UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-23086

WP Trust

(Exact name of registrant as specified in charter)

| 4300 Shawnee Mission Parkway, Suite 100 Fairway, KS | 66205 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company

Corporation Trust Center

1209 Orange St.

Wilmington, DE 19801

(Name and address of agent for service)

With Copies To:

John H. Lively

Practus, LLP

11300 Tomahawk Creek Parkway, Suite 310

Leawood, KS 66211

Registrant’s telephone number, including area code: 877-244-6235

Date of fiscal year end: 11/30/2018

Date of reporting period: 11/30/2018

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the WP Smaller Companies Income Plus Fund (“WPSMX”), WP International Companies Income Plus Fund (“WPITX”), WP Income Plus Fund (“WPINX”), each a series of the WP Trust (the “registrant”), for the year ended November 30, 2018 and for the three month period ended November 30, 2018 for the WP Large Cap Income Plus Fund (“WPLCX”) pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

WP Smaller Companies Income Plus Fund

Institutional Class Shares (Ticker Symbol: WPSMX)

WP International Companies Income Plus Fund

Institutional Class Shares (Ticker Symbol: WPITX)

WP Income Plus Fund

Institutional Class Shares (Ticker Symbol: WPINX)

WP Large Cap Income Plus Fund

Institutional Class Shares (Ticker Symbol: WPLCX)

Series of the

WP Trust

ANNUAL REPORT

November 30, 2018

Investment Adviser

Winning Points Advisers, LLC

129 NW 13th Street, Suite D-26

Boca Raton, Florida 33431

IMPORTANT NOTE: Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the WP Funds’ shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports from a WP Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive all future reports in paper free of charge. You can inform a WP Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling or sending an e-mail request. Your election to receive reports in paper will apply to all funds held with the WP Fund complex/your financial intermediary.

TABLE OF CONTENTS

To the shareholders of WPSMX, WPITX and WPINX:

This is our third Shareholder letter as the WP Smaller Companies Income Plus Fund (“WPSMX”), WP International Companies Income Plus Fund (“WPITX”) and WP Income Plus Fund (“WPINX”), (individually, a “Fund”, together, the “Funds”) have now been open for three years and this year proved to be our most challenging year so far especially in light of the market performance in December. Our performance numbers are as follows:

Average Annual Total Returns as of November 30, 2018 | | One Year ended November 30, 2018 | | Since Inception from January 4, 2016 through November 30, 2018 |

| WP Smaller Companies Income Plus Fund Institutional Class shares | | 2.23% | | 11.21% |

| S&P 500® Total Return Index | | 6.27% | | 13.79% |

| Russell 2000® Total Return Index | | 0.57% | | 13.34% |

| | One Year ended November 30, 2018 | | Since Inception from January 4, 2016 through November 30, 2018 |

| WP International Companies Income Plus Fund Institutional Class shares | | (11.97)% | | 4.03% |

| S&P 500® Total Return Index | | 6.27% | | 13.79% |

| MSCI EAFE Index | | (7.94)% | | 5.69% |

| | One Year ended November 30, 2018 | | Since Inception from January 4, 2016 through November 30, 2018 |

| WP Income Plus Fund Institutional Class shares | | (4.69)% | | 4.35% |

| S&P 500® Total Return Index | | 6.27% | | 13.79% |

| Markit iBoxx USD Liquid High Yield Index | | 0.89% | | 7.66% |

All of our Funds utilize our Option/Cash Flow Process which is something we developed ourselves and has been evolving over the eight years since we started it with individual accounts and now with our Mutual Funds. Through the use of options, we are able to increase our cash flow in each Fund on a yearly basis and use some of that cash flow to purchase puts which may act as a buffer in market downturns. The structure of the Funds (because of the options) and their objectives are to: (1) out- perform in up markets, and (2) protect in violent and sharp down markets, but unfortunately there are no full proof investments and the structure of our Funds will cause us to under-perform in markets that go through a gradual and rolling correction which is what we did or are experiencing right now and our performance numbers reflect just that. This was expected and our Funds are performing as we expected them to perform in this type of market. We are hopeful the market stabilizes in 2019 at which point objective (1) from above comes back into play.

WPINX owns two Corporate High Yield Bond ETFs, HYG and JNK, which invest in liquid, U.S. dollar-denominated high yielding corporate bonds for sale in the U.S. We also have a few smaller dividend paying stocks. We made no significant changes to the portfolio in 2018. The Bond Market took a downturn in the latter part of 2018 which caused the price of our underlying positions to decline: HYG -7.1% for the year and JNK -8.7% for the year. These price declines and how the Fund is structured is what produced our underperformance for the year. We expect yields to work slightly higher in 2019 and hope to increase our monthly dividend to reach $0.03 (from $0.025 now) a share which will produce a yield of 3.6%.

WPITX owns the iShares MSCI EAFE ETF, EAF, and two smaller positions in DGS and DLS, two Wisdom Tree ETFs. These ETFs invest in large and mid-capitalization developed market equities excluding the U.S. and Canada markets. We made no significant changes to the portfolio in 2018. The developed market space was hit hard in 2018 because of slower growth fears and the unwinding of the balance sheet of the ECB which is a large “unknown”. This can be seen in the prices of our 3 holdings EFA -16.5% for the year, DGS -19.6% for the year, and DLS -21.6% for the year. These price declines and how the Fund is structured is what produced our underperformance for the year.

WPSMX owns the iShares Russell 2000 ETF, IWM, which invests in the small-capitalization sector of the U.S. equity market, and two very small positions in stocks involved in fighting the opioid addiction problem. We made no significant changes to the portfolio in 2018. The small cap space, which had been outperforming most asset classes, was not exempt from the market decline and we saw a 12.8 % decline in IWM. This price decline and how the Fund is structured is what produced our underperformance for the year.

We expect the stock market to be much more volatile in 2019 and expect big swings in the market on a frequent basis due to trading by “algorithms” and computer-based decisions. According to the Wall Street Journal 85% of all trades in December 2018 were on what they described as “auto-pilot” which to us means the potential circuit breakers of human input is missing and all the algorithm or computer knows is to “hit the bid”. This very well might be the new normal and will produce the kind of volatility the Wall Street trading desks thrive on. Being short volatility for the past 3 years has been a winning trade but it appears those days are over and volatility is here to stay for a while.

We still like the income space, the small cap space, and the developed markets space so we will stick with the underlying positions in our three Funds, continue to refine our option cash/flow process, and adapt to the ever changing landscape in the stock market and hopefully produce positive returns in 2019.

Thank you for your confidence in us.

|  | |

| | | |

| John Brandt | Charles S Soll | |

| Portfolio Manager | Portfolio Manager | |

To the shareholders of WPLCX:

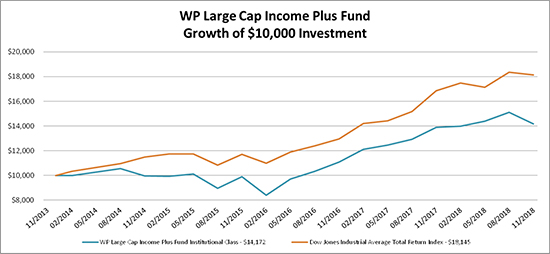

It has been five years since we started the WP Large Cap Income Plus Fund (the “Fund’ or “WPLCX”) and the fifth year has been our most challenging period yet. We underperformed in this period due to the structure of the Fund. We typically underperform in times of a gradual market decline, which we saw in the latter part of the year.

During the year, we changed the Fund’s fiscal year-end from August 31st to November 30th to align with our other three Funds’ fiscal year end. During the three-month period ended November 30, 2018, WPLCX returned (6.26)% vs (1.07)% for the Dow Jones Industrial Average Total Return Index. Other performance figures are as follows:

Average Annual Total Returns as of November 30, 2018 | | One Year ended November 30, 2018 | | Since Inception from December 4, 2013 through November 30, 2018 |

| WP Large Cap Income Plus Fund Institutional Class shares | | 2.11% | | 7.24% |

| Dow Jones Industrial Average Total Return Index | | 7.62% | | 12.68% |

We are a Large Cap Value Fund and 88% of our assets are in Large Cap stocks paying dividends in the 2% to 4% range. We sold Clough Global Equities and Virtus Total Return Fund, took new positions in Facebook and Archer Daniels Midland and added to positions in Catasys, WalMart, China Mobile, Intel and Alibaba.

We are positive on the stock market for 2019 and while we don’t think we will see 4% GDP growth, we think the economy will grow in the 2 ½% to 3% range for the year. We don’t think the market is anticipating this kind of growth and if it turns out to be the case we think the market will do well and will be a good environment for the stocks we own and produce a successful year for our Funds.

In the mean time we will collect our dividends and our positive option cash flow. Expect a dividend again from this Fund prior to the next year end.

Thank you for your confidence in us.

|  | |

| | | |

| John Brandt | Charles S Soll | |

| Portfolio Manager | Portfolio Manager | |

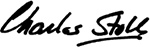

WP Smaller Companies Income Plus Fund

INVESTMENT HIGHLIGHTS

November 30, 2018 (Unaudited)

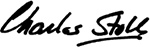

The investment objective of the WP Smaller Companies Income Plus Fund (the “Fund” or “Smaller Companies Fund”) is total return. The Smaller Companies Fund seeks to meet its investment objective by investing at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in unaffiliated mutual funds and exchange-traded funds (“ETFs”) that invest primarily in securities of small-capitalization issuers (“Underlying Small-Cap Funds”). The Smaller Companies Fund seeks to produce income through dividends paid on such Underlying Small-Cap Funds. The Smaller Companies Fund also seeks to produce income (e.g., premium income on the sale of an option) and total return through an options strategy.

