Exhibit 99.1

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 ARRIS INVESTOR DAY 2018 March 2018

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 SAFE HARBOR 2 Statements made in this presentation, including those related to projected financial results for the first quarter 2018 and b eyo nd, the impact of the Ruckus Networks acquisition, market share growth, our expected tax rate, increased profitability, shareholder returns, th e t iming of introduction and acceptance of new products, and the general market outlook and industry trends are forward - looking statements. These and other forward - looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those indicated in the forward - looking statements. Such risks and uncertainties include, but are not limited to: projected results for the first qu arter and full year 2018 are based on preliminary estimates, assumptions and projections that management believes to be reasonable at this time, but are beyond management’s control; the anticipated benefits from the Ruckus Networks acquisition may not be realized and we may encounter sig nificant integration costs and unknown liabilities in connection with the acquisition; volatility in component pricing and supply cou ld impact revenues and gross margins more than currently anticipated and we may not be able to pass increased costs on to our customers; recently a nno unced U.S. tariffs and expected tariffs imposed in foreign jurisdictions as a result could materially impact the costs associated with o ur products which we may not be able to pass on to our customers; volatility in the currency fluctuation may adversely impact our international cu sto mers’ ability or willingness to purchase products and the pricing of our products; regulatory changes, including those related to recently com ple ted changes to the U.S. tax code, could have an adverse impact on our operations and results of operations; the impact of litigation and similar re gulatory proceedings that we are currently involved in, or may become involved in, including the costs of such litigation, could have an adverse effect on our operations and results; our customers operate in a capital intensive consumer - based industry, and volatility in the capital markets or changes in customer spending may adversely impact their ability or willingness to purchase the products that we offer. These factors are not intended to be an all - encompassing list of risks and uncertainties that may affect our business. Additiona l information regarding these and other factors can be found in our reports filed with the Securities and Exchange Commission, including ou r A nnual Report on Form 10 - K for the year ended December 31, 2017. In providing forward - looking statements, we expressly disclaim any obligation to update publicly or otherwise these statements, whether as a result of new information, future events or otherwise, except as required by law. FORWARD - LOOKING STATEMENTS

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Agenda 3 2018 ARRIS INVESTOR DAY 8:00 - 8:05 Welcome Bob Puccini Bruce McClelland ARRIS Strategy and Industry Trends 8:05 - 8:25 Steve McCaffery and Tim O’Loughlin Customer and Market Overview 8:25 - 8:45 Dan Whalen Network & Cloud Business Update 8:45 – 9:10 Larry Robinson Customer Premises Business Update 9:10 – 9:35 Break 9:35 – 9:50 Dan Rabinovitsj Enterprise Networks Business Update 9:50 – 10:20 Steve Martin Technology Talk - CBRS 10:20 – 10:50 David Potts Financial Update 10:50 – 11:15 Executive Team Leadership Panel Q&A 11:15 – 11:50 Bruce McClelland Wrap - up 11:50 – 12:00

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 ARRIS Strategy and Industry Trends Bruce McClelland 4

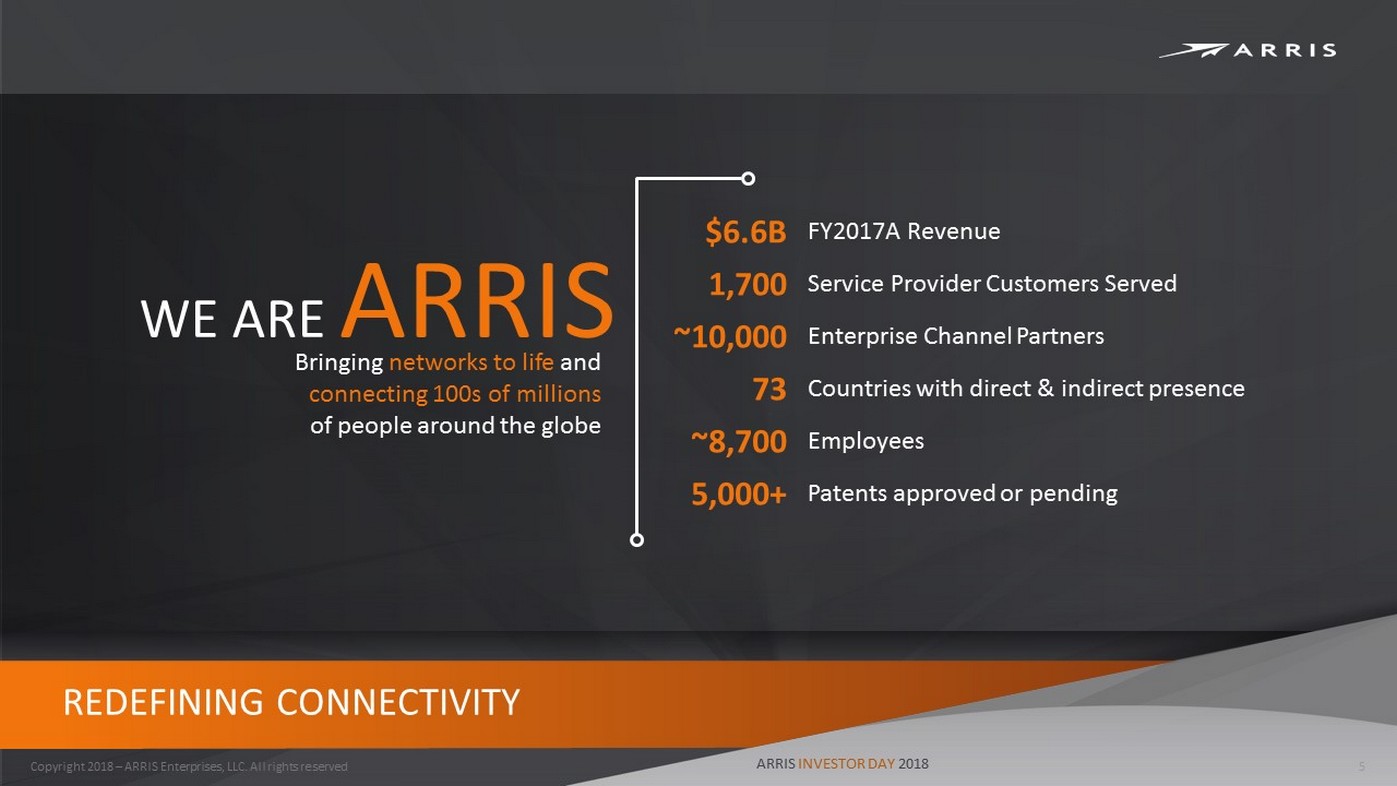

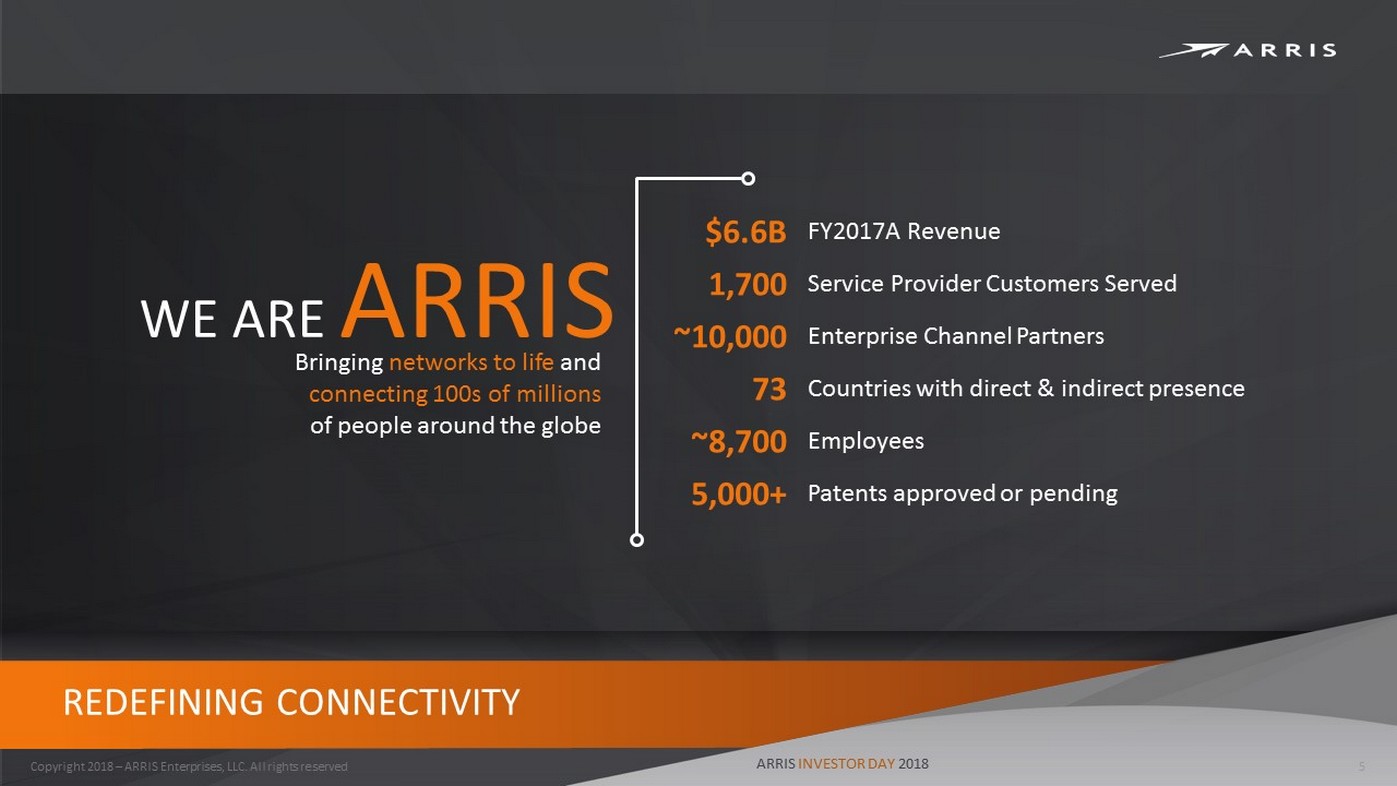

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 5 WE ARE ARRIS REDEFINING CONNECTIVITY Bringing networks to life and connecting 100s of millions of people around the globe $6.6B FY2017A Revenue 1,700 Service Provider Customers Served ~10,000 Enterprise Channel Partners 73 Countries with direct & indirect presence ~8,700 Employees 5,000+ Patents approved or pending

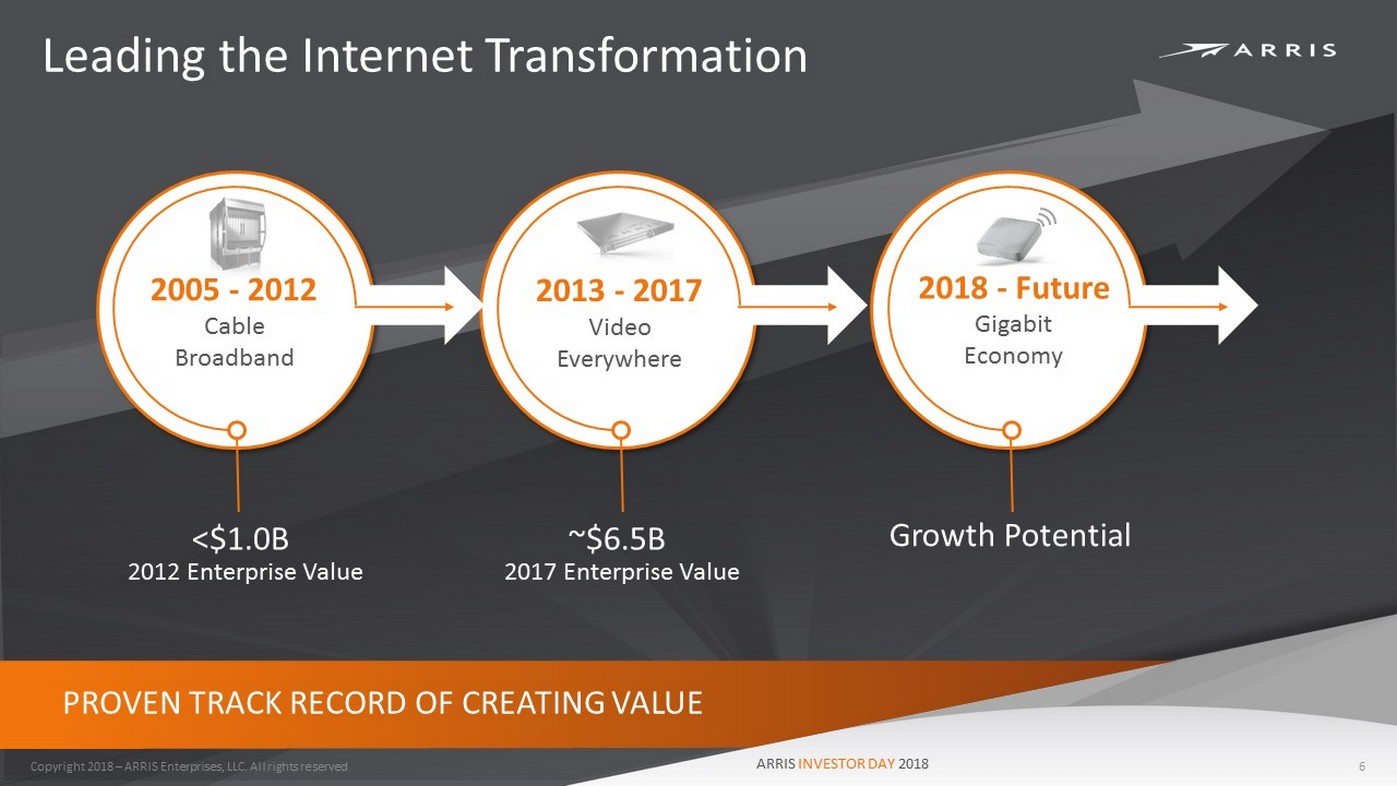

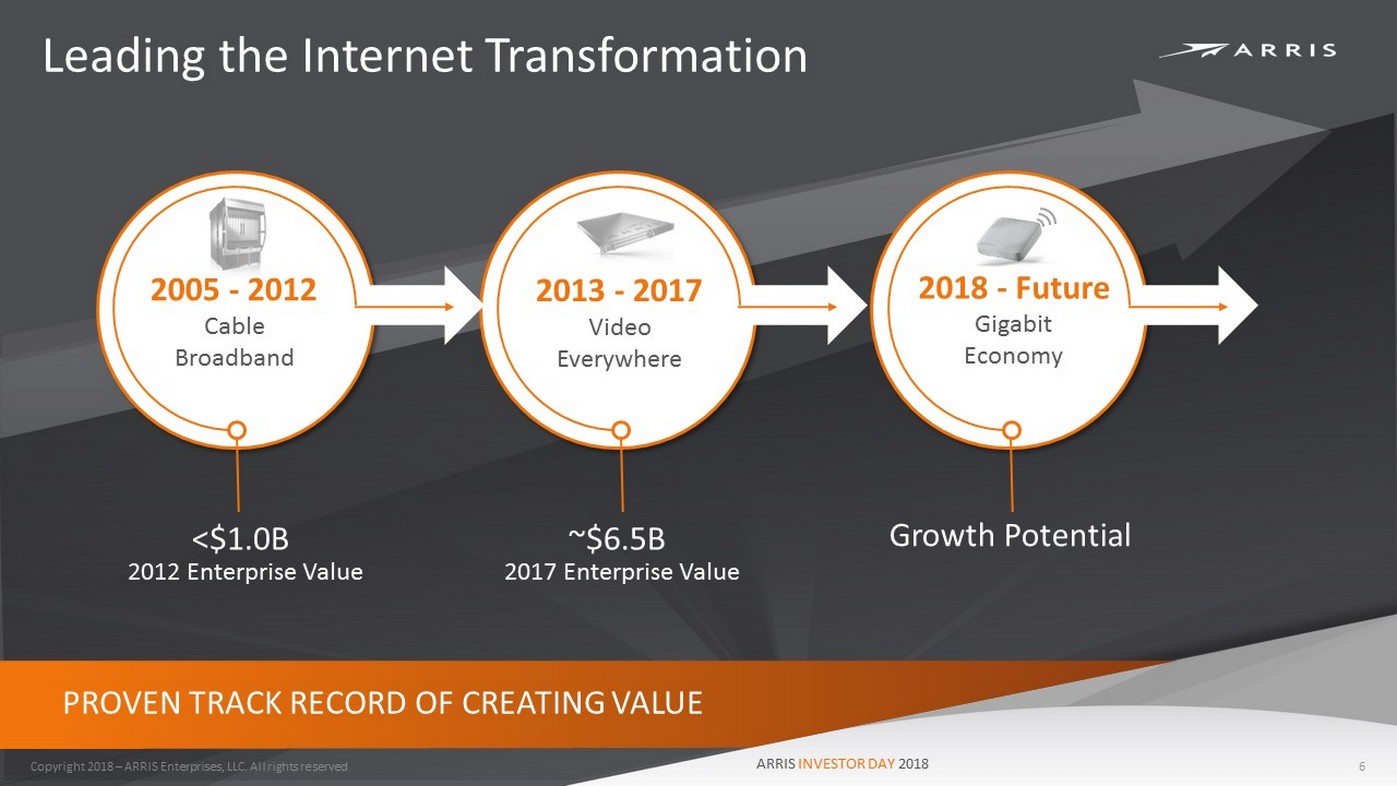

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Leading the Internet Transformation 6 2005 - 2012 Cable Broadband 2013 - 2017 Video Everywhere 2018 - Future Gigabit Economy <$1.0B 2012 Enterprise Value ~$6.5B 2017 Enterprise Value Growth Potential PROVEN TRACK RECORD OF CREATING VALUE

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 ARRIS Vision 7 • ARRIS is a global innovator enabling the Gigabit Generation with a new era of compelling connectivity experiences where we live, learn, work, and play • We partner with the world’s leading network operators and enterprises providing them with: – Innovation in the network – from core to edge – Seamless connectivity that just works – meeting and exceeding ever increasing consumer and business demands – Cost - effective scalable solutions enabling customers and partners to succeed

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Why ARRIS? 8 TECHNOLOGY Wireless System Design Embedded Real - time Software Digital Signal Processing SYSTEMS KNOWLEDGE Video Delivery Networks Complex Data Networks GO - TO - MARKET Distribution and Channel Management Customer Intimacy Operations

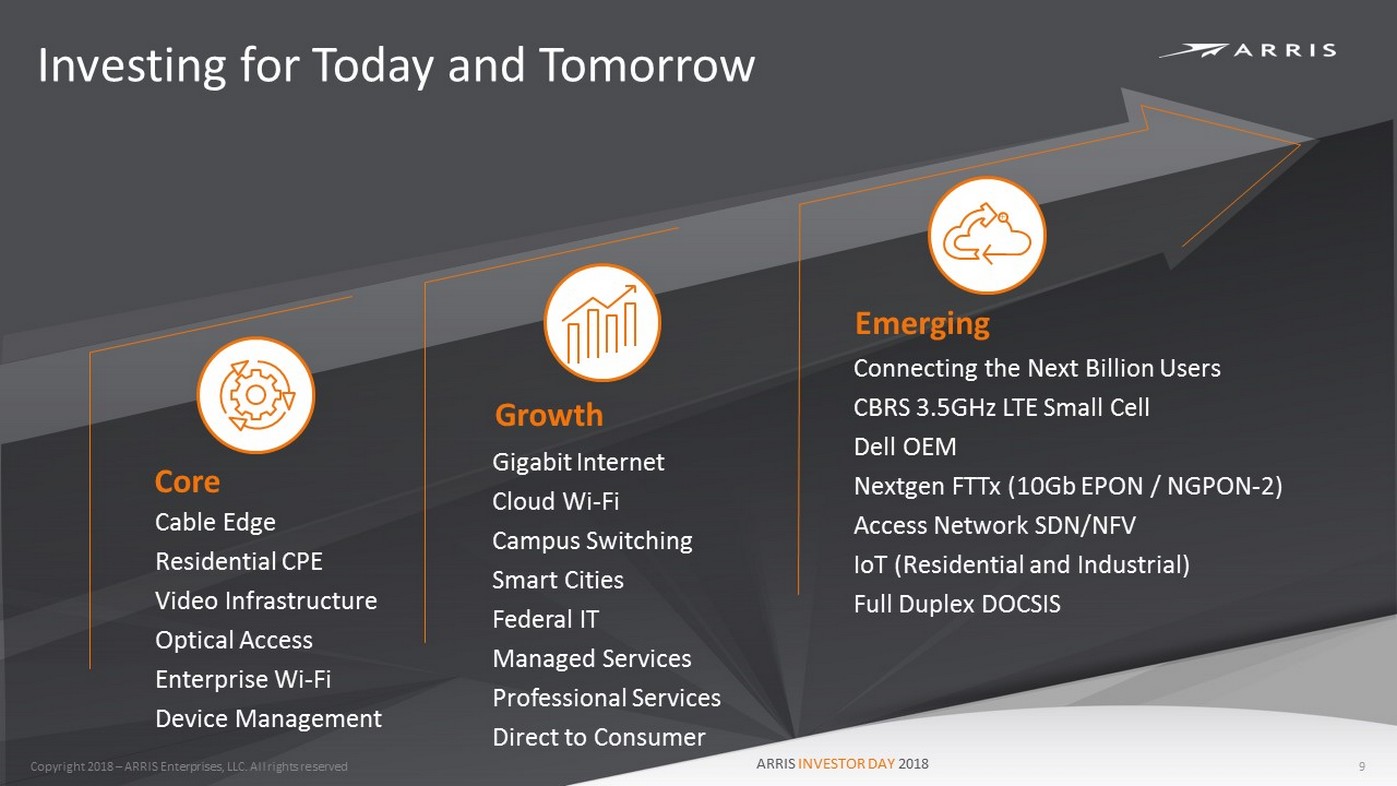

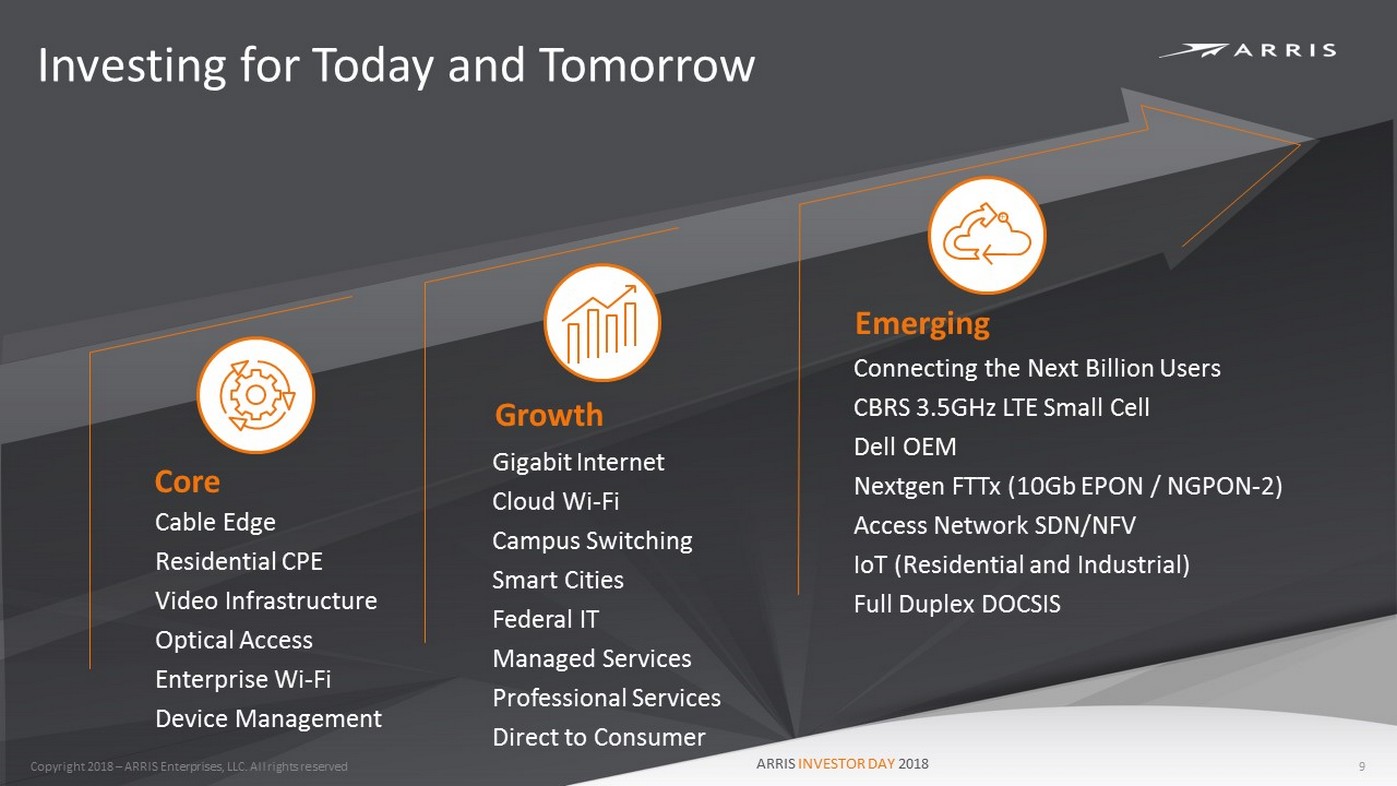

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 9 Investing for Today and Tomorrow Core Emerging Connecting the Next Billion Users CBRS 3.5GHz LTE Small Cell Dell OEM Nextgen FTTx (10Gb EPON / NGPON - 2) Access Network SDN/NFV IoT (Residential and Industrial) Full Duplex DOCSIS Growth Gigabit Internet Cloud Wi - Fi Campus Switching Smart Cities Federal IT Managed Services Professional Services Direct to Consumer Cable Edge Residential CPE Video Infrastructure Optical Access Enterprise Wi - Fi Device Management

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Value Creation Drivers 10 Addressable Market Growth International Expansion Margin and Earnings Growth Portfolio Expansion Strategic M&A and Capital Return Target Available Total Addressable

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Organic Value Creation Strategy 11 Gigabit Networks Video Everywhere Enterprise Networking Mobile Network Convergence Margin Expansion 1 2 3 4 5

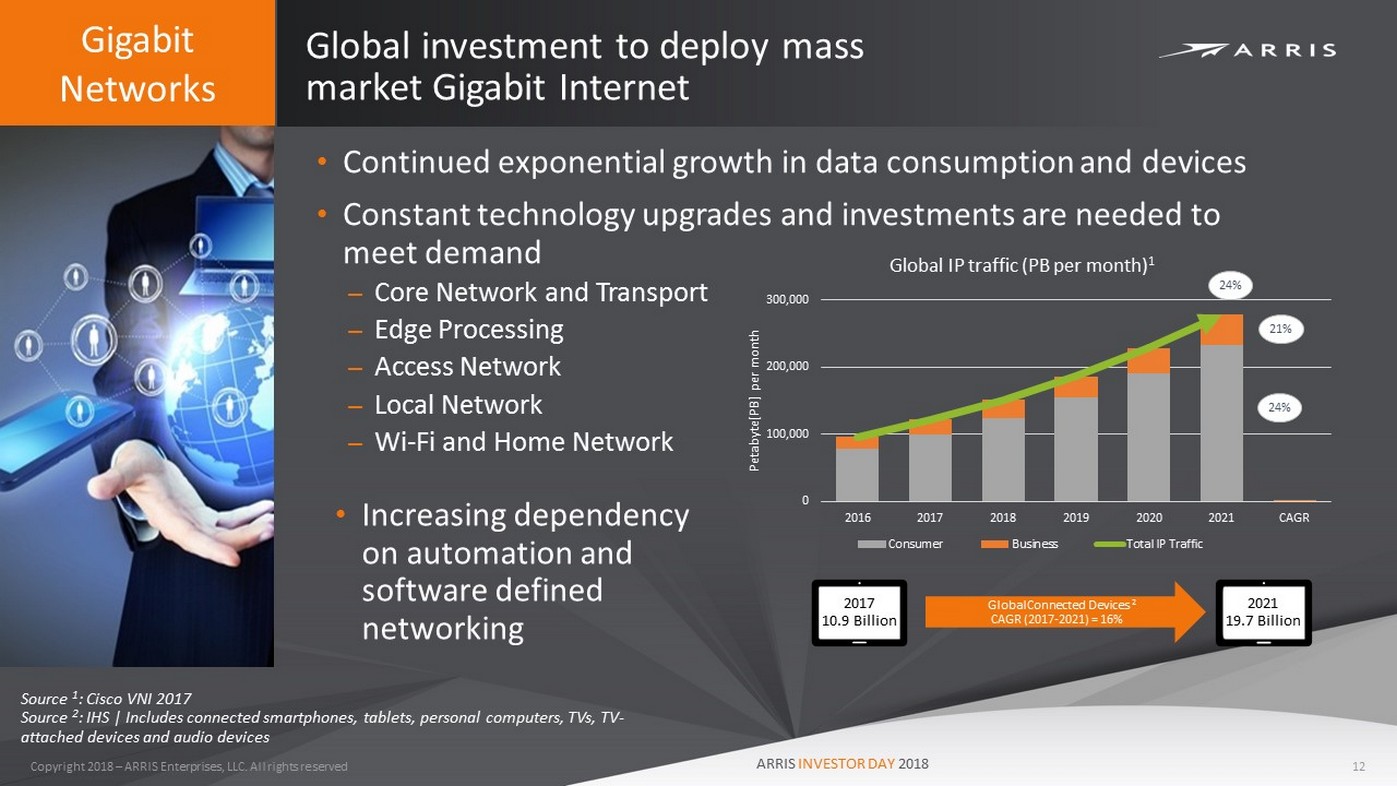

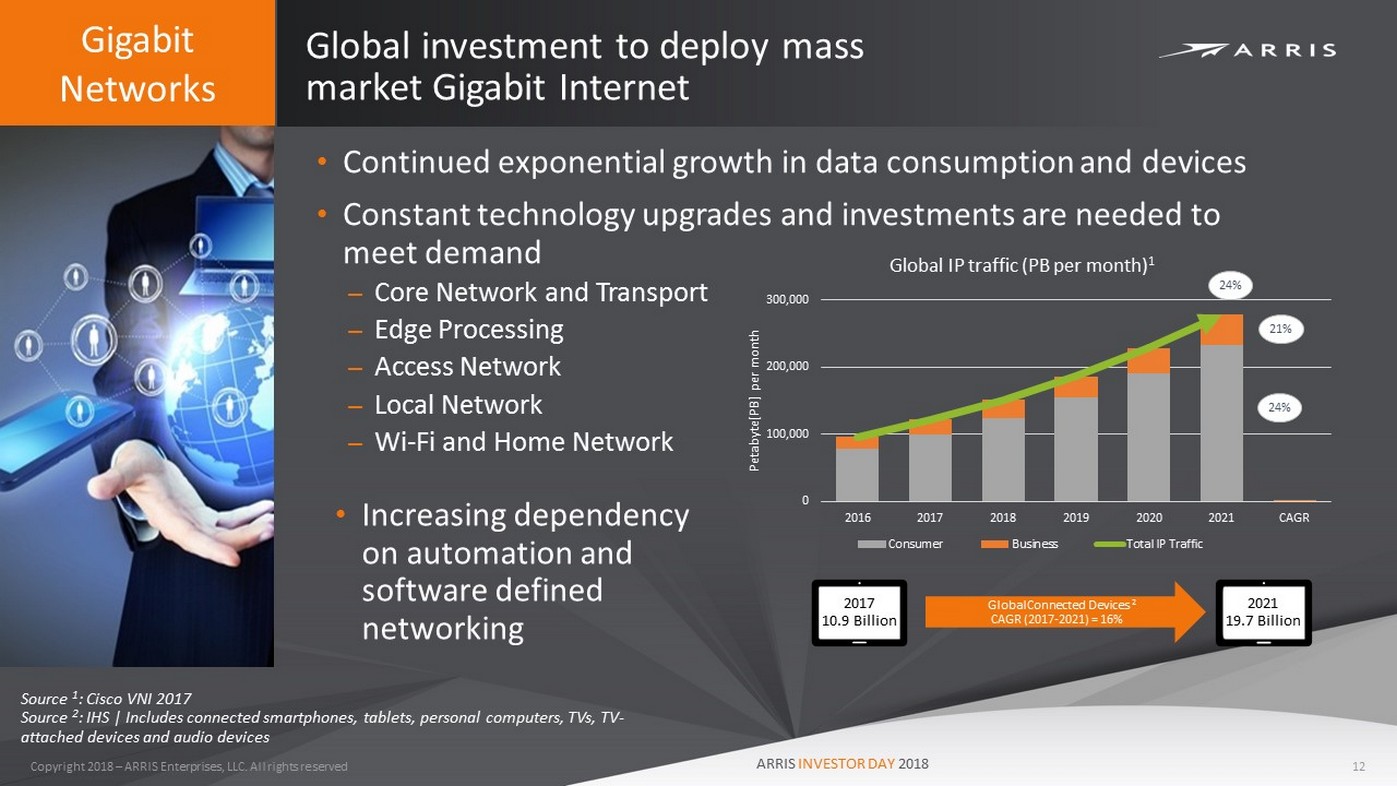

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Global investment to deploy mass market Gigabit Internet 12 • Continued exponential growth in data consumption and devices • Constant technology upgrades and investments are needed to meet demand – Core Network and Transport – Edge Processing – Access Network – Local Network – Wi - Fi and Home Network Gigabit Networks • Increasing dependency on automation and software defined networking 24% 21% 24% 0 100,000 200,000 300,000 2016 2017 2018 2019 2020 2021 CAGR Petabyte[PB] per month Global IP traffic (PB per month) 1 Consumer Business Total IP Traffic Global Connected Devices 2 CAGR (2017 - 2021) = 16% 2017 10.9 Billion 2021 19.7 Billion Source 1 : Cisco VNI 2017 Source 2 : IHS | Includes connected smartphones, tablets, personal computers, TVs, TV - attached devices and audio devices

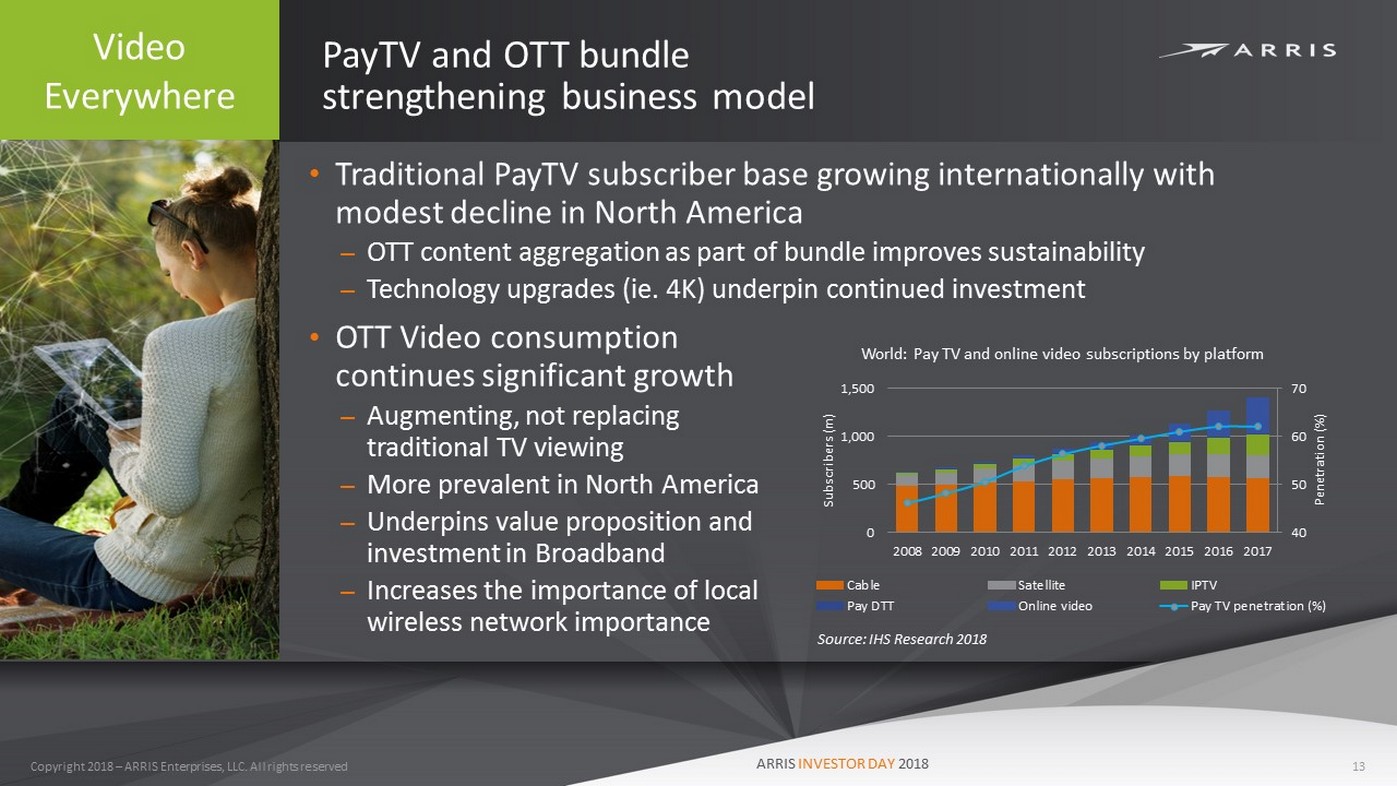

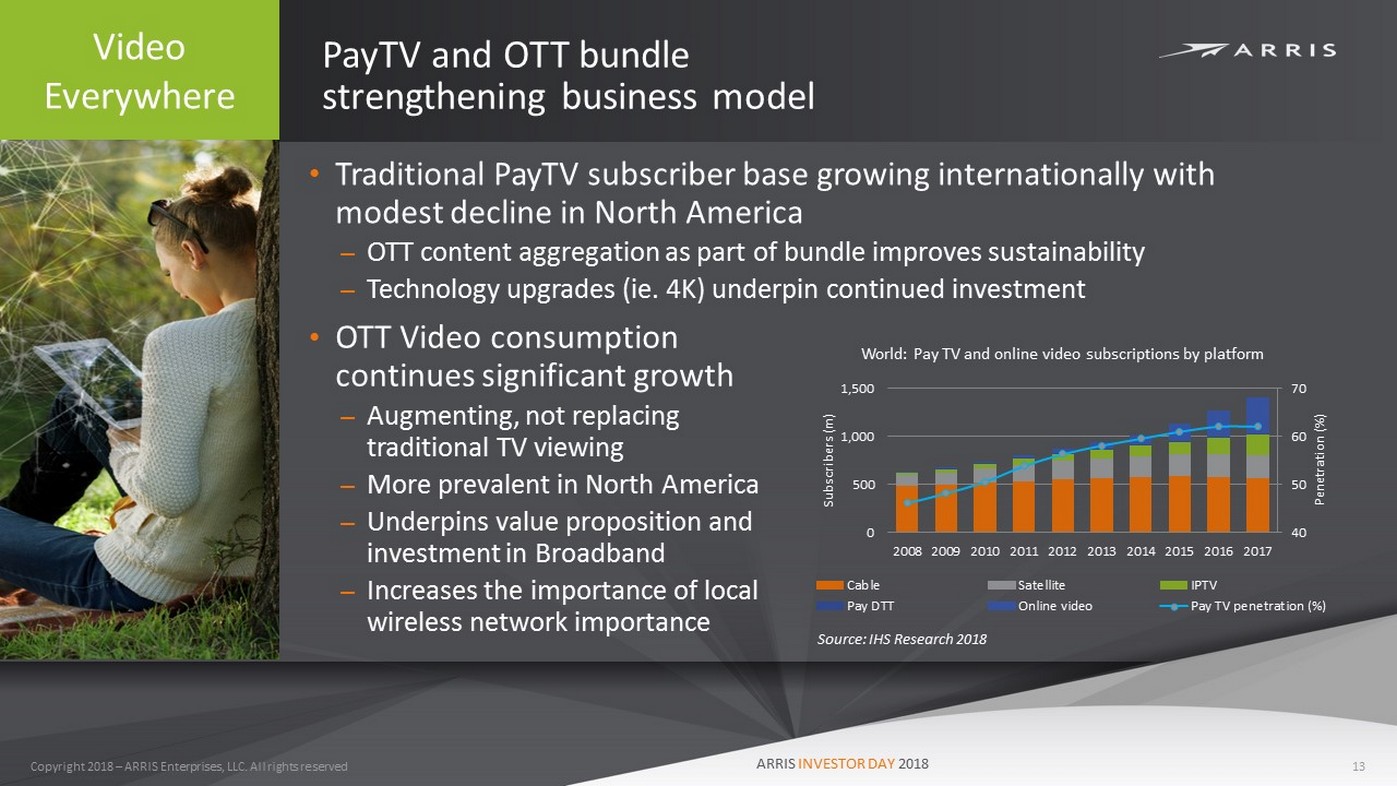

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 PayTV and OTT bundle strengthening business model 13 Video Everywhere • Traditional PayTV subscriber base growing internationally with modest decline in North America – OTT content aggregation as part of bundle improves sustainability – Technology upgrades ( ie . 4K) underpin continued investment • OTT Video consumption continues significant growth – Augmenting, not replacing traditional TV viewing – More prevalent in North America – Underpins value proposition and investment in Broadband – Increases the importance of local wireless network importance 40 50 60 70 0 500 1,000 1,500 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Penetration (%) Subscribers (m) World: Pay TV and online video subscriptions by platform Cable Satellite IPTV Pay DTT Online video Pay TV penetration (%) Source: IHS Research 2018

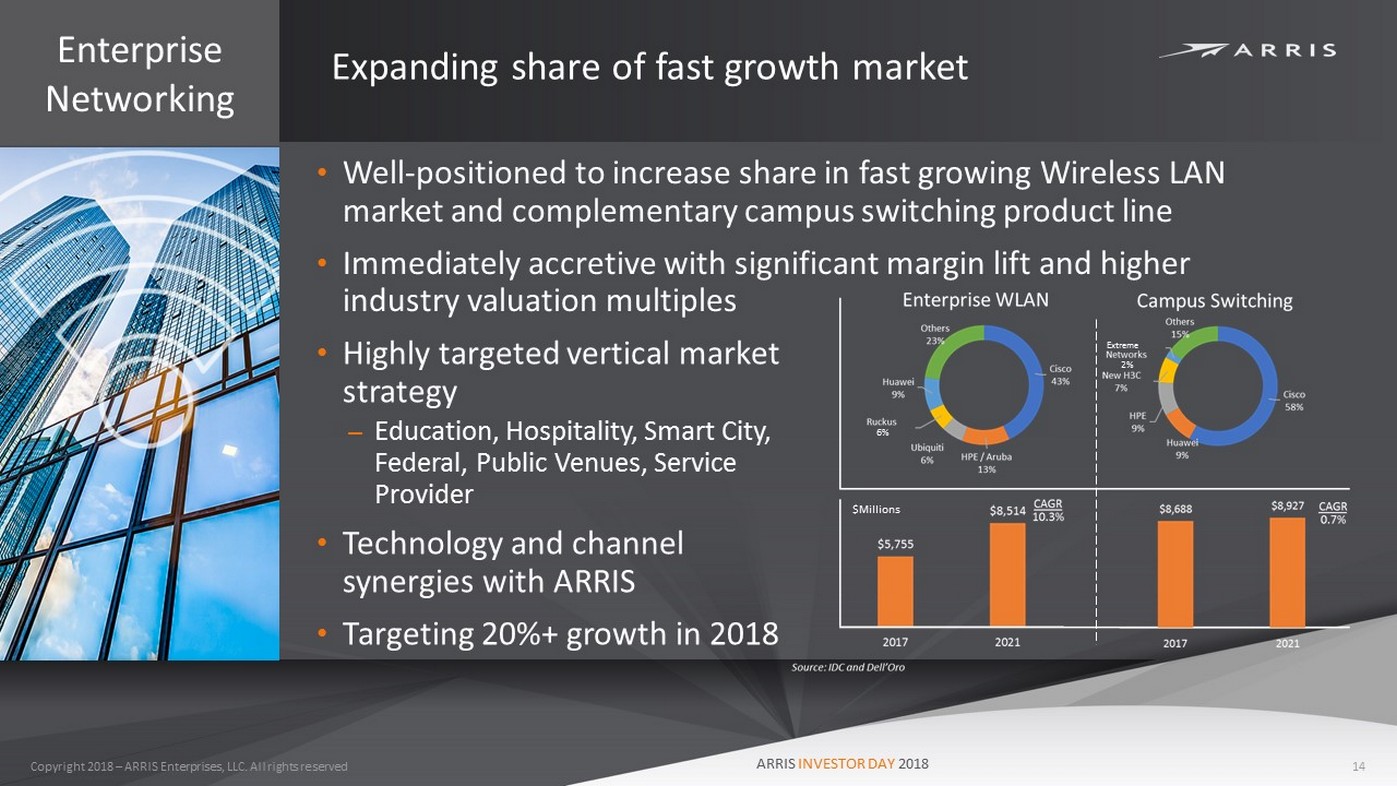

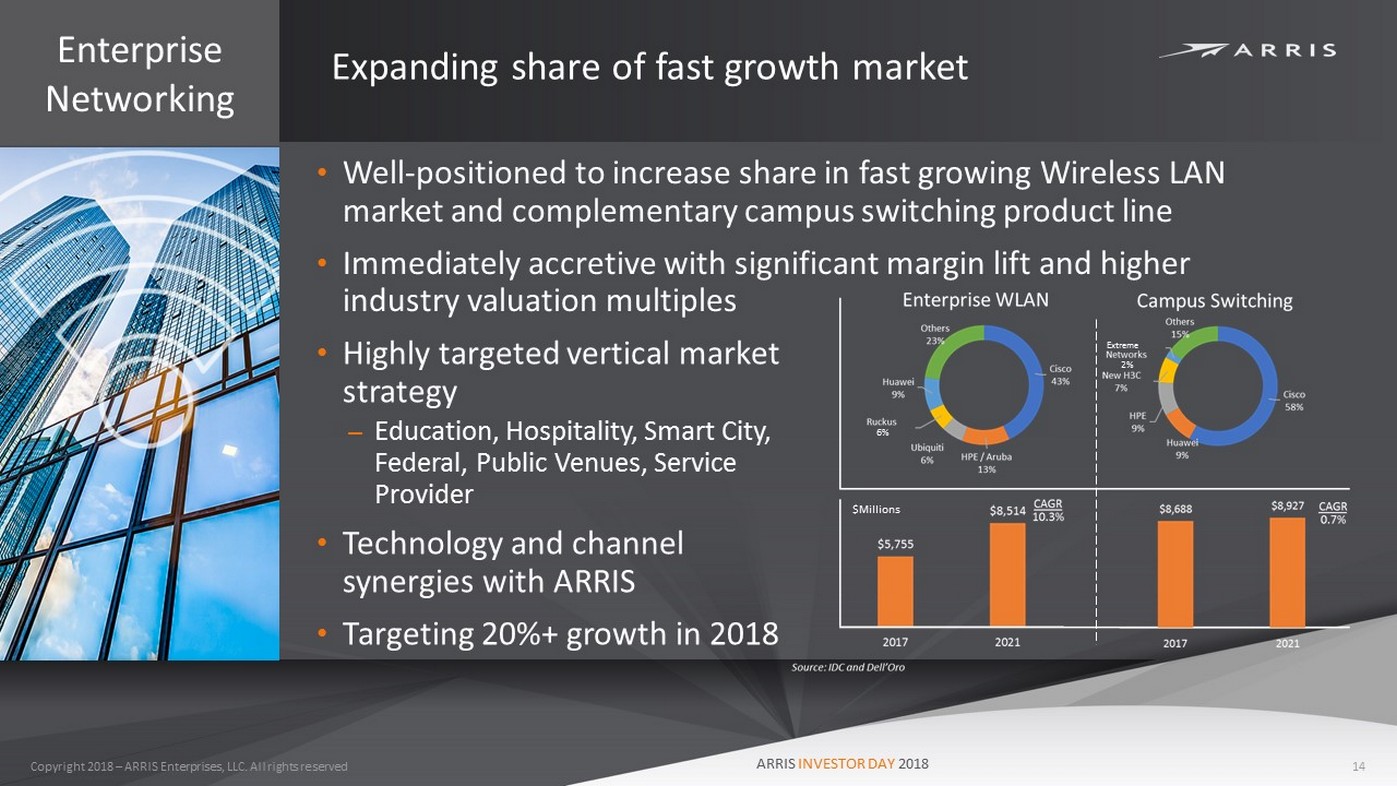

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Expanding share of fast growth market 14 Enterprise Networking • Well - positioned to increase share in fast growing Wireless LAN market and complementary campus switching product line • Immediately accretive with significant margin lift and higher industry valuation multiples • Highly targeted vertical market strategy – Education, Hospitality, Smart City, Federal, Public Venues, Service Provider • Technology and channel synergies with ARRIS • Targeting 20%+ growth in 2018 $Millions 6% Extreme 2%

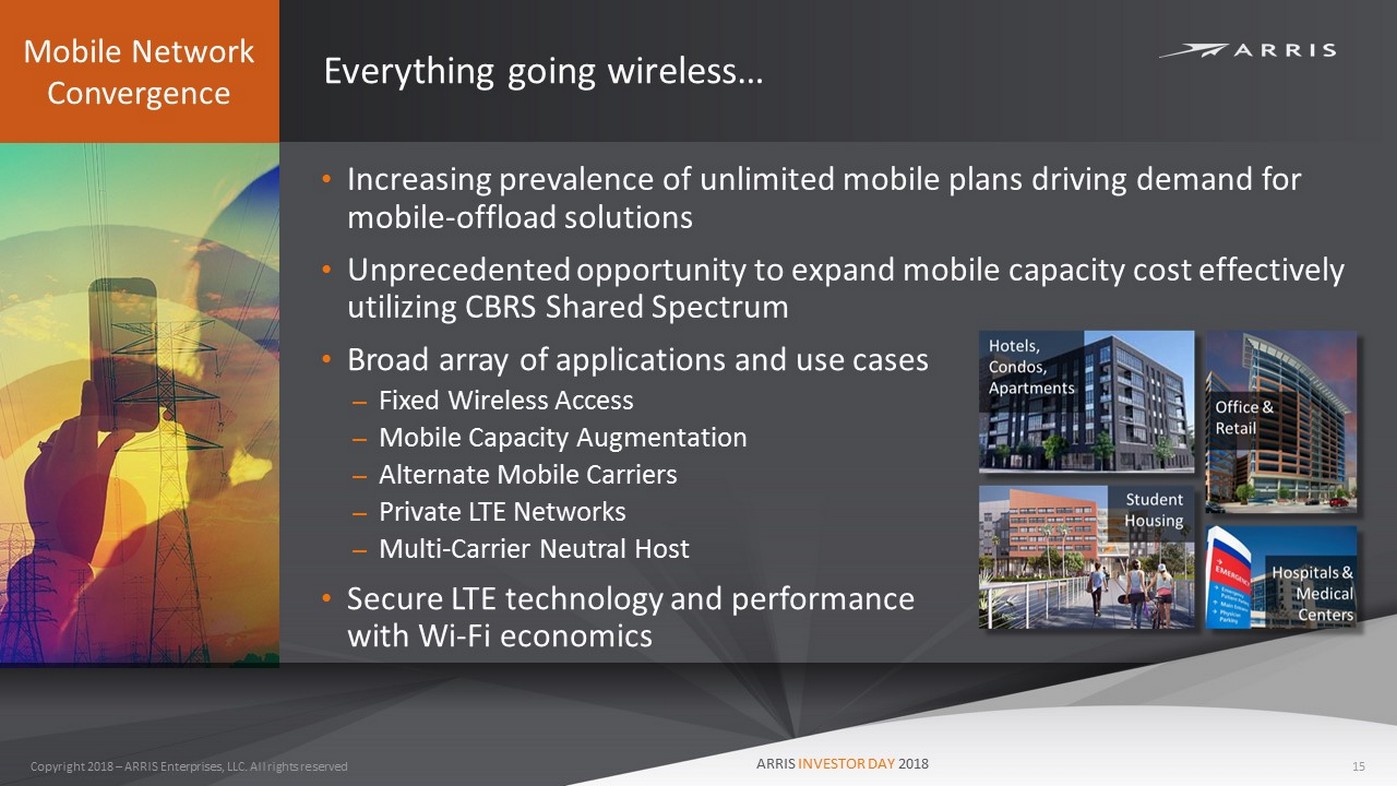

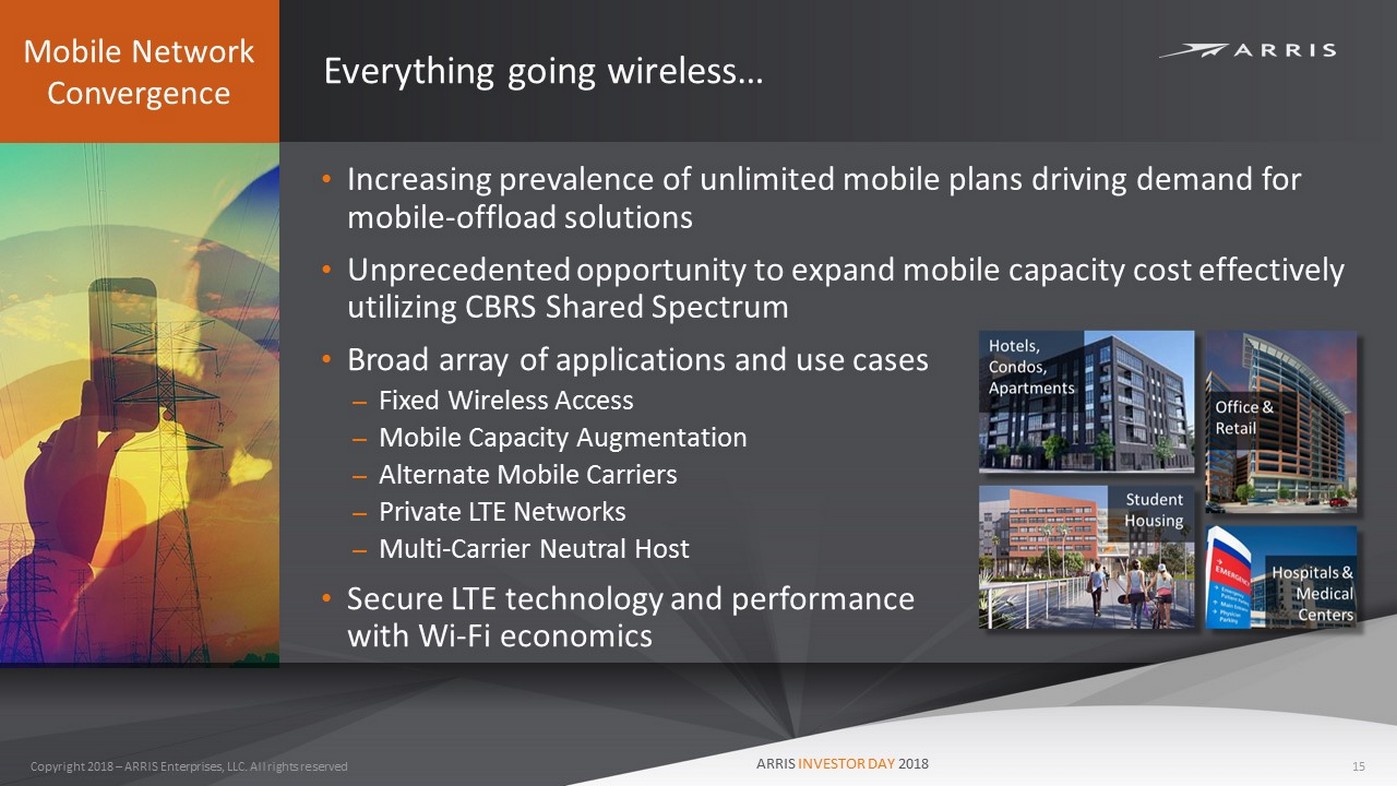

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Everything going wireless… 15 Mobile Network Convergence • Increasing prevalence of unlimited mobile plans driving demand for mobile - offload solutions • Unprecedented opportunity to expand mobile capacity cost effectively utilizing CBRS Shared Spectrum • Broad array of applications and use cases – Fixed Wireless Access – Mobile Capacity Augmentation – Alternate Mobile Carriers – Private LTE Networks – Multi - Carrier Neutral Host • Secure LTE technology and performance with Wi - Fi economics

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Intense focus on margin expansion 16 Product mix – New Enterprise segment – Network and Cloud growth – Increasing Software and Services Margin Expansion Pricing – Adjustments to reflect continued component cost pressure – Increased discipline on new opportunities $ Cost improvements – Factory divestiture – Component costs – Operational efficiencies

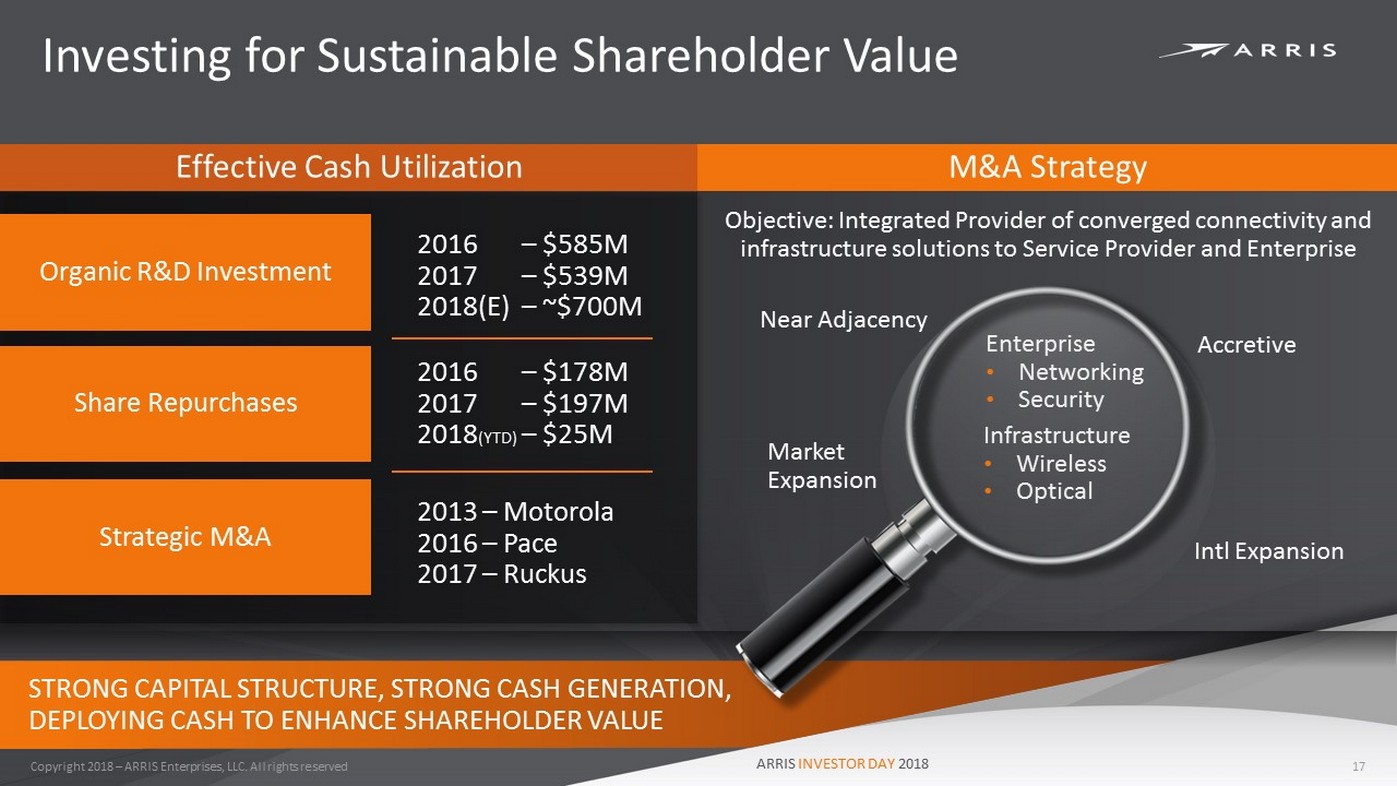

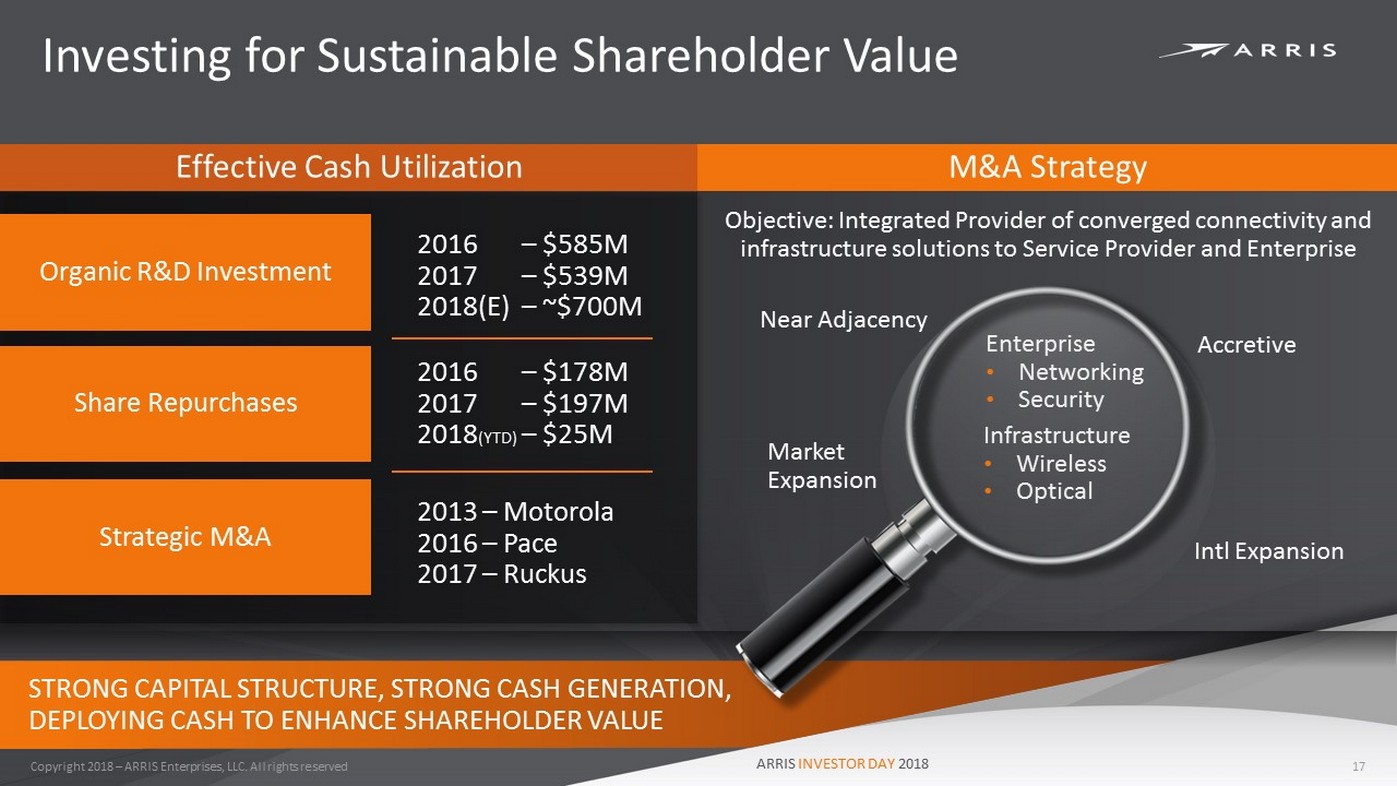

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Investing for Sustainable Shareholder Value 17 Effective Cash Utilization M&A Strategy Share Repurchases Organic R&D Investment Strategic M&A 2016 – $585M 2017 – $539M 2018(E) – ~$700M 2013 – Motorola 2016 – Pace 2017 – Ruckus 2016 – $178M 2017 – $197M 2018 (YTD) – $25M Objective: Integrated Provider of converged connectivity and infrastructure solutions to Service Provider and Enterprise Near Adjacency Accretive Intl Expansion STRONG CAPITAL STRUCTURE, STRONG CASH GENERATION, DEPLOYING CASH TO ENHANCE SHAREHOLDER VALUE Enterprise • Networking • Security Infrastructure • Wireless • Optical Market Expansion

