Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO THE FINANCIAL STATEMENTS

Table of Contents

As filed with the Securities and Exchange Commission on June 23, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Oressa Limited

(Exact name of Registrant as specified in its charter)

| | | | |

Bermuda

(State or other jurisdiction of

incorporation or organization) | | 3411

(Primary Standard Industrial

Classification Code Number) | | Not Applicable

(I.R.S. Employer

Identification No.) |

10 Portman Square

London W1H 6AZ

United Kingdom

(Address, including zip code, and telephone number, including

area code, of Registrant's principal executive offices)

Ardagh Metal Packaging USA Inc.

Attention: James Willich

Carnegie Office Park

600 North Bell Avenue

Building 1, Suite 200

Carnegie, PA 15106

(412) 429-5290

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| | |

| With copies to: |

David J. Beveridge

Richard B. Alsop

Shearman & Sterling LLP

599 Lexington Avenue

New York, N.Y. 10022

(212) 848-4000 |

|

Jonathan A. Schaffzin

Geoffrey E. Liebmann

Cahill Gordon & Reindel LLP

80 Pine Street

New York, N.Y. 10005

(212) 701-3000 |

Approximate date of commencement of proposed sale to the public:

as soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

| | | | |

| | | | |

| |

Title Of Each Class Of Securities

To Be Registered

| | Proposed Maximum

Aggregate Offering

Price(1)(2)

| | Amount Of

Registration Fee

|

|---|

| |

Class A Common Shares, par value $0.01 per share | | $100,000,000 | | $11,620 |

|

- (1)

- Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act, as amended.

- (2)

- Includes shares that may be purchased by the underwriters to cover overallotments, if any. See "Underwriting."

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 23, 2015

PRELIMINARY PROSPECTUS

Oressa Limited

Class A Common Shares

$ per Share

This is the initial public offering of our Class A common shares. We are selling Class A common shares. We currently expect the initial public offering price to be between $ and $ per Class A common share.

Our parent company has granted the underwriters an option to purchase up to additional Class A common shares to cover overallotments.

After this offering, we will have two classes of common shares: Class A common shares and Class B common shares. The rights of the Class A and Class B common shares will be identical except for voting and conversion rights. Each Class A common share will be entitled to one vote per share. Each Class B common share will be entitled to ten votes per share. Each Class B common share will be convertible at any time into one Class A common share. Following this offering, our issued and outstanding Class B common shares will represent approximately % of the voting power of our issued and outstanding share capital (assuming no exercise of the underwriters' overallotment option). Following this offering, Ardagh Group S.A. will, indirectly through its subsidiaries, own all of our issued and outstanding Class B common shares.

We intend to apply to have the Class A common shares listed on the New York Stock Exchange ("NYSE") under the symbol "ORES."

Investing in our Class A common shares involves risks. See "Risk Factors" beginning on page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | |

| | | | |

| |

| | Per share

| | Total

|

|---|

| |

Public Offering Price | | $ | | $ |

| |

Underwriting Discount | | $ | | $ |

| |

Proceeds to the Company (before expenses) | | $ | | $ |

|

Consent under the Exchange Control Act 1972 (and its related regulations) will be applied for from the Bermuda Monetary Authority for the issue and transfer of the Class A common shares to and between residents and non-residents of Bermuda for exchange control purposes provided our Class A common shares remain listed on an appointed stock exchange, which includes the NYSE. In granting such consent, the Bermuda Monetary Authority does not accept any responsibility for our financial soundness or the correctness of any of the statements made or opinions expressed in this prospectus.

The underwriters expect to deliver the Class A common shares to purchasers on or about , 2015 through the book-entry facilities of The Depository Trust Company and its direct and indirect participants.

Citigroup

, 2015

Table of Contents

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We do not take any responsibility for, and can provide no assurances as to, the reliability of any information that others may provide you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

TABLE OF CONTENTS

| | |

Prospectus Summary | | 1 |

Risk Factors | | 12 |

Forward-Looking Statements | | 33 |

Exchange Rate Information | | 35 |

Use of Proceeds | | 36 |

Capitalization | | 37 |

Dilution | | 38 |

Dividend Policy | | 40 |

Selected Financial Data | | 41 |

Unaudited Pro Forma Combined Financial Information | | 42 |

Management's Discussion and Analysis of Financial Condition and Results of Operations | | 46 |

Business | | 64 |

Management | | 77 |

Principal Shareholders | | 82 |

Certain Relationships and Related Party Transactions | | 83 |

Description of Share Capital | | 86 |

Comparison of Bermuda Corporate Law and Delaware Corporate Law | | 96 |

Debt Financing | | 104 |

Shares Eligible For Future Sale | | 105 |

Taxation | | 107 |

Underwriting | | 111 |

Expenses of This Offering | | 118 |

Enforceability of Civil Liabilities | | 119 |

Legal Matters | | 120 |

Experts | | 120 |

Where You Can Find More Information | | 121 |

Index to the Financial Statements | | F-1 |

i

Table of Contents

Certain Conventions

Oressa Limited (the "Company") was incorporated on June 16, 2015 to acquire the existing metal packaging business of Ardagh Group S.A. (the "Ardagh Metal Packaging Business"). The Company has not, to date, conducted any activities other than those incident to its formation and the preparation of the registration statement of which this prospectus forms a part. Accordingly, financial statements of the Company are not included in this prospectus. Ardagh Group S.A. and its subsidiaries hold all of the historical assets and liabilities related to the business that the Company will acquire. Except where the context otherwise requires or where otherwise indicated, (1) all references to "Ardagh" refer to Ardagh Group S.A. and its direct and indirect wholly owned subsidiaries, unless the context suggests that the term only means Ardagh Group S.A., and (2) all references to "Oressa," the "Company," "we," "us," and "our" refer to Oressa Limited. Unless otherwise indicated, the information described in this prospectus assumes the completion of the corporate separation transactions that we expect to consummate with Ardagh as described in this prospectus under "Certain Relationships and Related Party Transactions," which are referred to as the "Separation," concurrently with the consummation of this offering.

Presentation of Financial Information

Except as otherwise noted, the financial statements included in this prospectus have been prepared in accordance with IFRS as issued by the IASB in effect as of December 31, 2014, including interpretations of the International Financial Reporting Interpretations Committee. The preparation of financial statements in conformity with IFRS as issued by the IASB requires the use of certain critical accounting estimates. It also requires management to exercise its judgment in the process of applying the Company's accounting policies. The areas involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to the combined financial statements, are disclosed in the financial statements.

The combined financial statements included herein have been prepared based on a calendar year and are presented in euro rounded to the nearest million. Therefore, discrepancies in the tables between totals and the sums of the amounts listed may occur due to such rounding. The combined financial statements have been prepared under the historical cost convention.

