Filed by Micro Focus International plc

Pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Company: Hewlett Packard Enterprise Company

Commission File No.: 001-37483

Date: November 18, 2016

Micro Focus International plcDebt Investor Breakfast Mike Phillips – Chief Financial OfficerRob Ebrey – Director of Tax, Treasury & Risk 18 November 2016

Agenda Micro Focus Company OverviewAnnounced Transaction SummaryHPE Software Assets OverviewFinancial Impact & IntegrationAppendix 2

Micro Focus International plcCompany Overview

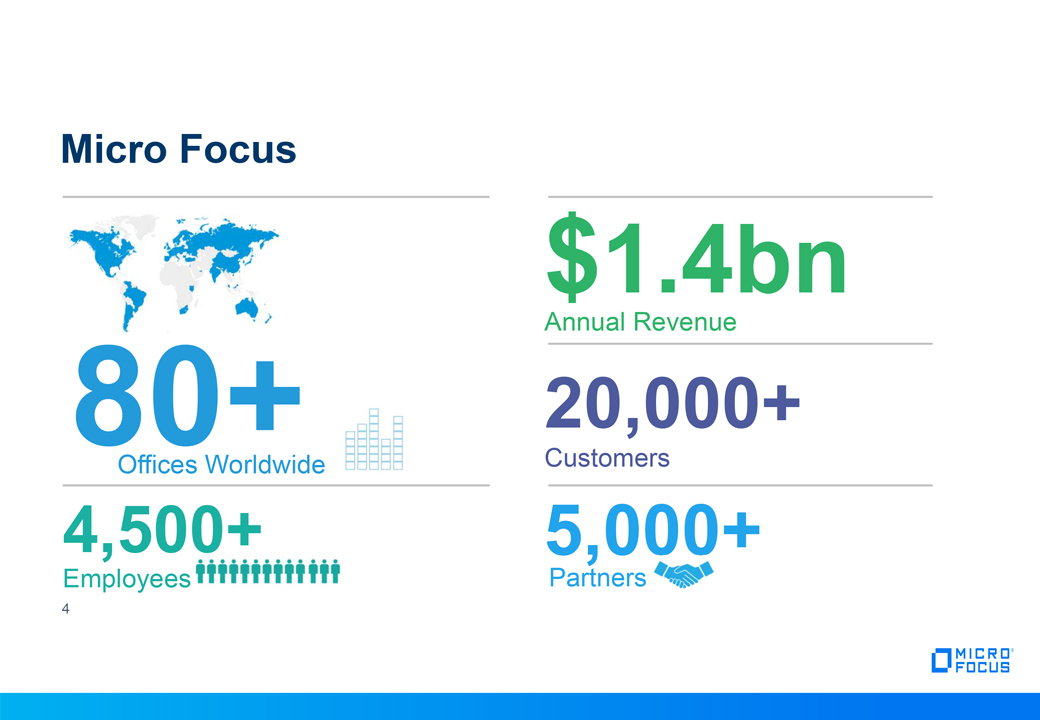

Micro Focus $1.4bn Offices Worldwide 20,000+ Customers Annual Revenue 5,000+ Partners 80+ 4,500+ Employees 4

We Are a Software CompanyWe make software, we sell software and we support software 5 Everything is organised to help us do this:Our systemsThe way we interact with customers and partnersHow we deliver consulting servicesWe aim to provide investors with a sustainable return of between 15% to 20% per annumIn doing so we need to be building a company with sustainable prospects for the ‘long’ term!

Micro Focus helps its customers to innovate faster with lower riskWe enable them to embrace new technology while building on what already works. We call this bridging the old and the new 6

An Evolutionary Journey Resulting in Great Complexity- all in the last 35 years! Internet of Things (IoT) z / OSPL / I COBOL CICS IMS Public Cloud PrivateCloud 7

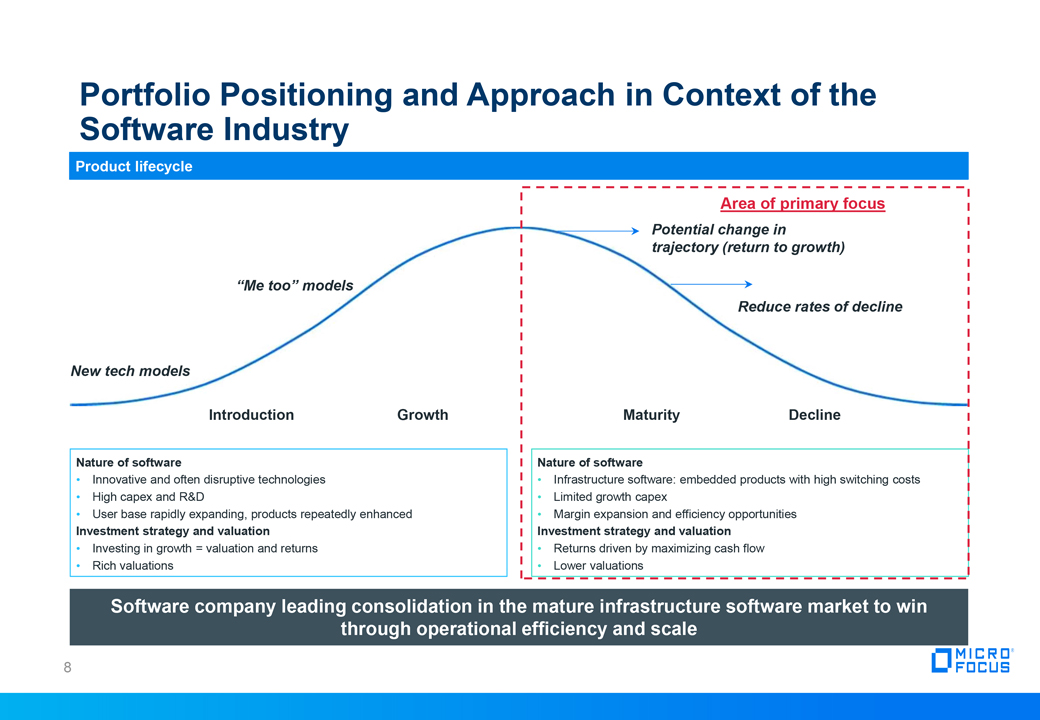

Portfolio Positioning and Approach in Context of the Software Industry Software company leading consolidation in the mature infrastructure software market to win through operational efficiency and scale Product lifecycle Introduction Growth Maturity Decline Area of primary focus New tech models “Me too” models Potential change in trajectory (return to growth) Reduce rates of decline Nature of softwareInnovative and often disruptive technologiesHigh capex and R&DUser base rapidly expanding, products repeatedly enhancedInvestment strategy and valuationInvesting in growth = valuation and returnsRich valuations Nature of softwareInfrastructure software: embedded products with high switching costsLimited growth capexMargin expansion and efficiency opportunitiesInvestment strategy and valuation Returns driven by maximizing cash flowLower valuations 8

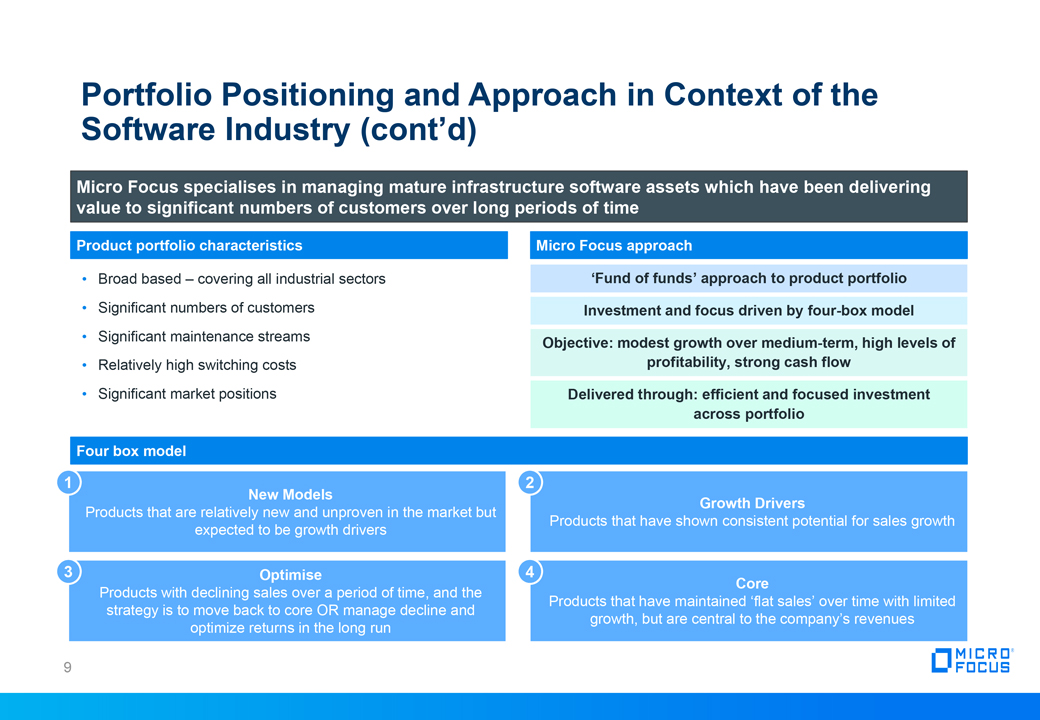

Portfolio Positioning and Approach in Context of the Software Industry (cont’d) Micro Focus specialises in managing mature infrastructure software assets which have been delivering value to significant numbers of customers over long periods of time Product portfolio characteristics Micro Focus approach Broad based – covering all industrial sectorsSignificant numbers of customersSignificant maintenance streamsRelatively high switching costsSignificant market positions ‘Fund of funds’ approach to product portfolio Investment and focus driven by four-box model Objective: modest growth over medium-term, high levels of profitability, strong cash flow Delivered through: efficient and focused investment across portfolio Four box model New ModelsProducts that are relatively new and unproven in the market but expected to be growth drivers 1 OptimiseProducts with declining sales over a period of time, and the strategy is to move back to core OR manage decline and optimize returns in the long run 3 Growth DriversProducts that have shown consistent potential for sales growth 2 CoreProducts that have maintained ‘flat sales’ over time with limited growth, but are central to the company’s revenues 4 9

Operating Model & Structure:One company with two product portfolios 10 North America International(EMEA, LATAM) APJ Corporate Operations Finance IT HR Product Development Legal Business Operations & PMO Field Marketing Product Management Go To Market Product Development NA, EMEA & APJ(LATAM from MF shared team) Product Management Field Marketing Services, Customer Care, Renewals, Shared Marketing Services, Sales Operations Channel, Systems Integrators & OEM Channel, Systems Integrators & Independent Software Vendors Product Group Go To Market Product Group