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Today’s Key Messages 18 • Well - positioned to benefit from mass - market Gigabit Internet spend • Deeply entrenched leadership in evolving video market • Expanded addressable market with increasingly diversified customer base • Leadership in emerging mobile CBRS LTE small cell market • Three year outlook and earnings growth target • Capital allocation strategy

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Customer Overview Steve McCaffery and Tim O’Loughlin

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Global Customer Trends Broadband and Mobile Connectivity Key 7.6B mobile subscriptions by 2021, 1.1B broadband subscribers by 2021 ¹ Massive Bandwidth Demand Unrelenting traffic from video, mobile offload, broadband subscriber growth, and IoT . Data traffic growing 20 - 30% year over year ² Evolution of Video 4K consumer adoption underway, OTT application integration, rich media user interface, and voice control driving CPE refresh and subscriber trends Wi - Fi as Core Service Residential and business customers demanding Wi - Fi connectivity and throughput resulting in ongoing device refresh Service and Control Driving cloud control, virtualization, and telemetry across residential, mobile, and enterprise customers ¹ Source: Dataxis 3Q17 ² Source: IHS Markit 20

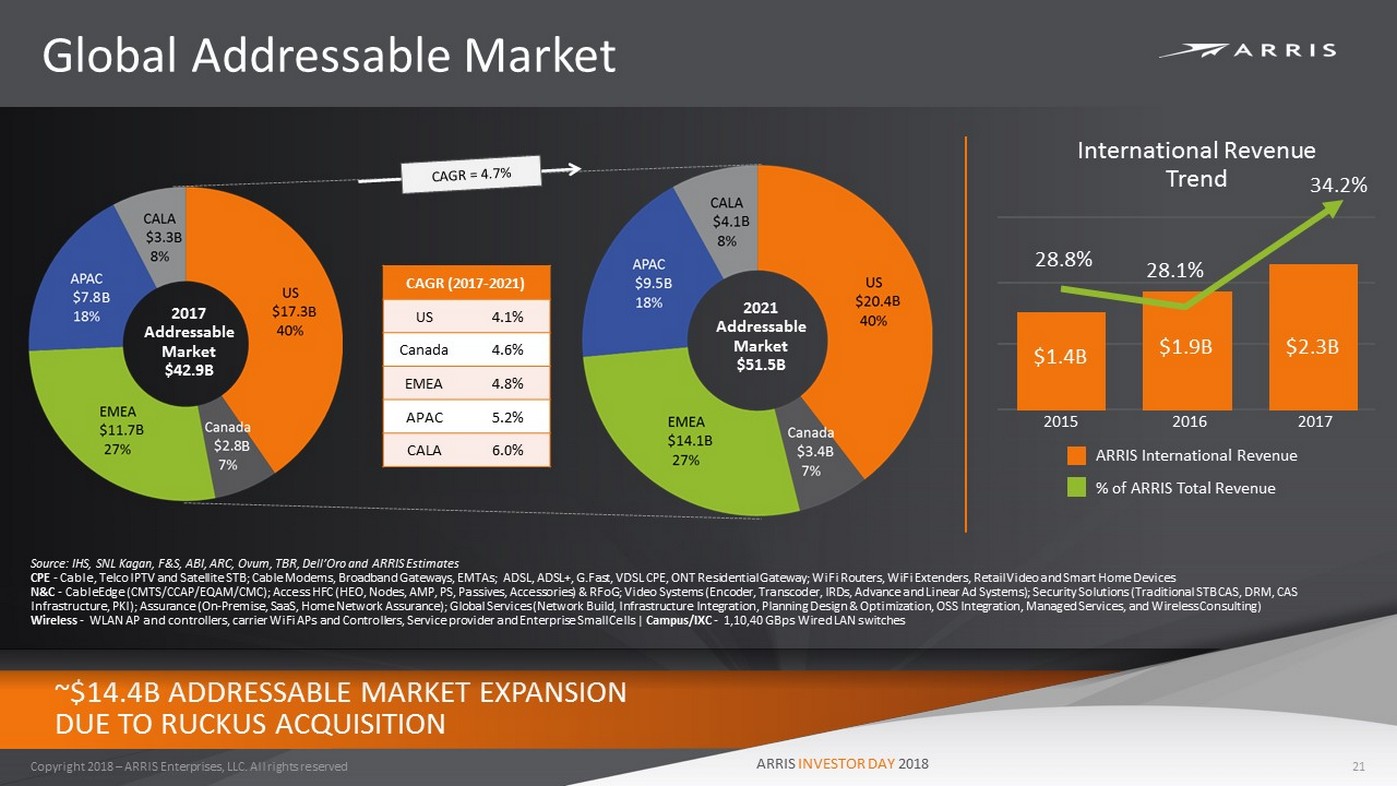

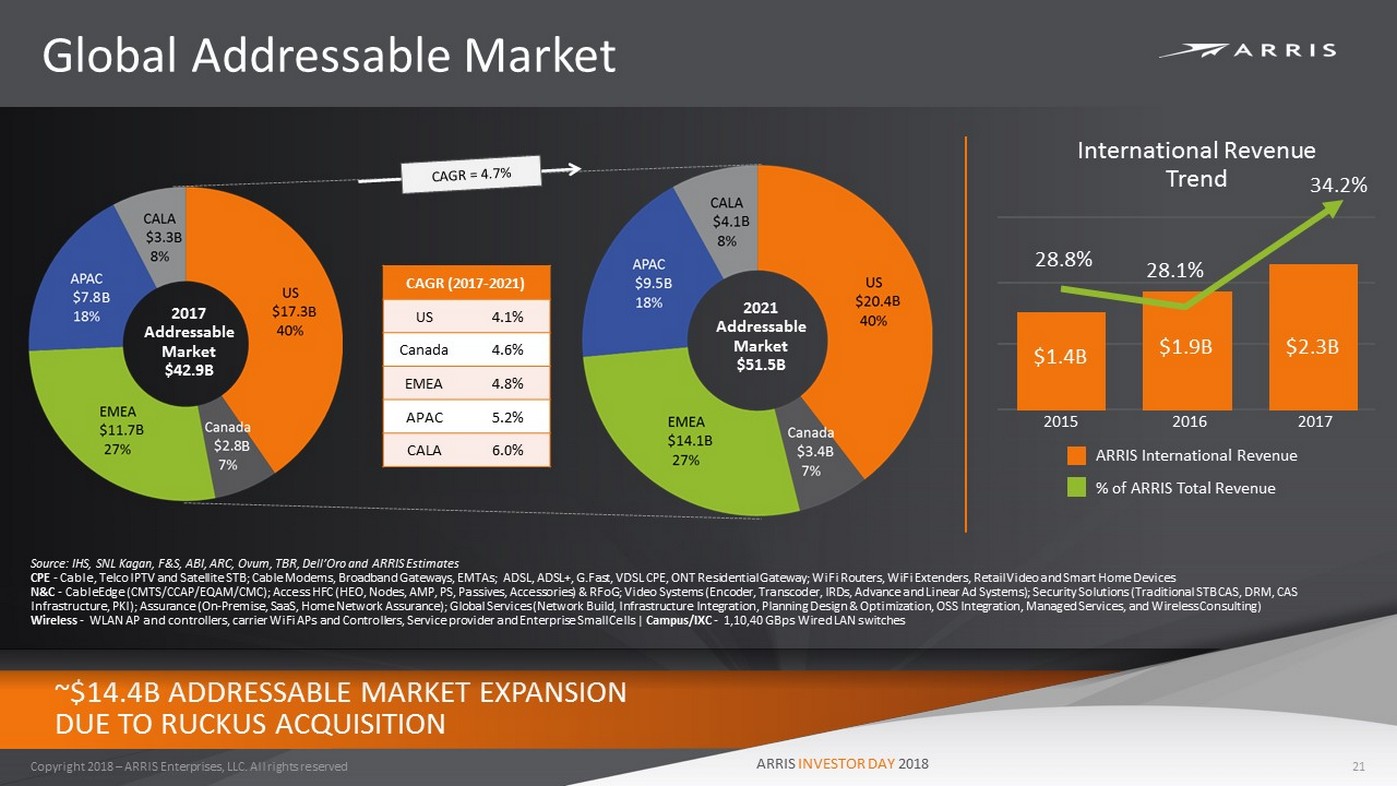

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Global Addressable Market 21 ~$14.4B ADDRESSABLE MARKET EXPANSION DUE TO RUCKUS ACQUISITION Source: IHS, SNL Kagan, F&S, ABI, ARC, Ovum, TBR, Dell’Oro and ARRIS Estimates CPE - Cable, Telco IPTV and Satellite STB; Cable Modems, Broadband Gateways, EMTAs; ADSL, ADSL+, G.Fast , VDSL CPE, ONT Residential Gateway; WiFi Routers, WiFi Extenders, Retail Video and Smart Home Devices N&C - CableEdge (CMTS/CCAP/EQAM/CMC); Access HFC (HEO, Nodes, AMP, PS, Passives, Accessories) & RFoG ; Video Systems (Encoder, Transcoder, IRDs, Advance and Linear Ad Systems); Security Solutions ( Traditional STB CAS, DRM, CAS Infrastructure, PKI); Assurance ( On - Premise, SaaS, Home Network Assurance); Global Services (Network Build, Infrastructure Integration, Planning Design & Optimiz ation, OSS Integration, Managed Services, and Wireless Consulting) Wireless - WLAN AP and controllers, carrier WiFi APs and Controllers, Service provider and Enterprise Small Cells | Campus/IXC - 1,10,40 GBps Wired LAN switches CAGR (2017 - 20 21) US 4.1% Canada 4.6% EMEA 4.8% APAC 5.2% CALA 6.0% 2021 Addressable Market $51.5B 2017 Addressable Market $42.9B $1.4B $1.9B $2.3B 28.8% 28.1% 34.2% ARRIS International Revenue % of ARRIS Total Revenue 2015 2016 2017 International Revenue Trend B B B B B B B B B B

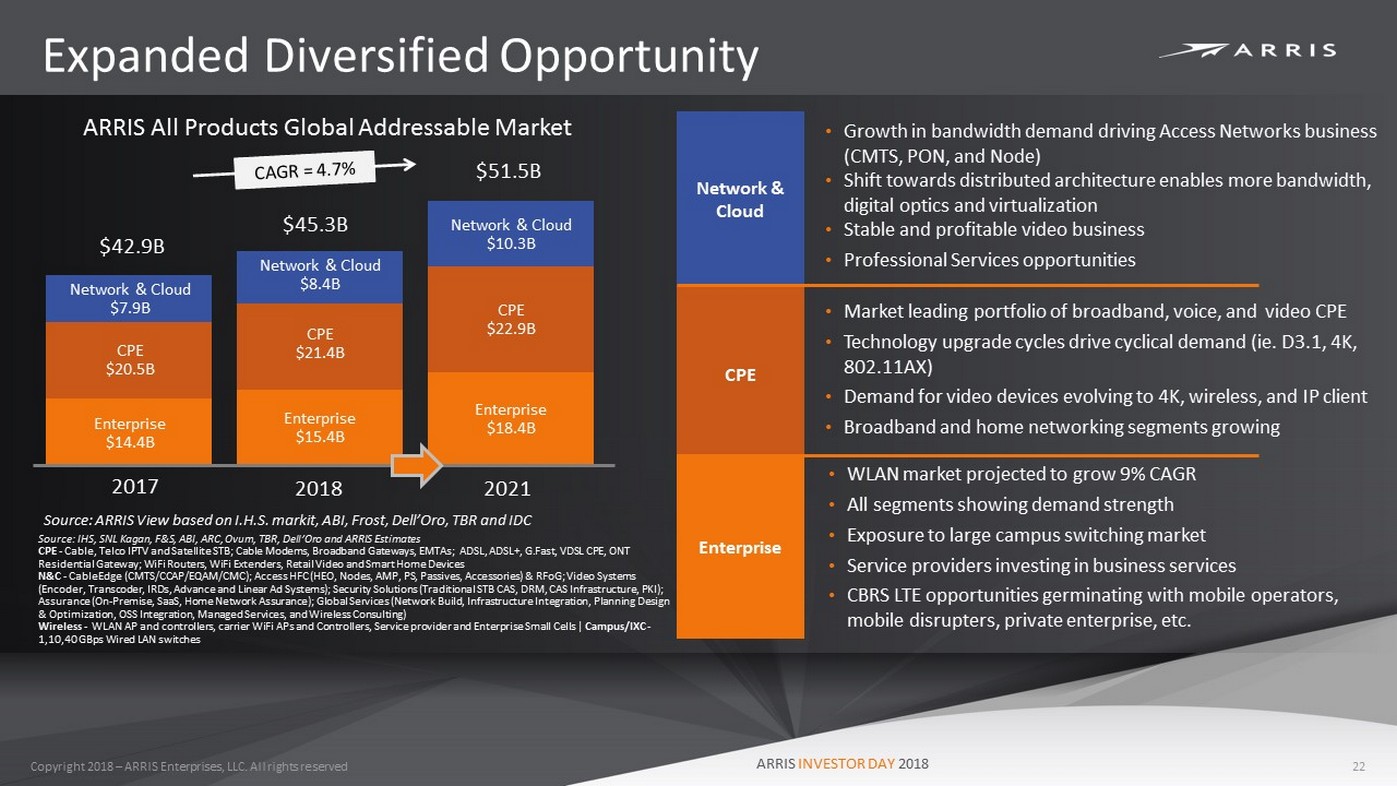

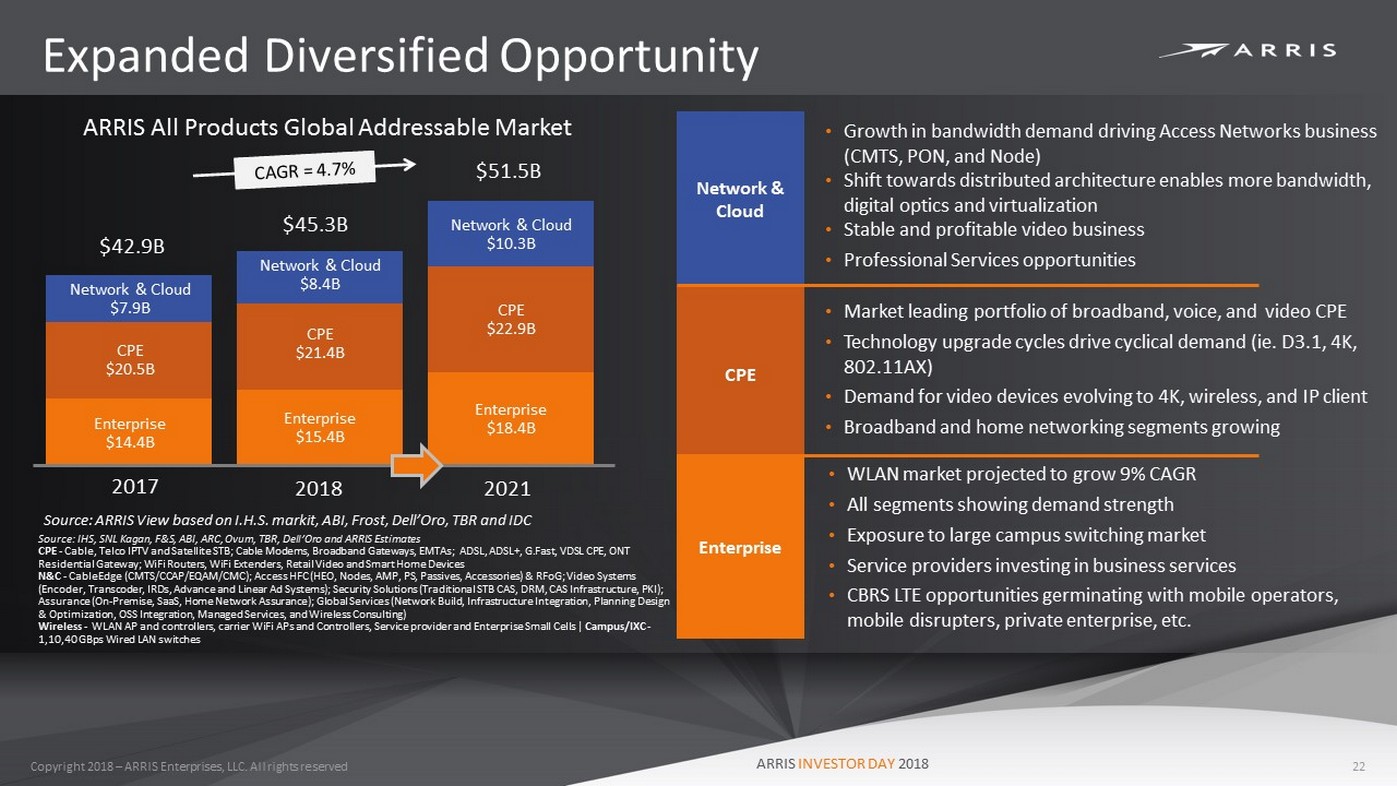

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Expanded Diversified Opportunity 22 Enterprise $14.4B CPE $20.5B Network & Cloud $7.9B Enterprise $15.4B CPE $21.4B Network & Cloud $8.4B Enterprise $18.4B CPE $22.9B Network & Cloud $10.3B $42.9B $45.3B $51.5B ARRIS All Products Global Addressable Market 2017 2018 2021 Source: ARRIS View based on I.H.S. markit , ABI, Frost, Dell’Oro , TBR and IDC Network & Cloud CPE Enterprise • Growth in bandwidth demand driving Access Networks business (CMTS, PON, and Node) • Shift towards distributed architecture enables more bandwidth, digital optics and virtualization • Stable and profitable video business • Professional Services opportunities • Market leading portfolio of broadband, voice, and video CPE • Technology upgrade cycles drive cyclical demand ( ie . D3.1, 4K, 802.11AX) • Demand for video devices evolving to 4K, wireless, and IP client • Broadband and home networking segments growing • WLAN market projected to grow 9% CAGR • All segments showing demand strength • Exposure to large campus switching market • Service providers investing in business services • CBRS LTE opportunities germinating with mobile operators, mobile disrupters, private enterprise, etc. Source: IHS, SNL Kagan, F&S, ABI, ARC, Ovum, TBR, Dell’Oro and ARRIS Estimates CPE - Cable, Telco IPTV and Satellite STB; Cable Modems, Broadband Gateways, EMTAs; ADSL, ADSL+, G.Fast , VDSL CPE, ONT Residential Gateway; WiFi Routers, WiFi Extenders, Retail Video and Smart Home Devices N&C - CableEdge (CMTS/CCAP/EQAM/CMC); Access HFC (HEO, Nodes, AMP, PS, Passives, Accessories) & RFoG ; Video Systems (Encoder, Transcoder, IRDs, Advance and Linear Ad Systems); Security Solutions ( Traditional STB CAS, DRM, CAS Infrastructure, PKI); Assurance ( On - Premise, SaaS, Home Network Assurance); Global Services (Network Build, Infrastructure Integration, Planning Design & Optimization, OSS Integration, Managed Services, and Wireless Consulting) Wireless - WLAN AP and controllers, carrier WiFi APs and Controllers, Service provider and Enterprise Small Cells | Campus/IXC - 1,10,40 GBps Wired LAN switches

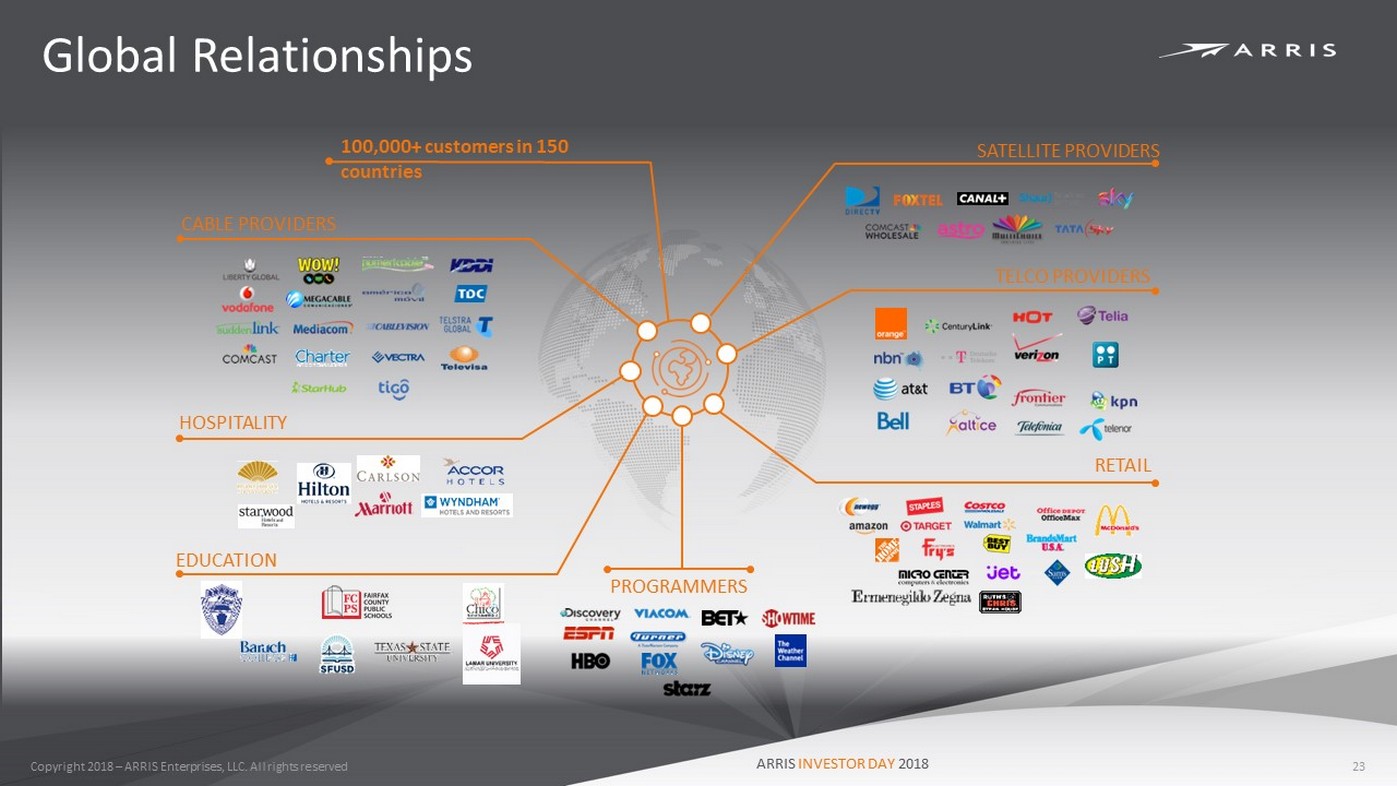

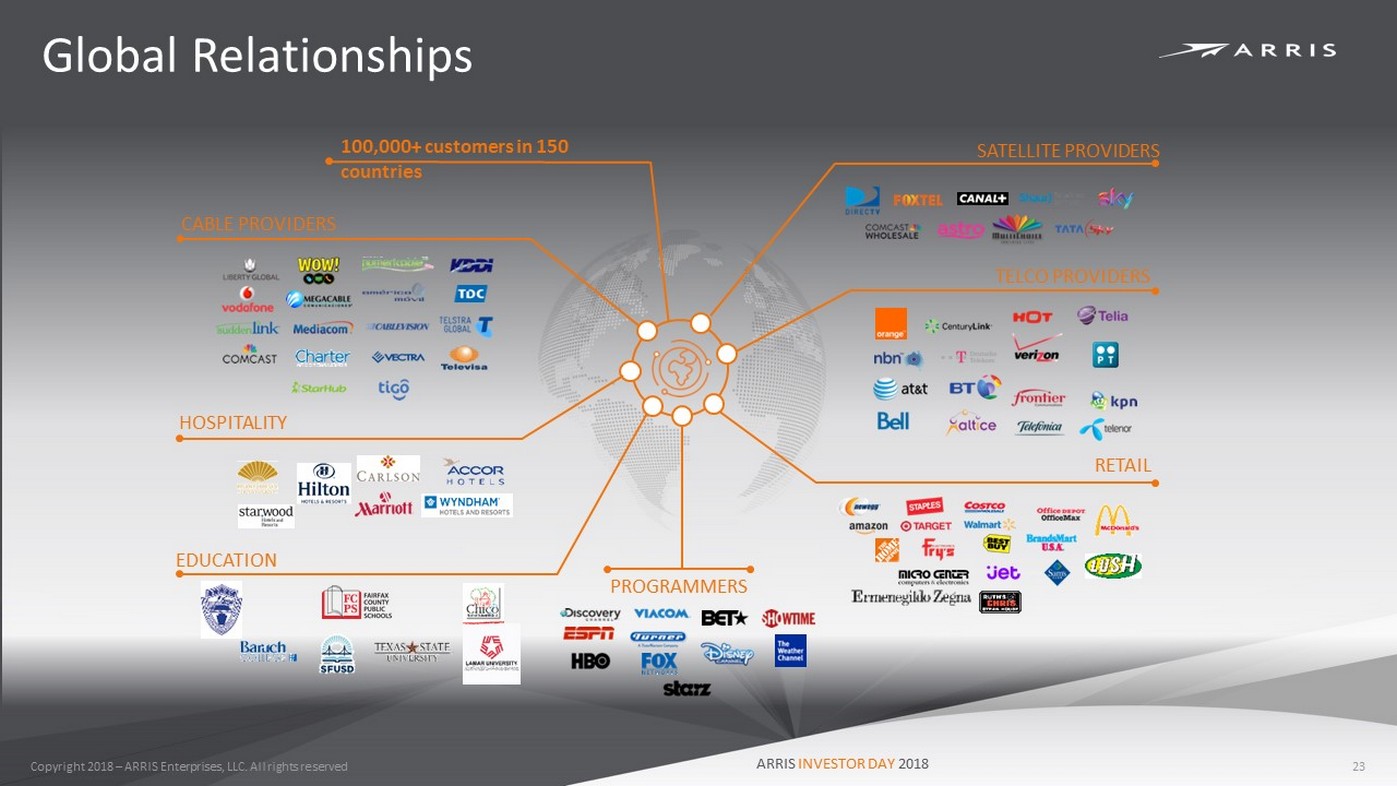

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Global Relationships 23 CABLE PROVIDERS TELCO PROVIDERS RETAIL SATELLITE PROVIDERS PROGRAMMERS HOSPITALITY EDUCATION 100,000+ customers in 150 countries

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Diversified and Deep Customer Engagement Large Cable Operator Global Hospitality Brand Mobile/Telco Network Operator • CMTS • Optical Access • CPE • Wi - Fi for Enterprise • Bulk Wi - Fi for MDU • Pro - services • OTT CPE • Device Management • Legacy CPE • Wi - Fi for Enterprise • Bulk Wi - Fi for MDU • Wi - Fi Access Points • Wi - Fi Controllers • Campus Switching • Pro - services c 24

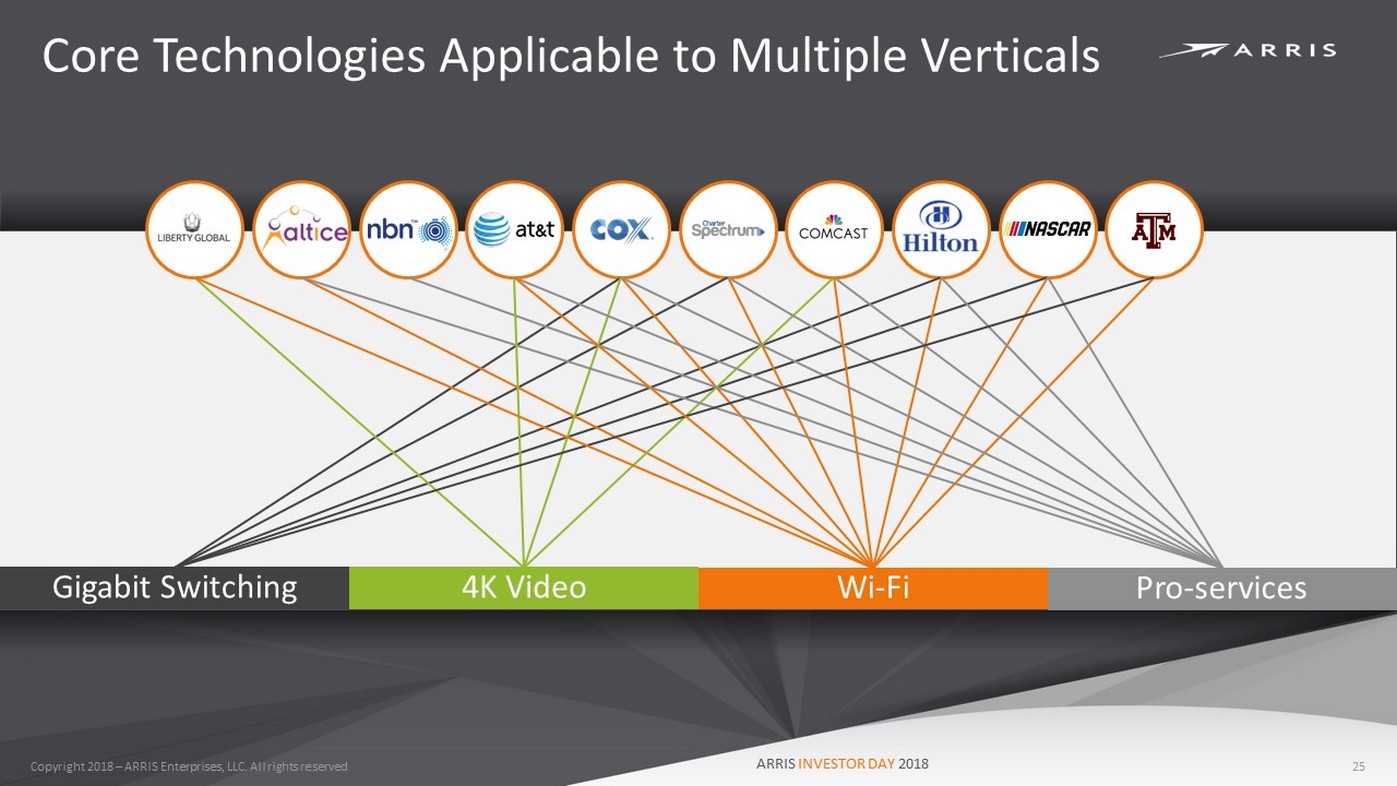

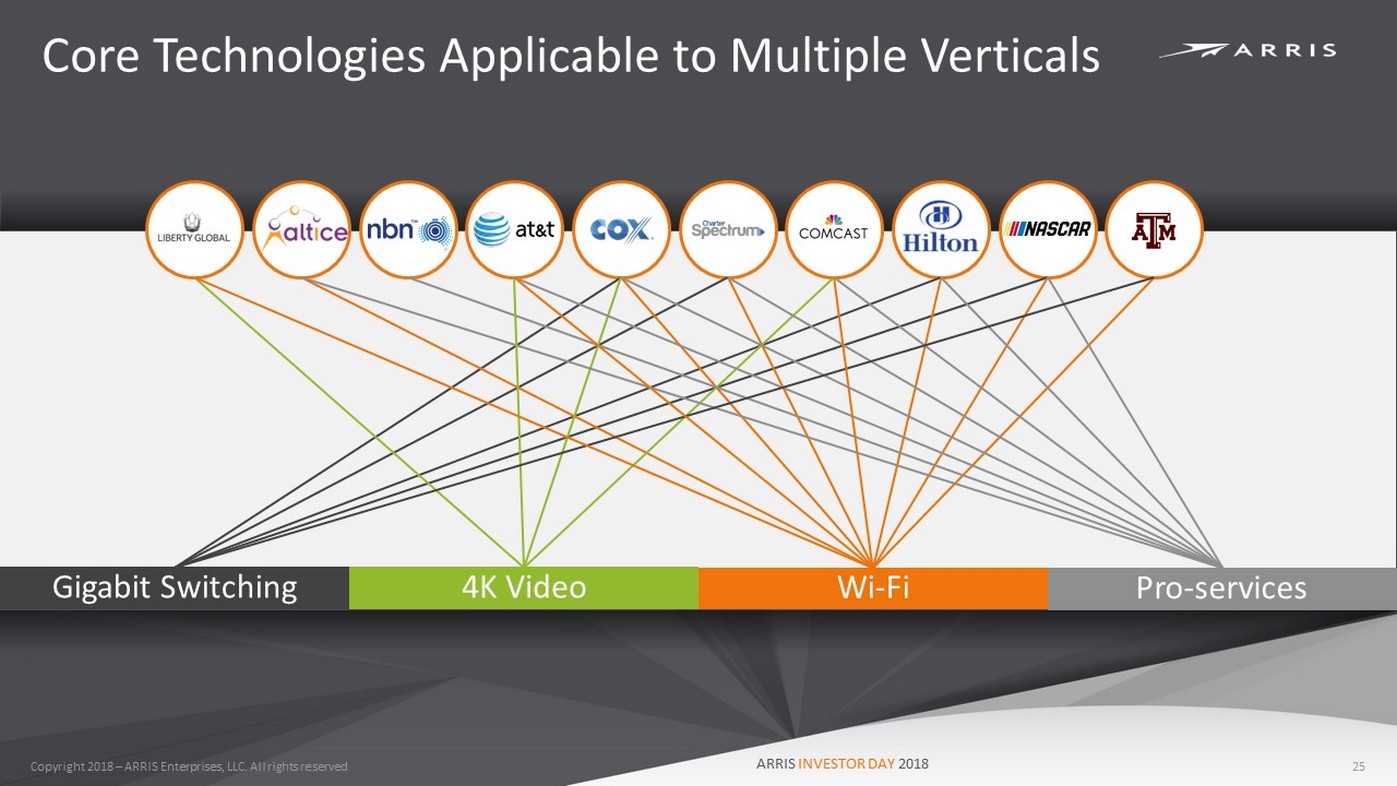

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Core Technologies Applicable to Multiple Verticals Gigabit Switching 4K Video Wi - Fi Pro - services 25

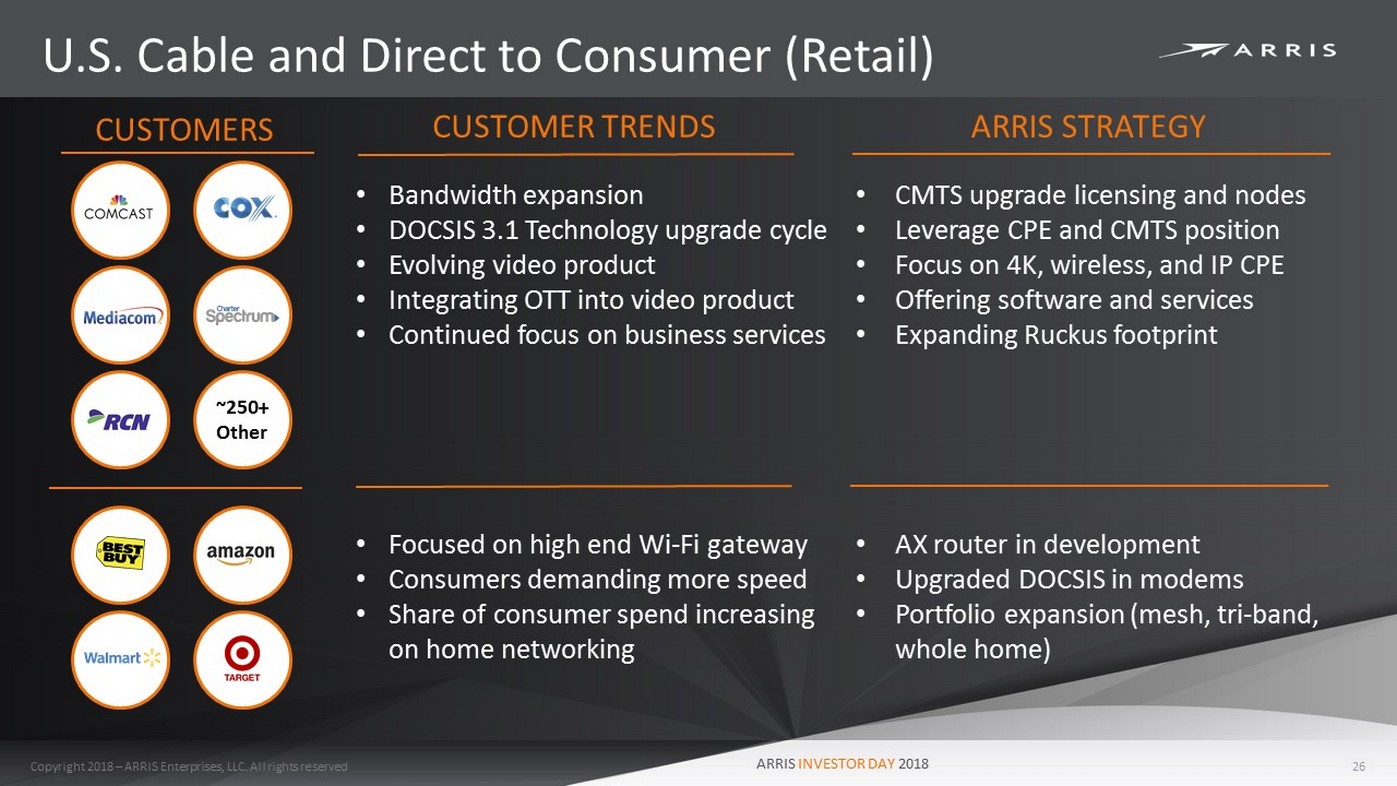

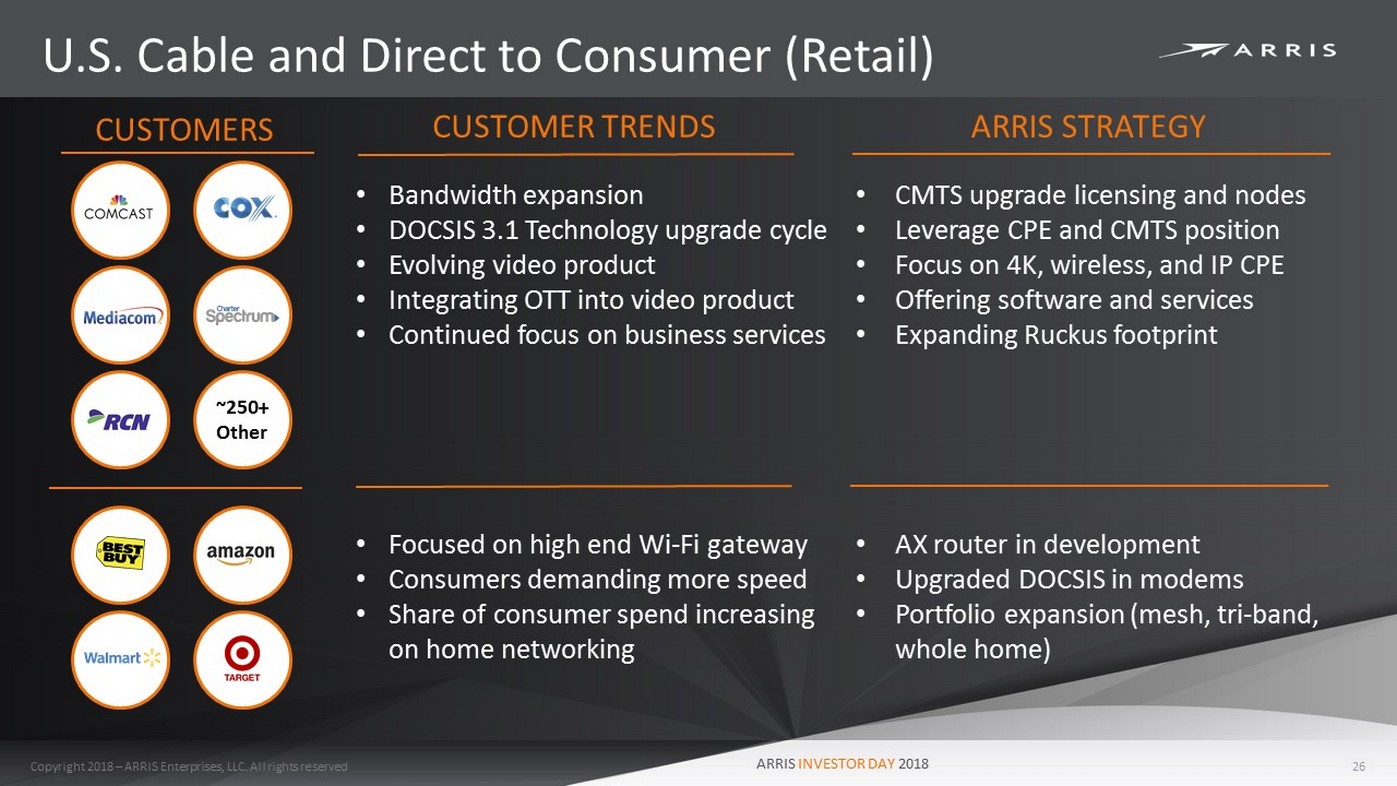

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 U.S. Cable and Direct to Consumer (Retail) 26 CUSTOMERS CUSTOMER TRENDS • Bandwidth expansion • DOCSIS 3.1 Technology upgrade cycle • Evolving video product • Integrating OTT into video product • Continued focus on business services • Focused on high end Wi - Fi gateway • Consumers demanding more speed • Share of consumer spend increasing on home networking ARRIS STRATEGY • CMTS upgrade licensing and nodes • Leverage CPE and CMTS position • Focus on 4K, wireless, and IP CPE • Offering software and services • Expanding Ruckus footprint • AX router in development • Upgraded DOCSIS in modems • Portfolio expansion (mesh, tri - band, whole home) ~250+ Other

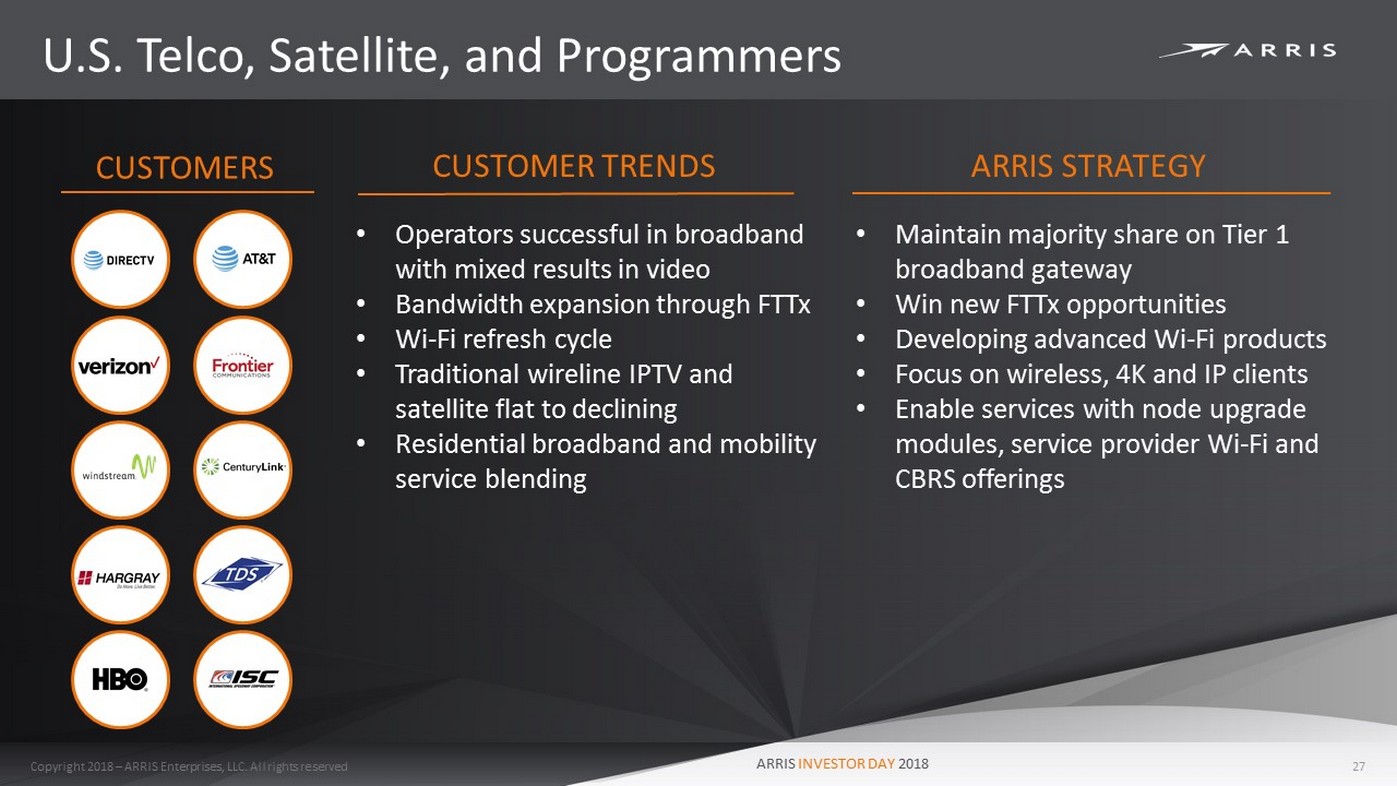

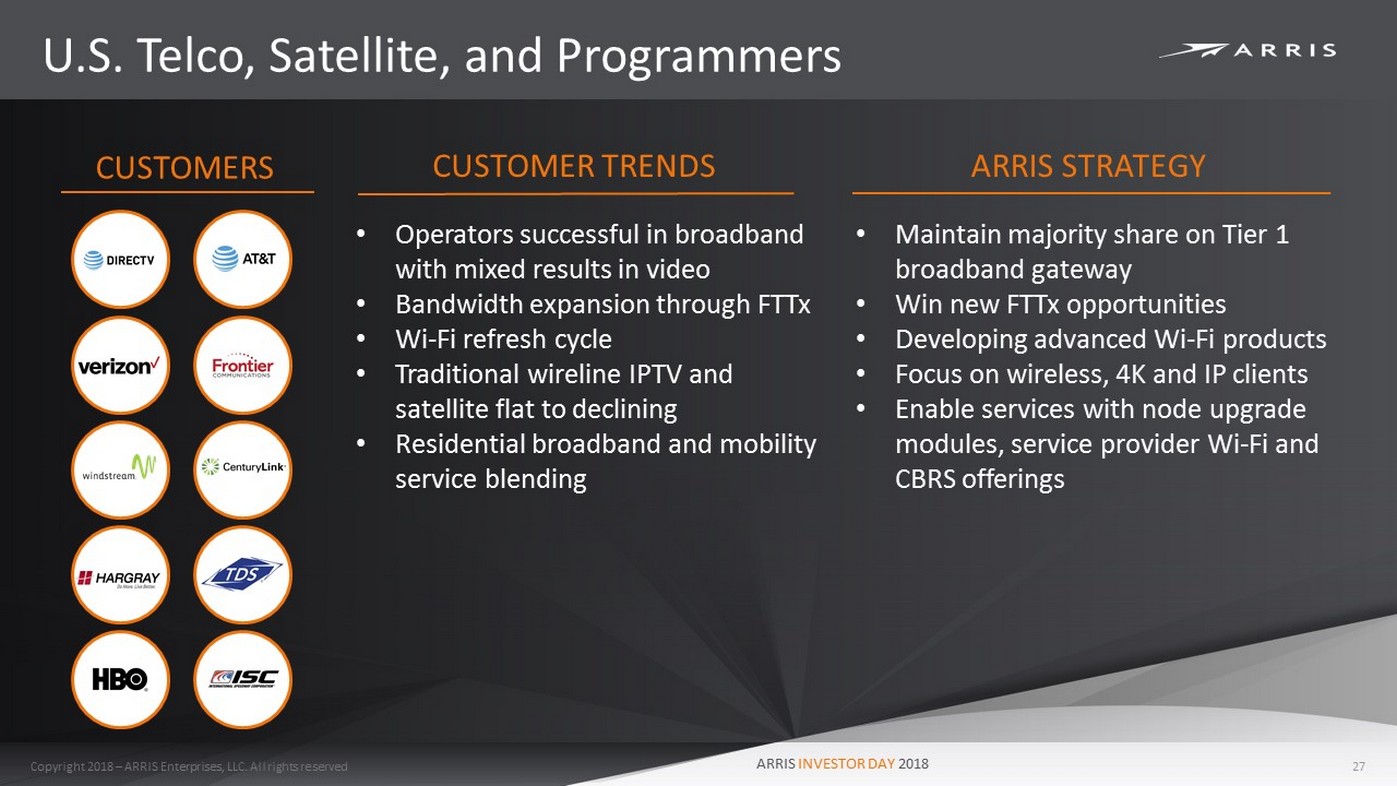

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 U.S. Telco, Satellite, and Programmers 27 CUSTOMERS CUSTOMER TRENDS • Operators successful in broadband with mixed results in video • Bandwidth expansion through FTTx • Wi - Fi refresh cycle • Traditional wireline IPTV and satellite flat to declining • Residential broadband and mobility service blending ARRIS STRATEGY • Maintain majority share on Tier 1 broadband gateway • Win new FTTx opportunities • Developing advanced Wi - Fi products • Focus on wireless, 4K and IP clients • Enable services with node upgrade modules, service provider Wi - Fi and CBRS offerings

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Canada Market Macro View 28 • Cable and Telco competition driving innovation, ARRIS supporting multiple 4K launches across both industries. • Addressing Cable offering services for HSD and mobile data as they represent the highest margin business for operators. • Rogers and Shaw execution against announced Comcast syndication. • Supporting Bell in all aspects of business through video partnership. • Maintain dominant share in Telco space.

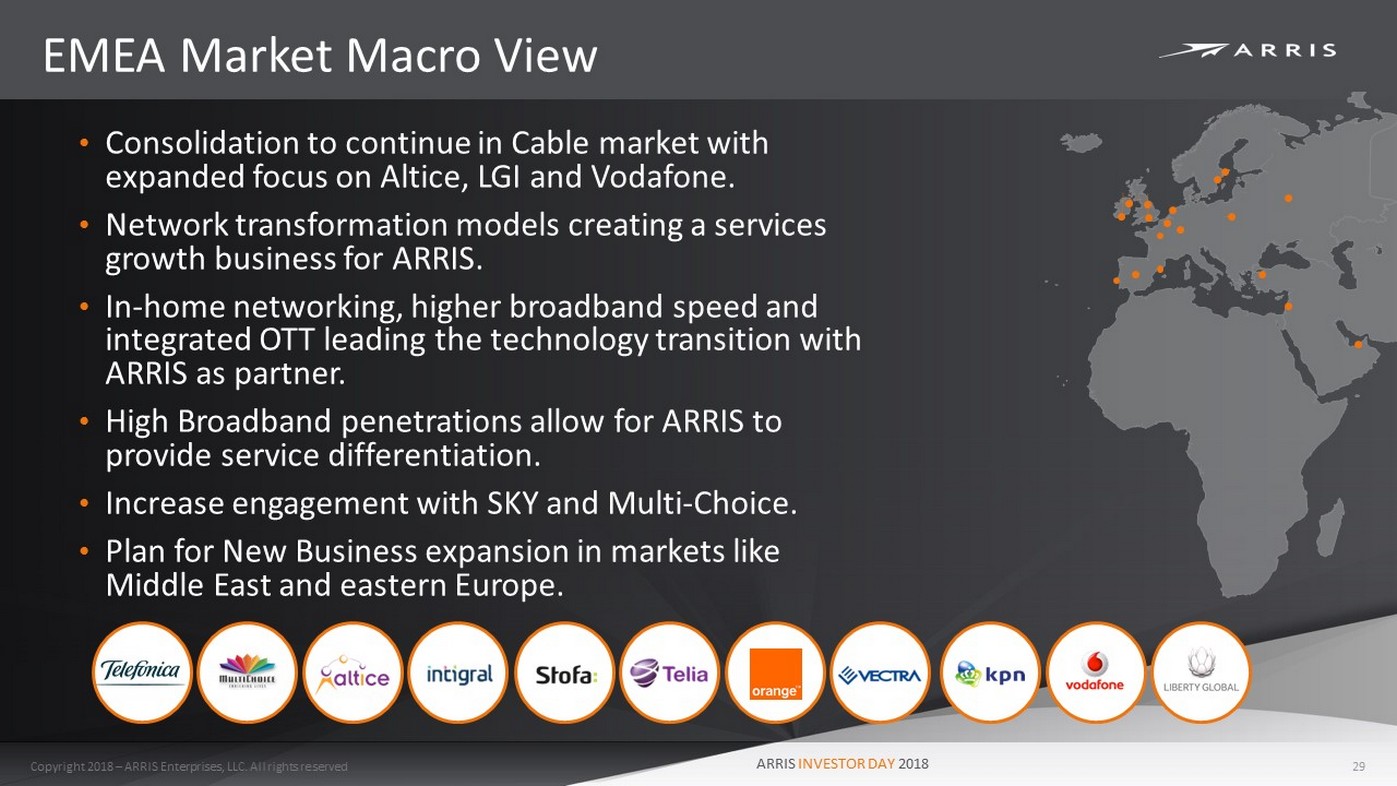

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 EMEA Market Macro View 29 • Consolidation to continue in Cable market with expanded focus on Altice, LGI and Vodafone. • Network transformation models creating a services growth business for ARRIS. • In - home networking, higher broadband speed and integrated OTT leading the technology transition with ARRIS as partner. • High Broadband penetrations allow for ARRIS to provide service differentiation. • Increase engagement with SKY and Multi - Choice. • Plan for New Business expansion in markets like Middle East and eastern Europe.

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 CALA Market Macro View 30 • Growth in 2018 as environment stabilizes. • Business models to support diverse economic conditions across the markets. • Focus on global players that operate inside and outside region ie Telefonica, Altice, LGI, AMX. • Significant technology transition underway led by DVB and deep fiber, creating a focus new customer opportunities. • Increased D3.1 transformation creating services offerings. • Target the ongoing significant HFC investment expected to continue through 2019.

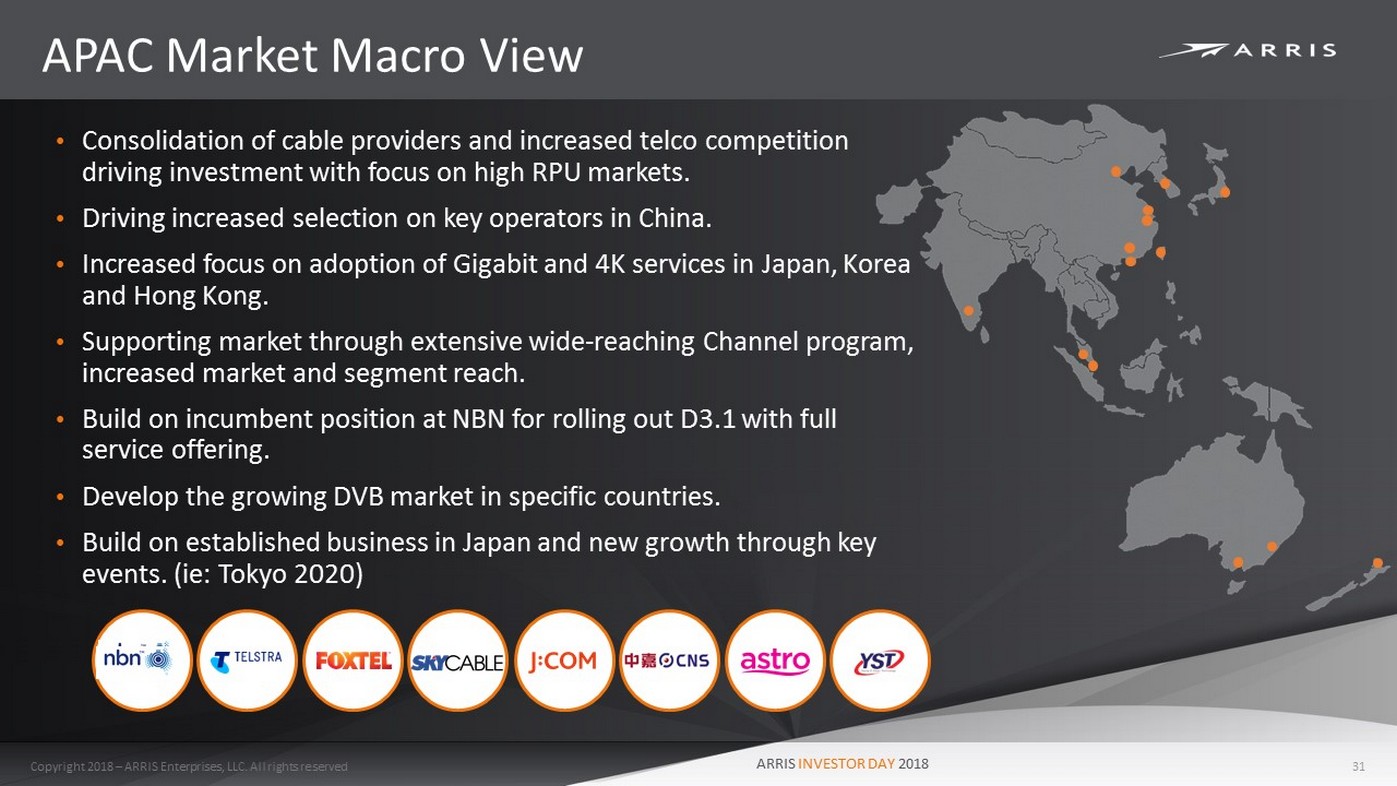

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 APAC Market Macro View 31 • Consolidation of cable providers and increased telco competition driving investment with focus on high RPU markets. • Driving increased selection on key operators in China. • Increased focus on adoption of Gigabit and 4K services in Japan, Korea and Hong Kong. • Supporting market through extensive wide - reaching Channel program, increased market and segment reach. • Build on incumbent position at NBN for rolling out D3.1 with full service offering. • Develop the growing DVB market in specific countries. • Build on established business in Japan and new growth through key events. ( ie : Tokyo 2020)

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Enterprise Market Opportunity 32 Strong Go - to - Market Architecture • Diversified verticals • Hospitality • Education • Enterprise • Retail • Venue • Smart Cities • +8,000 Channel Partners (VARs, Distributors, partners) • Close cooperation with traditional Service Providers as a channel to Enterprise Hospitality Education Service Provider Others Not Public Retail Warehouse/ Transportation Smart Cities Sports/Ent

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 ARRIS Strategy for Customers Broadband and Mobile Connectivity Key Grow with service providers in broadband and mobile space Evolution of Video Enable next generation of video services: operator OTT, 4K, wireless and IP client Wi - Fi as Core Service Leverage Ruckus portfolio to win traditional enterprise verticals and service provider driven initiatives in business services space Service and Control Win more cloud, pro - services, managed services, and device management 33

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Network and Cloud Overview Dan Whalen 34

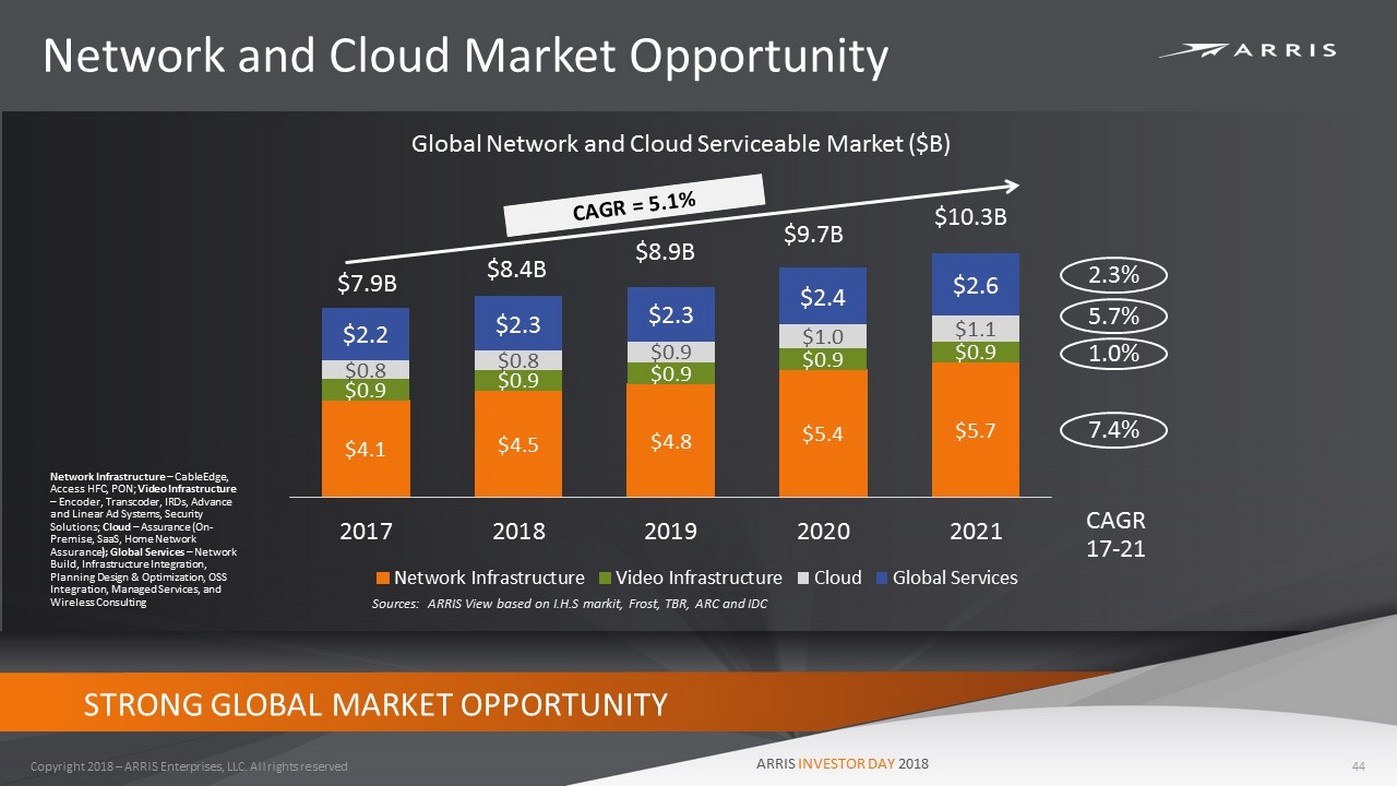

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 WELL POSITIONED FOR CONTINUED PROFITABLE GROWTH Network and Cloud Segment Summary 35 • $8B market growing 5%+ annually (1) – Strong portfolio addressing Cable Internet Service Providers and broader video systems networks – Growing Professional Services capability • Growth in Over - the - top video streaming creating strong fundamentals • State - of - the - art internet access is a key global social imperative • Highly competitive industry dynamics compelling Service Providers to invest Note 1 – Sources: ARRIS View based on I.H.S Markit , Frost, TBR, ARC and IDC

