Exhibit 99.3

|

Spin-Merger of Non-Core Software Assets with Micro Focus

September 7, 2016

hewlett packard enterprise

|

Forward Looking Statements

–Information set forth in this communication, oral statements made by representatives of Hewlett Packard Enterprise or Micro Focus regarding the Transaction, and other information published by Hewlett Packard Enterprise and Micro Focus, including statements as to Hewlett Packard Enterprise’s and Micro Focus’s outlook and financial estimates and statements as to the expected timing, completion and effects of the proposed merger between a wholly-owned subsidiary of Micro Focus and HPE’s non-core software assets, which will immediately follow the proposed spin-off of HPE’s non-core software assets from Hewlett Packard Enterprise (collectively, the “Transaction”), constitute or may be deemed to constitute forward-looking statements (including within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995). These estimates and statements are prospective in nature and are subject to risks and uncertainties that could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements.

–These statements are based on various assumptions and the current expectations of the management of Hewlett Packard Enterprise and Micro Focus, and may not be accurate because of risks and uncertainties surrounding these assumptions and expectations. Such forward-looking statements should therefore be construed in light of such factors. Neither Hewlett Packard Enterprise nor Micro Focus, nor any of their respective associates or directors, officers or advisers, provides any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements in this communication will actually occur or that if any of the events occur, that the effect on the operations or financial condition of Hewlett Packard Enterprise or Micro Focus will be as expressed or implied in such forward-looking statements. Forward-looking statements included herein are made as of the date hereof, and, other than in accordance with their legal or regulatory obligations (including under the UK Listing Rules, EU Market Abuse Regulation, the UK Disclosure and Transparency Rules and federal securities laws, as relevant), Hewlett Packard Enterprise and Micro Focus undertake no obligation, and Hewlett Packard Enterprise and Micro Focus expressly disclaim any intention or obligation, to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. You are cautioned not to place undue reliance on these forward-looking statements.

–Some forward-looking statements discuss Hewlett Packard Enterprise’s or Micro Focus’s plans, strategies and intentions. They use words such as “expects,” “may,” “will,” “believes,” “should,” “would,” “could,” “approximately,” “anticipates,” “estimates,” “targets,” “intends,” “likely,” “projects,” “positioned,” “strategy,” “future” and “plans.” In addition, these words may use the positive or negative or other variations of those terms. Forward-looking statements in this communication include, but are not limited to, statements regarding the expected effects on Hewlett Packard Enterprise, HPE’s non-core software assets and Micro Focus of the proposed Transaction, the anticipated timing and benefits of the Transaction, including future financial and operating results, the tax consequences of the Transaction to Hewlett Packard Enterprise or its stockholders for U.S. federal income tax purposes, and the combined company’s plans, objectives, expectations and intentions. Forward-looking statements also include all other statements in this communication that are not historical facts.

–Important factors that could cause actual results to differ materially from those in the forward-looking statement include, but are not limited to: the satisfaction of the conditions to the Transaction and other risks related to the completion of the Transaction and actions related thereto; Hewlett Packard Enterprise’s and Micro Focus’s ability to complete the Transaction on the anticipated terms and schedule, including the ability to obtain shareholder and regulatory approvals and the anticipated tax treatment of the Transaction and related transactions; risks relating to any unforeseen changes to or effects on liabilities, future capital expenditures, revenues, expenses, earnings, synergies, indebtedness, financial condition, losses and future prospects; Micro Focus’s ability to integrate HPE’s non-core software assets successfully after the closing of the Transaction and to achieve anticipated synergies; the risk that disruptions from the Transaction will harm Hewlett Packard Enterprise’s or Micro Focus’s businesses; and the effect of economic, competitive, legal, governmental and technological factors and other factors described under “Risk Factors” in Hewlett Packard Enterprise’s Annual Report on Form 10-K for the fiscal year ended October 31, 2015 and subsequent Quarterly Reports on Form 10-Q. For a discussion of important factors which could cause actual results to differ from forward looking statements relating to Micro Focus and the Micro Focus Group, please refer to Micro Focus’ Annual Report and Accounts 2016. However, it is not possible to predict or identify all such factors. Consequently, while the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties.

2

|

Additional Information and Where to Find It

–This communication is not for release, publication or distribution, in whole or in part, in, into or from any jurisdiction where to do so would constitute a violation of the relevant laws of such jurisdiction. This communication is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities of Micro Focus or HPE’s non-core software assets in any jurisdiction in contravention of applicable law. Micro Focus will publish a circular and prospectus in connection with the Transaction and any decision in respect of, or other response to, the Transaction should be made on the basis of the information contained in such documents. This communication does not constitute a prospectus or prospectus equivalent document.