Winning Points Advisers, LLC (the “Adviser”) will generally buy and sell options linked to either the Russell 2000® Index or the S&P 500® Index. The portfolio managers will strategically allocate the Smaller Companies Fund’s resources to the Underlying Small-Cap Funds and the options strategy as the portfolio managers deem appropriate to perform well over a market cycle.

The Smaller Companies Fund may also sell put options on ETFs that the Adviser believes are attractive for purchase at prices at or above the exercise price of the put options sold. The Adviser generally will sell put options to increase the total return component of the options strategy described in the Fund’s investment objective. The Smaller Companies Fund may, in certain circumstances, purchase put options on the S&P 500® Index (or another broad-based securities index deemed suitable for this purpose) to protect against a loss of principal value due to stock price decline. The Adviser generally purchases put options to protect the total return component of the options strategy described in the Fund’s investment objective. The extent of option selling or purchasing activity will depend upon market conditions and the Adviser’s assessment of the advantages of selling index call options, purchasing index put options and selling put options on individual stocks.

The Smaller Companies Fund may be appropriate for investors with long-term time horizons who are not sensitive to short-term losses and want to participate in the long-term growth of the financial markets.

The percentages in the above graph are based on the portfolio holdings of the Fund as of November 30, 2018 and are subject to change. For a detailed break-out of holdings by investment type, please refer to the Schedules of Investments and Options Purchased.

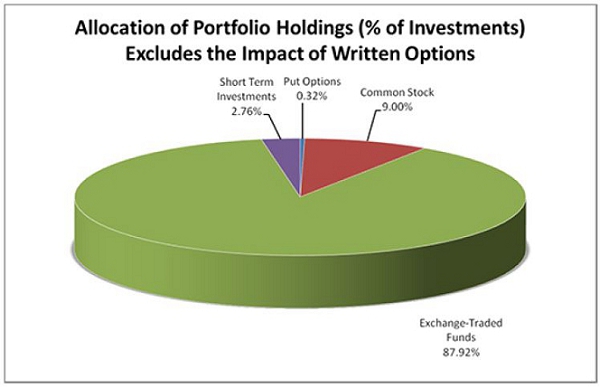

WP Smaller Companies Income Plus Fund

INVESTMENT HIGHLIGHTS

November 30, 2018 (Unaudited)

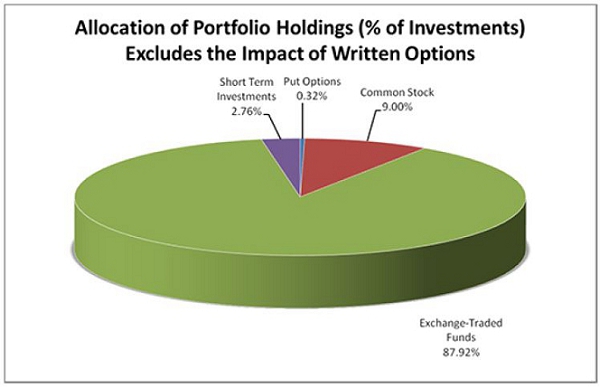

Average Annual Total Returns as of November 30, 2018 | | One Year ended November 30, 2018 | | Since Inception from January 4, 2016 through November 30, 2018 |

| WP Smaller Companies Income Plus Fund Institutional Class shares | | 2.23% | | 11.21% |

| S&P 500® Total Return Index | | 6.27% | | 13.79% |

| Russell 2000® Total Return Index | | 0.57% | | 13.34% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the WP Smaller Companies Income Plus Fund versus the S&P 500® Total Return Index and the Russell 2000® Total Return Index. The S&P 500® Total Return Index is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Russell 2000® Total Return Index measures the performance of the small-cap segment of the U.S. equity universe. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500® Total Return Index and the Russell 2000® Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indexes; so too with the WP Smaller Companies Income Plus Fund, which will generally not invest in all the securities comprising each index.

WP International Companies Income Plus Fund

INVESTMENT HIGHLIGHTS

November 30, 2018 (Unaudited)

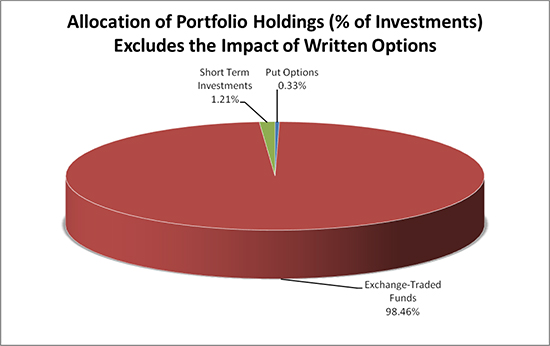

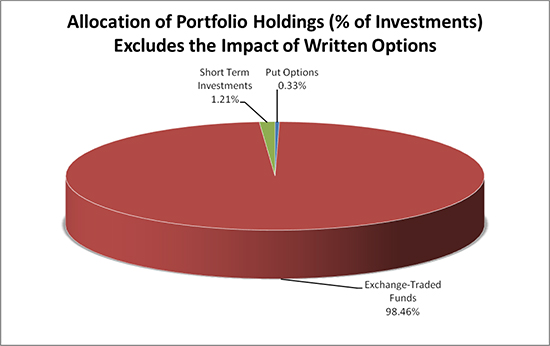

The investment objective of the WP International Companies Income Plus Fund (the “Fund” or “International Companies Fund”) is total return. The International Companies Fund seeks to meet its investment objective by investing in unaffiliated mutual funds and exchange-traded funds (“ETFs”) that invest primarily in equity securities and depositary receipts of internationally-domiciled issuers (“Underlying International Funds”). The International Companies Fund seeks to produce income through dividends paid on such Underlying International Funds. The International Companies Fund also seeks to produce income (e.g., premium income on the sale of an option) and total return through an options strategy.

The Adviser will generally buy and sell options linked to either the MSCI EAFE Index or the S&P 500® Index. The portfolio managers will strategically allocate the International Companies Fund’s resources to the Underlying International Funds and the options strategy as the portfolio managers deem appropriate to perform well over a market cycle.

The International Companies Fund may also sell put options on ETFs that the Adviser believes are attractive for purchase at prices at or above the exercise price of the put options sold. The Adviser generally will sell put options to increase the total return component of the options strategy described in the Fund’s investment objective. The International Companies Fund may, in certain circumstances, purchase put options on the S&P 500® Index (or another broad-based securities index deemed suitable for this purpose) to protect against a loss of principal value due to stock price decline. The Adviser generally purchases put options to protect the total return component of the options strategy described in the Fund’s investment objective. The extent of option selling or purchasing activity will depend upon market conditions and the Adviser’s assessment of the advantages of selling index call options, purchasing index put options and selling put options on individual stocks.

The International Companies Fund may be appropriate for investors with long-term time horizons who are not sensitive to short-term losses and want to participate in the long-term growth of the financial markets.

The percentages in the above graph are based on the portfolio holdings of the Fund as of November 30, 2018 and are subject to change. For a detailed break-out of holdings by investment type, please refer to the Schedules of Investments and Options Purchased.

WP International Companies Income Plus Fund

INVESTMENT HIGHLIGHTS

November 30, 2018 (Unaudited)

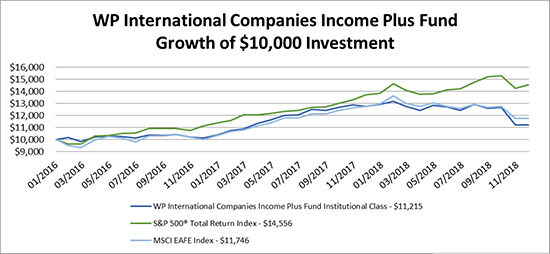

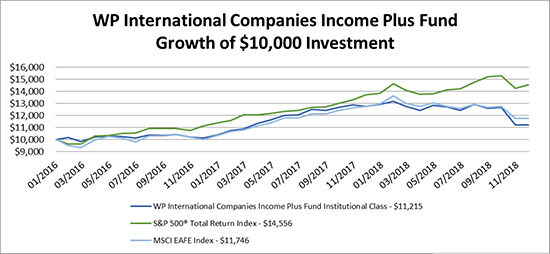

Average Annual Total Returns as of November 30, 2018 | | One Year ended November 30, 2018 | | Since Inception from January 4, 2016 through November 30, 2018 |

| WP International Companies Income Plus Fund Institutional Class shares | | (11.97)% | | 4.03% |

| S&P 500® Total Return Index | | 6.27% | | 13.79% |

| MSCI EAFE Index | | (7.94)% | | 5.69% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the WP International Companies Income Plus Fund versus the S&P 500® Total Return Index and the MSCI EAFE Index. The S&P 500® Total Return Index is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The MSCI EAFE Index is a free-float weighted equity index that covers DM countries in Europe, Australasia, Israel and the Far East. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500® Total Return Index and the MSCI EAFE Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indexes; so too with the WP International Companies Income Plus Fund, which will generally not invest in all the securities comprising each index.

