SUBJECT TO COMPLETION, DATED DECEMBER 19, 2019

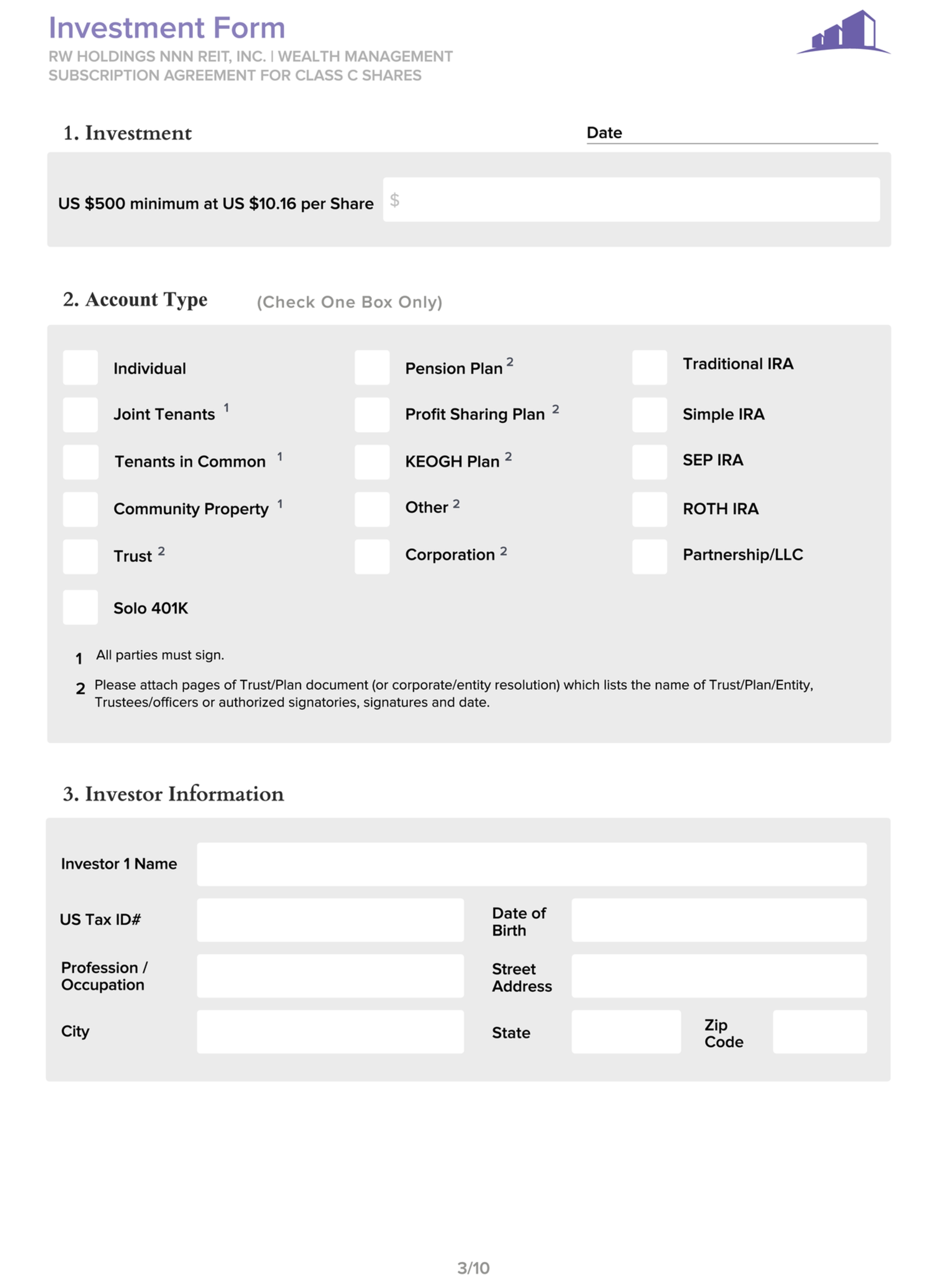

$800,000,000 of Class C Common Stock

RW Holdings NNN REIT, Inc. is an incorporated public, non-listed real estate investment trust (“REIT”) and was formed to primarily invest, directly or indirectly through investments in real estate owning entities, in single-tenant income-producing properties located in the United States, which are leased to creditworthy tenants under long-term net leases. As of December 2, 2019, our real estate investment portfolio consisted of 25 operating properties, a 72.7% tenant-in-common interest in an office property and one parcel of land in 14 states, including 10 office, nine retail, and six industrial properties with approximately 1,754,000 square feet of aggregate leasable space. We are externally managed by Rich Uncles NNN REIT Operator, LLC, our advisor and a wholly owned subsidiary of our sponsor, BrixInvest, LLC (which we also refer to herein as “our sponsor”).

