- MDV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

FWP Filing

Modiv (MDV) FWPFree writing prospectus

Filed: 14 Nov 16, 12:00am

Filed Pursuant to Rule 433

Registration No. 333-205684

FREE WRITING PROSPECTUS

(To Prospectus dated June 29, 2016

as supplemented by Supplement No.1

dated October 11, 2016

Hello Howard,

I want to personally reach out regarding a subject that is very important to us here at Rich Uncles, your financial future. In fact, it's one of the core reasons why Ray, Harold and I started Rich Uncles in 2012.

With the election now over, and the stock market currently considered inflated by experts, it's now more important than ever to diversify your investment and retirement portfolios away from the volatile stock market.

We have great news to report on our national Rich Uncles NNN REIT:

| · | Recent acquisition of 6 additional properties, leased for 14 years to an investment grade tenant, generating $540,000 annually in net rental revenue. Purchase Price was $7,700,000 for this multi-state portfolio. |

| · | Monthly cash dividend being paid tomorrow equal to a 7% annualized return. |

If you're ready to invest, click the link below to get started:

If you have any questions, our Investor Relations team is standing by to answer your questions. Just call(855) Rich-Uncles or email us at info@richuncles.com

Sincerely,

Howard Makler

President & Co-Founder

(855) Rich-Uncles

Rich Uncles NNN REIT, Inc. has filed a registration statement (including prospectus) with the US Securities and Exchange Commission (SEC) for the offering to which this communication relates. Before you invest, you should carefully read the prospectus in the registration statement and the other documents Rich Uncles NNN REIT has filed with the SEC for more complete information about Rich Uncles and the securities offering. You may get these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, Rich Uncles will arrange to send you the prospectus if you request it by calling toll free (855) Rich-Uncles or emailing prospectus-nnn@richuncles.com, or by visiting https://www.richuncles.com/prospectus/nnn. This is not an offering, which may be made only by prospectus. The Attorney General of the State of New York has not passed on or endorsed the merits of this offering. Any representation to the contrary is unlawful.

[The following text appears when the “Read Full Message” tab is accessed.]

The $1 Billion offering of our common stock is currently approved in the following States: California, Colorado, Connecticut, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Kentucky, Louisiana, Nevada, Montana, New Hampshire, New York, South Dakota, Texas, Utah, Vermont, Wisconsin and Wyoming. No offer to sell any securities, and no solicitation of an offer to buy any securities, is being made in any jurisdiction in which such offer, sale or solicitation would not be permitted by applicable law. We continue to seek approval of other States and we frequently update our approved States list on our website (http://www.richuncles.com).

Copyright © 2016 Rich Uncles

Our address is 3080 Bristol Street, Suite 550, Costa Mesa, CA 92626

If you do not wish to receive future email,click here.

(You can also send your request toCustomer Care at the street address above.)

State of the Union:

Yesterday we learned that the next President of the United States will be Donald Trump. Regardless of your opinion regarding his policies or politics, there are three things in which we can be confident:

Source: Yahoo Finance

| 1. | In election years where the current incumbent is not running, the stock market tends to flounder. |

| 2. | Mutual funds and advisors that are alreadystruggling to provide additional value to their clients will have to fight against a volatile and down-trending stock market. |

| 3. | In the 2 years after elections, the stock market struggles to break 4% market gains, a disappointing return considering the alternative investments available to investors these days. |

Knowing what we know about the stock market in the months following an election, as well as theother factors that influence stock prices that have nothing to do with company performance, the question is:

Do you think it’s smart for 100% of your investment and retirement dollars to be in the stock market?

Most of us intuitively understand that the answer is “absolutely not,” even with a modest understanding of the value ofproper diversification.

And yet for some reason, most of us reading this probably have the vast majority of our retirement and investment dollars in the stock market, whether it be in a 401k, IRA, mutual fund, or just investing on our own.

Now more than ever, smart investors are turning to alternative asset classes in an effort to diversify their portfolio outside of the volatile stock market.

How do Harvard and Yale invest in real estate?

If what you just read makes sense, and you agree that having all your investment dollars in the stock market at this time is a less-than-smart position, the next question you should ask yourself is:“Well, how do I properly diversify OUTSIDE of the stock market?”

