has the opportunity to create their own unique and unforgettable experiences.

The mission of Webstar Technology Group resorts is to be the premier destination Hotel & Resort by distinguishing its services not only as unique but above and beyond all other competing resorts.

To accomplish this Mission, we are committed to hiring the most skilled management company who will in turn ensure our staff will be well trained, friendly and always willing to go above and beyond the call of duty to cater to our guests’ individualized needs. We will place the strongest degree of attention and commitment on service, atmosphere, quality and personal experience.

Each Bear Village Asset Holdings LLC company will construct its own resort, and operate a mixed-use, unique destination, resorts and time-shares themed to highlight the local environment, community and bring new exhilarating experiences that are easily accessible to the resort visitors and residents.

KEYS TO SUCCESS

Based on research, the overwhelming success of Webstar Technology Group will be defined by its appeal and overall ability to service a variety of markets. The independent themed hotel and bear habitat joined with a Family Entertainment Center will primarily target families with children from ages 3-18. The property will primarily target travelers interested in eco-tourism and educational vacations.

We believe that our main keys to success include:

| | | ● | Ideal location: |

| | | | | | |

| | | | | ☐ | Centrally located near major highways and access roads |

| | | | | ☐ | Adjacent to destinations that are already successful and attacks large numbers of families |

| | | | | ☐ | Easy access from multiple major roads |

| | | | | ☐ | Within a day’s drive of over 23 million people of the United States |

| | | ● | Creating a “drive to” destination resort: |

| | | ☐ | Providing popular and wide-ranging unique activities |

| | | ☐ | Indoor and outdoor environments for year-round entertainment |

| | | ☐ | Superior lodging accommodations |

| | | ☐ | Ample family activities |

| | | ☐ | Family Friendly Experiences |

| | | ☐ | Unique Lodging Opportunities for education-based tourism and eco-tourism |

| | | ● | Professionally managed to: |

| | | ☐ | Optimize Occupancy and Rate in each travel segment |

| | | ☐ | Higher weekend demand compared to competition |

| | | ☐ | Aggressive yield rate management program |

| | | ☐ | Provide a consistently superior guest experience |

| | | ☐ | Control costs through superior design and operational supervision |

| | | ● | Ample Parking & Easy Access |

THE WEBSTAR TECHNOLOGY GROUP EXPERIENCE

Webstar Technology Groups’ focus is to create a known experience for its patrons and their families where they can experience a mixture of family activities, dining, adult activities, and eco-friendly exploration. A model for the resorts is Kiawah Island in South Carolina. The significant difference is that Webstar Technology Group focuses on mountain and inland waters to create the experience they desire. By bringing the experience off of the crowded and expensive coastline the resort becomes more affordable to families for vacation homes and extended visits.

Webstar Technology Group has partnered with national and regional industry leaders and experts on this project including: CBRE Valuation and Advisory Services, Wyndham Hotels and Resorts (hotel management and reservations), Greengate Consulting, LLC (EB-5 investment and land use economic analysis), Skyline Engineering & Construction, LLC (cost management & civil engineering), Nelson Worldwide Architects and will team with Legacy Entertainment (design and theming), McGillivary Consulting Group (project cost management), Aquatic Pools and Construction (water park design and construction) once the project is funded and moving forward. The Wyndham Agreement is being amended and therefore, is not included with this filing but the latest communication from the Director of Franchise Development is attached. We are waiting for this Regulation A filing to be accepted.

Common Resort Features:

As a family resort it is important the clients know what to expect and how the resort operates so children are easily managed and entertained while adults can find interesting activities for themselves. Common features include:

| | ● | Full-Service Name Brand Hotel: Webstar Technology Group has recruited Wyndham Hotels and Resorts as a partner hotel service provider for the Georgia and Tennessee resorts. |

| | ● | Indoor and Outdoor Water Park: The activity center for the entire family will include indoor and outdoor access, slides, lazy rivers, dry land sprays and open swim areas. |

| | ● | Family Entertainment Center: The family entertainment center will consist of electronic activities prizes, movies and restaurant. The Entertainment Center will also offer age-appropriate educational activities for children under 15 to allow adults to enjoy the resort on a different level. |

| | ● | Restaurants: As part of the resort a main Village Square consisting of unique restaurants, ice cream and snack areas. |

| | ● | Day Trips, Hikes and Outdoor Activities: The resort will partner with local activity centers to promote day trips to attractions, hiking local trails and taking advantage of what the local community offers such as canoeing, boating or skiing. |

