UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant X Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

☐ | Preliminary Proxy Statement. |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

X | Definitive Proxy Statement. |

☐ | Definitive Additional Materials. |

☐ | Soliciting Material Pursuant to §240.14a-12. |

MULTI PACKAGING SOLUTIONS INTERNATIONAL LIMITED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | |

X | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| |

☐ | Fee paid previously with preliminary materials. |

| |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (6) | Amount Previously Paid: |

| | |

| (7) | Form, Schedule or Registration Statement No.: |

| | |

| (8) | Filing Party: |

| | |

| (9) | Date Filed: |

October 6, 2016

Dear Member:

You are cordially invited to the 2016 Annual General Meeting of Members (the “Annual Meeting”) of Multi Packaging Solutions International Limited, a Bermuda exempted company (the “Company”), to be held on November 17, 2016 at 10:00 a.m., local time, at the offices of Latham & Watkins LLP located at 885 Third Avenue, New York, New York 10022.

You will find information regarding the matters to be voted upon in the attached Notice of 2016 Annual General Meeting of Members and Proxy Statement. We are sending these materials to our shareholders, referred to as “members” under Bermuda law.

Whether or not you attend in person, it is important that your common shares be represented and voted at the Annual Meeting. I encourage you to sign, date and return the enclosed proxy card, or vote via telephone or the Internet as directed on the proxy card, at your earliest convenience. You are, of course, welcome to attend the Annual Meeting and vote in person, even if you have previously returned your proxy card or voted over the Internet or by telephone.

Sincerely,

William H. Hogan

Executive Vice President and Chief Financial Officer

MULTI PACKAGING SOLUTIONS INTERNATIONAL LIMITED

150 East 52nd St., 28th Floor

New York, NY 10022

NOTICE OF 2016 ANNUAL GENERAL MEETING OF MEMBERS

| | |

| | |

Time and Date: | | 10:00 a.m. local time on Thursday, November 17, 2016 |

| |

Place: | | The offices of Latham & Watkins LLP, located at 885 Third Avenue, New York, New York 10022.

|

| |

Who Can Vote: | | Only holders of our common shares at the close of business on September 28, 2016, the record date, will be entitled to receive notice of, and to vote at, the Annual Meeting. |

| |

Annual Report: | | Our 2016 Annual Report to Members accompanies this Notice and Proxy Statement. |

| |

Proxy Voting: | | Your Vote is Important. Please vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares via the Internet, by telephone, or by signing, dating and returning the enclosed proxy card or voting instruction form will save the Company the expenses and extra work of additional solicitation. If you wish to vote by mail, we have enclosed an envelope, postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares at the meeting, as your proxy is revocable at your option. You may revoke your proxy at any time before it is voted by delivering to the Company a subsequently executed proxy or a written notice of revocation or by voting in person at the Annual Meeting. |

| |

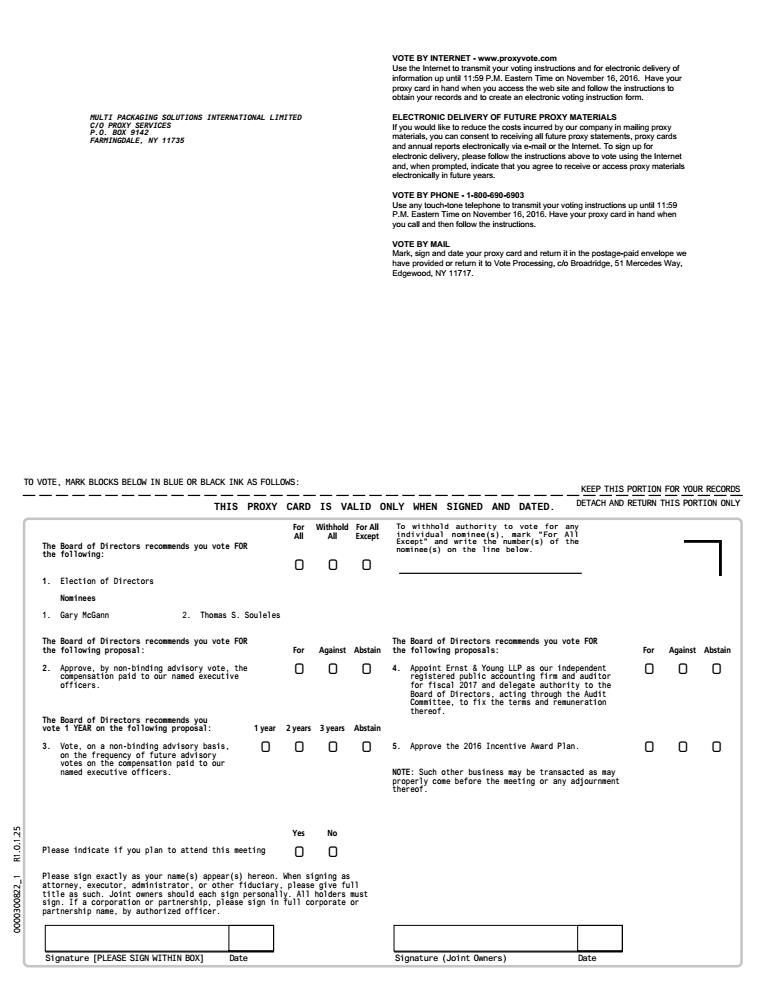

Items of Business: | | • To elect two Class I directors for terms ending at the 2019 Annual General Meeting of Members; • To approve, on a non-binding advisory basis, the compensation paid to our named executive officers; • To vote, on a non-binding advisory basis, on the frequency of future advisory votes on the compensation paid to our named executive officers; • To appoint Ernst & Young LLP as the Company’s independent registered public accounting firm and auditor for our fiscal year ending June 30, 2017 (“fiscal 2017”) and to delegate authority to the board of directors (the “Board” or the “board of directors”), acting through the Audit Committee, to fix the terms and remuneration thereof; • To approve the 2016 Incentive Award Plan; and • To transact any other business that may properly come before the Annual Meeting. |

| |

Date of Mailing: | | This Proxy Statement is first being mailed to members on or about October 6, 2016. |

BY ORDER OF THE BOARD OF DIRECTORS,

Sincerely,

William H. Hogan

Executive Vice President and Chief Financial Officer

October 6, 2016

MULTI PACKAGING SOLUTIONS INTERNATIONAL LIMITED

PROXY STATEMENT

TABLE OF CONTENTS

PROXY STATEMENT

Annual General Meeting of Members

November 17, 2016

This proxy statement and accompanying proxy (the “Proxy Statement”) are being furnished to the members of Multi Packaging Solutions International Limited, a Bermuda exempted company (the “Company” or “MPS”), in connection with the solicitation of proxies by the board of directors of the Company for use at the 2016 Annual General Meeting of Members, and at any adjournment or postponement thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of 2016 Annual General Meeting of Members. The Annual Meeting will be held on November 17, 2016 at 10:00 a.m., local time, at the offices of Latham & Watkins LLP located at 885 Third Avenue, New York, New York 10022.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Why did I receive these Proxy Materials?

You are receiving this Proxy Statement because you owned MPS common shares at the close of business on September 28, 2016 (the “Record Date”), and that entitles you to vote at the Annual Meeting. By use of a proxy, you can vote regardless of whether you attend the Annual Meeting.

We are furnishing proxy materials to our shareholders, referred to as “members” under Bermuda law, primarily via mailing printed copies of those materials to each member. On or about October 6, 2016, we mailed our proxy materials to our members. The proxy materials contain instructions about how to access our proxy materials and vote via the Internet.

Who is entitled to vote at the Annual Meeting?

