- HPE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Hewlett Packard Enterprise (HPE) DEF 14ADefinitive proxy

Filed: 13 Feb 19, 4:39pm

Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| HEWLETT PACKARD ENTERPRISE COMPANY | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Hewlett Packard Enterprise Company 6280 America Center Drive San Jose, California 95002 www.hpe.com |

|

Fellow Stockholders,

This time last year, I shared with you a message of transformation, marking the end of an era and beginning the next chapter for Hewlett Packard Enterprise. Many of you have been with the HPE family every step of the way and some of you have joined us more recently because you are excited about the possibilities before us. As Antonio mentioned, we have indeed made important progress with our transformation over the last year. We have a clear strategy, a more agile structure, a streamlined portfolio, and a strong leadership team. This year, from our enhanced position of strength, we are furthering our investments in our people, our business, and our world.

Over the past year, we have significantly increased the investment in our people and in the culture we are building at our company. From humble beginnings in a Palo Alto garage to the global industry leader we are today, we have always recognized that people are the heart of HPE. As you read in Antonio's message, in 2018, he declared that the HPE culture was one of his top three priorities for the company. Additionally, the Board of Directors is very committed to HPE's talent and culture agenda, and we are very pleased with the increased engagement across the teams.

Additionally, Antonio, his leadership team, and our Board have made important investments in our business. Our company has always been an engine of innovation. That spirit is alive and well today, fueled by recent acquisitions like BlueData and Cape Networks; collaborations with innovative startups like Jungla and leading institutions like COSMOS Research Group; and a $4 billion commitment to the Intelligent Edge business. Our customers are advancing leading-edge research, realizing greater efficiencies, and improving outcomes for their customers because of HPE's best-in-class innovations. That's both inspiring and a big part of why the company will continue to drive both customer and stockholder value.

Finally, one of the most critical ways we invest in our collective future is by strengthening the communities where we live and work. We are proud to have both a legacy and a modern-day commitment to community engagement and support. Last year, we donated to more than 4,300 charities in 41 countries, delivered eHealth solutions to more than 500,000 patients in 18 Indian states, provided more than $14.5 million in loans to entrepreneurs in 85 countries, and launched a global day of service across every geography. We reduced our greenhouse gas emissions by 25% and introduced important sustainability goals and smart city partnerships that earned global awards and recognition.

As we reflect on where the company has been and where we are going, we are excited to invite you to attend the fourth annual meeting of stockholders of HPE on Wednesday, April 3, 2019 at 11:00 a.m., Pacific Time. This year's meeting will again be completely virtual, conducted via live webcast. We are pleased to provide access to our proxy materials over the Internet under the U.S. Securities and Exchange Commission's "notice and access" rules. As a result, we are mailing to many of our stockholders a notice of Internet availability rather than a paper copy of this proxy statement and our 2018 Annual Report. The notice contains instructions on how to access those documents over the Internet as well as how to receive a paper copy of our proxy materials. All stockholders who do not receive a notice will receive a paper copy by mail unless they have previously requested delivery of proxy materials electronically. Continuing to employ this distribution process will conserve natural resources and reduce the costs of printing and distributing our proxy materials. Your vote is important to us and we do hope you will vote as soon as possible.

It has been a pleasure for us, your Board of Directors, to provide independent and expert oversight over the transformative strategies being advanced to create value for our customers. Our investments in building a strong culture and business were all made possible by the investment you, our stockholders, made in us. So, on behalf of our people and our business, I thank you for your continued support of Hewlett Packard Enterprise.

| On behalf of the Hewlett Packard Enterprise Board of Directors, | ||

Patricia F. Russo Chair of the Board |

| ||||

Hewlett Packard Enterprise Company 6280 America Center Drive San Jose, California 95002 (650) 687-5817 |

Notice of annual meeting of

stockholders

| | | | | | | | | |

| Time and Date | 11:00a.m., Pacific Time, on Wednesday, April 3, 2019 | ||||||

Place | Online at HPE.onlineshareholdermeeting.com | |||||||

| | | | | | | | | |

| | | | | | | |

1 | To elect the 12 directors named in this proxy statement | |||||

2 | To ratify the appointment of the independent registered public accounting firm for the fiscal year ending October 31, 2019 | |||||

3 | To approve, on an advisory basis, the Company's executive compensation | |||||

4 | To consider and vote upon one stockholder proposal, if properly presented | |||||

5 | To consider such other business as may properly come before the meeting | |||||

| | | | | | | |

Adjournments and postponements

Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed.

You are entitled to vote only if you were a Hewlett Packard Enterprise Company stockholder as of the close of business on February 4, 2019.

![]()

2019 notice and proxy statement

Stockholders of record as of February 4, 2019 will be able to participate in the annual meeting by visitingHPE.onlineshareholdermeeting.com. To participate in the annual meeting, you will need the 16-digit control number included on your notice of Internet availability of the proxy materials, on your proxy card or on the instructions that accompanied your proxy materials. The annual meeting will begin promptly at 11:00 a.m., Pacific Time.

The online format for the annual meeting also allows us to communicate more effectively with you via www.proxyvote.com for beneficial owners and proxyvote.com/hpe for registered stockholders; at these sites you can submit questions in advance of the annual meeting, and also access copies of our proxy statement and 2018 Annual Report on Form 10-K.

Your vote is very important to us. Regardless of whether you plan to participate in the annual meeting, we hope you will vote as soon as possible. You may vote your shares over the Internet or via a toll-free telephone number. If you received a paper copy of a proxy or voting instruction card by mail, you may also submit your proxy or voting instruction card for the annual meeting by completing, signing, dating and returning your proxy or voting instruction card in the pre-addressed envelope provided. Stockholders of record and beneficial owners will be able to vote their shares electronically during the annual meeting (other than shares held through the Hewlett Packard Enterprise Company 401(k) Plan, which must be voted prior to the meeting). For specific instructions on how to vote your shares, please refer to the section entitledQuestions and answers—Voting information beginning on page 91 of the proxy statement.

| By order of the Board of Directors, John F. Schultz Executive Vice President, Chief Legal and Administrative Officer and Corporate Secretary |

This notice of annual meeting and proxy statement and form of proxy are being distributed and made available on or about February 13, 2019.

Important notice regarding the availability of proxy materials for the stockholder meeting to be held on April 3, 2019.

This proxy statement and Hewlett Packard Enterprise Company's 2018 Annual Report on Form 10-K are available electronically atwww.hpe.com/investor/stockholdermeeting2019 and with your 16-digit control number by visitingwww.proxyvote.com for beneficial owners andproxyvote.com/hpe for registered stockholders.

![]()

2019 notice and proxy statement

Proxy statement executive summary | 1 | |||

Corporate governance | 2 | |||

Stockholder outreach and engagement | 2 | |||

Environmental and social governance through living progress | 4 | |||

Hewlett Packard Enterprise board of directors | 5 | |||

Board composition | 5 | |||

Director candidate selection and evaluation | 7 | |||

Board and committee meetings and attendance | 8 | |||

Board leadership structure | 8 | |||

Board structure and committee composition | 9 | |||

Board risk oversight | 14 | |||

Succession planning | 15 | |||

Director evaluations | 15 | |||

Limits on director service on other public company boards | 15 | |||

Director independence | 16 | |||

Director compensation and stock ownership guidelines | 19 | |||

Non-employee director stock ownership guidelines | 22 | |||

Stock ownership information | 23 | |||

Common stock ownership of certain beneficial owners and management | 23 | |||

Section 16(a) beneficial ownership reporting compliance | 25 | |||

Related persons transaction policies and procedures | 25 | |||

Governance documents | 27 | |||

Communications with the board | 27 | |||

Proposals to be voted on | 28 | |||

Proposal No. 1 Election of directors | 28 | |||

Proposal No. 2 Ratification of independent registered public accounting firm | 43 | |||

Proposal No. 3 Advisory vote to approve executive compensation | 44 | |||

Proposal No. 4 Stockholder proposal related to action by written consent of stockholders | 46 | |||

Executive compensation | 50 | |||

Compensation discussion and analysis | 50 | |||

Executive summary | 50 | |||

Executive compensation pay-for-performance philosophy | 53 | |||

Oversight and authority over executive compensation | 54 | |||

Detailed compensation discussion and analysis | 55 | |||

Process for setting and awarding fiscal 2018 executive compensation | 56 | |||

Compensation program enhancements for fiscal 2018 | 57 | |||

Determination of fiscal 2018 executive compensation | 58 | |||

Other compensation-related matters | 65 | |||

HRC committee report on executive compensation | 68 | |||

Summary compensation table | 69 | |||

Grants of plan-based awards in fiscal 2018 | 72 |

![]()