Industry and Market Data

Except where otherwise indicated, market share information and other statistical information and quantitative statements in this prospectus regarding our market position relative to our competitors are not based on published statistical data or information obtained from independent third parties. Rather, such information and statements reflect management estimates based upon our internal records and surveys, statistics published by providers of industry data, information published by our competitors, and information published by trade and business organizations and associations and other sources within the industries in which we operate. While we believe our internal data and surveys to be reliable, such data and surveys have not been verified by any independent sources. In addition, we have not independently verified any data produced by third parties or industry or general publications.

ii

Table of Contents

PROSPECTUS SUMMARY

The following is a summary of the information discussed in this prospectus. The summary is not complete and does not contain all of the information you should consider before investing in our Class A common shares. You should read this entire prospectus carefully, including the risks discussed under "Risk Factors" and our financial statements and the related notes included elsewhere in this prospectus, before making an investment decision to purchase our Class A common shares. Some of the statements in the summary may constitute forward-looking statements. See "Forward-Looking Statements."

This prospectus describes the business to be acquired by the Company in the Separation as if the transferred business were the Company's businesses for all historical periods described. Except as otherwise noted, references in this prospectus to the historical assets, liabilities, products, or activities of the Company are intended to refer to the historical assets, liabilities, products or activities of the Ardagh Metal Packaging Business as it was conducted by Ardagh prior to the Separation.

Our Company

We are a leading supplier of innovative, value-added metal can packaging for the consumer products industry. We supply a broad range of products, including two-piece aluminum and tinplate and three-piece tinplate cans, and a wide range of can ends, including easy open ("EZO") and peelable ends. Many of our products feature high-quality printed graphics, customized sizes and shapes or other innovative designs. These innovative products provide functionality and differentiation and enhance our customers' brands on the shelf.

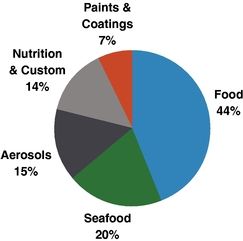

We supply metal can packaging to a wide range of consumer-driven end-use categories including food (processed food such as fruit, vegetables, soups, sauces, ready meals and pet food), seafood, aerosols (personal care and household products), nutrition & custom (including dairy and infant nutrition powders, as well as other customized packaging), and paints & coatings. We have dedicated manufacturing facilities and sales teams organized around serving these end-use categories. We enjoy leading positions in nearly all categories in which we compete. Over 80% of our revenue is derived from categories where we believe we hold #1, #2 or #3 positions.

With approximately 1,300 customers across more than 70 countries, we sell our products to a diverse range of multi-national companies, large national and regional companies, and small local businesses. Our customers include a wide variety of Consumer Packaged Goods companies ("CPGs"), including some of the best known brands in the world. Over half of our 2014 revenue was from multi-year contracts, with the balance largely subject to annual arrangements. We have a highly stable customer base, characterized by long-standing relationships, including an average relationship of over 30 years with our ten largest customers.

We operate 54 production facilities in 20 countries and employ approximately 7,300 personnel. Generally, our plants are strategically located to serve our customers, with some facilities located on-site at our customers' filling locations. Our facilities require significant up-front investment, have long useful lives and have relatively modest on-going maintenance capital expenditure requirements. We operate our facilities with a focus on continuous improvement, applying Lean Manufacturing techniques ("Lean Manufacturing" or "Lean") which focus on eliminating waste while delivering quality products at minimum cost and with the greatest efficiency. To supplement our Lean efforts, we formed our Operational Support Group ("OSG") to standardize and share best practices across our network of plants.

Consistent with our commitment to market leading innovations, we maintain a dedicated research and development ("R&D") center in Crosmières, France, which has developed numerous award-winning innovations and solutions for our customers. This center focuses on three main areas of R&D: (i) innovations that provide improved product design, differentiation and usability; (ii) innovations that

1

Table of Contents

reduce metal content to generate cost savings (down-gauging); and (iii) developments to meet evolving food safety standards and regulations.

We believe the combination of our manufacturing footprint, cost efficient operating model and focus on innovation enables us to grow our business and improve our competitive position while expanding our margins and generating significant cash flow. Our operational footprint has been enhanced through both acquisitions and strategic "greenfield" (new construction) investments. We have made recent strategic growth investments in new facilities in the United States, supported by a long-term contract with a major U.S. customer. These facilities provide scalable capacity to supply our innovative products to new and existing U.S. customers. In addition, we believe we are the first manufacturer in the United States and Canada of two-piece Draw & Wall Ironing ("DWI") cans with both external and internal BPA NIA ("Bisphenol A Not Intentionally Added") lacquers, which are specifically designed to address perceived health considerations in response to customer and end-consumer demands. For more information on DWI cans, see "Business—Our Operations—Food."

In 2012, we commenced a footprint optimization program following the acquisition of Impress Group, FiPar and Boxal from 2010 to 2012, with the objective of lowering our cost base and enhancing our operating efficiency. In 2013, we initiated a multi-level footprint optimization and business repositioning, where we focused on optimizing our operational footprint, personnel structure and approach to customer engagement. These processes resulted in plant closures, plant consolidations, relocation of production lines to lower cost regions and investments in new capacity in these regions. As a result, we moved more of our production capacity for can components to lower cost and centralized locations in Eastern Europe, which enables us to ship materials to our broader European network on a more cost effective basis. As part of our footprint optimization and business repositioning, we reorganized our sales force to better align with our customer categories, which, together with our ongoing improvement initiatives, has resulted in a more efficient operating model. By the end of 2014, we had further streamlined our footprint through the sale of non-core operations in Australia, New Zealand, American Samoa and Greece.

Our revenue and our operating profit/(loss) for the period before depreciation, amortization, non-exceptional impairment and exceptional items ("Adjusted EBITDA") for the year ended December 31, 2014 were €1,850 million and €246 million, respectively. Our operating profit and our loss for the same period were €70 million and €79 million, respectively. The total capital expenditure associated with our recent investments in the United States ("U.S. Expansion Capex") is $200 million through December 31, 2014, of which $139 million (€105 million) was invested in 2014. Excluding U.S. Expansion Capex, our capital expenditure for the year ended December 31, 2014 was €45 million.

2

Table of Contents

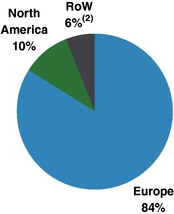

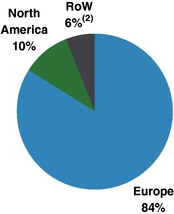

The following charts illustrate the breakdown of our revenue by end-use categories and destination for the year ended December 31, 2014.

| | |

| Revenue by Category(1) | | Revenue by Destination |

| |

| |

|

- (1)

- Based on Company estimates.

- (2)

- Rest of world.

Our Industry

The global packaging industry is a large, consumer-driven industry with stable growth characteristics. Within the $800 billion global packaging industry, the metal can packaging market represents a $70 billion market that is comprised of beverage cans (58% of the market), food (including seafood) cans (28%), and specialty cans (14%), according to Smithers Pira*, a leading independent market research firm with extensive specialized experience in the packaging, paper and print industries. Within the metal can packaging market, we primarily compete in the food and specialty can sectors, which account for approximately $30 billion of the overall metal can packaging market according to Smithers Pira.* The $20 billion food can sector is a relatively stable market which includes cans for a variety of food, pet food and seafood applications. The food can sector is expected to remain stable on a unit volume basis in our target regions of Europe and North America according to Smithers Pira.* The $10 billion specialty can sector is characterized by a number of different products and applications including specialty, aerosol, and other cans. The specialty can sector is expected to grow in our target region of Europe by 1.8% per annum on a volume basis through 2019 according to Smithers Pira.*

Globally, the metal can packaging industry has benefited from increasing consumer awareness of sustainability, driven by environmental concerns. Metal, including steel and aluminum, differs from other packaging materials, such as paper and plastic, in that it can be recycled repeatedly without any degradation in its performance. We estimate that over 70% of the metal packaging in Europe is recycled. In addition to its recyclability, metal can packaging has additional benefits related to energy usage and emissions. These include the fact that the strength and rigidity of metal cans allows them to be filled at higher speeds. The shelf stable nature of the metal food can also means that refrigeration is not required, thereby resulting in further energy savings in the supply chain, from food producer to end consumer.