Holders of our outstanding common shares at the close of business on the Record Date are entitled to vote their shares at the Annual Meeting. As of the Record Date, 77,460,008 common shares were issued and outstanding. Each common share is entitled to one vote on each matter properly brought before the Annual Meeting.

The presence at the Annual Meeting in person or by proxy of the holders of record of a majority in voting power of the common shares entitled to vote at the Annual Meeting, or 38,730,005 shares, will constitute a quorum for the transaction of business at the Annual Meeting.

What will I be voting on at the Annual Meeting and how does the Board recommend that I vote?

There are five proposals that members will vote on at the Annual Meeting:

| · | | Proposal No. 1 — Election of two Class I directors to serve until the 2019 Annual General Meeting; |

| · | | Proposal No. 2 — Non-binding advisory vote to approve the compensation paid to our named executive officers; |

| · | | Proposal No. 3 — Non-binding advisory vote on the frequency of future advisory votes on the compensation paid to our named executive officers; |

| · | | Proposal No. 4 —Appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm and auditor for fiscal 2017 and delegation of authority to the board of directors, acting through the Audit Committee, to fix the terms and remuneration thereof; and |

| · | | Proposal No. 5 — Approval of 2016 Incentive Award Plan. |

The Board recommends that you vote:

| · | | Proposal No. 1 — FOR the election of the two nominees to the Board; |

| · | | Proposal No. 2 — FOR the advisory vote to approve the compensation paid to our named executive officers; |

| · | | Proposal No. 3 — FOR 1 YEAR as the frequency of future advisory votes on the compensation paid to our named executive officers; |

| · | | Proposal No. 4 — FOR the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm and auditor for fiscal 2017 and the delegation of authority to the board of directors, acting through the Audit Committee, to fix the terms and remuneration thereof; and |

| · | | Proposal No. 5 — FOR approval of 2016 Incentive Award Plan. |

Marc Shore and William Hogan, two of our executive officers, have been selected by our Board to serve as proxy holders for the Annual Meeting. All of our common shares represented by properly delivered proxies received in time for the Annual Meeting will be voted at the Annual Meeting by the proxy holders in the manner specified in the proxy by the member. If you sign and return a proxy card without indicating how you want your shares to be voted, the persons named as proxies will vote your shares in accordance with the recommendations of the Board.

What is the difference between holding common shares as a member of record and as a beneficial owner?

If your common shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered, with respect to those shares, the “member of record.” The proxy materials have been or will be sent directly to you.

If your common shares are held in a stock brokerage account, by a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” The proxy materials have been or will be sent to you by your broker, bank or other holder of record who is considered, with respect to those shares, to be the member of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote the shares in your account.

How do I vote?

Member of Record. If you are a member of record, you may vote by using any of the following methods:

| · | | Through the Internet. You may vote by proxy through the Internet by following the instructions on the proxy card. |

| · | | By Telephone. You may vote by proxy by calling the toll-free telephone number shown on the proxy card and following the recorded instructions. |

| · | | By Mail. You may vote by proxy by completing, signing and dating the proxy card and sending it back to the Company in the envelope provided. |

| · | | In Person at the Annual Meeting. If you attend the Annual Meeting, you may vote your shares in person. We encourage you, however, to vote through the Internet, by telephone or by mailing us your proxy card even if you plan to attend the Annual Meeting so that your shares will be voted in the event you later decide not to attend the Annual Meeting. |

Beneficial Owners. If you are a beneficial owner of shares, you may vote by using any of the following methods:

| · | | Through the Internet. You may vote by proxy through the Internet by following the instructions provided in the voting instruction form provided by your broker, bank or other holder of record. |

| · | | By Telephone. You may vote by proxy by calling the toll-free number found on the voting instruction form and following the recorded instructions. |

| · | | By Mail. If your broker, bank or other holder of record provides you with printed copies of the proxy materials by mail, you may vote by proxy by completing, signing and dating the voting instruction form and sending it back to the record holder in the envelope provided. |

| · | | In Person at the Annual Meeting. If you are a beneficial owner of shares held in street name and you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from your broker, bank or other holder of record and present it at the Annual Meeting. Please contact that organization for instructions regarding obtaining a legal proxy. |

What does it mean if I receive more than one proxy card or voting instruction form?

If you received more than one proxy card or voting instruction form, it means you hold your common shares in more than one name or are registered as the holder of common shares in different accounts. Please follow the voting instructions included in each proxy card and voting instruction form to ensure that all of your shares are voted.

May I change my vote after I have submitted a proxy?

If you are a member of record, you have the power to revoke your proxy at any time prior to the Annual Meeting by:

| · | | delivering to our Secretary an instrument revoking the proxy; |

| · | | delivering a new proxy in writing, through the Internet or by telephone, dated after the date of the proxy being revoked; or |

| · | | attending the Annual Meeting and voting in person (attendance without casting a ballot will not, by itself, constitute revocation of a proxy). |

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or other holder of record. You may also revoke your previous voting instructions by voting in person at the Annual Meeting if you obtain a legal proxy from your broker, bank or other holder of record and present it at the Annual Meeting.

Who will serve as the proxy tabulator and inspector of election?

A representative from Broadridge Financial Solutions, Inc. will serve as the independent inspector of election and will tabulate votes cast by proxy or in person at the Annual Meeting. We will report the results in a Current Report on Form 8-K filed with the Securities and Exchange Commission (the “Commission”) within four business days after the Annual Meeting.

What vote is required to approve each proposal?

The common shares of a member whose ballot on any or all proposals is marked as “abstain” will be included in the number of shares present at the Annual Meeting to determine whether a quorum is present.

If you are a beneficial owner of shares and do not provide the record holder of your shares with specific voting instructions, your record holder may vote your shares on the appointment of Ernst & Young LLP as our independent registered public accounting firm and auditor for fiscal 2017 and delegation of authority to the board of directors, acting through the Audit Committee, to fix the terms and remuneration thereof (Proposal No. 4). However, your record holder cannot vote your shares without specific instructions on the election of directors (Proposal No. 1), the non-binding, advisory vote on the compensation paid to our named executive officers (Proposal No. 2), the non-binding, advisory vote on the frequency of future advisory votes on the compensation paid to our named executive officers (Proposal No. 3) or the approval of the 2016 Incentive Award Plan (Proposal No. 5). If your record holder does not receive instructions from you on how to vote your shares on Proposal 1, 2, 3 or 5, your record holder will inform the inspector of election that it does not have the authority to vote on the applicable proposal with respect to your common shares. This is generally referred to as a “broker non-vote.” Broker non-votes will be counted as present for purposes of determining whether a quorum is present, but they will not be counted in determining the outcome of the vote on the applicable proposal.

The following table summarizes the votes required for passage of each proposal and the effect of abstentions and broker non-votes.

| | |

Proposal | Vote Required | Impact of Abstentions and Broker

Non-Votes, if any |

No. 1 — Election of directors | Directors will be elected by a plurality of the votes cast, meaning the directors receiving the largest number of “for” votes will be elected. | Abstentions and broker non-votes will not affect the outcome of the vote. |

No. 2 — Non-binding, advisory vote to approve compensation paid to our named executive officers | Approval by a majority of the votes cast. | Abstentions and broker non-votes will not affect the outcome of the vote. |

No. 3 — Non-binding, advisory vote on the frequency of future advisory votes on the compensation paid to our named executive officers | Approval by a majority of the votes cast.* | Abstentions and broker non-votes will not affect the outcome of the vote. |

No. 4 — Appointment of independent registered public accounting firm and auditor for fiscal 2017 and delegation of authority to the board of directors, acting through the Audit Committee, to fix the terms and remuneration thereof | Approval by a majority of the votes cast. | Abstentions will not affect the outcome of the vote. We do not expect any broker non-votes for this proposal. |

No. 5 — Approval of the 2016 Incentive Award Plan | Approval by a majority of the votes cast. | Abstentions and broker non-votes will not affect the outcome of the vote. |

| * | | In determining the frequency with which we hold future advisory votes on the compensation paid to our named executive officers, the Board will consider the frequency (every one year, every two years or every three years) receiving the most votes as representing the members’ views on how frequently such votes should occur. |

Who is paying for the cost of this proxy solicitation?