2019 notice and proxy statement

Outstanding equity awards at 2018 fiscal year-end | 74 | |||

Option exercises and stock vested in fiscal 2018 | 75 | |||

Fiscal 2018 pension benefits table | 76 | |||

Fiscal 2018 non-qualified deferred compensation table | 77 | |||

Potential payments upon termination or change in control | 79 | |||

Equity compensation plan information | 84 | |||

Audit-related matters | 85 | |||

Principal accounting fees and services | 85 | |||

Report of the audit committee of the board of directors | 87 | |||

Other matters | 88 | |||

Questions and answers | 89 | |||

Proxy materials | 89 | |||

Voting information | 91 | |||

Annual meeting information | 95 | |||

Stockholder proposals, director nominations and related Bylaws provisions | 96 |

![]()

2019 notice and proxy statement — Proxy statement executive summary

Proxy statement executive summary

The following is a summary of proposals to be voted on at the annual meeting. This is only a summary, and it may not contain all of the information that is important to you. For more complete information, please review the proxy statement as well as our 2018 Annual Report on Form 10-K for the fiscal year ended October 31, 2018. References to "Hewlett Packard Enterprise," "HPE," "the Company," "we," "us" or "our" refer to Hewlett Packard Enterprise Company.

Annual meeting of stockholders

| | | | | |||||

| | | | | | | | | |

| |

| Time and Date | | 11:00 a.m., Pacific Time, on Wednesday, | |

| ||

| |

| | Place | | Online at HPE.onlineshareholdermeeting.com | |

| |

| |

| Record Date | | February 4, 2019 | |

| ||

| | | | | | | | | |

Proposals to be voted on and board voting recommendations

| | | Proposal | | Recommendation | ||

1 | | Election of directors The Nominating, Governance and Social Responsibility Committee (the "NGSR Committee") has nominated 12 directors for re-election at the annual meeting to hold office until the 2020 annual meeting. Information regarding the skills and qualifications of each nominee can be found on page 28. | | | Our Board recommends a voteFOR the election to the Board of each of the 12 nominees. | |

| | | | | | | |

| 2 | | Ratification of independent registered public accounting firm The Audit Committee has appointed, and is asking stockholders to ratify, Ernst & Young LLP ("EY") as the independent registered public accounting firm for fiscal 2019. Information regarding fees paid to and services rendered by EY can be found on page 43. | | Our Board recommends a voteFOR the ratification of the appointment. | ||

| | | | | | | |

| 3 | | Advisory vote to approve executive compensation Our Board of Directors and HR and Compensation Committee (the "HRC Committee") of the Board are committed to excellence in corporate governance and to executive compensation programs that align the interests of our executives with those of our stockholders. Information regarding our programs can be found on pages 44 and 45. | | | Our Board recommends a voteFOR the approval of the compensation of our named executive officers. | |

| | | | | | | |

| 4 | | Stockholder proposal related to action by written consent of stockholders We received a stockholder proposal seeking to have us amend HPE's Bylaws to enable stockholder action by written consent and, if properly presented, the proposal will be voted on at the annual meeting. Information can be found on pages 46 through 49. | | Our Board recommends a voteAGAINST a stockholder proposal seeking to have us amend HPE's Bylaws to enable stockholder action by written consent. | ||

| | | | | | | |

| | |

| | | Page 1 |

![]()

2019 notice and proxy statement — Corporate governance

Our Board of Directors (the "Board") is committed to excellence in corporate governance. We know that our long-standing tradition of principled, ethical governance benefits you, our stockholders, as well as our customers, employees and communities, and we have developed and continue to maintain a governance profile that aligns with industry-leading standards. We believe that the high standards set by our governance structure have had and will continue to have a direct impact on the strength of our business. The following table presents a brief summary of highlights of our governance profile, followed by more in-depth descriptions of some of the key aspects of our governance structure.

| | | | | | | | | | | | | | | | | | | |

| | Board conduct and oversight | | Independence and participation | | Stockholder rights | | ||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Development and oversight of execution of Company strategy | 10 of 12 director nominees are independent by NYSE standards | Proxy Access Right for eligible stockholders holding 3% or more of outstanding common stock for at least three years to nominate up to 20% of the Board | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Rigorous stock ownership guidelines, including a 7x base salary requirement for the CEO | | Independent Chair | | Special Meeting Right for stockholders of an aggregate of 25% of voting stock | | |||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Regular, conscientious risk assessment | Executive sessions of non-management directors generally held at each Board and committee meeting | All directors annually elected; no staggered Board | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Standards of Business Conduct, applied to all directors, executive officers and employees | | Audit, HRC, and NGSR Committees are each made up entirely of independent directors | | Majority voting in uncontested director elections | | |||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Annual review of developments in best practices | Governance guidelines express preference for the separation of the Chair and CEO roles | No "poison pill" | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Significant time devoted to succession planning and leadership development efforts | | Participation in one-on-one meetings with management | | No supermajority voting requirements to change organizational documents | | |||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Annual evaluations of Board, committees, and individual directors | Expansive direct engagement with stockholders | |||||||||||||||||

| | | | | | | | | | | | | | | | | | �� | |

| | Frequent participation at customer events | | | |||||||||||||||

| | | | | | | | | | | | | | | | | | | |

Stockholder outreach and engagement

We maintain a dynamic, robust, and multi-faceted stockholder outreach program designed to provide continuous and meaningful engagement and participation throughout the entire year. Rather than focusing on short-term results, we maintain the goal of fostering strong stockholder relationships leading to mutual understanding of issues and approaches, ultimately giving the company insight into stockholder support as it designs and implements strategies for long-term growth.

The key elements of our stockholder outreach program are (i) the Securities Analyst Meeting, (ii) the Board Outreach Program, and (iii) the Annual Stockholders Meeting. Our comprehensive stockholder engagement program is supplemented by our year-round investor relations outreach program that includes post-earnings communications, roadshows, bus tours, one-on-one conferences, group meetings, technology webcasts, and general availability to respond to investor inquiries. The multi-faceted nature of this program allows us to maintain meaningful engagement with a broad audience including large institutional investors, smaller to mid-size institutions, pension funds, advisory firms, and individual investors.

| | |

Page 2 | | | |

![]()

2019 notice and proxy statement — Corporate governance

We recognize that stockholders are the owners of the company and remain committed to stockholder outreach programs that are truly a dialogue. We use every element of the outreach program to provide stockholders with honest, candid information on relevant issues, sharing the rationale for our corporate strategy and the impact of the Board's oversight in key areas of the company, gathering stockholder views and feedback on each area, as well as on the outreach program itself.

We launch our stockholder outreach program in the fall with our annual Securities Analyst Meeting ("SAM"). At SAM, our leadership team provides an update on strategy and the financial outlook, including detailed information for each business unit, for the upcoming fiscal year. Although the event itself is geared toward the analyst community, a primary purpose of SAM is to give stockholders direct insight into our business, strategy, and outlook, providing those who plan to participate in the off-season engagement an informed basis on which to formulate their views and questions. Accordingly, the entire event is publicly broadcast live, with the recorded videos and transcripts also available on our investor relations website following the event.

On the heels of SAM comes a cornerstone of our stockholder outreach—our innovative board outreach program. The program consists of focused, one-on-one meetings between stockholders and our directors over a three-month period that are designed to give institutional stockholders an opportunity to better understand the companies in which they invest. These meetings enable our stockholders to better fulfil their fiduciary duties toward their investors and voice any concerns they have about HPE to our directors. This season, we extended our extensive board outreach efforts to holders of nearly 57% of our stock, with holders of more than 45% of our stock electing to participate.

We maintain clear structural goals for these meetings:

| | |

| | | Page 3 |

![]()

2019 notice and proxy statement — Corporate governance

Our year-long stockholder outreach program culminates in our annual stockholder meeting, which is conducted virtually through a live webcast and online stockholder tools. We have implemented the virtual annual meeting format in order to facilitate stockholder attendance and participation by enabling stockholders to participate fully, and equally, from any location around the world, at no cost. We believe this is the right choice for a company with a global footprint; not only bringing cost savings to the company and stockholders, but also increasing the ability to engage with all stockholders, regardless of size, resources, or physical location. We remain very sensitive to concerns regarding virtual meetings generally from investor advisory groups and other stockholder rights advocates, who have voiced concerns that virtual meetings may diminish stockholder voice or reduce accountability. Accordingly, we have designed our virtual format to enhance, rather than constrain, stockholder access, participation and communication. For example, the online format allows stockholders to communicate with us in advance of, and during, the meeting so they can ask any questions of our Board or management. We do not place restrictions on the type or form of questions that may be asked; however, we reserve the right to edit profanity or other inappropriate language for publication. During the live Q&A session of the meeting, we answer questions as they come in and address those asked in advance, as time permits. We have committed to publishing and answering each question received, following the meeting. Although the live webcast is available only to stockholders at the time of the meeting, a replay of the meeting is made publicly available on the company's investor relations site. In addition to strong participation from individual stockholders, we have continued to receive positive support from institutional stockholders who have indicated that the virtual format is beneficial and appropriate in the context of our broader direct outreach program.