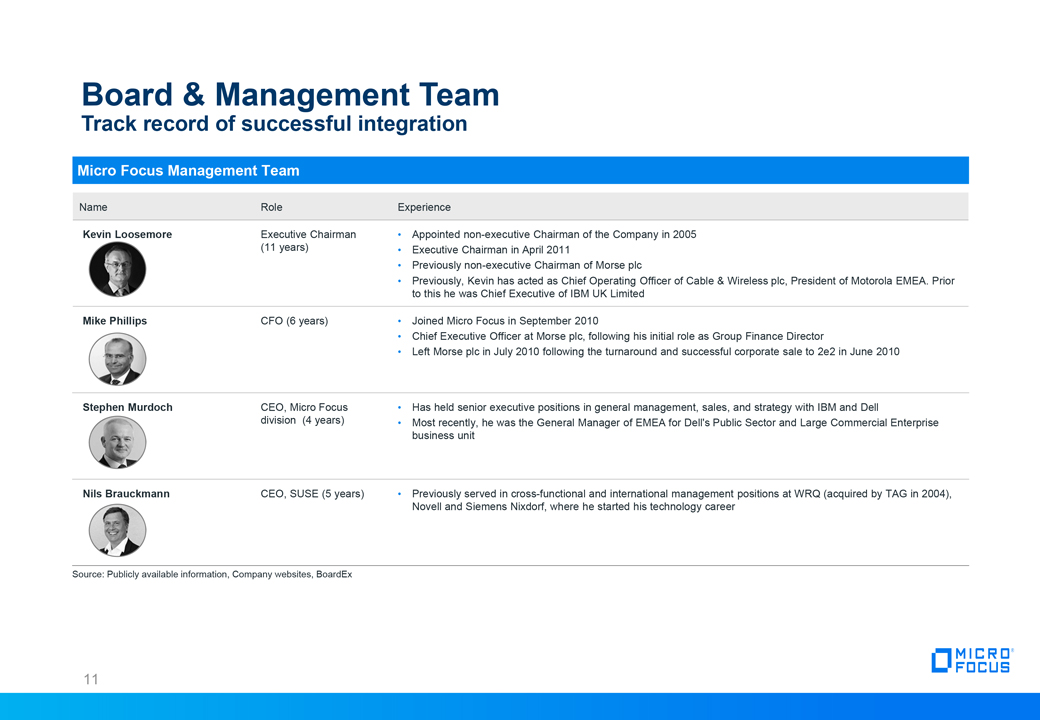

Name Role Experience Kevin Loosemore Executive Chairman (11 years) Appointed non-executive Chairman of the Company in 2005 Executive Chairman in April 2011Previously non-executive Chairman of Morse plcPreviously, Kevin has acted as Chief Operating Officer of Cable & Wireless plc, President of Motorola EMEA. Prior to this he was Chief Executive of IBM UK Limited Mike Phillips CFO (6 years) Joined Micro Focus in September 2010 Chief Executive Officer at Morse plc, following his initial role as Group Finance DirectorLeft Morse plc in July 2010 following the turnaround and successful corporate sale to 2e2 in June 2010 Stephen Murdoch CEO, Micro Focus division (4 years) Has held senior executive positions in general management, sales, and strategy with IBM and DellMost recently, he was the General Manager of EMEA for Dell's Public Sector and Large Commercial Enterprise business unit Nils Brauckmann CEO, SUSE (5 years) Previously served in cross-functional and international management positions at WRQ (acquired by TAG in 2004), Novell and Siemens Nixdorf, where he started his technology career Micro Focus Management Team Source: Publicly available information, Company websites, BoardEx Board & Management TeamTrack record of successful integration 11

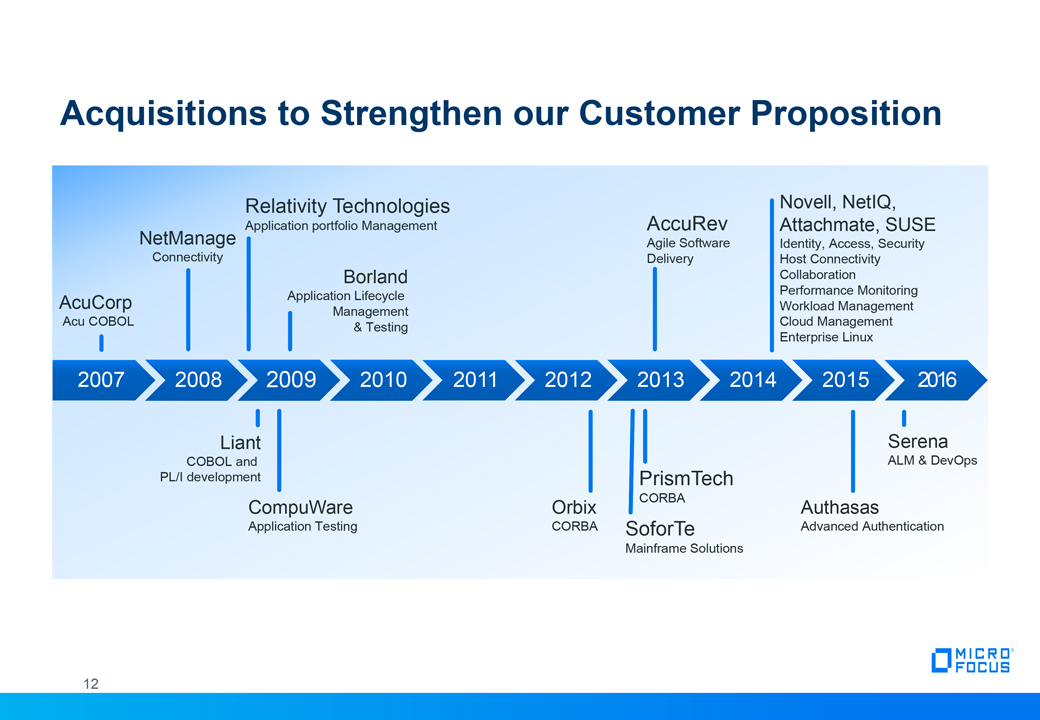

CompuWareApplication Testing LiantCOBOL and PL/I development OrbixCORBA Novell, NetIQ, Attachmate, SUSEIdentity, Access, SecurityHost ConnectivityCollaborationPerformance MonitoringWorkload ManagementCloud ManagementEnterprise Linux BorlandApplication Lifecycle Management & Testing Acquisitions to Strengthen our Customer Proposition AuthasasAdvanced Authentication SerenaALM & DevOps NetManageConnectivity AcuCorp Acu COBOL Relativity TechnologiesApplication portfolio Management AccuRevAgile Software Delivery PrismTechCORBA SoforTeMainframe Solutions 12

10_84 Note: Does not include acquisitions smaller than $10M: Authasas (’15), Openfusion (’13), Soforte (’13), Relativity (’09) and Liant (’08).*Values for Borland, NetManage, Acucorp and Accurev are operating profit, not EBITDA. **Orbix acquisition value includes other assets acquired from Progress Software.Source: Micro Focus and other companies annual reports, Internal Micro Focus data; Bain Analysis. Acquisition Portfolio groups / main products Year Acquisition value ($M) EBITDA ($M) 1 2 4 Micro Focus made eight major acquisitions in last 10 years Serena Dev & ITOM: Mainframe and distributed ALM and BPM 2016 540 80 Attachmate (TAG) Collab. & Networking (Novell), Host Connectivity (Attachmate), IAS (NetIQ) and SUSE 2014 2,350 313 Accurev Dev & ITOM: Accurev 2013 19 (2)* Orbix assets from Progress SW Collab. & Networking: CORBA 2012 15** 8 Borland Dev & ITOM: Borland / Silk Suite 2009 87 (11)* Compuware Dev & ITOM: Application Testing and Automated Software Quality 2009 63 19 NetManage Host Connectivity: RUMBA 2008 46 (2)* Acucorp CDMS: AcuCobol 2007 40 4* 3 5 6 7 8 13

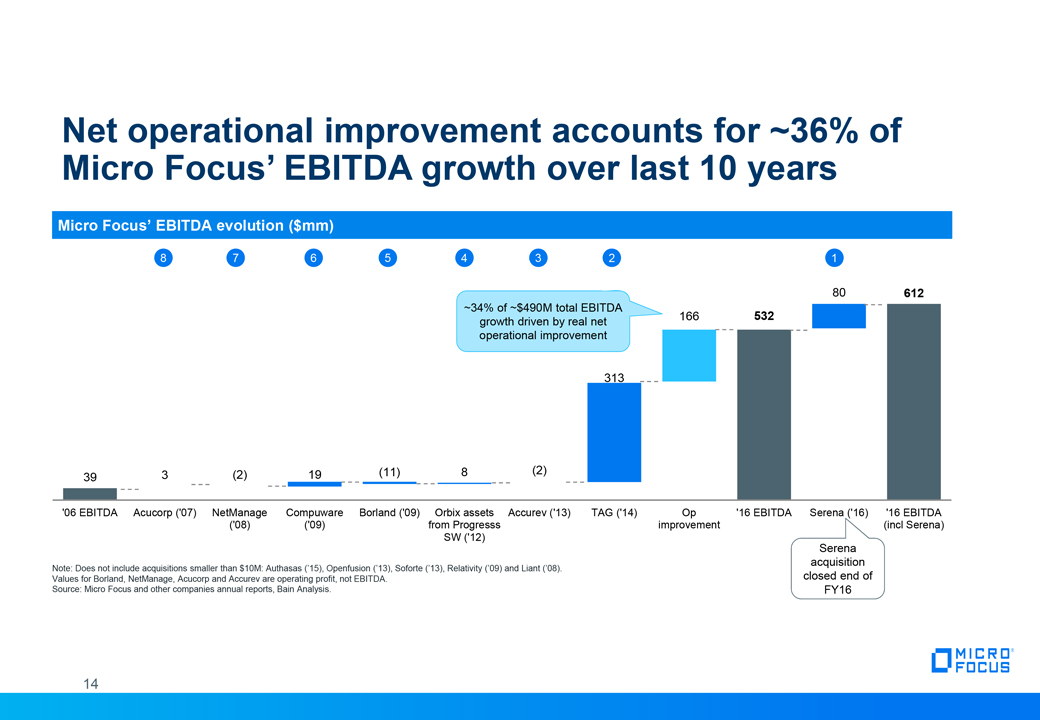

Net operational improvement accounts for ~36% of Micro Focus’ EBITDA growth over last 10 years Micro Focus’ EBITDA evolution ($mm) Note: Does not include acquisitions smaller than $10M: Authasas (’15), Openfusion (’13), Soforte (’13), Relativity (’09) and Liant (’08).Values for Borland, NetManage, Acucorp and Accurev are operating profit, not EBITDA.Source: Micro Focus and other companies annual reports, Bain Analysis. ~34% of ~$490M total EBITDA growth driven by real net operational improvement Serena acquisition closed end of FY16 1 2 4 3 5 6 7 8 14

Product Portfolio 15 Linux and Open Source 18% COBOL Development and MainframeSolutions 18% COBOL Enterprise Identity, Access and Security Solutions 16% Identity Manager Sentinel Development and IT OperationsManagementTools 13% Development and IT Operations ManagementTools 23% Silk AccuRev PlateSpin 11% OES GroupWise CORBA Collaborationand NetworkingSolutions Host Connectivity Solutions 14% MSS Reflection Rumba

Micro Focus – Product Portfolio Snapshot 16 Identity, Access and Security Solutions (IAS) COBOL Development and Mainframe solutions (CDMS) Host Connectivity Solutions Development and IT Operations Mgmt (Dev & ITOM1) Collaboration and Networking Solutions SUSE $217m(16% of total) Facilitate secure access by using identity information (identity management, access management, single-sign-on etc)Increased compliance / regulation, expansion and diversity of cyber threats and resultant financial impact and virtualisation and cloud deployment are key trends driving industry growth $259m(18% of total) CD products enable programmers to develop applications written in COBOL across multiple platforms including Windows, UNIX, Linux and the cloudMS products let customers maximise value out of their mainframe. These technologies allow customers flexibility in deciding the platform choice for development, testing and deployment of their business applications $198m(14% of total) Enable use of centralised applications (especially mainframes) to end-users across different environments and devicesEnable use of mainframe applications and data with modern dev. environments and business analyticsCore products deliver graphical user interfaces (GUI) for legacy applications $320m(23% of total) Includes tools (applications) that enable IT departments to better manage their datacenters, software development and testing as well as system monitor and support toolsSource Code Change Management, Application Lifecycle Management and Business Process Management software from the Serena acquistion $160m(11% of total) Core products include email, calendaring, contact management, solutions for file & print / storage of enterprise filesBrings people, projects and processes together in a secure environment $254m(18% of total) Operating system built on top of the open source Linux kernel that allows a computer and its various hardware and software components to interactEnterprise grade Linux server, open stack, cloud and storage solutions Description FY16 Rev2 Total $1,408m Source: Micro Focus annual report and filings; company data1 Incl. Serena2 Pro Forma for Serena acquisition COBOL Enterprise Identity Manager Sentinel Rumba MSS Reflection Silk AccuRev PlateSpin OES GroupWise CORBA Products Linux & Open Stack 1 2 3 4 5 6