Our Board is furnishing this Proxy Statement in connection with the solicitation of proxies for the Annual Meeting. The Company will pay all proxy solicitation costs. Proxies may be solicited by our officers, directors, and employees, none of whom will receive any additional compensation for their services. These solicitations may be made personally or by mail, facsimile, telephone, messenger, email, or the Internet. We will pay brokers, banks, and certain other holders of record holding common shares in their names or in the names of nominees, but not owning such shares beneficially, for the expense of forwarding solicitation materials to the beneficial owners.

What do I need to do to attend the meeting in person?

In order to be admitted to the Annual Meeting, you must present proof of ownership of MPS common shares as of the close of business on the Record Date in any of the following ways:

| · | | a brokerage statement or letter from a bank or broker that is a record holder indicating your ownership of MPS common shares as of the close of business on September 28, 2016; |

| · | | a printout of the proxy distribution email (if you received your materials electronically) from a bank, broker or other record holder; |

| · | | a voting instruction form; or |

| · | | a legal proxy provided by your broker, bank or other holder of record. |

Any holder of a proxy from a member must present the proxy card, properly executed, and a copy of one of the proofs of ownership listed above. Members and proxy holders must also present a form of photo identification such as a driver’s license. We will be unable to admit anyone who does not present identification or refuses to comply with our security procedures.

Is there a list of members entitled to vote at the Annual Meeting?

A list of members entitled to vote at the Annual Meeting will be available at the meeting and for ten days prior to the meeting, between the hours of 10:00 a.m. and 4:00 p.m. Eastern Time, at our offices at 150 East 52nd St., 28th floor, New York, New York 10022. If you would like to view the member list, please contact our Secretary to schedule an appointment.

I share an address with another member, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

To reduce costs and reduce the environmental impact of our Annual Meeting, we have adopted a procedure approved by the Commission called “householding.” Under this procedure, members of record who have the same address and last name and who do not participate in electronic delivery of proxy materials will receive only a single copy of our Proxy Statement and 2016 Annual Report, unless we have received contrary instructions from such member. Members who participate in householding will continue to receive separate proxy cards.

We will promptly deliver, upon written or oral request, individual copies of this Proxy Statement or the 2016 Annual Report to any member that received a householded mailing. If you would like an additional copy of the Proxy Statement or 2016 Annual Report, or you would like to request separate copies of future proxy materials, please contact our Secretary, by mail at 150 East 52nd St., 28th floor, New York, New York 10022 or by telephone at (646) 885-0165. If you are a beneficial owner, you may contact the broker or bank where you hold the account.

If you are eligible for householding, but you and other members of record with whom you share an address currently receive multiple copies of our Proxy Statement and 2016 Annual Report, or if you hold shares in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact Broadridge Financial Solutions, Inc. at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717 or by telephone at (800) 542-1061.

Could other matters be decided at the Annual Meeting?

As of the date of this Proxy Statement, our Board is not aware of any matters, other than those described in this Proxy Statement, which are to be voted on at the Annual Meeting. If any other matters are properly raised at the Annual Meeting, however, the persons named as proxy holders intend to vote the shares represented by your proxy in accordance with their judgment on such matters.

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Controlled Company

For purposes of the New York Stock Exchange (“NYSE”) listing standards, we are and expect to continue to be a “controlled company.” Controlled companies under those rules are companies of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company. Since our formation, investment funds affiliated with The Carlyle Group (collectively, “Carlyle”) and Madison Dearborn Partners, LLC (collectively, “Madison Dearborn” and, together with Carlyle, the “Sponsors”) have controlled more than 50% of the combined voting power of our common shares and have the right to designate a majority of the members of our board of directors for nomination for election and the voting power to elect those nominees as directors. Accordingly, we take advantage of certain exemptions from corporate governance requirements provided in the NYSE listing standards, and we may continue to take advantage of these exemptions for so long as we continue to be a controlled company. Specifically, as a controlled company, we are not required to have (i) a majority of independent directors, (ii) a nominating and corporate governance committee composed entirely of independent directors, (iii) a compensation committee composed entirely of independent directors or (iv) an annual performance evaluation of the nominating and corporate governance and compensation committees. Accordingly, our members do not have the same protections afforded to shareholders of companies that are subject to all of the NYSE corporate governance listing standards. The controlled company exemption does not modify the independence requirements for the audit committee, and we are in compliance with the requirements of the Sarbanes-Oxley Act and the NYSE listing standard stock exchange rules with respect to audit committee independence.

Policies on Corporate Governance

Our Board believes that good corporate governance is important to ensure that our business is managed for the long-term benefit of our members. We have adopted a Code of Conduct and Business Ethics that applies to all of our employees and directors, including our executive officers and senior financial and accounting officers. We have also adopted Corporate Governance Guidelines. Copies of the current versions of the Code of Conduct and Business Ethics and the Corporate Governance Guidelines are available on our website and will also be provided upon request to any person without charge. Requests should be made in writing to our Secretary at Multi Packaging Solutions International Limited, 150 East 52nd St., 28th floor, New York, New York 10022, or by telephone at (646) 885-0165.

Board Leadership Structure

The board of directors does not have a set policy with respect to the separation of the offices of Chairman of the Board and Chief Executive Officer, as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. The Board evaluates from time to time whether the roles of Chairman of the Board and Chief Executive Officer should be separate and, if they are to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee of the Company. The Board believes these issues should be considered as part of the Board’s broader oversight and succession planning process. Currently, Mr. Shore serves as our Chairman and Chief Executive Officer.

Board Role in Risk Oversight

While risk management is primarily the responsibility of our management, the Board provides overall risk oversight focusing on the most significant risks facing us. The Board oversees the risk management processes that have been designed and are implemented by our executives to determine whether these processes are functioning as intended and are consistent with our business and strategy. The Board executes its oversight responsibility for risk management directly and through its committees. The Board’s role in risk oversight has not affected its leadership structure.

The Audit Committee is specifically tasked with reviewing with management, the independent auditors and our legal counsel, as appropriate, our compliance with legal and regulatory requirements and any related compliance policies and programs. The Audit Committee is also tasked with reviewing our financial and risk management policies. Members of our management who have responsibility for designing and implementing our risk management processes regularly meet with the Audit Committee. The Board’s other committees oversee risks associated with their respective areas of responsibility.

The full Board considers specific risk topics, including risk-related issues pertaining to laws and regulations enforced by the United States and foreign government regulators and risks associated with our business plan, strategies and capital structure. In addition, the Board receives reports from members of our management that include discussions of the risks and exposures involved with their respective areas of responsibility, and the Board is routinely informed of developments that could affect our risk profile or other aspects of our business.

Director Independence

Our Corporate Governance Guidelines generally require that that the Board be comprised of a majority of directors who are “independent” under applicable NYSE rules. However, there is an exception to this requirement for so long as we qualify as a controlled company. Our Board has determined that a majority of our directors are independent under the NYSE listing standards, including each of Ms. Bain and Messrs. Bayly, Copans, Kump, McGann, Souleles and Tyler.