WP Income Plus Fund

INVESTMENT HIGHLIGHTS

November 30, 2018 (Unaudited)

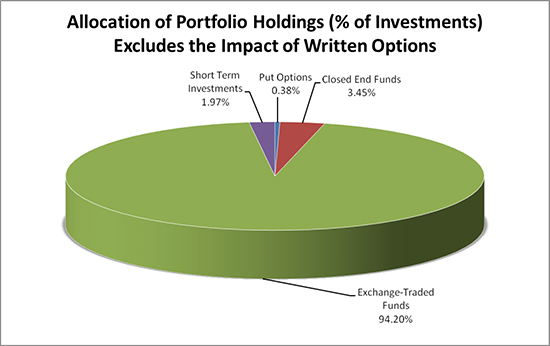

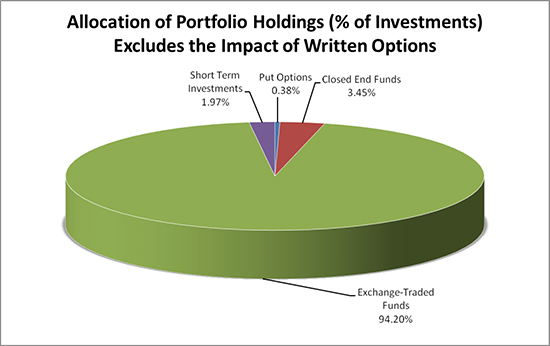

The investment objective of the WP Income Plus Fund (the “Fund” or “Income Fund”) is total return. The Income Fund seeks to meet its investment objective by investing approximately 80% in unaffiliated open- and closed-end mutual funds and exchange-traded funds that primarily invest in fixed-income securities (“Underlying Bond Funds”). The principal types of fixed-income securities in which the Underlying Bond Funds invest are bonds, U.S. Treasury and agency securities, and mortgage-backed and asset-backed securities. The Underlying Bond Funds may invest in fixed income securities of any credit or maturity. The Underlying Bond Funds’ investments in securities rated below investment-grade are also known as “junk bonds” and are speculative in nature. The Income Fund seeks to produce income through yield on the Underlying Bond Funds. The Income Fund also seeks to produce income (e.g., premium income on the sale of an option) and total return through an options strategy.

The Adviser will generally buy and sell options linked to either the Markit iBoxx USD Liquid High Yield Index or the S&P 500® Index. The portfolio managers will strategically allocate the Income Fund’s resources to the Underlying Bond Funds and the options strategy as the portfolio managers deem appropriate to perform well over a market cycle.

The Income Fund may also sell put options on ETFs that the portfolio managers believe are attractive for purchase at prices at or above the exercise price of the put options sold. The Adviser generally will sell put options to increase the total return component of the options strategy described in the Fund’s investment objective. The Income Fund may, in certain circumstances, purchase put options on the S&P 500® Index (or another broad-based securities index deemed suitable for this purpose) to protect against a loss of principal value due to stock price decline. The Adviser generally purchases put options to protect the total return component of the options strategy described in the Fund’s investment objective. The extent of option selling or purchasing activity will, again, depend upon market conditions and the portfolio managers’ assessment of the advantages of selling index call options, purchasing index put options and selling put options on individual stocks.

The Income Fund may be appropriate for investors with long-term time horizons who are not sensitive to short-term losses and want to participate in the long-term growth of the financial markets.

The percentages in the above graph are based on the portfolio holdings of the Fund as of November 30, 2018 and are subject to change. For a detailed break-out of holdings by investment type, please refer to the Schedules of Investments and Options Purchased.

WP Income Plus Fund

INVESTMENT HIGHLIGHTS

November 30, 2018 (Unaudited)

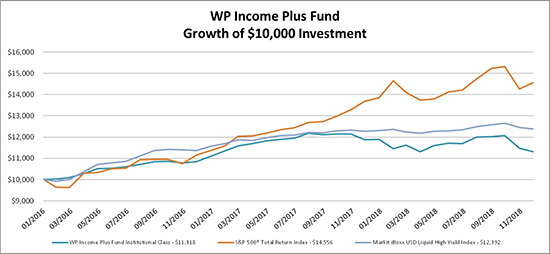

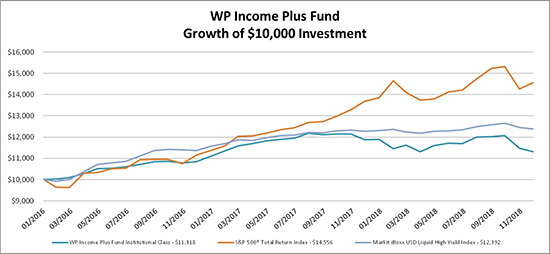

Average Annual Total Returns as of November 30, 2018 | | One Year ended November 30, 2018 | | Since Inception from January 4, 2016 through November 30, 2018 |

| WP Income Plus Fund Institutional Class shares | | (4.69)% | | 4.35% |

| S&P 500® Total Return Index | | 6.27% | | 13.79% |

| Markit iBoxx USD Liquid High Yield Index | | 0.89% | | 7.66% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the WP Income Plus Fund versus the S&P 500® Total Return Index and the Markit iBoxx USD Liquid High Yield Index. The S&P 500® Total Return Index is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Markit iBoxx USD Liquid High Yield Index consists of liquid USD high yield bonds, selected to provide a balanced representation of the broad USD high yield corporate bond universe. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500® Total Return Index and the Markit iBoxx USD Liquid High Yield Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indexes; so too with the WP Income Plus Fund, which will generally not invest in all the securities comprising each index.

WP Large Cap Income Plus Fund

INVESTMENT HIGHLIGHTS

November 30, 2018 (Unaudited)

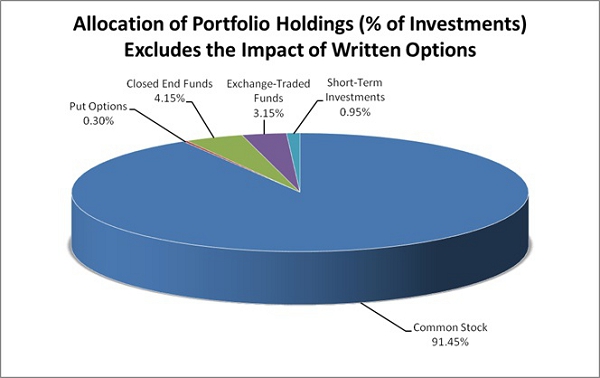

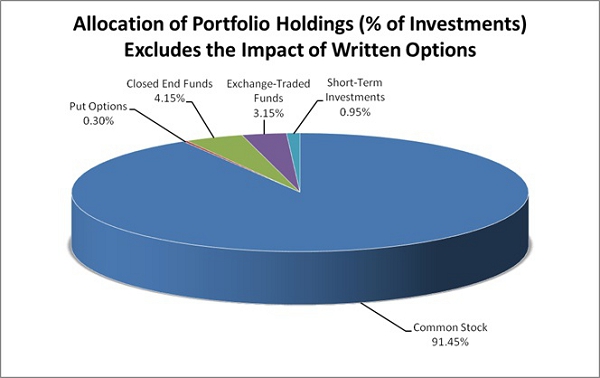

The investment objective of the WP Large Cap Income Plus Fund (the “Fund”) is total return. To meet its investment objective, the Fund will invest 80% of its total assets in large cap domestic equity securities and exchange-traded funds (“ETFs”) that primarily invest in large cap domestic equity securities. The Fund will seek income through dividends paid on such securities. The Fund will also seek to produce income (e.g., premium income on the sale of an option) and return stability through an options strategy.

Winning Points Advisers, LLC (the “Adviser”), the investment adviser to the Fund, intends to sell covered call options on a portion of the Fund’s stock holdings. The extent of option selling will depend on market conditions and the Adviser’s consideration of the advantages of selling call options on the Fund’s equity investments.

The Fund may also sell put options on stocks and ETFs the Adviser believes are attractive for purchase at prices at or above the exercise price of the put options sold. The Fund may, in certain circumstances, purchase put options on the S&P 500® Composite Stock Price Index (the “S&P 500”) and on individual stocks to protect against a loss of principal value due to stock price decline. The extent of option selling depends on market conditions and the Adviser’s judgment. The Fund may also seek to pursue its investment objective by selling a series of call and put option spread combinations on the S&P 500.

The Fund may be appropriate for investors with long-term horizons who are not sensitive to short-term losses and want to participate in the long-term growth of the financial markets. The Fund seeks to minimize the effects of inflation on its portfolio.

The percentages in the above graph are based on the portfolio holdings of the Fund as of November 30, 2018 and are subject to change. For a detailed break-out of holdings by investment type, please refer to the Schedules of Investments and Options Purchased.

WP Large Cap Income Plus Fund

INVESTMENT HIGHLIGHTS

November 30, 2018 (Unaudited)

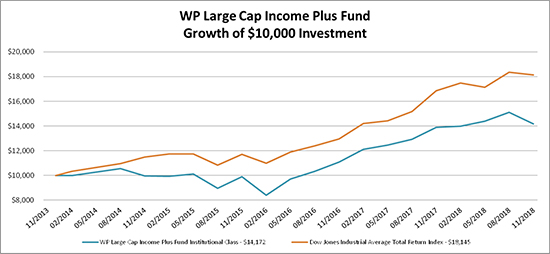

Average Annual Total Returns as of November 30, 2018 | One Year ended November 30, 2018 | Since Inception from December 4, 2013 through November 30, 2018 |

| WP Large Cap Income Plus Fund Institutional Class shares | 2.11% | 7.24% |

| Dow Jones Industrial Average Total Return Index | 7.62% | 12.68% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the WP Large Cap Income Plus Fund versus the Dow Jones Industrial Average Total Return Index. The Dow Jones Industrial Total Return Average Index is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Dow Jones Industrial Average Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the WP Large Cap Income Plus Fund, which will generally not invest in all the securities comprising the index.

