Exhibit 99.2

Third Quarter 202 4 Earfiifigs Release Copyright 2024. All rights reserved. N A S D A Q : O N D S | N o v e m b e r 1 2 , 2 0 2 4

N a s d a q : O N D S This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Holdings Inc . (“Ondas” or the “Company”) cautions readers that forward - looking statements are predictions based on its current expectations about future events . These forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from those expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the Company’s other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law . Also, this presentation contains certain non - GAAP financial measures . For a description of these non - GAAP financial measures, including reconciliations to the most comparable measure under GAAP, see the Appendix to this presentation . Information in this presentation is not an offer to sell securities or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction . 2 D i s c l a i m e r

N a s d a q : O N D S Ag e f i da 3 • Introduction • F i n a nc i a l R e v i e w & O u t l o o k • B u s i n e s s U pd a t e • Ondas Networks • Ondas Autonomous Systems (OAS) • Closing Remarks • Q&A

N a s d a q : O N D S M E I R K L I N E R PRESIDENT Meir is an entrepreneur with over 20 years of proven track record in aerospace development and manufacturing. GUY SIMPSON P R E S I D E N T & C O O Guy joined Ondas Networks in 2010 bringing over 25 years of leadership, operations and engineering experience. E R I C B R O C K C H A I R M A N & C E O Eric is an entrepreneur with over 25 years of management and investing experience. N E I L L A I R D I N T E R I M C F O , TREASURER & SECRETARY Neil is an experienced financial executive with over 25 years of performance in the technology sector which includes CFO roles with multiple publicly listed companies. L e a d e r s h i p T e a m 4

N a s d a q : O N D S O v e r v i e w 5 S t r o n g f i n i s h t o 2 0 2 4 • Iron Drone and Optimus secure $14.4 million in military orders • Defense sector is new vertical for OAS with expanded TAM / SOM • Iron Drone Raider positioned as best - in - class C - UAS • Global customer pipeline maturing; American Robotics gaining traction • Growing demand for public safety; DFR market evolving • Ondas Networks – improved visibility with 900 MHz • Secured 900 MHz system - wide buildout with Metra in Chicago • Expanding 900 MHz program with Class I Railroad, also in Chicago • Visibility on network architecture plans for 900 MHz improved • Outlook remains positive; revenue recovery expected • OAS revenue driven by order backlog and pipeline maturation • Ondas Networks sees certain railroads signaling 900 MHz plans; seeking timelines and orders for 2025

