UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23072

First Trust Dynamic Europe Equity Income Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

registrant’s telephone number, including area code: (630) 765-8000

Date of fiscal year end:December 31

Date of reporting period:December 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

First Trust

Dynamic Europe Equity Income Fund (FDEU)

Annual Report

For the Year Ended

December 31, 2018

First Trust Dynamic Europe Equity Income Fund (FDEU)

Annual Report

December 31, 2018

Caution Regarding Forward-Looking Statements

This report contains certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and/or Janus Capital Management LLC (“Janus Capital” or the “Sub-Advisor”) and their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would” or other words that convey uncertainty of future events or outcomes.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of First Trust Dynamic Europe Equity Income Fund (the “Fund”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and/or Sub-Advisor and their respective representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Managed Distribution Policy

The Board of Trustees of the Fund has approved a managed distribution policy for the Fund (the “Plan”) in reliance on exemptive relief received from the Securities and Exchange Commission that permits the Fund to make periodic distributions of long-term capital gains as frequently as monthly each tax year. Under the Plan, the Fund currently intends to continue to pay a recurring monthly distribution in the amount of $0.121 per Common Share that reflects the distributable cash flow of the Fund. A portion of this monthly distribution may include realized capital gains. This may result in a reduction of the long-term capital gain distribution necessary at year end by distributing realized capital gains throughout the year. The annual distribution rate is independent of the Fund’s performance during any particular period. Accordingly, you should not draw any conclusions about the Fund’s investment performance from the amount of any distribution or from the terms of the Plan. The Board of Trustees may amend or terminate the Plan at any time without prior notice to shareholders.

Performance and Risk Disclosure

There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the Fund shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in the Fund. See “Risk Considerations” in the Additional Information section of this report for a discussion of certain other risks of investing in the Fund.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visitwww.ftportfolios.comor speak with your financial advisor. Investment returns, net asset value and common share price will fluctuate and Fund shares, when sold, may be worth more or less than their original cost.

The Advisor may also periodically provide additional information on Fund performance on the Fund’s web page atwww.ftportfolios.com.

How to Read This Report

This report contains information that may help you evaluate your investment in the Fund. It includes details about the Fund and presents data and analysis that provide insight into the Fund’s performance and investment approach.

By reading the portfolio commentary by the portfolio management team of the Fund, you may obtain an understanding of how the market environment affected the Fund’s performance. The statistical information that follows may help you understand the Fund’s performance compared to that of a relevant market benchmark.

It is important to keep in mind that the opinions expressed by personnel of First Trust and Janus Capital are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the period through the date on the cover of this report. The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory filings.

First Trust Dynamic Europe Equity Income Fund (FDEU)

Annual Letter from the Chairman and CEO

December 31, 2018

Dear Shareholders:

First Trust is pleased to provide you with the annual report for the First Trust Dynamic Europe Equity Income Fund (the “Fund”), which contains detailed information about the Fund for the twelve months ended December 31, 2018, including a market overview and performance analysis. We encourage you to read this report carefully and discuss it with your financial advisor.

As I wrote in my June 2018 letter, investors were hoping for another strong year in the markets for 2018. For the entire year, however, increased market volatility was the norm for U.S. and global markets. Despite the volatility, August was a strong month for stocks, and the Dow Jones Industrial Average (“DJIA”) finished the month just under its previous high in January 2018. At the close of the third quarter in September, the markets had moved higher into positive territory. In fact, all three major U.S. indices (the Nasdaq Composite Index, the DJIA and the S&P 500® Index) hit record levels during the third quarter. Yet, in October, markets were again very volatile, surprising analysts and investors alike. Both global markets and U.S. markets fell on fears of slowing growth, trade wars and higher interest rates. The DJIA was down 5% for October and the MSCI EAFE Index, an index of stocks in 21 developed markets (excluding the U.S. and Canada), was down 9% for the month. However, investors cheered as November ended, and the DJIA climbed 617 points (2.5%) to its biggest one-day gain in eight months. The MSCI EAFE Index ended November down slightly. December held its own shocks as it became the worst December for stocks since the Great Depression. The DJIA and the MSCI EAFE Index ended December with year-to-date returns of -3.48% and -13.79%, respectively.

Based on continued strong job growth and the economic outlook in the U.S., the Federal Reserve (the “Fed”) raised interest rates in March, June and September. At their September meeting, the Fed indicated the possibility of one additional rate hike in 2018 and three more in 2019. At their November meeting, the Fed did not raise interest rates. However, at their December 19th meeting, the Fed did raise interest rates by 25 basis points. Analysts and investors will be watching to see what the Fed does with rates in 2019.

While trade tensions have had an impact on markets around the world and could continue to do so in the future, our economists believe that the long-term impact of U.S. tariffs will be to encourage countries to come back to the table and talk about more equal trade. Despite market volatility, we continue to believe that the combination of low interest rates, low inflation and strong corporate earnings still point to a positive economic environment and further growth, though we understand that past performance can never guarantee future performance.

We continue to believe that you should invest for the long term and be prepared for market movements, which can happen at any time. You can do this by keeping current on your portfolio and by speaking regularly with your investment professional. Markets go up and they also go down, but savvy investors are prepared for either through careful attention to investment goals.

Thank you for giving First Trust the opportunity to be a part of your financial plan. We value our relationship with you and will report on the Fund again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust Advisors L.P.

First Trust Dynamic Europe Equity Income Fund (FDEU)

“AT A GLANCE”

As of December 31, 2018 (Unaudited)

| Fund Statistics | |

| Symbol on New York Stock Exchange | FDEU |

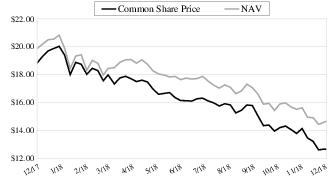

| Common Share Price | $12.64 |

| Common Share Net Asset Value (“NAV”) | $14.66 |

| Premium (Discount) to NAV | (13.78)% |

| Net Assets Applicable to Common Shares | $252,662,751 |

| Current Monthly Distribution per Common Share(1) | $0.1210 |

| Current Annualized Distribution per Common Share | $1.4520 |

| Current Distribution Rate on Common Share Price(2) | 11.49% |

| Current Distribution Rate on NAV(2) | 9.90% |

Common Share Price & NAV (weekly closing price)

| Performance | | | |

| | | | Average Annual

Total Returns |

| | | 1 Year Ended

12/31/18 | Inception (9/24/15)

to 12/31/18 |

| Fund Performance(3) | | | |

| NAV | | -19.36% | 0.82% |

| Market Value | | -26.64% | -5.00% |

| Index Performance | | | |

| MSCI Europe Index | | -14.86% | 3.11% |

| (1) | Most recent distribution paid or declared through 12/31/2018. Subject to change in the future. |

| (2) | Distribution rates are calculated by annualizing the most recent distribution paid or declared through the report date and then dividing by Common Share Price or NAV, as applicable, as of 12/31/2018. Subject to change in the future. |

| (3) | Total return is based on the combination of reinvested dividend, capital gain, and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per share for NAV returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of future results. |

First Trust Dynamic Europe Equity Income Fund (FDEU)

“AT A GLANCE” (Continued)