Nominations for Directors

Subject to our shareholders’ agreement (as defined below), the Nominating and Corporate Governance Committee will consider director nominees recommended by our members. For more information regarding our shareholders’ agreement, see “Certain Relationships and Related Party Transactions—Shareholders’ Agreement.” A member who wishes to recommend a director candidate for consideration by the Nominating and Corporate Governance Committee should send the recommendation to our Secretary at Multi Packaging Solutions International Limited, 150 East 52nd St., 28th floor, New York, New York 10022, who will then forward it to the Nominating and Corporate Governance Committee. The recommendation must include a description of the candidate’s qualifications for board service, including all of the information that would be required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the Commission (as amended from time to time), the candidate’s written consent to be considered for nomination and to serve if nominated and elected, and addresses and telephone numbers for contacting the member and the candidate for more information. A member who wishes to nominate an individual as a candidate for election, rather than recommend the individual to the Nominating and Corporate Governance Committee as a nominee, must comply with the notice procedures set forth in our Amended and Restated Bye-Laws (“Bye-Laws”). See “Member Proposals for the Company’s 2017 Annual General Meeting of Members” for more information on these procedures.

The Nominating and Corporate Governance Committee will consider and evaluate persons recommended by the members in the same manner as it considers and evaluates other potential directors. However, as described in more detail below, pursuant to our shareholders’ agreement, Carlyle and Madison Dearborn currently each have the right to designate two of our eight Board members. See “Certain Relationships and Related Party Transactions—Shareholders’ Agreement.”

Director Qualifications

Subject to our shareholders’ agreement, the Nominating and Corporate Governance Committee is responsible for reviewing the qualifications of potential director candidates and recommending to the board of directors those candidates to be nominated for election to the board of directors. For more information regarding our shareholders’ agreement, see “Certain Relationships and Related Party Transactions—Shareholders’ Agreement.” Our Corporate Governance Guidelines, which are available on our website as described above, set forth criteria that the Nominating and Corporate Governance Committee will consider when evaluating a director candidate for membership on the board of directors. These criteria are as follows: professional experience; education; skill; diversity; differences of viewpoint; and other individual qualities and attributes that will positively contribute to the Board. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for any prospective nominee. Our Nominating and Corporate Governance Committee also considers the mix of backgrounds and qualifications of the directors in order to assure that the board of directors has the necessary experience, knowledge and abilities to perform its responsibilities effectively and to consider the value of diversity on the board of directors. While diversity and variety of experiences and viewpoints represented on the Board should always be considered, a director nominee should not be chosen nor excluded solely or largely because of race, religion, national origin, sex, sexual orientation or disability.

Board Composition

Our board of directors currently consists of eight members, with Mr. Shore serving as Chairman of the board of directors.

The number of members on our board of directors may be modified from time to time by our board of directors, subject to the terms of our shareholders’ agreement. Our Board is divided into three classes whose members serve three-year terms expiring in successive years. Directors hold office until their successors have been duly elected and qualified or until the earlier of their respective death, resignation or removal.

At each annual general meeting, the successors to the directors whose terms will then expire will be elected to serve from the time of election and qualification until the third annual general meeting following such election. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

In connection with our initial public offering (“IPO”), we entered into a shareholders’ agreement with affiliates of Carlyle and Madison Dearborn. See “Certain Relationships and Related Party Transactions—Shareholders’ Agreement.” Pursuant to the shareholders’ agreement, but subject to the annual election process, Carlyle and Madison Dearborn each have the right to designate two of our eight directors. All parties to the shareholders’ agreement have agreed to vote their shares in favor of such designees. If either of Carlyle or Madison Dearborn loses its right to designate any directors pursuant to the terms of the shareholders’ agreement, these positions will be filled by our members in accordance with our memorandum of association and Bye-Laws. Ms. Bain and Mr. Kump have been designated by Carlyle and Messrs. Copans and Souleles have been designated by Madison Dearborn.

When considering whether directors and nominees have the experience, qualifications, attributes or skills, taken as a whole, to enable the board of directors to satisfy their oversight responsibilities effectively in light of our business and structure, the board of directors focused primarily on each person’s background and experience as reflected in the information discussed in each of the directors’ individual biographies set forth below. See “Proposal No. 1: Election of Directors.” We believe that our directors provide an appropriate diversity of experience and skills relevant to the size and nature of our business.

Communications with Board

The board of directors provides a process for members and other interested parties to send communications to the Board or any of the directors. Members and other interested parties may send written communications to the board of directors, or any of the individual directors, c/o the Secretary of the Company at Multi Packaging Solutions International Limited, 150 East 52nd St., 28th floor, New York, New York 10022. All communications will be compiled by the Secretary of the Company and submitted to the board of directors or the individual directors, as applicable, on a periodic basis. In addition, all directors are invited, but not required, to attend our annual general meetings of members.

Board Meetings, Attendance and Executive Sessions

Directors are expected to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. The Board meets on a regularly scheduled basis during the year to review significant developments affecting us and to act on matters requiring Board approval. It also holds special meetings when an important matter requires Board action between scheduled meetings. Members of senior management regularly attend meetings of the Board and its committees to report on and discuss their areas of responsibility. Directors are expected to attend Board meetings and meetings of committees on which they serve. In addition, all directors are invited, but not required, to attend our annual general meeting of members. Directors are expected to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities.

In general, the Board reserves time during each regularly scheduled meeting to allow the non-management Board members and the independent directors to each meet in executive sessions. During these executive sessions, the participants choose among themselves who will preside over the discussion.

In the fiscal year ended June 30, 2016 (“fiscal 2016”), the Board met four times. All directors attended 75% or more of the meetings of the Board and committees on which they served during the period for which they served on the Board and such committees, as applicable.

Board Committees

Our Board directs the management of our business and affairs as provided by Bermuda law and conducts its business through meetings of the board of directors and three standing committees: the Audit, the Compensation and the Nominating and Corporate Governance Committees. In addition, from time to time, other committees may be established under the direction of the Board when necessary or advisable to address specific issues.

Each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee operates under a charter that was approved by our Board. A copy of each of these charters is available on our website at www.ir.multipkg.com.

Audit Committee

The Audit Committee, which currently consists of Messrs. McGann (Chairman), Bayly and Tyler, is responsible for, among its other duties and responsibilities, assisting the board of directors in overseeing our accounting and financial reporting processes and other internal control processes, the audits and integrity of our financial statements, our compliance with legal and regulatory requirements, the qualifications, independence and performance of our independent registered public accounting firm and the performance of our internal audit function. Our Audit Committee is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm.

The board of directors has determined that each of Messrs. McGann, Bayly and Tyler is an “audit committee financial expert” as such term is defined under the applicable regulations of the Commission and has the requisite accounting or related financial management expertise and financial sophistication under the applicable rules and regulations of the NYSE. The board of directors has also determined that Messrs. McGann, Bayly and Tyler are independent under Rule 10A-3 under the Exchange Act and the NYSE standards, for purposes of the Audit Committee. All members of the Audit Committee are able to read and understand fundamental financial statements, are familiar with finance and accounting practices and principles and are financially literate.

In fiscal 2016, the Audit Committee met six times.

Compensation Committee

The Compensation Committee, which consists of Messrs. Kump (Chairman), Bayly and Souleles, is responsible for, among its other duties and responsibilities, reviewing and approving the compensation philosophy for our chief executive officer, reviewing and approving all forms of compensation and benefits to be provided to our other executive officers and reviewing and overseeing the administration of our equity incentive plans. The Compensation Committee’s processes for fulfilling its responsibilities and duties with respect to executive compensation and the role of executive officers and management in the compensation process are each described under the heading “Determination of Compensation” in this Proxy Statement.