We have carefully designed our outreach program to provide continuous and meaningful stockholder engagement and participation. Our committed Board of Directors and management team value these interactions and invest significant time and resources to ensure that they have an open line of communication with stockholders. Stockholders and other stakeholders may directly communicate with our Board by contacting: Secretary to the Board of Directors, 6280 America Center Drive, San Jose, California 95002; e-mail: bod-hpe@hpe.com.

For more information about the virtual stockholder meeting, see "Questions and answers—Annual meeting information" on page 95.

Environmental and social governance through living progress

Living Progress is our plan to apply the innovation engine of HPE to create sustainable IT solutions. This commitment to environmental and social governance ("ESG") is integrated into our business strategy, increasing the competitiveness and resilience of our business.

Our customers consider HPE's sustainable and efficient IT solutions to be a strategic differentiator, helping to meet both their financial and sustainability goals. Through innovative product designs and solutions, HPE enables our customers to maximize the efficiency of IT infrastructure, achieving more work for less cost and lower environmental impact.

Building the operational and reputational resilience of our value chain is also key to meeting and exceeding the expectations of our stakeholders. HPE's proactive approach to managing ESG factors mitigates risks to our company, such as fluctuating commodity prices or tightening regulations, while creating new financial opportunities.

HPE Living Progress is overseen by the NGSR Committee which reviews, assesses, reports and provides guidance to management and the Board regarding HPE's policies and programs relating to ESG. Living Progress engages at least annually with the Board and Executive Committee as a matter of best practice to drive ESG strategies for continued business success. Our leadership has earned HPE recognition on global rankings including theDow Jones Sustainability Index,EcoVadis Gold, andCDP Climate A List. This

| | |

Page 4 | | | |

![]()

2019 notice and proxy statement — Corporate governance

leadership fosters employee pride both in our company and in the important role HPE products and solutions play in solving the world's biggest social and environmental challenges.

More information regarding our award-winning Living Progress plan and our recent annual reports are available athttps://www.hpe.com/us/en/living-progress.html.

Hewlett Packard Enterprise board of directors

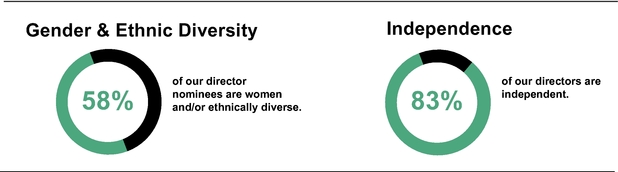

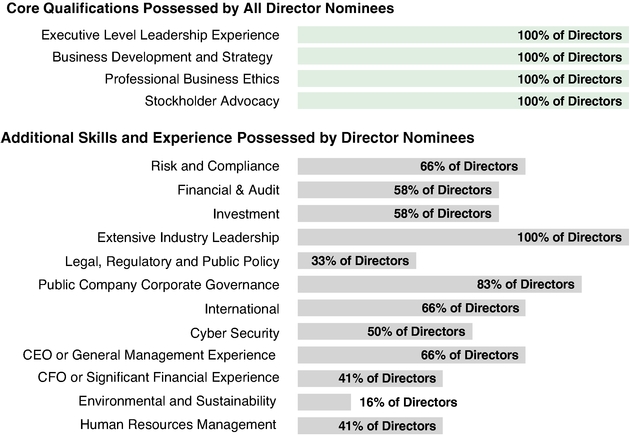

Our Board was thoughtfully structured after a global search targeting world-class directors with the diversity of skills, experience, ethnicity, and gender resulting in exceptional leadership for HPE.

The selection criteria for our directors included:

The following page includes a skills and qualifications matrix highlighting many of the key experiences and competencies our directors bring to the company.

| | |

| | | Page 5 |

![]()

2019 notice and proxy statement — Corporate governance

Hewlett Packard Enterprise Company board of directors

skills and qualifications

| | Daniel Ammann | | Michael J. Angelakis | | Pamela L. Carter | | Jean M. Hobby | | Raymond J. Lane | | Ann M. Livermore | | Antonio F. Neri | | Raymond E. Ozzie | | Gary M. Reiner | | Patricia F. Russo | | Lip-Bu Tan | | Margaret C. Whitman | | Mary Agnes Wilderotter | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Risk and Compliance | | • | | • | | • | | • | | | • | | • | | | | • | | | • | | • | ||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Financial and Audit | | • | | • | | • | | • | | | | | | • | | | | | | • | | | | • | | • |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Business Development and Strategy | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Investment | | • | | • | | | | • | | • | | | | • | | | | • | | | | • | | • | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Executive Level Leadership | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Business Ethics | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Extensive Industry Leadership | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • | | • |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Legal, Regulatory and Public Policy | | | | | | • | | • | | • | | | | | | | | | | | | | | • | | • |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Corporate Governance | | | • | | • | | • | | • | | • | | • | | | • | | • | | • | | • | | • | ||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | International | | • | | • | | • | | • | | • | | | | • | | | | | | • | | • | | • | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Cyber Security | | | | | | | | • | | • | | • | | • | | • | | • | | • | ||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Environmental and Sustainability | | | | | | | | | | • | | | | | | | | | | | | | | | | • |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Human Resources Management | | | • | | • | | | | • | | | | | • | | | • | | • | |||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Risk and Compliance: Experience identifying, mitigating, and managing risk in enterprise operations helps our directors effectively oversee our Enterprise Risk Management program, which is vital to customer and stockholder protection.

Financial and Audit: Experience in accounting and audit functions and the ability to analyze financial statements and oversee budgets are key to supporting the Board's oversight of our financial reporting and functions.

Business Development and Strategy: Experience in setting and executing corporate strategy is critical to the successful planning and execution of our long-term vision.

Investment: Experience in venture and investment capital underlies our capital allocation decisions and ensures that the investors' view of our business is incorporated in board discussions.

Executive Level Leadership: Experience in executive positions within enterprise businesses is key to the effective oversight of management.

Business Ethics: Experience in and continued dedication to the highest levels of ethics and integrity within the enterprise context underpins the holistic commitment of HPE to operate with integrity.

Extensive Industry Leadership: Experience at the executive level in the technology sector enhances our Board's ability to oversee management in a constantly changing industry.

| | |

Page 6 | | | |

![]()

2019 notice and proxy statement — Corporate governance

Legal, Regulatory and Public Policy: Experience in setting and analyzing public policy supports board oversight of our business in heavily regulated sectors.

Corporate Governance: Experience on other public company boards provides insight into developing practices consistent with our commitment to excellence in corporate governance.

International: Experience operating in a global context by managing international enterprises, residence abroad, and studying other cultures enables oversight of how HPE navigates a global marketplace.

Cyber Security: Experience in understanding the cyber security threat landscape is increasingly important in our own business and that of our customers.

Environmental and Sustainability: Experience in environmental and sustainability topics strengthens the Board's oversight and assures that strategic business imperatives and long-term value creation for stockholders are achieved within a responsible, sustainable business model.

Human Resources Management: Experience in human resources management in large organizations assists our Board in overseeing succession planning, effective talent development and our executive compensation program.

Director candidate selection and evaluation

Stockholder recommendations

The policy of the NGSR Committee is to consider properly submitted stockholder recommendations of candidates for membership on the Board as described below under "Identifying and evaluating candidates for directors." In evaluating such recommendations, the NGSR Committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership criteria set forth on page 28 under "Proposals to be voted on—Proposal No.1 Election of Directors—Director nominee experience and qualifications." Any stockholder recommendations submitted for consideration by the NGSR Committee should include verification of the stockholder status of the person submitting the recommendation and the recommended candidate's name and qualifications for Board membership and should be addressed to:

Corporate Secretary

Hewlett Packard Enterprise Company

6280 America Center Drive

San Jose, California 95002

Email:bod-hpe@hpe.com

Stockholder nominations

In addition, our Bylaws permit stockholders to nominate directors for consideration at an annual stockholder meeting and, under certain circumstances, to include their nominees in the Hewlett Packard Enterprise proxy statement. For a description of the process for nominating directors in accordance with our Bylaws, see "Questions and answers—Stockholder proposals, director nominations and related Bylaws provisions—How may I recommend individuals to serve as directors and what is the deadline for a director recommendation?" on page 97.

