UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23096

Legg Mason ETF Investment Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: October 31

Date of reporting period: October 31, 2017

ITEM 1. REPORT TO STOCKHOLDERS.

The Annual Report to Stockholders is filed herewith.

| Annual Report | October 31, 2017 |

LEGG MASON

US DIVERSIFIED CORE ETF

UDBI

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks to track the investment results of an index composed of publicly traded U.S. equity securities.

Dear Shareholder,

We are pleased to provide the annual report of Legg Mason US Diversified Core ETF for the twelve-month reporting period ended October 31, 2017. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | Fund net asset value and market price, |

| • | Market insights and commentaries from our portfolio managers, and |

| • | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

November 30, 2017

| II | Legg Mason US Diversified Core ETF |

Economic review

Economic activity in the U.S. improved during the twelve months ended October 31, 2017 (the “reporting period”). Looking back, the U.S. Department of Commerce reported that U.S. gross domestic product (“GDP”)i growth was 1.8% and 1.2%, as revised, for the fourth quarter of 2016 and the first quarter of 2017, respectively. Second quarter 2017 GDP growth then accelerated to 3.1%. Finally, the U.S. Department of Commerce’s second estimate for third quarter 2017 GDP growth — released after the reporting period ended — was 3.3%. Stronger growth was attributed to a number of factors, including positive contributions from personal consumption expenditures, private inventory investment, nonresidential fixed investment and exports. These positive factors were partly offset by a decrease in imports.

Job growth in the U.S. was solid overall and a tailwind for the economy during the reporting period. When the reporting period ended on October 31, 2017, the unemployment rate was 4.1%, as reported by the U.S. Department of Labor. This represented the lowest unemployment rate since December 2000. The percentage of longer-term unemployed fluctuated during the reporting period. However, in October 2017, 24.8% of Americans looking for a job had been out of work for more than six months, the same as when the period began.

Looking back, after an extended period of maintaining the federal funds rateii at a historically low range between zero and 0.25%, the Federal Reserve Board (the “Fed”)iii increased the rate at its meeting on December 16, 2015. In particular, the U.S. central bank raised the federal funds rate to a range between 0.25% and 0.50%. The Fed then kept rates on hold at each meeting prior to its meeting on December 14, 2016, at which time, the Fed raised rates to a range between 0.50% and 0.75%.

After holding rates steady at its meeting that concluded on February 1, 2017, the Fed raised rates to a range between 0.75% and 1.00% at its meeting that ended on March 15, 2017. At its meeting that concluded on June 14, 2017, the Fed raised rates to a range between 1.00% and 1.25%. At its meeting that concluded on July 26, 2017, the Fed kept rates on hold, as expected. At its meeting that concluded on September 20, 2017, the Fed again kept rates on hold, but reiterated its intention to begin reducing its balance sheet, saying, “In October, the Committee will initiate the balance sheet normalization program….” Finally, at its meeting that ended on November 1, 2017, after the reporting period ended, the Fed maintained the federal funds rate in the target range of 1.00% to 1.25%, but left open the possibility of another rate hike in December 2017.

As always, thank you for your confidence in

our stewardship of your assets.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

November 30, 2017

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results.

| Legg Mason US Diversified Core ETF | III |

Investment commentary (cont’d)

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| iii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| IV | Legg Mason US Diversified Core ETF |

Q. What is the Fund’s investment strategy?

A. Legg Mason US Diversified Core ETF (the “Fund”) seeks to track the investment results of the QS DBI US Diversified Index (the “Underlying Index”). The Underlying Index seeks to provide exposure to equities of U.S. companies and is based on a proprietary methodology created and sponsored by QS Investors, LLC (“QS”), the Fund’s subadviser. The Underlying Index is composed of U.S. companies that are included in the MSCI USA IMI Index.

The proprietary rules-based process initially groups this universe of securities into multiple investment categories based on industries. Within each of these investment categories, securities are weighted by

market capitalization. The process then combines those investment categories with more highly correlated historical performance into a smaller number of “clusters.” A cluster is a group of investment categories based on industry that have demonstrated a tendency to behave similarly (high correlation). Thereafter, each of these clusters is equally weighted in the Underlying Index to produce a diversified portfolio. QS anticipates that the number of component securities in the Underlying Index will range from 2,200 to 2,500. The Underlying Index may include large, medium and small capitalization companies. The components of the Underlying Index, and the degree to which these components represent certain sector and industries, may change over time. The Underlying Index’s components are reconstituted annually and rebalanced quarterly. The Underlying Index is reconstituted on a different date from the MSCI USA IMI Index. Securities that are removed from, or added to, the MSCI USA IMI Index are removed from, or considered for inclusion in, the Underlying Index at the next annual reconstitution or quarterly rebalancing of the Underlying Index. The Fund’s portfolio is rebalanced when the Underlying Index is

rebalanced or reconstituted. The Fund may trade at times other than when the Underlying Index is rebalanced or reconstituted for a variety of reasons, including when adjustments may be made to its representative sampling process from time to time or when investing cash.

The term “diversified” highlights the purpose of QS’ Diversification Based Investing methodology, which seeks to avoid concentration risks often identified with market cap-weighted funds. The term “core” high-lights the segment of the investment universe where the Fund invests — as opposed to introducing value or size biases or investing in niche segments of the market.

The Fund uses a “passive” or indexing investment approach to achieve its investment objective. Unlike many investment companies, the Fund does not try to outperform its Underlying Index and does not seek temporary defensive positions when markets decline or appear overvalued. Indexing may eliminate the chance that the Fund will substantially outperform the Underlying Index and also may reduce some of the risks of active management, such as poor security selection. Indexing seeks to achieve lower costs and better after-tax performance by keeping portfolio turnover low in comparison to actively managed investment companies.

QS may use a representative sampling indexing strategy to manage the Fund. “Representative sampling” is an indexing strategy that involves investing in a representative sample of securities that collectively

| Legg Mason US Diversified Core ETF 2017 Annual Report | 1 |

Fund overview (cont’d)

has an investment profile similar to that of the Underlying Index. When representative sampling is used, the securities selected are expected to have, in the aggregate, investment characteristics (based on factors such as return variability, risk, market capitalization and sector exposures) and fundamental characteristics (such as portfolio yield, price/earnings ratios and price/book ratios) similar to those of the Underlying Index. The Fund may or may not hold all of the securities in the Underlying Index.

The Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, if any, in securities that compose the Underlying Index. The equity securities that the Fund will hold are principally

common stocks.

The Fund may invest up to 20% of its net assets in certain index futures, options, options on index futures, swap contracts or other derivatives related to its Underlying Index and its component securities; cash and cash equivalents; other investment companies, including exchange-traded funds; exchange-traded notes; and in securities and other instruments not included in its Underlying Index but which we believe will help the Fund track its Underlying Index. The Fund may invest in exchange-traded equity index futures to manage industry exposure and for cash management purposes.

The Fund will concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying Index is concentrated. For purposes of this limitation, securities of the U.S. government (including its agencies and instrumentalities) and repurchase agreements collateralized by U.S. government securities are not considered to be issued by members of any industry.

Q. What were the overall market conditions during the Fund’s reporting period?

A. This was a strong twelve-month reporting period ended October 31, 2017 for U.S. equities, beginning with the run-up in November 2016 after the U.S. presidential election. The first quarter of 2017 largely extended the so-called “Trump rally”, with steady equity gains tapering off after mid-March. Most major economies, including the U.S., saw largely positive economic indicators. These positive trends prompted the Federal Reserve Board (the “Fed”)i to continue to modestly raise rates, and set expectations for two more hikes to follow in 2017, as well as a gradual tapering of its bond holdings.

Across equity sectors, the Energy sector was the only decliner, sliding after its run-up in late 2016; oil prices declined over 5% during the first quarter of 2017 amid reports of large U.S. reserves and suspected cheating on recently-placed quotas by the Organization of Petroleum Exporting Countries (“OPEC”).

U.S. large cap equities ended the second quarter of 2017 with a gain, in a low-volatility environment. Continued solid corporate earnings and general global growth outweighed news events that included a cyber ransomware attack and other terror attacks. Earning revisions weakened at quarter end after months of positive trends. The U.S. experienced some softening in growth metrics, though indicators were not actually weak. Manufacturing has slowed slightly but service sector growth has been rising. The Fed appeared optimistic as it implemented an

| 2 | Legg Mason US Diversified Core ETF 2017 Annual Report |

interest rate hike, pointed toward one more in 2017, and may start to pare back its balance sheet against a backdrop of strong employment and low inflation.

Large cap stocks saw a wide dispersion in sector returns with the laggard again being the Energy sector. Oil prices have remained stubbornly low amid higher-than-expected reserves.

U.S. large cap equities ended the third quarter of 2017 in positive territory; the Russell 1000 Indexii, the S&P 500 Indexiii, and several other major stock indices hit all-time highs during the period. The market has been benefiting from strong economic statistics and muted inflation, and reacted positively to the possibility of tax cuts. Volatility increased in August 2017, but fell back in September 2017, as strong corporate earnings and positive future estimates continued across most sectors. The active hurricane season was blamed for a recent weak employment report; we believe it will likely hit U.S. gross domestic product (“GDP”)iv growth in the short term, but boost auto sales, construction, and other industries over the coming quarters. In this environment, we expect the Fed to raise rates and rein in its balance sheet.