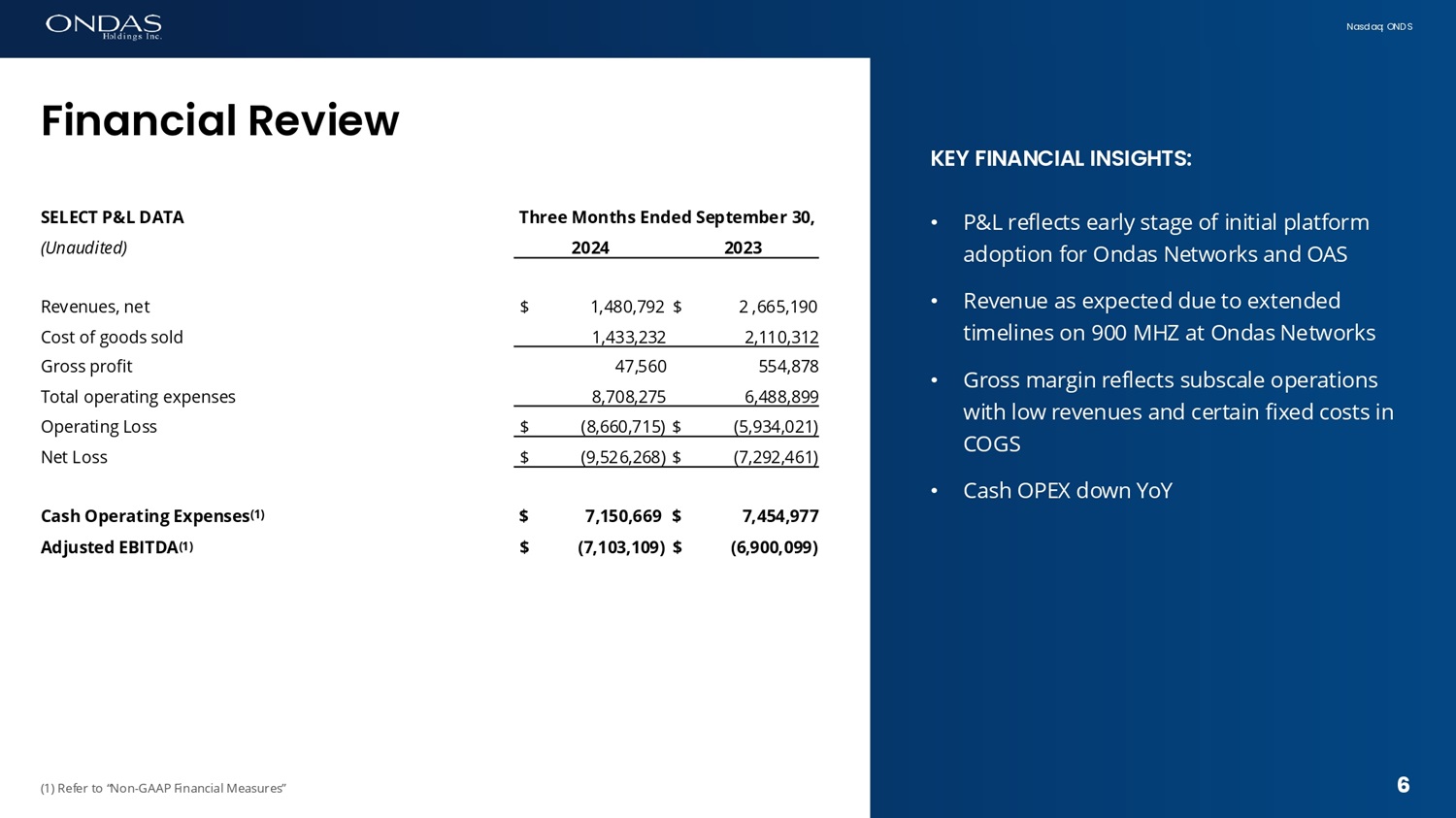

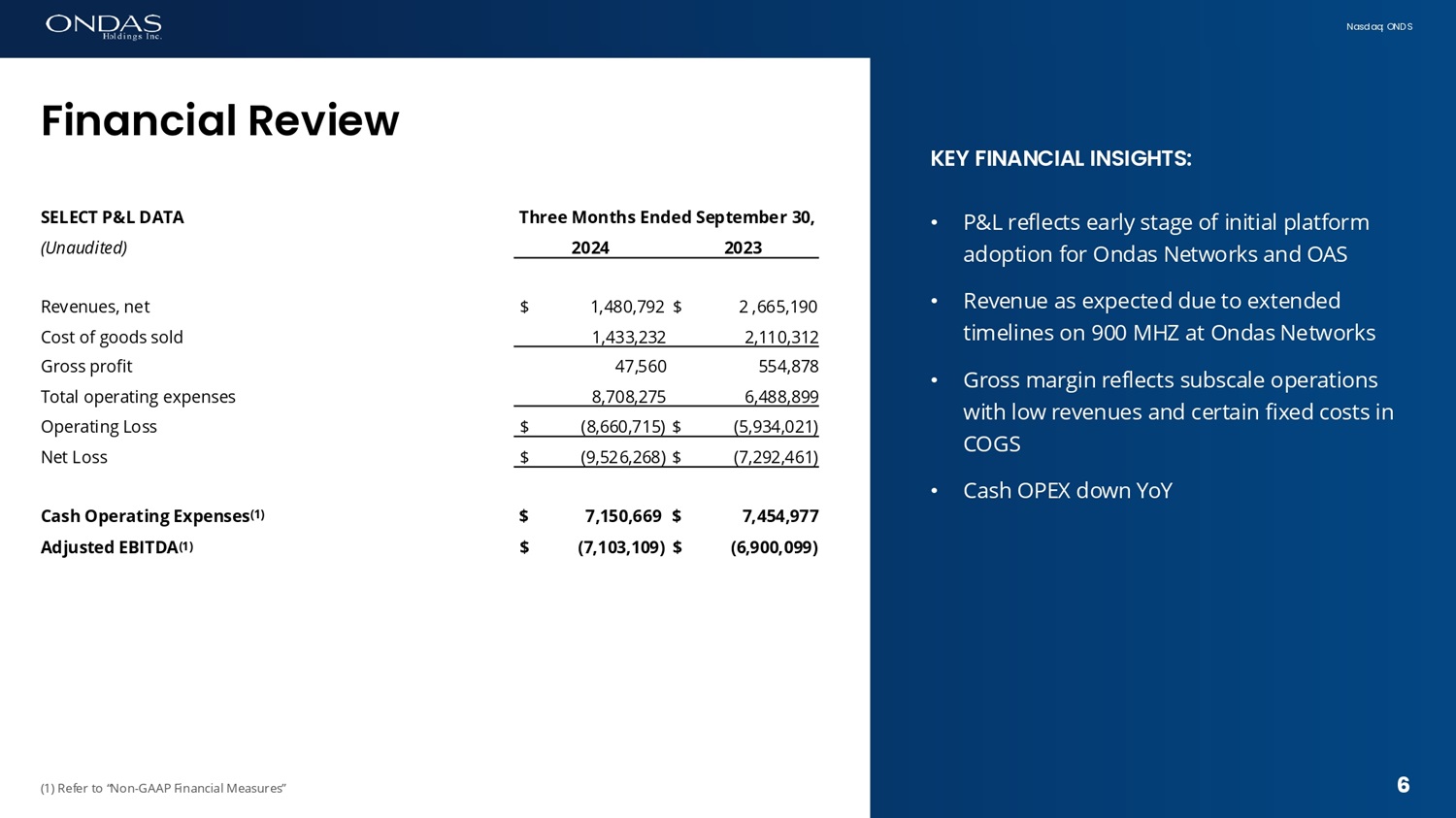

6 N a s d a q : O N D S K E Y F I N A N C I A L I N S I G H T S : • P&L reflects early stage of initial platform adoption for Ondas Networks and OAS • Revenue as expected due to extended timelines on 900 MHZ at Ondas Networks • Gross margin reflects subscale operations with low revenues and certain fixed costs in COGS • C a s h O P E X d o w n Y o Y (1) Refer to “Non - GAAP Financial Measures” Fifiaficial Review 6 T h r e e M o n t h s E n d e d S e p t e m b e r 30 , S E L E C T P & L D A T A 2023 2024 (Unaudited) $ 2 ,665,190 $ 1,480,792 R e v e nu e s , n e t 2,110,312 1,433,232 C o s t o f g oo d s s o l d 554,878 47,560 G r o s s p r of i t 6,488,899 8,708,275 Total operating expenses $ (5,934,021) $ (8,660,715) Operating Loss $ (7,292,461) $ (9,526,268) Net Loss $ 7,454,977 $ 7,150,669 C a s h O p e r a t i n g E x p e n s e s ( 1 ) $ (6,900,099) $ (7,103,109) A d j u s t e d E B I T D A ( 1 )