–No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. In connection with the proposed Transaction, Micro Focus will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 or F-4, which will include a prospectus. In addition, HPE’s non-core software assets expects to file a registration statement in connection with its separation from Hewlett Packard Enterprise.

–INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE CIRCULAR, REGISTRATION STATEMENTS/PROSPECTUSES AND ANY OTHER RELEVANT DOCUMENTS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MICRO FOCUS, HPE’S NON-CORE SOFTWARE ASSETS AND THE TRANSACTION. Investors and security holders will be able to obtain the registration statements (when available) and other documents filed with the SEC free of charge from the SEC’s website, www.sec.gov. These documents (when available) can also be obtained free of charge from Hewlett Packard Enterprise by directing a written request to Hewlett Packard Enterprise at Hewlett Packard Enterprise Company, 3000 Hanover Street, Palo Alto, California 94304, Attention: Investor Relations, or by calling (650) 857-2246.

–The release, publication or distribution of this communication in jurisdictions other than the United States or the United Kingdom, and the ability of shareholders located outside of these jurisdictions to participate in the Transaction, may be restricted by law and therefore any persons who are subject to the laws of any other jurisdiction should inform themselves about, and observe any applicable legal or regulatory requirements.

3

Overseas Jurisdictions

|

The HPE Journey

4

|

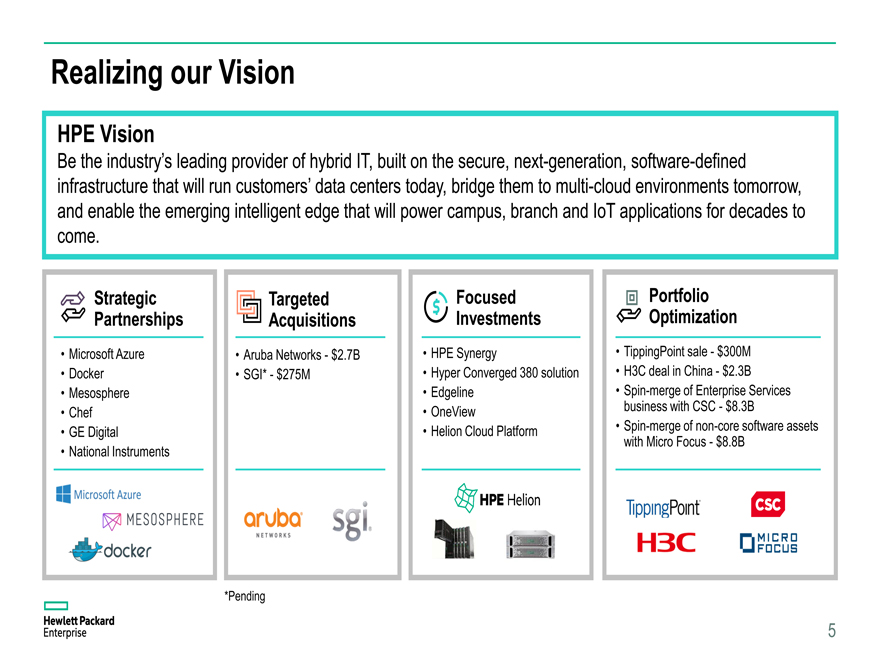

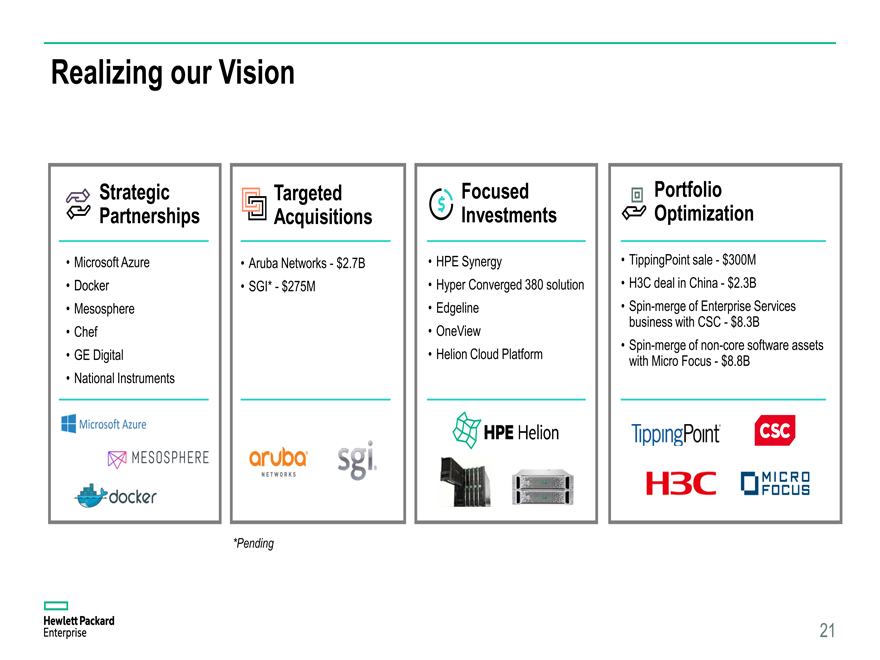

Realizing our Vision HPE Vision Be the industry’s leading provider of hybrid IT, built on the secure, next-generation, software-defined infrastructure that will run customers’ data centers today, bridge them to multi-cloud environments tomorrow, and enable the emerging intelligent edge that will power campus, branch and IoT applications for decades to come. Strategic Partnerships

