UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

| |

| | (Mark One) |

| | |

| | x ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year ended __December 31, 2017_________ |

| | |

| | OR |

| | |

| | o TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the transition period from ________________________to_______________________ |

| | |

| | |

| | Commission File Number: 001-37483 |

| | |

| | |

| | A. Full title of the plan and address of the plan, if different from that of the issuer named below: |

| | |

| | |

| | HEWLETT PACKARD ENTERPRISE 401(k) PLAN |

| |

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

| | |

| | |

| | |

| | |

| | HEWLETT PACKARD ENTERPRISE COMPANY 3000 HANOVER STREET PALO ALTO, CALIFORNIA 94304 |

Hewlett Packard Enterprise 401(k) Plan

Financial Statements and Supplemental Schedules

December 31, 2017 and 2016 and For the Year Ended December 31, 2017

Contents

|

| |

| Report of Independent Registered Public Accounting Firm | |

| | |

| Audited Financial Statements | |

| Statements of Net Assets Available for Benefits | |

| Statement of Changes in Net Assets Available for Benefits | |

| Notes to Financial Statements | |

| | |

| Supplemental Schedules | |

| Schedule H, Part IV, Line 4a – Schedule of Delinquent Participant Contributions | |

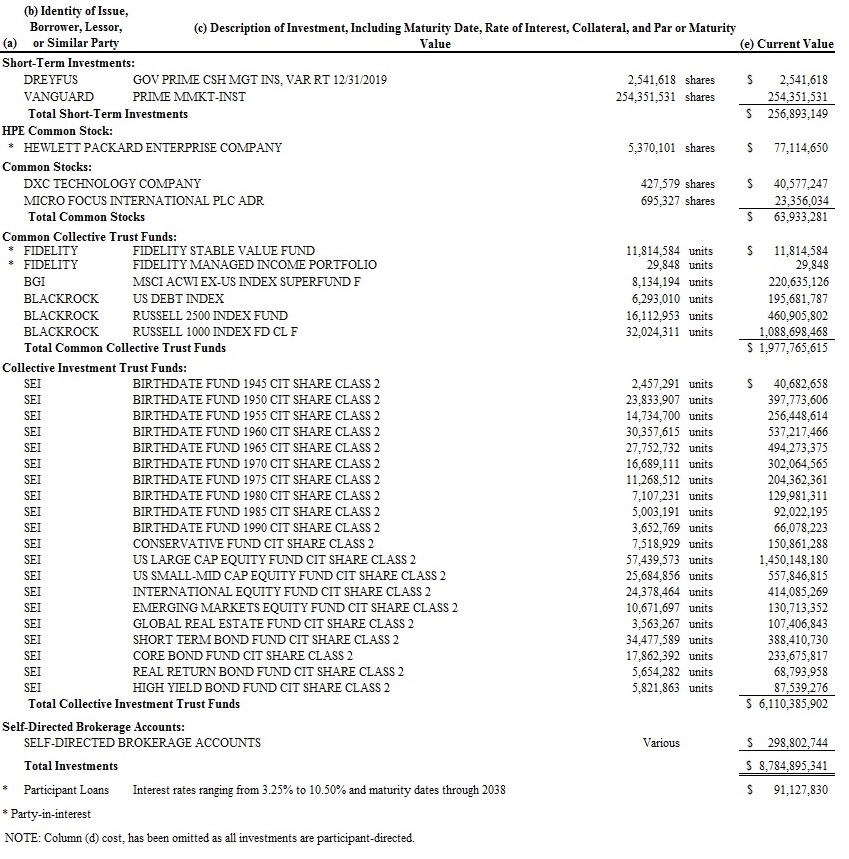

| Schedule H, Part IV, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2017 | |

| | |

| Signature | |

| | |

| Exhibit Index | |

| Exhibit 23.1 - Consent of Independent Registered Public Accounting Firm | |

Report of Independent Registered Public Accounting Firm

To the Plan Participants and the Plan Administrator of

Hewlett Packard Enterprise 401(k) Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Hewlett Packard Enterprise 401(k) Plan (the Plan) as of December 31, 2017 and 2016, and the related statement of changes in net assets available for benefits for the year ended December 31, 2017, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan at December 31, 2017 and 2016, and the changes in its net assets available for benefits for the year ended December 31, 2017, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Schedules

The accompanying supplemental schedules of assets (held at end of year) as of December 31, 2017, and delinquent participant contributions for the year then ended, have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The

information in the supplemental schedules is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedules. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

We have served as the Plan’s auditor since 2016.