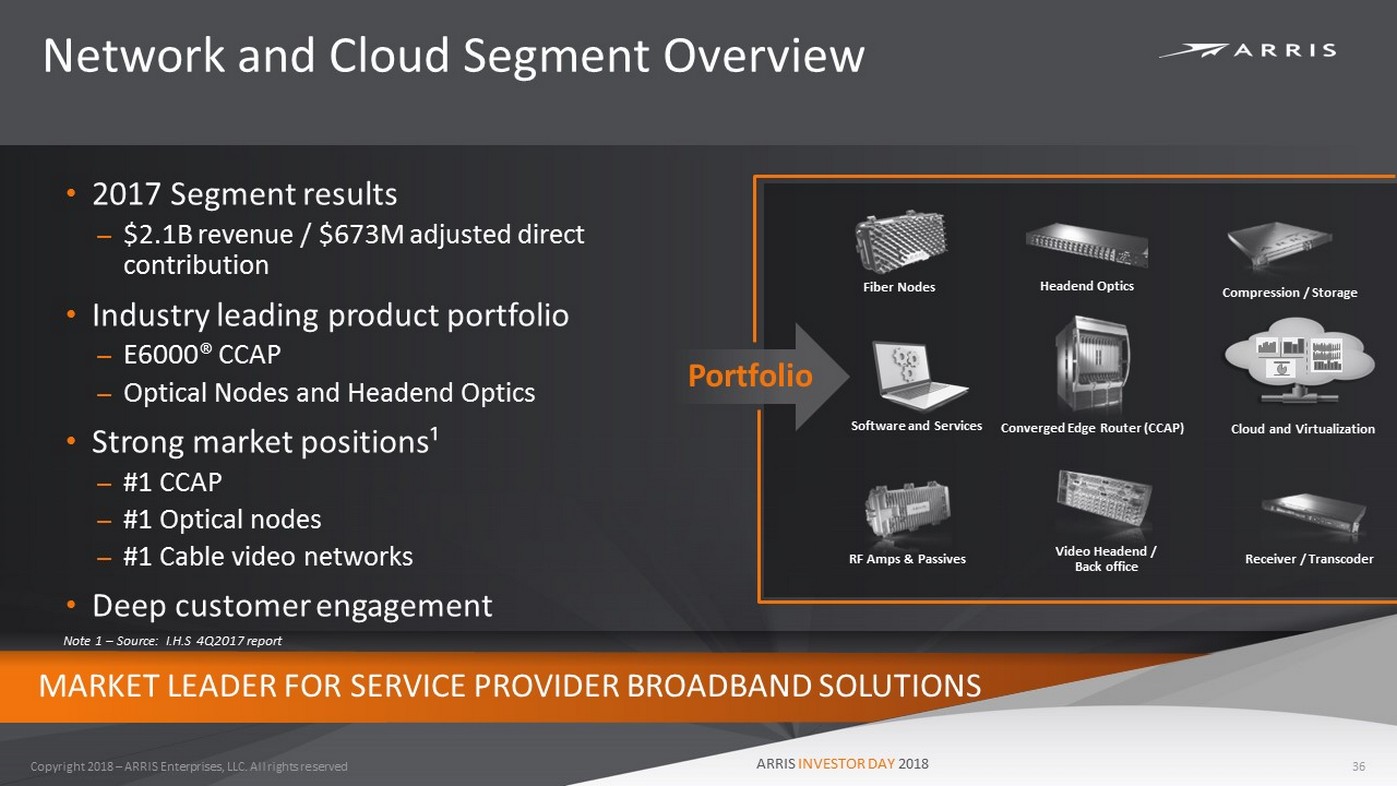

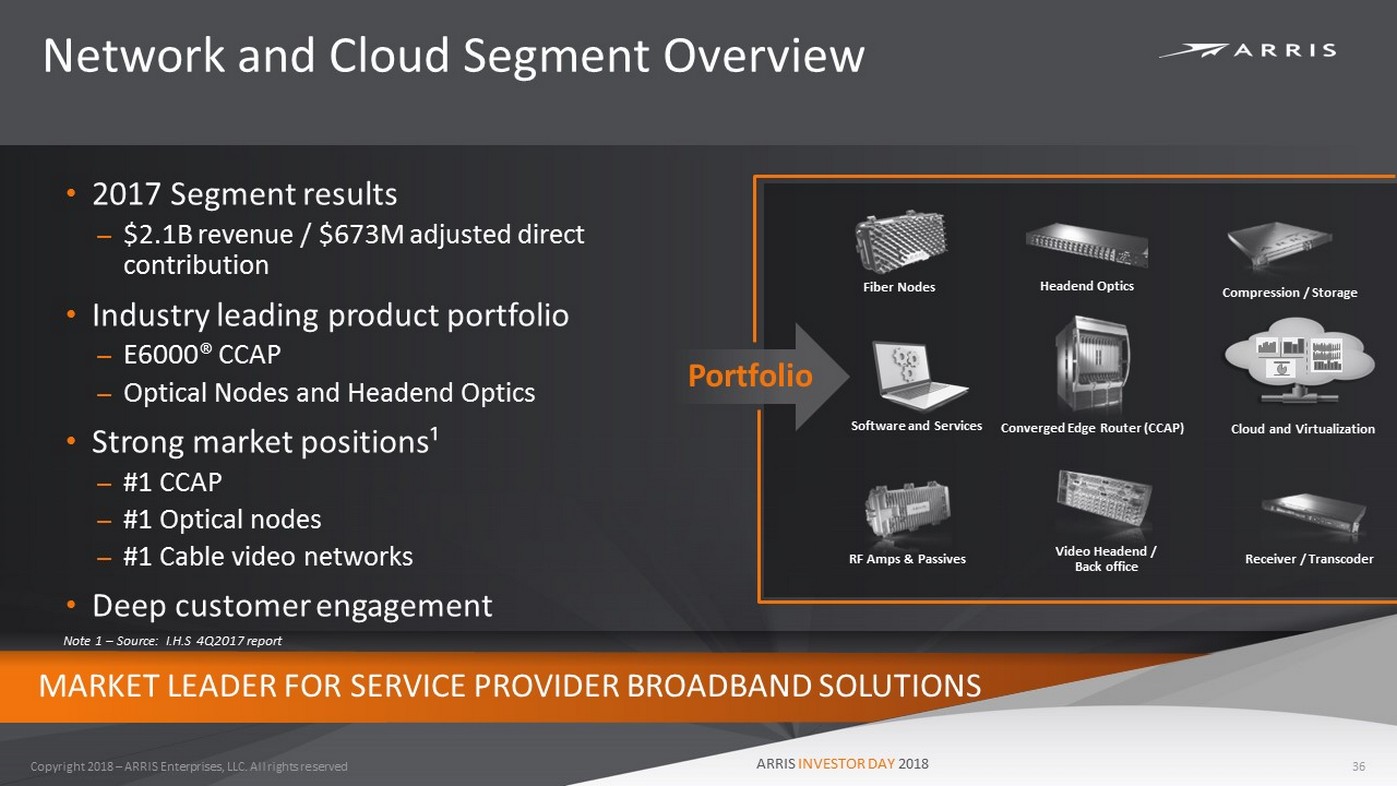

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Network and Cloud Segment Overview • 2017 Segment results – $2.1B revenue / $673M adjusted direct contribution • Industry leading product portfolio – E6000® CCAP – Optical Nodes and Headend Optics • Strong market positions¹ – #1 CCAP – #1 Optical nodes – #1 Cable video networks • Deep customer engagement 36 MARKET LEADER FOR SERVICE PROVIDER BROADBAND SOLUTIONS Converged Edge Router (CCAP) Headend Optics Compression / Storage Video Headend / Back office RF Amps & Passives Fiber Nodes Receiver / Transcoder Software and Services Portfolio Note 1 – Source: I.H.S 4Q2017 report Cloud and Virtualization

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Key Drivers Behind Continued Exponential Bandwidth Growth 37 Broadband Subscriber growth and device proliferation Cable gaining share of Business Services market Cable Networks adopting OTT Technology Mobile device explosion driving offload demand Exponential growth in Internet usage

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Broadband Subscriber Growth and Device Proliferation 38 Continued growth in global broadband subscriber base – Highly competitive battle for premium consumers Exponential growth in connected devices spurring faster adoption of WiFi internet usage in homes and business 11 B 20 B 2017 2018 2019 2020 2021 Global Connected / IoT Devices (Billions) CAGR 16% 16 B 36 B CAGR 22% Source: IHS | Includes connected smartphones, tablets, personal computers, TVs, TV - attached devices and audio devices Source Frost and Sullivan | Includes Connected CE Devices, Sensors, Actuators IoT Devices Connected Devices

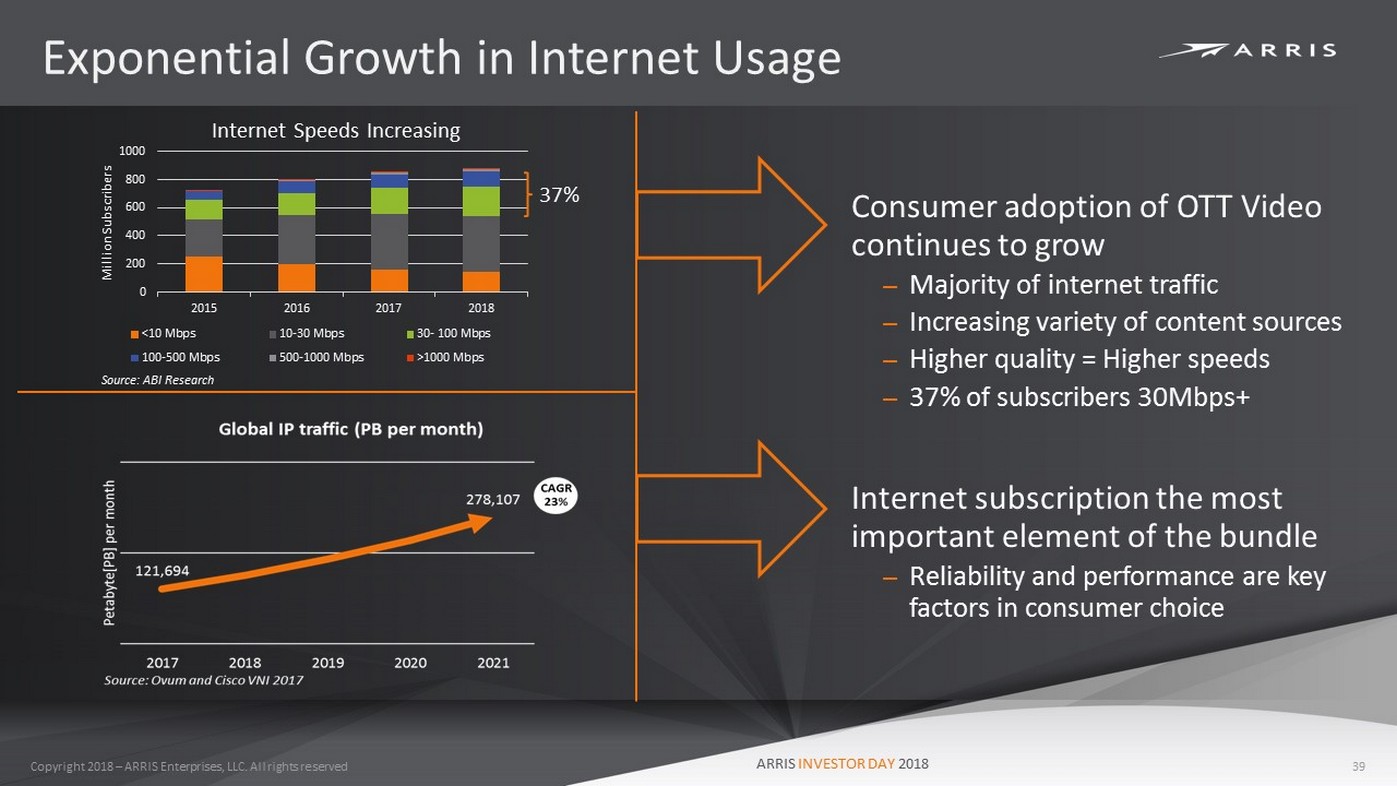

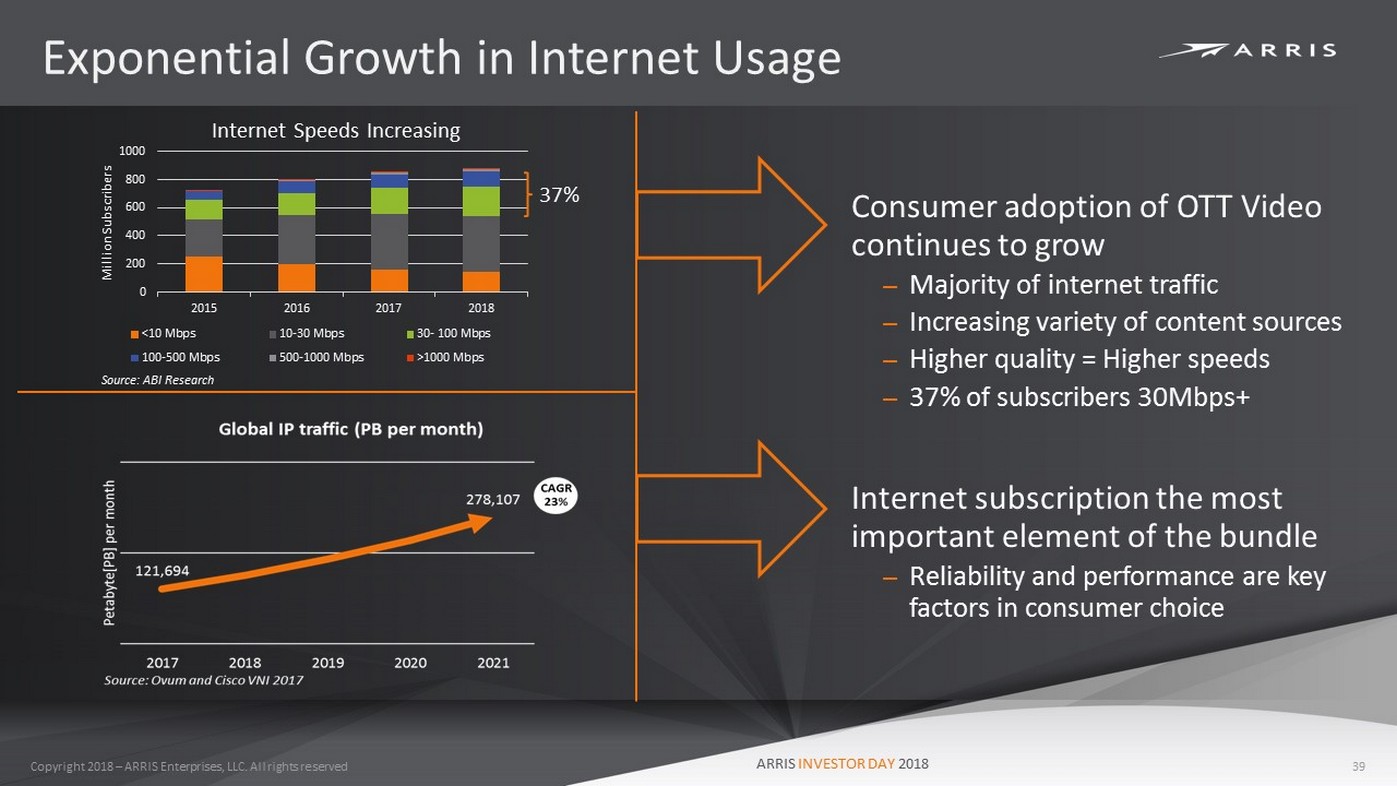

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Exponential Growth in Internet Usage 39 Consumer adoption of OTT Video continues to grow – Majority of internet traffic – Increasing variety of content sources – Higher quality = Higher speeds – 37% of subscribers 30Mbps+ Internet subscription the most important element of the bundle – Reliability and performance are key factors in consumer choice 0 200 400 600 800 1000 2015 2016 2017 2018 Million Subscribers Internet Speeds Increasing <10 Mbps 10-30 Mbps 30- 100 Mbps 100-500 Mbps 500-1000 Mbps >1000 Mbps 37% Source: ABI Research

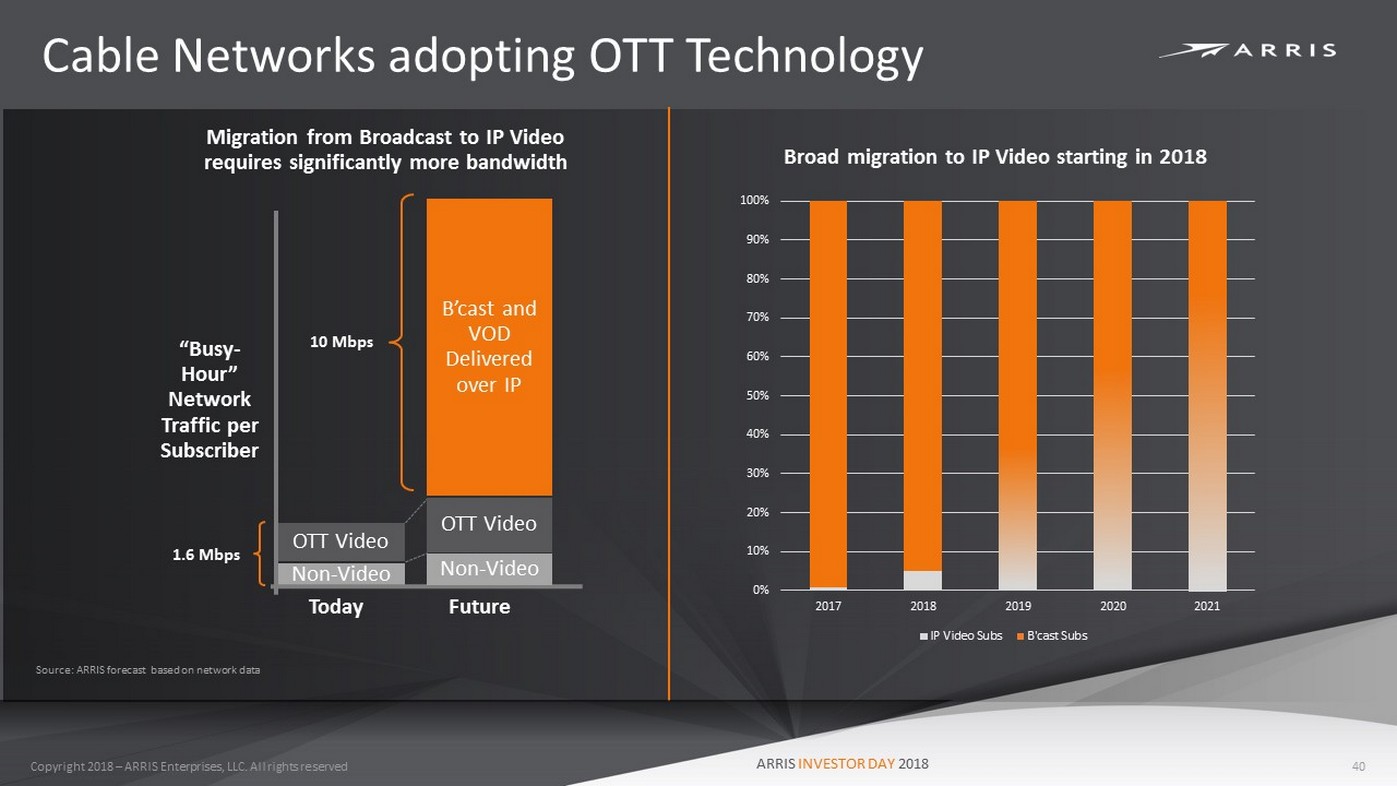

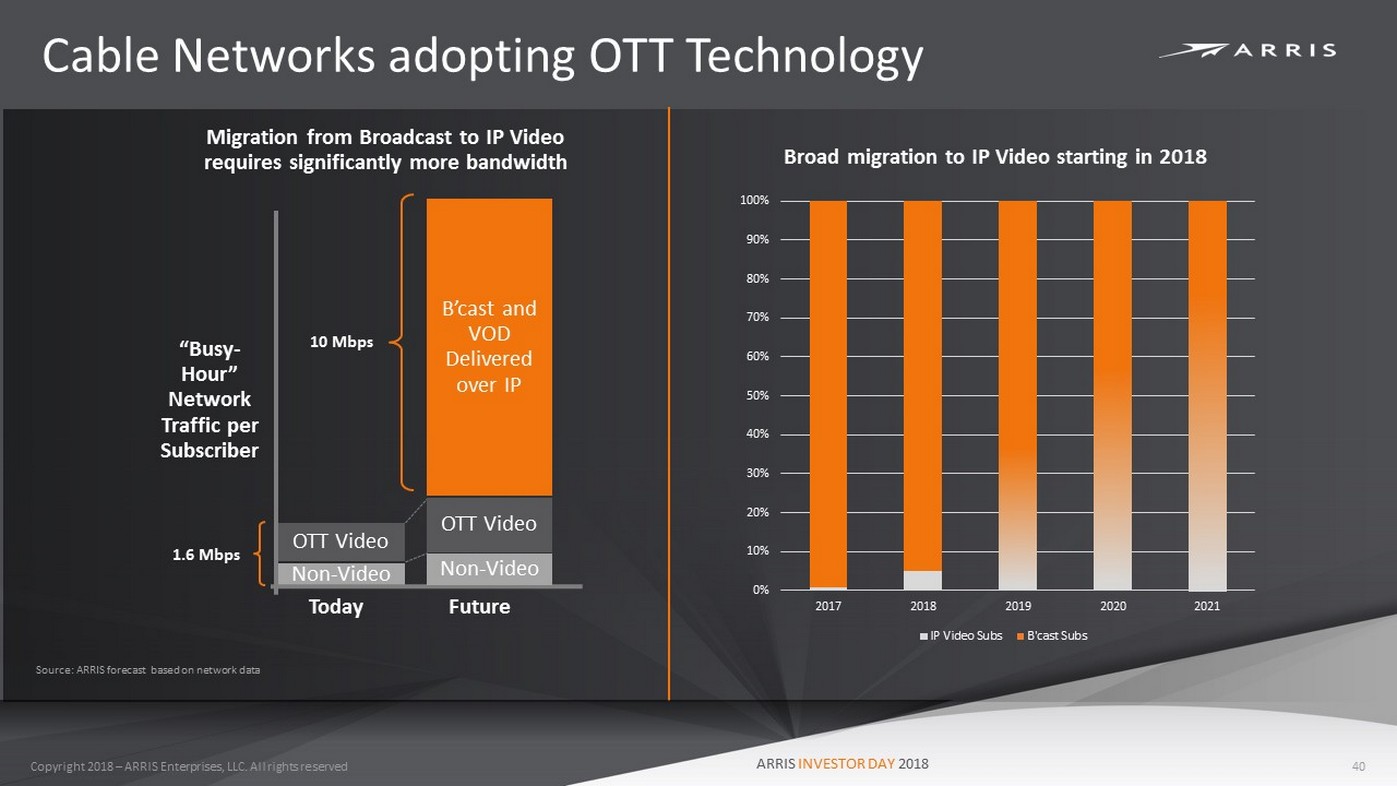

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Cable Networks adopting OTT Technology 40 Non - Video OTT Video “Busy - Hour” Network Traffic per Subscriber 1.6 Mbps Today Future OTT Video Non - Video B’cast and VOD Delivered over IP 10 Mbps 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2017 2018 2019 2020 2021 IP Video Subs B'cast Subs Migration from Broadcast to IP Video requires significantly more bandwidth Broad migration to IP Video starting in 2018 Source: ARRIS forecast based on network data

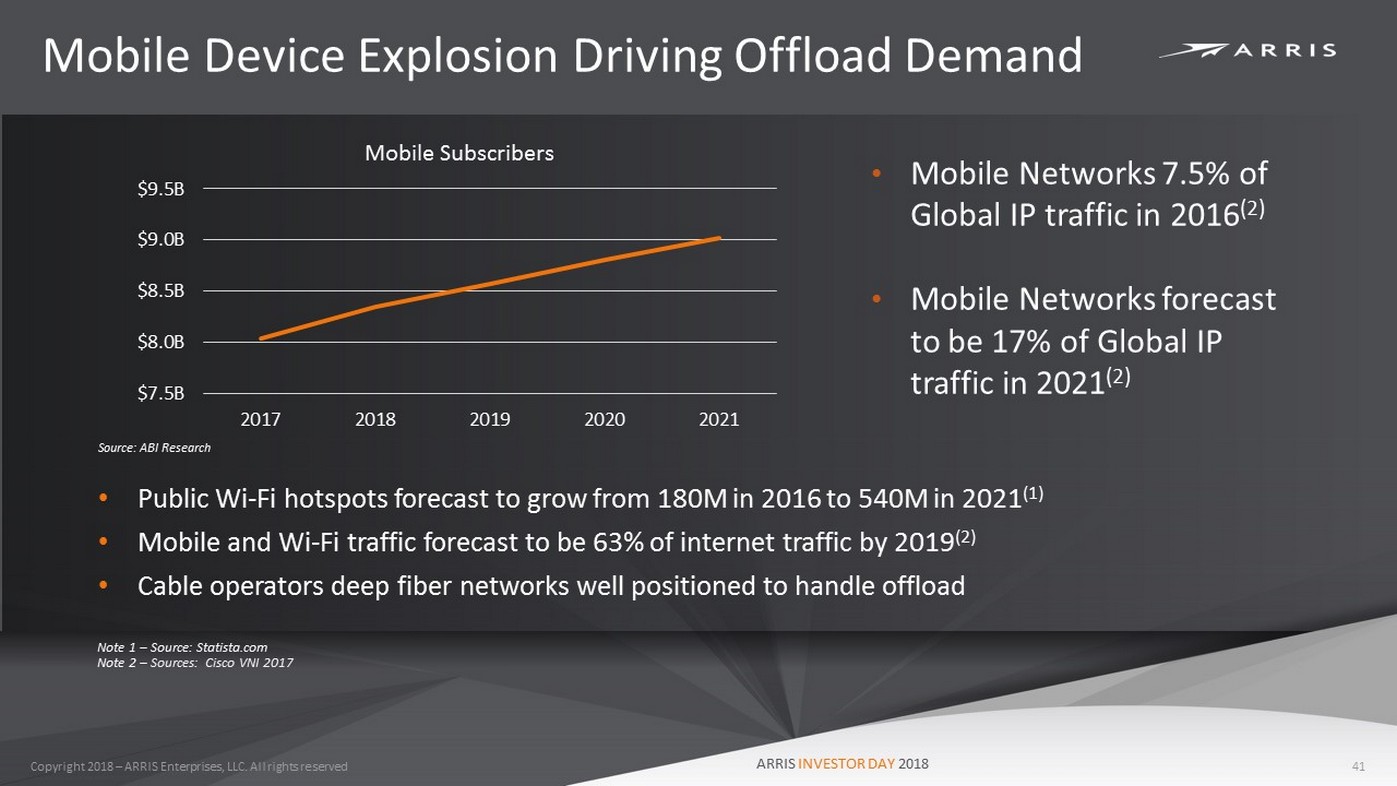

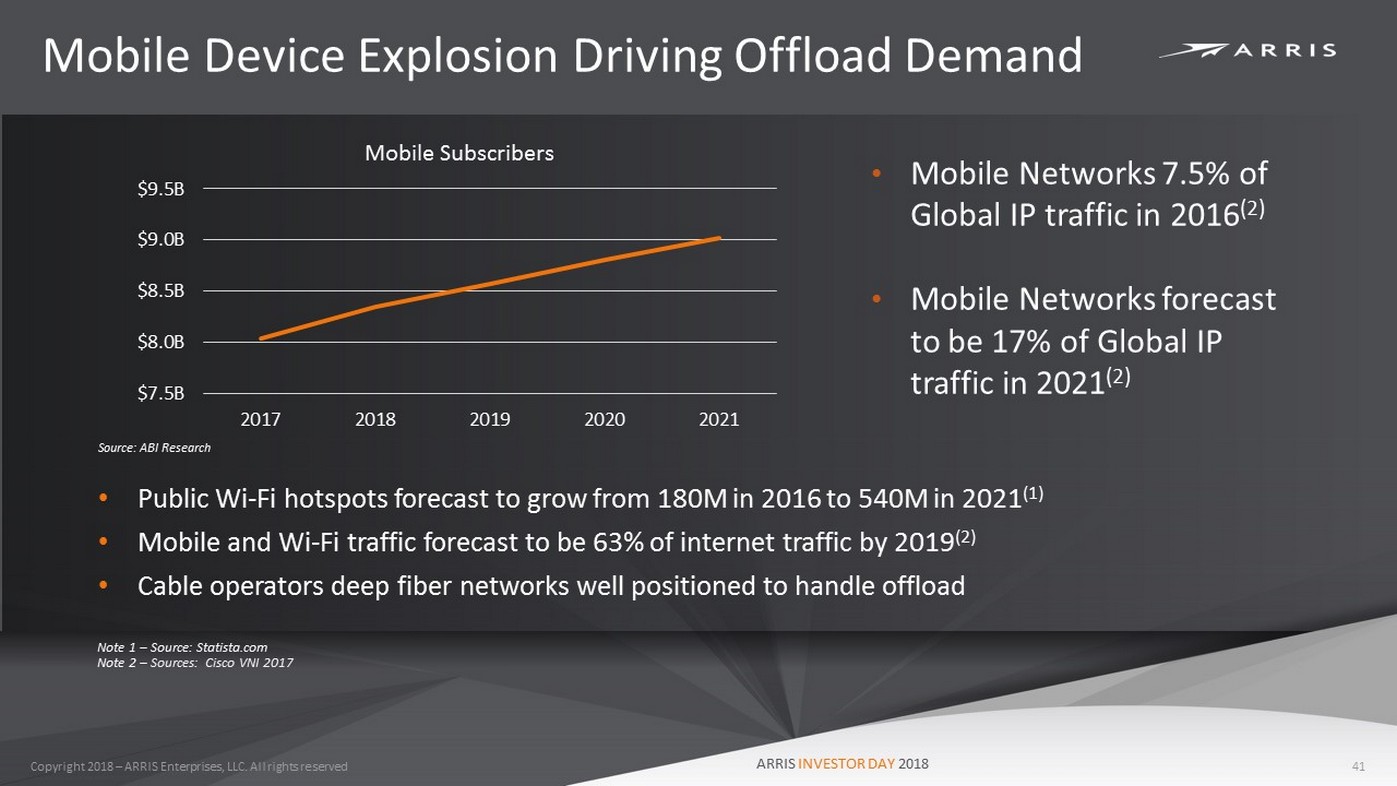

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Mobile Device Explosion Driving Offload Demand 41 • Mobile Networks 7.5% of Global IP traffic in 2016 (2) • Mobile Networks forecast to be 17% of Global IP traffic in 2021 (2) • Public Wi - Fi hotspots forecast to grow from 180M in 2016 to 540M in 2021 (1) • Mobile and Wi - Fi traffic forecast to be 63% of internet traffic by 2019 (2) • Cable operators deep fiber networks well positioned to handle offload Source: ABI Research $7.5B $8.0B $8.5B $9.0B $9.5B 2017 2018 2019 2020 2021 Mobile Subscribers Note 1 – Source: Statista.com Note 2 – Sources: Cisco VNI 2017

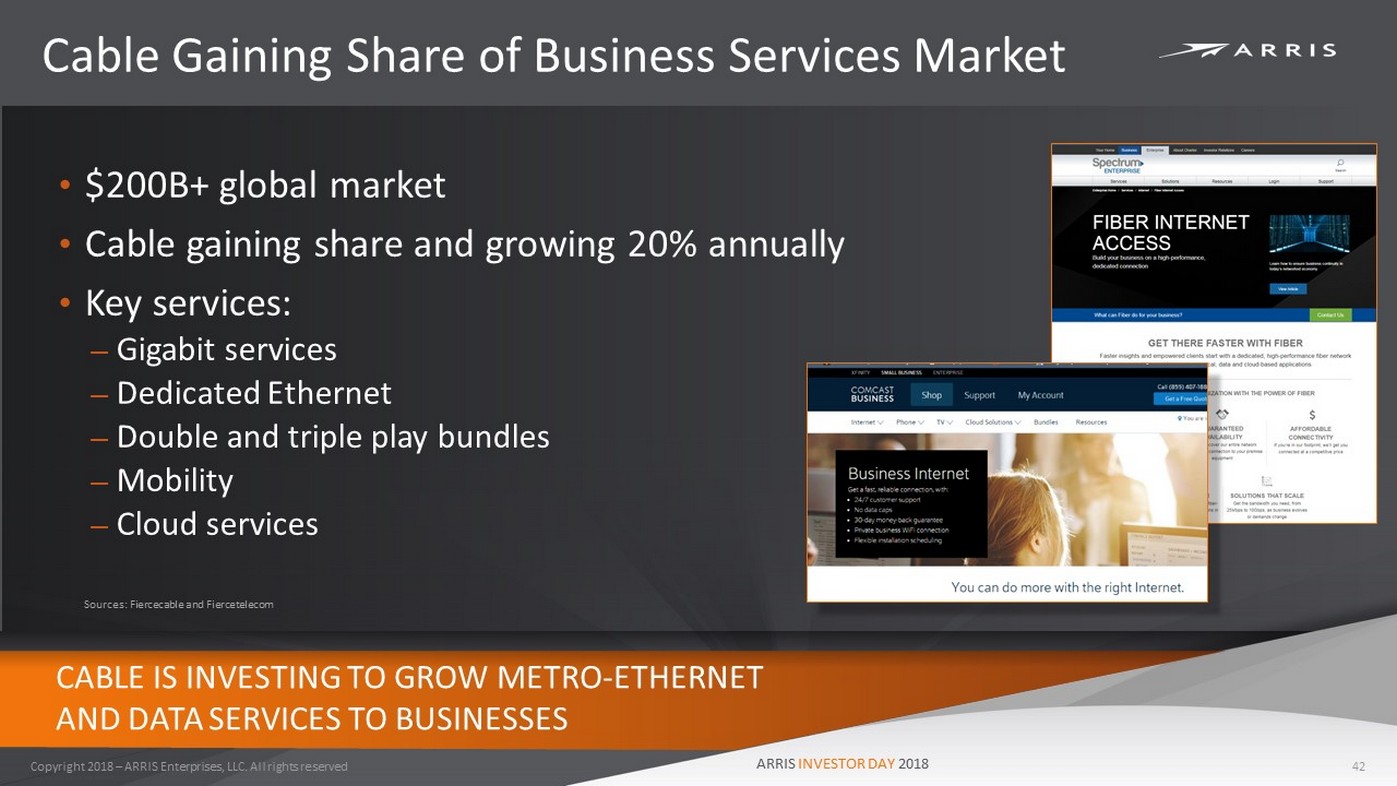

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Cable Gaining Share of Business Services Market 42 CABLE IS INVESTING TO GROW METRO - ETHERNET AND DATA SERVICES TO BUSINESSES • $200B+ global market • Cable gaining share and growing 20% annually • Key services: – Gigabit services – Dedicated Ethernet – Double and triple play bundles – Mobility – Cloud services Sources: Fiercecable and Fiercetelecom

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Access Network Technology Upgrades crucial to addressing Market Demands 43 Technology Upgrades Fiber Deeper in Networks Distributed Access Architecture Virtualization

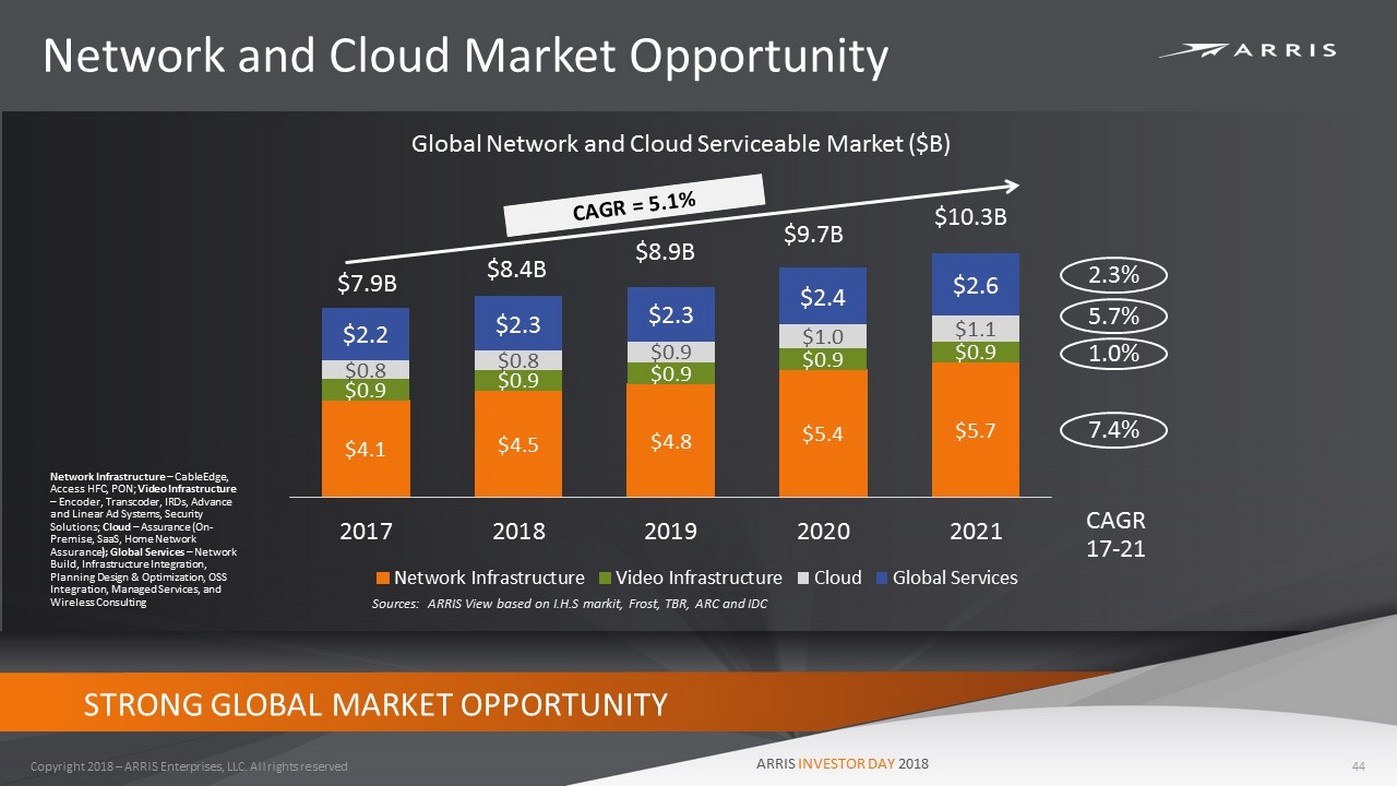

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Network and Cloud Market Opportunity 44 STRONG GLOBAL MARKET OPPORTUNITY $4.1 $4.5 $4.8 $5.4 $5.7 $0.9 $0.9 $0.9 $0.9 $0.9 $0.8 $0.8 $0.9 $1.0 $1.1 $2.2 $2.3 $2.3 $2.4 $2.6 2017 2018 2019 2020 2021 Network Infrastructure Video Infrastructure Cloud Global Services $7.9B $8.4B $8.9B $9.7B $10.3B 2.3% 5.7% 1.0% 7.4% CAGR 17 - 21 Global Network and Cloud Serviceable Market ($B) Network Infrastructure – CableEdge , Access HFC, PON; Video Infrastructure – Encoder, Transcoder, IRDs, Advance and Linear Ad Systems, Security Solutions ; Cloud – Assurance ( On - Premise, SaaS, Home Network Assurance ); Global Services – Network Build, Infrastructure Integration, Planning Design & Optimization, OSS Integration, Managed Services, and Wireless Consulting Sources: ARRIS View based on I.H.S markit , Frost, TBR, ARC and IDC

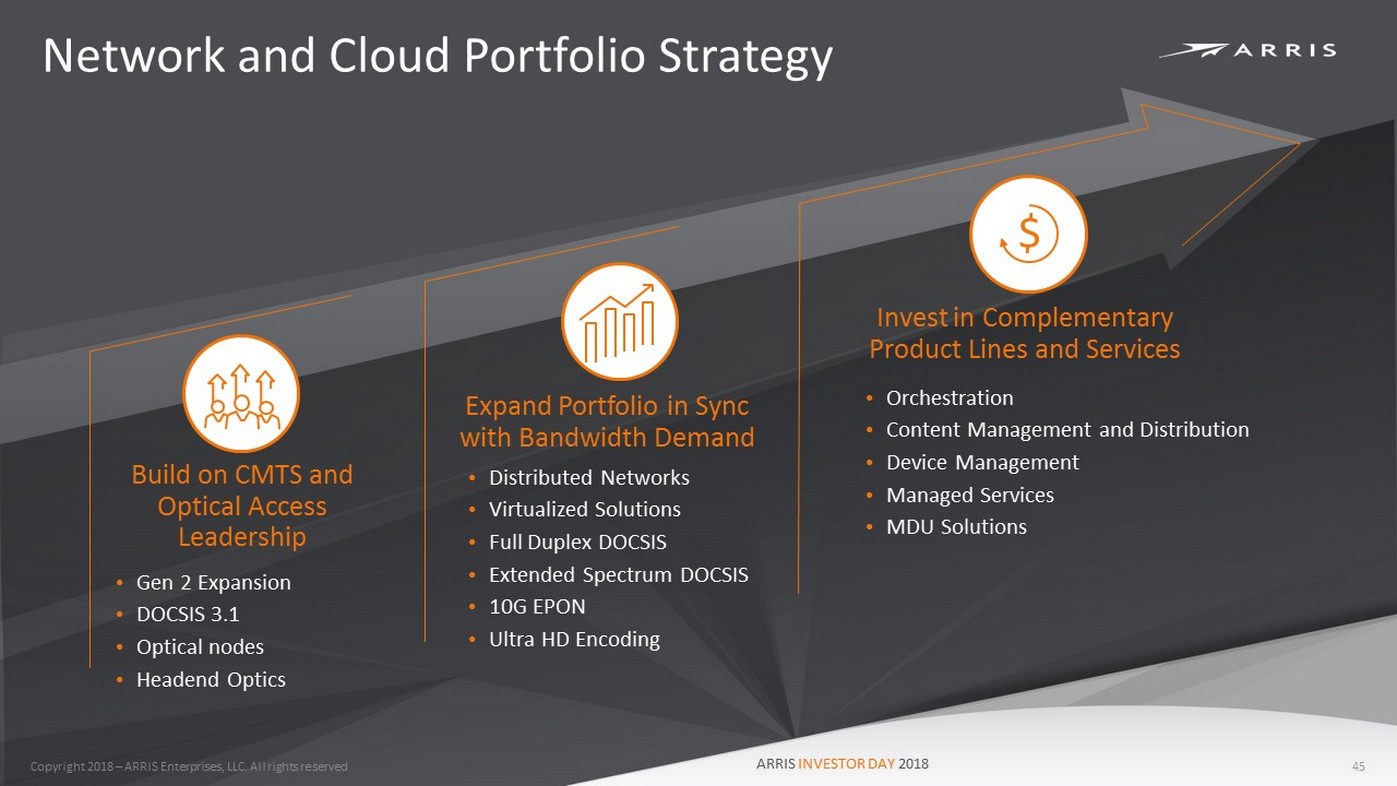

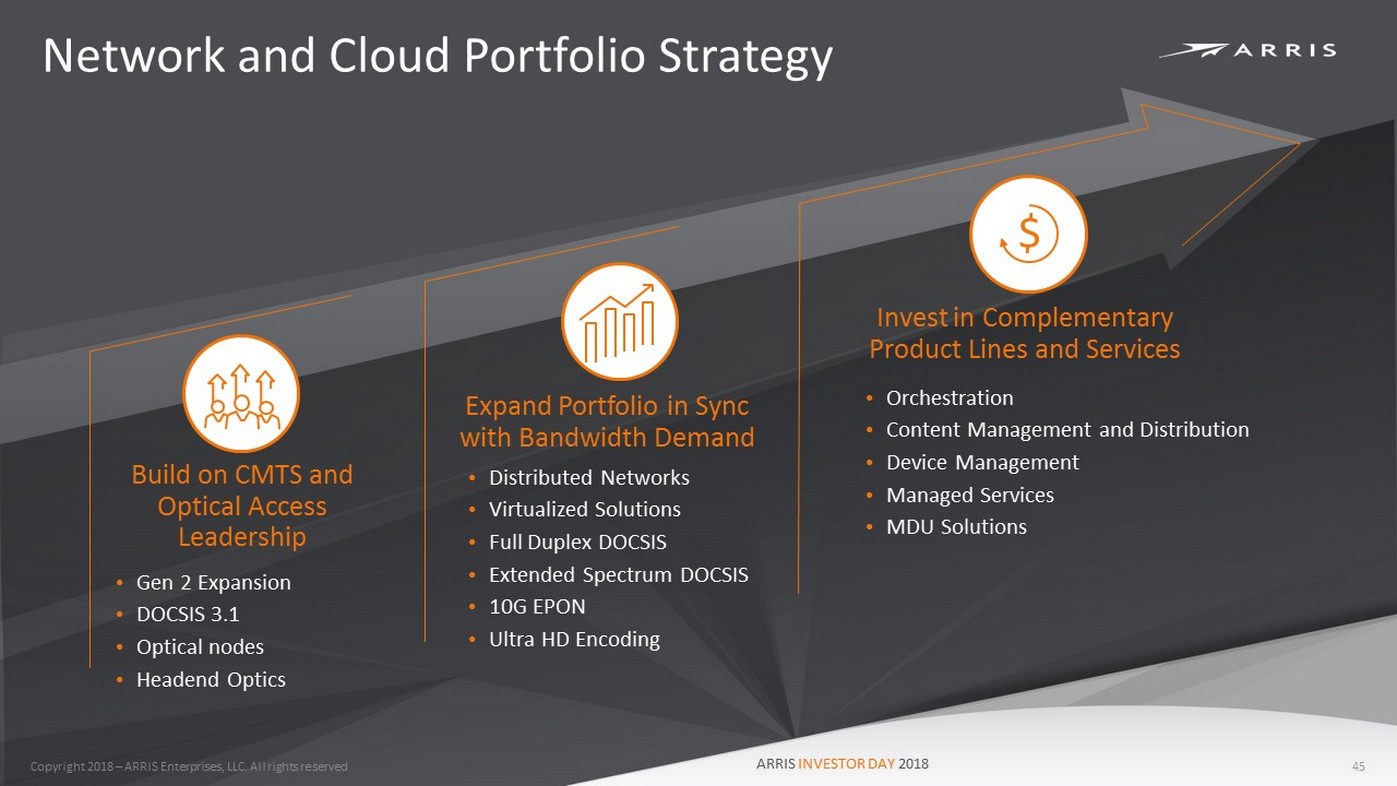

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Network and Cloud Portfolio Strategy 45 Build on CMTS and Optical Access Leadership Invest in Complementary Product Lines and Services • Orchestration • Content Management and Distribution • Device Management • Managed Services • MDU Solutions Expand Portfolio in Sync with Bandwidth Demand • Distributed Networks • Virtualized Solutions • Full Duplex DOCSIS • Extended Spectrum DOCSIS • 10G EPON • Ultra HD Encoding • Gen 2 Expansion • DOCSIS 3.1 • Optical nodes • Headend Optics Ω $

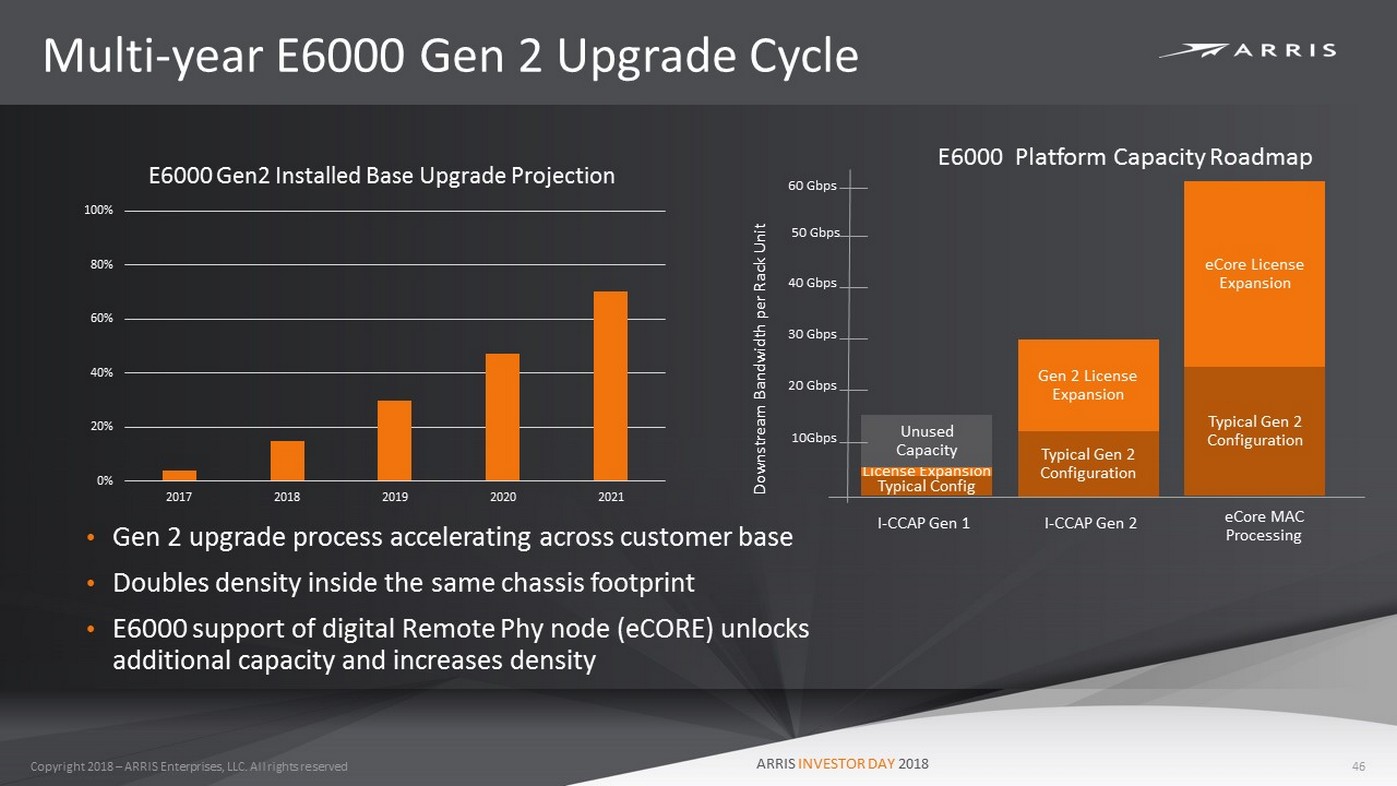

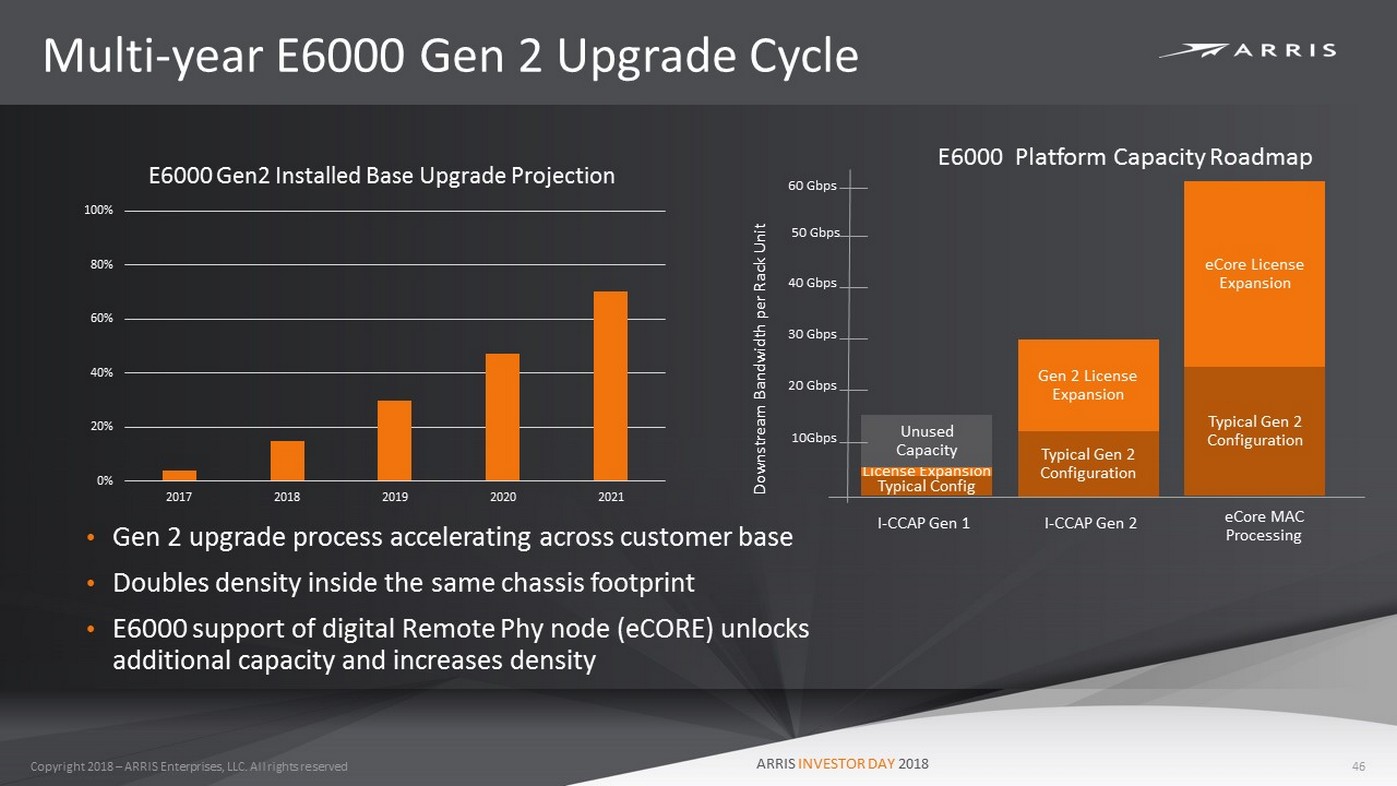

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Multi - year E6000 Gen 2 Upgrade Cycle 46 • Gen 2 upgrade process accelerating across customer base • Doubles density inside the same chassis footprint • E6000 support of digital Remote Phy node ( eCORE ) unlocks additional capacity and increases density 0% 20% 40% 60% 80% 100% 2017 2018 2019 2020 2021 E6000 Gen2 Installed Base Upgrade Projection Typical Config License Expansion Typical Gen 2 Configuration Gen 2 License Expansion Downstream Bandwidth per Rack Unit I - CCAP Gen 1 I - CCAP Gen 2 Unused Capacity Typical Gen 2 Configuration eCore License Expansion eCore MAC Processing 20 Gbps 30 Gbps 40 Gbps 50 Gbps 60 Gbps 10Gbps E6000 Platform Capacity Roadmap

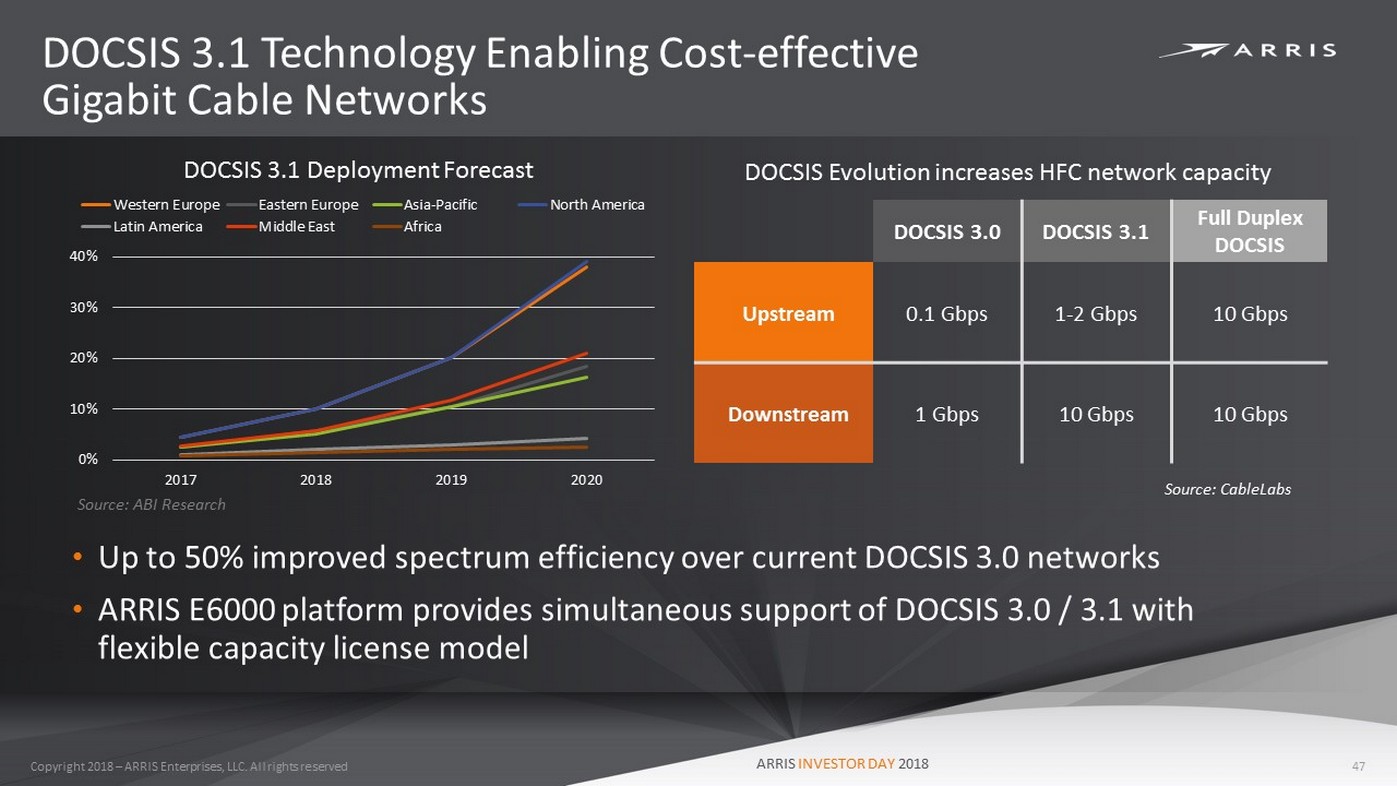

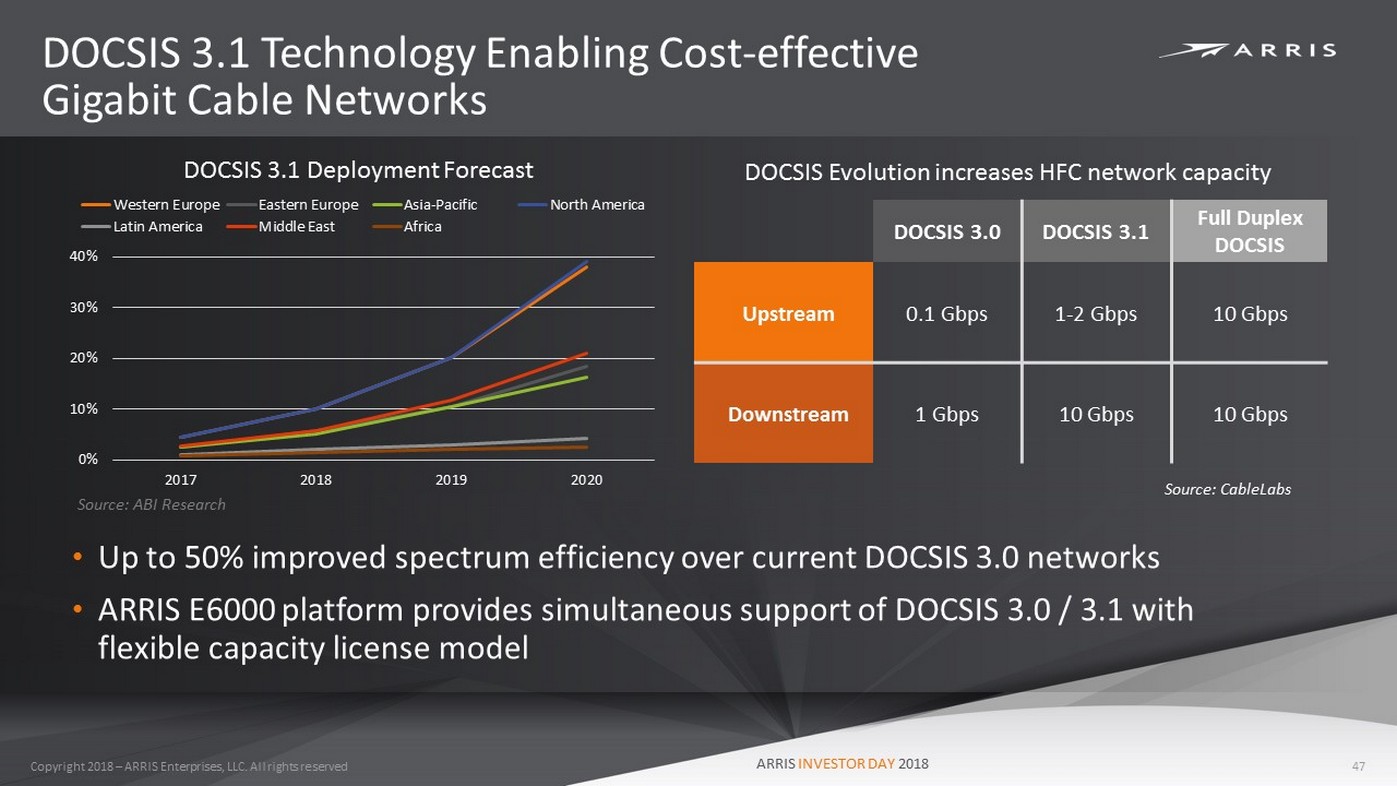

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 DOCSIS 3.1 Technology Enabling Cost - effective Gigabit Cable Networks 47 • Up to 50% improved spectrum efficiency over current DOCSIS 3.0 networks • ARRIS E6000 platform provides simultaneous support of DOCSIS 3.0 / 3.1 with flexible capacity license model DOCSIS 3.1 Deployment Forecast Source: ABI Research DOCSIS 3.0 DOCSIS 3.1 Full Duplex DOCSIS Upstream 0.1 Gbps 1 - 2 Gbps 10 Gbps Downstream 1 Gbps 10 Gbps 10 Gbps DOCSIS Evolution increases HFC network capacity 0% 10% 20% 30% 40% 2017 2018 2019 2020 Western Europe Eastern Europe Asia-Pacific North America Latin America Middle East Africa Source: CableLabs