Identifying and evaluating candidates for directors

The NGSR Committee, in consultation with the Chair, assesses the appropriate size of the Board, as well as the alignment of director skills with company strategy, and whether any vacancies on the Board are expected due to retirement or otherwise, or whether the Board would benefit from the addition of a director with a specific skillset. The NGSR Committee also considers board refreshment in its annual evaluation of the Board.

| | |

| | | Page 7 |

![]()

2019 notice and proxy statement — Corporate governance

We balance our respect for historical knowledge of our company with our regard for fresh perspectives by considering director tenure on a case-by-case basis, rather than imposing arbitrary term limits.

The NGSR Committee uses a variety of methods for identifying and evaluating nominees for director. Candidates may come to the attention of the NGSR Committee through current Board members, professional search firms, stockholders or other persons. Identified candidates are evaluated at regular or special meetings of the NGSR Committee and may be considered at any point during the year. As described above, the NGSR Committee considers properly submitted stockholder recommendations of candidates for the Board to be included in our proxy statement. Following verification of the stockholder status of individuals proposing candidates, recommendations are considered collectively by the NGSR Committee at a regularly scheduled meeting. If any materials are provided by a stockholder in connection with the nomination of a director candidate, such materials are forwarded to the NGSR Committee. The NGSR Committee also reviews materials provided by professional search firms and other parties in connection with a nominee who is not proposed by a stockholder. In evaluating such nominations, the NGSR Committee seeks to achieve a balance of knowledge, experience and capability on the Board that will enable the Board to effectively oversee the business. The NGSR Committee evaluates nominees recommended by stockholders using the same criteria as it uses to evaluate all other candidates.

We engage a professional search firm on an ongoing basis to identify and assist the NGSR Committee in identifying, evaluating and conducting due diligence on potential director nominees. In each instance, the NGSR Committee considers the totality of the circumstances of each individual candidate.

Board and committee meetings and attendance

Our Board has regularly scheduled meetings and an annual meeting of stockholders each year, in addition to special meetings scheduled as appropriate. During fiscal 2018, our Board held nine meetings. In addition, our five committees held a total of 36 meetings, with the Audit Committee meeting 11 times, the HRC Committee meeting seven times, and the NGSR Committee meeting five times. Each of the five regularly scheduled Board meetings held during fiscal 2018 included an executive session, consisting of only non-management directors. The Board expects that its members will rigorously prepare for, attend and participate in all Board and applicable Committee meetings and each annual meeting of stockholders. In addition to participation at Board and committee meetings, our directors discharged their responsibilities throughout the year through frequent one-on-one meetings and other communications with our Chair, our CEO and other members of senior management regarding matters of interest.

Each of our incumbent directors who was a director during fiscal 2018 attended at least 75% of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which each such director served, during the period for which each such director served.

Directors are also encouraged to attend our annual meeting of stockholders. Last year, each of our directors was in attendance.

The Board is currently led by an independent director, Patricia F. Russo, Chair of the Board. Our Bylaws and Corporate Governance Guidelines permit the roles of Chair of the Board and Chief Executive Officer to be filled by the same or different individuals, although the Corporate Governance Guidelines express a preference for the separation of the two roles. This flexibility allows the Board to determine whether the two roles should be combined or separated based upon our needs and the Board's assessment of its leadership from time to time. The Board believes that our stockholders are best served at this time by having an independent director serve as Chair of the Board. Our Board believes this leadership structure effectively allocates authority, responsibility, and oversight between management and the independent members of our Board. It gives primary responsibility for the operational leadership and strategic direction of the Company to our CEO, while the Chair facilitates our Board's independent oversight of management, promotes communication between senior management and our

| | |

Page 8 | | | |

![]()

2019 notice and proxy statement — Corporate governance

Board about issues such as management development and succession planning, executive compensation, and company performance, engages with stockholders, and leads our Board's consideration of key governance matters.

| | | | |

|

| • presides at all meetings of the Board, including executive sessions of the independent directors, • oversees the planning of the annual Board calendar, schedules and sets the agenda for meetings of the Board in consultation with the other directors, and leads the discussion at such meetings, • chairs the annual meeting of stockholders, • is available in appropriate circumstances to speak on behalf of the Board, and • performs such other functions and responsibilities as set forth in our Corporate Governance Guidelines or as requested by the Board from time to time. | ||