San Jose, California

June 12, 2018

Hewlett Packard Enterprise 401(k) Plan

Statements of Net Assets Available for Benefits

|

| | | | | | | | | |

| | | | December 31, |

| | | | 2017 | | 2016 |

| | | | (In thousands) |

| Assets | | | | |

| Investments, at fair value | | $ | 8,784,895 |

| | $ | 8,721,579 |

|

| Receivables: | | | | |

| | Notes receivable from participants | 91,128 |

| | 141,383 |

|

| | Employer contributions | 46,436 |

| | 24,994 |

|

| | Participant contributions | 6,010 |

| | 12,578 |

|

| | Interest, dividends, and other | 764 |

| | 538 |

|

| | Due from broker for securities sold | 264 |

| | — |

|

| Total receivables | | 144,602 |

| | 179,493 |

|

| Total assets | | 8,929,497 |

| | 8,901,072 |

|

| | | | | | |

| Liabilities | | | | |

| Administrative expenses and other payables | 1,516 |

| | 946 |

|

| Total liabilities | | 1,516 |

| | 946 |

|

| | | | | | |

| Net assets available for benefits | | $ | 8,927,981 |

| | $ | 8,900,126 |

|

| | | | | | |

| See accompanying notes. | | | | |

Hewlett Packard Enterprise 401(k) Plan

Statement of Changes in Net Assets Available for Benefits

|

| | | | |

| | | Year Ended |

| | | December 31, 2017 |

| | | (In thousands) |

| Additions | |

| Investment income: | |

| | Net realized and unrealized appreciation in fair value of investments | $ | 1,461,057 |

|

| | Interest and dividends | 16,870 |

|

| Total investment income | 1,477,927 |

|

| | | |

| Contributions: | |

| | Employer | 64,316 |

|

| | Participants | 283,653 |

|

| | Rollovers | 214,412 |

|

| Total contributions | 562,381 |

|

| Interest income on notes receivable from participants | 5,344 |

|

| Total additions | 2,045,652 |

|

| | | |

| Deductions | |

| Benefits paid directly to participants | 2,015,894 |

|

| Administrative expenses and other fees | 3,495 |

|

| Total deductions | 2,019,389 |

|

| Net increase in net assets before plan transfer in | 26,263 |

|

| | | |

| Transfer in | 1,592 |

|

| | | |

| Net increase | 27,855 |

|

| | | |

| Net assets available for benefits: | |

| | Beginning of year | 8,900,126 |

|

| | End of year | $ | 8,927,981 |

|

| | | |

| See accompanying notes. | |

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements

1. Description of the Plan

The following brief description of the Hewlett Packard Enterprise 401(k) Plan (the Plan) provides only general information. Participants should refer to the summary plan description for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan covering eligible employees of Hewlett Packard Enterprise Company (the Company, Employer, Plan Sponsor, or HPE) and designated domestic subsidiaries who are on the U.S. payroll and who are employed as a regular full-time or regular part-time or limited-term employees. The Plan was established on November 1, 2015. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). The Plan’s trustee is Bank of New York Mellon (BNYM) and the recordkeeper is Fidelity Workplace Services LLC (Fidelity).