As of December 31, 2018 (Unaudited)

| Top Ten Holdings | % of Total

Investments |

| Roche Holding AG | 3.3% |

| Enel S.p.A. | 3.2 |

| Imperial Brands PLC | 2.9 |

| Siemens AG | 2.8 |

| Deutsche Telekom AG | 2.7 |

| Nestle S.A. | 2.7 |

| Snam S.p.A. | 2.7 |

| BAE Systems PLC | 2.5 |

| Eni S.p.A. | 2.5 |

| Vodafone Group PLC | 2.5 |

| Total | 27.8% |

| Sector Allocation | % of Total

Investments |

| Financials | 19.1% |

| Industrials | 14.8 |

| Communication Services | 11.7 |

| Energy | 11.2 |

| Consumer Staples | 11.1 |

| Utilities | 9.4 |

| Health Care | 7.3 |

| Materials | 5.6 |

| Real Estate | 4.9 |

| Information Technology | 4.1 |

| Consumer Discretionary | 0.8 |

| Total | 100.0% |

| Country Allocation | % of Total

Investments |

| United Kingdom | 35.2% |

| Switzerland | 12.7 |

| Italy | 11.0 |

| Netherlands | 10.4 |

| Germany | 8.5 |

| France | 8.2 |

| Spain | 4.2 |

| Sweden | 3.6 |

| Austria | 1.6 |

| Finland | 1.5 |

| Norway | 1.0 |

| Denmark | 0.8 |

| Luxembourg | 0.7 |

| Belgium | 0.6 |

| Total | 100.0% |

Portfolio Commentary

First Trust Dynamic Europe Equity Income Fund (FDEU)

Annual Report

December 31, 2018 (Unaudited)

Advisor

First Trust Advisors L.P. (“First Trust” or the “Advisor”) serves as the investment advisor to the First Trust Dynamic Europe Equity Income Fund (the “Fund”). First Trust is responsible for the ongoing monitoring of the Fund’s investment portfolio, managing the Fund’s business affairs and providing certain administrative services necessary for the management of the Fund.

Sub-Advisor

Janus Capital Management LLC., (“Janus Capital” or the “Sub-Advisor”), a legal entity of Janus Henderson Investors, serves as the Fund’s investment sub-advisor. Janus Henderson Investors is headquartered in London and is a global investment management firm that provides a full spectrum of investment products and services to clients around the world. With offices in 28 cities with more than 2,000 employees, Janus Henderson Investors managed approximately $328.5 billion in assets as of December 31, 2018.

Portfolio Management Team

Alex Crooke, Co-Head of Equities-EMEA & Asia Pacific, Janus Henderson Investors

Ben Lofthouse, CFA, Head of Global Equity Income, Janus Henderson Investors

Commentary

First Trust Dynamic Europe Equity Income Fund

The Fund’s investment objective is to provide a high level of current income with a secondary focus on capital appreciation. Under normal market conditions, the Fund pursues its objective by investing at least 80% of its Managed Assets in a portfolio of equity securities of European companies of any market capitalization, including, but not limited to, common and preferred stocks that pay dividends, depositary receipts, and real estate investment trusts (“REITs”). “Managed Assets” means the total asset value of the Fund minus the sum of the Fund’s liabilities other than the principal amount of borrowings, if any. There can be no assurance that the Fund will achieve its investment objective.

Market Recap

After an eventful year, the MSCI Europe Index (the “Benchmark”) posted a net fall in USD terms of -14.86%. After initial optimism, sentiment on global gross domestic product (“GDP”) growth waned as the year progressed due to a number of different factors. There were escalating concerns over trade wars, with the threat of a trade war between the U.S. and Europe worrying investors in the early summer, followed by rising tariffs between the U.S. and China in the second half of the year. Fear that these tariffs may worsen weighed on markets. A challenging political environment in Europe led investors to fear disruptive government action. This was caused by the election of a populist government in Italy, failure of Brexit negotiations, and large-scale protests against the French president, Emmanuel Macron. Underlying GDP and earnings growth continued to remain healthy for most companies in Europe in 2018, however at the very end of the year there were signs that various economies were beginning to soften.

In country terms, Italy and Germany were the largest underperformers versus the Benchmark primarily due to weakness in the financial and industrial sectors. Outperforming countries included Switzerland, Norway, France and the Netherlands thanks to the performance of defensive sectors and sectors with global earnings power, such as Energy.

In summary, investor fears of a significant weakening of economic trends going into 2019 has led to a substantial drop in equity market values across Europe.

Performance Analysis

During the 12-month period ended December 31, 2018, the Fund underperformed the Benchmark to deliver -19.36% net asset value (“NAV”) return1 and -26.64% market value return1.The Fund continued to make distributions over the year, totaling $1.45 for the period.

The Fund maintained its tilt towards high quality businesses focusing on strong balance sheets and cash flow. Many of the holdings have delivered strong fundamentals, but the performance of the equity portfolio was disappointing versus the Benchmark.

| 1 | Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per share for NAV returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of future results. |

Portfolio Commentary (Continued)

First Trust Dynamic Europe Equity Income Fund (FDEU)

Annual Report

December 31, 2018 (Unaudited)

A number of the stocks in the portfolio were expected to be beneficiaries of stronger European economic growth and the increasing interest rates. However, as the market digested various political interruptions and potential slowdowns in different sectors, the increased uncertainty impacted the share prices of companies with economically sensitive earnings.

The European Central Bank tried to be consistent with messaging that economic momentum in Europe will soon justify a move away from negative interest rates. Despite this, towards the end of the year, the market returned to doubting the possibility of rate rises 2019. These concerns, coupled with political volatility in Italy, France and the United Kingdom (“UK”), contributed to the poor performance of the Bank sector. Holdings such as Société Générale S.A., ING Groep N.V, and Standard Chartered PLC had particularly poor returns for a variety of unrelated factors while the whole sector de-rated. We believe that the strength of the franchises at these businesses remains significantly undervalued.

The Fund benefited from holdings in automaker stocks early in the year, and exited positions in early summer to take profits. A change to testing rules in European autos and tax incentives in China led to significant sector disruption as consumers brought forward purchases to the first half of the year. The sector subsequently suffered downgrades in the second half of the year. The Fund had no automaker holdings but did have positions in subsidiary sectors such as chemicals which were impacted, such as the chemical company BASF SE.

The overweight in the Fund in the Energy sector was a positive contributor to performance, as investors rewarded the Integrated Oil companies for demonstrating good performance on cash flows. Similarly, long held positions in Italian utilities did very well toward the end of the year as market fears over GDP growth led investors to seek out defensive business models. Both Terna S.p.A. and Enel also demonstrated better than expected earnings growth during the period.

Many stocks in the UK market had a poor year thanks to “Brexit”, the ongoing process to exit the European Union. This uncertainty has especially impacted certain sectors such as support services and defense; defense companies BAE Systems plc and Babcock International were both significant negative detractors for the Fund. Conversely, UK telecoms provider BT Group plc made a large positive contribution to performance. The Fund established a position when expectations were extremely low and regulatory relationships appeared very poor and gained a large positive contribution as these fears abated over the second half of the year.

Notable detractors from performance included Bpost, the Belgian postal operator and logistics provider, and affordable luxury jewelry Pandora A/S. Both stocks are in the middle of restructuring plans. Much better performance has been seen in the non-life insurer Scor, which experienced a take-over bid during the period. The Fund took this opportunity to exit the position.

Hedges

The Fund utilizes a dynamic currency hedging process to mitigate the risk of adverse currency movements on the portfolio. With the Euro declining by -4.48% and British Pound depreciating -5.62% during the period versus the U.S. dollar, both hedges were accretive to performance. The Fund has borrowed in Euros as the associated interest rate is lower than borrowing in dollars, and Euro borrowing provides a currency hedge to U.S. based investors.

Leverage

The Fund utilizes leverage to enhance returns for shareholders. During this period, the financial leverage was a negative contributor to performance, although some of the negative equity contribution was offset by a positive foreign currency impact from the loan. Over the period, the Fund reduced leverage, as it became more cautious on economic activity. The Benchmark of the Fund does not include any leverage, it is an unlevered, total return Benchmark.

Market Outlook

The European market has lowered significantly despite little sign of a significant GDP slowdown in the region. Political risk remains elevated, as the world awaits further details regarding a Chinese GDP slowdown or a China-U.S. trade war resolution to form significant further views. In our view, the poor sentiment for European assets is reflected in share prices.