| | | | |

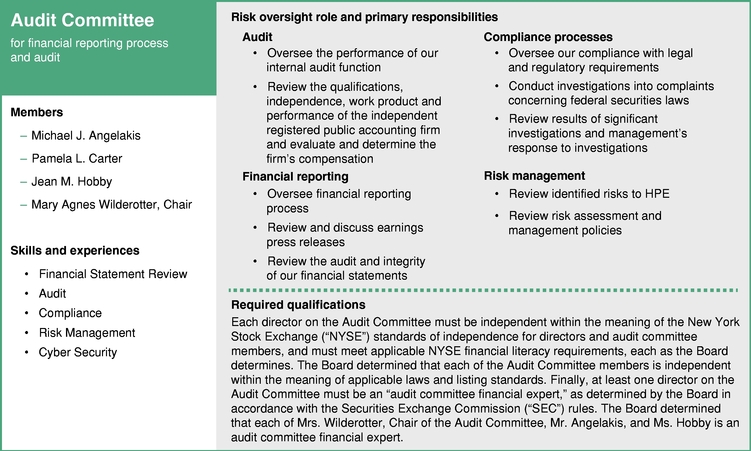

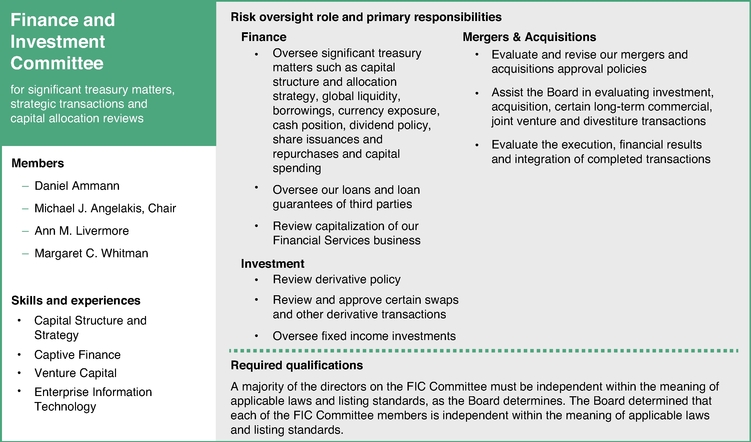

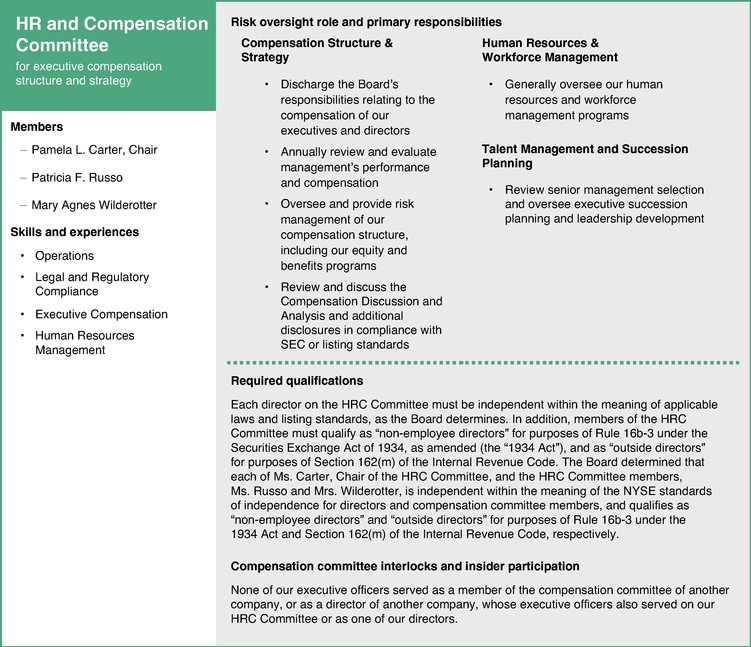

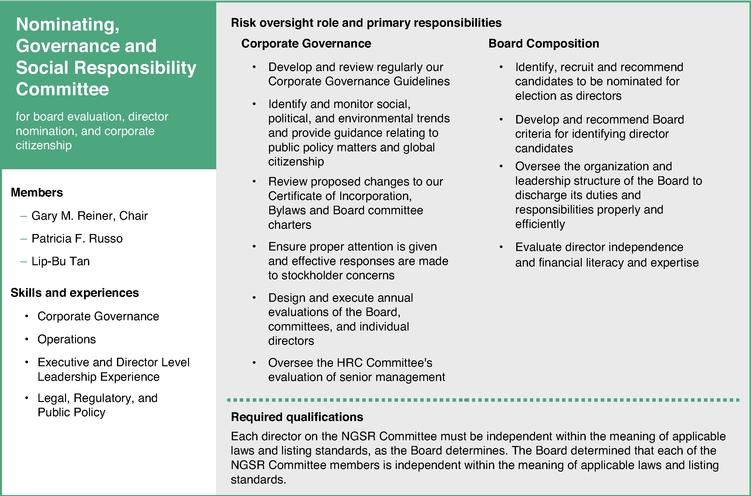

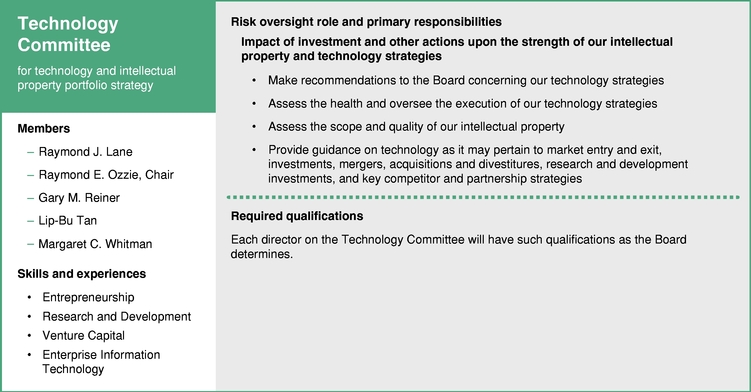

Board structure and committee composition

As of the date of this proxy statement, the Board has 13 directors and the following five standing committees: (1) Audit Committee; (2) Finance and Investment Committee; (3) HR and Compensation Committee; (4) Nominating, Governance and Social Responsibility Committee; and (5) Technology Committee. The current committee membership and the function of each of these standing committees are described below. Each of the standing committees operates under a written charter adopted by the Board. All of the committee charters are available on our Governance website atinvestors.hpe.com/governance#committee-charters. Each committee reviews and reassesses the adequacy of their charter annually, conducts annual evaluations of their performance with respect to their duties and responsibilities as laid out in the charter, and reports regularly to the Board with respect to the committees' activities. Additionally, the Board and each of the committees has the authority to retain, terminate and receive appropriate funding for outside advisors as the Board and/or each committee deems necessary.

| | |

| | | Page 9 |

![]()

2019 notice and proxy statement — Corporate governance

The composition of each standing committee is as follows:

| Independent Directors | Audit | FIC | HRC | NGSRC | Tech | |||||

| Daniel Ammann | ||||||||||

| | | | | | | | | | | |

| Michael J. Angelakis | ||||||||||

| | | | | | | | | | | |

| Pamela L. Carter | ||||||||||

| | | | | | | | | | | |

| Jean M. Hobby | ||||||||||

| | | | | | | | | | | |

| Raymond J. Lane | ||||||||||

| | | | | | | | | | | |

| Raymond E. Ozzie | ||||||||||

| | | | | | | | | | | |

| Gary M. Reiner | ||||||||||

| | | | | | | | | | | |

| Patricia F. Russo | ||||||||||

| | | | | | | | | | | |

| Lip-Bu Tan | ||||||||||

| | | | | | | | | | | |

| Mary Agnes Wilderotter | ||||||||||

| Other Directors | ||||||||||

| Ann M. Livermore | ||||||||||

| | | | | | | | | | | |

| Antonio F. Neri | ||||||||||

| | | | | | | | | | | |

| Margaret C. Whitman | ||||||||||

| | | | | | | | | | | |

| | |

Page 10 | | | |

![]()

2019 notice and proxy statement — Corporate governance

| | |

| | | Page 11 |

![]()

2019 notice and proxy statement — Corporate governance

| | |

Page 12 | | | |

![]()

2019 notice and proxy statement — Corporate governance

| | |

| | | Page 13 |

![]()

2019 notice and proxy statement — Corporate governance

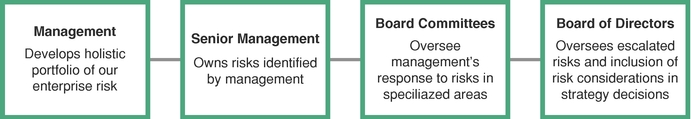

Given today's ever-changing economic, social, and political landscape, structured, conscientious risk management is more important than ever for every public company. Our Board, with the assistance of its committees as discussed below, reviews and oversees our Enterprise Risk Management ("ERM") program, which is an enterprise-wide program designed to enable effective and efficient identification of, and management visibility into, critical enterprise risks and to facilitate the incorporation of risk considerations into decision making. The ERM program was established to clearly define risk management roles and responsibilities, bring together senior management to discuss risk, promote visibility and constructive dialogue around risk at the senior management and Board levels and facilitate appropriate risk response strategies.

Under the ERM program, management develops a holistic portfolio of our enterprise risks by facilitating business and function risk assessments, performing targeted risk assessments and incorporating information regarding specific categories of risk gathered from various internal Hewlett Packard Enterprise organizations. Management then develops risk response plans for risks categorized as needing management focus and response and monitors other identified risk focus areas. Management provides reports on the risk portfolio and risk response efforts to senior management and to the Audit Committee.

| | |

Page 14 | | | |

![]()

2019 notice and proxy statement — Corporate governance

The Board oversees management's implementation of the ERM program, including reviewing our enterprise risk portfolio and evaluating management's approach to addressing identified risks. Various Board committees also have responsibilities for oversight of risk management that supplement the ERM program. For example, the HRC Committee considers the risks associated with our compensation policies and practices as discussed below, the Audit Committee is responsible for overseeing financial risks and those related to information and cyber security, and the NGSR Committee oversees risks associated with our governance structure and processes. This structure allows specialized attention to and oversight over key risk areas by aligning our carefully crafted committees with risk oversight in their individual areas of expertise. The Board is kept informed of its committees' risk oversight and related activities primarily through reports of the committee chairs to the full Board. In addition, the Audit Committee escalates issues relating to risk oversight to the full Board as appropriate to keep the Board appropriately informed of developments that could affect our risk profile or other aspects of our business. The Board also considers specific risk topics in connection with strategic planning and other matters.

During fiscal 2018, we undertook an annual review of our material compensation processes, policies and programs for all employees and determined that our compensation programs and practices are not reasonably likely to have a material adverse effect on Hewlett Packard Enterprise. In conducting this assessment, we reviewed our compensation risk infrastructure, including our material plans, our risk control systems and governance structure, the design and oversight of our compensation programs and the developments, improvements and other changes made to those programs, and we presented a summary of the findings to the HRC Committee. Overall, we believe that our programs contain an appropriate balance of fixed and variable features and short- and long-term incentives, as well as complementary metrics and reasonable, performance-based goals with linear payout curves under most plans. We believe that these factors, combined with effective Board and management oversight, operate to mitigate risk and reduce the likelihood of employees engaging in excessive risk-taking behavior with respect to the compensation-related aspects of their jobs.

Among the HRC Committee's responsibilities described in its charter is to oversee succession planning and leadership development. On an ongoing basis, the Board reviews succession plans for the CEO and other senior executive positions. These reviews occur with input from the CEO and EVP, Chief People Officer and the Board also reviews succession plans in executive sessions, with no members of management present. Succession reviews for key executive roles consist of an assessment of internal candidates as well as the review of external talent as identified by executive search partners employed by the Board.

Our Board maintains a regular and robust evaluation process designed to continually assess its effectiveness. The Board annually conducts a formal evaluation of the Board, each committee, and individual directors. The process involves the NGSR Committee, working with the Board Chair, designing each year's evaluation process, selecting from a variety of elements, which may include external evaluators, individual interviews, written questionnaires, and/or group discussions, taking into account the current dynamics of the Board and of the Company as well as the format of previous annual evaluations. This year, evaluations were completed through a group discussion conducted by the Board Chair, and were intended to gauge effectiveness in board composition and conduct, meeting structure, materials, committee composition and effectiveness; strategic and succession planning; culture and exercise of oversight as well as continued education and access to management.