Microsoft Azure

Docker

Mesosphere

Chef

GE Digital

National Instruments

Targeted Acquisitions

Aruba Networks—$2.7B

SGI*—$275M

Portfolio Optimization

TippingPoint sale—$300M

H3C deal in China—$2.3B

Spin-merge of Enterprise Services business with CSC—$8.3B

Spin-merge of non-core software assets with Micro Focus—$8.8B

Focused Investments

HPE Synergy

Hyper Converged 380 solution

Edgeline

OneView

Helion Cloud Platform

*Pending

5

|

Transaction Overview

6

|

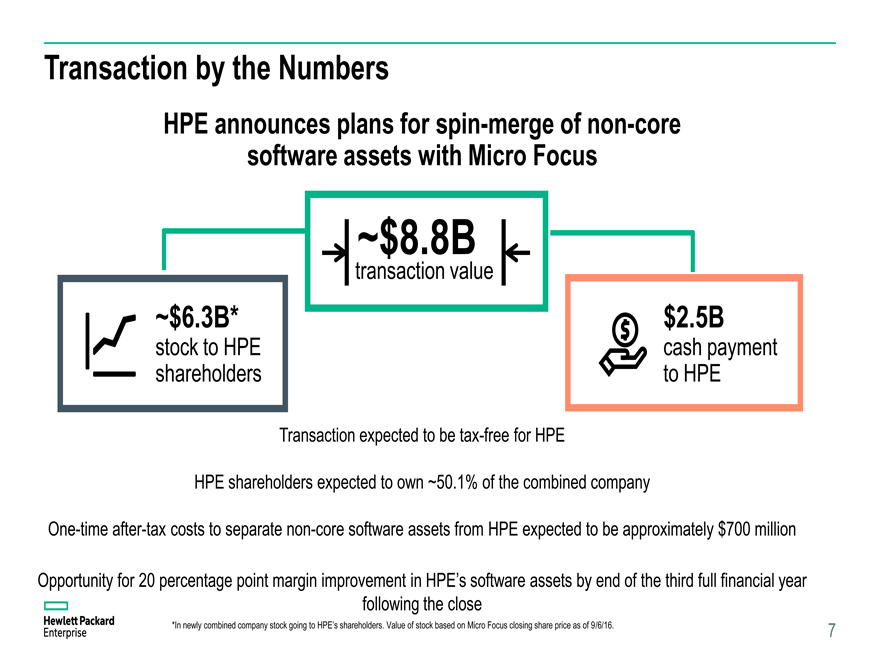

Transaction by the Numbers

Transaction expected to be tax-free for HPE

HPE shareholders expected to own ~50.1% of the combined company

One-time after-tax costs to separate non-core software assets from HPE expected to be approximately $700 million

Opportunity for 20 percentage point margin improvement in HPE’s software assets by end of the third full financial year following the close

HPE announces plans for spin-merge of non-core software assets with Micro Focus

*In newly combined company stock going to HPE’s shareholders. Value of stock based on Micro Focus closing share price as of 9/6/16. 7 ~$8.8B transaction value ~$6.3B* stock to HPE shareholders $2.5B cash payment to HPE