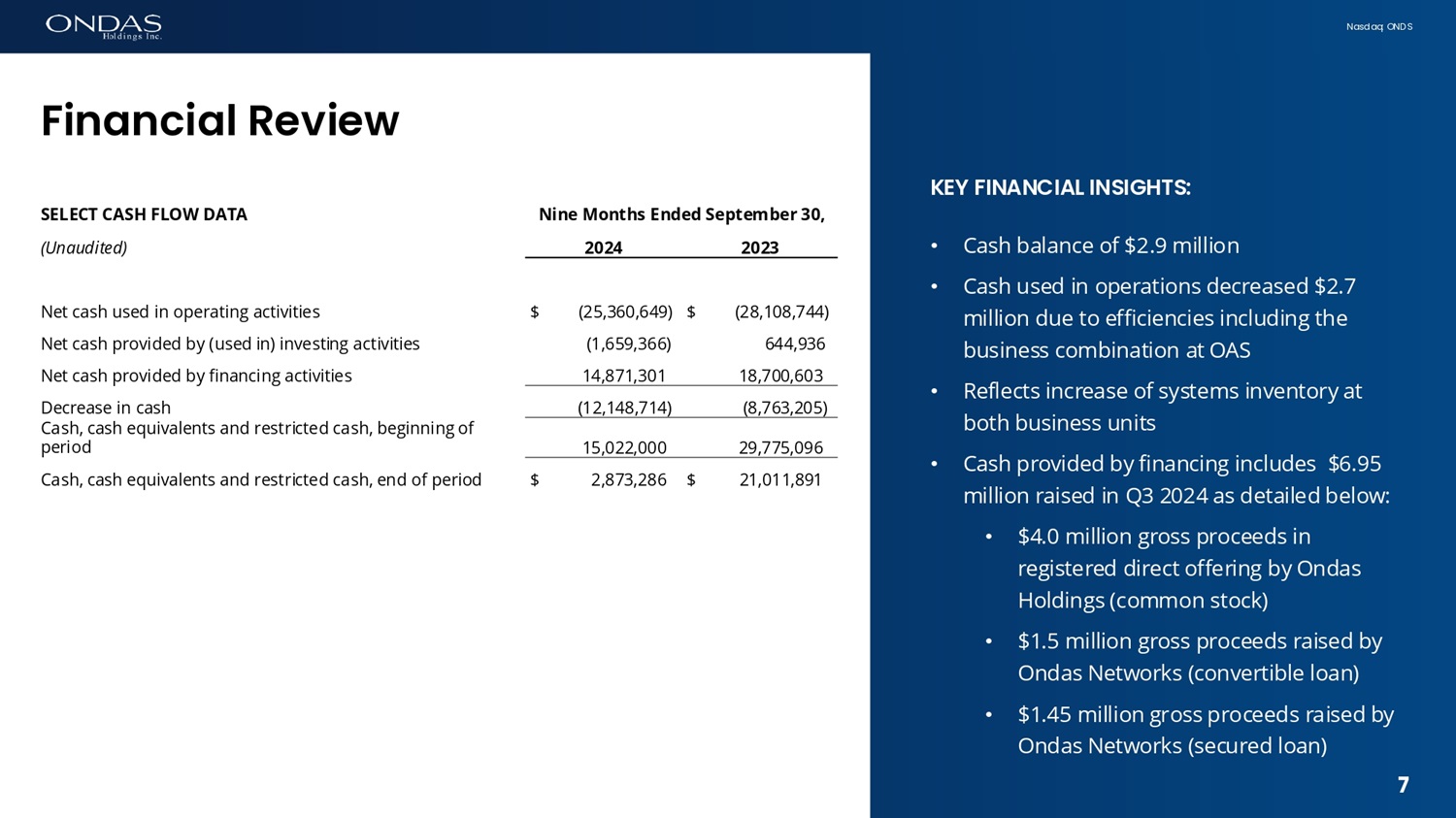

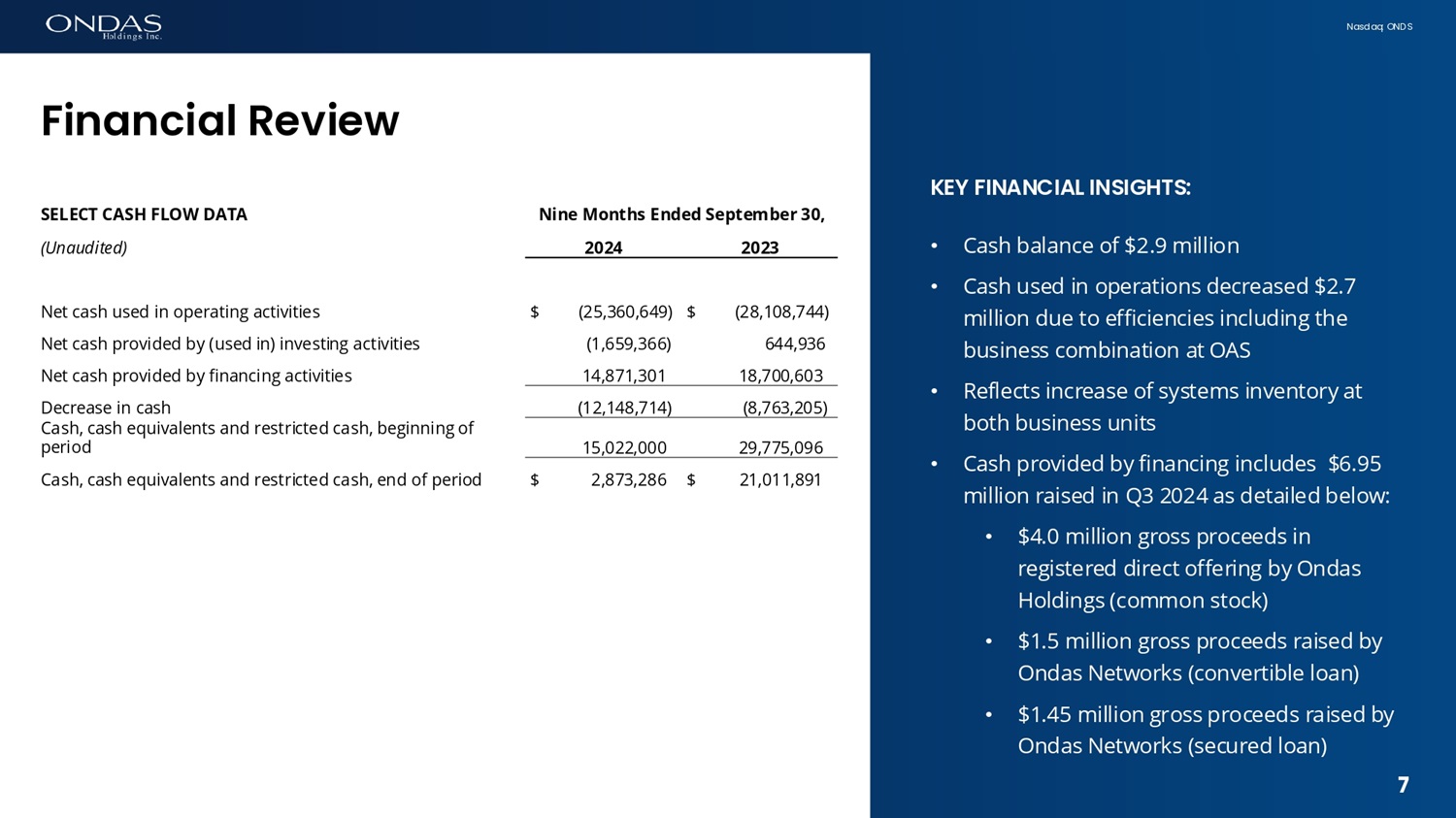

N a s d a q : O N D S K E Y F I N A N C I A L I N S I G H T S : • Cash balance of $2.9 million • Cash used in operations decreased $2.7 million due to efficiencies including the business combination at OAS • Reflects increase of systems inventory at both business units • Cash provided by financing includes $6.95 million raised in Q3 2024 as detailed below: • $4.0 million gross proceeds in registered direct offering by Ondas Holdings (common stock) • $1.5 million gross proceeds raised by Ondas Networks (convertible loan) • $1.45 million gross proceeds raised by Ondas Networks (secured loan) 7 7 Fifiaficial Review N i n e M o n t h s E n d e d S e p t e m b e r 3 0 , S E L E C T C A S H F L OW D A T A 2023 2024 (Unaudited) $ (28,108,744) $ (25,360,649) Net cash used in operating activities 644,936 (1,659,366) Net cash provided by (used in) investing activities 18,700,603 14,871,301 Net cash provided by financing activities (8,763,205) (12,148,714) Decrease in cash 29,775,096 15,022,000 Cash, cash equivalents and restricted cash, beginning of period $ 21,011,891 $ 2,873,286 Cash, cash equivalents and restricted cash, end of period

N a s d a q : O N D S K E Y F I N A N C I A L I N S I G H T S : • Convertible notes outstanding at Ondas Holdings total $27.8 million • Convertible notes outstanding at Ondas Networks total $1.5 million • Additional capital raised subsequent to September 30, 2024: • $ 3 . 5 million gross proceeds raised by OAS (convertible note) in financing led by Privet Ventures and Charles & Potomac • $ 500 , 000 in short - term working capital loan via KLEAR Inc . Balafice Sheet D e c . 3 1 , 2 0 2 3 S e p t . 3 0 , 2 02 4 S E L E C T B A L A N C E S H E E T D A T A (Unaudited) ASSETS $ 15,022,000 $ 2,873,286 C a s h a n d r e s t r i c t e d c a s h $ 92,164,682 $ 80,158,656 Total assets L I A B I L I T I E S A N D S T O C K H O L D E R S ' D E F I C IT $ 300,000 $ 1,191,215 Other debt - 1,486,847 Convertible notes - Networks, current 25,692,505 27,824,724 Convertible notes - Holdings, current 2,812,156 - Convertible notes - Holdings, long - term $ 28,804,661 $ 30,502,786 Total debt $ 47,108,861 $ 47,063,442 Total liabilities $ 11,920,694 $ 18,176,422 Redeemable noncontrolling interests $ 33,135,127 $ 14,918,792 Total Stockholders' equity $ 92,164,682 $ 80,158,656 Total liabilities and stockholders' equity 7 8