* Source: Smithers Pira—The Future of Metal Cans to 2019(Nov. 2014).

3

Table of Contents

In metal can packaging, customers value functionality, differentiation, sustainability and cost efficiency. The industry is characterized by a significant invested capital base, extensive technology and manufacturing know-how and established customer relationships. Generally, metal can packaging in Europe is characterized by lightweight, three-piece and two-piece cans with easy open or peelable ends that are decorated with printed graphics and other innovative designs. By contrast, metal can packaging in the United States typically features heavier cans with more modest levels of decoration. We believe the U.S. market represents a significant opportunity for the introduction of our products and innovations, including lighter weight cans incorporating our advanced coating solutions, which deliver superior performance and efficiency to our customers, as well as enhancing the end-consumer experience.

Our Competitive Strengths

We believe a number of strengths differentiate us from our competitors, including:

- •

- Leading positions in value-added metal can packaging. We believe we are one of the leading suppliers of metal can packaging in the world with the capability to supply multi-national CPGs in many parts of the world. We believe we are the #2 supplier of metal cans by value in the European food category, the #1 supplier of metal cans by value in the European seafood, nutrition, paints & coatings, and aerosols categories and the #1 supplier of metal cans by value in the North American seafood category. We believe our scale and reach, focus on innovation, proximity to customers and high level of service underpin our leading positions in these categories.

- •

- A leader in innovating and commercializing metal can packaging solutions. We have significant expertise in developing products together with our customers and commercializing innovative, value-added metal can packaging solutions, such as easy open ends, Easy Peel® and Easip®, as well as process technologies such as DWI and down-gauging to reduce raw material content. We believe our continued investment in R&D delivers a number of competitive advantages for our business. Our ability to deliver innovative product features, enhanced usability and product differentiation positions us to remain the partner of choice of our customers for new business development projects. Our focus on down-gauging enables us to reduce our manufacturing cost, thereby improving our margins while improving overall economics for our customers. For example, we believe we are a leading manufacturer of the lightest easy open ends in the industry. Our research and laboratory capabilities, utilizing techniques such as electrochemical impedance spectroscopy ("EIS"), ensure that we can effectively manage food safety issues, such as the transition to BPA NIA lacquers, on behalf of our customers, which we believe further strengthens our relationships. Additionally, we use finite elemental analysis ("FEA") to predict in advance the performance of innovations, thereby reducing the cost and time needed to bring these innovations to market. As a result of our focus on innovation, we currently hold and maintain over 50 different patent families, each filed in several countries. These patents cover both design and process information for a range of different products in each jurisdiction. Our new U.S. facilities incorporate many of these innovative technologies.

- •

- Strong customer relationships. We supply some of the world's best known brands with innovative packaging solutions, and we have been recognized with numerous industry awards including 10 World Star Awards and 27 Cans of the Year Awards since 2005. We offer a diverse range of value-added services to our customers, including can handling, R&D, and engineering services, which support new product development, introduction, production and logistics. We have long-standing relationships with many of our major customers, which include leading multi-national consumer products companies, large national and regional food companies, as well as numerous local companies. More than half of our revenue is under multi-year contracts of between two and ten years. Some of our major customers, with most of whom we have

4

Table of Contents

long-term relationships, include AkzoNobel, Big Heart Pet Brands, Bumble Bee Seafoods, ConAgra Foods, Danone, Heineken, H.J. Heinz, L'Oréal, Mars, Mead Johnson, Nestlé, Procter & Gamble, Reckitt Benckiser and Unilever. The average length of relationship with our top 10 customers is more than 30 years. We believe the total value proposition we offer, in the form of product quality, reliability, innovation, customer service and geographic reach, positions us to grow our business alongside our customers.

- •

- Significant scale and well-invested asset base. We operate 54 strategically-located production facilities in 20 countries. Since 2012, we have focused on optimizing our footprint through targeted plant closures, plant consolidations and relocation of production lines for can components to lower cost regions in Eastern Europe. Through the end of 2014, we had invested $200 million in two new can-making facilities in Roanoke, Virginia and Reno, Nevada as well as a significant expansion of our Conklin, New York can ends plant. The new facilities currently manufacture two-piece cans utilizing high output DWI technology as well as three-piece cans and have significant additional capacity to supply new and existing customers. These facilities supply substantially all of the U.S. food can requirements of a major U.S. customer pursuant to a long-term contract, and we expect these investments will provide us with attractive returns.

- •

- Focus on operational excellence. We operate a large asset base dedicated to efficient manufacturing and cost-effective production. We employ Lean Manufacturing to continually drive further improvements in productivity, cost, quality, spoilage and safety. We also focus on reducing our costs of procurement and selling, as well as general and administrative functions. We seek to improve the quality of our products and processes through focused investment in new technology. We have established our OSG, which is comprised of technical experts, to support our plants and to drive standardization and sharing of best practices. We also conduct regular reviews of our manufacturing operations, where we measure performance and track progress on initiatives relating to safety, quality, productivity, capital expenditure, working capital and other areas leading to improved financial results. These system wide evaluations have driven strategic decisions regarding our asset base.

- •

- Attractive margin and strong cash flow generation. We believe our business has attractive margins and strong cash flow characteristics. We are generally able to pass through changes in our cost of raw materials through price adjustments in long-term contracts or through disciplined price setting in our shorter-term contracts. We promote a culture of accountability and focus on cost reduction from senior management through to the plant floor. Additionally, we believe our disciplined approach to capital expenditure, combined with the limited requirement for on-going maintenance capital expenditure that is characteristic of our industry, contribute to our strong cash flow generation. Adjusted EBITDA for the year ended December 31, 2014 was €246 million and, excluding U.S. Expansion Capex, our capital expenditure for the year ended December 31, 2014 was €45 million.

- •

- Proven track record of successful acquisitions, integration and disciplined capital deployment. We have grown our business through a series of acquisitions over the past 15 years and have successfully integrated these acquired businesses to achieve our current scale and competitive positions. We view sourcing, negotiating, acquiring and integrating businesses as a core competency of our Company. While our business currently enjoys leading positions in many end-use categories, we believe there are opportunities for future growth through acquisition and strategic investments, similar to our two new plants in the United States, where we invested with the expectation that we will achieve attractive returns.

