UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23086

WP Trust

(Exact name of registrant as specified in charter) |

| 127 NW 13th Street Suite 13, Boca Raton, FL | 33432 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company

Corporation Trust Center

1209 Orange St., Wilmington, DE 19801

(Name and address of agent for service) |

Registrant’s telephone number, including area code: (800) 950-9112

Date of fiscal year end: February 28

Date of reporting period: February 28, 2022

Item 1. Report to Stockholders.

IPS Strategic Capital Absolute Return Fund

Institutional Class Shares (Ticker Symbol: IPSAX)

A series of the

WP TRUST

ANNUAL REPORT

February 28, 2022 |

Investment Adviser

IPS Strategic Capital, Inc.

215 S. Wadsworth Blvd., Suite 540

Denver, CO 80226

| Table of Contents |

| |

| |

| |

| |

| IPS Strategic Capital Absolute Return Fund | |

| |

| Letter to Shareholders | 1 |

| Investment Highlights | 3 |

| Allocation of Portfolio Holdings | 3 |

| Performance Information | 4 |

| Schedule of Investments | 5 |

| Schedule of Options Written | 6 |

| Statement of Assets and Liabilities | 7 |

| Statement of Operations | 8 |

| Statements of Changes in Net Assets | 9 |

| Financial Highlights | 10 |

| |

| NOTES TO FINANCIAL STATEMENTS | 11 |

| |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 18 |

| |

| ADDITIONAL INFORMATION | 19 |

| |

| TRUSTEES AND OFFICERS | 23 |

IPS Strategic Capital Absolute Return Fund

Annual Report

February 28, 2022

(Unaudited) |

Dear Shareholders,

The flagship IPS Strategic Capital Absolute Return Fund Class I Institutional (IPSAX) (the “Fund”) posted a return of 6.70% for the fiscal year ended February 28, 2022. During the fiscal year, Standard and Poor’s 500 Index (the “S&P 500”) rose 16.39% while the Bloomberg U.S. Aggregate Bond Index posted a return of -2.64% . A blended portfolio of 60% U.S. Equity and 40% U.S. Bonds as represented by the Bloomberg U.S. Equity/Fixed Income 60/40 Index returned 7.56% over the fiscal year.

The Fund utilizes a hedge equity strategy, seeking meaningful participation during up markets in U.S. equities. However, the Fund is managed with a view that it will not fully capture all of the gains in up markets due to the costs associated with protecting the portfolio via downside risk mitigation. With that in mind, the performance of the Fund over the 12 months ended February 28, 2022, was, in the view of the investment adviser (“IPS Strategic Capital”) to the Fund, within the realm of expectations for a hedged equity approach. The core holdings of the Fund, which generally includes exposure to the S&P 500 through investments in exchange-traded funds (“ETFs”), futures, and options that are designed to track the S&P 500, performed in line with the gains seen in the S&P 500 during the fiscal year.

The Fund utilizes derivatives to manage its downside risk. Specifically, the Fund will utilize options contracts on the S&P 500, that are used to hedge the equity exposure of the Fund. The goal of the strategy is to provide returns that are competitive with that of a traditional portfolio, allocated to both U.S. equities and bonds, through the use of option contracts to hedge equity risk rather than allocating a substantial portion of the portfolio to debt. The performance of these hedges during the fiscal year ended February 28, 2022, declined in value as the markets increased in value, which detracted from the performance of the Fund. Despite the losses in the hedging portion of the portfolio, the Fund’s overall performance was in line with that of a portfolio consisting of 60% equities and 40% bonds.

The poor performance of bonds over the fiscal year detracted from traditional (60/40) asset allocation models in a manner similar to that experienced by the Fund due to its hedging strategy. The drag created by the Fund’s hedging strategy during the fiscal year was partially offset by the income generated from the Fund’s investments in options on the S&P 500.

It is important to keep in mind that a hedged equity approach carries an explicit trade off when compared to a traditional (60/40) asset allocation portfolio. By investing in hedges that are explicitly designed to protect the Fund when markets fall, IPS Strategic Capital believes these hedges can help protect the Fund’s portfolio during bear markets. These hedges are less reliant on the correlation between equities and bonds, as a traditional asset allocation approach is beholden to. However, the cost of hedging can be variable in nature and there is no guarantee that the performance of using a hedged equity approach will outperform that of the traditional (60/40) portfolio.

2022 Annual Report 1

Looking to the future, IPS Strategic Capital believes that the outlook for bonds remains bleak and the performance of traditional (60/40) asset allocation approaches could suffer due to higher inflation across the U.S. economy. IPS Strategic Capital believes that this environment favors the Fund’s hedged equity strategy over that of a more traditional (60/40) portfolio. With volatility in the equity markets still around long-term averages, the implied cost of insuring one’s portfolio using direct hedges with more reliable correlation characteristics than that of bonds remains an attractive strategy in the eyes of IPS Strategic Capital.

We appreciate the trust in our Fund and look forward to continuing to manage the risks of these ever-changing markets in the future with the goal of producing above-average, risk-adjusted returns.

Best regards,

Dominick Paoloni, CIMA®

Portfolio Manager, IPSAX

Disclaimers:

S&P 500 ® Index is widely regarded as the best gauge of large-cap U.S. Equities. The S&P 500 Index assumes the re-investment of dividends and is an untraded index, therefore it does not reflect the cost of any management fees. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures U.S. investment grade debt. The Bloomberg U.S. Aggregate Bond Index assumes the reinvestment of dividends and is an untraded index, therefore it does not reflect the cost of any management fees. The Bloomberg U.S. Equity/Fixed Income 60/40 Index is designed to measure the performance of an index that rebalances monthly to 60% equities and 40% fixed income. The equity and fixed income allocations are represented by the Bloomberg U.S. Large Cap (B500T Index) and Bloomberg U.S. Aggregate Bond Index, respectively.

Past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investors shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-866-959-9260.

The IPS Strategic Capital Absolute Return Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read and considered carefully before investing. You may obtain a current copy of the Fund’s prospectus by calling 1-866-959-9260. Distributed by Arbor Court Capital, LLC.

2022 Annual Report 2

IPS Strategic Capital Absolute Return Fund (Unaudited)

INVESTMENT HIGHLIGHTS

February 28, 2022

The investment objective of the IPS Strategic Capital Absolute Return Fund (the “Fund”) is total return. Under normal circumstances, the Fund’s primary strategy consists of selling and purchasing put and call options on equity indices and exchange traded funds (“ETFs”). The sale of put options generates income for the Fund, but exposes it to the risk of declines in the value of the underlying assets. The risk in purchasing options is limited to the premium paid by the Fund for the options. The sale of call options generates income for the Fund, but may limit the Fund's participation in equity market gains.

IPS Strategic Capital, Inc. (the “Adviser”) seeks to reduce the overall volatility of returns by managing a portfolio of options. The Fund buys and sells both put and call exchange-traded listed options to establish exposure to the overall market. When the Adviser believes the value of an underlying asset will decline, the Fund may purchase a put option to profit from the decline. Similarly, when the Adviser anticipates an increase in the value of an underlying asset, the Fund may purchase a call option with respect to that asset.

The Fund may take a defensive position when the Adviser believes that current market, economic, political or other conditions are unsuitable and would impair the pursuit of the Fund’s investment objectives. When taking a defensive position, the Fund may invest up to 100% of its assets in cash, cash equivalents, including but not limited to, obligations of the U.S. Government, money market fund shares, commercial paper, certificates of deposit and/or bankers acceptances, as well as other interest bearing or discount obligations or debt instruments that carry an investment grade rating by a national rating agency. When the Fund takes a defensive position, the Fund may not achieve its investment objectives.