N a s d a q : O N D S 9 0 0 M H z – A T C S & d o t 1 6 U p d a t e 10 90 0 MH Z p l a n s c o m i n g i n t o f o c u s • Metra order reflects growing visibility in railroad 900 MHz plans • S ys t e m - w i d e u p g r a d e f o r 90 0 M H z A T C S n e t w o r k b e g i n s i n Q 4 20 2 4 • Class I Railroad ordered expanded 900 MHz deployment in Chicago • Live Airlink data traffic active since November 2023 • Class I Railroads signal intent to build mixed - use, multi - application network in 900 MHz • Railroads intend 900 MHz to be both a primary ATCS network, as well as a b a c k u p s ys t em f o r t h e 22 0 M H z P T C n e t w o r k • Railroads plan to move legacy 900 MHz CTC traffic to 220 MHz network in certain locations; a redundant path for ITCM traffic on the new 900 MHz is planned • AAR maintains commitment to build 900 MHz in FCC comment letter

N a s d a q : O N D S S t r a t e g i c R o a d m a p 11 P u r su i n g d e p l o y me n t t i m e li n e s a n d o r d e rs • Supporting deployment of customer networks • Migration of multiple networks to new 900 MHz A - Block • Expect initial ITCM over 900 MHz field activity during Q4 • Execute on 220 MHz PTC data radio on behalf of Amtrak • Milestones achieved; first prototypes delivered in August • Development program to complete in Q1 2025 • E x p e d i t ed d e l i ve r y o f P T C d a t a r a d i o s i n Q 2 2 02 5 • Siemens UK program for on - locomotive data radio continues; prototypes to be delivered by end of the year • Next Generation HOT / EOT Testing with AAR in Progress • Continue prudent expense management

N a s d a q : O N D S OAS Update 13 OAS leverages growing investments in defense, homeland security and public safety capabilities • Secured $14.4 million in orders for Iron Drone and Optimus for military and homeland security applications • Established programs with major military customer • Advanced Iron Drone Raider capabilities and operational deployments with defense customers • E x ec u t e d f i x e d p r i c e c o n t r ac t f o r t h e U S C oa s t G u a r d f o r e m i s s i o n s m o n i t o r i n g a t P o rt s o f L A a n d L o n g B e ac h • C u s to m e r p i pe l i n e de e p e n i n g a n d m a t u r i n g i n U S a n d E u r o p e • Advanced marketing with additional customers • Public safety, ports and terminals • Data centers and construction project management • Multiple demonstrations and BVLOS waivers secured • Established a strategic alliance with GenLab Venture Studio