Limits on director service on other public company boards

We have a highly effective and engaged Board, and we believe that our directors' outside directorships enable them to contribute valuable knowledge and experience to the HPE Board. Nonetheless, the Board is sensitive

| | |

| | | Page 15 |

![]()

2019 notice and proxy statement — Corporate governance

to the external obligations of its directors and the potential for overboarding to compromise the ability of these directors to effectively serve on the Board. HPE's Corporate Governance Guidelines limit each director's service on other boards of public companies to a number that permits them, given their individual circumstances, to perform responsibly all director duties and, in all events, this service may not exceed four other public company boards. Further, the ability of each director to devote sufficient time and attention to director duties is expressly considered as part of the annual board self-evaluation process, which aims to evaluate the effectiveness and engagement of HPE's directors, including in the context of their external commitments.

While the Board considers its directors' outside directorships during this evaluation process, the Board recognizes that this is one of many outside obligations which could potentially impair a director's capacity to dedicate sufficient time and focus to their service on the HPE Board. As such, the Board evaluates many factors when assessing the effectiveness and active involvement of each director. Such other factors include:

We schedule our Board and committee meetings up to two years in advance, to ensure director availability and maximum participation. Directors serve for one-year terms; accordingly, there is an opportunity to evaluate annually each director's ability to serve.

Our Corporate Governance Guidelines provide that a substantial majority of the Board will consist of independent directors and that the Board can include no more than three directors who are not independent directors. These standards are available on our website athttp://investors.hpe.com/governance/guidelines. Our director independence standards generally reflect the NYSE corporate governance listing standards. In addition, each member of the Audit Committee and the HRC Committee meets the heightened independence standards required for such committee members under the applicable listing standards.

Under our Corporate Governance Guidelines, a director will not be considered independent in the following circumstances:

| | |

Page 16 | | | |

![]()

2019 notice and proxy statement — Corporate governance

For these purposes, an "immediate family member" includes a director's spouse, parents, step-parents, children, step-children, siblings, mother-in-law, father-in-law, sons-in-law, daughters-in-law, brothers-in-law, sisters-in-law, and any person (other than tenants or employees) who shares the director's home.

In determining independence, the Board reviews whether directors have any material relationship with Hewlett Packard Enterprise. An independent director must not have any material relationship with Hewlett Packard Enterprise, either directly or as a partner, stockholder or officer of an organization that has a relationship with Hewlett Packard Enterprise, nor any relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In assessing the materiality of a director's relationship to Hewlett Packard Enterprise, the Board considers all relevant facts and circumstances, including consideration of the issues from the director's standpoint and from the perspective of the persons or organizations with which the director has an affiliation, and is guided by the standards set forth above.

In making its independence determinations, the Board considered transactions occurring since the beginning of fiscal 2016 between Hewlett Packard Enterprise and entities associated with the independent directors or their immediate family members. The Board's independence determinations included consideration of the following transactions:

| | |

| | | Page 17 |

![]()

2019 notice and proxy statement — Corporate governance

any of the previous three fiscal years, exceed the greater of $1 million or 2% of Comcast Corporation's consolidated gross revenues. Mr. Angelakis is also the Chairman and Chief Executive Officer of Atairos Group, Inc. Hewlett Packard Enterprise has entered into transactions for the purchase and/or sale of goods and services in the ordinary course of its business during the past three fiscal years with Atairos Group, Inc. The amount that Hewlett Packard Enterprise paid in each of the last three fiscal years to Atairos Group, Inc., and the amount received in each fiscal year by Hewlett Packard Enterprise from Atairos Group, Inc., did not, in any of the previous three fiscal years, exceed the greater of $1 million or 2% of Atairos Group, Inc.'s consolidated gross revenues.

As a result of this review, the Board has determined the transactions and relationships described above would not interfere with the director's exercise of independent judgment in carrying out the responsibilities of a director. The Board has also determined that, with the exception of Ms. Livermore and Ms. Whitman, each non-employee director during fiscal 2018, including Mr. Ammann, Mr. Angelakis, Ms. Carter, Mr. Lane, Mr. Ozzie, Mr. Reiner, Ms. Russo, Mr. Tan, Mrs. Wilderotter and each of the members of the Audit Committee, the HRC Committee and the NGSR Committee, had, and, with respect to current directors, has, no material relationship with Hewlett Packard Enterprise (either directly or as a partner, stockholder or officer of an organization that has a relationship with Hewlett Packard Enterprise) and is independent within the meaning of both our and the NYSE director independence standards. The Board has determined that (i) Ms. Livermore is not independent under either standard because she was an employee of Hewlett Packard Enterprise through October 31, 2016 and was an executive officer of our former parent within the last five fiscal years, (ii) Mr. Neri is not independent under either standard because of his status as our current President and CEO, and (iii) Ms. Whitman is not independent because she was an executive officer of Hewlett Packard Enterprise through February 1, 2018.

| | |

Page 18 | | | |

![]()

2019 notice and proxy statement — Corporate governance

Director compensation and stock ownership guidelines

Non-employee director compensation is determined by the independent members of our Board, acting on the recommendation of the HRC Committee. On an annual basis when determining compensation, the HRC Committee considers market data for our peer group, which is the same peer group used for HPE's executive compensation benchmarking (see "Fiscal 2018 Peer Companies" in the Compensation Discussion and Analysis section), and input from Frederic W. Cook & Co., Inc. ("FW Cook"), the third party compensation consultant retained by the HRC Committee, regarding market practices for director compensation. Directors who are employees of the Company or its affiliates do not receive separate compensation for their board activities.

The HRC Committee intends to set director compensation levels at or near the market median relative to directors at companies of comparable size, industry, and scope of operations in order to ensure directors are paid competitively for their time commitment and responsibilities. Providing a competitive compensation package is important because it enables us to attract and retain highly qualified directors who are critical to our long-term success. As noted above, during fiscal 2018, FW Cook conducted a review of director compensation levels relative to our peer group. Results of their review indicated HPE's current director compensation program is positioned near the median relative to our peer group, and therefore no changes were made compared to the prior year. The HRC Committee intends to continue to conduct director compensation reviews annually.

During fiscal 2018, non-employee directors were compensated for their service as shown in the chart below:

| | PAY COMPONENT | | DIRECTOR COMPENSATION | ADDITIONAL INFORMATION(1) | |||

| | | | | | | | |

| | Annual Cash Retainer | | | • $100,000(2) | | • May elect to receive up to 100% in HPE stock(3), which may be deferred(4) | |

| | | | | | | | |

| | Annual Equity Retainer | | | • $215,000 granted in restricted stock units(5) | | • May defer up to 100%(4) | |

| | | | | | | | |

| | Meeting Fees | | | • $2,000 for each board meeting in excess of ten • $2,000 for each committee meeting in excess of ten (per committee) | | • Paid in cash • May elect to receive up to 100% in HPE stock(3), which may be deferred(4) | |

| | | | | | | | |

| | Chairman of the Board Fee | | | • $200,000 | | • May elect to receive up to 100% in HPE stock(3), which may be deferred(4) | |

| | | | | | | | |

| | Committee Chair Fees | | | • Lead independent director: $35,000 • Audit committee: $25,000 • HRC committee: $20,000 • All others: $15,000 | | • May elect to receive up to 100% in HPE stock(3), which may be deferred(4) | |

| | | | | | | | |

| | Stock Ownership Guidelines | | | • 5x annual cash retainer (i.e., $500,000) | | • Shares held by the director, directly or indirectly, and deferred vested Restricted Stock Units ("RSUs") are included in the stock ownership calculation • Should be met within five years of election to the Board | |

| | | | | | | | |

| | |

| | | Page 19 |

![]()

2019 notice and proxy statement — Corporate governance

Non-employee directors are reimbursed for their expenses in connection with attending board meetings (including expenses related to spouses when spouses are invited to attend board events), and non-employee directors may use company aircraft for travel to and from board meetings and other company events, provided that the aircraft are not otherwise needed for direct business related activities.