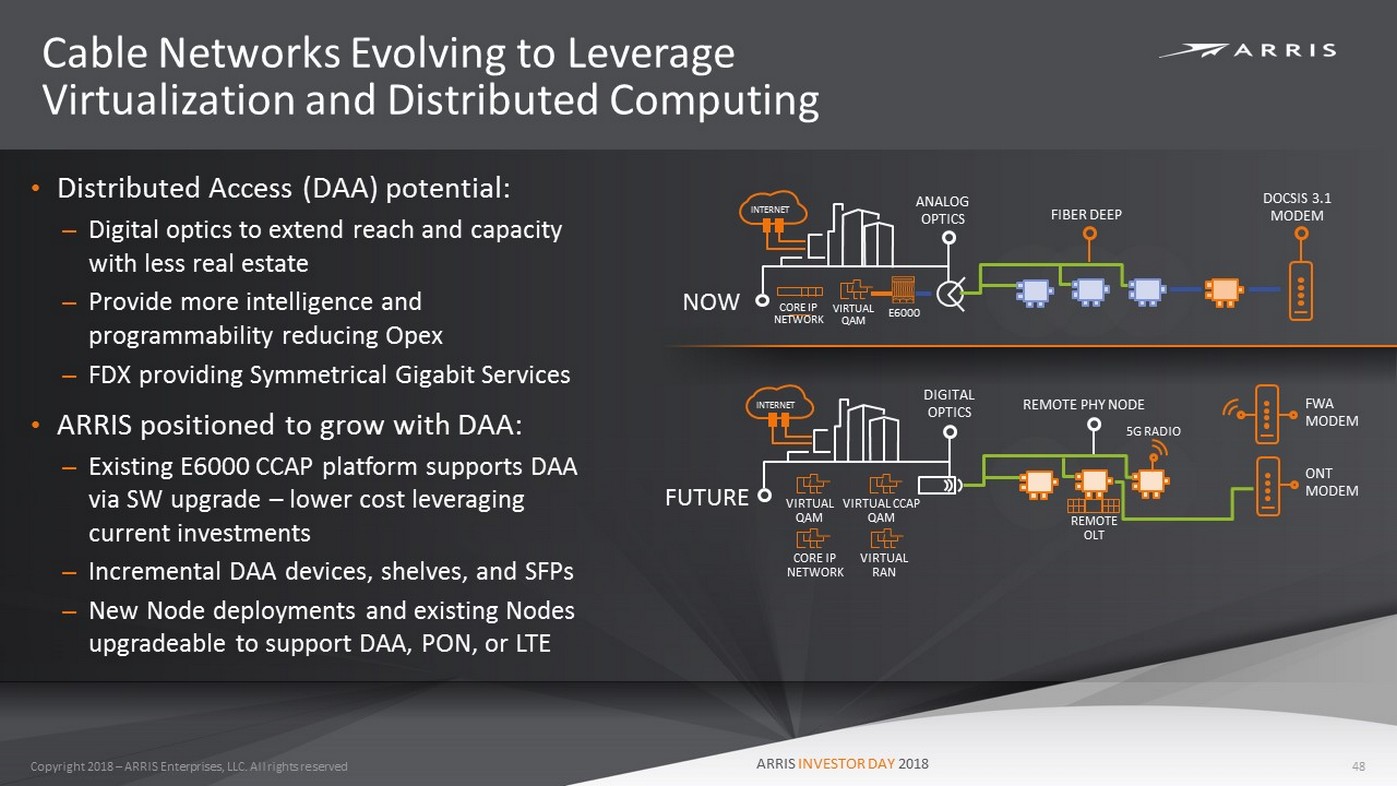

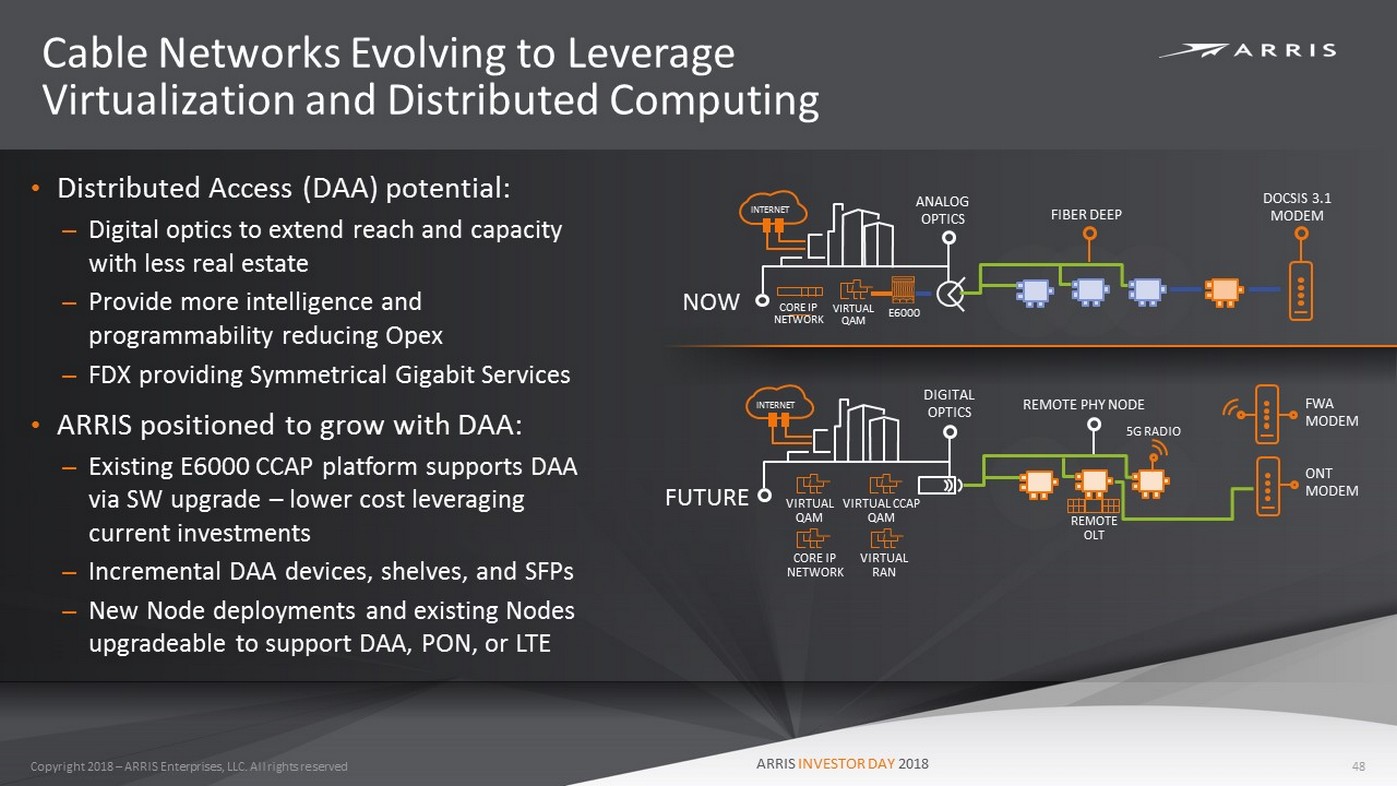

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Cable Networks Evolving to Leverage Virtualization and Distributed Computing 48 • Distributed Access (DAA) potential : – Digital optics to extend reach and capacity with less real estate – Provide more intelligence and programmability reducing Opex – FDX providing Symmetrical Gigabit Services • ARRIS positioned to grow with DAA: – Existing E6000 CCAP platform supports DAA via SW upgrade – lower cost leveraging current investments – Incremental DAA devices, shelves, and SFPs – New Node deployments and existing Nodes upgradeable to support DAA, PON, or LTE INTERNET NOW CORE IP NETWORK E6000 VIRTUAL QAM DOCSIS 3.1 MODEM ANALOG OPTICS FIBER DEEP INTERNET FUTURE VIRTUAL QAM DIGITAL OPTICS CORE IP NETWORK VIRTUAL CCAP QAM VIRTUAL RAN REMOTE PHY NODE FWA MODEM ONT MODEM 5G RADIO REMOTE OLT

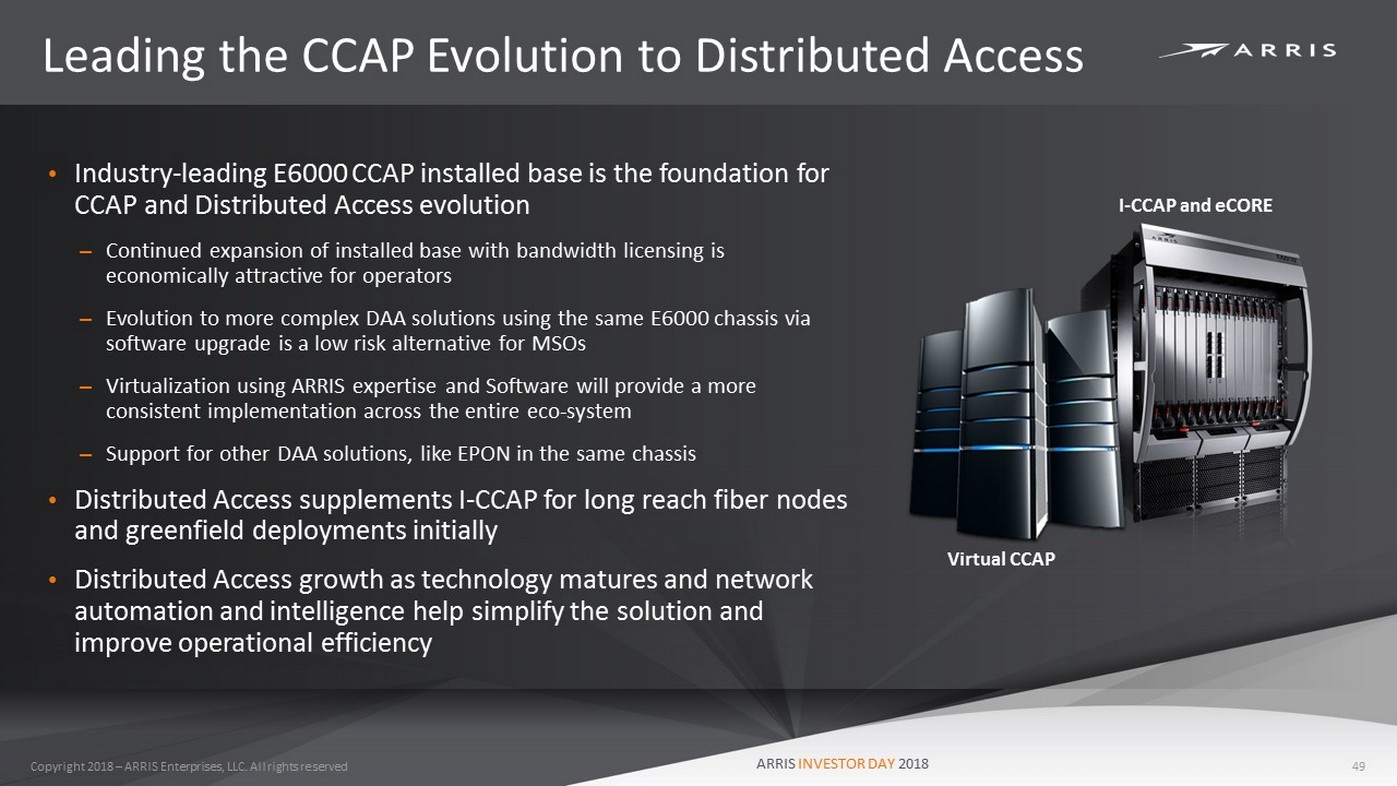

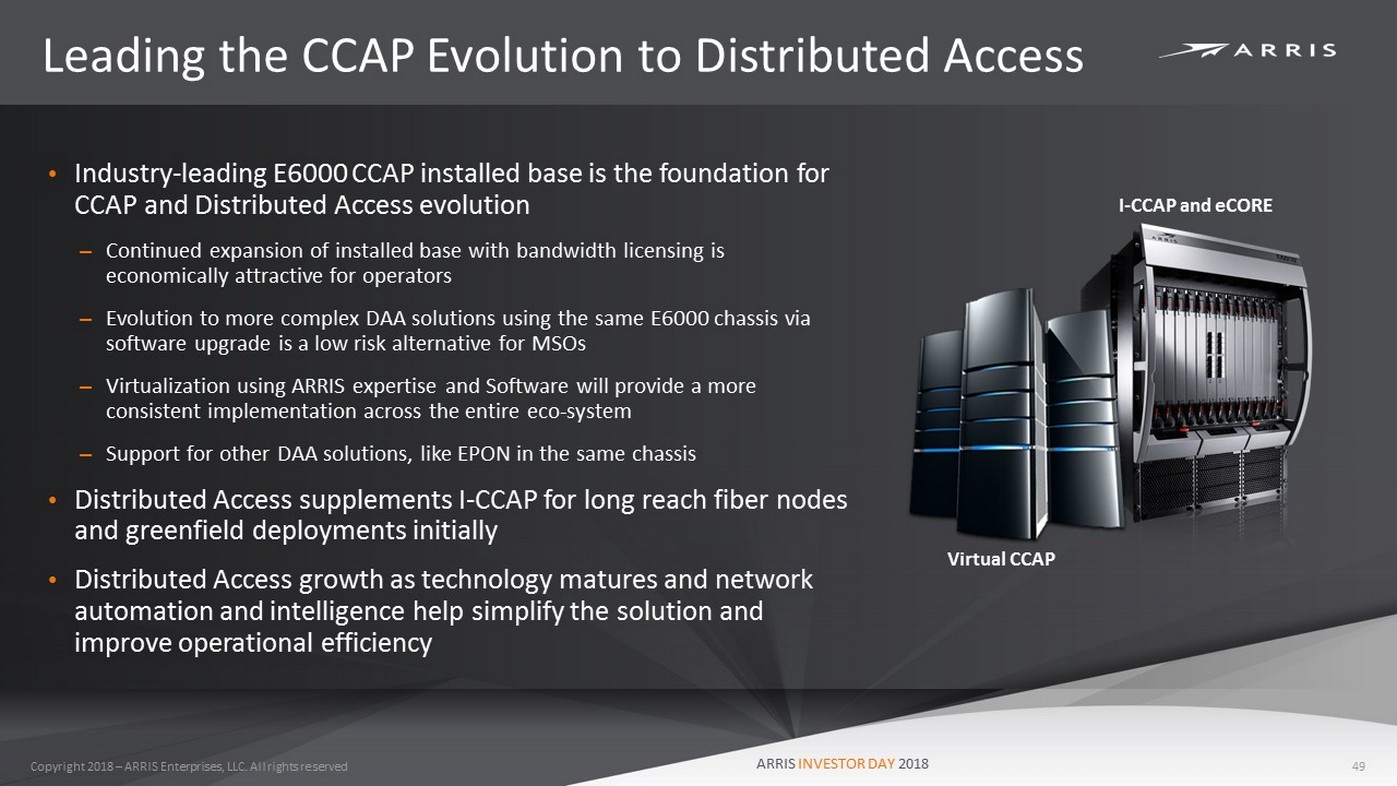

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Leading the CCAP Evolution to Distributed Access 49 • Industry - leading E6000 CCAP installed base is the foundation for CCAP and Distributed Access evolution – Continued expansion of installed base with bandwidth licensing is economically attractive for operators – Evolution to more complex DAA solutions using the same E6000 chassis via software upgrade is a low risk alternative for MSOs – Virtualization using ARRIS expertise and Software will provide a more consistent implementation across the entire eco - system – Support for other DAA solutions, like EPON in the same chassis • Distributed Access supplements I - CCAP for long reach fiber nodes and greenfield deployments initially • Distributed Access growth as technology matures and network automation and intelligence help simplify the solution and improve operational efficiency I - CCAP and eCORE Virtual CCAP

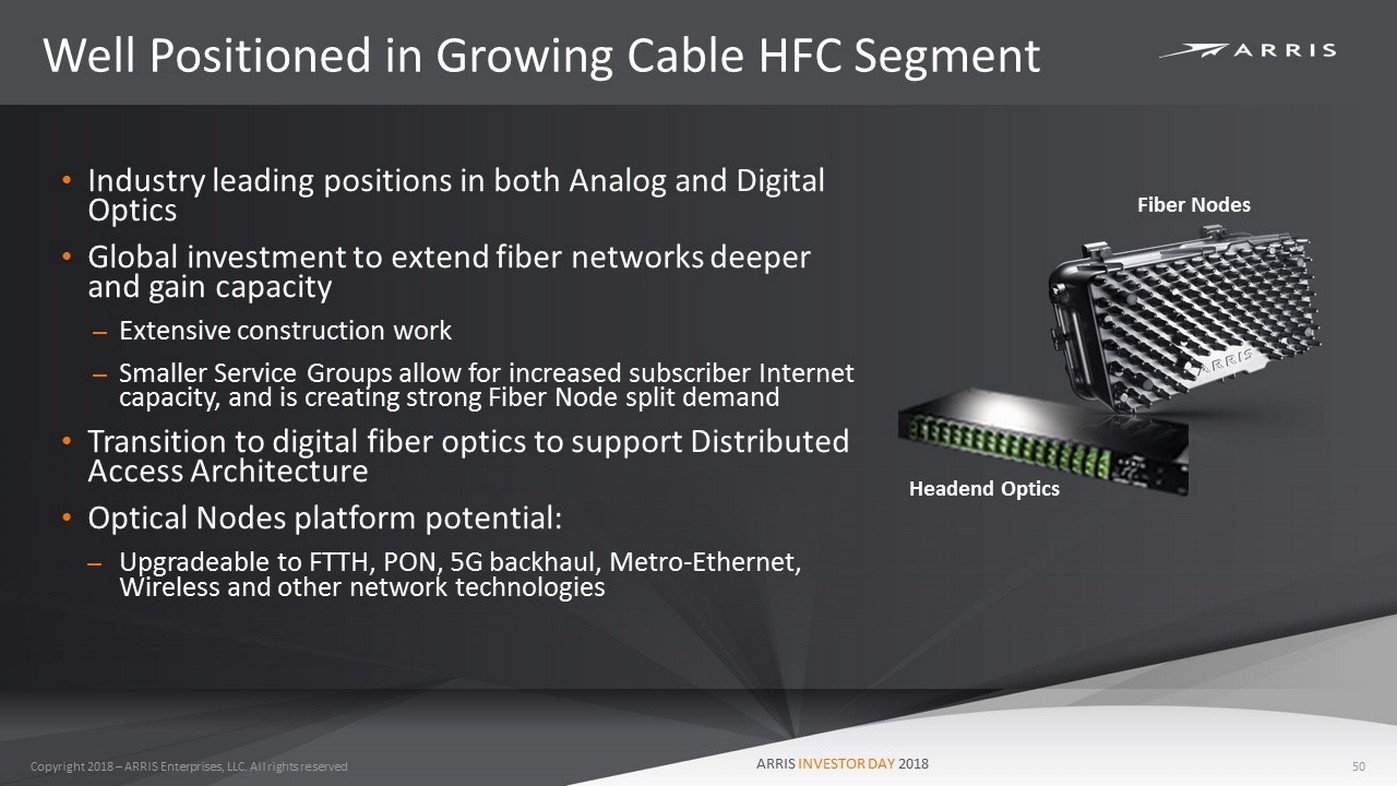

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Well Positioned in Growing Cable HFC Segment 50 • Industry leading positions in both Analog and Digital Optics • Global investment to extend fiber networks deeper and gain capacity – Extensive construction work – Smaller Service Groups allow for increased subscriber Internet capacity, and is creating strong Fiber Node split demand • Transition to digital fiber optics to support Distributed Access Architecture • Optical Nodes platform potential: – Upgradeable to FTTH, PON, 5G backhaul, Metro - Ethernet, Wireless and other network technologies Fiber Nodes Headend Optics

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Network Orchestration and Automation 51 • Distributed Access Architecture needs network automation for efficient operation and reliable service • Big Data analytics provides insights to manage traffic and predict network growth • Virtualized implementation builds on open source software ⎼ Software Defined Networks ⎼ Network Function Virtualization Network Planning Process Network Design Business Inputs Network Operations Network Intelligence SaaS Network Automation and Management Private Cloud Operations Center Optical Node Hub Site CPE Metro Data Center / Headend

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 FTTH 10G EPON Options Available 52 10G EPON Installs in E6000 Chassis Remote 10G EPON in Optical Node • RFoG • Currently the largest FTTH technology being deployed by our customers • ARRIS is the performance leader in this technology • 10 EPON Options • ARRIS has the widest selection of EPON technologies available to the MSO Industry • DPOE 2.0 Compatibility • Headend and Node Based Variants • 300k EPON - ready ARRIS Nodes deployed • EPON Extenders designed to better utilize EPON architectures • EPON is a fast growing market with a 17% CAGR (1) • Provides 10G symmetrical services • Suitable for Business Service Customers 1 - Source IHS Markit

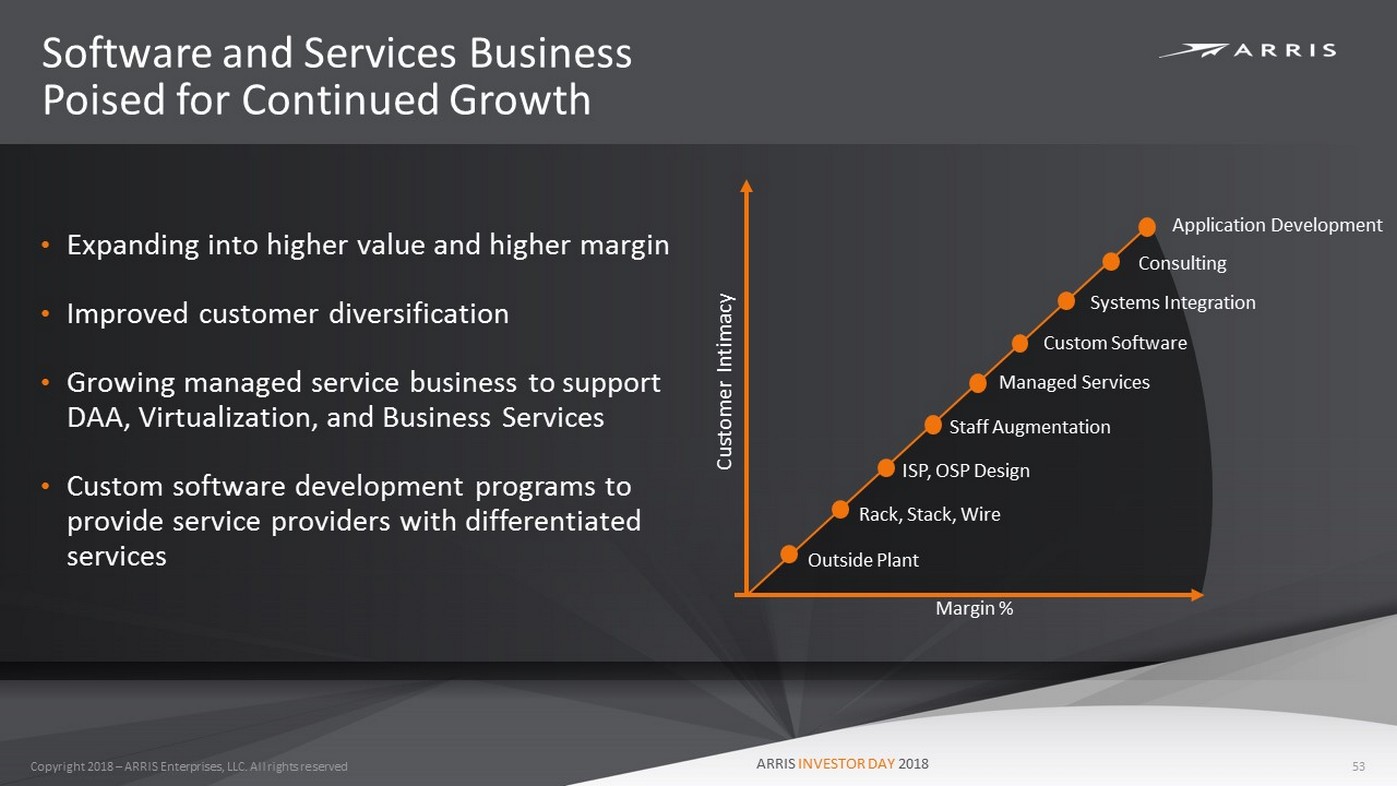

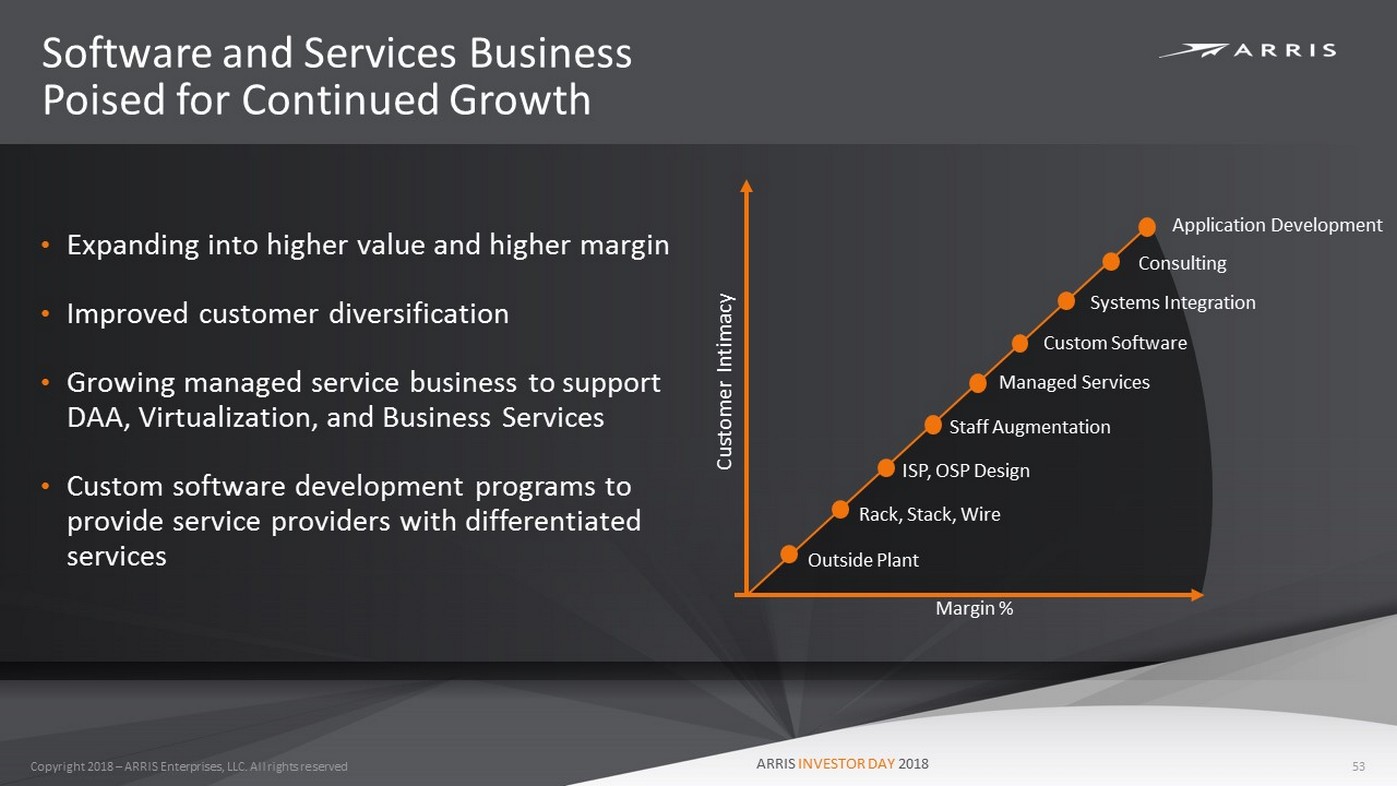

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Software and Services Business Poised for Continued Growth 53 Customer Intimacy Margin % Outside Plant Rack, Stack, Wire Application Development Consulting Staff Augmentation Custom Software Systems Integration ISP, OSP Design Managed Services • Expanding into higher value and higher margin • Improved customer diversification • Growing managed service business to support DAA, Virtualization, and Business Services • Custom software development programs to provide service providers with differentiated services

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Network & Cloud Outlook • Projecting 4 - 7% long term annual growth with margin stability • Building on leading share in CCAP and Optical Access • Near - term growth driven by: – E6000 capacity licensing and Gen 2 upgrades – Optical Access bandwidth expansions and upgrades – Roll - out of initial Distributed Access Architecture • Longer - term growth driven by convergence of services on one network – Platform extensibility of the E6000 CCAP and OM6000 Node – Business services and Metro - Ethernet, Mobile traffic, Wi - Fi, CBRS – Intelligent software to manage complexity of virtualization and DAA • Growing software & services business 54 LEADING INDUSTRY POSITION IN A GROWING MARKET!

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Customer Premises Equipment Larry Robinson

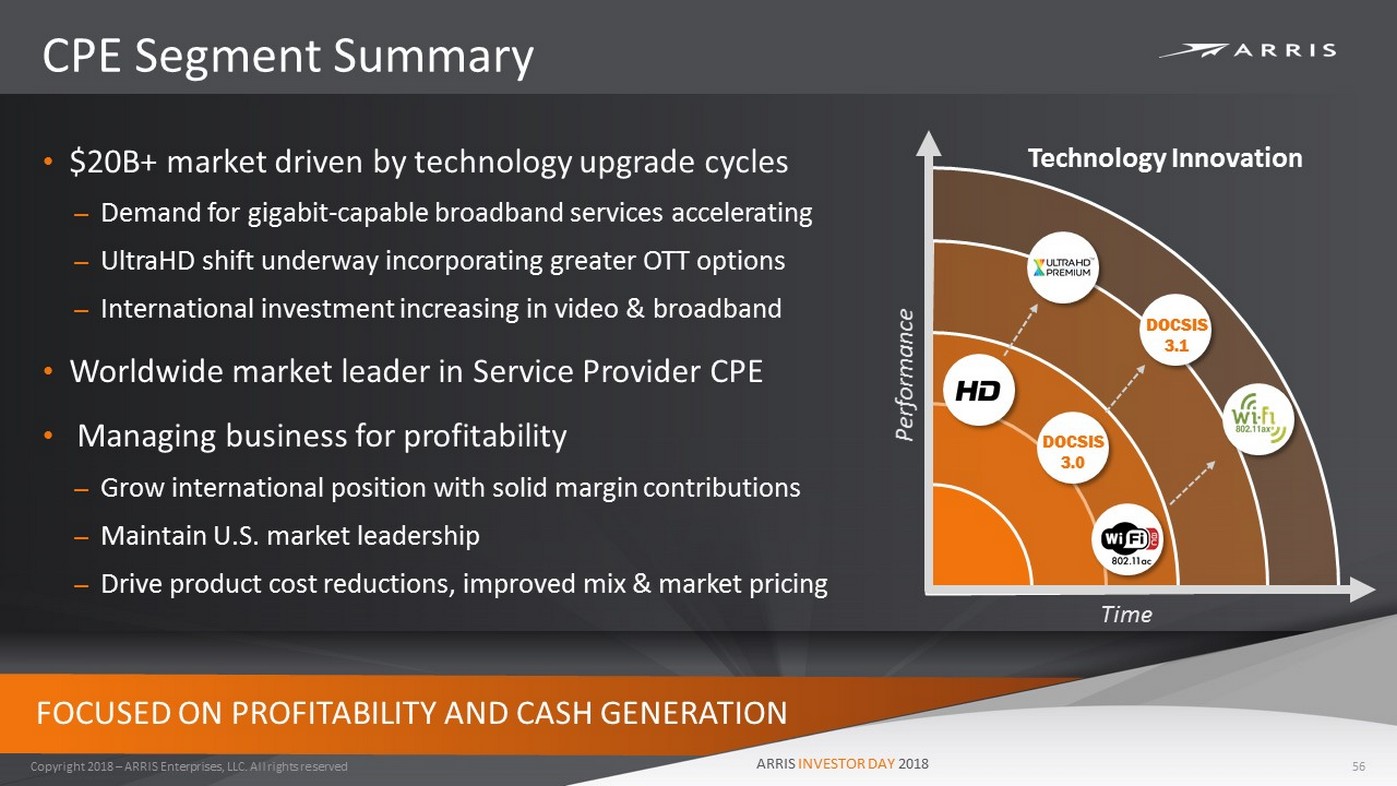

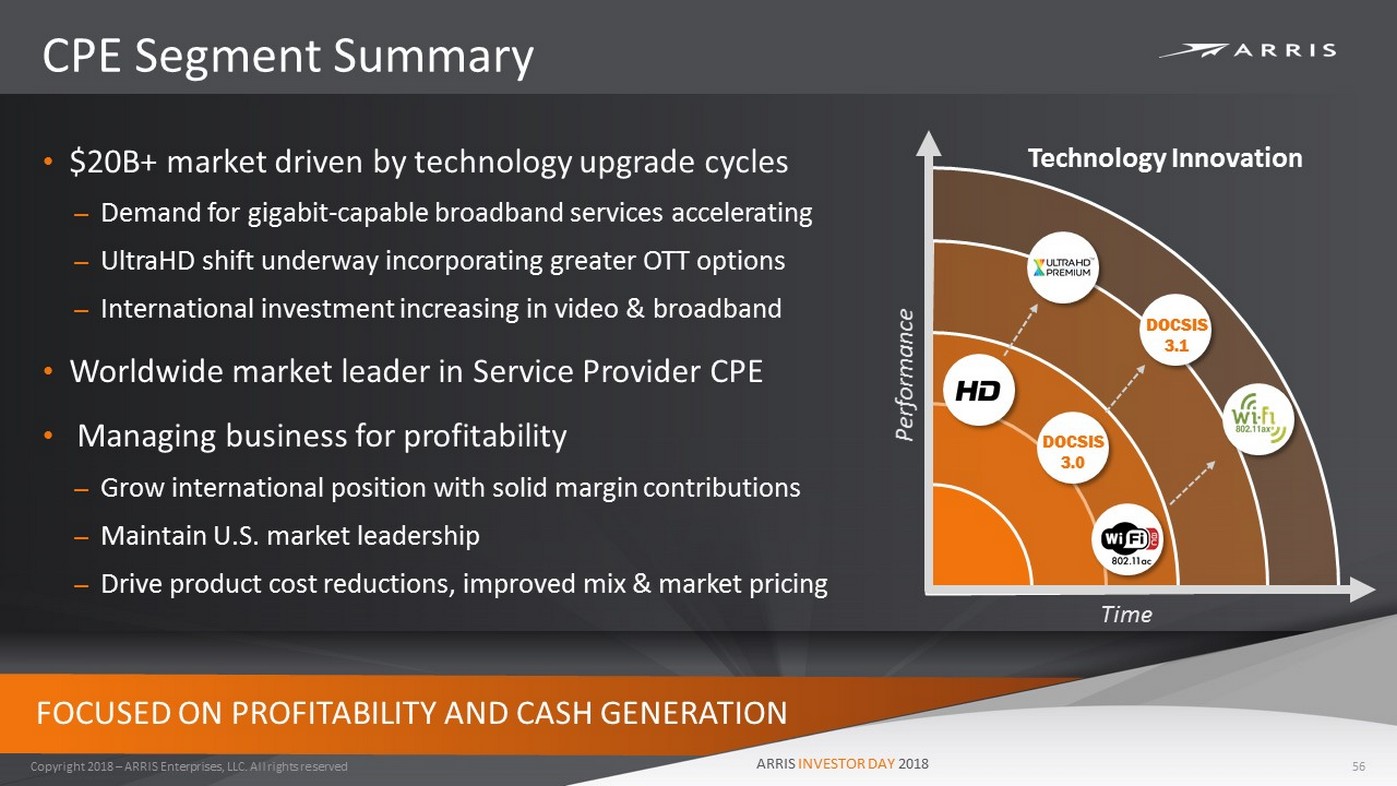

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 CPE Segment Summary 56 FOCUSED ON PROFITABILITY AND CASH GENERATION • $20B+ market driven by technology upgrade cycles – Demand for gigabit - capable broadband services accelerating – UltraHD shift underway incorporating greater OTT options – International investment increasing in video & broadband • Worldwide market leader in Service Provider CPE • Managing business for profitability – Grow international position with solid margin contributions – Maintain U.S. market leadership – Drive product cost reductions, improved mix & market pricing Time Technology Innovation Performance DOCSIS 3.0 DOCSIS 3.1

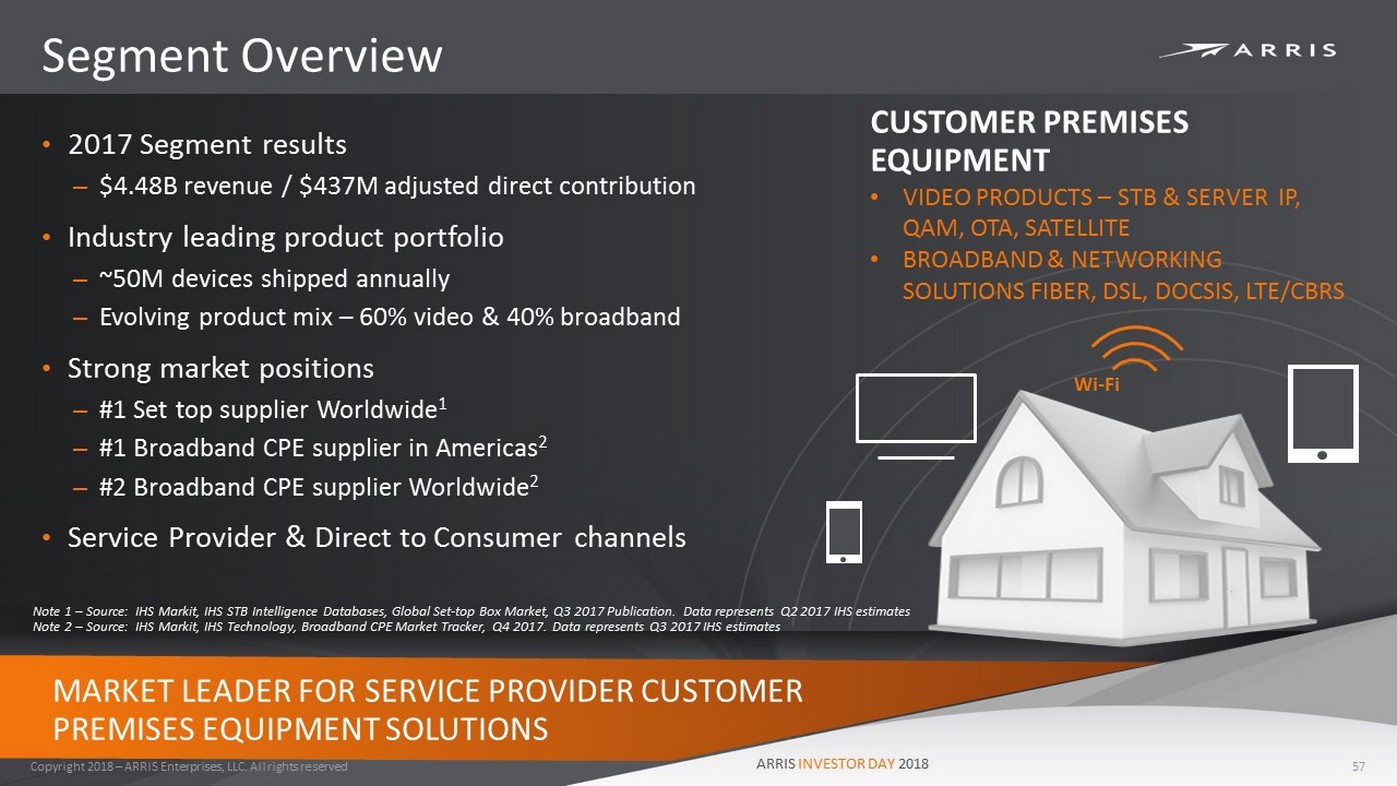

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Segment Overview 57 MARKET LEADER FOR SERVICE PROVIDER CUSTOMER PREMISES EQUIPMENT SOLUTIONS • 2017 Segment results – $4.48B revenue / $437M adjusted direct contribution • Industry leading product portfolio – ~50M devices shipped annually – Evolving product mix – 60% video & 40% broadband • Strong market positions – #1 Set top supplier Worldwide 1 – #1 Broadband CPE supplier in Americas 2 – #2 Broadband CPE supplier Worldwide 2 • Service Provider & Direct to Consumer channels Note 1 – Source: IHS Markit , IHS STB Intelligence Databases, Global Set - top Box Market, Q3 2017 Publication. Data represents Q2 2017 IHS estimates Note 2 – Source: IHS Markit , IHS Technology, Broadband CPE Market Tracker, Q4 2017. Data represents Q3 2017 IHS estimates Wi - Fi CUSTOMER PREMISES EQUIPMENT • VIDEO PRODUCTS – STB & SERVER IP, QAM, OTA, SATELLITE • BROADBAND & NETWORKING SOLUTIONS FIBER, DSL, DOCSIS, LTE/CBRS

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Market Trends Enabled By Technology Advances 58 Wi - Fi Momentum Smart Home Solutions Gigabit Broadband Access Video Device Evolution IoT Ecosystem Interoperability DOCSIS Evolution (DOCSIS 3.1 / FDX) G.Fast Next Generation FTTx / PON OTT Integration Non - graphical UI; Ambient voice Enhanced Resolution & Dynamic Range 802.11ax / ad Intelligent Mesh Networking (Multi - AP) Smart Home Interface Self Install / Management Fixed Wireless Broadband (LTE, CBRS) Always Connected Sensors Data Storage Solutions Cloud - centric Control & Management Security

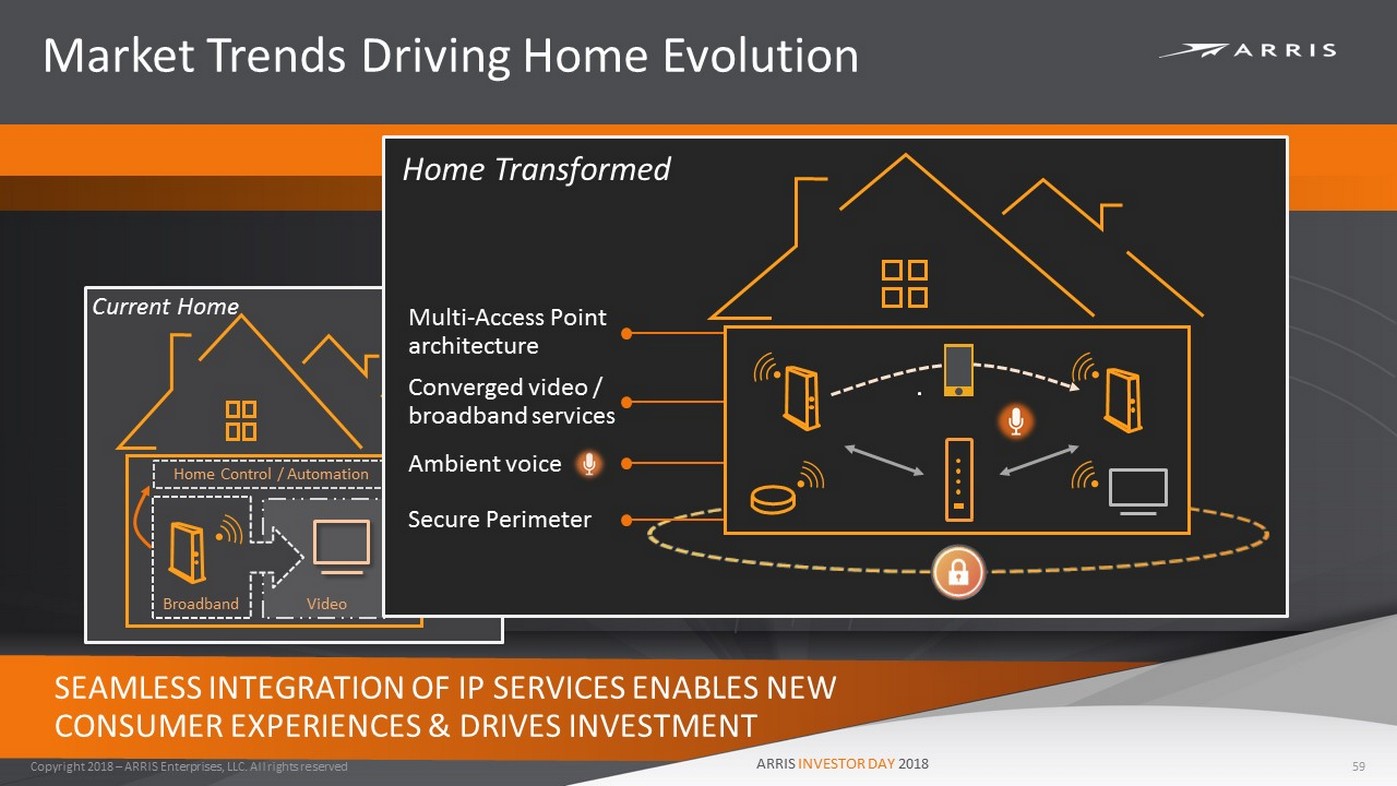

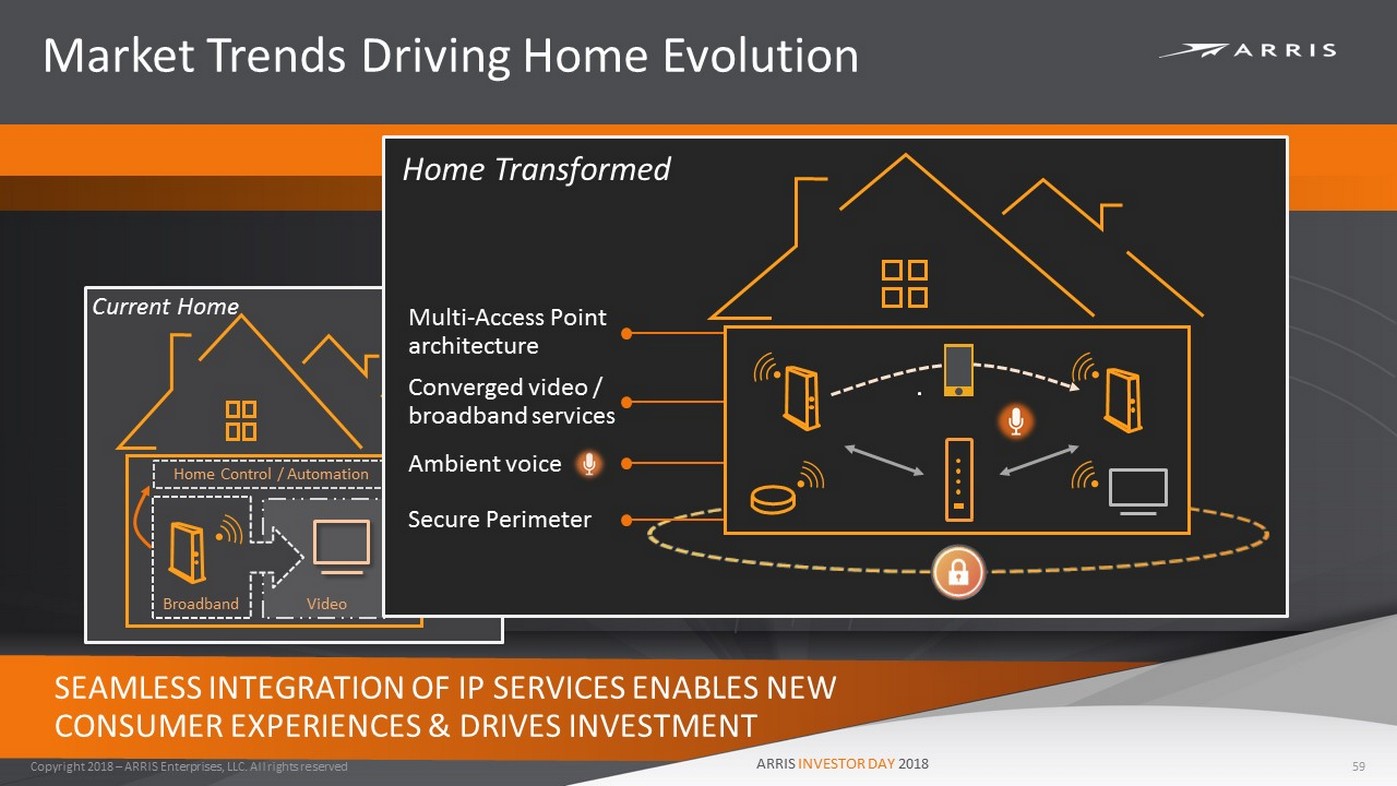

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 59 SEAMLESS INTEGRATION OF IP SERVICES ENABLES NEW CONSUMER EXPERIENCES & DRIVES INVESTMENT Market Trends Driving Home Evolution Home Control / Automation Broadband Video Secure Perimeter Multi - Access Point architecture Ambient voice Converged video / broadband services Home Transformed Current Home

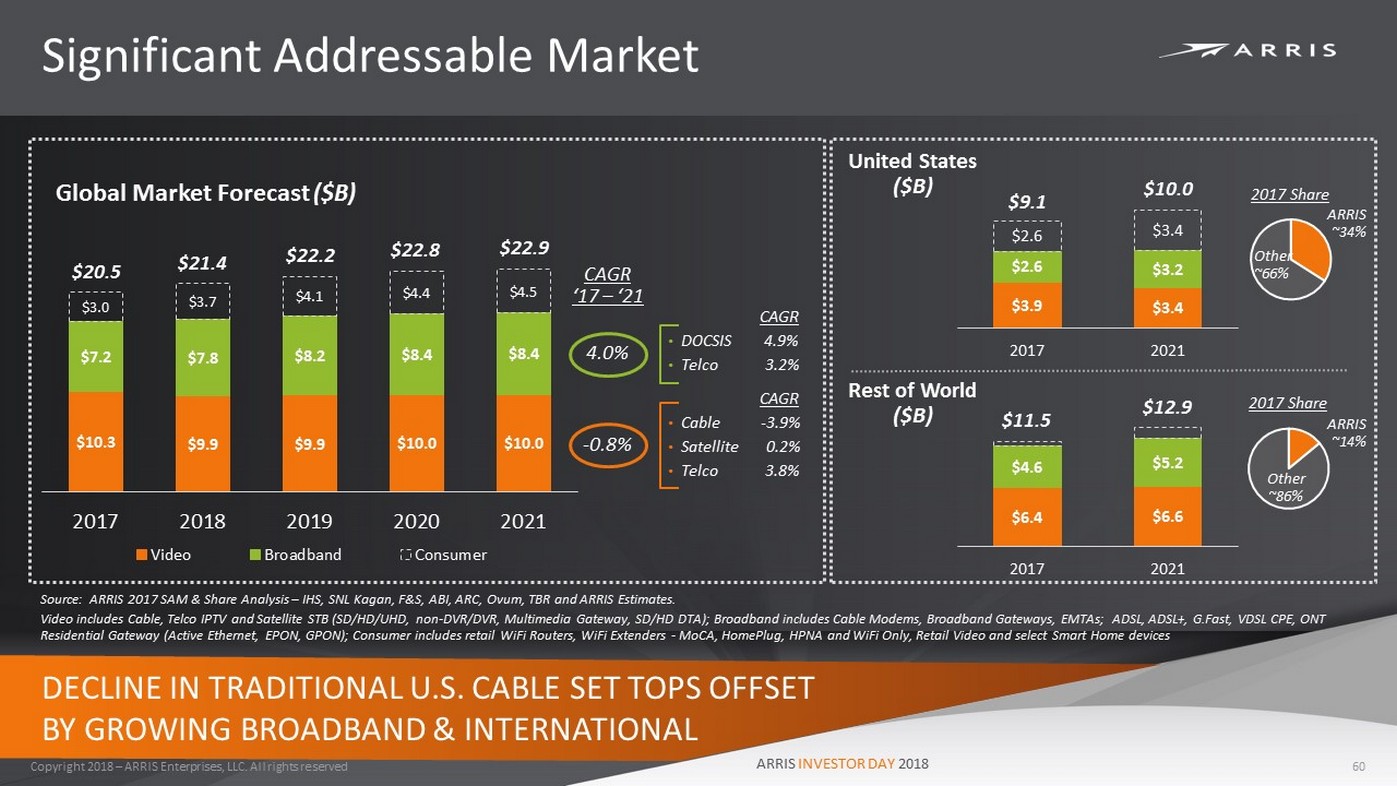

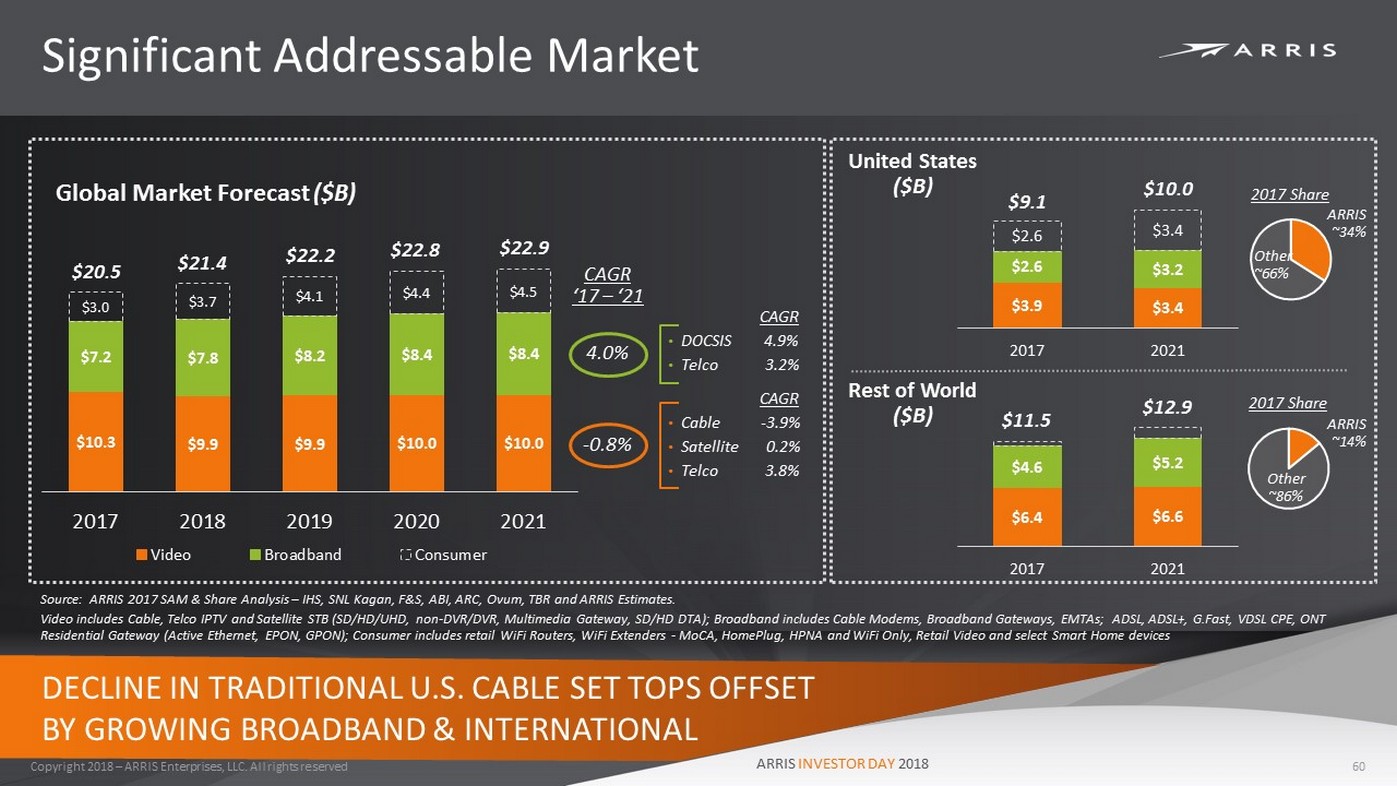

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Significant Addressable Market 60 DECLINE IN TRADITIONAL U.S. CABLE SET TOPS OFFSET BY GROWING BROADBAND & INTERNATIONAL Global Market Forecast ($B) $10.3 $9.9 $9.9 $10.0 $10.0 $7.2 $7.8 $8.2 $8.4 $8.4 $3.0 $3.7 $4.1 $4.4 $4.5 2017 2018 2019 2020 2021 Video Broadband Consumer CAGR • DOCSIS 4.9% • Telco 3.2% Source: ARRIS 2017 SAM & Share Analysis – IHS, SNL Kagan, F&S, ABI, ARC, Ovum, TBR and ARRIS Estimates. Video includes Cable, Telco IPTV and Satellite STB (SD/HD/UHD, non - DVR/DVR, Multimedia Gateway, SD/HD DTA); Broadband includes C able Modems, Broadband Gateways, EMTAs; ADSL, ADSL+, G.Fast , VDSL CPE, ONT Residential Gateway (Active Ethernet, EPON, GPON); Consumer includes retail WiFi Routers, WiFi Extenders - MoCA , HomePlug , HPNA and WiFi Only, Retail Video and select Smart Home devices CAGR • Cable - 3.9% • Satellite 0.2% • Telco 3.8% $3.9 $3.4 $2.6 $3.2 $2.6 $3.4 2017 2021 $6.4 $6.6 $4.6 $5.2 2017 2021 United States ($B) Rest of World ($B) 2017 Share 2017 Share $20.5 $21.4 $22.2 $22.8 $22.9 Other ~66% Other ~86% ARRIS ~14% ARRIS ~34% $9.1 $10.0 $12.9 $11.5 4.0% - 0.8% CAGR ‘17 – ‘21

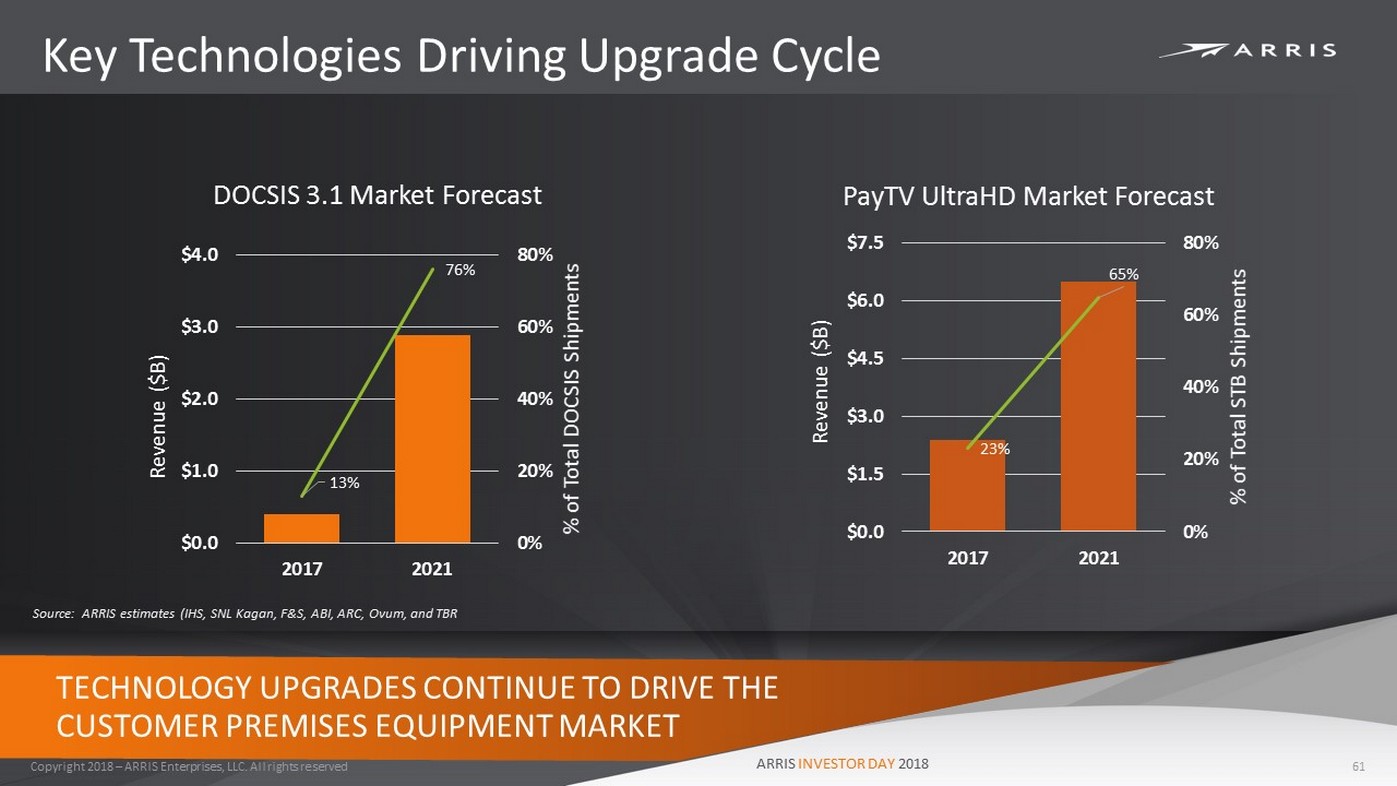

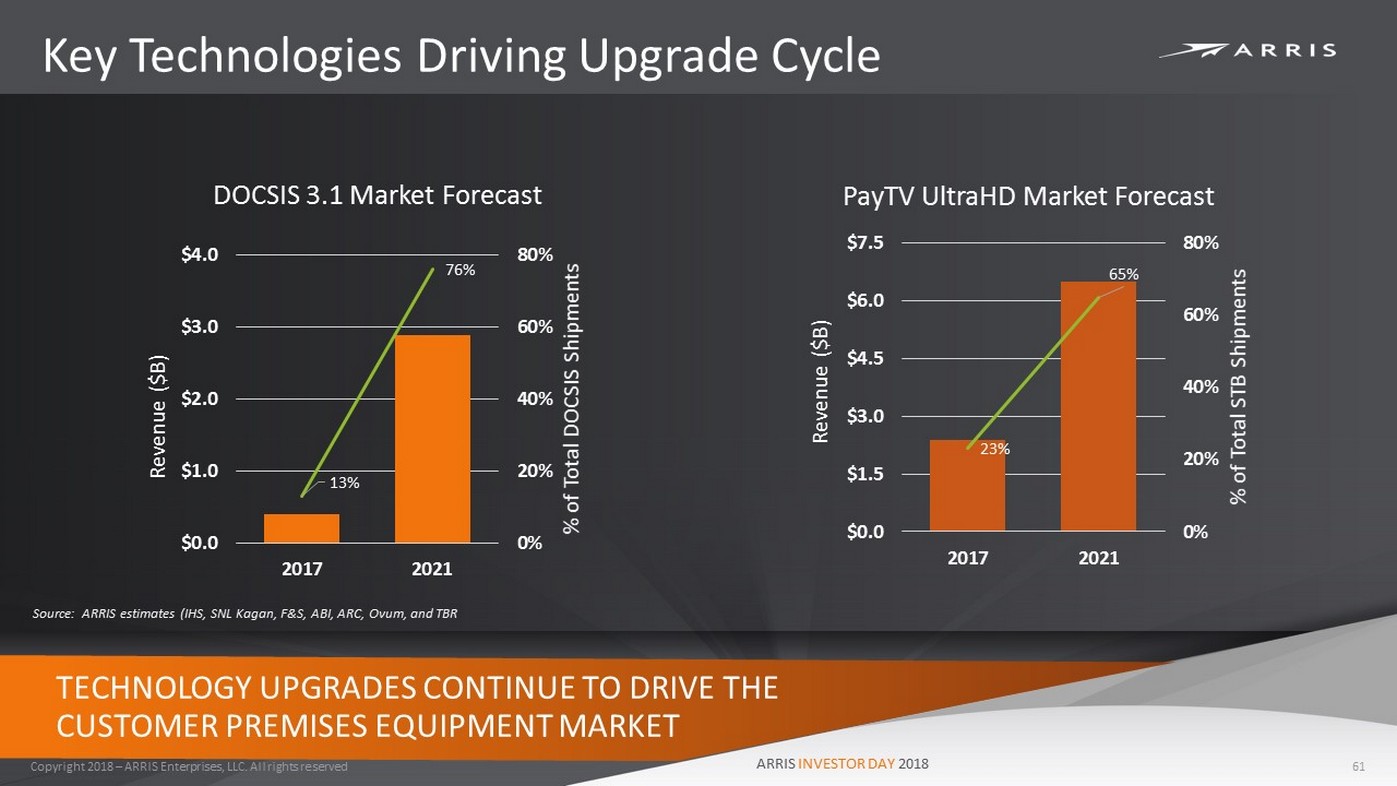

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Key Technologies Driving Upgrade Cycle 61 DOCSIS 3.1 Market Forecast TECHNOLOGY UPGRADES CONTINUE TO DRIVE THE CUSTOMER PREMISES EQUIPMENT MARKET 13% 76% 0% 20% 40% 60% 80% $0.0 $1.0 $2.0 $3.0 $4.0 2017 2021 % of Total DOCSIS Shipments Revenue ($B) 23% 65% 0% 20% 40% 60% 80% $0.0 $1.5 $3.0 $4.5 $6.0 $7.5 2017 2021 % of Total STB Shipments Revenue ($B) Source: ARRIS estimates (IHS, SNL Kagan, F&S, ABI, ARC, Ovum, and TBR PayTV UltraHD Market Forecast