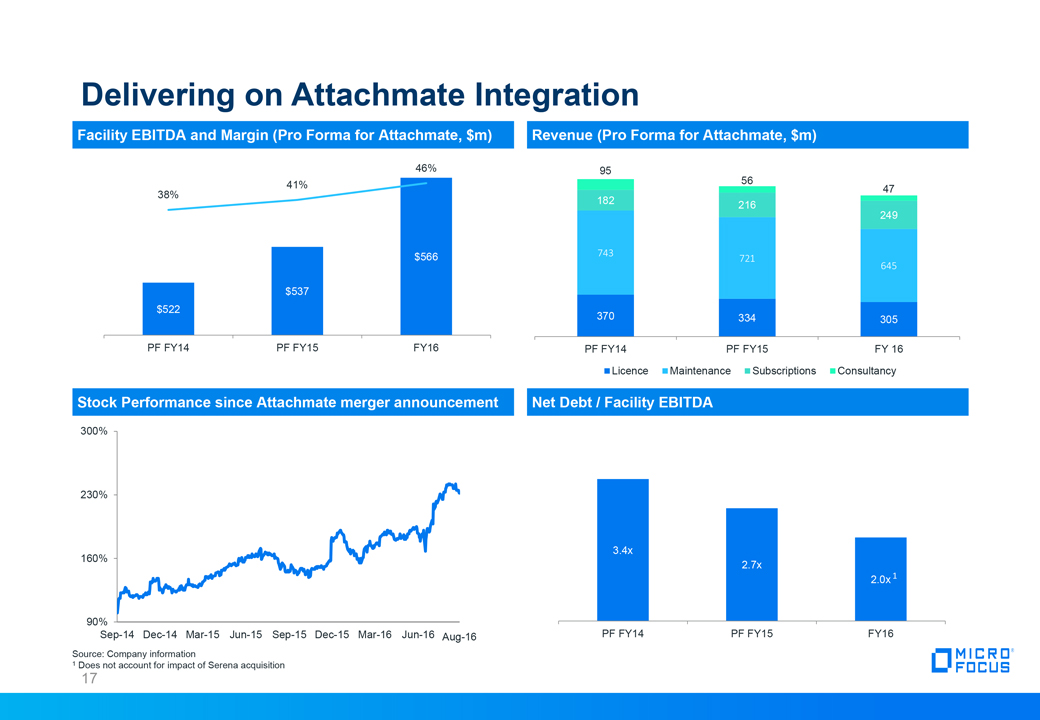

Facility EBITDA and Margin (Pro Forma for Attachmate, $m) 17 Delivering on Attachmate Integration Revenue (Pro Forma for Attachmate, $m) Stock Performance since Attachmate merger announcement Net Debt / Facility EBITDA Aug-16 Source: Company information1 Does not account for impact of Serena acquisition 1

Micro Focus Overview and Outlook 18 Source: Micro Focus FY16 preliminary results presentation OverviewFY16 Results at the high end of management expectations Total Shareholder Return strategy continuesFinal Dividend increased by 50.7% to 49.74 cents (2015: 33.00 cents)Full Year Dividend increased by 37.8% to 66.68 cents (2015: 48.40 cents)Return of Value to shareholders in 2017OutlookConsistent double digit shareholder returnsRevenue in FY17 minus 2% to zero Compared to FY16 CCY pro-forma with SerenaFY17 revenue exit rate flat with FY16 and anticipate revenue growth in FY18Maintain target net debt at 2.5 times to Facility EBITDAAppropriate value enhancing acquisitions

Announced Transaction Summary

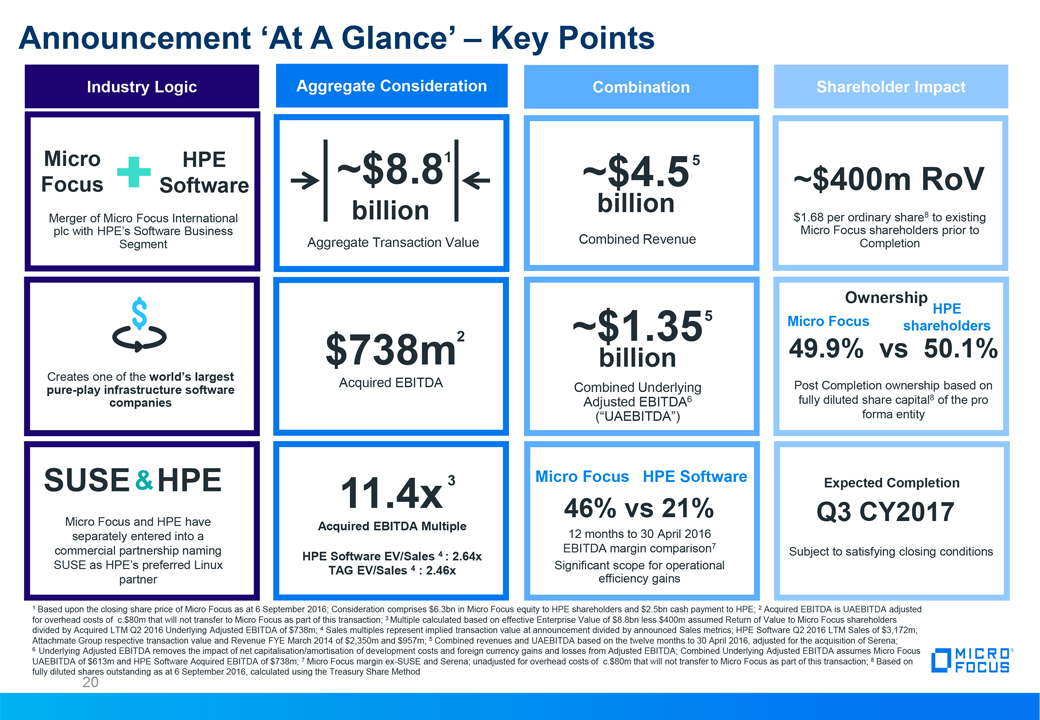

Announcement ‘At A Glance’ – Key Points 20 Industry Logic Aggregate Consideration Combination Shareholder Impact 1 Based upon the closing share price of Micro Focus as at 6 September 2016; Consideration comprises $6.3bn in Micro Focus equity to HPE shareholders and $2.5bn cash payment to HPE; 2 Acquired EBITDA is UAEBITDA adjusted for overhead costs of c.$80m that will not transfer to Micro Focus as part of this transaction; 3 Multiple calculated based on effective Enterprise Value of $8.8bn less $400m assumed Return of Value to Micro Focus shareholders divided by Acquired LTM Q2 2016 Underlying Adjusted EBITDA of $738m; 4 Sales multiples represent implied transaction value at announcement divided by announced Sales metrics; HPE Software Q2 2016 LTM Sales of $3,172m; Attachmate Group respective transaction value and Revenue FYE March 2014 of $2,350m and $957m; 5 Combined revenues and UAEBITDA based on the twelve months to 30 April 2016, adjusted for the acquisition of Serena; 6 Underlying Adjusted EBITDA removes the impact of net capitalisation/amortisation of development costs and foreign currency gains and losses from Adjusted EBITDA; Combined Underlying Adjusted EBITDA assumes Micro Focus UAEBITDA of $613m and HPE Software Acquired EBITDA of $738m; 7 Micro Focus margin ex-SUSE and Serena; unadjusted for overhead costs of c.$80m that will not transfer to Micro Focus as part of this transaction; 8 Based on fully diluted shares outstanding as at 6 September 2016, calculated using the Treasury Share Method $1.68 per ordinary share8 to existing Micro Focus shareholders prior to Completion Merger of Micro Focus International plc with HPE’s Software Business Segment $738m Acquired EBITDA 11.4x Expected Completion Micro Focus HPE Software ~$400m RoV Creates one of the world’s largest pure-play infrastructure software companies ~$8.8billion Aggregate Transaction Value SUSE ~$4.5billion Combined Revenue ~$1.35billion Combined Underlying Adjusted EBITDA6 (“UAEBITDA”) 46% vs 21% 12 months to 30 April 2016EBITDA margin comparison7 Significant scope for operational efficiency gains HPE Micro Focus and HPE have separately entered into a commercial partnership naming SUSE as HPE’s preferred Linux partner Post Completion ownership based on fully diluted share capital8 of the pro forma entity Micro Focus HPE shareholders 49.9% vs 50.1% Acquired EBITDA Multiple HPE Software EV/Sales 4 : 2.64xTAG EV/Sales 4 : 2.46x Q3 CY2017 Subject to satisfying closing conditions & Micro Focus HPE Software 1 5 2 5 3 Ownership

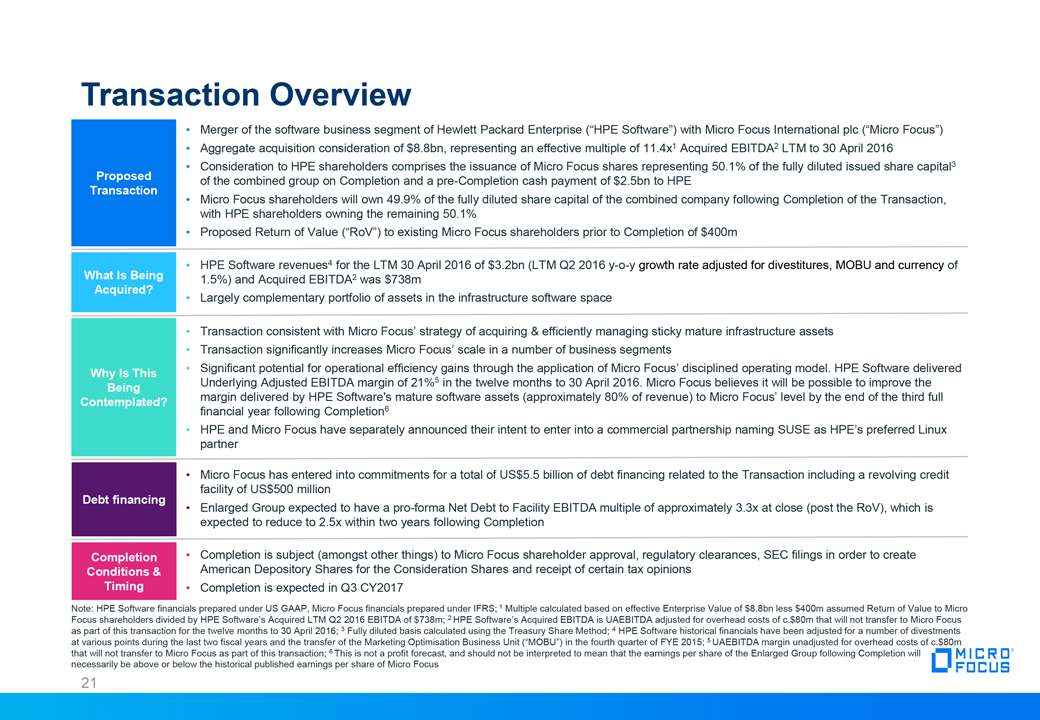

Transaction Overview HPE Software revenues4 for the LTM 30 April 2016 of $3.2bn (LTM Q2 2016 y-o-y growth rate adjusted for divestitures, MOBU and currency of 1.5%) and Acquired EBITDA2 was $738mLargely complementary portfolio of assets in the infrastructure software space What Is Being Acquired? Proposed Transaction Merger of the software business segment of Hewlett Packard Enterprise (“HPE Software”) with Micro Focus International plc (“Micro Focus”)Aggregate acquisition consideration of $8.8bn, representing an effective multiple of 11.4x1 Acquired EBITDA2 LTM to 30 April 2016Consideration to HPE shareholders comprises the issuance of Micro Focus shares representing 50.1% of the fully diluted issued share capital3 of the combined group on Completion and a pre-Completion cash payment of $2.5bn to HPEMicro Focus shareholders will own 49.9% of the fully diluted share capital of the combined company following Completion of the Transaction, with HPE shareholders owning the remaining 50.1%Proposed Return of Value (“RoV”) to existing Micro Focus shareholders prior to Completion of $400m Why Is This Being Contemplated? Transaction consistent with Micro Focus’ strategy of acquiring & efficiently managing sticky mature infrastructure assetsTransaction significantly increases Micro Focus’ scale in a number of business segmentsSignificant potential for operational efficiency gains through the application of Micro Focus’ disciplined operating model. HPE Software delivered Underlying Adjusted EBITDA margin of 21%5 in the twelve months to 30 April 2016. Micro Focus believes it will be possible to improve the margin delivered by HPE Software's mature software assets (approximately 80% of revenue) to Micro Focus’ level by the end of the third full financial year following Completion6HPE and Micro Focus have separately announced their intent to enter into a commercial partnership naming SUSE as HPE’s preferred Linux partner 21 Note: HPE Software financials prepared under US GAAP, Micro Focus financials prepared under IFRS; 1 Multiple calculated based on effective Enterprise Value of $8.8bn less $400m assumed Return of Value to Micro Focus shareholders divided by HPE Software’s Acquired LTM Q2 2016 EBITDA of $738m; 2 HPE Software’s Acquired EBITDA is UAEBITDA adjusted for overhead costs of c.$80m that will not transfer to Micro Focus as part of this transaction for the twelve months to 30 April 2016; 3 Fully diluted basis calculated using the Treasury Share Method; 4 HPE Software historical financials have been adjusted for a number of divestments at various points during the last two fiscal years and the transfer of the Marketing Optimisation Business Unit (“MOBU”) in the fourth quarter of FYE 2015; 5 UAEBITDA margin unadjusted for overhead costs of c.$80m that will not transfer to Micro Focus as part of this transaction; 6 This is not a profit forecast, and should not be interpreted to mean that the earnings per share of the Enlarged Group following Completion will necessarily be above or below the historical published earnings per share of Micro Focus Debt financing Micro Focus has entered into commitments for a total of US$5.5 billion of debt financing related to the Transaction including a revolving credit facility of US$500 millionEnlarged Group expected to have a pro-forma Net Debt to Facility EBITDA multiple of approximately 3.3x at close (post the RoV), which is expected to reduce to 2.5x within two years following Completion Completion Conditions & Timing Completion is subject (amongst other things) to Micro Focus shareholder approval, regulatory clearances, SEC filings in order to create American Depository Shares for the Consideration Shares and receipt of certain tax opinionsCompletion is expected in Q3 CY2017