The Fund will continue to hunt for interesting companies with appropriately low valuations in areas where we have comfort in cashflow providing a good back-stop to the dividend payments. There are many areas in the European markets where dividend yields are higher than historical averages, and the we will continue to screen the market to find the best long-term opportunities in this environment.

First Trust Dynamic Europe Equity Income Fund (FDEU)

Portfolio of Investments

December 31, 2018

| Shares | | Description | | Value |

| COMMON STOCKS (a) – 113.6% |

| | | Aerospace & Defense – 3.0% | | |

| 1,283,816 | | BAE Systems PLC

| | $7,514,128 |

| | | Air Freight & Logistics – 1.7% | | |

| 201,130 | | bpost S.A.

| | 1,844,710 |

| 90,126 | | Deutsche Post AG

| | 2,468,991 |

| | | | | 4,313,701 |

| | | Banks – 14.9% | | |

| 276,117 | | ABN AMRO Group N.V. (b)

| | 6,498,056 |

| 115,284 | | BAWAG Group AG (b)

| | 4,733,985 |

| 679,686 | | ING Groep N.V.

| | 7,328,040 |

| 3,690,154 | | Lloyds Banking Group PLC

| | 2,438,749 |

| 304,584 | | Nordea Bank Abp

| | 2,563,015 |

| 115,560 | | Societe Generale S.A.

| | 3,683,448 |

| 645,806 | | Standard Chartered PLC

| | 5,015,418 |

| 240,656 | | Swedbank AB, Class A

| | 5,369,513 |

| | | | | 37,630,224 |

| | | Beverages – 1.6% | | |

| 111,918 | | Diageo PLC

| | 3,987,087 |

| | | Building Products – 1.7% | | |

| 129,931 | | Cie de Saint-Gobain

| | 4,341,748 |

| | | Capital Markets – 2.3% | | |

| 276,474 | | Credit Suisse Group AG

| | 3,037,867 |

| 586,715 | | Natixis S.A.

| | 2,768,910 |

| | | | | 5,806,777 |

| | | Chemicals – 2.6% | | |

| 93,084 | | BASF SE

| | 6,441,720 |

| | | Commercial Services & Supplies – 2.5% | | |

| 478,056 | | Babcock International Group PLC

| | 2,981,452 |

| 1,541,149 | | Prosegur Cash S.A. (b)

| | 3,415,002 |

| | | | | 6,396,454 |

| | | Diversified Financial Services – 1.0% | | |

| 495,786 | | Banca Farmafactoring S.p.A (b)

| | 2,578,932 |

| | | Diversified Telecommunication Services – 7.3% | | |

| 1,642,862 | | BT Group PLC

| | 4,985,795 |

| 474,871 | | Deutsche Telekom AG

| | 8,063,316 |

| 328,469 | | Orange S.A.

| | 5,327,140 |

| | | | | 18,376,251 |

| | | Electric Utilities – 8.4% | | |

| 1,660,424 | | Enel S.p.A.

| | 9,595,861 |

| 454,746 | | SSE PLC

| | 6,268,582 |

| 925,893 | | Terna Rete Elettrica Nazionale S.p.A

| | 5,254,350 |

| | | | | 21,118,793 |

| | | Electrical Equipment – 1.7% | | |

| 226,140 | | ABB Ltd.

| | 4,301,238 |

| | | Energy Equipment & Services – 0.9% | | |

| 202,047 | | Tenaris S.A.

| | 2,185,316 |

| | | Food Products – 4.3% | | |

| 138,070 | | Mowi ASA

| | 2,917,411 |

See Notes to Financial Statements

Page 7

First Trust Dynamic Europe Equity Income Fund (FDEU)

Portfolio of Investments (Continued)

December 31, 2018

| Shares | | Description | | Value |

| COMMON STOCKS (a) (Continued) |

| | | Food Products (Continued) | | |

| 98,780 | | Nestle S.A.

| | $8,019,782 |

| | | | | 10,937,193 |

| | | Industrial Conglomerates – 3.3% | | |

| 75,337 | | Siemens AG

| | 8,405,585 |

| | | Insurance – 4.4% | | |

| 850,474 | | Phoenix Group Holdings PLC

| | 6,107,336 |

| 274,194 | | Prudential PLC

| | 4,899,817 |

| | | | | 11,007,153 |

| | | Media – 1.5% | | |

| 600,287 | | Mediaset Espana Comunicacion S.A.

| | 3,775,906 |

| | | Metals & Mining – 3.4% | | |

| 275,706 | | BHP Group PLC

| | 5,803,968 |

| 58,961 | | Rio Tinto PLC

| | 2,803,158 |

| | | | | 8,607,126 |

| | | Multi-Utilities – 2.7% | | |

| 702,312 | | National Grid PLC

| | 6,840,865 |

| | | Oil, Gas & Consumable Fuels – 12.3% | | |

| 470,439 | | Eni S.p.A.

| | 7,410,247 |

| 320,412 | | Repsol S.A.

| | 5,168,937 |

| 180,482 | | Royal Dutch Shell PLC, Class A

| | 5,305,127 |

| 1,814,021 | | Snam S.p.A.

| | 7,937,465 |

| 99,179 | | TOTAL S.A.

| | 5,247,634 |

| | | | | 31,069,410 |

| | | Paper & Forest Products – 0.7% | | |

| 72,468 | | UPM-Kymmene OYJ

| | 1,839,119 |

| | | Personal Products – 2.1% | | |

| 96,387 | | Unilever N.V.

| | 5,236,847 |

| | | Pharmaceuticals – 8.6% | | |

| 267,479 | | GlaxoSmithKline PLC

| | 5,083,929 |

| 80,561 | | Novartis AG

| | 6,888,134 |

| 39,709 | | Roche Holding AG

| | 9,833,320 |

| | | | | 21,805,383 |

| | | Professional Services – 3.6% | | |

| 126,898 | | Adecco Group AG

| | 5,929,825 |

| 147,287 | | RELX PLC

| | 3,032,511 |

| | | | | 8,962,336 |

| | | Real Estate Management & Development – 1.2% | | |

| 68,608 | | Nexity S.A.

| | 3,097,140 |

| | | Semiconductors & Semiconductor Equipment – 3.0% | | |

| 23,908 | | ASML Holding N.V.

| | 3,757,168 |

| 184,316 | | BE Semiconductor Industries N.V.

| | 3,902,185 |

| | | | | 7,659,353 |

| | | Software – 1.8% | | |

| 608,340 | | Sage Group (The) PLC

| | 4,663,196 |

| | | Textiles, Apparel & Luxury Goods – 1.0% | | |

| 61,883 | | Pandora A.S.

| | 2,519,383 |

Page 8

See Notes to Financial Statements

First Trust Dynamic Europe Equity Income Fund (FDEU)

Portfolio of Investments (Continued)

December 31, 2018

| Shares | | Description | | Value |

| COMMON STOCKS (a) (Continued) |

| | | Tobacco – 5.1% | | |

| 139,701 | | British American Tobacco PLC

| | $4,451,572 |

| 281,600 | | Imperial Brands PLC

| | 8,531,703 |

| | | | | 12,983,275 |

| | | Wireless Telecommunication Services – 5.0% | | |

| 415,132 | | Tele2 AB, Class B

| | 5,290,469 |

| 3,781,706 | | Vodafone Group PLC

| | 7,370,028 |

| | | | | 12,660,497 |

| | | Total Common Stocks

| | 287,062,136 |

| | | (Cost $340,685,293) | | |

| REAL ESTATE INVESTMENT TRUSTS (a) – 4.5% |

| | | Equity Real Estate Investment Trusts – 4.5% | | |

| 1,035,035 | | British Land (The) Co., PLC

| | 7,034,271 |

| 142,658 | | Eurocommercial Properties N.V.