|

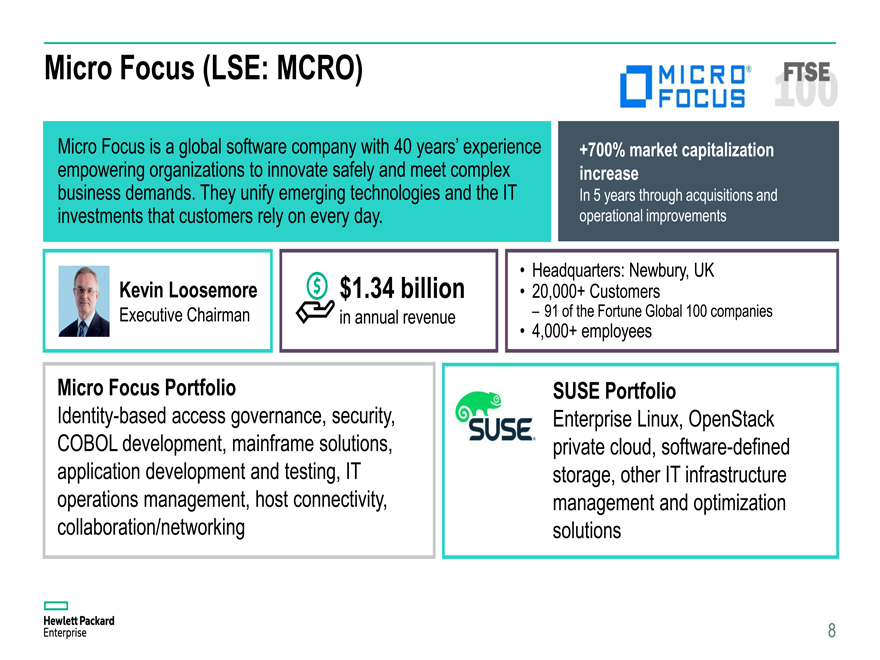

Micro Focus (LSE: MCRO)

+700% market capitalization increase

In 5 years through acquisitions and operational improvements

Headquarters: Newbury, UK

20,000+ Customers

–91 of the Fortune Global 100 companies

4,000+ employees

$1.34 billion in annual revenue

Kevin Loosemore Executive Chairman

Micro Focus Portfolio

Identity-based access governance, security, COBOL development, mainframe solutions, application development and testing, IT operations management, host connectivity, collaboration/networking.

SUSE Portfolio

Enterprise Linux, OpenStack private cloud, software-defined storage, other IT infrastructure management and optimization solutions

8 Micro Focus is a global software company with 40 years’ experience empowering organizations to innovate safely and meet complex business demands. They unify emerging technologies and the IT investments that customers rely on every day.

|

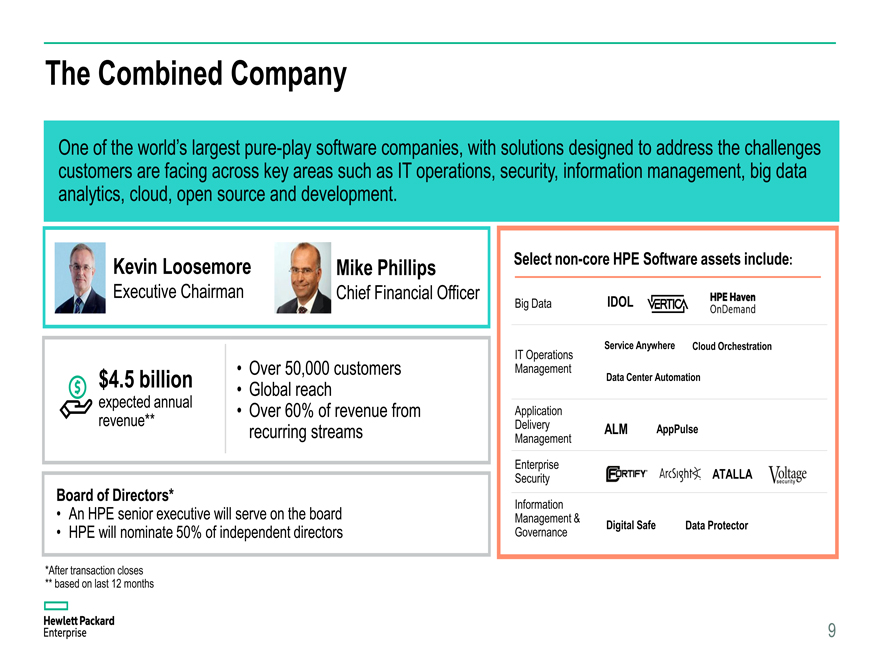

The Combined Company One of the world’s largest pure-play software companies, with solutions designed to address the challenges customers are facing across key areas such as IT operations, security, information management, big data analytics, cloud, open source and development. Kevin Loosemore Executive Chairman