THE COMPANY’S PROPERTIES

PROPERTY 1 - BEAR VILLAGE ASSET HOLDINGS – GA, LLC

BEAR VILLAGE – GA owned and operated by Bear Village Asset Holdings – GA, LLC a wholly owned subsidiary of Webstar Technology Group, is strategically located near wildlife habitats and hiking trails while the resort itself will include:

| | ● | 150,000+ and 80,000+ sq. ft. Indoor and Outdoor Water Parks, respectively |

| | ● | 120,000+ and 65,000+ Indoor and Outdoor Cart Track and Adventure Centers, respectively |

| | ● | 600 Time Shares Units |

| | ● | 600 Room Uniquely Themed Hotel |

| | ● | Entertainment/Retail Areas |

| | ● | Family Oriented Entertainment and Dining |

| | ● | 50,000+ Family Entertainment Center. |

| | ● | 20,000+ Banquet and Conference Center |

The proposed resort will be constructed in Commerce, Georgia. Centrally located within the Banks County retail areas and adjacent to Interstate 85, the resort will bring much needed family focused experiences to the region.

The resort would be completed as a phased development. Phase I will be developed consisting of 100 timeshares. Phase II will be the development of the resort amenities including the 600-room themed hotel and meeting place, outdoor water park, outdoor kart track, family entertainment center and some retail and restaurants. Phase III would include an indoor water park and kart track, the addition of 500 timeshare units and additional retail/restaurants. The initial Phase I timeshare sales/pre-sales coupled with the Phase II resort amenities will provide the resort project with operational revenue based on revenue estimates of stabilization after year 2 with a 50% occupancy rate where the average regional occupancy rate for hotels and timeshares was 75% to 80% in 2019 based on Georgia (and Tennessee) hospitality and tourism annual numbers. The resort amenities will contain the following: 600 deluxe hotel rooms and suites, a 120,000+ and 65,000+ sq. ft. indoor and outdoor kart track, respectively, which will include a family entertainment facility including an arcade and adventure park, 150,000+ and 80,000+ sq. ft. indoor and outdoor water park, respectively, a 15,000 Gallon Fresh Water Aquarium, themed restaurants, gift shops, retail shopping and other family-oriented entertainment venues.

The “Use of Proceeds” will be utilized for the initial land acquisition, which is estimated to be $5.0M, and initial engineering and design to obtain all permitting for the proposed development. Future rounds of financing and or Offerings are projected to follow once permitting has been secured.

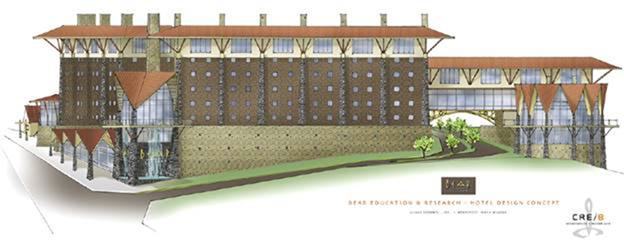

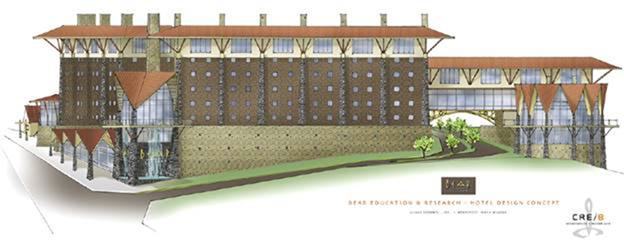

Conceptual Design:

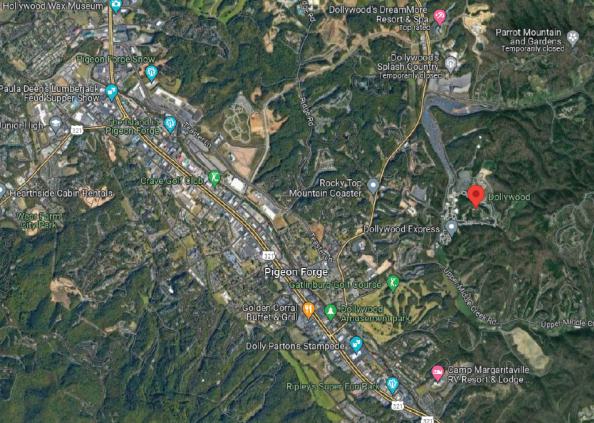

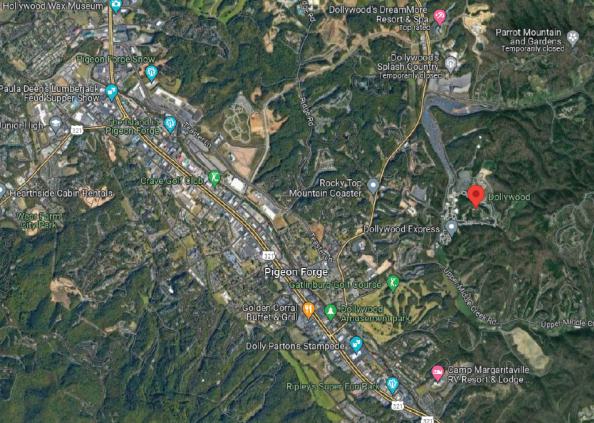

Location:

Map-Radials of 50, 100, 150 and 200 miles around Commerce, Georgia.

Georgia Resort Market:

Commerce, Georgia, is located in Banks and Jackson counties located in approximately 60 miles northeast of downtown Atlanta. Located off of I-85 the trip from Atlanta and Greenville/Spartanburg SC are easy drives to escape the city life. Family attractions include:

| | ● | Hurricane Shoals Park. This park includes outdoor play areas, trails, the “Heritage Village”, and the shoals water feature. In September the Park sponsors a BBQ and bluegrass festival. |

| | ● | Fort Yargo State Park. An 1,816 acres wildlife park with a 260-acre lake that offers boating, swimming and hiking. |

| | ● | State Botanical Garden of Georgia. This garden is a 313 acre preserve set aside by the University of Georgia. |

| | ● | University of Georgia. The Bulldog Campus is a short 25 minutes away where families can attend activities and fall SEC football games. |

| | ● | Elachee Nature Science Center. The Science Center offers summer camps for children as well as hiking trails, an interactive educational program, biking and a small lake. |

| | ● | Lake Lanier and Lake Hartwell. These lakes provide a variety of water-based activities, including boating, fishing, and swimming in the lake’s refreshing waters along with camping, golfing and horseback riding with exceptional views. |

FACILITY OVERVIEW

Bear Village, Georgia will feature:

| | ● | 600 Room Full-Service Themed Hotel |

| | ● | 600 Timeshares |

| | ● | 65,000+ and 120,000+ sq. ft. Indoor and Outdoor Cart Tracks, respectively |

| | ● | 80,000+ and 150,000+ sq. ft. Indoor and Outdoor Water Parks, respectively |

| | ● | 50,000+ Family Entertainment Center |

| | ● | 15,000-gallon aquarium |

| | ● | 20,000+ sq. ft. Conference and Banquet Center |

| | ● | 10,000+ sq. ft Themed Restaurants and Specialty Retail |

The hotel at Bear Village will feature 600 beautifully appointed themed guest rooms and suites. From an overnight stay, educational field trip, to a family reunion, you will find the hotel perfect for your needs.

The suites will include:

| | ● | Deluxe Rooms and Two Bedroom Units – Each oversized room and suite will be tastefully decorated with uniquely themed touches, designed with the family in mind and constructed with the most durable goods for high occupancy levels. |

| | ● | Serta Master Suite King or Queen Beds |

| | ● | Terraces with exceptional views (available with some rooms) |

| | ● | 300 Count Egyptian Cotton Linen Package with overstuffed duvets and A Pillow Towers. The bedding package will be soothing and comfortable. Guests will also have the option of requesting pillows in a variety of firmness levels. |

| | ● | Oversized Queen size Sofa Sleepers |

| | ● | Upgraded Bathrooms: |

| | ○ | Deluxe Shower Head and Control Features |

| | ○ | Lighted Adjustable Makeup Mirrors |

| | ○ | Larger Granite Vanity Tops |

| | ● | Granite Wet Bar Areas with Microwaves & Refrigerators |

| | ● | Tech Savvy Room Features – |

| | ○ | 40+” LCD Televisions with front AV inputs |

| | ○ | RF and Electronic Door Locks |

| | ○ | I-Pod docking stations at all clock radios |

| | ○ | Wired and wireless high-speed internet |

The Hotel will also feature:

| | ● | Full-Service Restaurant – Featuring Upscale Family Friendly Menu |

| | ● | Sports Pub |

| | ● | Additional Food Kiosks (Coffee Bar, Grab N Go, Dessert Bar etc.) |

| | ● | Concierge Desk – Featuring Dream Makers |

| | ● | Business Center (a larger business center will be available in the meeting space(s)) |

| | ● | Laundry and Valet Service |

| | ● | GEM Guest Service Program |

| | ● | Green Program |

Food, Beverage & Catering Production

Located within the resort will be multiple food and beverage outlets. Besides the more traditional full-service restaurant and lounge, there will also be several kiosks that will offer the latest trends in novelty food and drinks. Food and beverage outlets will be strategically located to provide an optimum guest experience while maximizing efforts to consolidate kitchens, storage and operational costs.