We are offering up to $725,000,000 in shares of our Class C common stock in our primary offering and $75,000,000 in shares of our Class C common stock pursuant to our distribution reinvestment plan at a price currently equal to $10.16 per share. We will offer our shares of Class C common stock in this offering utilizing the website www.RichUncles.com, an online investment platform owned and operated by our sponsor. We reserve the right to reallocate the shares of common stock we are offering between the primary offering and our distribution reinvestment plan. There is no minimum offering amount, and upon acceptance of subscriptions, we will use the proceeds for the purposes described in this prospectus.

We consider our company to be a perpetual-life investment vehicle because we have no finite date for liquidation and no intention to list shares of our Class C common stock for trading on a national securities exchange or other over-the-counter trading market. Although we have registered a fixed amount of shares for this public offering, we intend to effectively conduct a continuous offering of an unlimited amount of shares of our Class C common stock over an unlimited time period by conducting an uninterrupted series of additional public offerings, subject to regulatory approval of our filings for such additional offerings. This perpetual-life structure is aligned with our overall objective of investing in real estate assets with a long-term view towards making regular cash distributions and generating capital appreciation.

As of the date of this prospectus, we, Rich Uncles NNN REIT Operating Partnership, LP (the “Operating Partnership”), Rich Uncles Real Estate Investment Trust I (“REIT I”), a REIT that is also sponsored by, and advised by, our sponsor, and Katana Merger Sub, LP, our wholly owned subsidiary (“Merger Sub”), are parties to an agreement and plan of merger dated as of September 19, 2019 (the “Merger Agreement”). Pursuant to the Merger Agreement, REIT I will merge with and into Merger Sub, with Merger Sub surviving as a direct, wholly owned subsidiary of ours (the “Merger”). At such time, the separate existence of REIT I will cease. In addition, as of the date of this prospectus, we, the Operating Partnership, our sponsor, and Daisho OP Holdings, LLC, a wholly owned subsidiary of our sponsor, are parties to a contribution agreement dated as of September 19, 2019 (the “Contribution Agreement’) pursuant to which we will acquire substantially all of the assets of our sponsor and will become self-managed (the “Self-Management Transaction”). As of the date of this prospectus, the Merger and the Self-Management Transaction have not been consummated. Please see Supplement No. 1 dated December [ ], 2019 included herewith and any subsequent supplements to this prospectus for additional information about the Merger and the Self-Management Transaction (together, the “Prospectus Supplement(s)”).

We are an “emerging growth company” under the federal securities laws and will be subject to reduced reporting requirements. Investing in shares of our Class C common stock involves a high degree of risk. You should purchase shares only if you can afford a complete loss of your investment. See Risk Factors beginning on page 12 to read about risks you should consider before buying shares of our Class C common stock. These risks include the following high-risk factors:

•We have only a limited prior operating history, and the prior performance of real estate programs sponsored by our sponsor or its affiliates may not be indicative of our future results.

•This is a “best efforts” offering. If we are unable to raise substantial funds in this offering, we may not be able to invest in a diverse portfolio of real estate and real estate-related investments, and the value of your investment may fluctuate more widely with the performance of specific investments.

•We are a “blind pool” because, to date, we have acquired only twenty-five (25) properties, one (1) parcel of land which currently serves as an easement to one of our office properties, one (1) tenant-in-common real estate investment in which we have an approximate 72.7% interest and an approximate 4.8% interest in REIT I, which is the subject of the proposed Merger described herein and in the Prospectus Supplement(s) included herewith. Other than REIT I’s real estate portfolio, which we will acquire if the Merger is completed, we have not identified a significant number of properties to be acquired with the net proceeds from this offering. As a result, you will not be able to evaluate the economic merits of our future investments prior to their purchase. We may be unable to invest the net proceeds from this offering on acceptable terms to investors, or at all.

