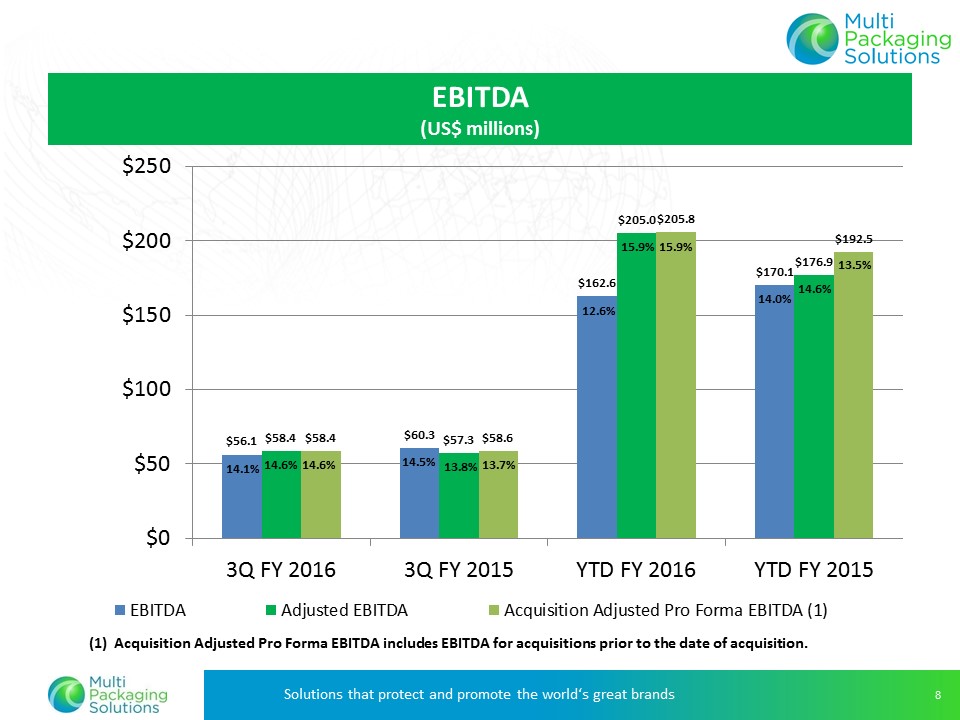

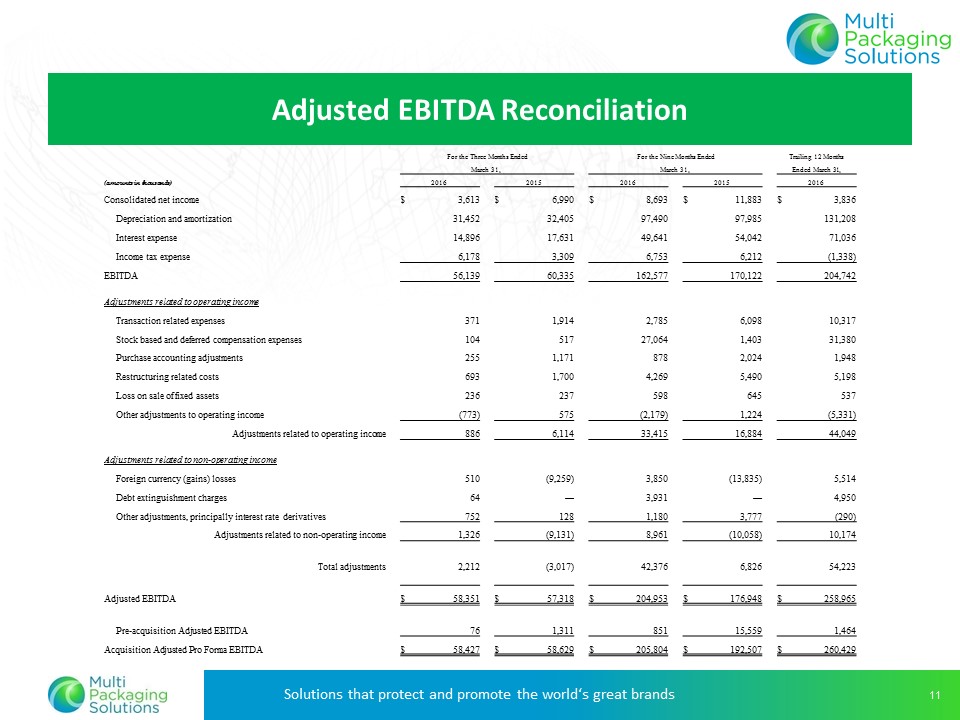

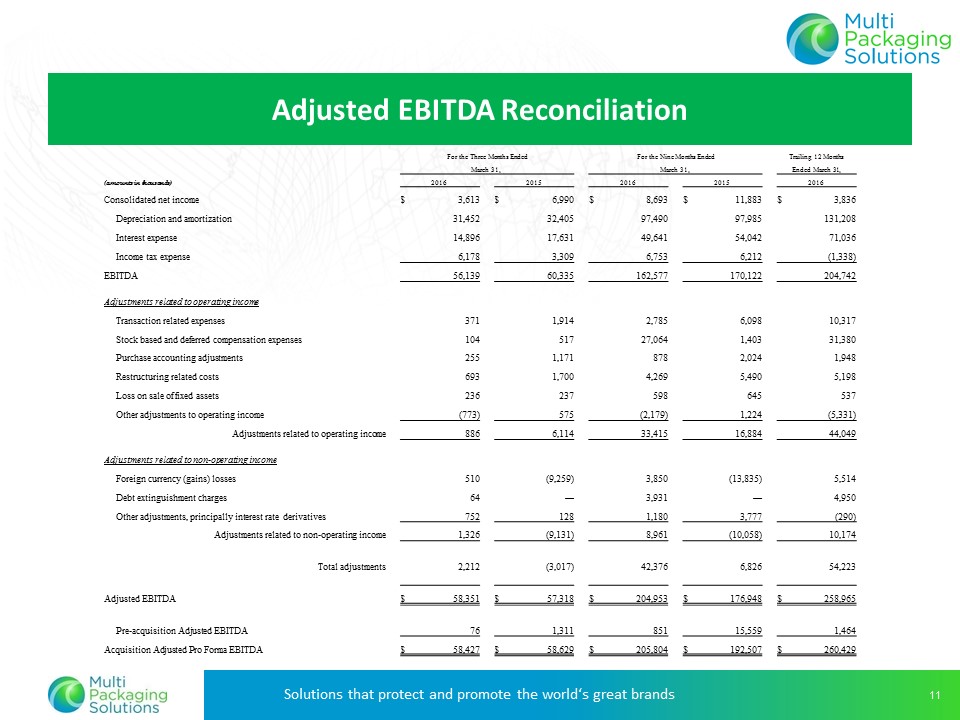

| Multi packaging Solutions Solutions that protect and promote the world‘s great brands 11 Adjusted EBITDA Reconciliation For the Three Months Ended For the Nine Months Ended Trailing 12 Months March 31, March 31, Ended March 31, (amounts in thousands) 2016 2015 2016 2015 2016 Consolidated net income $ 3,613 $ 6,990 $ 8,693 $ 11,883 $ 3,836 Depreciation and amortization 31,452 32,405 97,490 97,985 131,208 Interest expense 14,896 17,631 49,641 54,042 71,036 Income tax expense 6,178 3,309 6,753 6,212 (1,338) EBITDA 56,139 60,335 162,577 170,122 204,742 Adjustments related to operating income Transaction related expenses 371 1,914 2,785 6,098 10,317 Stock based and deferred compensation expenses 104 517 27,064 1,403 31,380 Purchase accounting adjustments 255 1,171 878 2,024 1,948 Restructuring related costs 693 1,700 4,269 5,490 5,198 Loss on sale of fixed assets 236 237 598 645 537 Other adjustments to operating income (773) 575 (2,179) 1,224 (5,331) Adjustments related to operating income 886 6,114 33,415 16,884 44,049 Adjustments related to non-operating income Foreign currency (gains) losses 510 (9,259) 3,850 (13,835) 5,514 Debt extinguishment charges 64 — 3,931 — 4,950 Other adjustments, principally interest rate derivatives 752 128 1,180 3,777 (290) Adjustments related to non-operating income 1,326 (9,131) 8,961 (10,058) 10,174 Total adjustments 2,212 (3,017) 42,376 6,826 54,223 Adjusted EBITDA $ 58,351 $ 57,318 $ 204,953 $ 176,948 $ 258,965 Pre-acquisition Adjusted EBITDA 76 1,311 851 15,559 1,464 Acquisition Adjusted Pro Forma EBITDA $ 58,427 $ 58,629 $ 205,804 $ 192,507 $ 260,429 |