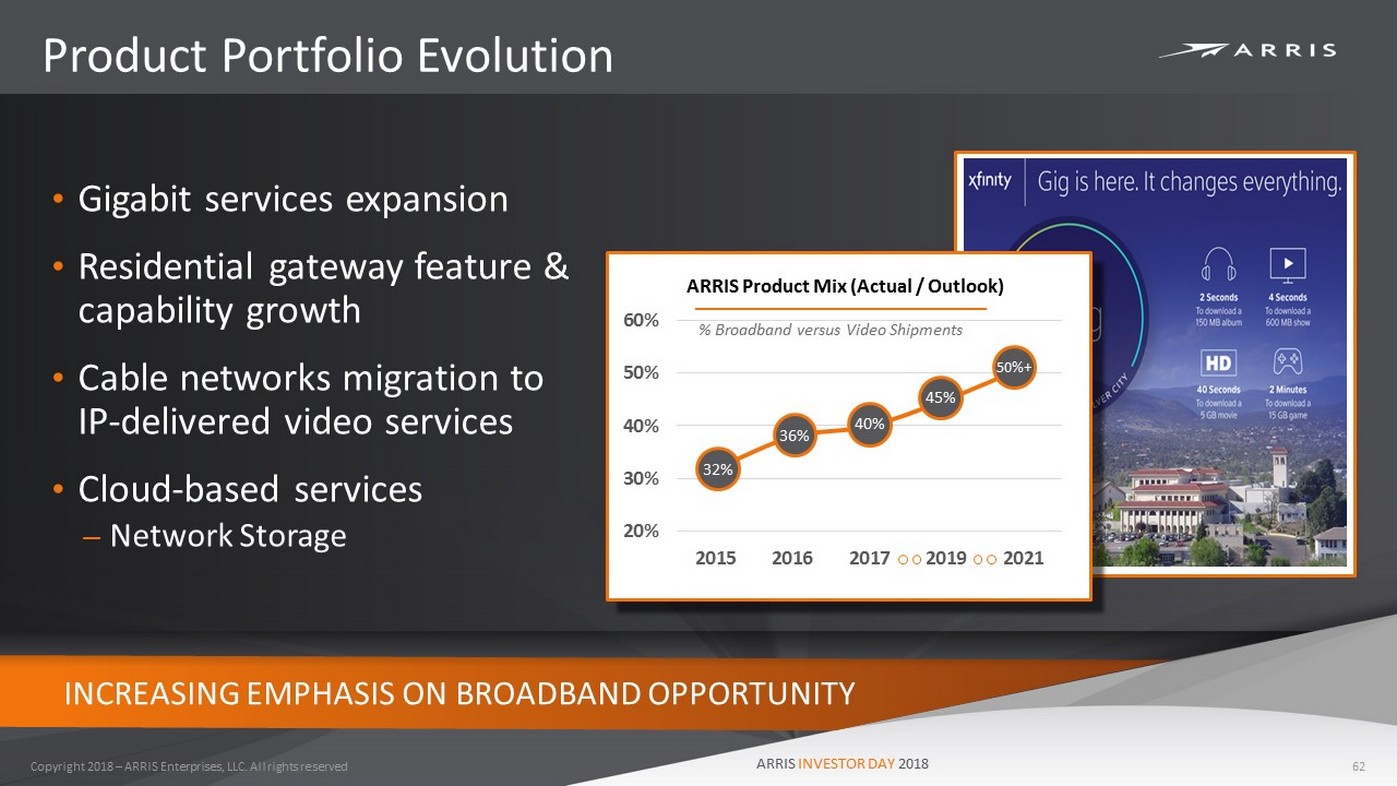

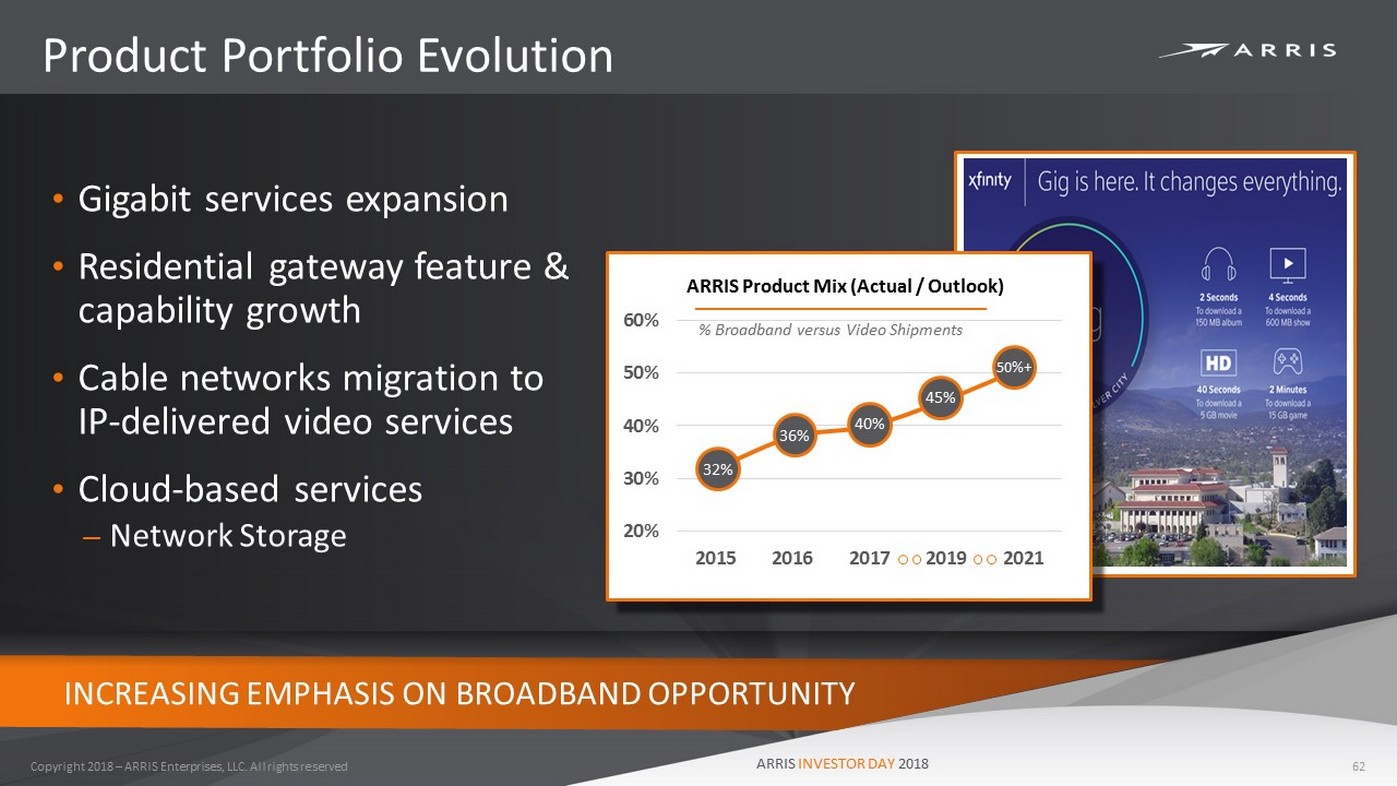

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Product Portfolio Evolution 62 • Gigabit services expansion • Residential gateway feature & capability growth • Cable networks migration to IP - delivered video services • Cloud - based services – Network Storage INCREASING EMPHASIS ON BROADBAND OPPORTUNITY 20% 30% 40% 50% 60% 2015 2016 2017 2019 2021 ARRIS Product Mix (Actual / Outlook) 50%+ 45% 40% 36% 32% % Broadband versus Video Shipments

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Key Business Objectives • Build upon product leadership position – Disciplined portfolio evolution / management • Expand customer connections – Grow international service provider business – Increase direct - to - consumer solution investment • Streamline business operations – Increase operational efficiency – Drive product cost improvements – Enhance OPEX leverage 63 FOCUSED ON CASH GENERATION & PROFITABILITY 1 3 2

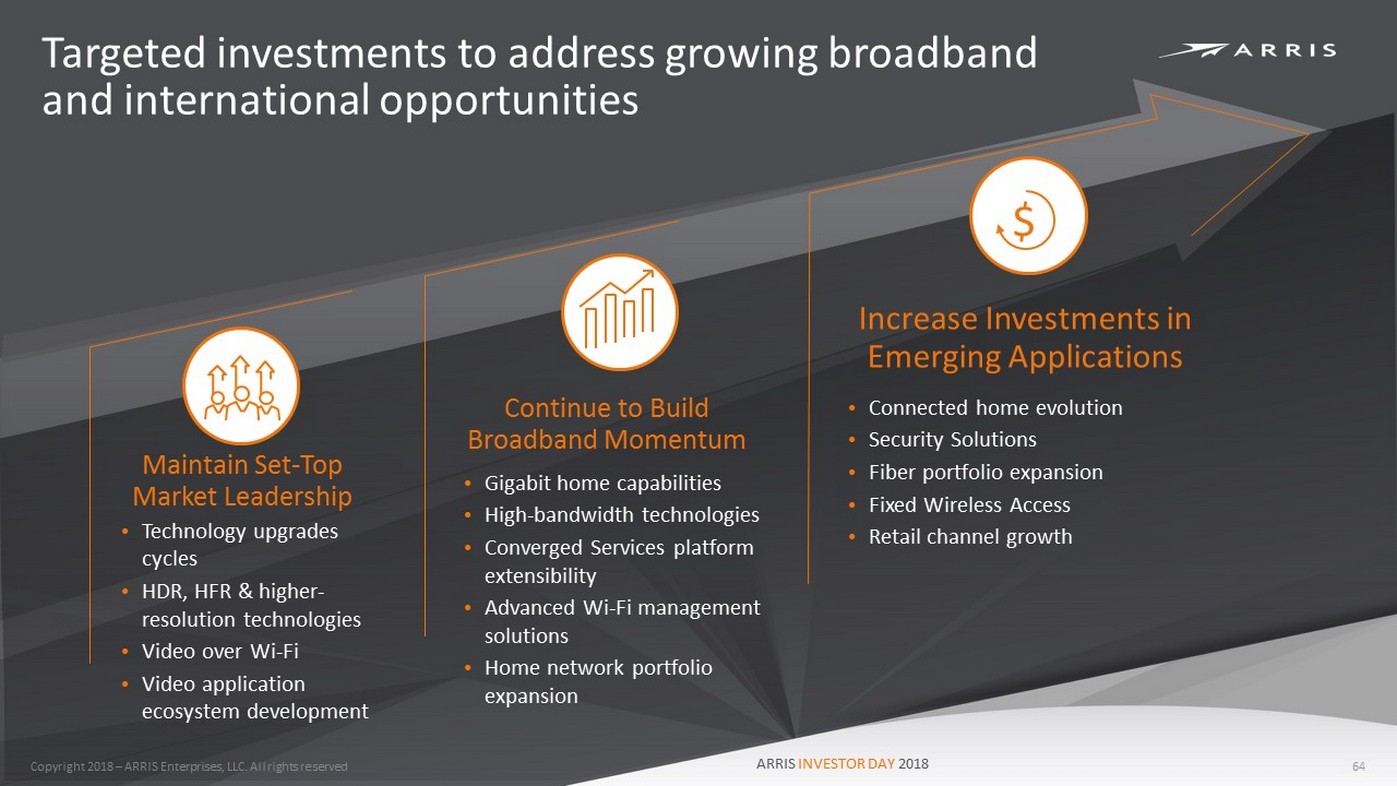

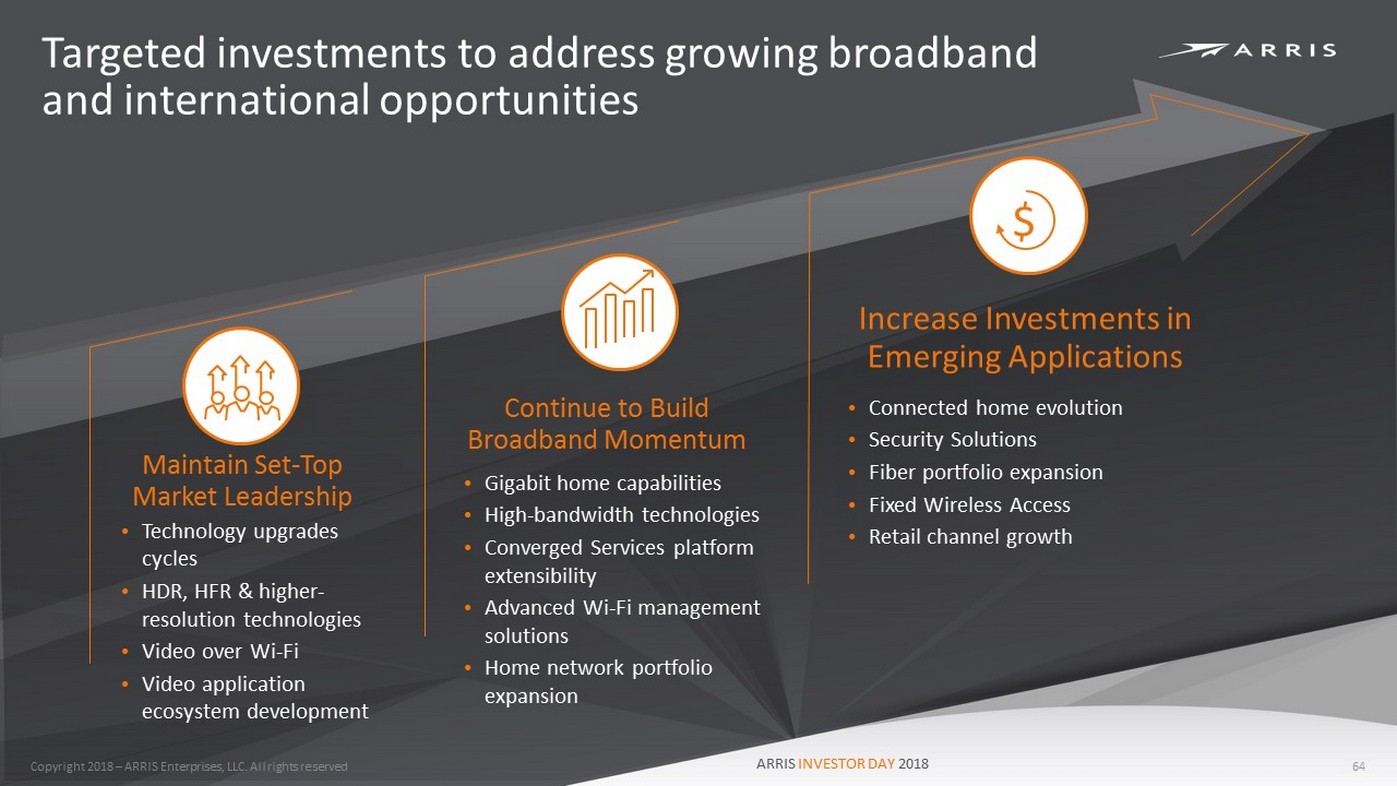

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Targeted investments to address growing broadband and international opportunities 64 Ω $ Maintain Set - Top Market Leadership • Technology upgrades cycles • HDR, HFR & higher - resolution technologies • Video over Wi - Fi • Video application ecosystem development Continue to Build Broadband Momentum • Gigabit home capabilities • High - bandwidth technologies • Converged Services platform extensibility • Advanced Wi - Fi management solutions • Home network portfolio expansion Increase Investments in Emerging Applications • Connected home evolution • Security Solutions • Fiber portfolio expansion • Fixed Wireless Access • Retail channel growth

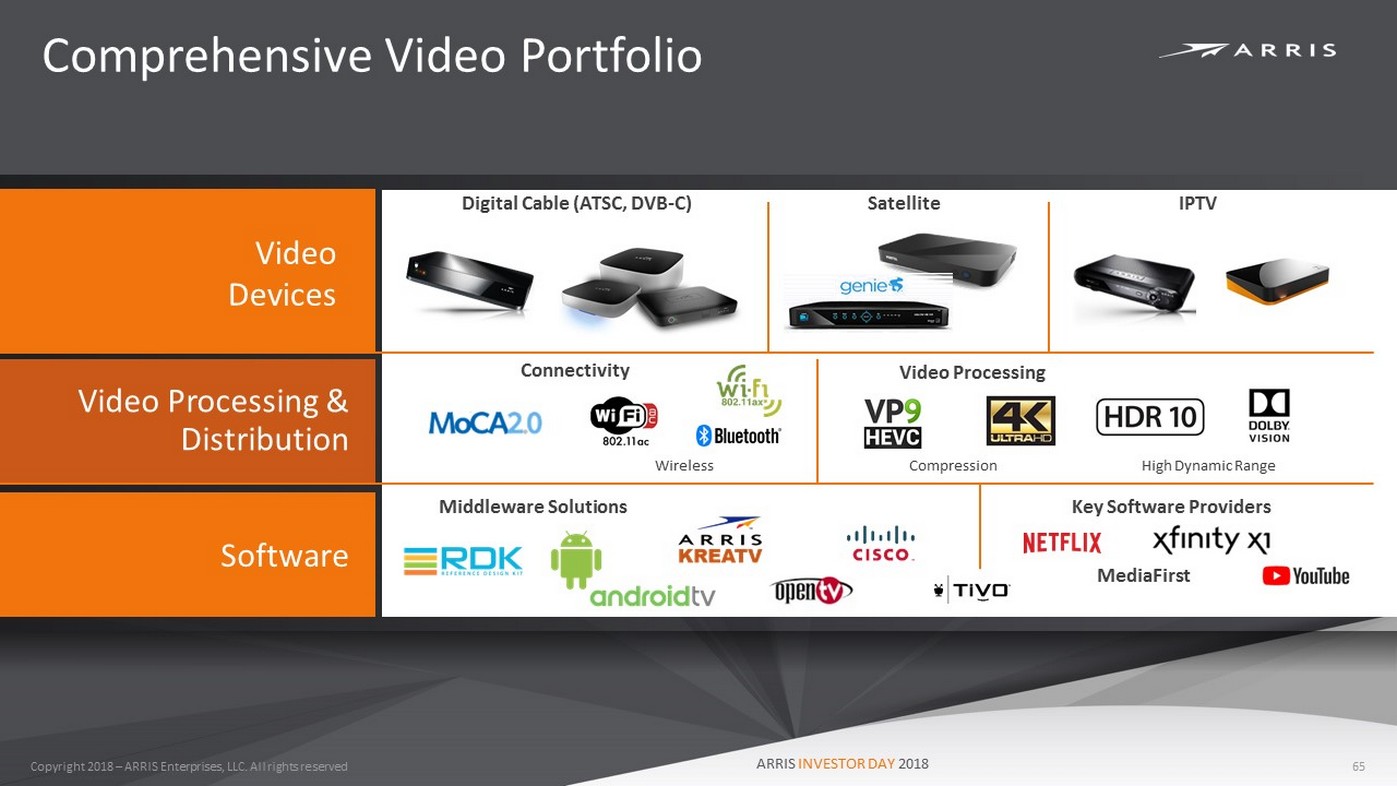

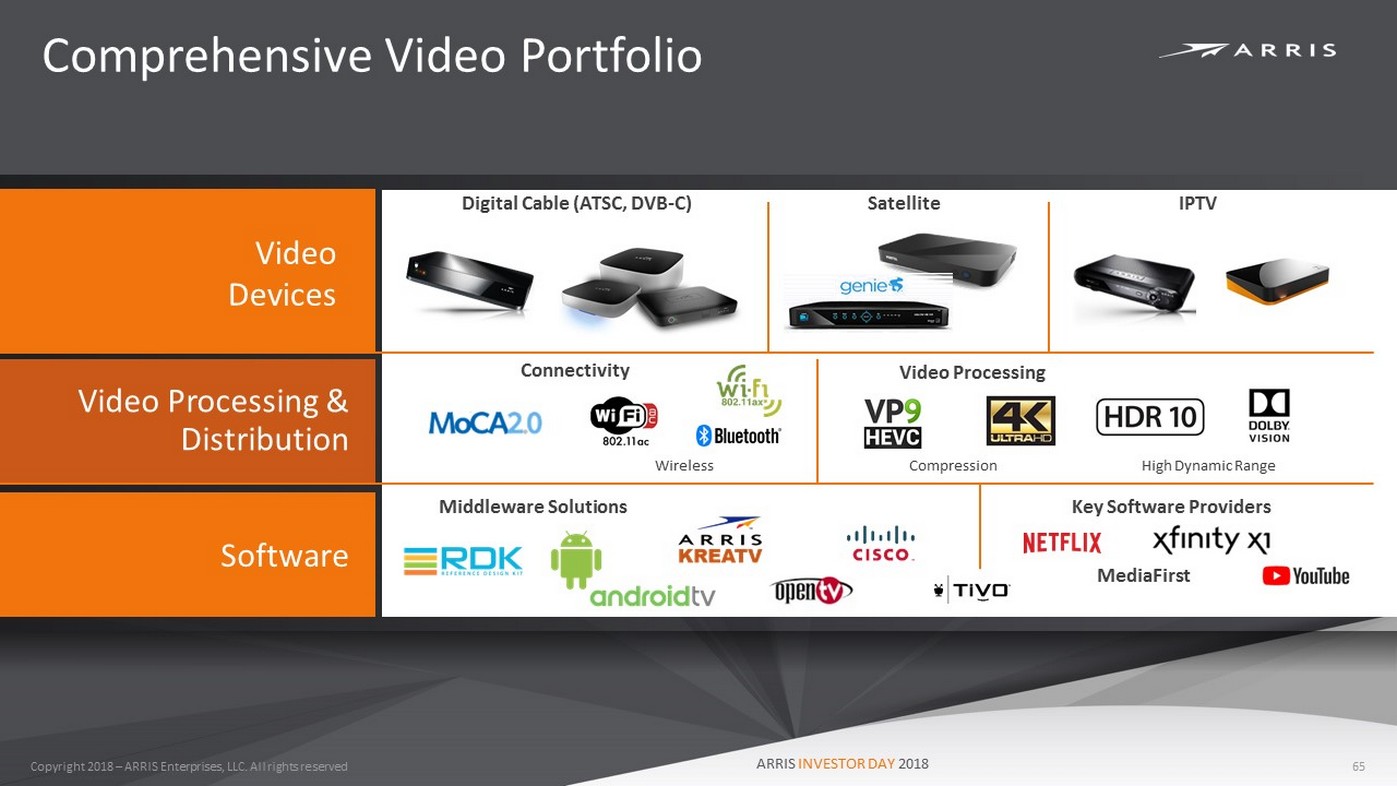

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Comprehensive Video Portfolio 65 Video Devices Video Processing & Distribution Digital Cable (ATSC, DVB - C) Connectivity MoCA2.0 Channel Bonded Satellite IPTV Software Key Software Providers Middleware Solutions Video Processing Compression MediaFirst High Dynamic Range Wireless

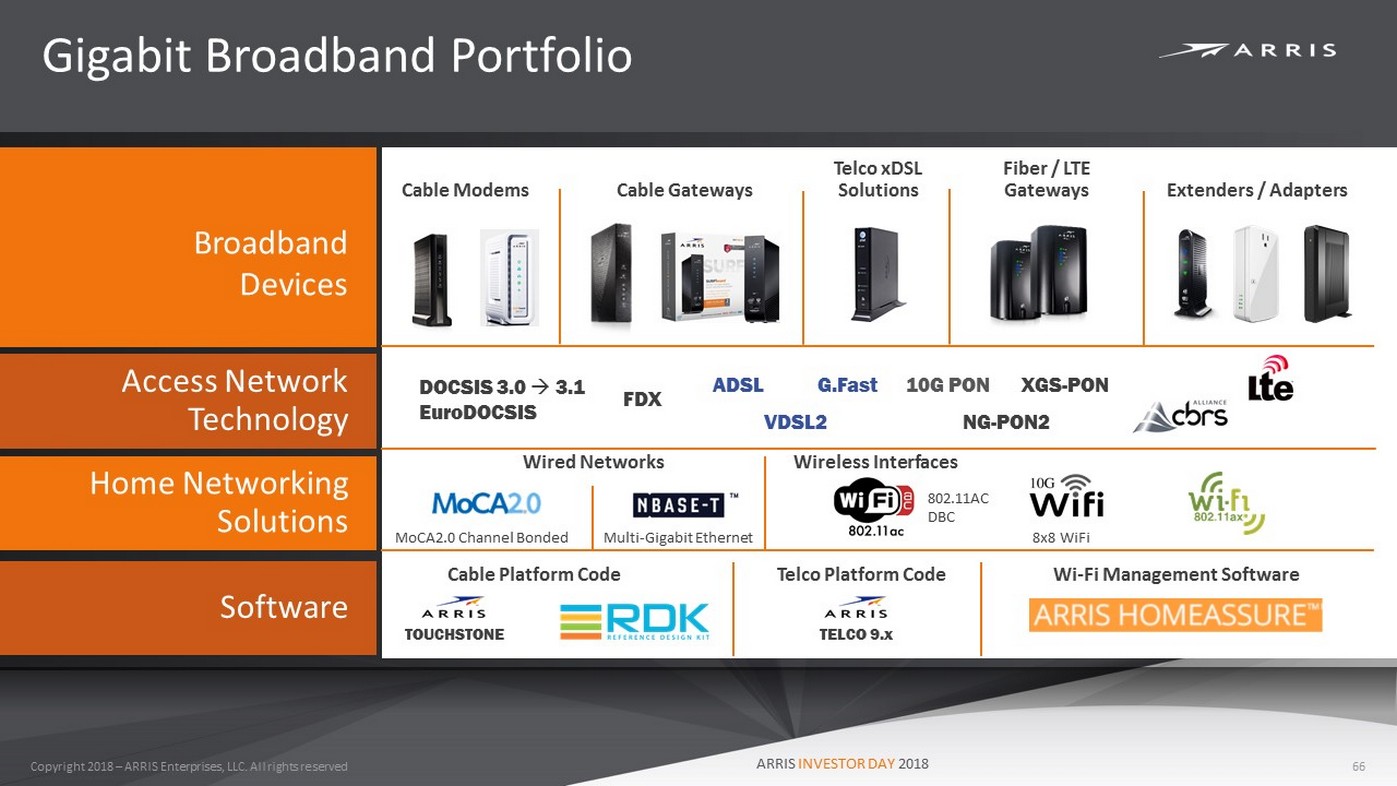

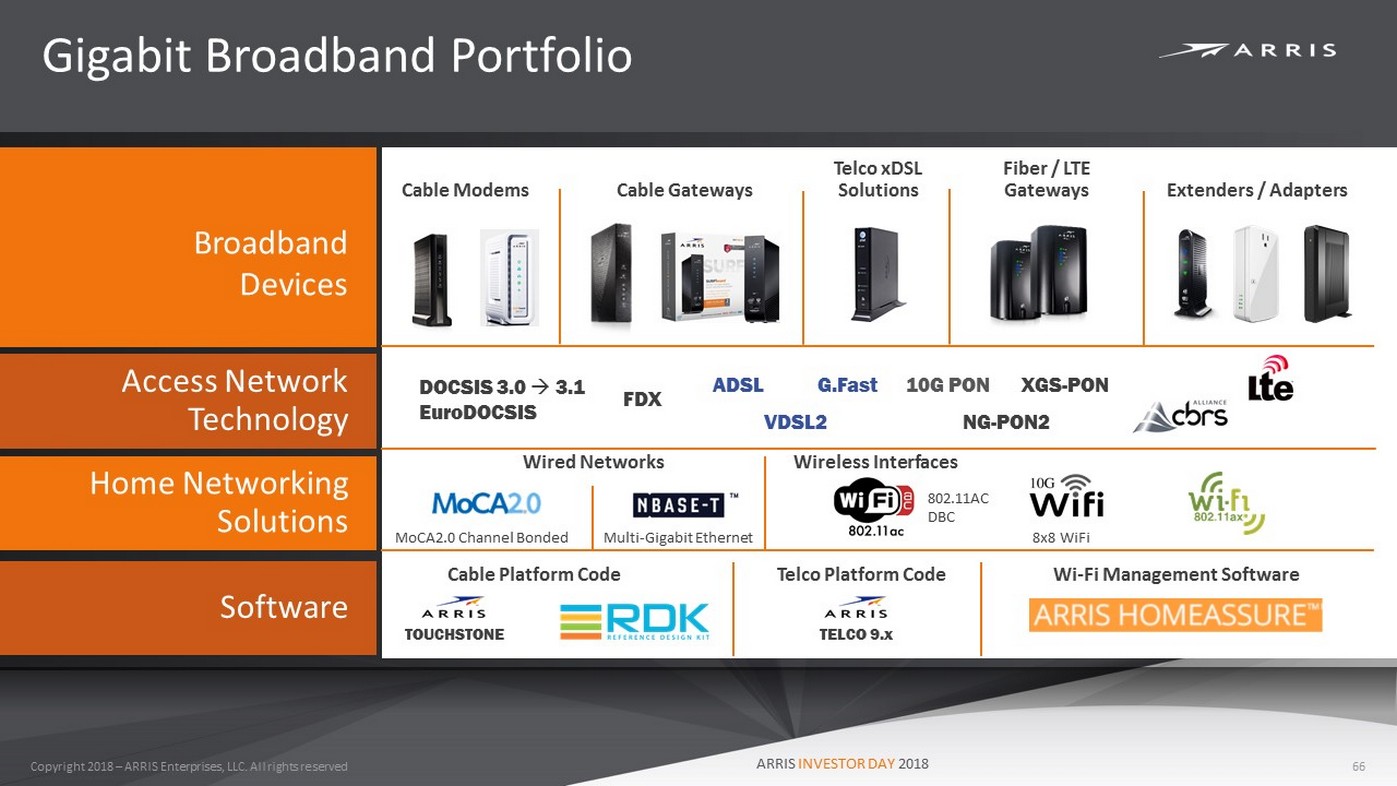

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Gigabit Broadband Portfolio 66 Cable Modems Cable Gateways Telco xDSL Solutions Wi - Fi Management Software Cable Platform Code Telco Platform Code Extenders / Adapters TELCO 9.x TOUCHSTONE Wired Networks MoCA2.0 Channel Bonded Wireless Interfaces 8x8 WiFi 802.11AC DBC Multi - Gigabit Ethernet Fiber / LTE Gateways DOCSIS 3.0 3.1 EuroDOCSIS FDX Broadband Devices Access Network Technology Software Home Networking Solutions ADSL G.Fast VDSL2 10G PON NG - PON2 XGS - PON

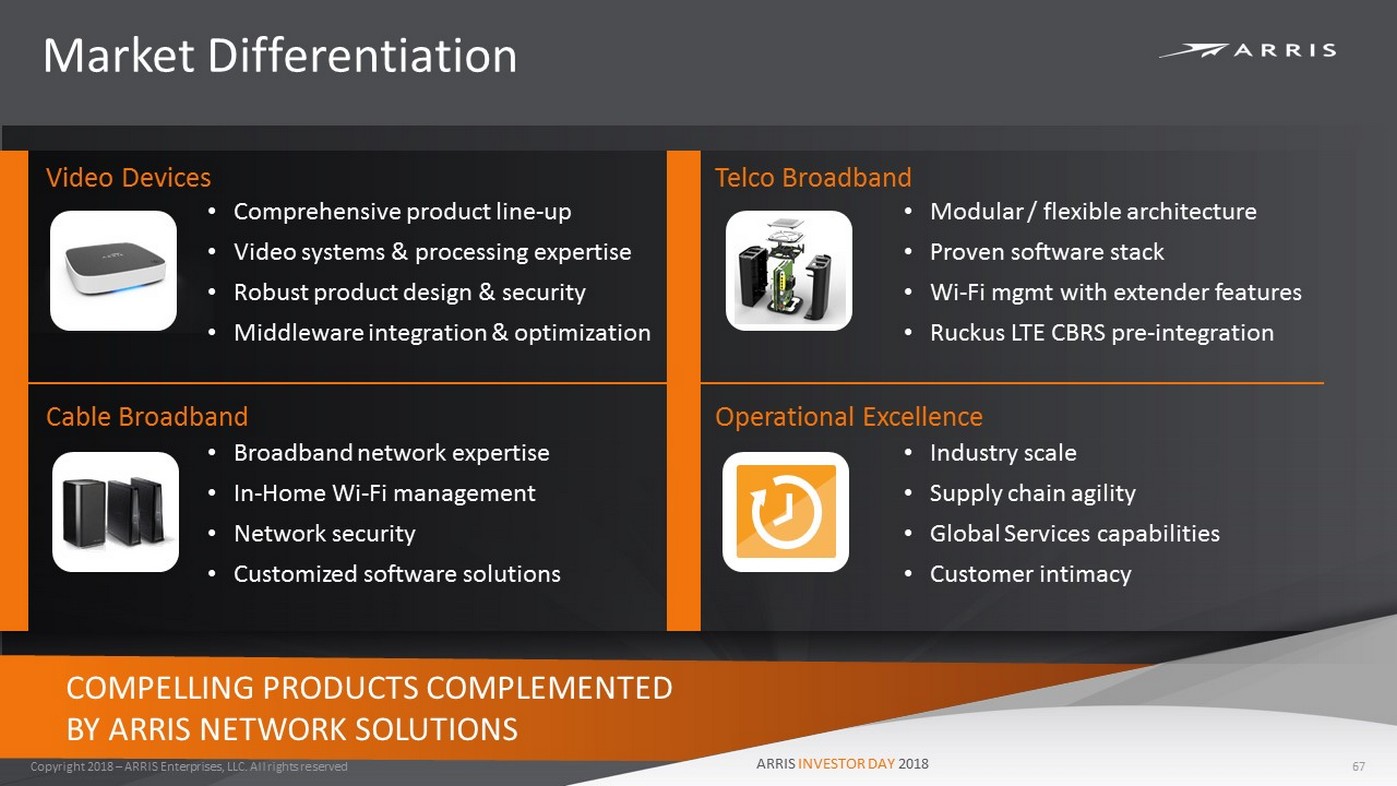

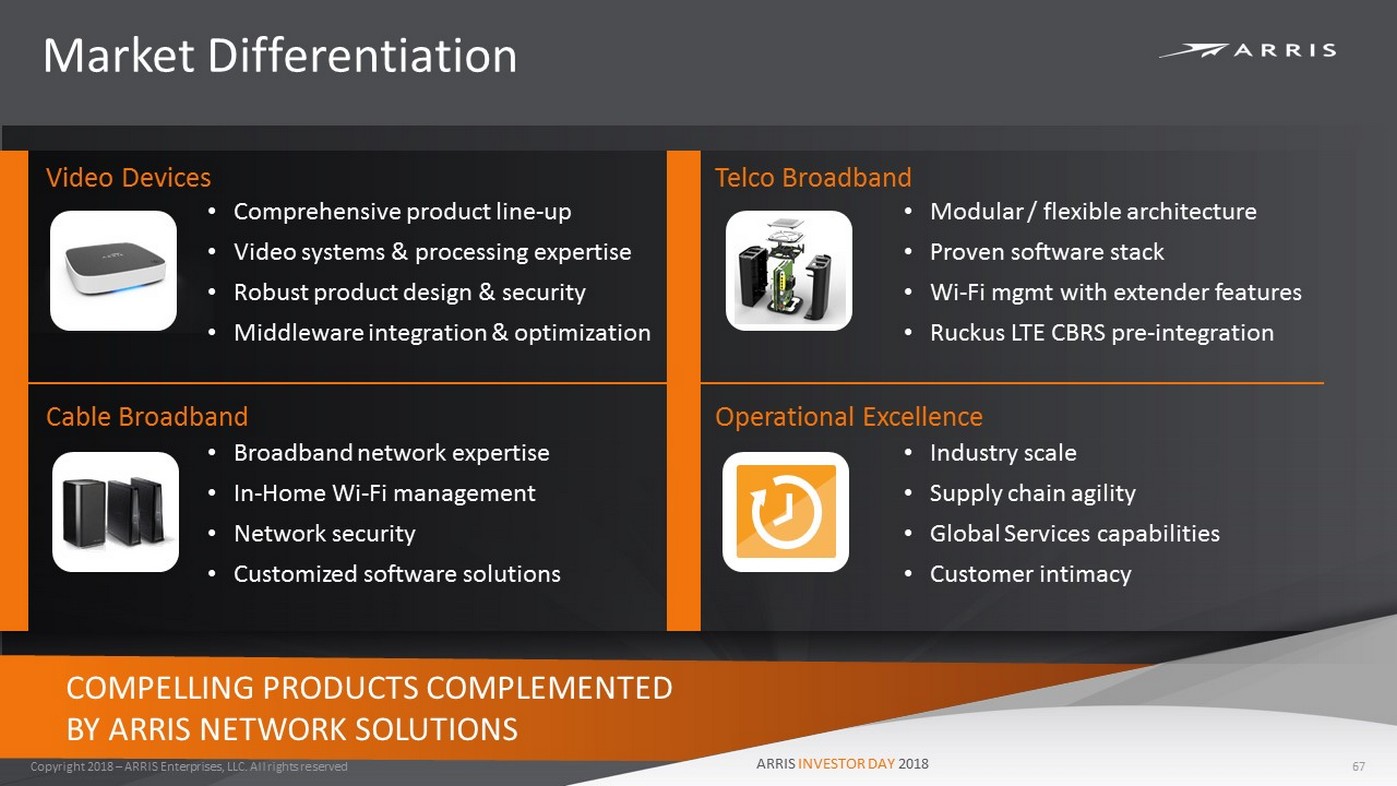

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Market Differentiation 67 Video Devices • Comprehensive product line - up • Video systems & processing expertise • Robust product design & security • Middleware integration & optimization Cable Broadband • Broadband network expertise • In - Home Wi - Fi management • Network security • Customized software solutions Telco Broadband • Modular / flexible architecture • Proven software stack • Wi - Fi mgmt with extender features • Ruckus LTE CBRS pre - integration Operational Excellence • Industry scale • Supply chain agility • Global Services capabilities • Customer intimacy COMPELLING PRODUCTS COMPLEMENTED BY ARRIS NETWORK SOLUTIONS

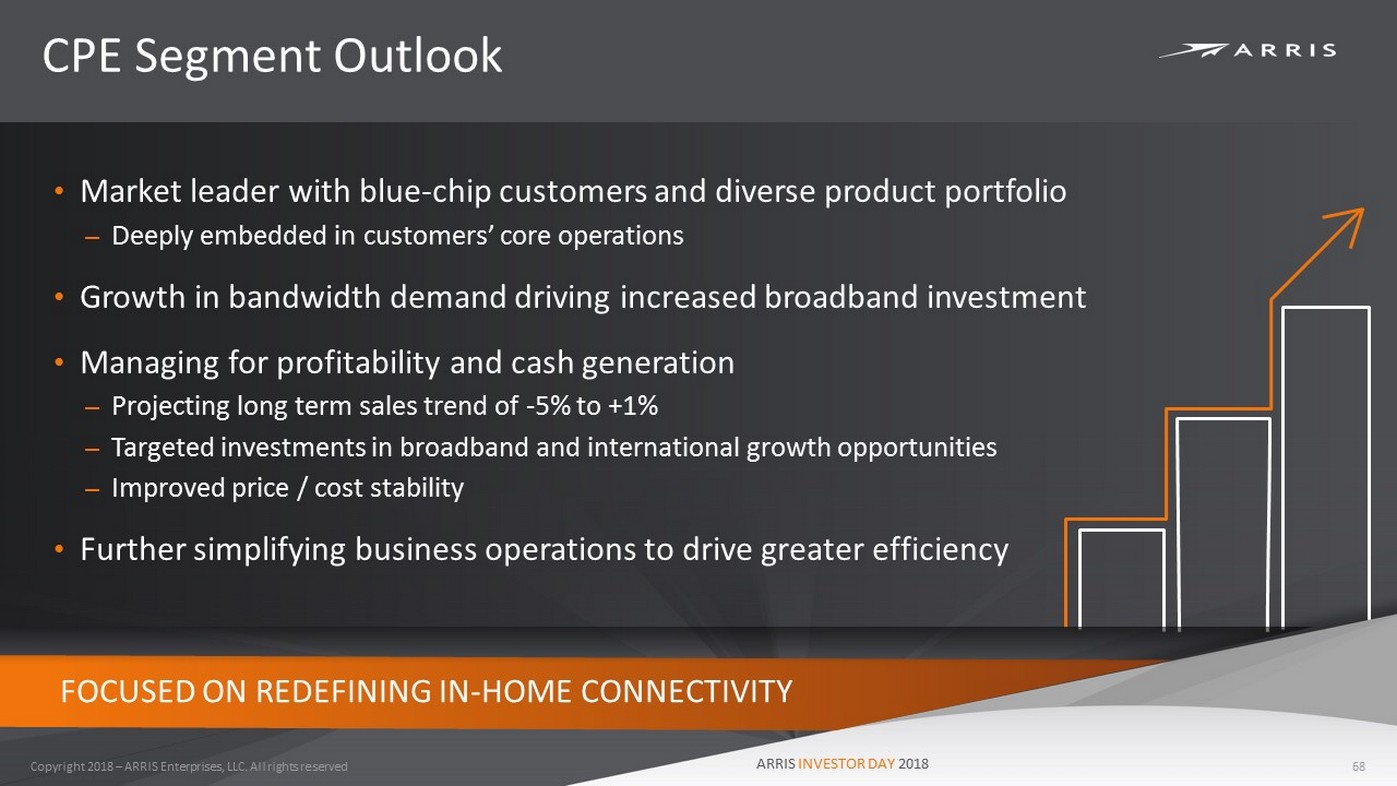

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 CPE Segment Outlook 68 • Market leader with blue - chip customers and diverse product portfolio – Deeply embedded in customers’ core operations • Growth in bandwidth demand driving increased broadband investment • Managing for profitability and cash generation – Projecting long term sales trend of - 5% to +1% – Targeted investments in broadband and international growth opportunities – Improved price / cost stability • Further simplifying business operations to drive greater efficiency FOCUSED ON REDEFINING IN - HOME CONNECTIVITY

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 Enterprise Networks Dan Rabinovitsj

Enterprise Networks Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Growing, profitable business in a growth market Diversified customer base Heritage of innovation with sustainable differentiation Robust go - to - market approach leveraging a large partner community Growth in new areas such as CBRS and IoT Building on the integration with ARRIS through stronger Service Provider momentum ARRIS INVESTOR DAY 2018 70

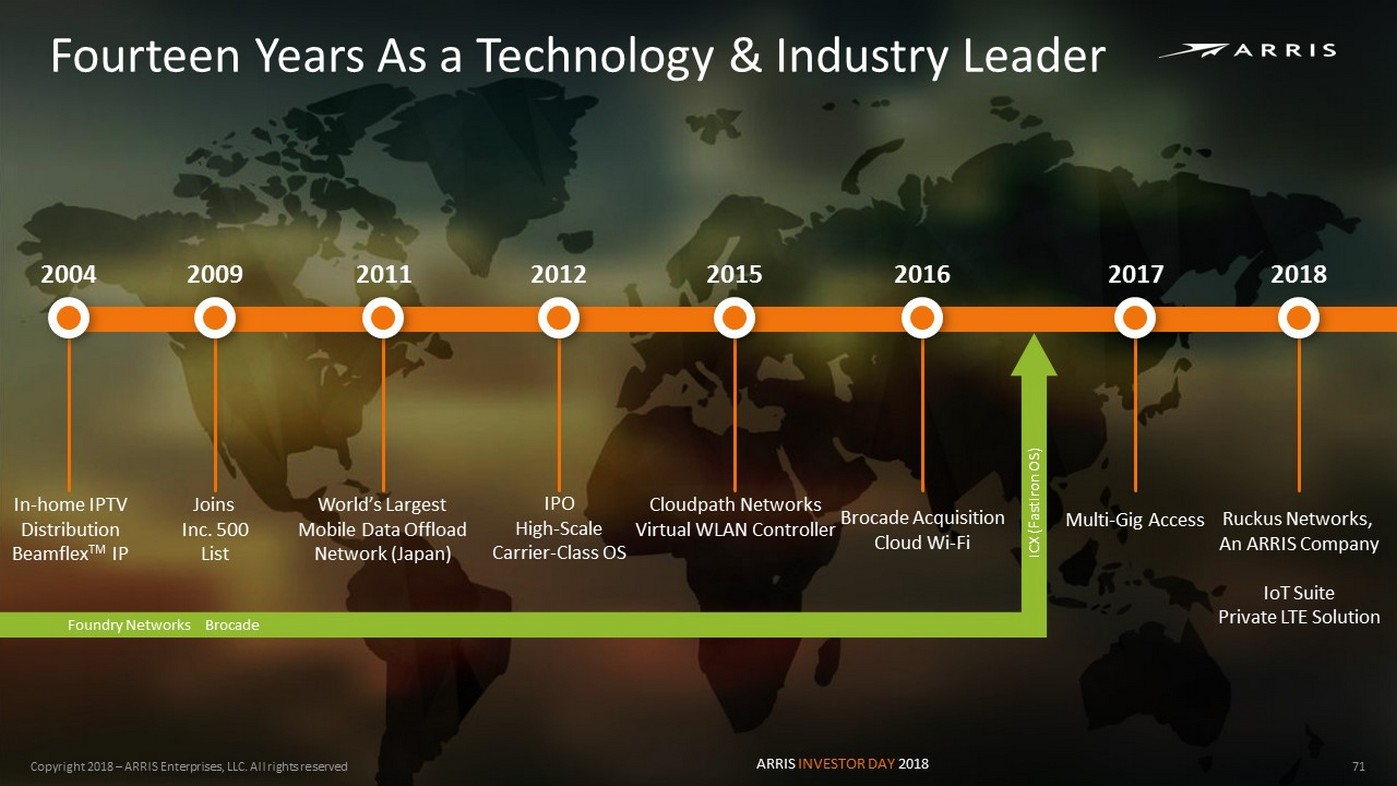

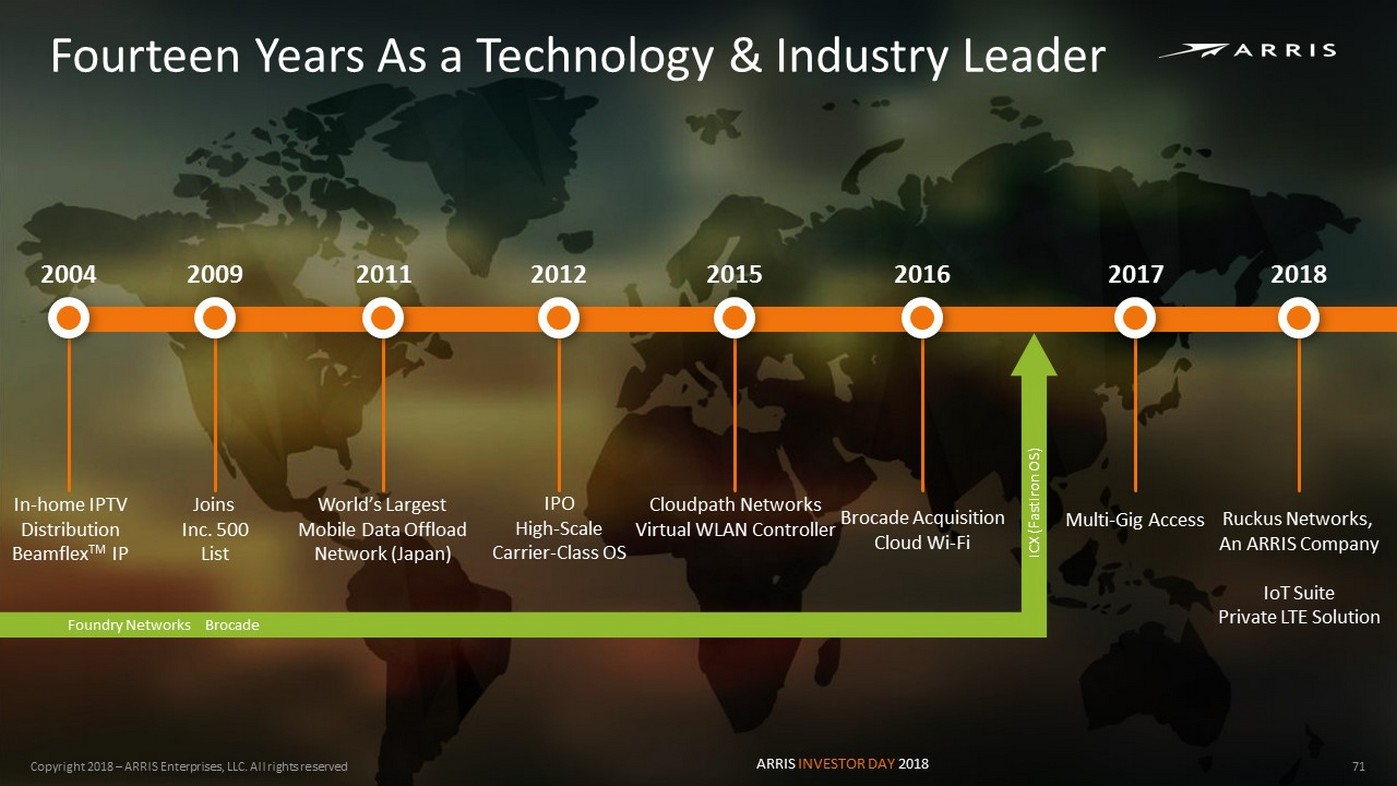

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Fourteen Years As a Technology & Industry Leader In - home IPTV Distribution Beamflex TM IP 2004 Joins Inc. 500 List 2009 World’s Largest Mobile Data Offload Network (Japan) 2011 IPO High - Scale Carrier - Class OS 2012 Cloudpath Networks Virtual WLAN Controller 2015 Brocade Acquisition Cloud Wi - Fi 2016 Multi - Gig Access 2017 Ruckus Networks, An ARRIS Company IoT Suite Private LTE Solution 2018 Foundry Networks Brocade ICX (FastIron OS) Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 71

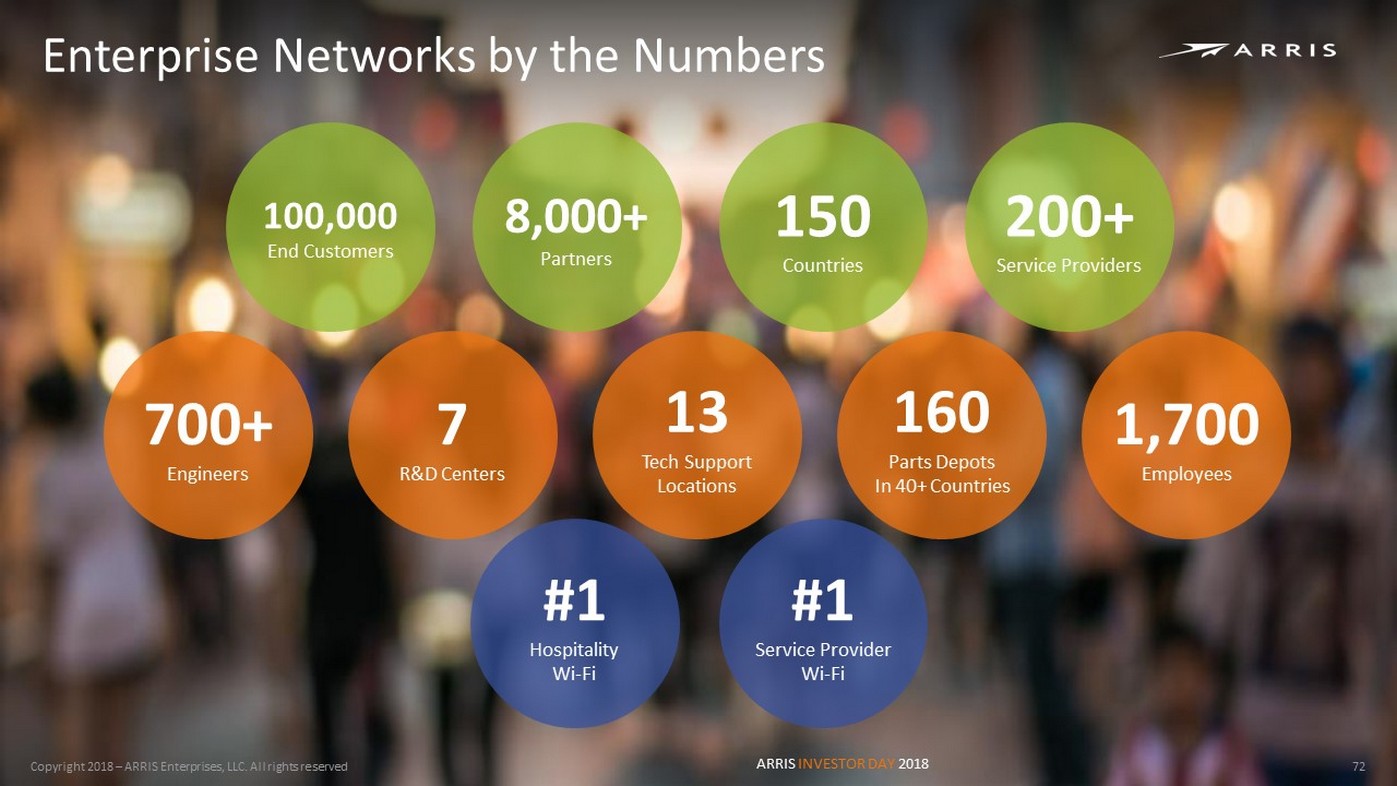

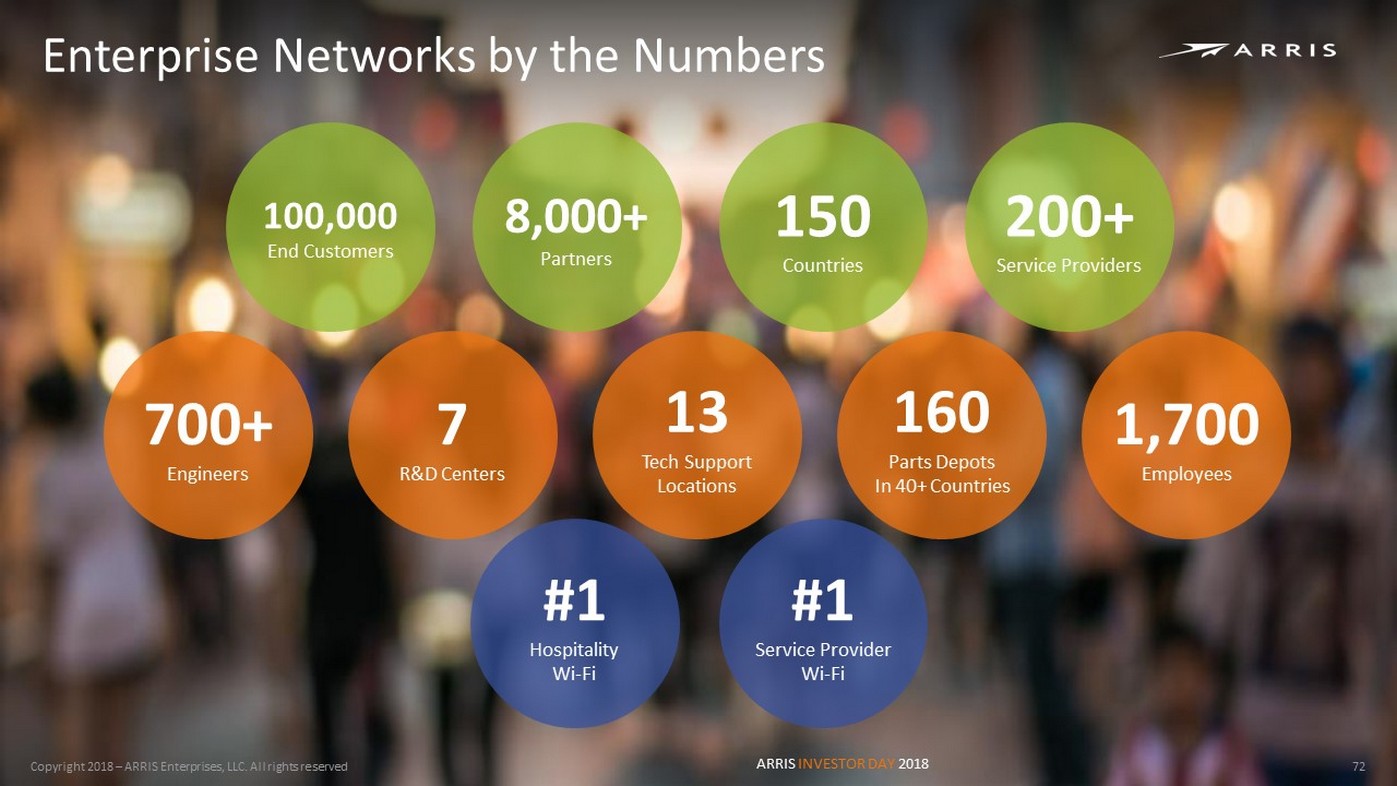

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Enterprise Networks by the Numbers 100,000 End Customers 8,000+ Partners 150 Countries 200+ Service Providers 1,700 Employees 700+ Engineers 7 R&D Centers 13 Tech Support Locations 160 Parts Depots In 40+ Countries #1 Hospitality Wi - Fi #1 Service Provider Wi - Fi Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 72

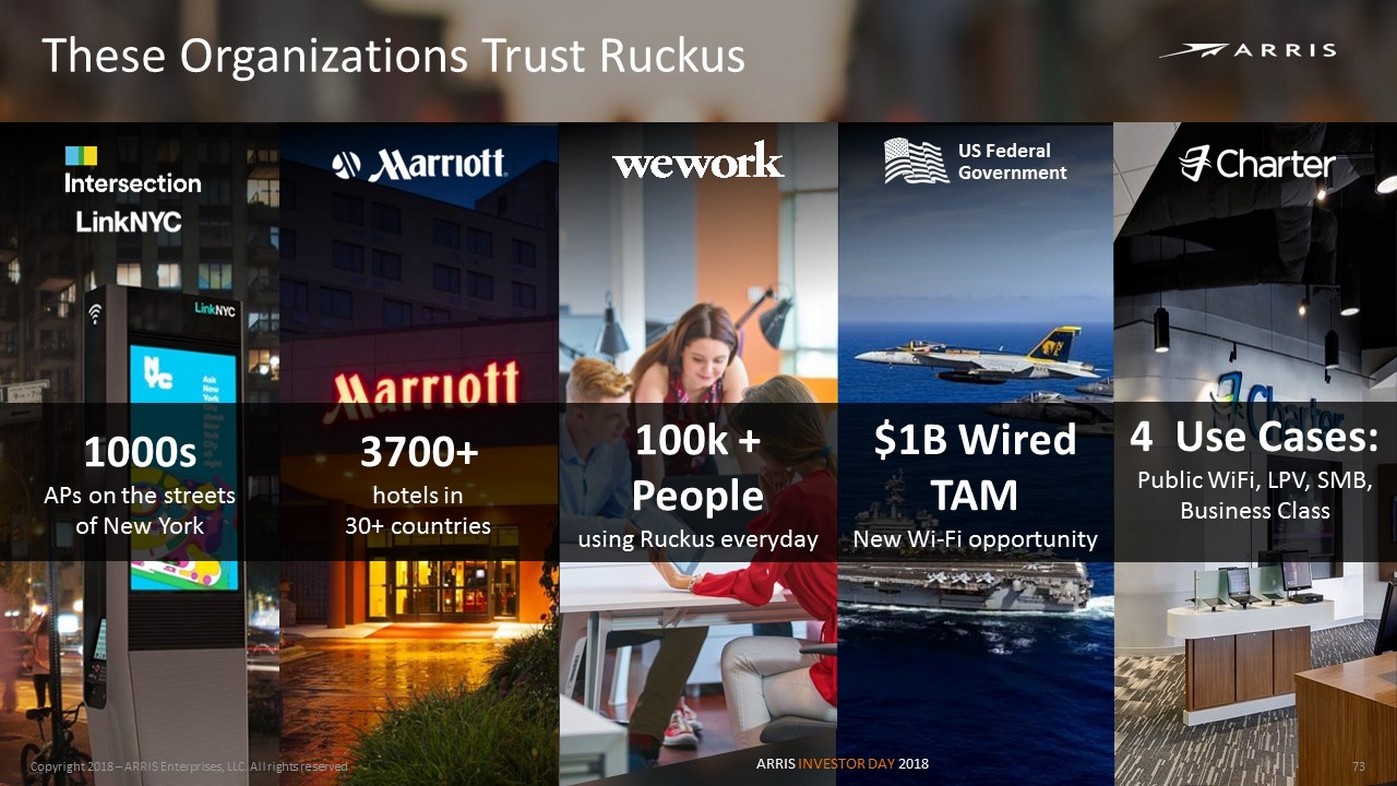

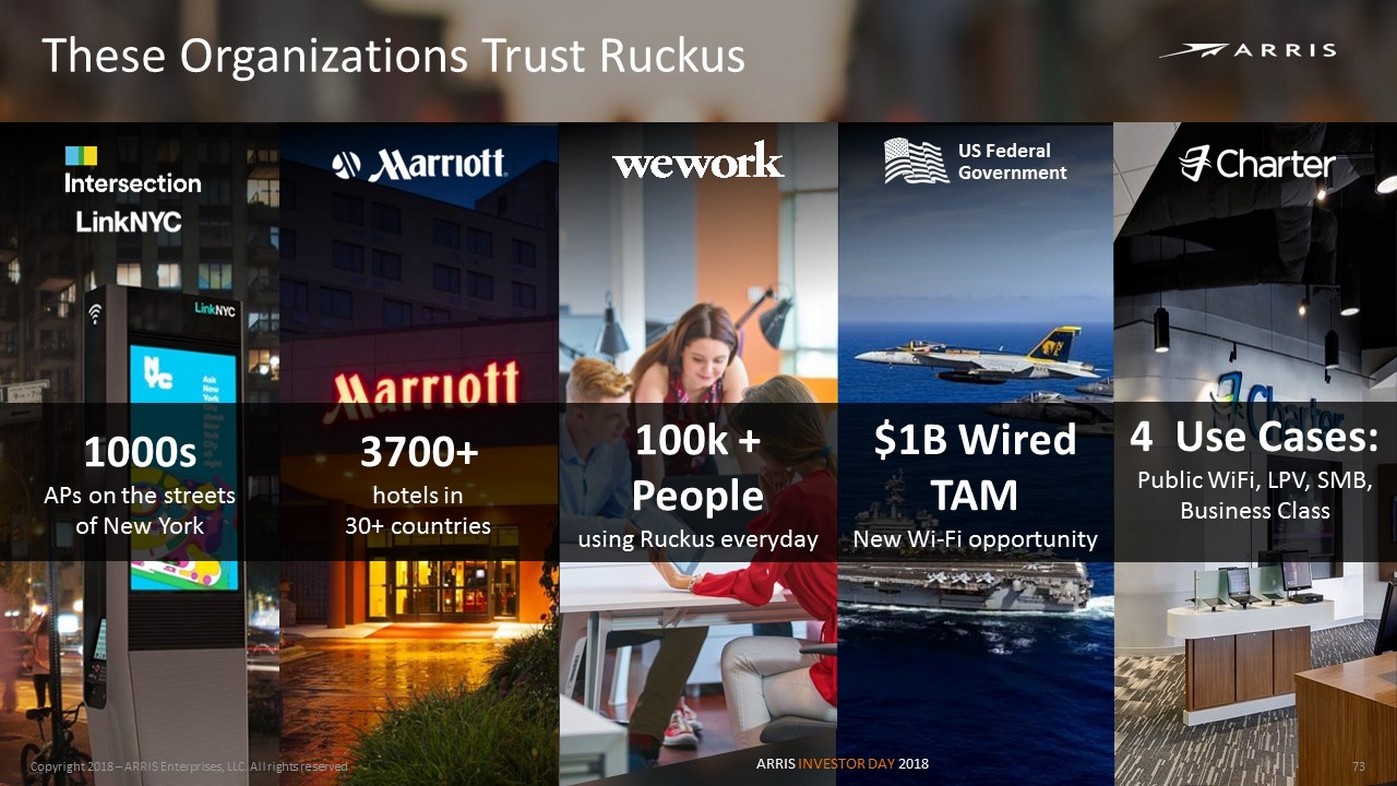

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved $1B Wired TAM New Wi - Fi opportunity US Federal Government These Organizations Trust Ruckus 3700+ hotels in 30+ countries 4 Use Cases: Public WiFi , LPV, SMB, Business Class 1000s APs on the streets of New York 100k + People using Ruckus everyday Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 73