The Adviser reallocates the Fund’s investments continually to be commensurate with the risk profile that the Adviser deems appropriate for the Fund. The Fund seeks to use leverage to modify portfolio risk to be equal to, or less than that of, the market in total.

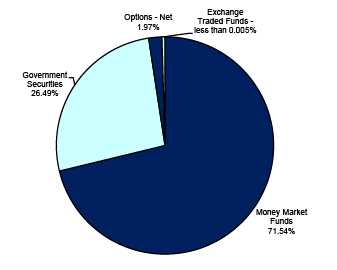

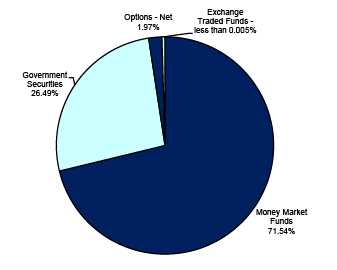

Allocation of Portfolio Holdings

(% of Investments, Net Written Options) as of February 28, 2022 |

The percentages in the above graph are based on the portfolio holdings of the Fund as of February 28, 2022, and are subject to change.

For a detailed break-out of holdings by industry and exchange traded funds by investment type, please refer to the Schedule of Investments and Schedule of Options Written.

2022 Annual Report 3

IPS Strategic Capital Absolute Return Fund (Unaudited)

PERFORMANCE INFORMATION

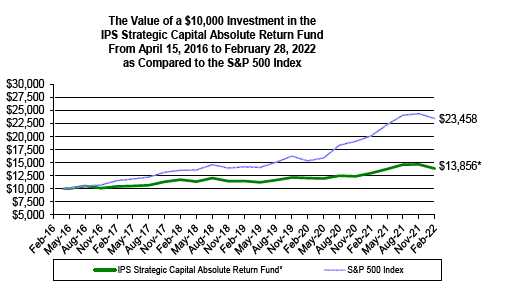

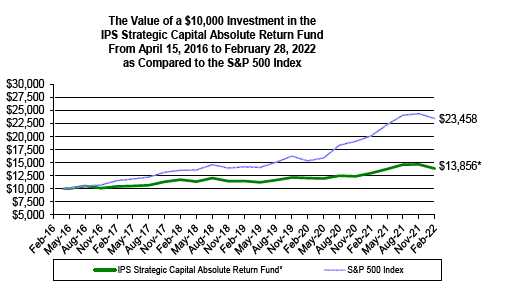

Average Annual Rate of Return (%) for the Periods Ended February 28, 2022

| | | | | | Since | |

| | 1 Year(A) | | 5 Year(A) | | Inception(A) | |

| IPS Strategic Capital Absolute Return Fund | 6.70% | | 5.80% | | 5.71% | |

| S&P 500® Index (B) | 16.39% | | 15.17% | | 15.62% | |

(A) 1 Year, 5 Year and Since Inception returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The inception date of the Fund was April 15, 2016.

(B) The S&P 500® Index is a broad, unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. Please note that the index does not take into account any fees and expenses of investing in the individual securities that it tracks and individuals cannot invest directly in any index.

For purposes of the graph and the accompanying table, it is assumed that all dividends and distributions were reinvested.

Per the Fund’s most recent prospectus, the Fund’s Total Annual Operating Expense Ratio is 1.74% . The Total Annual Fund Operating Expense Ratio reported above may not correlate to the expense ratios presented in the Fund’s financial highlights because (a) the financial highlights include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in acquired funds, and (b) the gross expense ratio may fluctuate due to changes in net assets and actual expenses incurred during the reported period.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAT THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-866-959-9260. THE FUND’S DISTRIBUTOR IS ARBOR COURT CAPITAL, LLC.

2022 Annual Report 4

| IPS Strategic Capital Absolute Return Fund |

| |

| | | | | | | Schedule of Investments |

| | | | | | | February 28, 2022 |

| Shares / Principal Amount | | | | | Fair Value | | % of Net Assets |

| EXCHANGE TRADED FUNDS | | | | | | | | |

| Equity Funds - Equity | | | | | | | | |

| 1 | SPDR S&P 500 ETF Trust | | | | | $ 437 | | | |

| Total for Exchange Traded Funds (Cost $209) | | | | | 437 | | 0.00 | % |

| GOVERNMENT SECURITIES | | | | | | | | |

| $5,000,000 | U. S. Treasury Bill, 0.00%, 05/12/2022 ** | | | | 4,997,235 | | | |

| 5,000,000 | U. S. Treasury Bill, 0.00%, 06/07/2022 ** | | | | 4,994,705 | | | |

| 5,000,000 | U. S. Treasury Bill, 0.00%, 06/21/2022 ** | | | | 4,992,920 | | | |

| Total for Government Securities (Cost $14,986,320) | | | | 14,984,860 | | 22.48 | % |

| MONEY MARKET FUNDS | | | | | | | | |

| 40,484,553 | Federated Hermes Government Obligations Fund - Institutional | | 40,484,553 | | | |

| | Class 0.03% *** (a) | | | | | 40,484,553 | | 60.73 | % |

| Total for Money Market Funds (Cost $40,484,553) | | | | | | | |

| CALL/PUT OPTIONS PURCHASED | | | Notional | | | | | |

| Expiration Date/Exercise Price | Contracts | | Amount | | Fair Value | | % of Net Assets |

| CBOE S&P 500 Index * | | | | | | | | |

| March 16, 2022, Call @ $4,525.00 | 472 | | $ 213,580,000 | | 1,128,080 | | | |

| Total for Options Purchased (Premiums Paid $1,121,944) | | $ 213,580,000 | | 1,128,080 | | 1.69 | % |

| Total Investments (Cost $56,593,026) | | | | | 56,597,930 | | 84.90 | % |

| Other Assets in Excess of Liabilities | | | | | 10,068,208 | | 15.10 | % |

| Net Assets | | | | | | $ 66,666,138 | | 100.00 | % |

* Non-Income Producing Securities.

** Rate shown represents the effective yield at February 28, 2022.

*** The Yield Rate shown represents the 7-day yield at February 28, 2022.

(a) Additional information, including the current prospectus and annual report, is available at

https://www.federatedinvestors.com/products/mutual-funds/govt-obligations/is.do or www.sec.gov. |

The accompanying notes are an integral part of these

financial statements. |

2022 Annual Report 5

| IPS Strategic Capital Absolute Return Fund | | | |

| |

| | | | Schedule of Options Written |

| | | | February 28, 2022 |

| CALL/PUT OPTIONS WRITTEN | | | Notional | | |

| Expiration Date/Exercise Price | Contracts | | Amount | | Fair Value |

| Put Options Written | | | | | |

| CBOE S&P 500 Index * | | | | | |

| March 2, 2022, Put @ $3,975.00 | 77 | $ | 30,607,500 | | $ 11,550 |

| Total Put Options Written (Premiums Received $81,645) | | | 30,607,500 | | 11,550 |

| Total Options (Premiums Received $81,645) | | $ | 30,607,500 | | $ 11,550 |

* Non-Income Producing Securities.

