| | | Goodwin Procter LLP The New York Times Building

620 Eighth Avenue

New York, NY 10018 goodwinlaw.com +1 212 813 8800 |

May 11, 2021

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Corporation Finance – Office of Real Estate & Commodities

100 F Street, N.E.

Washington, D.C. 20549-3010

| Re: | Fundrise Real Estate Investment Trust, LLC

Offering Statement on Form 1-A Post-Qualification Amendment No. 5 Response dated April 19, 2021 File No. 024-11140 |

Dear Staff of the Division of Corporation Finance:

This letter is submitted on behalf of Fundrise Real Estate Investment Trust, LLC (the “Company”) in response to a comment letter from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) dated April 30, 2021 (the “Comment Letter”) with respect to the Company’s Post-Qualification Amendment on Form 1-A filed with the Commission on March 18, 2021 (the “Offering Statement”). The responses provided are based upon information provided to Goodwin Procter LLP by the Company.

For your convenience, the Staff’s comments have been reproduced in italics herein with responses immediately following the comment. Defined terms used herein but not otherwise defined have the meanings given to them in the Offering Statement.

Post-Qualification Amendment No. 5 to Offering Statement on Form 1-A

Appendix B - Year-End Letter to Investors - 2020, page B-1

1. We note your response to comment 1. Your response did not adequately address all the issues raised in the comment. Please provide more specific detail regarding how the Fundrise returns are calculated. In this respect, we note that footnote (1) does not clarify how the returns for the Fundrise programs are calculated and aggregated. For example, please clarify whether returns are based on distributions paid, changes in NAV or a combination of both. To the extent that distributions are included in the return calculation, please disclose whether they include programs that use offering proceeds to fund distributions and identify such programs. In addition, since you are using Vanguard ETF funds for comparison, please provide more detail as to how the Vanguard returns are calculated.

Response to Comment No. 1

RESPONSE: Fundrise returns are calculated using the Modified Dietz method, which is one of the methodologies of calculating returns recommended by the Investment Performance Council (IPC) as part of their Global Investment Performance Standards (GIPS). Returns include both changes in NAV as well as distributions paid, and are net of fees. The Company will endeavor to make this calculation more clear in any future communications and offering documents.

Generally, the Company and its affiliated programs did not pay distributions from offering proceeds during 2020; however, a program's GAAP net income alone is not a strong depiction of cash available for distributions. As the Staff is aware, real estate investments have operating income in excess of their GAAP income due to adjustments, such as for depreciation. Other times refinancing provides a source of proceeds but has no income statement effect. As a result, while the Company's distributions were made 100% from GAAP net income and from ordinary income for U.S federal income tax purposes, and there was no return of capital for the year ended December 31, 2020, several of its affiliated programs did report returns of capital for U.S federal income tax purposes during 2020, including: (a) Fundrise East Coast Opportunistic REIT, LLC; (b) Fundrise Midland Opportunistic REIT, LLC; (c) Fundrise Growth eREIT II, LLC; (d) Fundrise Income eREIT III, LLC; (e) Fundrise Growth eREIT III, LLC; (f) Fundrise Growth eREIT 2019, LLC; and (g) Fundrise Growth eREIT V, LLC.

Fundrise Real Estate Investment Trust, LLC

May 11, 2021

Page 2

In each of the above instances, disclosure was included in the appropriate annual reports on Forms 1-K describing the distributions tax bases, and each of the above described programs filed and made public (on fundrise.com/oc) IRS Forms 8937 describing such distributions. An example of the disclosure included in the Company’s Annual Report on Form 1-K for the year ended December 31, 2020 in noted below:

When calculated on a tax basis, all distributions were made 100% from ordinary income and there was no return of capital for the year ended December 31, 2020.

However, more importantly, the Company respectfully advises the Staff that if it, or any of its affiliated programs, were using offering proceeds to fund a material amount of their respective distributions, such distribution of offering proceeds would have had a material, detrimental effect on the respective NAVs of such programs as cash payments or accruals for distributions in excess of cash distributions/ earned income from investments would reduce net assets, ultimately reducing NAV and, accordingly, negatively affecting the performance calculation described above.

As to how Vanguard calculates performance, the Vanguard ETF funds’ returns are the “Total return by NAV” for each respective fund sourced directly from vanguard.com, which likewise include both changes in NAV and distributions paid.

Finally, the Company respectfully notes that all of the performance calculations done by its Manager, which is a registered investment advisor under the Investment Advisers Act of 1940, are periodically reviewed by the SEC's Division of Examinations.

2. Refer to comment 1 above. We also note that on page 17 of your Form 1-K for the fiscal year ended December 31, 2020, you compare your returns to that of The Vanguard Real Estate Index and highlight that you "outperformed" your "peers." Please explain to us why you view The Vanguard Real Estate Index to be a "peer." In this respect, we note that the index appears to track the performance of publicly traded equity REITs. In addition, we note that your discussion of management's outlook and trends appears less fulsome than the information provided in your year-end letter. For example, we note that your year-end letter provided additional context for management's decision to suspend redemptions and the resulting investor response as well as management's views regarding acquisitions during the economic recovery. In addition, your year-end letter also highlights the long-term nature of an investment in Fundrise programs by providing an anecdotal discussion of the effect of the company's outlook and acquisition approach on new investors. Please tell us what consideration was given to providing similarly detailed information in your Form 1-K.