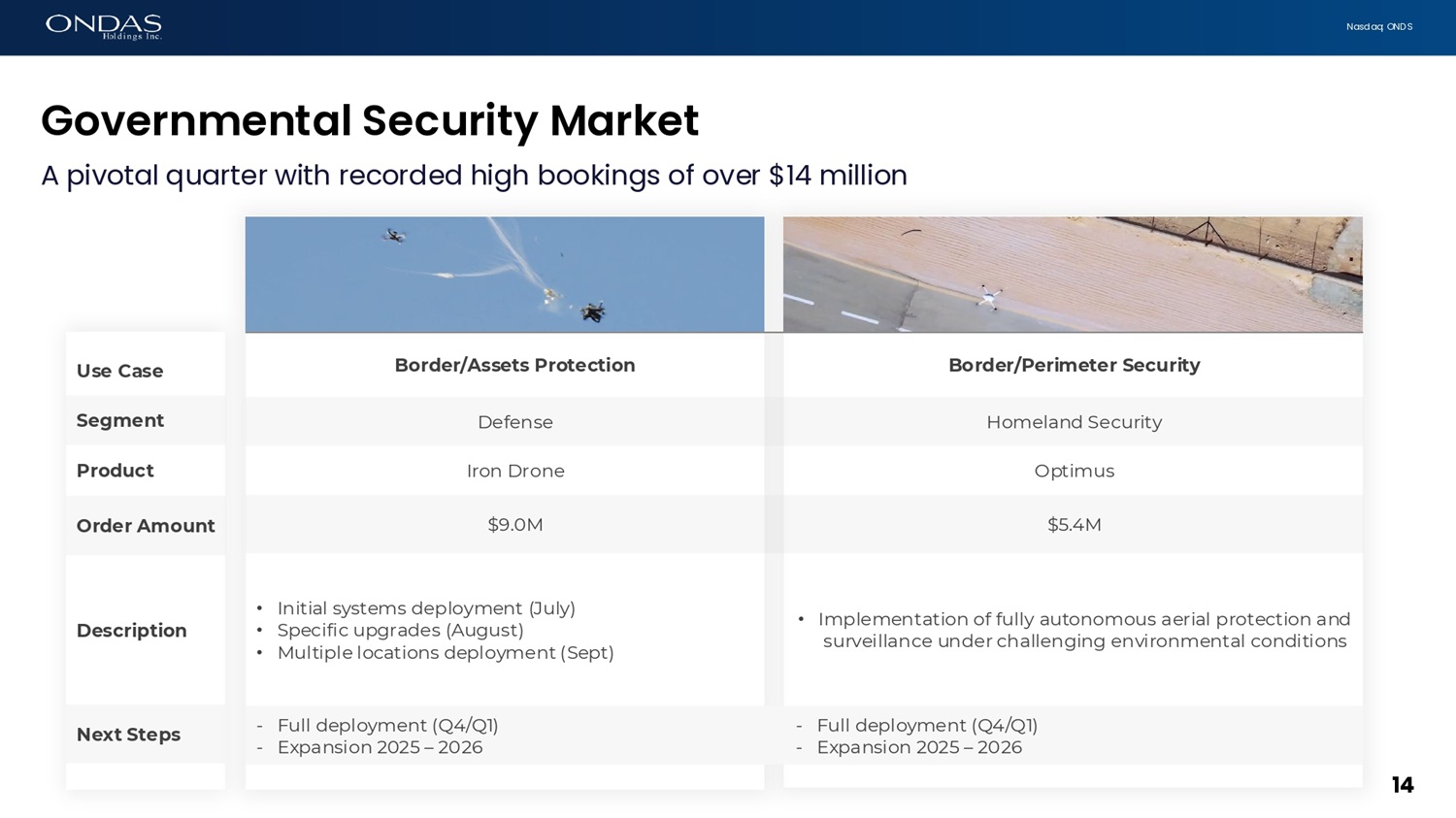

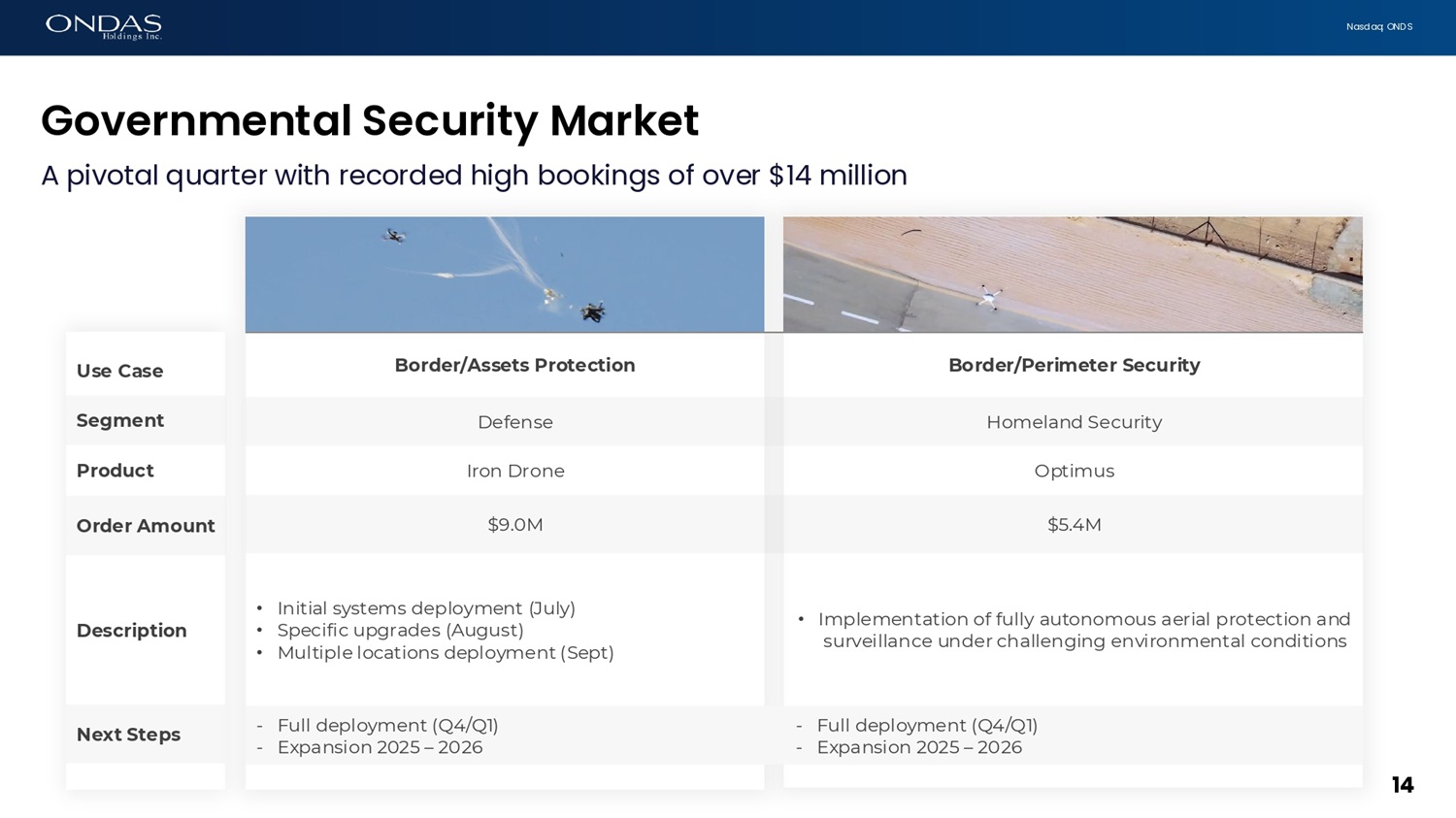

N a s d a q : O N D S Goverfimefital Security Market A pivotal quarter with recorded high bookings of over $14 million U s e C a se Segment Product O r d e r A mo unt Description N e x t S t e ps B o r d e r / P e r i m e t e r S e c u r i ty B o r d e r / A s s e ts P r o t e c t i o n H o m e l a n d S e c u r i t y Defense Optimus I r o n D r o n e $5.4M $9.0M • I m p l e m e n t a t i on of f u l l y a u t o n omo u s a e r i a l p r o t e c t i on a n d surveillance under challenging environmental conditions • I n i t i a l s y s t e ms d e p l o y m e n t ( J u l y ) • Sp e c i f i c u p g r a d e s ( A u g u s t ) • M u l t i p l e l o c a t i o n s d e p l o y m e n t ( S e p t ) - F u l l d e p l o y m e n t ( Q 4 / Q 1 ) - E x p a n s i o n 2 0 2 5 – 2 0 2 6 - F u l l d e p l o y m e n t ( Q 4 / Q 1 ) - E x p a n s i o n 2 0 2 5 – 2 0 2 6 14

N a s d a q : O N D S Market, Customer afid Product Expafisiofi Enhancing security and monitoring of critical facilities p r o j e c t s , p u b li c s a f e t y a n d m il i t a ry a s s e t s • Deliver and leverage Q3 bookings of the Iron Drone Raider and Optimus Systems • Advance specific upgrades in both systems • Execute on operational deployments; secure follow - on volume orders • Build supply chain and services infrastructure for sustainment • Capture new global defense customers • Fleet expansion in UAE expected to continue • Renewed and expanded service contract ; target 22 system fleet by end of 2025 • Potential for expanded commercial use cases in UAE • Drive Optimus adoption via American Robotics and our European partners • Demos in Europe with our partner HHLA SKY to potential customers • US police departments trending “Drone as a First Responder” 15