- •

- Experienced and highly focused management team with a proven track record. Our senior management team is highly experienced in the metal can packaging industry. They have a proven ability to innovate for our customers, manage costs, adapt to changing market conditions,

5

Table of Contents

Our Strategy

We intend to leverage our leading positions in value-added metal can packaging to increase our Adjusted EBITDA and cash flow in order to reduce our financial leverage and increase shareholder value. We seek to achieve this objective by pursuing the following strategies:

- •

- Continue to drive Adjusted EBITDA and cash flow generation. We carefully assess the potential for Adjusted EBITDA growth and cash flow generation when we evaluate our operations and consider new investments in our business. We will seek to leverage our leading positions to grow revenue with new and existing customers, improve our efficiency, and reduce our costs. We will continue to take decisive actions with respect to our assets, invest in our business and manage our capital expenditure and working capital to grow our Adjusted EBITDA and increase our cash flow.

- •

- Leverage our product innovations to meet customer needs. Our customers use packaging to differentiate their products on the shelf, strengthen their brands and meet evolving food safety requirements. We will continue to leverage our dedicated R&D center and our track record of innovation to add value for our customers. We employ processes such as EIS and FEA to ensure that safe, reliable and cost-efficient products are offered to our customers. We intend to continue to invest in new product development and innovations to drive the growth of our business, deepen our customer relationships and enhance our overall profitability.

- •

- Continue to focus on optimizing our manufacturing footprint and operational excellence. Our goal is to be the most cost-efficient producer of metal can packaging in our target categories. We continually seek to optimize our manufacturing footprint by locating can assembly lines in close proximity to our customers and by relocating component manufacturing lines, where appropriate, to lower cost regions such as Eastern Europe. Within our plants we promote a culture of continuous improvement and employ Lean Manufacturing to continually drive further improvements in productivity, cost, quality, spoilage and safety. We believe these actions will enhance our total value proposition and reduce costs, while improving our capital efficiency and return on capital.

- •

- Selective investments in our business. We have achieved our current competitive position by pursuing strategic investment opportunities with attractive financial characteristics, rather than pursuing market share gains at the expense of operating margins. We will continue to evaluate investments in our business in line with our strategic objectives. We may selectively explore business opportunities with new and existing customers in our current and new end-use categories and regions. We expect these investments, including our recent investments in the United States and other projects, to contribute to our Adjusted EBITDA growth and deliver attractive return on capital.

- •

- Opportunistically pursue strategic value-enhancing acquisitions. We believe our core competencies include acquisitions, business integration and synergy capture. We have successfully acquired and integrated a number of businesses and we will continue to prudently evaluate potential acquisitions on a disciplined basis, in keeping with our stringent investment criteria.

6

Table of Contents

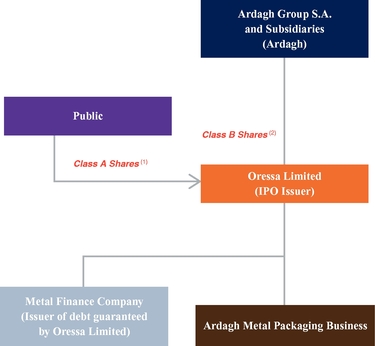

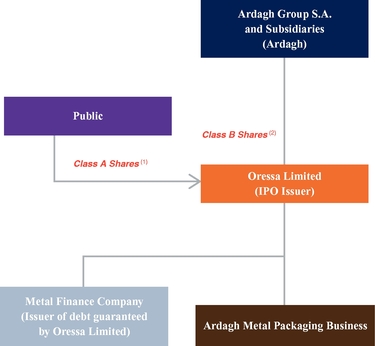

Corporate Separation Transactions

Oressa Limited was incorporated on June 16, 2015, in order to effect the Separation and acquire the Ardagh Metal Packaging Business. Prior to this offering, the Ardagh Metal Packaging Business has been owned by Ardagh and its subsidiaries. The Company has no assets or liabilities, other than those associated with its formation, and will conduct no operations until the completion of this offering.

The Separation consists of the following transactions, all of which will occur contemporaneously:

- •

- The share capital of the Company will be restructured to consist of Class B common shares, each with 10 votes per share, and Class A common shares, each with one vote per share. Class A common shares will be sold in this offering and Class B common shares will be owned indirectly by Ardagh through its subsidiaries, assuming, in each case, no exercise of the underwriters' overallotment option.

- •

- A wholly-owned finance subsidiary of the Company will issue debt securities for estimated net proceeds of $ (the "Debt Financing"). See "Debt Financing."

- •

- In a series of transactions pursuant to an asset sale and separation agreement, the Ardagh Metal Packaging Business will be transferred to subsidiaries of the Company.

- •

- The Company will enter into other ancillary agreements with Ardagh and its affiliates covering matters including transition services, tax matters and shareholders' and registration rights.

The following chart summarizes our ownership and voting structure following the Separation and this offering (assuming no exercise of the underwriters' overallotment option):

- (1)

- Class A Shares: Shares offered hereby. One vote each ( % of voting power), % of issued and outstanding common shares.

- (2)

- Class B Shares: Ten votes each ( % of voting power), % of issued and outstanding common shares. Ardagh will own all of the issued Class B common shares indirectly through its subsidiaries.

7

Table of Contents

Historically, Ardagh and its affiliates have provided and, following the completion of this offering, will continue to provide significant corporate and shared service functions to us. The terms of these services and amounts to be paid by us to Ardagh will be provided for in the transition services agreement. See "Certain Relationships and Related Party Transactions." In addition to the charges for these services, we may incur other corporate and operational costs, which may be greater than historically allocated levels, to replace some of these services or for additional services relating to our being a listed company, including those related to our reporting and compliance obligations as a listed company. See "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Our executive offices are located at 10 Portman Square, London W1H 6AZ, United Kingdom. Our telephone number is . Our website address is . The information included or referred to, on or otherwise accessible through our website, is not included or incorporated by reference in this prospectus.

Risk Factors

There are a number of risks you should consider before buying our shares. These risks are discussed more fully under "Risk Factors" beginning on page 12 of this prospectus. These risks include, but are not limited to:

- •

- Our business may be adversely affected by global and regional economic downturns.

- •

- We face intense competition from other metal can packaging producers, as well as from manufacturers of alternative forms of packaging.

- •

- An increase in metal container manufacturing capacity without a corresponding increase in demand for metal containers could cause prices to decline.

- •

- Because our customers are concentrated, our business could be adversely affected if we were unable to maintain relationships with our largest customers.

- •

- Our profitability could be affected by varied seasonal demands, climate and water conditions, and the availability and cost of raw materials.

- •

- Currency and interest rate fluctuations may have a material impact on our business.

- •

- Our expansion strategy may adversely affect our business if we are not able to integrate acquisitions successfully.

- •

- We are subject to various environmental, health and safety requirements and may be subject to new requirements of this kind in the future that could impose substantial costs upon us.

- •

- Our substantial debt could adversely affect our financial condition.

- •

- The dual class structure of our common shares has the effect of concentrating voting control with Ardagh and limiting our other shareholders' ability to influence corporate matters.

- •

- An active, liquid trading market for our Class A common shares may not develop and Class A common share prices may be volatile and could decline substantially following this offering.