In fiscal 2016, the Compensation Committee met four times.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee, which consists of Messrs. Copans (Chairman), Shore and McGann, is responsible for, among its other duties and responsibilities, identifying and recommending candidates to our board of directors for election to our board of directors, reviewing the composition of members of our board of directors and its committees, developing and recommending to our board of directors corporate governance guidelines that are applicable to us and overseeing our board of directors’ and its committees’ evaluations.

In fiscal 2016, the Nominating and Corporate Governance Committee met one time.

Compensation Committee Interlocks and Insider Participation

During fiscal 2016, our Compensation Committee consisted of Messrs. Kump (Chairman), Bayly and Souleles. None of the members of our Compensation Committee is currently, or was during fiscal 2016, one of our officers or employees and none of the members of our Compensation Committee has ever served as an officer of the Company. Mr. Kump is employed by Carlyle and Mr. Souleles is employed by Madison Dearborn. Carlyle and Madison Dearborn are parties to our shareholders’ agreement. See “Certain Relationships and Related Party Transactions.” During fiscal 2016, none of our executive officers served as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our board of directors or our Compensation Committee.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Our Board has adopted a written statement of policy for the evaluation of and the approval, disapproval and monitoring of transactions involving us and “related persons.” For the purposes of the policy, “related persons” will include our executive officers, directors and director nominees or their immediate family members, or members owning five percent or more of our outstanding common shares and their immediate family members.

The policy covers any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which we were or are to be a participant, the amount involved exceeds $120,000 and a related person has, had or will have a direct or indirect material interest. Pursuant to this policy, our management will present to our Audit Committee each proposed related person transaction, including all relevant facts and circumstances relating thereto. Our Audit Committee will then:

| · | | review the relevant facts and circumstances of each related person transaction, including the financial terms of such transaction, the benefits to us, the availability of other sources for comparable products or services, if the transaction is on |

terms no less favorable to us than those that could be obtained in arm’s-length dealings with an unrelated third party or employees generally and the extent of the related person’s interest in the transaction; and |

| · | | take into account the impact on the independence of any independent director and the actual or apparent conflicts of interest. |

All related person transactions may only be consummated if our Audit Committee has approved or ratified such transaction in accordance with the guidelines set forth in the policy. Certain types of transactions have been pre-approved by our Audit Committee under the policy. These pre-approved transactions include:

| · | | The purchase of the Company’s products on an arm’s length basis in the ordinary course of business and on terms and conditions generally available to other similarly situated customers; |

| · | | Resolution of warranty claims and associated activities relating to the Company’s products, provided such claims and activities are administered on an arm’s length basis in the ordinary course of business and consistent with the administration of the claims of other similar situated customers; |

| · | | Any related person transaction within the scope of a related person’s ordinary business duties to the Company or the Company’s ordinary course of business when the interest of the related person arises solely from the ownership of a class of equity securities of the Company and all holders of such class of equity securities of the Company will receive the same benefit on a pro rata basis; |

| · | | Receipt of compensation and benefits (subject to necessary Compensation Committee approvals) by an executive officer or director of the Company if the compensation is required to be reported in the Company’s proxy statement pursuant to Item 402 of Regulation S-K or to an executive officer of the Company, if such compensation would have been required to be reported under Item 402 of Regulation S-K as compensation earned for services to the Company if the executive was a “named executive officer” in the proxy statement and such compensation has been approved, or recommended to the Company’s Board for approval, by the Compensation Committee of the Board of the Company; |

| · | | The Company’s payment or reimbursement of a related person’s expenses incurred in performing his or her Company-related responsibilities in accordance with the Company’s policies and procedures; |

| · | | Any related person transaction in which the related person’s interest arises only: (i) from the related person’s position as a director of another corporation or organization that is a party to the related person transaction; (ii) from the direct or indirect ownership by the related person and all other related persons, in the aggregate, of less than a ten percent equity interest in another person (other than a partnership) which is a party to the related person transaction; or (iii) from both such position and ownership; |

| · | | Any related person transaction in which the related person’s interest arises only from the related person’s position as a limited partner in a partnership in which the related person and all other related persons have an interest of less than ten percent and the person is not a general partner of and does not have another position in the partnership; |

| · | | Any related person transaction in which the related person is providing investment advisory, investment management, participant record-keeping, securities brokerage, clearing services or any similar services as part of an employee benefit plan or similar plan offered by the Company to its executive officers, directors or employees where (i) the related person was not a related person at the time the Company first engaged the related person for such services; (ii) the related person became a related person solely through the acquisition of five percent or more of the Company’s common shares; and (iii) the related person is eligible to, and does, report shareholdings on Schedule 13G. |

No director may participate in the approval of a related person transaction for which he or she, or his or her immediate family members, is a related person.

Dividends

We did not pay cash dividends in our fiscal year ended June 30, 2016.

Shareholders’ Agreement

In connection with our IPO, we entered into a shareholders’ agreement with affiliates of Carlyle and Madison Dearborn. Our board of directors currently consists of eight members. Pursuant to the shareholders’ agreement, affiliates of Carlyle and Madison Dearborn have each designated two members of our board of directors. In addition, our chief executive officer, Mr. Shore, shall serve as Chairman of the board of directors for so long as he is the Company’s chief executive officer.

The shareholders’ agreement also includes provisions pursuant to which we granted affiliates of Carlyle and Madison Dearborn the right to cause us, in certain instances, at our expense, to file registration statements under the Securities Act covering resales of our common shares held by affiliates of Carlyle and Madison Dearborn or to piggyback on such registration statements in certain circumstances. These shares currently represent approximately 57.2% of our outstanding common shares. These common shares also may be sold under Rule 144 under the Securities Act, depending on their holding period and subject to restrictions in the case of shares held by persons deemed to be our affiliates. The shareholders’ agreement also requires us to indemnify certain of our shareholders and their affiliates in connection with any registrations of our securities.

Indemnification Agreements

In connection with our IPO, we entered into indemnification agreements with each of our directors and certain of our officers. These indemnification agreements provide those directors and officers with contractual rights to indemnification and expense advancement that are, in some cases, broader than the specific indemnification provisions contained under Bermuda law. We believe that these indemnification agreements are, in form and substance, substantially similar to those commonly entered into in transactions of like size and complexity sponsored by private equity firms.

Employment Agreements

See “Compensation Discussion and Analysis—Employment Agreements” for information regarding the employment agreements that we have entered into with our chief executive officer and two of our other named executive officers.

Net Sales to and Purchases from Portfolio Companies of Funds Affiliated with Carlyle or Madison Dearborn

We made net sales of packaging-related products in the amounts of approximately $0.4 million for the fiscal year ended June 30, 2016 to NBTY, Inc., a Carlyle portfolio company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our common shares as of September 28, 2016 by:

| · | | each person known to us to own beneficially more than 5% of our common shares; |

| · | | each of our named executive officers; and |

| · | | all of our directors and executive officers as a group. |

The amounts and percentages of shares beneficially owned are reported on the basis of Commission regulations governing the determination of beneficial ownership of securities. Under the Commission rules, a person is deemed to be a “beneficial” owner of a security if that person has or shares voting power or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Securities that can be so acquired are not deemed to be outstanding for purposes of computing any other person’s percentage. Under these rules, more than one person may be deemed to be a beneficial owner of securities as to which such person has no economic interest.