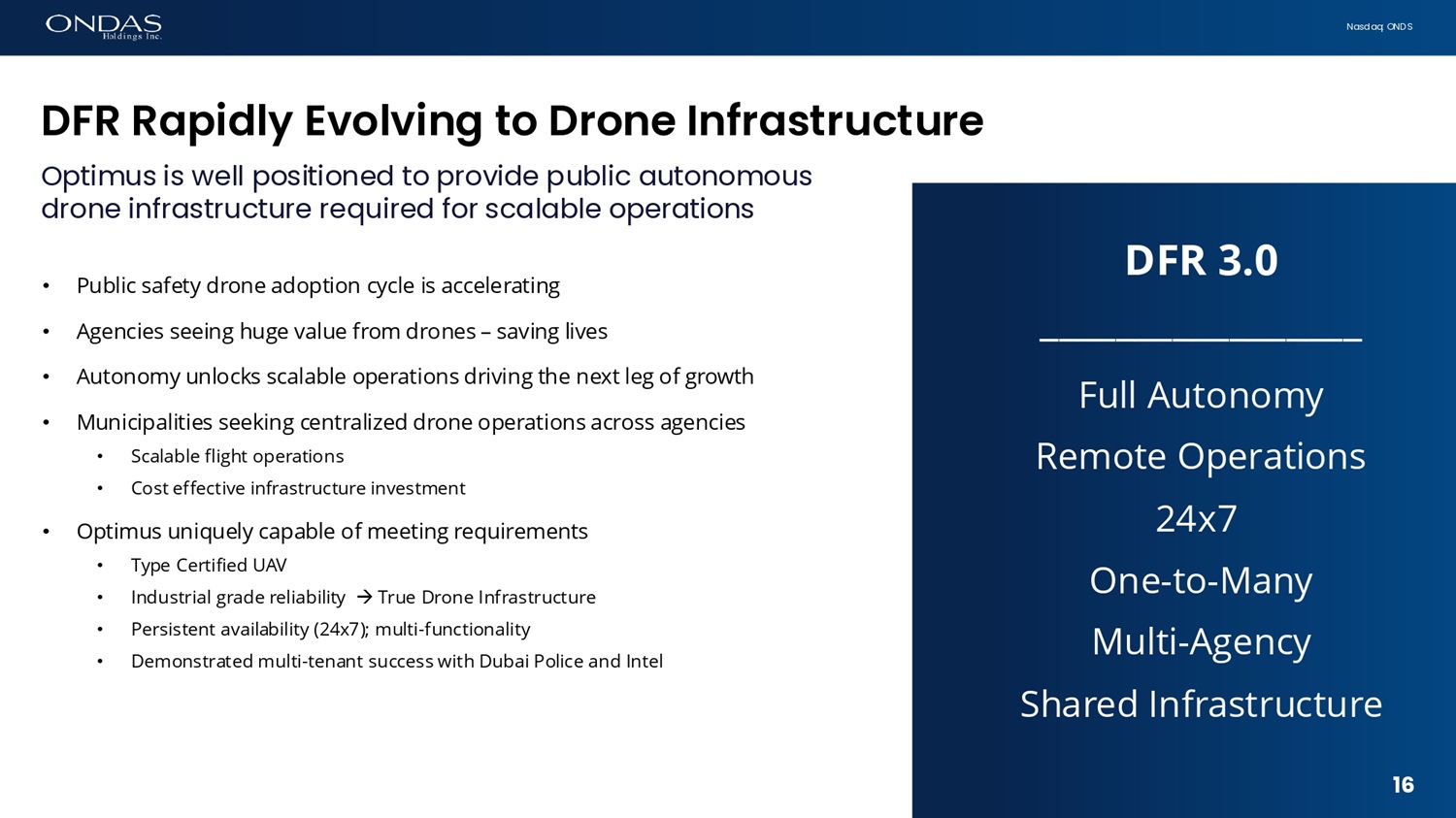

N a s d a q : O N D S DFR Rapidly Evolvifig to Drofie Ififrastructure 16 16 Optimus is well positioned to provide public autonomous drone infrastructure required for scalable operations • Public safety drone adoption cycle is accelerating • A g en c i e s s e e i n g h u g e v a l u e f r o m d r o ne s – sa v i n g l i v e s • Autonomy unlocks scalable operations driving the next leg of growth • Municipalities seeking centralized drone operations across agencies • Scalable flight operations • Cost effective infrastructure investment • Optimus uniquely capable of meeting requirements • Type Certified UAV • Industrial grade reliability True Drone Infrastructure • Persistent availability (24x7); multi - functionality • Demonstrated multi - tenant success with Dubai Police and Intel DFR 3.0 _ _ _ _ _ __ Full Autonomy Remote Operations 24x7 One - to - Many Multi - Agency Shared Infrastructure

N a s d a q : O N D S • Expect significant revenue recovery beginning in Q4 2024 • Delivering on OAS military orders; drive order book expansion • Advanced development programs; work with Railroads on 2025 buildout plans • Tracking demand for Optimus Systems from existing and new customers • Execute in field and build capacity to secure Iron Drone volume orders • Capitalize on security demand tailwinds for Optimus and Iron Drone platforms • Support additional Iron Drone orders with combat success • Optimus Systems orders from existing and new customers, including military • Accelerate a growing and maturing American Robotics pipeline • Management advancing funding strategy • Applied to Nasdaq for an 180 - day extension to meet minimum bid requirement Outlook F o c u s o n d e p l o y m e n t s a n d o p e r a t i o n a l s c a l e 17

Third Quarter 2024 Earnings Release N A S D A Q : O N D S | N ov e m b e r 1 2 , 2 0 2 4 Q & A C o p y r i g h t 2 02 4 . A l l r i g h t s r e s e r v e d .