Over 50,000 customers

Global reach

Over 60% of revenue from recurring streams

Select non-core HPE Software assets include: Big Data

IT Operations Management

Application Delivery

Management

Enterprise Security

Information Management & Governance

|

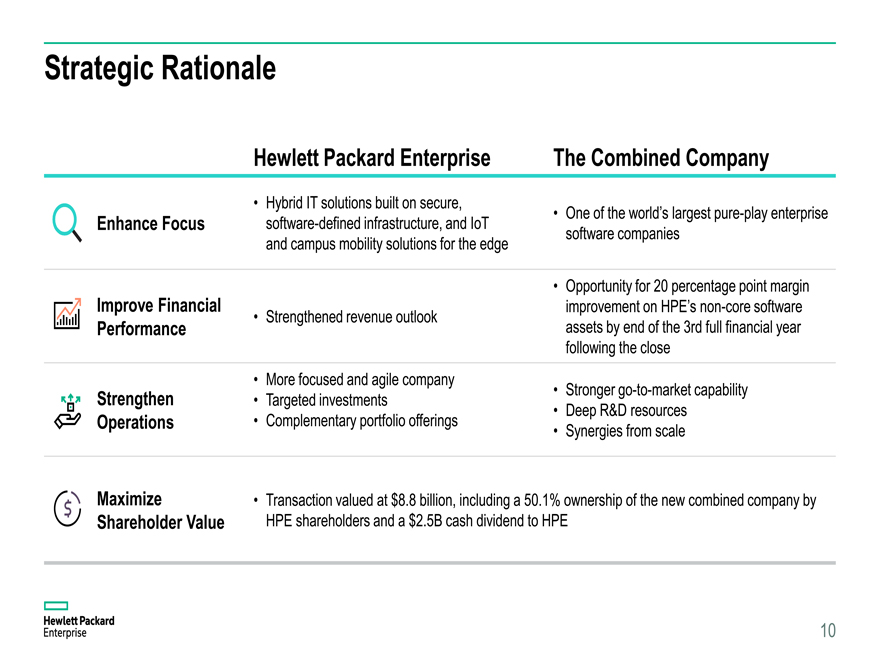

Strategic Rationale

10 Hewlett Packard Enterprise The Combined Company

Enhance Focus

•Hybrid IT solutions built on secure, software-defined infrastructure, and IoT and campus mobility solutions for the edge

•One of the world’s largest pure-play enterprise software companies

Improve Financial Performance

•Strengthened revenue outlook

•Opportunity for 20 percentage point margin improvement on HPE’s non-core software assets by end of the 3rd full financial year following the close

Strengthen Operations

•More focused and agile company

Targeted investments

Complementary portfolio offerings

•Stronger go-to-market capability

Deep R&D resources

Synergies from scale

Maximize Shareholder Value

•Transaction valued at $8.8 billion, including a 50.1% ownership of the new combined company by HPE shareholders and a $2.5B cash dividend to HPE

|

11

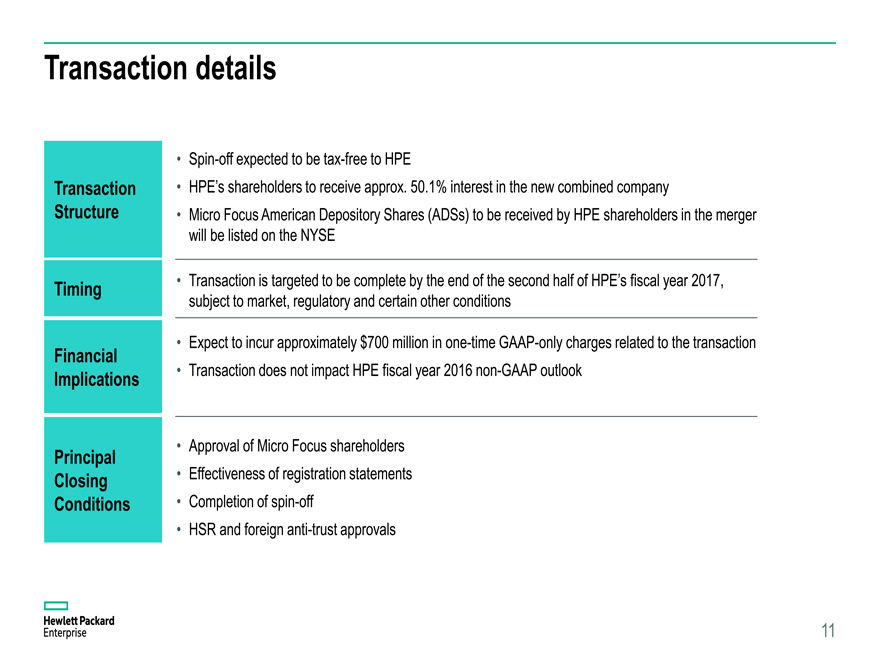

Transaction details

Transaction Structure

Financial Implications

Spin-off expected to be tax-free to HPE

HPE’s shareholders to receive approx. 50.1% interest in the new combined company

Micro Focus American Depository Shares (ADSs) to be received by HPE shareholders in the merger will be listed on the NYSE

Timing

Principal Closing Conditions

Approval of Micro Focus shareholders

Effectiveness of registration statements

Completion of spin-off

HSR and foreign anti-trust approvals

Expect to incur approximately $700 million in one-time GAAP-only charges related to the transaction