| WP TRUST | |

| WP SMALLER COMPANIES INCOME PLUS FUND | |

| SCHEDULE OF INVESTMENTS | |

| November 30, 2018 | ANNUAL REPORT |

| | | Shares | | | Fair Value | |

| | | | | | | |

| COMMON STOCKS - 10.24% | | | | | | |

| | | | | | | |

| Healthcare - Services - 9.65% | | | | | | | | |

| Catasys, Inc. (a) (b) | | | 66,000 | | | $ | 772,860 | |

| | | | | | | | | |

| Pharmaceuticals - 0.08% | | | | | | | | |

| Titan Pharmaceuticals, Inc. (a) (b) | | | 20,000 | | | | 6,606 | |

| | | | | | | | | |

| Products - 0.51% | | | | | | | | |

| Alphatec Holdings, Inc. (a) (b) | | | 15,000 | | | | 40,650 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS (Cost $417,014) | | | | | | | 820,116 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUND - 100.01% | | | | | | | | |

| | | | | | | | | |

| Equity Fund - 100.01% | | | | | | | | |

| iShares Russell 2000 ETF (a) | | | 52,500 | | | | 8,012,550 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUND (Cost $6,824,538) | | | | | | | 8,012,550 | |

| | | | | | | | | |

| OPTIONS PURCHASED (Cost $59,008) - 0.37% (c) | | | | | | | 29,375 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT - 3.13% | | | | | | | | |

| Federated Government Obligations Fund - Institutional Class, 2.08% (d) | | | 251,034 | | | | 251,034 | |

| TOTAL SHORT-TERM INVESTMENT (Cost $251,034) | | | | | | | 251,034 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $7,551,594) – 113.75% | | | | | | $ | 9,113,075 | |

| | | | | | | | | |

| OPTIONS WRITTEN (Proceeds $881,453) - (14.67%) (e) | | | | | | | (1,175,120 | ) |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 0.92% | | | | | | | 73,882 | |

| | | | | | | | | |

| NET ASSETS - 100% | | | | | | $ | 8,011,837 | |

| (a) | All or a portion of the security is segregated as collateral for options written. |

| (b) | Non-income producing security. |

| (c) | Please refer to the Schedule of Options Purchased for details of options purchased. |

| (d) | Rate shown represents the 7-day effective yield at November 30, 2018, is subject to change and resets daily. |

| (e) | Please refer to the Schedule of Options Written for details of options written. |

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| WP SMALLER COMPANIES INCOME PLUS FUND | |

| SCHEDULE OF OPTIONS PURCHASED | |

| November 30, 2018 | ANNUAL REPORT |

OPTIONS PURCHASED - 0.37%

| PUT OPTIONS PURCHASED - 0.37% | | | | | Notional | | | Exercise | | | | | | | |

| | | Contracts1 | | | Amount | | | Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 94 | | | $ | 21,150,000 | | | $ | 2,250.00 | | | | 12/28/2018 | | | $ | 9,400 | |

| CBOE S&P 500 Index | | | 94 | | | $ | 19,975,000 | | | $ | 2,125.00 | | | | 1/25/2019 | | | | 19,975 | |

| TOTAL PUT OPTIONS PURCHASED (Cost $59,008) | | | | | | | | | | | | | | | | | | | 29,375 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS PURCHASED (Cost $59,008) | | | | | | | | | | | | | | | | | | $ | 29,375 | |

| 1 | Each option contract is equivalent to 100 units of the underlying Index. |

All options are non-income producing.

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| WP SMALLER COMPANIES INCOME PLUS FUND | |

| SCHEDULE OF OPTIONS WRITTEN | |

| November 30, 2018 | ANNUAL REPORT |

OPTIONS WRITTEN - (14.67)%

| | | | | | Notional | | | Exercise | | | | | | | |

| CALL OPTIONS WRITTEN - (2.04)% | | Contracts1 | | | Amount | | | Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 11 | | | $ | 3,382,500 | | | $ | 3,075.00 | | | | 12/18/2020 | | | $ | 163,680 | |

| TOTAL CALL OPTIONS WRITTEN (Proceeds $253,503) | | | | | | | | | | | | | | | | | | | 163,680 | |

| | | | | | | | | | | | | | | | | | | | | |

| PUT OPTIONS WRITTEN - (12.63)% | | | | | | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 94 | | | $ | 23,500,000 | | | $ | 2,500.00 | | | | 12/20/2019 | | | | 1,011,440 | |

| TOTAL PUT OPTIONS WRITTEN (Proceeds $627,950) | | | | | | | | | | | | | | | | | | | 1,011,440 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS WRITTEN (Proceeds $881,453) | | | | | | | | | | | | | | | | | | $ | 1,175,120 | |

| 1 | Each option contract is equivalent to 100 units of the underlying Index. |

All options are non-income producing.

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| WP INTERNATIONAL COMPANIES INCOME PLUS FUND | |

| SCHEDULE OF INVESTMENTS | |

| November 30, 2018 | ANNUAL REPORT |

| | | | | | | |

| EXCHANGE-TRADED FUNDS- 112.97% | | Shares | | | Fair Value | |

| | | | | | | |

| Equity Funds - 112.97% | | | | | | | | |

| iShares MSCI EAFE ETF (a) | | | 148,500 | | | $ | 9,321,345 | |

| WisdomTree Emerging Markets SmallCap Dividend Fund (a) | | | 9,850 | | | | 426,308 | |

| WisdomTree International SmallCap Dividend Fund (a) | | | 6,216 | | | | 404,972 | |

| | | | | | | | 10,152,625 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS (Cost $9,819,039) | | | | | | | 10,152,625 | |

| | | | | | | | | |

| OPTIONS PURCHASED (Cost $69,051) - 0.38% (b) | | | | | | | 34,375 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT - 1.38% | | | | | | | | |

| Federated Government Obligations Fund - Institutional Class, 2.08% (c) | | | 124,198 | | | | 124,198 | |

| TOTAL SHORT-TERM INVESTMENT (Cost $124,198) | | | | | | | 124,198 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $10,012,288) – 114.73% | | | | | | $ | 10,311,198 | |

| | | | | | | | | |

| OPTIONS WRITTEN (Proceeds $1,150,192) - (16.15%) (d) | | | | | | | (1,451,440 | ) |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 1.42% | | | | | | | 127,731 | |

| | | | | | | | | |

| NET ASSETS - 100% | | | | | | $ | 8,987,489 | |

| (a) | All or a portion of the security is segregated as collateral for options written. |

| (b) | Please refer to the Schedule of Options Purchased for details of options purchased. |

| (c) | Rate shown represents the 7-day effective yield at November 30, 2018, is subject to change and resets daily. |

| (d) | Please refer to the Schedule of Options Written for details of options written. |

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| WP INTERNATIONAL COMPANIES INCOME PLUS FUND | |

| SCHEDULE OF OPTIONS PURCHASED | |

| November 30, 2018 | ANNUAL REPORT |

| | | | | | | | | | | | | | | | |

| OPTIONS PURCHASED - 0.38% | | | | | | | | | | | | | | | |

| | | | | | Notional | | | Exercise | | | | | | | |

| PUT OPTIONS PURCHASED - 0.38% | | Contracts1 | | | Amount | | | Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 110 | | | $ | 24,750,000 | | | $ | 2,250.00 | | | | 12/28/2018 | | | $ | 11,000 | |

| CBOE S&P 500 Index | | | 110 | | | $ | 23,375,000 | | | $ | 2,125.00 | | | | 1/25/2019 | | | | 23,375 | |

| TOTAL PUT OPTIONS PURCHASED (Cost $69,051) | | | | | | | | | | | | | | | | | | | 34,375 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS PURCHASED (Cost $69,051) | | | | | | | | | | | | | | | | | | $ | 34,375 | |

| 1 | Each option contract is equivalent to 100 units of the underlying Index. |

All options are non-income producing.

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| WP INTERNATIONAL COMPANIES INCOME PLUS FUND | |

| SCHEDULE OF OPTIONS WRITTEN | |

| November 30, 2018 | ANNUAL REPORT |

| OPTIONS WRITTEN - (16.15)% | | | | | | | | | | | | | | | |

| | | | | | Notional | | | Exercise | | | | | | | |

| CALL OPTIONS WRITTEN - (2.98)% | | Contracts1 | | | Amount | | | Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 18 | | | $ | 5,535,000 | | | $ | 3,075.00 | | | | 12/18/2020 | | | | 267,840 | |

| TOTAL CALL OPTIONS WRITTEN (Proceeds $414,824) | | | | | | | | | | | | | | | | | | | 267,840 | |

| | | | | | | | | | | | | | | | | | | | | |

| PUT OPTIONS WRITTEN - (13.17)% | | | | | | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 110 | | | $ | 27,500,000 | | | $ | 2,500.00 | | | | 12/20/2019 | | | | 1,183,600 | |

| TOTAL PUT OPTIONS WRITTEN (Proceeds $735,368) | | | | | | | | | | | | | | | | | | | 1,183,600 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS WRITTEN (Proceeds $1,150,192) | | | | | | | | | | | | | | | | | | $ | 1,451,440 | |

| 1 | Each option contract is equivalent to 100 units of the underlying Index. |

All options are non-income producing.

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| WP INCOME PLUS FUND | |

| SCHEDULE OF INVESTMENTS | |

| November 30, 2018 | ANNUAL REPORT |

| | | | | | | |

| EXCHANGE-TRADED FUNDS - 109.72% | | Shares | | | Fair Value | |

| | | | | | | |

| Debt Fund - 109.72% | | | | | | | | |

| iShares iBoxx $ High Yield Corporate Bond ETF (a) | | | 127,400 | | | $ | 10,650,640 | |

| SPDR Bloomberg Barclays High Yield Bond ETF (a) | | | 181,000 | | | | 6,286,130 | |

| | | | | | | | 16,936,770 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS (Cost $17,461,002) | | | | | | | 16,936,770 | |

| | | | | | | | | |

| CLOSED END FUND- 4.01% | | | | | | | | |

| | | | | | | | | |

| Closed End Fund - 4.01% | | | | | | | | |

| Alpine Total Dynamic Dividend Fund (a) | | | 76,400 | | | | 619,604 | |

| | | | | | | | | |

| TOTAL CLOSED END FUND (Cost $604,676) | | | | | | | 619,604 | |

| | | | | | | | | |

| OPTIONS PURCHASED (Cost $138,102) - 0.45% (b) | | | | | | | 68,750 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT - 2.29% | | | | | | | | |

| Federated Government Obligations Fund - Institutional Class, 2.08% (c) | | | 354,052 | | | | 354,052 | |

| TOTAL SHORT-TERM INVESTMENT (Cost $354,052) | | | | | | | 354,052 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $18,557,832) – 116.47% | | | | | | $ | 17,979,176 | |

| | | | | | | | | |

| OPTIONS WRITTEN (Proceeds $2,027,601) - (16.15%) (d) | | | | | | | (2,492,900 | ) |

| | | | | | | | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (0.32)% | | | | | | | (49,300 | ) |

| | | | | | | | | |

| NET ASSETS - 100% | | | | | | $ | 15,436,976 | |

| (a) | All or a portion of the security is segregated as collateral for options written. |

| (b) | Please refer to the Schedule of Options Purchased for details of options purchased. |

| (c) | Rate shown represents the 7-day effective yield at November 30, 2018, is subject to change and resets daily. |

| (d) | Please refer to the Schedule of Options Written for details of options written. |

The accompanying notes are an integral part of these financial statements.