Sources & Uses 22 Sources $bn Uses $bn Issue of new shares 6.3 Equity to HPE shareholders 6.3 New debt 5.0 Cash payment to HPE 2.5 Acquisition purchase price 8.8 RoV 0.4 Acquiror existing debt, other 2.1 Total Sources 11.3 Total Uses 11.3 Capitalisation $bn X LTM EBITDA RCF ($500mm) - Debt committed funding 5.0 Total debt 5.0 3.6x Apr-16 / 3.3x Closing Micro Focus market cap 6.3 HPE Software equity value 6.3 Equity value (at announcement)1 12.6 PF Adj. LTM Facility EBITDA Apr-16 1.392 Source: FactSet, Company announcementsNote: Micro Focus Facility EBITDA PF Serena acquisition of $81mm; Facility EBITDA is Adjusted EBITDA before amortisation and impairment of capitalised development costs1 Based upon the closing share price of Micro Focus as at 6 September 2016 and the fully diluted share count under the Treasury Method2 $1,385mm Facility EBITDA as of 30 Apr-16 LTM based on Micro Focus Facility EBITDA of $647mm (PF for Serena acquisition), HPE Software Facility EBITDA of $738mm, adjusted for overhead costs of c.$80m that will not transfer to Micro Focus as part of this transaction; as per RNS release on 7 September 2016, HPE Software’s underlying adjusted EBITDA and Facility EBITDA as calculated result in the same figure Sources and Uses Pro Forma capitalisation (Apr-16A)

HPE Software Combination Offers Micro Focus a Unique Opportunity to Create an Industry Leader that Can Consolidate at a Much Larger Scale 23 Sources: Capital IQ and HPE Software management financials; LTM as of 31-Jul-2016 23 #6 #23 Potential leaders/targets of mid-size consolidation to create scale to compete with the largest software companies Nuance Communications Potential targets to consolidate and create scale in maturing market

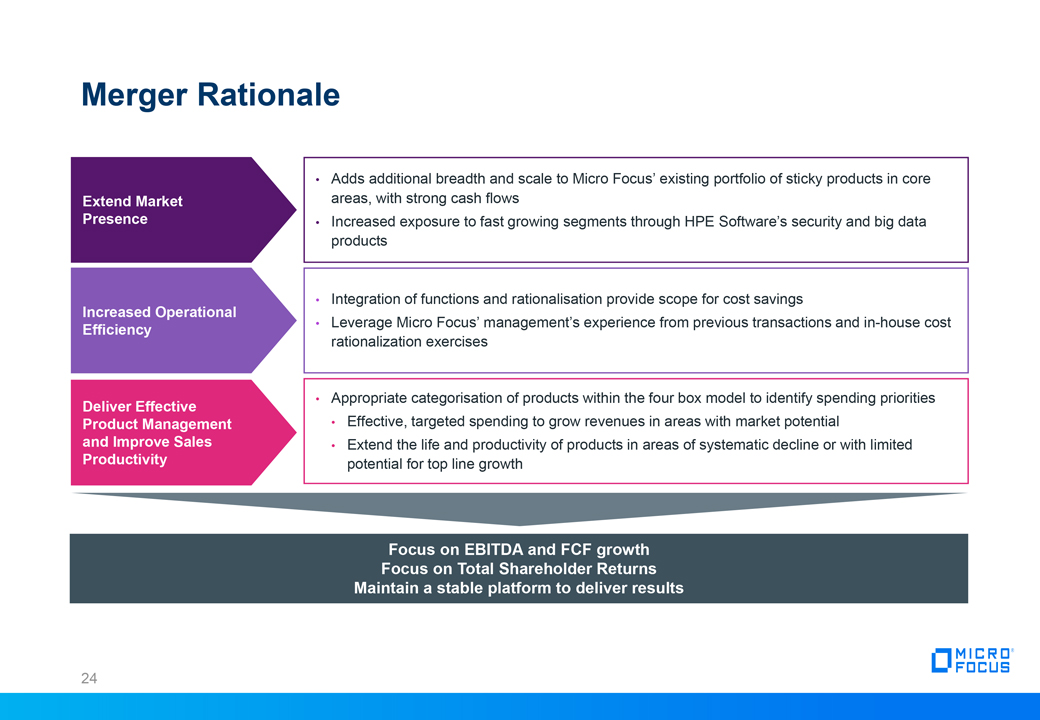

24 Merger Rationale Adds additional breadth and scale to Micro Focus’ existing portfolio of sticky products in core areas, with strong cash flowsIncreased exposure to fast growing segments through HPE Software’s security and big data products Integration of functions and rationalisation provide scope for cost savingsLeverage Micro Focus’ management’s experience from previous transactions and in-house cost rationalization exercises Appropriate categorisation of products within the four box model to identify spending prioritiesEffective, targeted spending to grow revenues in areas with market potentialExtend the life and productivity of products in areas of systematic decline or with limited potential for top line growth Extend Market Presence Increased Operational Efficiency Deliver Effective Product Management and Improve Sales Productivity Focus on EBITDA and FCF growthFocus on Total Shareholder ReturnsMaintain a stable platform to deliver results

Credit Highlights 25 Well positioned in both mature and growth sectors of the software market Leader in managing mature infrastructure software assetsSignificant presence in growth segments Highly cash generative with the potential for further operational efficiencies Strong track record for cash generationTarget EBITDA margin differential provides ample opportunity (Micro Focus c .44%1 vs HPE Software c.21%), e.g. Attachmate80% of HPE Software products are mature and there remains opportunity to increase margin to Micro Focus portfolio margins by the third full year following completion of the merger Diversity by product, customer base and geography Micro Focus customer base >20K and HPE Software >50K and including virtually all Fortune 500 companies and representing all major industriesBalanced geographic split across North America and the rest of the world Predictable performance from portfolio effects and sticky customer base Breadth of portfolio helps to mitigate fluctuations in performance at product level, providing highly predictable overall resultsSignificant recurring revenues for Micro Focus and HPE Software Management team with a strong M&A track record Track record of acquiring businesses and improving margins Track record of deleveraging e.g. de-levered 0.7x (post Serena transaction) since TAG merger completion in November 2014Voluntary prepayment by Micro Focus of $150m of Term Loan B 2 1 2 2 2 3 2 4 2 5 Source: Micro Focus 2016A preliminary results presentation1 Pro Forma for impact of Serena acquisition

HPE Software Assets Overview

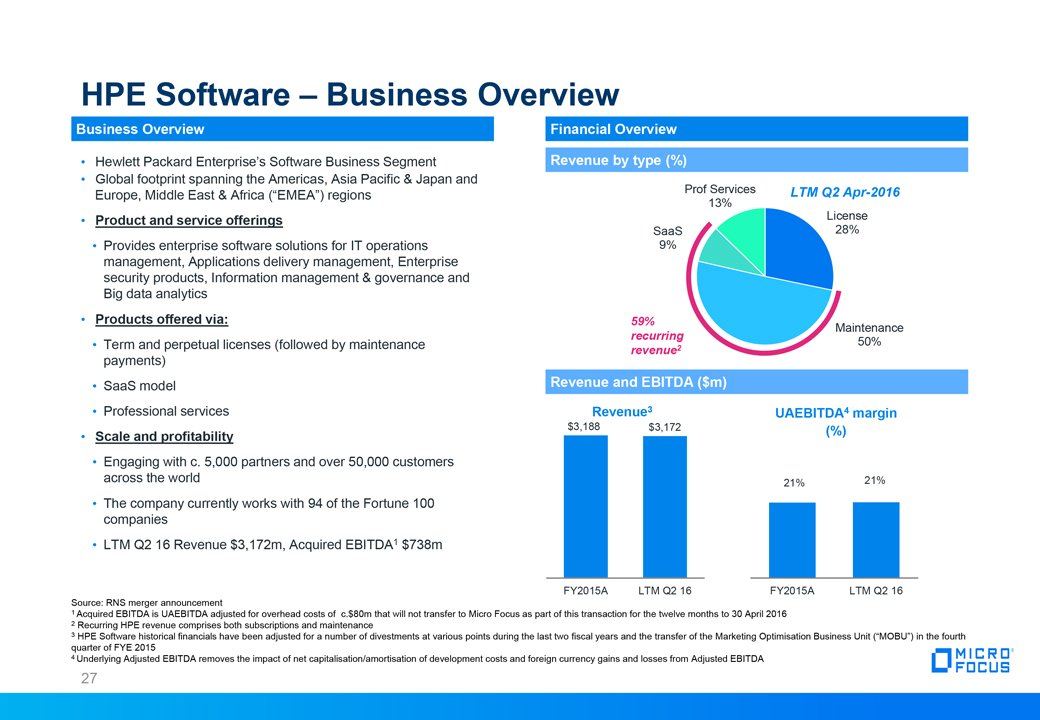

Business Overview Hewlett Packard Enterprise’s Software Business SegmentGlobal footprint spanning the Americas, Asia Pacific & Japan and Europe, Middle East & Africa (“EMEA”) regionsProduct and service offeringsProvides enterprise software solutions for IT operations management, Applications delivery management, Enterprise security products, Information management & governance and Big data analyticsProducts offered via:Term and perpetual licenses (followed by maintenance payments)SaaS modelProfessional servicesScale and profitabilityEngaging with c. 5,000 partners and over 50,000 customers across the world The company currently works with 94 of the Fortune 100 companiesLTM Q2 16 Revenue $3,172m, Acquired EBITDA1 $738m Revenue3 UAEBITDA4 margin (%) Source: RNS merger announcement1 Acquired EBITDA is UAEBITDA adjusted for overhead costs of c.$80m that will not transfer to Micro Focus as part of this transaction for the twelve months to 30 April 20162 Recurring HPE revenue comprises both subscriptions and maintenance3 HPE Software historical financials have been adjusted for a number of divestments at various points during the last two fiscal years and the transfer of the Marketing Optimisation Business Unit (“MOBU”) in the fourth quarter of FYE 20154 Underlying Adjusted EBITDA removes the impact of net capitalisation/amortisation of development costs and foreign currency gains and losses from Adjusted EBITDA 27 HPE Software – Business Overview Revenue and EBITDA ($m) Financial Overview LTM Q2 Apr-2016 59% recurring revenue2 Revenue by type (%)

IT operations management Application delivery management (ADM) Enterprise security products (ESP) Information management & governance (IM&G) Big data analytics Description Facilitating management, automation and optimisation of data centers and cloud infrastructure Quality and lifecycle tools for traditional and DevOps application development models Enabling enterprises to protect interactions among users, apps and data across locations and devicesKey offerings include threat identification, digital asset protection, data security and application hardening Helping customers manage, govern, store and secure their informationSolutions: data protection, archiving & e-Discovery, and content management Providing platforms that help customers harness their data and identify new opportunitiesPlatforms: next-generation enterprise search and data analytics (IDOL) and columnar database (Vertica) Select Product portfolio 28 HPE Software Product Portfolio HPE Software – Product Portfolio Digital Safe Data Protector AppPulse Cloud Orchestration Service Anywhere Data Center Automation ALM IDOL