Discontinued Operations

On April 1, 2017, HPE completed the separation and merger of its Enterprise Services business (including its dedicated employees) with Computer Sciences Corporation (CSC) (collectively, the Everett Transaction). The Everett Transaction was accomplished by a series of transactions among CSC, HPE, Everett SpinCo, Inc. (a wholly-owned subsidiary of HPE) (Everett), and New Everett Merger Sub Inc., a wholly-owned subsidiary of Everett (Merger Sub). HPE transferred the Enterprise Services business to Everett and distributed all of the shares of Everett to HPE stockholders. Following the distribution, the Merger Sub merged with and into CSC, which became a wholly-owned subsidiary of Everett. At the time of the merger, Everett changed its name to DXC Technology (DXC).

On September 1, 2017, HPE completed the separation and merger of its Software business segment (including its dedicated employees) with Micro Focus International Plc (Micro Focus) (collectively, the Seattle Transaction). The Seattle Transaction was accomplished by a series of transactions among Micro Focus, HPE, Seattle SpinCo, Inc. (a wholly-owned subsidiary of HPE) (Seattle), and Seattle Merger Sub, Inc., an indirect wholly-owned subsidiary of Micro Focus (Merger Sub). HPE transferred the Software business segment to Seattle and distributed all of the shares of Seattle to HPE stockholders. Following the share distribution, the Merger Sub merged with and into Seattle, which became an indirect wholly-owned subsidiary of Micro Focus.

As a result of the separations above the Plan holds shares of HPE, DXC and Micro Focus stock (the HPE Stock Fund, DXC Stock Fund, and the Micro Focus Stock Fund). The DXC and Micro Focus Stock Funds are wasting stock funds through March 29, 2018 and on or about August 31, 2018, respectively.

The Company treated each of the Everett Transaction and Seattle Transaction as a partial plan termination for affected participants and fully vested the Company matching contribution account balances for such participants.

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

Investments

Assets of the Plan are invested in a five-tier investment structure. Tier 1 includes ten Birth Date Funds and the Conservative Portfolio. The Birth Date Funds’ investment strategies are designed to become more conservative as participants grow older. The Conservative Portfolio’s investment strategy is designed for a participant who has a low tolerance for risk and/or a shorter time horizon for investing. Tier 2 includes six actively-managed institutional funds from the main asset classes – stocks, bonds, and short-term investments. Tier 3 includes four index funds that seek to mirror a specific market index by investing in similar equities and bonds that the index funds are benchmarked against. Tier 4 includes six funds in the secondary or specialty asset classes, such as real-return income and real estate, including the HPE Stock Fund. As of the closing of each of the Everett Transaction and the Seattle Transaction, the DXC Stock Fund and a Micro Focus Stock Fund, respectively, were added to Tier 4 to reflect the DXC and Micro Focus shares distributed to the HPE Stock Fund participants. Participants with investments in the DXC Stock Fund and the Micro Focus Stock Fund (the Stock Funds) can sell their interest in the Stock Funds at any time until the DXC Stock Fund liquidates on March 29, 2018 and the Micro Focus Stock Fund liquidates on or about August 31, 2018, but the participants are not able to purchase any additional shares of the DXC or Micro Focus stock. Tier 5 is a self-directed mutual fund brokerage window that offers more than 8,500 brand-name mutual funds through an affiliate of Fidelity. All investments are participant-directed.

The Plan includes an employee stock ownership plan feature (the ESOP) within the meaning of Section 4975(e)(7) of the Internal Revenue Code of 1986, as amended (the Code). The ESOP is maintained as part of the Plan and is designed to invest primarily in the Company’s common stock. The purpose of the ESOP is to permit eligible participants the option of having dividends on the Company’s common stock re-invested in the Plan or paid directly to them in cash.

If a participant’s account balance currently has more than 20% invested in the HPE Stock Fund, the participant will not be forced to reduce his or her holdings in the HPE Stock Fund; however, the investment election for ongoing contributions and loan repayments will be limited to a maximum of 20% in the HPE Stock Fund. Any percentage above the 20% limit for ongoing contributions and loan repayments will automatically be directed to the appropriate Birth Date Fund based generally on the year the participant was born. In addition, future requested exchanges into the HPE Stock Fund will be blocked if the requested change will cause the participant to exceed the 20% limit or if the participant is already at or above the 20% limit. Finally, if the participant chooses to rebalance his or her portfolio, the respective holdings in the HPE Stock Fund will be limited to a maximum of 20% regardless of the current investments in the HPE Stock Fund.