WP TRUST

WP INCOME PLUS FUND

SCHEDULE OF OPTIONS PURCHASED

| November 30, 2018 | ANNUAL REPORT |

| OPTIONS PURCHASED - 0.45% | | | | | | | | | | | | | | | |

| | | | | | Notional | | | Exercise | | | | | | | |

| PUT OPTIONS PURCHASED - 0.45% | | Contracts 1 | | | Amount | | | Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 220 | | | $ | 49,500,000 | | | $ | 2,250.00 | | | | 12/28/2018 | | | $ | 46,750 | |

| CBOE S&P 500 Index | | | 220 | | | $ | 46,750,000 | | | $ | 2,125.00 | | | | 1/25/2019 | | | | 22,000 | |

| TOTAL PUT OPTIONS PURCHASED (Cost $138,102) | | | | | | | | | | | | | | | | | | | 68,750 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS PURCHASED (Cost $138,102) | | | | | | | | | | | | | | | | | | $ | 68,750 | |

| 1 | Each option contract is equivalent to 100 units of the underlying Index. |

All options are non-income producing.

The accompanying notes are an integral part of these financial statements.

WP TRUST

WP INCOME PLUS FUND

SCHEDULE OF OPTIONS WRITTEN

| November 30, 2018 | ANNUAL REPORT |

| OPTIONS WRITTEN - (16.15)% | | | | | | | | | | | | | | | |

| | | | | | Notional | | | Exercise | | | | | | | |

| CALL OPTIONS WRITTEN - (3.32)% | | Contracts 1 | | | Amount | | | Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 10 | | | $ | 3,175,000 | | | $ | 3,175.00 | | | | 12/20/2019 | | | $ | 36,900 | |

| CBOE S&P 500 Index | | | 32 | | | $ | 9,840,000 | | | $ | 3,075.00 | | | | 12/18/2020 | | | | 476,160 | |

| TOTAL CALL OPTIONS WRITTEN (Proceeds $798,047) | | | | | | | | | | | | | | | | | | | 513,060 | |

| | | | | | | | | | | | | | | | | | | | | |

| PUT OPTIONS WRITTEN - (12.83)% | | | | | | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 184 | | | $ | 46,000,000 | | | $ | 2,500.00 | | | | 12/20/2019 | | | | 1,979,840 | |

| TOTAL PUT OPTIONS WRITTEN (Proceeds $1,229,554) | | | | | | | | | | | | | | | | | | | 1,979,840 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS WRITTEN (Proceeds $2,027,601) | | | | | | | | | | | | | | | | | | $ | 2,492,900 | |

| 1 | Each option contract is equivalent to 100 units of the underlying Index. |

All options are non-income producing.

The accompanying notes are an integral part of these financial statements.

WP TRUST

WP LARGE CAP INCOME PLUS FUND

SCHEDULE OF INVESTMENTS

| November 30, 2018 | ANNUAL REPORT |

| COMMON STOCKS - 105.28% | | Shares | | | Fair Value | |

| | | | | | | |

| Aerospace & Defense - 3.64% | | | | | | | | |

| Lockheed Martin Corp. (b) | | | 4,200 | | | $ | 1,261,806 | |

| | | | | | | | | |

| Agriculture - 2.84% | | | | | | | | |

| Altria Group, Inc. (b) | | | 15,400 | | | | 844,382 | |

| Archer-Daniels-Midland Co. (b) | | | 3,000 | | | | 138,060 | |

| | | | | | | | 982,442 | |

| Banks - 22.81% | | | | | | | | |

| Bank of America Corp. (b) | | | 69,000 | | | | 1,959,600 | |

| BB&T Corp. (b) | | | 4,900 | | | | 250,390 | |

| Citigroup, Inc. (b) | | | 21,000 | | | | 1,360,590 | |

| Goldman Sachs Group, Inc. (b) | | | 2,600 | | | | 495,794 | |

| JPMorgan Chase & Co. (b) | | | 17,200 | | | | 1,912,468 | |

| Lloyds Banking Group PLC - ADR (b) | | | 58,000 | | | | 164,140 | |

| PNC Financial Services Group, Inc. (b) | | | 2,300 | | | | 312,294 | |

| Wells Fargo & Co. (b) | | | 26,600 | | | | 1,443,848 | |

| | | | | | | | 7,899,124 | |

| Beverages - 4.92% | | | | | | | | |

| Diageo PLC - ADR (b) | | | 5,800 | | | | 837,230 | |

| PepsiCo, Inc. (b) | | | 7,100 | | | | 865,774 | |

| | | | | | | | 1,703,004 | |

| Biotechnology - 0.50% | | | | | | | | |

| Biogen, Inc. (a) (b) | | | 300 | | | | 100,116 | |

| Gilead Sciences, Inc. (b) | | | 1,000 | | | | 71,940 | |

| | | | | | | | 172,056 | |

| Building Materials - 0.20% | | | | | | | | |

| Johnson Controls International PLC (b) | | | 2,000 | | | | 69,560 | |

| | | | | | | | | |

| Computers - 7.22% | | | | | | | | |

| Apple, Inc. (b) | | | 10,500 | | | | 1,875,090 | |

| International Business Machines Corp. (b) | | | 4,700 | | | | 584,069 | |

| Leidos Holdings, Inc. (b) | | | 665 | | | | 41,895 | |

| | | | | | | | 2,501,054 | |

| Diversified Financial Services - 3.83% | | | | | | | | |

| BlackRock, Inc. (b) | | | 3,100 | | | | 1,326,831 | |

| | | | | | | | | |

| Food - 3.52% | | | | | | | | |

| Sysco Corp. (b) | | | 18,100 | | | | 1,219,940 | |

| | | | | | | | | |

| Healthcare - Products - 1.80% | | | | | | | | |

| Baxter International, Inc. (b) | | | 9,100 | | | | 623,805 | |

| | | | | | | | | |

| Healthcare - Services - 3.81% | | | | | | | | |

| Catasys, Inc. (a) (b) | | | 112,600 | | | | 1,318,546 | |

| | | | | | | | | |

| Insurance - 4.44% | | | | | | | | |

| Allianz SE - ADR (b) | | | 1,400 | | | | 29,582 | |

| Berkshire Hathaway, Inc. - Class B (a) (b) | | | 6,900 | | | | 1,505,856 | |

| | | | | | | | 1,535,438 | |

| Internet - 0.78% | | | | | | | | |

| Alibaba Group Holding Ltd. - ADR (a) (b) | | | 800 | | | | 128,688 | |

| Facebook, Inc. - Class A (a) (b) | | | 1,000 | | | | 140,610 | |

| | | | | | | | 269,298 | |

| Investment Companies - 0.19% | | | | | | | | |

| Ares Capital Corp. (b) | | | 2,300 | | | | 39,192 | |

| BlackRock Capital Investment Corp. (b) | | | 4,500 | | | | 26,370 | |

| | | | | | | | 65,562 | |

WP TRUST

WP LARGE CAP INCOME PLUS FUND

SCHEDULE OF INVESTMENTS

| November 30, 2018 | ANNUAL REPORT |

| COMMON STOCKS - 105.28% (Continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Lodging - 0.39% | | | | | | | | |

| MGM Resorts International (b) | | | 5,000 | | | $ | 134,800 | |

| | | | | | | | | |

| Media - 1.13% | | | | | | | | |

| Comcast Corp. - Class A (b) | | | 10,000 | | | | 390,100 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 0.15% | | | | | | | | |

| General Electric Co. (b) | | | 7,000 | | | | 52,500 | |

| | | | | | | | | |

| Oil & Gas - 16.66% | | | | | | | | |

| BP PLC - ADR (b) | | | 36,200 | | | | 1,460,670 | |

| Chevron Corp. (b) | | | 8,900 | | | | 1,058,566 | |

| China Petroleum & Chemical Corp. - ADR (b) | | | 5,500 | | | | 469,370 | |

| ConocoPhillips (b) | | | 18,000 | | | | 1,191,240 | |

| Exxon Mobil Corp. (b) | | | 20,000 | | | | 1,590,000 | |

| | | | | | | | 5,769,846 | |

| Pharmaceuticals - 1.01% | | | | | | | | |

| AstraZeneca PLC - ADR (b) | | | 2,800 | | | | 111,496 | |

| Pfizer, Inc. (b) | | | 5,000 | | | | 231,150 | |

| Titan Pharmaceuticals, Inc. (a) (b) | | | 22,000 | | | | 7,267 | |

| | | | | | | | 349,913 | |

| Retail - 10.79% | | | | | | | | |

| McDonald’s Corp. (b) | | | 10,800 | | | | 2,035,908 | |

| Target Corp. (b) | | | 8,800 | | | | 624,448 | |

| Walmart, Inc. (b) | | | 11,000 | | | | 1,074,150 | |

| | | | | | | | 3,734,506 | |

| Semiconductors - 4.75% | | | | | | | | |

| Intel Corp. (b) | | | 32,000 | | | | 1,577,920 | |

| Skyworks Solutions, Inc. (b) | | | 900 | | | | 65,493 | |

| | | | | | | | 1,643,413 | |

| Software - 7.33% | | | | | | | | |

| Microsoft Corp. (b) | | | 22,900 | | | | 2,539,381 | |

| | | | | | | | | |

| Telecommunications - 2.57% | | | | | | | | |

| China Mobile Ltd. - ADR (b) | | | 17,900 | | | | 890,346 | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL COMMON STOCKS (Cost $26,963,090) | | | | | | | 36,453,271 | |