Transaction does not impact HPE fiscal year 2016 non-GAAP outlook

Transaction is targeted to be complete by the end of the second half of HPE’s fiscal year 2017, subject to market, regulatory and certain other conditions

|

Hewlett Packard Enterprise

12

|

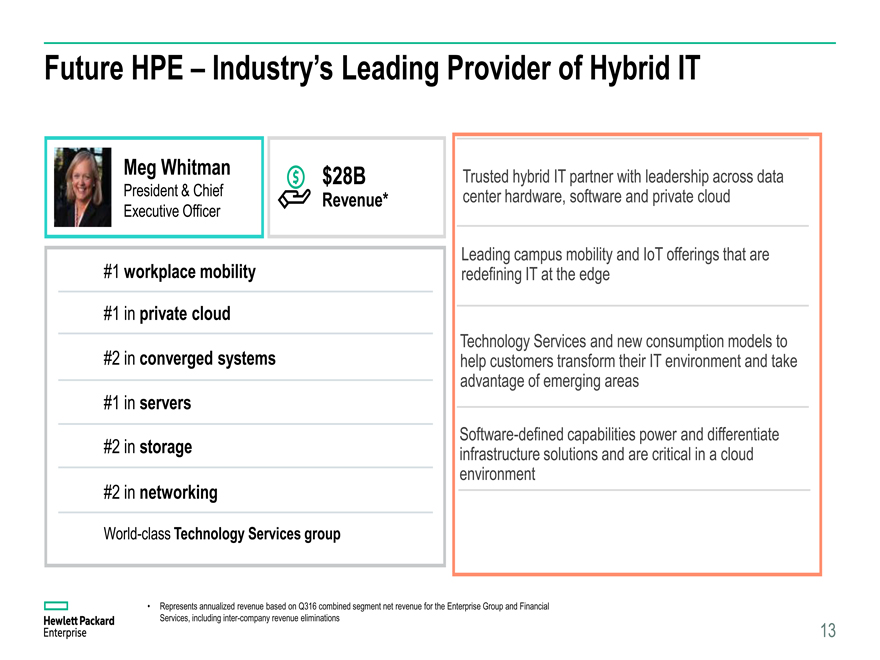

Future HPE – Industry’s Leading Provider of Hybrid IT

Represents annualized revenue based on Q316 combined segment net revenue for the Enterprise Group and Financial Services, including inter-company revenue eliminations

Meg Whitman President & Chief Executive Officer

$28B Revenue*

13

#1 in servers

#2 in storage

World-class Technology Services group

#1 in private cloud

#2 in converged systems #2 in networking

#1 workplace mobility

Trusted hybrid IT partner with leadership across data center hardware, software and private cloud

Leading campus mobility and IoT offerings that are redefining IT at the edge

Technology Services and new consumption models to help customers transform their IT environment and take advantage of emerging areas

Software-defined capabilities power and differentiate infrastructure solutions and are critical in a cloud environment

|

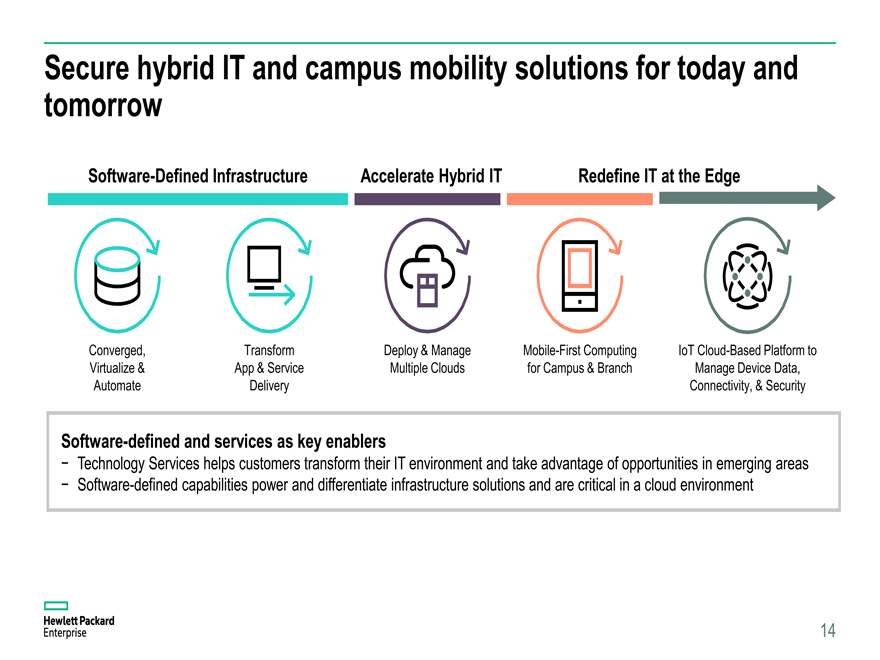

Secure hybrid IT and campus mobility solutions for today and tomorrow

14 Software-defined and services as key enablers

?Technology Services helps customers transform their IT environment and take advantage of opportunities in emerging areas