The Fund uses a passive investment approach to achieve its investment objective, and therefore, made no change in investment approach in response to market conditions.

Performance review

For the twelve months ended October 31, 2017, Legg Mason US Diversified Core ETF generated a 19.62% return on a net asset value (“NAV”)v basis and 19.99% based on its market pricevi per share.

The performance table shows the Fund’s total return for the twelve months ended October 31, 2017 based on its NAV and market price as of October 31, 2017. The Fund seeks to track the investment results of the QS DBI US Diversified Index, which returned 20.15% for the same period. The Fund’s broad-based market index, the Russell 3000 Indexvii, returned 23.98% over the same time frame. The Lipper Multi-Cap Core Funds Category Average1 returned 21.97% for the same period. Please note that Lipper performance returns are based on each fund’s NAV.

| Performance Snapshot as of October 31, 2017 (unaudited) | ||||||||

| 6 months | 12 months | |||||||

| Legg Mason US Diversified Core ETF: | ||||||||

$31.02 (NAV) | 7.22 | % | 19.62 | %*† | ||||

$31.08 (Market Price) | 7.43 | % | 19.99 | %*‡ | ||||

| QS DBI US Diversified Index | 7.49 | % | 20.15 | % | ||||

| Russell 3000 Index | 8.92 | % | 23.98 | % | ||||

| Lipper Multi-Cap Core Funds Category Average1 | 7.77 | % | 21.97 | % | ||||

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Principal value and investment returns will fluctuate so shares, when sold, may be worth more or less than their original cost. Performance data current to the most recent month-end is available at www.leggmason.com/etf.

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended October 31, 2017 calculated among the 806 funds for the six-month period and among the 762 funds for the twelve-month period in the Fund’s Lipper category. |

| Legg Mason US Diversified Core ETF 2017 Annual Report | 3 |

Fund overview (cont’d)

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. These shares are not individually available for purchase or redemption directly from the ETF. Market price returns are based upon the National Best Bid and Offer (“NBBO”)viii at 4:00 p.m. Eastern Time. These returns do not represent investors’ returns had they traded shares at other times. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Information showing the number of days the market price of the Fund’s shares was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV (i.e., premium or discount) for various time periods is available by visiting the Fund’s website at www.leggmason.com/etf.

As of the Fund’s current prospectus dated March 1, 2017, the gross total annual fund operating expense ratio for the Fund was 0.30%.

* Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions at NAV.

‡ Total return assumes the reinvestment of all distributions at market price.

Q. What were the leading contributors to performance?

A. The primary contributors to performance in the Underlying Index for the reporting period were the Industrials, Consumer Discretionary and Information Technology sectors.

Q. What were the leading detractors from performance?

A. The leading detractors from performance in the Underlying Index were the Telecommunication Services and Energy sectors, both of which had negative total returns for the period. The latter suffered throughout the reporting period from low oil prices and large reserves.

Looking for additional information?

The Fund’s daily NAV is available on-line at www.leggmason.com/etf. The Fund is traded under the symbol “UDBI” and its closing market price is available on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-877-721-1926 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in Legg Mason US Diversified Core ETF. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

QS Investors, LLC

November 20, 2017

RISKS: Equity securities are subject to market and price fluctuations. In rising markets, the value of large-cap stocks may not rise as much as smaller-cap stocks. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. Diversification does not guarantee a profit or protect against a loss. The Fund may focus its investments in certain industries, increasing its vulnerability to market volatility. There is no guarantee that

| 4 | Legg Mason US Diversified Core ETF 2017 Annual Report |

the Fund will achieve a high degree of correlation to the index it seeks to track. The Fund does not seek to outperform the index it tracks, and does not seek temporary defensive positions when markets decline or appear overvalued. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

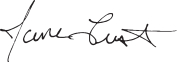

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of October 31, 2017 were: Consumer Discretionary (21.6%), Industrials (17.3%), Financials (11.9%), Health Care (11.2%) and Consumer Staples (9.3%). The Fund’s composition may differ over time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. An index is a statistical composite that tracks a specified financial market sector or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| ii | The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000 Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 92% of the U.S. market. |

| iii | The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. |

| iv | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| v | Net Asset Value (“NAV”) is calculated by subtracting total liabilities from total assets and dividing the result by the number of shares outstanding. |

| vi | Market Price is determined by supply and demand. It is the price at which an investor purchases or sells shares of the Fund. The Market Price may differ from the Fund’s NAV. |

| vii | The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| viii | The National Best Bid and Offer (“NBBO”) is the best (lowest) available ask price and the best (highest) available bid price to investors when they buy and sell securities. |

| Legg Mason US Diversified Core ETF 2017 Annual Report | 5 |

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of October 31, 2017 and October 31, 2016. The composition of the Fund’s investments is subject to change at any time. |

| 6 | Legg Mason US Diversified Core ETF 2017 Annual Report |

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, such as brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

This example is based on an investment of $1,000 invested on May 1, 2017 and held for the six months ended October 31, 2017.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| Based on actual total return1 | Based on hypothetical total return1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Total Return2 | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period3 | Hypothetical Annualized Total Return | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period3 | |||||||||||||||||||||||||||||||||||||||||

| 7.22% | $ | 1,000.00 | $ | 1,072.20 | 0.30 | % | $ | 1.57 | 5.00 | % | $1,000.00 | $ | 1,023.69 | 0.30 | % | $ | 1.53 | |||||||||||||||||||||||||||||||||

| 1 | For the six months ended October 31, 2017. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| Legg Mason US Diversified Core ETF 2017 Annual Report | 7 |

| Net Asset Value | ||||

| Average annual total returns1 | ||||

| Twelve Months Ended 10/31/17 | 19.62 | % | ||

| Inception* through 10/31/17 | 13.62 | |||

| Cumulative total returns1 | ||||

| Inception date of 12/28/15 through 10/31/17 | 26.51 | % | ||

| Market Price | ||||

| Average annual total returns2 | ||||

| Twelve Months Ended 10/31/17 | 19.99 | % | ||

| Inception* through 10/31/17 | 13.74 | |||

| Cumulative total returns2 | ||||

| Inception date of 12/28/15 through 10/31/17 | 26.75 | % | ||

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

Investors buy and sell shares of the Fund at market price, not NAV, in the secondary market throughout the trading day. These shares are not individually available for purchase or redemption directly from the Fund. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. Market price returns shown are based upon the National Best Bid and Offer (“NBBO”) at 4:00 p.m. Eastern Time. These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other exchange-traded funds, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at market price. |

| * | Inception date of the Fund is December 28, 2015. |

| 8 | Legg Mason US Diversified Core ETF 2017 Annual Report |

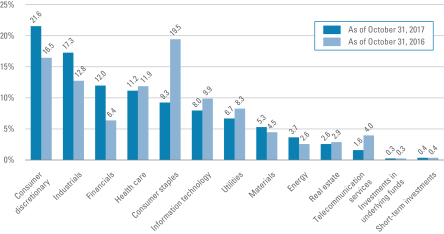

Historical performance

Value of $10,000 invested in

Legg Mason US Diversified Core ETF vs. QS DBI US Diversified Index and Russell 3000 Index† — December 28, 2015 - October 2017

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in the Legg Mason US Diversified Core ETF on December 28, 2015, assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through October 31, 2017. The hypothetical illustration also assumes a $10,000 investment in the QS DBI US Diversified Index and the Russell 3000 Index. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund. The QS DBI US Diversified Index (the “Underlying Index”) is an index composed of publicly traded U.S. equity securities that are included in the MSCI USA IMI Index. The Underlying Index is based on a proprietary methodology created and sponsored by QS Investors, LLC, the Fund’s subadviser. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. The indices are not subject to the same management and trading expenses as a fund. An index is a statistical composite that tracks a specified financial market, sector, or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index. |

| Legg Mason US Diversified Core ETF 2017 Annual Report | 9 |

October 31, 2017

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Common Stocks — 99.2% | ||||||||||||||||