8

Table of Contents

The Offering

| | |

Shares Offered | | Class A common shares (or Class A common shares if the underwriters exercise their overallotment option in full). |

Shares Issued and Outstanding Immediately After This Offering | | Class A common shares (or Class A common shares if the underwriters exercise their overallotment option in full) and Class B common shares (or Class B common shares if the underwriters exercise their overallotment option in full). |

Use of Proceeds | | We estimate that we will receive net proceeds from this offering of approximately $ million, assuming an initial public offering price of $ per share, the midpoint of the estimated range of the initial public offering price, after deducting underwriting discounts and estimated aggregate offering expenses payable by us. |

| | The proceeds of the offering will be used, together with the proceeds of the Debt Financing, to acquire the Ardagh Metal Packaging Business. See "Use of Proceeds" and "Debt Financing." |

| | Our parent company has granted the underwriters an option to purchase up to additional Class A common shares to cover overallotments. We will not receive any proceeds from the sale of any additional Class A common shares pursuant to the overallotment option. |

Dividend Policy | | We do not currently intend to pay any dividends on the Class A or Class B common shares. See "Dividend Policy." |

Listing | | We intend to apply to have the Class A common shares listed on the New York Stock Exchange under the symbol "ORES." |

Unless we indicate otherwise or the context requires, all information in this prospectus assumes:

- •

- an initial public offering price of $ per share, the midpoint of the offering range set forth on the cover page of this prospectus; and

- •

- the underwriters do not exercise their overallotment option.

9

Table of Contents

SUMMARY FINANCIAL INFORMATION

The following table sets forth certain historical financial data of the Company. The summary historical financial data as of and for the fiscal years ended December 31, 2014, 2013 and 2012 have been derived from the audited combined financial statements and related notes included elsewhere in this prospectus. The summary historical financial data set forth below should be read in conjunction with and is qualified in its entirety by reference to the audited combined financial statements and the related notes thereto. Our historical results are not necessarily indicative of results to be expected in any future period.

The following financial information should be read in conjunction with "Selected Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations," our historical combined financial statements and the related notes, and the "Unaudited Combined Pro Forma Financial Information" included elsewhere in this prospectus.

| | | | | | | | | | | | | |

| |

| | 2014 | | 2013 | | 2012 | |

|

|---|

| |

| | (in euro millions, except percentages)

| |

|

|---|

| | Income Statement Data | | | | | | | | | | | |

| | Revenue | | | 1,850 | | | 1,848 | | | 1,909 | | |

| | Cost of sales | | | (1,642 | ) | | (1,707 | ) | | (1,727 | ) | |

| | | | | | | | | | | | | | |

| | Gross profit | | | 208 | | | 141 | | | 182 | | |

| | | | | | | | | | | | | | |

| | Exceptional cost of sales | | | 80 | | | 112 | | | 133 | | |

| | Gross profit before exceptional cost of sales | | | 288 | | | 253 | | | 315 | | |

| | | | | | | | | | | | | | |

| | Sales, general and administration expenses(1) | | | (106 | ) | | (119 | ) | | (125 | ) | |

| | Amortization | | | (23 | ) | | (23 | ) | | (21 | ) | |

| | Exceptional costs | | | (9 | ) | | (11 | ) | | (3 | ) | |

| | | | | | | | | | | | | | |

| | Operating profit/(loss) | | | 70 | | | (12 | ) | | 33 | | |

| | Net finance expense | | |

(107 |

) | |

(111 |

) | |

(135 |

) | |

| | | | | | | | | | | | | | |

| | Loss before tax | | | (37 | ) | | (123 | ) | | (102 | ) | |

| | Income tax credit | | |

4 | | |

29 | | |

10 | | |

| | | | | | | | | | | | | | |

| | Loss for the period from continuing operations | | | (33 | ) | | (94 | ) | | (92 | ) | |

| | Loss for the period from discontinued operations | | |

(46 |

) | |

(8 |

) | |

(11 |

) | |

| | | | | | | | | | | | | | |

| | Loss for the period | | | (79 | ) | | (102 | ) | | (103 | ) | |

| | Balance Sheet Data | | |

| | |

| | |

| |

|

| | Cash and cash equivalents | | | 45 | | | 45 | | | 95 | | |

| | Working capital(2) | | | 220 | | | 314 | | | 288 | | |

| | Net debt(3) | | | 1,486 | | | 1,250 | | | 1,542 | | |

| | Total assets | | | 2,248 | | | 2,316 | | | 2,535 | | |

| | Total liabilities | | | (2,355 | ) | | (2,052 | ) | | (2,489 | ) | |

| | Other Data from Continuing Operations | | |

| | |

| | |

| |

|

| | Adjusted EBITDA(4) | | | 246 | | | 212 | | | 255 | | |

| | Adjusted EBITDA margin(4) | | | 13.3 | % | | 11.5 | % | | 13.4 | % | |

| | Depreciation, amortization and non-exceptional impairment | | | 87 | | | 101 | | | 86 | | |

| | Capital expenditure(5) | | | 150 | | | 110 | | | 69 | | |

10

Table of Contents

The reconciliation of loss for the year to Adjusted EBITDA is as follows:

| | | | | | | | | | |

| | Year ended

December 31, | |

|---|

| | 2014 | | 2013 | | 2012 | |

|---|

| | (in euro millions)

| |

|---|

Loss for the period | | | (79 | ) | | (102 | ) | | (103 | ) |

Loss for the period from discontinued operations | | | 46 | | | 8 | | | 11 | |

Income tax credit | | | (4 | ) | | (29 | ) | | (10 | ) |

Net finance expense | | | 107 | | | 111 | | | 135 | |

Depreciation, amortization and non-exceptional impairment | | | 87 | | | 101 | | | 86 | |

Exceptional items | | | 89 | | | 123 | | | 136 | |

| | | | | | | | | | | |

Adjusted EBITDA | | | 246 | | | 212 | | | 255 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Footnotes:

- (1)

- Sales, general and administration expenses are before amortization and exceptional costs.

- (2)

- Working capital is defined as comprising inventories, trade and other receivables, trade and other payables and current provisions, and excludes derivatives, cash, short term borrowings and income taxes payable.

- (3)

- Net debt is defined as related party debt, bank loans and other borrowings (current and non-current) less cash, cash equivalents and restricted cash. The following table provides a calculation of net debt.

| | | | | | | | | | |

| | At December 31, | |

|---|

| | 2014 | | 2013 | | 2012 | |

|---|

| | (in euro millions)

| |

|---|

Related party debt | | | 1,515 | | | 1,278 | | | 1,541 | |

Bank loans | | | 12 | | | 13 | | | 87 | |

Other borrowings | | | 10 | | | 11 | | | 15 | |

Total borrowings | | | 1,537 | | | 1,302 | | | 1,643 | |

| | | | | | | | | | | |

Cash, cash equivalents and restricted cash | | | (51 | ) | | (52 | ) | | (101 | ) |

Net debt | | | 1,486 | | | 1,250 | | | 1,542 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (4)

- Adjusted EBITDA is defined as operating profit (loss) for the period before depreciation, amortization, non-exceptional impairment and exceptional items. Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by revenue. Adjusted EBITDA and Adjusted EBITDA margin are presented because we believe that they are frequently used by securities analysts, investors and other interested parties in evaluating companies in the metal can packaging industry. However, other companies may calculate EBITDA and Adjusted EBITDA in a manner different from ours. Adjusted EBITDA and Adjusted EBITDA margin are not measures of financial performance under IFRS and should not be considered an alternative to cash flow from operating activities or as a measure of liquidity or an alternative to profit (loss) as indicators of operating performance or any other measures of performance derived in accordance with IFRS. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Supplemental Management's Discussion and Analysis—Key Operating Measures."