| | 4,409,892 |

| | | Total Real Estate Investment Trusts

| | 11,444,163 |

| | | (Cost $17,238,214) | | |

| RIGHTS (a) – 0.1% |

| | | Oil, Gas & Consumable Fuels – 0.1% | | |

| 320,412 | | Repsol S.A., expiring 01/09/19 (c)

| | 146,845 |

| | | (Cost $147,305) | | |

| | | Total Investments – 118.2%

| | 298,653,144 |

| | | (Cost $358,070,812) (d) | | |

| Number of Contracts | | Description | | Notional Amount | | Exercise Price

(Euro) | | Expiration Date | | Value |

| CALL OPTIONS WRITTEN – (0.5)% |

| 662 | | EURO STOXX 50 Index

| | $22,765,359 | | €3,200.00 | | Jan 2019 | | (18,218) |

| 620 | | EURO STOXX 50 Index

| | 21,321,031 | | 3,250.00 | | Jan 2019 | | (7,104) |

| 600 | | EURO STOXX 50 Index

| | 20,633,256 | | 3,000.00 | | Feb 2019 | | (539,648) |

| 660 | | EURO STOXX 50 Index

| | 22,696,581 | | 3,225.00 | | Feb 2019 | | (70,326) |

| 600 | | EURO STOXX 50 Index

| | 20,633,256 | | 3,025.00 | | Mar 2019 | | (587,082) |

| | | Total Call Options Written

| | (1,222,378) |

| | | (Premiums received $2,503,576) | | | | | | | | |

| | Outstanding Loan – (34.7)%

| | (87,649,874) |

| | Net Other Assets and Liabilities – 17.0%

| | 42,881,859 |

| | Net Assets – 100.0%

| | $252,662,751 |

| Forward Foreign Currency Contracts |

Settlement

Date | | Counterparty | | Amount

Purchased | | Amount

Sold | | Purchase

Value as of

12/31/2018 | | Sale

Value as of

12/31/2018 | | Unrealized

Appreciation/

(Depreciation) |

| 03/05/19 | | BNS | | USD | 17,568,675 | | GBP | 13,720,703 | | $ 17,568,675 | | $ 17,540,520 | | $ 28,155 |

| Counterparty Abbreviations |

| BNS | Bank of Nova Scotia |

See Note 3D – Forward Foreign Currency Contracts in the Notes to Financial Statements.

See Note 3I – Offsetting on the Statement of Assets and Liabilities in the Notes to Financial Statements for a table that presents the forward foreign currency contracts’ assets and liabilities on a gross basis.

|

| (a) | All or a portion of these securities are available to serve as collateral for the outstanding loan and call options written. |

See Notes to Financial Statements

Page 9

First Trust Dynamic Europe Equity Income Fund (FDEU)

Portfolio of Investments (Continued)

December 31, 2018

| (b) | This security is restricted in the U.S. and cannot be offered for public sale without first being registered under the Securities Act of 1933, as amended. This security is not restricted on the foreign exchange where it trades freely without any additional registration. As such, it does not require the additional disclosure required of restricted securities. |

| (c) | Non-income producing security. |

| (d) | Aggregate cost for federal income tax purposes was $355,789,164. As of December 31, 2018, the aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost was $10,690,504 and the aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value was $69,020,747. The net unrealized depreciation was $58,330,243. The amounts presented are inclusive of derivative contracts. |

Valuation Inputs

A summary of the inputs used to value the Fund’s investments as of December 31, 2018 is as follows (see Note 3A - Portfolio Valuation in the Notes to Financial Statements):

| ASSETS TABLE |

| | Total

Value at

12/31/2018 | Level 1

Quoted

Prices | Level 2

Significant

Observable

Inputs | Level 3

Significant

Unobservable

Inputs |

Common Stocks*

| $ 287,062,136 | $ 287,062,136 | $ — | $ — |

Real Estate Investment Trusts*

| 11,444,163 | 11,444,163 | — | — |

Rights*

| 146,845 | 146,845 | — | — |

Total Investments

| 298,653,144 | 298,653,144 | — | — |

Forward Foreign Currency Contracts

| 28,155 | — | 28,155 | — |

Total

| $ 298,681,299 | $ 298,653,144 | $ 28,155 | $— |

LIABILITIES TABLE |

| | Total

Value at

12/31/2018 | Level 1

Quoted

Prices | Level 2

Significant

Observable

Inputs | Level 3

Significant

Unobservable

Inputs |

Call Options Written

| $ (1,222,378) | $ — | $ (1,222,378) | $ — |

| * | See Portfolio of Investments for industry breakout. |

Currency Exposure

Diversification | % of Total

Investments† |

| EUR | 48.6% |

| GBP | 26.5 |

| CHF | 12.7 |

| USD | 5.9 |

| SEK | 4.4 |

| NOK | 1.0 |

| DKK | 0.9 |

| Total | 100.0% |

| † | The weightings include the impact of forward foreign currency contracts. |

| Currency Abbreviations |

| CHF | Swiss Franc |

| DKK | Danish Krone |

| EUR | Euro |

| GBP | British Pound Sterling |

| NOK | Norwegian Krone |

| SEK | Swedish Krona |

| USD | United States Dollar |

Page 10

See Notes to Financial Statements

First Trust Dynamic Europe Equity Income Fund (FDEU)

Statement of Assets and Liabilities

December 31, 2018

| ASSETS: | |

Investments, at value

(Cost $358,070,812)

| $ 298,653,144 |

Cash

| 37,049,383 |

Foreign currency (Cost $3,267,847)

| 3,279,394 |

Unrealized appreciation on forward foreign currency contracts

| 28,155 |

| Receivables: | |

Dividend reclaims

| 1,759,364 |

Investment securities sold

| 832,386 |

Dividends

| 613,298 |

Prepaid expenses

| 2,930 |

Total Assets

| 342,218,054 |

| LIABILITIES: | |

Outstanding loan

| 87,649,874 |

Options written, at value (Premiums received $2,503,576)

| 1,222,378 |

| Payables: | |

Investment advisory fees

| 320,974 |

Interest and fees on loan

| 188,360 |

Audit and tax fees

| 59,050 |

Administrative fees

| 53,978 |

Shareholder reporting fees

| 28,796 |

Custodian fees

| 16,616 |

Legal fees

| 8,211 |

Transfer agent fees

| 3,003 |

Financial reporting fees

| 771 |

Trustees’ fees and expenses

| 67 |

Other liabilities

| 3,225 |

Total Liabilities

| 89,555,303 |

NET ASSETS

| $252,662,751 |

| NET ASSETS consist of: | |

Paid-in capital

| $ 305,695,356 |

Par value

| 172,319 |

Accumulated distributable earnings (loss)

| (53,204,924) |

NET ASSETS

| $252,662,751 |

NET ASSET VALUE,per Common Share (par value $0.01 per Common Share)

| $14.66 |

Number of Common Shares outstanding (unlimited number of Common Shares has been authorized)

| 17,231,908 |

See Notes to Financial Statements

Page 11

First Trust Dynamic Europe Equity Income Fund (FDEU)