Restaurant

Within the themed independent full-service hotel at Bear Village there will be a full-service restaurant. The restaurant will seat 300 in the main dining area with additional seating available at the attached sports bar. Additional seating will be provided seasonally along the terrace. The restaurant will be thoughtfully designed in the theme of the resort. The full-service restaurant will be open for breakfast, lunch and dinner daily. In keeping with the resort’s theme, menus will offer individual entrees as well as family style entrees.

The dinner menu will change seasonally while breakfast and lunch menus will be updated twice a year. The menu will consist of items made from scratch daily by our skilled culinary team. Produce, dairy, meat, and paper will be purchased from local vendors as much as possible. The restaurant will utilize a national food service vendor for a majority of its products.

Guests will have the availability to order room service from the full-service restaurant and lounge.

Sports Bar

The resort’s sports bar will share a common wall with the full-service restaurant. Open early afternoon through late evening the sports bar will also offer the lunch and dinner menus from the adjoining restaurant. The sports bar will then offer a limited late night finger food menu after 10:00 p.m. The sports bar will be heavily themed and offer a variety of specialty drinks served in souvenir glasses and mugs. All specialty drinks will also be available in a non-alcohol version.

The sports bar will offer entertainment weekly. The entertainment will range from acoustic groups to disc jockeys. Multiple video screens will be carefully located to allow for the displaying of various sporting events without affecting the overall ambiance of the lounge.

Family Entertainment Center

| | ● | A wide range of state-of-the-art arcade video games |

| | ● | Pool Tables |

| | ● | Bowling |

| | ● | Shuffleboard |

| | ● | Entertainment |

The Shoppes at Bear Village

The Shoppes at Bear Village will be a 10,000+ sq. ft. mixed use facility located on the resort’s campus which will include multiple specialty retailers. The upscale feel of The Shoppes at Bear Village will be carried over in the outdoor terrace seating for both the restaurants and the habitat areas.

OPERATIONS

Bear Village will be located in Commerce, Georgia. The individual components of the resort will have varying hours of operation. There will be multiple access points to the resort property. All lodging areas will have secured access via electronic card key locks. Separate parking and service drives will be established for staff parking and deliveries.

All efforts will be focused on creating seamless operations between the individual resort components. All resort staff members will be expertly trained to provide accurate and knowledgeable information about all resort areas. Signage and all printed collateral pieces will also communicate a message of seamless operations.

Hours of Operation

The resort’s wide array of attractions and facilities will offer varied hours throughout the year. The operational hours will be carefully determined after taking numerous factors into consideration. Ultimately hours of operation will be tied directly to overall demand.

Hotel

The themed hotel will be open 24 hours a day, 7 days per week. The hotels will operate at close to peak conditions year-round with the highest demand periods typically based around school breaks and conference and convention months.

Family Entertainment Center (FEC)

The FEC will be open 7 days per week 9:00a.m. to 12:00a.m. On Fridays, Saturdays and Holiday periods, the arcade will operate from 9:00a.m. to 12:00a.m. or later if business warrants. Marketing of “lock-in” parties will generate additional business to take place after hours when the FEC is typically closed.

Retail Shopping

The Shoppes at Bear Village will generally be open 10:00 a.m. – 9:00 p.m. Monday through Saturday and 12:00 p.m. – 9:00 p.m. on Sundays. Some shops will be closed on various holidays throughout the year, but leases will be written to ensure that at least some shops are open to Resort guests every day of the year. Shop hours will also generally increase around the Christmas Holiday shopping season and special Center wide sales periods.

Restaurants within the Center will be open 365 days a year and will be required to be open extended hours as needed.

Operating Philosophies – Creating the Best Guest Experience

Today’s guests are more demanding than ever. Guests are well educated and need to feel as they are in control at all times. It is important to realize that it is no longer just about providing excellent guest service, but rather in today’s age it is critical to provide a POSITIVE GUEST EXPERIENCE.

The guest experience starts from the first message a potential guest ever receives regarding Bear Village, through the reservation process, every moment of the physical trip and then the messages received after their trip. A guest experience is all encompassing and never ending. With this in mind, Bear Village is dedicated to providing the ultimate guest experience to every guest during every visit.