Except as otherwise indicated in these footnotes, each of the beneficial owners listed has, to our knowledge, sole voting and investment power with respect to the shares of capital stock and the business address of each such beneficial owner is c/o Multi Packaging Solutions International Limited, 150 East 52nd St., 28th Floor, New York, New York 10022.

| | | | |

| | Number of Common Shares

Beneficially Owned |

Name of Beneficial Owner | | Number | | Percent of Class |

| | | | |

Principal Shareholders | | | | |

Investments funds affiliated with The Carlyle Group (1) | | 21,163,072 | | 27.1% |

Madison Dearborn (2) | | 23,482,216 | | 30.1% |

| | | | |

Executive Officers and Directors | | | | |

Marc Shore (3)(4) | | 217,748 | | * |

Dennis Kaltman (3)(5) | | 111,787 | | * |

William H. Hogan (3)(6) | | 56,100 | | * |

Rick Smith (7) | | 310,524 | | * |

Ross Weiner (8) | | 9,854 | | * |

Zeina Bain (1) | | — | | — |

George Bayly | | 4,436 | | * |

Richard H. Copans (2) | | — | | — |

Eric Kump (1) | | — | | — |

Gary McGann | | 4,436 | | * |

Thomas S. Souleles (2) | | — | | — |

Jason J. Tyler | | 4,642 | | * |

All executive officers and directors as a group (12 persons) | | 719,527 | | * |

* Denotes less than 1.0% of beneficial ownership.

| (1) | | CEP III Chase S.à r.l. (“CEP III”) is the record holder of 21,163,072 common shares. Carlyle Group Management L.L.C. is the general partner of The Carlyle Group L.P., which is a publicly traded entity listed on NASDAQ. The Carlyle Group L.P. is the managing member of Carlyle Holdings II GP L.L.C., which is the general partner of Carlyle Holdings II L.P., which is the general partner of TC Group Cayman Investment Holdings, L.P., which is the general partner of TC Group Cayman Investment Holdings Sub L.P., which is the sole shareholder of CEP III Managing GP Holdings, Ltd., which is the general partner of CEP III Managing GP, L.P., which is the general partner of Carlyle Europe Partners III, L.P., which is the sole shareholder of CEP III Participations, S.à r.l., SICAR, which is the sole shareholder of CEP III.

Voting and investment determinations with respect to the common shares held by CEP III are made by an investment committee of CEP III Managing GP, L.P. comprised of Daniel D’Aniello, William Conway, David Rubenstein, Louis Gerstner, Allan Holt, Kewsong Lee and Thomas Mayrhofer. Each member of the investment committees disclaims beneficial ownership of such common shares.

The address for each of TC Group Cayman Investment Holdings, L.P. and TC Group Cayman Investment Holdings Sub L.P. is c/o Intertrust Corporate Services, 190 Elgin Avenue, George Town, Grand Cayman, KY1-9005, Cayman Islands. The address for CEP III and CEP III Participations, S.à r.l., SICAR is c/o The Carlyle Group, 2, avenue Charles de Gaulle, 4th floor, L -1653 Luxembourg, Luxembourg. The address of each of the other persons or entities named in this footnote is c/o The Carlyle Group, 1001 Pennsylvania Ave. NW, Suite 220 South, Washington, D.C. 20004-2505. |

| (2) | | Held by Mustang Investment Holdings L.P. (“Holdings”). MDP Global Investors II Limited (“MDP Limited”) is the general partner of MDP VI Global GP, LP, which in turn is the general partner of each of MDCP VI-A Global Investments LP (“Global VI-A”), MDCP VI-C Global Investments LP (“Global VI-C”) and MDCP Executive VI-A Global Investments LP (“Global Executive VI-A”, together with Global VI-A and Global VI-C, the “MDP Global Funds”). MDP Limited is also the general partner of Holdings, and each of the MDP Global Funds, along with certain other persons, is a limited partner of Holdings. |

Voting and investment determinations by MDP Limited are made by a majority vote of the members of MDP Limited. Each member of MDP Limited disclaims beneficial ownership of such shares, except to the extent of its pecuniary interest therein.

The address for Holdings, each of the MDP Global Funds, and MDP Limited is c/o Maples and Calder, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

| (3) | | In addition to the common shares listed, Messrs. Shore, Kaltman and Hogan are investors in Holdings. None of the foregoing persons has direct or indirect voting or dispositive power with respect to our common shares held of record by Holdings. |

| (4) | | Includes 190,160 common shares issuable upon vesting of restricted stock units that remain subject to continued vesting conditions. |

| (5) | | Includes 84,199 common shares issuable upon vesting of restricted stock units that remain subject to continued vesting conditions.

|

| (6) | | Includes 42,100 common shares issuable upon vesting of restricted stock units that remain subject to continued vesting conditions.

|

| (7) | | Includes 271,566 common shares held directly by Mr. Smith and 24,981 common shares common shares issuable upon vesting of restricted stock units that remain subject to continued vesting conditions. Also includes 13,977 common shares held by Mr. Smith’s wife. |

| (8) | | Represents 9,854 common shares issuable upon vesting of restricted stock units that remain subject to continued vesting conditions. |

EXECUTIVE OFFICERS

The following table provides information regarding our executive officers:

Name | Age* | Position |

Marc Shore......................................................... | 62 | Chief Executive Officer |

Dennis Kaltman................................................... | 51 | President |

Rick Smith........................................................... | 47 | Executive Vice President |

William H. Hogan................................................. | 57 | Chief Financial Officer and Executive Vice President |

Ross Weiner....................................................... | 38 | Vice President — Finance, Chief Accounting Officer |

*As of October 6, 2016.

Marc Shore, Chief Executive Officer

Mr. Shore joined MPS in March 2005. Mr. Shore has 38 years of experience in the print-based specialty packaging industry. Prior to joining MPS, Mr. Shore was CEO of Shorewood Packaging, which grew under his direction from $72 million in sales to $680 million, becoming one of the largest independent packaging companies in North America at that time. Mr. Shore led Shorewood through a successful initial public offering in 1986 and for 14 years as a public company, before its sale to International Paper (“IP”). Following IP’s acquisition of Shorewood in 2000, Mr. Shore continued as President of the business and as a corporate officer of IP until 2004. Mr. Shore received his B.S. in business administration from Boston University. Our board of directors has concluded that Mr. Shore should serve as a director because of his leadership role with our company and his extensive experience in and knowledge of the packaging industry.

Dennis Kaltman, President

Mr. Kaltman joined MPS in July 2005. Mr. Kaltman has more than 20 years of experience in the print-based specialty packaging industry. Prior to joining MPS, Mr. Kaltman served as Senior Vice President of IP’s Home Entertainment Packaging Division. Before joining IP, Mr. Kaltman was Senior Vice President of Shorewood Packaging from 1998 to 2000 and was Senior Vice President of Queens Group from 1990 to 1998. Queens Group was acquired by Shorewood Packaging in 1998. Mr. Kaltman and Mr. Shore have worked together for 17 years. Mr. Kaltman received his B.A. in political science from Northwestern University and his M.B.A. from Columbia University.

Rick Smith, Executive Vice President

Mr. Smith joined MPS in 2014 upon the combination of the Company with Chesapeake. Mr. Smith has more than 20 years of experience in the print and packaging sector. Prior to joining MPS, Mr. Smith served as Chief Financial Officer for Chesapeake and had been with the company for 18 years. Mr. Smith received his ACMA from the University of Derby and his DMS from Nottingham Trent University.