Statement of Operations

For the Year Ended December 31, 2018

| INVESTMENT INCOME: | |

Dividends (net of foreign withholding tax of $1,681,875)

| $ 18,223,742 |

Interest

| 361,012 |

Total investment income

| 18,584,754 |

| EXPENSES: | |

Investment advisory fees

| 4,428,628 |

Interest and fees on loan

| 793,180 |

Administrative fees

| 171,106 |

Shareholder reporting fees

| 147,661 |

Audit and tax fees

| 70,325 |

Custodian fees

| 56,575 |

Legal fees

| 45,733 |

Listing expense

| 21,850 |

Transfer agent fees

| 18,088 |

Trustees’ fees and expenses

| 16,057 |

Financial reporting fees

| 9,250 |

Other

| 37,454 |

Total expenses

| 5,815,907 |

NET INVESTMENT INCOME (LOSS)

| 12,768,847 |

| NET REALIZED AND UNREALIZED GAIN (LOSS): | |

| Net realized gain (loss) on: | |

Investments

| 7,777,152 |

Written options

| 5,073,386 |

Forward foreign currency contracts

| 2,058,520 |

Foreign currency transactions

| (235,818) |

Net realized gain (loss)

| 14,673,240 |

| Net change in unrealized appreciation (depreciation) on: | |

Investments

| (97,263,481) |

Written options

| (145,382) |

Forward foreign currency contracts

| 1,014,742 |

Foreign currency translation

| 4,252,588 |

Net change in unrealized appreciation (depreciation)

| (92,141,533) |

NET REALIZED AND UNREALIZED GAIN (LOSS)

| (77,468,293) |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS

| $(64,699,446) |

Page 12

See Notes to Financial Statements

First Trust Dynamic Europe Equity Income Fund (FDEU)

Statements of Changes in Net Assets

| | Year

Ended

12/31/2018 | | Year

Ended

12/31/2017 |

| OPERATIONS: | | | |

Net investment income (loss)

| $ 12,768,847 | | $ 13,528,985 |

Net realized gain (loss)

| 14,673,240 | | 8,794,902 |

Net change in unrealized appreciation (depreciation)

| (92,141,533) | | 43,250,007 |

Net increase (decrease) in net assets resulting from operations

| (64,699,446) | | 65,573,894 |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | |

Investment operations

| (25,020,730) | | |

Net investment income

| | | (2,427,255) |

Net realized gain

| | | (13,035,761) |

Return of capital

| — | | (17,182,834) |

Total distributions to shareholders

| (25,020,730) | | (32,645,850) |

Total increase (decrease) in net assets

| (89,720,176) | | 32,928,044 |

| NET ASSETS: | | | |

Beginning of period

| 342,382,927 | | 309,454,883 |

End of period

| $ 252,662,751 | | $ 342,382,927 |

Accumulated net investment income (loss) at end of period

| | | $159,015 |

| COMMON SHARES: | | | |

Common Shares at end of period

| 17,231,908 | | 17,231,908 |

See Notes to Financial Statements

Page 13

First Trust Dynamic Europe Equity Income Fund (FDEU)

Statement of Cash Flows

For the Year Ended December 31, 2018

| Cash flows from operating activities: | | |

Net increase (decrease) in net assets resulting from operations

| $(64,699,446) | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by operating activities: | | |

Purchases of investments

| (162,078,279) | |

Sales of investments

| 186,267,443 | |

Proceeds from written options

| 8,802,567 | |

Amount paid to close written options

| (3,132,939) | |

Net realized gain/loss on investments and written options

| (12,850,538) | |

Net change in unrealized appreciation/depreciation on investments and written options

| 97,408,863 | |

Net change in unrealized appreciation/depreciation on forward foreign currency contracts

| (1,014,742) | |

| Changes in assets and liabilities: | | |

Decrease in dividend reclaims receivable

| 124,433 | |

Decrease in dividends receivable

| 1,565 | |

Decrease in prepaid expenses

| 126 | |

Decrease in interest and fees payable on loan

| (31,479) | |

Decrease in investment advisory fees payable

| (89,296) | |

Increase in audit and tax fees payable

| 14,025 | |

Increase in legal fees payable

| 3,399 | |

Increase in shareholder reporting fees payable

| 4,470 | |

Increase in administrative fees payable

| 20,681 | |

Increase in custodian fees payable

| 12,509 | |

Decrease in transfer agent fees payable

| (2,241) | |

Decrease in Trustees’ fees and expenses payable

| (222) | |

Increase in financial reporting fees payable

| 1 | |

Increase in other liabilities payable

| 2,546 | |

Cash provided by operating activities

| | $48,763,446 |

| Cash flows from financing activities: | | |

Distributions to Common Shareholders from investment operations

| (25,020,730) | |

Repayment of borrowing

| (10,001,525) | |

Effect of exchange rate changes on Euro Loans (a)

| (4,335,849) | |

Cash used in financing activities

| | (39,358,104) |

Increase in cash and foreign currency (b)

| | 9,405,342 |

Cash and foreign currency at beginning of period

| | 30,923,435 |

Cash and foreign currency at end of period

| | $40,328,777 |

| Supplemental disclosure of cash flow information: | | |

Cash paid during the period for interest and fees

| | $824,659 |

| (a) | This amount is a component of net change in unrealized appreciation (depreciation) on foreign currency translation as shown on the Statement of Operations. |

| (b) | Includes net change in unrealized appreciation (depreciation) on foreign currency of $(83,261), which does not include the effect of exchange rate changes on Euro borrowings. |

Page 14

See Notes to Financial Statements

First Trust Dynamic Europe Equity Income Fund (FDEU)

Financial Highlights

For a Common Share outstanding throughout each period

| | Year Ended December 31, | | Period Ended

12/31/2015 (a) |

| 2018 | | 2017 | | 2016 | |

Net asset value, beginning of period

| $ 19.87 | | $ 17.96 | | $ 19.07 | | $ 19.10 |

| Income from investment operations: | | | | | | | |

Net investment income (loss)

| 0.74 | | 0.78 | | 0.73 | | 0.04 |

Net realized and unrealized gain (loss)

| (4.50) | | 3.02 | | (0.39) | | 0.05 |

Total from investment operations

| (3.76) | | 3.80 | | 0.34 | | 0.09 |

| Distributions paid to shareholders from: | | | | | | | |

Net investment income

| (0.70) | | (0.14) | | (1.13) | | (0.07) |

Net realized gain

| (0.75) | | (0.75) | | — | �� | (0.05) |

Return of capital

| — | | (1.00) | | (0.32) | | — |

Total distributions paid to Common Shareholders

| (1.45) | | (1.89) | | (1.45) | | (0.12) |

Net asset value, end of period

| $14.66 | | $19.87 | | $17.96 | | $19.07 |

Market value, end of period

| $12.64 | | $18.83 | | $15.52 | | $17.16 |

Total return based on net asset value (b)

| (19.36)% | | 22.66% | | 3.30% | | 0.52% |

Total return based on market value (b)

| (26.64)% | | 34.51% | | (0.80)% | | (13.61)% |

| Ratios to average net assets/supplemental data: | | | | | | | |

Net assets, end of period (in 000’s)

| $ 252,663 | | $ 342,383 | | $ 309,455 | | $ 328,648 |

Ratio of total expenses to average net assets

| 1.91% | | 1.85% | | 1.83% | | 1.72% (c) |

Ratio of total expenses to average net assets excluding interest expense

| 1.65% | | 1.60% | | 1.59% | | 1.56% (c) |

Ratio of net investment income (loss) to average net assets

| 4.19% | | 4.09% | | 4.13% | | 0.82% (c) |

Portfolio turnover rate

| 44% | | 39% | | 41% | | 5% |

| Indebtedness: | | | | | | | |

Total loan outstanding (in 000’s)

| $ 87,650 | | $ 101,987 | | $ 85,791 | | $ 89,113 |

Asset coverage per $1,000 of indebtedness (d)

| $ 3,883 | | $ 4,357 | | $ 4,607 | | $ 4,688 |

| (a) | The Fund was seeded on August 20, 2015 and commenced operations on September 24, 2015. |

| (b) | Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan, and changes in net asset value per share for net asset value returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of future results. |

| (c) | Annualized. |

| (d) | Calculated by subtracting the Fund’s total liabilities (not including the loan outstanding) from the Fund’s total assets, and dividing by the outstanding loan balance in 000’s. |

See Notes to Financial Statements

Page 15

Notes to Financial Statements

First Trust Dynamic Europe Equity Income Fund (FDEU)

December 31, 2018

1. Organization

First Trust Dynamic Europe Equity Income Fund (the “Fund”) is a non-diversified, closed-end management investment company organized as a Massachusetts business trust on May 11, 2015, and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund trades under the ticker symbol FDEU on the New York Stock Exchange (“NYSE”).