Financial Impact & Integration

Micro Focus – Standalone Historical Financials 30 Historical financials (Pro Forma for Serena acquisition, $m) Source: Micro Focus company filingsNote: Financials pro forma for acquisition of Serena in May 2016; Underlying Adjusted EBITDA removes the impact of net capitalisation/amortisation of development costs and foreign currency gains and losses from Adjusted EBITDA FY Apr-16 FY Apr-15 FY Apr-14 Licence Revenue 336 367 401 Maintenance Revenue 763 849 877 Subscriptions 249 216 182 Consultancy 60 67 112 Total Reported Revenue 1,408 1,500 1,572 % growth (6.1%) (4.6%) – Underlying Adjusted EBITDA 613 592 586

Micro Focus Pro Forma Revenue (FYE April, IFRS) HPE Software Pro Forma Revenue(FYE October, US GAAP) ~$4.5bnCombined Revenue Note: Actual Currency, Pro Forma (i.e. adjusted for a number of divestments at various points during the last two fiscal years and the transfer of the Marketing Optimisation Business Unit (“MOBU”) in the fourth quarter of FYE 2015)Accounting Standard: US GAAPFYE 31-October This represents the Micro Focus IFRS revenues added to the HPE Software revenues adjusted for divestitures and MOBU for the twelve months to 30 April 2016IFRS treatment of the US GAAP financial statements are likely to produce a difference from this calculation Note: Actual currency, Pro Forma1Accounting Standard: IFRSFYE 30-April Revenue ($m) Revenue ($m) 31 Revenues: Micro Focus (IFRS) and HPE Software (US GAAP) 1 Pro Forma for acquisitions of the Attachmate Group and Serena acquisition

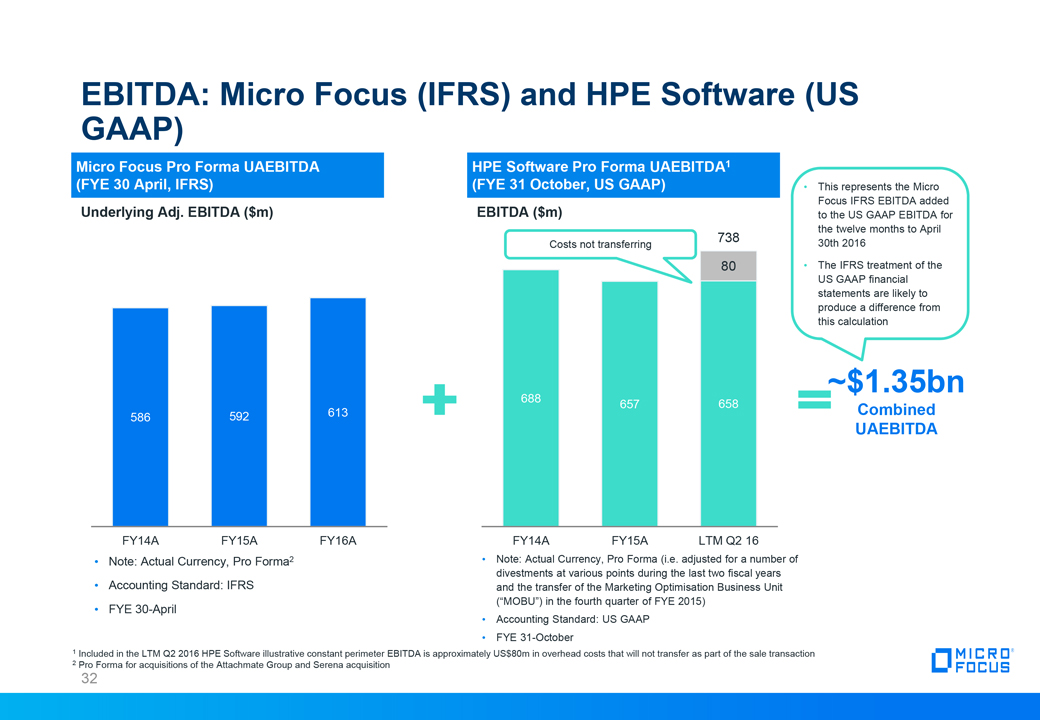

Micro Focus Pro Forma UAEBITDA (FYE 30 April, IFRS) HPE Software Pro Forma UAEBITDA1(FYE 31 October, US GAAP) ~$1.35bnCombined UAEBITDA This represents the Micro Focus IFRS EBITDA added to the US GAAP EBITDA for the twelve months to April 30th 2016The IFRS treatment of the US GAAP financial statements are likely to produce a difference from this calculation Note: Actual Currency, Pro Forma2Accounting Standard: IFRSFYE 30-April Underlying Adj. EBITDA ($m) EBITDA ($m) 1 Included in the LTM Q2 2016 HPE Software illustrative constant perimeter EBITDA is approximately US$80m in overhead costs that will not transfer as part of the sale transaction2 Pro Forma for acquisitions of the Attachmate Group and Serena acquisition 32 EBITDA: Micro Focus (IFRS) and HPE Software (US GAAP) Costs not transferring Note: Actual Currency, Pro Forma (i.e. adjusted for a number of divestments at various points during the last two fiscal years and the transfer of the Marketing Optimisation Business Unit (“MOBU”) in the fourth quarter of FYE 2015)Accounting Standard: US GAAPFYE 31-October

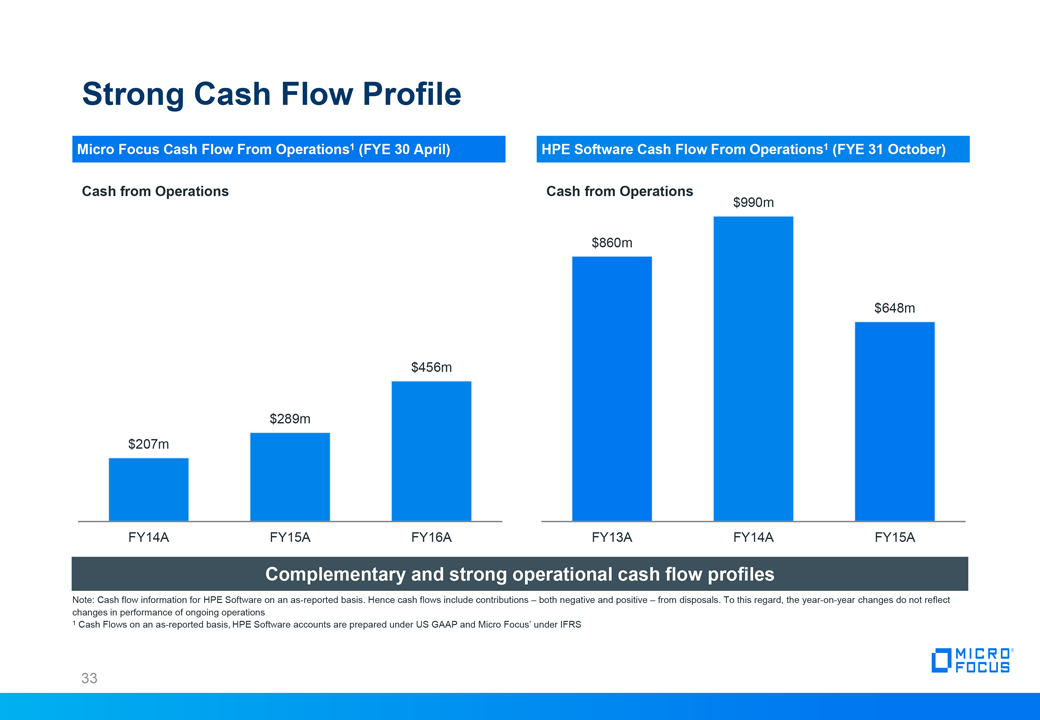

Strong Cash Flow Profile Micro Focus Cash Flow From Operations1 (FYE 30 April) HPE Software Cash Flow From Operations1 (FYE 31 October) Note: Cash flow information for HPE Software on an as-reported basis. Hence cash flows include contributions – both negative and positive – from disposals. To this regard, the year-on-year changes do not reflect changes in performance of ongoing operations1 Cash Flows on an as-reported basis, HPE Software accounts are prepared under US GAAP and Micro Focus’ under IFRS Cash from Operations Cash from Operations 33 Complementary and strong operational cash flow profiles

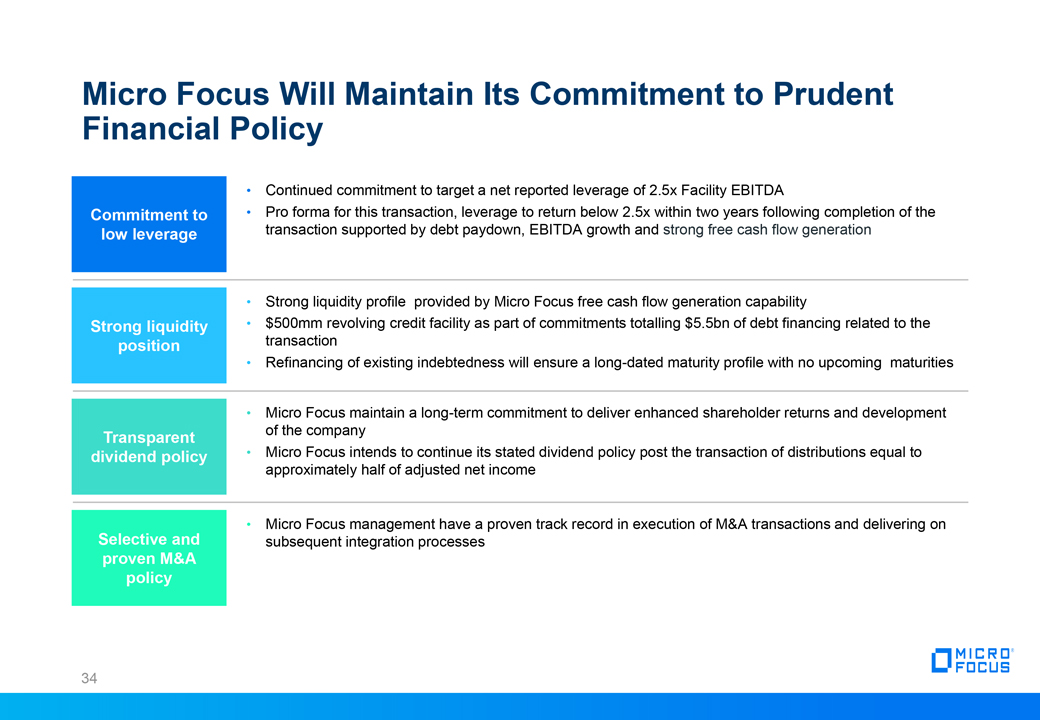

Micro Focus Will Maintain Its Commitment to Prudent Financial Policy 34 Commitment to low leverage Continued commitment to target a net reported leverage of 2.5x Facility EBITDAPro forma for this transaction, leverage to return below 2.5x within two years following completion of the transaction supported by debt paydown, EBITDA growth and strong free cash flow generation Strong liquidity position Strong liquidity profile provided by Micro Focus free cash flow generation capability$500mm revolving credit facility as part of commitments totalling $5.5bn of debt financing related to the transactionRefinancing of existing indebtedness will ensure a long-dated maturity profile with no upcoming maturities Transparent dividend policy Micro Focus maintain a long-term commitment to deliver enhanced shareholder returns and development of the companyMicro Focus intends to continue its stated dividend policy post the transaction of distributions equal to approximately half of adjusted net income Selective and proven M&A policy Micro Focus management have a proven track record in execution of M&A transactions and delivering on subsequent integration processes

Micro Focus Approach to Acquisition Integration HPE and Micro Focus have formed a separation committee to monitor and oversee the separation of HPE Software in accordance with the Transaction documentsMicro Focus has integrated many business over the last five years and takes a structured approach to post acquisition integration, which includes:Minimise day 1 changes – we will ensure changes are well planned – key integration planning over the first 90 days post Completion1Multiple work streams to plan and then manage changes, and deliver to integration objectives:Identify, leverage and embed best practiceDecide where teams fit, and the shape of the organisationIdentify and validate synergy opportunitiesDecide system changes and timelinesImplement system and process cutoversTransition people related changes, including benefitsIdentify, leverage and embed best practiceMinimise Go To Market disruption 1 Accelerate if pre-close integration planning possible, once regulatory approvals have been given 35