?Software-defined capabilities power and differentiate infrastructure solutions and are critical in a cloud environment

Software-Defined Infrastructure

Redefine IT at the Edge

Accelerate Hybrid IT

Converged, Virtualize & Automate Transform App & Service Delivery

Deploy & Manage Multiple Clouds

IoT Cloud-Based Platform to Manage Device Data, Connectivity, & Security

Mobile-First Computing for Campus & Branch

|

Appendix

15

|

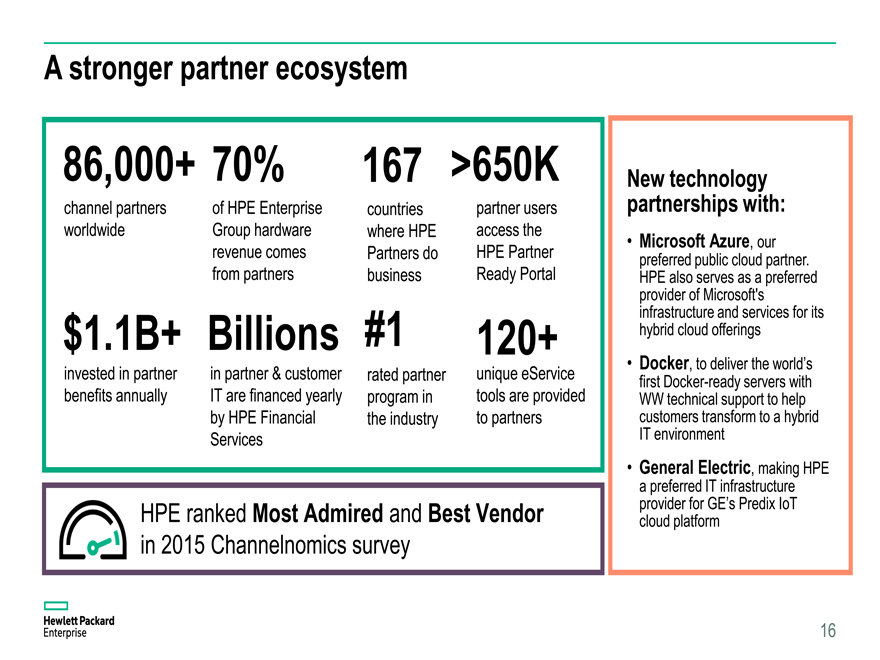

A stronger partner ecosystem

16 channel partners worldwide

86,000+

167

countries where HPE Partners do business

70% of HPE Enterprise Group hardware revenue comes from partners

#1

rated partner program in the industry

$1.1B+

Billions

invested in partner benefits annually

in partner & customer IT are financed yearly by HPE Financial Services

>650K

partner users access the HPE Partner Ready Portal

120+

unique eService tools are provided to partners HPE ranked Most Admired and Best Vendor in 2015 Channelnomics survey New technology partnerships with:

Microsoft Azure, our preferred public cloud partner. HPE also serves as a preferred provider of Microsoft’s infrastructure and services for its hybrid cloud offerings

Docker, to deliver the world’s first Docker-ready servers with WW technical support to help customers transform to a hybrid IT environment

General Electric, making HPE a preferred IT infrastructure provider for GE’s Predix IoT cloud platform