The Fund’s investment objective is to provide a high level of current income with a secondary focus on capital appreciation. Under normal market conditions, the Fund pursues its objective by investing at least 80% of its Managed Assets in a portfolio of equity securities of European companies of any market capitalization, including, but not limited to, common and preferred stocks that pay dividends, depositary receipts, and real estate investment trusts (“REITs”). “Managed Assets” means the total asset value of the Fund minus the sum of the Fund’s liabilities other than the principal amount of borrowings, if any. There can be no assurance that the Fund will achieve its investment objective.

2. Managed Distribution Policy

The Board of Trustees of the Fund has approved a managed distribution policy for the Fund (the “Plan”) in reliance on exemptive relief received from the SEC that permits the Fund to make periodic distributions of long-term capital gains as frequently as monthly each tax year. Under the Plan, the Fund currently intends to continue to pay a recurring monthly distribution in the amount of $0.121 per Common Share that reflects the distributable cash flow of the Fund. A portion of this monthly distribution may include realized capital gains. This may result in a reduction of the long-term capital gain distribution necessary at year end by distributing realized capital gains throughout the year. The annual distribution rate is independent of the Fund’s performance during any particular period. Accordingly, you should not draw any conclusions about the Fund’s investment performance from the amount of any distribution or from the terms of the Plan. The Board of Trustees may amend or terminate the Plan at any time without prior notice to shareholders.

3. Significant Accounting Policies

The Fund is considered an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. The preparation of the financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

A. Portfolio Valuation

The net asset value (“NAV”) of the Common Shares of the Fund is determined daily as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern time, on each day the NYSE is open for trading. If the NYSE closes early on a valuation day, the NAV is determined as of that time. Domestic debt securities and foreign securities are priced using data reflecting the earlier closing of the principal markets for those securities. The Fund’s NAV per Common Share is calculated by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses, the value of call options written (sold), dividends declared but unpaid, and any borrowings of the Fund) by the total number of Common Shares outstanding.

The Fund’s investments are valued daily at market value or, in the absence of market value with respect to any portfolio securities, at fair value. Market value prices represent last sale or official closing prices from a national or foreign exchange (i.e., a regulated market) and are primarily obtained from third-party pricing services. Fair value prices represent any prices not considered market value prices and are either obtained from a third-party pricing service or are determined by the Pricing Committee of the Fund’s investment advisor, First Trust Advisors L.P. (“First Trust” or the “Advisor”), in accordance with valuation procedures adopted by the Fund’s Board of Trustees, and in accordance with provisions of the 1940 Act. Investments valued by the Advisor’s Pricing Committee, if any, are footnoted as such in the footnotes to the Portfolio of Investments. The Fund’s investments are valued as follows:

Common stocks, REITs, and other equity securities listed on any national or foreign exchange (excluding The Nasdaq Stock Market LLC (“Nasdaq”) and the London Stock Exchange Alternative Investment Market (“AIM”)) are valued at the last sale price on the exchange on which they are principally traded or, for Nasdaq and AIM securities, the official closing price. Securities traded on more than one securities exchange are valued at the last sale price or official closing price, as applicable, at the close of the securities exchange representing the principal market for such securities.

Securities traded in an over-the-counter market are fair valued at the mean of their most recent bid and asked price, if available, and otherwise at their closing bid price.

Notes to Financial Statements (Continued)

First Trust Dynamic Europe Equity Income Fund (FDEU)

December 31, 2018

Over-the-counter options contracts are fair valued at the closing price in the market of the underlying contracts where such contracts are principally traded.

Forward foreign currency contracts are valued at the current day’s interpolated foreign exchange rate, as calculated using the current day’s spot rate, and the thirty, sixty, ninety, and one-hundred eighty day forward rates provided by a third-party pricing service.

Certain securities may not be able to be priced by pre-established pricing methods. Such securities may be valued by the Fund’s Board of Trustees or its delegate, the Advisor’s Pricing Committee, at fair value. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933, as amended) for which a third-party pricing service is unable to provide a market price; securities whose trading has been formally suspended; a security whose market or fair value price is not available from a pre-established pricing source; a security with respect to which an event has occurred that is likely to materially affect the value of the security after the market has closed but before the calculation of the Fund’s NAV or make it difficult or impossible to obtain a reliable market quotation; and a security whose price, as provided by the third-party pricing service, does not reflect the security’s fair value. As a general principle, the current fair value of a security would appear to be the amount which the owner might reasonably expect to receive for the security upon its current sale. When fair value prices are used, generally they will differ from market quotations or official closing prices on the applicable exchanges. A variety of factors may be considered in determining the fair value of such securities, including, but not limited to, the following:

| 1) | the type of security; |

| 2) | the size of the holding; |

| 3) | the initial cost of the security; |

| 4) | transactions in comparable securities; |

| 5) | price quotes from dealers and/or third-party pricing services; |

| 6) | relationships among various securities; |

| 7) | information obtained by contacting the issuer, analysts, or the appropriate stock exchange; |

| 8) | an analysis of the issuer’s financial statements; and |

| 9) | the existence of merger proposals or tender offers that might affect the value of the security. |

If the securities in question are foreign securities, the following additional information may be considered:

| 1) | the value of similar foreign securities traded on other foreign markets; |

| 2) | ADR trading of similar securities; |

| 3) | closed-end fund or exchange-traded fund trading of similar securities; |

| 4) | foreign currency exchange activity; |

| 5) | the trading prices of financial products that are tied to baskets of foreign securities; |

| 6) | factors relating to the event that precipitated the pricing problem; |

| 7) | whether the event is likely to recur; and |

| 8) | whether the effects of the event are isolated or whether they affect entire markets, countries or regions. |

Because foreign markets may be open on different days than the days during which investors may transact in the shares of the Fund, the value of the Fund’s securities may change on the days when investors are not able to transact in the shares of the Fund. The value of securities denominated in foreign currencies is converted into U.S. dollars using exchange rates determined daily as of the close of regular trading on the NYSE.

The Fund is subject to fair value accounting standards that define fair value, establish the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation as of the measurement date. The three levels of the fair value hierarchy are as follows:

| • | Level 1 – Level 1 inputs are quoted prices in active markets for identical investments. An active market is a market in which transactions for the investment occur with sufficient frequency and volume to provide pricing information on an ongoing basis. |

| • | Level 2 – Level 2 inputs are observable inputs, either directly or indirectly, and include the following: |

| o | Quoted prices for similar investments in active markets. |

Notes to Financial Statements (Continued)

First Trust Dynamic Europe Equity Income Fund (FDEU)

December 31, 2018

| o | Quoted prices for identical or similar investments in markets that are non-active. A non-active market is a market where there are few transactions for the investment, the prices are not current, or price quotations vary substantially either over time or among market makers, or in which little information is released publicly. |

| o | Inputs other than quoted prices that are observable for the investment (for example, interest rates and yield curves observable at commonly quoted intervals, volatilities, prepayment speeds, loss severities, credit risks, and default rates). |

| o | Inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

| • | Level 3 – Level 3 inputs are unobservable inputs. Unobservable inputs may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the investment. |

The inputs or methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in those investments. A summary of the inputs used to value the Fund’s investments as of December 31, 2018, is included with the Fund’s Portfolio of Investments.