The accompanying notes are an integral part of these

financial statements. |

2022 Annual Report 6

| IPS Strategic Capital Absolute Return Fund | |

| |

| Statement of Assets and Liabilities | | | |

| February 28, 2022 | | | |

| |

| Assets: | | | |

| Investments at Fair Value* | $ | 56,597,930 |

| Deposit at Broker for Written Options | | | 10,160,914 |

| Dividends Receivable | | | 332 |

| Prepaid Expenses | | | 6,661 |

| Total Assets | | | 66,765,837 |

| Liabilities: | | | |

| Options Written at Fair Value (Premiums Received $81,645) | | | 11,550 |

| Payable to Adviser | | | 51,920 |

| Payable to Administrator | | | 4,005 |

| Payable to Trustees | | | 1,318 |

| Other Accrued Expenses | | | 30,906 |

| Total Liabilities | | | 99,699 |

| Net Assets | $ | 66,666,138 |

| Net Assets Consist of: | | | |

| Paid In Capital | $ | 61,636,639 |

| Total Distributable Earnings (Accumulated Deficit) | | | 5,029,499 |

| Net Assets | $ | 66,666,138 |

| |

| Net Asset Value, Offering and Redemption Price | $ | 10.89 |

| |

| * Investments at Identified Cost | $ | 56,593,026 |

| |

| Shares Outstanding (Unlimited number of shares | | | 6,123,712 |

| authorized without par value) | | | |

The accompanying notes are an integral part of these

financial statements. |

2022 Annual Report 7

| IPS Strategic Capital Absolute Return Fund | | |

| |

| Statement of Operations | | | | |

| For the fiscal year ended February 28, 2022 | | | | |

| |

| Investment Income: | | | | |

| Dividends | $ | 633,498 | |

| Total Investment Income | | | 633,498 | |

| Expenses: | | | | |

| Management Fees | | | 673,652 | |

| Administration, Fund Accounting & Transfer Agent Fees | | | 152,456 | |

| Portfolio Software Fees | | | 62,833 | |

| Legal Fees | | | 37,283 | |

| Audit Fees | | | 20,250 | |

| Compliance Officer Expense | | | 15,300 | |

| Registration Expense | | | 11,421 | |

| Trustees Fees | | | 11,257 | |

| Miscellaneous Expense | | | 10,460 | |

| Custody Fees | | | 9,020 | |

| Printing and Postage Expense | | | 7,279 | |

| Insurance Expense | | | 1,766 | |

| Total Expenses | | | 1,012,977 | |

| |

| |

| Net Investment Income (Loss) | | | (379,479 | ) |

| |

| Net Realized and Unrealized Gain (Loss) on Investments: | | | | |

| Net Realized Gain (Loss) on Investments | | | 6,597,593 | |

| Net Realized Gain (Loss) on Options Purchased | | | (9,338,441 | ) |

| Net Realized Gain (Loss) on Options Written | | | 7,044,646 | |

| Net Realized Gain (Loss) on Futures Contracts | | | 2,500,242 | |

| Net Change in Unrealized Appreciation (Depreciation) on Investments | | | (1,517,940 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on Options Purchased | | | (877,090 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on Options Written | | | 667,888 | |

| Net Change in Unrealized Appreciation (Depreciation) on Futures Contracts | | | (634,342 | ) |

| Net Realized and Unrealized Gain (Loss) on Investments | | | 4,442,556 | |

| |

| Net Increase (Decrease) in Net Assets from Operations | $ | 4,063,077 | |

The accompanying notes are an integral part of these

financial statements. |

| IPS Strategic Capital Absolute Return Fund |

| | |

| Statements of Changes in Net Assets | | | | | | | | |

| | |

| | | 3/1/2021 | | | | 3/1/2020 | | |

| | | to | | | | to | | |

| | | 2/28/2022 | | | | 2/28/2021 | | |

| From Operations: | | | | | | | | |

| Net Investment Income (Loss) | $ | (379,479 | ) | | $ | (642,959 | ) | |

| Net Realized Gain (Loss) on Investments, Options | | | | | | | | |

| Contracts and Futures Contracts | | 6,804,040 | | | | 2,002,529 | | |

| Net Change in Unrealized Appreciation (Depreciation) | | | | | | | | |

| on Investments, Options Contracts and Futures | | | | | | | | |

| Contracts | | (2,361,484 | ) | | | 3,685,614 | | |

| Net Increase (Decrease) in Net Assets from Operations | | 4,063,077 | | | | 5,045,184 | | |

| From Distributions to Shareholders: | | (3,548,901 | ) | | | (280,150 | ) | |

| From Capital Share Transactions: | | | | | | | | |

| Proceeds From Sale of Shares | | 8,129,893 | | | | 15,770,834 | | |

| Shares Issued on Reinvestment of Dividends | | 3,548,259 | | | | 269,732 | | |

| Cost of Shares Redeemed | | (7,174,184 | ) | | | (10,858,143 | ) | |

| Net Increase (Decrease) from Shareholder Activity | | 4,503,968 | | | | 5,182,423 | | |

| Net Increase (Decrease) in Net Assets | | 5,018,144 | | | | 9,947,457 | | |

| | |

| Net Assets at Beginning of Year | | 61,647,994 | | | | 51,700,537 | | |

| | |

| Net Assets at End of Year | $ | 66,666,138 | | | $ | 61,647,994 | | |

| | |

| | |

| Share Transactions: | | | | | | | | |

| Issued | | 702,795 | | | | 1,625,163 | | |

| Reinvested | | 302,752 | | | | 25,936 | | |

| Redeemed | | (621,100 | ) | | | (1,083,116 | ) | |

| Net Increase (Decrease) in Shares | | 384,447 | | | | 567,983 | | |

The accompanying notes are an integral part of these

financial statements. |

2022 Annual Report 9

| IPS Strategic Capital Absolute Return Fund |

| | |

| Financial Highlights | | | | | | | | | | | | | | | | | | | | |

| | |

| Selected data for a share outstanding throughout the year: | | | | | | | | | | | | | | | | | | | | |

| | | 3/1/2021 | | | | 3/1/2020 | | | | 3/1/2019 | | | | 3/1/2018 | | | | 3/1/2017 | | |

| | | to | | | | to | | | | to | | | | to | | | | to | | |

| | | 2/28/2022 | | | | 2/28/2021 | | | | 2/29/2020 | | | | 2/28/2019 | | | | 2/28/2018 | | |

| Net Asset Value - Beginning of Year | $ | 10.74 | | | $ | 10.00 | | | $ | 9.54 | | | $ | 10.66 | | | $ | 10.38 | | |

| Net Investment Income (Loss) (a) | | (0.07 | ) | | | (0.11 | ) | | | - | | + | | (0.02 | ) | | | (0.09 | ) | |

| Net Gain (Loss) on Investments (Realized and Unrealized) | | 0.83 | | | | 0.90 | | | | 0.46 | | | | (0.20 | ) | | | 1.33 | | |

| Total from Investment Operations | | 0.76 | | | | 0.79 | | | | 0.46 | | | | (0.22 | ) | | | 1.24 | | |

| Distributions (From Net Investment Income) | | - | | | | - | | + | | - | | | | - | | | | - | | |

| Distributions (From Capital Gains) | | (0.61 | ) | | | (0.05 | ) | | | - | | | | (0.90 | ) | | | (0.96 | ) | |

| Total Distributions | | (0.61 | ) | | | (0.05 | ) | | | - | | | | (0.90 | ) | | | (0.96 | ) | |

| | |

| Net Asset Value - End of Year | $ | 10.89 | | | $ | 10.74 | | | $ | 10.00 | | | $ | 9.54 | | | $ | 10.66 | | |

| Total Return (b) | | 6.70 | % | | | 7.90 | % | | | 4.82 | % | | | (2.05 | )% | | | 12.15 | % | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net Assets - End of Year (Thousands) | $ | 66,666 | | | $ | 61,648 | | | $ | 51,701 | | | $ | 62,598 | | | $ | 86,384 | | |

| Ratio of Expenses to Average Net Assets (c) (e) | | 1.50 | % | | | 1.67 | % | | | 1.65 | % | | | 1.84 | % | | | 1.69 | % | |

| Ratio of Net Investment Income (Loss) to Average | | | | | | | | | | | | | | | | | | | | |

| Net Assets (c) (d) (e) | | (0.56 | )% | | | (1.07 | )% | | | 0.00 | % | + | | (0.15 | )% | | | (0.89 | )% | |

| Portfolio Turnover Rate | | 0.00 | % | | | 50.17 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | |

+ Less than $0.005/0.005% .