Contributions

Eligible employees are enrolled automatically in the Plan at a 3% pre-tax contribution rate in the Birth Date Fund based generally on the year the eligible employee was born.

Participants may contribute, up to 50% of their eligible compensation on a per payroll period basis, as defined in the plan document and subject to Code Section 401(a)(17). Contributions are also

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

subject to annual limits specified under the Code. The annual limit was $18,000 for 2017. Participants who are age 50 or older by the end of the plan year can contribute an additional $6,000 above the annual limit. Contributions can be made as whole or fractional percentages of eligible compensation. Employees can choose pre-tax contributions, after-tax Roth 401(k) contributions, or a combination of the two, subject to the aggregate limits. Both types of contributions are eligible for the Company matching contributions. Catch-up contributions are not eligible for the Company matching contributions.

The Plan also accepts rollover contributions of amounts representing distributions from other qualified defined benefit or defined contribution plans, including amounts from a Roth deferred account, as described in Section 402A(e)(1) of the Code, to the extent the rollover is permitted under Section 402(c) of the Code.

During the plan year, the Company provided an annual matching contribution equal to 50% of the first 6% of eligible compensation a participant contributed each pay period during the plan year. The Company matching contribution was funded after the end of the plan year.

In order to qualify for the Company matching contribution, a participant must be employed by HPE, or a member of its affiliated group, on the last day of the plan year, or have terminated employment during the year as a result of such participant’s death, under certain phased retirement programs of the Company, or in connection with a sale or divestiture by the Company of the business unit in which the participant was employed.

Effective January 1, 2018, the Company matching contribution is equal to 100% of the first 4% of eligible compensation a participant contributes each payroll period. The Company matching contribution will be funded after the end of the calendar quarter. In order to qualify for the quarterly Company matching contribution, a participant must be employed by HPE or a member of its affiliated group on the last day of the quarter or have terminated employment during the calendar quarter as a result of such participant’s death, or in connection with a sale or other disposition by the Company of the business unit in which the participant was employed.

In addition, effective January 1, 2018, a participant is entitled to receive the Company matching contribution “true-up” in an amount equal to the difference between 100% of the first 4% of eligible compensation a participant contributed during a plan year and the sum of Company matching contribution contributed on behalf of such participant during the calendar year, if the participant is an eligible employee with HPE at the end of the calendar year (with a few limited exceptions) or terminates employment due to the approved termination events.

Vesting

Participants are fully-vested at all times with regard to their pre-tax and Roth deferral contributions and earnings thereon.

In general, participants become fully-vested in their Company matching contributions, and earnings thereon, upon completion of three years of vesting service. In addition, a participant becomes 100%

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

vested in their Company matching contributions, and earnings thereon, at attainment of age 65, death before termination of employment, or termination of employment due to a partial or total disability while receiving long-term disability benefits under the Hewlett Packard Enterprise Disability Plan.

Participants are also fully vested in their Company matching contributions, and earnings thereon, if they terminate employment in connection with a sale or divestiture by the Company of the business unit in which the participant had been employed, pursuant to the terms of certain service schedules under the approved termination events, or as set forth in the plan document.

Participant Accounts

Each participant’s account is credited with the participant’s contributions, applicable Company matching contributions, and plan earnings, and is charged with an allocation of administrative expenses. Plan earnings are allocated to each participant’s account based on the ratio of the participant’s account balance and share of net earnings of their respective elected investment options. Allocations are determined in accordance with the provisions of the plan document. The benefit to which a participant is entitled is the benefit that can be provided from the vested portion of the participant’s account.

Notes Receivable from Participants

The Plan offers two types of loans, which are general-purpose loans and primary residence loans. The repayment period for a general-purpose loan may not exceed five years, and the repayment period for a primary residence loan may not exceed 15 years.