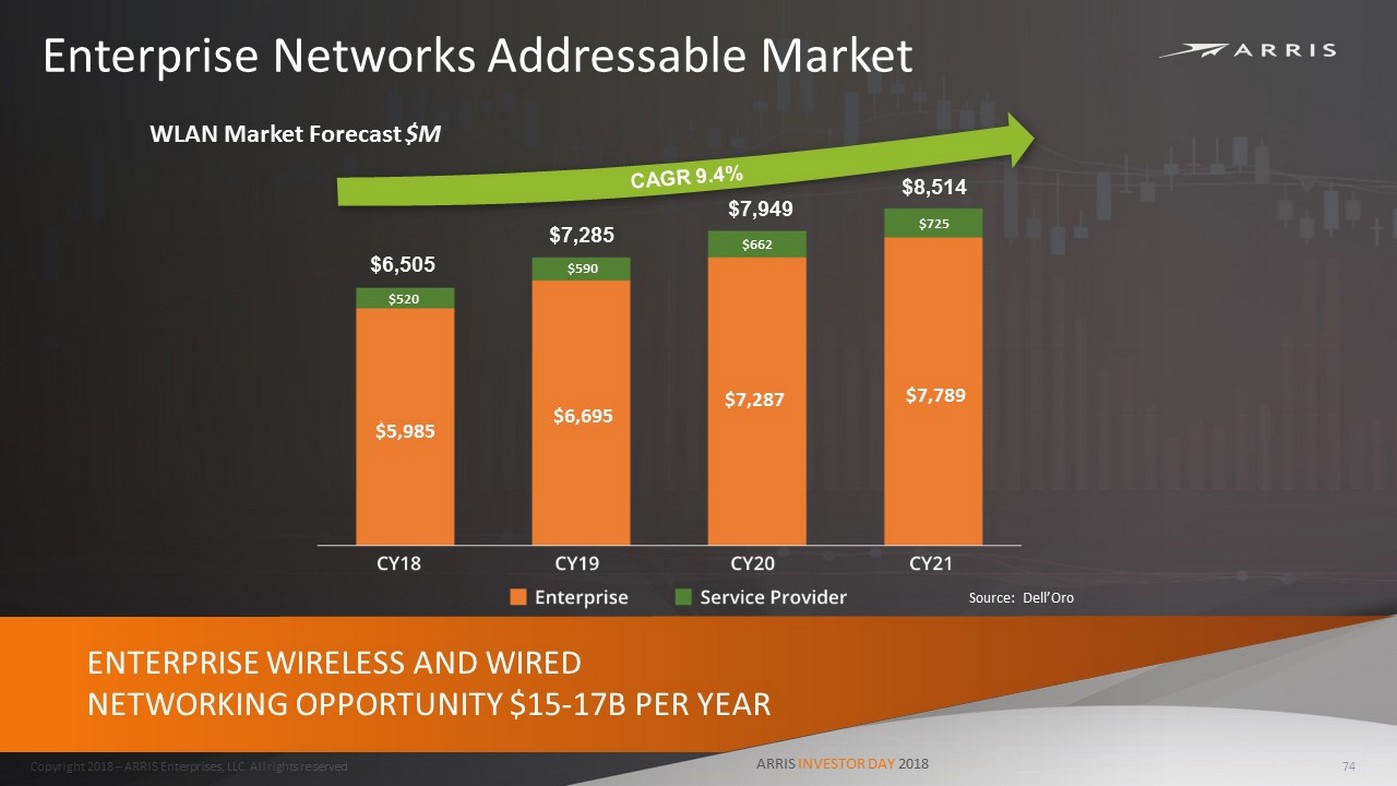

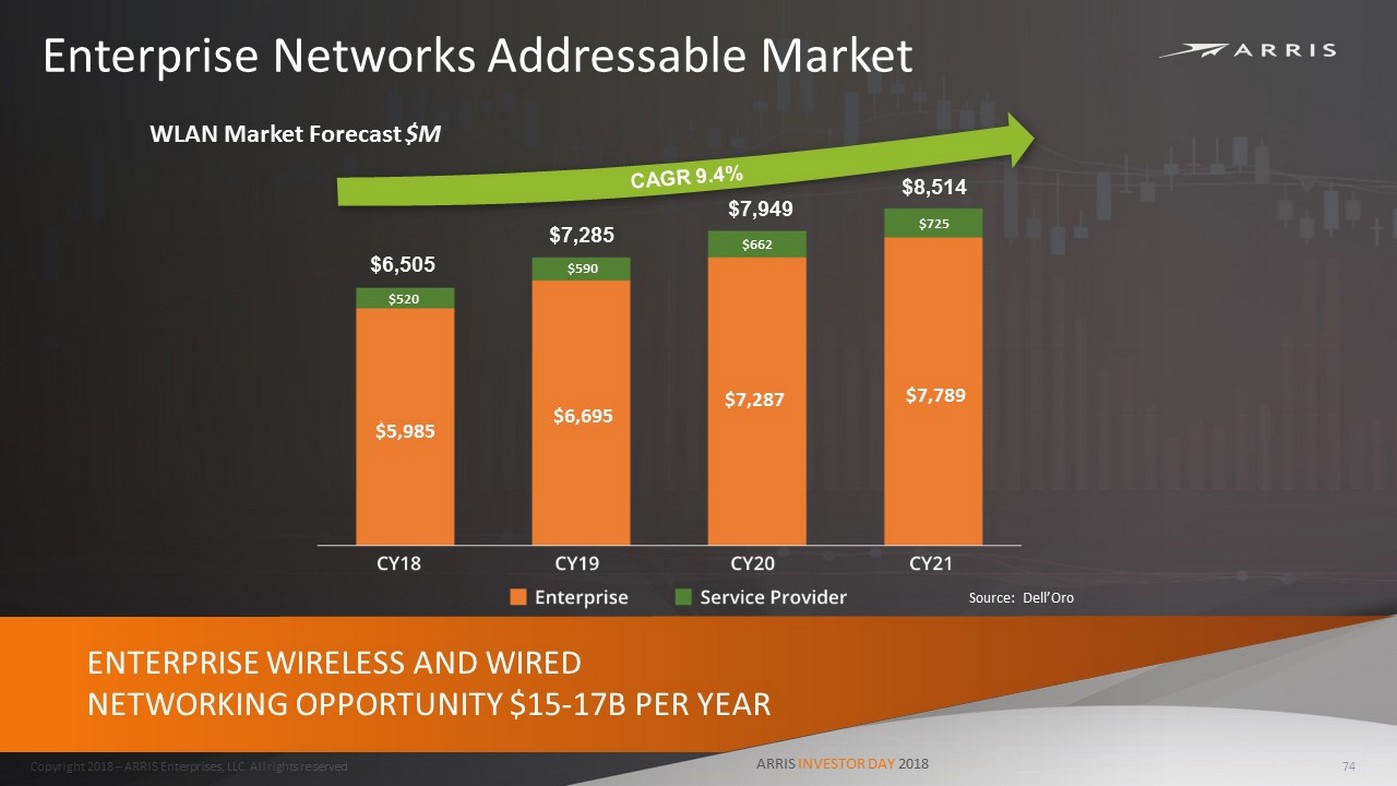

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Enterprise Networks Addressable Market ENTERPRISE WIRELESS AND WIRED NETWORKING OPPORTUNITY $15 - 17B PER YEAR WLAN Market Forecast $M Source: Dell’Oro $6,505 $7,285 $7,949 $8,514 $5,985 $6,695 $7,287 $7,789 $520 $590 $662 $725 ARRIS INVESTOR DAY 2018 74

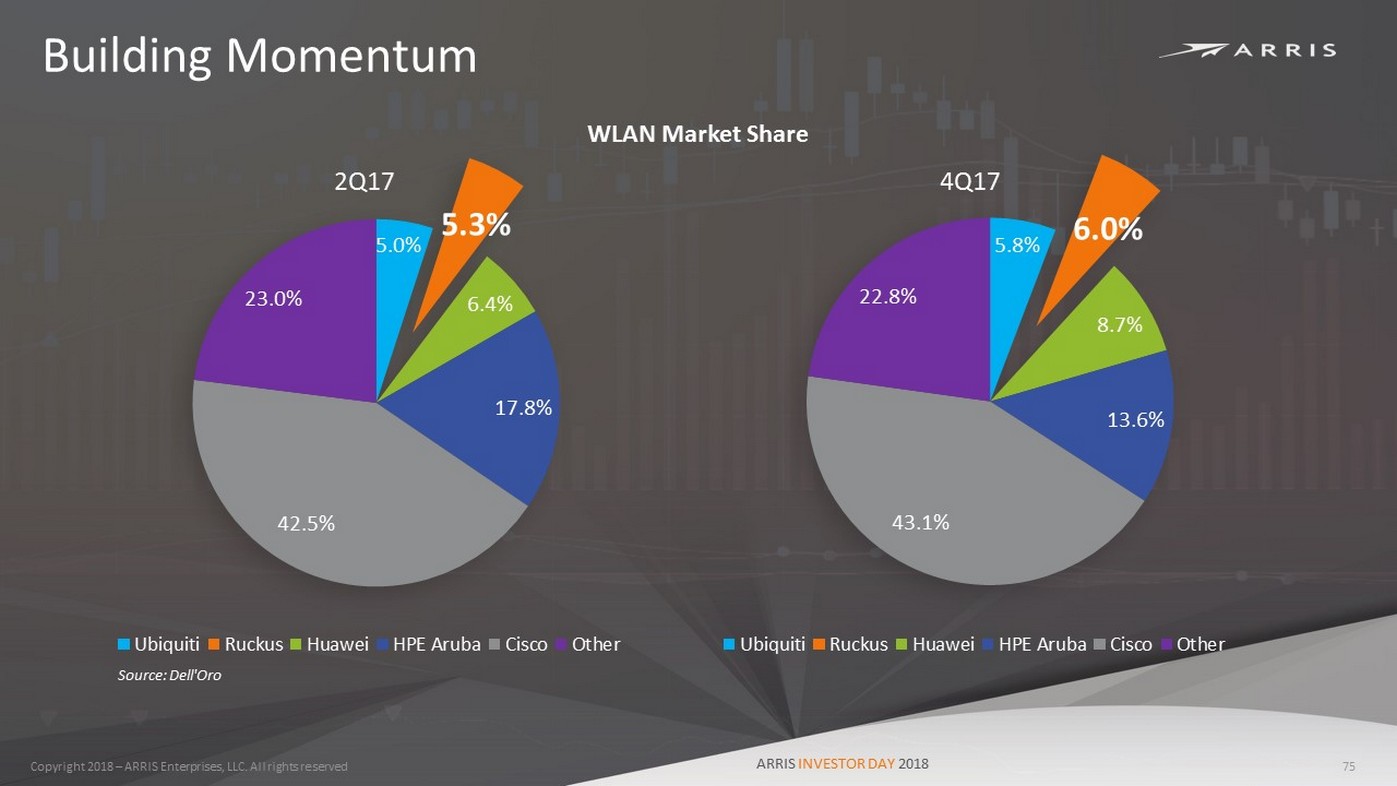

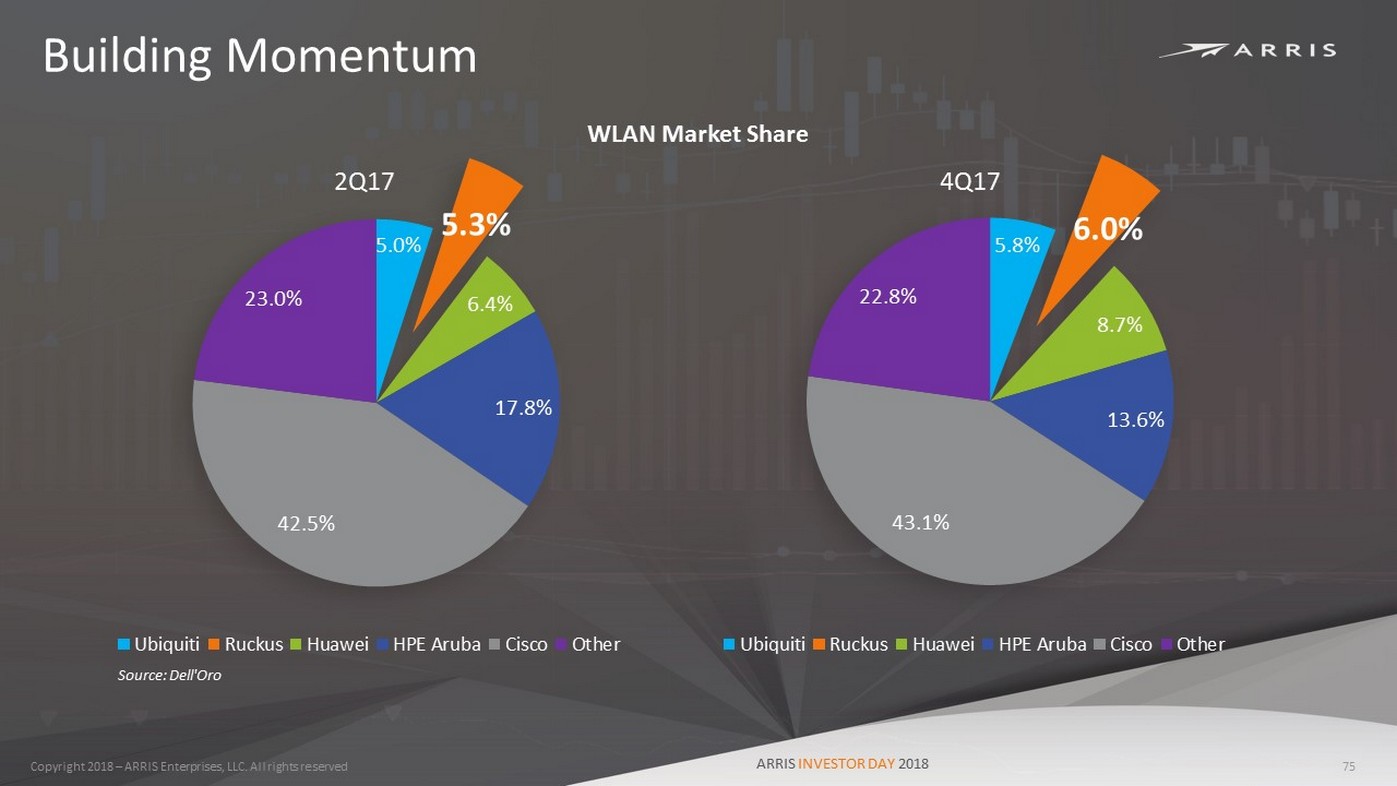

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Building Momentum 5.0% 5.3% 6.4% 17.8% 42.5% 23.0% 2Q17 Ubiquiti Ruckus Huawei HPE Aruba Cisco Other 5.8% 6.0% 8.7% 13.6% 43.1% 22.8% 4Q17 Ubiquiti Ruckus Huawei HPE Aruba Cisco Other WLAN Market Share ARRIS INVESTOR DAY 2018 75 Source: Dell'Oro

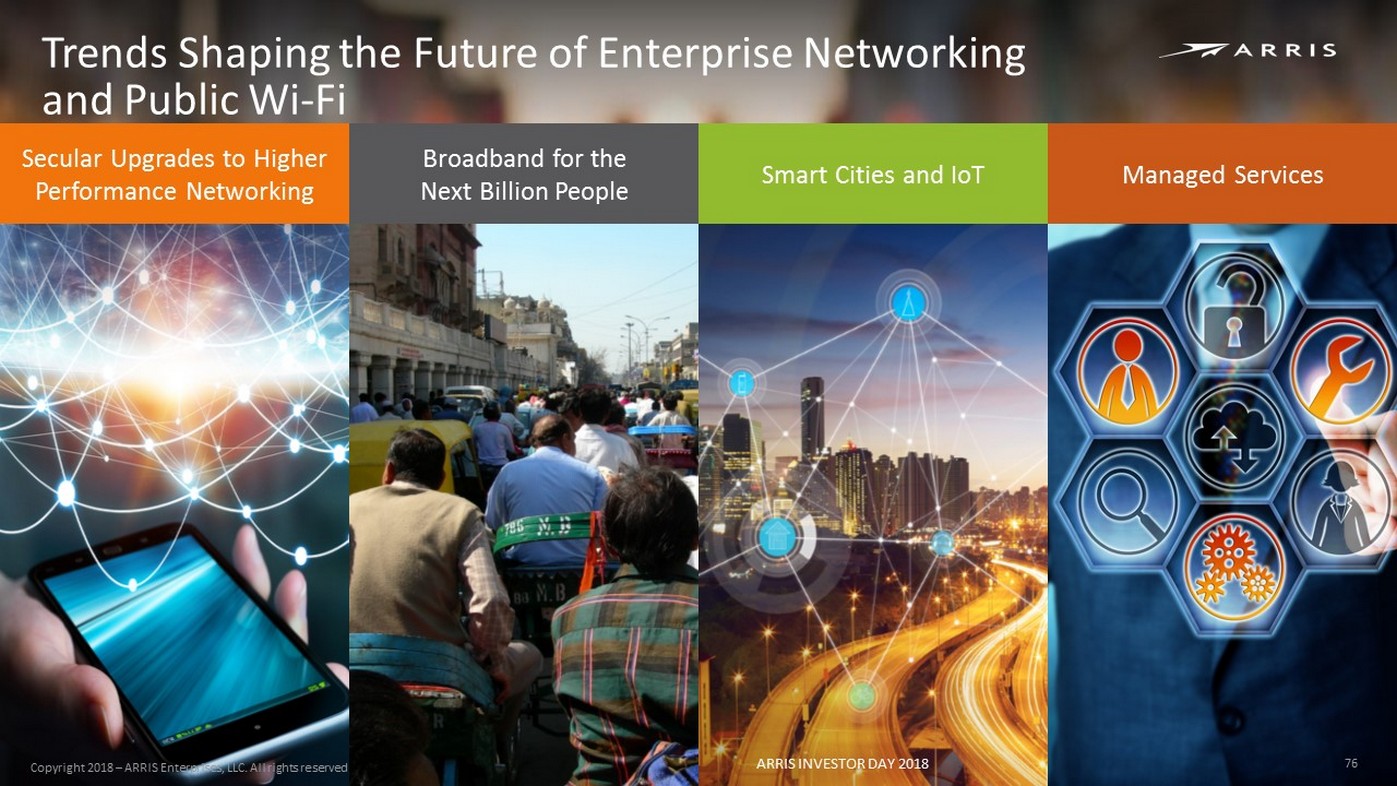

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Trends Shaping the Future of Enterprise Networking and Public Wi - Fi Secular Upgrades to Higher Performance Networking Broadband for the Next Billion People Smart Cities and IoT Managed Services 76 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018

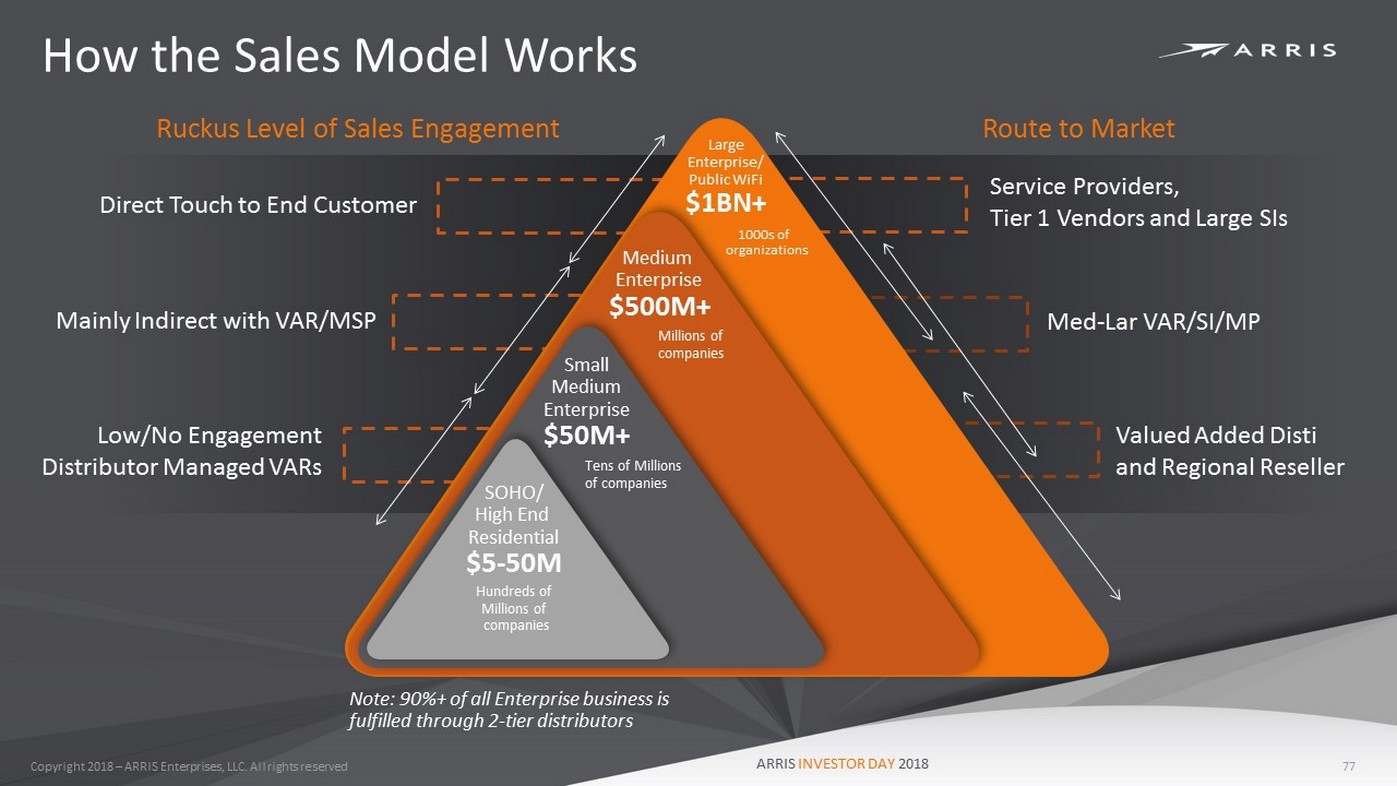

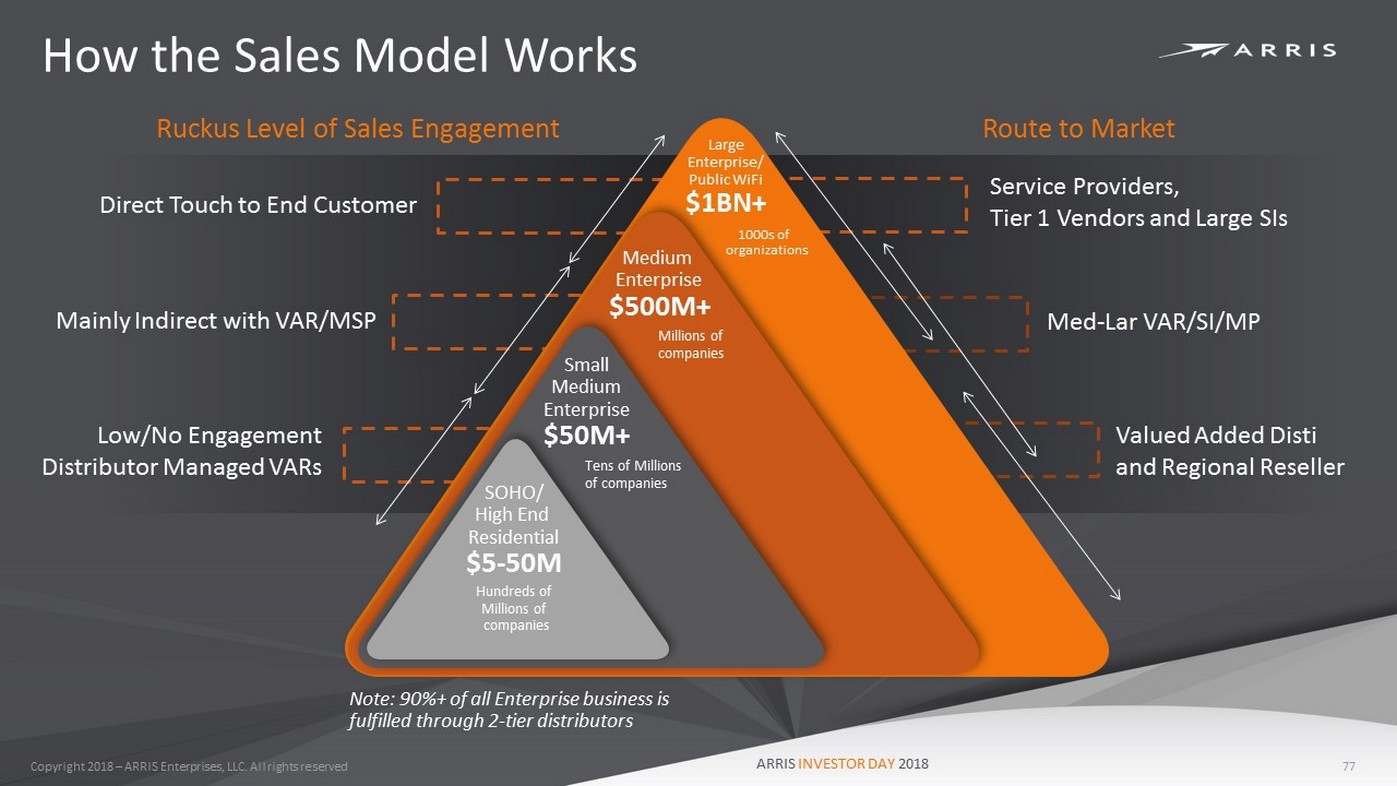

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved How the Sales Model Works Large Enterprise/ Public WiFi $1BN+ 1000s of organizations Medium Enterprise $500M+ Millions of companies Small Medium Enterprise $50M+ Tens of Millions of companies SOHO/ High End Residential $5 - 50M Hundreds of Millions of companies Direct Touch to End Customer Mainly Indirect with VAR/MSP Low/No Engagement Distributor Managed VARs Ruckus Level of Sales Engagement Service Providers, Tier 1 Vendors and Large SIs Med - Lar VAR/SI/MP Valued Added Disti and Regional Reseller Route to Market Note: 90%+ of all Enterprise business is fulfilled through 2 - tier distributors ARRIS INVESTOR DAY 2018 77

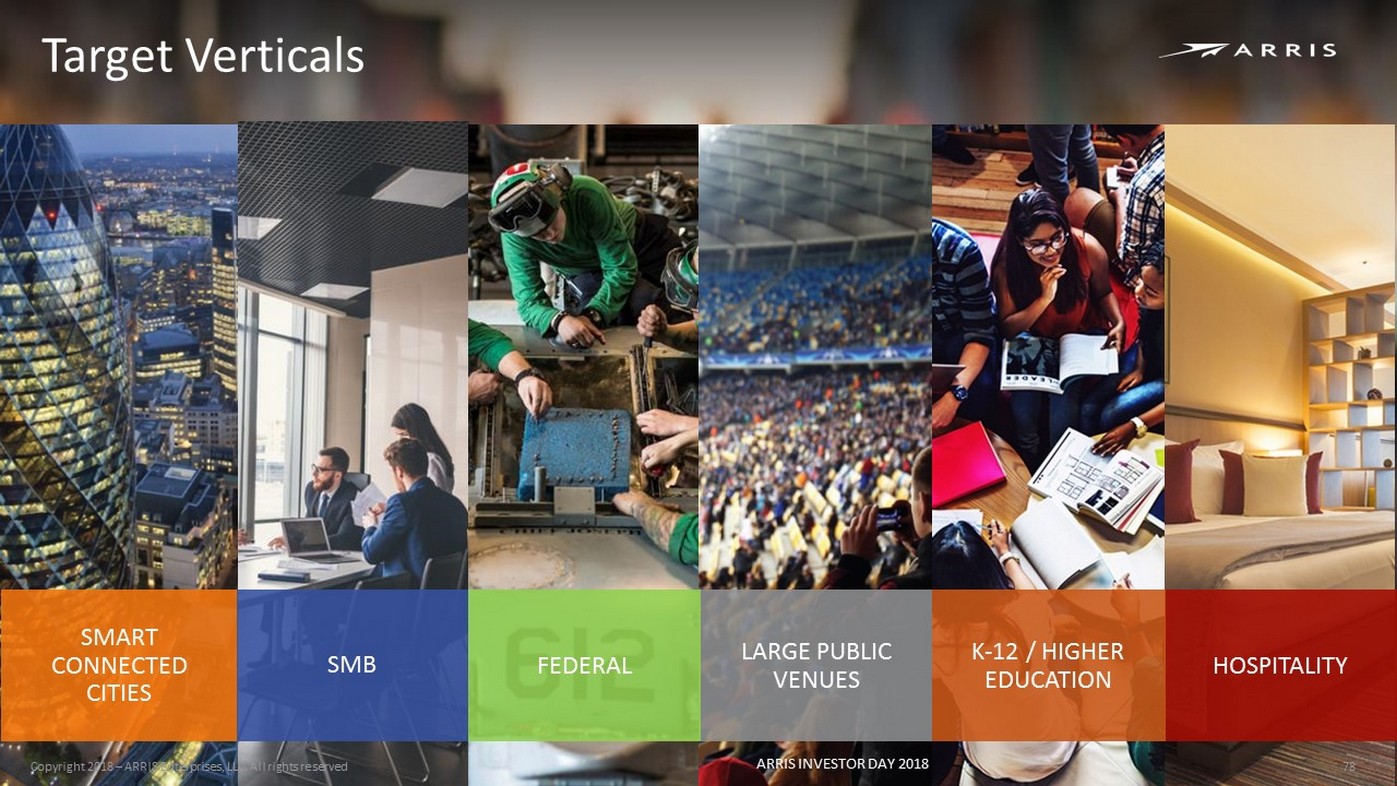

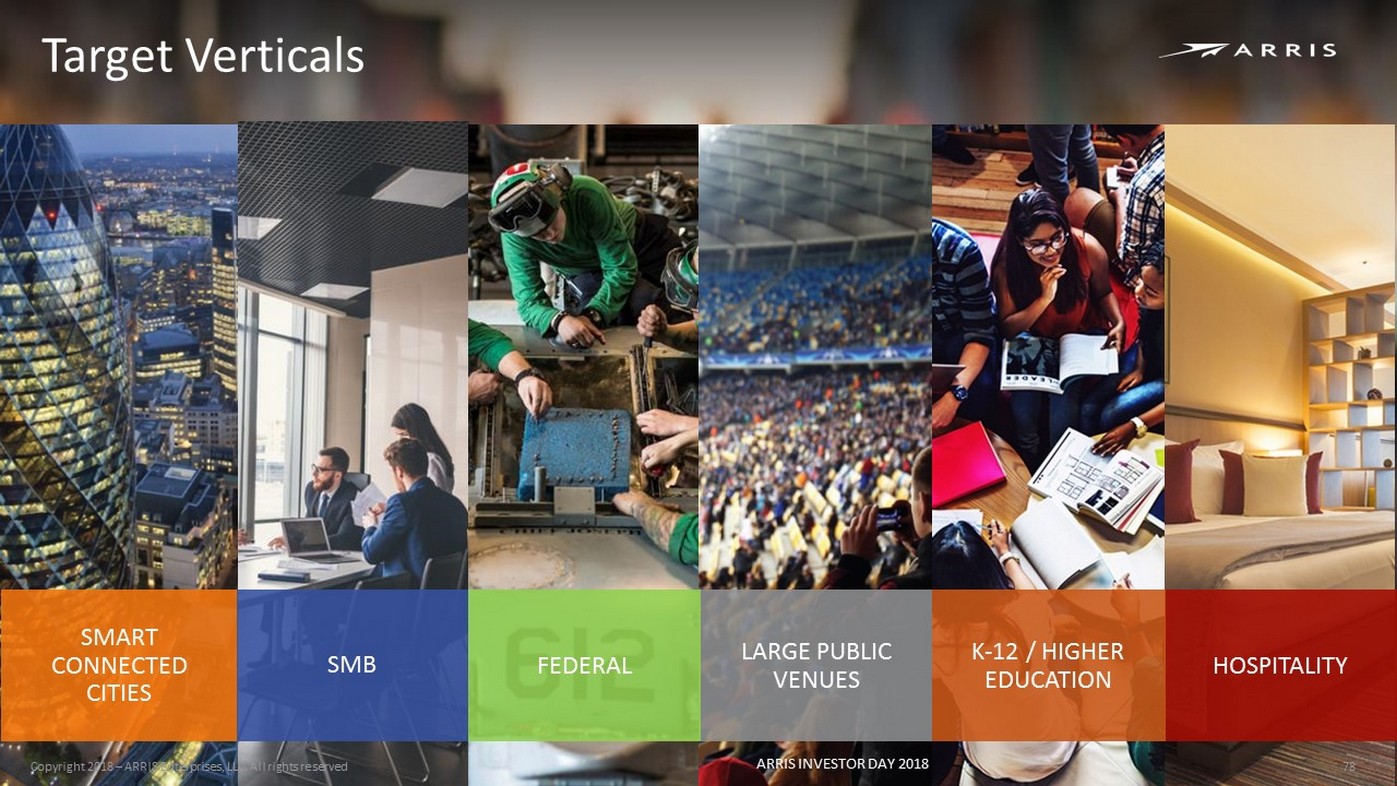

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Target Verticals 78 SMART CONNECTED CITIES LARGE PUBLIC VENUES SMB FEDERAL HOSPITALITY K - 12 / HIGHER EDUCATION Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 78

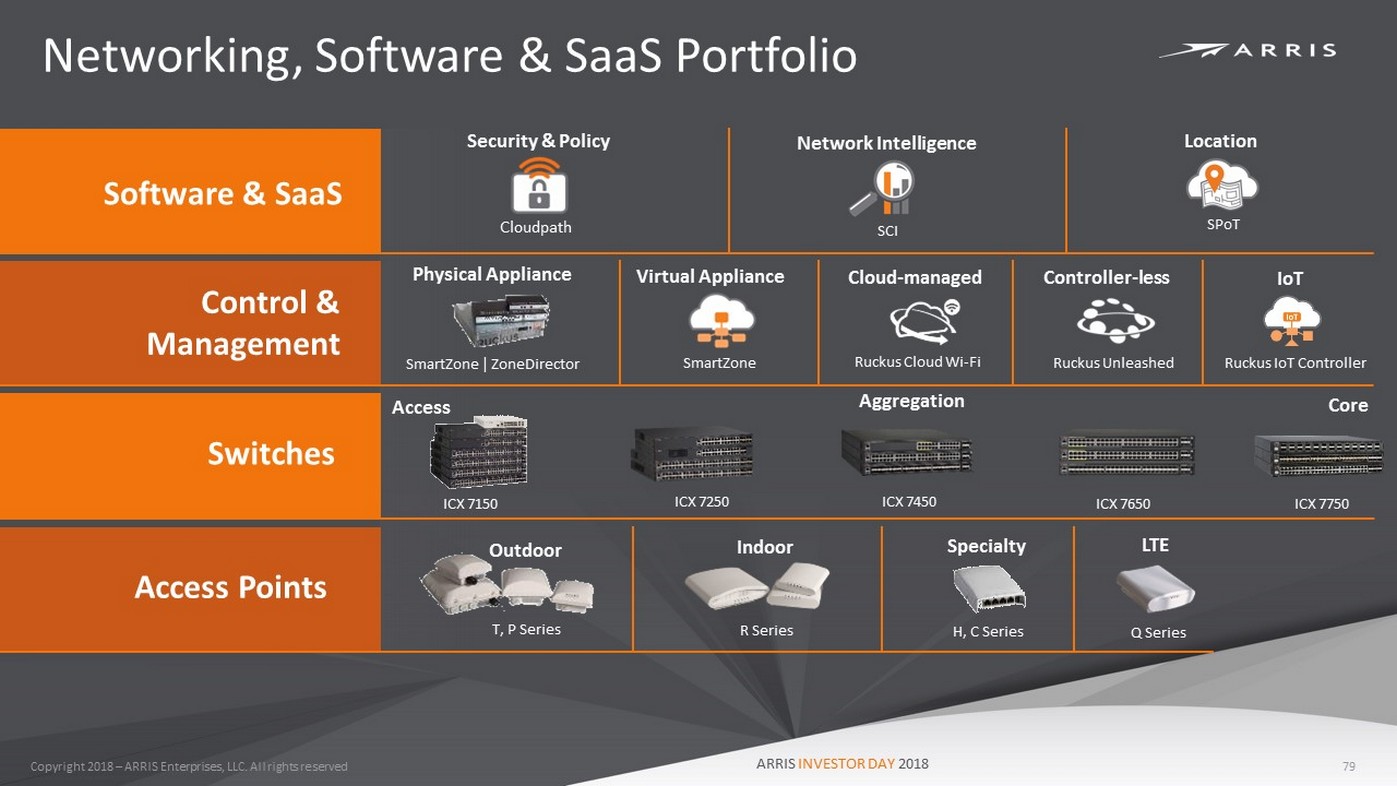

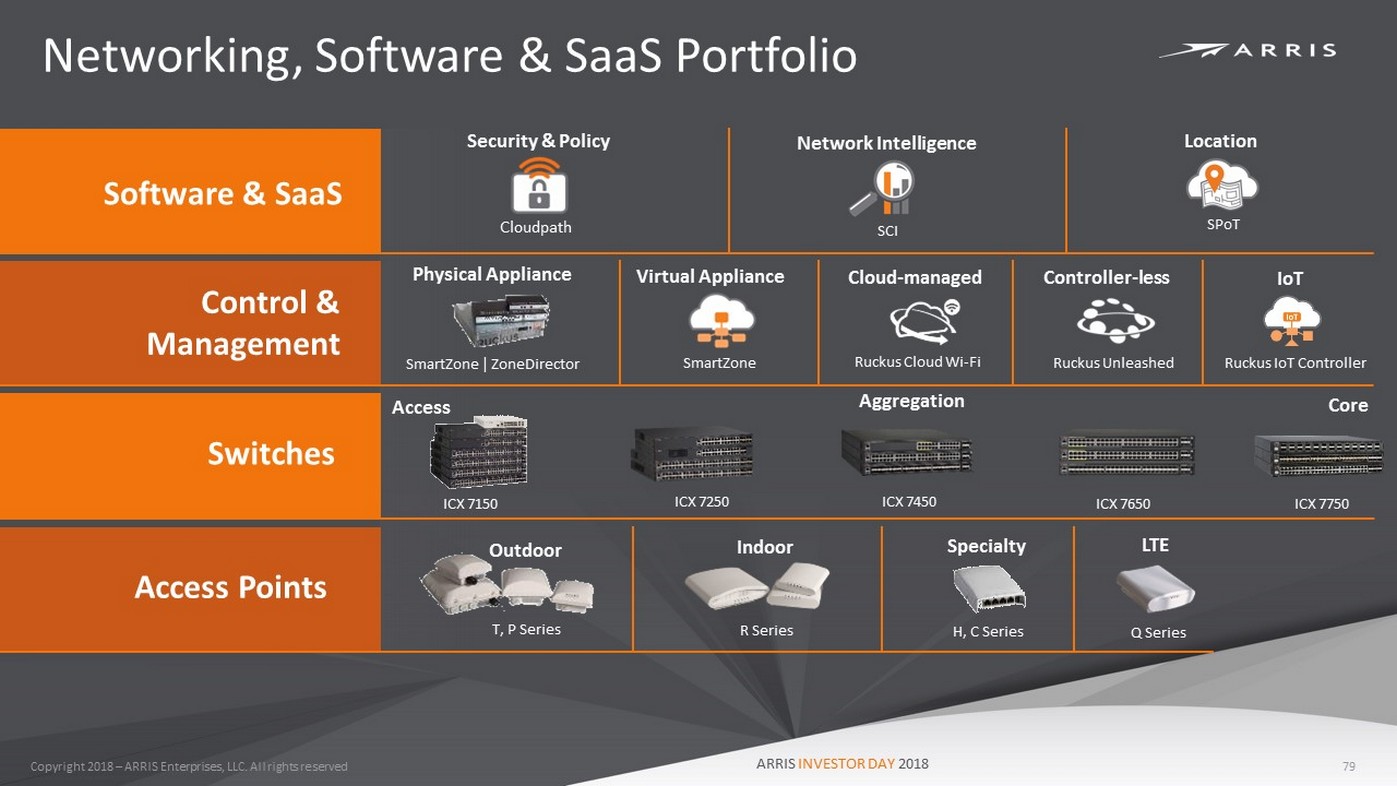

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Software & SaaS Control & Management Switches Access Points Location SPoT Network Intelligence SCI Security & Policy Cloudpath Physical Appliance SmartZone | ZoneDirector Virtual Appliance SmartZone Controller - less Ruckus Unleashed Ruckus Cloud Wi - Fi Cloud - managed IoT Ruckus IoT Controller Aggregation Access ICX 7150 ICX 7250 ICX 7450 ICX 7750 Core ICX 7650 Outdoor T, P Series Indoor R Series Specialty H, C Series LTE Q Series Networking, Software & SaaS Portfolio ARRIS INVESTOR DAY 2018 79

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved 2018 Focus Areas Ruckus Cloud Dell OEM and Strategic Partnerships Commercialization of OpenG Expansion of our Federal Government Mission Vertical Market Expansion into MDU and Retail Network Intelligence and IoT ARRIS INVESTOR DAY 2018 80

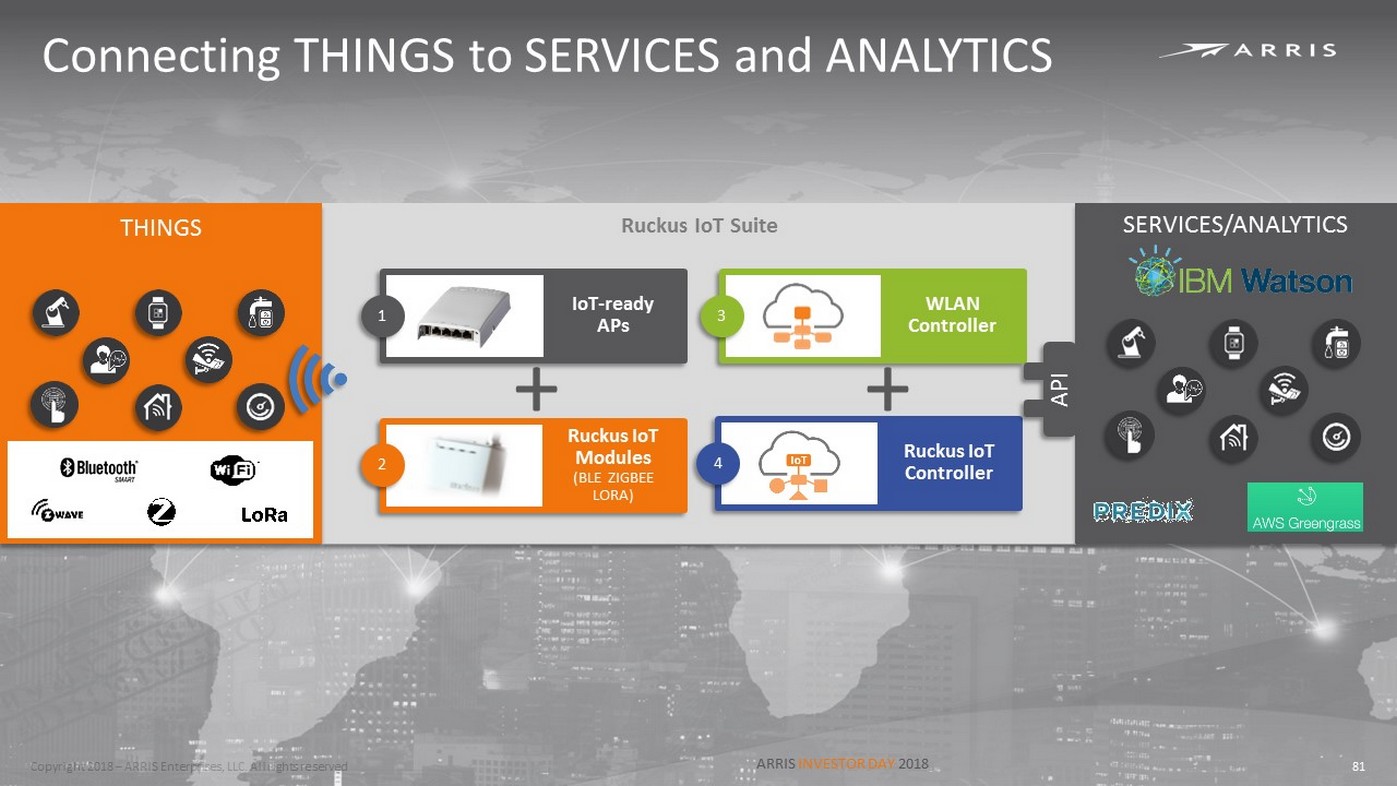

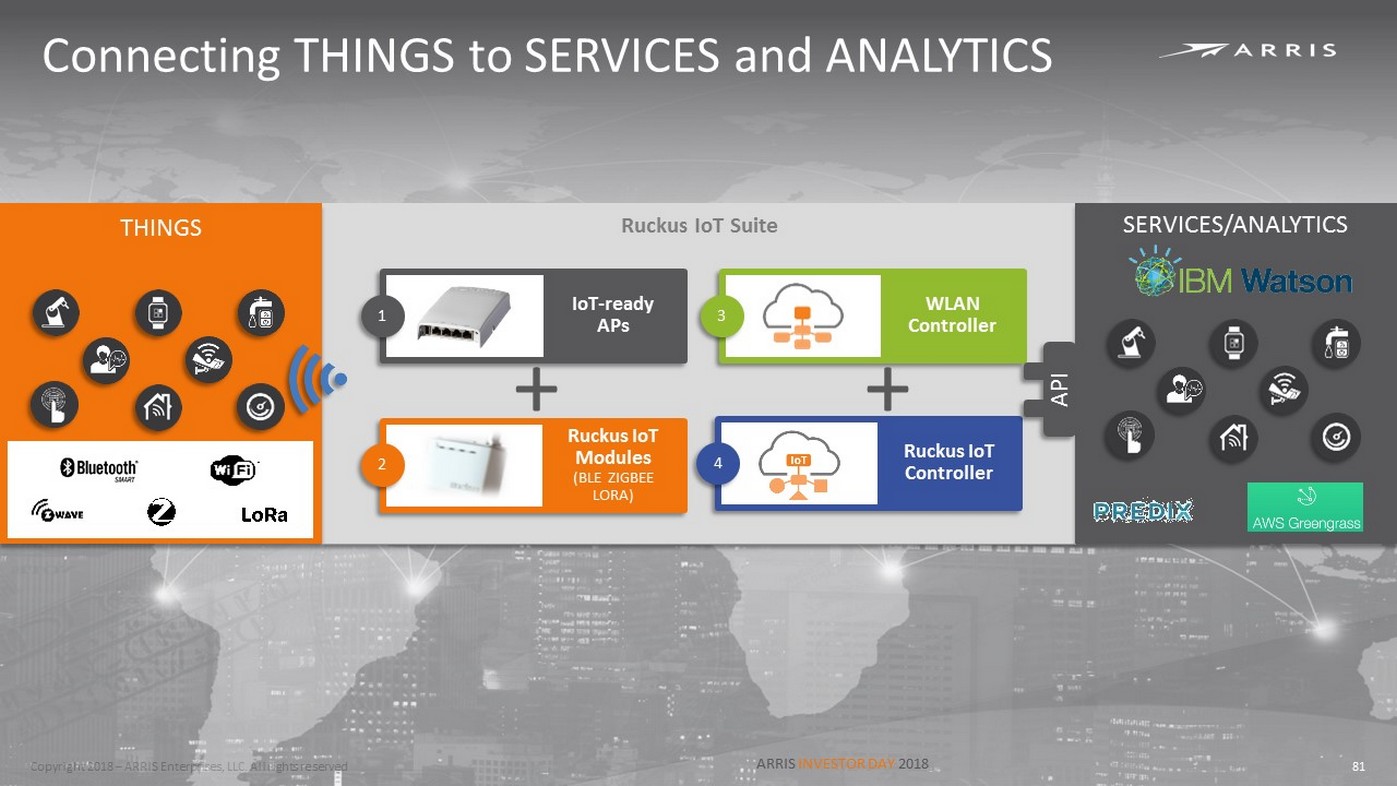

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Device specific network Ruckus IoT Suite + 2 Ruckus IoT Modules (BLE ZIGBEE LORA) 1 IoT - ready APs 3 WLAN Controller 4 Ruckus IoT Controller + THINGS Connecting THINGS to SERVICES and ANALYTICS SERVICES/ANALYTICS API ARRIS INVESTOR DAY 2018 ARRIS INVESTOR DAY 2018 81

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 82

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Technology Talk - CBRS Steve Martin ARRIS INVESTOR DAY 2018

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved 84 Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018 84

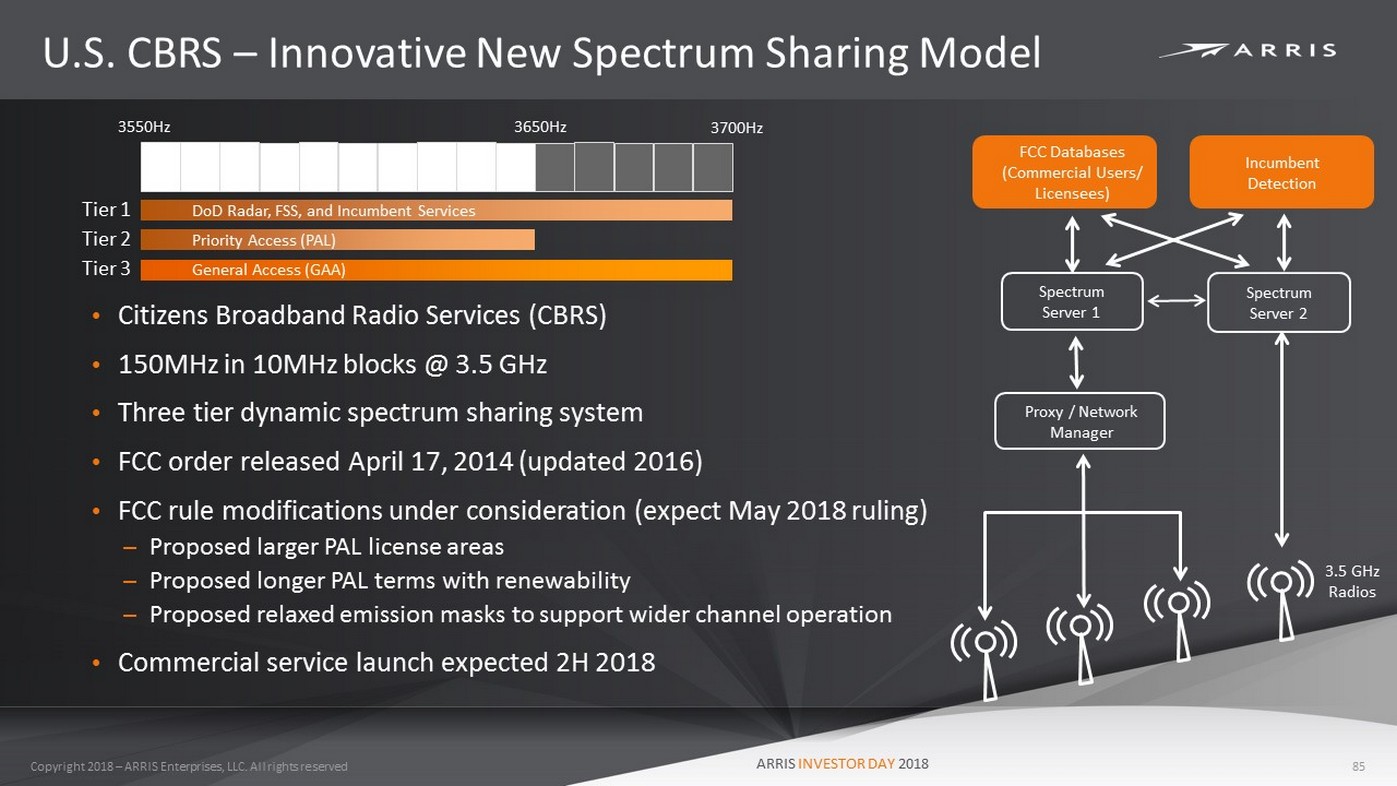

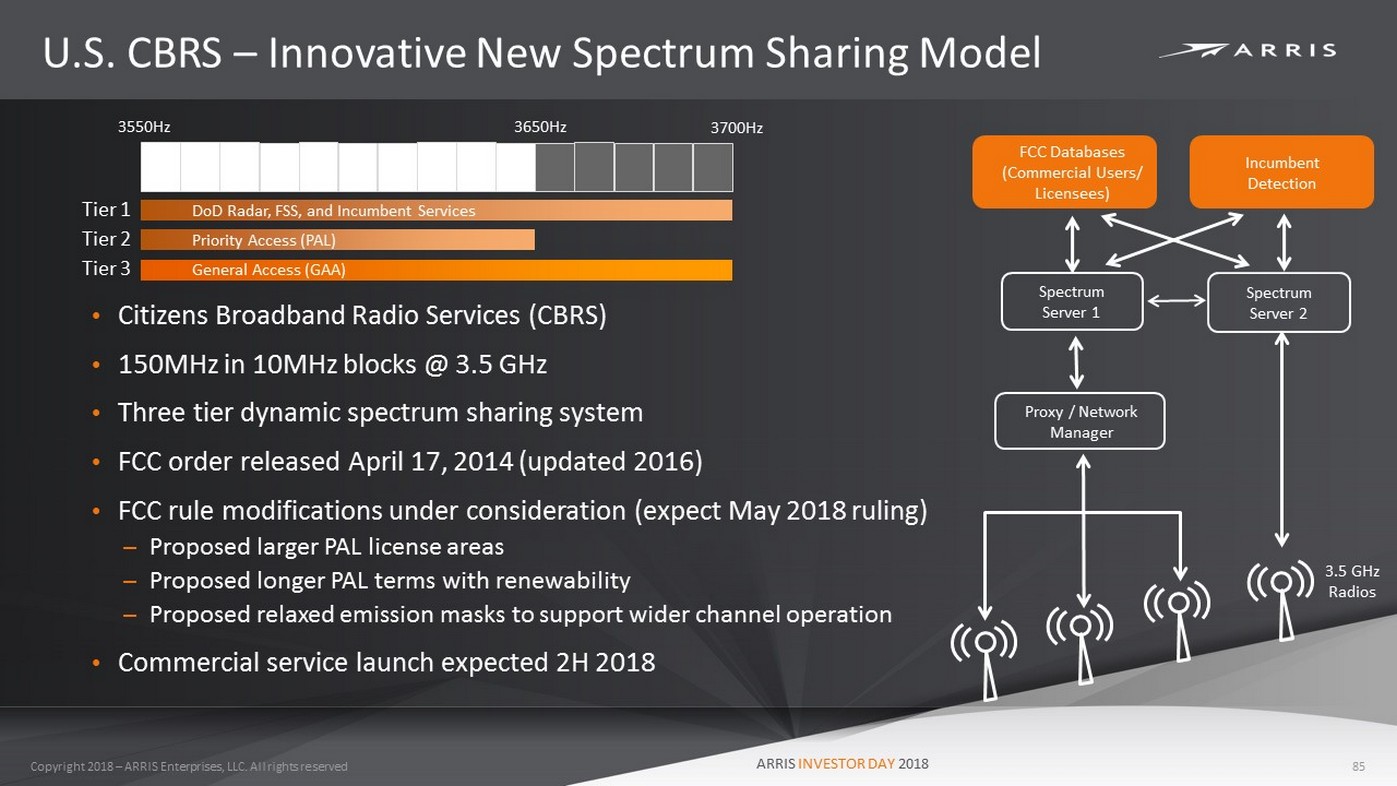

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved U.S. CBRS – Innovative New Spectrum Sharing Model 85 3550Hz 3650Hz 3700Hz Tier 1 Tier 2 Tier 3 DoD Radar, FSS, and Incumbent Services Priority Access (PAL) General Access (GAA) • Citizens Broadband Radio Services (CBRS) • 150MHz in 10MHz blocks @ 3.5 GHz • Three tier dynamic spectrum sharing system • FCC order released April 17, 2014 (updated 2016) • FCC rule modifications under consideration (expect May 2018 ruling) – Proposed larger PAL license areas – Proposed longer PAL terms with renewability – Proposed relaxed emission masks to support wider channel operation • Commercial service launch expected 2H 2018 Spectrum Server 2 Incumbent Detection Proxy / Network Manager FCC Databases (Commercial Users/ Licensees) Spectrum Server 1 3.5 GHz Radios ARRIS INVESTOR DAY 2018

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved CBRS Alliance Overview 86 Mission & Purpose Support the development, commercialization, and adoption of LTE solutions for the US 3.5 GHz Citizens Broadband Radio Service (CBRS) – Evangelize CBRS technology and applications – Drive necessary technology requirements (Coexistence, Radio, E2E Services) – Establish certifications to ensure vendor interoperability … 85 MEMBERS AFTER JUST 18 MONTHS! ARRIS INVESTOR DAY 2018

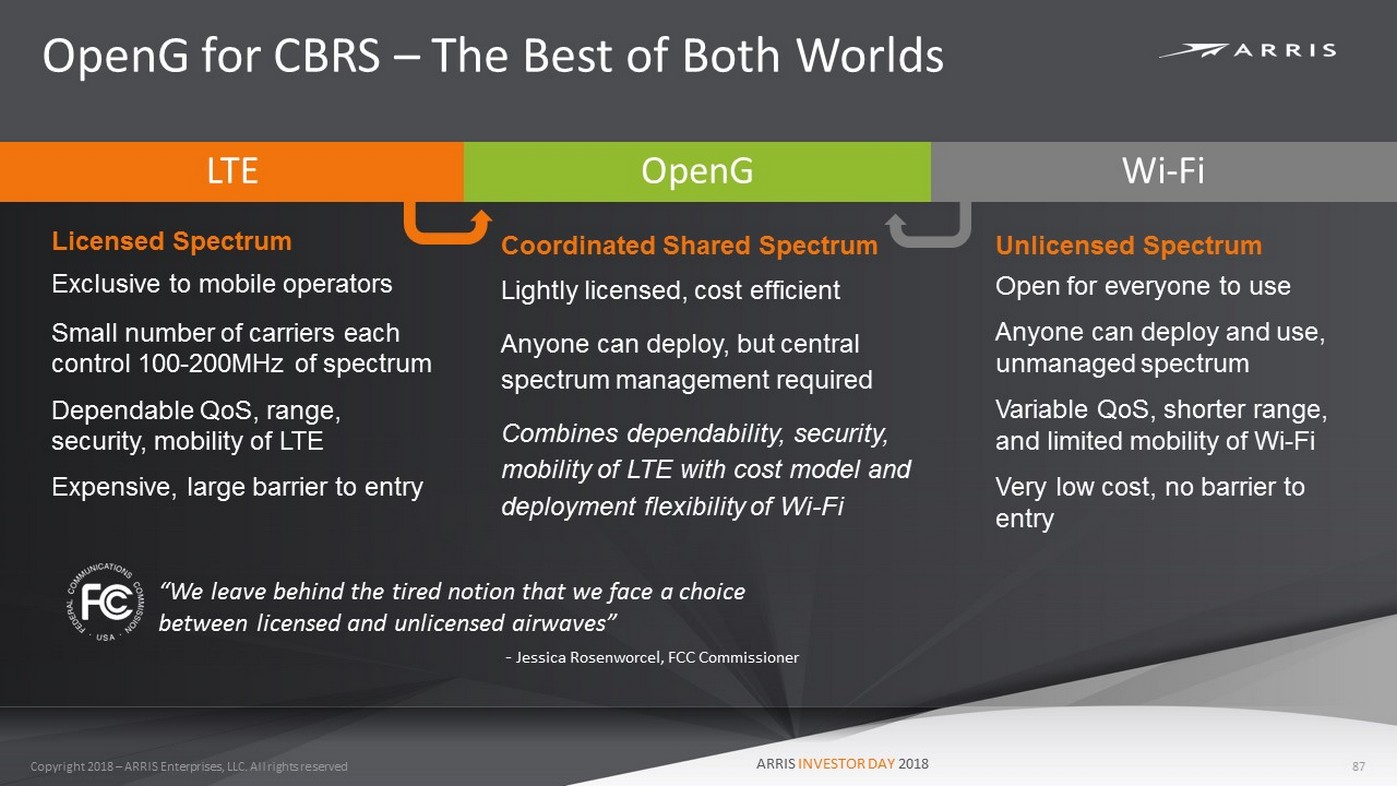

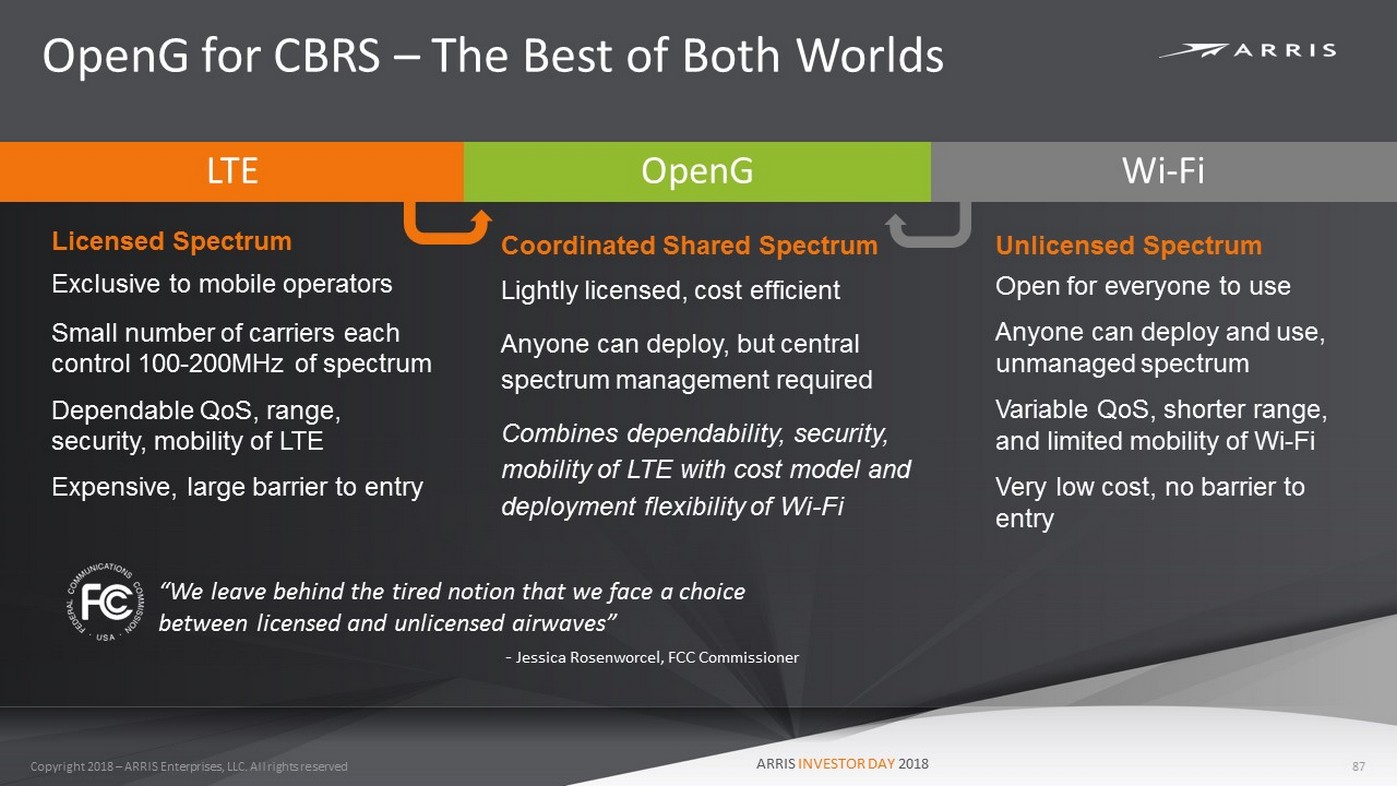

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved OpenG for CBRS – The B est of Both Worlds 87 Licensed Spectrum Exclusive to mobile operators Small number of carriers each control 100 - 200MHz of spectrum Dependable QoS , range, security, mobility of LTE Expensive, large barrier to entry LTE OpenG Wi - Fi Coordinated Shared Spectrum Lightly licensed, cost efficient Anyone can deploy, but central spectrum management required C ombines d ependability , security, m obility of LTE with cost model and deployment flexibility of Wi - Fi Unlicensed Spectrum Open for everyone to use Anyone can deploy and use, unmanaged spectrum V ariable QoS , shorter range, and limited mobility o f Wi - Fi Very low cost, no barrier to entry “We leave behind the tired notion that we face a choice between licensed and unlicensed airwaves” - Jessica Rosenworcel , FCC Commissioner ARRIS INVESTOR DAY 2018