(a) Per share amount calculated using the average shares method.

(b) Total return represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

(c) Ratios do not include expenses of the investment companies (“ETFs”) in which the Fund invests.

(d) Recognition of net investment income by the Fund is affected by the timing of the declaration of the dividends by the underlying investment companies (“ETFs”) in which the Fund invests.

(e) The ratios include 0.00%, 0.00%, 0.00%, 0.33% and 0.19% of interest expense during years ended February 28, 2022, February 28, 2021, February 29, 2020, February 28, 2019 and February 28, 2018, respectively.

The accompanying notes are an integral part of these

financial statements. |

2022 Annual Report 10

NOTES TO FINANCIAL STATEMENTS

IPS STRATEGIC CAPITAL ABSOLUTE RETURN FUND

February 28, 2022

1.) ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

The IPS Strategic Capital Absolute Return Fund (the “Fund”) is a series of WP Trust (the “Trust”). The Trust was organized on June 4, 2015, as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). As of February 28, 2022, there were 5 series authorized by the Trust. The Fund is a non-diversified Fund. As a non-diversified Fund, the Fund may invest a significant portion of its assets in a small number of companies. The Fund’s investment objective is total return. The Fund’s investment adviser is IPS Strategic Capital, Inc. (the “Adviser”). The Fund has three classes of shares, Class A, Class C and Institutional Class shares. Currently, only the Institutional Class shares are being offered for sale. The Institutional Class shares commenced operations on April 15, 2016.

The Fund is an investment company that follows the investment company accounting and reporting guidance of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements are prepared in conformity with accounting principals generally accepted in the United States of America ("GAAP"). The Fund follows the significant accounting policies described in this section.

SHARE VALUATION: The net asset value (“NAV”) is generally calculated as of the close of trading on the New York Stock Exchange (the “Exchange”) (normally 4:00 p.m. Eastern time) every day the Exchange is open. The NAV is calculated by taking the total value of the Fund’s assets, subtracting its liabilities, and then dividing by the total number of shares outstanding, rounded to the nearest cent. For the Institutional Class, the offering price and redemption price per share is equal to the NAV per share.

SECURITY VALUATION: All investments in securities are recorded at their estimated fair value, as described in note 2.

OPTIONS: The Fund’s option strategy consists of selling and purchasing put and call options on equity indices and exchange traded funds (“ETFs”). The sale of put options generates income for the Fund, but exposes it to the risk of declines in the value of the underlying assets. The risk in purchasing options is limited to the premium paid by the Fund for the options. The sale of call options generates income for the Fund, but may limit the Fund's participation in equity market gains. The Fund’s Adviser seeks to reduce the overall volatility of returns by managing a portfolio of options. When the Fund writes or purchases an option, an amount equal to the premium received or paid by the Fund is recorded as a liability or an asset and is subsequently adjusted to the current value of the option written or purchased. Premiums received or paid from writing or purchasing options which expire unexercised are treated by the Fund on the expiration date as realized gains or losses. The difference between the premium and the amount paid or received on effecting a closing purchase or sale transaction, including brokerage commissions, is also treated as a realized gain or loss. If an option is exercised, the premium paid or received is added to the cost of the purchase or proceeds from the sale in determining whether the Fund has realized a gain or a loss on investment transactions.

Purchasing and selling put and call options are highly specialized activities and entail greater than ordinary investment risks. The successful use of options depends in part on the ability of the Adviser to manage future price fluctuations and the degree of correlation between the options and securities (or currency) markets. By selling call options on equity securities or indices, the Fund gives up the opportunity to benefit from potential increases in the value of the underlying securities above the strike prices of the sold call options, but continues to bear the risks of declines in the value of the markets, including the underlying indices for the puts as well, if different, as the securities that are held by the Fund. The premium received from the sold options may not be sufficient to offset any losses sustained from the volatility of the underlying equity indices over time.

The Fund will incur a loss as a result of a written option (also referred to as a short position) if the price of the written option instrument increases in value between the date when the Fund writes the option and the date on which the Fund purchases an offsetting position. The Fund’s losses are potentially large in a written put transaction and potentially unlimited in a written call transaction. Please refer to the Fund’s prospectus for a full listing of risks associated with these instruments.

ETFs AND MONEY MARKET FUNDS: The Fund may invest in ETFs and money market mutual funds (“MM Funds”). An ETF is a fund that may hold a portfolio of common stocks or bonds designed to track the performance of a securities index or sector of an index. ETFs are traded on a securities exchange based on their market value. Some ETF portfolios are designed to track the performance of an index and it is possible the ETF’s performance may not closely track its index. ETFs and MM Funds incur fees and expenses such as operating expenses, licensing fees, registration fees, trustees’ fees, and marketing expenses; and ETF and MM Fund shareholders, such as the Fund, pay their proportionate share of these expenses. Your cost of

2022 Annual Report 11

Notes to Financial Statements - continued

investing in the Fund will generally be higher than the cost of investing directly in ETFs and MM Funds. By investing in the Fund, you will indirectly bear fees and expenses charged by the underlying ETFs and MM Funds in which the Fund invests in addition to the Fund’s direct fees and expenses.

The Fund may invest a significant portion of its assets in MM Funds. From time to time, the Fund may invest greater than 25% of its net assets in one security. As of February 28, 2022, Federated Hermes Government Obligations Fund - Institutional Class represented 60.73% of the Fund’s net assets. Additional information for this security, including its financial statements, is available from the U.S. Securities and Exchange Commission’s website at www.sec.gov.

SHORT SALES OF SECURITIES: The Fund may make short sales, which are transactions in which the Fund sells a security it does not own in anticipation of a decline in the market value of that security. To complete a short-sale transaction, the Fund will borrow the security from a broker-dealer, which generally involves the payment of a premium and transaction costs. The Fund then sells the borrowed security to a buyer in the market. The Fund will then cover the short position by buying shares in the market either (i) at its discretion; or (ii) when called by the broker-dealer lender. Until the security is replaced, the Fund is required to pay the broker-dealer lender any dividends or interest that accrue during the period of the loan. In addition, the net proceeds of the short sale will be retained by the broker to the extent necessary to meet regulatory or other requirements, until the short position is closed out.

The Fund will incur a loss, unlimited in size, as a result of the short sale if the price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund will realize a gain if the security declines in price between those dates. The amount of any gain will be decreased, and the amount of any loss increased, by the amount of the premium, dividends, interest or expenses the Fund may be required to pay in connection with a short sale. When the Fund makes a short sale, the Fund will segregate liquid assets (such as cash, U.S. government securities, or equity securities) on the Fund’s books and/or in a segregated account at the Fund’s custodian in an amount sufficient to cover the current value of the securities to be replaced as well as any dividends, interest and/or transaction costs due to the broker-dealer lender. In determining the amount to be segregated, any securities that have been sold short by the Fund will be marked to market daily. To the extent the market price of the security sold short increases and more assets are required to meet the Fund’s short sale obligations, additional assets will be segregated to ensure adequate coverage of the Fund’s short position obligations.