Fiscal 2018 director compensation

The following table provides information regarding compensation for directors who served during fiscal 2018:

| | Name | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2)(3)(4) ($) | All Other Compensation ($) | Total ($) | | |||||||||||||||

| | Patricia F. Russo | | | 150,000 | | | | 370,984 | | | | — | | | 520,984 | | |||||

| | | | | | | | | | | | | ||||||||||

| | Daniel Ammann | | | 102,000 | | | | 215,005 | | | | — | | | 317,005 | | ||||

| | | | | | | | | | | | | ||||||||||

| | Marc L. Andreessen | | | — | | | | 45,659 | | | | — | | | 45,659 | | |||||

| | | | | | | | | | | | | ||||||||||

| | Michael J. Angelakis | | | 119,000 | | | | 215,005 | | | | — | | | 334,005 | | ||||

| | | | | | | | | | | | | ||||||||||

| | Leslie A. Brun | | | 66,109 | | | | 219,004 | | | | — | | | 285,113 | | |||||

| | | | | | | | | | | | | ||||||||||

| | Pamela L. Carter | | | 110,037 | | | | 215,005 | | | | — | | | 325,042 | | ||||

| | | | | | | | | | | | | ||||||||||

| | Raymond J. Lane | | | — | | | | 314,981 | | | | — | | | 314,981 | | |||||

| | | | | | | | | | | | | ||||||||||

| | Ann M. Livermore | | | 104,000 | | | | 215,005 | | | | — | | | 319,005 | | ||||

| | | | | | | | | | | | | ||||||||||

| | Antonio F. Neri(5) | | | — | | | | — | | | | | | — | | ||||||

| | | | | | | | | | | | | ||||||||||

| | Raymond E. Ozzie | | | 119,000 | | | | 215,005 | | | | — | | | 334,005 | | ||||

| | | | | | | | | | | | | ||||||||||

| | Gary M. Reiner | | | — | | | | 333,979 | | | | — | | | 333,979 | | |||||

| | | | | | | | | | | | | ||||||||||

| | Lip-Bu Tan | | | — | | | | 320,979 | | | | — | | | 320,979 | | ||||

| | | | | | | | | | | | | ||||||||||

| | Margaret C. Whitman(6) | | | 58,333 | | | | 249,420 | | | | — | | | 307,753 | | |||||

| | | | | | | | | | | | | ||||||||||

| | Mary Agnes Wilderotter | | | 129,000 | | | | 215,005 | | | | — | | | 344,005 | | ||||

| | | | | | | | | | | | | ||||||||||

| | |

Page 20 | | | |

![]()

2019 notice and proxy statement — Corporate governance

Additional information about fees earned or paid in cash in fiscal 2018

The following table provides additional information regarding fees earned or paid in cash to non-employee directors in fiscal 2018:

| | Name | Annual Retainers(1) ($) | Committee Chair/Chairman Fees(2) ($) | Additional Meeting Fees(3) ($) | Total(4) ($) | | ||||||||||||||

| | Patricia F. Russo | | | 50,000 | | | | 100,000 | | | | — | | | 150,000 | | ||||

| | | | | | | | | | | | ||||||||||

| | Daniel Ammann | | | 100,000 | | | | — | | | | 2,000 | | | 102,000 | | ||||

| | | | | | | | | | | | ||||||||||

| | Marc L. Andreessen | | | — | | | | — | | | | — | | | — | | ||||

| | | | | | | | | | | | ||||||||||

| | Michael J. Angelakis | | | 100,000 | | | | 15,000 | | | | 4,000 | | | 119,000 | | ||||

| | | | | | | | | | | | ||||||||||

| | Leslie A. Brun | | | 55,091 | | | | 11,018 | | | | — | | | 66,109 | | ||||

| | | | | | | | | | | | ||||||||||

| | Pamela L. Carter | | | 100,000 | | | | 10,037 | | | | — | | | 110,037 | | ||||

| | | | | | | | | | | | ||||||||||

| | Raymond J. Lane | | | — | | | | — | | | | — | | | — | | ||||

| | | | | | | | | | | | ||||||||||

| | Ann M. Livermore | | | 100,000 | | | | — | | | | 4,000 | | | 104,000 | | ||||

| | | | | | | | | | | | ||||||||||

| | Antonio F. Neri(5) | | | — | | | | — | | | | — | | | — | | ||||

| | | | | | | | | | | | ||||||||||

| | Raymond E. Ozzie | | | 100,000 | | | | 15,000 | | | | 4,000 | | | 119,000 | | ||||

| | | | | | | | | | | | ||||||||||

| | Gary M. Reiner | | | — | | | | — | | | | — | | | — | | ||||

| | | | | | | | | | | | ||||||||||

| | Lip-Bu Tan | | | — | | | | — | | | | — | | | — | | ||||

| | | | | | | | | | | | ||||||||||

| | Margaret C. Whitman(6) | | | 58,333 | | | | — | | | | — | | | 58,333 | | ||||

| | | | | | | | | | | | ||||||||||

| | Mary Agnes Wilderotter | | | 100,000 | | | | 25,000 | | | | 4,000 | | | 129,000 | | ||||

| | | | | | | | | | | | ||||||||||

| | |

| | | Page 21 |

![]()

2019 notice and proxy statement — Corporate governance

Additional information about non-employee director equity awards

The following table provides additional information regarding the stock awards made to non-employee directors during fiscal 2018, the grant date fair value of each of those awards, and the number of stock awards and option awards outstanding as of the end of fiscal 2018:

| | Name | Stock Awards Granted During Fiscal 2018 (#) | Grant Date Fair Value of Stock Awards Granted During Fiscal 2018(1) ($) | Stock Awards Outstanding at Fiscal Year End(2) (#) | Option Awards Outstanding at Fiscal Year End(3) (#) | | ||||||||||||||||

| | Patricia F. Russo | | | 22,774 | | | | 370,984 | | | | 127,933 | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Daniel Ammann | | | 12,493 | | | | 215,005 | | | | 12,672 | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Marc L. Andreessen | | | 2,860 | | | | 45,659 | | | | — | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Michael J. Angelakis | | | 12,493 | | | | 215,005 | | | | 12,672 | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Leslie A. Brun(4) | | | 12,721 | | | | 219,004 | | | | — | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Pamela L. Carter | | | 12,493 | | | | 215,005 | | | | 46,168 | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Raymond J. Lane | | | 19,119 | | | | 314,981 | | | | 12,672 | | | | 605,339 | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Ann M. Livermore | | | 12,493 | | | | 215,005 | | | | 12,672 | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Antonio F. Neri(5) | | | — | | | | — | | | | — | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Raymond E. Ozzie | | | 12,493 | | | | 215,005 | | | | 12,672 | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Gary M. Reiner | | | 20,340 | | | | 333,979 | | | | 12,672 | | | | 314,423 | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Lip-Bu Tan | | | 19,461 | | | | 320,979 | | | | 12,672 | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Margaret C. Whitman(6) | | | 14,560 | | | | 249,420 | | | | 12,672 | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

| | Mary Agnes Wilderotter | | | 12,493 | | | | 215,005 | | | | 12,672 | | | | — | | | ||||

| | | | | | | | | | | | ||||||||||||

Non-employee director stock ownership guidelines

Under our stock ownership guidelines, non-employee directors are expected to accumulate, within five years of their election to the Board, shares of Hewlett Packard Enterprise stock equal in value to at least five times the amount of their annual cash retainer. Service on the HP Inc. (formerly known as Hewlett-Packard Company, also referred to herein as "Former Parent") Board of Directors immediately prior to the separation of HPE from HP Inc. on November 1, 2015, is recognized for purposes of such five year period. Shares counted toward these guidelines include any shares held by the director directly or indirectly, including deferred vested awards.

All non-employee directors with more than five years of service have met our stock ownership guidelines, and all non-employee directors with less than five years of service have either met, or are on track to meet, our stock ownership guidelines within the expected time based on the trading price of HPE's stock as of October 31, 2018.

| | |

Page 22 ��| | | |

![]()

2019 notice and proxy statement — Corporate governance

Anti-hedging/pledging policy

HPE has a policy prohibiting directors from engaging in any form of hedging transaction (derivatives, equity swaps, forwards, etc.) in HPE stock, including, among other things, short sales and transactions involving publicly traded options. In addition, with limited exceptions, HPE's directors are prohibited from holding HPE stock in margin accounts and from pledging HPE stock as collateral for loans. We believe that these policies further align directors' interests with those of our stockholders.

Common stock ownership of certain beneficial owners and management

The following table sets forth information as of December 31, 2018 concerning beneficial ownership by:

The information provided in the table is based on our records, information filed with the SEC and information provided to Hewlett Packard Enterprise, except where otherwise noted.