| Consumer Discretionary — 21.6% | ||||||||||||||||

Auto Components — 1.0% |

| |||||||||||||||

Adient PLC | 24 | $ | 2,025 | |||||||||||||

American Axle & Manufacturing Holdings Inc. | 37 | 658 | * | |||||||||||||

Autoliv Inc. | 26 | 3,246 | ||||||||||||||

BorgWarner Inc. | 67 | 3,532 | ||||||||||||||

Cooper Tire & Rubber Co. | 13 | 426 | ||||||||||||||

Cooper-Standard Holdings Inc. | 5 | 557 | * | |||||||||||||

Dana Inc. | 40 | 1,220 | ||||||||||||||

Delphi Automotive PLC | 79 | 7,851 | ||||||||||||||

Dorman Products Inc. | 8 | 553 | * | |||||||||||||

Fox Factory Holding Corp. | 17 | 723 | * | |||||||||||||

Gentex Corp. | 72 | 1,398 | ||||||||||||||

Gentherm Inc. | 9 | 302 | * | |||||||||||||

Goodyear Tire & Rubber Co. | 78 | 2,386 | ||||||||||||||

LCI Industries | 6 | 743 | ||||||||||||||

Lear Corp. | 18 | 3,161 | ||||||||||||||

Modine Manufacturing Co. | 34 | 716 | * | |||||||||||||

Standard Motor Products Inc. | �� | 8 | 349 | |||||||||||||

Tenneco Inc. | 14 | 814 | ||||||||||||||

Visteon Corp. | 10 | 1,260 | * | |||||||||||||

Total Auto Components | 31,920 | |||||||||||||||

Automobiles — 1.0% |

| |||||||||||||||

Ford Motor Co. | 738 | 9,055 | ||||||||||||||

General Motors Co. | 270 | 11,605 | ||||||||||||||

Harley-Davidson Inc. | 41 | 1,941 | ||||||||||||||

Tesla Inc. | 25 | 8,288 | * | |||||||||||||

Thor Industries Inc. | 10 | 1,362 | ||||||||||||||

Winnebago Industries Inc. | 13 | 639 | ||||||||||||||

Total Automobiles | 32,890 | |||||||||||||||

Diversified Consumer Services — 1.6% |

| |||||||||||||||

Adtalem Global Education Inc. | 74 | 2,734 | ||||||||||||||

American Public Education Inc. | 19 | 380 | * | |||||||||||||

Bridgepoint Education Inc. | 43 | 416 | * | |||||||||||||

Bright Horizons Family Solutions Inc. | 53 | 4,574 | * | |||||||||||||

Capella Education Co. | 15 | 1,222 | ||||||||||||||

Career Education Corp. | 73 | 780 | * | |||||||||||||

Carriage Services Inc. | 21 | 544 | ||||||||||||||

See Notes to Financial Statements.

| 10 | Legg Mason US Diversified Core ETF 2017 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Diversified Consumer Services — continued |

| |||||||||||||||

Chegg Inc. | 136 | $ | 2,109 | * | ||||||||||||

Graham Holdings Co., Class B Shares | 6 | 3,339 | ||||||||||||||

Grand Canyon Education Inc. | 55 | 4,923 | * | |||||||||||||

H&R Block Inc. | 253 | 6,259 | ||||||||||||||

Houghton Mifflin Harcourt Co. | 164 | 1,624 | * | |||||||||||||

K12 Inc. | 38 | 616 | * | |||||||||||||

Laureate Education Inc., Class A Shares | 54 | 722 | * | |||||||||||||

Regis Corp. | 42 | 627 | * | |||||||||||||

Service Corporation International | 241 | 8,546 | ||||||||||||||

ServiceMaster Global Holdings Inc. | 163 | 7,679 | * | |||||||||||||

Sotheby’s | 49 | 2,539 | * | |||||||||||||

Strayer Education Inc. | 12 | 1,125 | ||||||||||||||

Weight Watchers International Inc. | 31 | 1,392 | * | |||||||||||||

Total Diversified Consumer Services | 52,150 | |||||||||||||||

Hotels, Restaurants & Leisure — 1.4% |

| |||||||||||||||

Aramark | 15 | 655 | ||||||||||||||

Carnival Corp. | 26 | 1,726 | ||||||||||||||

Chipotle Mexican Grill Inc. | 2 | 544 | * | |||||||||||||

Cracker Barrel Old Country Store Inc. | 4 | 625 | ||||||||||||||

Darden Restaurants Inc. | 8 | 658 | ||||||||||||||

Dave & Buster’s Entertainment Inc. | 9 | 434 | * | |||||||||||||

Dominos Pizza Inc. | 3 | 549 | ||||||||||||||

Dunkin’ Brands Group Inc. | 10 | 591 | ||||||||||||||

Extended Stay America Inc. | 32 | 634 | ||||||||||||||

Hilton Worldwide Holdings Inc. | 12 | 867 | ||||||||||||||

Jack in the Box Inc. | 4 | 414 | ||||||||||||||

Las Vegas Sands Corp. | 38 | 2,409 | ||||||||||||||

Marriott International Inc., Class A Shares | 31 | 3,704 | ||||||||||||||

Marriott Vacations Worldwide Corp. | 5 | 658 | ||||||||||||||

McDonald’s Corp. | 73 | 12,184 | ||||||||||||||

MGM Resorts International | 48 | 1,505 | ||||||||||||||

Norwegian Cruise Line Holdings Ltd. | 12 | 669 | * | |||||||||||||

Royal Caribbean Cruises Ltd. | 17 | 2,104 | ||||||||||||||

Starbucks Corp. | 129 | 7,074 | ||||||||||||||

Texas Roadhouse Inc. | 7 | 350 | ||||||||||||||

Vail Resorts Inc. | 3 | 687 | ||||||||||||||

Wendy’s Co. | 39 | 593 | ||||||||||||||

Wyndham Worldwide Corp. | 7 | 748 | ||||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2017 Annual Report | 11 |

Schedule of investments (cont’d)

October 31, 2017

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Hotels, Restaurants & Leisure — continued |

| |||||||||||||||

Wynn Resorts Ltd. | 10 | $ | 1,475 | |||||||||||||

Yum! Brands Inc. | 33 | 2,457 | ||||||||||||||

Total Hotels, Restaurants & Leisure | 44,314 | |||||||||||||||

Household Durables — 1.5% |

| |||||||||||||||

CalAtlantic Group Inc. | 16 | 789 | ||||||||||||||

Cavco Industries Inc. | 4 | 628 | * | |||||||||||||

D.R. Horton Inc. | 112 | 4,951 | ||||||||||||||

Ethan Allen Interiors Inc. | 11 | 327 | ||||||||||||||

Garmin Ltd. | 37 | 2,095 | ||||||||||||||

GoPro Inc., Class A Shares | 44 | 459 | * | |||||||||||||

Helen of Troy Ltd. | 7 | 650 | * | |||||||||||||

Installed Building Products Inc. | 11 | 767 | * | |||||||||||||

iRobot Corp. | 10 | 672 | * | |||||||||||||

KB Home | 25 | 686 | ||||||||||||||

La-Z-Boy Inc. | 16 | 431 | ||||||||||||||

Leggett & Platt Inc. | 45 | 2,127 | ||||||||||||||

Lennar Corp., Class A Shares | 61 | 3,396 | ||||||||||||||

LGI Homes Inc. | 16 | 965 | * | |||||||||||||

M.D.C. Holdings Inc. | 13 | 482 | ||||||||||||||

M/I Homes Inc. | 15 | 501 | * | |||||||||||||

Meritage Homes Corp. | 11 | 536 | * | |||||||||||||

Mohawk Industries Inc. | 19 | 4,973 | * | |||||||||||||

Newell Brands Inc. | 160 | 6,525 | ||||||||||||||

NVR Inc. | 1 | 3,281 | * | |||||||||||||

PulteGroup Inc. | 89 | 2,690 | ||||||||||||||

Taylor Morrison Home Corp., Class A Shares | 25 | 604 | * | |||||||||||||

Tempur Sealy International Inc. | 13 | 850 | * | |||||||||||||

Toll Brothers Inc. | 48 | 2,210 | ||||||||||||||

TopBuild Corp. | 13 | 858 | * | |||||||||||||

TRI Pointe Group Inc. | 31 | 548 | * | |||||||||||||

Tupperware Brands Corp. | 12 | 705 | ||||||||||||||

Universal Electronics Inc. | 6 | 360 | * | |||||||||||||

Whirlpool Corp. | 25 | 4,098 | ||||||||||||||

Total Household Durables | 48,164 | |||||||||||||||

Internet & Direct Marketing Retail — 2.2% |

| |||||||||||||||

Amazon.com Inc. | 43 | 47,527 | * | |||||||||||||

Expedia Inc. | 12 | 1,496 | ||||||||||||||

Groupon Inc. | 97 | 463 | * | |||||||||||||

See Notes to Financial Statements.

| 12 | Legg Mason US Diversified Core ETF 2017 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Internet & Direct Marketing Retail — continued |

| |||||||||||||||

Liberty Interactive Corp. QVC Group, Class A Shares | 58 | $ | 1,318 | * | ||||||||||||

Liberty Ventures, Series A Shares | 10 | 569 | * | |||||||||||||

Netflix Inc. | 46 | 9,036 | * | |||||||||||||

Priceline Group Inc. | 5 | 9,560 | * | |||||||||||||

Shutterfly Inc. | 7 | 299 | * | |||||||||||||

TripAdvisor Inc. | 16 | 600 | * | |||||||||||||

Total Internet & Direct Marketing Retail | 70,868 | |||||||||||||||

Media — 0.8% |

| |||||||||||||||

CBS Corp., Class B Shares, Non Voting Shares | 16 | 898 | ||||||||||||||

Charter Communications Inc., Class A Shares | 8 | 2,673 | * | |||||||||||||

Comcast Corp., Class A Shares | 172 | 6,197 | ||||||||||||||

Discovery Communications Inc., Class A Shares | 18 | 340 | * | |||||||||||||

Discovery Communications Inc., Class C Shares | 20 | 356 | * | |||||||||||||

DISH Network Corp., Class A Shares | 10 | 485 | * | |||||||||||||

Liberty Broadband Corp., Class C Shares | 6 | 524 | * | |||||||||||||

Liberty Global PLC, Class A Shares | 15 | 463 | * | |||||||||||||

Liberty Global PLC, Series C Shares | 25 | 747 | * | |||||||||||||

Liberty Media Corp.-Liberty SiriusXM, Class C Shares | 14 | 583 | * | |||||||||||||