In addition, the Fund may make short sales “against the box” (i.e., when the Fund sells a security short when the Fund has segregated securities equivalent in kind and amount to the securities sold short, or securities convertible or exchangeable into such securities) and will hold such securities while the short sale is outstanding. The Fund will incur transaction costs, including interest, in connection with opening, maintaining, and closing short sales against the box.

FUTURES CONTRACTS: The Fund may buy and sell stock index futures contracts. A stock index futures contract obligates the seller to deliver (and the buyer to take) an amount of cash equal to a specific dollar amount times the difference between the value of a specific stock index at the close of the last trading day of the contract and the price at which the agreement was made. To the extent the Fund enters into a futures contract, it will deposit with the broker cash, cash equivalents or U.S. Treasury obligations equal to a specified percentage of the value of the futures contract (the initial margin), as required by the relevant contract market and futures commission merchant. The futures contract will be marked to market daily. Should the value of the futures contract decline relative to the Fund's position, the Fund, if required by law, will pay the futures commission merchant an amount equal to the change in value to maintain its appropriate margin balance. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the proceeds from (or cost of) the closing transaction and the Fund's basis in the contract. The use of futures transactions involves the risk of imperfect correlation in movements in the price of futures contracts, interest rates, and the underlying hedged assets. The Fund may sell stock index futures contracts in anticipation of or during a market decline to attempt to offset the decrease in market value of its long positions in equity securities that might otherwise result. When the Fund is not fully invested in equity securities and anticipates a significant market advance, it may buy stock index futures in order to gain rapid market exposure that may in part or entirely offset increases in the cost of equity securities that it intends to buy. With futures, there is minimal counterparty credit risk to the Fund since futures are exchange traded and the exchange's clearing-house, as counterparty to all exchange traded futures, guarantees the futures against default.

FEDERAL INCOME TAXES: The Fund has qualified and intends to continue to qualify as a regulated investment company (“RIC’) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

As of and during the fiscal year ended February 28, 2022, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax liability as

2022 Annual Report 12

Notes to Financial Statements - continued

income tax expense in the Statement of Operations. During the fiscal year ended February 28, 2022, the Fund did not incur any interest or penalties. The Fund identifies its major tax jurisdictions as U.S. Federal and the state of Delaware.

In addition, GAAP requires management of the Fund to analyze all open tax years, as defined by IRS statute of limitations, including federal tax authorities and certain state tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years. The Fund has no examination in progress and is not aware of any tax positions for which it is reasonably possible that the total tax amounts of unrecognized tax benefits will significantly change in the next twelve months.

DISTRIBUTIONS TO SHAREHOLDERS: Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. GAAP requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in capital or net realized gains.

USE OF ESTIMATES: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

EXPENSES: Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund's relative net assets or another appropriate basis (as determined by the Board of Trustees (the “Board”)).

OTHER: Investment and shareholder transactions are recorded on trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds using the identified cost method. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund. Interest income and interest expenses, if any, are recognized on an accrual basis. Discounts and premiums on securities purchased are amortized over the lives of the respective securities or until call date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

2.) SECURITIES VALUATIONS

PROCESSES AND STRUCTURE: The Fund’s Board has adopted guidelines for valuing securities and other derivative instruments including in circumstances in which market quotes are not readily available, and has delegated authority to the Adviser to apply those guidelines in determining fair value prices, subject to review by the Board.

HIERARCHY OF FAIR VALUE INPUTS: The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s best information about the assumptions a market participant would use in valuing the assets or liabilities.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

2022 Annual Report 13

Notes to Financial Statements - continued

FAIR VALUE MEASUREMENTS: A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities. (including ETFs) Securities traded on a national securities exchange (or reported on the NASDAQ national market) are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in level 1 of the fair value hierarchy. Certain foreign securities may be fair valued using a pricing service that considers the correlation of the trading patterns of the foreign security to the intraday trading in the U.S. markets for investments such as American Depositary Receipts, financial futures, ETFs, and the movement of the certain indexes of securities based on a statistical analysis of the historical relationship and that are categorized in level 2. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are also categorized in level 2.

Money market funds. Money market funds are valued at net asset value and are classified in level 1 of the fair value hierarchy.

Derivative instruments. Listed derivatives, including options and futures, that are actively traded are valued based on quoted prices from the exchange and categorized in level 1 of the fair value hierarchy. Derivatives held by the Fund for which no current quotations are readily available and which are not traded on the valuation date are valued at the mean price and are categorized within level 2 of the fair value hierarchy. Derivatives that are thinly traded for which a mean price is not available are valued at the ask price or the bid price, whichever is available, and are categorized within level 2 of the fair value hierarchy. Over-the-counter (“OTC”) derivative contracts include forward, swap, and option contracts related to interest rates; foreign currencies; credit standing of reference entities; equity prices; or commodity prices, and warrants on exchange-traded securities. Depending on the product and terms of the transaction, the fair value of the OTC derivative products can be modeled taking into account the counterparties’ creditworthiness and using a series of techniques, including simulation models. Many pricing models do not entail material subjectivity because the methodologies employed do not necessitate significant judgments, and the pricing inputs are observed from actively quoted markets, as is the case of interest rate swap and option contracts. OTC derivative products valued using pricing models are categorized within level 2 of the fair value hierarchy.

Fixed income securities. Fixed income securities, including government securities denominated in U.S. dollars, valued using market quotations in an active market, will be categorized as level 1 securities. However, they may be valued on the basis of prices furnished by a pricing service when the Adviser believes such prices more accurately reflect the fair value of such securities. A pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of debt securities without regard to sale or bid prices. These securities will generally be categorized as level 2 securities.

If the Adviser decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when certain restricted or illiquid securities are being valued, these securities are valued at fair value as determined in good faith by the Adviser, in conformity with guidelines adopted by and subject to review of the Board and the Fair Valuation Committee. These securities will be categorized as level 3 securities.

The following tables summarize the inputs used to value the Funds’ assets and liabilities measured at fair value as of February 28, 2022:

| Valuation Inputs of Assets | | Level 1 | | Level 2 | Level 3 | | Total |

| Exchange Traded Funds | | $437 | | $ – | $– | | $ 437 |

| Government Securities | | – | | 14,984,860 | – | | 14,984,860 |

| Call Options Purchased | | 1,128,080 | | – | – | | 1,128,080 |

| Money Market Funds | | 40,484,553 | | – | – | | 40,484,553 |

| Total | | $41,613,070 | | $14,984,860 | $– | | $56,597,930 |

| Valuation Inputs of Liabilities | | Level 1 | Level 2 | Level 3 | | Total |

| Put Options Written | | $11,550 | $– | $– | | $11,550 |

| Total | | $11,550 | $– | $– | | $11,550 |

Refer to the Fund’s Schedule of Investments for a listing of securities by industry. The Fund did not hold any level 3 assets during the fiscal year ended February 28, 2022.

3. DERIVATIVES TRANSACTIONS

As of February 28, 2022, cash of $10,160,914 was held at the broker as collateral for options and futures transactions.