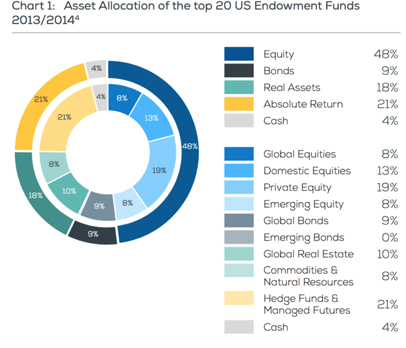

Every so often,Frontier Gottex puts out a great piece of research that outlines how top endowments allocate their funds across various asset classes. For this example, we will look at how Harvard and Yale invested their endowments last year (I think most of us would agree that institutions of this caliber are worthy of us paying some attention to their investment strategy).

Source: Frontier Gottex

What surprises most people when they read this graph is that the top 20 endowments in the United States invest almost 1/5 of their entire fund into “real assets,” primarily real estate.

Now take a moment and contemplate your current asset allocation. If major institutions such as Harvard and Yale are investing so heavily in real estate, why aren’t you following the same strategy?

If you are anything like the investors I speak to on a daily basis, it is for one of two reasons: you either didn’t think about your risk exposure in the stock market, or you don’t think investing in commercial real estate is within reach.

Rich Uncles makes commercial real estate investing available to everyone!

It’s no secret that an investment in commercial real estate can be a reliable, long-term investment designed to generate a consistent dividend yield. The wealthiest individuals in the world have generated some, most, or all of their wealth from commercial real estate. It’s an asset class that mirrors job growth, which is fairly reliable compared to the volatile stock market. Regardless of the brief ebbs and flows in property value, creditworthy commercial tenants are likely to keep paying rent each month.

Listen to Ray Wirta, founding Uncle and Chairman of CBRE (the world’s largest real estate investment and services firm) share his vision for Rich Uncles and his belief in commercial real estate:

The problem with commercial real estate as an investment option for most people is that the minimum investment amount is in the millions, far surpassing the cash on hand most of us have available for investment opportunities.

This is the specific problem Rich Uncles’ founding investor Ray Wirta sought to address when developing the first version of Rich Uncles, which was a $25 million real estate investment trust (REIT) that allowed California residents the opportunity to access commercial real estate investments the same way the ultra-wealthy have.

That REIT quickly sold out, so we doubled its size, growing to over $140 million in assets owned. Now our current offering is a whopping $1 Billion REIT (Rich Uncles NNN REIT) that follows the same investment strategy as our massively successful California-only REIT.

Our Rich Uncles NNN REIT investors are scheduled to receive their monthly dividends tomorrow. Now is a perfect time to add more or start your first investment!Click here to calculate your potential ROI

Rich Uncles NNN REIT gives investors the opportunity to benefit from commercial real estate the same way the ultra-wealthy have for years.

Rental Cash Flow

Rich Uncles NNN REIT owns buildings leased to creditworthy tenants who pay us rent. This cash flow is one of the most compelling reasons to own income producing commercial real estate.

Property Appreciation

In addition to the cash flows generated from rents being paid, our investors may benefit from appreciation in property value resulting from increases in rent as provided in our long-term tenant leases.

Tax Benefits

About 1/3 of your dividends are expected to be shielded from ordinary income tax thanks to property depreciation deductions.

Click here to explore our entire portfolio and get started for as little as $500!

Diversify out of the stock market and into income producing commercial real estate

Now that Rich Uncles has helped bring the benefits of investing in commercial real estate within reach for most investors, and now that you have seen an example of how the world’s best endowments allocate their investment dollars into commercial real estate, I have one last question for you:

What is keeping you from taking action?

Regardless of your politics, the market’s reaction to the election yesterday shows just how volatile the stock market can be, which can be troubling to investors trying to earn a strong stable dividend yield.

One advantage of our public but non-traded commercial real estate investment trust is that the value of our assets is only adjusted once at the end of each year. Our creditworthy and in many cases investment grade tenants pay rent which becomes the basis of your monthly cash flow.

While investing in commercial real estate still has risks, it’s certainly immune from the wild mood swings of Wall Street.

If you’re ready to invest,click here to get started.

If you have questions, our Investor Relations team is available at(855) Rich-Uncles andinfo@richuncles.com.

We look forward to hearing from you!

Sincerely,

Howard Makler

President & Co-Founder of Rich Uncles

Leave a Reply

Your email address will not be published. Required fields are marked *