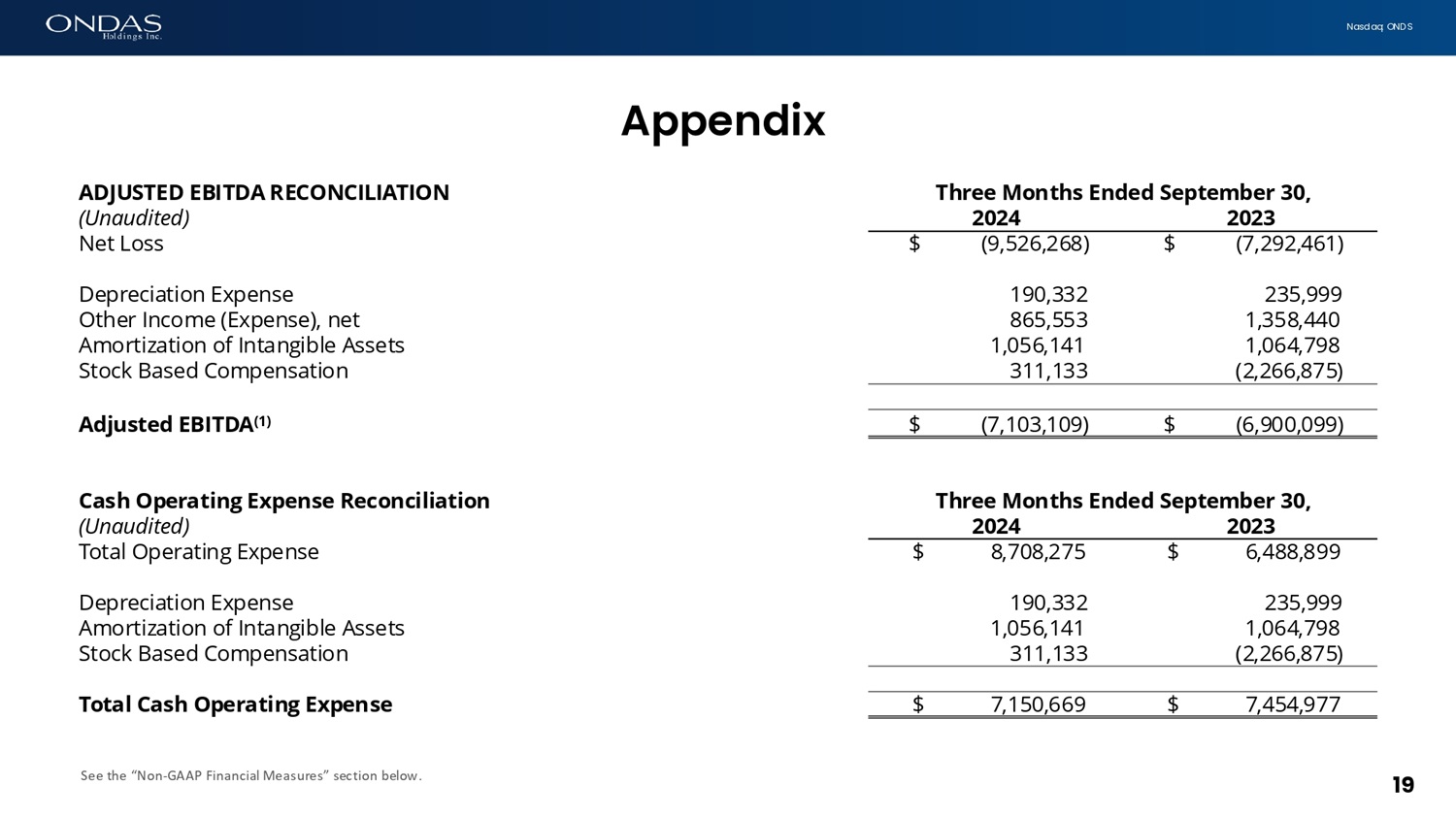

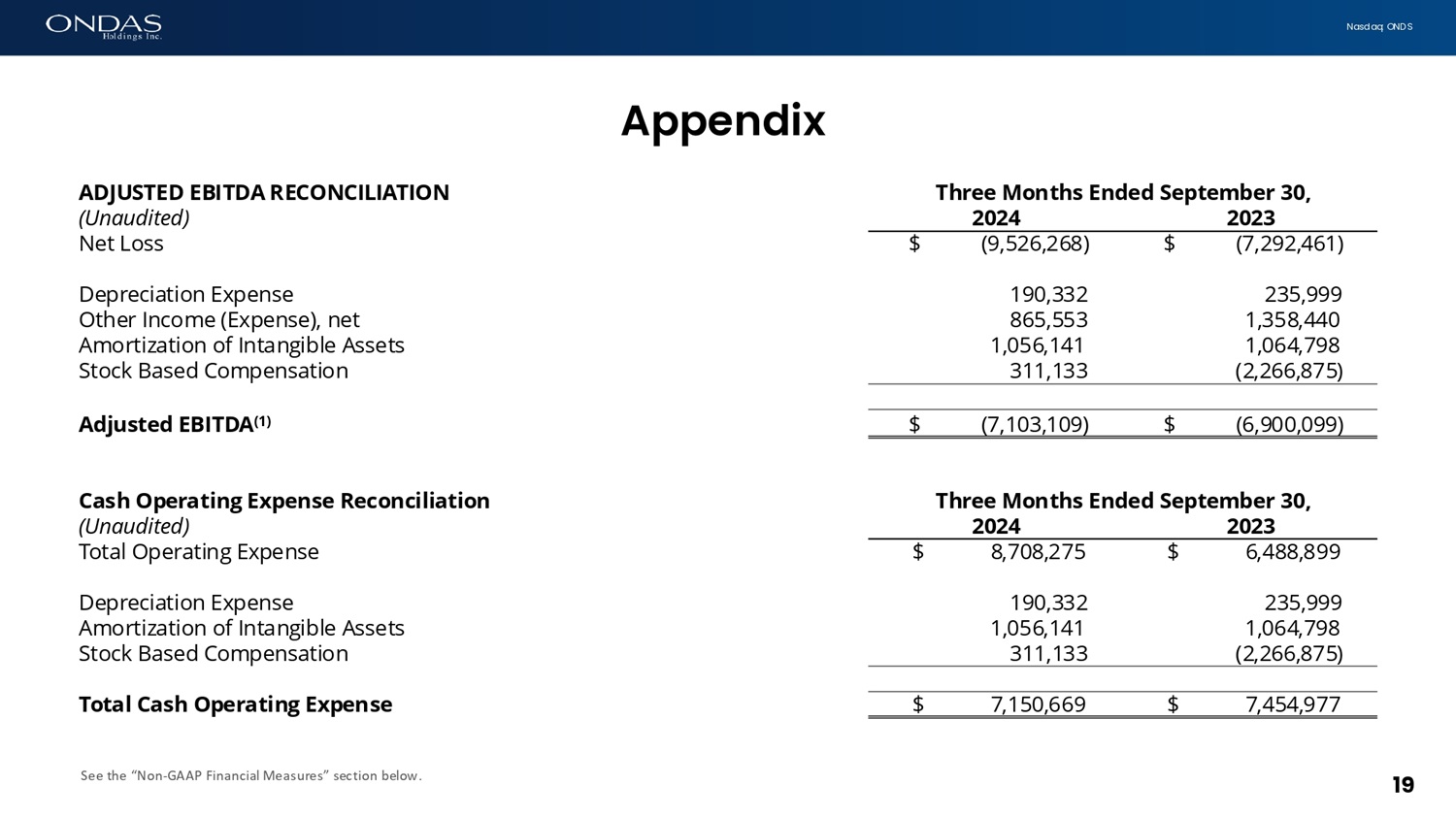

19 N a s d a q : O N D S See the “Non - GAAP Financial Measures” section below. Appefidix Three Months Ended September 30, A D J U S T E D E B I T D A R E CO N C I L I A T I O N 2023 2024 (Unaudited) $ (7,292,461) $ (9,526,268) Net Loss 235,999 190,332 Depreciation Expense 1,358,440 865,553 Other Income (Expense), net 1,064,798 1,056,141 Amortization of Intangible Assets (2,266,875) 311,133 Stock Based Compensation $ (6,900,099) $ (7,103,109) Adjusted EBITDA (1) Three Months Ended September 30, C a s h O p e r a t i n g E x p e n s e R e c o n c il i a t i o n 2023 2024 (Unaudited) $ 6,488,899 $ 8,708,275 Total Operating Expense 235,999 190,332 Depreciation Expense 1,064,798 1,056,141 Amortization of Intangible Assets (2,266,875) 311,133 Stock Based Compensation $ 7,454,977 $ 7,150,669 T o t a l C a s h O p e r a t i n g E x p e n s e

20 N a s d a q : O N D S As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of Earnings (Loss) before interest, depreciation, amortization, stock - based compensation and taxes (“Adjusted EBITDA”) and cash operating expenses, the non - GAAP financial measures contained in this presentation to the most directly comparable measures under GAAP, which reconciliations are set forth in the tables included in the Appendix of this presentation . We believe that Adjusted EBITDA and cash operating expenses facilitate the analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, the Company’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses . Other companies may calculate Adjusted EBITDA and cash operating expenses differently, and therefore our measures may not be comparable to similarly titled measures used by other companies . Adjusted EBITDA and cash operating expenses should only be used as supplemental measures of our operating performance . We believe that Adjusted EBITDA improves comparability from period to period by removing the impact of our asset base (depreciation and amortization) and other adjustments as set out in the tables included in the Appendix of this presentation, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses . We believe that cash operating expenses is useful to manage expenses as it excludes non - cash items (depreciation expense, amortization expense and stock - based compensation expense) that may obscure our underlying business performance . Management uses Adjusted EBITDA and cash operating expenses in making financial, operating and planning decisions and evaluating the Company's ongoing performance . Nofi - GAAP Fifiaficial Measures

N a s d a q : O N D S 21 C o p y r i gh t 20 2 4 . A l l r i gh ts r e s e r v e d . N A S D A Q : O N D S | N o v e m b e r 1 2 , 2 0 2 4 T H A NK Y O U