- (5)

- Capital expenditure comprises purchases of property, plant and equipment and software and other intangibles, less proceeds from disposal of property, plant and equipment.

11

Table of Contents

RISK FACTORS

An investment in our Class A common shares involves a high degree of risk. In addition to the other information contained in this prospectus, you should carefully consider the following risk factors before purchasing the Class A common shares. If any of the possible events described below occurs, our business, financial condition, results of operations or prospects could be adversely affected. If that happens, the value of the shares may decline and you could lose all or part of your investment. The risks and uncertainties below are those known to us and that we currently believe may materially affect us.

Risks Relating to Our Business

Our business may be adversely affected by global and regional economic downturns.

Our primary direct customers sell to consumers of food, personal care and household products. If economic conditions negatively impact consumer demand, our customers may be affected and so reduce the demand for our products, which would decrease our sales volume. Changes in global economic conditions may reduce our ability to forecast developments in our industry and plan our operations and costs, resulting in operational inefficiencies. Negative developments in our business, results of operations and financial condition due to changes in global economic conditions or other factors could impair our ability to raise equity or debt capital or refinance our maturing borrowings and could increase our cost of capital.

The global financial crisis adversely impacted consumer confidence and led to declines in income and asset values in many areas. This resulted, and may continue to result, in reduced spending on our customers' products, which also reduced our customers' demand for our products.

The global financial crisis and its aftermath also led to more limited availability of credit, which has adversely impacted and may continue to adversely impact the financial condition, particularly on the purchasing ability, of some of our customers and may also result in requests for extended payment terms, and result in credit losses, insolvencies and diminished sales channels available to us. Our suppliers may have difficulties obtaining necessary credit, which could jeopardize their ability to provide timely deliveries of raw materials and other essentials to us. The current credit environment may also lead to suppliers requesting credit support or otherwise reducing credit, which may have a negative effect on our cash flows and working capital.

Furthermore, the global financial crisis and its aftermath have increased the risk that one or more eurozone countries could come under increasing pressure to leave the European Monetary Union, or the euro as the single currency of the eurozone could cease to exist. Any of these developments, or the perception that any of these developments are likely to occur, could have a material adverse effect on the economic development of the affected countries and could lead to severe economic recession or depression, and a general anticipation that such risks will materialize in the future could jeopardize the stability of financial markets or the overall financial and monetary system. This, in turn, would have a material adverse effect on our business, financial position, liquidity and results of operations.

We face intense competition from other metal can packaging producers, as well as from manufacturers of alternative forms of packaging.

The metal can packaging industry in which we operate is competitive and mature, and has experienced limited growth, or in some cases declines, in demand in recent years. We experience price pressure from competitors, which can lead to price reductions or limit our ability to increase prices, for example to recover increases in raw material costs, wages or operating costs. Price-driven competition may increase as producers seek to capture more sales volumes in order to keep their plants operating at optimal levels and to reduce unit costs.

12

Table of Contents

The most competitive part of the metal can packaging industry is the sale of undifferentiated, standardized cans and containers. Prices for these products are primarily driven by raw material costs and seasonal overcapacity, and price competition is sometimes fierce. Competition for customized, differentiated packaging is based on price and, increasingly, on innovation, design, quality and service. Our principal competitors include Crown Holdings in Europe and Ball Corporation, Crown Holdings and Silgan Holdings in North America. To the extent that any one or more of our competitors become more successful with respect to any key competitive factor, our ability to attract and retain customers could be materially and adversely affected, which could have a material adverse effect on our business.

We are subject to substantial competition from producers of packaging made from plastic, carton and composites, particularly from producers of plastic containers and flexible packaging. Changes in consumer preferences in terms of food processing (e.g. fresh or frozen food content and dry versus wet pet food) or in terms of packaging materials, style and product presentation can significantly influence sales. To a more limited extent, changes in customer preference driven by cost or other considerations may also impact our sales. An increase in our costs of production or a decrease in the costs of, or a further increase in consumer demand for, alternative packaging could have a material adverse effect on our business, financial position, liquidity and results of operations.

An increase in metal container manufacturing capacity without a corresponding increase in demand for metal containers could cause prices to decline.

The profitability of metal can packaging companies is heavily influenced by the supply of, and demand for, metal cans. There can be no assurance that the metal container manufacturing capacity in any of our regions or categories will not increase further in the future, nor can there be any assurance that demand for metal containers will meet or exceed supply. If metal container manufacturing capacity increases and there is no corresponding increase in demand, the prices we receive for our products could materially decline, which could have a material adverse effect on our business, financial condition and results of operations.

Because our customers are concentrated, our business could be adversely affected if we were unable to maintain relationships with our largest customers.

For the year ended December 31, 2014, our ten largest customers accounted for approximately 32% of our revenue. As a result of our recent strategic investment in the United States and the related long-term contract, this percentage is expected to increase. We believe our relationships with these customers are good, but there can be no assurance that we will be able to maintain these relationships.

Over half of our 2014 revenue was from multi-year contracts, with the balance largely subject to annual arrangements. Although these arrangements have provided, and we expect they will continue to provide, the basis for long-term partnerships with our customers, they do not contain exclusivity provisions, and there can be no assurance that our customers will continue to purchase our products.

If our customers unexpectedly reduce the number of metal cans they purchase from us, or cease purchasing our metal cans altogether, our revenues could decrease and our inventory levels could increase, both of which could have an adverse effect on our business, financial condition and results of operations. In addition, while we believe that the arrangements that we have with our customers will be renewed, there can be no assurance that such arrangements will be renewed upon their expiration on terms as favorable as the current arrangements or that they will not be terminated prior to the expiration if permitted under the agreement. There is also the risk that our customers may shift their filling operations to locations in which we do not operate. The loss of one or more of these customers, a significant reduction in sales to these customers, a significant change in the commercial terms of our relationship with these customers or a decision by any of these customers to manufacture their own cans or to cease purchasing metal cans entirely could have a material adverse effect on our business.

13

Table of Contents

The continuing consolidation of our customer base may intensify pricing pressures or result in the loss of customers, either of which could have a material adverse effect on our business.

The market sectors in which our customers operate are consolidating. For example, H.J. Heinz and Kraft Foods Group agreed to merge in March 2015 and Thai Union Group agreed to acquire Bumble Bee Seafoods in December 2014. Thai Union Group also bought the canned food business of MW Brands in October 2010. Similarly, many of our largest customers have acquired companies with similar or complementary product lines. This consolidation has increased the concentration of our net sales with our largest customers, which may increase the degree to which our business could be adversely affected if we are unable to maintain those relationships. In many cases, such consolidation may be accompanied by pressure from customers for lower prices. Increased pricing pressures from our customers may have a material adverse effect on our business, financial condition and results of operations. In addition, this consolidation may lead manufacturers to rely on a reduced number of suppliers. If, following the consolidation of one of our customers with another company, a competitor was to be the main supplier to the consolidated companies, this could have a material adverse effect on our business, financial condition or results of operations.