William H. Hogan, Chief Financial Officer and Executive Vice President

Mr. Hogan joined MPS in February 2006. Mr. Hogan has 30 years of experience in the print and packaging industry. Prior to joining MPS, Mr. Hogan spent one year with Computer Associates International as Senior Vice President of Finance. Before joining Computer Associates, Mr. Hogan served as Chief Financial Officer of IP Europe from 2001 to 2004. Before joining IP, Mr. Hogan served in various finance capacities at Shorewood from 1995 to 2000 and as Chief Financial Officer from 2000 to 2001. Prior to that, Mr. Hogan was a professional at Deloitte. Mr. Hogan has worked with Mr. Shore for more than 30 years, both at Deloitte and Shorewood, and with Mr. Kaltman for more than 10 years. Mr. Hogan is a Certified Public Accountant. Mr. Hogan received his B.S. in accounting from the State University of New York at Geneseo.

Ross Weiner, Vice President — Finance, Chief Accounting Officer

Mr. Weiner joined MPS in February 2016. Prior to joining MPS, Mr. Weiner served as Vice President — Chief Accounting Officer for The Hain Celestial Group, Inc. (“Hain”), a manufacturer, marketer and distributor of organic and natural products. Before joining Hain, Mr. Weiner was a Senior Manager at Ernst & Young from 1999 to 2011. Mr. Weiner received his B.S. in Accounting from the State University of New York at Geneseo.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Our board of directors currently consists of eight directors. Our directors are divided into three classes with staggered three-year terms so that the term of one class expires at each annual general meeting of members. Two nominees will be proposed for election as Class I directors at the Annual Meeting. Information regarding our directors’ professional experience and ages (as of October 6, 2016) is set forth below.

It is intended that the persons named in the accompanying proxy will vote to elect the nominees listed below unless authority to vote is withheld. The elected directors will serve until the annual general meeting of members in 2019 or until an earlier resignation or retirement or until their successors are elected and qualify to serve.

All of the nominees are presently serving as directors of the Company. Mr. McGann was recommended by our non-management directors. The nominees have agreed to stand for reelection. However, if for any reason any nominee shall not be a candidate for election as a director at the Annual Meeting, it is intended that shares represented by the accompanying proxy will be voted for the election of a substitute nominee designated by our board of directors, or the board of directors may determine to leave the vacancy temporarily unfilled.

Nominees for Election as Class I Directors

Gary McGann

Mr. McGann, age 66, became a member of our board of directors following the IPO. Mr. McGann was previously Chief Executive Officer of the Smurfit Kappa Group from 2002 until his retirement in 2015 and President and Chief Operations Officer of the Smurfit Group from 2000 to 2002. He joined the Smurfit Group in 1998 as Chief Financial Officer. He has held a number of senior positions in both the private and public sectors over the previous 20 years, including Chief Executive of Gilbeys of Ireland Group and Aer Lingus Group plc. He is Chairman of Paddy Power Betfair plc, a non-executive Director of the Smurfit Kappa Group plc and Green REIT plc, the former President and director of the Irish Business Employers Confederation, a former member of the European Round Table of Industrialists and Chairman of the Confederation of European Paper Industries. Mr. McGann obtained a B.A. from University College Dublin and holds a M.S. degree in Management Science. He is a Fellow of the Chartered Institute of Certified Accountants (FCCA) and an Honorary Fellow of the National College of Ireland. The board of directors has concluded that Mr. McGann should serve as a director because of his experience in and knowledge of the packaging industry and his extensive understanding of the operational, financial and strategic issues facing public and private companies.

Thomas S. Souleles

Mr. Souleles, age 48, became a member of our board of directors in June 2015. Mr. Souleles is a Managing Director at Madison Dearborn concentrating on investments in the basic industries sector. Prior to joining Madison Dearborn in 1995, Mr. Souleles was with Wasserstein Perella & Co., Inc. Mr. Souleles received his A.B. in The Woodrow Wilson School of Public and International Affairs from Princeton University, his J.D. from Harvard Law School and his M.B.A. from the Harvard Graduate School of Business Administration. Mr. Souleles currently sits on the boards of directors of Packaging Corporation of America and Children’s Hospital of Chicago Medical Center, and on the board of trustees of the National Multiple Sclerosis Society, Greater Illinois Chapter. The board of directors has concluded that Mr. Souleles should serve as a director because he brings, among other things, extensive financial and management expertise and experience, extensive knowledge of and experience in the packaging industry and basic industries sector and general business and financial acumen.

The board of directors of the Company recommends a vote “FOR” each of the foregoing nominees for election as Class I directors.

Directors Continuing in Office

Continuing Class II Directors with Terms Expiring at the 2017 Annual General Meeting of Members

George Bayly

Mr. Bayly, age 74, became a member of our board of directors following the IPO. Mr. Bayly currently serves as principal of Whitehall Investors, LLC, a consulting and venture capital firm, having served in that role since August 2008. Mr. Bayly served as Chairman and Chief Executive Officer of Altivity Packaging LLC, a maker of consumer packaging products and services, from September 2006 to March 2008. He also served as Co-Chairman of U.S. Can Corporation from 2003 to 2006 and Chief Executive Officer in 2005. In addition, from January 1991 to December 2002, Mr. Bayly served as Chairman, President and Chief Executive Officer of Ivex Packaging Corporation. From 1987 to 1991, Mr. Bayly served as Chairman, President and Chief Executive Officer of Olympic Packaging, Inc. Mr. Bayly also held various management positions with Packaging Corporation of America from 1973 to 1987. Prior to joining Packaging Corporation of America, Mr. Bayly served as a Lieutenant Commander in the United States Navy. Mr. Bayly currently serves on the board of directors of ACCO Brands Corporation and Treehouse Foods, Inc. and formerly served on the board of directors of Graphic Packaging Holding Co. Mr. Bayly holds a B.S. from Miami University and an M.B.A. from Northwestern University. The board of directors has concluded that Mr. Bayly should serve as a director because of his experience as a former executive of numerous packaging companies and his extensive understanding of the operational, financial and strategic issues facing public and private companies.

Eric Kump

Mr. Kump, age 46, became a member of our board of directors in June 2015. Mr. Kump is a Managing Director at Carlyle with responsibility for coverage of the U.K. market. Prior to joining Carlyle in 2010, Mr. Kump was a Managing Director and head of the London-based private equity team of Dubai International Capital (“DIC”). While at DIC, he was on the board of various investments including Alliance Medical, Almatis, Travelodge, Mauser Group and Merlin Entertainments Group. Prior to that, he was a Managing Director with Merrill Lynch Global Private Equity (“MLGPE”), where he was a member of the investment committee and a director of numerous portfolio companies. While at MLGPE, he focused on investments in a range of industries, including financial services, consumer, distribution, industrial and healthcare. Mr. Kump received his B.A. in finance and accounting from Pace University and his M.B.A. from Harvard Business School. Mr. Kump currently sits on the board of directors of Integrated Dental Holdings Limited, Innovation Group and PA Consulting Group. The board of directors has concluded that Mr. Kump should serve as a director because he brings extensive experience regarding the management of public and private companies and has significant core business skills, including financial and strategic planning.

Jason J. Tyler

Mr. Tyler, age 45, became a member of our board of directors in January 2016. Mr. Tyler is the Global Head of the Institutional Group at Northern Trust Asset Management (“Northern Trust”) with oversight of institutional sales, client relationship management and advisory services, including the Outsourced Chief Investment Officer and Defined Contribution practices. Previously, Mr. Tyler was the Head of Corporate Strategy at Northern Trust. Mr. Tyler received his A.B. in Political Science from Princeton University and his M.B.A. from the University of Chicago Booth School of Business. Mr. Tyler currently sits on the boards of directors of Advance Illinois, Northwestern Memorial Hospital Foundation, One Million Degrees and the Joffrey Ballet. The board of directors has concluded that Mr. Tyler should serve as a director because of his extensive understanding of the operational, financial and strategic issues facing public and private companies.