Participants may borrow from their accounts a minimum of $1,000 up to a maximum equal to the lesser of $50,000 or 50% of their vested account balances. Loans are secured by the participant’s vested account. Interest rates remain fixed for the life of the loan and are based on a rate that is commensurate with interest charged for loans that would be made under similar circumstances. For the applicable period, that was determined to be the prevailing prime rate plus 1%. Principal and interest are paid ratably through payroll deductions. Participant loans are classified as notes receivable from participants on the Statements of Net Assets Available for Benefits and are valued at their unpaid principal balance, plus accrued but unpaid interest. Interest income on notes receivable from participants is recorded when earned. Related fees are recorded as administrative expenses and are recorded when they are incurred. No allowance for credit losses has been recorded as of December 31, 2017 and 2016. Participants can continue to repay their loans post-termination, as long as they have not taken a distribution from their accounts.

Forfeitures

If a participant terminates employment before becoming fully vested in their Company matching contributions, the non-vested Company matching contributions (and earnings thereon) are forfeited at the earlier of the date the participant receives a distribution or incurs a five-year break-in-service. Forfeited balances are restored if the participant returns to an eligible status within five years of

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

termination and repays any amount previously distributed. Forfeited balances of terminated participants’ non-vested accounts are used to reduce future Company matching contributions, restore previously forfeited balances, pay eligible Plan expenses, or for any other permitted use.

Approximately $6.3 million of the unallocated forfeitures were used to reduce Company matching contributions for 2017. As of December 31, 2017 and 2016, the balance of unallocated forfeiture totaled $3.9 million and $1.2 million, respectively.

Payment of Benefits

On termination, death, or retirement, participants may elect to receive a lump-sum amount equal to the vested value of their accounts. Lump-sum payments may be made in cash or whole shares of stock for distribution from the HPE Stock Fund, DXC Stock Fund, and Micro Focus Stock Fund. Installment distributions are also permitted for participants eligible to begin receiving their minimum required distributions. Hardship withdrawals and in-service withdrawals are permitted if certain criteria are met. Participants may also, at any time, withdraw all or part of their rollover accounts.

Administrative Expenses and Investment Management Fees

Certain expenses of the Plan for administrative services are paid directly by the Plan, except to the extent the Company chooses to pay such expenses. Each participant is charged a fixed amount of $34 per year for recordkeeping services. Certain investment management fees related to investment options are paid directly to the Plan’s investment managers.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right to discontinue its contributions and to terminate the Plan, in each case, at any time for any reason subject to the provisions of ERISA. In the event that the Plan is terminated, participants would become 100% vested in their accounts.

2. Summary of Significant Accounting Policies

Basis of Accounting

The accompanying financial statements have been prepared in accordance with U.S. generally accepted accounting principles (GAAP).

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates that affect the amounts reported in the financial statements and accompanying notes and supplemental schedules. Actual results could differ from those estimates.

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

Investment Valuation and Income Recognition

The Plan’s investments are stated at fair value. See Note 3 for discussion on fair value measurements.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded as earned. Dividends are recorded on the ex-dividend date. Net appreciation (depreciation) in the fair value of investments includes the Plan’s gains and losses on investments bought and sold, as well as held during the year.

Benefit Payments

Benefit payments are recorded when paid.

3. Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the measurement date.

Fair Value Hierarchy

Valuation techniques used by the Plan are based upon observable and unobservable inputs. Observable or market inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Plan’s consideration of market assumptions based on the best information available. Assets and liabilities are classified in the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement:

Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 – Quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, and inputs other than quoted prices that are observable for the assets and liabilities and market-corroborated inputs.

Level 3 – Unobservable inputs for the asset or liability.

The fair value hierarchy gives the highest priority to observable inputs and lowest priority to unobservable inputs.

Valuation Techniques

The following is a description of the valuation techniques used to measure fair value. There were no changes in the techniques used to measure fair value for the year ended December 31, 2017 .