The number of shares beneficially owned by each entity or individual is determined under SEC rules, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the entity or individual has sole or shared voting or investment power and also any shares that the entity or individual has the right to acquire as of March 1, 2019 (60 days after December 31, 2018) through the exercise of any stock options, through the vesting and settlement of RSUs payable in shares, or upon the exercise of other rights. Beneficial ownership excludes options or other rights vesting after March 1, 2019 and any RSUs vesting or settling on or before March 1, 2019 that may be payable in cash or shares at Hewlett Packard Enterprise's election. Unless otherwise indicated, each person has sole voting and investment power (or shares such powers with his or her spouse) with respect to the shares set forth in the following table.

| | |

| | | Page 23 |

![]()

2019 notice and proxy statement — Corporate governance

| NAME OF BENEFICIAL OWNER | | SHARES OF COMMON STOCK BENEFICIALLY OWNED | | PERCENT OF COMMON STOCK OUTSTANDING | ||||||||

| | | | | | | | | | | | | |

| BlackRock(1) | 96,939,177 | 6.9% | ||||||||||

| | | | | | | | | | | | | |

| Dodge & Cox(2) | | | 238,392,731 | | | 15.0% | ||||||

| | | | | | | | | | | | | |

| Hotchkiss and Wiley Capital Management Co(3) | 85,684,540 | 5.38% | ||||||||||

| | | | | | | | | | | | | |

| PRIMECAP Management Co(4) | | | 92,440,645 | | | 6.61% | ||||||

| | | | | | | | | | | | | |

| The Vanguard Group(5) | 110,380,627 | 6.92% | ||||||||||

| | | | | | | | | | | | | |

| Daniel Ammann(6) | | | 33,044 | | | * | ||||||

| | | | | | | | | | | | | |

| Michael J. Angelakis(7) | 66 | * | ||||||||||

| | | | | | | | | | | | | |

| Pamela L. Carter(8) | | | 37,624 | | | * | ||||||

| | | | | | | | | | | | | |

| Jean M. Hobby | 0 | * | ||||||||||

| | | | | | | | | | | | | |

| Raymond J. Lane(9) | | | 811,639 | | | * | ||||||

| | | | | | | | | | | | | |

| Ann M. Livermore(10) | 90,349 | * | ||||||||||

| | | | | | | | | | | | | |

| Raymond E. Ozzie | | | 48,358 | | | * | ||||||

| | | | | | | | | | | | | |

| Gary M. Reiner(11) | 391,141 | * | ||||||||||

| | | | | | | | | | | | | |

| Patricia F. Russo(12) | | | 133,417 | | | * | ||||||

| | | | | | | | | | | | | |

| Lip-Bu Tan | 49,939 | * | ||||||||||

| | | | | | | | | | | | | |

| Margaret C. Whitman(13) | | | 739,740 | | | * | ||||||

| | | | | | | | | | | | | |

| Mary A. Wilderotter | 28,916 | * | ||||||||||

| | | | | | | | | | | | | |

| Philip Davis(14) | | | 58,330 | | | * | ||||||

| | | | | | | | | | | | | |

| Henry Gomez(15) | 334,849 | * | ||||||||||

| | | | | | | | | | | | | |

| Alan R. May(16) | | | 1,606,017 | | | * | ||||||

| | | | | | | | | | | | | |

| Antonio F. Neri(17) | 2,502,083 | * | ||||||||||

| | | | | | | | | | | | | |

| Tarek Robbiati | | | 0 | | | * | ||||||

| | | | | | | | | | | | | |

| John F. Schultz(18) | 1,511,254 | * | ||||||||||

| | | | | | | | | | | | | |

| Timothy C. Stonesifer(19) | | | 603,132 | | | * | ||||||

| | | | | | | | | | | | | |

| All current executive officers and directors as a group (20 persons)(20) | 8,096,957 | |||||||||||

| | | | | | | | | | | | | |

| | |

Page 24 | | | |

![]()

2019 notice and proxy statement — Corporate governance

Section 16(a) beneficial ownership reporting compliance

Section 16(a) of the Exchange Act, requires our directors, executive officers and holders of more than 10% of Hewlett Packard Enterprise's stock to file reports with the SEC regarding their ownership and changes in ownership of our securities. Based upon our examination of the copies of Forms 3, 4, and 5, and amendments thereto furnished to us and the written representations of our directors, executive officers and 10% stockholders, we believe that, during fiscal 2018, our directors, executive officers and 10% stockholders complied with all Section 16(a) filing requirements, except that, due to a delay in the receipt of his Edgar filer codes, Philip Davis was unable to timely submit his Form 4 on March 1, 2018, which was filed on March 2, 2018.

Related persons transactions policies and procedures

We have adopted a written policy for approval of transactions between us and our directors, director nominees, executive officers, beneficial owners of more than five percent (5%) of Hewlett Packard Enterprise's stock, and their respective immediate family members where the amount involved in the transaction exceeds or is expected to exceed $120,000 in a single 12-month period and such "related persons" have or will have a direct or indirect material interest (other than solely as a result of being a director or a less than ten percent (10%) beneficial owner of another entity).

The policy provides that the NGSR Committee reviews certain transactions subject to the policy and decides whether or not to approve or ratify those transactions. In doing so, the NGSR Committee determines whether the transaction is in the best interests of Hewlett Packard Enterprise. In making that determination, the NGSR Committee takes into account, among other factors it deems appropriate:

| | |

| | | Page 25 |

![]()

2019 notice and proxy statement — Corporate governance

The NGSR Committee has delegated authority to the chair of the NGSR Committee to pre-approve or ratify transactions where the aggregate amount involved is expected to be less than $1 million. A summary of any new transactions pre-approved by the chair is provided to the full NGSR Committee for its review at each of the NGSR Committee's regularly scheduled meetings.

The NGSR Committee has adopted standing pre-approvals under the policy for limited transactions with related persons.

Pre-approved transactions include:

A summary of transactions covered by the standing pre-approvals described in paragraphs 3 and 4 above is provided to the NGSR Committee for its review as applicable.

Fiscal 2018 related person transactions

We enter into commercial transactions with many entities for which our executive officers or directors serve as directors and/or executive officers in the ordinary course of our business. All of those transactions were pre-approved transactions as defined above or were approved or ratified by the NGSR Committee or our Former Parent's NGSR Committee. Hewlett Packard Enterprise considers all pre-approved or ratified transactions to have been at arm's-length and does not believe that any of our executive officers or directors had a material direct or indirect interest in any of such commercial transactions.

| | |

Page 26 | | | |

![]()

2019 notice and proxy statement — Corporate governance

We maintain a code of business conduct and ethics for directors, officers and employees known as our Standards of Business Conduct. We also have adopted Corporate Governance Guidelines, which, in conjunction with our Certificate of Incorporation, Bylaws and respective charters of the Board committees, form the framework for our governance. All of these documents are available atinvestors.hpe.com/governance for review, downloading and printing. We will post on this website any amendments to the Standards of Business Conduct or waivers of the Standards of Business Conduct for directors and executive officers. Stockholders may request free printed copies of our Certificate of Incorporation, Bylaws, Standards of Business Conduct, Corporate Governance Guidelines and charters of the committees of the Board by contacting: Hewlett Packard Enterprise Company, Attention: Investor Relations, 6280 America Center Drive, San Jose, California 95002,www.investors.hpe.com/.

Individuals may communicate with the Board by contacting: Secretary to the Board of Directors, 6280 America Center Drive, San Jose, California 95002, e-mail:bod-hpe@hpe.com.

All directors have access to this correspondence. In accordance with instructions from the Board, the Secretary to the Board reviews all correspondence, organizes the communications for review by the Board and posts communications to the full Board or to individual directors, as appropriate. Our independent directors have requested that certain items that are unrelated to the Board's duties, such as spam, junk mail, mass mailings, solicitations, resumes and job inquiries, not be posted.

Communications that are intended specifically for the Chair of the Board, independent directors or the non-employee directors should be sent to the e-mail address or street address noted above, to the attention of the Chair of the Board.

| | |

| | | Page 27 |

![]()

2019 notice and proxy statement — Proposals to be voted on

On the recommendation of the NGSR Committee, the Board has nominated the 12 persons named below for election as directors this year, each to serve for a one-year term or until the director's successor is elected and qualified.

Director nominee experience and qualifications

The Board annually reviews the appropriate skills and characteristics required of directors in the context of the current composition of the Board, our operating requirements, and the long-term interests of our stockholders. The Board believes that its members should possess a variety of skills, professional experience and backgrounds in order to effectively oversee our business. In addition, the Board believes that each director should possess certain attributes, as reflected in the Board membership criteria described below.