Continuing Class III Directors with Terms Expiring at the 2018 Annual General Meeting of Members

Marc Shore

Mr. Shore, age 62, became the Chairman of the board of directors following the IPO. Mr. Shore initially joined MPS in March 2005 and has 38 years of experience in the print-based specialty packaging industry. Prior to joining MPS, Mr. Shore was CEO of Shorewood Packaging, which grew under his direction from $72 million in sales to $680 million, becoming one of the largest independent packaging companies in North America at that time. Mr. Shore led Shorewood through a successful initial public offering in 1986 and for 14 years as a public company, before its sale to IP. Following IP’s acquisition of Shorewood in 2000, Mr. Shore continued as President of the business and as a corporate officer of IP until 2004. Mr. Shore received his B.S. in business administration from Boston University. The board of directors has concluded that Mr. Shore should serve as a director because of his leadership role with our company and his extensive experience in and knowledge of the packaging industry.

Zeina Bain

Ms. Bain, age 39, became a member of our board of directors following the IPO. Ms. Bain is a Managing Director at Carlyle and she advises on European buyout opportunities. Prior to joining Carlyle in 2001, Ms. Bain was an associate at European Digital Capital, a technology venture capital fund, and she also previously worked as an investment banking analyst in the emerging markets group at Merrill Lynch. Ms. Bain received her B.A. in philosophy, politics and economics from Oxford University. Ms. Bain currently serves on the board of directors of Innovation Group and formerly served on the boards of directors of AZ Electronic Materials, Britax Childcare, Firth Rixson and RAC Limited, among others, and as an observer on the board of directors of Axalta Coating Systems Limited. The board of directors has concluded that Ms. Bain should serve as a director because she brings extensive experience regarding the management of public and private companies and has significant core business skills, including financial and strategic planning.

Richard H. Copans

Mr. Copans, age 40, became a member of our board of directors following the IPO. Mr. Copans is a Managing Director at Madison Dearborn concentrating on investments in the basic industries sector. Prior to joining Madison Dearborn in 2005, Mr. Copans was an analyst with Thomas H. Lee Partners and Morgan Stanley & Co. Mr. Copans received his A.B. in economics from Duke University and his M.B.A. from Northwestern University’s J.L. Kellogg Graduate School of Management. Mr. Copans formerly served on the boards of directors of BWAY Holding Company, Schrader International and Yankee Candle Company, Inc. The board of directors has concluded that Mr. Copans should serve as a director because he brings, among other things, extensive financial and management expertise and experience, extensive knowledge of and experience in the packaging industry and manufacturing sector and general business and financial acumen.

PROPOSAL NO. 2: ADVISORY VOTE ON EXECUTIVE COMPENSATION

Pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the “Dodd-Frank Act,” the Commission enacted requirements for the Company to present to its members a separate resolution, subject to an advisory (non-binding) vote, to approve the compensation of its named executive officers. This proposal is commonly referred to as a “Say on Pay” proposal. This proposal is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this Proxy Statement. As required by these rules, the board of directors invites you to review carefully the Compensation Discussion and Analysis beginning on page 30 and the tabular and other disclosures on compensation under Executive Compensation beginning on page 36, and cast an advisory vote on the Company’s executive compensation programs through the following resolution:

“Resolved, that the members approve, on an advisory basis, the compensation of the Company’s named executive officers, including the Company’s compensation practices and principles and their implementation, as discussed and disclosed in the Compensation Discussion and Analysis, the compensation tables, and any narrative executive compensation disclosure contained in the Company’s Proxy Statement for the 2016 Annual General Meeting of Members.”

As discussed in the Compensation Discussion and Analysis beginning on page 30, the board of directors believes that the Company’s long-term success depends in large measure on the talents of our employees. The Company’s compensation system plays a significant role in our ability to attract, retain, and motivate the highest quality workforce. The board of directors believes that its current compensation program directly links executive compensation to performance, aligning the interests of the Company’s executive officers with those of its members.

Pursuant to the Dodd-Frank Act, this vote is advisory and will not be binding on the Company. While the vote does not bind the board of directors to any particular action, the board of directors values the input of the members, and will take into account the outcome of this vote in considering future compensation arrangements.

Although this vote is advisory in nature and does not impose any action on the Company or the Compensation Committee of the board of directors, the Company strongly encourages all members to vote on this matter.

The board of directors recommends a vote “FOR” Proposal No. 2, to approve an advisory (non-binding) resolution regarding the compensation of the Company’s named executive officers.

PROPOSAL NO. 3: ADVISORY VOTE ON FREQUENCY OF ADVISORY VOTES ON EXECUTIVE COMPENSATION

As discussed in Proposal No. 2, the board of directors values the input of members regarding the Company’s executive compensation practices. Members are also invited to express their views on how frequently advisory votes on named executive officer compensation, such as Proposal No. 2, will occur. Members can advise the board of directors on whether such votes should occur every one year, every two years or every three years or may abstain from voting.

This is an advisory vote, and as such is not binding on the board of directors. However, the board of directors will take the results of the vote into account when deciding when to call for the next advisory vote on executive compensation. A frequency vote similar to this will occur at least once every six years.

The board of directors recommends that members vote for advisory votes on executive compensation to be held every year. An annual approach provides regular input by members. Members are not being asked to approve or disapprove of the board of directors’ recommendation, but rather to indicate their own choice as among the frequency options.

Please mark on the proxy card your preference as to the frequency of holding member advisory votes on executive compensation, as either “1 year,” “2 years,” or “3 years” or you may mark “abstain” on this proposal.

The board of directors recommends a vote for “1 YEAR” for Proposal No. 3.

PROPOSAL NO. 4: APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed the firm of Ernst & Young LLP (“E&Y”) as the Company’s independent registered public accounting firm and auditor to examine the books of account and other records of the Company and its consolidated subsidiaries for fiscal 2017. The board of directors is asking the members to approve this action and to delegate authority to the board of directors, acting through the Audit Committee, to fix the terms and remuneration thereof.

Representatives of E&Y are expected to be present at the Annual Meeting and will be afforded the opportunity to make a statement and will be available to respond to appropriate questions that may come before the Annual Meeting.

In the event that the members fail to appoint E&Y as independent registered accounting firm and auditor, the Audit Committee will consider the member vote in determining whether to retain the services of E&Y in connection with the 2017 audit.

Independent Registered Public Accounting Firm

The following table shows the aggregate fees for professional services provided by E&Y and its affiliates for the audits of the Company’s consolidated financial statements for the fiscal years ended June 30, 2016 and 2015, and other services rendered during the fiscal years ended June 30, 2016 and 2015:

| | | | | | |

Fee Category | | Fiscal 2016 | | Fiscal 2015 |

Audit Fees | | $ | 2,635,000 | | $ | 2,564,000 |

Audit-Related Fees | | | — | | | 904,000 |

Tax Fees | | | 2,027,000 | | | 900,000 |

Total | | $ | 4,662,000 | | $ | 4,368,000 |

Audit Fees

Audit fees consist of the fees and expenses for professional services rendered for the audit of the Company’s annual consolidated financial statements, reviews of quarterly financial statements, statutory audits and related services. Audit fees in fiscal 2016 and 2015 also include fees and expenses for services associated with filing the registration statements with the Commission for the Company’s initial public and secondary offerings.

Audit-Related Fees

Audit-related fees consist of due diligence services pertaining to potential business acquisitions and dispositions, including accounting and financial reporting matters. The fees in fiscal 2015 primarily related to the Company’s acquisition of the North American and Asian print businesses of AGI Global Holdings Coöperatief U.A. and AGI Shorewood Group, US Holdings, LLC (collectively, “ASG”). There were no such services performed during fiscal 2016.

Tax Fees