2022 Annual Report 14

Notes to Financial Statements - continued

The average monthly notional values of futures contracts purchased and options contracts purchased and written by the Fund for the fiscal year ended February 28, 2022, were as follows:

| Derivative Type | | Average Notional Value |

| Call Options Purchased | | $24,947,731 | |

| Put Options Purchased | | $148,138,769 | |

| Call Options Written | | ($13,892,308 | ) |

| Put Options Written | | ($86,844,077 | ) |

| Futures Contracts Purchased | | $12,750,294 | |

As of February 28, 2022, the location on the Statement of Assets and Liabilities for financial derivative instrument fair values is as follows:

| Assets | | Location | | Equity Contracts/Total |

| Call Options Purchased | | Investments at Fair Value | | $1,128,080 |

| Total Assets | | | | $1,128,080 |

| |

| Liabilities | | Location | | Equity Contracts/Total |

| Put Options Written | | Options Written at Fair Value | | $11,550 |

| Total Liabilities | | | | $11,550 |

Realized and unrealized gains and losses on derivatives contracts entered into by the Fund during the fiscal year ended February 28, 2022, are recorded in the following locations in the Statement of Operations:

| Net Change in Unrealized | | | | | |

| Appreciation (Depreciation) on: | | Location | | Equity Contracts/Total |

| Call Options Purchased | | Options Purchased | | $6,136 | |

| Put Options Purchased | | Options Purchased | | (883,226 | ) |

| Put Options Written | | Options Written | | 667,888 | |

| Futures Contracts Purchased | | Futures Contracts | | (634,342 | ) |

| | | | | $(843,544 | ) |

| |

| Net Realized Gain (Loss) on: | | Location | | Equity Contracts/Total |

| Call Options Purchased | | Options Purchased | | $834,173 | |

| Put Options Purchased | | Options Purchased | | (10,172,614 | ) |

| Call Options Written | | Options Written | | (229,221 | ) |

| Put Options Written | | Options Written | | 7,273,867 | |

| Futures Contracts Purchased | | Futures Contracts | | 2,500,242 | |

| | | | | $206,447 | |

All open derivative positions at February 28, 2022, are reflected on the Fund's Schedule of Investments and Schedule of Options Written.

The following tables present the Fund’s asset and liability derivatives available for offset under a master netting arrangement as of February 28, 2022.

| Assets: | Gross Amounts of Assets Presented in the Statement of Assets & Liabilities |

| | | | | | | | | | Gross Amounts Not Offset in | | |

| | | | | | | | | | the Statement of Assets and | | |

| | | | | | | | | | Liabilities | | |

| | | | | | Gross | | Net Amount of | | | | | | | | |

| | | | | | Amounts | | Assets | | | | | | | | |

| | | Gross | | | Offset in the | | Presented in the | | | | | | | | |

| | | Amounts of | | | Statement of | | Statement of | | | | Financial | | Cash | | |

| | | Recognized | | | Assets and | | Assets and | | | | Instruments | | Collateral | | Net Amount |

| Description | | Assets | | | Liabilities | | Liabilities | | | | Pledged | | Pledged | | of Assets |

| Options Purchased | $ | 1,128,080 | (1) | $ | - | $ | 1,128,080 | (1) | | $ | (11,550) | (2) | $ - | $ | 1,116,530 |

| |

| Total | $ | 1,128,080 | | $ | - | $ | 1,128,080 | | | $ | (11,550) | | $ - | $ | 1,116,530 |

(1) Purchased options at value as presented in the Schedule of Investments.

(2) The amount is limited to the derivative liability balance and accordingly does not include excess collateral pledged.

2022 Annual Report 15

Notes to Financial Statements - continued

| Liabilities: | | Gross Amounts of Liabilities Presented in the Statement of Assets & Liabilities | |

| | | | | | | | | | | Gross Amounts Not Offset in | | |

| | | | | | | | | | | the Statement of Assets and | | |

| | | | | | | | | | | | | Liabilities | | |

| | | | | | Gross | | Net Amount of | | | | | | | | |

| | | | | | Amounts | | | Liabilities | | | | | | | | |

| | | Gross | | | Offset in the | | Presented in the | | | | | | | | |

| | | Amounts of | | | Statement of | | | Statement of | | | | Financial | | Cash | | |

| | | Recognized | | | Assets and | | | Assets and | | | | Instruments | | Collateral | Net Amount |

| Description | | Liabilities | | | Liabilities | | | Liabilities | | | | Pledged | | Pledged | of Liabilities |

| Options Written | $ | (11,550) | (3) | $ | - | $ | | (11,550) | (3) | | $ | 11,550 | (2) | $ - | $ - |

|

| Total | $ | (11,550) | | $ | - | $ | | (11,550) | | | $ | 11,550 | | $- | $ - |

(2) The amount is limited to the derivative liability balance and accordingly does not include excess collateral pledged.

(3) Written options at value as presented in the Schedule of Options Written.

4.) ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS

The Fund has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Pursuant to the Advisory Agreement, the Adviser manages the operations of the Fund and manages the Fund’s investments in accordance with the stated policies of the Fund. As compensation for the investment advisory services provided to the Fund, the Adviser receives a monthly management fee equal to an annual rate of 1.00% of the Fund’s net assets. For the fiscal year ended February 28, 2022, the Adviser earned $673,652 of advisory fees.

Prior to June 12, 2021, the Fund had entered into an Investment Company Services Agreement (“ICSA”) with M3Sixty Administration, LLC (“M3Sixty” or “Prior Administrator”). Pursuant to the ICSA, M3Sixty provided day-to-day operational services to the Fund including, but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Fund's portfolio securities; (d) pricing the Fund's shares; (e) assistance in preparing tax returns; (f) preparation and filing of required regulatory reports; (g) communications with shareholders; (h) coordination of Board and shareholder meetings; (i) monitoring the Fund's legal compliance; and (j) maintaining shareholder account records.

For their services provided through June 11, 2021, M3Sixty earned $89,370 including compliance officer fees and out of pocket expenses.

Through June 11, 2021, certain officers of the Fund were also employees of the Prior Administrator.

Prior to June 12, 2021 the Fund had entered into a Distribution Agreement with Matrix 360 Distributors, LLC (“M3SixtyD”). Pursuant to the Distribution Agreement, M3SixtyD provided distribution services to the Fund through June 12, 2021. M3SixtyD served as underwriter/distributor of the Fund. M3SixtyD was an affiliate of M3Sixty. Fees earned by M3SixtyD were paid by the Adviser.

Effective June 12, 2021, Premier Fund Solutions, Inc. (“PFS” or “Administrator”) serves as the Administrator for all the Funds in the Trust, pursuant to a written agreement with the Trust. PFS provides day-to-day administrative services to the Funds. For PFS’s services to the Funds, each Fund of the Trust pays PFS an annualized asset-based fee of 0.07% of average daily net assets up to $200 million, with lower fees at higher asset levels; subject to a minimum monthly fee of $2,800 per Fund, plus reimbursement of out-of-pocket expenses. For its services to the Fund, from June 12, 2021, through February 28, 2022, amounts earned by PFS were $34,567.

An officer of the Fund is also an employee of the Administrator.

5.) INVESTMENT TRANSACTIONS

For the fiscal year ended February 28, 2022, purchases and sales of investment securities other than U.S. Government obligations and short-term investments were $0 and $47,076,493, respectively.

6.) TAX MATTERS

For federal income tax purposes, at February 28, 2022, the cost of securities on a tax basis and the composition of gross unrealized appreciation (the excess of value over tax cost) and depreciation (the excess of tax cost over value) including written options were as follows:

2022 Annual Report 16

| Notes to Financial Statements - continued | | | |

| |

| Cost of Investments | $ | 56,599,162 | |

| |

| Gross Unrealized Appreciation | $ | 229 | |

| Gross Unrealized Depreciation | | (1,461 | ) |

| Net Unrealized Appreciation (Depreciation) on Investments | $ | (1,232 | ) |

The difference between book basis and tax basis unrealized appreciation (depreciation) is primarily attributable to the tax treatment of derivatives.