Our business may be adversely affected by cyclicality in the business of our customers.

Some of our customers operate in cyclical markets. For example, our sales in the paints & coatings category are impacted by the building and construction industries and the do-it-yourself home decorating market. Demand in these markets is cyclical, as to a lesser extent is demand for products in the aerosols market. Variations in the demand for metal can packaging products in these categories could have a material adverse effect on our business, financial condition and results of operations.

Our profitability could be affected by varied seasonal demands.

Demand for our products is seasonal. Our sales are typically greater in the second and third quarters of the year, with generally lower sales in the first and fourth quarters. Seasonal consumption cycles in the markets in which certain of our customers operate may result in fluctuations in demand for our products and therefore may have an adverse impact on our business, results of operations and financial condition. A significant part of our revenue is attributable to the seasonal canning of fruit and vegetables and hence is dependent on the fruit and vegetable harvest in certain regions. Our seafood canning activities are also affected by seasonal variations in local fish catches. The variable nature of the food and seafood packaging businesses could have a material adverse effect on our business, financial condition and results of operations.

Our profitability could be affected by climate and water conditions.

The potential impact of climate change on our customers' operations is uncertain, and it could have various effects on the demand for our products in different regions around the world. Weather conditions can adversely affect crop yields or fish catches, and thus adversely affect customer demand for our products. In addition, water is a limited resource in many parts of the world, facing unprecedented challenges from overexploitation, increasing pollution, poor management and climate change. As demand for water continues to increase around the world, water becomes scarcer and the quality of available water deteriorates, our customers may incur increased production costs and/or reduce demand for our products. Our vulnerability to natural conditions could have a material adverse effect on our business, financial condition and results of operations.

Our profitability could be affected by the availability and cost of raw materials.

The raw materials that we use have historically been available in adequate supply from multiple sources. For certain raw materials, however, there may be temporary shortages due to weather,

14

Table of Contents

transportation, production delays or other factors. In such an event, no assurance can be given that we would be able to secure our raw materials from sources other than our current suppliers on terms as favorable as our current terms, or at all. Any such shortages, as well as material increases in the cost of any of the principal raw materials that we use, could have a material adverse effect on our business, financial condition and results of operations.

The primary raw materials that we use are steel (both in tinplate and tin-free forms) and aluminum. Furthermore, the relative price of oil and its by-products may materially impact our business, affecting our transport, lacquer and ink costs.

Steel is generally obtained under one-year contracts, with prices that are usually fixed in advance. When such contracts are renewed in the future, our steel costs under such contracts will be subject to prevailing global steel and/or tinplate prices at the time of renewal, which may be different from historical prices.

Unlike steel, where there is no functioning hedging market, aluminum ingot is traded daily as a commodity (priced in U.S. dollars) on the London Metal Exchange, which has historically been subject to significant price volatility. Because aluminum is priced in U.S. dollars, fluctuations in the U.S. dollar/euro rate also affect the euro cost of aluminum.

We may not be able to pass on all or substantially all raw material price increases, now or in the future. In addition, we may not be able to hedge successfully against raw material cost increases. Furthermore, while in the past sufficient quantities of steel and aluminum have been generally available for purchase, these quantities may not be available in the future, and, even if available, we may not be able to continue to purchase them at current prices. For instance, the significant increase in worldwide demand for steel in 2008 resulted in temporary tinplate shortages, and substantial price increases in the period 2008 to 2011 for supplies of tinplate and tin-free steel as contracts expired, initially in the United States and Asia and later in Europe. Availability has increased and prices have eased since 2011, but this situation could quickly reverse. Also, during the period of declining prices in 2012 and 2013, certain customers deferred purchasing decisions in anticipation of the pass-through of continued declining tinplate prices. Increases in the cost of raw materials could adversely affect our operating margins and cash flows. In addition, decisions by customers to defer purchases of our products in anticipation of declining raw material prices could adversely affect our revenues, financial condition and cash flows.

The supplier industries from which we receive our raw materials are relatively concentrated, and this concentration can impact raw material costs. Over the last ten years, the number of major tinplate and aluminum suppliers has decreased. Further consolidation could occur both among tinplate and aluminum suppliers, and such consolidation could hinder our ability to obtain adequate supplies of these raw materials and could lead to higher prices for tinplate and aluminum. The failure to obtain adequate supplies of raw materials or future price increases could have a material adverse effect on our business, financial condition and results of operations.

Currency and interest rate fluctuations may have a material impact on our business.

We have production facilities in 20 different countries worldwide. We sell products to, and obtain raw materials from, companies located in different regions and countries globally. As a consequence, a significant portion of our consolidated revenue, costs, assets and liabilities are denominated in currencies other than the euro, particularly the British pound and the U.S. dollar. Accordingly, we are subject to translation risk when we consolidate our financial statements. The exchange rates between some of these currencies, such as U.S. dollars, British pounds, Czech koruna and Polish zloty, have fluctuated significantly in the past and may continue to do so in the future, which could adversely affect our results of operations and assets and liabilities as reported in our financial statements.

15

Table of Contents

We are subject to currency transaction risk when we incur raw material costs in one currency and sell our products in another currency. For example, aluminum ingot prices are denominated in U.S. dollars, while a portion of our sales of our end-products are denominated in British pounds or euros. Our policy is, where practical, to hedge such transaction risks associated with exchange rate fluctuations. However, we may not be successful in limiting such exposure, which could adversely affect our business, financial condition and results of operations.

Changes in exchange rates can affect our ability to purchase raw materials and sell products at profitable prices, reduce the value of our assets and revenues, and increase liabilities and costs. The volatility in exchange rates may also increase the costs of our products that we may not be able to pass on to our customers; impair the purchasing power of our customers in different markets; result in a competitive benefit to certain of our competitors who incur a material part of their costs in other currencies than we do; hamper our pricing and margins; and increase our hedging costs and limit our ability to hedge our exchange rate exposure.

We are also exposed to interest rate risk. Fluctuations in interest rates may affect our interest expense on existing debt and the cost of new financing. We may use swaps to manage this risk, but sustained increases in interest rates could nevertheless materially adversely affect our business, financial condition and results of operations.

Our expansion strategy may adversely affect our business.

We aim over the longer term to continue to capitalize on strategic opportunities to expand our activities. We believe that such future expansion is likely to require the further acquisition of existing businesses. Because we believe that such businesses may be acquired with modest equity and relatively high levels of financial leverage, given the cash-generating capabilities of our business, our leverage may increase in the future in connection with any acquisitions. This could have an adverse effect on our business, financial condition and results of operations. In addition, any future expansion is subject to various risks and uncertainties, including the inability to integrate effectively the operations, personnel or products of acquired companies, failing to identify material problems and liabilities in our due diligence review of acquisition targets, failing to obtain sufficient indemnification rights to fully offset possible liabilities associated with acquired businesses, impairing relationships with employees and customers of the acquired business as a result of changes in ownership and management and the potential disruption of existing businesses and diversion of management's attention from our existing businesses. Furthermore, there is no assurance that any future expansions will achieve positive results.