A Phased Approach to Delivery and Setting Market Expectations 36 Phase I: Assessment Deliver plans for FY17Detailed review of combined businessesInvigorate Product Management Actions Phase II: Integration Actions Standardise systemsRationalise PropertiesRationalise Legal entitiesNew Go to Market (GTM) modelMaintain/improve cash conversionRationalise underperforming elements New market initiatives Phase III: Stabilisation Stabilise top lineImprove GTM productivityGrowth from new areasImproved profitabilityStandardise systems Actions Phase IV: Growth Top line growthClick and repeat! Actions FY17 FY18 FY19 FY20

Credit Highlights 37 Well positioned in both mature and growth sectors of the software market Leader in managing mature infrastructure software assetsSignificant presence in growth segments Highly cash generative with the potential for further operational efficiencies Strong track record for cash generationTarget EBITDA margin differential provides ample opportunity (Micro Focus c .44%1 vs HPE Software c.21%), e.g. Attachmate80% of HPE Software products are mature and there remains opportunity to increase margin to Micro Focus portfolio margins by the third full year following completion of the merger Diversity by product, customer base and geography Micro Focus customer base >20K and HPE Software >50K and including virtually all Fortune 500 companies and representing all major industriesBalanced geographic split across North America and the rest of the world Predictable performance from portfolio effects and sticky customer base Breadth of portfolio helps to mitigate fluctuations in performance at product level, providing highly predictable overall resultsSignificant recurring revenues for Micro Focus and HPE Software Management team with a strong M&A track record Track record of acquiring businesses and improving margins Track record of deleveraging e.g. de-levered 0.7x (post Serena transaction) since TAG merger completion in November 2014Voluntary prepayment by Micro Focus of $150m of Term Loan B 2 1 2 2 2 3 2 4 2 5 Source: Micro Focus 2016A preliminary results presentation1 Pro Forma for impact of Serena acquisition

Appendix

Selected Financial Information on HPE Software JPM – pls add financial schedules For the fiscal years ended 31 October LTM Q2 2016 2015 2014 US$m US$m US$m Net Revenues as reported under SEC US GAAP Carveout rules HPE Software Segment $3,412 $3,622 $3,933 Less: MOBU Transfer (56) (163) (232) Disposals in the period1 (184) (271) (310) HPE Software revenue adjusted for divestitures and MOBU $3,172 $3,188 $3,391 Revenue growth rate adjusted for divestitures, MOBU and currency 1.5% (1.9)% N/A Earnings before taxes as reported in SEC US GAAP Carveout rules 344 319 413 Add back interest – – – Add back depreciation and amortisation of capitalised software 81 104 111 Add back amortisation of intangibles 186 224 248 HPE Software EBITDA 611 647 772 Add back separation costs 89 91 – Add back restructuring charges 74 35 48 Add back stock based compensation 61 59 60 Add back acquisition related charges 2 5 10 HPE Software Underlying Adjusted EBITDA2 837 837 890 Less: MOBU Transfer (13) (33) (48) Disposals in the period* (166) (147) (154) HPE Software underlying adjusted EBITDA further adjusted for divestitures and MOBU3 $658 $657 $688 Note: LTM Q2 2016 refers to the trailing twelve months for the period 1 May 2015 through 30 April 20161 Disposals of Tipping Point, iManage, Live Vault, HPPA Teleform. Amounts shown for these divestitures are management's best estimate of the amount of revenue and EBITDA generated by these divested businesses during the periods presented, adjusted for management's estimate of overhead and other costs that did not exit HPE Software on divestment of these businesses2 Micro Focus reports a metric referred to as “Facility EBITDA,” which is defined earlier in this document. HPE Software’s underlying adjusted EBITDA and Facility EBITDA as calculated result in the same figure 3 Included in the LTM Q2 2016 HPE Software illustrative EBITDA is approximately US$80m in overhead costs that will not transfer as part of the transaction 39

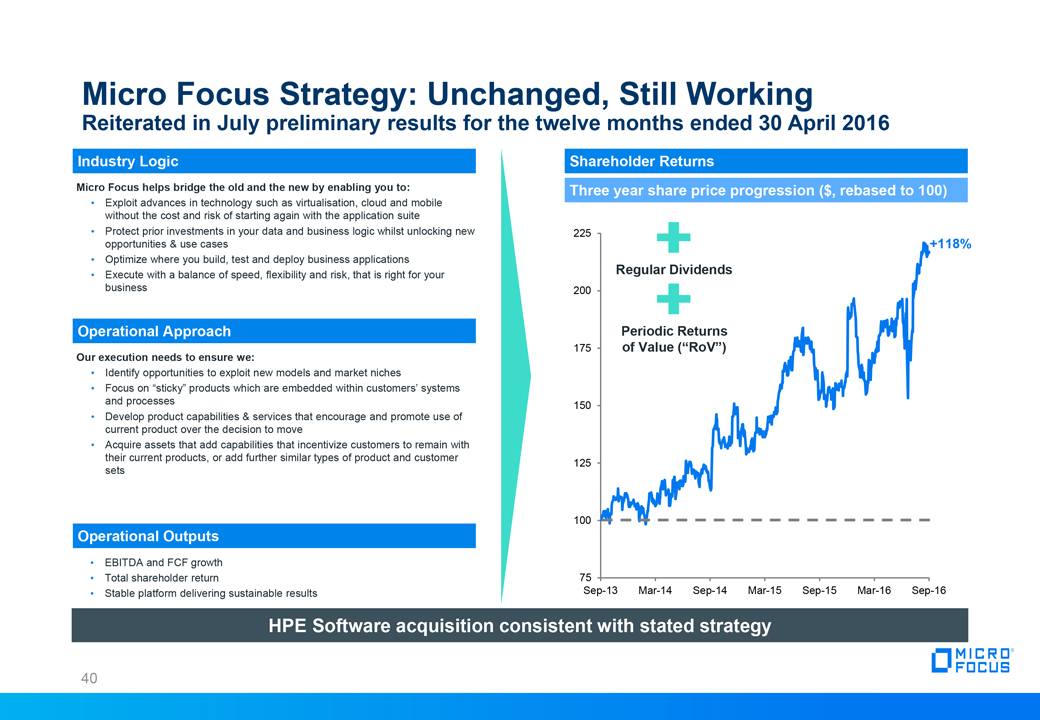

Micro Focus Strategy: Unchanged, Still WorkingReiterated in July preliminary results for the twelve months ended 30 April 2016 Micro Focus helps bridge the old and the new by enabling you to: Exploit advances in technology such as virtualisation, cloud and mobile without the cost and risk of starting again with the application suiteProtect prior investments in your data and business logic whilst unlocking new opportunities & use casesOptimize where you build, test and deploy business applicationsExecute with a balance of speed, flexibility and risk, that is right for your business Our execution needs to ensure we: Identify opportunities to exploit new models and market nichesFocus on “sticky” products which are embedded within customers’ systems and processesDevelop product capabilities & services that encourage and promote use of current product over the decision to moveAcquire assets that add capabilities that incentivize customers to remain with their current products, or add further similar types of product and customer sets EBITDA and FCF growthTotal shareholder returnStable platform delivering sustainable results Industry Logic Operational Approach Operational Outputs +118% Regular Dividends 40 Shareholder Returns Three year share price progression ($, rebased to 100) Periodic Returns of Value (“RoV”) HPE Software acquisition consistent with stated strategy

Micro Focus COBOL Development and Mainframe solutions (CDMS) 41 COBOL development (CD) products primarily target the off-mainframe distributed development market The CD products enable programmers to develop and deploy applications written in COBOL across multiple platforms including Windows, UNIX and Linux and the cloudCOBOL applications continue to be at the heart of the world’s business transactions and to power the majority of large organizations’ key business operationsVisual COBOL is the key growth driver to enable migration of existing COBOL applications to the cloud and mobileMainframe Solutions (MS) allow customers the choice of where they develop, test and deploy their business applications, either within the mainframe environment or outside of it on distributed Windows, UNIX and Linux machinesEnables customers to re-use existing business logic and data, while also looking to exploit new innovations in technology such as mobile and cloud through enabling the re-deployment of enterprise mainframe applications to distributed systems, virtualized mobile platforms, and the cloud Description Market opportunities Development OpportunitiesTransforming the way that mainframe customers maintain and develop their business applicationsMobileHelping customers to adapt to the way their customers want to consume their applications and servicesEmerging marketsRemoving the platform constraints associated with fit for purpose enterprise applicationsCost containmentEnabling customers to align the cost of application service delivery with the business value Source: Company presentations Historical revenues by half-year, CCY basis

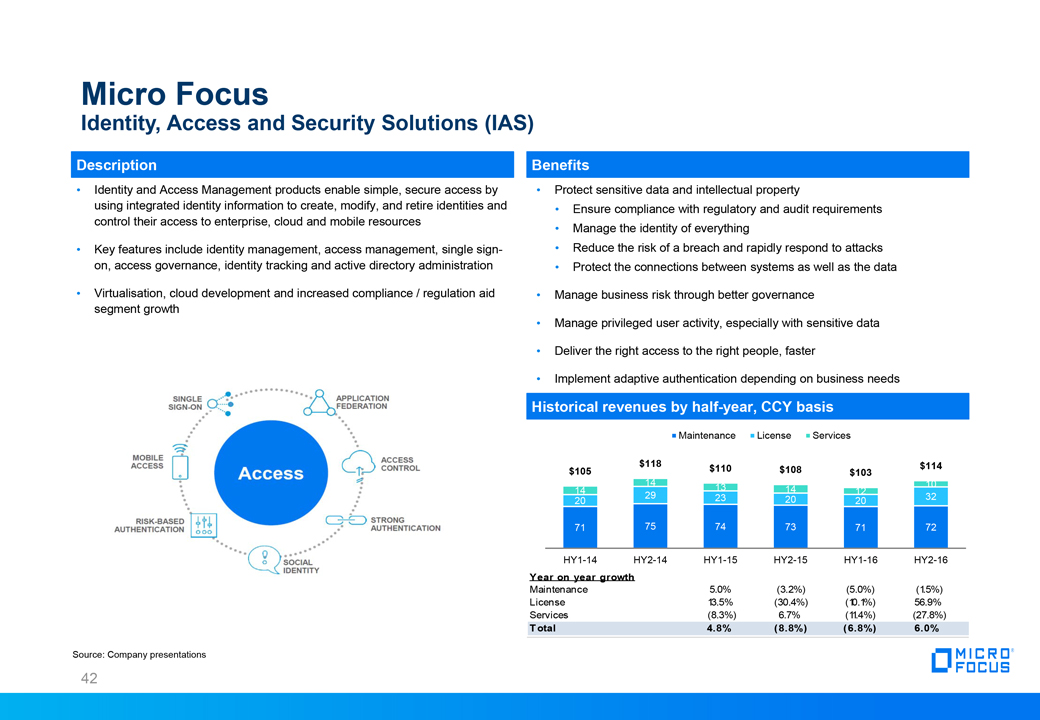

Micro Focus Identity, Access and Security Solutions (IAS) 42 Description Benefits Protect sensitive data and intellectual propertyEnsure compliance with regulatory and audit requirementsManage the identity of everythingReduce the risk of a breach and rapidly respond to attacksProtect the connections between systems as well as the dataManage business risk through better governanceManage privileged user activity, especially with sensitive dataDeliver the right access to the right people, fasterImplement adaptive authentication depending on business needs Identity and Access Management products enable simple, secure access by using integrated identity information to create, modify, and retire identities and control their access to enterprise, cloud and mobile resourcesKey features include identity management, access management, single sign-on, access governance, identity tracking and active directory administrationVirtualisation, cloud development and increased compliance / regulation aid segment growth Source: Company presentations Historical revenues by half-year, CCY basis

Micro Focus Host Connectivity Solutions 43 The Host Connectivity product set is the combination of the Attachmate products from TAG and the Micro Focus Rumba productsEnable IT organizations using centralized applications to provide business-critical information to the end-user of the system while modernizing the functionality and access to the information which can be held across a broad array of new and legacy systemsCore products deliver graphical user interfaces (GUI) for legacy applicationsThe customer value proposition centers on user productivity; and the ability to extend modern and secure user access to legacy systems on the mobile device technologies that continue to emerge Description Market opportunities Security and Regulatory ComplianceContinue to invest in security technologies that enable enterprises to protect host data and adhere to regulatory mandatesNavigate Evolution of Desktop PlatformSupport continuous evolution of desktop with certification for Windows 10, Citrix, VMware, DaaS, cloud, containersMobilityEnable users to leverage modern devices to productively interact with host applications from anywhereCentrally Manage and Secure Host AssetsCentrally administer desktop host access and configurations to gain central control of terminal emulation clients Source: Company presentations Historical revenues by half-year, CCY basis