The Fund’s tax basis distributable earnings are determined only at the end of each fiscal year. The tax character of distributable earnings (deficit) at February 28, 2022, the Fund’s most recent fiscal year end, was as follows:

| Accumulated Undistributed Ordinary Income | $ | 5,030,959 | |

| Other Accumulated Loss | | (228 | ) |

| Unrealized Depreciation | | (1,232 | ) |

| | $ | 5,029,499 | |

As of February 28, 2022, other accumulated losses are attributable to losses on straddles from options of $228.

As of February 28, 2022, the Fund did not have any capital loss carryforwards available for federal income tax purposes to offset future capital gains.

As of February 28, 2022, the Fund recorded reclassifications to increase Paid In Capital and decrease Distributable Earnings by $550,286, which was primarily related to the use of equalization for tax purposes.

During the fiscal year ended February 28, 2022, the Fund distributed $668,552 of ordinary income and $2,880,349 of long-term capital gains.

During the fiscal year ended February 28, 2021, the Fund distributed $118,463 of ordinary income and $161,687 of long-term capital gains.

7.) COMMITMENTS AND CONTINGENCIES

In the normal course of business, the Trust may enter into contracts that may contain a variety of representations and warranties and provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, management considers the risk of loss from such claims to be remote.

8.) COVID-19 RISKS

Unexpected local, regional or global events, such as war; acts of terrorism; financial, political or social disruptions; natural, environmental or man-made disasters; the spread of infectious illnesses or other public health issues; and recessions and depressions could have a significant impact on the Fund and its investments and may impair market liquidity. Such events can cause investor fear, which can adversely affect the economies of nations, regions and the market in general, in ways that cannot necessarily be foreseen. The impact of COVID-19 has adversely affected, and other infectious illness outbreaks that may arise in the future could adversely affect, the economies of many nations and the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

9.) SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. In order to meet the distribution requirements under Subchapter M and maintain RIC status, the Fund intends to pay a “deficiency dividend” of approximately $1,120,000 as of or prior to June 30, 2022, relating to the Fund’s taxable year ended February 28, 2021. Management has concluded that there are no other subsequent events requiring adjustment to or disclosure in the financial statements.

2022 Annual Report 17

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of IPS Strategic Capital Absolute Return Fund and

Board of Trustees of WP Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedules of investments and options written, of IPS Strategic Capital Absolute Return Fund (the “Fund”), a series of WP Trust, as of February 28, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of February 28, 2022, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of February 28, 2022, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2016.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

April 27, 2022

2022 Annual Report 18

ADDITIONAL INFORMATION

February 28, 2022

(Unaudited)

EXPENSE EXAMPLE |

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. Although the Fund charges no sales loads or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by Mutual Shareholder Services, LLC, the Fund’s transfer agent. IRA accounts will be charged an $8.00 annual maintenance fee. Additionally, your account will be indirectly subject to the expenses of any underlying funds. The following example is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with similar costs of investing in other mutual funds. The example is based on an investment of $1,000 invested in the Fund on September 1, 2021, and held through February 28, 2022.

The first line of the table below provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6) and then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period.”

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid by a shareholder for the period. Shareholders may use this information to compare the ongoing costs of investing in the Fund and other funds. In order to do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in other funds’ shareholder reports.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as the annual maintenance fee charged to IRA accounts, or exchange fees or expenses of any underlying funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | Expenses Paid |

| | | Beginning | | Ending | | During the Period* |

| | | Account Value | | Account Value | | September 1, 2021 |

| | | September 1, 2021 | | February 28, 2022 | | to February 28, 2022 |

| |

| Actual | | $1,000.00 | | $947.86 | | $6.38 |

| |

| Hypothetical | | $1,000.00 | | $1,017.36 | | $6.61 |

| (5% annual return | | | | | | |

| before expenses) | | | | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.32%, multiplied by the average account

value over the period, multiplied by 181/365 (to reflect the one-half year period).

AVAILABILITY OF QUARTERLY SCHEDULE OF INVESTMENTS

The Fund publicly files its complete schedules of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT is available on the SEC’s website at http://www.sec.gov.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-866-959-9260; and on the Commission’s website at http://www.sec.gov.

Form N-PX provides information regarding how the Fund voted proxies with regards to portfolio securities held during the most recent 12-month period ended June 30th and is available without charge, upon request, by calling 1-866-959-9260. This information is also available on the SEC’s website at http://www.sec.gov.

2022 Annual Report 19

Additional Information (Unaudited) - continued

APPROVAL OF THE ADVISORY AGREEMENT RENEWAL FOR THE

IPS STRATEGIC CAPITAL ABSOLUTE RETURN FUND

At a meeting held on January 19, 2022, the Board of Trustees (the “Board”) considered the approval of the renewal of the Investment Advisory Agreement (the “Advisory Agreement”) between the Trust and IPS Strategic Capital, Inc. (the “Adviser”) in regard to the IPS Strategic Capital Absolute Return Fund (the “IPS Fund”).

Legal Counsel to the Trust (“Counsel”) reviewed with the Board a memorandum from Counsel and addressed to the Trustees that summarized, among other things, the fiduciary duties and responsibilities of the Board in reviewing and approving the renewal of the Advisory Agreement between the Trust and the Adviser with respect to the IPS Fund. A copy of this memorandum was circulated to the Trustees in advance of the Meeting. Counsel discussed with the Trustees the types of information and factors that should be considered by the Board in order to make an informed decision regarding the approval of the continuation of the Advisory Agreement, including the following material factors: (i) the nature, extent and quality of the services provided by the Adviser; (ii) the investment performance of the IPS Fund; (iii) the costs of the services provided and profits to be realized by the Adviser from its relationship with the IPS Fund; (iv) the extent to which economies of scale would be realized if the IPS Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the IPS Fund’s investors; and (v) the Adviser’s practices regarding possible conflicts of interest and other benefits derived by the Adviser.

In assessing these factors and reaching its decisions, the Board took into consideration information furnished for the Board’s review and consideration throughout the year at regular Board meetings, as well as information specifically prepared and/or presented in connection with the annual renewal process, including information presented to the Board in the Adviser’s presentation earlier in the Meeting. The Board requested and was provided with information and reports relevant to the annual renewal of the Advisory Agreement, including: (i) reports regarding the services and support provided to the IPS Fund and its shareholders by the Adviser; (ii) quarterly assessments of the investment performance of IPS Fund from the Adviser; (iii) periodic commentary on the reasons for the performance; (iv) presentations by the Adviser regarding its investment philosophy, investment strategy, personnel and operations; (v) compliance reports concerning the IPS Fund and the Adviser; (vi) disclosure information contained in the registration statement of the Trust and the Form ADV of the Adviser; and (vii) a memorandum from Counsel, that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the renewal of the Advisory Agreement, including the material factors set forth above and the types of information included in each factor that should be considered by the Board in order to make an informed decision.

The Board also requested and received various informational materials including, without limitation: (i) documents containing information about the Adviser, including financial information, a description of personnel and the services provided to the IPS Fund, information on investment advice, performance, summaries of the IPS Fund’s expenses, compliance program, current legal matters and other general information; (ii) comparative expense and performance information for other mutual funds with strategies similar to the IPS Fund; (iii) the anticipated effect of size on the IPS Fund’s performance and expenses; and (iv) benefits to be realized by the Adviser from its relationship with the IPS Fund. The Board did not identify any particular information that was most relevant to its consideration to approve the Advisory Agreement and each Trustee may have afforded different weight to the various factors.