We are subject to various environmental, health and safety requirements and may be subject to new requirements of this kind in the future that could impose substantial costs upon us.

Our operations and properties are subject to comprehensive environmental, health and safety laws and regulations in each of the countries where we operate. Such laws and regulations which may affect our operations include requirements regarding remediation of contaminated soil, groundwater and buildings, water supply and use, natural resources, water discharges, air emissions, waste management, noise pollution, asbestos and other regulated materials, the generation, storage, handling, transportation and disposal of regulated materials, product safety, and workplace health and safety.

The scope of such laws and regulations varies across the different jurisdictions in which we operate. Our operations and properties in the Member States of the European Union must comply with the environmental, health and safety requirements of the relevant Member State, as well as EU and international legal requirements. Similarly, our operations and properties in the United States must comply with federal, state and local requirements. These requirements are complex and changing and have tended to become more stringent over time. Failure to comply with, or other liability under, these

16

Table of Contents

laws and regulations may have a material adverse effect on our business, financial condition and results of operations.

We are also subject to requirements that regulate air emissions and we must obtain environmental permits for certain of our operations such as for solvent emissions. In order to comply with air emission requirements, significant capital investments or operational changes may be necessary at some sites. We have incurred, and expect to continue to incur, costs to comply with such legal requirements, and these costs could increase in the future. Failure to obtain and maintain the relevant permits, as well as non-compliance with such permits or related rules and regulations, could have a material adverse effect on our business, financial condition and results of operations. If we were to violate or fail to comply with these laws and regulations or our permits, we could be subject to criminal, civil and administrative sanctions and liabilities, including substantial fines, penalties, additional capital expenditures and orders, or a partial or total shutdown of our operations.

Facilities at which we operate often have a long history of industrial activities and may be, or have been in the past, engaged in activities involving the use of materials and processes that could give rise to contamination and result in potential liability to investigate or remediate, as well as claims for alleged damage to persons, property or natural resources. Liability may be imposed on us as owners, occupiers or operators of contaminated facilities. These legal requirements may apply to contamination at sites that we currently or formerly owned, occupied or operated, or that were formerly, owned, occupied or operated by companies we acquired or at sites where we have sent waste offsite for treatment or disposal. Regarding facilities of our acquired companies, there is no assurance that our due diligence investigations identified or accurately quantified all material environmental matters related to those facilities. Furthermore, from time to time we may close manufacturing or other industrial sites. The closure of a site may accelerate the need to investigate and remediate any contamination at the site.

Impositions of laws or regulations relating to food safety, recycling or other packaging requirements could adversely affect our business.

Changes in laws and regulations laying down restrictions on, and conditions for use of, food contact materials or on the use of materials and agents in the production of our products could adversely affect our business. Changes to health and food safety regulations could increase costs and also might have a material adverse effect on revenues if, as a result, the public attitude toward end-products, for which we provide packaging, were substantially affected.

For example, in 2007, the European Union passed regulations concerning the Registration, Evaluation, Authorization and Restriction of Chemicals ("REACH"), which place onerous obligations on the manufacturers and importers of substances, preparations and articles containing substances, and which may have a material adverse effect on our business. Furthermore, substances we use may have to be removed from the market (under REACH's authorization and restriction provisions or otherwise) or need to be substituted for alternative chemicals which may also adversely impact upon our operations. Development of substitute materials to comply with any such requirements may not be feasible or cost effective. Environmental concerns could lead United States or EU bodies to implement other regulations that are likely to be restrictive for us and have a material negative impact on our or its business, financial condition and results of operations.

Another example is restrictions on Bisphenol-A ("BPA") in coatings for some of our products, which have been proposed or adopted in the European Union and some of its Member States, as well as the United States, with wider restrictions under consideration. This change has required us to develop substitute materials for our production, which we have done. However, there is no assurance that substitute products will not be challenged in the future on health or safety issues.

17

Table of Contents

Changes in laws and regulations relating to deposits on, and the recycling of, metal cans could adversely affect our business if implemented on a large scale in the regions where we operate. The effectiveness of new standards such as the ones related to recycling or deposits on different packaging materials could result in excess costs or logistical constraints for some of our customers who could choose to reduce their consumption and even terminate the use of metal can packaging for their products. We could thus be forced to reduce, suspend or even stop the production of certain types of products. The regulatory changes could also affect our prices, margins, investments and activities, particularly if these changes resulted in significant or structural changes in the market for food packaging that might affect the market shares for metal cans, the volumes produced or production costs.

Our manufacturing facilities are subject to operating hazards.

Our manufacturing processes involve operating heavy machinery and equipment and entail a number of risks and hazards, including industrial accidents, fire, mechanical failures and environmental hazards, all with potential requirements for environmental remediation and civil, criminal and administrative sanctions and liabilities. These hazards may cause unplanned business interruptions, unscheduled downtime, transportation interruptions, personal injury and loss of life, severe damage to or the destruction of property and equipment, environmental contamination and other environmental damage, civil, criminal and administrative sanctions and liabilities, harm to our reputation, and third-party claims, any of which may have a material adverse effect on our business, financial condition and results of operations.

An interruption in the operations of our manufacturing facilities may adversely affect our business, financial condition and results of operations.

Due to the operating conditions inherent in some of our manufacturing processes, a mechanical or electrical failure or disruption affecting any major operating line may result in a disruption to our ability to supply customers, and standby capacity may not be available. The potential impact of any disruption would depend on the nature and extent of the damage caused to such facility. Further, our operations may be disrupted by the occurrence of natural phenomena, such as earthquakes, tsunamis and hurricanes. There can be no assurance that we will not incur unplanned business interruption or that such interruptions will not have an adverse impact on our business, financial condition and results of operations.

We could incur significant costs in relation to claims of injury and illness resulting from materials present or used at our production sites.

Since the 1990s, items made of asbestos have gradually been removed at our sites in Europe and the United States. Because of the age of some of our sites, however, asbestos-cement may have been used in construction and may still be present at these sites. When these buildings are modernized or repaired, the cost of upgrades is higher because of the restrictions associated with removing asbestos-containing materials.

We are exposed to claims alleging injury or illness associated with asbestos and related compensation over and above the support that may be offered through various existing social security systems in countries where we operate.

We could incur significant costs due to the location of some of our industrial sites in urban areas.

Obtaining, renewing or maintaining permits and authorizations issued by administrative authorities necessary to operate our production plants could be made more difficult due to the increasing urbanization of the sites where some of our manufacturing plants are located. Some of our older sites

18

Table of Contents

are located in urban areas. Urbanization could lead to more stringent operating conditions (by imposing traffic restrictions for example), conditions for obtaining or renewing the necessary authorizations, the refusal to grant or renew these authorizations, or expropriations of these sites in order to allow urban planning projects to proceed.

The occurrence of such events could result in us incurring significant costs. There can be no assurance that the occurrence of such events would entitle us to partial or full compensation.

Organized strikes or work stoppages by unionized employees may have a material adverse effect on our business.