B. Option Contracts

The Fund is subject to equity price risk in the normal course of pursuing its investment objective and may write (sell) options to hedge against changes in the value of equities. Also, the Fund seeks to generate additional income, in the form of premiums received, from writing (selling) the options. The Fund may write (sell) covered call options (“options”) on all or a portion of the equity securities held in the Fund’s portfolio and on certain broad-based securities indices as determined to be appropriate by the Advisor, and consistent with the Fund’s investment objective in an amount up to 40% of the value of its Managed Assets. The Fund will write (sell) a call option on an individual security only if the Fund owns the security underlying the call or has an absolute and immediate right to acquire that security without additional cash consideration (or, if additional cash consideration is required, cash or other assets determined to be liquid by the Advisor or Janus Capital Management LLC (“Janus Capital” or the “Sub-Advisor”) (in accordance with procedures approved by the Board of Trustees) in such amount that are segregated by the Fund’s custodian) upon conversion or exchange of other securities held by the Fund. Options on securities indices are designed to reflect price fluctuations in a group of securities or segment of the securities market rather than price fluctuations in a single security and are similar to options on single securities, except that the exercise of securities index options requires cash settlement payments and does not involve the actual purchase or sale of securities. The Fund will not write (sell) “naked” or uncovered options. If certain equity securities held in the Fund’s portfolio are not covered by a related call option on the individual equity security, securities index options may be written on all or a portion of such uncovered securities. Options are marked-to-market daily and their value will be affected by changes in the value and dividend rates of the underlying equity securities, changes in interest rates, changes in the actual or perceived volatility of the securities markets and the underlying equity securities and the remaining time to the options’ expiration. The value of options may also be adversely affected if the market for the options becomes less liquid or trading volume diminishes.

The options that the Fund writes (sells) will either be exercised, expire or be canceled pursuant to a closing transaction. If an index option written (sold) by the Fund is exercised, the Fund will be obligated to deliver cash equal to the difference between the closing price of the stock index and the exercise price of the option times a specified multiple. If the price of the index is less than the option’s strike price, the index option will likely expire without being exercised. The Fund may also elect to close out its position in an option prior to its expiration by purchasing an option of the same series as the option written (sold) by the Fund. Gain or loss on options is presented separately as “Net realized gain (loss) on written options” on the Statement of Operations.

The index options that the Fund writes (sells) give the option holder the right to any appreciation in the value of the index over the exercise price of the option on or before the expiration date. Because the exercise of index options is settled in cash, sellers of index call options, such as the Fund, cannot provide in advance for their potential settlement obligations by acquiring and holding the underlying securities. The Fund will lose money if it is required to pay the purchaser of an index option the difference between the cash value of the index on which the option was written and the exercise price, and such difference is greater than the premium received by the Fund for writing the option. Net index option premiums can vary widely over the short-term and long-term.

Over-the-counter options have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund’s maximum equity price risk for purchased options is limited to the premium initially paid. In addition, certain risks may arise upon entering into option contracts including the risk that an illiquid secondary market will limit the Fund’s ability to close out an option contract prior to the expiration date and that a change in the value of the option contract may not correlate exactly with changes in the value of the securities hedged.

C. Securities Transactions and Investment Income

Securities transactions are recorded as of the trade date. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date. Interest income is recorded daily on the accrual basis.

Notes to Financial Statements (Continued)

First Trust Dynamic Europe Equity Income Fund (FDEU)

December 31, 2018

Distributions received from the Fund’s investments in REITs may be comprised of return of capital, capital gains, and income. The actual character of the amounts received during the year are not known until after the REITs’ fiscal year end. The Fund records the character of distributions received from the REITs during the year based on estimates available. The characterization of distributions received by the Fund may be subsequently revised based on information received from the REITs after their tax reporting periods conclude.

D. Forward Foreign Currency Contracts

The Fund is subject to foreign currency risk in the normal course of pursuing its investment objective. Forward foreign currency contracts are agreements between two parties (“Counterparties”) to exchange one currency for another at a future date and at a specified price. The Fund uses forward foreign currency contracts to facilitate transactions in foreign securities and to manage the Fund’s foreign currency exposure. These contracts are valued daily, and the Fund’s net equity therein, representing unrealized gain or loss on the contracts as measured by the difference between the forward foreign exchange rates at the dates of entry into the contracts and the forward rates at the reporting date, is included in “Unrealized appreciation on forward foreign currency contracts” and “Unrealized depreciation on forward foreign currency contracts” on the Statement of Assets and Liabilities. The change in unrealized appreciation (depreciation) is included in “Net change in unrealized appreciation (depreciation) on forward foreign currency contracts” on the Statement of Operations. When the forward contract is closed, the Fund records a realized gain or loss equal to the difference between the proceeds from (or the cost of) the closing transaction and the Fund’s basis in the contract. This realized gain or loss is included in “Net realized gain (loss) on forward foreign currency contracts” on the Statement of Operations. Risks arise from the possible inability of Counterparties to meet the terms of their contracts and from movement in currency, securities values and interest rates. Due to the risks, the Fund could incur losses in excess of the net unrealized value shown on the Forward Foreign Currency Contracts table in the Portfolio of Investments. In the event of default by the Counterparty, the Fund will provide notice to the Counterparty of the Fund’s intent to convert the currency held by the Fund into the currency that the Counterparty agreed to exchange with the Fund. If a Counterparty becomes bankrupt or otherwise fails to perform its obligations due to financial difficulties, the Fund may experience significant delays in obtaining any recovery in a bankruptcy or other reorganization proceeding. The Fund may obtain only limited recovery or may obtain no recovery in such circumstances.

E. Foreign Currency

The books and records of the Fund are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the exchange rates prevailing at the end of the period. Purchases and sales of investments and items of income and expense are translated on the respective dates of such transactions. Unrealized gains and losses on assets and liabilities, other than investments in securities, which result from changes in foreign currency exchange rates have been included in “Net change in unrealized appreciation (depreciation) on foreign currency translation” on the Statement of Operations. Unrealized gains and losses on investments in securities which result from changes in foreign exchange rates are included with fluctuations arising from changes in market price and are shown in “Net change in unrealized appreciation (depreciation) on investments” on the Statement of Operations. Net realized foreign currency gains and losses include the effect of changes in exchange rates between trade date and settlement date on investment security transactions, foreign currency transactions and interest and dividends received and are shown in “Net realized gain (loss) on foreign currency transactions” on the Statement of Operations. The portion of foreign currency gains and losses related to fluctuation in exchange rates between the initial purchase settlement date and subsequent sale trade date is included in “Net realized gain (loss) on investments” on the Statement of Operations.

F. Dividends and Distributions to Shareholders

The Fund intends to pay holders of its Common Shares a recurring monthly distribution that reflects the distributable cash flow of the Fund. Distributions will automatically be reinvested into additional Common Shares pursuant to the Fund’s Dividend Reinvestment Plan unless cash distributions are elected by the shareholder.

Distributions from net investment income and realized capital gains are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These permanent differences are primarily due to the varying treatment of income and gain/loss on portfolio securities held by the Fund and have no impact on net assets or NAV per share. Temporary differences, which arise from recognizing certain items of income, expense and gain/loss in different periods for financial statement and tax purposes, will reverse at some point in the future.

Permanent differences incurred during the fiscal year ended December 31, 2018, primarily a result of differing book and tax treatment of realization of foreign currency gains (losses), have been reclassified at year end to reflect an increase in accumulated net investment income (loss) of $1,822,702 and a decrease in accumulated net realized gain (loss) of $1,822,702. Accumulated distributable earnings (loss) consists of accumulated net investment income (loss), accumulated net realized gain (loss), and unrealized appreciation (depreciation). Net assets were not affected by this reclassification.