| | | | | | | | | |

| CLOSED-END FUNDS - 4.78% | | | | | | | | |

| Aberdeen Emerging Markets Equity, Income Fund, Inc. (b) | | | 3,363 | | | | 22,532 | |

| Aberdeen Total Dynamic Dividend Fund (b) | | | 30,000 | | | | 243,300 | |

| Boulder Growth & Income Fund, Inc. (b) | | | 97,000 | | | | 1,075,730 | |

| Special Opportunities Fund, Inc. (b) | | | 22,185 | | | | 313,474 | |

| | | | | | | | | |

| TOTAL CLOSED-END FUNDS (Cost $1,343,780) | | | | | | | 1,655,036 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS - 3.63% | | | | | | | | |

| | | | | | | | | |

| Equity Funds - 3.63% | | | | | | | | |

| iShares MSCI EAFE ETF (b) | | | 10,200 | | | | 640,254 | |

| iShares U.S. Financial Services ETF (b) | | | 4,800 | | | | 617,040 | |

| | | | | | | | 1,257,294 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS (Cost $1,041,345) | | | | | | | 1,257,294 | |

WP TRUST

WP LARGE CAP INCOME PLUS FUND

SCHEDULE OF INVESTMENTS

| November 30, 2018 | ANNUAL REPORT |

| | | Shares | | | Fair Value | |

| | | | | | | |

| OPTIONS PURCHASED (Cost $242,106) - 0.35% (c) | | | | | | $ | 120,625 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT - 1.09% | | | | | | | | |

| Federated Government Obligations Fund - Institutional Shares, 2.08% (d) | | | 376,615 | | | | 376,615 | |

| TOTAL SHORT-TERM INVESTMENT (Cost $376,615) | | | | | | | 376,615 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $29,966,936) – 115.13% | | | | | | $ | 39,862,841 | |

| | | | | | | | | |

| OPTIONS WRITTEN (Proceeds $5,194,224) - (16.67)% (e) | | | | | | | (5,771,340 | ) |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 1.54% | | | | | | | 534,391 | |

| | | | | | | | | |

| NET ASSETS - 100% | | | | | | $ | 34,625,892 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is segregated as collateral for options written. |

| (c) | Please refer to the Schedule of Options Purchased for details of options purchased. |

| (d) | Rate shown represents the 7-day effective yield at November 30, 2018, is subject to change and resets daily. |

| (e) | Please refer to the Schedule of Options Written for details of options written. |

ADR - American Depositary Receipt.

ETF - Exchange-Traded Fund

PLC - Public Limited Company

The accompanying notes are an integral part of these financial statements.

WP TRUST

WP LARGE CAP INCOME PLUS FUND

SCHEDULE OF OPTIONS PURCHASED

| November 30, 2018 | ANNUAL REPORT |

| OPTIONS PURCHASED - 0.35% | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| PUT OPTIONS PURCHASED - 0.35% | | | | | Notional | | | Exercise | | | | | | | |

| | | Contracts 1 | | | Amount | | | Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 386 | | | $ | 86,850,000 | | | $ | 2,250.00 | | | | 12/28/2018 | | | $ | 38,600 | |

| CBOE S&P 500 Index | | | 386 | | | $ | 82,025,000 | | | $ | 2,125.00 | | | | 1/25/2019 | | | | 82,025 | |

| TOTAL PUT OPTIONS PURCHASED (Cost $242,106) | | | | | | | | | | | | | | | | | | | 120,625 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS PURCHASED (Cost $242,106) | | | | | | | | | | | | | | | | | | $ | 120,625 | |

| 1 | Each option contract is equivalent to 100 units of the underlying index. |

All options are non-income producing.

The accompanying notes are an integral part of these financial statements.

WP TRUST

WP LARGE CAP INCOME PLUS FUND

SCHEDULE OF OPTIONS WRITTEN

| November 30, 2018 | ANNUAL REPORT |

| OPTIONS WRITTEN - (16.67)% | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| CALL OPTIONS WRITTEN - (4.67)% | | | | | Notional | | | Exercise | | | | | | | |

| | | Contracts 1 | | | Amount | | | Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 1 | | | $ | 307,500 | | | $ | 3,075.00 | | | | 12/18/2020 | | | $ | 14,880 | |

| CBOE S&P 500 Index | | | 115 | | | $ | 35,650,000 | | | $ | 3,100.00 | | | | 12/18/2020 | | | | 1,603,100 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL CALL OPTIONS WRITTEN (Proceeds $2,501,020) | | | | | | | | | | | | | | �� | | | | | 1,617,980 | |

| PUT OPTIONS WRITTEN - (12.00%) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| CBOE S&P 500 Index | | | 386 | | | $ | 96,500,000 | | | $ | 2,500.00 | | | | 12/20/2019 | | | | 4,153,360 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL PUT OPTIONS WRITTEN (Proceeds $2,693,204) | | | | | | | | | | | | | | | | | | | 4,153,360 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS WRITTEN (Proceeds $5,194,224) | | | | | | | | | | | | | | | | | | $ | 5,771,340 | |

| 1 | Each option contract is equivalent to 100 units of the underlying index. |

All options are non-income producing.

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| | |

| STATEMENTS OF ASSETS AND LIABILITIES | |

| | |

| November 30, 2018 | ANNUAL REPORT |

| | | WP Smaller Companies

Income Plus Fund | | | WP International Companies

Income Plus Fund | | | WP Income Plus Fund | | | WP Large Cap

Income Plus Fund | |

| Assets: | | | | | | | | | | | | |

| Investments, at cost | | $ | 7,551,594 | | | $ | 10,012,288 | | | $ | 18,557,832 | | | $ | 29,966,936 | |

| Investments, at value | | | 9,113,075 | | | | 10,311,198 | | | | 17,979,176 | | | | 39,862,841 | |

| Deposits at broker for written options | | | 107,690 | | | | 161,872 | | | | 79 | | | | 491,400 | |

| Expense reimbursement due from administrator | | | — | | | | — | | | | 4,792 | | | | — | |

| Receivables: | | | | | | | | | | | | | | | | |

| Interest | | | 457 | | | | 257 | | | | 552 | | | | 570 | |

| Dividends | | | — | | | | — | | | | — | | | | 129,132 | |

| Prepaid expenses | | | 3,153 | | | | 3,509 | | | | 3,153 | | | | 7,393 | |

| Total assets | | | 9,224,375 | | | | 10,476,836 | | | | 17,987,752 | | | | 40,491,336 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Options written, at proceeds | | $ | 881,453 | | | $ | 1,150,192 | | | $ | 2,027,601 | | | $ | 5,194,224 | |

| Options written, at value | | | 1,175,120 | | | | 1,451,440 | | | | 2,492,900 | | | | 5,771,340 | |

| Payables: | | | | | | | | | | | | | | | | |

| Fund shares redeemed | | | — | | | | — | | | | 8,300 | | | | 8,000 | |

| Due to adviser, net | | | 6,428 | | | | 7,113 | | | | 17,365 | | | | 37,953 | |

| Accrued distribution (12b-1) fees | | | 4,704 | | | | 3,631 | | | | 7,756 | | | | 15,453 | |

| Due to administrator | | | 5,284 | | | | 5,610 | | | | — | | | | 10,574 | |

| Accrued expenses | | | 21,002 | | | | 21,553 | | | | 24,455 | | | | 22,124 | |

| Total liabilities | | | 1,212,538 | | | | 1,489,347 | | | | 2,550,776 | | | | 5,865,444 | |

| Net Assets | | $ | 8,011,837 | | | $ | 8,987,489 | | | $ | 15,436,976 | | | $ | 34,625,892 | |

| | | | | | | | | | | | | | | | | |

| Sources of Net Assets: | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 6,984,977 | | | | 8,970,090 | | | $ | 16,519,777 | | | $ | 26,016,053 | |

| Total distributable earnings | | | 1,026,860 | | | | 17,399 | | | | (1,082,801 | ) | | | 8,609,839 | |

Total Net Assets (Unlimited shares of beneficial

interest authorized) | | $ | 8,011,837 | | | $ | 8,987,489 | | | $ | 15,436,976 | | | $ | 34,625,892 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Institutional Class Shares: | | | | | | | | | | | | | | | | |

| Net assets | | $ | 8,011,837 | | | $ | 8,987,489 | | | $ | 15,436,976 | | | $ | 34,625,892 | |

Shares Outstanding (Unlimited shares of beneficial

interest authorized) | | | 601,757 | | | | 822,506 | | | | 1,535,192 | | | | 2,515,002 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 13.31 | | | $ | 10.93 | | | $ | 10.06 | | | $ | 13.77 | |