Omnicom Group Inc. | 9 | 605 | ||||||||||||||

Scripps Networks Interactive Inc., Class A Shares | 8 | 666 | ||||||||||||||

Time Warner Inc. | 30 | 2,949 | ||||||||||||||

Twenty-First Century Fox Inc., Class A Shares | 41 | 1,072 | ||||||||||||||

Twenty-First Century Fox Inc., Class B Shares | 13 | 331 | ||||||||||||||

Viacom Inc., Class B Shares | 15 | 361 | ||||||||||||||

Walt Disney Co. | 61 | 5,966 | ||||||||||||||

Total Media | 25,216 | |||||||||||||||

Multiline Retail — 3.8% |

| |||||||||||||||

Big Lots Inc. | 56 | 2,873 | ||||||||||||||

Dillard’s Inc., Class A Shares | 25 | 1,270 | ||||||||||||||

Dollar General Corp. | 336 | 27,162 | ||||||||||||||

Dollar Tree Inc. | 288 | 26,280 | * | |||||||||||||

J.C. Penney Co. Inc. | 327 | 916 | * | |||||||||||||

Kohl’s Corp. | 217 | 9,062 | ||||||||||||||

Macy’s Inc. | 376 | 7,054 | ||||||||||||||

Nordstrom Inc. | 161 | 6,384 | ||||||||||||||

Ollie’s Bargain Outlet Holdings Inc. | 59 | 2,634 | * | |||||||||||||

Sears Holdings Corp. | 72 | 397 | * | |||||||||||||

Target Corp. | 637 | 37,608 | ||||||||||||||

Total Multiline Retail | 121,640 | |||||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2017 Annual Report | 13 |

Schedule of investments (cont’d)

October 31, 2017

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Specialty Retail — 4.1% |

| |||||||||||||||

Aaron’s Inc. | 21 | $ | 773 | |||||||||||||

Advance Auto Parts Inc. | 17 | 1,390 | ||||||||||||||

American Eagle Outfitters Inc. | 52 | 677 | ||||||||||||||

AutoNation Inc. | 10 | 474 | * | |||||||||||||

AutoZone Inc. | 7 | 4,127 | * | |||||||||||||

Bed Bath & Beyond Inc. | 38 | 756 | ||||||||||||||

Best Buy Co. Inc. | 65 | 3,639 | ||||||||||||||

Burlington Stores Inc. | 17 | 1,596 | * | |||||||||||||

Caleres Inc. | 21 | 574 | ||||||||||||||

CarMax Inc. | 44 | 3,304 | * | |||||||||||||

Chico’s FAS Inc. | 74 | 591 | ||||||||||||||

Children’s Place Inc. | 6 | 653 | ||||||||||||||

Dick’s Sporting Goods Inc. | 25 | 612 | ||||||||||||||

DSW Inc., Class A Shares | 22 | 421 | ||||||||||||||

Five Below Inc. | 10 | 553 | * | |||||||||||||

Foot Locker Inc. | 32 | 963 | ||||||||||||||

GameStop Corp., Class A Shares | 30 | 561 | ||||||||||||||

Gap Inc. | 63 | 1,637 | ||||||||||||||

Group 1 Automotive Inc. | 7 | 550 | ||||||||||||||

Guess? Inc. | 38 | 616 | ||||||||||||||

Home Depot Inc. | 301 | 49,900 | ||||||||||||||

L Brands Inc. | 59 | 2,539 | ||||||||||||||

Lithia Motors Inc., Class A Shares | 6 | 679 | ||||||||||||||

Lowe’s Cos. Inc. | 215 | 17,189 | ||||||||||||||

Lumber Liquidators Holdings Inc. | 17 | 523 | * | |||||||||||||

Michaels Cos. Inc. | 29 | 563 | * | |||||||||||||

Monro Inc. | 7 | 345 | ||||||||||||||

Murphy USA Inc. | 5 | 372 | * | |||||||||||||

O’Reilly Automotive Inc. | 24 | 5,063 | * | |||||||||||||

Office Depot Inc. | 117 | 363 | ||||||||||||||

Penske Automotive Group Inc. | 12 | 559 | ||||||||||||||

RH | 10 | 899 | * | |||||||||||||

Ross Stores Inc. | 93 | 5,905 | ||||||||||||||

Sally Beauty Holdings Inc. | 51 | 883 | * | |||||||||||||

Signet Jewelers Ltd. | 19 | 1,246 | ||||||||||||||

Tiffany & Co. | 28 | 2,621 | ||||||||||||||

TJX Cos. Inc. | 160 | 11,168 | ||||||||||||||

Tractor Supply Co. | 34 | 2,049 | ||||||||||||||

See Notes to Financial Statements.

| 14 | Legg Mason US Diversified Core ETF 2017 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Specialty Retail — continued |

| |||||||||||||||

Ulta Salon, Cosmetics & Fragrance Inc. | 16 | $ | 3,229 | * | ||||||||||||

Urban Outfitters Inc. | 37 | 907 | * | |||||||||||||

Williams-Sonoma Inc. | 24 | 1,238 | ||||||||||||||

Total Specialty Retail | 132,707 | |||||||||||||||

Textiles, Apparel & Luxury Goods — 4.2% |

| |||||||||||||||

Carter’s Inc. | 38 | 3,676 | ||||||||||||||

Columbia Sportswear Co. | 22 | 1,372 | ||||||||||||||

Crocs Inc. | 76 | 775 | * | |||||||||||||

Deckers Outdoor Corp. | 27 | 1,842 | * | |||||||||||||

Fossil Group Inc. | 62 | 489 | * | |||||||||||||

G-III Apparel Group Ltd. | 45 | 1,140 | * | |||||||||||||

Hanesbrands Inc. | 274 | 6,165 | ||||||||||||||

Lululemon Athletica Inc. | 84 | 5,167 | * | |||||||||||||

Michael Kors Holdings Ltd. | 116 | 5,662 | * | |||||||||||||

Movado Group Inc. | 27 | 748 | ||||||||||||||

NIKE Inc., Class B Shares | 1,022 | 56,200 | ||||||||||||||

Oxford Industries Inc. | 15 | 969 | ||||||||||||||

PVH Corp. | 61 | 7,735 | ||||||||||||||

Ralph Lauren Corp. | 40 | 3,577 | ||||||||||||||

Skechers USA Inc., Class A Shares | 107 | 3,415 | * | |||||||||||||

Sleep Number Corp. | 19 | 618 | ||||||||||||||

Steven Madden Ltd. | 40 | 1,560 | * | |||||||||||||

Tapestry Inc. | 224 | 9,173 | ||||||||||||||

Under Armour Inc., Class A Shares | 155 | 1,941 | * | |||||||||||||

Under Armour Inc., Class C Shares | 163 | 1,879 | * | |||||||||||||

Unifi Inc. | 14 | 533 | * | |||||||||||||

V.F. Corp. | 272 | 18,945 | ||||||||||||||

Wolverine World Wide Inc. | 80 | 2,184 | ||||||||||||||

Total Textiles, Apparel & Luxury Goods | 135,765 | |||||||||||||||

Total Consumer Discretionary | 695,634 | |||||||||||||||

| Consumer Staples — 9.3% | ||||||||||||||||

Beverages — 1.7% |

| |||||||||||||||

Brown-Forman Corp., Class B Shares | 27 | 1,540 | ||||||||||||||

Coca-Cola Co. | 504 | 23,174 | ||||||||||||||

Constellation Brands Inc., Class A Shares | 20 | 4,382 | ||||||||||||||

Dr. Pepper Snapple Group Inc. | 20 | 1,713 | ||||||||||||||

Molson Coors Brewing Co., Class B Shares | 21 | 1,698 | ||||||||||||||

Monster Beverage Corp. | 52 | 3,012 | * | |||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2017 Annual Report | 15 |

Schedule of investments (cont’d)