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Disrupting Mobile Infrastructure with OpenG 88 Mobile Capacity Augmentation Alternative Mobile Footprint Private LTE Fixed Wireless Access Enterprise Neutral Host Low cost capacity boost to mobile networks No cost MVNO within wired footprint Residential, Enterprise and Outdoor Strand Financial, Transportation, Government, Oil & Gas, Manufacturing, Shipping, Healthcare Broadband Access Rural Connectivity Lower cost and complexity versus Distributed Antenna Systems (DAS) or MNO - specific small cells Telco/WISP MNO MSO Enterprise/MSP ARRIS INVESTOR DAY 2018

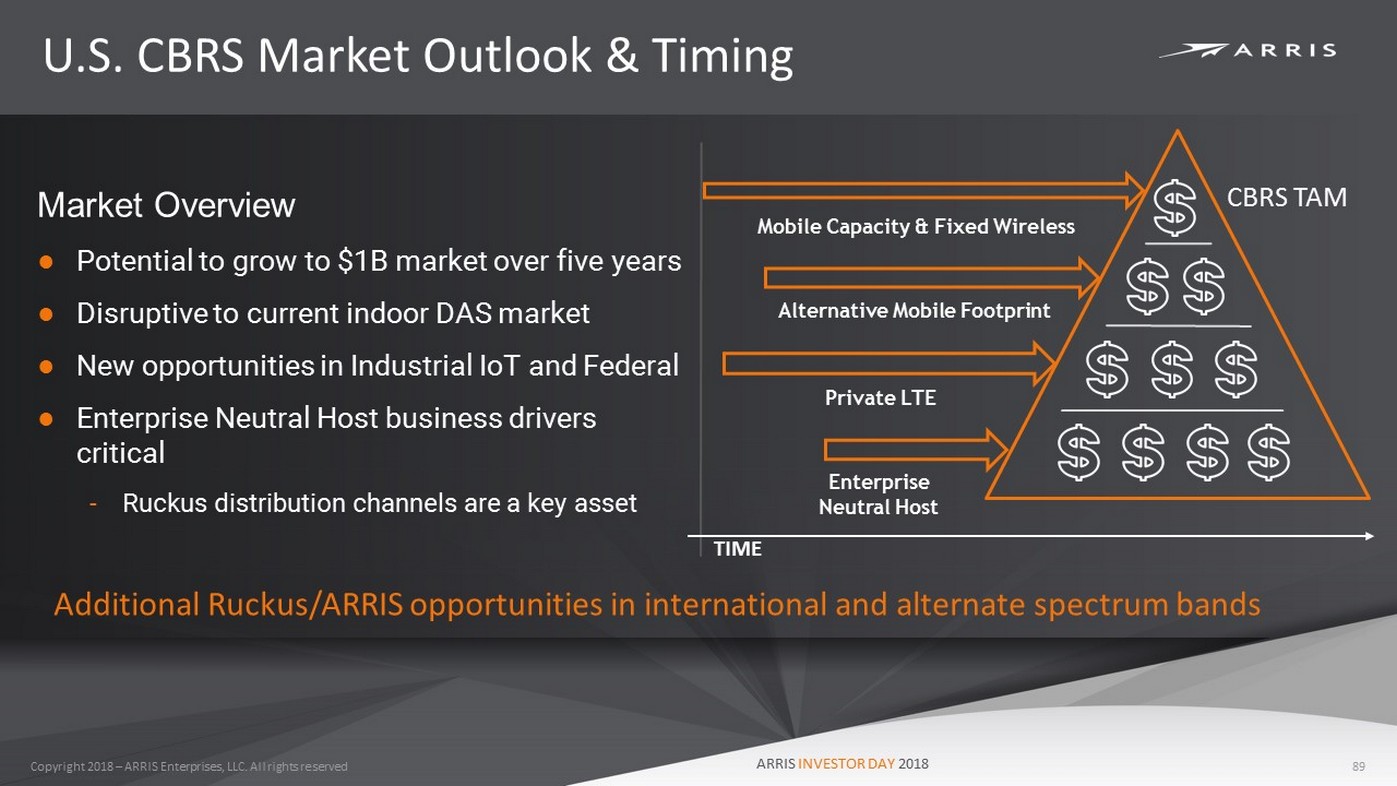

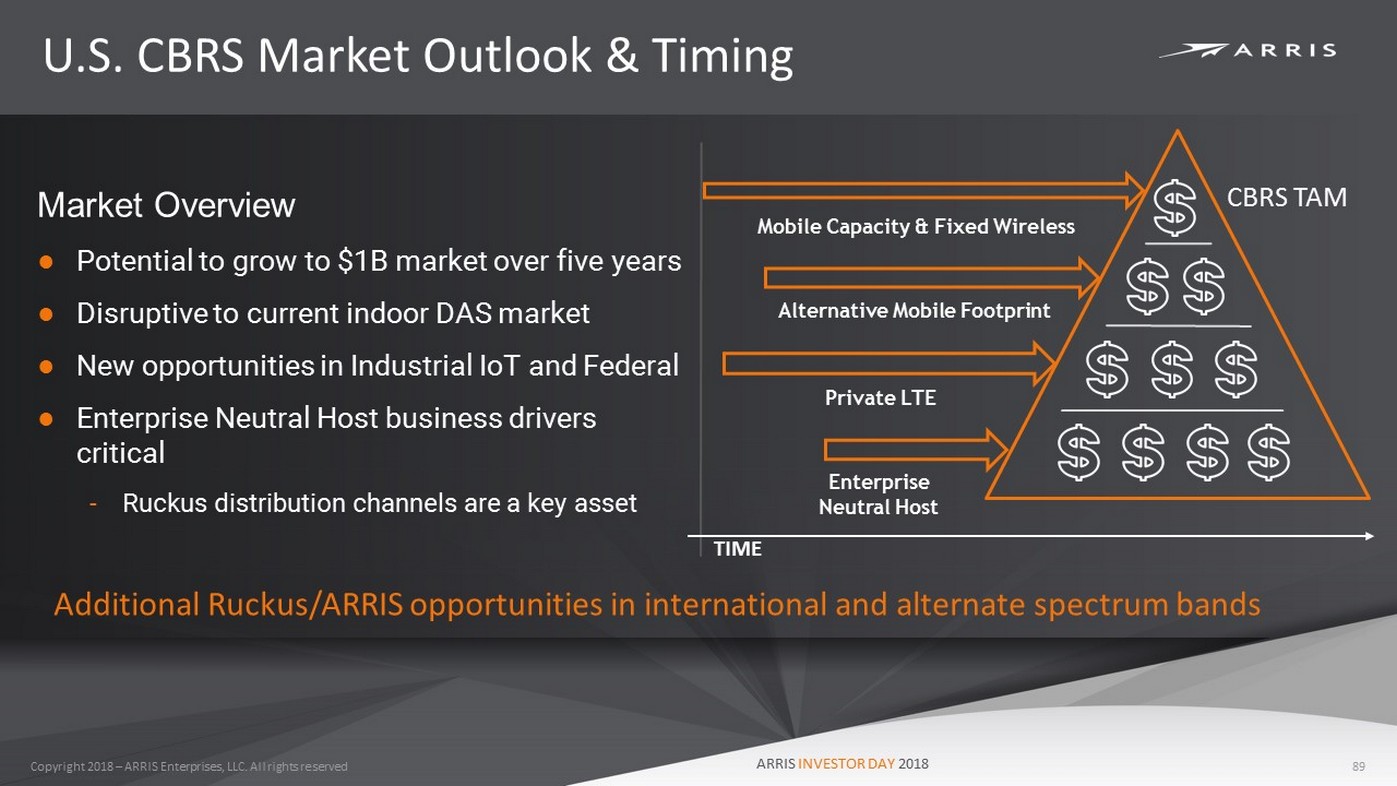

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved U.S. CBRS Market Outlook & Timing 89 Market Overview ● Potential to grow to $1B market over five years ● Disruptive to current indoor DAS market ● New opportunities in Industrial IoT and Federal ● Enterprise Neutral Host business drivers critical - Ruckus distribution channels are a key asset CBRS TAM Mobile Capacity & Fixed Wireless Alternative Mobile Footprint Enterprise Neutral Host Private LTE Additional Ruckus/ARRIS opportunities in international and alternate spectrum bands TIME ARRIS INVESTOR DAY 2018

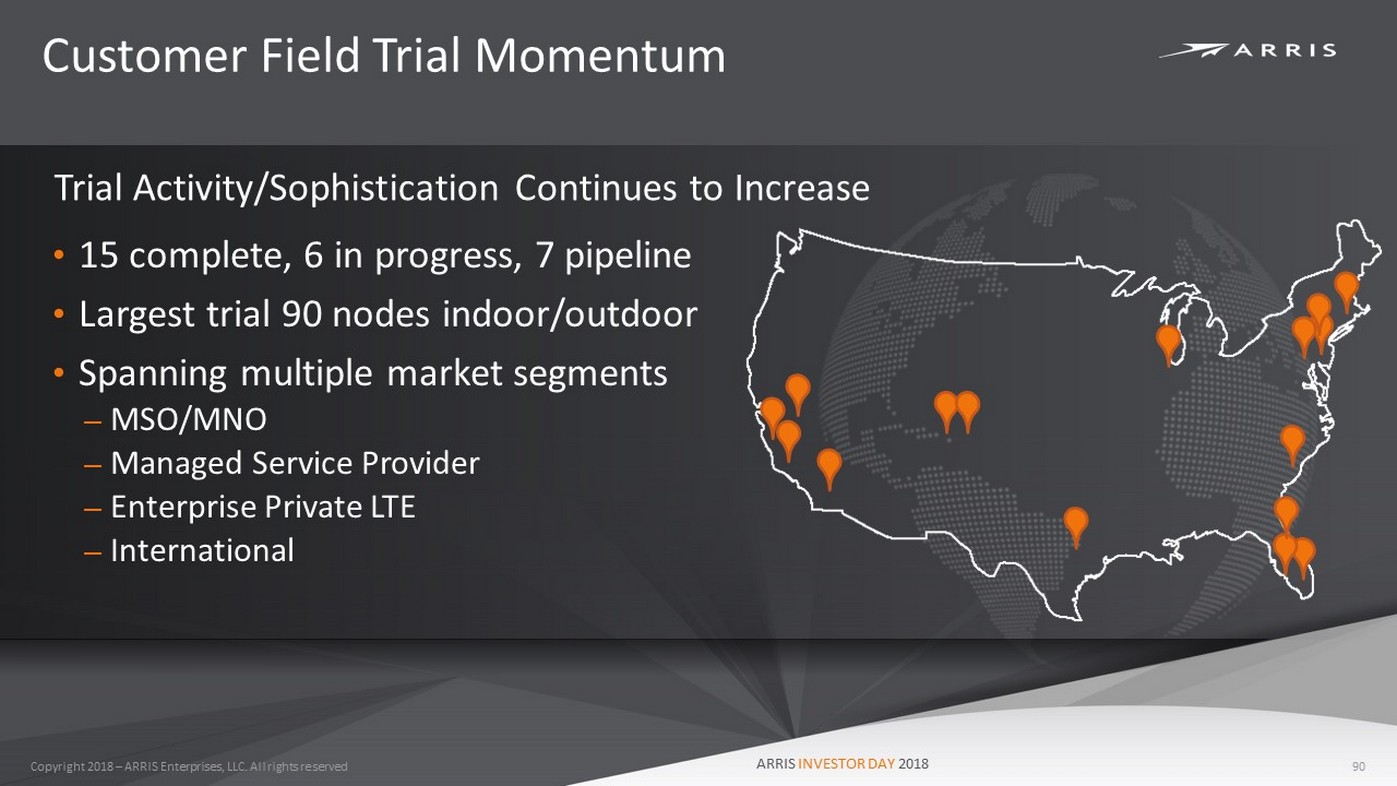

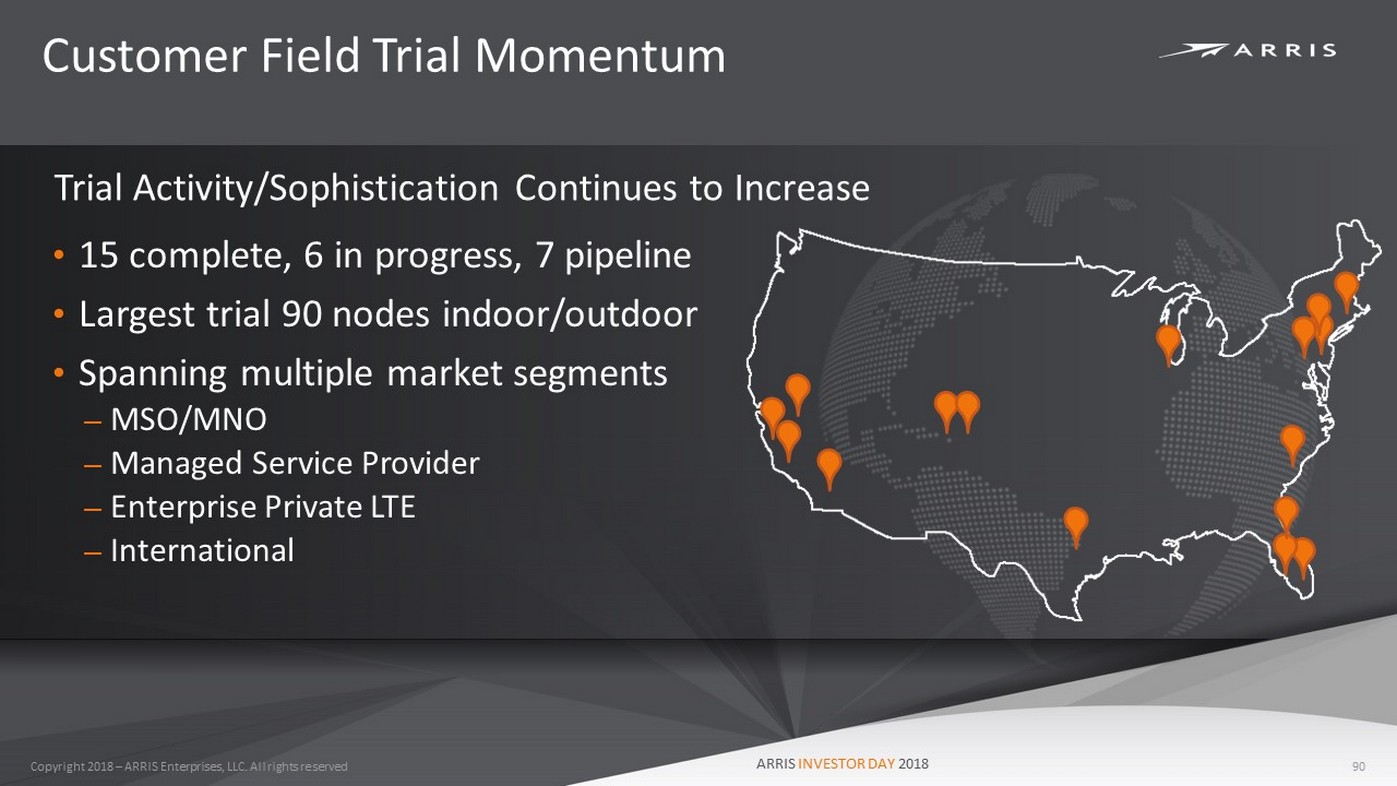

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Customer Field Trial Momentum • 15 complete, 6 in progress, 7 pipeline • Largest trial 90 nodes indoor/outdoor • Spanning multiple market segments – MSO/MNO – Managed Service Provider – Enterprise Private LTE – International Trial Activity/Sophistication Continues to Increase ARRIS INVESTOR DAY 2018 90

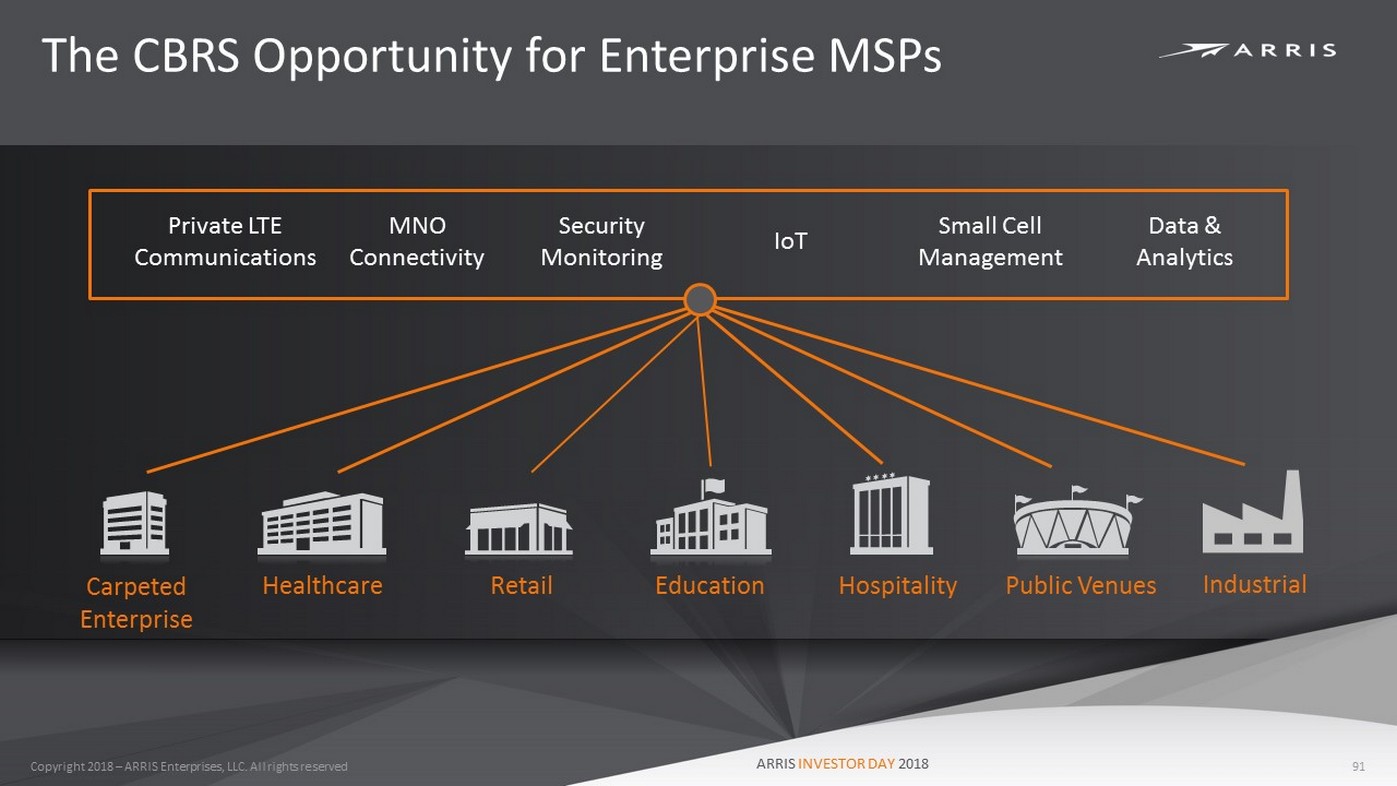

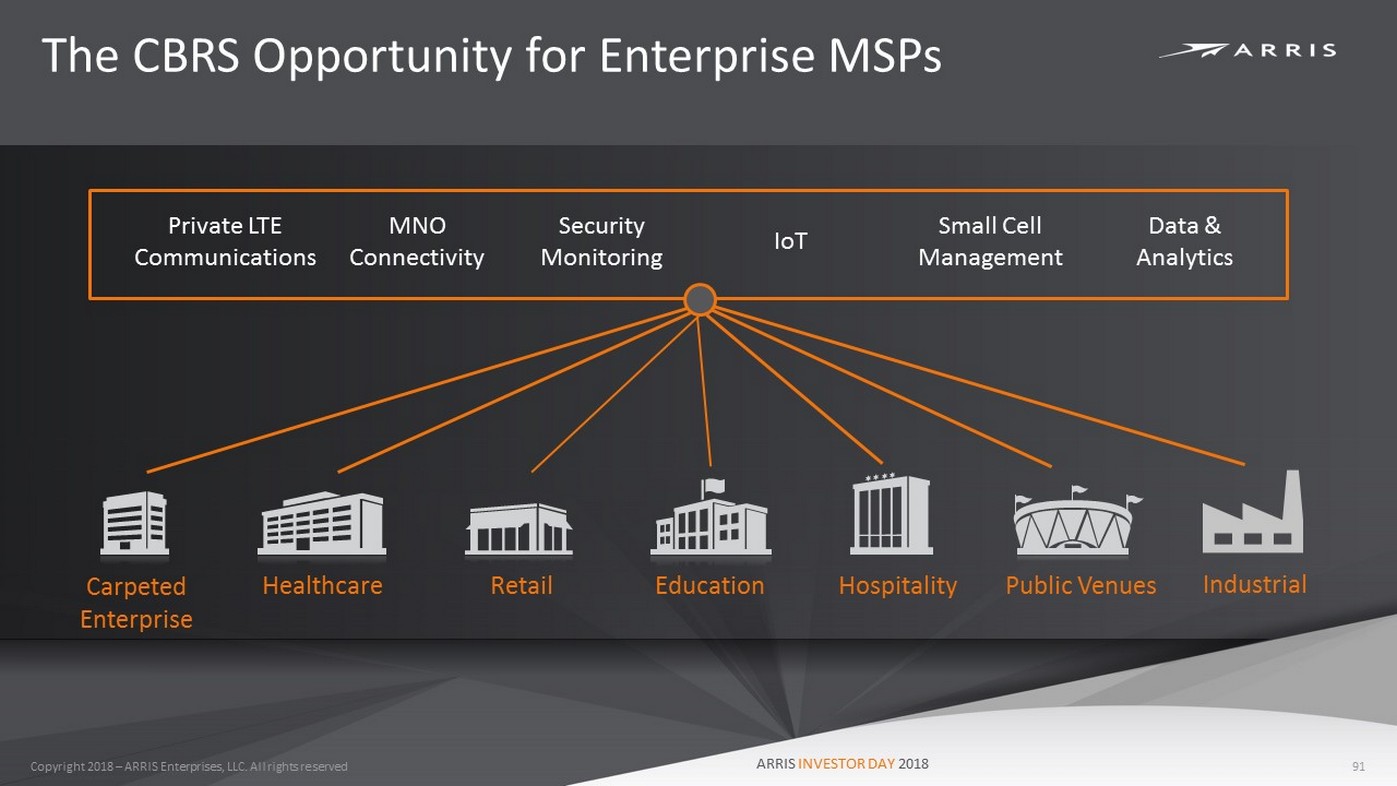

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved The CBRS Opportunity for Enterprise MSPs 91 Carpeted Enterprise Healthcare Education Hospitality Retail Public Venues Industrial IoT MNO Connectivity Private LTE Communications Data & Analytics Small Cell Management Security Monitoring ARRIS INVESTOR DAY 2018

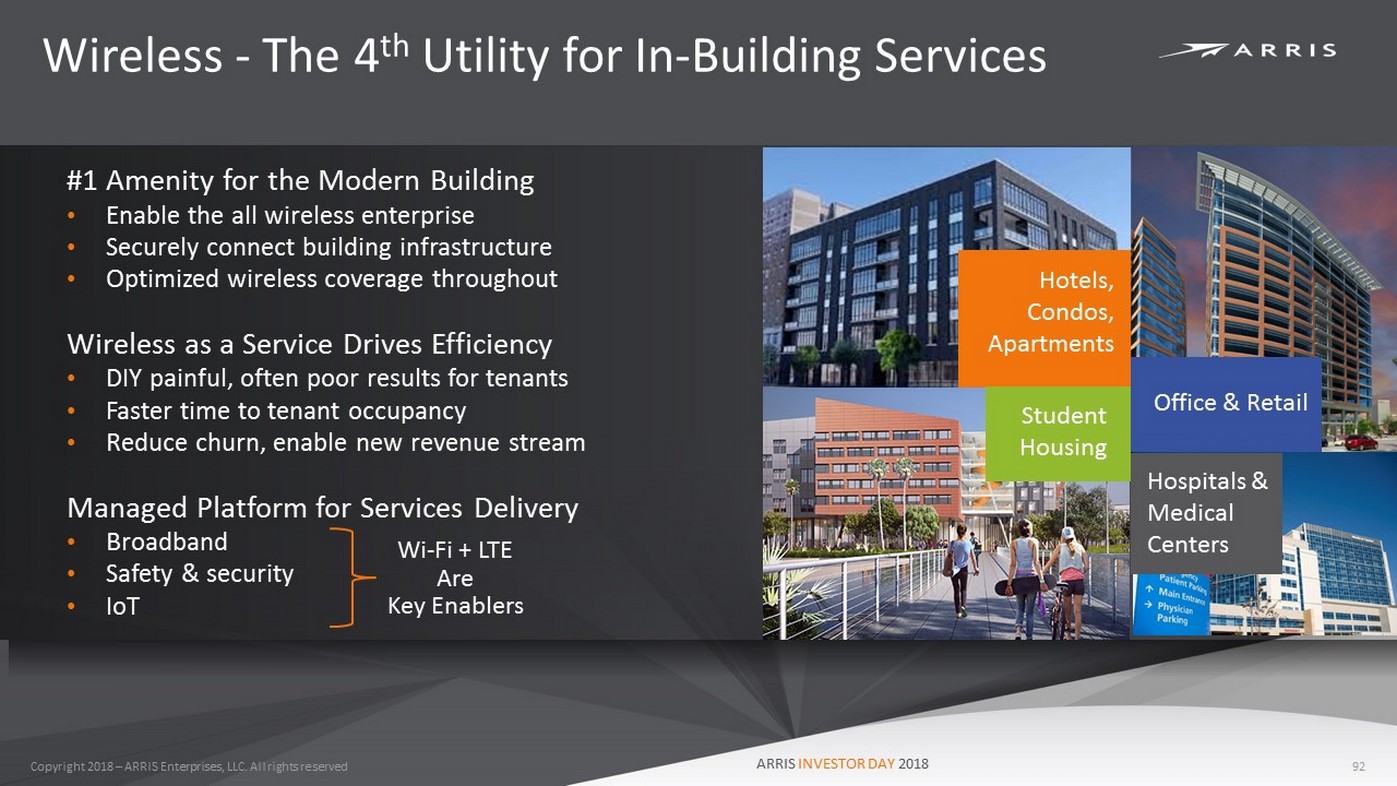

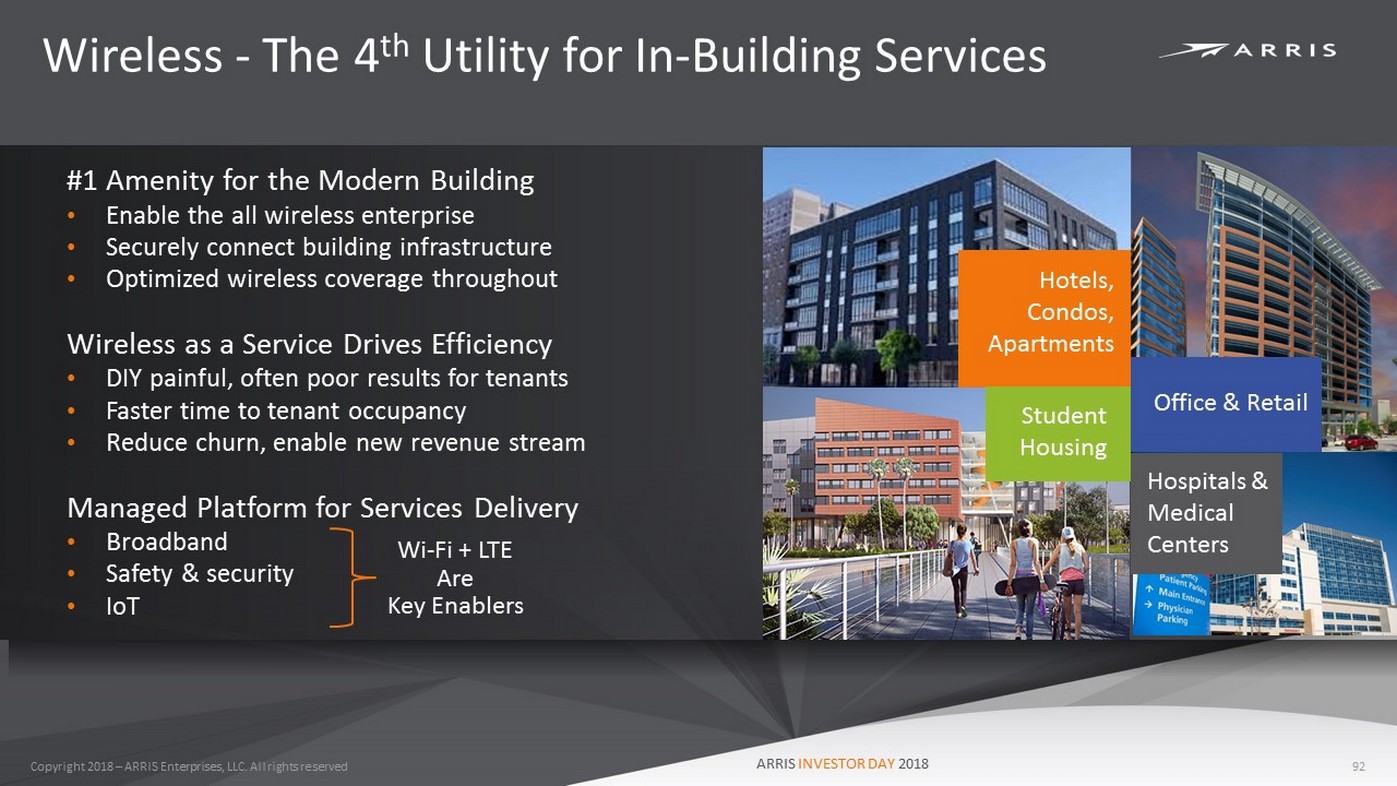

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Wireless - The 4 th Utility for In - Building Services 92 #1 Amenity for the Modern Building • Enable the all wireless enterprise • Securely connect building infrastructure • Optimized wireless coverage throughout Wireless as a Service Drives Efficiency • DIY painful, often poor results for tenants • Faster time to tenant occupancy • Reduce churn, enable new revenue stream Managed Platform for Services Delivery • Broadband • Safety & security • IoT Hotels, Condos, Apartments Student Housing Office & Retail Hospitals & Medical Centers Wi - Fi + LTE Are Key Enablers ARRIS INVESTOR DAY 2018

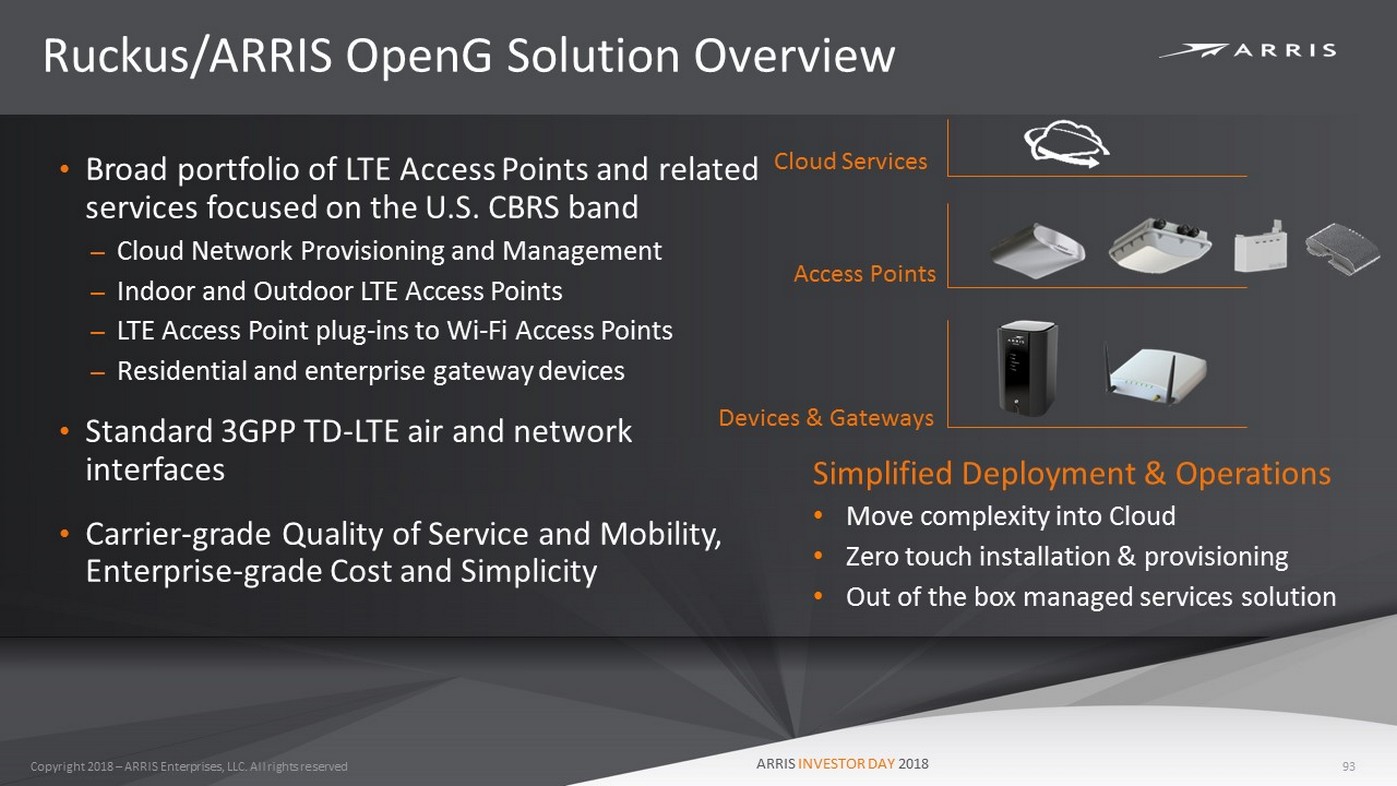

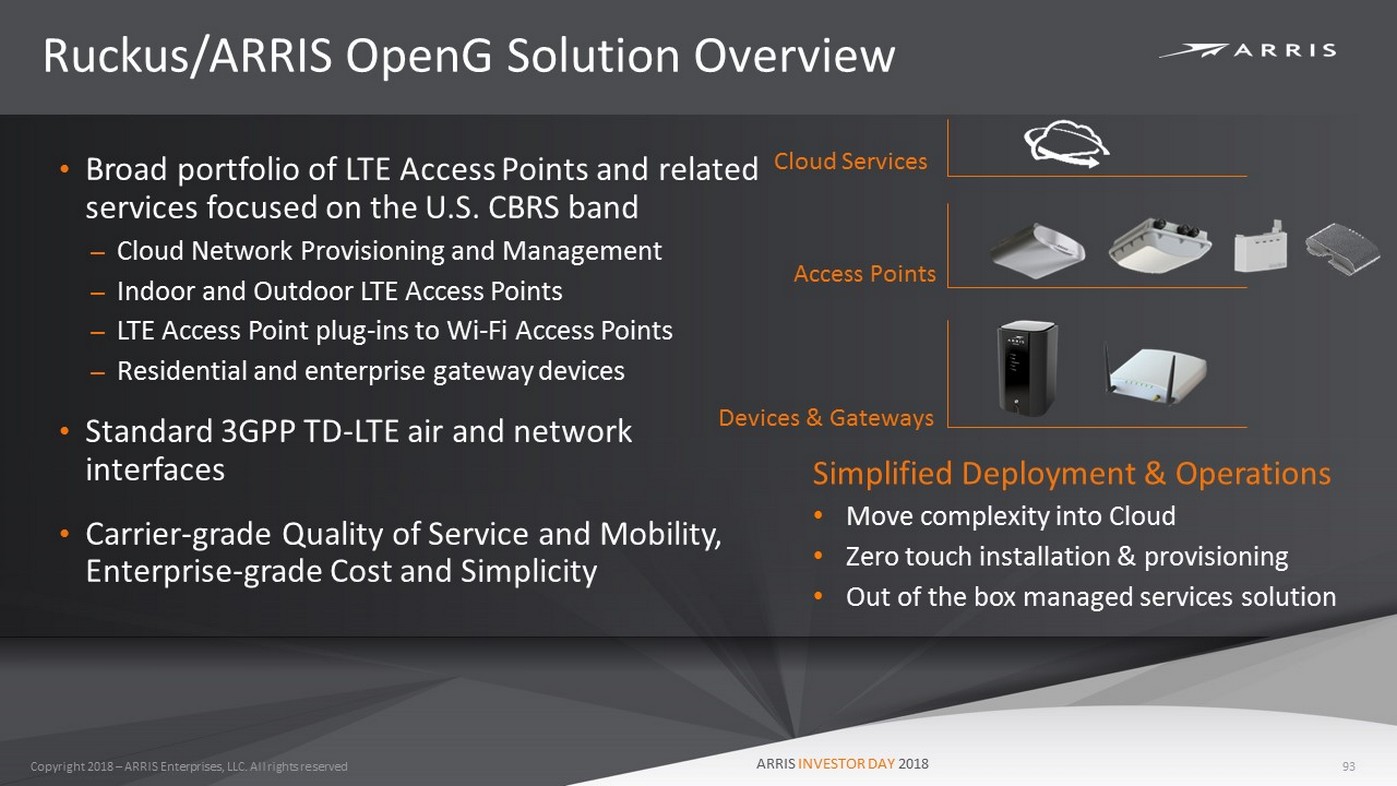

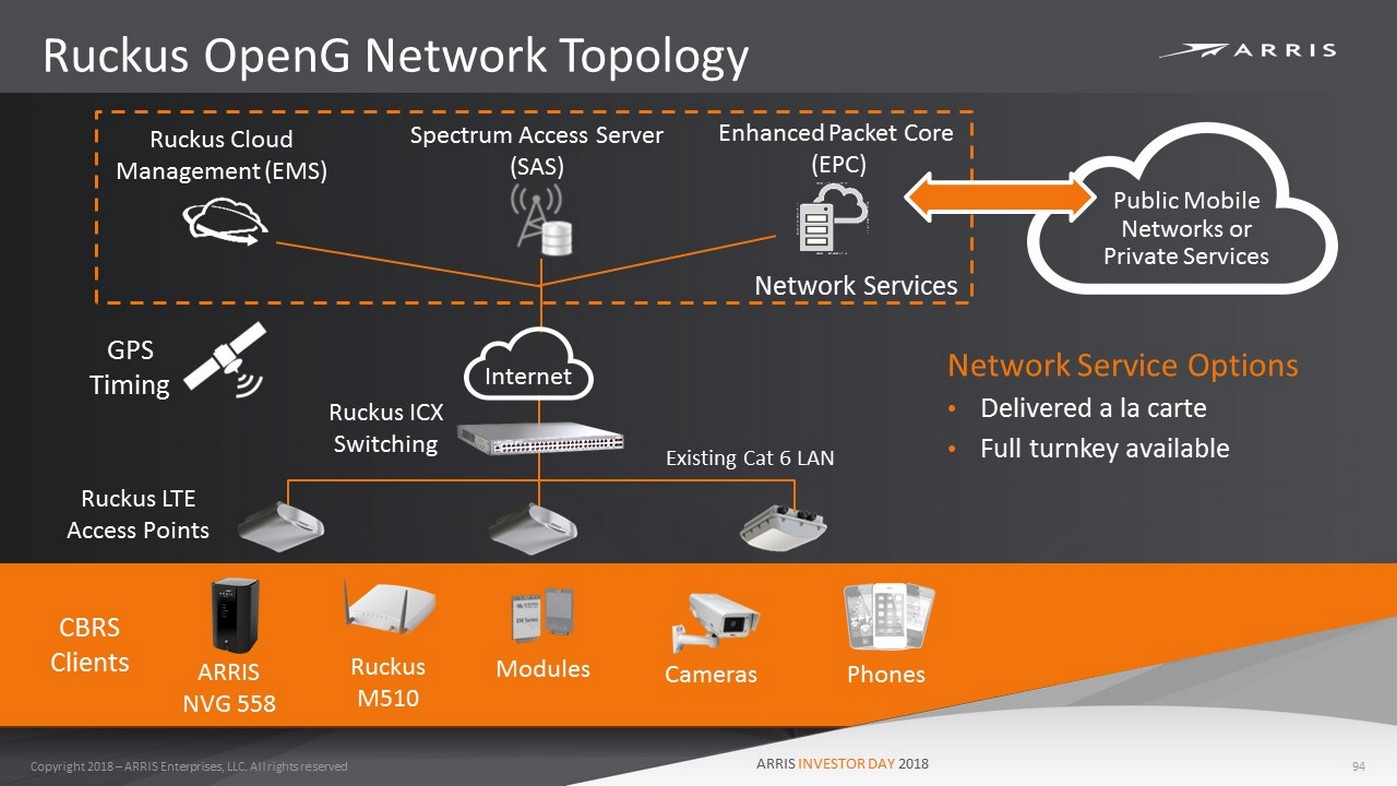

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Ruckus/ARRIS OpenG Solution Overview • Broad portfolio of LTE Access Points and related services focused on the U.S. CBRS band – Cloud Network Provisioning and Management – Indoor and Outdoor LTE Access Points – LTE Access Point plug - ins to Wi - Fi Access Points – Residential and enterprise gateway devices • Standard 3GPP TD - LTE air and network interfaces • Carrier - grade Quality of Service and Mobility, Enterprise - grade Cost and Simplicity Devices & Gateways Cloud Services Access Points Simplified Deployment & Operations • Move complexity into Cloud • Zero touch installation & provisioning • Out of the box managed services solution ARRIS INVESTOR DAY 2018 93

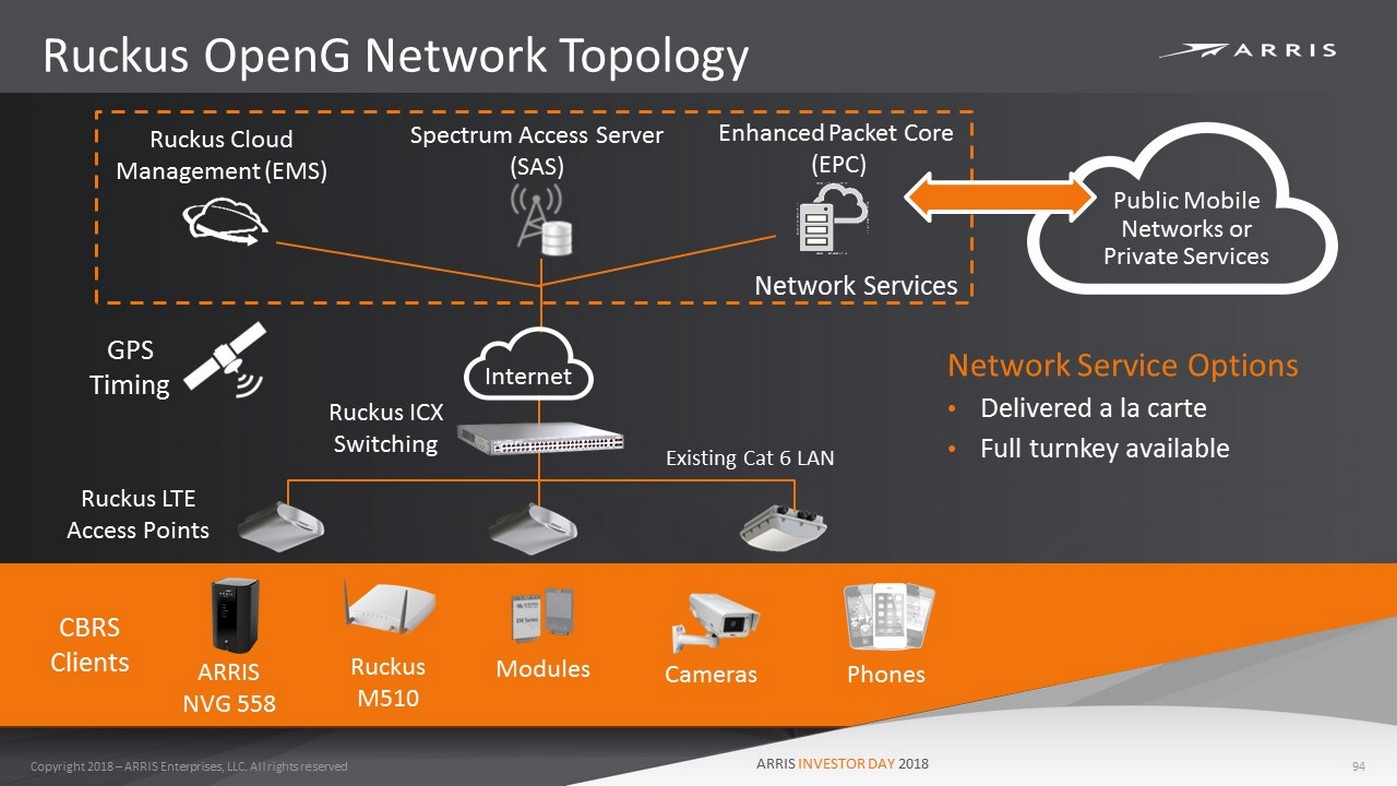

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Ruckus OpenG Network Topology 94 Enhanced Packet Core (EPC) Ruckus Cloud Management (EMS) Spectrum Access Server (SAS) Network Services Public Mobile Networks or Private Services Ruckus ICX Switching GPS Timing Internet Ruckus LTE Access Points Existing Cat 6 LAN CBRS Clients ARRIS NVG 558 Ruckus M510 Modules Cameras Phones Network Service Options • Delivered a la carte • Full turnkey available ARRIS INVESTOR DAY 2018

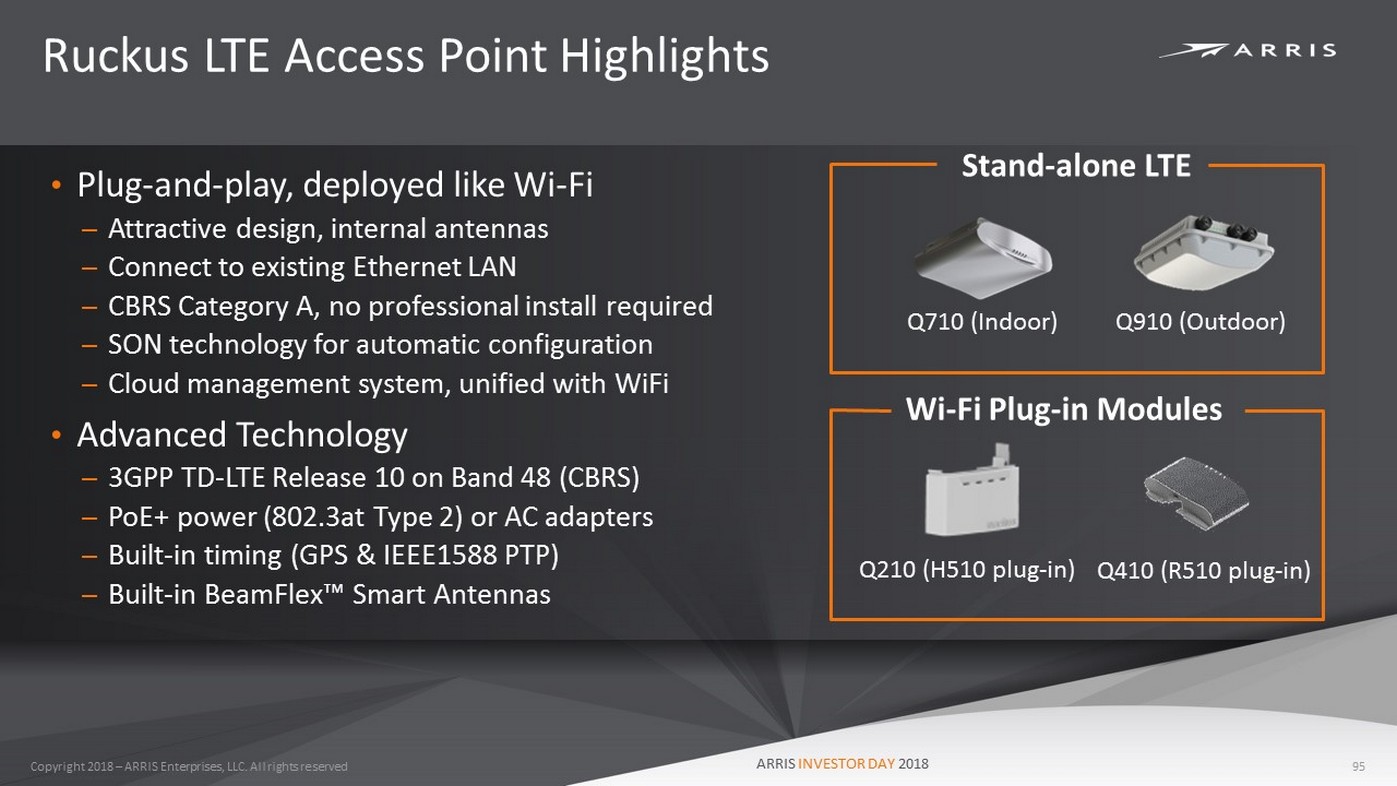

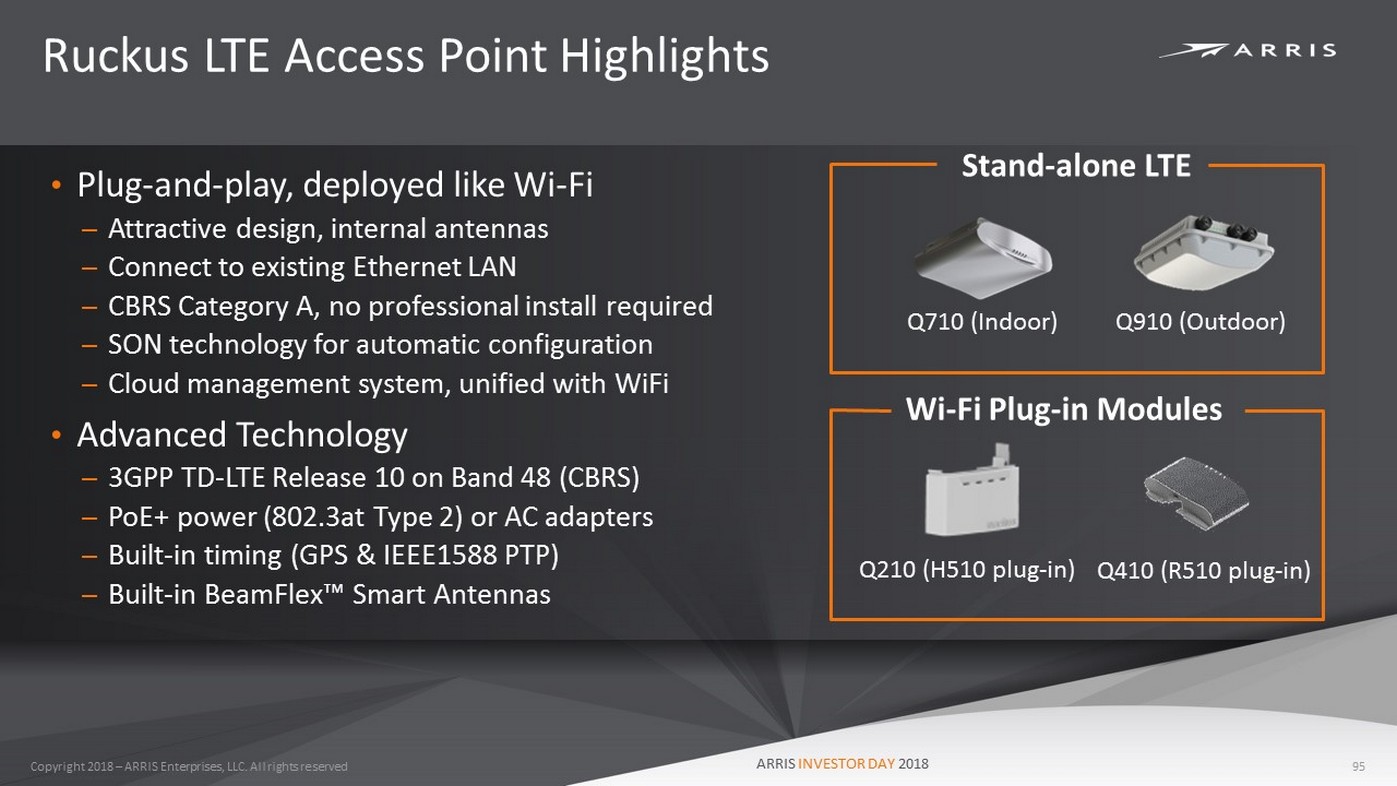

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Ruckus LTE Access Point Highlights • Plug - and - play, deployed like Wi - Fi – Attractive design, internal antennas – Connect to existing Ethernet LAN – CBRS Category A, no professional install required – SON technology for automatic configuration – Cloud management system, unified with WiFi • Advanced Technology – 3GPP TD - LTE Release 10 on Band 48 (CBRS) – PoE + power (802.3at Type 2) or AC adapters – Built - in timing (GPS & IEEE1588 PTP) – Built - in BeamFlex ™ Smart Antennas Q710 (Indoor) Q910 (Outdoor) Stand - alone LTE Q210 (H510 plug - in) Q410 (R510 plug - in) Wi - Fi Plug - in Modules ARRIS INVESTOR DAY 2018 95

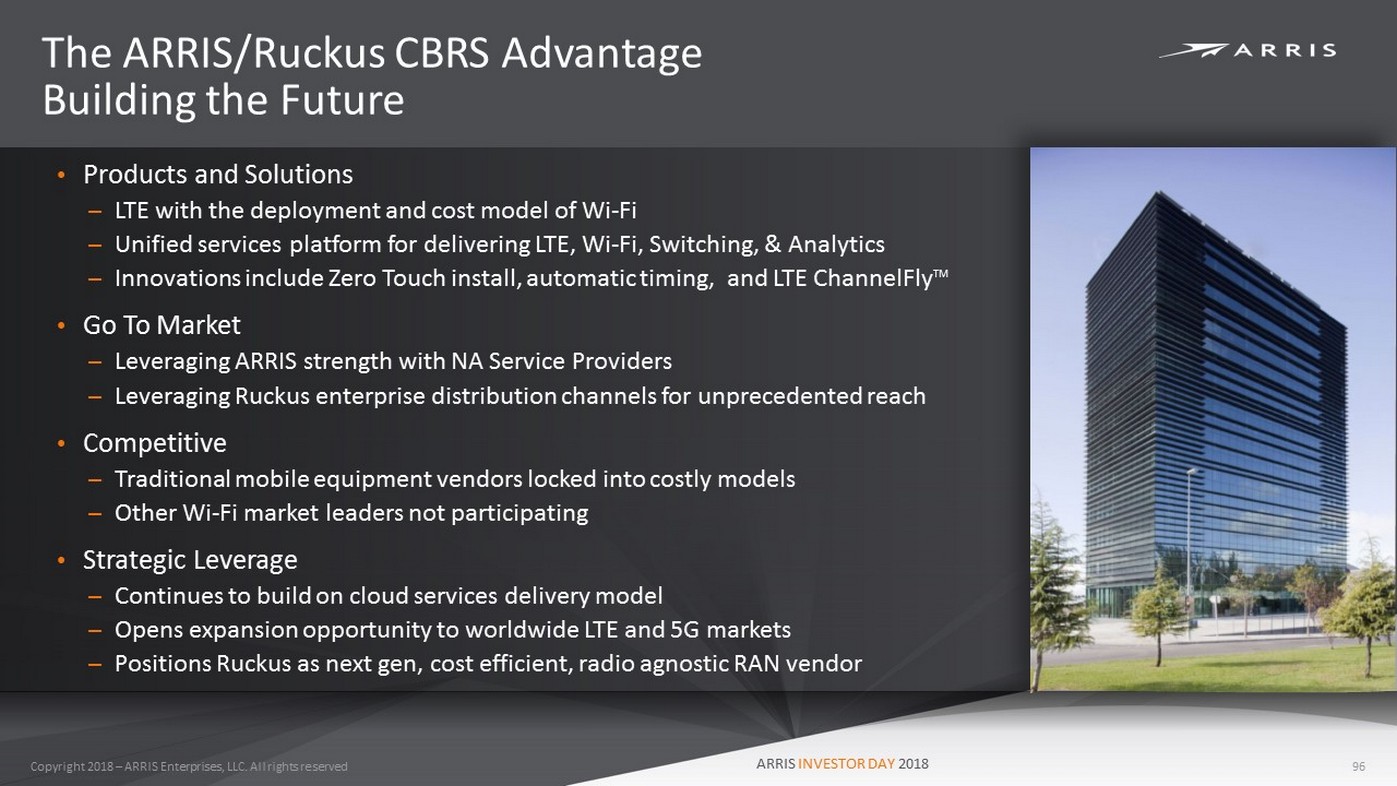

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved The ARRIS/Ruckus CBRS Advantage Building the Future • Products and Solutions – LTE with the deployment and cost model of Wi - Fi – Unified services platform for delivering LTE, Wi - Fi, Switching, & Analytics – Innovations include Zero Touch install, automatic timing, and LTE ChannelFly TM • Go To Market – Leveraging ARRIS strength with NA Service Providers – Leveraging Ruckus enterprise distribution channels for unprecedented reach • Competitive – Traditional mobile equipment vendors locked into costly models – Other Wi - Fi market leaders not participating • Strategic Leverage – Continues to build on cloud services delivery model – Opens expansion opportunity to worldwide LTE and 5G markets – Positions Ruckus as next gen, cost efficient, radio agnostic RAN vendor ARRIS INVESTOR DAY 2018 96

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Financial Update David Potts ARRIS INVESTOR DAY 2018

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Value Creation Drivers 98 Addressable Market Growth International Expansion Margin and Earnings Growth Portfolio Expansion Strategic M&A and Capital Return Target Available Total Addressable ARRIS INVESTOR DAY 2018

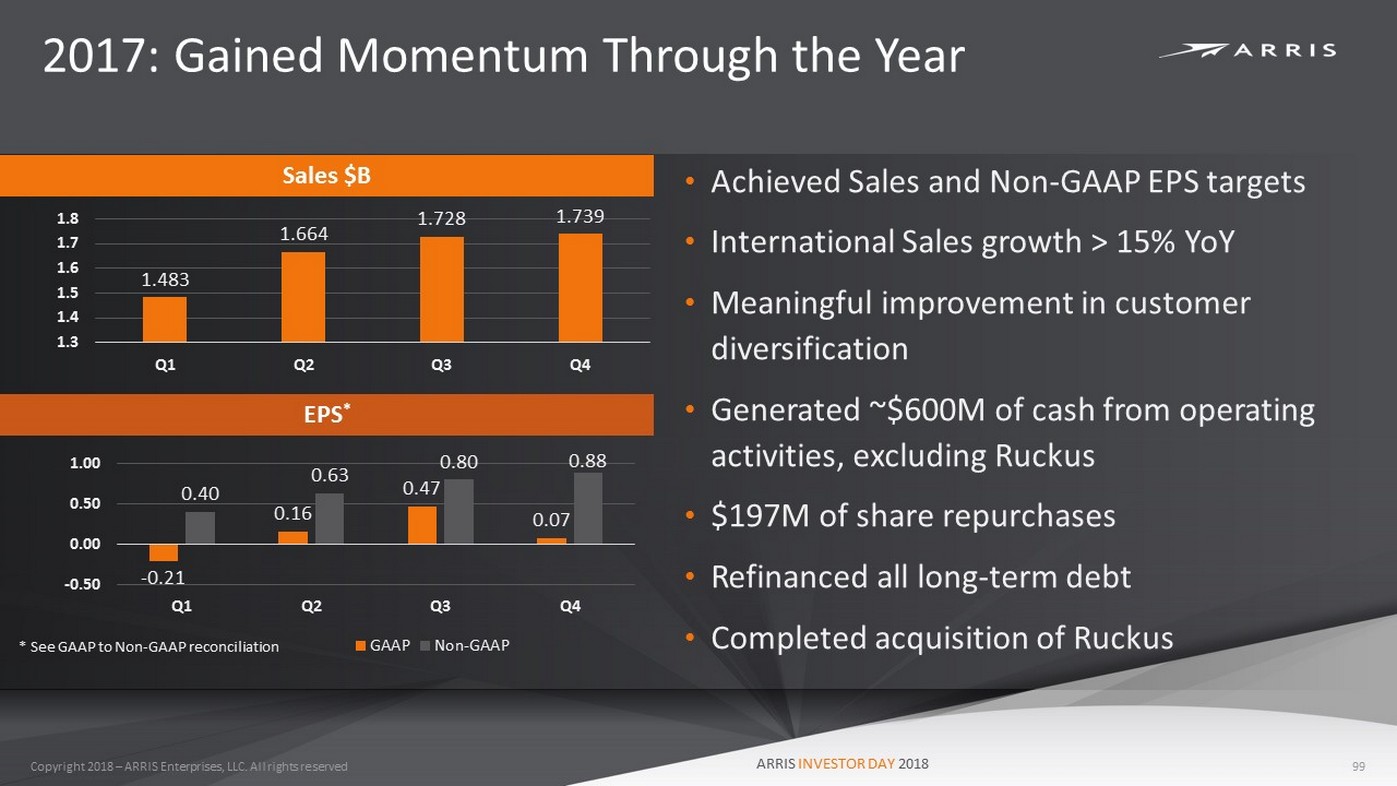

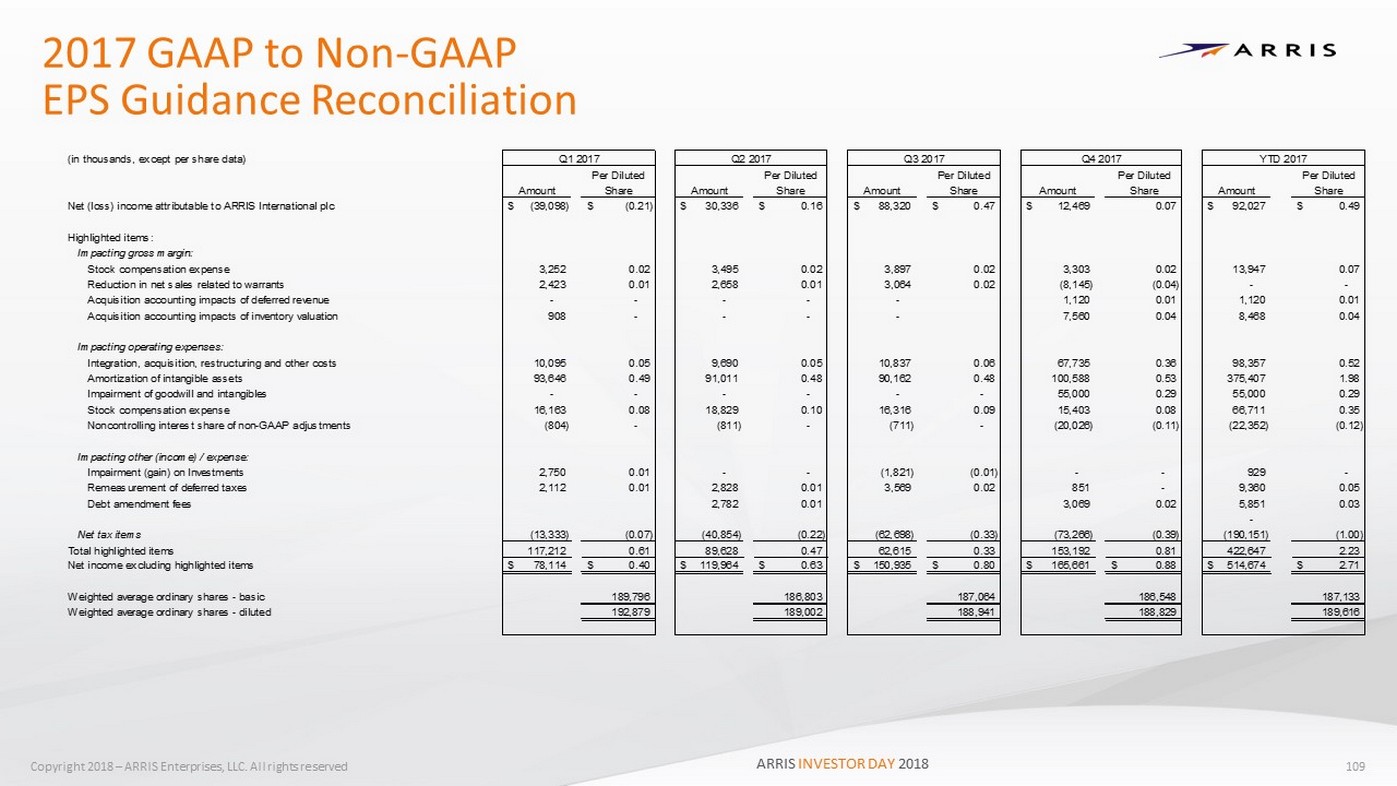

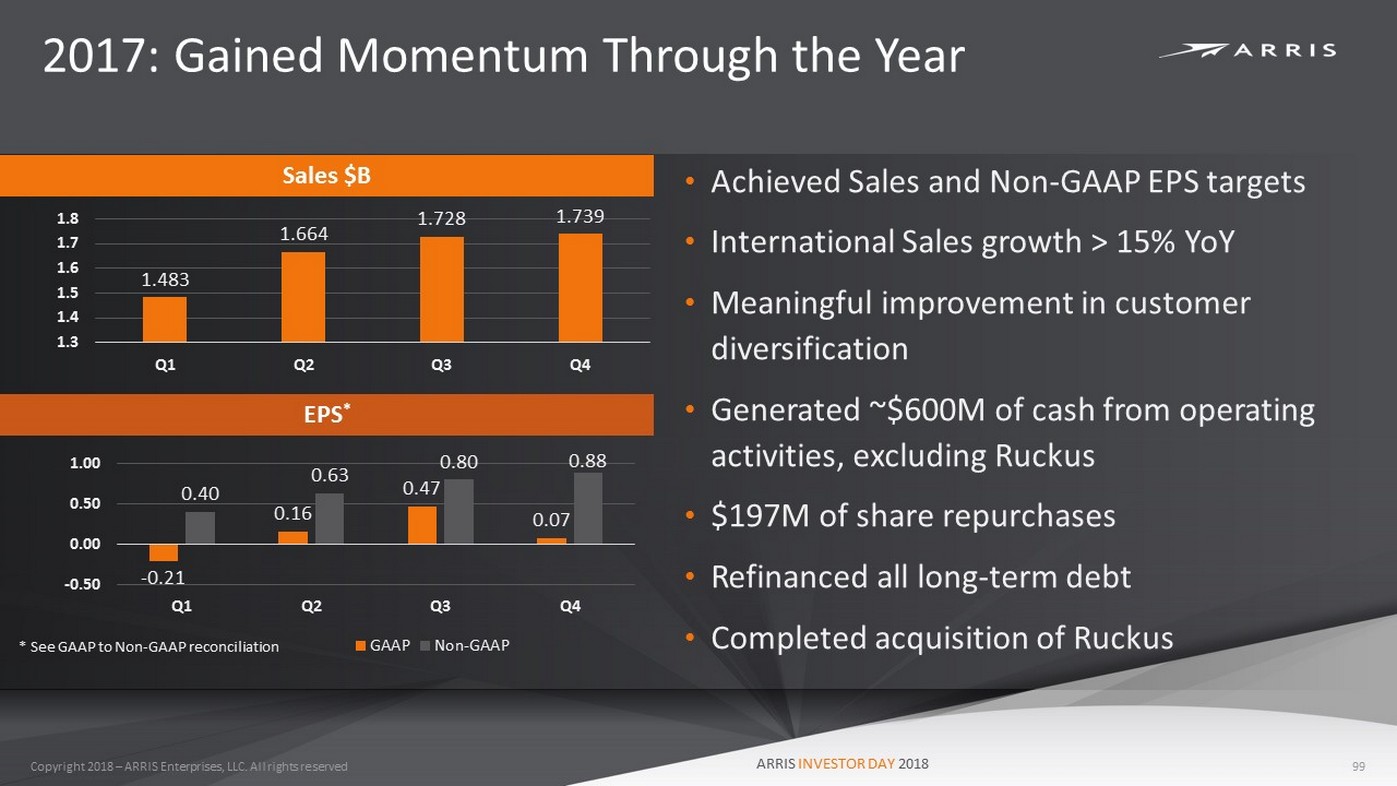

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved 2017: Gained Momentum Through the Year 99 Sales $B 1.483 1.664 1.728 1.739 1.3 1.4 1.5 1.6 1.7 1.8 Q1 Q2 Q3 Q4 EPS * - 0.21 0.16 0.47 0.07 0.40 0.63 0.80 0.88 -0.50 0.00 0.50 1.00 Q1 Q2 Q3 Q4 GAAP Non-GAAP • Achieved Sales and Non - GAAP EPS targets • International Sales growth > 15% YoY • Meaningful improvement in customer diversification • Generated ~$600M of cash from operating activities, excluding Ruckus • $197M of share repurchases • Refinanced all long - term debt • Completed acquisition of Ruckus * See GAAP to Non - GAAP reconciliation ARRIS INVESTOR DAY 2018