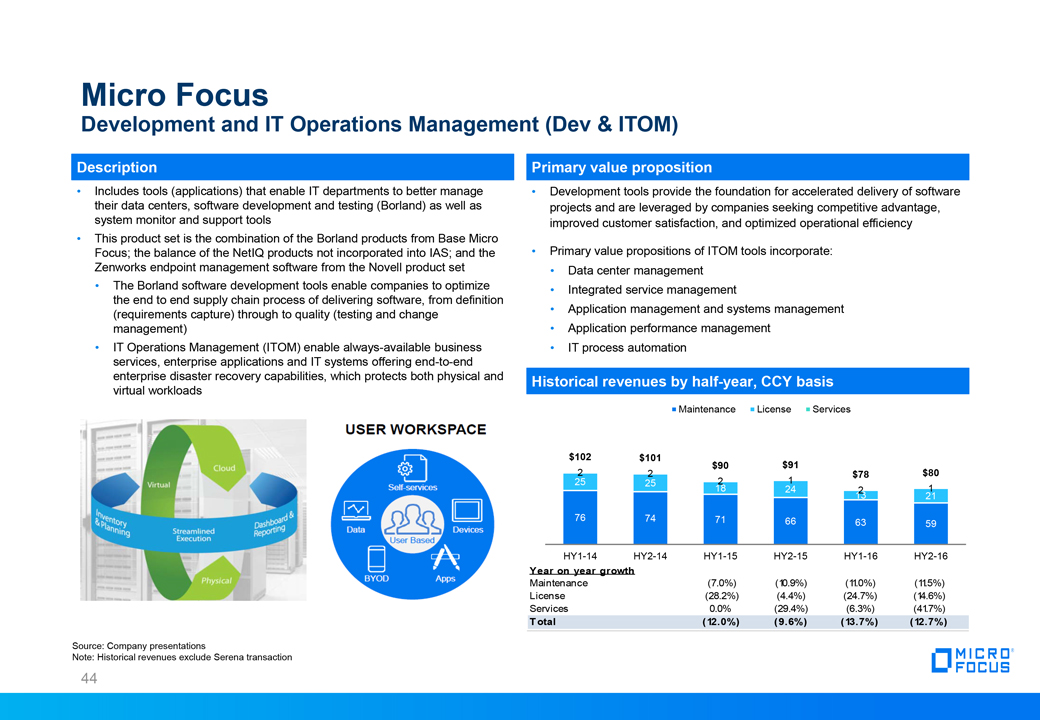

Micro Focus Development and IT Operations Management (Dev & ITOM) 44 Includes tools (applications) that enable IT departments to better manage their data centers, software development and testing (Borland) as well as system monitor and support toolsThis product set is the combination of the Borland products from Base Micro Focus; the balance of the NetIQ products not incorporated into IAS; and the Zenworks endpoint management software from the Novell product setThe Borland software development tools enable companies to optimize the end to end supply chain process of delivering software, from definition (requirements capture) through to quality (testing and change management)IT Operations Management (ITOM) enable always-available business services, enterprise applications and IT systems offering end-to-end enterprise disaster recovery capabilities, which protects both physical and virtual workloads Description Development tools provide the foundation for accelerated delivery of software projects and are leveraged by companies seeking competitive advantage, improved customer satisfaction, and optimized operational efficiencyPrimary value propositions of ITOM tools incorporate:Data center managementIntegrated service managementApplication management and systems managementApplication performance managementIT process automation Primary value proposition Source: Company presentationsNote: Historical revenues exclude Serena transaction Historical revenues by half-year, CCY basis

Micro Focus Collaboration and Networking Solutions 45 Collaboration products enable organizations to be more productive in work environments that are more secure and easier to manage, regardless of how or where people workFully distributed networking services such as centralized server management; secure file storage; and storage management, provide full enterprise distributed networking environment suitable for small workgroups, right through to global enterprise deploymentsThis portfolio has the balance of the Novell product portfolio together with the CORBA portfolio from Base Micro Focus Description File and PrintProvide enterprise-class file services across Windows, OES, and storage platforms to make storing, accessing and printing enterprise files easy, secure and affordableCollaborationProvide unified instant and persistent exchange of messages, including relevant files and communication history to enhance team collaboration Vision Historical revenues by half-year, CCY basis Source: Company presentations

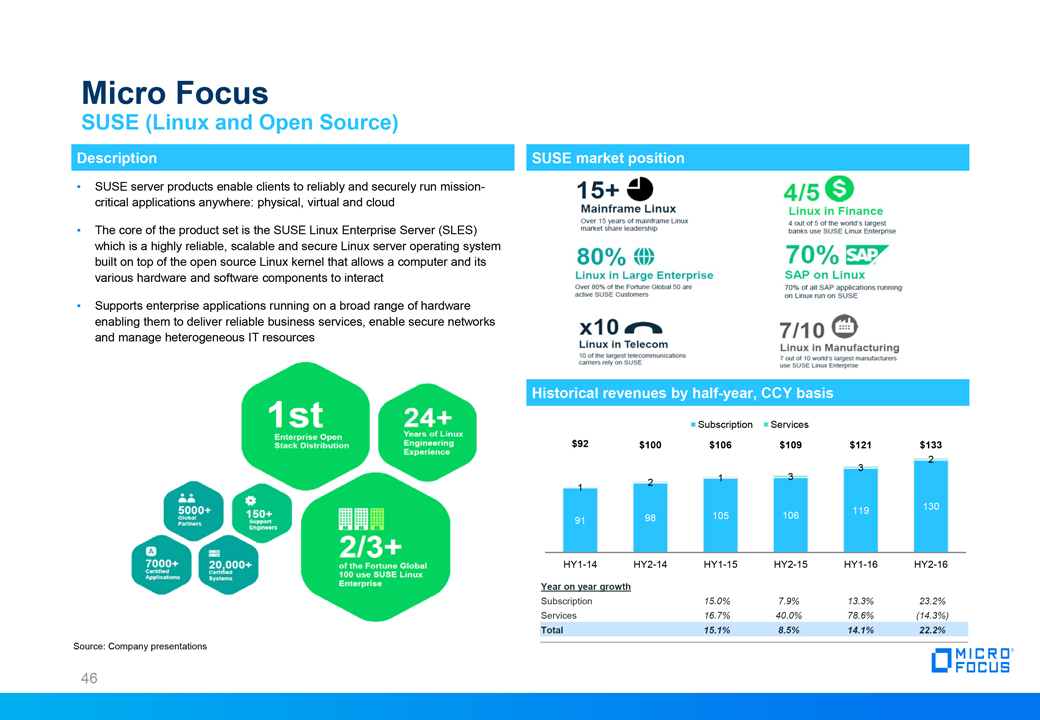

Micro Focus SUSE (Linux and Open Source) 46 SUSE server products enable clients to reliably and securely run mission-critical applications anywhere: physical, virtual and cloudThe core of the product set is the SUSE Linux Enterprise Server (SLES) which is a highly reliable, scalable and secure Linux server operating system built on top of the open source Linux kernel that allows a computer and its various hardware and software components to interactSupports enterprise applications running on a broad range of hardware enabling them to deliver reliable business services, enable secure networks and manage heterogeneous IT resources Description SUSE market position Historical revenues by half-year, CCY basis Source: Company presentations Year on year growth Subscription 15.0% 7.9% 13.3% 23.2% Services 16.7% 40.0% 78.6% (14.3%) Total 15.1% 8.5% 14.1% 22.2%

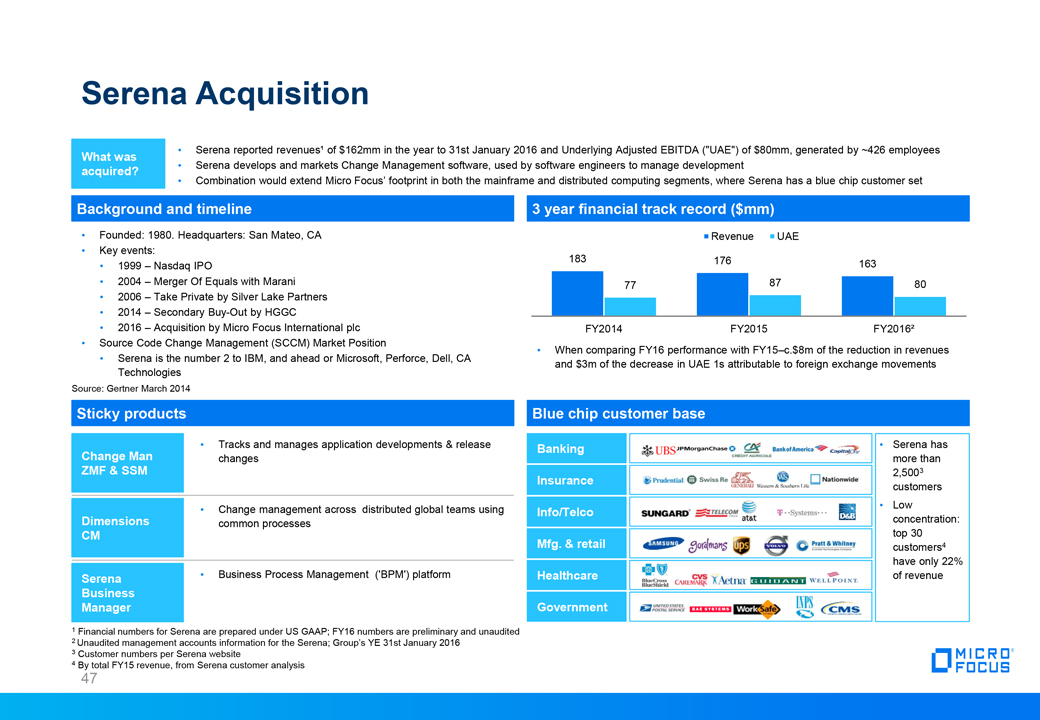

Serena Acquisition 47 What was acquired? Serena reported revenues¹ of $162mm in the year to 31st January 2016 and Underlying Adjusted EBITDA ("UAE") of $80mm, generated by ~426 employeesSerena develops and markets Change Management software, used by software engineers to manage developmentCombination would extend Micro Focus’ footprint in both the mainframe and distributed computing segments, where Serena has a blue chip customer set Founded: 1980. Headquarters: San Mateo, CAKey events:1999 – Nasdaq IPO2004 – Merger Of Equals with Marani2006 – Take Private by Silver Lake Partners2014 – Secondary Buy-Out by HGGC2016 – Acquisition by Micro Focus International plcSource Code Change Management (SCCM) Market PositionSerena is the number 2 to IBM, and ahead or Microsoft, Perforce, Dell, CA Technologies Background and timeline 3 year financial track record ($mm) When comparing FY16 performance with FY15–c.$8m of the reduction in revenues and $3m of the decrease in UAE 1s attributable to foreign exchange movements Source: Gertner March 2014 Tracks and manages application developments & release changes Change Man ZMF & SSM Change management across distributed global teams using common processes Dimensions CM Business Process Management ('BPM') platform Serena Business Manager Sticky products Blue chip customer base Banking Insurance Info/Telco Mfg. & retail Healthcare Government Serena has more than 2,5003 customersLow concentration: top 30 customers4 have only 22% of revenue 1 Financial numbers for Serena are prepared under US GAAP; FY16 numbers are preliminary and unaudited2 Unaudited management accounts information for the Serena; Group’s YE 31st January 20163 Customer numbers per Serena website4 By total FY15 revenue, from Serena customer analysis