|

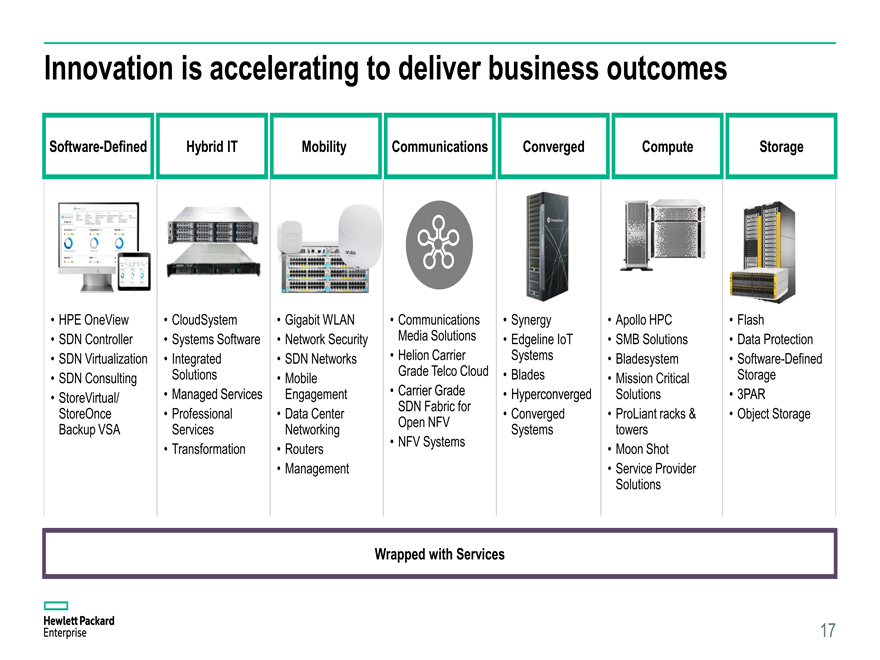

Innovation is accelerating to deliver business outcomes

17

HPE OneView

SDN Controller

SDN Virtualization

SDN Consulting

StoreVirtual/ StoreOnce Backup VSA

•CloudSystem

Systems Software

Integrated Solutions

Managed Services

Professional Services

Transformation

•Gigabit WLAN

Network Security

SDN Networks

Mobile Engagement

Data Center Networking

Routers

Management

•Communications Media Solutions

Helion Carrier Grade Telco Cloud

Carrier Grade SDN Fabric for Open NFV

NFV Systems

•Synergy

Edgeline IoT Systems

Blades

Hyperconverged

Converged Systems

•Apollo HPC

SMB Solutions

Bladesystem

Mission Critical Solutions

ProLiant racks & towers

Moon Shot

Service Provider Solutions

•Flash

Data Protection

Software-Defined Storage

3PAR

Object Storage

|

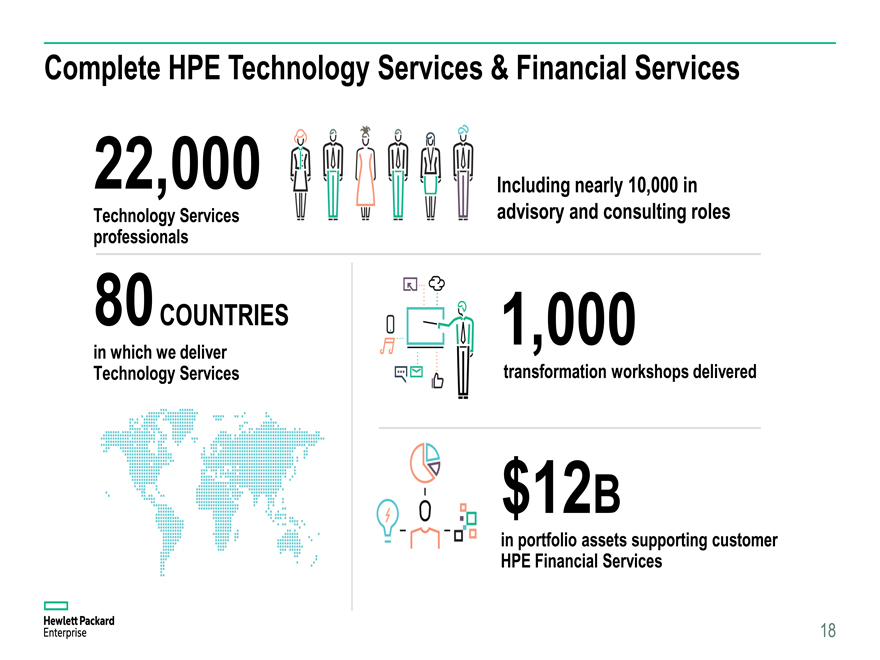

Complete HPE Technology Services & Financial Services

22,000

Technology Services

professionals

80 COUNTRIES

in which we deliver

Technology Services

1,000

transformation workshops delivered

$12B

in portfolio assets supporting customer HPE Financial Services

Including nearly 10,000 in advisory and consulting roles 18

|

Alternative: slide 4 as two slides

19

|

HPE Vision

Be the industry’s leading provider of hybrid IT, built on the secure, next-generation, software-defined infrastructure that will run customers’ data centers today, bridge them to multi-cloud environments tomorrow, and enable the emerging intelligent edge that will power campus, branch and IoT applications for decades to come.

20

|

Strategic Partnerships

Microsoft Azure

Docker

Mesosphere

Chef

GE Digital

National Instruments

Targeted Acquisitions

Aruba Networks—$2.7B

SGI*—$275M

Portfolio Optimization

TippingPoint sale—$300M

H3C deal in China—$2.3B

Spin-merge of Enterprise Services business with CSC—$8.3B

Spin-merge of non-core software assets with Micro Focus—$8.8B

Realizing our Vision Focused Investments

HPE Synergy

Hyper Converged 380 solution

Edgeline

OneView

Helion Cloud Platform

*Pending 21