October 31, 2017

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Beverages — continued |

| |||||||||||||||

PepsiCo Inc. | 169 | $ | 18,629 | |||||||||||||

Total Beverages | 54,148 | |||||||||||||||

Food & Staples Retailing — 1.7% |

| |||||||||||||||

Casey’s General Stores Inc. | 7 | 802 | ||||||||||||||

Costco Wholesale Corp. | 60 | 9,665 | ||||||||||||||

CVS Health Corp. | 139 | 9,526 | ||||||||||||||

Kroger Co. | 119 | 2,463 | ||||||||||||||

PriceSmart Inc. | 4 | 335 | ||||||||||||||

Rite Aid Corp. | 193 | 318 | * | |||||||||||||

SpartanNash Co. | 16 | 393 | ||||||||||||||

Sprouts Farmers Market Inc. | 28 | 518 | * | |||||||||||||

Sysco Corp. | 74 | 4,116 | ||||||||||||||

United Natural Foods Inc. | 9 | 349 | * | |||||||||||||

US Foods Holding Corp. | 16 | 437 | * | |||||||||||||

Wal-Mart Stores Inc. | 201 | 17,549 | ||||||||||||||

Walgreens Boots Alliance Inc. | 127 | 8,416 | ||||||||||||||

Total Food & Staples Retailing | 54,887 | |||||||||||||||

Food Products — 1.7% |

| |||||||||||||||

Archer-Daniels-Midland Co. | 83 | 3,392 | ||||||||||||||

B&G Foods Inc. | 13 | 413 | ||||||||||||||

Blue Buffalo Pet Products Inc. | 16 | 463 | * | |||||||||||||

Bunge Ltd. | 21 | 1,444 | ||||||||||||||

Calavo Growers Inc. | 6 | 442 | ||||||||||||||

Campbell Soup Co. | 25 | 1,184 | ||||||||||||||

Conagra Brands Inc. | 58 | 1,981 | ||||||||||||||

Darling Ingredients Inc. | 38 | 694 | * | |||||||||||||

Flowers Foods Inc. | 42 | 799 | ||||||||||||||

Fresh Del Monte Produce Inc. | 8 | 356 | ||||||||||||||

General Mills Inc. | 96 | 4,984 | ||||||||||||||

Hain Celestial Group Inc. | 23 | 829 | * | |||||||||||||

Hershey Co. | 19 | 2,018 | ||||||||||||||

Hormel Foods Corp. | 40 | 1,246 | ||||||||||||||

Ingredion Inc. | 9 | 1,128 | ||||||||||||||

J&J Snack Foods Corp. | 3 | 400 | ||||||||||||||

J.M. Smucker Co. | 21 | 2,227 | ||||||||||||||

John B. Sanfilippo & Son Inc. | 6 | 353 | ||||||||||||||

Kellogg Co. | 36 | 2,251 | ||||||||||||||

Kraft Heinz Co. | 103 | 7,965 | ||||||||||||||

See Notes to Financial Statements.

| 16 | Legg Mason US Diversified Core ETF 2017 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Food Products — continued |

| |||||||||||||||

Lamb Weston Holdings Inc. | 17 | $ | 867 | |||||||||||||

Lancaster Colony Corp. | 4 | 501 | ||||||||||||||

McCormick & Co. Inc., Non Voting Shares | 14 | 1,394 | ||||||||||||||

Mondelez International Inc., Class A Shares | 245 | 10,150 | ||||||||||||||

Pinnacle Foods Inc. | 14 | 762 | ||||||||||||||

Post Holdings Inc. | 13 | 1,078 | * | |||||||||||||

Sanderson Farms Inc. | 4 | 598 | ||||||||||||||

Snyder’s-Lance Inc. | 16 | 602 | ||||||||||||||

TreeHouse Foods Inc. | 12 | 797 | * | |||||||||||||

Tyson Foods Inc., Class A Shares | 49 | 3,573 | ||||||||||||||

Total Food Products | 54,891 | |||||||||||||||

Household Products — 1.6% |

| |||||||||||||||

Church & Dwight Co. Inc. | 34 | 1,536 | ||||||||||||||

Clorox Co. | 16 | 2,024 | ||||||||||||||

Colgate-Palmolive Co. | 122 | 8,595 | ||||||||||||||

Energizer Holdings Inc. | 15 | 645 | ||||||||||||||

HRG Group Inc. | 23 | 373 | * | |||||||||||||

Kimberly-Clark Corp. | 52 | 5,850 | ||||||||||||||

Procter & Gamble Co. | 367 | 31,687 | ||||||||||||||

Spectrum Brands Holdings Inc. | 6 | 659 | ||||||||||||||

WD-40 Co. | 3 | 333 | ||||||||||||||

Total Household Products | 51,702 | |||||||||||||||

Personal Products — 1.0% |

| |||||||||||||||

Avon Products Inc. | 326 | 743 | * | |||||||||||||

Coty Inc., Class A Shares | 306 | 4,712 | ||||||||||||||

e.l.f. Beauty Inc. | 32 | 678 | * | |||||||||||||

Edgewell Personal Care Co. | 35 | 2,273 | * | |||||||||||||

Estee Lauder Cos. Inc., Class A Shares | 133 | 14,871 | ||||||||||||||

Herbalife Ltd. | 45 | 3,268 | * | |||||||||||||

Inter Parfums Inc. | 21 | 972 | ||||||||||||||

Medifast Inc. | 15 | 936 | ||||||||||||||

Nu Skin Enterprises Inc., Class A Shares | 34 | 2,163 | ||||||||||||||

Revlon Inc., Class A Shares | 16 | 360 | * | |||||||||||||

USANA Health Sciences Inc. | 14 | 920 | * | |||||||||||||

Total Personal Products | 31,896 | |||||||||||||||

Tobacco — 1.6% |

| |||||||||||||||

Altria Group Inc. | 350 | 22,477 | ||||||||||||||

Philip Morris International Inc. | 279 | 29,194 | ||||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2017 Annual Report | 17 |

Schedule of investments (cont’d)

October 31, 2017

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Tobacco — continued |

| |||||||||||||||

Universal Corp. | 8 | $ | 459 | |||||||||||||

Vector Group Ltd. | 36 | 748 | ||||||||||||||

Total Tobacco | 52,878 | |||||||||||||||

Total Consumer Staples | 300,402 | |||||||||||||||

| Energy — 3.7% | ||||||||||||||||

Energy Equipment & Services — 1.9% |

| |||||||||||||||

Archrock Inc. | 51 | 612 | ||||||||||||||

Baker Hughes, a GE Co. | 112 | 3,520 | ||||||||||||||

Core Laboratories NV | 13 | 1,299 | ||||||||||||||

Dril-Quip Inc. | 13 | 547 | * | |||||||||||||

Ensco PLC, Class A Shares | 110 | 593 | ||||||||||||||

Exterran Corp. | 20 | 645 | * | |||||||||||||

Forum Energy Technologies Inc. | 23 | 331 | * | |||||||||||||

Halliburton Co. | 232 | 9,916 | ||||||||||||||

Helix Energy Solutions Group Inc. | 83 | 566 | * | |||||||||||||

Helmerich & Payne Inc. | 30 | 1,629 | ||||||||||||||

McDermott International Inc. | 93 | 616 | * | |||||||||||||

Nabors Industries Ltd. | 121 | 681 | ||||||||||||||

National-Oilwell Varco Inc. | 94 | 3,214 | ||||||||||||||

Newpark Resources Inc. | 64 | 560 | * | |||||||||||||

Noble Corp. PLC | 164 | 682 | * | |||||||||||||

Oceaneering International Inc. | 42 | 849 | ||||||||||||||

Oil States International Inc. | 17 | 392 | * | |||||||||||||

Patterson-UTI Energy Inc. | 64 | 1,266 | ||||||||||||||

Rowan Cos. PLC, Class A Shares | 48 | 688 | * | |||||||||||||

RPC Inc. | 19 | 462 | ||||||||||||||

Schlumberger Ltd. | 374 | 23,936 | ||||||||||||||

Superior Energy Services Inc. | 72 | 635 | * | |||||||||||||

TechnipFMC PLC | 107 | 2,931 | * | |||||||||||||

Transocean Ltd. | 132 | 1,386 | * | |||||||||||||

Unit Corp. | 30 | 562 | * | |||||||||||||

US Silica Holdings Inc. | 28 | 854 | ||||||||||||||

Weatherford International PLC | 288 | 999 | * | |||||||||||||

Total Energy Equipment & Services | 60,371 | |||||||||||||||

Oil, Gas & Consumable Fuels — 1.8% |

| |||||||||||||||

Anadarko Petroleum Corp. | 35 | 1,728 | ||||||||||||||

Andeavor | 4 | 425 | ||||||||||||||

Apache Corp. | 26 | 1,076 | ||||||||||||||

See Notes to Financial Statements.

| 18 | Legg Mason US Diversified Core ETF 2017 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Oil, Gas & Consumable Fuels — continued |