Response to Comment No. 2

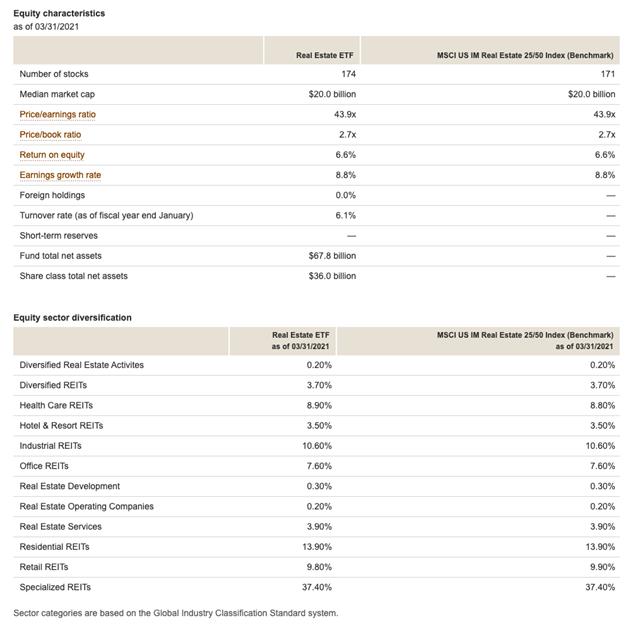

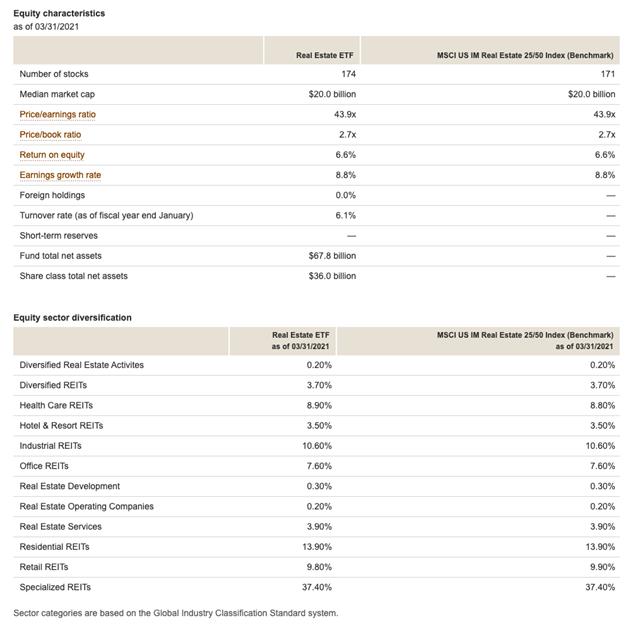

RESPONSE: As stated in its previous response, the Company believes that the Vanguard Real Estate ETF ("VNQ"), which it believes is the most commonly known real estate investment option available to retail investors, is an appropriate benchmark by which to measure itself and its affiliated programs. In addition, the Company respectfully advises the Staff that it does not consider itself a peer of VNQ, but rather of the 174 distinct real estate investment trusts that make up VNQ. In the future, the Company will be more careful to clarify that when it is referring to "peers", it is not referring to VNQ (or other benchmark) but to its underlying component parts.

In addition, as shown in the chart below, the Company respectfully notes that, as shown in the charts below, VNQ closely, but not exactly, mirrors the MSCI US IM Real Estate 25/50 Index (the "MSCI Index"), the benchmark used by Blackstone Real Estate Income Trust ("BREIT").

Fundrise Real Estate Investment Trust, LLC

May 11, 2021

Page 3

*Image taken from Vanguard's website, https://investor.vanguard.com/etf/profile/portfolio/vnq, on May 1, 2021.

Accordingly, the Company respectfully reiterates its belief that the VNQ is a better benchmark than the MSCI Index because it is widely known to retail investors, available as an alternative investment (e.g., a retail investor could not invest in the MSCI Index instead of the Company), and its performance history is much more readily available to a retail investor than the performance of the MSCI Index.

However, despite the Company's belief that VNQ is a better overall benchmark for the reasons given above, going forward, the Company and its affiliated programs endeavor to use both the VNQ and the MSCI Index (or similar index) as a benchmark for peer real estate performance, and both the Vanguard Total Stock Market ETF and the S&P 500 Index (or similar index) as a benchmark for total market performance. As noted above, the Company respectfully notes that the MSCI Index and the S&P 500 Index are two benchmarks that are used by BREIT in its investor communications.

Fundrise Real Estate Investment Trust, LLC

May 11, 2021

Page 4

As to the Company's Annual Report on Form 1-K, the Company and its affiliated programs generally endeavor to provide investors with very robust disclosure, but respectfully reminds the Staff that neither the Company nor its affiliated programs that offer securities under Regulation A are subject to the additional disclosure requirements that smaller reporting companies (or accelerated filers or large accelerated filers) are subject to as a result of being registered under the Securities Exchange Act of 1934 (the "Exchange Act"), and to require disclosure above and beyond what is required under Regulation A, without receiving the additional benefits of being an Exchange Act reporting company, would place an undue burden on the Company and any other Regulation A filer. The Company also notes that it nonetheless provided the additional anecdotal information in the annual shareholder letter itself and that letter was disseminated to all existing shareholders of the Company and its affiliated programs.

* * * * *

If you have any questions or would like further information concerning the Company’s responses to the Comment Letter, please do not hesitate to contact me at (212) 813-8842 or Bjorn J. Hall at (202) 584-0550.

| | Sincerely, |

| | |

| | /s/ Mark Schonberger |

| | |

| | Mark Schonberger |

| cc: | Via E-mail |

| Benjamin S. Miller, Chief Executive Officer |

| Bjorn J. Hall, General Counsel and Secretary |

| Michelle A. Mirabal, Deputy General Counsel |

| | | Rise Companies Corp. |

| | | |

| Matthew Schoenfeld, Esq. |

| | | Goodwin Procter LLP |