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| | |

| STATEMENTS OF OPERATIONS | |

| | |

| November 30, 2018 | ANNUAL REPORT |

| | | | | | | | | | | | | |

| | | WP Smaller Companies

Income Plus Fund | | | WP International Companies

Income Plus Fund | | | WP Income

Plus Fund | | | WP Large Cap

Income Plus Fund | |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | | | Year Ended | |

| | | November 30, 2018 | | | November 30, 2018 | | | November 30, 2018 | | | November 30, 2018(a) | | | August 31, 2018 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment income: | | | | | | | | | | | | | | | | | | | | |

| Dividends (net of foreign withholding taxes of $0, $0, $0, $328 and $6,283, respectively) | | $ | 84,722 | | | $ | 298,029 | | | $ | 911,385 | | | $ | 258,399 | | | $ | 929,751 | |

| Interest | | | 6,159 | | | | 5,000 | | | | 4,306 | | | | 3,582 | | | | 7,470 | |

| Total investment income | | | 90,881 | | | | 303,029 | | | | 915,691 | | | | 261,981 | | | | 937,221 | |

| | | | | | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | | | |

| Management fees (Note 5) | | | 96,470 | | | | 126,705 | | | | 206,174 | | | | 119,560 | | | | 450,919 | |

| Distribution (12b-1) fees - Institutional Class | | | 17,865 | | | | 23,464 | | | | 38,180 | | | | 22,141 | | | | 83,504 | |

| Accounting and transfer agent fees and expenses | | | 35,970 | | | | 42,415 | | | | 57,746 | | | | 32,926 | | | | 130,235 | |

| Audit fees | | | 15,250 | | | | 15,250 | | | | 15,250 | | | | 7,700 | | | | 16,440 | |

| Legal fees | | | 16,272 | | | | 16,789 | | | | 15,758 | | | | 2,910 | | | | 58,507 | |

| Interest expense (b) | | | 28,690 | | | | 38,910 | | | | 68,030 | | | | 42,114 | | | | 110,886 | |

| Trustee fees and expenses | | | 14,199 | | | | 14,199 | | | | 14,199 | | | | 2,561 | | | | 17,065 | |

| Custodian fees | | | 10,348 | | | | 10,349 | | | | 10,349 | | | | 3,235 | | | | 15,780 | |

| Miscellaneous | | | 6,968 | | | | 6,999 | | | | 7,090 | | | | 6,603 | | | | 13,203 | |

| Registration and filing fees | | | 2,767 | | | | 3,208 | | | | 3,252 | | | | 635 | | | | 3,940 | |

| Pricing fees | | | 872 | | | | 876 | | | | 769 | | | | 2,134 | | | | 7,627 | |

| Insurance | | | 1,928 | | | | 1,928 | | | | 1,928 | | | | 584 | | | | 2,046 | |

| Reports to shareholders | | | — | | | | — | | | | — | | | | 67 | | | | 304 | |

| Compliance officer fees | | | 22,000 | | | | 22,000 | | | | 15,228 | | | | — | | | | — | |

| Total expenses | | | 269,599 | | | | 323,092 | | | | 453,953 | | | | 243,170 | | | | 910,456 | |

| Less: fees waived | | | (44,420 | ) | | | (27,465 | ) | | | — | | | | — | | | | — | |

| Net expenses | | | 225,179 | | | | 295,627 | | | | 453,953 | | | | 243,170 | | | | 910,456 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (134,298 | ) | | | 7,402 | | | | 461,738 | | | | 18,811 | | | | 26,765 | |

| | | | | | | | | | | | | | | | | | | | | |

| Realized and unrealized gain (loss): | | | | | | | | | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | | | | | | | | | |

| Investments | | | — | | | | — | | | | (11,597 | ) | | | (18,325 | ) | | | (591,554 | ) |

| Long-term capital gains distributions from other investment companies | | | — | | | | — | | | | — | | | | 16,730 | | | | 49,590 | |

| Options purchased | | | (126,993 | ) | | | (163,979 | ) | | | (336,362 | ) | | | (235,488 | ) | | | (472,364 | ) |

| Options written | | | 199,179 | | | | 226,129 | | | | 318,788 | | | | 282,542 | | | | 318,566 | |

| Net realized gain (loss) on investments and options | | | 72,186 | | | | 62,150 | | | | (29,171 | ) | | | 45,459 | | | | (695,762 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | | | | | |

| Investments | | | 306,718 | | | | (1,139,208 | ) | | | (955,585 | ) | | | (1,682,321 | ) | | | 5,860,047 | |

| Options purchased | | | (30,247 | ) | | | (35,705 | ) | | | (71,460 | ) | | | (13,023 | ) | | | (68,586 | ) |

| Options written | | | (187,480 | ) | | | (130,440 | ) | | | (165,144 | ) | | | (688,251 | ) | | | 85,533 | |

| Net change in unrealized appreciation (depreciation) on investments and options | | | 88,991 | | | | (1,305,353 | ) | | | (1,192,189 | ) | | | (2,383,595 | ) | | | 5,876,994 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net gain (loss) on investments and options | | | 161,177 | | | | (1,243,203 | ) | | | (1,221,360 | ) | | | (2,338,136 | ) | | | 5,181,232 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net increase (decrease) in net assets resulting from operations | | $ | 26,879 | | | $ | (1,235,801 | ) | | $ | (759,622 | ) | | $ | (2,319,325 | ) | | $ | 5,207,997 | |

| (a) | Represents the period from September 1, 2018 through November 30, 2018. The WP Large Cap Income Plus Fund changed its fiscal year end from August 31 to November 30. |

| (b) | Interest expense is incurred with respect to the Funds’ options investment strategy. |

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| | |

| STATEMENTS OF CASH FLOWS | |

| | |

| November 30, 2018 | ANNUAL REPORT |

| | | WP Smaller Companies

Income Plus Fund | | WP International Companies

Income Plus Fund | | WP Income

Plus Fund | | WP Large Cap

Income Plus Fund | |

| | | For the | | For the | | For the | | For the | | For the | |

| | | Year Ended | | Year Ended | | Year Ended | | Period Ended | | Year Ended | |

| | | November 30, 2018 | | November 30, 2018 | | November 30, 2018 | | November 30, 2018(a) | | August 31, 2018 | |

| | | | | | | | | | | | | | | | | |

| Increase (decrease) in cash: | | | | | | | | | | | | | | | | |

| Cash flows from operating activities: | | | | | | | | | | | | | | | | |

| Net increase (decrease) in net assets from operations | | $ | 26,879 | | $ | (1,235,801 | ) | $ | (759,622 | ) | $ | (2,319,325 | ) | $ | 5,207,997 | |

| Adjustments to reconcile net increase (decrease) in net assets from operations to net cash used in operating activities: | | | | | | | | | | | | | | | | |

| Purchase of investments and options | | | (3,368,935 | ) | | (2,800,392 | ) | | (4,900,117 | ) | | (2,366,582 | ) | | (7,309,489 | ) |

| Proceeds from disposition of investments and options | | | 598,246 | | | 871,837 | | | 1,837,879 | | | 1,047,744 | | | 3,709,280 | |

| Purchases/sales of short-term investment securities, net | | | 29,797 | | | 202,299 | | | (39,257 | ) | | (180,057 | ) | | 186,607 | |

| Increase (decrease) in deposits with brokers for options written | | | (5,219 | ) | | 26,563 | | | 166,872 | | | (187,602 | ) | | (303,798 | ) |

| Increase (decrease) in dividends and interest receivable | | | (262 | ) | | (14 | ) | | (325 | ) | | (1,276 | ) | | 27,417 | |

| Increase in prepaid expenses | | | 574 | | | 217 | | | 602 | | | (2,659 | ) | | 64 | |

| Premiums received from options written | | | 6,601,093 | | | 9,600,103 | | | 16,184,055 | | | 8,048,831 | | | 39,538,126 | |

| Payments to cover options written | | | (6,090,803 | ) | | (9,169,034 | ) | | (15,436,800 | ) | | (6,877,370 | ) | | (37,282,722 | ) |

| Increase in accrued distribution (12b-1) fees | | | 2,724 | | | 1,502 | | | 3,064 | | | 949 | | | 6,536 | |

| Increase in expense reimbursement due from administrator | | | — | | | — | | | (4,792 | ) | | — | | | — | |

| Decrease in accrued expenses | | | 10,864 | | | 5,583 | | | 9,279 | | | (12,581 | ) | | 13,743 | |

| Increase in due to broker | | | — | | | — | | | — | | | — | | | (47,034 | ) |

| Net unrealized appreciation (depreciation) on investments and options | | | (88,991 | ) | | 1,305,353 | | | 1,192,189 | | | 2,383,595 | | | (5,876,994 | ) |

| Net realized gain (loss) on investments and options | | | (72,186 | ) | | (62,150 | ) | | 29,171 | | | (28,746 | ) | | 741,176 | |

| Net cash used in operating activities | | | (2,356,219 | ) | | (1,253,934 | ) | | (1,717,802 | ) | | (495,079 | ) | | (1,389,091 | ) |

| | | | | | | | | | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | | | | | | | | | |

| Proceeds from Fund shares sold | | | 2,489,576 | | | 1,714,335 | | | 2,942,676 | | | 911,050 | | | 4,093,289 | |

| Payment on Fund shares redeemed | | | (132,272 | )(b) | | (459,290 | )(c) | | (1,162,599 | )(d) | | (415,971 | ) | | (2,695,904 | )(e) |

| Cash distributions paid | | | (1,085 | ) | | (1,111 | ) | | (62,275 | ) | | — | | | (8,294 | ) |

| Net cash provided from financing activities | | | 2,356,219 | | | 1,253,934 | | | 1,717,802 | | | 495,079 | | | 1,389,091 | |

| | | | | | | | | | | | | | | | | |

| Net increase in cash | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

| Cash: | | | | | | | | | | | | | | | | |

| Beginning of year/period | | | — | | | — | | | — | | | — | | | — | |

| End of year/period | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | |

Supplemental disclosure of cash flow information:

| (a) | Represents the period from September 1, 2018 through November 30, 2018. The WP Large Cap Income Plus Fund changed its fiscal year end from August 31 to November 30. |

| (b) | Noncash financing activities not included herein consist of reinvestment of distributions of $125,808 and a decrease in payable for Fund shares redeemed of $300. |

| (c) | Noncash financing activities not included herein consist of reinvestment of distributions of $229,459 and a decrease in payable for Fund shares redeemed of $300. |

| (d) | Noncash financing activities not included herein consist of reinvestment of distributions of $1,133,995 and an increase in payable for Fund shares redeemed of $8,000. |

| (e) | Noncash financing activities not included herein consist of reinvestment of distributions of $823,099. |

Interest paid by the Funds was $28,690, $38,910, $68,030, $42,114 and $110,886, respectively.