| |||||||||||||||

Cabot Oil & Gas Corp. | 15 | $ | 416 | |||||||||||||

Cheniere Energy Inc. | 8 | 374 | * | |||||||||||||

Chevron Corp. | 91 | 10,546 | ||||||||||||||

Cimarex Energy Co. | 5 | 585 | ||||||||||||||

Concho Resources Inc. | 9 | 1,208 | * | |||||||||||||

ConocoPhillips | 64 | 3,274 | ||||||||||||||

Devon Energy Corp. | 36 | 1,328 | ||||||||||||||

Diamondback Energy Inc. | 4 | 429 | * | |||||||||||||

EOG Resources Inc. | 30 | 2,996 | ||||||||||||||

EQT Corp. | 9 | 563 | ||||||||||||||

Exxon Mobil Corp. | 194 | 16,170 | ||||||||||||||

Hess Corp. | 8 | 353 | ||||||||||||||

HollyFrontier Corp. | 18 | 665 | ||||||||||||||

Kinder Morgan Inc. | 109 | 1,974 | ||||||||||||||

Marathon Oil Corp. | 36 | 512 | ||||||||||||||

Marathon Petroleum Corp. | 29 | 1,732 | ||||||||||||||

Newfield Exploration Co. | 21 | 647 | * | |||||||||||||

Noble Energy Inc. | 13 | 362 | ||||||||||||||

Occidental Petroleum Corp. | 41 | 2,647 | ||||||||||||||

ONEOK Inc. | 18 | 977 | ||||||||||||||

Parsley Energy Inc., Class A Shares | 19 | 505 | * | |||||||||||||

Phillips 66 | 23 | 2,095 | ||||||||||||||

Pioneer Natural Resources Co. | 9 | 1,347 | ||||||||||||||

Range Resources Corp. | 29 | 525 | ||||||||||||||

Targa Resources Corp. | 11 | 457 | ||||||||||||||

Valero Energy Corp. | 23 | 1,814 | ||||||||||||||

Williams Cos. Inc. | 50 | 1,425 | ||||||||||||||

WPX Energy Inc. | 58 | 654 | * | |||||||||||||

Total Oil, Gas & Consumable Fuels | 59,809 | |||||||||||||||

Total Energy | 120,180 | |||||||||||||||

| Financials — 11.9% | ||||||||||||||||

Banks — 1.7% |

| |||||||||||||||

1st Source Corp. | 12 | 616 | ||||||||||||||

Bank of America Corp. | 278 | 7,614 | ||||||||||||||

Bank of Hawaii Corp. | 8 | 653 | ||||||||||||||

BB&T Corp. | 29 | 1,428 | ||||||||||||||

Citigroup Inc. | 75 | 5,512 | ||||||||||||||

Citizens Financial Group Inc. | 26 | 988 | ||||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2017 Annual Report | 19 |

Schedule of investments (cont’d)

October 31, 2017

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Banks — continued |

| |||||||||||||||

Comerica Inc. | 9 | $ | 707 | |||||||||||||

Cullen/Frost Bankers Inc. | 7 | 690 | ||||||||||||||

Eagle Bancorp Inc. | 11 | 733 | * | |||||||||||||

East-West Bancorp Inc. | 11 | 658 | ||||||||||||||

Fifth Third Bancorp | 19 | 549 | ||||||||||||||

First Citizens BancShares Inc., Class A Shares | 2 | 810 | ||||||||||||||

First Republic Bank | 5 | 487 | ||||||||||||||

FNB Corp. | 50 | 675 | ||||||||||||||

Heartland Financial USA Inc. | 17 | 837 | ||||||||||||||

Huntington Bancshares Inc. | 61 | 842 | ||||||||||||||

JPMorgan Chase & Co. | 107 | 10,765 | ||||||||||||||

KeyCorp | 26 | 475 | ||||||||||||||

PacWest Bancorp | 19 | 918 | ||||||||||||||

PNC Financial Services Group Inc. | 14 | 1,915 | ||||||||||||||

Popular Inc. | 16 | 587 | ||||||||||||||

Regions Financial Corp. | 39 | 604 | ||||||||||||||

S&T Bancorp Inc. | 21 | 859 | ||||||||||||||

Sterling Bancorp | 115 | 2,881 | ||||||||||||||

Sun Bancorp Inc. | 24 | 608 | ||||||||||||||

SunTrust Banks Inc. | 11 | 662 | ||||||||||||||

SVB Financial Group | 4 | 877 | * | |||||||||||||

U.S. Bancorp | 36 | 1,958 | ||||||||||||||

Wells Fargo & Co. | 145 | 8,140 | ||||||||||||||

Zions Bancorp | 15 | 697 | ||||||||||||||

Total Banks | 55,745 | |||||||||||||||

Capital Markets — 1.6% |

| |||||||||||||||

Affiliated Managers Group Inc. | 4 | 746 | ||||||||||||||

Ameriprise Financial Inc. | 12 | 1,878 | ||||||||||||||

Arlington Asset Investment Corp., Class A Shares | 41 | 470 | ||||||||||||||

Bank of New York Mellon Corp. | 72 | 3,704 | ||||||||||||||

BlackRock Inc. | 8 | 3,767 | ||||||||||||||

Cboe Global Markets Inc. | 8 | 904 | ||||||||||||||

Charles Schwab Corp. | 94 | 4,215 | ||||||||||||||

CME Group Inc. | 23 | 3,155 | ||||||||||||||

E*TRADE Financial Corp. | 13 | 567 | * | |||||||||||||

Eaton Vance Corp. | 9 | 454 | ||||||||||||||

FactSet Research Systems Inc. | 4 | 759 | ||||||||||||||

Franklin Resources Inc. | 25 | 1,053 | ||||||||||||||

See Notes to Financial Statements.

| 20 | Legg Mason US Diversified Core ETF 2017 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Capital Markets — continued |

| |||||||||||||||

Goldman Sachs Group Inc. | 26 | $ | 6,304 | |||||||||||||

Intercontinental Exchange Inc. | 43 | 2,842 | ||||||||||||||

Invesco Ltd. | 34 | 1,217 | ||||||||||||||

Janus Henderson Group PLC | 21 | 730 | ||||||||||||||

MarketAxess Holdings Inc. | 3 | 522 | ||||||||||||||

Moody’s Corp. | 11 | 1,567 | ||||||||||||||

Morgan Stanley | 106 | 5,300 | ||||||||||||||

Morningstar Inc. | 5 | 426 | ||||||||||||||

MSCI Inc. | 8 | 939 | ||||||||||||||

Nasdaq Inc. | 10 | 727 | ||||||||||||||

Northern Trust Corp. | 16 | 1,496 | ||||||||||||||

Raymond James Financial Inc. | 6 | 509 | ||||||||||||||

S&P Global Inc. | 16 | 2,504 | ||||||||||||||

SEI Investments Co. | 12 | 774 | ||||||||||||||

State Street Corp. | 28 | 2,576 | ||||||||||||||

T. Rowe Price Group Inc. | 15 | 1,394 | ||||||||||||||

TD Ameritrade Holding Corp. | 26 | 1,300 | ||||||||||||||

Total Capital Markets | 52,799 | |||||||||||||||

Consumer Finance — 1.7% |

| |||||||||||||||

Ally Financial Inc. | 134 | 3,501 | ||||||||||||||

American Express Co. | 200 | 19,104 | ||||||||||||||

Capital One Financial Corp. | 133 | 12,260 | ||||||||||||||

Credit Acceptance Corp. | 2 | 574 | * | |||||||||||||

Discover Financial Services | 106 | 7,052 | ||||||||||||||

Encore Capital Group Inc. | 15 | 697 | * | |||||||||||||

FirstCash Inc. | 12 | 766 | ||||||||||||||

Green Dot Corp., Class A Shares | 16 | 906 | * | |||||||||||||

LendingClub Corp. | 96 | 546 | * | |||||||||||||

Navient Corp. | 96 | 1,196 | ||||||||||||||

OneMain Holdings Inc. | 17 | 540 | * | |||||||||||||

PRA Group Inc. | 16 | 446 | * | |||||||||||||

SLM Corp. | 132 | 1,398 | * | |||||||||||||

Synchrony Financial | 209 | 6,818 | ||||||||||||||

Total Consumer Finance | 55,804 | |||||||||||||||

Diversified Financial Services — 1.6% |

| |||||||||||||||

Berkshire Hathaway Inc., Class B Shares | 251 | 46,922 | * | |||||||||||||

FNFV Group | 47 | 811 | * | |||||||||||||

Leucadia National Corp. | 78 | 1,973 | ||||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2017 Annual Report | 21 |

Schedule of investments (cont’d)

October 31, 2017

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Diversified Financial Services — continued |

| |||||||||||||||

Texas Pacific Land Trust | 2 | $ | 815 | |||||||||||||

Voya Financial Inc. | 51 | 2,048 | ||||||||||||||

Total Diversified Financial Services | 52,569 | |||||||||||||||

Insurance — 1.4% |

| |||||||||||||||

AFLAC Inc. | 23 | 1,929 | ||||||||||||||

Alleghany Corp. | 1 | 566 | * | |||||||||||||

Allstate Corp. | 23 | 2,159 | ||||||||||||||

American Financial Group Inc. | 4 | 422 | ||||||||||||||

American International Group Inc. | 63 | 4,070 | ||||||||||||||

Aon PLC | 15 | 2,151 | ||||||||||||||

Arch Capital Group Ltd. | 7 | 697 | * | |||||||||||||

Arthur J. Gallagher & Co. | 7 | 443 | ||||||||||||||

Assurant Inc. | 4 | 403 | ||||||||||||||

Assured Guaranty Ltd. | 11 | 408 | ||||||||||||||

Axis Capital Holdings Ltd. | 9 | 490 | ||||||||||||||

Brown & Brown Inc. | 8 | 399 | ||||||||||||||

Chubb Ltd. | 32 | 4,826 | ||||||||||||||

Cincinnati Financial Corp. | 5 | 351 | ||||||||||||||

CNO Financial Group Inc. | 22 | 527 | ||||||||||||||

Everest Re Group Ltd. | 3 | 712 | ||||||||||||||

First American Financial Corp. | 8 | 435 | ||||||||||||||

FNF Group | 23 | 861 | ||||||||||||||

Hartford Financial Services Group Inc. | 24 | 1,321 | ||||||||||||||

Lincoln National Corp. | 19 | 1,440 | ||||||||||||||

Loews Corp. | 7 | 347 | ||||||||||||||

Markel Corp. | 1 | 1,084 | * | |||||||||||||

Marsh & McLennan Cos. Inc. | 28 | 2,266 | ||||||||||||||

MetLife Inc. | 65 | 3,483 | ||||||||||||||

Old Republic International Corp. | 16 | 325 | ||||||||||||||

Principal Financial Group Inc. | 23 | 1,515 | ||||||||||||||

Progressive Corp. | 37 | 1,800 | ||||||||||||||

Prudential Financial Inc. | 26 | 2,872 | ||||||||||||||

Reinsurance Group of America Inc. | 4 | 598 | ||||||||||||||

RenaissanceRe Holdings Ltd. | 4 | 553 | ||||||||||||||

Torchmark Corp. | 5 | 421 | ||||||||||||||

Travelers Cos. Inc. | 17 | 2,252 | ||||||||||||||

Unum Group | 16 | 833 | ||||||||||||||

Validus Holdings Ltd. | 12 | 625 | ||||||||||||||

See Notes to Financial Statements.