Notes to Financial Statements (Continued)

First Trust Dynamic Europe Equity Income Fund (FDEU)

December 31, 2018

The tax character of distributions paid by the Fund during the fiscal years ended December 31, 2018 and 2017, was as follows:

| Distributions paid from: | 2018 | 2017 |

Ordinary income

| $18,854,304 | $2,427,255 |

Capital gains

| 6,166,426 | 13,035,761 |

Return of capital

| — | 17,182,834 |

As of December 31, 2018, the components of distributable earnings and net assets on a tax basis were as follows:

Undistributed ordinary income

| $2,761,691 | |

Undistributed capital gains

| — | |

Total undistributed earnings

| 2,761,691 | |

Accumulated capital and other losses

| — | |

Net unrealized appreciation (depreciation)

| (55,744,687) | |

Total accumulated earnings (losses)

| (52,982,996) | |

Other

| (221,928) | |

Paid-in capital

| 305,867,675 | |

Total net assets

| $252,662,751 | |

G. Income Taxes

The Fund intends to continue to qualify as a regulated investment company by complying with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, which includes distributing substantially all of its net investment income and net realized gains to shareholders. Accordingly, no provision has been made for federal and state income taxes. However, due to the timing and amount of distributions, the Fund may be subject to an excise tax of 4% of the amount by which approximately 98% of the Fund’s taxable income exceeds the distributions from such taxable income for the calendar year.

The Fund intends to utilize provisions of the federal income tax laws, which allow it to carry a realized capital loss forward indefinitely following the year of the loss and offset such loss against any future realized capital gains. The Fund is subject to certain limitations under U.S. tax rules on the use of capital loss carryforwards and net unrealized built-in losses. These limitations apply when there has been a 50% change in ownership. At December 31, 2018, the Fund had no non-expiring capital loss carryforwards for federal income tax purposes.

Certain losses realized during the current fiscal year may be deferred and treated as occurring on the first day of the following fiscal year for federal income tax purposes. For the fiscal year ended December 31, 2018, the Fund did not incur any net ordinary losses.

The Fund is subject to accounting standards that establish a minimum threshold for recognizing, and a system for measuring, the benefits of a tax position taken or expected to be taken in a tax return. Taxable years ended 2015, 2016, 2017, and 2018 remain open to federal and state audit. As of December 31, 2018, management has evaluated the application of these standards to the Fund, and has determined that no provision for income tax is required in the Fund’s financial statements for uncertain tax positions.

H. Expenses

The Fund will pay all expenses directly related to its operations.

I. Offsetting on the Statement of Assets and Liabilities

Offsetting assets and liabilities requires entities to disclose both gross and net information about instruments and transactions eligible for offset on the Statement of Assets and Liabilities, and disclose instruments and transactions subject to master netting or similar agreements. These disclosure requirements are intended to help investors and other financial statement users better assess the effect or potential effect of offsetting arrangements on a fund’s financial position. The transactions subject to offsetting disclosures are derivative instruments, repurchase agreements and reverse repurchase agreements, and securities borrowing and securities lending transactions.

For financial reporting purposes, the Fund does not offset financial assets and financial liabilities that are subject to master netting arrangements (“MNAs”) or similar agreements on the Statement of Assets and Liabilities. MNAs provide the right, in the event of default (including bankruptcy and insolvency), for the non-defaulting Counterparty to liquidate the collateral and calculate the net exposure to the defaulting party or request additional collateral.

Notes to Financial Statements (Continued)

First Trust Dynamic Europe Equity Income Fund (FDEU)

December 31, 2018

At December 31, 2018, derivative assets and liabilities (by type) on a gross basis are as follows:

| | | | | | | | Gross Amounts not Offset

in the Statement of

Assets and Liabilities | | |

| | Gross

Amounts of

Recognized

Assets | | Gross Amounts

Offset in the

Statement of

Assets

and Liabilities | | Net Amounts of

Assets

Presented

in the Statement

of Assets and

Liabilities | | Financial

Instruments | | Collateral

Amounts

Received | | Net

Amount |

Forward Foreign

Currency Contracts* | $ 28,155 | | $ — | | $ 28,155 | | $ — | | $ — | | $ 28,155 |

* The respective Counterparties for each contract are disclosed in the Forward Foreign Currency Contracts table in the Portfolio of Investments.

J. New Accounting Pronouncement

On August 28, 2018, the FASB issued Accounting Standards Update (“ASU”) 2018-13, “Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement,” which amends the fair value measurement disclosure requirements of ASC 820. The amendments of ASU 2018-13 include new, eliminated, and modified disclosure requirements of ASC 820. In addition, the amendments clarify that materiality is an appropriate consideration of entities when evaluating disclosure requirements. The ASU is effective for fiscal years beginning after December 15, 2019, including interim periods therein. Early adoption is permitted for any eliminated or modified disclosures upon issuance of this ASU. The Fund has early adopted ASU 2018-13 for these financial statements, which did not result in a material impact.

4. Investment Advisory Fee, Affiliated Transactions and Other Fee Arrangements

First Trust, the investment advisor to the Fund, is a limited partnership with one limited partner, Grace Partners of DuPage L.P., and one general partner, The Charger Corporation. The Charger Corporation is an Illinois corporation controlled by James A. Bowen, Chief Executive Officer of First Trust. First Trust is responsible for the ongoing monitoring of the Fund’s investment portfolio, managing the Fund’s business affairs and providing certain administrative services necessary for the management of the Fund. For these services, First Trust is entitled to a monthly fee calculated at an annual rate of 1.10% of the Fund’s Managed Assets. First Trust also provides fund reporting services to the Fund for a flat annual fee in the amount of $9,250.

Janus Capital serves as the Fund’s sub-advisor and manages the Fund’s portfolio subject to First Trust’s supervision. The Sub-Advisor receives a monthly portfolio management fee calculated at an annual rate of 0.50% of the Fund’s Managed Assets that is paid by First Trust out of its investment advisory fee.

Brown Brothers Harriman & Co. (“BBH”) serves as the Fund’s administrator, fund accountant and custodian in accordance with certain fee arrangements. As administrator and fund accountant, BBH is responsible for providing certain administrative and accounting services to the Fund, including maintaining the Fund’s books of account, records of the Fund’s securities transactions, and certain other books and records. As custodian, BBH is responsible for custody of the Fund’s assets.

Computershare, Inc. (“Computershare”) serves as the Fund’s transfer agent in accordance with certain fee arrangements. As transfer agent, Computershare is responsible for maintaining shareholder records for the Fund.

Each Trustee who is not an officer or employee of First Trust, any sub-advisor or any of their affiliates (“Independent Trustees”) is paid a fixed annual retainer that is allocated equally among each fund in the First Trust Fund Complex. Each Independent Trustee is also paid an annual per fund fee that varies based on whether the fund is a closed-end or other actively managed fund, or is an index fund.

Additionally, the Lead Independent Trustee and the Chairmen of the Audit Committee, Nominating and Governance Committee and Valuation Committee are paid annual fees to serve in such capacities, with such compensation allocated pro rata among each fund in the First Trust Fund Complex based on net assets. Independent Trustees are reimbursed for travel and out-of-pocket expenses in connection with all meetings. The Lead Independent Trustee and Committee Chairmen rotate every three years. The officers and “Interested” Trustee receive no compensation from the Fund for acting in such capacities.

Notes to Financial Statements (Continued)

First Trust Dynamic Europe Equity Income Fund (FDEU)

December 31, 2018

5. Purchases and Sales of Securities

The cost of purchases and proceeds from sales of securities, excluding short-term investments, for the fiscal year ended December 31, 2018, were $162,078,279 and $187,099,829, respectively.

6. Derivative Transactions

The following table presents the types of derivatives held by the Fund at December 31, 2018, the primary underlying risk exposure and the location of these instruments as presented on the Statement of Assets and Liabilities. In compliance with the 1940 Act, the Fund covers its derivative commitments by earmarking liquid assets, entering into offsetting transactions or owning positions covering its obligations.

| | | | | Asset Derivatives | | Liability Derivatives |

Derivative

Instrument | | Risk

Exposure | | Statement of Assets and

Liabilities Location | | Value | | Statement of Assets and

Liabilities Location | | Value |

Forward foreign

currency contracts | | Currency Risk | | Unrealized appreciation

on forward foreign

currency contracts | | $ 28,155 | | Unrealized depreciation

on forward foreign

currency contracts | | $ — |