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| | |

| STATEMENTS OF CHANGES IN NET ASSETS | |

| | |

| November 30, 2018 | ANNUAL REPORT |

| | | WP Smaller Companies | |

| | | Income Plus Fund | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | November 30, 2018 | | | November 30, 2017 | |

| Increase (decrease) in net assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment loss | | $ | (134,298 | ) | | $ | (78,294 | ) |

| Net realized gain (loss) on investments and options | | | 72,186 | | | | 156,890 | |

| Net change in unrealized appreciation on investments and options | | | 88,991 | | | | 565,735 | |

| Net increase in net assets resulting from operations | | | 26,879 | | | | 644,331 | |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Total distributable earnings - Institutional Class | | | (126,893 | ) | | | — | |

| Total distributions | | | (126,893 | ) | | | — | |

| | | | | | | | | |

| Capital transactions: | | | | | | | | |

| Net proceeds from shares sold | | | 2,489,576 | | | | 1,889,387 | |

| Reinvestment of distributions | | | 125,808 | | | | — | |

| Cost of shares redeemed | | | (131,972 | ) | | | (237,647 | ) |

| Net increase in net assets from capital transactions | | | 2,483,412 | | | | 1,651,740 | |

| | | | | | | | | |

| Increase in net assets | | | 2,383,398 | | | | 2,296,071 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 5,628,439 | | | | 3,332,368 | |

| | | | | | | | | |

| End of year (a) | | $ | 8,011,837 | | | $ | 5,628,439 | |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Shares sold | | | 179,447 | | | | 152,594 | |

| Shares reinvested | | | 9,700 | | | | — | |

| Shares redeemed | | | (9,824 | ) | | | (19,250 | ) |

| Net increase from capital share transactions | | | 179,323 | | | | 133,344 | |

| (a) | Includes $81,318 of net investment loss for the year ended November 30, 2017. The SEC eliminated the requirement to disclose net investment income in 2018. |

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| | |

| STATEMENTS OF CHANGES IN NET ASSETS | |

| | |

| November 30, 2018 | ANNUAL REPORT |

| | | WP International Companies | |

| | | Income Plus Fund | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | November 30, 2018 | | | November 30, 2017 | |

| Increase (decrease) in net assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment income (loss) | | $ | 7,402 | | | $ | (44,227 | ) |

| Net realized gain (loss) on investments and options | | | 62,150 | | | | 264,219 | |

| Net change in unrealized appreciation (depreciation) on investments and options | | | (1,305,353 | ) | | | 1,233,211 | |

| Net increase (decrease) in net assets resulting from operations | | | (1,235,801 | ) | | | 1,453,203 | |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Total distributable earnings - Institutional Class | | | (230,570 | ) | | | — | |

| Total distributions | | | (230,570 | ) | | | — | |

| | | | | | | | | |

| Capital transactions: | | | | | | | | |

| Net proceeds from shares sold | | | 1,714,335 | | | | 4,626,993 | |

| Reinvestment of distributions | | | 229,459 | | | | — | |

| Cost of shares redeemed | | | (458,990 | ) | | | (336,449 | ) |

| Net increase in net assets from capital transactions | | | 1,484,804 | | | | 4,290,544 | |

| | | | | | | | | |

| Increase in net assets | | | 18,433 | | | | 5,743,747 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 8,969,056 | | | | 3,225,309 | |

| | | | | | | | | |

| End of year (a) | | $ | 8,987,489 | | | $ | 8,969,056 | |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Shares sold | | | 137,779 | | | | 415,049 | |

| Shares reinvested | | | 18,327 | | | | — | |

| Shares redeemed | | | (37,537 | ) | | | (28,597 | ) |

| Net increase from capital share transactions | | | 118,569 | | | | 386,452 | |

| (a) | Includes $63,746 of net investment loss for the year ended November 30, 2017. The SEC eliminated the requirement to disclose net investment income in 2018. |

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| | |

| STATEMENTS OF CHANGES IN NET ASSETS | |

| | |

| November 30, 2018 | ANNUAL REPORT |

| | | WP Income Plus Fund | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | November 30, 2018 | | | November 30, 2017 | |

| Increase (decrease) in net assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 461,738 | | | $ | 272,105 | |

| Net realized gain (loss) on investments and options | | | (29,171 | ) | | | 766,976 | |

| Net change in unrealized appreciation (depreciation) on investments and options | | | (1,192,189 | ) | | | (140,334 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (759,622 | ) | | | 898,747 | |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Total distributable earnings - Institutional Class (a) | | | (1,196,270 | ) | | | (343,327 | ) |

| Total distributions | | | (1,196,270 | ) | | | (343,327 | ) |

| | | | | | | | | |

| Capital transactions: | | | | | | | | |

| Net proceeds from shares sold | | | 2,942,676 | | | | 5,369,289 | |

| Reinvestment of distributions | | | 1,133,995 | | | | 326,648 | |

| Cost of shares redeemed | | | (1,170,599 | ) | | | (369,837 | ) |

| Net increase in net assets from capital transactions | | | 2,906,072 | | | | 5,326,100 | |

| | | | | | | | | |

| Increase in net assets | | | 950,180 | | | | 5,881,520 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 14,486,796 | | | | 8,605,276 | |

| | | | | | | | | |

| End of year (b) | | $ | 15,436,976 | | | $ | 14,486,796 | |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Shares sold | | | 276,985 | | | | 468,807 | |

| Shares reinvested | | | 105,867 | | | | 28,570 | |

| Shares redeemed | | | (111,726 | ) | | | (31,835 | ) |

| Net increase from capital share transactions | | | 271,126 | | | | 465,542 | |

| (a) | Current year presentation of distributions conforms with S-X Disclosure Simplification. Prior year distributions were $259,737 from net investment income and $83,590 from realized capital gains and have been consolidated to conform with S-X Disclosure Simplification. See Note 8 in the Notes to the Financial Statements. |

| (b) | Includes $20,427 of net investment income for the year ended November 30, 2017. The SEC eliminated the requirement to disclose net investment income in 2018. |

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| | |

| STATEMENTS OF CHANGES IN NET ASSETS | |

| | |

| November 30, 2018 | ANNUAL REPORT |

| | | WP Large Cap Income Plus Fund | |

| | | For the | | | For the | | | For the | |

| | | Period Ended | | | Year Ended | | | Year Ended | |

| | | November 30, 2018(a) | | | August 31, 2018 | | | August 31, 2017 | |

| Increase (decrease) in net assets from: | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | |

| Net investment income | | $ | 18,811 | | | $ | 26,765 | | | $ | 177,607 | |

| Net realized gain (loss) on investments and options | | | 45,459 | | | | (695,762 | ) | | | 2,040,391 | |

| Net change in unrealized appreciation (depreciation) on investments and options | | | (2,383,595 | ) | | | 5,876,994 | | | | 3,721,085 | |

| Net increase (decrease) in net assets resulting from operations | | | (2,319,325 | ) | | | 5,207,997 | | | | 5,939,083 | |

| | | | | | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | | | | | |

| Total distributable earnings - Institutional Class (b) | | | — | | | | (831,393 | ) | | | (46,285 | ) |

| Total distributions | | | — | | | | (831,393 | ) | | | (46,285 | ) |

| | | | | | | | | | | | | |

| Capital transactions: | | | | | | | | | | | | |

| Net proceeds from shares sold | | | 911,050 | | | | 4,093,289 | | | | 3,152,335 | |

| Reinvestment of distributions | | | — | | | | 823,099 | | | | 46,163 | |

| Cost of shares redeemed | | | (423,971 | ) | | | (2,695,904 | ) | | | (3,226,309 | ) |

| Net increase (decrease) in net assets from capital transactions | | | 487,079 | | | | 2,220,484 | | | | (27,811 | ) |

| | | | | | | | | | | | | |

| Increase (decrease) in net assets | | | (1,832,246 | ) | | | 6,597,088 | | | | 5,864,987 | |

| | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | |

| Beginning of year/period | | | 36,458,138 | | | | 29,861,050 | | | | 23,996,063 | |

| | | | | | | | | | | | | |

| End of year/period (c) | | $ | 34,625,892 | | | $ | 36,458,138 | | | $ | 29,861,050 | |

| | | | | | | | | | | | | |

| Capital share transactions: | | | | | | | | | | | | |

| Shares sold | | | 64,140 | | | | 296,471 | | | | 265,483 | |

| Shares reinvested | | | — | | | | 59,558 | | | | 3,987 | |

| Shares redeemed | | | (30,384 | ) | | | (196,281 | ) | | | (274,689 | ) |

| Net increase (decrease) from capital share transactions | | | 33,756 | | | | 159,748 | | | | (5,219 | ) |

| (a) | Represents the period from September 1, 2018 through November 30, 2018. The WP Large Cap Income Plus Fund changed its fiscal year end from August 31 to November 30. |

| (b) | Current year presentation of distributions conforms with S-X Disclosure Simplification. Distributions were $148,390 from net investment income and $683,003 from realized capital gains for the year ended August 31, 2018 and $46,285 from net investment income for the year ended August 31, 2017 and have been consolidated to conform with S-X Disclosure Simplification. See Note 8 in the Notes to the Financial Statements. |

| (c) | Includes $0 and $124,900 of net investment income for the years ended August 31, 2018 and August 31, 2017, respectively. The SEC eliminated the requirement to disclose net investment income in 2018. |

The accompanying notes are an integral part of these financial statements.

| WP TRUST | |

| | |

| FINANCIAL HIGHLIGHTS | |

| | |

| November 30, 2018 | ANNUAL REPORT |

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | WP Smaller Companies | |