| 22 | Legg Mason US Diversified Core ETF 2017 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Insurance — continued |

| |||||||||||||||

W.R. Berkley Corp. | 5 | $ | 343 | |||||||||||||

Willis Towers Watson PLC | 5 | 805 | ||||||||||||||

XL Group Ltd. | 15 | 607 | ||||||||||||||

Total Insurance | 45,339 | |||||||||||||||

Mortgage Real Estate Investment (REITs) — 2.2% |

| |||||||||||||||

AG Mortgage Investment Trust Inc. | 46 | 865 | ||||||||||||||

AGNC Investment Corp. | 383 | 7,710 | ||||||||||||||

Annaly Capital Management Inc. | 1,299 | 14,886 | ||||||||||||||

Anworth Mortgage Asset Corp. | 108 | 604 | ||||||||||||||

Apollo Commercial Real Estate Finance Inc. | 162 | 2,927 | ||||||||||||||

Arbor Realty Trust, Inc. | 96 | 794 | ||||||||||||||

ARMOUR Residential REIT Inc. | 54 | 1,353 | ||||||||||||||

Blackstone Mortgage Trust Inc., Class A Shares | 74 | 2,355 | ||||||||||||||

Capstead Mortgage Corp. | 111 | 979 | ||||||||||||||

Chimera Investment Corp. | 184 | 3,367 | ||||||||||||||

CYS Investments Inc. | 230 | 1,840 | ||||||||||||||

Dynex Capital Inc. | 105 | 735 | ||||||||||||||

Hannon Armstrong Sustainable Infrastructure Capital Inc. | 71 | 1,708 | ||||||||||||||

Invesco Mortgage Capital Inc. | 122 | 2,101 | ||||||||||||||

Ladder Capital Corp. | 93 | 1,250 | ||||||||||||||

MFA Financial Inc. | 483 | 3,980 | ||||||||||||||

MTGE Investment Corp. | 56 | 1,014 | ||||||||||||||

New Residential Investment Corp. | 360 | 6,347 | ||||||||||||||

New York Mortgage Trust Inc. | 233 | 1,405 | ||||||||||||||

Pennymac Mortgage Investment Trust | 78 | 1,253 | ||||||||||||||

Redwood Trust Inc. | 94 | 1,477 | ||||||||||||||

Resource Capital Corp. | 91 | 934 | ||||||||||||||

Starwood Property Trust Inc. | 256 | 5,506 | ||||||||||||||

Sutherland Asset Management Corp. | 28 | 438 | ||||||||||||||

Two Harbors Investment Corp. | 362 | 3,548 | ||||||||||||||

Total Mortgage Real Estate Investment (REITs) | 69,376 | |||||||||||||||

Thrifts & Mortgage Finance — 1.7% |

| |||||||||||||||

Bank Mutual Corp. | 48 | 508 | ||||||||||||||

Beneficial Bancorp Inc. | 65 | 1,073 | ||||||||||||||

BofI Holding Inc. | 67 | 1,802 | * | |||||||||||||

Capitol Federal Financial Inc. | 136 | 1,875 | ||||||||||||||

Dime Community Bancshares Inc. | 23 | 507 | ||||||||||||||

Essent Group Ltd. | 77 | 3,282 | * | |||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2017 Annual Report | 23 |

Schedule of investments (cont’d)

October 31, 2017

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Thrifts & Mortgage Finance — continued |

| |||||||||||||||

Federal Agricultural Mortgage Corp. (FAMC), Class C Shares | 10 | $ | 742 | |||||||||||||

First Defiance Financial Corp. | 15 | 813 | ||||||||||||||

Flagstar Bancorp Inc. | 31 | 1,159 | * | |||||||||||||

HomeStreet Inc. | 35 | 1,017 | * | |||||||||||||

Kearny Financial Corp. | 74 | 1,114 | ||||||||||||||

LendingTree Inc. | 9 | 2,413 | * | |||||||||||||

Meridian Bancorp Inc. | 49 | 965 | ||||||||||||||

Meta Financial Group Inc. | 8 | 698 | ||||||||||||||

MGIC Investment Corp. | 374 | 5,348 | * | |||||||||||||

Nationstar Mortgage Holdings Inc. | 28 | 545 | * | |||||||||||||

New York Community Bancorp Inc. | 456 | 5,727 | ||||||||||||||

NMI Holdings Inc., Class A Shares | 48 | 698 | * | |||||||||||||

Northfield Bancorp Inc. | 47 | 802 | ||||||||||||||

Northwest Bancshares Inc. | 105 | 1,771 | ||||||||||||||

OceanFirst Financial Corp. | 35 | 971 | ||||||||||||||

Ocwen Financial Corp. | 175 | 611 | * | |||||||||||||

Oritani Financial Corp. | 87 | 1,475 | ||||||||||||||

PHH Corp. | 47 | 621 | * | |||||||||||||

Provident Financial Services Inc. | 67 | 1,822 | ||||||||||||||

Radian Group Inc. | 228 | 4,779 | ||||||||||||||

TFS Financial Corp. | 48 | 740 | ||||||||||||||

United Financial Bancorp Inc. | 78 | 1,428 | ||||||||||||||

Walker & Dunlop Inc. | 36 | 1,976 | * | |||||||||||||

Washington Federal Inc. | 109 | 3,793 | ||||||||||||||

Waterstone Financial Inc. | 24 | 461 | ||||||||||||||

WSFS Financial Corp. | 37 | 1,839 | ||||||||||||||

Total Thrifts & Mortgage Finance | 53,375 | |||||||||||||||

Total Financials | 385,007 | |||||||||||||||

| Health Care — 11.2% | ||||||||||||||||

Biotechnology — 1.9% |

| |||||||||||||||

AbbVie Inc. | 125 | 11,281 | ||||||||||||||

ACADIA Pharmaceuticals Inc. | 17 | 592 | * | |||||||||||||

Alexion Pharmaceuticals Inc. | 18 | 2,154 | * | |||||||||||||

Alkermes PLC | 9 | 439 | * | |||||||||||||

Alnylam Pharmaceuticals Inc. | 8 | 975 | * | |||||||||||||

Amgen Inc. | 58 | 10,163 | ||||||||||||||

Biogen Inc. | 17 | 5,298 | * | |||||||||||||

BioMarin Pharmaceutical Inc. | 12 | 985 | * | |||||||||||||

See Notes to Financial Statements.

| 24 | Legg Mason US Diversified Core ETF 2017 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Biotechnology — continued |

| |||||||||||||||

Bioverativ Inc. | 10 | $ | 565 | * | ||||||||||||

Bluebird Bio Inc. | 7 | 974 | * | |||||||||||||

Celgene Corp. | 61 | 6,159 | * | |||||||||||||

Clovis Oncology Inc. | 6 | 452 | * | |||||||||||||

Dyax Corp., Contingent Value Rights | 15 | 0 | *(a)(b)(c) | |||||||||||||

Exact Sciences Corp. | 18 | 990 | * | |||||||||||||

Exelixis Inc. | 38 | 942 | * | |||||||||||||

Gilead Sciences Inc. | 102 | 7,646 | ||||||||||||||

Incyte Corp. | 14 | 1,585 | * | |||||||||||||

Ionis Pharmaceuticals Inc. | 10 | 571 | * | |||||||||||||

Ligand Pharmaceuticals Inc. | 3 | 436 | * | |||||||||||||

Neurocrine Biosciences Inc. | 9 | 559 | * | |||||||||||||

Portola Pharmaceuticals Inc. | 11 | 543 | * | |||||||||||||

Regeneron Pharmaceuticals Inc. | 6 | 2,416 | * | |||||||||||||

Seattle Genetics Inc. | 11 | 674 | * | |||||||||||||

Tesaro Inc. | 6 | 695 | * | |||||||||||||

Ultragenyx Pharmaceutical Inc. | 7 | 323 | * | |||||||||||||

United Therapeutics Corp. | 5 | 593 | * | |||||||||||||

Vertex Pharmaceuticals Inc. | 20 | 2,925 | * | |||||||||||||

Total Biotechnology | 60,935 | |||||||||||||||

Health Care Equipment & Supplies — 2.2% |

| |||||||||||||||

Abbott Laboratories | 167 | 9,056 | ||||||||||||||

ABIOMED Inc. | 4 | 772 | * | |||||||||||||

Align Technology Inc. | 6 | 1,434 | * | |||||||||||||

Baxter International Inc. | 49 | 3,159 | ||||||||||||||

Becton, Dickinson & Co. | 22 | 4,591 | ||||||||||||||

Boston Scientific Corp. | 137 | 3,855 | * | |||||||||||||

C.R. Bard Inc. | 7 | 2,289 | ||||||||||||||

Cantel Medical Corp. | 5 | 490 | ||||||||||||||

Cooper Cos. Inc. | 4 | 961 | ||||||||||||||

Danaher Corp. | 58 | 5,352 | ||||||||||||||

Dentsply Sirona Inc. | 24 | 1,466 | ||||||||||||||

DexCom Inc. | 7 | 315 | * | |||||||||||||

Edwards Lifesciences Corp. | 22 | 2,249 | * | |||||||||||||

Globus Medical Inc., Class A Shares | 15 | 478 | * | |||||||||||||

Halyard Health Inc. | 11 | 464 | * | |||||||||||||

Hill-Rom Holdings Inc. | 6 | 484 | ||||||||||||||

Hologic Inc. | 26 | 984 | * | |||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2017 Annual Report | 25 |