•There can be no certainty that the Merger or the Self-Management Transaction will be consummated, and failure to consummate the Merger or the Self-Management Transaction could negatively affect our future business and financial results. In the event that the Merger or Self-Management Transaction is consummated, we will assume certain potential liabilities related to REIT I (in the case of the Merger) and our sponsor and advisor (in the case of the Self-Management Transaction), and our performance will suffer if we do not effectively integrate and manage our expanded operations following these transactions.

•The offering price of shares of our Class C common stock may not accurately represent the value of our assets at any given time and the actual value of your investment may be substantially less.

•The amount of distributions we may pay, if any, is uncertain. Due to the risks involved in the ownership of real estate and real estate-related investments, there is no guarantee of any return on your investment in us and you may lose money.

•We may fail to qualify as a REIT, which could adversely affect our operations and our ability to make distributions.

•Our charter does not require us to pursue a transaction to provide liquidity to our stockholders by a specified date, nor does our charter require us to list our shares for trading on a stock exchange by a specified date. Our charter does not require us to ever provide a liquidity event to our stockholders. No public market currently exists for our shares, and we have no plans to list our shares on a national securities exchange. Consequently, you must be prepared to hold your shares for an indefinite length of time and, if you are able to sell your shares, you may have to sell them at a substantial discount.

•The only source of cash for distributions to investors will be from net rental income, sales of properties and, in certain limited circumstances as described in this prospectus, proceeds from this offering. If we pay distributions from sources other than operations, we may have less cash available for investments and your overall return may be reduced.

•There are significant restrictions and limitations on your ability to have any of your shares of our Class C common stock repurchased under our share repurchase program and, if you are able to have your shares repurchased by us, the stated purchase price under the repurchase program, which is based on our most recently published net asset value per share, could be less than the then-current fair market value of the shares.

•Because no underwriter is selling our shares, investors will not have the benefit of an independent “due diligence” review and investigation of the type normally performed by an underwriter in connection with a securities offering.

•Investing in our Class C common stock involves a high degree of risk. You should purchase shares of our Class C common stock only if you can afford a complete loss of your investment.

Neither the SEC, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of our Class C common stock, determined if this prospectus is truthful or complete or passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

The use of forecasts in this offering is prohibited. Any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any present or future cash benefit or tax consequence which may flow from an investment in this program is not permitted.

| Price to the

Public(1) | Selling

Commissions(2) | Dealer Manager

Fees(2) | Proceeds to Us,

Before Expenses(3) |

Primary Offering | $ | 10.16 | | $ | — | | $ | 0.056 | | $ | 10.104 | |

Distribution Reinvestment Plan | $ | 10.16 | | $ | — | | $ | — | | $ | 10.16 | |

| (1) | The price per share presented is based on our most recently published net asset value (“NAV”) per share. Our board of directors will adjust the offering price of the shares during the course of the offering on an annual basis, to equal NAV per share. Our board of directors generally anticipates that the NAV per share will be determined in the first quarter of each year. |

| (2) | The table assumes that all shares are sold in the primary offering. Investors will not pay upfront selling commissions in connection with the purchase of our shares of Class C common stock in this offering. Any required fees payable to the dealer manager will be paid by us. For providing compliance services as the dealer manager for this offering North Capital (as defined below) will receive an amount equal to $12,000 per month. When aggregate gross offering proceeds in the primary offering exceed $25 million, we will pay to North Capital an additional upfront monthly variable fee equal to 0.60% of the purchase price of each incremental share of Class C common stock sold in the primary offering, which upfront monthly fee will be reduced to 0.50% of the purchase price of each share of Class C common stock sold in the primary offering once the aggregate gross offering proceeds in the primary offering equal or exceed $75 million. We will also pay to North Capital a monthly retainer of $60,000 for the first three months following the commencement of this offering, for a maximum retainer of $180,000. See the Plan of Distribution for further information. |

| (3) | Proceeds are calculated before deducting organization and offering expenses, which are payable by us and will be paid over time as they are incurred. The net proceeds to us, after the payment of fees to the dealer manager and other organization and offering expenses, is expected to be not less than $9.86 per share. |

| | North Capital Private Securities Corporation (“North Capital”), a registered broker-dealer, will serve as the dealer manager of this offering and will offer shares of our Class C common stock on a “best efforts” basis. The minimum initial investment is at least $500, except under certain circumstances. |

Prospectus Dated December [ ], 2019.