Collective investment/common collective trusts: Valued at the net asset value (NAV) established by the fund’s sponsor on the last business day of the plan year, based on the fair value of the assets underlying the funds. There are no redemption restrictions or future commitments on these investments.

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

Common stocks and mutual funds held in self-directed brokerage accounts: Valued at the closing price reported on the active market on which the individual securities are traded.

Short-term investments: Valued at cost plus accrued interest, which approximates fair value.

The methods described above may produce a fair value estimate that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the plan administrator believes its valuation techniques are appropriate and consistent with other market participants, the use of different techniques or assumptions to estimate fair value could result in a different fair value measurement at the reporting date.

The following table sets forth the Plan’s assets and liabilities at fair value as of December 31, 2017, by level, within the fair value hierarchy:

|

| | | | | | | | | |

| |

|

| December 31, 2017 (In thousands) Level 1 | Level 2 |

| Assets | | | |

| Common collective trusts at NAV | $ | 1,977,765 |

| | |

| Collective investment trusts at NAV | 6,110,386 |

| | |

| Self-directed brokerage accounts | 298,803 |

| $ | 298,803 |

| $ | — |

|

| Short-term investments | 256,893 |

| — |

| 256,893 |

|

| HPE common stock | 77,115 |

| 77,115 |

| — |

|

| Other common stocks | 63,933 |

| 63,933 |

| — |

|

| Total investments, at fair value | $ | 8,784,895 |

| $ | 439,851 |

| $ | 256,893 |

|

The following table sets forth the Plan’s assets and liabilities at fair value as of December 31, 2016, by level, within the fair value hierarchy:

|

| | | | | | | | | |

| |

| December 31, 2016 (In thousands) Level 1 | Level 2 |

| Assets | | | |

| Common collective trusts at NAV | $ | 2,002,923 |

| | |

| Collective investment trusts at NAV | 5,912,686 |

| | |

| Self-directed brokerage accounts | 319,123 |

| $ | 319,123 |

| $ | — |

|

| Short-term investments | 335,649 |

| — |

| 335,649 |

|

| HPE common stock | 151,198 |

| 151,198 |

| — |

|

| Total investments, at fair value | $ | 8,721,579 |

| $ | 470,321 |

| $ | 335,649 |

|

Transfers between Levels

The availability of observable market data is monitored to assess the appropriate classification of assets and liabilities within the fair value hierarchy. Changes in economic conditions, changes in

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

observability of significant inputs, or changes in model-based valuation techniques may require the transfer of an asset or liability between levels of the fair value hierarchy. In such instances, the transfer is reported at the beginning of the reporting period. For the year ended December 31, 2017, there were no transfers between levels.

4. Income Tax Status

The Plan has received a determination letter from the Internal Revenue Service (IRS) dated April 26, 2018, stating that the Plan is tax-qualified under Section 401(a) of the Code, and the related trust is tax exempt under section 501(a) of the Code. Subsequent to this determination by the IRS, the Plan was amended. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualified status. The plan sponsor has indicated that it will take the necessary steps, if any, to bring the Plan's operations into compliance with the Code and to maintain the tax qualified status of the Plan.

Plan management evaluates uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2017, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

5. Related Party and Party-in-Interest Transactions

The Plan engages in certain transactions involving the Company and BNYM (the trustee), and affiliates of Fidelity, which are parties-in-interest under the provisions of ERISA. These transactions involve the purchase and sale of the Company’s common stock and the payment of trustee fees to BNYM, and investments in money market and mutual funds and a self-directed brokerage feature managed by affiliates of Fidelity.

At December 31, 2017 and 2016, the Plan held approximately 5.4 and 6.5 million shares, respectively, of common stock of the Company, with fair values of approximately $77.1 million and $151.2 million, respectively. The Plan made purchases of $4.8 million and sales of $23.7 million of the Company’s common stock, and recorded dividend income of $1.6 million from the Company’s common stock during 2017.