Schedule of investments (cont’d)

October 31, 2017

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Health Care Equipment & Supplies — continued |

| |||||||||||||||

IDEXX Laboratories Inc. | 8 | $ | 1,329 | * | ||||||||||||

Insulet Corp. | 13 | 765 | * | |||||||||||||

Integra LifeSciences Holdings Corp. | 8 | 374 | * | |||||||||||||

Intuitive Surgical Inc. | 9 | 3,378 | * | |||||||||||||

LivaNova PLC | 9 | 665 | * | |||||||||||||

Masimo Corp. | 7 | 614 | * | |||||||||||||

Medtronic PLC | 130 | 10,468 | ||||||||||||||

Neogen Corp. | 10 | 802 | * | |||||||||||||

NxStage Medical Inc. | 14 | 377 | * | |||||||||||||

Penumbra Inc. | 5 | 503 | * | |||||||||||||

ResMed Inc. | 15 | 1,263 | ||||||||||||||

STERIS PLC | 8 | 747 | ||||||||||||||

Stryker Corp. | 35 | 5,420 | ||||||||||||||

Teleflex Inc. | 4 | 948 | ||||||||||||||

Varian Medical Systems Inc. | 8 | 834 | * | |||||||||||||

West Pharmaceutical Services Inc. | 6 | 608 | ||||||||||||||

Wright Medical Group NV | 16 | 419 | * | |||||||||||||

Zimmer Biomet Holdings Inc. | 19 | 2,311 | ||||||||||||||

Total Health Care Equipment & Supplies | 70,224 | |||||||||||||||

Health Care Providers & Services — 1.4% |

| |||||||||||||||

Aetna Inc. | 26 | 4,421 | ||||||||||||||

AmerisourceBergen Corp. | 10 | 770 | ||||||||||||||

Anthem Inc. | 19 | 3,975 | ||||||||||||||

Cardinal Health Inc. | 17 | 1,052 | ||||||||||||||

Centene Corp. | 15 | 1,405 | * | |||||||||||||

CIGNA Corp. | 19 | 3,747 | ||||||||||||||

DaVita Inc. | 8 | 486 | * | |||||||||||||

Envision Healthcare Corp. | 10 | 426 | * | |||||||||||||

Express Scripts Holding Co. | 46 | 2,819 | * | |||||||||||||

HCA Healthcare Inc. | 24 | 1,816 | * | |||||||||||||

HealthSouth Corp. | 8 | 369 | ||||||||||||||

Henry Schein Inc. | 8 | 629 | * | |||||||||||||

Humana Inc. | 11 | 2,809 | ||||||||||||||

Laboratory Corporation of America Holdings | 5 | 769 | * | |||||||||||||

LifePoint Health Inc. | 6 | 289 | * | |||||||||||||

McKesson Corp. | 16 | 2,206 | ||||||||||||||

Mednax Inc. | 12 | 525 | * | |||||||||||||

Quest Diagnostics Inc. | 7 | 656 | ||||||||||||||

See Notes to Financial Statements.

| 26 | Legg Mason US Diversified Core ETF 2017 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Health Care Providers & Services — continued |

| |||||||||||||||

UnitedHealth Group Inc. | 70 | $ | 14,715 | |||||||||||||

Universal Health Services Inc., Class B Shares | 4 | 411 | ||||||||||||||

WellCare Health Plans Inc. | 4 | 791 | * | |||||||||||||

Total Health Care Providers & Services | 45,086 | |||||||||||||||

Health Care Technology — 1.9% |

| |||||||||||||||

Allscripts Healthcare Solutions Inc. | 237 | 3,195 | * | |||||||||||||

athenahealth Inc. | 48 | 6,138 | * | |||||||||||||

Castlight Health Inc., Class B Shares | 184 | 708 | * | |||||||||||||

Cerner Corp. | 364 | 24,577 | * | |||||||||||||

Computer Programs & Systems Inc. | 22 | 663 | ||||||||||||||

Cotiviti Holdings Inc. | 57 | 2,004 | * | |||||||||||||

Evolent Health Inc., Class A Shares | 89 | 1,446 | * | |||||||||||||

HealthStream Inc. | 27 | 660 | * | |||||||||||||

HMS Holdings Corp. | 109 | 2,097 | * | |||||||||||||

Inovalon Holdings Inc., Class A Shares | 74 | 1,240 | * | |||||||||||||

Medidata Solutions Inc. | 69 | 5,191 | * | |||||||||||||

Omnicell Inc. | 47 | 2,341 | * | |||||||||||||

Quality Systems Inc. | 66 | 929 | * | |||||||||||||

Veeva Systems Inc., Class A Shares | 132 | 8,044 | * | |||||||||||||

Vocera Communications Inc. | 31 | 875 | * | |||||||||||||

Total Health Care Technology | 60,108 | |||||||||||||||

Life Sciences Tools & Services — 2.1% |

| |||||||||||||||

Accelerate Diagnostics Inc. | 18 | 357 | * | |||||||||||||

Agilent Technologies Inc. | 105 | 7,143 | ||||||||||||||

Bio-Rad Laboratories Inc., Class A Shares | 7 | 1,539 | * | |||||||||||||

Bio-Techne Corp. | 13 | 1,703 | ||||||||||||||

Bruker Corp. | 42 | 1,319 | ||||||||||||||

Cambrex Corp. | 11 | 476 | * | |||||||||||||

Charles River Laboratories International Inc. | 19 | 2,210 | * | |||||||||||||

Illumina Inc. | 45 | 9,234 | * | |||||||||||||

INC Research Holdings Inc., Class A Shares | 15 | 857 | * | |||||||||||||

Mettler-Toledo International Inc. | 8 | 5,461 | * | |||||||||||||

NeoGenomics Inc. | 47 | 407 | * | |||||||||||||

Patheon NV | 18 | 630 | *(b)(c) | |||||||||||||

PerkinElmer Inc. | 37 | 2,676 | ||||||||||||||

PRA Health Sciences Inc. | 12 | 977 | * | |||||||||||||

Quintiles IMS Holdings Inc. | 47 | 5,081 | * | |||||||||||||

Thermo Fisher Scientific Inc. | 122 | 23,647 | ||||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2017 Annual Report | 27 |

Schedule of investments (cont’d)

October 31, 2017

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

Life Sciences Tools & Services — continued |

| |||||||||||||||

VWR Corp. | 26 | $ | 861 | * | ||||||||||||

Waters Corp. | 26 | 5,097 | * | |||||||||||||

Total Life Sciences Tools & Services | 69,675 | |||||||||||||||

Pharmaceuticals — 1.7% |

| |||||||||||||||

Allergan PLC | 18 | 3,190 | ||||||||||||||

Bristol-Myers Squibb Co. | 81 | 4,994 | ||||||||||||||

Eli Lilly & Co. | 53 | 4,343 | ||||||||||||||

Jazz Pharmaceuticals PLC | 5 | 708 | * | |||||||||||||

Johnson & Johnson | 137 | 19,099 | ||||||||||||||

Mallinckrodt PLC | 9 | 285 | * | |||||||||||||

Medicines Co. | 11 | 316 | * | |||||||||||||

Merck & Co. Inc. | 143 | 7,878 | ||||||||||||||

Mylan NV | 31 | 1,107 | * | |||||||||||||

Perrigo Co. PLC | 11 | 891 | ||||||||||||||

Pfizer Inc. | 314 | 11,009 | ||||||||||||||

Zoetis Inc. | 26 | 1,659 | ||||||||||||||

Total Pharmaceuticals | 55,479 | |||||||||||||||

Total Health Care | 361,507 | |||||||||||||||

| Industrials — 17.3% | ||||||||||||||||

Aerospace & Defense — 1.5% |

| |||||||||||||||

Arconic Inc. | 28 | 703 | ||||||||||||||

Boeing Co. | 48 | 12,383 | ||||||||||||||

BWX Technologies Inc. | 8 | 479 | ||||||||||||||