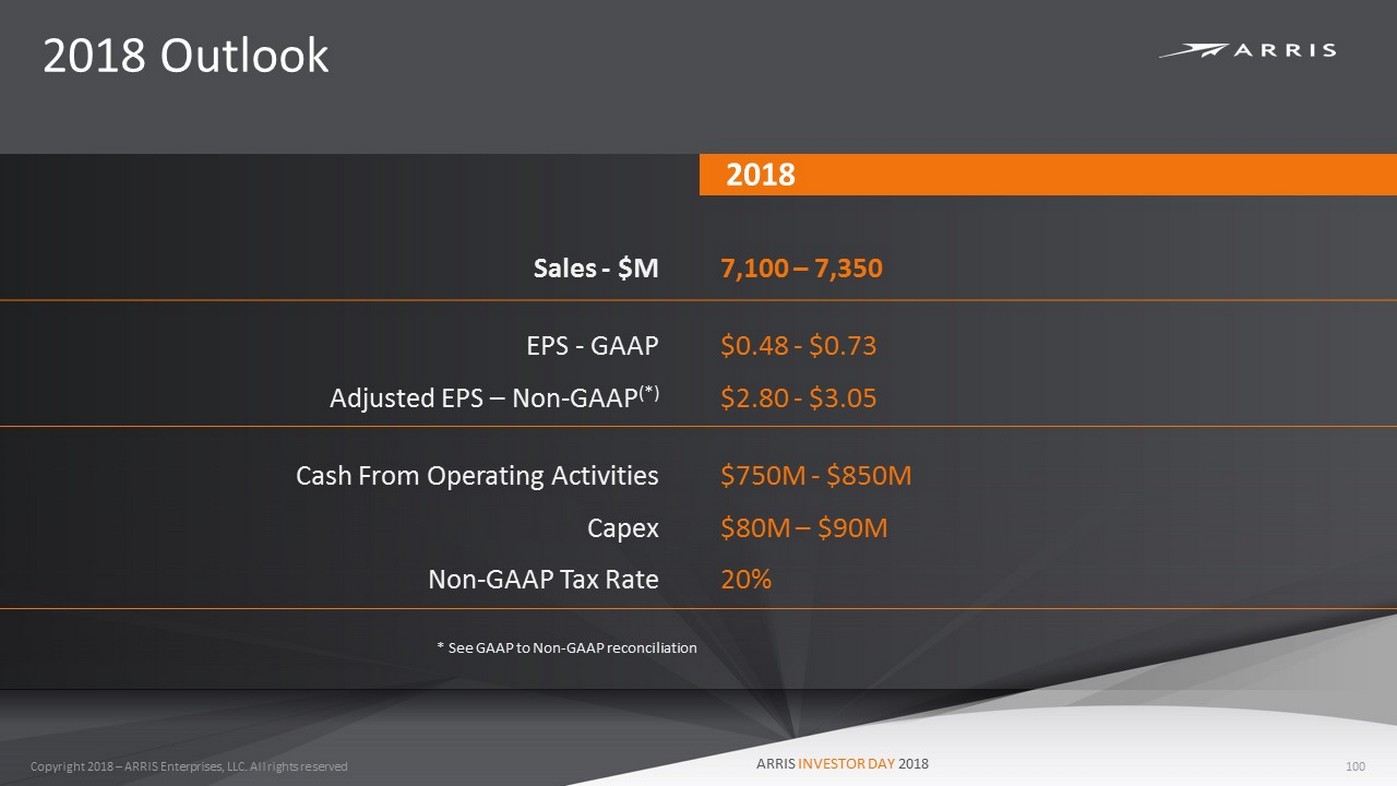

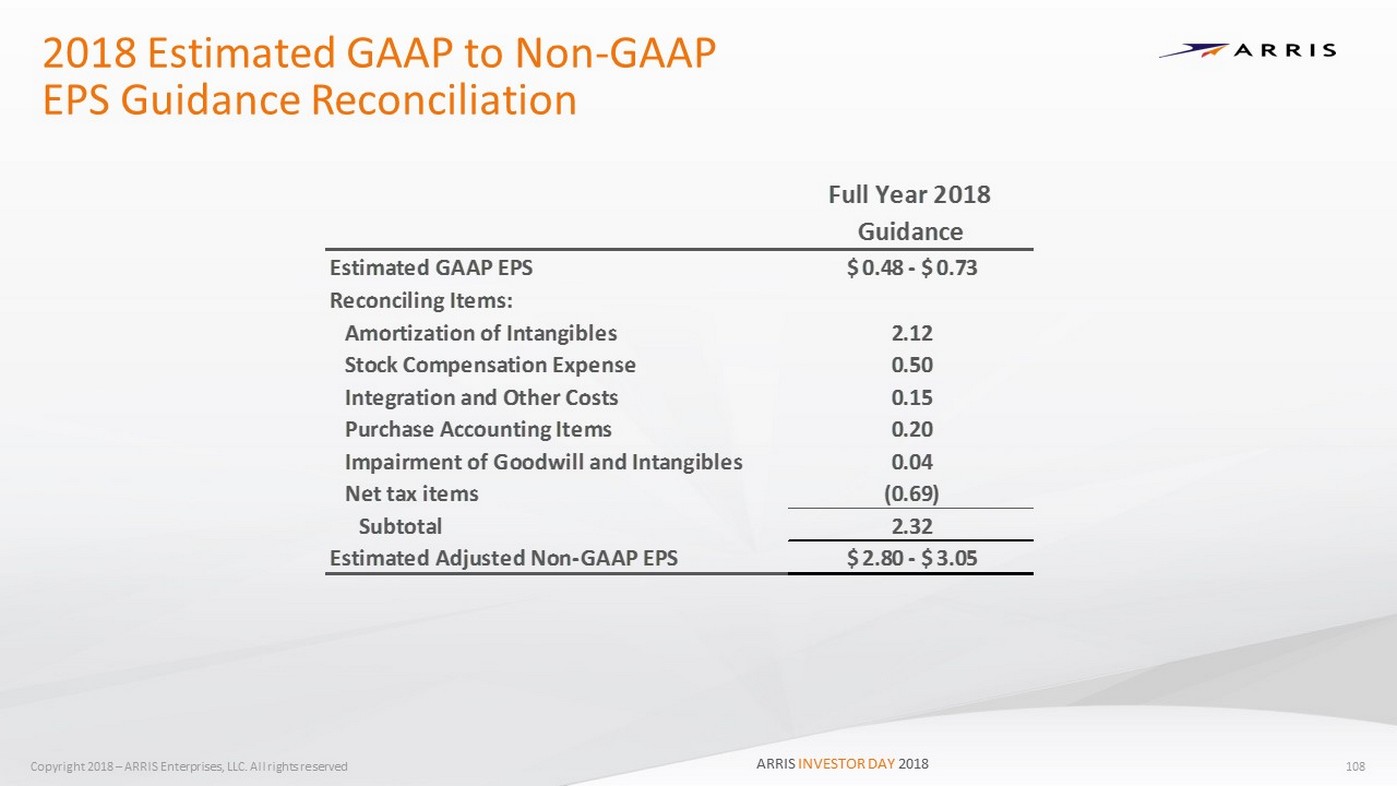

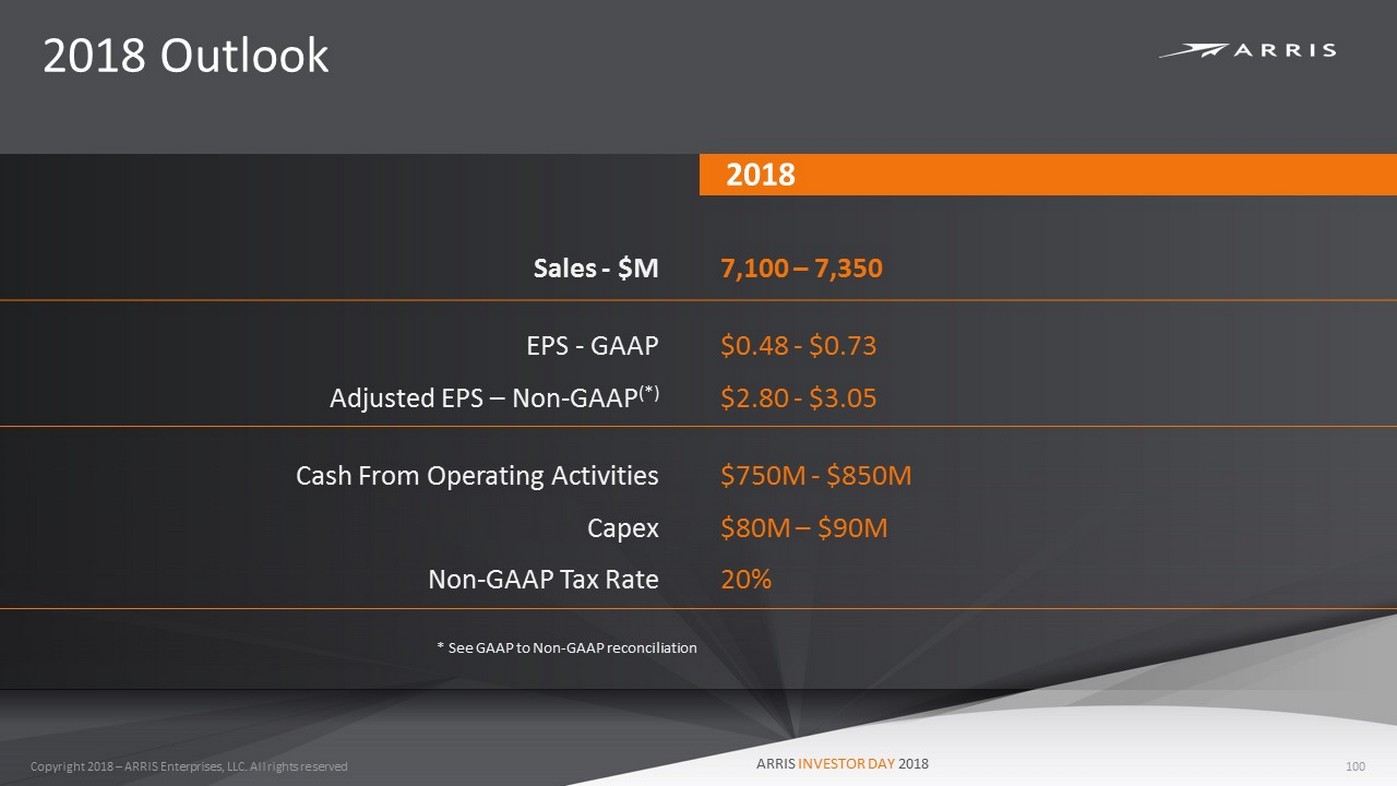

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved 2018 Outlook 100 Sales - $M 7,100 – 7,350 EPS - GAAP $0.48 - $0.73 Adjusted EPS – Non - GAAP (*) $2.80 - $3.05 Cash From Operating Activities $750M - $850M Capex $80M – $90M Non - GAAP Tax Rate 20% 2018 * See GAAP to Non - GAAP reconciliation ARRIS INVESTOR DAY 2018

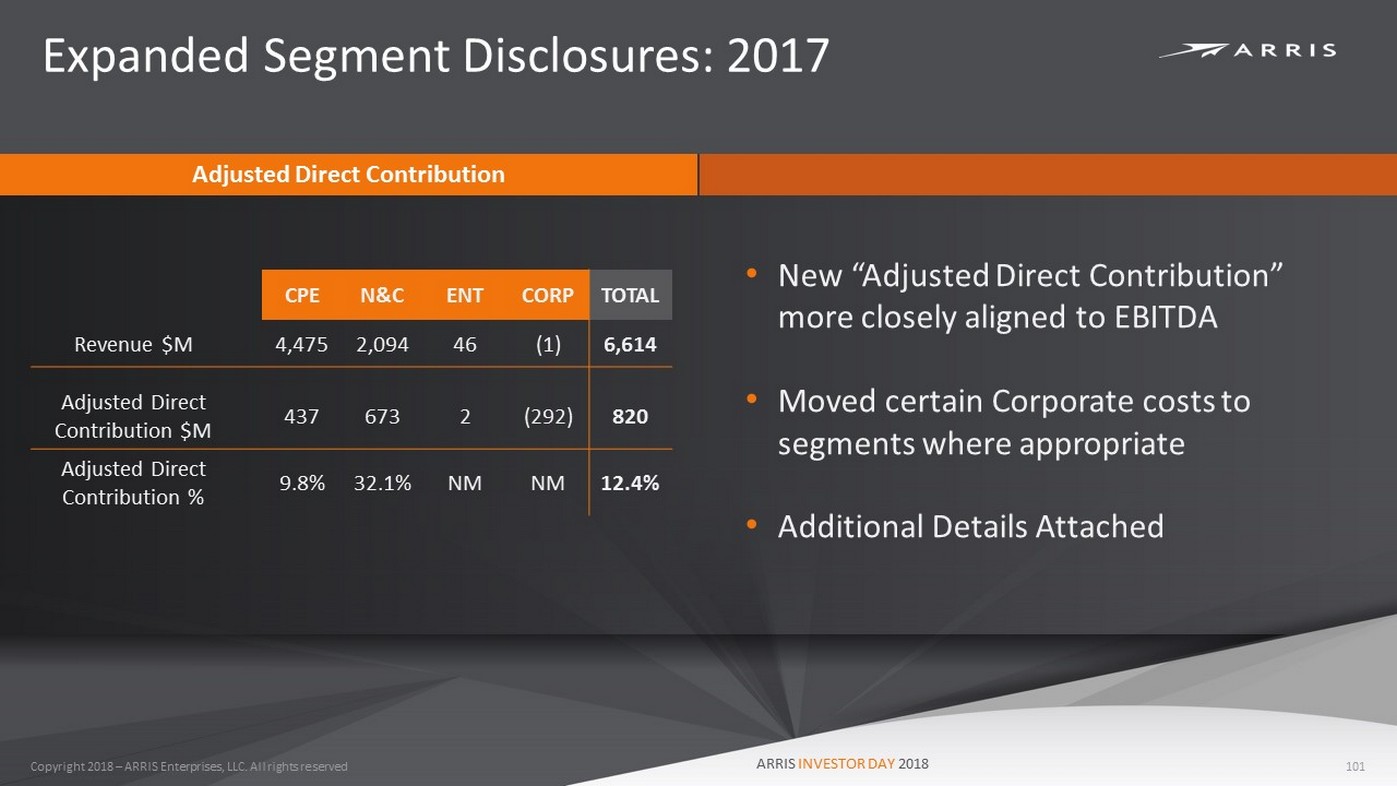

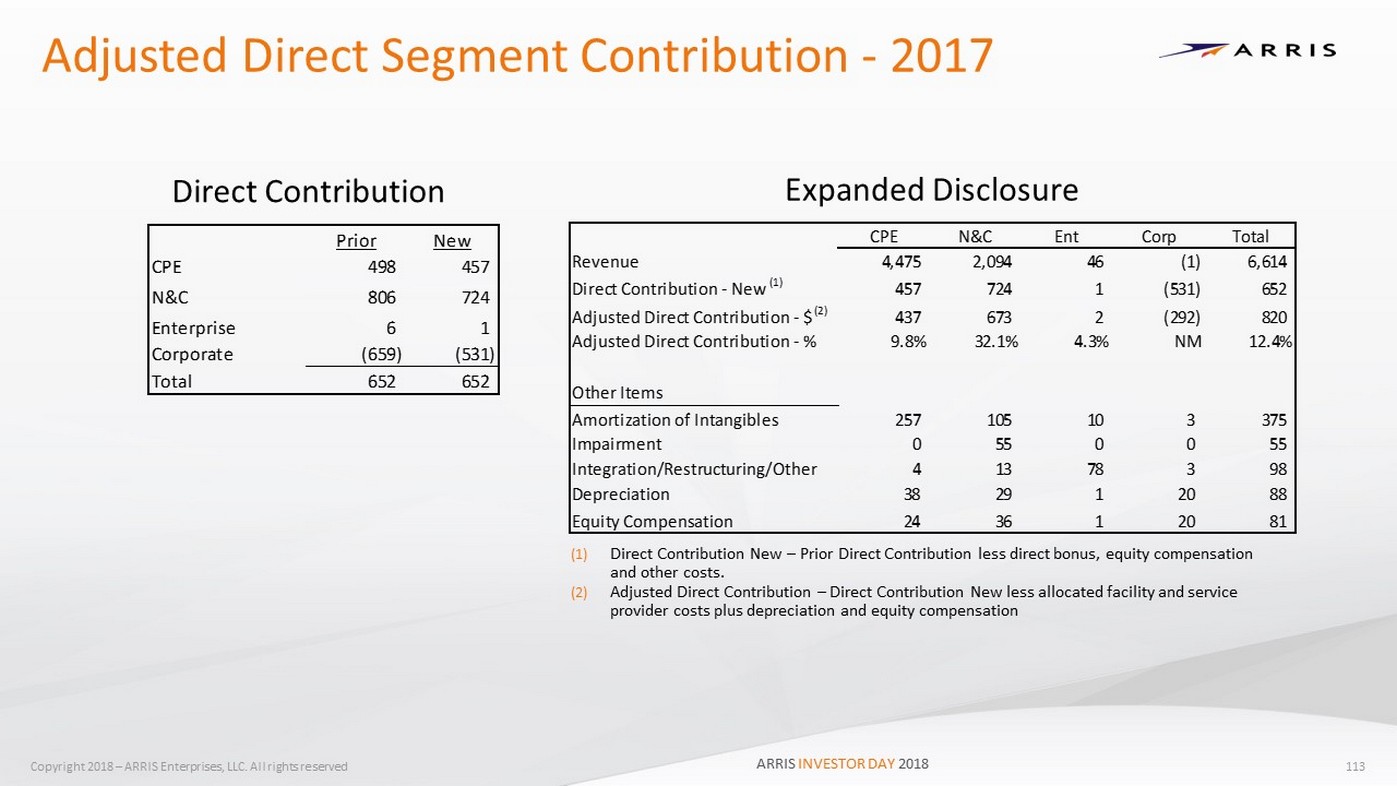

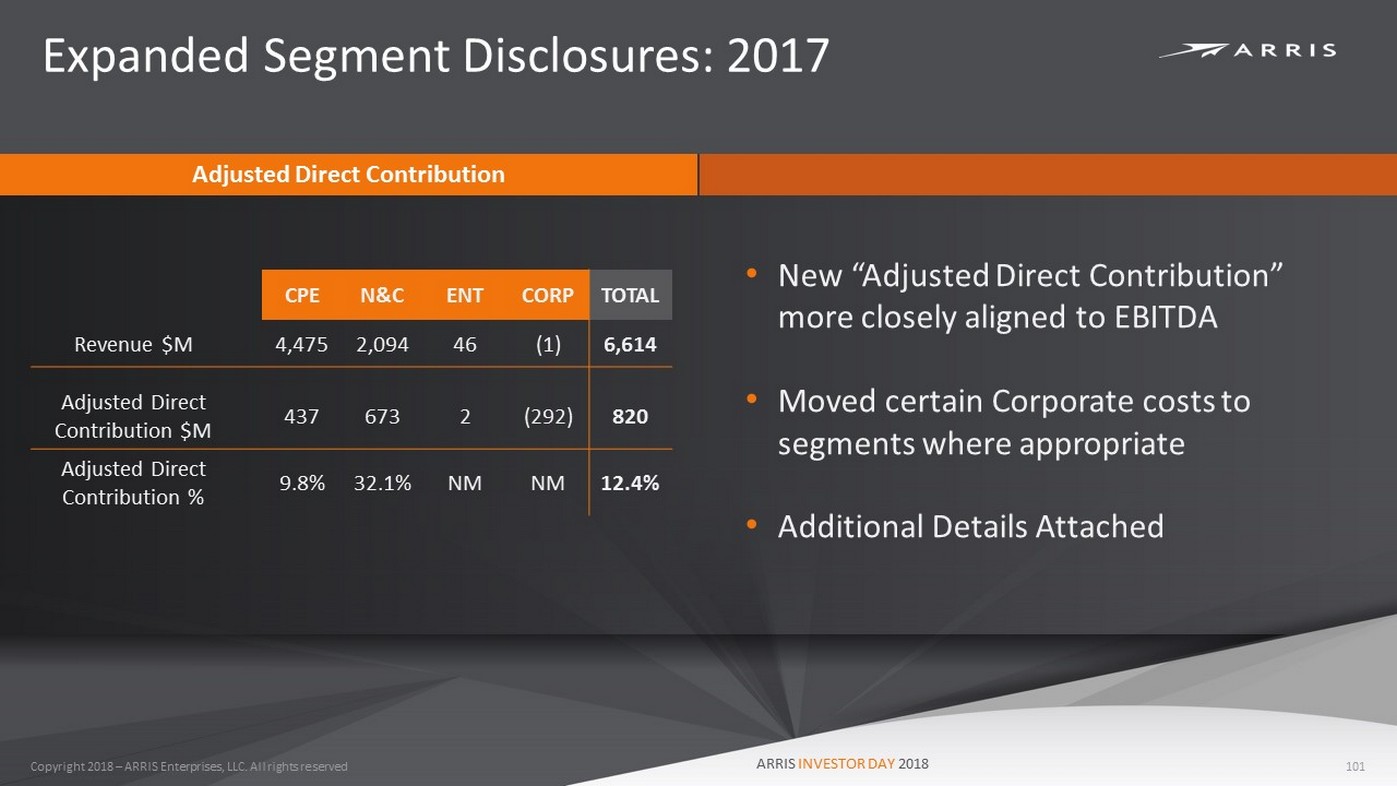

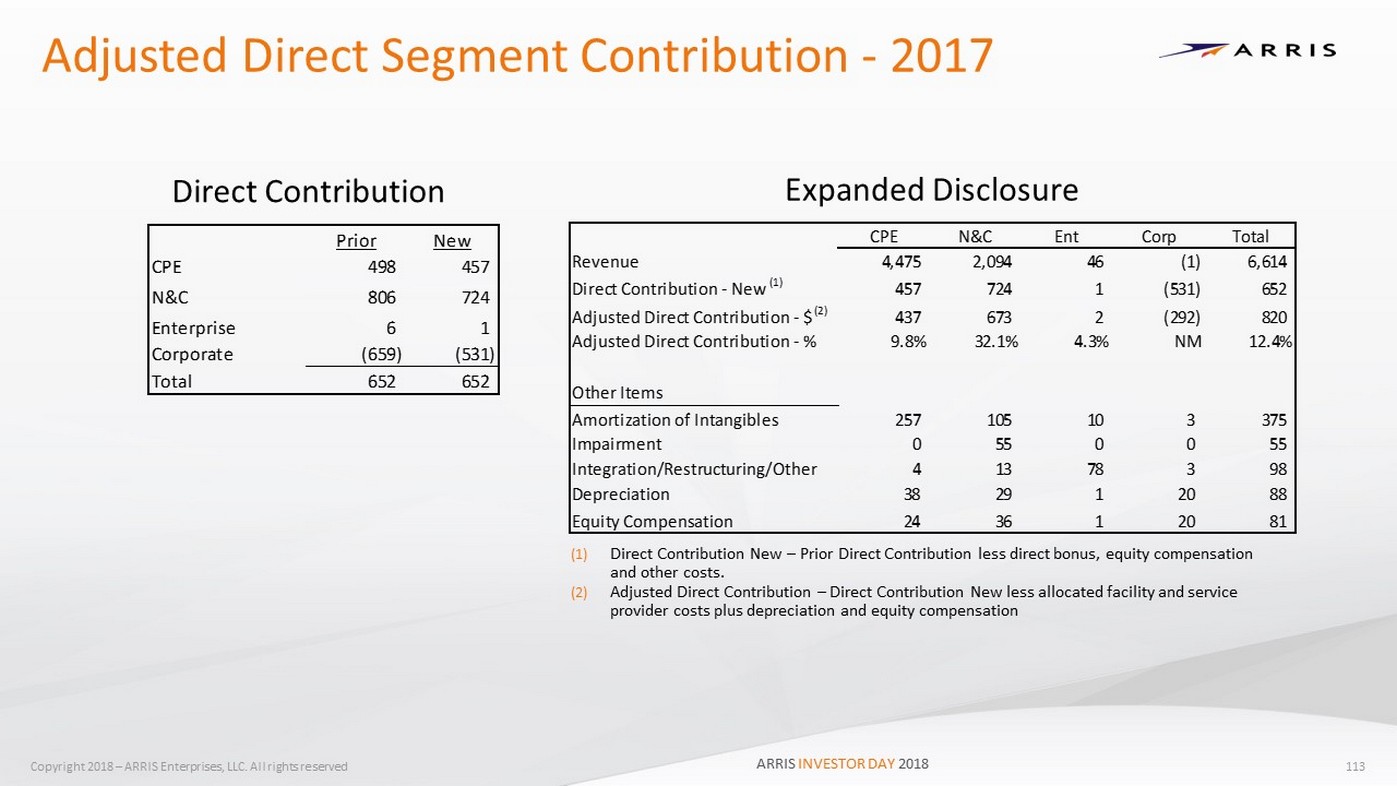

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Expanded Segment Disclosures: 2017 101 Adjusted Direct Contribution CPE N&C ENT CORP TOTAL Revenue $M 4,475 2,094 46 (1) 6,614 Adjusted Direct Contribution $M 437 673 2 (292) 820 Adjusted Direct Contribution % 9.8% 32.1% NM NM 12.4% • New “Adjusted Direct Contribution” more closely aligned to EBITDA • Moved certain Corporate costs to segments where appropriate • Additional Details Attached ARRIS INVESTOR DAY 2018

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Financial Goals 102 Adjusted Direct Contribution (Excluding Corporate) Organic Outlook Drivers Organic Non - GAAP EPS 2017 2021 62% 38% 55% 15% 30% $2.71* • Segment Revenue Assumptions - CPE: - 5% to +1% - N&C: 4% to 7% - Enterprise: 10% to 15% • Keys to Revenue - CPE: Refresh cycles, international share, pricing - N&C: Bandwidth growth, share gains, migration to DAA - Enterprise: Growth in core markets, Service Providers, 802.11 upgrades, CBRS • Margins - CPE: Improvement related to lower memory costs and pricing - N&C: Consistent with historical trends - Enterprise: Consistent with historical trends, 60% to 65% Gross Margin - Nominal growth in OPEX * See GAAP to Non - GAAP reconciliation 6% - 9% CAGR • Growth in core business EPS with more diversified contribution mix • Accretive M&A and Share Repurchases provide incremental upside • Enterprise • N&C • CPE ARRIS INVESTOR DAY 2018

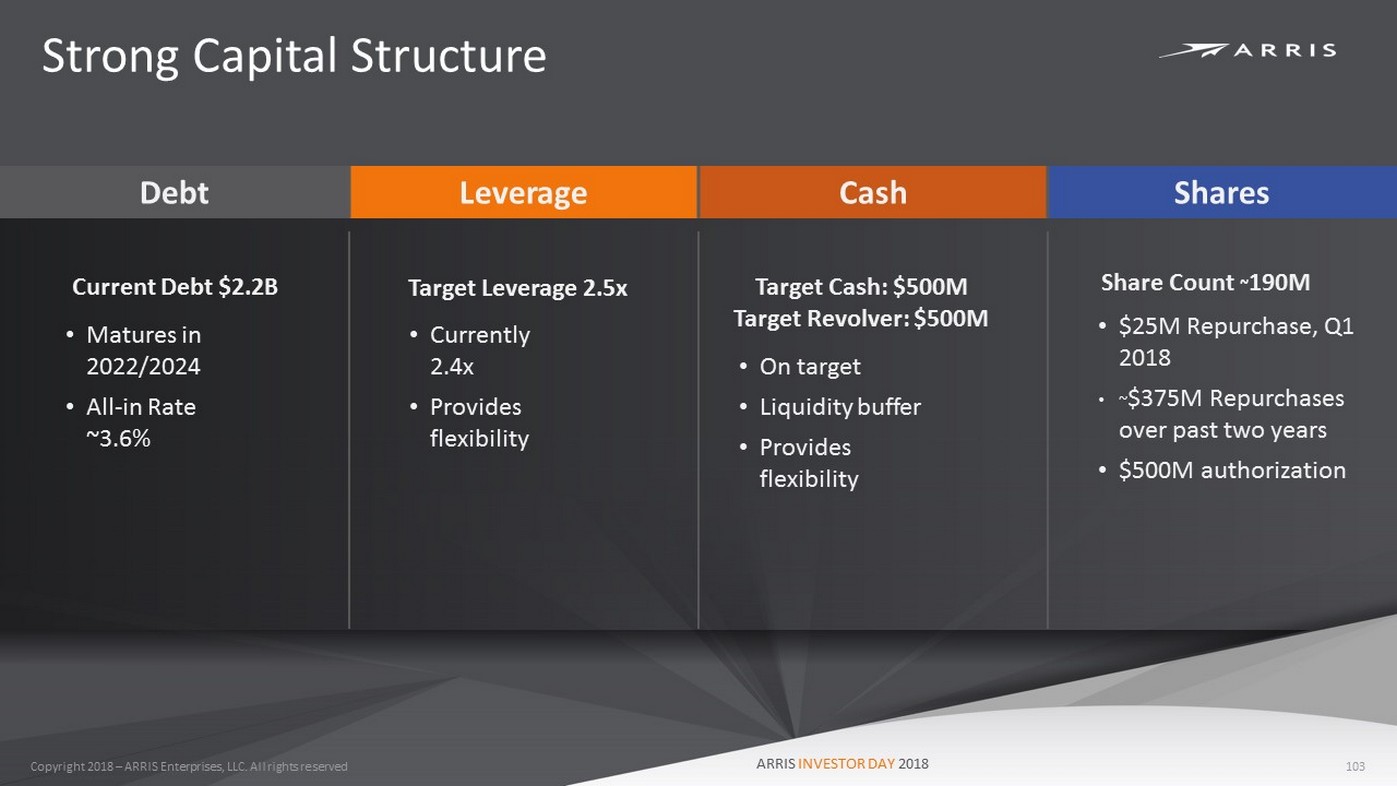

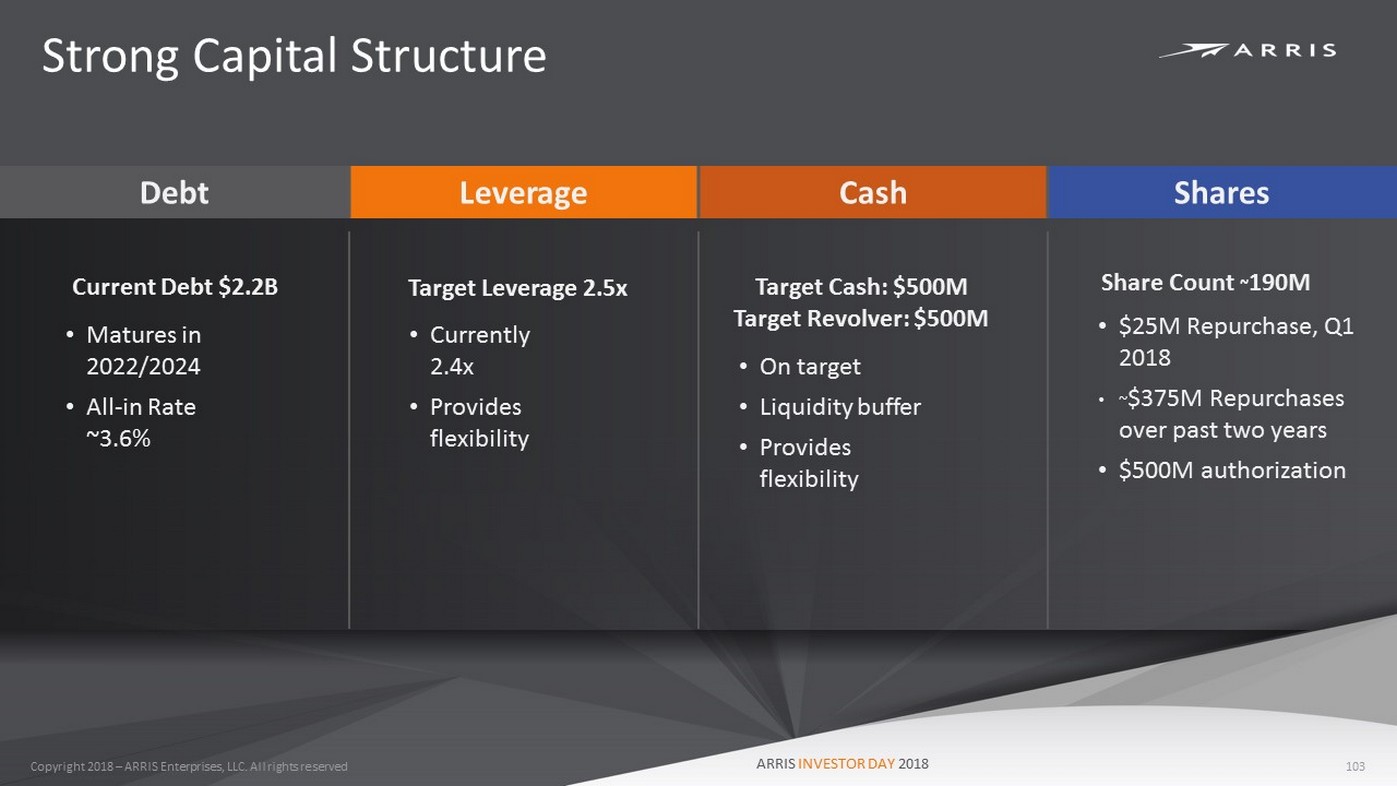

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Strong Capital Structure 103 Current Debt $2.2B Target Leverage 2.5x Target Cash: $500M Target Revolver: $500M Share Count ~ 190M • $25M Repurchase, Q1 2018 • ~ $375M Repurchases over past two years • $500M authorization • On target • Liquidity buffer • Provides flexibility • Currently 2.4x • Provides flexibility • Matures in 2022/2024 • All - in Rate ~3.6% Debt Leverage Cash Shares ARRIS INVESTOR DAY 2018

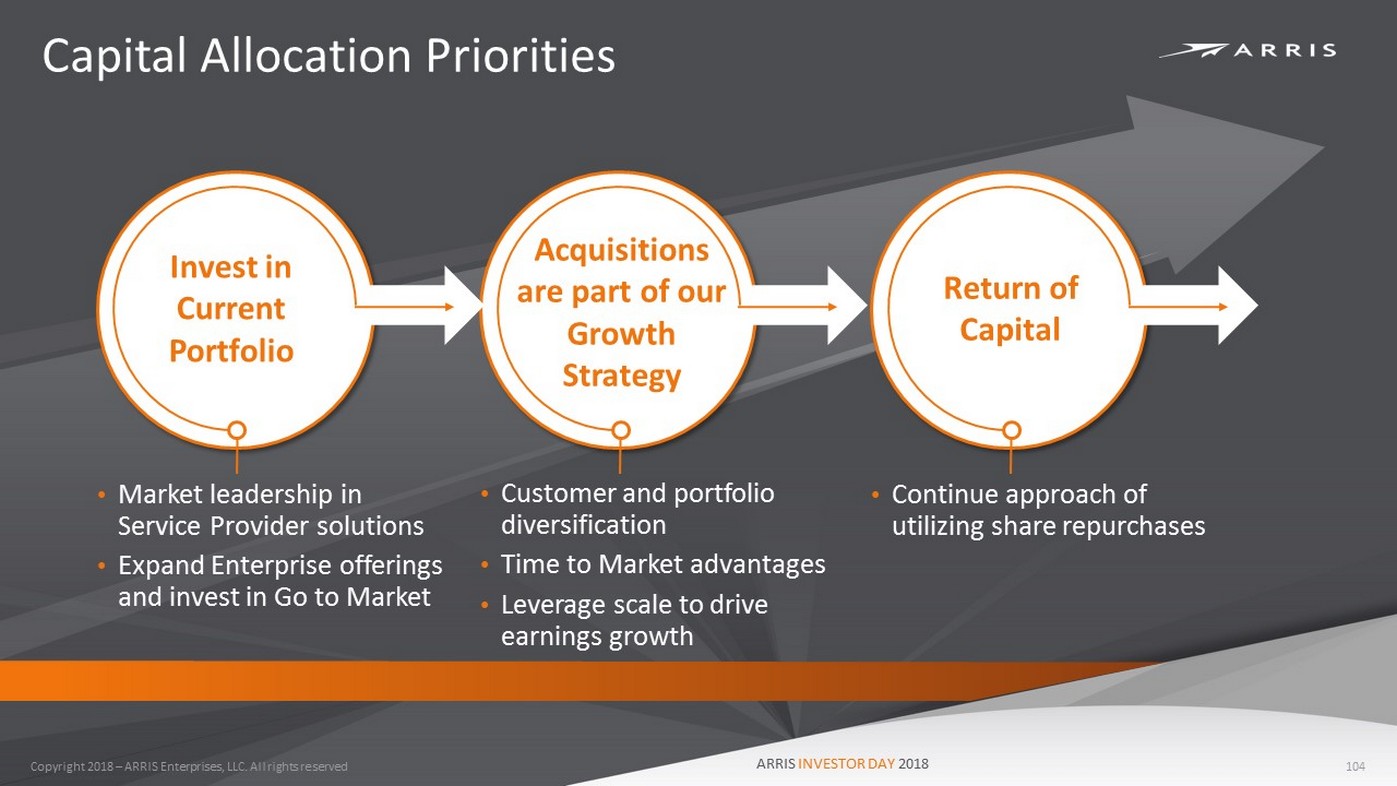

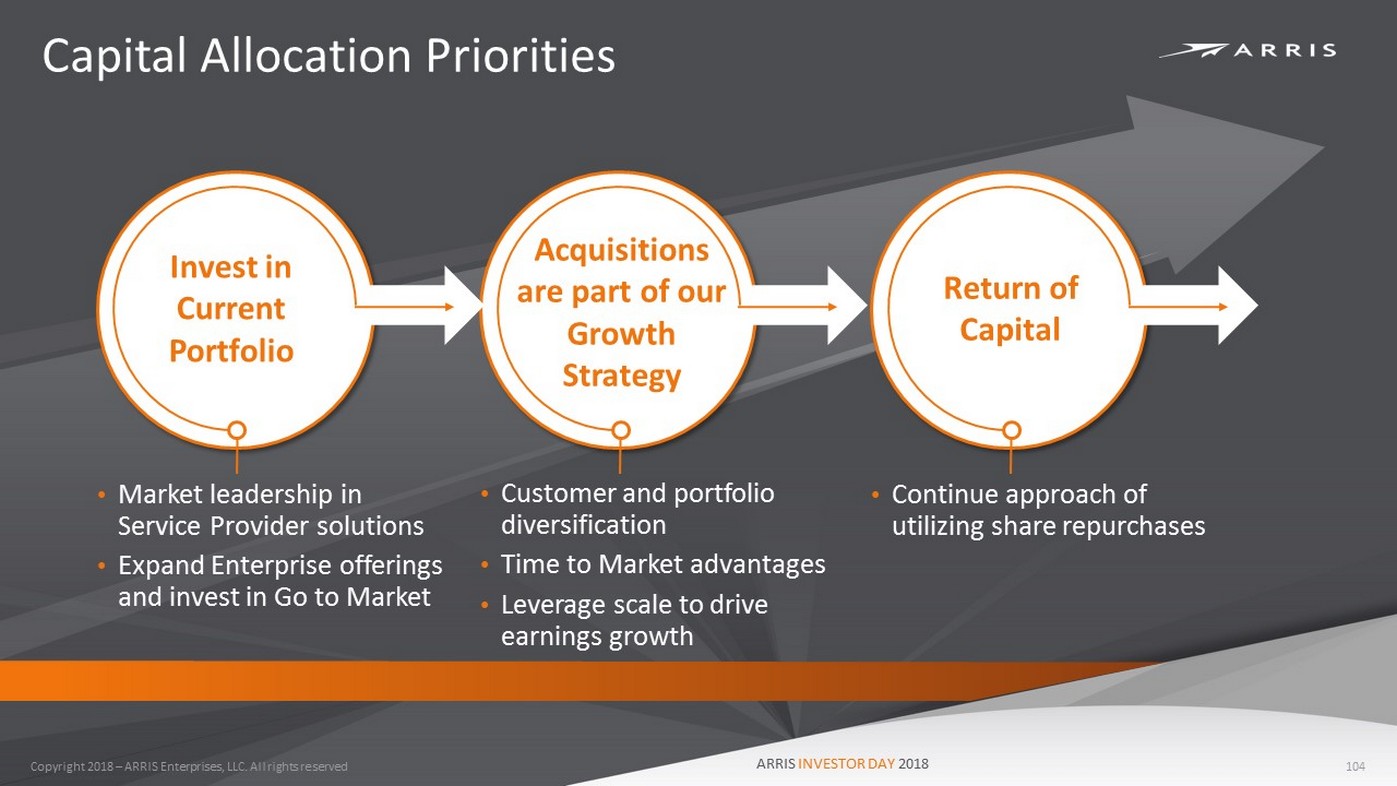

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Capital Allocation Priorities 104 Invest in Current Portfolio Acquisitions are part of our Growth Strategy Return of Capital • Market leadership in Service Provider solutions • Expand Enterprise offerings and invest in Go to Market • Customer and portfolio diversification • Time to Market advantages • Leverage scale to drive earnings growth • Continue approach of utilizing share repurchases ARRIS INVESTOR DAY 2018

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Summary 105 Growing profitability with strong cash generation Significant growth opportunity with Enterprise and N&C Flexibility provided by strong balance sheet & capital structure ARRIS INVESTOR DAY 2018

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Today’s Key Messages • Well - positioned to benefit from mass - market Gigabit Internet spend • Deeply entrenched leadership in evolving video market • Expanded addressable market with increasingly diversified customer base • Leadership in emerging mobile CBRS LTE small cell market • Three year outlook and earnings growth target • Capital allocation strategy 106 ARRIS INVESTOR DAY 2018

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved ARRIS INVESTOR DAY 2018

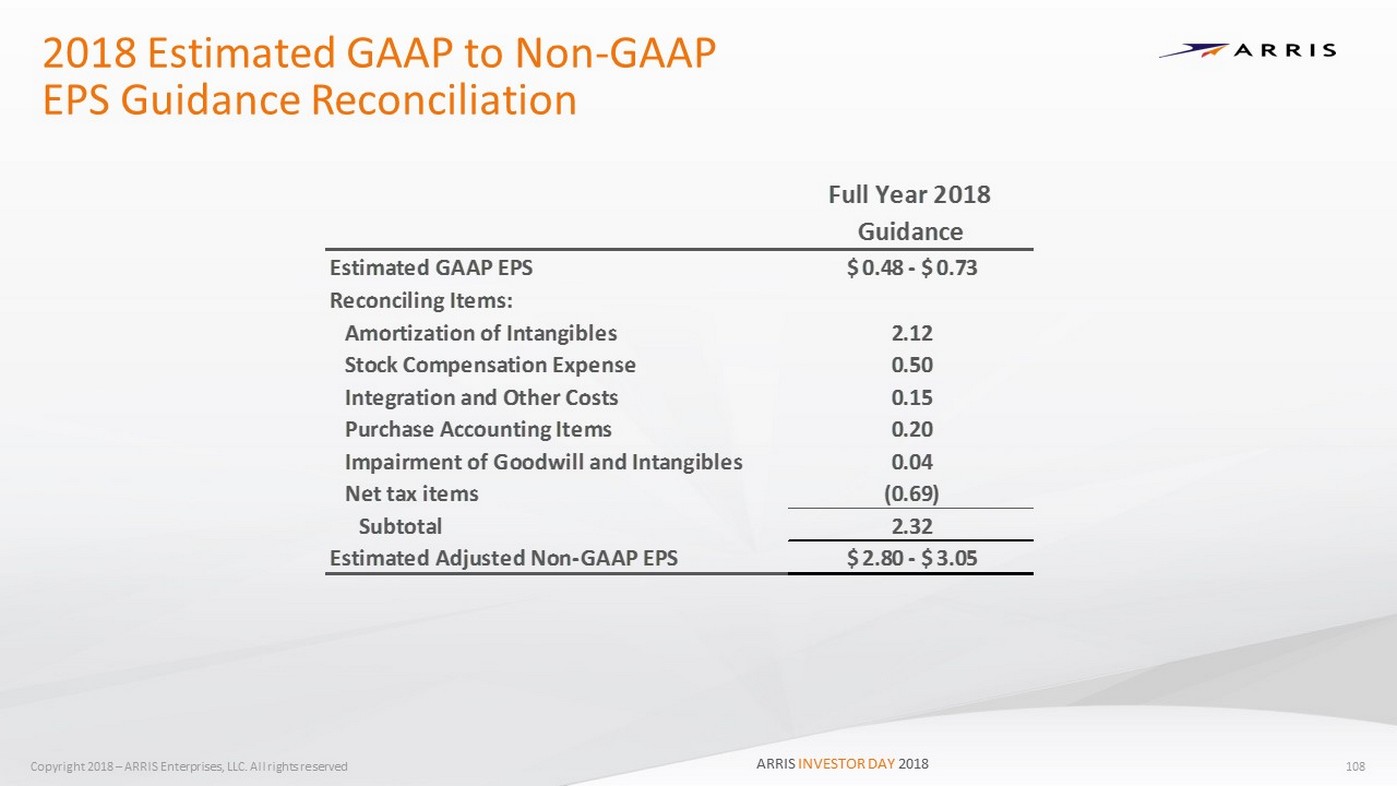

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved Full Year 2018 Guidance Estimated GAAP EPS $ 0.48 - $ 0.73 Reconciling Items: Amortization of Intangibles 2.12 Stock Compensation Expense 0.50 Integration and Other Costs 0.15 Purchase Accounting Items 0.20 Impairment of Goodwill and Intangibles 0.04 Net tax items (0.69) Subtotal 2.32 Estimated Adjusted Non-GAAP EPS $ 2.80 - $ 3.05 2018 Estimated GAAP to Non - GAAP EPS Guidance Reconciliation 108 ARRIS INVESTOR DAY 2018

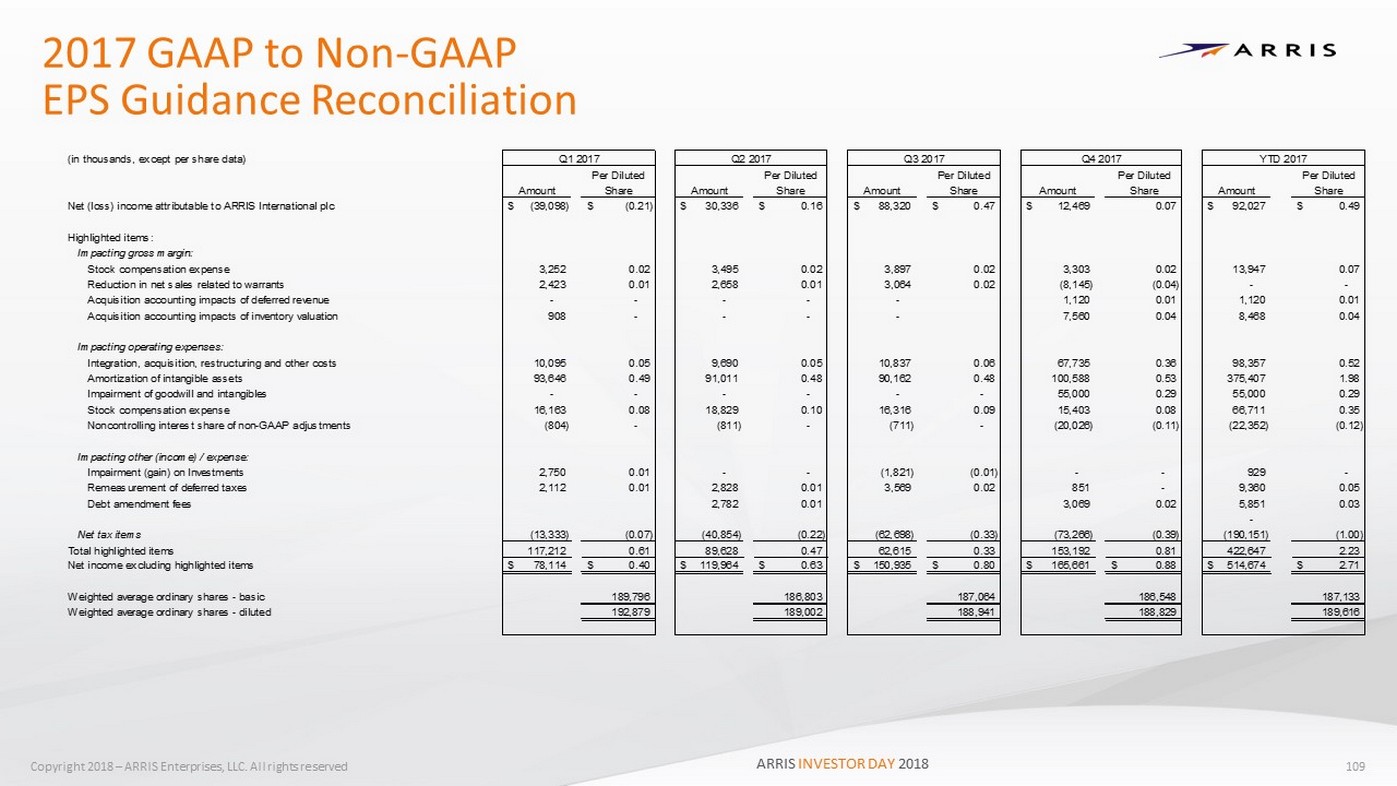

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved 2017 GAAP to Non - GAAP EPS Guidance Reconciliation 109 (in thousands, except per share data) Per Diluted Per Diluted Per Diluted Per Diluted Per Diluted Amount Share Amount Share Amount Share Amount Share Amount Share Net (loss) income attributable to ARRIS International plc (39,098)$ (0.21)$ 30,336$ 0.16$ 88,320$ 0.47$ 12,469$ 0.07 92,027$ 0.49$ Highlighted items: Impacting gross margin: Stock compensation expense 3,252 0.02 3,495 0.02 3,897 0.02 3,303 0.02 13,947 0.07 Reduction in net sales related to warrants 2,423 0.01 2,658 0.01 3,064 0.02 (8,145) (0.04) - - Acquisition accounting impacts of deferred revenue - - - - - 1,120 0.01 1,120 0.01 Acquisition accounting impacts of inventory valuation 908 - - - - 7,560 0.04 8,468 0.04 Impacting operating expenses: Integration, acquisition, restructuring and other costs 10,095 0.05 9,690 0.05 10,837 0.06 67,735 0.36 98,357 0.52 Amortization of intangible assets 93,646 0.49 91,011 0.48 90,162 0.48 100,588 0.53 375,407 1.98 Impairment of goodwill and intangibles - - - - - - 55,000 0.29 55,000 0.29 Stock compensation expense 16,163 0.08 18,829 0.10 16,316 0.09 15,403 0.08 66,711 0.35 Noncontrolling interest share of non-GAAP adjustments (804) - (811) - (711) - (20,026) (0.11) (22,352) (0.12) Impacting other (income) / expense: Impairment (gain) on Investments 2,750 0.01 - - (1,821) (0.01) - - 929 - Remeasurement of deferred taxes 2,112 0.01 2,828 0.01 3,569 0.02 851 - 9,360 0.05 Debt amendment fees 2,782 0.01 3,069 0.02 5,851 0.03 - Net tax items (13,333) (0.07) (40,854) (0.22) (62,698) (0.33) (73,266) (0.39) (190,151) (1.00) Total highlighted items 117,212 0.61 89,628 0.47 62,615 0.33 153,192 0.81 422,647 2.23 Net income excluding highlighted items 78,114$ 0.40$ 119,964$ 0.63$ 150,935$ 0.80$ 165,661$ 0.88$ 514,674$ 2.71$ Weighted average ordinary shares - basic 189,796 186,803 187,064 186,548 187,133 Weighted average ordinary shares - diluted 192,879 189,002 188,941 188,829 189,616 Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 ARRIS INVESTOR DAY 2018

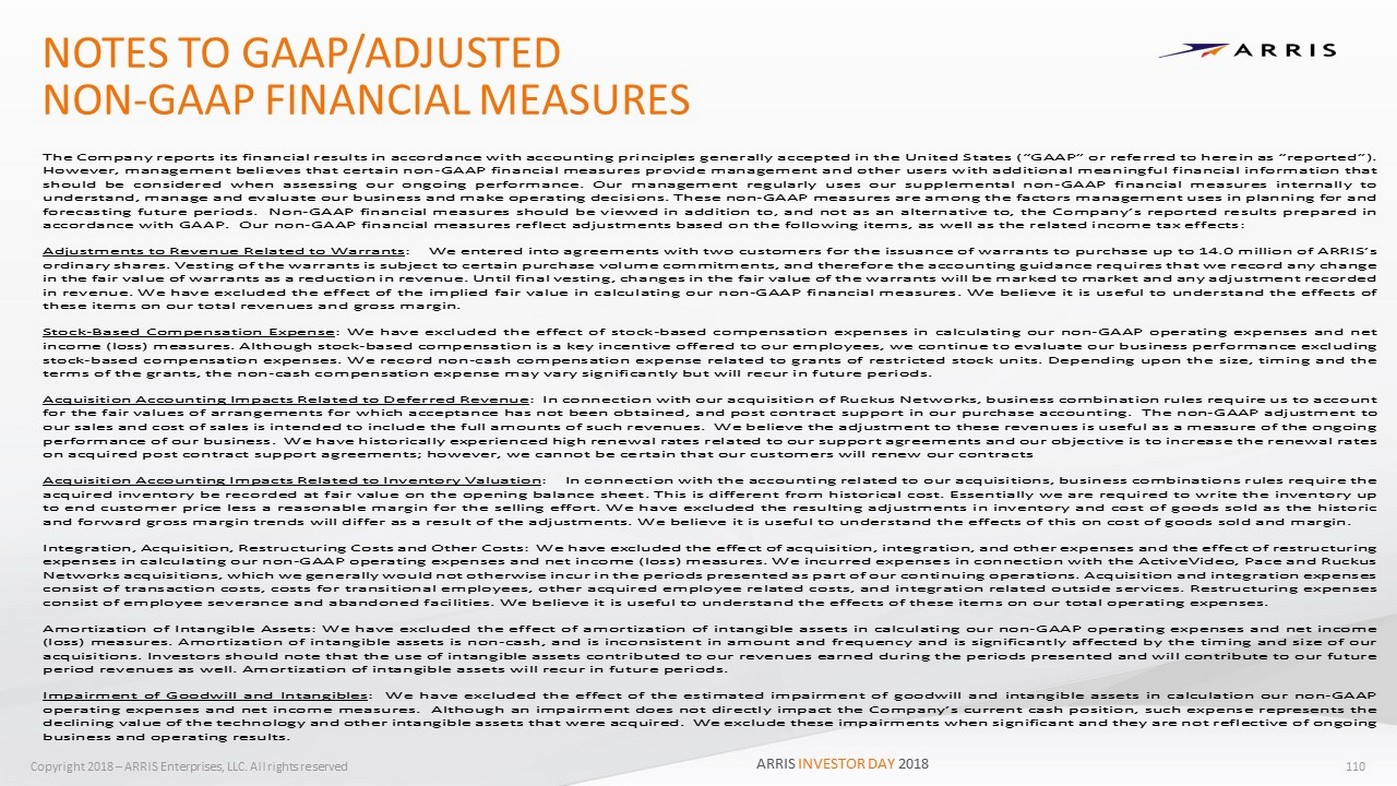

Copyright 2018 – ARRIS Enterprises, LLC. All rights reserved NOTES TO GAAP/ADJUSTED NON - GAAP FINANCIAL MEASURES 110 The Company reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP” or referred to herein as “reported”). However, management believes that certain non-GAAP financial measures provide management and other users with additional meaningful financial information that should be considered when assessing our ongoing performance. Our management regularly uses our supplemental non -GAAP financial measures internally to understand, manage and evaluate our business and make operating decisions. These non-GAAP measures are among the factors management uses in planning for and forecasting future periods. Non-GAAP financial measures should be viewed in addition to, and not as an alternative to, the Company’s reported results prepared in accordance with GAAP. Our non-GAAP financial measures reflect adjustments based on the following items, as well as the related income tax effects: Adjustments to Revenue Related to Warrants: We entered into agreements with two customers for the issuance of warrants to purchase up to 14.0 million of ARRIS’s ordinary shares. Vesting of the warrants is subject to certain purchase volume commitments, and therefore the accounting guidance requires that we record any change in the fair value of warrants as a reduction in revenue. Until final vesting, changes in the fair value of the warrants will be marked to market and any adjustment recorded in revenue. We have excluded the effect of the implied fair value in calculating our non-GAAP financial measures. We believe it is useful to understand the effects of these items on our total revenues and gross margin. Stock-Based Compensation Expense: We have excluded the effect of stock-based compensation expenses in calculating our non-GAAP operating expenses and net income (loss) measures. Although stock-based compensation is a key incentive offered to our employees, we continue to evaluate our business performance excluding stock-based compensation expenses. We record non-cash compensation expense related to grants of restricted stock units. Depending upon the size, timing and the terms of the grants, the non-cash compensation expense may vary significantly but will recur in future periods. Acquisition Accounting Impacts Related to Deferred Revenue: In connection with our acquisition of Ruckus Networks, business combination rules require us to account for the fair values of arrangements for which acceptance has not been obtained, and post contract support in our purchase accounting. The non-GAAP adjustment to our sales and cost of sales is intended to include the full amounts of such revenues. We believe the adjustment to these revenues is useful as a measure of the ongoing performance of our business. We have historically experienced high renewal rates related to our support agreements and our objective is to increase the renewal rates on acquired post contract support agreements; however, we cannot be certain that our customers will renew our contracts Acquisition Accounting Impacts Related to Inventory Valuation: In connection with the accounting related to our acquisitions, business combinations rules require the acquired inventory be recorded at fair value on the opening balance sheet. This is different from historical cost. Essentially we are required to write the inventory up to end customer price less a reasonable margin for the selling effort. We have excluded the resulting adjustments in inventory and cost of goods sold as the historic and forward gross margin trends will differ as a result of the adjustments. We believe it is useful to understand the effects of this on cost of goods sold and margin. Integration, Acquisition, Restructuring Costs and Other Costs: We have excluded the effect of acquisition, integration, and other expenses and the effect of restructuring expenses in calculating our non-GAAP operating expenses and net income (loss) measures. We incurred expenses in connection with the ActiveVideo, Pace and Ruckus Networks acquisitions, which we generally would not otherwise incur in the periods presented as part of our continuing operations. Acquisition and integration expenses consist of transaction costs, costs for transitional employees, other acquired employee related costs, and integration related outside services. Restructuring expenses consist of employee severance and abandoned facilities. We believe it is useful to understand the effects of these items on our total operating expenses. Amortization of Intangible Assets: We have excluded the effect of amortization of intangible assets in calculating our non -GAAP operating expenses and net income (loss) measures. Amortization of intangible assets is non-cash, and is inconsistent in amount and frequency and is significantly affecte d by the timing and size of our acquisitions. Investors should note that the use of intangible assets contributed to our revenues earned during the periods presented and will contribute to our future period revenues as well. Amortization of intangible assets will recur in future periods. Impairment of Goodwill and Intangibles: We have excluded the effect of the estimated impairment of goodwill and intangible assets in calculation our non-GAAP operating expenses and net income measures. Although an impairment does not directly impact the Company’s current cash position, such expense represents the declining value of the technology and other intangible assets that were acquired. We exclude these impairments when significant and they are not reflective of ongoing business and operating results. ARRIS INVESTOR DAY 2018