While the trustee and recordkeeping fees paid to BNYM and affiliates of Fidelity are considered parties-in-interest transactions of the Plan, these transactions are covered by an exemption from the prohibited transaction provisions of ERISA and the IRC. As of December 31, 2017 and 2016, the Plan held investments issued by affiliates of Fidelity totaling $194.9 million and $181.4 million, respectively.

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

6. Risk and Uncertainties

Investment securities are exposed to various risks, such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities held by the Plan, it is at least reasonably possible that changes in fair value may occur and that such changes could materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

7. Reconciliation of Financial Statements to the Form 5500

A reconciliation of net assets available for benefits per the financial statements to the net assets available for benefits per the Form 5500, was as follows:

|

| | | | | | | |

| | December 31, |

| | 2017 | | 2016 |

| | (In thousands) |

| Net assets available for benefits per the financial statements | $ | 8,927,981 |

| | $ | 8,900,126 |

|

| Benefits payable to participants at year-end | (4,566 | ) | | (1,813 | ) |

| Net assets available for benefits per Form 5500 | $ | 8,923,415 |

| | $ | 8,898,313 |

|

A reconciliation of benefits paid to participants per the financial statements to benefits paid to participants per the Form 5500, was as follows:

|

| | | |

| | Year Ended December 31, 2017 |

| | (In thousands) |

| Benefits paid directly to participants per financial statements | $ | 2,015,894 |

|

| Benefits payable to participants at December 31, 2017 | 4,566 |

|

| Benefits payable to participants at December 31, 2016 | (1,813 | ) |

| Deemed distributions of participant loans | (274 | ) |

| Total benefits paid to participants per the form 5500 | $ | 2,018,373 |

|

Amounts allocated to withdrawing participants are recorded on the Form 5500 for benefit payments that have been processed and approved for payment prior to year-end, but not paid as of that date. Deemed distributions of delinquent participant loans are included in “Benefits paid directly to participants” in the financial statements but reported separately on the Form 5500.

8. Subsequent Events

HPE has evaluated subsequent events through June 12, 2018, the date the financial statements were available to be issued.

Effective March 1, 2018, the Plan changed its trustee from BNYM to Fidelity Management Trust Company. To effect the transition, Plan participants were restricted from initiating any transactions

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

after close of business on February 27, 2018. All restrictions were lifted after the close of business on March 1, 2018.

As of March 1, 2018, the Plan also changed the investment options available under the Plan. The Plan’s five investment tiers remained, and Plan participants were given the opportunity to update their investment elections prior to the change in investment options. If the participants invested in any of the funds that changed, their account balances and future contribution elections were automatically mapped to the new investment options after the stock market closed on February 27, 2018.

Hewlett Packard Enterprise 401(k) Plan

EIN: 47-3298624; PN: 001

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions

Year Ended December 31, 2017

|

| | | | | | | | | | |

| Participant Contributions | | | | | | |

| Transferred Late to Plan | | Total That Constitute Nonexempt Prohibited Transactions | | |

| Check Here if | | | | | | Total Fully |

| Late Participant | | | Contributions | Contributions | | Corrected Under |

| Loan Repayments | | Contributions | Corrected | Pending | | VFCP and PTE |

| are Included: X | | Not Corrected | Outside VFCP | Correction in VFCP | | 2002-51 |

| | | | | | | |

| $ | 27,079 |

| | $ — | $ — | $ | 27,079 |

| | $ — |

Hewlett Packard Enterprise 401(k) Plan

EIN: 47-3298624 PN: 001

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

December 31, 2017

SIGNATURE

The Plan. Pursuant to the requirements of the Securities and Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plans) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | HEWLETT PACKARD ENTERPRISE 401(k) PLAN |

| | | |

| | | |

| | | |

| June 12, 2018 | By: | /s/ Rishi Varma |

| | | Rishi Varma |

| | | Senior Vice President, General Counsel and Assistant Secretary |

EXHIBIT INDEX

|

| |

| Exhibit Number | Description |

| | |

| |