(1) The nature, extent and quality of the services provided by the Adviser.

In this regard, the Board considered the responsibilities the Adviser has under the Advisory Agreement with respect to the IPS Fund. The Board reviewed the services provided by the Adviser to the IPS Fund including, without limitation: the Adviser’s processes for formulating investment recommendations, researching and developing improvements to the investment process, and assuring compliance with the IPS Fund’s investment objectives and limitations; its efforts to coordinate services among the IPS Fund’s service providers; and the anticipated efforts to promote the IPS Fund, grow assets and assist in the distribution of the IPS Fund’s shares. The Board considered: the Adviser’s staffing, personnel, and methods of operating; the education and experience of the Adviser’s personnel; and the Adviser’s compliance program, policies, and procedures. After reviewing the foregoing and other information from the Adviser, the Board concluded that the quality, extent, and nature of the services to be provided by the Adviser was satisfactory and adequate for the IPS Fund.

2022 Annual Report 20

Additional Information (Unaudited) - continued

(2) Investment Performance of the IPS Fund and the Adviser.

In considering the investment performance of IPS Fund and the Adviser, the Trustees compared the performance of the IPS Fund with the performance of comparable funds with similar objectives managed by other investment advisers. The Trustees also considered the consistency of the Adviser’s management of the IPS Fund with its investment objective and policies and the Adviser’s ongoing commitment to researching and improving its overall investment process. The Board noted that the IPS Fund, in comparison with its Morningstar Options Based Category, had outperformed the category average for the 1-year, 3-year and 5-year periods ended December 31, 2021. They also compared the IPS Fund’s performance to a subset of the Morningstar Options Based Category which included funds in the Category with assets ranging from $25 million to $125 million (the “Options Subset Category”). The Board noted that the IPS Fund had outperformed the Options Subset Category average for the 1-year, 3-year and 5-year periods ended December 31, 2021. The Board also considered the IPS Fund’s performance relative to a peer group selected by the Adviser (the “Peer Group”), noting that the IPS Fund’s performance was comparable to Peer Group for the 1-year, 3-year and 5-year periods ended December 31, 2021. The Board also considered the range of performance within the Morningstar Options Based Category, noting that the Category captures funds with very diverse strategies. The Board considered the Adviser’s periodic explanations of performance, including those that occurred at this Meeting. The Trustees noted that the Adviser does not manage any separate accounts that are substantially similar to the IPS Fund. Based on the foregoing, the Board concluded that the investment performance of the IPS Fund was satisfactory.

(3) The costs of the services to be provided and profits to be realized by the Adviser from the relationship with the IPS Fund.

In considering the costs of the services to be provided and profits to be realized by the Adviser from the relationship with the IPS Fund, the Trustees considered: the Adviser’s staffing, personnel, and methods of operating; the financial condition of the Adviser and its affiliates and the level of commitment to the Adviser’s operations by the Adviser and its principals; the current asset level of the IPS Fund; and the projected overall expenses, including software related expenses of the IPS Fund. The Trustees considered the financial circumstances of the Adviser and discussed the financial stability and productivity of the firm. The Trustees considered the fees and expenses of the IPS Fund (including the management fee) relative to its category median and average. The Trustees noted that the IPS Fund’s management fee of 1.00% was higher than the Morningstar Options Based Category’s median and average management fees of 0.75% and 0.83%, respectively. They also discussed how the IPS Fund’s management fee compared to the Options Subset Category and Peer Group, noting that the Fund’s management fee was within the range of management fees charged by the funds within these two comparative groups. The Trustees compared the IPS Fund’s overall expense ratio to its Morningstar Options Based Category and Options Subset Category’s median and average expense ratios, noting that the Fund’s expense ratio was higher than both comparative ratios for the respective Categories. They also noted that the IPS Fund’s expense ratio was higher than the expense ratio for each fund within the Peer Group. The Board discussed the complexity of the IPS Fund’s strategy and the labor intense nature of the strategy. The Board also considered the ongoing investment the Adviser has made in research and refinement of its investment strategies. They discussed the software expenses being incurred by the IPS Fund and the impact that has on the Adviser and the Fund. The Board also considered the Adviser’s decision to implement a plan that will over time diversify its ownership structure by offering a non-controlling ownership stake in the firm to one of its key employees. It was noted that the IPS Fund may invest in other investment companies so the Board considered the nature of the services rendered and determined, based on the information provided by the Adviser in its response, as well as discussions with the Adviser, that the fees paid with respect to the IPS Fund were based on services provided that are in addition to, rather than duplicative of, the services provided by the investment advisers to the underlying investment companies in which the IPS Fund may invest. The Board discussed the Adviser’s high level of service provided to shareholders and its overall performance record relative to its stated investment strategy. The Board considered the Adviser’s profitability as it relates to its services to the IPS Fund, concluding that, in consideration of the above the factors, the Adviser’s profitability was reasonable. The Board further concluded that the fee to be paid to the Adviser by the IPS Fund was fair and reasonable.

2022 Annual Report 21

Additional Information (Unaudited) - continued

(4) The extent to which economies of scale would be realized as the IPS Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the IPS Fund’s investors.

In this regard, the Board considered the IPS Fund’s fee arrangements with the Adviser. The Trustees noted that the IPS Fund would benefit from economies of scale under its agreements with some of its service providers other than the Adviser as fees that were in place with those other service providers were either fixed or essentially semi-fixed, and the Board considered the Adviser’s efforts to secure such arrangements for the IPS Fund. The Trustees noted that the Adviser does not manage separately managed accounts with substantially similar strategies as the IPS Fund. Following further discussion of the IPS Fund’s expected asset levels, expectations for growth and levels of fees, the Board determined that the IPS Fund’s fee arrangements, in light of all the facts and circumstances, were fair and reasonable.

(5) Possible conflicts of interest and benefits derived by the Adviser.

In considering the Adviser’s practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as: the experience and ability of the advisory and compliance personnel assigned to the IPS Fund; the fact that the Adviser does not utilize soft dollars; the basis of decisions to buy or sell securities for the IPS Fund; and the substance and administration of the Adviser’s code of ethics. Based on the foregoing, the Board determined that the Adviser’s standards and practices relating to the identification and mitigation of possible conflicts of interest were satisfactory. The Trustees noted that there were no benefits identified by the Adviser to the Board, other than the receipt of advisory fees under the Advisory Agreement, in managing the assets of the IPS Fund.

After additional consideration of the factors delineated in the memorandum provided by Counsel and further discussion among the Board, the Board determined that the compensation payable under the Advisory Agreement with respect to the IPS Fund was fair, reasonable and within a range of what could have been negotiated at arms-length in light of all the surrounding circumstances, and they resolved to approve the Advisory Agreement with respect to the IPS Fund.

| LIQUIDITY RISK MANAGEMENT PROGRAM |

During the fiscal year ended February 28, 2022, the Board reviewed the Fund’s liquidity risk management program, adopted pursuant to Rule 22e-4 under the Investment Company Act. The program is overseen by the Adviser, who has delegated certain responsibilities for managing the program to a liquidity program administrator (the “LPA”). The LPA reported that it had assessed, managed and reviewed the program for the Fund taking into consideration several factors including the liquidity of the Fund’s portfolio investments and the market, trading or investment specific considerations that may reasonably affect a security’s classification as a liquid investment. The LPA certified that the program was adequate, effectively implemented and needed no changes at that time.