Serena Product SummaryPortfolio of mature infrastructure software products 48 LTM Dec 15Revenue Makret Products Mainframe ALM/SCCM¹ Distributed ALM/SCCM Distributed BPM Mainframe Other and SaaS SerenaTotal 57 53 37 15 162 Governance of software development lifecycle Governance of software development lifecycle Business process optimization N/A Change Man ZMF Dimensions CM, Release Management, PVCS Serena Business Manager Comparex, Startool 4% (10)% (11)% (7)% (6)% Revenue ($mm) Growth² Primary Market Description Key Competitors Market Rank Top 2 Top 10 N/A IBM,CA, Compuwar IBM, MicrosoftPerforce IBM, Oracle,Progress SW N/A Key Products 1 ALM = Application Lifecycle Management; SCCM = Source Code Change Management2 Product growth is 2yr CAGR FY14-LTM Dec 15. Market rank and competitor data provided by Gartner 2013

www.microfocus.com

Disclaimer NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION. This presentation does not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, any securities, or any solicitation of any vote or approval. It does not constitute a prospectus or a prospectus "equivalent" document. ADDITIONAL INFORMATION AND WHERE TO FIND ITThis presentation has been prepared and issued by and is the sole responsibility of Micro Focus International PLC (the "Company"). This presentation relates to the Company and its conditional agreement to acquire the software business of Hewlett Packard Enterprise Co. (“HPE") to be held by HPE Software Spinco, Inc. ("HPE Software"), a wholly owned subsidiary of HPE, constituting a reverse takeover for the purposes of the Listing Rules of the UKLA (the "Acquisition" or the "Transaction"). The Transaction will be submitted to the Company’s shareholders for their consideration and approval. In connection with the Transaction, the Company will file relevant materials with the SEC, including a registration statement on Form F-4 or S-4 containing a prospectus relating to the Company’s American Depositary Shares to be issued in connection with the Transaction, and HPE Software will file a registration statement with the SEC. The Company will mail the prospectus contained in the Form F-4 or S-4 to HPE’s stockholders. This presentation is not a substitute for the registration statements or other document(s) that the Company and/or HPE Software may file with the SEC in connection with the Transaction. INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENTS AND OTHER DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PARTIES, AND THE TRANSACTION. Shareholders will be able to obtain copies of these documents (when they are available) and other documents filed with the SEC with respect to the Company free of charge from the SEC’s website at www.sec.gov. These documents (when they are available) can also be obtained free of charge from the Company upon written request to the Company’s investor relations or HPE’s investor relations. For the purposes of this notice, "presentation" means this document, any oral presentation, any question and answer session and any written or oral material discussed or distributed during the presentation meeting or while access to the presentation has been made available to you. This presentation has not been approved by the UK Financial Conduct Authority ("FCA") or any other regulator. This presentation is for information purposes only. The material and information herein is not to be shared with any other parties. Neither this presentation, nor any part of it nor the fact of its availability or distribution is investment or financial product advice and nor is it intended to be used as the basis for making an investment decision. Neither the Company nor J.P. Morgan Limited ("J.P. Morgan Cazenove") nor Numis Securities Limited ("Numis") makes any representation to any recipient regarding an investment in the securities referred to in this presentation. This presentation has been prepared without taking into account the investment objectives, financial situation or particular needs of any particular person. You should seek your own legal, investment and tax advice as you see fit and you should not act upon any information contained in this presentation without first consulting a financial or other professional adviser. This presentation must not be recorded, copied, reproduced, published, distributed, disclosed, stored in a retrieval system, transmitted or passed on, directly or indirectly, in whole or in part, or disclosed by any recipient, to any other person (whether within or outside such person’s organisation or firm) at any time without the written consent of the Company. The availability and distribution of this presentation in certain jurisdictions may be restricted by law. No action has been taken by the Company, J.P. Morgan Cazenove or Numis that would permit access to or possession or distribution of this presentation or any other offering or publicity material relating to the Company in any jurisdiction where action for that purpose is required. Persons into whose possession this presentation comes or who have accessed this presentation are required by the Company, J.P. Morgan Cazenove and Numis to inform themselves about, and to observe, such restrictions. 50

Disclaimer (Cont’d) Neither this presentation nor the information contained herein constitutes or forms part of an offer to sell or the solicitation of an offer to buy securities in the United States. Securities may not be offered or sold in the United States absent registration or an exemption from registration. The securities of the Company have not been and will not be registered under the US Securities Act of 1933, as amended (the "Securities Act"), or under any securities laws of any state or other jurisdiction of the United States and may not be offered, sold or transferred, directly or indirectly, in or into the United States absent registration or pursuant to an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in compliance with the securities laws of any state or other jurisdiction of the United States. There will be no public offer of any securities in the United States or any other jurisdiction.J.P. Morgan Cazenove, which is authorised and regulated in the United Kingdom by the FCA, is acting as financial adviser and sponsor to the Company and no-one else in connection with the Acquisition and will not regard any other person as its client in relation to the Acquisition and is not, and will not be, responsible to anyone other than the Company for providing the protections afforded to its clients or for providing advice in relation to the Acquisition and/or any other matter referred to in this presentation. Apart from the responsibilities and liabilities, if any, which may be imposed on J.P. Morgan Cazenove by FSMA (as defined below), or the regulatory regime established thereunder, J.P. Morgan Cazenove accepts no responsibility or liability whatsoever and makes no representation or warranty, express or implied, in relation to the contents of this presentation, including its accuracy, completeness or for any other statement made or purported to be made by it or on behalf of it, the Company, its directors or any other person in connection with the Company, the Acquisition or any other matter in this presentation and nothing in this presentation shall be relied upon as a promise or representation in this respect, whether as to the past or the future. J.P. Morgan Cazenove accordingly disclaims all and any liability whatsoever, whether arising out of tort, contract or otherwise (save as referred to above), which it might otherwise have in respect of this presentation or any such statement.Numis, which is authorised and regulated in the United Kingdom by the FCA, is acting as corporate broker and financial adviser to the Company and no-one else in connection with the Acquisition and will not regard any other person as its client in relation to the Acquisition and is not, and will not be, responsible to anyone other than the Company for providing the protections afforded to its clients or for providing advice in relation to the Acquisition and/or any other matter referred to in this presentation. Apart from the responsibilities and liabilities, if any, which may be imposed on Numis by FSMA (as defined below), or the regulatory regime established thereunder, Numis accepts no responsibility or liability whatsoever and makes no representation or warranty, express or implied, in relation to the contents of this presentation, including its accuracy, completeness or for any other statement made or purported to be made by it or on behalf of it, the Company, its directors or any other person in connection with the Company, the Acquisition or any other matter in this presentation and nothing in this presentation shall be relied upon as a promise or representation in this respect, whether as to the past or the future. Numis accordingly disclaims all and any liability whatsoever, whether arising out of tort, contract or otherwise (save as referred to above), which it might otherwise have in respect of this presentation or any such statement.Information set forth in this announcement (including information incorporated by reference in this announcement), oral statements made regarding the Transaction, and other information published by Micro Focus or HPE may contain certain statements about the Company, HPE and HPE Software that are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements contained in this presentation may include statements about the expected effects on the Company, HPE and HPE Software of the Transaction, the anticipated timing and benefits of the Transaction, the Company’s and HPE Software’s anticipated standalone or combined financial results and all other statements in this document other than historical facts. Without limitation, any statements preceded or followed by or that include the words “targets”, “plans”, “believes”, “expects”, “intends”, “will”, “likely”, “may”, “anticipates”, “estimates”, “projects”, “should”, “would”, “expect”, “positioned”, “strategy”, “future” or words, phrases or terms of similar substance or the negative thereof, are forward-looking statements. These statements are based on the current expectations of the management of the Company, HPE or HPE Software (as the case may be) and are subject to uncertainty and changes in circumstances and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. As such, forward-looking statements should be construed in light of such factors. Neither Micro Focus nor HPE, nor any of their respective associates or directors, officers or advisers, provides any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements in this announcement will actually occur or that if any of the events occur, that the effect on the operations or financial condition of Micro Focus, HPE or HPE Software will be as expressed or implied in such forward-looking statements. Forward-looking statements contained in this presentation based on past trends or activities should not be taken as a representation that such trends or activities will necessarily continue in the future. In addition, these statements are based on a number of assumptions that are subject to change. Such risks, uncertainties and assumptions include: the satisfaction of the conditions to the Transaction and other risks related to the completion of the Transaction and actions related thereto; the Company’s and HPE’s ability to complete the Transaction on anticipated terms and schedule, including the ability to obtain shareholder or regulatory approvals of the Transaction; risks relating to any unforeseen liabilities of the Company or HPE Software; future capital expenditures, expenses, revenues, earnings, synergies, economic performance, indebtedness, financial condition, losses and future prospects of the Company, HPE Software and the resulting combined company; business and management strategies and the expansion and growth of the operations of the Company, HPE Software and the resulting combined company; the ability to successfully combine the business of the Company and HPE Software and to realise expected operational improvement from the Transaction; the effects of government regulation on the businesses of the Company, HPE Software or the combined company; the risk that disruptions from the Transaction will impact the Company’s or HPE Software’s business; and the Company’s, HPE Software’s or HPE’s plans, objectives, expectations and intentions generally. Additional factors can be found under “Risk Factors” in HPE’s Annual Report on Form 10-K for the fiscal year ended October 31, 2015 and subsequent Quarterly Reports on Form 10-Q. For a discussion of important factors which could cause actual results to differ from forward looking statements relating to Micro Focus, refer to Micro Focus's Annual Report and Accounts 2016. Forward-looking statements included herein are made as of the date hereof, and none of the Company, HPE Software or HPE undertakes any obligation to update publicly such statements to reflect subsequent events or circumstances. 51

Disclaimer (Cont’d) Subject to any requirement under applicable law, Miami undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Investors should not place undue reliance on forward-looking statements, which speak only as of the date of this communication. Except as otherwise explicitly stated, neither the content of the Miami website nor the Houston website, nor any other website accessible via hyperlinks on either such website, is incorporated into, or forms part of, this communication.The information contained within this presentation has not been independently verified by J.P. Morgan Cazenove or Numis. No reliance may be placed, for any purpose whatsoever, on the information or opinions contained in this presentation nor on its completeness, accuracy or fairness and no representation or warranty, express or implied, is given by or on behalf of the Company, J.P. Morgan Cazenove or Numis or any of their respective parent or subsidiary undertakings, or the subsidiary undertakings of any such parent undertakings, or any of their respective directors, officers, employees, agents, affiliates or advisers as to the accuracy, completeness or fairness of the information or opinions contained in this presentation and to the extent permitted by law no responsibility or liability is assumed by any such persons for any such information or opinions or for any errors or omissions. The projections contained herein should not be regarded as a representation or warranty, express or implied, by the Company, J.P. Morgan Cazenove or Numis or any of their respective parent or subsidiary undertakings, or the subsidiary undertakings of any such parent undertakings or any of their respective directors, officers, employees, agents, affiliates or advisers that the projected or estimated results will be achieved. To the maximum extent permitted by law, neither the Company, its directors, officers, shareholders, advisers, affiliates, employees or agents, nor any other person accept any liability, including, without limitation, any liability arising out of fault or negligence for any loss arising from the use of the information contained in this presentation. Statements contained in this presentation regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. This presentation speaks as at the date on which it is made. All information presented or contained in this presentation is subject to verification, correction, completion and change without notice. Neither the delivery of this presentation nor any further discussions by the Company, J.P. Morgan Cazenove or Numis with any of the recipients thereof shall, under any circumstances, create any implication that there has been no change in the affairs of the Company and/or HPE Software since that date and neither the Company nor J.P. Morgan Cazenove nor Numis undertakes any duty or assumes any obligation to update, revise publicly or correct this presentation whether as a result of new information, future events or otherwise, except to the extent required by the FCA, the London Stock Exchange or by the Listing Rules, the Disclosure Guidance and Transparency Rules or by applicable law. No statement in this presentation is, is intended to be, or should be construed as, a profit forecast or profit estimate for any period or to imply that the earnings of the Company for the current or future financial years will necessarily match or exceed the historical or published earnings of the Company.Certain market data information in this presentation is based on management’s estimates. The Company obtained the industry, market and competitive position data used throughout this presentation from internal estimates and research as well as from industry publications and research, surveys and studies conducted by third parties. However, this information may prove to be inaccurate because of the method by which the Company obtained some of the data for their estimates or because this information cannot always be verified due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. Where information contained in this presentation has been sourced from a third party (including HPE Software and/or HPE), the Company confirms that such information has been accurately reproduced and, so far as the Company is aware and has been able to ascertain from that information, no facts have been omitted which would render the reproduced information, or information derived from it, inaccurate or misleading. By attending this presentation or otherwise accessing this presentation you warrant, represent, acknowledge and agree to and with the Company, J.P. Morgan Cazenove and Numis that (i) you are a Relevant Person as defined above, (ii) you have read, agree to and will comply with the contents of this disclaimer including, without limitation, the obligation to keep this presentation and its contents confidential and (iii) you will not at any time have any discussion, correspondence or contact concerning the information in this presentation with any of the directors or employees of the Company or with any of their suppliers in respect of the Company without the prior written consent of the Company. 52